Attached files

| file | filename |

|---|---|

| EX-32.1 - Brazil Minerals, Inc. | ex32_1.htm |

| EX-31.2 - Brazil Minerals, Inc. | ex31_2.htm |

| EX-31.1 - Brazil Minerals, Inc. | ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

⌧

|

QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the quarterly period ended March 31, 2018

|

◻

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from ____________ to ____________

Commission File Number 000-55191

Brazil Minerals, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

39-2078861

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

Rua Vereador João Alves Praes, nº 95-A

Olhos D'Água, MG 39398-000, Brazil

(Address of principal executive offices)

(213) 590-2500

(Registrant's telephone number, including area code)

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or, an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company", and "emerging growth company", in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☒

|

|

(Do not check if smaller reporting company)

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No ⌧

APPLICABLE ONLY TO CORPORATE ISSUERS

As of May 17, 2018 the registrant had 184,481,132 shares of common stock, par value $0.001 per share, issued and outstanding.

TABLE OF CONTENTS

|

|

|

Page

|

|

|

PART I - FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

|

|

Item 1.

|

Financial Statements

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets as of March 31, 2018 (Unaudited) and December 31, 2017

|

|

F-1

|

|

|

|

|

|

|

|

Consolidated Statements of Operations and Comprehensive Loss for the Three Months Ended March 31, 2018 and 2017 (Unaudited)

|

|

F-2

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2018 and 2017 (Unaudited)

|

|

F-3

|

|

|

|

||

|

|

Notes to the Consolidated Financial Statements (Unaudited)

|

|

F-4

|

|

|

|

|

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

|

15

|

|

|

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

22

|

|

|

|

|

|

|

Item 4.

|

Controls and Procedures.

|

|

22

|

|

|

|

|

|

|

PART II - OTHER INFORMATION

|

|

||

|

|

|

|

|

|

Item 6.

|

Exhibits

|

|

24

|

|

|

|

|

|

|

Signatures

|

|

25

|

|

|

|

|

|

|

|

Exhibits/Certifications

|

|

|

|

PART I - FINANCIAL INFORMATION

Item 1 FINANCIAL STATEMENTS

BRAZIL MINERALS, INC.

CONSOLIDATED BALANCE SHEETS

|

March 31,

|

December 31,

|

|||||||

|

2018

|

2017

|

|||||||

| (Unaudited) | (Audited) | |||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

26,709

|

$

|

84,107

|

||||

|

Taxes recoverable

|

27,714

|

27,846

|

||||||

|

Inventory

|

38,690

|

38,875

|

||||||

|

Deposits and advances

|

4,269

|

4,290

|

||||||

|

Total current assets

|

97,382

|

155,118

|

||||||

|

Capital assets:

|

||||||||

|

Property and equipment, net

|

341,276

|

365,472

|

||||||

|

Other assets:

|

||||||||

|

Intangible assets, net

|

617,864

|

620,805

|

||||||

|

Equity Investments

|

150,000

|

150,000

|

||||||

|

Total assets

|

$

|

1,206,522

|

$

|

1,291,395

|

||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

422,452

|

$

|

407,650

|

||||

|

Convertible notes payable, net of debt discounts totaling $160,787 and $219,608, respectively

|

734,499

|

665,394

|

||||||

|

Related party payable

|

559,800

|

537,183

|

||||||

|

Total current liabilities

|

1,716,751

|

1,610,227

|

||||||

|

Long term liabilities:

|

||||||||

|

Other noncurrent liabilities

|

202,930

|

200,815

|

||||||

|

Total liabilities

|

1,919,681

|

1,811,042

|

||||||

| Commitments and contingencies (Note 5) | - | - | ||||||

|

Stockholders' deficit:

|

||||||||

|

Series A preferred stock, $0.001 par value. 10,000,000 shares authorized; 1 share issued and outstanding

|

1

|

1

|

||||||

|

Common stock, $0.001 par value. 950,000,000 shares authorized; 168,155,392 and 121,274,424 shares

|

||||||||

|

issued and outstanding as of March 31, 2018 and December 31, 2017, respectively

|

168,155

|

121,274

|

||||||

|

Additional paid-in capital

|

45,884,146

|

45,788,819

|

||||||

|

Accumulated other comprehensive loss

|

(501,904

|

)

|

(524,819

|

)

|

||||

|

Stock purchase warrants

|

218,656

|

218,656

|

||||||

|

Accumulated deficit

|

(47,864,057

|

)

|

(47,515,131

|

)

|

||||

|

Total Brazil Minerals, Inc. stockholders' deficit

|

(2,095,003

|

)

|

(1,911,200

|

)

|

||||

|

Non-controlling interest

|

1,381,844

|

1,391,553

|

||||||

|

Total stockholders' deficit

|

(713,159

|

)

|

(519,647

|

)

|

||||

|

Total liabilities and stockholders' deficit

|

$

|

1,206,522

|

$

|

1,291,395

|

||||

The accompanying notes are an integral part of the consolidated financial statements.

F-1

BRAZIL MINERALS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (Unaudited)

|

Three Months Ended March 31,

|

Three Months Ended March 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

Revenue

|

$

|

4,915

|

$

|

3,396

|

||||

|

Cost of revenue

|

35,868

|

33,195

|

||||||

|

Gross margin

|

(30,953

|

)

|

(29,799

|

)

|

||||

|

Operating expenses:

|

||||||||

|

Professional fees

|

24,841

|

9,793

|

||||||

|

General and administrative

|

79,599

|

60,501

|

||||||

|

Compensation and related costs

|

61,023

|

83,639

|

||||||

|

Stock based compensation

|

12,500

|

-

|

||||||

|

Total operating expenses

|

177,963

|

153,933

|

||||||

|

Loss from operations

|

(208,916

|

)

|

(183,732

|

)

|

||||

|

Other expense (income):

|

||||||||

|

Interest on promissory notes

|

25,389

|

24,339

|

||||||

|

Amortization of debt discounts and other fees

|

124,330

|

66,311

|

||||||

|

Total other expense (income)

|

149,719

|

90,650

|

||||||

|

Loss before provision for income taxes

|

(358,635

|

)

|

(274,382

|

)

|

||||

|

Provision for income taxes

|

-

|

-

|

||||||

|

Net loss

|

(358,635

|

)

|

(274,382

|

)

|

||||

|

Loss attributable to non-controlling interest

|

(9,709

|

)

|

(5,077

|

)

|

||||

|

Net loss attributable to Brazil Minerals, Inc. stockholders

|

$

|

(348,926

|

)

|

$

|

(269,305

|

)

|

||

|

Basic and diluted loss per share

|

||||||||

|

Net loss per share attributable to Brazil Minerals, Inc. common stockholders

|

$

|

-

|

$

|

(0.01

|

)

|

|||

|

Weighted-average number of common shares outstanding:

|

||||||||

|

Basic and diluted

|

138,510,812

|

45,795,240

|

||||||

|

Comprehensive loss:

|

||||||||

|

Net loss

|

$

|

(358,635

|

)

|

$

|

(274,382

|

)

|

||

|

Foreign curreny translation adjustment

|

22,915

|

37,636

|

||||||

|

Comprehensive loss

|

(335,720

|

)

|

(236,746

|

)

|

||||

|

Comprehensive loss attributable to noncontrolling interests

|

(9,709

|

)

|

(5,077

|

)

|

||||

|

Comprehensive loss attributable to Brazil Minerals, Inc. stockholders

|

$

|

(326,011

|

)

|

$

|

(231,669

|

)

|

||

The accompanying notes are an integral part of the consolidated financial statements.

F-2

BRAZIL MINERALS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

Three Months Ended March 31,

|

Three Months Ended March 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

Cash flows from operating activities of continuing operations:

|

||||||||

|

Net loss

|

$

|

(358,635

|

)

|

$

|

(274,382

|

)

|

||

|

Adjustments to reconcile net loss to cash used in operating activities:

|

||||||||

|

Stock based compensation and services

|

12,500

|

-

|

||||||

|

Amortization of debt discounts

|

124,330

|

66,311

|

||||||

|

Common stock issued in satisfaction of other financing costs

|

1,050

|

-

|

||||||

|

Depreciation and amortization

|

23,006

|

23,393

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

-

|

2,759

|

||||||

|

Prepaid expenses

|

-

|

(4,015

|

)

|

|||||

|

Inventory

|

-

|

(75

|

)

|

|||||

|

Accounts payable and accrued expenses

|

19,895

|

10,811

|

||||||

|

Accrued salary due to officer

|

50,531

|

-

|

||||||

|

Other noncurrent liabilities

|

3,146

|

-

|

||||||

|

Net cash provided by (used in) operating activities

|

(124,177

|

)

|

(175,198

|

)

|

||||

|

Cash flows from investing activities:

|

||||||||

|

Acquisition of capital assets

|

-

|

(6,762

|

)

|

|||||

|

Advances to related parties

|

(1,173 | ) | - | |||||

|

Net cash provided by (used in) investing activities

|

(1,173

|

)

|

(6,762

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Loan from officer

|

(30,316

|

)

|

75,425

|

|||||

|

Net proceeds from sale of common stock

|

-

|

19,334

|

||||||

|

Proceeds from sale of subsidiary common stock to noncontrolling interests

|

-

|

6,666

|

||||||

|

Proceeds from convertible notes payable

|

68,836

|

110,250

|

||||||

|

Net cash provided by (used in) financing activities

|

38,520

|

211,675

|

||||||

|

Effect of exchange rates on cash and cash equivalents

|

30,165

|

14,990

|

||||||

|

Net increase (decrease) in cash and cash equivalents

|

(56,665

|

)

|

44,705

|

|||||

|

Cash and cash equivalents at beginning of period

|

83,374

|

6,268

|

||||||

|

Cash and cash equivalents at end of period

|

$

|

26,709

|

$

|

50,973

|

||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Cash paid for interest

|

$

|

-

|

$

|

-

|

||||

|

Cash paid for income taxes

|

$

|

-

|

$

|

-

|

||||

|

Supplemental disclosure of non-cash investing and financing activities:

|

||||||||

|

Shares issued in connection with conversion of debt and accrued interest

|

$

|

59,822

|

$

|

20,775

|

||||

|

Deferred financing costs accrued in relation to the issuance of debt

|

$

|

-

|

$

|

5,250

|

||||

|

Discount for beneficial conversion features on convertible notes

|

$

|

68,836

|

$

|

110,250

|

||||

The accompanying notes are an integral part of the consolidated financial statements.

F-3

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION, BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Description of Business

Brazil Minerals, Inc. ("Brazil Minerals" or the "Company") was incorporated as Flux Technologies, Corp. under the laws of the State of Nevada, U.S. on December 15, 2011. The Company changed its management and business on December 18, 2012, to focus on mineral exploration. Brazil Minerals, through subsidiaries, owns mineral rights in Brazil for gold, diamonds, cobalt, copper, lithium, manganese, nickel, precious gems (aquamarine, beryl, tourmaline) and sand, among others. In one of these rights, a mining concession, the Company currently mines diamonds, gold, and sand.

On July 27, 2016, upon approval by its Board of Directors, the Company sold a 99.99% equity interest in Mineração Jupiter Ltda to Jupiter Gold Corporation ("Jupiter Gold"), a newly created company, in exchange for 4,000,000 shares of the common stock of Jupiter Gold. On December 16, 2016, the Securities and Exchange Commission ("SEC") declared effective a Registration Statement filed by Jupiter Gold for the sale of shares in a public offering in the U.S. As of December 31, 2017, the Company has ownership of approximately 55.4% of the equity of Jupiter Gold. As such, the accounts and results of Jupiter Gold, and its subsidiary MJL, have been included in the Company's consolidated financial statements. See Note 2 for more information.

Management's Representation of Interim Financial Statements

The accompanying unaudited consolidated financial statements have been prepared by the Company without audit pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC"). Certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States ("GAAP") have been condensed or omitted as allowed by such rules and regulations, and management believes that the disclosures are adequate to make the information presented not misleading. These consolidated financial statements include all of the adjustments, which in the opinion of management are necessary to a fair presentation of financial position and results of operations. All such adjustments are of a normal and recurring nature. Interim results are not necessarily indicative of results for a full year. These consolidated financial statements should be read in conjunction with the audited consolidated financial statements at December 31, 2017 and 2016, as presented in the Company's Form 10-K filed on April 17, 2018 with the SEC.

Basis of Presentation

The consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles ("GAAP") of the United States of America and are expressed in United States dollars. The consolidated financial statements include the accounts of the Company and its subsidiaries. All material intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingencies at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results may differ from those estimates.

Going Concern

The consolidated financial statements have been prepared on a going concern basis which contemplates the realization of assets and the settlement of liabilities in the normal course of business. The Company has limited working capital, has incurred losses in each of the past two years, and has not yet received material revenues from sales of products or services. These factors create substantial doubt about the Company's ability to continue as a going concern. The consolidated financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

F-4

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

The ability of the Company to continue as a going concern is dependent on the Company generating cash from its operations, the sale of its stock and/or obtaining debt financing. Historically, the Company has funded its operations primarily through the sale of debt and equity securities and through the receipt of proceeds from revenues. Management's plan to fund its capital requirements and ongoing operations include an increase in cash received from sales of gold and rough diamonds recovered from a new modular processing and recovery plant. Management's secondary plan to cover any shortfall is selling its equity securities, including common stock in the Company or common stock in Jupiter Gold that it owns, and obtaining debt financing. There can be no assurance the Company will be successful in these efforts.

Share Count

All share and per share amounts have been restated to give effect to a 1-for-500 reverse split of the Company's common stock which became effective on January 27, 2017.

Fair Value of Financial Instruments

The Company follows the guidance of Accounting Standards Codification ("ASC") Topic 820 – Fair Value Measurement and Disclosure. Fair value is defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The guidance also establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the asset or liability and are developed based on market data obtained from sources independent of our Company. Unobservable inputs are inputs that reflect our Company's assumptions about the factors market participants would use in valuing the asset or liability. The guidance establishes three levels of inputs that may be used to measure fair value:

|

·

|

Level 1. Observable inputs such as quoted prices in active markets;

|

|

·

|

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

|

|

·

|

Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

|

The Company's financial instruments consist of cash and cash equivalents, accounts receivable, taxes recoverable, prepaid expenses, inventory, deposits and other assets, accounts payable, accrued expenses, deferred revenue and convertible notes payable. The carrying amount of these financial instruments approximates fair value due to either length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these consolidated financial statements.

Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents to the extent that the funds are not being held for investment purposes. The Company's bank accounts are deposited in FDIC insured institutions. Funds held in U.S. banks are insured up to $250,000 and funds held in Brazilian banks are insured up to $250,000 Brazilian Reais (translating into approximately $75,215 as of March 31, 2018).

Inventory

Inventory for the Company consists of ore stockpile, containing auriferous and diamondiferous gravel, which after processing in a recovery plant yields diamonds and gold, and is stated at lower of cost or market. No value was placed on sand. The amount of any write-down of inventories to net realizable value and all losses, are recognized in the period the write-down of loss occurs. At March 31, 2018 and December 31, 2017, inventory consisted primarily of rough ore stockpiled for further gold and diamonds recovery. During the three months ended March 31, 2018 and 2017, the Company did not record any write downs against the value of its inventory.

F-5

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Value-Added Taxes Receivable

The Company records a receivable for value added taxes recoverable from Brazilian authorities on goods and services purchased by its Brazilian subsidiaries. The Company intends to recover the taxes through the acquisition of capital equipment from sellers who accept tax credits as payments.

Property and Equipment

Property and equipment are stated at cost. Major improvements and betterments are capitalized. Maintenance and repairs are expensed as incurred. Depreciation is computed using the straight-line method over the estimated useful life. At the time of retirement or other disposition of property and equipment, the cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in the statements of operations as other gain or loss, net.

The diamond and gold processing plant and other machinery are depreciated over an estimated useful life of ten years; vehicles are depreciated over an estimated life of four years; and computer and other office equipment over an estimated useful life of three years.

Mineral Properties

Costs of exploration, carrying and retaining unproven mineral lease properties are expensed as incurred. Mineral property acquisition costs, including licenses and lease payments, are capitalized. Although the Company has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Company's rights. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

Impairment losses are recorded on mineral properties used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets' carrying amount. As of March 31, 2018 and December 31, 2017, the Company did not recognize any impairment losses related to mineral properties held.

Intangible Assets

For intangible assets purchased in a business combination, the estimated fair values of the assets received are used to establish their recorded values. For intangible assets acquired in a non-monetary exchange, the estimated fair values of the assets transferred (or the estimated fair values of the assets received, if more clearly evident) are used to establish their recorded values, unless the values of neither the assets received nor the assets transferred are determinable within reasonable limits, in which case the assets received are measured based on the carrying values of the assets transferred. Valuation techniques consistent with the market approach, income approach and/or cost approach are used to measure fair value. Intangible assets consist of mineral rights awarded by the Brazilian national mining department and held by the Company's subsidiaries.

Impairment of Long-Lived Assets

For long-lived assets, such as property and equipment and intangible assets subject to amortization, the Company continually monitors events and changes in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events or changes in circumstances are present, the Company assesses the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through undiscounted expected future cash flows. If the total of the future cash flows is less than the carrying amount of those assets, the Company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell.

Equity Investments without Readily Determinable Fair Values

In the first quarter of 2018, the Company adopted the ASU 2016-01, Financial Instruments — Overall (Subtopic 825-10). Under the new guidance, an entity shall no longer use the cost method of accounting as was applied before, but rather it can elect a measurement alternative for equity investments that do not have readily determinable fair values and do not qualify for the practical expedient in ASC 820 to estimate fair value using the NAV per share. Management assessed its investments and concluded that they should be accounted for using measurement alternative. Under this election, the Company measures its investments at cost, less any impairment, plus or minus any changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer. ASU 2016-01 requires the Company to make a separate election to use the measurement alternative for each eligible investment, and to apply the measurement alternative consistently from period to period until the investment's fair value becomes readily determinable. It further requires that the Company use the prospective method for all equity investments without readily determinable fair values.

F-6

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Revenue Recognition

On January 1, 2018, the Company adopted ASC Topic 606, Revenue from Contracts with Customers ("ASC 606"), using the modified retrospective method applied to those contracts which were not completed as of January 1, 2018. Results for reporting periods beginning after January 1, 2018 are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported in accordance with our historic accounting under ASC 605. As of and for the three months ended March 31, 2018, the consolidated financial statements were not materially impacted as a result of the application of Topic 606 compared to Topic 605.

The Company recognizes revenue under ASC 606, Revenue from Contracts with Customers. The core principle of the new revenue standard is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The following five steps are applied to achieve that core principle:

● Step 1: Identify the contract with the customer

● Step 2: Identify the performance obligations in the contract

● Step 3: Determine the transaction price

● Step 4: Allocate the transaction price to the performance obligations in the contract

● Step 5: Recognize revenue when the company satisfies a performance obligation

In order to identify the performance obligations in a contract with a customer, a company must assess the promised goods or services in the contract and identify each promised good or service that is distinct. A performance obligation meets ASC 606's definition of a "distinct" good or service (or bundle of goods or services) if both of the following criteria are met:

● The customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer (i.e., the good or service is capable of being distinct).

● The entity's promise to transfer the good or service to the customer is separately identifiable from other promises in the contract (i.e., the promise to transfer the good or service is distinct within the context of the contract).

If a good or service is not distinct, the good or service is combined with other promised goods or services until a bundle of goods or services is identified that is distinct.

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. The consideration promised in a contract with a customer may include fixed amounts, variable amounts, or both. When determining the transaction price, an entity must consider the effects of all of the following:

● Variable consideration

● Constraining estimates of variable consideration

● The existence of a significant financing component in the contract

● Noncash consideration

● Consideration payable to a customer

Variable consideration is included in the transaction price only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved.

F-7

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

The transaction price is allocated to each performance obligation on a relative standalone selling price basis.

The transaction price allocated to each performance obligation is recognized when that performance obligation is satisfied, at a point in time or over time as appropriate.

Costs of Goods Sold

Included within costs of goods sold are the costs of cutting and polishing rough diamonds and costs of production such as diesel fuel, labor, and transportation.

Stock-Based Compensation

The Company records stock-based compensation in accordance with ASC Topic 718, Compensation - Stock Compensation. ASC 718 requires companies to measure compensation cost for stock-based employee compensation at fair value at the grant date and recognize the expense over the employee's requisite service period. Under ASC 718, volatility is based on the historical volatility of our stock or the expected volatility of the stock of similar companies. The expected life assumption is primarily based on historical exercise patterns and employee post-vesting termination behavior. The risk-free interest rate for the expected term of the option is based on the U.S. Treasury yield curve in effect at the time of grant.

The Company utilizes the Black-Scholes option-pricing model, which was developed for use in estimating the fair value of options. Option-pricing models require the input of highly complex and subjective variables including the expected life of options granted and the expected volatility of our stock price over a period equal to or greater than the expected life of the options. Because changes in the subjective assumptions can materially affect the estimated value of our employee stock options, it is management's opinion that the Black-Scholes option-pricing model may not provide an accurate measure of the fair value of our employee stock options. Although the fair value of employee stock options is determined in accordance with ASC Topic 718 using an option-pricing model, that value may not be indicative of the fair value observed in a willing buyer/willing seller market transaction.

The Company has adopted a stock plan to attract, retain and motivate its directors, officers, employees, consultants and advisors. The Company's stock incentive plan provides for the issuance of up to 25,000,000 common shares for employees, consultants, directors, and advisors.

Foreign Currency

The Company's foreign subsidiaries use a local currency as the functional currency. Resulting translation gains or losses are recognized as a component of accumulated other comprehensive income. Transaction gains or losses related to balances denominated in a currency other than the functional currency are recognized in the consolidated statements of operations. Net foreign currency transaction losses included in the Company's consolidated statements of operations were negligible for all periods presented.

Income Taxes

The Company accounts for income taxes in accordance with ASC Topic 740, Income Taxes. ASC 740 requires a company to use the asset and liability method of accounting for income taxes, whereby deferred tax assets are recognized for deductible temporary differences, and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion, or all of, the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. As of March 31, 2018 and December 31, 2017, the Company's deferred tax assets had a full valuation allowance.

F-8

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Under ASC 740, a tax position is recognized as a benefit only if it is "more likely than not" that the tax position would be sustained in a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the "more likely than not" test, no tax benefit is recorded. The Company has identified the United States Federal tax returns as its "major" tax jurisdiction.

On December 22, 2017, the United States enacted the Tax Cuts and Jobs Act ("TCJA"), which instituted fundamental changes to the taxation of multinational corporations, including a reduction the U.S. corporate income tax rate to 21% beginning in 2018.

The TCJA also requires a one-time transition tax on the mandatory deemed repatriation of the cumulative earnings of certain of the Company's foreign subsidiaries as of December 31, 2017. To determine the amount of this transition tax, the Company must determine the amount of earnings generated since inception by the relevant foreign subsidiaries, as well as the amount of non-U.S. income taxes paid on such earnings, in addition to potentially other factors. The Company believes that no such tax will be due since its Brazilian subsidiaries have, when required, paid taxes locally and that they have incurred a cumulative operating deficit since inception.

Earnings (Loss) Per Share

The Company computes loss per share in accordance with ASC Topic 260, Earnings per Share, which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. As of March 31, 2018, the Company's potentially dilutive securities relate to common stock issuable in connection with convertible notes payable, options and warrants.

Other Comprehensive Income

Other comprehensive income is defined as the change in equity of a business enterprise during a period from transactions and other events and circumstances from non-owner sources, other than net income and including foreign currency translation adjustments.

Recent Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 840), to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. The amendments in this standard are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, for a public entity. Early adoption of the amendments in this standard is permitted for all entities and the Company must recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The Company is currently in the process of evaluating the effect this guidance will have on its financial statements and related disclosures.

We have reviewed other recent accounting pronouncements issued to the date of the issuance of these consolidated financial statements, and we do not believe any of these pronouncements will have a material impact on the Company.

F-9

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – COMPOSITION OF CERTAIN FINANCIAL STATEMENT ITEMS

Property and Equipment

The following table sets forth the components of the Company's property and equipment at March 31, 2018 and December 31, 2017:

|

March 31, 2018

|

December 31, 2017

|

||||||||||

|

Gross Carrying Amount

|

Accumulated Depreciation

|

Net Book Value

|

Gross Carrying Amount

|

Accumulated Depreciation

|

Net Book Value

|

||||||

|

Capital assets subject to depreciation:

|

|||||||||||

|

Computers, software and office equipment

|

897

|

(897)

|

-

|

901

|

(863)

|

38

|

|||||

|

Furniture and fixtures

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Machinery and equipment

|

518,391

|

(264,309)

|

254,082

|

520,645

|

(250,067)

|

270,578

|

|||||

|

Vehicles

|

199,213

|

(112,019)

|

87,194

|

200,164

|

(105,308)

|

94,856

|

|||||

|

Total fixed assets

|

718,501

|

(377,225)

|

341,276

|

721,710

|

(356,238)

|

365,472

|

|||||

For the three months ended March 31, 2018 and 2017, the Company recorded depreciation expense of $23,006 and $23,393, respectively.

Intangible Assets

Intangible assets consist of mining rights are not amortized as the mining rights are perpetual. The carrying value was $617,864 and $620,805 at March 31, 2018 and December 31, 2017, respectively.

Equity Investments without Readily Determinable Fair Values

On October 2, 2017, the Company entered into an exchange agreement whereby it issued 25,000,000 shares of its common stock in exchange for 500,000 shares of Ares Resources Corporation, a related party. The shares were recorded at $150,000, or $0.006 per share. The shares were valued based upon the lowest market price of the Company's common stock on the date the agreement.

Under ASC 825-10, the Company elected to use a measurement alternative for its equity investment that does not have a readily determinable fair value. As such, the Company measured its investment at cost, less any impairment, plus or minus any changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer.

The Company has recognized the cost of its investment in Ares, which is a private company with no readily determinable fair value, at its cost of $150,000 and accounts for the investment as an equity investment without a readily determinable fair value.

F-10

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Accounts Payable and Accrued Liabilities

|

March 31, 2018

|

December 31, 2017

|

|||||||

|

Accounts payable and other accruals

|

$

|

139,296

|

$

|

131,172

|

||||

|

Accrued interest

|

303,156

|

275,478

|

||||||

|

Total

|

$

|

442,452

|

$

|

406,650

|

||||

NOTE 3 – CONVERTIBLE PROMISSORY NOTES PAYABLE

Convertible Notes Payable - Fixed Conversion Price

On January 7, 2014, the Company issued to a family trust a senior secured convertible promissory note in the principal amount, and received gross proceeds, of $244,000 (the "Note") and warrants to purchase an aggregate of 488,000 shares of the Company's common stock at an exercise price of $62.50 per share through December 26, 2018 (the "Warrants"). The Company received gross proceeds of $244,000 for the sale of such securities. The outstanding principal of the Note bears interest at the rate of 12% per annum. All principal on the Note was payable on March 31, 2015 (the "Maturity Date"), which as of the date of this filing is past due and in technical default. The Company is in negotiations with the note holder to satisfy, amend the terms or otherwise resolve the obligation in default. No demand for payment has been made. As a result of the default, the interest rate on the Note increased to 30% per annum. Interest was payable on September 30, 2014 and on the Maturity Date. As of March 31, 2018, the Company has accrued interest payable totaling $255,909. The Note is convertible at the option of the holder into common stock of the Company at a conversion rate of one share for each $50.00 of principal and interest converted.

Convertible Notes Payable - Variable Conversion Price

At various times to fund operations, the Company issues convertible notes payable in which the conversion features are variable. In addition, some of these convertible notes payable have on issuance discounts and other fees withheld.

During the year ended December 31, 2016, the Company issued to one noteholder in various transactions $242,144 in convertible promissory notes with fixed floors and received an aggregate of $232,344 in proceeds. The convertible promissory notes each bear interest at 8.0% per annum and mature one year from issuance. After six months from issuance, each convertible promissory note is convertible at the option of the holder at a 50% discount to the lowest traded price of the Company's common stock over the previous 20 days. In addition, each note's conversion rate has a floor of $0.0001. Total debt discounts related to the beneficial conversion features of $241,852 were recorded and are being amortized over the life of the notes.

F-11

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

During the year ended December 31, 2017, the Company issued to one noteholder in various transactions $477,609 in convertible promissory notes with fixed floors and received an aggregate of $454,584 in proceeds. The convertible promissory notes each bear interest at 8.0% per annum and mature one year from issuance. After six months from issuance, each convertible promissory note is convertible at the option of the holder at a 50% discount to the lowest traded price of the Company's common stock over the previous 20 days. In addition, each note's conversion rate has a floor of $0.0001. Total debt discounts related to the beneficial conversion features of $447,272 were recorded and are being amortized over the life of the notes.

During the three months ended March 31, 2018, the Company issued to one noteholder in various transactions $71,586 in convertible promissory notes with fixed floors and received an aggregate of $68,826 in proceeds. The convertible promissory notes each bear interest at 8.0% per annum and mature one year from issuance. After six months from issuance, each convertible promissory note is convertible at the option of the holder at a 50% discount to the lowest traded price of the Company's common stock over the previous 20 days. In addition, each note's conversion rate has a floor of $0.0001. Total debt discounts related to the beneficial conversion features of $71,586 were recorded and are being amortized over the life of the notes.

As of March 31, 2018, the Company has $901,364 in principal of notes payable with remaining discounts of $166,864. The convertible notes payable incur interest at rates ranging from 8.0% to 30.0% per annum with due dates ranging from currently due to September 2018.

During the three months ended March 31, 2018 and 2017, $124,330 and $66,311 of the discounts were amortized to interest expense, respectively.

During the three months ended March 31, 2018 and 2017, the Company issued 46,880,968 and 3,329,701 shares of common stock upon conversion of $60,872 and $19,500, respectively, in notes payable and accrued interest.

Future Potential Dilution

Most of the Company's convertible notes payable contain adjustable conversion terms with significant discounts to market. As of March 31, 2018, the Company's convertible notes are convertible into an aggregate of approximately 547,803,000 shares of common stock. Due to the variable conversion prices on some of the Company's convertible notes, the number of common shares issuable is dependent upon the traded price of the Company's common stock.

NOTE 4 – STOCKHOLDERS' DEFICIT

Authorized and Amendments

The Company filed a 1-for-500 reverse split with the state of Nevada on December 15, 2016, which became effective on January 27, 2017. On February 15, 2017, the Company amended its Articles of Incorporation to increase the authorized number of shares of its common stock to 100 million shares. On October 23, 2017, an amendment of the charter of the Company filed with the Secretary of State of Nevada increased the number of authorized common shares to 250,000,000.

As of December 31, 2017, the Company had 250,000,000 common shares authorized with a par value of $0.001 per share.

On March 15, 2018, an amendment of the charter of the Company filed with the Secretary of State of Nevada increased the number of authorized common shares to 950,000,000.

As of March 31, 2018, the Company had 950,000,000 common shares authorized with a par value of $0.001 per share.

F-12

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Series A Preferred Stock

On December 18, 2012, the Company filed with the Nevada Secretary of State a Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock ("Series A Stock") to designate one share of a new series of preferred stock. The Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock provides that for so long as Series A Stock is issued and outstanding, the holders of Series A Stock shall vote together as a single class with the holders of the Company's Common Stock, with the holders of Series A Stock being entitled to 51% of the total votes on all such matters regardless of the actual number of shares of Series A Stock then outstanding, and the holders of Common Stock are entitled to their proportional share of the remaining 49% of the total votes based on their respective voting power.

Three Months Ended March 31, 2018 Common Stock Transactions

During the three months ended March 31, 2018, the Company issued 46,880,968 shares of common stock upon conversion of $60,872 in convertible notes payable and accrued interest.

Three Months Ended March 31, 2017 Common Stock Transactions

During the three months ended March 31, 2017, the Company issued 1,600,000 shares of common stock for cash proceeds of $26,000. Additionally, the Company issued 3,329,701 shares of common stock upon conversion of $19,500 in convertible notes payable and accrued interest.

See Note 3 for additional discussions of common stock issuances in connection with convertible notes.

Common Stock Options

During the year ended December 31, 2017, the Company granted options to purchase an aggregate of 10,226,100 shares of common stock to non-management directors. The options were valued at $87,500 in total. The options were valued using the Black-Scholes option pricing model with the following average assumptions: our stock price on date of grant (range of $0.03 to $0.07), expected dividend yield of 0%, historical volatility ranging from 221% to 234%, risk-free interest rate of 1.80%, and an expected term of 5.00 years.

During the three months ended March 31, 2018, the Company granted options to purchase an aggregate of 4,893,000 shares of common stock to non-management directors. The options were valued at $12,500 in total. The options were valued using the Black-Scholes option pricing model with the following average assumptions: our stock price on the date of the grant ($0.0026), expected dividend yield of 0%, historical volatility calculated at 217%, risk-free interest rate of 1.80%, and an expected term of 5 years.

NOTE 5 – COMMITMENTS AND CONTINGENCIES

Operating Leases

The Company leases offices in Pasadena, California, U.S., and in the municipality of Olhos D'Agua, Brazil. Such costs are immaterial to the consolidated financial statements.

F-13

BRAZIL MINERALS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 6 - RELATED PARTY TRANSACTIONS

Chief Executive Officer

As of March 31, 2018 and December 31, 2017, amounts payable to the Chief Executive Officer for accrued salaries, retirement contributions, and advances made net of any repayments included within related party payable were $541,238 and $502,397, respectively.

Investment in Ares Resources Corporation's Common Stock

On October 2, 2017, the Company entered into an exchange agreement whereby it issued 25,000,000 shares of its common stock in exchange for 500,000 shares of Ares Resources Corporation, a related party. The shares were recorded at $150,000, or $0.006 per share. The shares were valued based upon the lowest market price of the Company's common stock on the date the agreement. As of March 31, 2018 and December 31, 2017, no change in the value of the Ares common stock was recorded as the recorded value still approximated fair value.

NOTE 7 - SUBSEQUENT EVENTS

In accordance with FASB ASC 855-10 Subsequent Events, the Company has analyzed its operations subsequent to March 31, 2018 to the date these consolidated financial statements were issued, and has determined that it does not have any material subsequent events to disclose in these consolidated financial statements, except as follows:

As of May 20, 2018, our subsidiary Jupiter Gold was near completion of the initial drilling campaign of its Paracatu Project and already struck gold in eleven of twelve holes drilled. Gold particles were visually seen in all positive drill holes and confirmed in pan concentrates in samples taken. Samples being collected at one-meter intervals of depth, to be processed for quantitative geochemical analysis at a premier analytical laboratory. The Paracatu Project consists of a mineral right for gold in this well-known gold district. Paracatu is home to the largest gold mine in Brazil, "Morro do Ouro" (Gold Hill), owned and operated by Kinross Gold, a large global producer. Morro do Ouro is an open-sky mine, with an ore body of 16 million ounces of gold, and annual production of 480,000 ounces, according to publicly-available information. The Paracatu Project area is located only a few miles downstream from Morro do Ouro.

F-14

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our unaudited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

This Quarterly Report contains forward-looking statements. Forward-looking statements for Brazil Minerals, Inc. reflect current expectations, as of the date of this Quarterly Report, and involve certain risks and uncertainties. Actual results could differ materially from those anticipated in these forward- looking statements as a result of various factors. Factors that could cause future results to materially differ from the recent results or those projected in forward-looking statements include: unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production; market fluctuations; government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection; competition; the loss of services of key personnel; unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of infrastructure as well as general economic conditions.

Description of Business

Overview

Brazil Minerals, Inc. with its controlled subsidiaries ("Brazil Minerals", the "Company", "we", "us", or "our") is an exploration project generator in Brazil with a large variety of minerals, and directly mines one area for gold, diamonds and sand. We consolidate the results of our controlled in this Annual Report.

Our progress as an exploration project generator has been steady. In early 2013 we owned mineral rights for gold and diamonds. Since then we have grown our land bank of high quality mineral properties that we own (the "BMIX Mineral Bank") several-fold to currently include mineral rights for gold, diamonds, cobalt, copper, lithium, manganese, nickel, precious gems (aquamarine, beryl, tourmaline) and sand.

In parallel, we are developing a portfolio of holdings of public mineral company equities for specific minerals and/or projects, of which the first one is Jupiter Gold Corporation ("Jupiter Gold"). Jupiter Gold has been a public company since December 16, 2016, and we own approximately 55.4% of Jupiter Gold's equity.

Mineral Properties

Our mineral properties are listed in the following table and summarized below.

- 15 -

|

Project Name

|

Minerals

|

Location (state, country)

|

Area (acres)

|

Status

|

|

Jequitinhonha Valley

|

Diamonds, Gold, Sand

|

Minas Gerais, Brazil

|

27,955

|

active mining

|

|

Paracatu*

|

Gold

|

Minas Gerais, Brazil

|

795

|

initial drilling campaign ongoing

|

|

Goiás

|

Cobalt, Copper, Nickel

|

Goiás, Brazil

|

5,011

|

pre-research planning

|

|

Salinas

|

Lithium, Aquamarine, Beryl, Tourmaline, Granite, Feldspar

|

Minas Gerais, Brazil

|

288

|

pre-research planning

|

|

Crixás*

|

Gold

|

Goiás, Brazil

|

4,925

|

research phase

|

|

Itabira*

|

Gold

|

Minas Gerais, Brazil

|

4,069

|

research phase

|

|

Diamantina*

|

Manganese

|

Minas Gerais, Brazil

|

4,970

|

research phase

|

|

Serrita*

|

Gold

|

Pernambuco, Brazil

|

14,169

|

pre-research planning

|

|

Amazonas*

|

Gold

|

Amazonas, Brazil

|

69,030

|

pre-research planning

|

* Projects owned by our subsidiary, Jupiter Gold.

Diamond, Gold, Sand – Jequitinhonha Valley

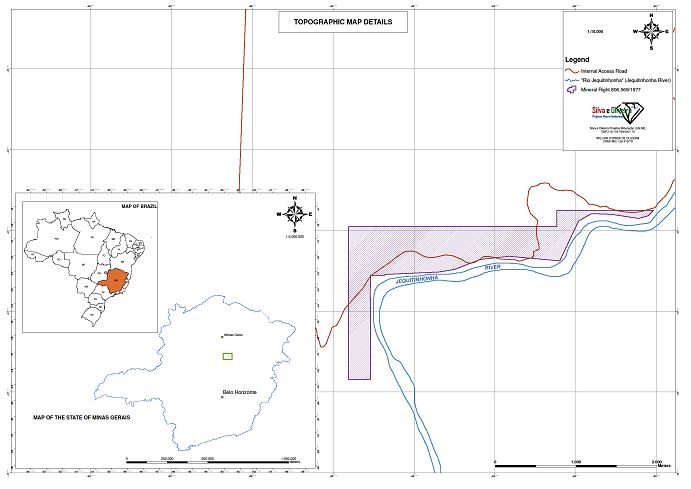

Brazil Minerals, through subsidiaries, has 31 mineral rights for diamond, gold, and sand, on and near the margins of the Jequitinhonha River in the state of Minas Gerais in Brazil. The Jequitinhonha River valley is a well-known area for diamond and gold production; it has hosted alluvial production since the 18th century.

One of our mineral rights, covering 422 acres, is a mining concession for diamond, gold and sand. Our concession, awarded by the Brazilian federal government through the Brazilian mining department, is the highest level of mineral right in Brazil. It permits us to mine in perpetuity provided that environmental licenses are kept current and that mining guidelines are followed.

Mineralization

Vaaldiam, the previous owner of this mining concession, and at that time a publicly-traded Canadian company, performed detailed geological studies leading to the publication of an NI 43-101 technical report in 2007, with an update in 2008, as required by the rules of the Canadian securities administrator and filed in SEDAR. The NI 43-101 report describes the existence of mineralized materials amounting to 1,639,200 cubic meters with the following concentrations: 0.16 carats of diamonds per cubic meter and 182 milligrams of gold per cubic meter. Vaaldiam also submitted a bankable feasibility study to the Brazilian mining department in accordance with local regulations. The NI 43-101 technical report and the bankable feasibility study were not prepared in accordance with the SEC-sanctioned Industry Guide 7 for mining companies. Under such regulation, no assertion can be made about reserves and the term "resources" is not recognized.

Equipment & Processing

Gold and diamonds are present within gravel found in alluvial material in our concession area. Following drilling for identification of mineralized areas, we excavate the chosen perimeters, and gravel is removed and accumulated by excavator and bulldozer working together and later transported by truck to our recovery unit described below.

- 16 -

Recovery Plants

We have two working recovery plants for diamonds and gold. Our subsidiary, Jupiter Gold owns a modular recovery plant which utilizes a large centrifuge for recovery, currently deployed in this concession area. During 2017, this plant was completed, tested and made operational. The plant uses centrifugation as the primary method of gold separation. Material identified as potentially containing diamonds is retrieved and further processed in specific high-precision equipment for detection of diamonds, located in our large plant, as described below.

The modular plant is highly cost-effective and has become our preferred method of gold and diamond recovery. Under an agreement between Brazil Minerals and Jupiter Gold, this modular plant is solely operated by Brazil Minerals which retains 100% of the diamonds and 50% of the gold recovered from it, while the other 50% of gold is for the account of Jupiter Gold. Under U.S. GAAP consolidation of financial results for subsidiaries, any gold revenues obtained by Jupiter Gold are added to the revenues of Brazil Minerals.

Our other plant at this concession is regarded as the largest such type in Latin America and capable of processing upwards of 45 tons of gravel per hour of operation. It was acquired when we took over the concession. From the best information we have, this plant cost $2.5 million and was built by South African mining engineers. We utilize the state-of-the-art diamond recovery facilities from this large plant, following separation of concentrated diamondiferous-yielding material obtained after initial processing in our modular plant. We also utilize the gold laboratory unit of the large plant for final processing of gold obtained from our modular plant.

Fuel & Water

All of our equipment at the concession runs on diesel, purchased from multiple local vendors. Our water comes from lagoons that receive water from the Jequitinhonha River. We do not utilize any chemicals in any processes.

No Chemicals

All of our processing is based on washing auriferous and diamondiferous gravel with water, then applying physical processes such as sieving, shaking, followed by centrifugation. Gold and diamonds are heavy substances, allowing separation by such methods. The final step in diamond recovery uses diffraction differential in light emitted by diamonds versus non-diamonds.

Sand

The mining concession contains a sand bay from which in natura sand is extracted via excavator and sold to truckers. Our sand is of high-quality and sought after locally for civil construction projects.

Logistics

Our mining concession is an approximately one and half hour drive from Montes Claros with a population close to 700,000 people, with all needed services and the regional airport.

- 17 -

Map

Additional Area

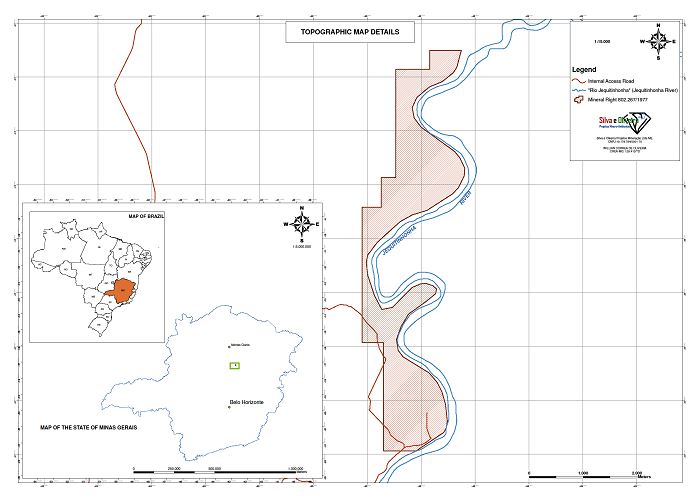

We have obtained an initial permit for mining another mineral right that is located approximately 2 miles downstream from the mining concession described above. This mineral right has 1,310 acres, and our current authorization covers only a small part of this available surface area. We have drilled this area and identified presence of both gold and diamonds. We intend to move to this area for recovery after further exploitation of the mining concession described above. A map of this area is found below.

- 18 -

Map

Gold – Paracatu

The Paracatu Project, held by our subsidiary, Jupiter Gold, consists of a mineral right for gold in this well-known gold district. This area of Brazil was settled in the early 17th century by pioneers searching for gold. Today Paracatu is home to the largest gold mine in Brazil, "Morro do Ouro" (Gold Hill), owned and operated by Kinross Gold, a large global producer. Morro do Ouro is an open-sky mine, with an ore body of 16 million ounces of gold, and annual production of 480,000 ounces, according to publicly-available information. The Paracatu Project area is located only a few miles downstream from Morro do Ouro.

As of May 20, 2018, Jupiter Gold is progressing in a drilling campaign of its Paracatu Project and already struck gold in eleven of twelve holes drilled. Gold particles were visually seen in all positive drill holes and confirmed in pan concentrates in samples taken. Samples being collected at one-meter intervals of depth, to be processed for quantitative geochemical analysis at a premier analytical laboratory.

- 19 -

Gold – Crixás

The Crixás Project, held by our subsidiary Jupiter Gold, consists of a mineral right for gold in this well-known gold district. This area of Brazil was settled in the 18th century by pioneers searching for gold. Today Crixás is home to the some of the largest gold operations in Brazil, with large gold mines and projects from AngloGold Ashanti and Cleveland Mining. AngloGold Ashanti's operations in Crixás encompass three underground and two open sky mines, with an ore body of greater than 7 million ounces of gold and annual production of 132,000 ounces, according to publicly-available information.

The Crixás Project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

Gold – Itabira

The Itabira Project, held by our subsidiary Jupiter Gold, consists of a mineral right for gold in a region of Brazil near the city of Itabira called the "Quadrilátero Ferrífero" (Iron Quandrangle) known for large iron mines as well as gold mines.

The Itabira Project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

Manganese – Diamantina

The Diamantina Project, held by our subsidiary, Jupiter Gold, consists of two mineral rights for manganese in the region in and surrounding Diamantina where other companies have explored for manganese.

The Diamantina Project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

Cobalt, Copper, Nickel – Goiás

The Goiás Project, held by our subsidiary Jupiter Gold, consists of two mineral rights for cobalt, copper, and nickel in the region in and surrounding Montes Claros de Goiás, where other companies have explored for these minerals, and some of the largest Brazilian reserves of nickel are located, according to publicly-available information.

The Goiás project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Lithium – Salinas

The Salinas Project consists of a mineral right for lithium, aquamarine, beryl, tourmaline, granite, and feldspar in the Salinas district, where other companies have explored for these minerals.

The Salinas Project is exploratory, and we intend to study the area or enter into a partnership for its study.

Gold – Serrita

The Serrita Project, held by our subsidiary, Jupiter Gold, consists of three mineral rights for gold in the Serrita district, a known gold district.

The Serrita Project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Gold – Amazonas

The Amazonas Project, held by our subsidiary, Jupiter Gold, consists of three mineral rights for gold in the Apui area, a known gold district.

- 20 -

The Amazonas Project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Results of Operations

Quarter Ended March 31, 2018 Compared to Quarter ended March 31, 2017

In the quarter ended March 31, 2018, we had revenues of $4,915 as compared to revenues of $3,396 in the quarter ended March 31, 2017, an increase of 44.7%. This increase is explained by more days of mining within the rainy season in 2018 as compared to the same period in 2017. The rainy season in northern Minas Gerais state normally lasts from late November to early April, and limits open-sky operations.

Our consolidated cost of goods sold in the first quarter of 2018 was $35,868, consisting entirely of production expenses, and comparable to our consolidated cost of goods sold in the first quarter of 2017, which was $33,195, an increase of 8.1%. This was attributable to the increase in the price of diesel from 2017 to 2018, and to more mining days within the rainy season in the first quarter of 2018 versus that in 2017.

Our gross loss in the first quarter of 2018 was $30,953, as compared to our gross loss in the first quarter of 2017 of $29,799, an increase of 3.9%. This result was due the simultaneous increase in revenues and decrease in the consolidated cost of goods sold.

We had an aggregate of $177,963 in operating expenses in the first quarter of 2018, as compared to an aggregate of $153,933 in operating expenses in the third quarter of 2017, an increase of 15.6%. This change was due primarily to higher general and administrative expenses and stock-based compensation in the first quarter of 2018 in comparison to the same period in 2017 and which were greater than the decline in compensation and other expenses seen in the first quarter of 2018 in relation to the first quarter of 2017.

In the first quarter of 2018 we had total other expenses of $149,719 as compared to $90,650 in the first quarter of 2017, an increase of 65.2%. This change was due primarily to higher interest in promissory notes which more than compensated for lower amortization of debt discount and other fees between the first quarter of 2018 and the same period in 2017.

In the first quarter of 2018, we experienced a net loss attributable to Brazil Minerals, Inc. common stockholders of $348,926, as compared to a net loss of $269,305 in the first quarter of 2017, an increase of 29.6%. This change was due to the greater loss from operations and the greater amount of total other expenses in the first quarter of 2018 versus the same period in 2017.

On a per share basis (both basic and diluted), in the first quarter of 2018, we had net loss attributable to Brazil Minerals, Inc. common stockholders of $0.00, as compared to a net loss attributable to Brazil Minerals, Inc. common stockholders of $0.01 in the first quarter of 2017. This change is primarily explained by the increase in share count between these periods which more than mitigated the change seen in net loss.

Net cash used in operating activities was $124,177 in the first three months of 2018, as compared to $175,198 in the first three months of 2017. Net cash used in investing activities was ($1,173) in the first three months of 2018, as compared to $6,762 in the first three months of 2017. Net cash provided by financing activities was $38,520 in the first three months of 2018, as compared to $211,675 in the first three months of 2017.

- 21 -

Liquidity and Capital Resources

As of March 31, 2018, we had total current assets of $97,382 compared to total current liabilities of $1,716,751 for a current ratio of 0.06 to 1 and working capital of ($1,619,369). By comparison, on March 31, 2017, we had total current assets of $169,416 compared to current liabilities of $1,127,458 for a current ratio of 0.15 to 1 and working capital of ($958,042).

In the first quarter of 2018, our sources of liquidity were revenues, proceeds from debt issued, and proceeds of equity issuance to a subsidiary. Our ability to continue as a going concern is dependent on our ability to generated cash from revenues, and/or to successfully sell equity and/or debt, all of which provide cash flow for operations. We believe that we will continue to be successful in these efforts but there can be no assurance. We have no plans for any significant cash acquisitions for the remainder of 2018 or in the foreseeable future.

Off-Balance Sheet Arrangements

We currently have no off-balance sheet arrangements.

Critical Accounting Policies and Estimates

Our financial instruments consist of cash and cash equivalents, loans to a related party, accrued expenses, and an amount due to a director. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in our financial statements. If our estimate of the fair value is incorrect at March 31, 2018, it could negatively affect our financial position and liquidity and could result in our having understated our net loss.

Recent Accounting Pronouncements

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles. Our significant accounting policies are described in Note 1 of the financial statements. We have reviewed all recent accounting pronouncements issued to the date of the issuance of these financial statements, and we do not believe any of these pronouncements will have a material impact on us.

Item 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None

Item 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Pursuant to Item 305(e) of Regulation S-K (§ 229.305(e)), the Company is not required to provide the information required by this Item as it is a "smaller reporting company," as defined by Rule 229.10(f)(1).

- 22 -

Item 4. CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the design, operation, and effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act as of March 31, 2018. On the basis of that evaluation, management concluded that our disclosure controls and procedures designed to provide reasonable assurance that the information required to be disclosed in reports filed or submitted pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act") is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission (the "Commission"), and that such information is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer as appropriate, to allow timely decisions regarding required disclosure were not effective for the reasons described in Item 4(b), but we intend to make them effective by the actions described in Item 4(b).

(b) Management's Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Our internal control system is designed to provide reasonable assurance to management and to our Board of Directors regarding the preparation and fair presentation of published financial statements. Our Chief Executive Officer and Chief Financial Officer conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on his evaluation under the framework in Internal Control—Integrated Framework, he concluded that our internal control over financial reporting was effective as of March 31, 2018.