Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Invitation Homes Inc. | ndrdeck8-k051618.htm |

Investor Presentation May 2018 Together with you, we make a house a home.

Disclaimer This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which include, but are not limited to, statements related to the Company’s expectations regarding the anticipated benefits of the merger with Starwood Waypoint Homes, the performance of the Company’s business, its financial results, its liquidity and capital resources, and other non-historical statements. In some cases, you can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "projects," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks associated with achieving expected revenue synergies or cost savings from the merger, risks inherent to the single-family rental industry sector and the Company’s business model, macroeconomic factors beyond the Company’s control, competition in identifying and acquiring the Company’s properties, competition in the leasing market for quality residents, increasing property taxes, homeowners' association fees and insurance costs, the Company’s dependence on third parties for key services, risks related to evaluation of properties, poor resident selection and defaults and non-renewals by the Company’s residents, performance of the Company’s information technology systems, and risks related to the Company’s indebtedness. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Additional factors that could cause the Company’s results to differ materially from those described in the forward-looking statements can be found under the section entitled "Part I. Item 1A. Risk Factors," of the Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the Securities and Exchange Commission (the "SEC"), as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at http://www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the Company’s filings with the SEC. The forward- looking statements speak only as of the date of this presentation, and we expressly disclaim any obligation or undertaking to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except to the extent otherwise required by law. 2

Southern California I. INVITATION HOMES INVESTMENT HIGHLIGHTS 3

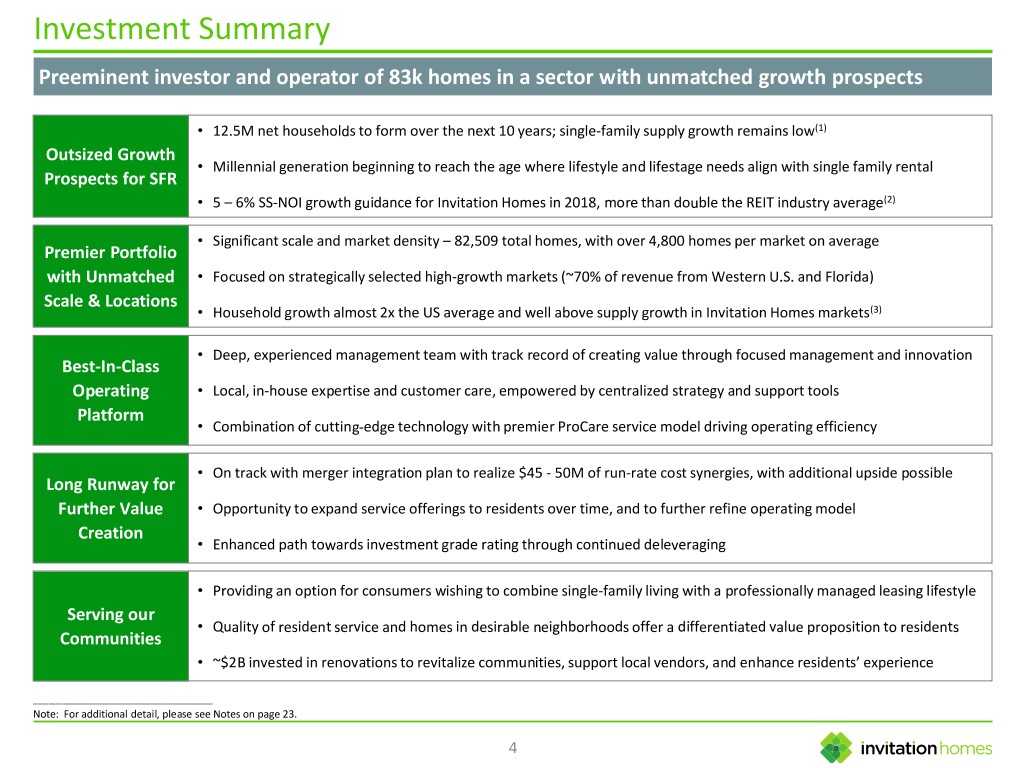

Investment Summary Preeminent investor and operator of 83k homes in a sector with unmatched growth prospects • 12.5M net households to form over the next 10 years; single-family supply growth remains low(1) Outsized Growth • Millennial generation beginning to reach the age where lifestyle and lifestage needs align with single family rental Prospects for SFR • 5 – 6% SS-NOI growth guidance for Invitation Homes in 2018, more than double the REIT industry average(2) • Significant scale and market density – 82,509 total homes, with over 4,800 homes per market on average Premier Portfolio with Unmatched • Focused on strategically selected high-growth markets (~70% of revenue from Western U.S. and Florida) Scale & Locations • Household growth almost 2x the US average and well above supply growth in Invitation Homes markets(3) • Deep, experienced management team with track record of creating value through focused management and innovation Best-In-Class Operating • Local, in-house expertise and customer care, empowered by centralized strategy and support tools Platform • Combination of cutting-edge technology with premier ProCare service model driving operating efficiency • On track with merger integration plan to realize $45 - 50M of run-rate cost synergies, with additional upside possible Long Runway for Further Value • Opportunity to expand service offerings to residents over time, and to further refine operating model Creation • Enhanced path towards investment grade rating through continued deleveraging • Providing an option for consumers wishing to combine single-family living with a professionally managed leasing lifestyle Serving our • Quality of resident service and homes in desirable neighborhoods offer a differentiated value proposition to residents Communities • ~$2B invested in renovations to revitalize communities, support local vendors, and enhance residents’ experience ________________________________________________ Note: For additional detail, please see Notes on page 23. 4

2018 Operational Priorities Operational priorities for 2018 are focused on execution 2018 Operational Priorities Targeted Outcomes/Benefits • 4 – 5% Same Store Core revenue growth 1 Continue to deliver strong operating results • 5 – 6% Same Store NOI growth • Enhance options for consumers who wish to combine single- Execute operationally to further enhance the quality of family living with a convenient and worry-free rental lifestyle 2 service we provide to residents • Continued resident loyalty and low turnover for Invitation Homes • Combination of the best elements of two innovative service Execute on our integration plan to realize the value we platforms to further optimize ProCare benefits for residents 3 indicated for residents, team members, and shareholders • $45 – 50 million of annual run-rate cost synergies, 75% realized on a run-rate basis by the end of 2018 4 Recycle capital • Enhance quality and location of our already best-in-class portfolio • Continue to progress towards an investment grade rating 5 Strengthen and optimize our balance sheet • Improve maturity profile and and borrowing costs 5

Outsized Growth Prospects and Attractive Risk Profile INVH offers an opportunity to own the premier portfolio and platform in a highly compelling asset class with significant growth potential, at a significant discount to embedded value 2018 SS-NOI Growth Guidance (1) Single Family Rental is a Uniquely Attractive Asset Class 6.0% Strong supply/demand and demographic fundamentals driving both cash flow and asset value growth 5.5% 5.0% Most liquid real estate asset class in the world 4.3% Value to both investors and owner-occupants 4.0% Significant diversification of assets within portfolio 3.0% 3.1% Non-SF Rental Wtd Avg: 2.5% 2.7% Stable, predictable cash flow 2.0% 2.1% 2.1% 2.0% 2.0% Low resident turnover 1.3% 1.0% Substantial upside to operating efficiency, with platform optimization early-stage compared to other real estate types 0.0% Rising interest rates and tax reform make renting more Invitation Industrial Storage Office Mall Strip Apartment Data Healthcare attractive Homes Center Center ________________________________________________ Source: Deutsche Bank Global Investment Banking. Note: For additional detail, please see Notes on page 23. 6

Premier Single-Family Portfolio Unmatched scale and density focused in strategically-selected high-growth locations 70% of Revenue Generated in Western U.S. and Seattle Florida Regions 5% Minne- apolis 2% >4,800 Northern Chicago California Homes per Market 5% on Average 7% Denver 3% Las Vegas Southern 3% Nashville Carolinas California Phoenix 1% 5% 13% 7% >95% Atlanta Dallas Jacksonville 12% of Revenue from Markets 3% 2% with >2,000 Homes Houston Orlando 2% 7% Tampa 10% South Florida 5 - 6% 13% Expected Increase in Percent of 1Q18 revenues 2018 Same Store NOI 7

Best-in-Class Operating & Asset Management Platform Innovative platform combining industry-leading people, practices, and technology Proprietary ProCare Service • Industry leading approach to service, combining in-house, local resident care with centralized oversight and support tools • Innovative technology including Smart Home optionality and proprietary ATLAS property and revenue management system • Collaboration between operations and investment management to drive consistency across the organization • Nearly 100% of “handyman work” performed by in-house maintenance technicians • Flexibility in catering to prospective residents’ preferences, with ability to offer self-showings or agent-assisted showings Efficient Service Driving High Resident Satisfaction and Low Turnover 8

Strong Revenue Momentum into Peak Leasing Season Occupancy is well positioned and rent growth is accelerating heading into peak season Same Store Average Occupancy Same Store New Lease Rental Rate Growth 96.1% 4.5% 96.0% 3.8% 95.8% 2.5% 95.4% 0.9% Jan 18 Feb 18 Mar 18 Apr 18 Jan 18 Feb 18 Mar 18 Apr 18 9

Merger Integration Remains on Track On track to deliver benefits committed to residents, team members, and shareholders Key Integration Milestones Status 1 Transition residents seamlessly upon merger close with uninterrupted service quality Complete 2 Finalize go-forward operating model and strategy decisions Complete 3 Select go-forward leadership personnel for both the corporate and field offices Complete 4 Build unified platform and technology for go-forward property management On track for completion in 2H 2018 5 Complete implementation of unified platform and field operations configuration On track for completion in 1H 2019 Synergy Projections Total Projected Synergy Savings (Annual Run-rate) Pace of Synergy Achievement (% of Projected Total) 100% Potential for 75% Property-Related Expenses $15.0 – 17.5 million additional upside as 50% best practices are Corporate-Related Expenses $30.0 – 32.5 million implemented across the organization Total Expected Synergies $45 – 50 million May 2018 Dec 2018 Jun 2019 10

Pursuing Investment Grade Balance Sheet Continuing to lower leverage, prolong maturities, and reduce borrowing costs Low Cost, Flexible Capital Structure Making Progress Towards Investment Grade ► No debt maturities until 2020(1) ► Recent refinancings have further strengthened our balance sheet: 3/31/17 9/30/17 Pro Forma(2) ► Recent swaps raise fixed or swapped to fixed rate debt 5.0 to 87% of total debt in 2019 from ~80% today Weighted Average Maturity (Yrs) 4.3 ► Flexible capital stack that is mostly prepayable at no cost 47% % of Assets Unencumbered 42% ► Significant liquidity with $1.1 billion available through revolving lines of credit and unrestricted cash 3.7% Weighted Average Cost of Debt 3.4% ► Cash flow growth provides opportunity to reduce Net Debt / Adjusted EBITDAre by ~1 turn per year, assuming debt were repaid with excess cash after dividend ________________________________________________ Note: For additional detail, please see Notes on page 23. 11

Seattle II. COMPELLING INDUSTRY FUNDAMENTALS 12

Favorable Macro Fundamentals Supply and demand remain supportive of growth, especially in Invitation Homes markets Projected Household Formations Total Single Family Completions (Household Growth, 2018e) (% of households) 1.9% 1.8% 1.3% 1.0% U.S. Average Invitation Homes Markets(1) 1985 - 2017 Average in Invitation Homes Markets, Invitation Homes Markets(1) 2018e(1) ________________________________________________ Source: Company public filings, Moody’s, John Burns, and BLS. Note: For additional detail, please see Notes on page 23. 13

Demographics Create a Long Runway for Household Formations JBREC expects 12.5M net households to form over the next 10 years Younger generations have shown a higher tendency to rent than own their homes 58% of the 12.5M net new households to be formed by 2025 are expected to be renters (1) 2016 - 2025e Forecast Household Growth by Decade Born (Millions) 15 25.8 million gains 14.0 10 5 5.9 4.3 13.3 million losses 1.6 0 (1.4) (0.1) (3.1) (3.8) Net Change in Households (Millions) Householdsin Change Net (4.9) (5) Pre 1930s 1930s Savers 1940s Achievers 1950s Innovators 1960s Equalers 1970s Balancers 1980s Sharers 1990s 2000s Globals Connectors Generation ________________________________________________ Source: John Burns Real Estate Consulting (JBREC) – Demographic Trends and the Outlook for Single Family Rentals, April 2017. Note: For additional detail, please see Notes on page 23. 14

Single-Family Rental Positioned to Take Incremental Market Share Age and lifestyle needs of renter base positions Single-Family Rentals to capture household growth Current Population by Age Cohort Comparing the United States’ 16 Million Single-Family (millions of people) Renters to its 28 Million Multifamily Renters (as estimated by John Burns Real Estate Consulting) Future Demand 24.0 Single-Family Renters Multifamily Renters Age Group 23.0 23.3 31% Under 35 37% 58% 35-64 46% 22.0 Avg. IH 11% 22.1 Resident 65+ 17% 21.9 Age: 39 21.0 21.1 21.2 38% Married Marital Status 21% Married 20.9 20.0 Number of Children 70% 19.6 48% None 19.0 37% 1-2 25% 15% 3+ 5% 18.0 15-19 20-24 25-29 30-34 35-39 40-44 45-49 ________________________________________________ Sources: U.S. Census Bureau (as of December 2017) and John Burns Real Estate Consulting (June 2017) 15

Denver III. THE INVITATION HOMES WAY – LEVERAGING OUR RESOURCES TO SERVE COMMUNITIES 16

Our Mission, Vision, and Values Mission Together with you, we make a house a home. Vision Values Unshakeable Integrity Continuous Excellence We hold ourselves accountable We always find a way to Be the premier choice in home leasing by to act with honesty, trust and innovate and deliver. continuously enhancing our residents’ respect. Standout Citizenship living experience. Genuine Care We strive to benefit our We serve with heart. neighbors and our communities. 17

Positive Impact on Residents and Communities Providing a high quality leasing experience for families and improving communities Resident Experience Community Investment “ProCare” professional resident services provided by in- $2 billion investment rehabilitating homes house local management and service teams $267 million annual local taxes supporting communities 24/7 resident service hotline $223 million annually to maintain homes for residents Resident First Look program for home sales Technology-enhanced resident experience $32 million paid to homeowner associations annually High quality homes in desirable neighborhoods Hundreds of local vendors supported Superior customer experience creating loyal residents 18

Orlando IV. APPENDIX 19

2018 Guidance Invitation Homes is positioned for another year of outsized growth FY 2018 Guidance Core FFO per common share, diluted $1.13 - $1.21 AFFO per common share, diluted $0.94 - $1.02 Same Store Core revenue growth 4% - 5% Same Store Core operating expense growth 2% - 3% Same Store NOI growth 5% - 6% ________________________________________________ Note: The Company does not provide guidance for the most comparable GAAP financial measures of net loss, total revenues, and property operating and maintenance, or a reconciliation of the forward- looking non-GAAP financial measures of Core FFO per share, AFFO per share, Same Store Core revenue growth, Same Store Core operating expense growth, and Same Store NOI growth to the comparable GAAP financial measures because it is unable to reasonably predict certain items contained in the GAAP measures, including non-recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, impairment on depreciated real estate assets, net (gain)/loss on sale of previously depreciated real estate assets, share-based compensation, casualty loss, non-Same Store revenues, and non-Same Store operating expenses. These items are uncertain, depend on various factors, and could have a material impact on our GAAP results for the guidance period. 20

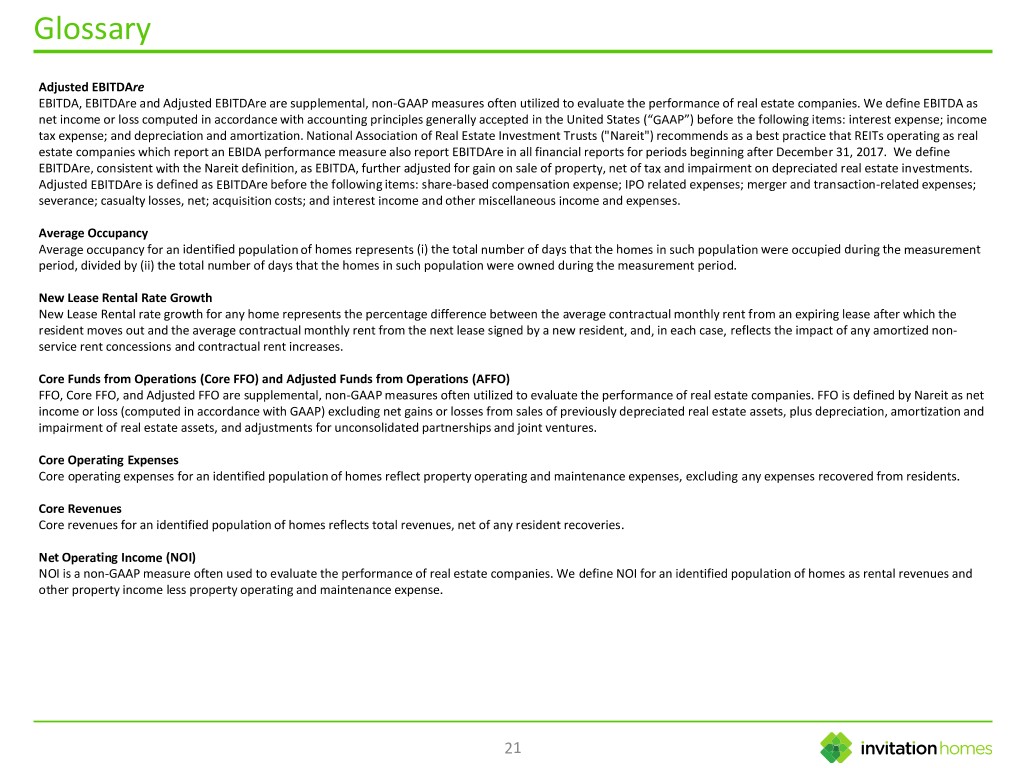

Glossary Adjusted EBITDAre EBITDA, EBITDAre and Adjusted EBITDAre are supplemental, non-GAAP measures often utilized to evaluate the performance of real estate companies. We define EBITDA as net income or loss computed in accordance with accounting principles generally accepted in the United States (“GAAP”) before the following items: interest expense; income tax expense; and depreciation and amortization. National Association of Real Estate Investment Trusts ("Nareit") recommends as a best practice that REITs operating as real estate companies which report an EBIDA performance measure also report EBITDAre in all financial reports for periods beginning after December 31, 2017. We define EBITDAre, consistent with the Nareit definition, as EBITDA, further adjusted for gain on sale of property, net of tax and impairment on depreciated real estate investments. Adjusted EBITDAre is defined as EBITDAre before the following items: share-based compensation expense; IPO related expenses; merger and transaction-related expenses; severance; casualty losses, net; acquisition costs; and interest income and other miscellaneous income and expenses. Average Occupancy Average occupancy for an identified population of homes represents (i) the total number of days that the homes in such population were occupied during the measurement period, divided by (ii) the total number of days that the homes in such population were owned during the measurement period. New Lease Rental Rate Growth New Lease Rental rate growth for any home represents the percentage difference between the average contractual monthly rent from an expiring lease after which the resident moves out and the average contractual monthly rent from the next lease signed by a new resident, and, in each case, reflects the impact of any amortized non- service rent concessions and contractual rent increases. Core Funds from Operations (Core FFO) and Adjusted Funds from Operations (AFFO) FFO, Core FFO, and Adjusted FFO are supplemental, non-GAAP measures often utilized to evaluate the performance of real estate companies. FFO is defined by Nareit as net income or loss (computed in accordance with GAAP) excluding net gains or losses from sales of previously depreciated real estate assets, plus depreciation, amortization and impairment of real estate assets, and adjustments for unconsolidated partnerships and joint ventures. Core Operating Expenses Core operating expenses for an identified population of homes reflect property operating and maintenance expenses, excluding any expenses recovered from residents. Core Revenues Core revenues for an identified population of homes reflects total revenues, net of any resident recoveries. Net Operating Income (NOI) NOI is a non-GAAP measure often used to evaluate the performance of real estate companies. We define NOI for an identified population of homes as rental revenues and other property income less property operating and maintenance expense. 21

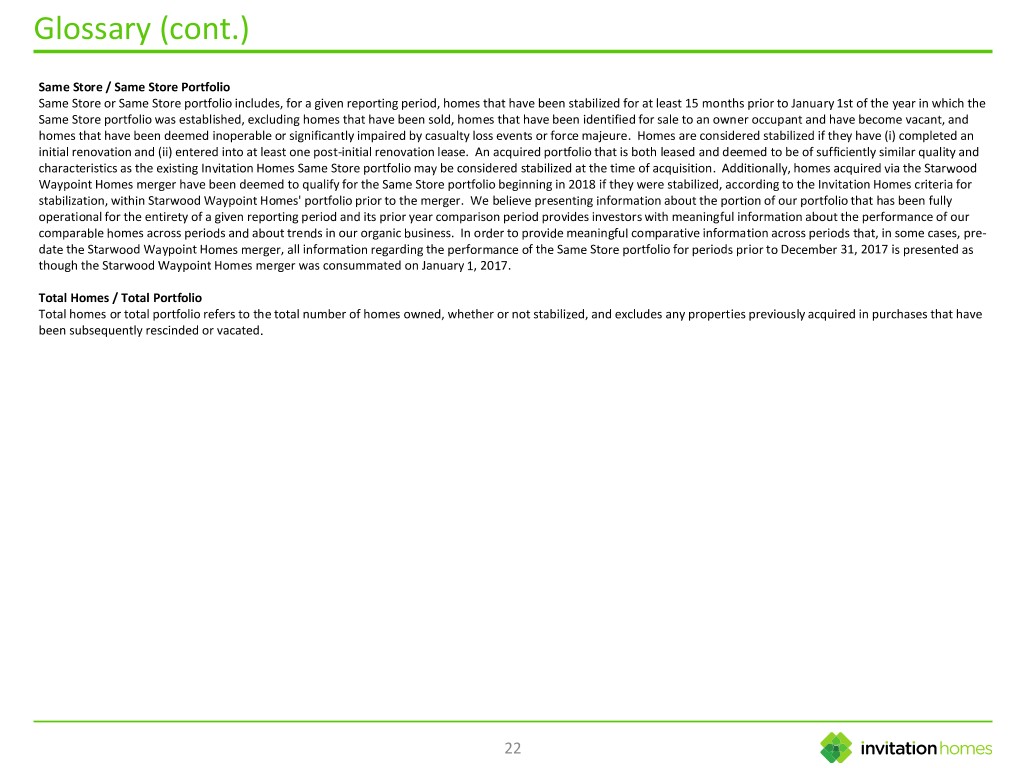

Glossary (cont.) Same Store / Same Store Portfolio Same Store or Same Store portfolio includes, for a given reporting period, homes that have been stabilized for at least 15 months prior to January 1st of the year in which the Same Store portfolio was established, excluding homes that have been sold, homes that have been identified for sale to an owner occupant and have become vacant, and homes that have been deemed inoperable or significantly impaired by casualty loss events or force majeure. Homes are considered stabilized if they have (i) completed an initial renovation and (ii) entered into at least one post-initial renovation lease. An acquired portfolio that is both leased and deemed to be of sufficiently similar quality and characteristics as the existing Invitation Homes Same Store portfolio may be considered stabilized at the time of acquisition. Additionally, homes acquired via the Starwood Waypoint Homes merger have been deemed to qualify for the Same Store portfolio beginning in 2018 if they were stabilized, according to the Invitation Homes criteria for stabilization, within Starwood Waypoint Homes' portfolio prior to the merger. We believe presenting information about the portion of our portfolio that has been fully operational for the entirety of a given reporting period and its prior year comparison period provides investors with meaningful information about the performance of our comparable homes across periods and about trends in our organic business. In order to provide meaningful comparative information across periods that, in some cases, pre- date the Starwood Waypoint Homes merger, all information regarding the performance of the Same Store portfolio for periods prior to December 31, 2017 is presented as though the Starwood Waypoint Homes merger was consummated on January 1, 2017. Total Homes / Total Portfolio Total homes or total portfolio refers to the total number of homes owned, whether or not stabilized, and excludes any properties previously acquired in purchases that have been subsequently rescinded or vacated. 22

Notes Page 4 1) Household formation forecast source: John Burns Real Estate Consulting (JBREC) – Demographic Trends and the Outlook for Single Family Rentals, April 2017. 2) REIT industry average guidance source: Deutsche Bank Global Investment Banking. REIT industry average represents the weighted average (by enterprise value) of the mid-points of guidance provided by each REIT in Green Street Advisors’ REIT coverage universe. Data as of May 11, 2018. 3) Household formation source: John Burns Real Estate Consulting (JBREC); Supply growth source: Moody’s. Page 6 1) Source: Deutsche Bank Global Investment Banking. REIT industry and subsector averages calculated as the weighted average (by enterprise value) of the mid- points of guidance provided by each REIT in Green Street Advisors’ REIT coverage universe. Data as of May 11, 2018. Page 11 1) Excludes $230 million of convertible notes maturing in 2019 2) Pro Forma the IH 2018-2 securitization loan and repayments of the IH 2015-1 and IH 2015-2 securitization loans in May 2018. Page 13 1) Weighted by total homes in each Invitation Homes market, as of March 31, 2018. Page 14 1) Estimated by John Burns Real Estate Consulting (JBREC) – Demographic Trends and the Outlook for Single Family Rentals, April 2017. 23