Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Magnolia Oil & Gas Corp | d589719d8k.htm |

May 16, 2018 Exhibit 99.1

Disclaimer FORWARD LOOKING STATEMENTS The information in this presentation and the oral statements made in connection therewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of present or historical fact included in this presentation, regarding TPG Pace Energy Holding Corp.’s (either as currently organized or as it may be reorganized in connection with the transactions contemplated in this presentation, “TPGE”) proposed acquisition of oil and gas assets from certain funds affiliated with EnerVest, Ltd. (“EnerVest”), TPGE’s ability to consummate the transaction, the benefits of the transaction and TPGE’s future financial performance following the transaction, as well as TPGE’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this presentation, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, TPGE disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. TPGE cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of TPGE, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. These risks include, but are not limited to, commodity price volatility, low prices for oil and/or natural gas, global economic conditions, inflation, increased operating costs, lack of availability of drilling and production equipment, supplies, services and qualified personnel, processing volumes and pipeline throughput, and certificates related to new technologies, geographical concentration of operations, environmental risks, weather risks, security risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, reductions in cash flow, lack of access to capital, TPGE’s ability to satisfy future cash obligations, restrictions in existing or future debt agreements, the timing of development expenditures, managing growth and integration of acquisitions, failure to realize expected value creation from property acquisitions, the defects and limited control over non-operated properties. Should one or more of the risks or uncertainties described in this presentation and the oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact TPGE's operations and projections can be found in its periodic filings with the Securities and Exchange Commission (the "SEC"), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2017. TPGE's SEC filings are available publicly on the SEC"s website at www.sec.gov. RESERVE INFORMATION Reserve engineering is a process of estimating underground accumulations of hydrocarbons that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions could impact TPGE’s strategy and change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered. Estimated Ultimate Recoveries, or “EURs,” refers to estimates of the sum of total gross remaining proved reserves per well as of a given date and cumulative production prior to such given date for developed wells. These quantities do not necessarily constitute or represent reserves as defined by the SEC and are not intended to be representative of all anticipated future well results. USE OF PROJECTIONS This presentation contains projections for TPGE, including with respect to its EBITDA, net debt to EBITDA ratio, capital budget, free cash flow and operating margin as well as its production volumes. TPGE’s independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessary indicative of future results. In this presentation, certain of the above-mentioned projected information has been repeated (in each case, with an indication that the information is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. Each of the assumptions and estimates underlying the projected information throughout this presentation are based on the data in Slide 16. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even of our assumptions and estimates are correct, projections are inherently uncertain due to a number of factors outside our control. Accordingly, there can be no assurance that the projected results are indicative of the future performance of TPGE after completion of the transaction or that actual results will not differ materially from those presented in the projected information. Inclusions of the projected information in this presentation should not be regarded as a representation by any person that the results contained in the projected information will be achieved. USE OF NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP financial measures, including EBITDA, Adjusted EBITDAX and free cash flow of TPGE. TPGE believes EBITDA, Adjusted EBITDAX and free cash flow are useful because they allow TPGE to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to financing methods or capital structure. TPGE does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of EBITDA, Adjusted EBITDAX and free cash flow may not be comparable to other similarly titled measures of other companies. TPGE excludes certain items from net (loss) income in arriving at EBITDA and Adjusted EBITDAX because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. EBITDA and Adjusted EBITDAX should not be considered as alternatives to, or more meaningful than, net income as determined in accordance with GAAP or as indicators of operating performance. Certain items excluded from EBITDA and Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of EBITDA or Adjusted EBITDAX. TPGE’s presentation of EBITDA and Adjusted EBITDAX should not be construed as an inference that its results will be unaffected by unusual or non-recurring terms. TPGE excludes capital expenditures from its cash flows from operations in arriving at its free cash flow in order to provide an understanding of certain factors and trends affecting its cash flows and liquidity. Free cash flow does not represent the residual cash flow available for discretionary expenditures. TPGE believes that free cash flow is useful to investors as a measure of the ability of its business to generate cash. INDUSTRY AND MARKET DATA This presentation has been prepared by TPGE and includes market data and other statistical information from sources believed by TPGE to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of TPGE, which are derived from its review of internal sources as well as the independent sources described above. Although TPGE believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness. TRADEMARKS AND TRADE NAMES TPGE and EnerVest own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with TPGE or EnerVest, or an endorsement or sponsorship by or of TPGE or EnerVest. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that TPGE or EnerVest will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. NO OFFER OR SOLICITATION This presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed business combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. IMPORTANT INFORMATION FOR INVESTORS AND SHAREHOLDERS In connection with the proposed business combination, TPGE has filed a preliminary proxy statement with the SEC. The definitive proxy statement, when available, and other relevant documents will be sent or given to the shareholders of TPGE and will contain important information about the proposed business combination and related matters. TPGE shareholders and other interested persons are advised to read, when available, the definitive proxy statement in connection with TPGE’s solicitation of proxies for the meeting of shareholders to be held to approve the business combination because the proxy statement will contain important information about the proposed business combination. When available, the definitive proxy statement will be mailed to TPGE shareholders as of a record date to be established for voting on the business combination and certain other matters. Shareholders will also be able to obtain copies of the definitive proxy statement, without charge, once available, at the SEC’s website at www.sec.gov. In addition, shareholders will be able to obtain free copies of the definitive proxy statement by directing a request to: TPG Pace Energy Holdings Corp., 301 Commerce Street, Suite 3300, Fort Worth, Texas 76102, Attn: Secretary. The information contained on, or that may be accessed through, the websites referenced in this presentation is not incorporated by reference into, and is not a part of, this presentation. PARTICIPANTS IN SOLICITATION TPGE, EnerVest and their respective directors and officers may be deemed participants in the solicitation of proxies of TPGE’s shareholders in connection with the proposed business combination. TPGE shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of TPGE in TPGE’s Registration Statement on Form S-1 initially filed with the SEC on April 17, 2017. Additional information will be available in the definitive proxy statement when it becomes available.

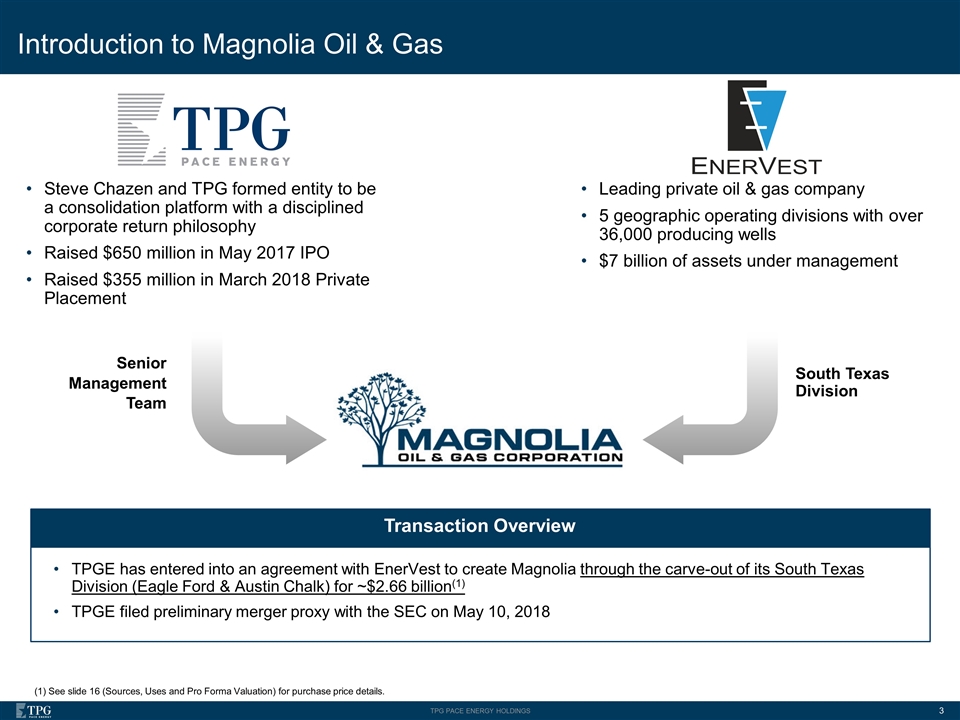

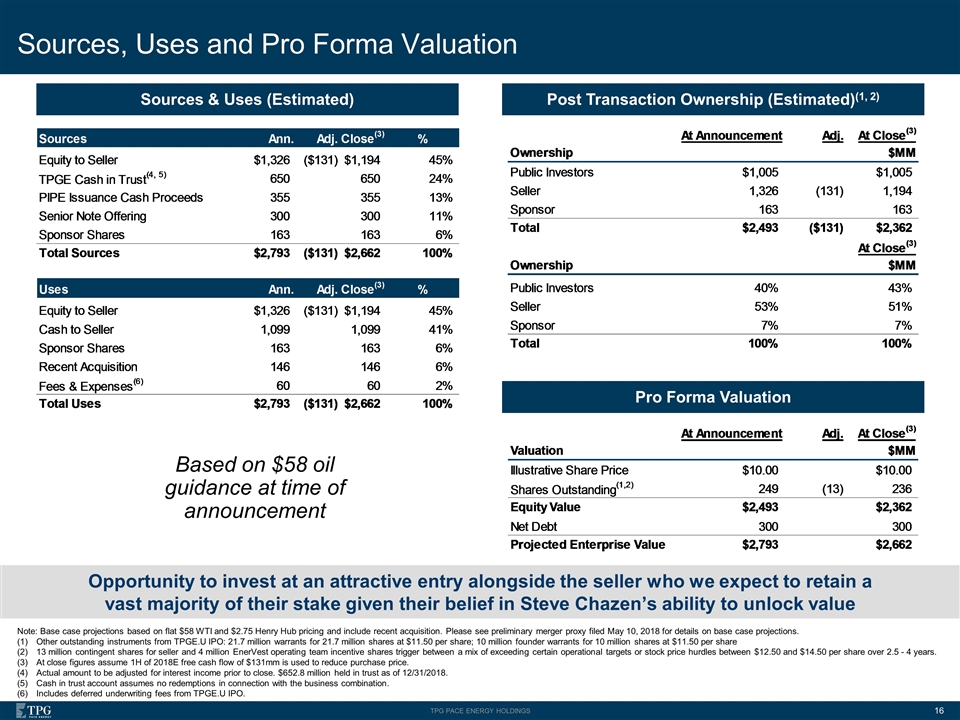

Introduction to Magnolia Oil & Gas TPGE has entered into an agreement with EnerVest to create Magnolia through the carve-out of its South Texas Division (Eagle Ford & Austin Chalk) for ~$2.66 billion(1) TPGE filed preliminary merger proxy with the SEC on May 10, 2018 Transaction Overview Steve Chazen and TPG formed entity to be a consolidation platform with a disciplined corporate return philosophy Raised $650 million in May 2017 IPO Raised $355 million in March 2018 Private Placement Leading private oil & gas company 5 geographic operating divisions with over 36,000 producing wells $7 billion of assets under management Senior Management Team South Texas Division (1) See slide 16 (Sources, Uses and Pro Forma Valuation) for purchase price details.

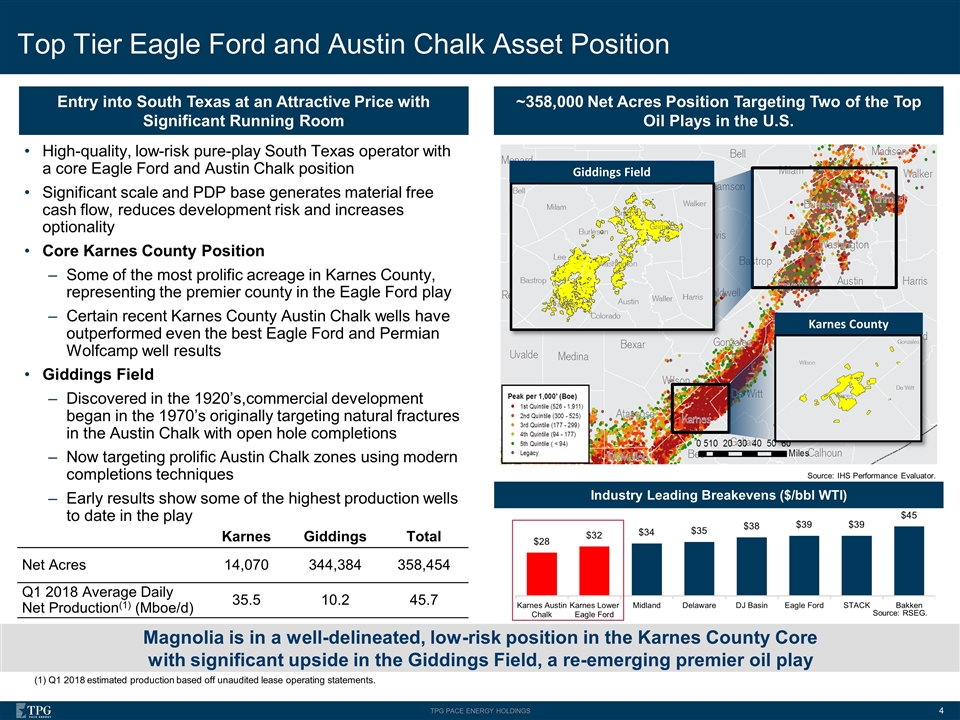

High-quality, low-risk pure-play South Texas operator with a core Eagle Ford and Austin Chalk position Significant scale and PDP base generates material free cash flow, reduces development risk and increases optionality Core Karnes County Position Some of the most prolific acreage in Karnes County, representing the premier county in the Eagle Ford play Certain recent Karnes County Austin Chalk wells have outperformed even the best Eagle Ford and Permian Wolfcamp well results Giddings Field Discovered in the 1920’s,commercial development began in the 1970’s originally targeting natural fractures in the Austin Chalk with open hole completions Now targeting prolific Austin Chalk zones using modern completions techniques Early results show some of the highest production wells to date in the play Top Tier Eagle Ford and Austin Chalk Asset Position ~358,000 Net Acres Position Targeting Two of the Top Oil Plays in the U.S. Entry into South Texas at an Attractive Price with Significant Running Room Industry Leading Breakevens ($/bbl WTI) Source: RSEG. Magnolia is in a well-delineated, low-risk position in the Karnes County Core with significant upside in the Giddings Field, a re-emerging premier oil play Source: IHS Performance Evaluator. Karnes Giddings Total Net Acres 14,070 344,384 358,454 Q1 2018 Average Daily Net Production(1) (Mboe/d) 35.5 10.2 45.7 Karnes County Giddings Field (1) Q1 2018 estimated production based off unaudited lease operating statements.

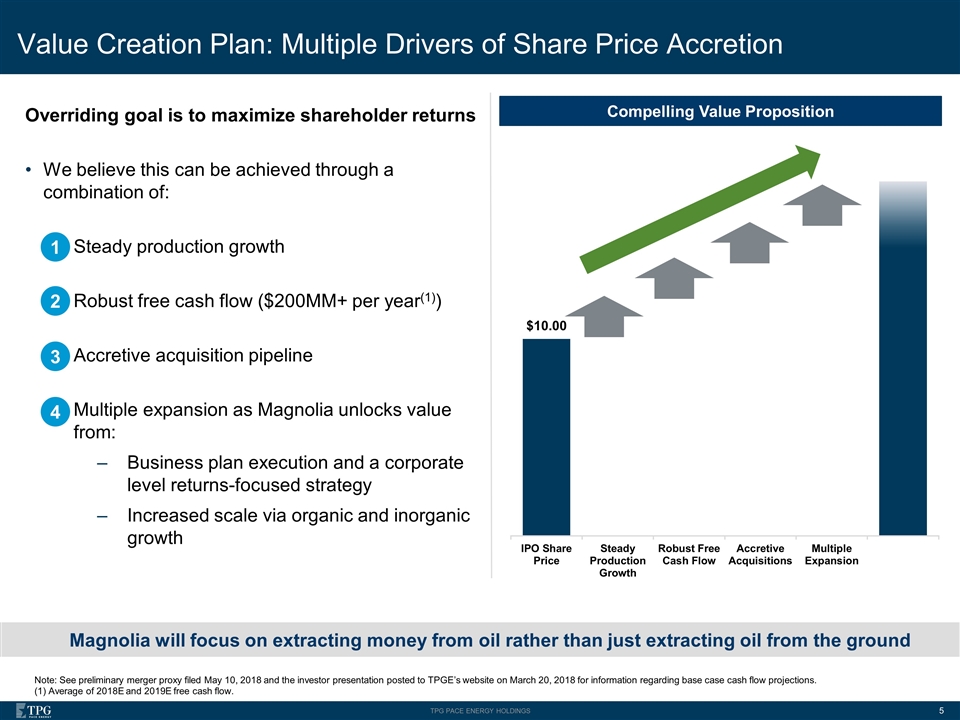

Value Creation Plan: Multiple Drivers of Share Price Accretion Magnolia will focus on extracting money from oil rather than just extracting oil from the ground Compelling Value Proposition Overriding goal is to maximize shareholder returns We believe this can be achieved through a combination of: Steady production growth Robust free cash flow ($200MM+ per year(1)) Accretive acquisition pipeline Multiple expansion as Magnolia unlocks value from: Business plan execution and a corporate level returns-focused strategy Increased scale via organic and inorganic growth 1 2 3 4 Note: See preliminary merger proxy filed May 10, 2018 and the investor presentation posted to TPGE’s website on March 20, 2018 for information regarding base case cash flow projections. (1) Average of 2018E and 2019E free cash flow.

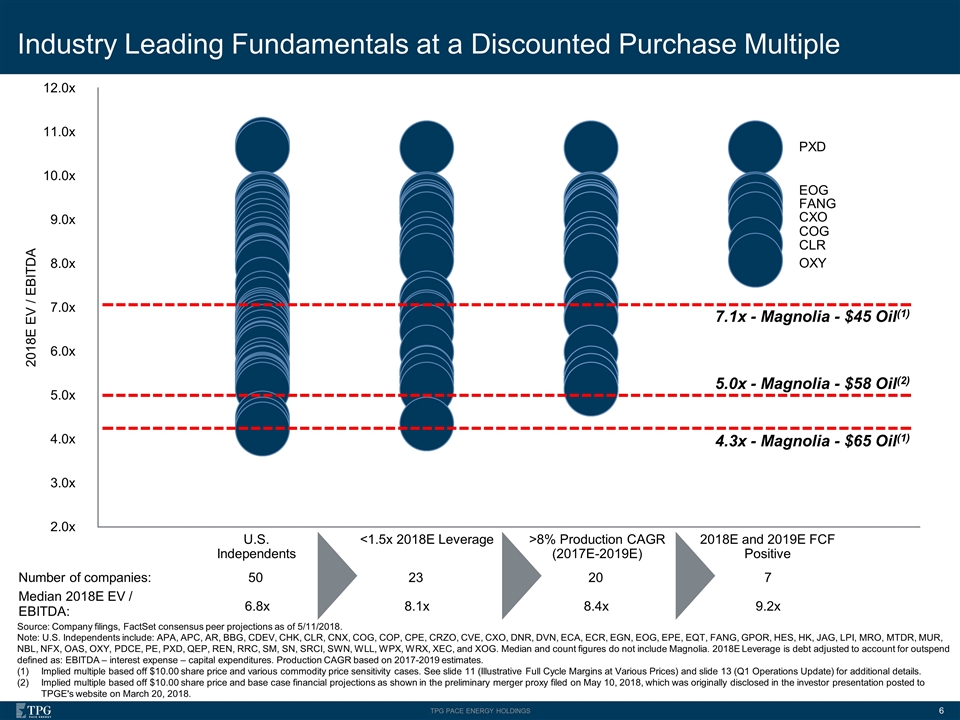

U.S. Independents <1.5x 2018E Leverage >8% Production CAGR (2017E-2019E) 2018E and 2019E FCF Positive Industry Leading Fundamentals at a Discounted Purchase Multiple Source: Company filings, FactSet consensus peer projections as of 5/11/2018. Note: U.S. Independents include: APA, APC, AR, BBG, CDEV, CHK, CLR, CNX, COG, COP, CPE, CRZO, CVE, CXO, DNR, DVN, ECA, ECR, EGN, EOG, EPE, EQT, FANG, GPOR, HES, HK, JAG, LPI, MRO, MTDR, MUR, NBL, NFX, OAS, OXY, PDCE, PE, PXD, QEP, REN, RRC, SM, SN, SRCI, SWN, WLL, WPX, WRX, XEC, and XOG. Median and count figures do not include Magnolia. 2018E Leverage is debt adjusted to account for outspend defined as: EBITDA – interest expense – capital expenditures. Production CAGR based on 2017-2019 estimates. Implied multiple based off $10.00 share price and various commodity price sensitivity cases. See slide 11 (Illustrative Full Cycle Margins at Various Prices) and slide 13 (Q1 Operations Update) for additional details. Implied multiple based off $10.00 share price and base case financial projections as shown in the preliminary merger proxy filed on May 10, 2018, which was originally disclosed in the investor presentation posted to TPGE's website on March 20, 2018. Number of companies: Median 2018E EV / EBITDA: 50 6.8x 23 8.1x 20 8.4x 7 9.2x CXO PXD EOG FANG COG OXY 7.1x - Magnolia - $45 Oil(1) CLR 5.0x - Magnolia - $58 Oil(2) 4.3x - Magnolia - $65 Oil(1)

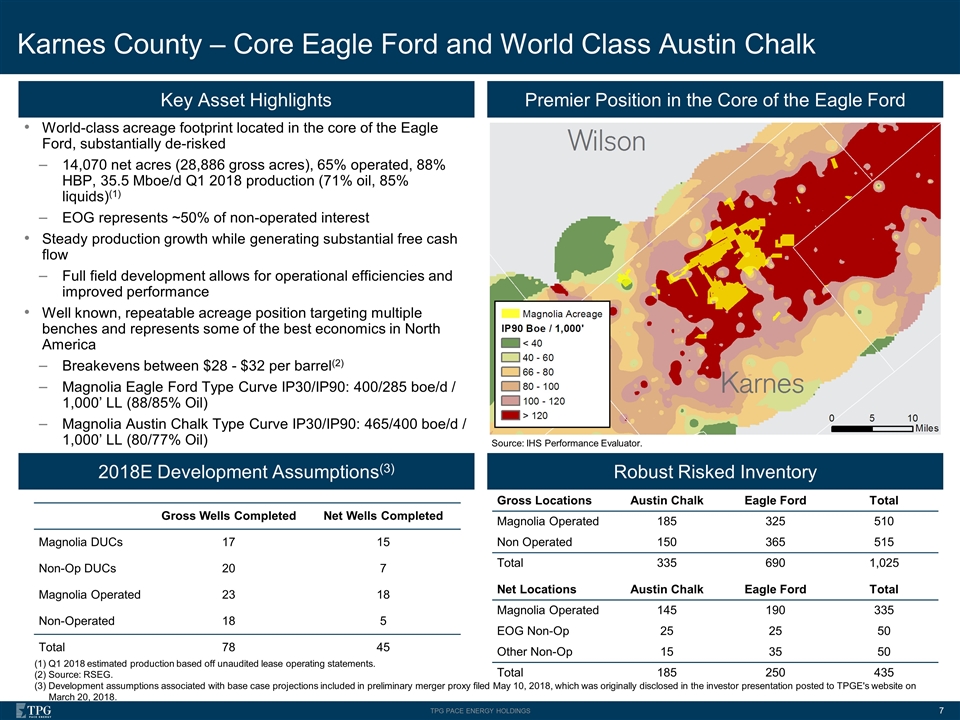

World-class acreage footprint located in the core of the Eagle Ford, substantially de-risked 14,070 net acres (28,886 gross acres), 65% operated, 88% HBP, 35.5 Mboe/d Q1 2018 production (71% oil, 85% liquids)(1) EOG represents ~50% of non-operated interest Steady production growth while generating substantial free cash flow Full field development allows for operational efficiencies and improved performance Well known, repeatable acreage position targeting multiple benches and represents some of the best economics in North America Breakevens between $28 - $32 per barrel(2) Magnolia Eagle Ford Type Curve IP30/IP90: 400/285 boe/d / 1,000’ LL (88/85% Oil) Magnolia Austin Chalk Type Curve IP30/IP90: 465/400 boe/d / 1,000’ LL (80/77% Oil) Karnes County – Core Eagle Ford and World Class Austin Chalk Key Asset Highlights Premier Position in the Core of the Eagle Ford Robust Risked Inventory 2018E Development Assumptions(3) Gross Locations Austin Chalk Eagle Ford Total Magnolia Operated 185 325 510 Non Operated 150 365 515 Total 335 690 1,025 Net Locations Austin Chalk Eagle Ford Total Magnolia Operated 145 190 335 EOG Non-Op 25 25 50 Other Non-Op 15 35 50 Total 185 250 435 (1) Q1 2018 estimated production based off unaudited lease operating statements. (2) Source: RSEG. (3) Development assumptions associated with base case projections included in preliminary merger proxy filed May 10, 2018, which was originally disclosed in the investor presentation posted to TPGE's website on March 20, 2018. Gross Wells Completed Net Wells Completed Magnolia DUCs 17 15 Non-Op DUCs 20 7 Magnolia Operated 23 18 Non-Operated 18 5 Total 78 45 Source: IHS Performance Evaluator.

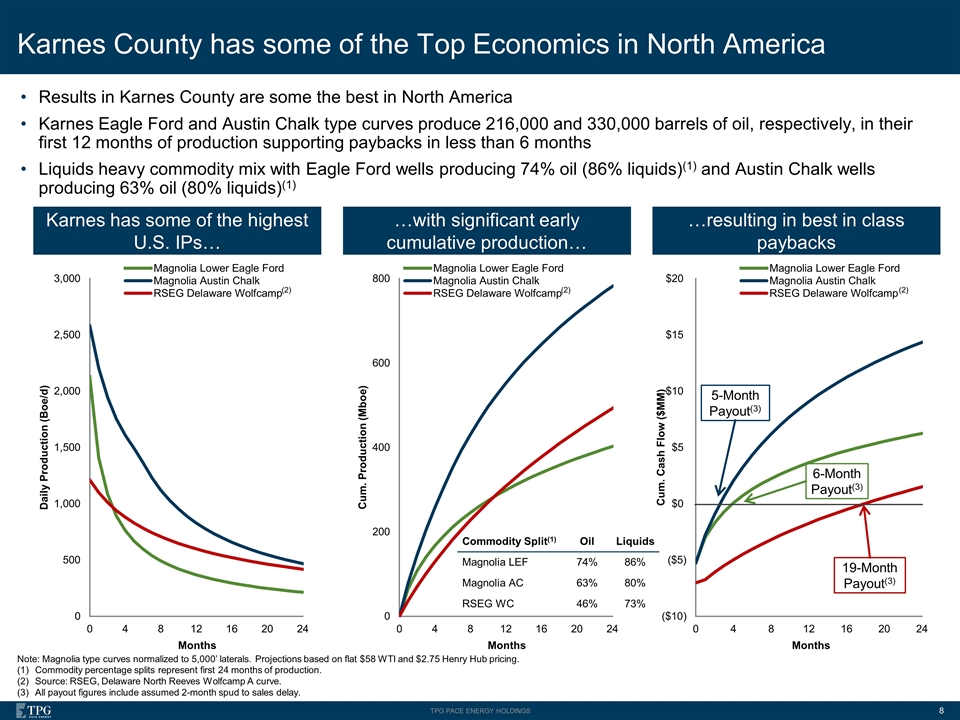

Karnes County has some of the Top Economics in North America Karnes has some of the highest U.S. IPs… Note: Magnolia type curves normalized to 5,000’ laterals. Projections based on flat $58 WTI and $2.75 Henry Hub pricing. Commodity percentage splits represent first 24 months of production. Source: RSEG, Delaware North Reeves Wolfcamp A curve. All payout figures include assumed 2-month spud to sales delay. Results in Karnes County are some the best in North America Karnes Eagle Ford and Austin Chalk type curves produce 216,000 and 330,000 barrels of oil, respectively, in their first 12 months of production supporting paybacks in less than 6 months Liquids heavy commodity mix with Eagle Ford wells producing 74% oil (86% liquids)(1) and Austin Chalk wells producing 63% oil (80% liquids)(1) …resulting in best in class paybacks 5-Month Payout(3) 6-Month Payout(3) 19-Month Payout(3) (2) …with significant early cumulative production… (2) (2) Commodity Split(1) Oil Liquids Magnolia LEF 74% 86% Magnolia AC 63% 80% RSEG WC 46% 73%

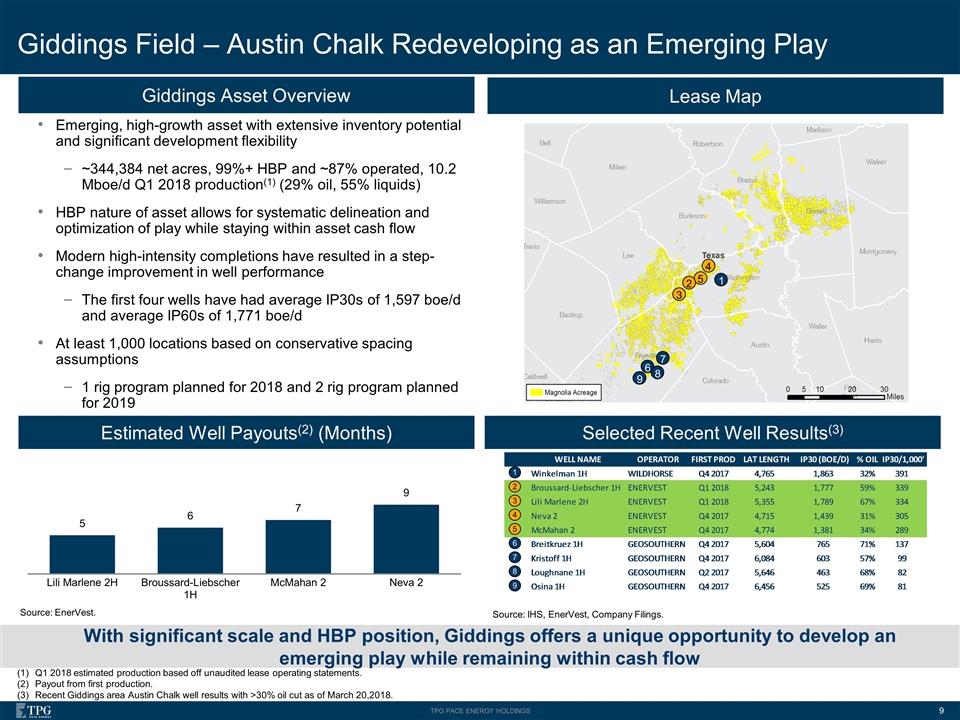

Giddings Field – Austin Chalk Redeveloping as an Emerging Play Giddings Asset Overview Emerging, high-growth asset with extensive inventory potential and significant development flexibility ~344,384 net acres, 99%+ HBP and ~87% operated, 10.2 Mboe/d Q1 2018 production(1) (29% oil, 55% liquids) HBP nature of asset allows for systematic delineation and optimization of play while staying within asset cash flow Modern high-intensity completions have resulted in a step-change improvement in well performance The first four wells have had average IP30s of 1,597 boe/d and average IP60s of 1,771 boe/d At least 1,000 locations based on conservative spacing assumptions 1 rig program planned for 2018 and 2 rig program planned for 2019 Lease Map Selected Recent Well Results(3) With significant scale and HBP position, Giddings offers a unique opportunity to develop an emerging play while remaining within cash flow Estimated Well Payouts(2) (Months) Q1 2018 estimated production based off unaudited lease operating statements. Payout from first production. Recent Giddings area Austin Chalk well results with >30% oil cut as of March 20,2018. Source: IHS, EnerVest, Company Filings. Source: EnerVest. 1 3 4 5 2 6 7 8 9 1 7 3 4 5 8 9 2 6

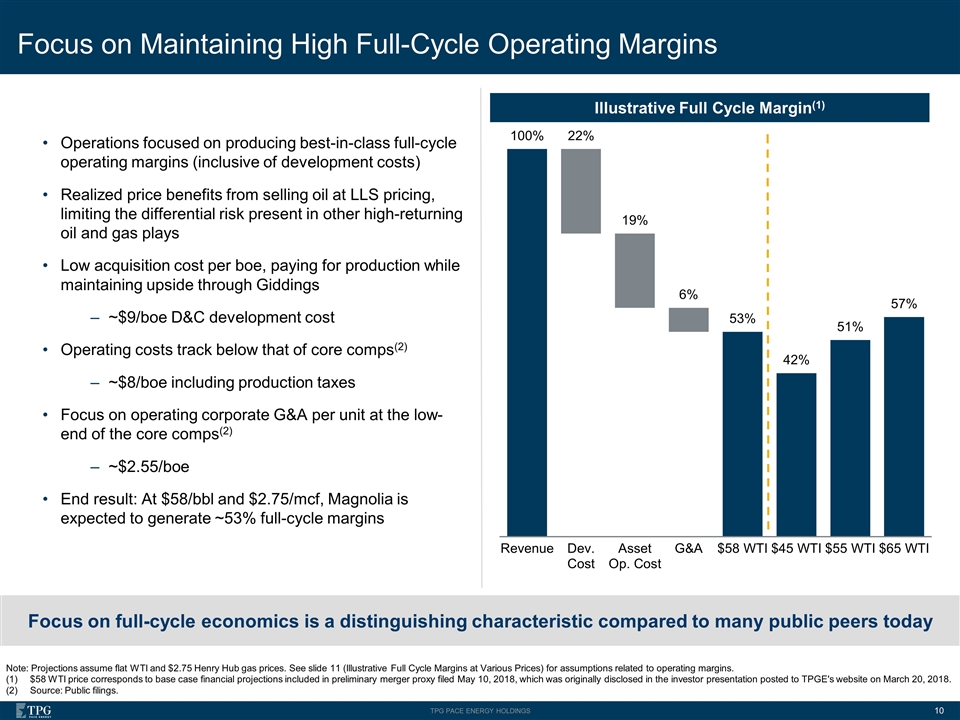

Focus on Maintaining High Full-Cycle Operating Margins Focus on full-cycle economics is a distinguishing characteristic compared to many public peers today Illustrative Full Cycle Margin(1) Operations focused on producing best-in-class full-cycle operating margins (inclusive of development costs) Realized price benefits from selling oil at LLS pricing, limiting the differential risk present in other high-returning oil and gas plays Low acquisition cost per boe, paying for production while maintaining upside through Giddings ~$9/boe D&C development cost Operating costs track below that of core comps(2) ~$8/boe including production taxes Focus on operating corporate G&A per unit at the low-end of the core comps(2) ~$2.55/boe End result: At $58/bbl and $2.75/mcf, Magnolia is expected to generate ~53% full-cycle margins Note: Projections assume flat WTI and $2.75 Henry Hub gas prices. See slide 11 (Illustrative Full Cycle Margins at Various Prices) for assumptions related to operating margins. $58 WTI price corresponds to base case financial projections included in preliminary merger proxy filed May 10, 2018, which was originally disclosed in the investor presentation posted to TPGE's website on March 20, 2018. Source: Public filings.

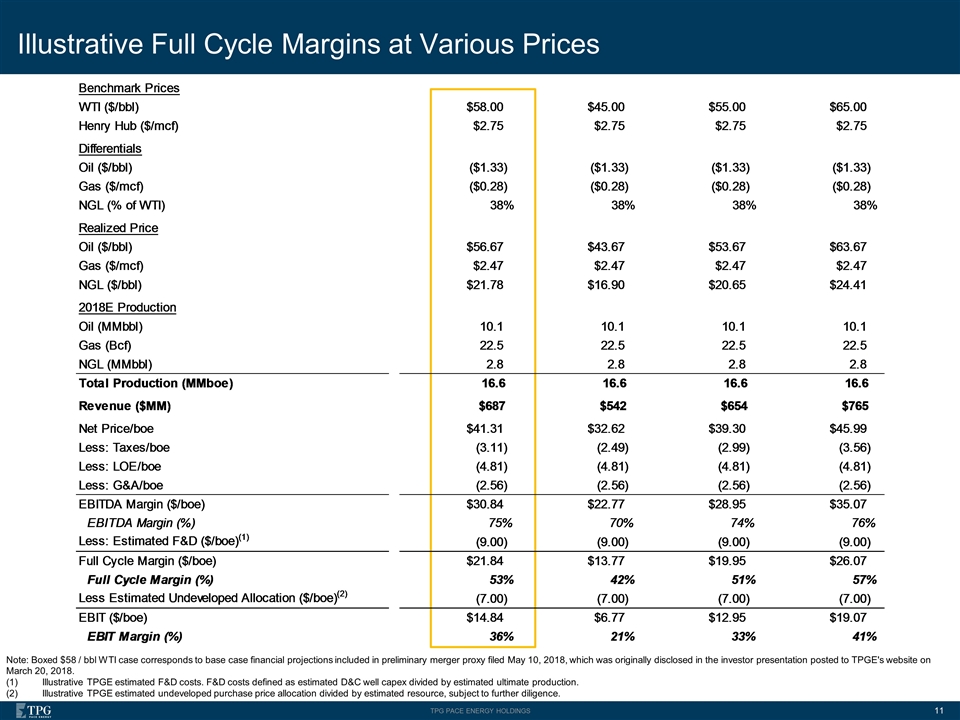

Illustrative Full Cycle Margins at Various Prices Note: Boxed $58 / bbl WTI case corresponds to base case financial projections included in preliminary merger proxy filed May 10, 2018, which was originally disclosed in the investor presentation posted to TPGE's website on March 20, 2018. Illustrative TPGE estimated F&D costs. F&D costs defined as estimated D&C well capex divided by estimated ultimate production. Illustrative TPGE estimated undeveloped purchase price allocation divided by estimated resource, subject to further diligence.

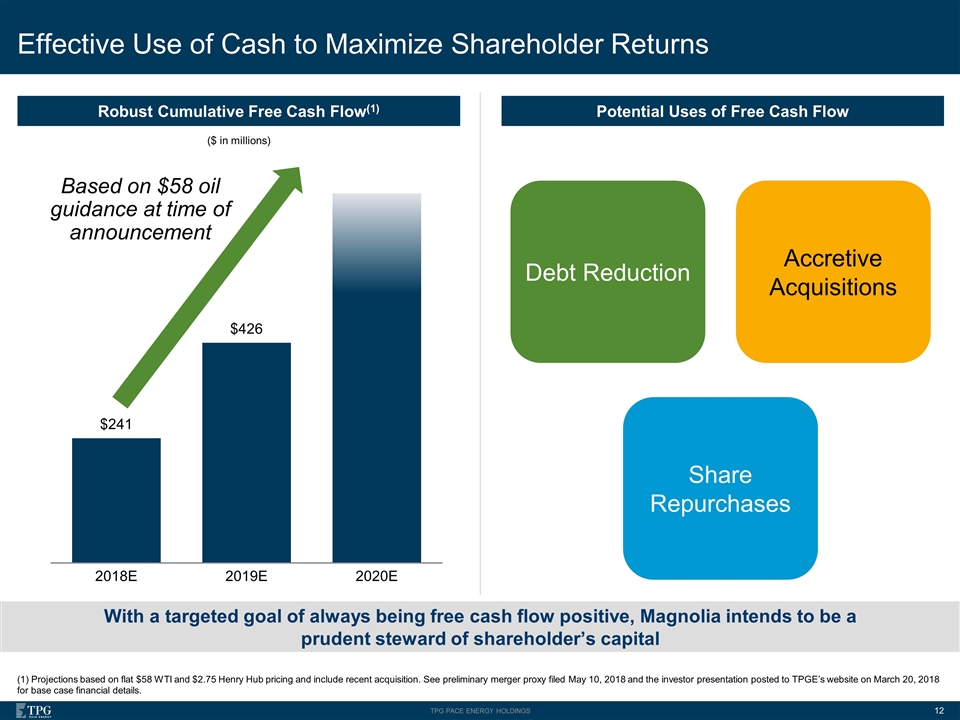

Effective Use of Cash to Maximize Shareholder Returns Robust Cumulative Free Cash Flow(1) (1) Projections based on flat $58 WTI and $2.75 Henry Hub pricing and include recent acquisition. See preliminary merger proxy filed May 10, 2018 and the investor presentation posted to TPGE’s website on March 20, 2018 for base case financial details. Potential Uses of Free Cash Flow With a targeted goal of always being free cash flow positive, Magnolia intends to be a prudent steward of shareholder’s capital Debt Reduction Accretive Acquisitions Share Repurchases ($ in millions) Based on $58 oil guidance at time of announcement

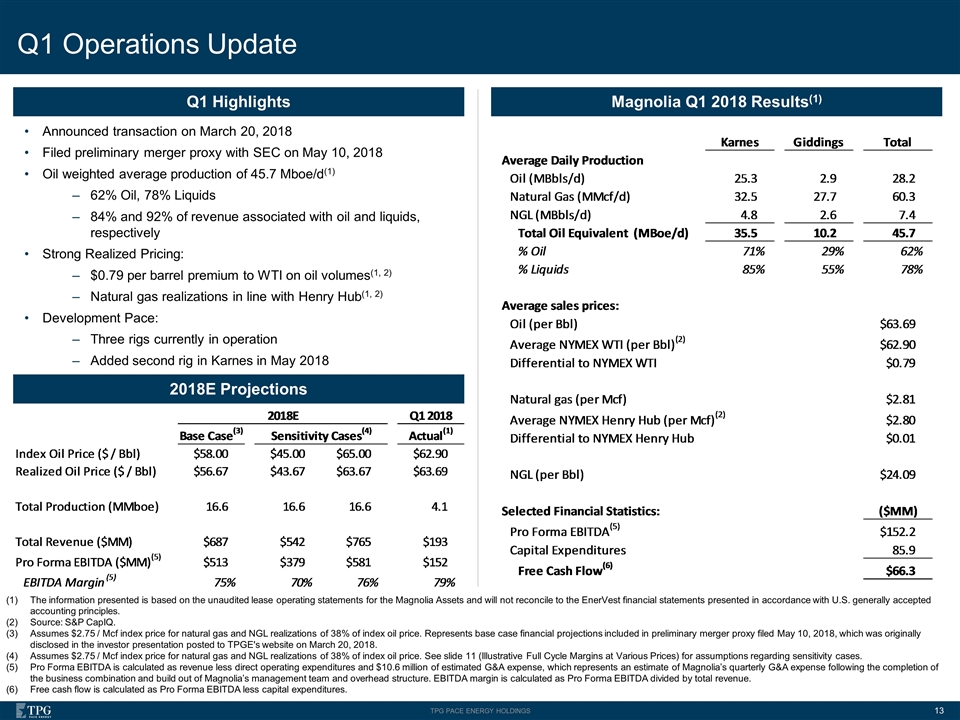

Q1 Operations Update Magnolia Q1 2018 Results(1) Q1 Highlights Announced transaction on March 20, 2018 Filed preliminary merger proxy with SEC on May 10, 2018 Oil weighted average production of 45.7 Mboe/d(1) 62% Oil, 78% Liquids 84% and 92% of revenue associated with oil and liquids, respectively Strong Realized Pricing: $0.79 per barrel premium to WTI on oil volumes(1, 2) Natural gas realizations in line with Henry Hub(1, 2) Development Pace: Three rigs currently in operation Added second rig in Karnes in May 2018 The information presented is based on the unaudited lease operating statements for the Magnolia Assets and will not reconcile to the EnerVest financial statements presented in accordance with U.S. generally accepted accounting principles. Source: S&P CapIQ. Assumes $2.75 / Mcf index price for natural gas and NGL realizations of 38% of index oil price. Represents base case financial projections included in preliminary merger proxy filed May 10, 2018, which was originally disclosed in the investor presentation posted to TPGE's website on March 20, 2018. Assumes $2.75 / Mcf index price for natural gas and NGL realizations of 38% of index oil price. See slide 11 (Illustrative Full Cycle Margins at Various Prices) for assumptions regarding sensitivity cases. Pro Forma EBITDA is calculated as revenue less direct operating expenditures and $10.6 million of estimated G&A expense, which represents an estimate of Magnolia’s quarterly G&A expense following the completion of the business combination and build out of Magnolia’s management team and overhead structure. EBITDA margin is calculated as Pro Forma EBITDA divided by total revenue. Free cash flow is calculated as Pro Forma EBITDA less capital expenditures. 2018E Projections

Premier Platform Positioned for Success Positive Free Cash Flow and Peer Leading Margins Multiple Levers of Growth Strong Balance Sheet and Financial Flexibility Experienced Management team Magnolia – Summary Investment Highlights

Appendix

Sources, Uses and Pro Forma Valuation Note: Base case projections based on flat $58 WTI and $2.75 Henry Hub pricing and include recent acquisition. Please see preliminary merger proxy filed May 10, 2018 for details on base case projections. Other outstanding instruments from TPGE.U IPO: 21.7 million warrants for 21.7 million shares at $11.50 per share; 10 million founder warrants for 10 million shares at $11.50 per share 13 million contingent shares for seller and 4 million EnerVest operating team incentive shares trigger between a mix of exceeding certain operational targets or stock price hurdles between $12.50 and $14.50 per share over 2.5 - 4 years. At close figures assume 1H of 2018E free cash flow of $131mm is used to reduce purchase price. Actual amount to be adjusted for interest income prior to close. $652.8 million held in trust as of 12/31/2018. Cash in trust account assumes no redemptions in connection with the business combination. Includes deferred underwriting fees from TPGE.U IPO. Opportunity to invest at an attractive entry alongside the seller who we expect to retain a vast majority of their stake given their belief in Steve Chazen’s ability to unlock value Post Transaction Ownership (Estimated)(1, 2) Sources & Uses (Estimated) Pro Forma Valuation Based on $58 oil guidance at time of announcement