Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH JERSEY INDUSTRIES INC | a8k2018agapresentation.htm |

American Gas Association Financial Forum May 20-22, 2018

Forward-Looking Statements and Use of Non-GAAP Measures Certain statements contained in this presentation may qualify as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact should be considered forward-looking statements made in good faith and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “expect”, “estimate”, “forecast”, “goal”, “intend”, “objective”, “plan”, “project”, “seek”, “strategy”, “target”, “will” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. These risks and uncertainties include, but are not limited to, the following: general economic conditions on an international, national, state and local level; weather conditions in our marketing areas; changes in commodity costs; changes in the availability of natural gas; “non-routine” or “extraordinary” disruptions in our distribution system; regulatory, legislative and court decisions; competition; the availability and cost of capital; costs and effects of legal proceedings and environmental liabilities; the failure of customers or suppliers to fulfill their contractual obligations; and changes in business strategies. These cautionary statements should not be construed by you to be exhaustive. While SJI believes these forward- looking statements to be reasonable, there can be no assurance that they will approximate actual experience. Further, SJI undertakes no obligation to update or revise any of its forward-looking statements, whether as a result of new information, future events or otherwise. This presentation includes certain non-GAAP financial measures, which the Company believes are useful in evaluating its performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. The Company has provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the supplemental information portion of this presentation. Investor Contact: Eric Jacobson 609-561-9000 x4363 ejacobson@sjindustries.com 2

Participants At AGA Financial Forum Mike Renna Steve Clark President and CEO EVP/CFO South Jersey Industries South Jersey Industries Steve Cocchi Dave Robbins SVP/Strategy & Development SVP/President SJG South Jersey Industries South Jersey Industries Greg Nuzzo Ann Anthony SVP/President Energy Solutions VP/Treasurer and Corporate Secretary South Jersey Industries South Jersey Industries Dan Fidell Eric Jacobson Investor Relations Representative Manager, Investor Relations South Jersey Industries South Jersey Industries 3

Table of Contents • Company Overview • South Jersey Gas • Acquisition Update • Midstream • Non-Regulated Operations • Energy Group • Energy Services • Recent Financial Performance • Appendix 4

Company Overview 5

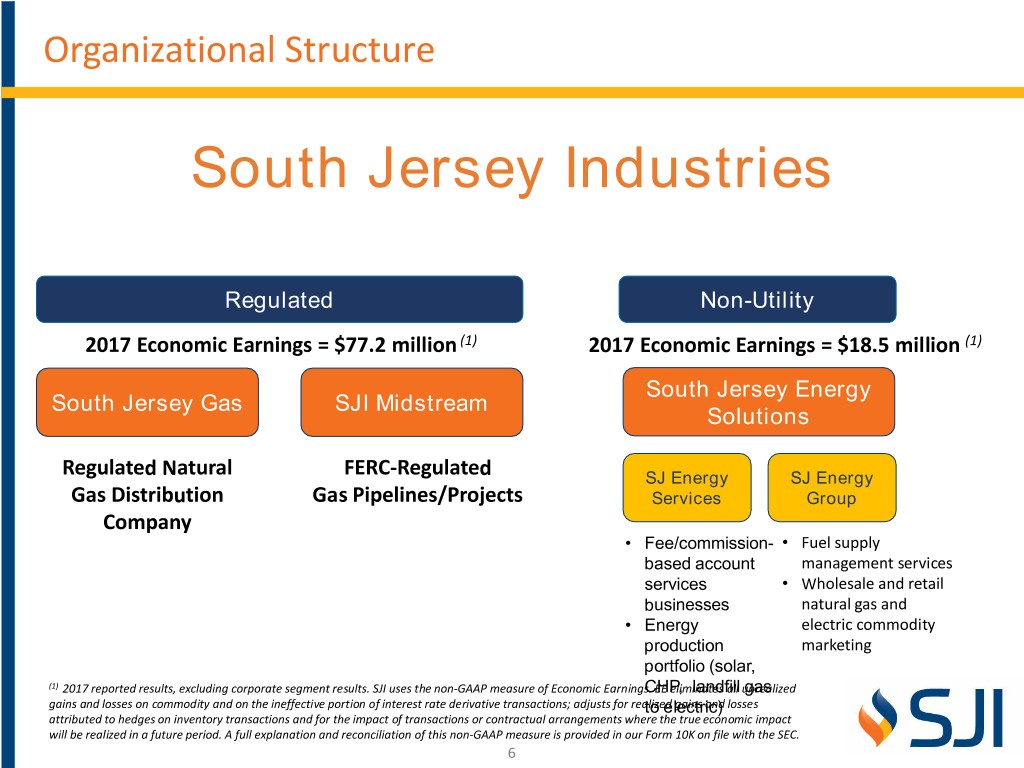

Organizational Structure South Jersey Industries Regulated Non-Utility 2017 Economic Earnings = $77.2 million (1) 2017 Economic Earnings = $18.5 million (1) South Jersey Energy South Jersey Gas SJI Midstream Solutions Regulated Natural FERC-Regulated SJ Energy SJ Energy Gas Distribution Gas Pipelines/Projects Services Group Company • Fee/commission- • Fuel supply based account management services services • Wholesale and retail businesses natural gas and • Energy electric commodity production marketing portfolio (solar, (1) 2017 reported results, excluding corporate segment results. SJI uses the non-GAAP measure of Economic Earnings.CHP, EE eliminates landfill all unrealizedgas gains and losses on commodity and on the ineffective portion of interest rate derivative transactions; adjusts for realizedto electric) gains and losses attributed to hedges on inventory transactions and for the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period. A full explanation and reconciliation of this non-GAAP measure is provided in our Form 10K on file with the SEC. 6

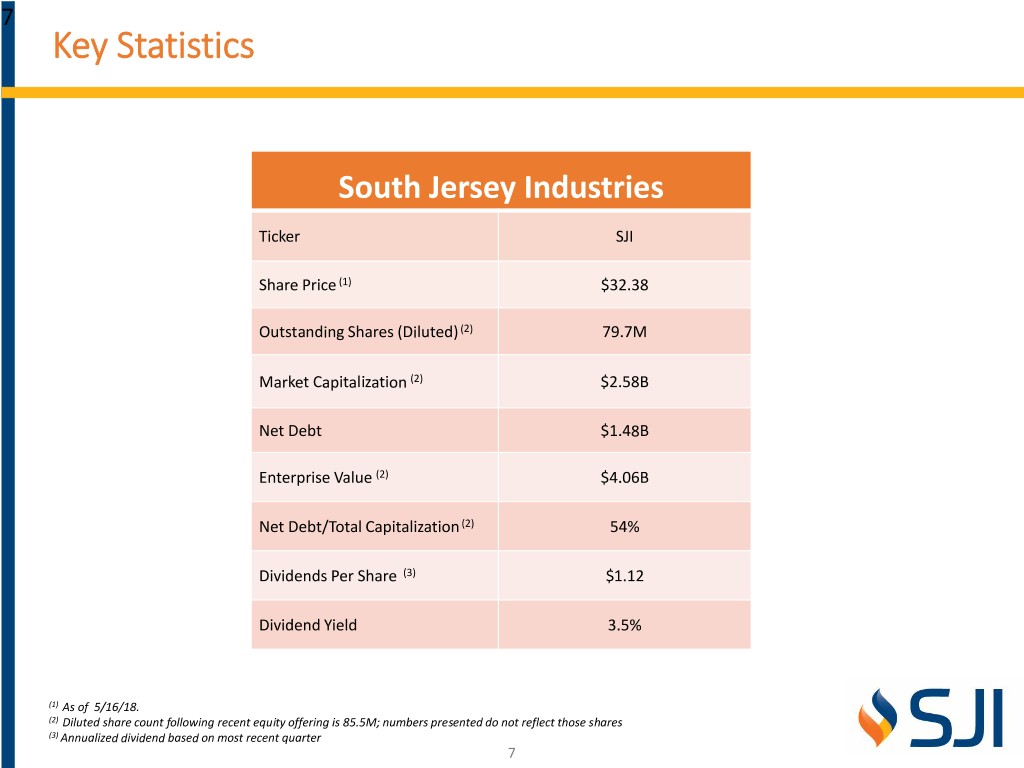

7 Key Statistics South Jersey Industries Ticker SJI Share Price (1) $32.38 Outstanding Shares (Diluted) (2) 79.7M Market Capitalization (2) $2.58B Net Debt $1.48B Enterprise Value (2) $4.06B Net Debt/Total Capitalization (2) 54% Dividends Per Share (3) $1.12 Dividend Yield 3.5% (1) As of 5/16/18. (2) Diluted share count following recent equity offering is 85.5M; numbers presented do not reflect those shares (3) Annualized dividend based on most recent quarter 7

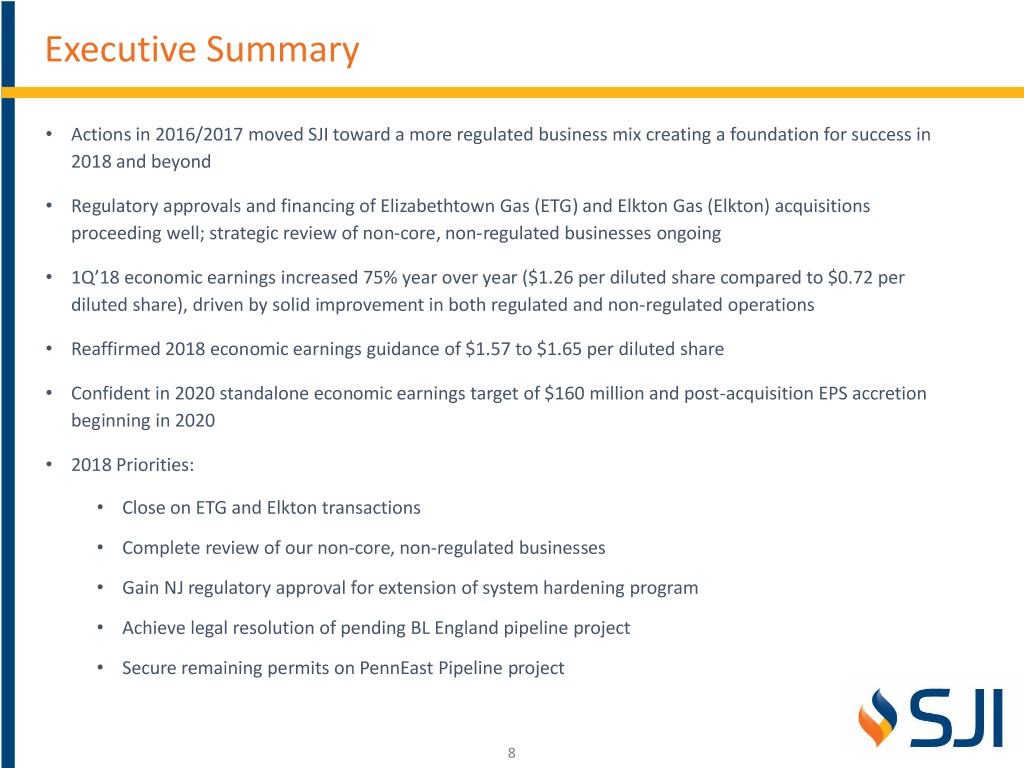

Executive Summary • Actions in 2016/2017 moved SJI toward a more regulated business mix creating a foundation for success in 2018 and beyond • Regulatory approvals and financing of Elizabethtown Gas (ETG) and Elkton Gas (Elkton) acquisitions proceeding well; strategic review of non-core, non-regulated businesses ongoing • 1Q’18 economic earnings increased 75% year over year ($1.26 per diluted share compared to $0.72 per diluted share), driven by solid improvement in both regulated and non-regulated operations • Reaffirmed 2018 economic earnings guidance of $1.57 to $1.65 per diluted share • Confident in 2020 standalone economic earnings target of $160 million and post-acquisition EPS accretion beginning in 2020 • 2018 Priorities: • Close on ETG and Elkton transactions • Complete review of our non-core, non-regulated businesses • Gain NJ regulatory approval for extension of system hardening program • Achieve legal resolution of pending BL England pipeline project • Secure remaining permits on PennEast Pipeline project 8

Business Transformation On Track • In 2015, began planned shift in operating strategy toward a more regulated business mix • Plan driven by desire to increase the quality of earnings by increasing investment in utility and FERC-regulated assets that provide highly-visible cash flows and earnings • Plan also sought to reduce earnings volatility and optimize the value of our non-core, non- regulated businesses • In 2016, announced cessation of new investment in solar projects, reduced our portfolio of on- site energy production businesses, and significantly strengthened our balance sheet through a successful equity offering • In 2017, announced plan to acquire ETG and Elkton, and received Certificate of Public Convenience and Necessity for PennEast from FERC • In 2018, completed highly-successful equity raise for ETG and Elkton, and announced strategic review of non-regulated businesses 9

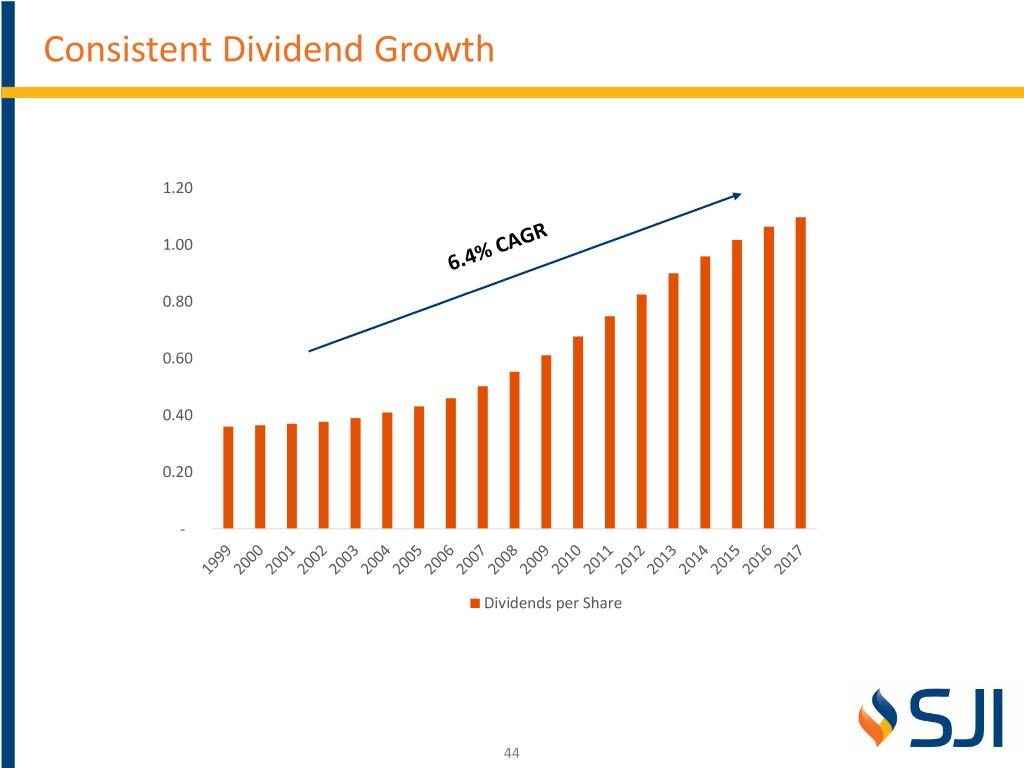

Delivering Shareholder Value Annual Dividend Growth(1) Economic Earnings (excluding ITC) grew at a compounded rate of 13% from 2013 - 2017 Economic Earnings(2) $104.0 $102.8 $36.9 $97.1 $99.0 $98.1 $1.07 $1.10 $1.02 $0.96 $0.90 $60.2 $73.7 $60.7 $93.7 $73.7 $93.7 $98.1 $60.7 $60.2 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 Non-ITC ITC 1 Based on actual dividends paid in each respective year 2 SJI uses the non-GAAP measure of Economic Earnings (EE.) EE eliminates all unrealized gains and losses on commodity and on the ineffective portion of interest rate derivative transactions; adjusts for realized gains and losses attributed to hedges on inventory transactions and for the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period or was realized in a previous period. 10

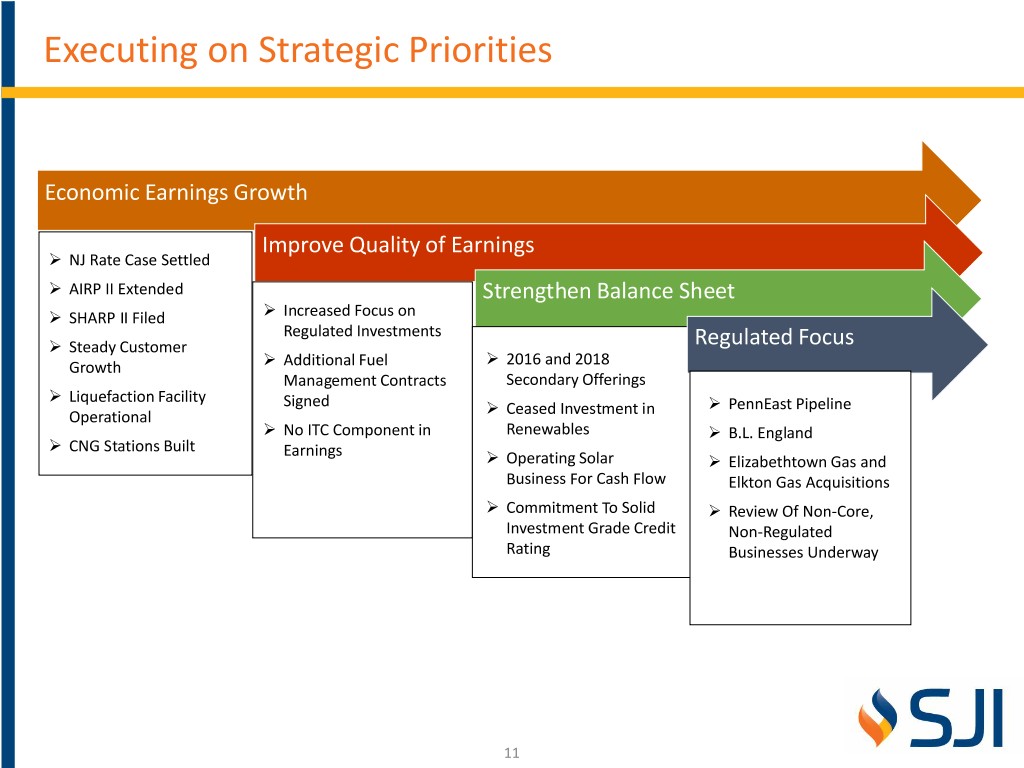

Executing on Strategic Priorities Economic Earnings Growth Improve Quality of Earnings NJ Rate Case Settled AIRP II Extended Strengthen Balance Sheet SHARP II Filed Increased Focus on Regulated Investments Steady Customer Regulated Focus Growth Additional Fuel 2016 and 2018 Management Contracts Secondary Offerings Liquefaction Facility Signed PennEast Pipeline Operational Ceased Investment in No ITC Component in Renewables B.L. England CNG Stations Built Earnings Operating Solar Elizabethtown Gas and Business For Cash Flow Elkton Gas Acquisitions Commitment To Solid Review Of Non-Core, Investment Grade Credit Non-Regulated Rating Businesses Underway 11

South Jersey Gas 12

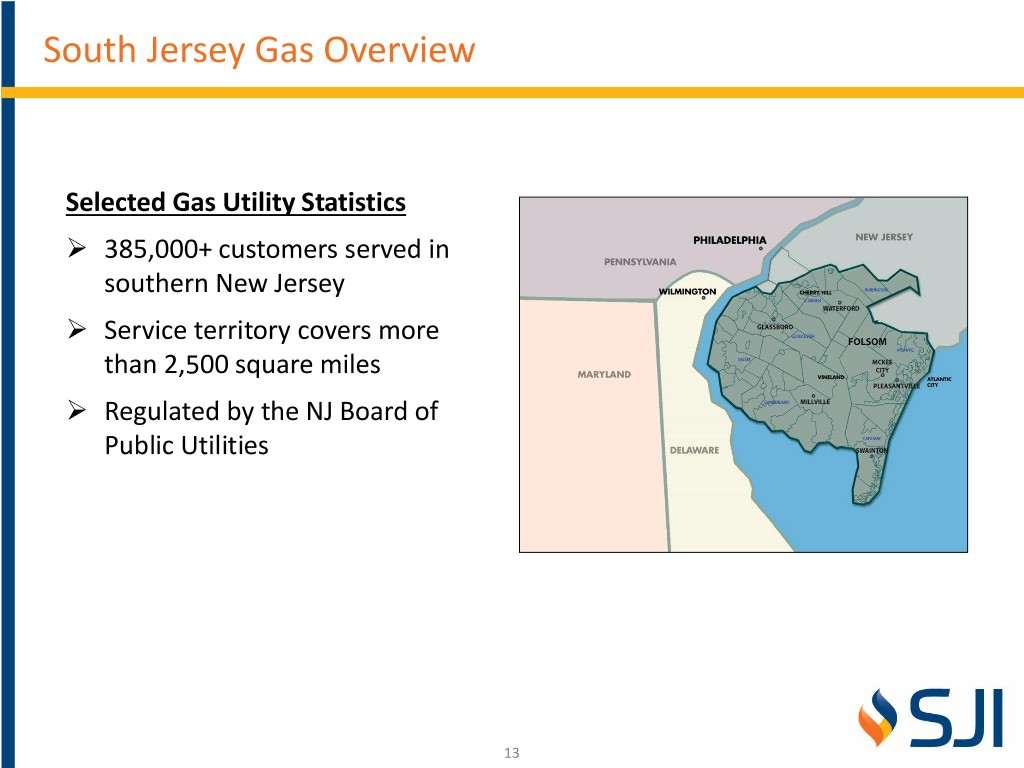

South Jersey Gas Overview Selected Gas Utility Statistics 385,000+ customers served in southern New Jersey Service territory covers more than 2,500 square miles Regulated by the NJ Board of Public Utilities 13

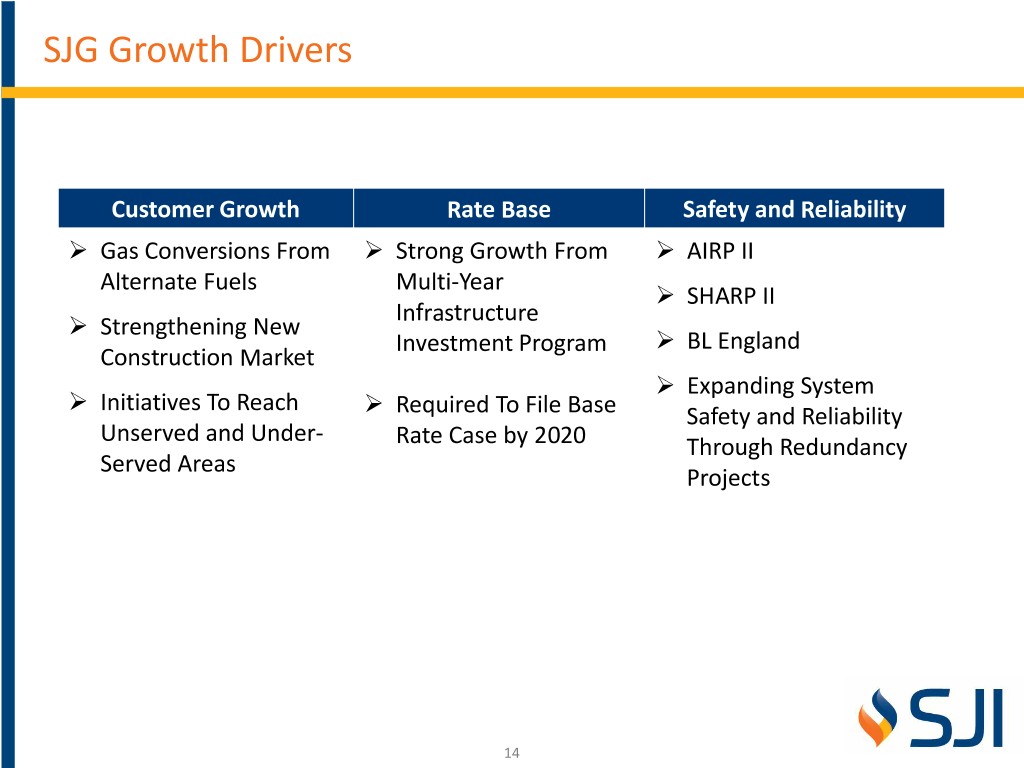

SJG Growth Drivers Customer Growth Rate Base Safety and Reliability Gas Conversions From Strong Growth From AIRP II Alternate Fuels Multi-Year SHARP II Infrastructure Strengthening New Investment Program BL England Construction Market Expanding System Initiatives To Reach Required To File Base Safety and Reliability Unserved and Under- Rate Case by 2020 Through Redundancy Served Areas Projects 14

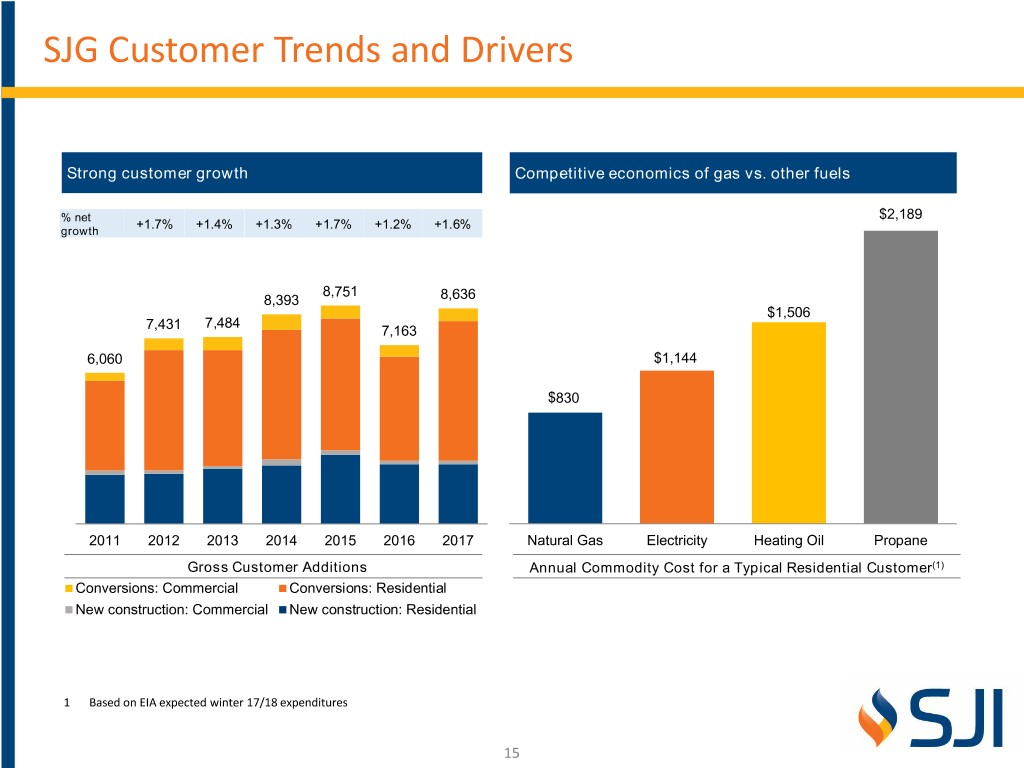

SJG Customer Trends and Drivers Strong customer growth Competitive economics of gas vs. other fuels % net $2,189 +1.7% +1.4% +1.3% +1.7% +1.2% +1.6% growth 8,751 8,393 8,636 $1,506 7,484 7,431 7,163 6,060 $1,144 $830 2011 2012 2013 2014 2015 2016 2017 Natural Gas Electricity Heating Oil Propane Gross Customer Additions Annual Commodity Cost for a Typical Residential Customer(1) Conversions: Commercial Conversions: Residential New construction: Commercial New construction: Residential 1 Based on EIA expected winter 17/18 expenditures 15

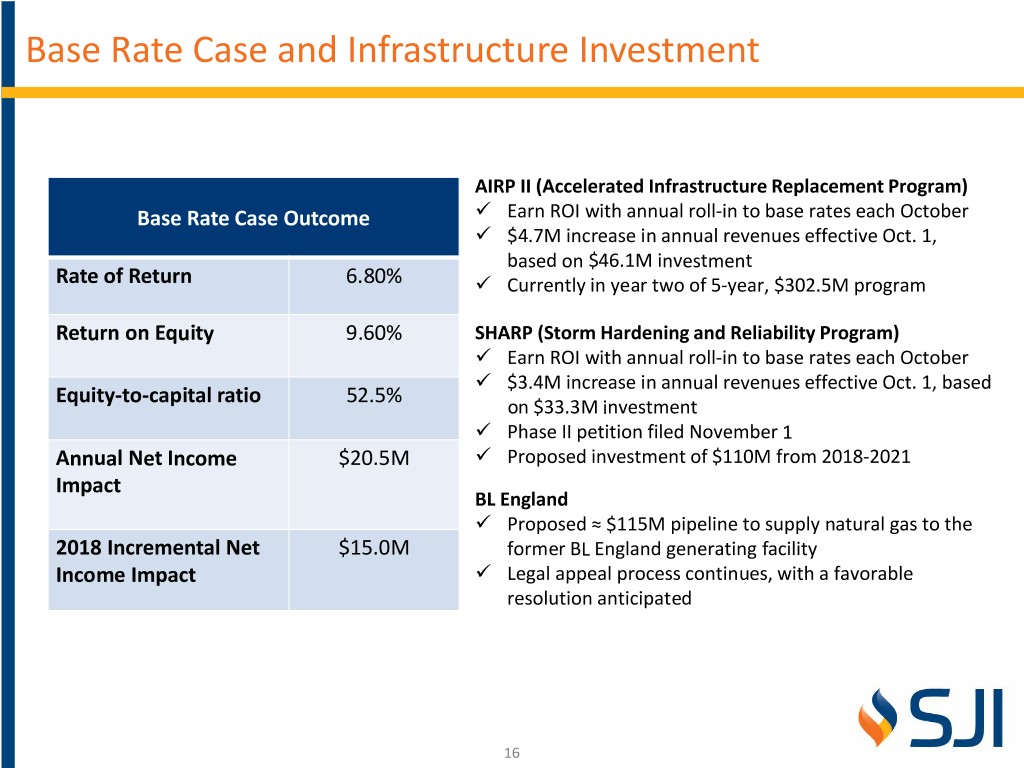

Base Rate Case and Infrastructure Investment AIRP II (Accelerated Infrastructure Replacement Program) Base Rate Case Outcome Earn ROI with annual roll-in to base rates each October $4.7M increase in annual revenues effective Oct. 1, based on $46.1M investment Rate of Return 6.80% Currently in year two of 5-year, $302.5M program Return on Equity 9.60% SHARP (Storm Hardening and Reliability Program) Earn ROI with annual roll-in to base rates each October $3.4M increase in annual revenues effective Oct. 1, based Equity-to-capital ratio 52.5% on $33.3M investment Phase II petition filed November 1 Annual Net Income $20.5M Proposed investment of $110M from 2018-2021 Impact BL England Proposed ≈ $115M pipeline to supply natural gas to the 2018 Incremental Net $15.0M former BL England generating facility Income Impact Legal appeal process continues, with a favorable resolution anticipated 16

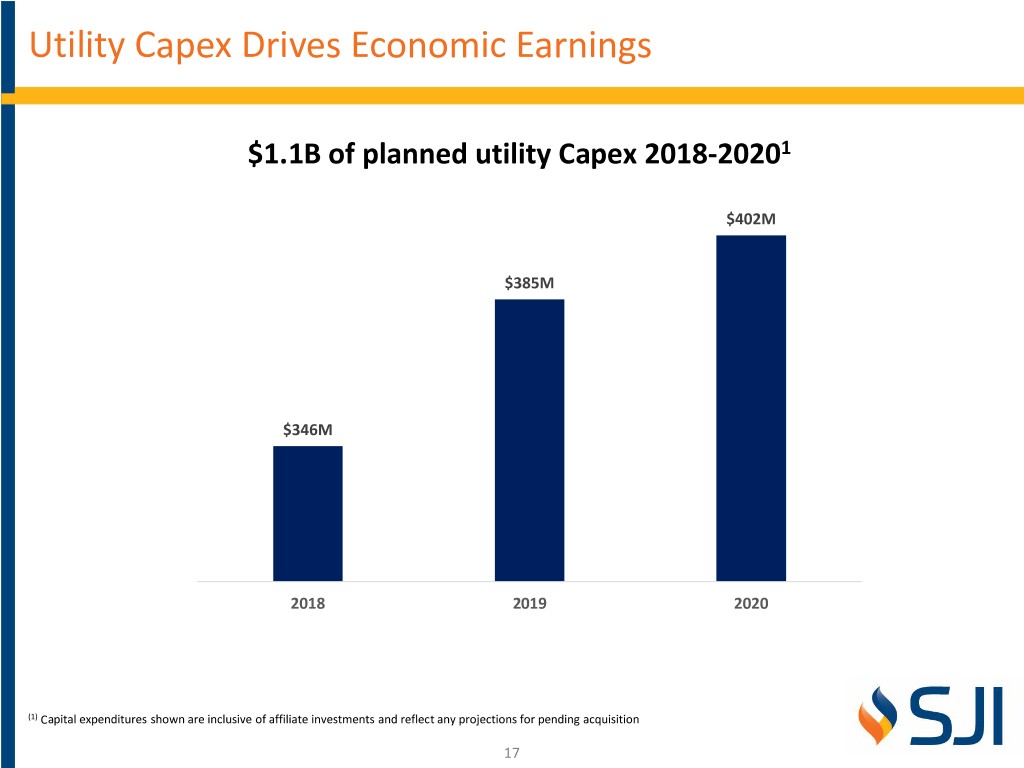

Utility Capex Drives Economic Earnings $1.1B of planned utility Capex 2018-20201 $402M $385M $49M $346M $1,484M 2018 2019 2020 (1) Capital expenditures shown are inclusive of affiliate investments and reflect any projections for pending acquisition 17

Elizabethtown Gas and Elkton Gas Acquisition Update 18

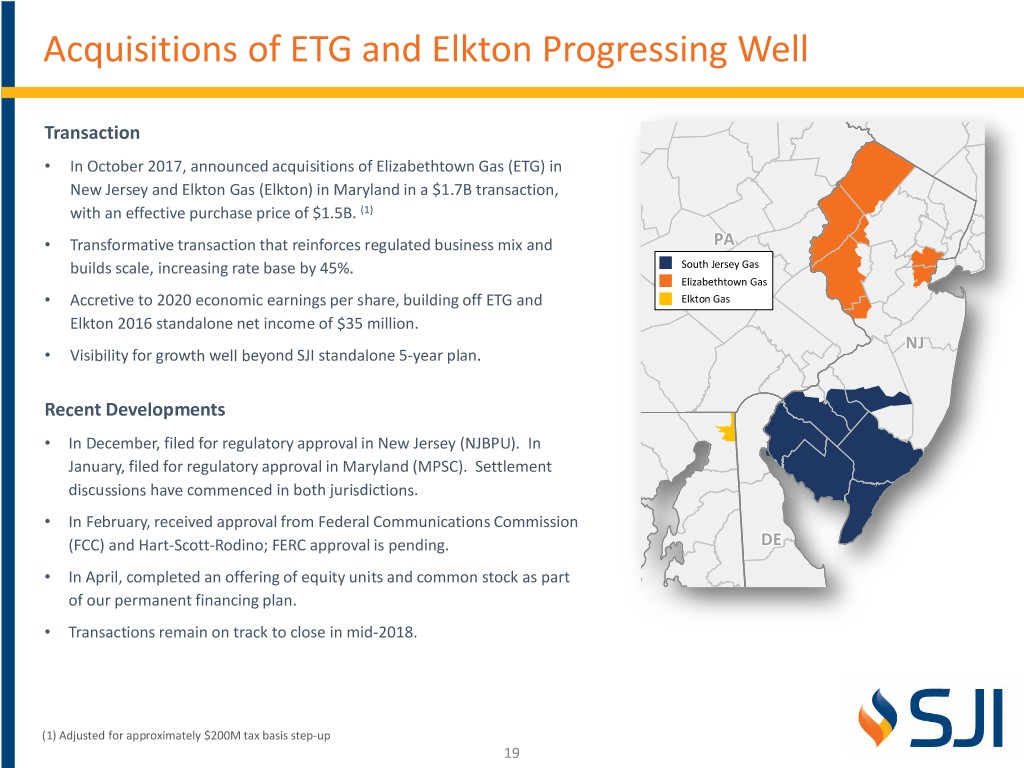

Acquisitions of ETG and Elkton Progressing Well Transaction • In October 2017, announced acquisitions of Elizabethtown Gas (ETG) in New Jersey and Elkton Gas (Elkton) in Maryland in a $1.7B transaction, with an effective purchase price of $1.5B. (1) • Transformative transaction that reinforces regulated business mix and PAPA builds scale, increasing rate base by 45%. South Jersey Gas Elizabethtown Gas • Accretive to 2020 economic earnings per share, building off ETG and Elkton Gas Elkton 2016 standalone net income of $35 million. NJNJ • Visibility for growth well beyond SJI standalone 5-year plan. Recent Developments • In December, filed for regulatory approval in New Jersey (NJBPU). In January, filed for regulatory approval in Maryland (MPSC). Settlement discussions have commenced in both jurisdictions. • In February, received approval from Federal Communications Commission (FCC) and Hart-Scott-Rodino; FERC approval is pending. DEDE • In April, completed an offering of equity units and common stock as part of our permanent financing plan. • Transactions remain on track to close in mid-2018. (1) Adjusted for approximately $200M tax basis step-up 19

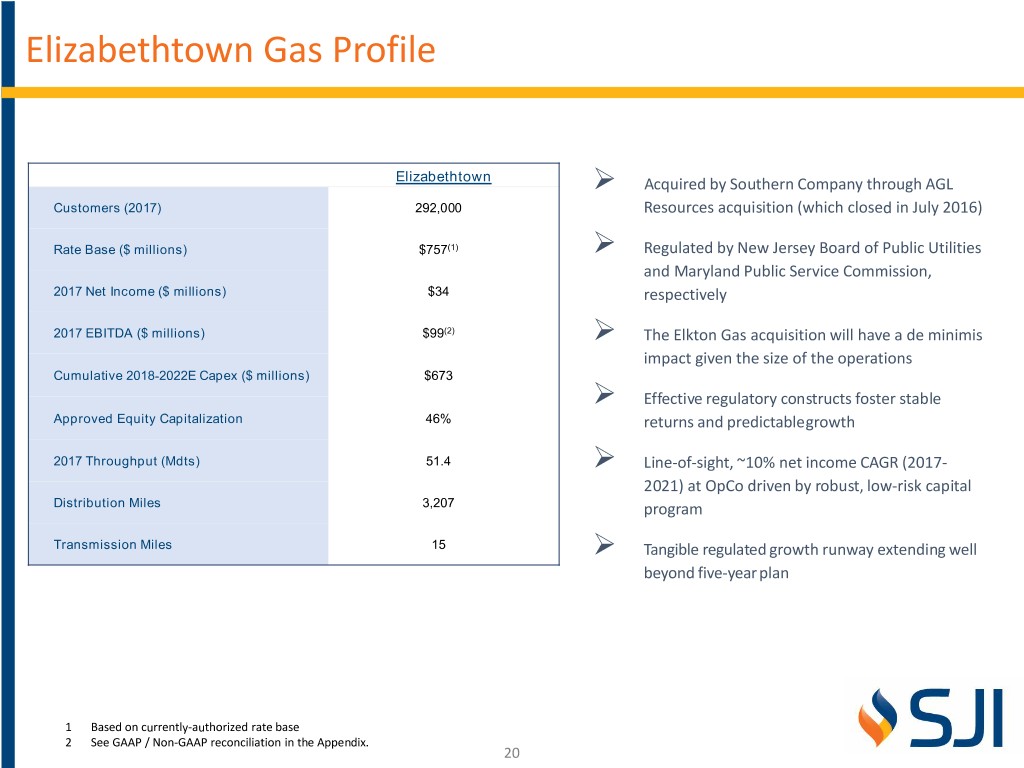

Elizabethtown Gas Profile Elizabethtown Acquired by Southern Company through AGL Customers (2017) 292,000 Resources acquisition (which closed in July 2016) Rate Base ($ millions) $757(1) Regulated by New Jersey Board of Public Utilities and Maryland Public Service Commission, 2017 Net Income ($ millions) $34 respectively 2017 EBITDA ($ millions) $99(2) The Elkton Gas acquisition will have a de minimis impact given the size of the operations Cumulative 2018-2022E Capex ($ millions) $673 Effective regulatory constructs foster stable Approved Equity Capitalization 46% returns and predictablegrowth 2017 Throughput (Mdts) 51.4 Line-of-sight, ~10% net income CAGR (2017- 2021) at OpCo driven by robust, low-risk capital Distribution Miles 3,207 program Transmission Miles 15 Tangible regulated growth runway extending well beyond five-year plan 1 Based on currently-authorized rate base 2 See GAAP / Non-GAAP reconciliation in the Appendix. 20

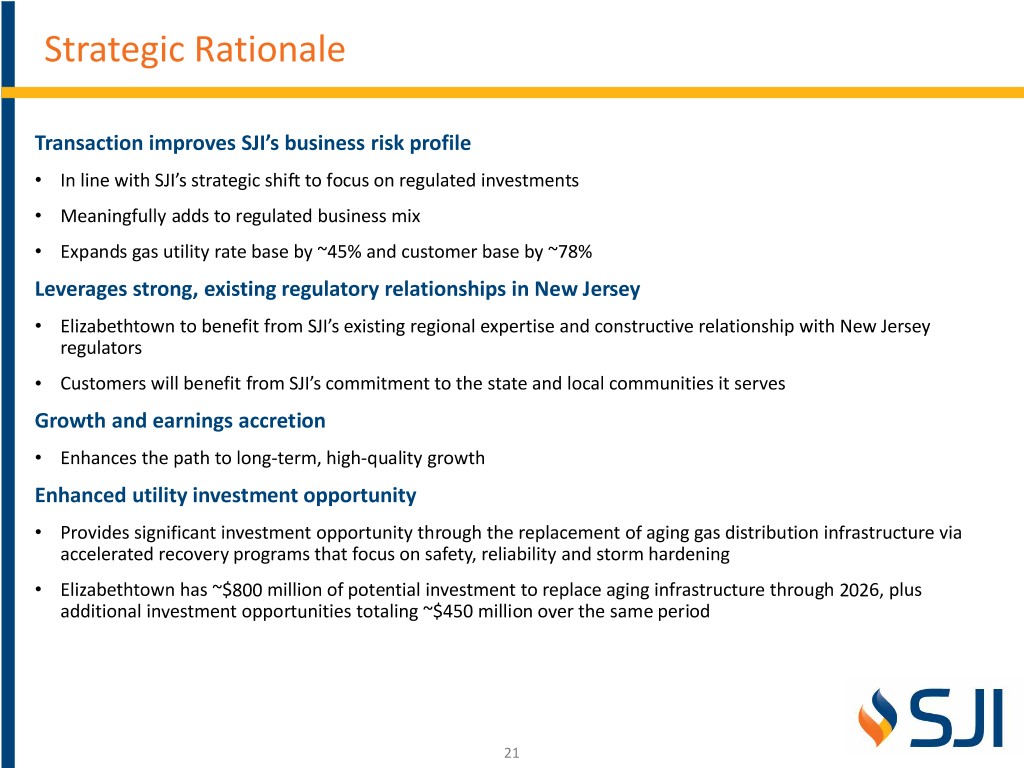

Strategic Rationale Transaction improves SJI’s business risk profile • In line with SJI’s strategic shift to focus on regulated investments • Meaningfully adds to regulated business mix • Expands gas utility rate base by ~45% and customer base by ~78% Leverages strong, existing regulatory relationships in New Jersey • Elizabethtown to benefit from SJI’s existing regional expertise and constructive relationship with New Jersey regulators • Customers will benefit from SJI’s commitment to the state and local communities it serves Growth and earnings accretion • Enhances the path to long-term, high-quality growth Enhanced utility investment opportunity • Provides significant investment opportunity through the replacement of aging gas distribution infrastructure via accelerated recovery programs that focus on safety, reliability and storm hardening • Elizabethtown has ~$800 million of potential investment to replace aging infrastructure through 2026, plus additional investment opportunities totaling ~$450 million over the same period 21

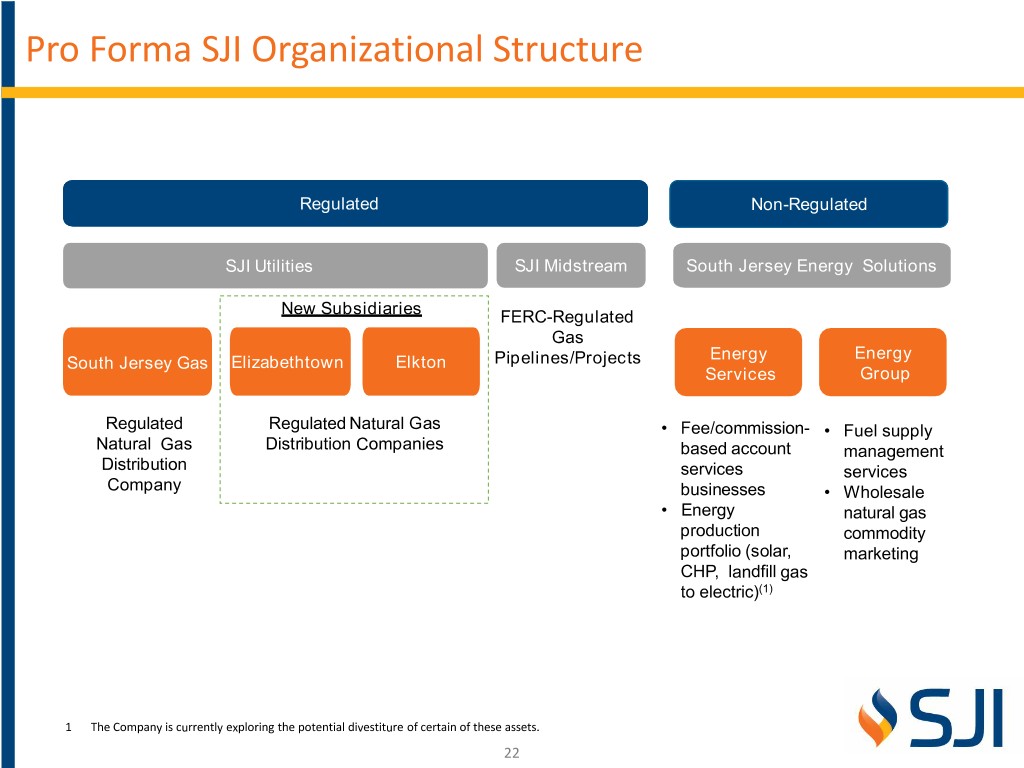

Pro Forma SJI Organizational Structure Regulated Non-Regulated SJI Utilities SJI Midstream South Jersey Energy Solutions New Subsidiaries FERC-Regulated Gas Energy Energy South Jersey Gas Elizabethtown Elkton Pipelines/Projects Services Group Regulated Regulated Natural Gas • Fee/commission- • Fuel supply Natural Gas Distribution Companies based account management Distribution services services Company businesses • Wholesale • Energy natural gas production commodity portfolio (solar, marketing CHP, landfill gas to electric)(1) 1 The Company is currently exploring the potential divestiture of certain of these assets. 22

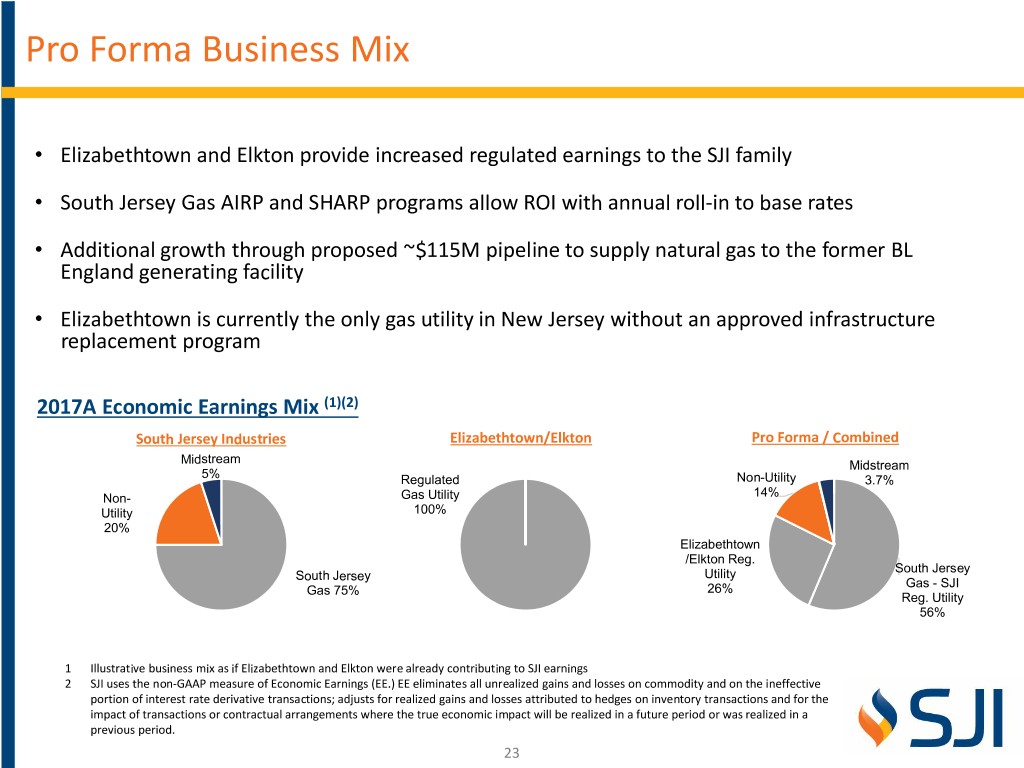

Pro Forma Business Mix • Elizabethtown and Elkton provide increased regulated earnings to the SJI family • South Jersey Gas AIRP and SHARP programs allow ROI with annual roll-in to base rates • Additional growth through proposed ~$115M pipeline to supply natural gas to the former BL England generating facility • Elizabethtown is currently the only gas utility in New Jersey without an approved infrastructure replacement program 2017A Economic Earnings Mix (1)(2) South Jersey Industries Elizabethtown/Elkton Pro Forma / Combined Midstream Midstream 5% Regulated Non-Utility 3.7% Non- Gas Utility 14% Utility 100% 20% Elizabethtown /Elkton Reg. South Jersey South Jersey Utility Gas - SJI Gas 75% 26% Reg. Utility 56% 1 Illustrative business mix as if Elizabethtown and Elkton were already contributing to SJI earnings 2 SJI uses the non-GAAP measure of Economic Earnings (EE.) EE eliminates all unrealized gains and losses on commodity and on the ineffective portion of interest rate derivative transactions; adjusts for realized gains and losses attributed to hedges on inventory transactions and for the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period or was realized in a previous period. 23

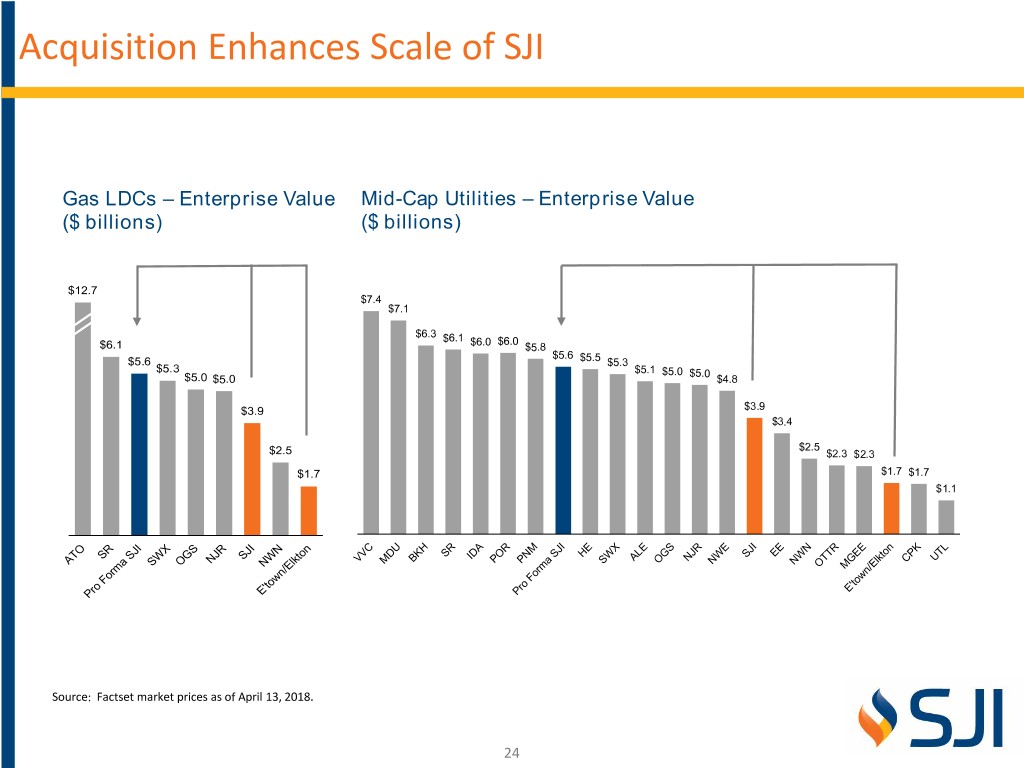

Acquisition Enhances Scale of SJI Gas LDCs – Enterprise Value Mid-Cap Utilities – Enterprise Value ($ billions) ($ billions) $12.7 $7.4 $7.1 $6.3 $6.1 $6.0 $6.1 $6.0 $5.8 $5.6 $5.6 $5.5 $5.3 $5.3 $5.1 $5.0 $5.0 $5.0 $5.0 $4.8 $3.9 $3.9 $3.4 $2.5 $2.5 $2.3 $2.3 $1.7 $1.7 $1.7 $1.1 Source: Factset market prices as of April 13, 2018. 24

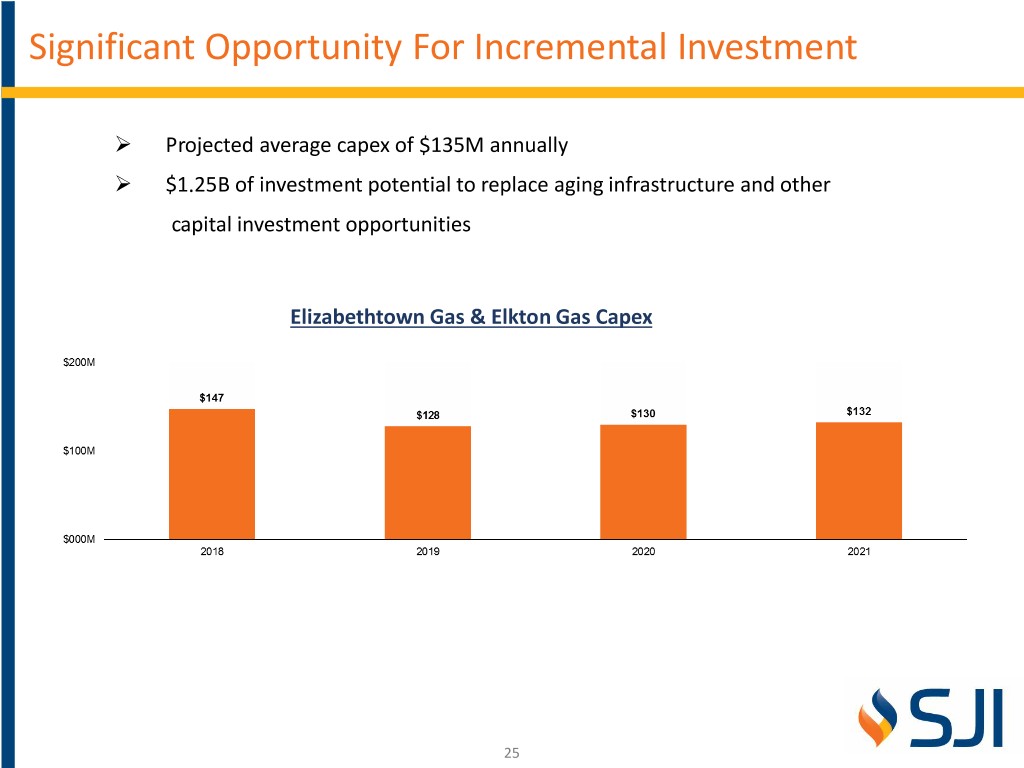

Significant Opportunity For Incremental Investment Projected average capex of $135M annually $1.25B of investment potential to replace aging infrastructure and other capital investment opportunities Elizabethtown Gas & Elkton Gas Capex 25

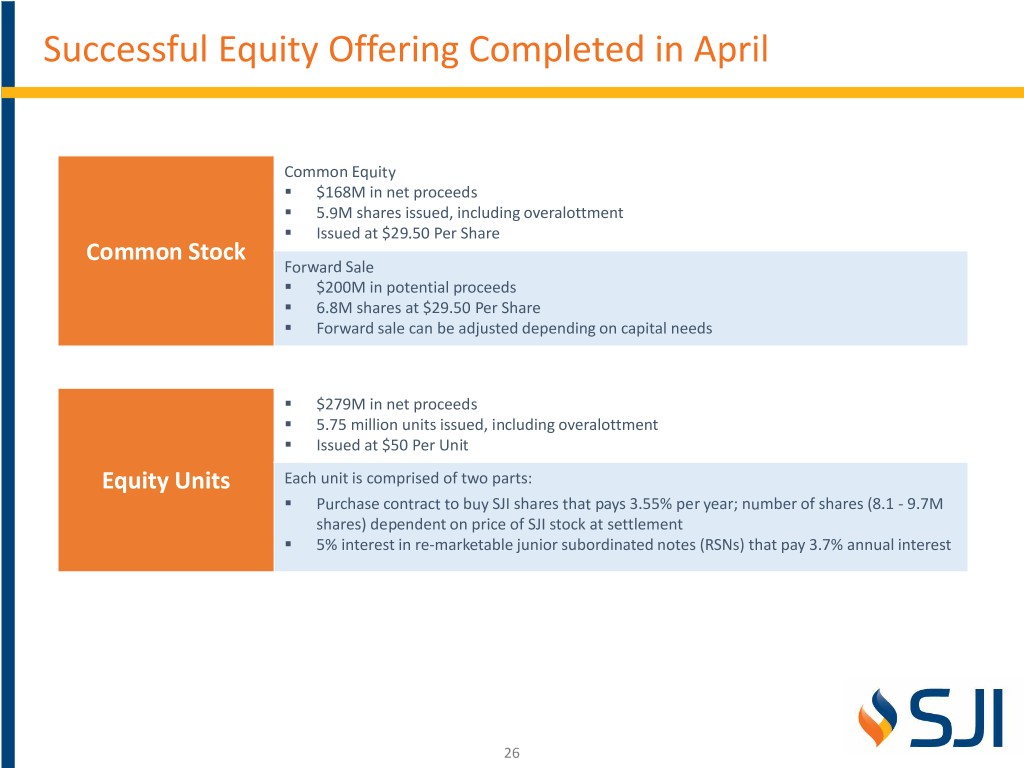

Successful Equity Offering Completed in April Common Equity . $168M in net proceeds . 5.9M shares issued, including overalottment . Issued at $29.50 Per Share Common Stock Forward Sale . $200M in potential proceeds . 6.8M shares at $29.50 Per Share . Forward sale can be adjusted depending on capital needs . $279M in net proceeds . 5.75 million units issued, including overalottment . Issued at $50 Per Unit Equity Units Each unit is comprised of two parts: . Purchase contract to buy SJI shares that pays 3.55% per year; number of shares (8.1 - 9.7M shares) dependent on price of SJI stock at settlement . 5% interest in re-marketable junior subordinated notes (RSNs) that pay 3.7% annual interest 26

SJI Midstream 27

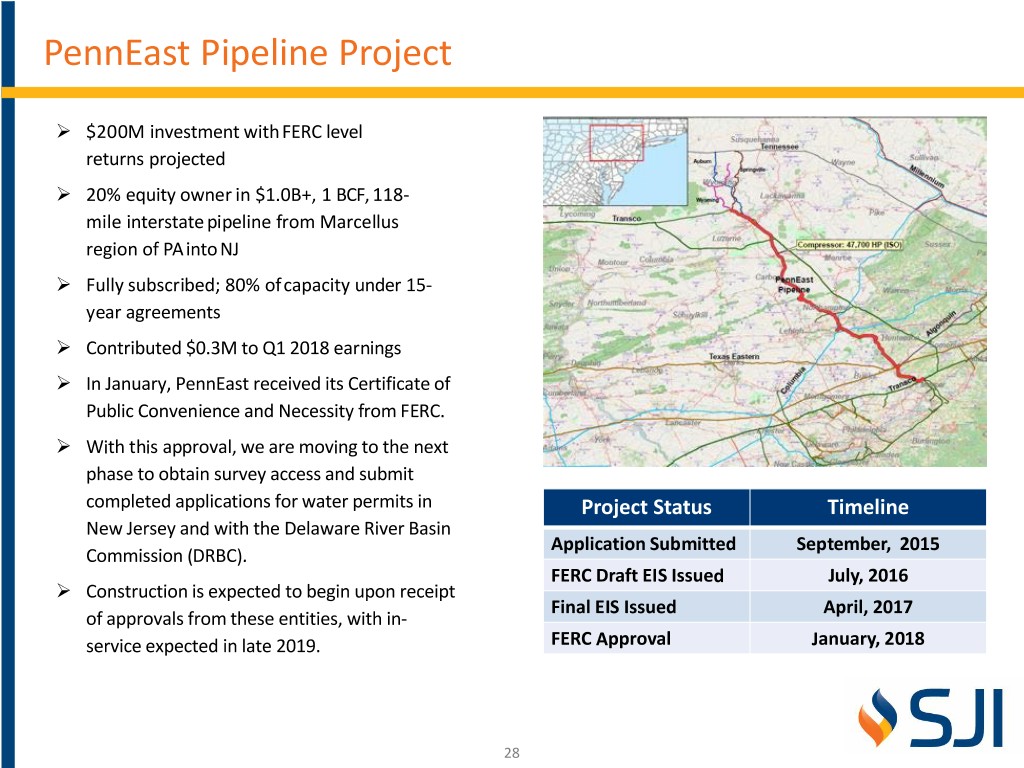

PennEast Pipeline Project $200M investment withFERC level returns projected 20% equity owner in $1.0B+, 1 BCF, 118- mile interstatepipeline from Marcellus region of PA into NJ Fully subscribed; 80% ofcapacity under 15- year agreements Contributed $0.3M to Q1 2018 earnings In January, PennEast received its Certificate of Public Convenience and Necessity from FERC. With this approval, we are moving to the next phase to obtain survey access and submit completed applications for water permits in Project Status Timeline New Jersey and with the Delaware River Basin Application Submitted September, 2015 Commission (DRBC). FERC Draft EIS Issued July, 2016 Construction is expected to begin upon receipt Final EIS Issued April, 2017 of approvals from these entities, with in- service expected in late 2019. FERC Approval January, 2018 28

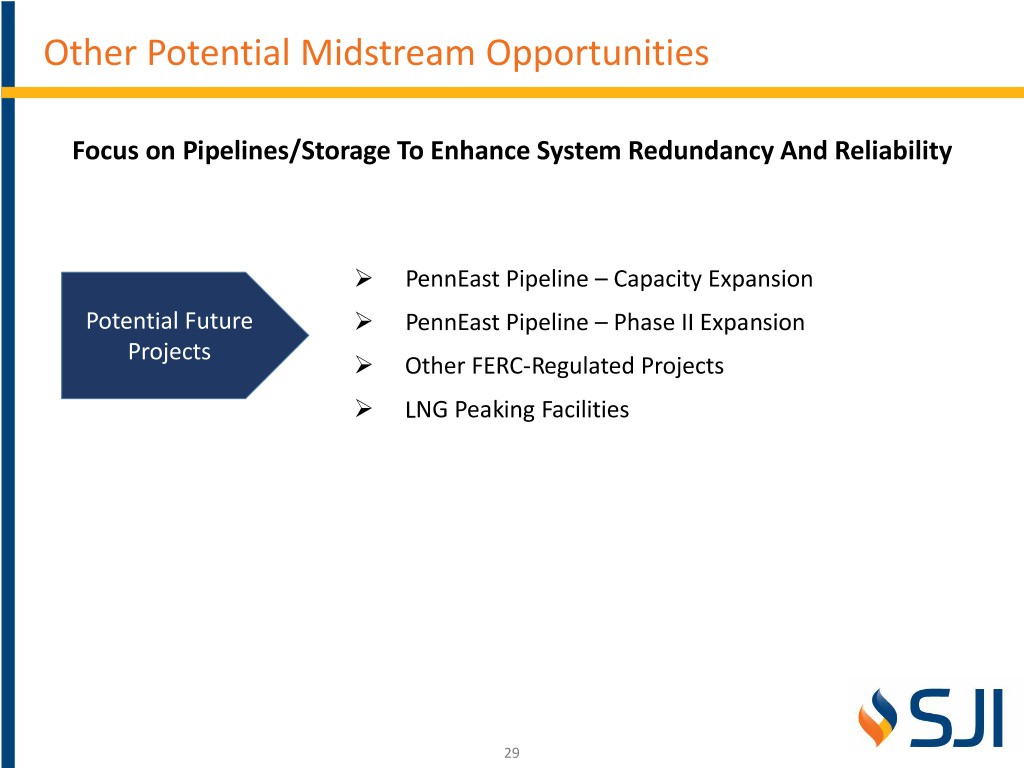

Other Potential Midstream Opportunities Focus on Pipelines/Storage To Enhance System Redundancy And Reliability PennEast Pipeline – Capacity Expansion Potential Future PennEast Pipeline – Phase II Expansion Projects Other FERC-Regulated Projects LNG Peaking Facilities 29

Non-Regulated Operations 30

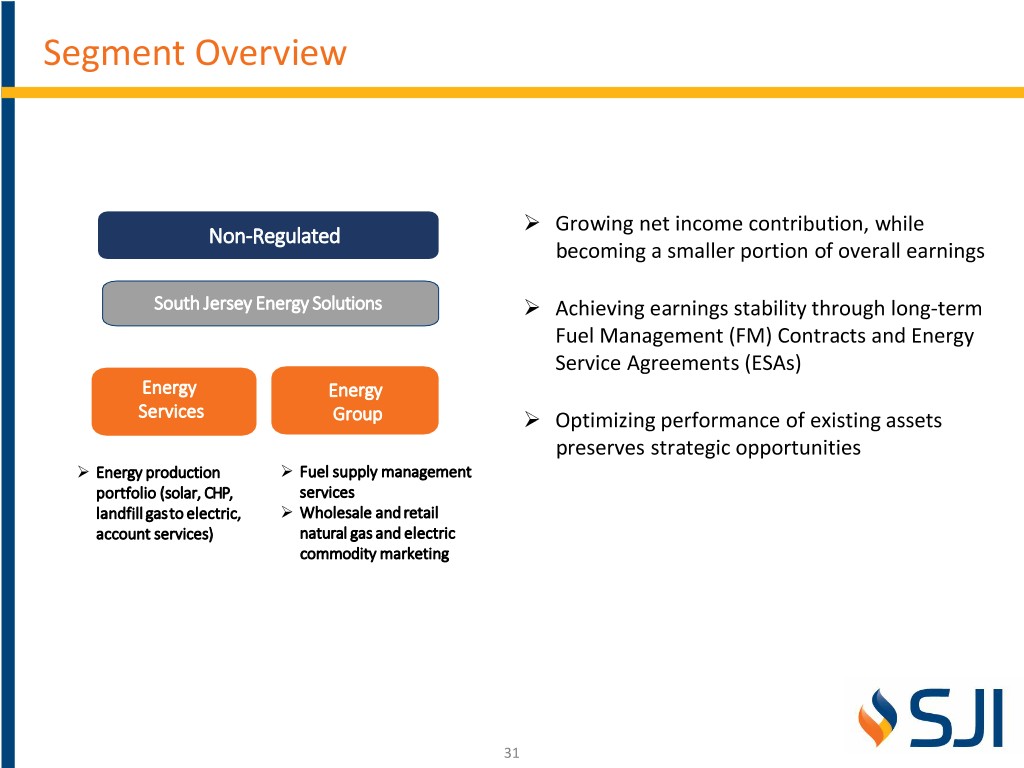

Segment Overview Growing net income contribution, while Non-Regulated becoming a smaller portion of overall earnings South Jersey Energy Solutions Achieving earnings stability through long-term Fuel Management (FM) Contracts and Energy Service Agreements (ESAs) Energy Energy Services Group Optimizing performance of existing assets preserves strategic opportunities Energy production Fuel supply management portfolio (solar, CHP, services landfill gasto electric, Wholesale andretail account services) natural gas and electric commodity marketing 31

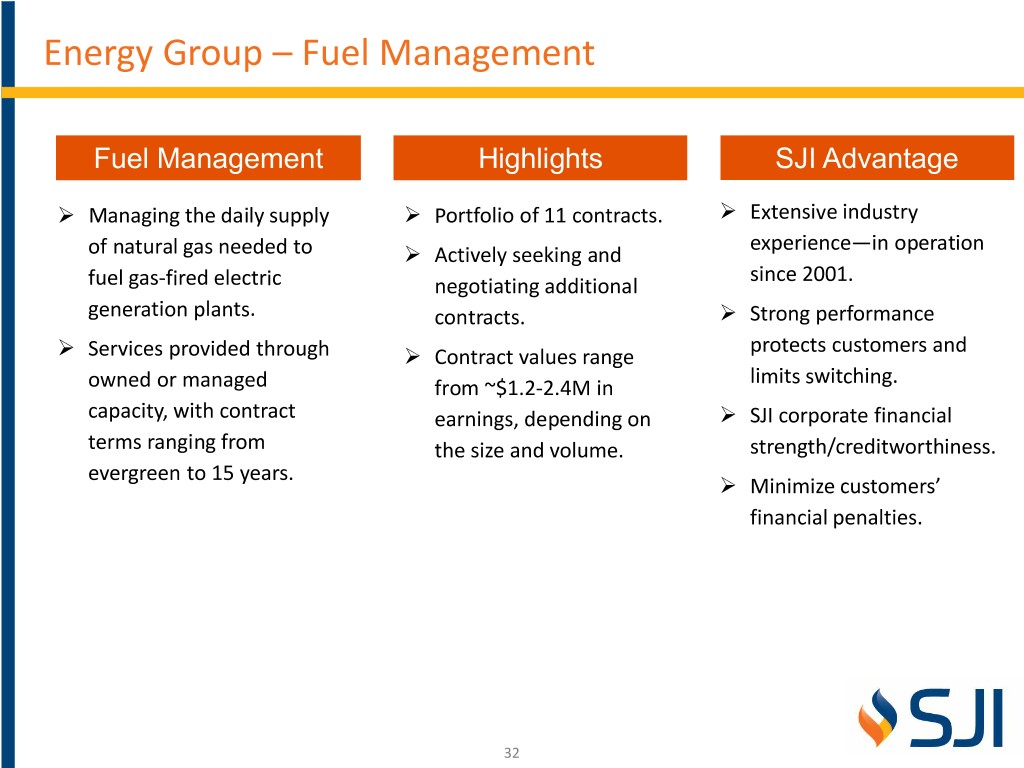

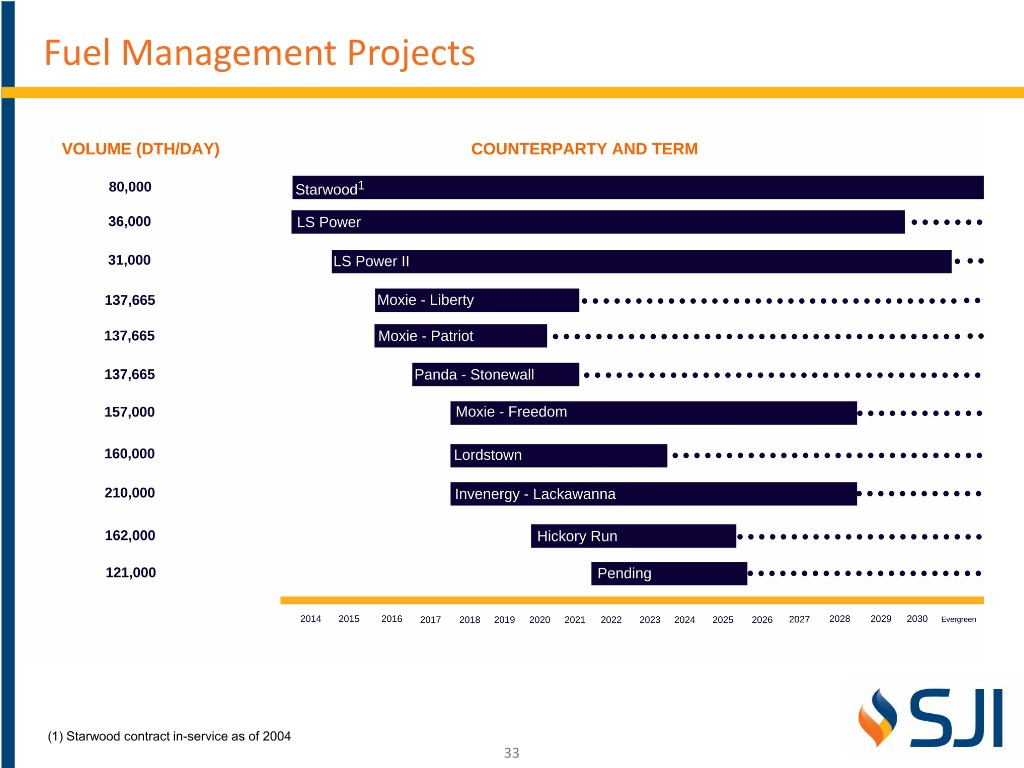

Energy Group – Fuel Management Fuel Management Highlights SJI Advantage Managing the daily supply Portfolio of 11 contracts. Extensive industry experience—in operation of natural gas needed to Actively seeking and since 2001. fuel gas-fired electric negotiating additional generation plants. contracts. Strong performance protects customers and Services provided through Contract values range limits switching. owned or managed from ~$1.2-2.4M in capacity, with contract earnings, depending on SJI corporate financial terms ranging from the size and volume. strength/creditworthiness. evergreen to 15 years. Minimize customers’ financial penalties. 32

Fuel Management Projects (1) Starwood contract in-service as of 2004 33

Energy Group – Wholesale & Retail Marketing Wholesale & Retail Marketing Highlights Retail electric and natural gas Recent strength from cold marketing across 8 states, with temperatures, and improved matched book approach and operating performance, minimal open positions provided significant boost to Relationship-driven marketing Q1’18 EPS business matches Marcellus Results benefitting from producers with end users, expiration of legacy producer maximizing the value of our contracts leased transportation assets through a combination of index- plus margin contracts and the ability to arbitrage (i.e., limited commodity/ market risk) 34

Energy Services Energy Production Highlights Constitutes our Solar, Combined Heat Wind-down of Energenic JV in and Power (CHP), and Landfill-gas-to- 2016 electric businesses Solar contribution since 2017 Restructured to focus on cash reflects active hedging production from existing assets program, and the elimination of Approximately $50M of current earnings from ITC annual EBITDA from solar business No longer investing in new solar assets Strategic review ongoing to optimize value of the assets 35

Recent Financial Performance 36

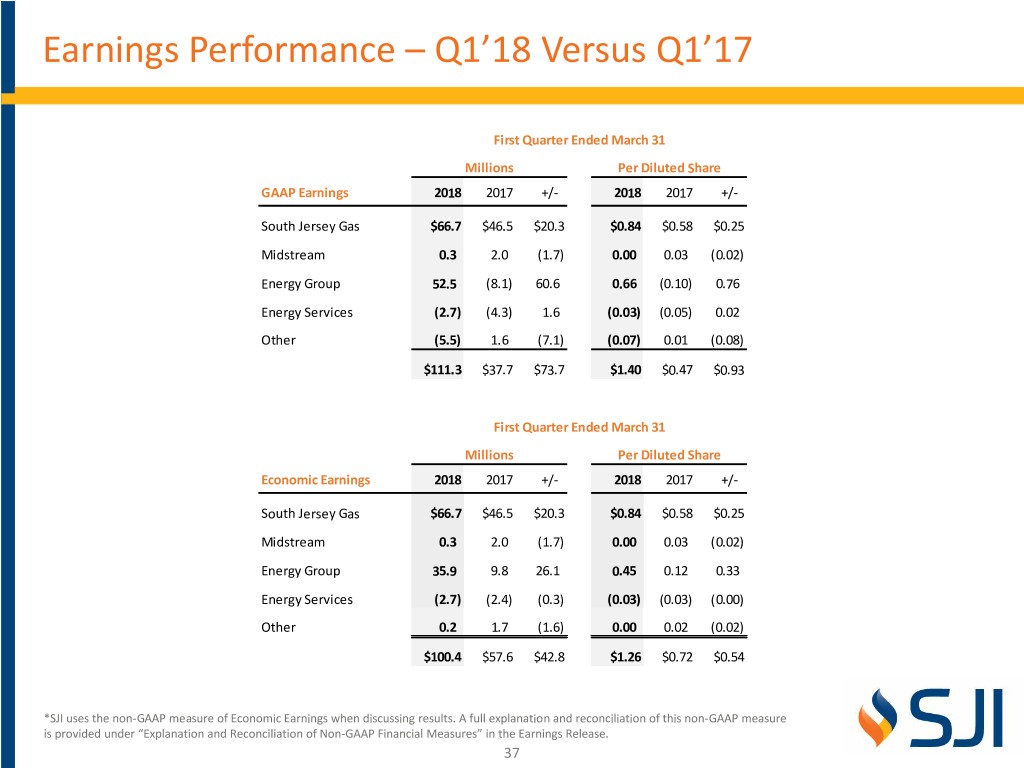

Earnings Performance – Q1’18 Versus Q1’17 First Quarter Ended March 31 Millions Per Diluted Share GAAP Earnings 2018 2017 +/- 2018 2017 +/- South Jersey Gas $66.7 $46.5 $20.3 $0.84 $0.58 $0.25 Midstream 0.3 2.0 (1.7) 0.00 0.03 (0.02) Energy Group 52.5 (8.1) 60.6 0.66 (0.10) 0.76 Energy Services (2.7) (4.3) 1.6 (0.03) (0.05) 0.02 Other (5.5) 1.6 (7.1) (0.07) 0.01 (0.08) $111.3 $37.7 $73.7 $1.40 $0.47 $0.93 First Quarter Ended March 31 Millions Per Diluted Share Economic Earnings 2018 2017 +/- 2018 2017 +/- South Jersey Gas $66.7 $46.5 $20.3 $0.84 $0.58 $0.25 Midstream 0.3 2.0 (1.7) 0.00 0.03 (0.02) Energy Group 35.9 9.8 26.1 0.45 0.12 0.33 Energy Services (2.7) (2.4) (0.3) (0.03) (0.03) (0.00) Other 0.2 1.7 (1.6) 0.00 0.02 (0.02) $100.4 $57.6 $42.8 $1.26 $0.72 $0.54 *SJI uses the non-GAAP measure of Economic Earnings when discussing results. A full explanation and reconciliation of this non-GAAP measure is provided under “Explanation and Reconciliation of Non-GAAP Financial Measures” in the Earnings Release. 37

South Jersey Gas – Earnings Performance First Quarter Ended March 31 South Jersey Gas – Map of Service Area Millions Per Diluted Share Economic Earnings 2018 2017 +/- 2018 2017 +/- South Jersey Gas $66.7 $46.5 $20.3 $0.84 $0.58 $0.25 Midstream 0.3 2.0 (1.7) 0.00 0.03 (0.02) Energy Group 35.9 9.8 26.1 0.45 0.12 0.33 Energy Services (2.7) (2.4) (0.3) (0.03) (0.03) (0.00) Other 0.2 1.7 (1.6) 0.00 0.02 (0.02) $100.4 $57.6 $42.8 $1.26 $0.72 $0.54 • Overview: Our gas utility segment currently includes the regulated gas distribution operations of South Jersey Gas (SJG). • Economic Earnings: GAAP earnings and economic earnings are the same for SJG. Quarterly improvement largely reflects an increase in utility margin partially offset by higher operating costs. • Margin: Utility margin(1) increased $15.5 million driven by our base rate case settlement ($22.8 million), the roll-in of investments for infrastructure replacement and improvement ($4.5 million) and customer growth ($1.0 million) partially offset by a deferral of excess taxes billed ($12.8 million) that will be returned to customers. • Expenses: Operating costs increased $9.2 million reflecting higher O&M expense ($7.5 million) tied to personnel, governance, compliance and system maintenance. These investments are aimed at improving efficiency and productivity for the benefit of customers. Higher depreciation expense ($1.7 million) reflects capital investment in infrastructure and customer growth. (1) We define utility margin, a non-GAAP measure, as natural gas revenues less natural gas costs, regulatory rider expenses and related volumetric and revenue-based energy taxes. 38

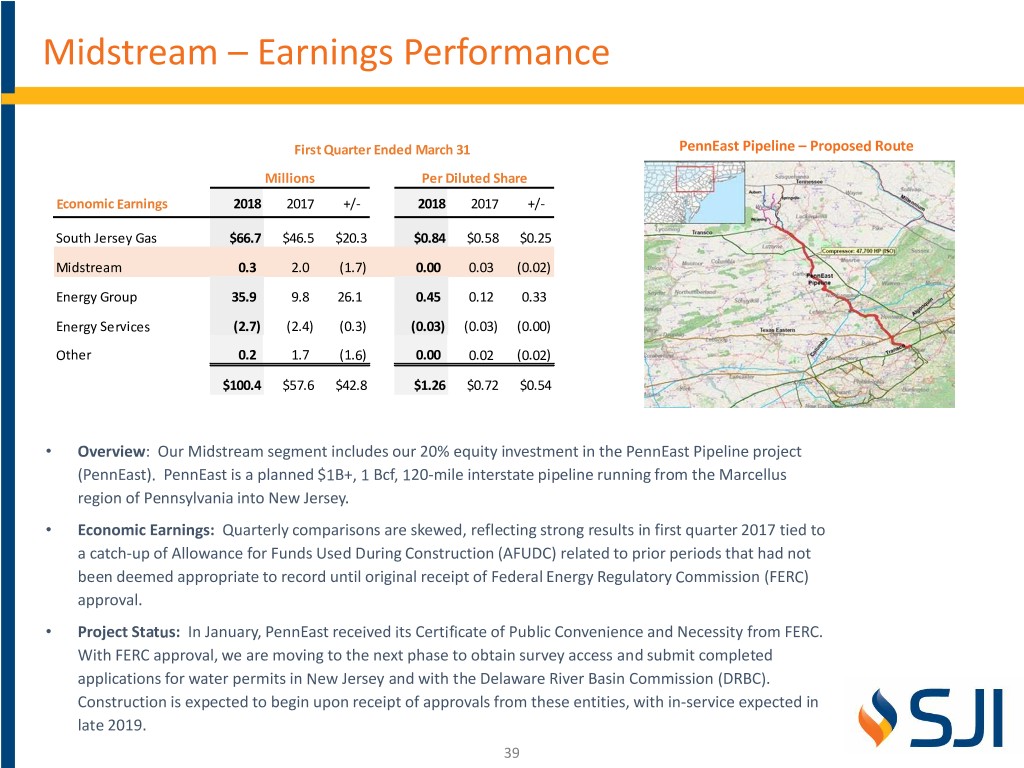

Midstream – Earnings Performance First Quarter Ended March 31 PennEast Pipeline – Proposed Route Millions Per Diluted Share Economic Earnings 2018 2017 +/- 2018 2017 +/- South Jersey Gas $66.7 $46.5 $20.3 $0.84 $0.58 $0.25 Midstream 0.3 2.0 (1.7) 0.00 0.03 (0.02) Energy Group 35.9 9.8 26.1 0.45 0.12 0.33 Energy Services (2.7) (2.4) (0.3) (0.03) (0.03) (0.00) Other 0.2 1.7 (1.6) 0.00 0.02 (0.02) $100.4 $57.6 $42.8 $1.26 $0.72 $0.54 • Overview: Our Midstream segment includes our 20% equity investment in the PennEast Pipeline project (PennEast). PennEast is a planned $1B+, 1 Bcf, 120-mile interstate pipeline running from the Marcellus region of Pennsylvania into New Jersey. • Economic Earnings: Quarterly comparisons are skewed, reflecting strong results in first quarter 2017 tied to a catch-up of Allowance for Funds Used During Construction (AFUDC) related to prior periods that had not been deemed appropriate to record until original receipt of Federal Energy Regulatory Commission (FERC) approval. • Project Status: In January, PennEast received its Certificate of Public Convenience and Necessity from FERC. With FERC approval, we are moving to the next phase to obtain survey access and submit completed applications for water permits in New Jersey and with the Delaware River Basin Commission (DRBC). Construction is expected to begin upon receipt of approvals from these entities, with in-service expected in late 2019. 39

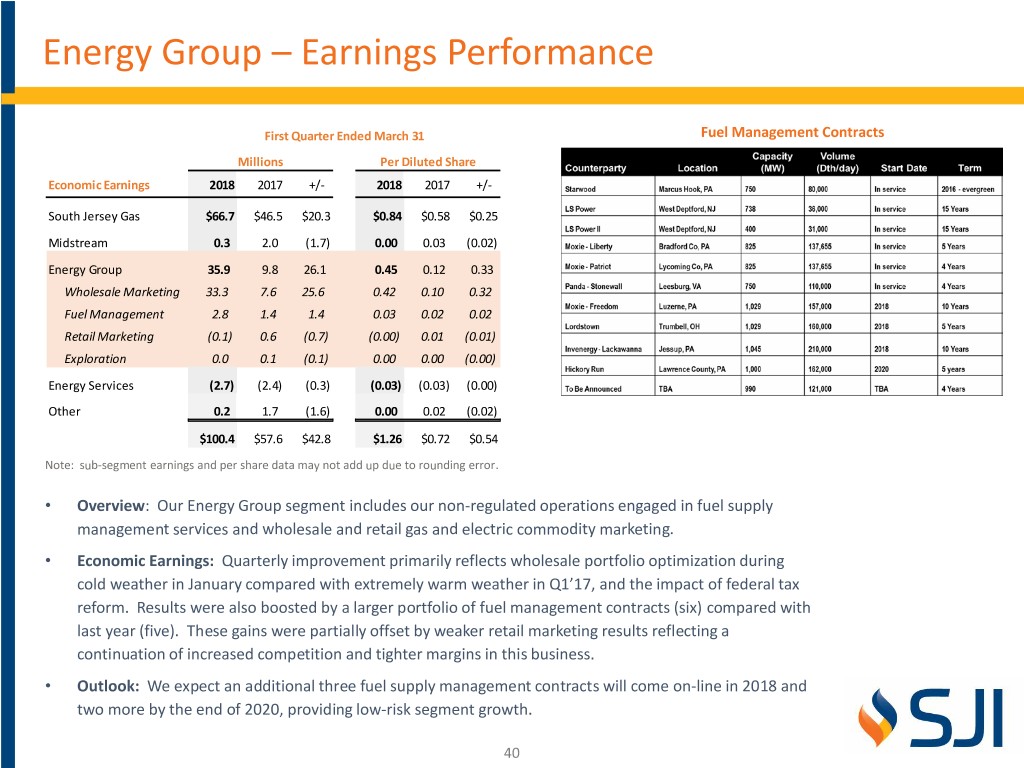

Energy Group – Earnings Performance First Quarter Ended March 31 Fuel Management Contracts Millions Per Diluted Share Economic Earnings 2018 2017 +/- 2018 2017 +/- South Jersey Gas $66.7 $46.5 $20.3 $0.84 $0.58 $0.25 Midstream 0.3 2.0 (1.7) 0.00 0.03 (0.02) Energy Group 35.9 9.8 26.1 0.45 0.12 0.33 Wholesale Marketing 33.3 7.6 25.6 0.42 0.10 0.32 Fuel Management 2.8 1.4 1.4 0.03 0.02 0.02 Retail Marketing (0.1) 0.6 (0.7) (0.00) 0.01 (0.01) Exploration 0.0 0.1 (0.1) 0.00 0.00 (0.00) Energy Services (2.7) (2.4) (0.3) (0.03) (0.03) (0.00) Other 0.2 1.7 (1.6) 0.00 0.02 (0.02) $100.4 $57.6 $42.8 $1.26 $0.72 $0.54 Note: sub-segment earnings and per share data may not add up due to rounding error. • Overview: Our Energy Group segment includes our non-regulated operations engaged in fuel supply management services and wholesale and retail gas and electric commodity marketing. • Economic Earnings: Quarterly improvement primarily reflects wholesale portfolio optimization during cold weather in January compared with extremely warm weather in Q1’17, and the impact of federal tax reform. Results were also boosted by a larger portfolio of fuel management contracts (six) compared with last year (five). These gains were partially offset by weaker retail marketing results reflecting a continuation of increased competition and tighter margins in this business. • Outlook: We expect an additional three fuel supply management contracts will come on-line in 2018 and two more by the end of 2020, providing low-risk segment growth. 40

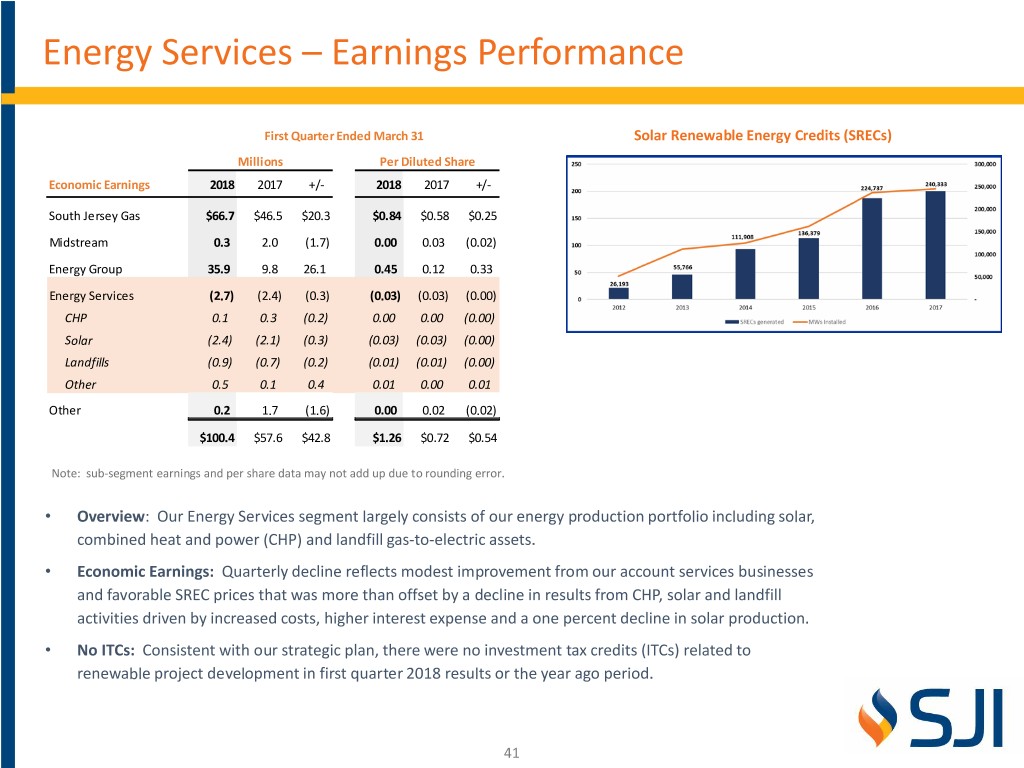

Energy Services – Earnings Performance First Quarter Ended March 31 Solar Renewable Energy Credits (SRECs) Millions Per Diluted Share Economic Earnings 2018 2017 +/- 2018 2017 +/- South Jersey Gas $66.7 $46.5 $20.3 $0.84 $0.58 $0.25 Midstream 0.3 2.0 (1.7) 0.00 0.03 (0.02) Energy Group 35.9 9.8 26.1 0.45 0.12 0.33 Energy Services (2.7) (2.4) (0.3) (0.03) (0.03) (0.00) CHP 0.1 0.3 (0.2) 0.00 0.00 (0.00) Solar (2.4) (2.1) (0.3) (0.03) (0.03) (0.00) Landfills (0.9) (0.7) (0.2) (0.01) (0.01) (0.00) Other 0.5 0.1 0.4 0.01 0.00 0.01 Other 0.2 1.7 (1.6) 0.00 0.02 (0.02) $100.4 $57.6 $42.8 $1.26 $0.72 $0.54 Note: sub-segment earnings and per share data may not add up due to rounding error. • Overview: Our Energy Services segment largely consists of our energy production portfolio including solar, combined heat and power (CHP) and landfill gas-to-electric assets. • Economic Earnings: Quarterly decline reflects modest improvement from our account services businesses and favorable SREC prices that was more than offset by a decline in results from CHP, solar and landfill activities driven by increased costs, higher interest expense and a one percent decline in solar production. • No ITCs: Consistent with our strategic plan, there were no investment tax credits (ITCs) related to renewable project development in first quarter 2018 results or the year ago period. 41

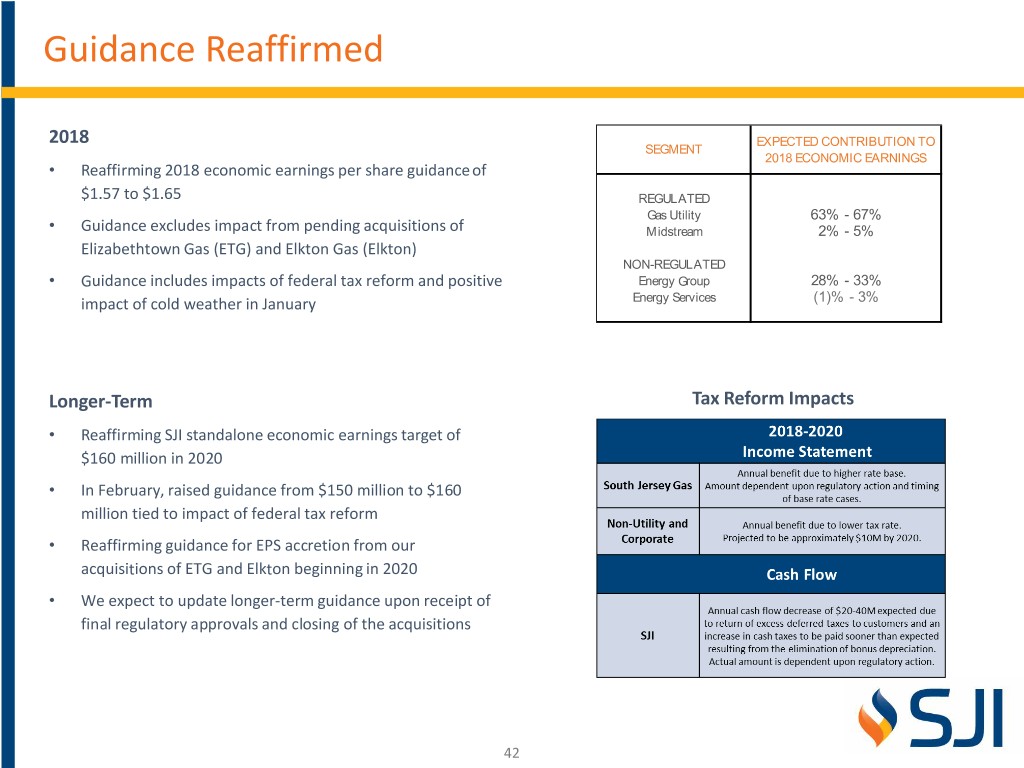

Guidance Reaffirmed 2018 EXPECTED CONTRIBUTION TO S EGMENT 2018 ECONOMIC EARNINGS • Reaffirming 2018 economic earnings per share guidanceof $1.57 to $1.65 REGULATED Gas Utility 63% - 67% • Guidance excludes impact from pending acquisitions of Midstream 2% - 5% Elizabethtown Gas (ETG) and Elkton Gas (Elkton) NON-REGULATED • Guidance includes impacts of federal tax reform and positive Energy Group 28% - 33% impact of cold weather in January Energy Services (1)% - 3% Longer-Term Tax Reform Impacts • Reaffirming SJI standalone economic earnings target of $160 million in 2020 • In February, raised guidance from $150 million to $160 million tied to impact of federal tax reform • Reaffirming guidance for EPS accretion from our acquisitions of ETG and Elkton beginning in 2020 • We expect to update longer-term guidance upon receipt of final regulatory approvals and closing of the acquisitions 42

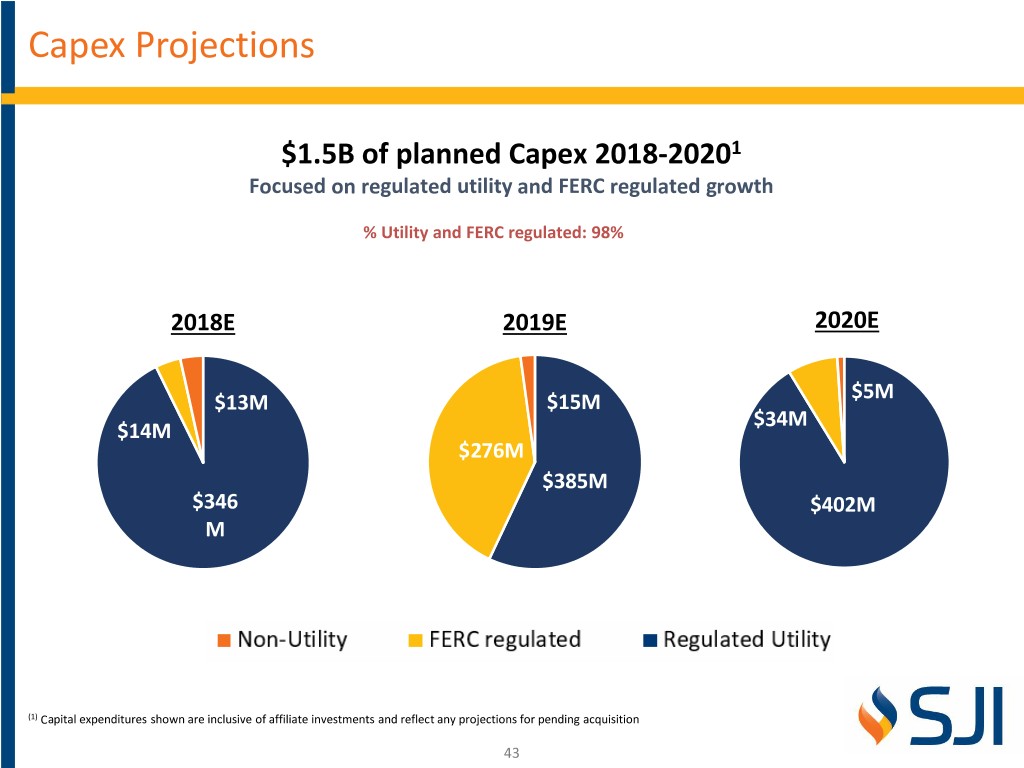

Capex Projections $1.5B of planned Capex 2018-20201 Focused on regulated utility and FERC regulated growth % Utility and FERC regulated: 98% 2018E 2019E 2020E $49M $13M $15M $5M $34M $14M $276M $385M $1,484M $346 $402M M (1) Capital expenditures shown are inclusive of affiliate investments and reflect any projections for pending acquisition 43

Consistent Dividend Growth 1.20 1.00 0.80 0.60 0.40 0.20 - Dividends per Share 44

Appendix 45

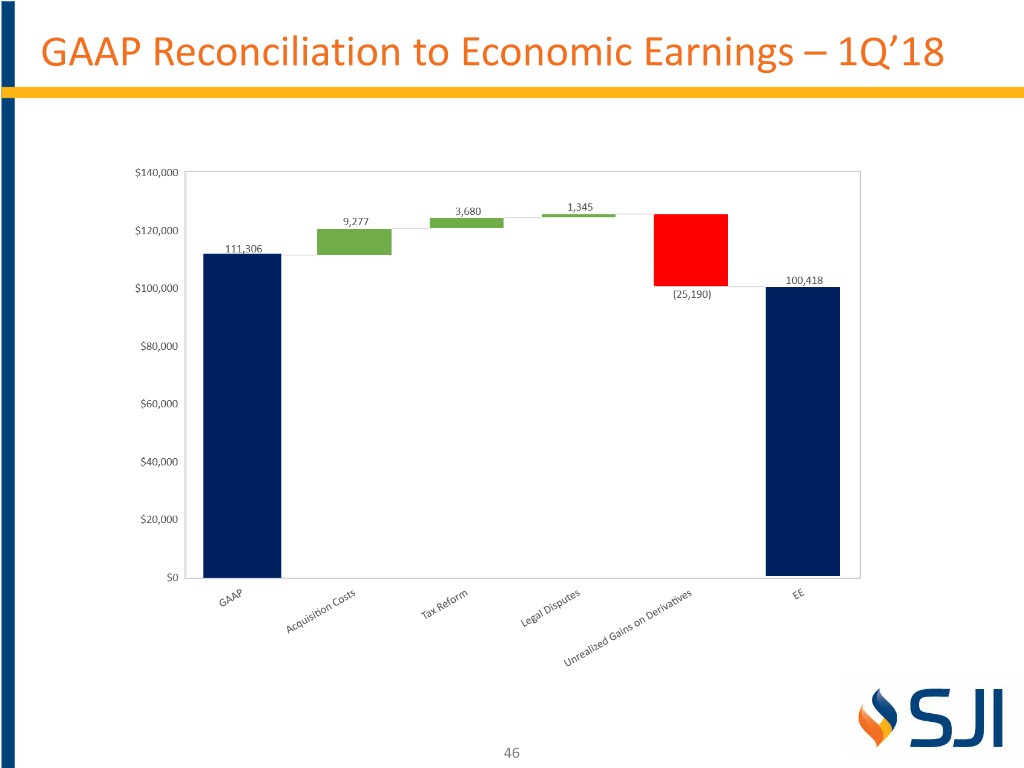

GAAP Reconciliation to Economic Earnings – 1Q’18 46

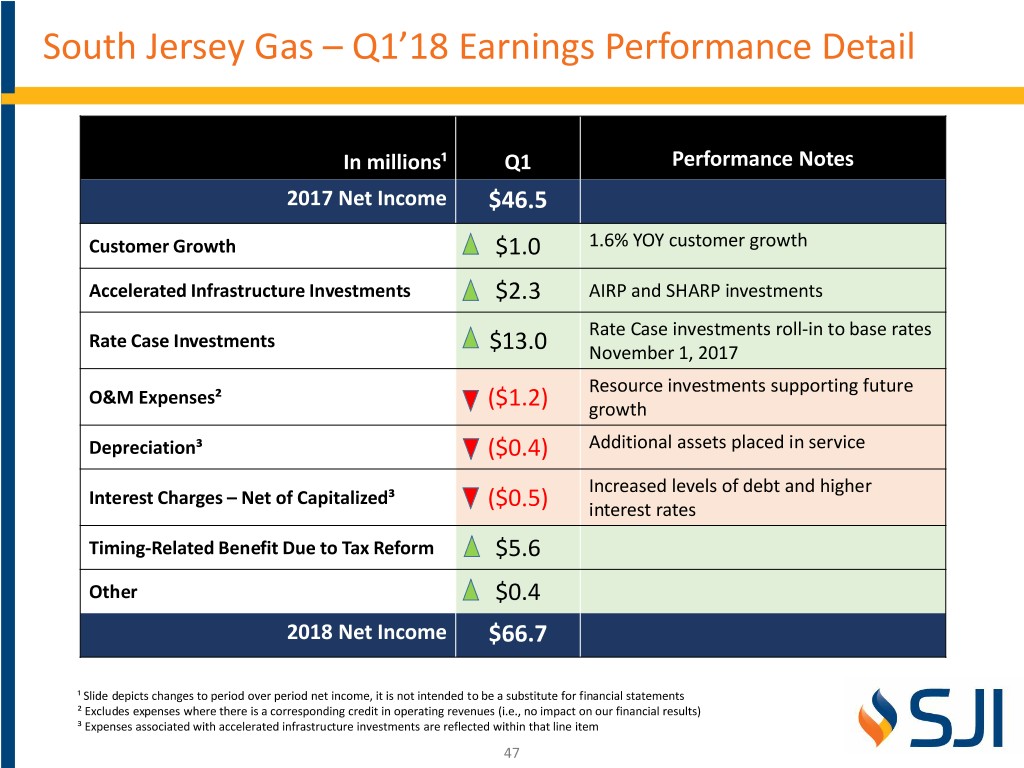

South Jersey Gas – Q1’18 Earnings Performance Detail In millions¹ Q1 Performance Notes 2017 Net Income $46.5 Customer Growth $1.0 1.6% YOY customer growth Accelerated Infrastructure Investments $2.3 AIRP and SHARP investments Rate Case investments roll-in to base rates Rate Case Investments $13.0 November 1, 2017 Resource investments supporting future O&M Expenses² ($1.2) growth Depreciation³ ($0.4) Additional assets placed in service Increased levels of debt and higher Interest Charges – Net of Capitalized³ ($0.5) interest rates Timing-Related Benefit Due to Tax Reform $5.6 Other $0.4 2018 Net Income $66.7 ¹ Slide depicts changes to period over period net income, it is not intended to be a substitute for financial statements ² Excludes expenses where there is a corresponding credit in operating revenues (i.e., no impact on our financial results) ³ Expenses associated with accelerated infrastructure investments are reflected within that line item 47

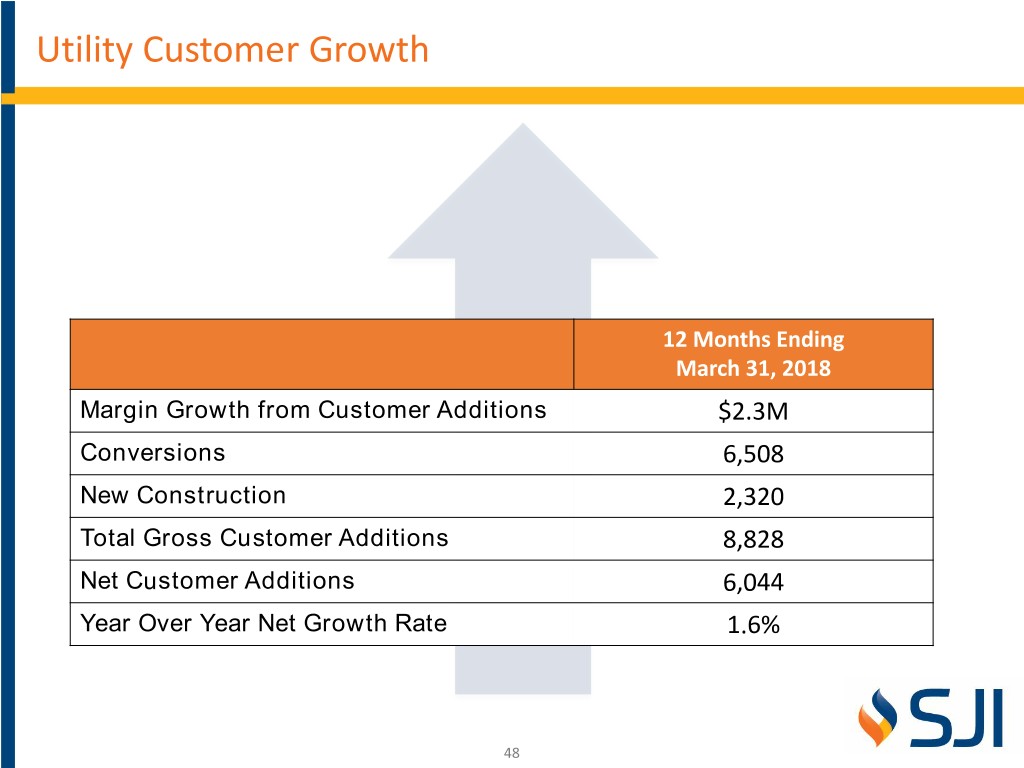

Utility Customer Growth 12 Months Ending March 31, 2018 Margin Growth from Customer Additions $2.3M Conversions 6,508 New Construction 2,320 Total Gross Customer Additions 8,828 Net Customer Additions 6,044 Year Over Year Net Growth Rate 1.6% 48