Attached files

| file | filename |

|---|---|

| 8-K - 8-K 2018 WESTBOUND SH PRESENTATION - GUARANTY BANCSHARES INC /TX/ | gnty20188-kwestboundshpres.htm |

Westbound Bank Special Shareholder Meeting May 21, 2018 Proposed Merger into Guaranty Bank & Trust, N.A

Safe Harbor Statement ABOUT GUARANTY BANCSHARES, INC. Guaranty Bancshares, Inc. (“GNTY”, “Guaranty” or the “Company”) is a bank holding company, headquartered in Mount Pleasant, Texas, that conducts banking activities through its wholly-owned subsidiary, Guaranty Bank & Trust, N.A., a national banking association (“Guaranty Bank & Trust” or the “Bank”) throughout East Texas, Central Texas, and the Dallas/Fort Worth metroplex. For more information, visit www.gnty.com. NO OFFER OR SOLICITATION This communication does not constitute an offer to sell, a solicitation of an offer to sell, the solicitation of an offer to buy any securities or a solicitation of any vote or approval. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT In connection with the proposed merger of Guaranty Bank & Trust and Westbound Bank (“Westbound”), Guaranty has filed with the Securities and Exchange Commission (the “Commission”) a registration statement on Form S-4 that includes a proxy statement of Westbound and a prospectus of Guaranty, as well as other relevant documents concerning the proposed merger. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY AMENDMENT OR SUPPLEMENTS TO THESE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GUARANTY, WESTBOUND AND THE MERGER. Investors and security holders are able to obtain free copies of the registration statement on Form S-4 and the related proxy statement/prospectus, as well as other documents filed with the SEC by Guaranty through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by Guaranty are also available free of charge upon written request at the following address: Guaranty Bancshares, Inc., 201 South Jefferson Avenue, Mount Pleasant, Texas 75455, Attn: Investor Relations. NON-GAAP FINANCIAL MEASURES Guaranty reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures used in managing its business may provide meaningful information about underlying trends in its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Guaranty’s reported results prepared in accordance with GAAP. PARTICIPANTS IN THE TRANSACTION Guaranty, Westbound and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Westbound in connection with the proposed merger. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, is included in the proxy statement/prospectus regarding the proposed merger. Information about Guaranty and its directors and officers may be found in the definitive proxy statement of Guaranty relating to its 2018 Annual Meeting of Shareholders that was filed with the SEC. The definitive proxy statement can be obtained free of charge from the sources described above. 2

Forward-Looking Statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995. This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933 (the “Securities Act”) and 21E of the Securities Exchange Act of 1934. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or forward- looking nature. Annualized, pro forma, project and estimated numbers are used for illustrative purposes only, are not forecast and may not reflect actual results. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, leadership’s beliefs and certain assumptions made by our leadership team, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are, or will be, important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but are limited to, the following: business and economic conditions generally and in the financial services industry, nationally and within our local market area; changes in leadership personnel and their ability to execute our strategy; economic, market, operational, liquidity, credit and interest rate risks associated with our business; deterioration of our asset quality; changes in real estate values; increased competition in the financial services industry, nationally, regionally or locally, which may adversely affect pricing and terms; our ability to identify potential candidates for, and consummate, acquisitions of banking franchises on attractive terms, or at all; our ability to achieve organic loan and deposit growth and the composition of that growth; volatility and direction of market interest rates; changes in the regulatory environment, including changes in regulations that affect the fees that we charge or expenses that we incur in connection with our operations; governmental legislation and regulation, including changes in accounting regulation or standards and changes in trade, monetary, tax and fiscal policies and laws; natural disasters, adverse weather and other man-made disasters, acts of terrorism, and other matters beyond our control; and other factors. For discussion of these and other risk that may cause actual results to differ from expectation, please refer to “Special Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” contained in the Annual Report on Form 10-K for the year ended December 31, 2017 and any updates to those risk factors set forth in Guaranty’s subsequent Quarterly Reports on Form 10-Q and the registration statement on Form S-4 and the related proxy statement/prospectus regarding the proposed merger of Guaranty Bank & Trust and Westbound. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, express or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Guaranty or persons acting on Guaranty’s behalf may issue. 3

Company Snapshot for 2017 Mission Statement: To continually improve the financial well-being of our customers and shareholders Financial Highlights Balance Sheet (Dollars in millions) Total Assets $1,963 Total Loans, Including Held for Sale $1,361 Total Deposits $1,676 Total Equity $207 Tang. Common Equity / Tang. Assets 9.58% Asset Quality NPAs / Assets 0.44% NPLs / Loans 0.29% Allowance / NPLs 321.15% Allowance / Loans 0.95% Net Charge Off Ratio 0.11% 100+ years of successful Profitability operating history 28 banking locations in 20 Texas ROAA 0.76% communities (32 locations with ROAE 7.78% Westbound) Focused on small- and medium- Net Interest Margin 3.38% sized businesses, professionals, executives and consumers Efficiency Ratio 65.61% Headquartered in Mount Noninterest Income to Average Assets 0.75% Pleasant, Texas with an additional corporate office in Noninterest Expense to Average Assets 2.55% Dallas, Texas 4

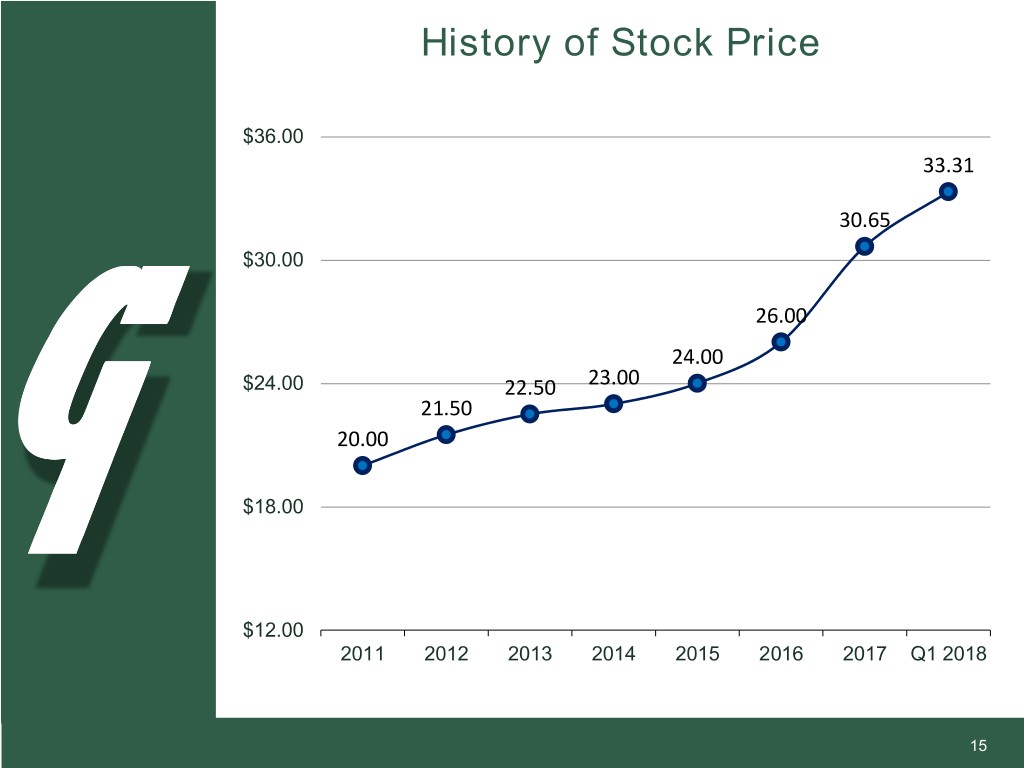

Investment Highlights • Respected Texas banking franchise with over a 100-year legacy that started in East Texas – Ranked in the top 3 by deposit market share in 7 of the 11 East Texas counties in which we operate • Started public trading on the NASDAQ as GNTY on May 9, 2017 • Currently focused on growing GBT presence in high-growth markets in the Dallas / Fort Worth MSA and the Central Texas region, and soon to be Houston MSA • Experienced leadership with strong reputation – Management has over 277 years of combined Texas banking experience – Have relocated select executive management into our new growth regions • Demonstrated success in acquisitions and de novo branching – Successful acquirer proven by three whole-bank acquisitions and one branch purchase since 2013 in addition to the Westbound Bank acquisition closing in June – Successful de novo branching proven by eight de novo locations since 2013 • Scalable platform with ability to increase profitability in recently established markets • Strong credit culture – Non-performing assets / total assets of 0.45% as of March 31, 2018 • Total return on GNTY stock from IPO price of $27.00 to March 31, 2018 price of $33.31 including dividends is 25.4% 5

Recent Franchise Expansion 6

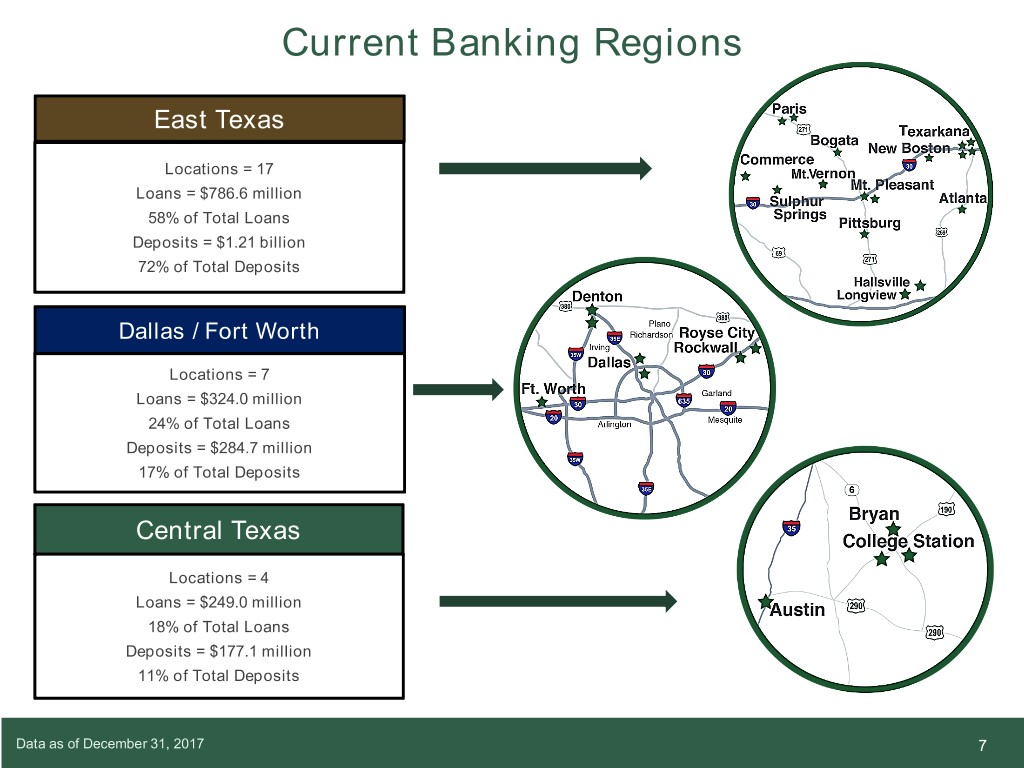

Current Banking Regions East Texas Locations = 17 Loans = $786.6 million 58% of Total Loans Deposits = $1.21 billion 72% of Total Deposits Dallas / Fort Worth Locations = 7 Loans = $324.0 million 24% of Total Loans Deposits = $284.7 million 17% of Total Deposits Central Texas Locations = 4 Loans = $249.0 million 18% of Total Loans Deposits = $177.1 million 11% of Total Deposits Data as of December 31, 2017 7

Future Banking Regions East Texas Locations = 17 1 Loans = $786.6 million Houston Market 52% of Total Loans Locations = 4 Deposits = $1.21 billion Loans = $160.3 million 65% of Total Deposits 11% of Total Loans Deposits = $188.1 million Dallas / Fort Worth 10% of Total Deposits Locations = 7 Loans = $324.0 million 21% of Total Loans Deposits = $284.7 million 15% of Total Deposits Central Texas Locations = 4 Loans = $249.0 million 16% of Total Loans Deposits = $177.1 million 9% of Total Deposits Data as of December 31, 2017 1 Assuming completion of our pending acquisition of Westbound Bank 8

Meaningful Growth Total Assets (Dollars in millions) Total Loans1 (Dollars in millions) $1,963 $1,361 $1,246 $1,828 $1,683 $1,071 $790 $1,334 $706 $1,246 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 Total Deposits (Dollars in millions) Core Earnings 2 (Dollars in millions) $25.4 $1,577 $1,676 $20.4 $1,466 $16.6 $15.0 $15.3 $1,077 $1,002 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 1 Total loans, including loans held for sale, as of each respective year-end. 2 Core earnings defined as pre-tax, pre-provision net earnings. See “Pre-Tax, Pre-Provision Methodology.” 9

Disciplined Credit & Risk Culture Net Charge Offs / Average Loans (%) Guaranty Bank & Trust, N.A. vs. Peer Groups 1.20% Average (National Peer Group**) 1.00% Average (Regional Peer Group*) 0.80% Guaranty Bank & Trust, N.A. 0.60% *Defined as all banks between $1.0 billion and $3.0 billion in assets located in the Dallas / Fort 0.40% Worth metroplex, East and Central Texas regions 0.20% **Defined as all banks between $1.0 billion and $3.0 billion in assets, nationally 0.00% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: S&P Global Market Intelligence - SNL 10

Culture & Employee Ownership “The secret sauce behind every great company The key to successful continued growth lies in our is always the same. It’s their culture. ability to attract and retain the best and brightest talent, while staying true to our core values and culture, and Our employees are owners and proud advocates never becoming complacent or content with our current of our brand and our culture. They provide the position or our risk management practices.” highest level of service and have an interest in good shareholder returns. – Ty Abston, CEO For 9 Straight Years What forces are driving our culture? Director, officer and employee ownership is 36.0% of our common stock, of which 11.9% as published in is owned by our employee stock ownership plan All prospective employees and board members receive a copy of our book The Guaranty Culture, which defines who we are, how we act and how we do business Strong commitment to community outreach and volunteerism 11

Pre-Tax, Pre-Provision Methodology (Dollars in thousands) 2013 2014 2015 2016 2017 Net earnings $ 9,776 $ 9,716 $ 10,111 $ 12,121 $ 14,439 Provision for loan losses 1,745 1,322 2,175 3,640 2,850 Income tax provision 4,009 4,023 4,362 4,715 8,238 Net realized (gain) loss on sale of securities (578) 212 (77) (82) (167) Pre-tax, pre-provision, pre-securities (gain) loss 14,952 15,273 16,571 20,394 25,360 Efficiency ratio 67.65% 69.47% 71.89% 69.36% 65.61% $25,360 $20,394 $16,571 $14,952 $15,273 2013 2014 2015 2016 2017 12

Loan Composition Guaranty 1 Westbound 1, 2 Pro Forma 1.6 1.5 1.4 3.5 3.3 10.1 14.4 10.6 13.8 13.6 12.5 32.0 34.6 4.6 4.4 56.1 2.7 10.2 27.1 25.3 2.7 2.5 2.7 Yield on Loans: 4.76% Yield on Loans: 5.53% Yield on Loans: 4.84% Construction & Development Agriculture 1-4 Family Residential Farmland Commercial Real Estate Multi-Family Residential Commercial & Industrial Consumer 1 Average balance for the three months ending March 31, 2018 2 Source: S&P Global Intelligence for Westbound Bank 13

Deposit Composition Guaranty 1 Westbound 1, 2 Pro Forma 0.5 4.0 3.6 18.0 21.3 19.8 23.9 24.2 35.8 9.6 15.7 16.4 37.4 37.0 32.8 Cost of Deposits: 1.03% Cost of Deposits: 1.07% Cost of Deposits: 1.03% Interest Bearing Demand Deposit Certificates of Deposit Money Market Savings Noninterest Bearing Demand Deposit 1 Average balance for the three months ending March 31, 2018 2 Source: S&P Global Intelligence for Westbound Bank 14

History of Stock Price $36.00 33.31 30.65 $30.00 26.00 24.00 $24.00 22.50 23.00 21.50 20.00 $18.00 $12.00 2011 2012 2013 2014 2015 2016 2017 Q1 2018 15

History of Dividends $0.60 0.53 0.52 0.50 0.50 $0.50 0.48 0.46 0.43 0.40 $0.40 $0.30 2010 2011 2012 2013 2014 2015 2016 2017 16

Westbound Bank Special Shareholder Meeting Q & A May 21, 2018