Attached files

| file | filename |

|---|---|

| 8-K/A - RELIANT BANCORP, INC. 8-K/A - Reliant Bancorp, Inc. | a51809249.htm |

| EX-99.1 - EXHIBIT 99.1 - Reliant Bancorp, Inc. | a51809249ex99_1.htm |

Exhibit 99.2

MAY 17, 2018 NASDAQ: RBNC Annual Meeting of Shareholders

Forward Looking Statement Statements in this presentation relating to Reliant Bancorp, Inc.’s plans, objectives, expectations or future performance are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “may,” “should,” “anticipate,” “estimate,” “expect,” “intend,” “objective,” “possible,” “seek,” “plan,” “strive” or similar words, or negatives of these words, identify forward-looking statements. These forward-looking statements are based on management’s current expectations. The Company’s actual results in future periods may differ materially from those indicated by forward-looking statements due to various risks and uncertainties. These and other risks and uncertainties are described in greater detail under “Risk Factors” in the Form 10-K and subsequent periodic reports filed with the Securities and Exchange Commission. The forward-looking statements in this presentation are made as of the date of the release and the Company does not assume any responsibility to update these statements.

2017 Highlights Record loans, deposits and assetsAchieved $1 billion in assets in second quarterCash dividend increased 9% to $0.24 per shareStrengthened capital base through earnings growth, exercise of stock options, and $25 million private placementAnnounced Community First merger in August, completed January 1, 2018Aligned brand under Reliant name with corporate name change and new symbol – RBNCOpened Chattanooga LPO in March

RBNC stock rose 20.7% in 2017 Total Return Stock Performance Total Return Stock Performance

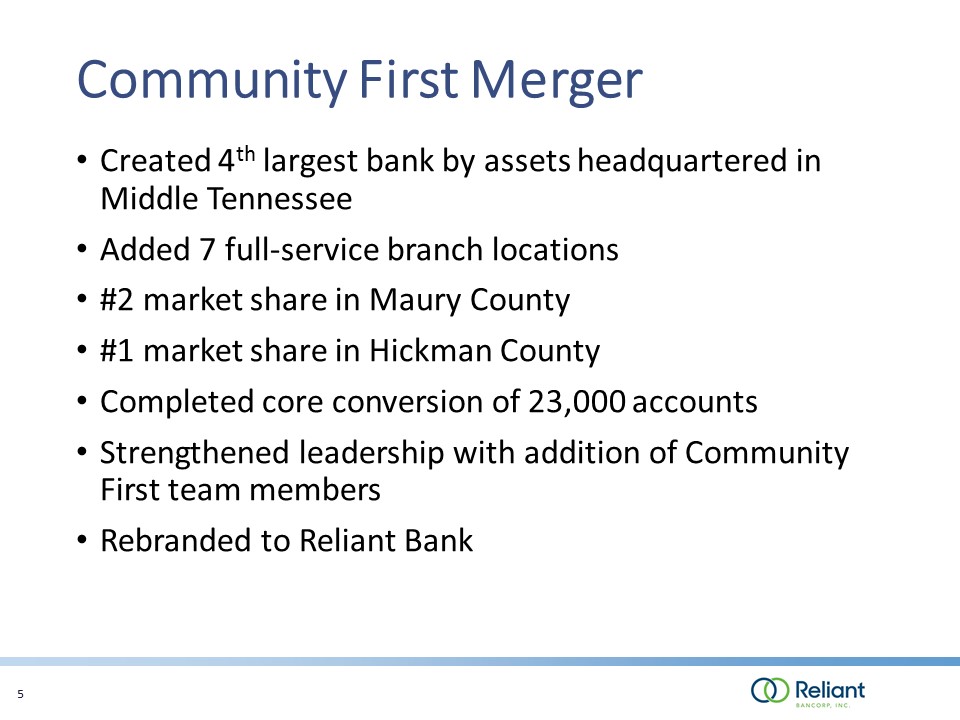

Community First Merger Created 4th largest bank by assets headquartered in Middle TennesseeAdded 7 full-service branch locations#2 market share in Maury County#1 market share in Hickman CountyCompleted core conversion of 23,000 accountsStrengthened leadership with addition of Community First team membersRebranded to Reliant Bank

SUMNER WILSON RUTHERFORD Gallatin Murfreesboro Nashville Franklin DAVIDSON 65 Lebanon MONTGOMERY ROBERTSON SUMNER WILSON RUTHERFORD MAURY HICKMAN WILLIAMSON DICKSON CHEATHAM Clarksville Springfield Gallatin Murfreesboro Brentwood Columbia Dickson AshlandCity Nashville 24 40 65 Lebanon HAMILTON Chattanooga RBNC Branches (8)Community First Branches (7)RBNC Mortgage LPO (1)RBNC LPO (2) DAVIDSON Reliant Bank Today

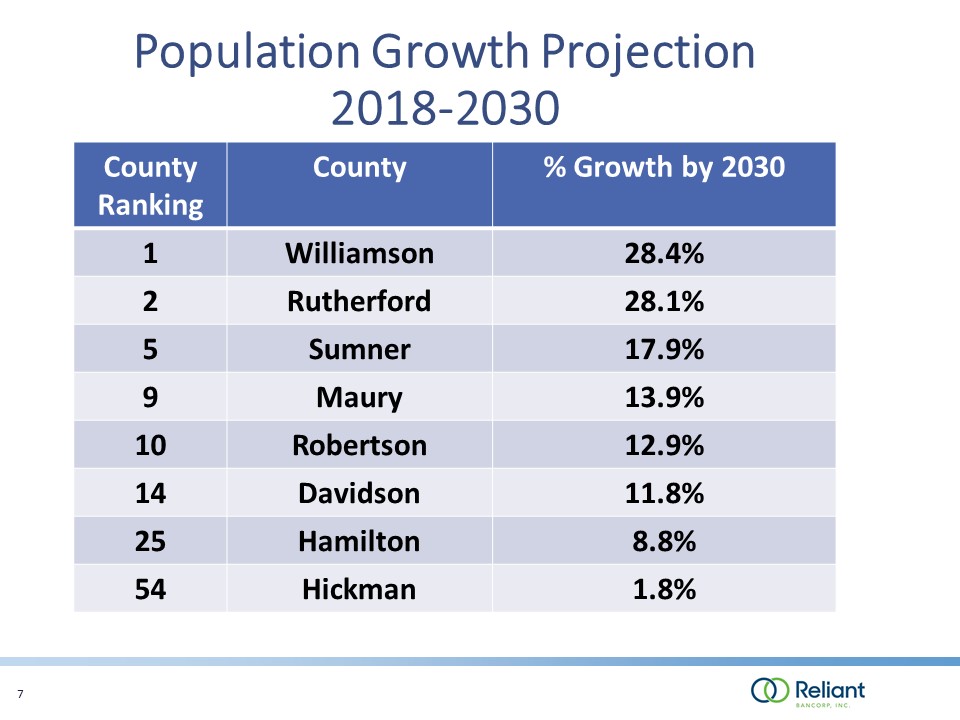

Population Growth Projection 2018-2030 County Ranking County % Growth by 2030 1 Williamson 28.4% 2 Rutherford 28.1% 5 Sumner 17.9% 9 Maury 13.9% 10 Robertson 12.9% 14 Davidson 11.8% 25 Hamilton 8.8% 54 Hickman 1.8%

First Quarter 2018 Highlights Record net income up 82% to $3.7 million, $.33 per share Return on average assets – 0.93% Return on average equity – 7.43%Loans up 59% to $1.1 billionDeposits rose 63% to $1.3 billionAssets increased 67% to $1.6 billionStrong net interest margin 3.79%Superior asset quality and low charge-offsStrong capital = all ratios exceed regulatory targets for “well capitalized”Positioned for further growth, profitability

Strategy for 2018 Maintain focus on strong, profitable organic growthGrow core depositsFull service office in Murfreesboro (Q3) and Chattanooga (Q4) Continue to add lending talentRemain committed to superior asset qualityImprove operating efficiency following Community First integrationEnhance digital experience – new website (May 1), on-line account openingStrategic M&A opportunities

NASDAQ: RBNC