Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Griffin Capital Essential Asset REIT, Inc. | gcear-03312018earningsrele.htm |

| 8-K - 8-K - Griffin Capital Essential Asset REIT, Inc. | gcearform8-kre1q2018earnin.htm |

SUMMARY OF EARNINGS RESULTS First Quarter 2018

Conference Call Agenda TOPIC SPEAKER Introduction and Portfolio Characteristics Michael Escalante | President & CIO Portfolio Update Michael Escalante | President & CIO Financial Performance Review Javier Bitar | Chief Financial Officer Questions & Answers Michael Escalante & Javier Bitar GRIFFIN CAPITAL 2

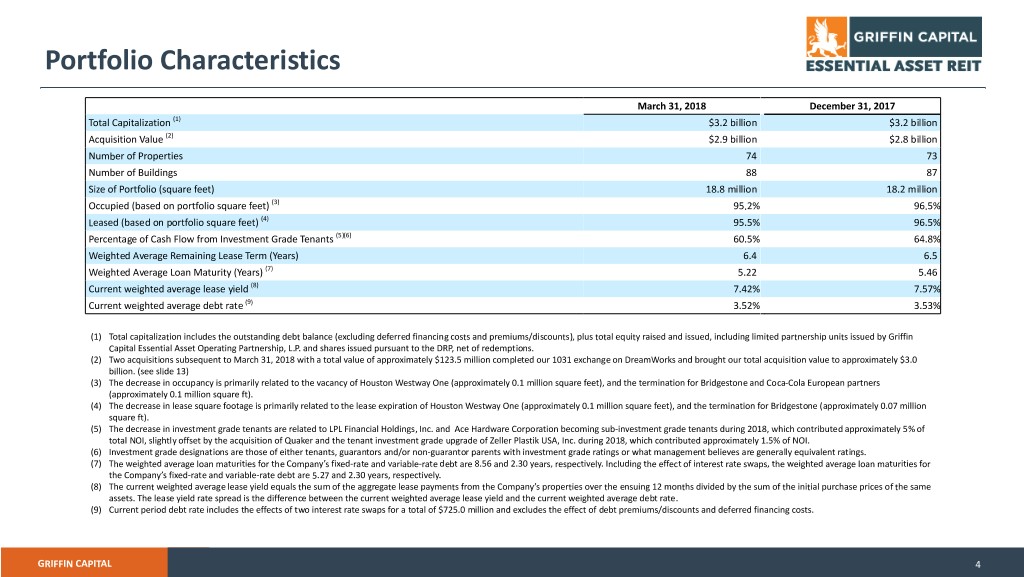

Portfolio Characteristics March 31, 2018 December 31, 2017 Total Capitalization (1) $3.2 billion $3.2 billion Acquisition Value (2) $2.9 billion $2.8 billion Number of Properties 74 73 Number of Buildings 88 87 Size of Portfolio (square feet) 18.8 million 18.2 million Occupied (based on portfolio square feet) (3) 95.2% 96.5% Leased (based on portfolio square feet) (4) 95.5% 96.5% Percentage of Cash Flow from Investment Grade Tenants (5)(6) 60.5% 64.8% Weighted Average Remaining Lease Term (Years) 6.4 6.5 Weighted Average Loan Maturity (Years) (7) 5.22 5.46 Current weighted average lease yield (8) 7.42% 7.57% Current weighted average debt rate (9) 3.52% 3.53% (1) Total capitalization includes the outstanding debt balance (excluding deferred financing costs and premiums/discounts), plus total equity raised and issued, including limited partnership units issued by Griffin Capital Essential Asset Operating Partnership, L.P. and shares issued pursuant to the DRP, net of redemptions. (2) Two acquisitions subsequent to March 31, 2018 with a total value of approximately $123.5 million completed our 1031 exchange on DreamWorks and brought our total acquisition value to approximately $3.0 billion. (see slide 13) (3) The decrease in occupancy is primarily related to the vacancy of Houston Westway One (approximately 0.1 million square feet), and the termination for Bridgestone and Coca-Cola European partners (approximately 0.1 million square ft). (4) The decrease in lease square footage is primarily related to the lease expiration of Houston Westway One (approximately 0.1 million square feet), and the termination for Bridgestone (approximately 0.07 million square ft). (5) The decrease in investment grade tenants are related to LPL Financial Holdings, Inc. and Ace Hardware Corporation becoming sub-investment grade tenants during 2018, which contributed approximately 5% of total NOI, slightly offset by the acquisition of Quaker and the tenant investment grade upgrade of Zeller Plastik USA, Inc. during 2018, which contributed approximately 1.5% of NOI. (6) Investment grade designations are those of either tenants, guarantors and/or non-guarantor parents with investment grade ratings or what management believes are generally equivalent ratings. (7) The weighted average loan maturities for the Company’s fixed-rate and variable-rate debt are 8.56 and 2.30 years, respectively. Including the effect of interest rate swaps, the weighted average loan maturities for the Company’s fixed-rate and variable-rate debt are 5.27 and 2.30 years, respectively. (8) The current weighted average lease yield equals the sum of the aggregate lease payments from the Company’s properties over the ensuing 12 months divided by the sum of the initial purchase prices of the same assets. The lease yield rate spread is the difference between the current weighted average lease yield and the current weighted average debt rate. (9) Current period debt rate includes the effects of two interest rate swaps for a total of $725.0 million and excludes the effect of debt premiums/discounts and deferred financing costs. GRIFFIN CAPITAL 4

Portfolio Characteristics (cont’d) March 31, 2018 December 31, 2017 Weighted Average Annual Rent Increase (1) 2.1% 2.1% Total Real Estate, Net $2.5 billion $2.4 billion Total Assets $2.8 billion $2.8 billion Total Debt $1.4 billion $1.4 billion Total Equity Raised (including DRP), Net of Redemptions $1.8 billion $1.8 billion Sponsor Equity Commitment (2) $26 million $26 million Ratios: Fixed Charge Coverage (Quarter to Date) (3) 3.70 3.49 Interest Coverage (Quarter to Date) (4) 4.20 3.94 Debt to Total Capitalization 43.3% 43.5% Debt to Total Real Estate Acquisition Value 48.2% 49.3% (1) Weighted average rental increase is based on the remaining term of the lease at acquisition date. Rental increase may differ based on the full lease term, which is from the original commencement date. (2) Represents investments by the principals and certain affiliates of Griffin Capital Company, LLC. (3) Fixed charge coverage is the ratio of principal amortization for the period plus interest expense as if the corresponding debt were in place at the beginning of the period plus preferred unit distributions as if in place at the beginning of the period over adjusted EBITDA. See reconciliation of net income to adjusted EBITDA and coverage ratios in the earnings release filed on May 16, 2018. (4) Interest coverage is the ratio of interest expense as if the corresponding debt was in place at the beginning of the period to adjusted EBITDA. See reconciliation of net income to adjusted EBITDA and coverage ratios in the earnings release filed on May 16, 2018. GRIFFIN CAPITAL 5

Diversified National Portfolio* Portfolio as of March 31, 2018 Logos shown are those of tenants, lease guarantors, or non-guarantor parent companies at our properties GRIFFIN CAPITAL 7

Portfolio Characteristics Acquisitions (dollars in thousands) Acquisition/ Initial Year of Net Rental Payment - 12 Disposition Approximate Credit Capitalization Lease Months Subsequent to Property Location Major Tenant Date Purchase Price Square Feet Rating (S&P) (1) Rate Expiration March 31, 2018 Total Portfolio as of December 31, 2017 $ 2,834,082 18,227,900 7.55% $ 212,744 Acquisition: Quaker Sales & Quaker Lakeland, FL Distribution, Inc. 3/13/2018 59,600 605,400 A+ 4.85% 2028 1,923 Total Portfolio as of (2) March 31, 2018 $ 2,893,682 18,833,300 7.49% $ 214,667 (1) Reflects the credit rating of tenant, parent, and/or guarantor. (2) Represents the weighted average initial capitalization rate based on total purchase price. GRIFFIN CAPITAL 8

Portfolio Concentration As of March 31, 2018 Capital Goods: 18.0% (3) Tenant Business (1) Diversity Telecommunication Services: Griffin Capital management makes a (4) 10.9% conscious effort to achieve All others: 11.8% diversification by tenant industry as Griffin Capital Essential Asset REIT’s portfolio grows. As of March 31, 2018, our analysis segmented Consumer Durables & Apparel: Griffin Capital Essential Asset REIT’s 3.7% portfolio into 19 industry groups (2), Insurance: 10.4% the largest of which, Capital Goods, Technology, Hardware & accounted for approximately 18 Equipment: 3.7% percent of net rental revenue. Consumer Services: 3.7% Health Care Equipment & Energy: 4.4% Services: 8.8% Retailing: 4.5% Media: 4.7% Software & Services: 6.9% Diversified Financials: 8.5% (1) As of March 31, 2018, no tenant accounted for more than 6.5% of total net rental revenue. (2) Based on 2016 Global Industry Classification Standard (GICS). (3) Capital goods includes the following industry sub-groups: Industrial Conglomerates (6.5%), Aerospace & Defense (5.2%), Machinery (2.1%), Construction & Engineering (2.0%), Electrical Equipment (1.2%) and Trading Companies & Distributors (1.0%). (4) All others account for less than 3% of total net rent for the 12-month period subsequent to March 31, 2018 on an individual basis. GRIFFIN CAPITAL 9

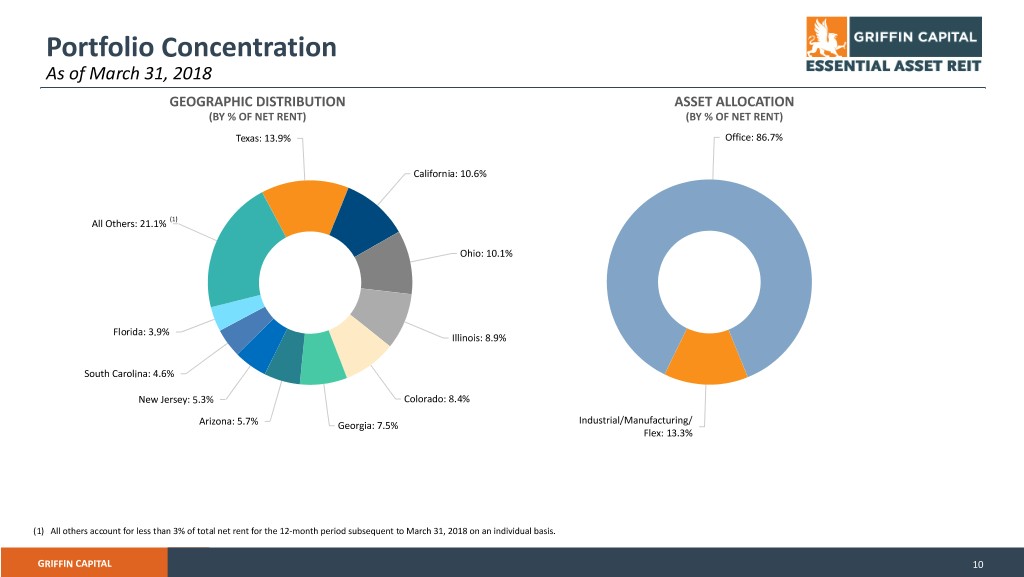

Portfolio Concentration As of March 31, 2018 GEOGRAPHIC DISTRIBUTION ASSET ALLOCATION (BY % OF NET RENT) (BY % OF NET RENT) Texas: 13.9% Office: 86.7% California: 10.6% All Others: 21.1% (1) Ohio: 10.1% Florida: 3.9% Illinois: 8.9% South Carolina: 4.6% New Jersey: 5.3% Colorado: 8.4% Industrial/Manufacturing/ Arizona: 5.7% Georgia: 7.5% Flex: 13.3% (1) All others account for less than 3% of total net rent for the 12-month period subsequent to March 31, 2018 on an individual basis. GRIFFIN CAPITAL 10

Portfolio Concentration As of March 31, 2018 CREDIT CHARACTERISTICS (BY % OF NET RENT) (1) Investment Grade: 60.5% Unrated Credit: 4.8% Sub-Investment Grade: 34.7% (1) Investment grade descriptions are those of either tenants, guarantors, and/or non-guarantor parents with investment grade ratings or what management believes are generally equivalent ratings. GRIFFIN CAPITAL 11

Strong Tenant Profile – Top 10 Tenants As of March 31, 2018 Top Tenants % of Portfolio(1) S&P(2) (3) 6.5% A+ (4) 3.7% BB- 3.7% AA 3.2% BB- (5) 3.1% HY1 (6) 3.1% BBB- 2.8% BB+ 2.4% IG7 (6) (1) Based on net rental payment. (2) Ratings are those of tenants, guarantors, or non-guarantor parent entities. 2.1% A (3) Represents the combined net rental revenue for the Atlanta, GA; West Chester, OH; and Houston, TX properties. 2.1% BBB- (4) Represents the Fitch rating. (5) Represents Egan-Jones rating. (6) Represents the Bloomberg rating. TOTAL 32.7% GRIFFIN CAPITAL 12

Subsequent Acquisitions (dollars in thousands) Approx. Square Credit Initial Cap Lease Net Rental Property Location Tenant Purchase Price Feet Rating (S&P) (1) Rate Expiration Payment Closing Date Total Portfolio as of March 31, 2018 $ 2,893,682 18,833,300 7.49% $ 214,667 Acquisitions McKesson McKesson Scottsdale, AZ Corporation 67,000 271,085 BBB+ 6.72 2/28/2028 4,504 4/10/2018 Shaw Industries, Shaw Savannah, GA Inc. 56,526 1,001,508 AA 5.90 3/31/2033 3,335 5/3/2018 Total $ 3,017,208 20,105,893 7.45% (2) $ 222,506 (1) Reflects the credit rating of tenant, parent, and/or guarantor. (2) Represents the weighted average initial capitalization rate based on total purchase price. GRIFFIN CAPITAL 13

McKesson Scottsdale Campus Scottsdale, AZ GRIFFIN CAPITAL 14

Shaw Distribution Center Savannah, GA GRIFFIN CAPITAL 15

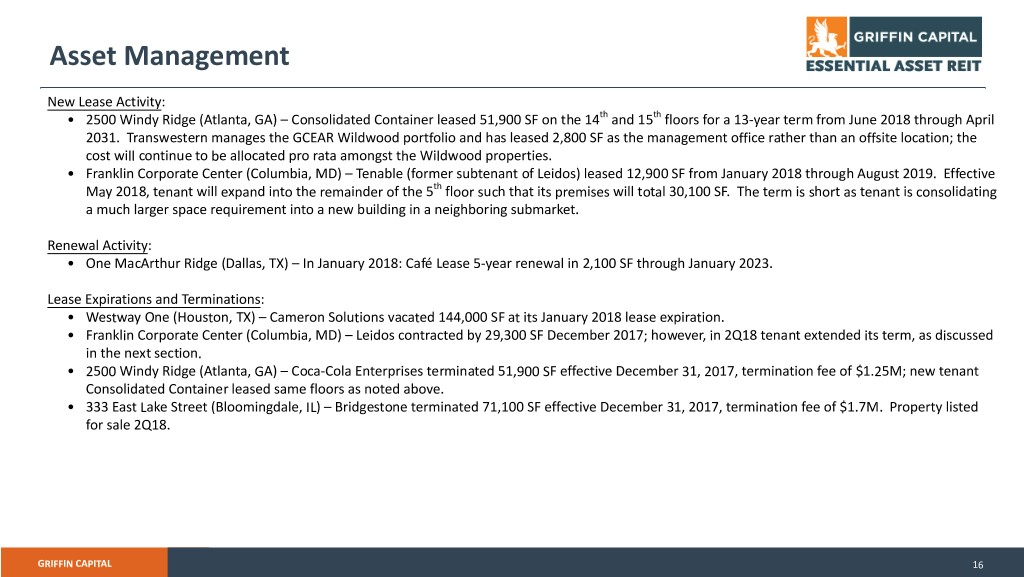

Asset Management New Lease Activity: • 2500 Windy Ridge (Atlanta, GA) – Consolidated Container leased 51,900 SF on the 14th and 15th floors for a 13-year term from June 2018 through April 2031. Transwestern manages the GCEAR Wildwood portfolio and has leased 2,800 SF as the management office rather than an offsite location; the cost will continue to be allocated pro rata amongst the Wildwood properties. • Franklin Corporate Center (Columbia, MD) – Tenable (former subtenant of Leidos) leased 12,900 SF from January 2018 through August 2019. Effective May 2018, tenant will expand into the remainder of the 5th floor such that its premises will total 30,100 SF. The term is short as tenant is consolidating a much larger space requirement into a new building in a neighboring submarket. Renewal Activity: • One MacArthur Ridge (Dallas, TX) – In January 2018: Café Lease 5-year renewal in 2,100 SF through January 2023. Lease Expirations and Terminations: • Westway One (Houston, TX) – Cameron Solutions vacated 144,000 SF at its January 2018 lease expiration. • Franklin Corporate Center (Columbia, MD) – Leidos contracted by 29,300 SF December 2017; however, in 2Q18 tenant extended its term, as discussed in the next section. • 2500 Windy Ridge (Atlanta, GA) – Coca-Cola Enterprises terminated 51,900 SF effective December 31, 2017, termination fee of $1.25M; new tenant Consolidated Container leased same floors as noted above. • 333 East Lake Street (Bloomingdale, IL) – Bridgestone terminated 71,100 SF effective December 31, 2017, termination fee of $1.7M. Property listed for sale 2Q18. GRIFFIN CAPITAL 16

Asset Management Early Discussions and Post Quarter End Lease Activity: • Heritage III (Fort Worth, TX) – Dyncorp lease expires December 2018; terms reached for 10-year renewal in 119,000 SF through December 2028. Lease documentation under way. • Mason II (Cincinnati, OH) – Community Insurance extended its lease term in 223,533 SF through November 2026. • Franklin Corporate Center (Columbia, MD) – In April, Leidos extended its lease term in 110,300 SF by 7 years through July 2026 on the 1st through 4th and the 7th floors. The tenant has a near term option to contract out of 30,100 SF which is the entire 7th floor: (a) if notice is given prior to May 15th, the contraction would be effective September 30, 2018, or (b) if notice is given prior to August 15th, the contraction would be effective December 31, 2018. Actively negotiating with a tenant for the vacant 6th floor. Recently Identified Tenant Non-Renewals: • 8990 Duke Boulevard (Columbus, OH) – ExpressScripts - 78,200 SF expires February 2019. During 1Q18, Cigna announced plans to buy ExpressScripts in a cash and stock deal valued at $67 billion. On April 10th, the tenant announced it would downsize its Ohio operations, and allow the Duke Boulevard lease to expire. GRIFFIN CAPITAL 17

Financial Performance Review Javier Bitar | Chief Financial Officer

Financial Performance (in thousands, except per share amounts) Three Months Ended March 31, 2018 2017 Total Revenue $ 80,399 $ 96,708 Net Income Attributable to Common Stockholders $ 6,319 $ 13,726 Net Income Attributable to Common Stockholders, Per Share, Basic and Diluted $ 0.04 $ 0.08 Adjusted EBIDTA (per facility agreement) (1) $ 54,802 $ 58,181 FFO (2) $ 34,581 $ 51,196 AFFO (3) $ 34,362 $ 38,227 Distributions (4) Cash Distributions $ 17,875 $ 17,501 Distribution Reinvestment Plan (DRP) 11,434 12,554 Total Distributions $ 29,309 $ 30,055 (1) See reconciliation of net income to adjusted EBITDA and coverage ratios in the earnings release filed on May 16, 2018. (2) FFO reflects distributions paid to noncontrolling interests. (3) Beginning with the three months ended March 31, 2018, the Company is using Adjusted Funds from Operations (“AFFO”) as a non-GAAP financial measure to evaluate the Company's operating performance. The Company previously used Modified Funds from Operations as a non-GAAP measure of operating performance. See reconciliation of AFFO in the earnings release filed on May 16, 2018. (4) Represents distributions paid and declared to common stockholders. GRIFFIN CAPITAL 19

Debt Maturity Schedule (including effect of interest rate swaps) As of March 31, 2018 (dollars in thousands) Statistics (1) Fixed Floating (2) Total Amount $ 1,376.9M $ 19.2M $ 1,396.1M Percentage of Total Debt 99 % 1 % 100 % W.A. Term Remaining (Yrs) 5.27 2.30 5.22 W.A. Interest Rate (%) 3.53 % 3.16 % 3.52 % $1,000,000 (3) $800,000 $744,153 ) s d $600,000 n a s u (6) o $375,000 h T $400,000 ( (4) $150,916 (7) $200,000 $108,855 (5) $17,141 $0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 (1) Includes the impact of two interest rate swap agreements totaling $725.0 million. (2) As of March 31, 2018, the Term Loan and Revolver Loan had an interest rate of LIBO Rate plus 140 bps and LIBO Rate plus 145 bps, respectively. (3) Represents the Unsecured Credit Facility, assuming the one-year extension on the Revolver Loan is exercised upon maturity. (4) Represents the Emporia, Midland, Samsonite, and HealthSpring mortgage loans. (5) Represents the Highway 94 mortgage loan. (6) Represents the Bank of America loan. (7) Represents the AIG loan. NOTE: Payments on the individual mortgages do not include the net debt premium/(discount) of ($0.3) million and deferred financing costs of $10.6 million. GRIFFIN CAPITAL 20