Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIFTH THIRD BANCORP | d569882dex991.htm |

| 8-K - 8-K - FIFTH THIRD BANCORP | d569882d8k.htm |

Fifth Third Bancorp Merger with MB Financial May 21, 2018 Refer to press release dated May 21, 2018 for further information. Exhibit 99.2

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed merger, Fifth Third Bancorp will file with the SEC a Registration Statement on Form S-4 that will include the Proxy Statement of MB Financial, Inc. and a Prospectus of Fifth Third Bancorp, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Fifth Third Bancorp and MB Financial, Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Fifth Third Bancorp at ir.53.com or from MB Financial, Inc. by accessing MB Financial, Inc.’s website at investor.mbfinancial.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Fifth Third Investor Relations at Fifth Third Investor Relations, MD 1090QC, 38 Fountain Square Plaza, Cincinnati, OH 45263, by calling (866) 670-0468, or by sending an e-mail to ir@53.com or to MB Financial, Attention: Corporate Secretary, at 6111 North River Road, Rosemont, Illinois 60018, by calling (847) 653-1992 or by sending an e-mail to dkoros@mbfinancial.com. Fifth Third Bancorp and MB Financial, Inc. and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of MB Financial, Inc. in respect of the transaction described in the Proxy Statement/Prospectus. Information regarding Fifth Third Bancorp’s directors and executive officers is contained in Fifth Third Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated March 6, 2018, which are filed with the SEC. Information regarding MB Financial, Inc.’s directors and executive officers is contained in its Proxy Statement on Schedule 14A filed with the SEC on April 3, 2018. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. FORWARD-LOOKING STATEMENTS This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Fifth Third Bancorp’s and MB Financial, Inc.’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in Fifth Third Bancorp’s and MB Financial, Inc.’s reports filed with or furnished to the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: the ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval of the merger by MB Financial, Inc.’s stockholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the businesses of MB Financial, Inc. or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Fifth Third Bancorp’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

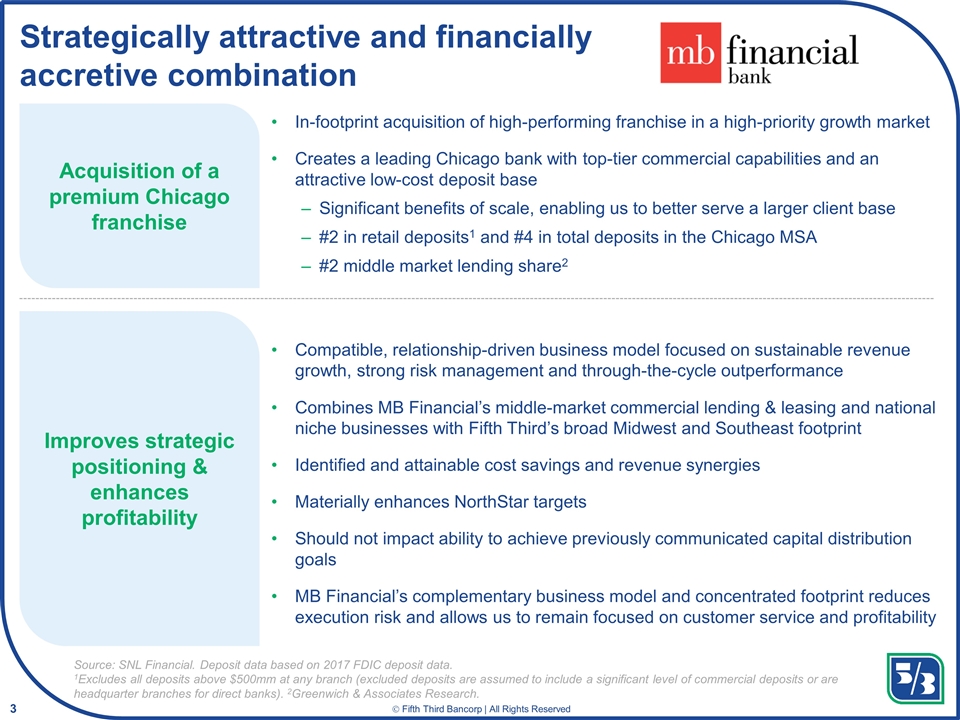

Strategically attractive and financially accretive combination Acquisition of a premium Chicago franchise Improves strategic positioning & enhances profitability In-footprint acquisition of high-performing franchise in a high-priority growth market Creates a leading Chicago bank with top-tier commercial capabilities and an attractive low-cost deposit base Significant benefits of scale, enabling us to better serve a larger client base #2 in retail deposits1 and #4 in total deposits in the Chicago MSA #2 middle market lending share2 Compatible, relationship-driven business model focused on sustainable revenue growth, strong risk management and through-the-cycle outperformance Combines MB Financial’s middle-market commercial lending & leasing and national niche businesses with Fifth Third’s broad Midwest and Southeast footprint Identified and attainable cost savings and revenue synergies Materially enhances NorthStar targets Should not impact ability to achieve previously communicated capital distribution goals MB Financial’s complementary business model and concentrated footprint reduces execution risk and allows us to remain focused on customer service and profitability Source: SNL Financial. Deposit data based on 2017 FDIC deposit data. 1Excludes all deposits above $500mm at any branch (excluded deposits are assumed to include a significant level of commercial deposits or are headquarter branches for direct banks). 2Greenwich & Associates Research.

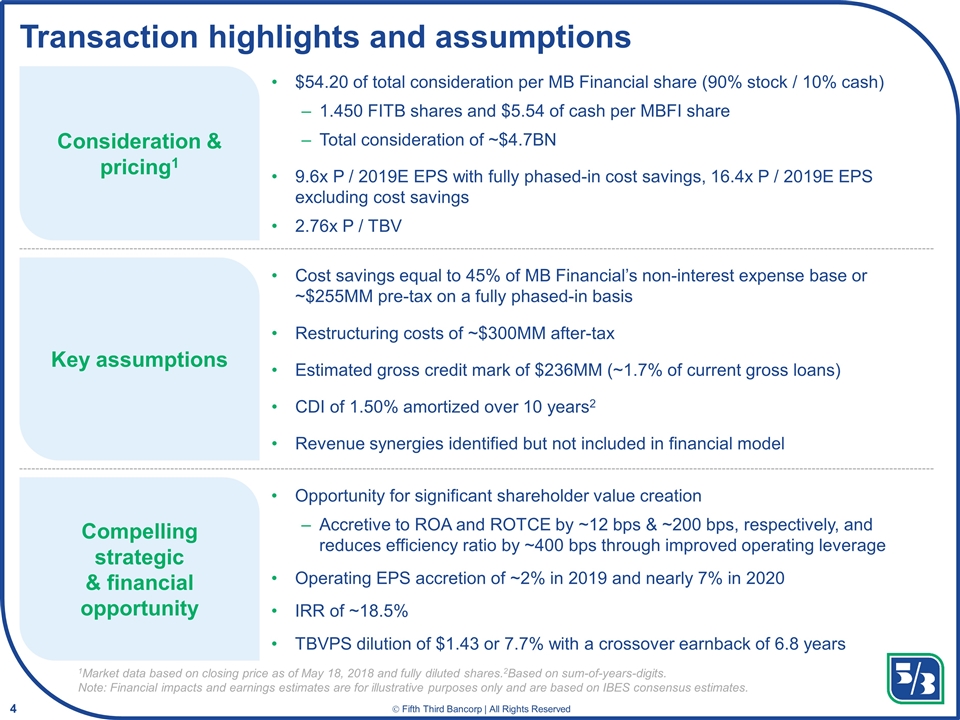

Transaction highlights and assumptions Compelling strategic & financial opportunity Opportunity for significant shareholder value creation Accretive to ROA and ROTCE by ~12 bps & ~200 bps, respectively, and reduces efficiency ratio by ~400 bps through improved operating leverage Operating EPS accretion of ~2% in 2019 and nearly 7% in 2020 IRR of ~18.5% TBVPS dilution of $1.43 or 7.7% with a crossover earnback of 6.8 years Consideration & pricing1 $54.20 of total consideration per MB Financial share (90% stock / 10% cash) 1.450 FITB shares and $5.54 of cash per MBFI share Total consideration of ~$4.7BN 9.6x P / 2019E EPS with fully phased-in cost savings, 16.4x P / 2019E EPS excluding cost savings 2.76x P / TBV Key assumptions Cost savings equal to 45% of MB Financial’s non-interest expense base or ~$255MM pre-tax on a fully phased-in basis Restructuring costs of ~$300MM after-tax Estimated gross credit mark of $236MM (~1.7% of current gross loans) CDI of 1.50% amortized over 10 years2 Revenue synergies identified but not included in financial model 1Market data based on closing price as of May 18, 2018 and fully diluted shares.2Based on sum-of-years-digits. Note: Financial impacts and earnings estimates are for illustrative purposes only and are based on IBES consensus estimates.

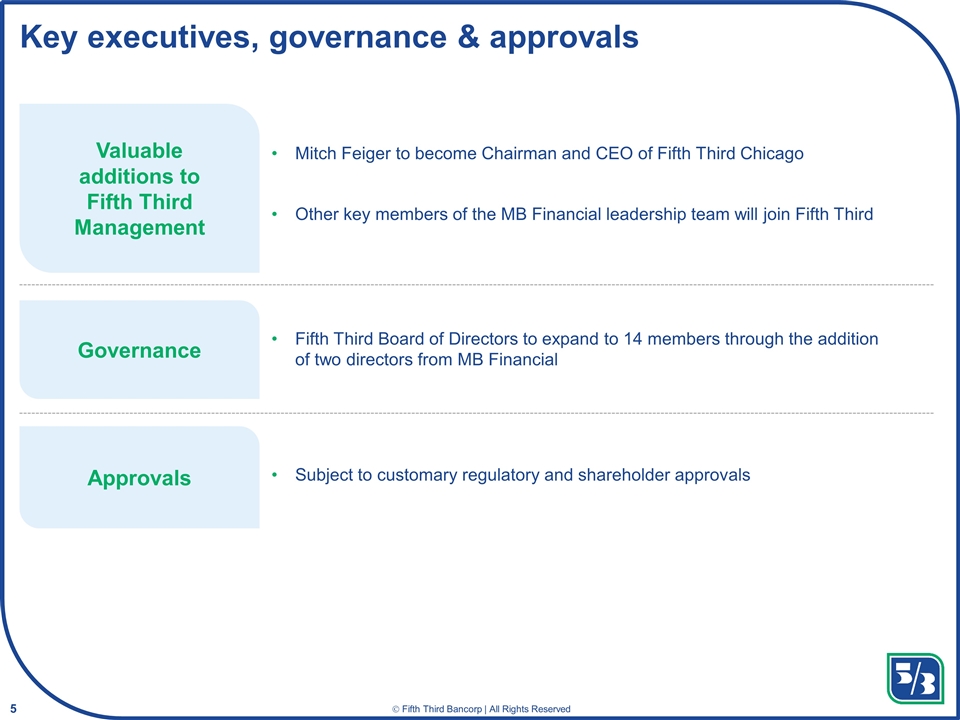

Key executives, governance & approvals Valuable additions to Fifth Third Management Approvals Mitch Feiger to become Chairman and CEO of Fifth Third Chicago Other key members of the MB Financial leadership team will join Fifth Third Subject to customary regulatory and shareholder approvals Governance Fifth Third Board of Directors to expand to 14 members through the addition of two directors from MB Financial

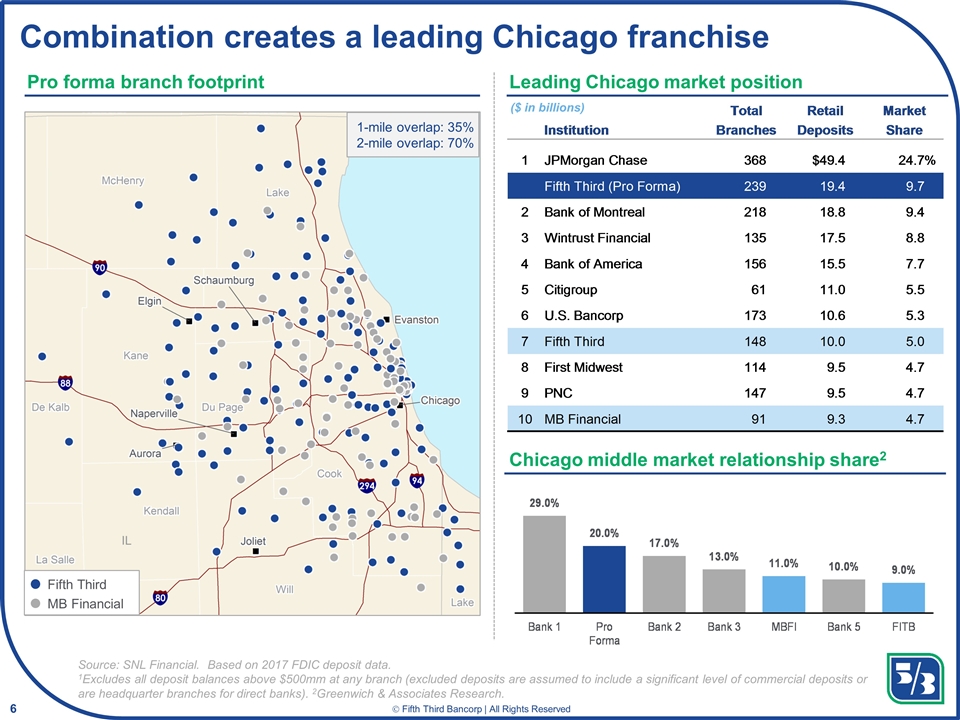

Combination creates a leading Chicago franchise Leading Chicago market position Pro forma branch footprint Fifth Third MB Financial Source: SNL Financial. Based on 2017 FDIC deposit data. 1Excludes all deposit balances above $500mm at any branch (excluded deposits are assumed to include a significant level of commercial deposits or are headquarter branches for direct banks). 2Greenwich & Associates Research. Chicago middle market relationship share2 1-mile overlap: 35% 2-mile overlap: 70% ($ in billions)

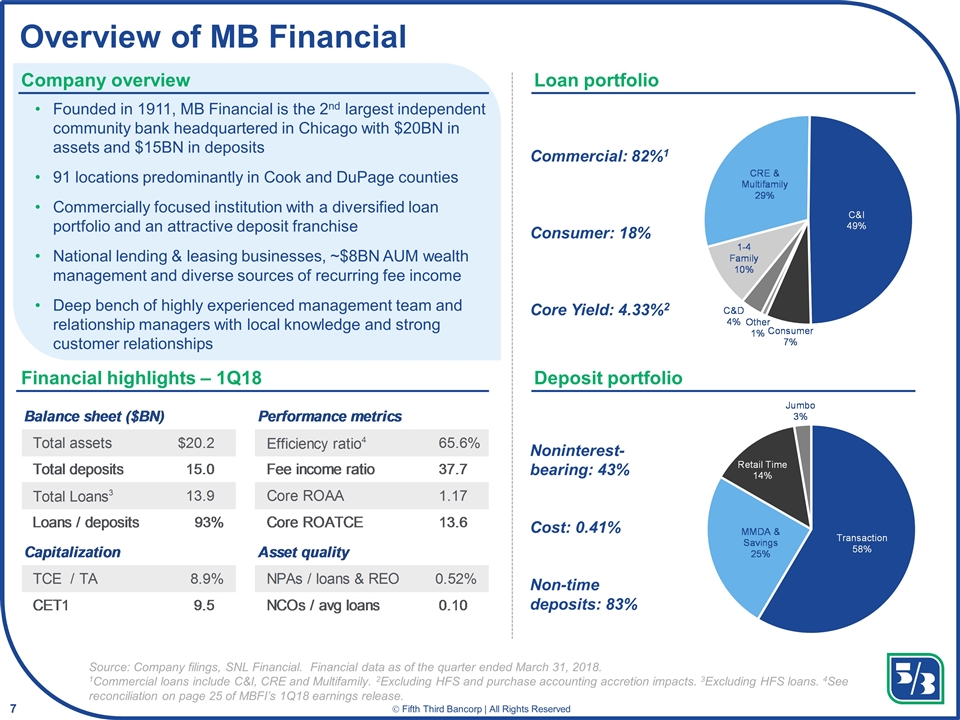

Overview of MB Financial Source: Company filings, SNL Financial. Financial data as of the quarter ended March 31, 2018. 1Commercial loans include C&I, CRE and Multifamily. 2Excluding HFS and purchase accounting accretion impacts. 3Excluding HFS loans. 4See reconciliation on page 25 of MBFI’s 1Q18 earnings release. Company overview Loan portfolio Deposit portfolio Financial highlights – 1Q18 Founded in 1911, MB Financial is the 2nd largest independent community bank headquartered in Chicago with $20BN in assets and $15BN in deposits 91 locations predominantly in Cook and DuPage counties Commercially focused institution with a diversified loan portfolio and an attractive deposit franchise National lending & leasing businesses, ~$8BN AUM wealth management and diverse sources of recurring fee income Deep bench of highly experienced management team and relationship managers with local knowledge and strong customer relationships Noninterest-bearing: 43% Cost: 0.41% Non-time deposits: 83% Commercial: 82%1 Consumer: 18% Core Yield: 4.33%2

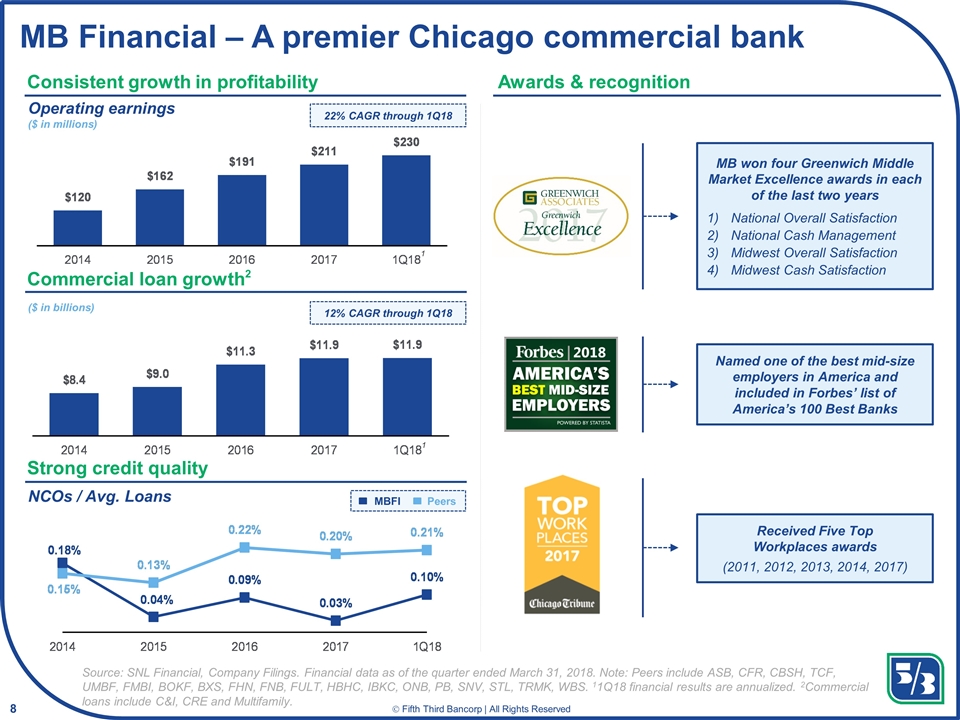

Commercial loan growth2 MB Financial – A premier Chicago commercial bank Consistent growth in profitability Source: SNL Financial, Company Filings. Financial data as of the quarter ended March 31, 2018. Note: Peers include ASB, CFR, CBSH, TCF, UMBF, FMBI, BOKF, BXS, FHN, FNB, FULT, HBHC, IBKC, ONB, PB, SNV, STL, TRMK, WBS. 11Q18 financial results are annualized. 2Commercial loans include C&I, CRE and Multifamily. Awards & recognition Strong credit quality MB won four Greenwich Middle Market Excellence awards in each of the last two years National Overall Satisfaction National Cash Management Midwest Overall Satisfaction Midwest Cash Satisfaction Received Five Top Workplaces awards (2011, 2012, 2013, 2014, 2017) Named one of the best mid-size employers in America and included in Forbes’ list of America’s 100 Best Banks NCOs / Avg. Loans MBFI Peers Operating earnings ($ in millions) 22% CAGR through 1Q18 12% CAGR through 1Q18 ($ in billions) 1 1

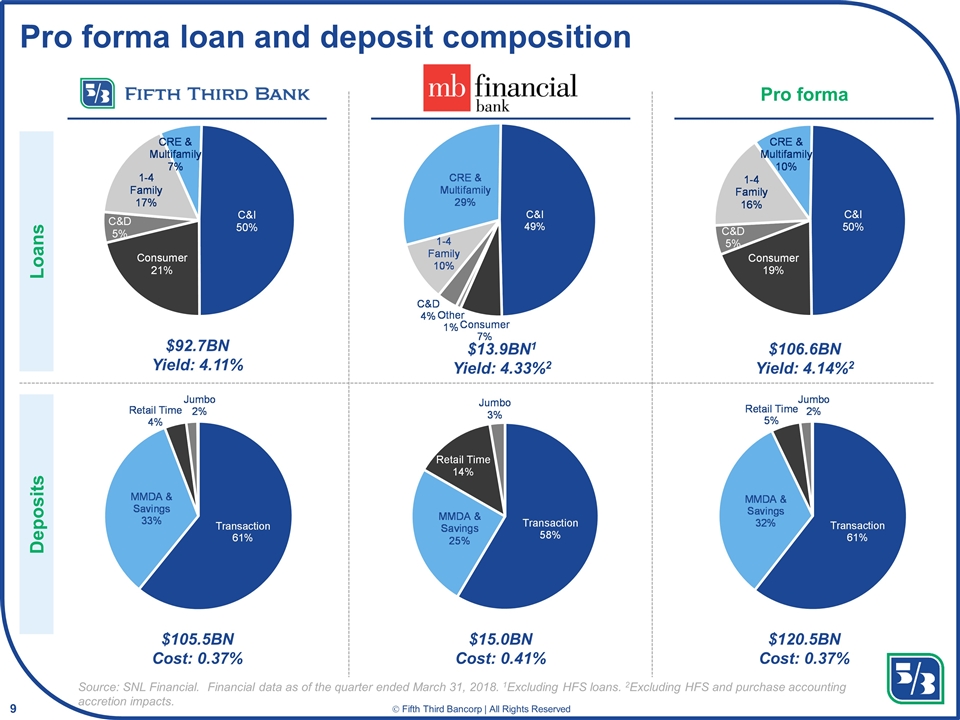

Pro forma loan and deposit composition Loans Deposits Pro forma $92.7BN Yield: 4.11% $105.5BN Cost: 0.37% $15.0BN Cost: 0.41% $120.5BN Cost: 0.37% $13.9BN1 Yield: 4.33%2 $106.6BN Yield: 4.14%2 Source: SNL Financial. Financial data as of the quarter ended March 31, 2018. 1Excluding HFS loans. 2Excluding HFS and purchase accounting accretion impacts.

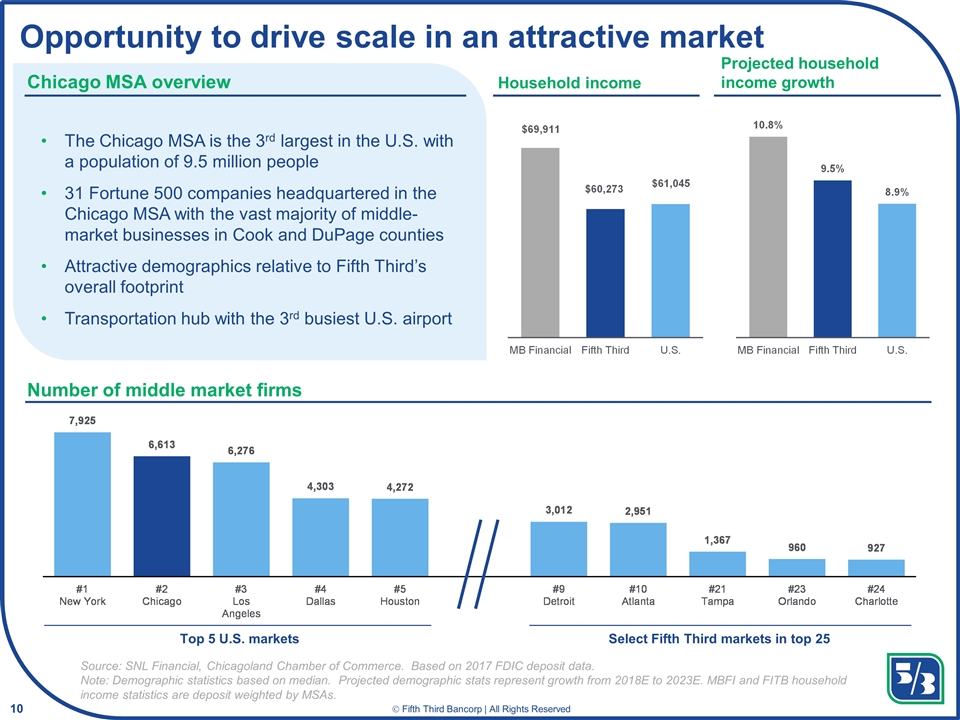

Number of middle market firms Opportunity to drive scale in an attractive market Chicago MSA overview The Chicago MSA is the 3rd largest in the U.S. with a population of 9.5 million people 31 Fortune 500 companies headquartered in the Chicago MSA with the vast majority of middle-market businesses in Cook and DuPage counties Attractive demographics relative to Fifth Third’s overall footprint Transportation hub with the 3rd busiest U.S. airport Source: SNL Financial, Chicagoland Chamber of Commerce. Based on 2017 FDIC deposit data. Note: Demographic statistics based on median. Projected demographic stats represent growth from 2018E to 2023E. MBFI and FITB household income statistics are deposit weighted by MSAs. Projected household income growth Household income Top 5 U.S. markets Select Fifth Third markets in top 25

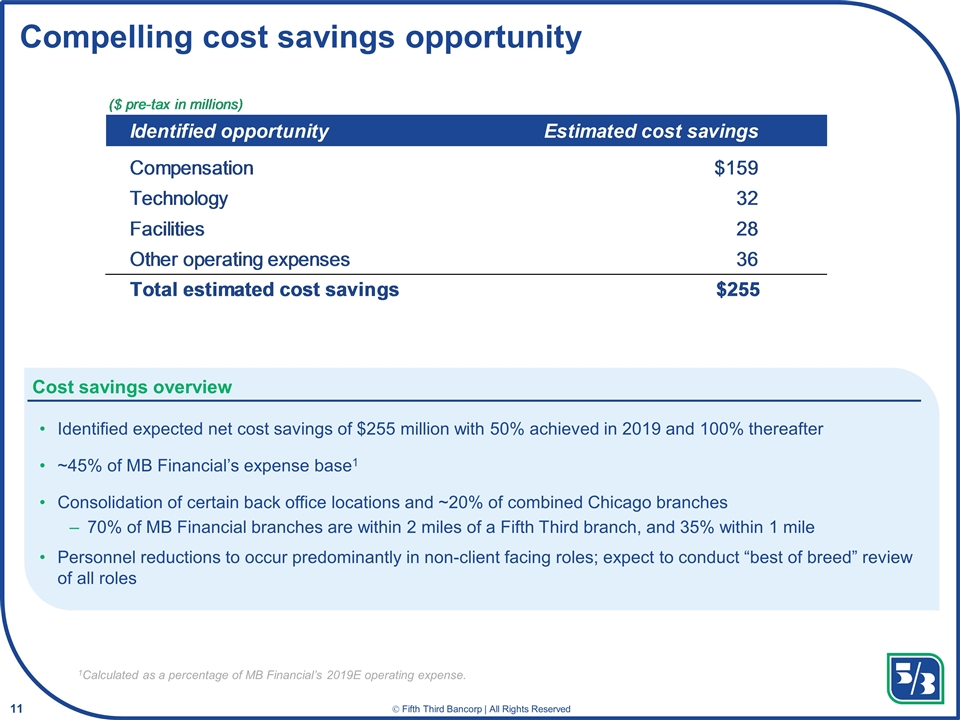

Compelling cost savings opportunity Cost savings overview Identified expected net cost savings of $255 million with 50% achieved in 2019 and 100% thereafter ~45% of MB Financial’s expense base1 Consolidation of certain back office locations and ~20% of combined Chicago branches 70% of MB Financial branches are within 2 miles of a Fifth Third branch, and 35% within 1 mile Personnel reductions to occur predominantly in non-client facing roles; expect to conduct “best of breed” review of all roles 1Calculated as a percentage of MB Financial’s 2019E operating expense.

Capitalizes on complementary strengths across franchise What MB Financial offers Diversified revenue base Efficient origination model in business banking Successful products and services able to be leveraged throughout footprint, including: Middle market banking franchise focused on smaller end of the market, including ABL Specialized equipment leasing in technology, healthcare, and equipment handling, among other areas Consumer banking products and services What Fifth Third offers Significant scale and range of products and services Robust capital markets capabilities Strong wealth & asset management teams Advanced treasury management products and services to appeal to middle market clients Innovative consumer payments and digital banking capabilities Leveraging a wider array of products and services to create strategic partnerships and generate higher returns

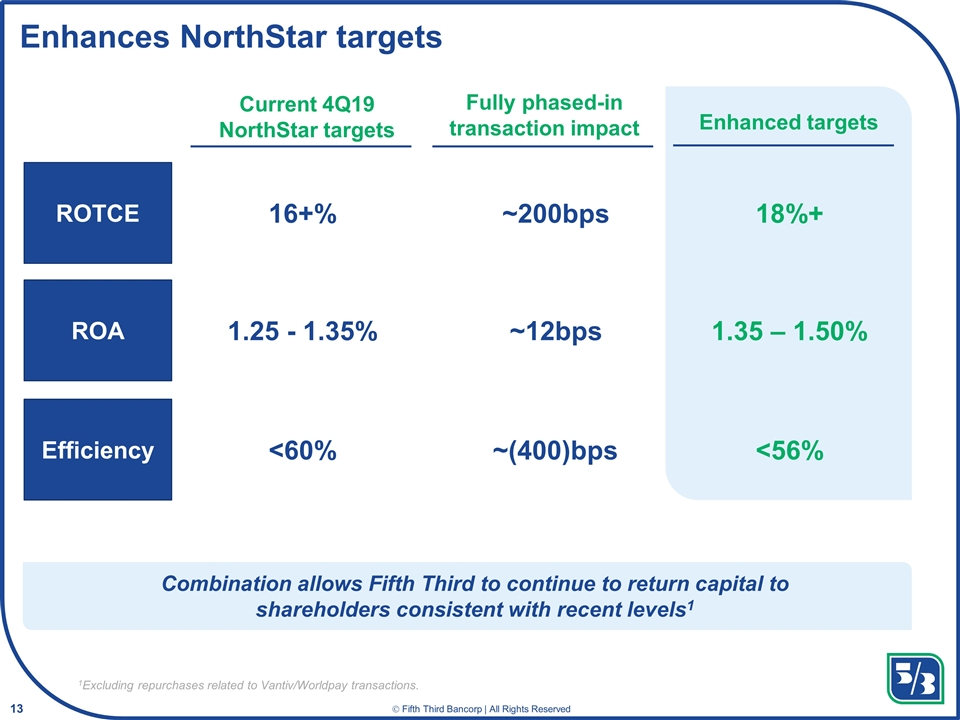

Enhances NorthStar targets Combination allows Fifth Third to continue to return capital to shareholders consistent with recent levels1 ROA Efficiency ROTCE Current 4Q19 NorthStar targets Fully phased-in transaction impact Enhanced targets <60% 1.25 - 1.35% 16+% ~200bps ~12bps ~(400)bps <56% 1.35 – 1.50% 18%+ 1Excluding repurchases related to Vantiv/Worldpay transactions.

Summary observations and takeaways Strategically important acquisition Adds significant scale in a priority market and enhances product and service delivery to a larger number of clients Builds upon strong commercial franchise with product expertise that can be deployed across a broader footprint Compatible corporate cultures with focus on customers and the community Financially attractive Substantial EPS accretion with improved profitability metrics above the previously-stated NorthStar targets Identified and realizable cost savings with additional upside from revenue synergies Internal rate of return in excess of alternative uses of capital Low-risk integration In-market acquisition with familiar customer and product base Thorough due-diligence process and clear integration plan Led by senior management with significant technology experience

15