Attached files

| file | filename |

|---|---|

| EX-5.2 - EX-5.2 - CANADIAN PACIFIC RAILWAY LTD/CN | d589342dex52.htm |

| EX-4.2 - EX-4.2 - CANADIAN PACIFIC RAILWAY LTD/CN | d589342dex42.htm |

| EX-4.1 - EX-4.1 - CANADIAN PACIFIC RAILWAY LTD/CN | d589342dex41.htm |

| EX-1.1 - EX-1.1 - CANADIAN PACIFIC RAILWAY LTD/CN | d589342dex11.htm |

| 8-K - 8-K - CANADIAN PACIFIC RAILWAY LTD/CN | d589342d8k.htm |

Exhibit 5.1

Canadian Pacific Railway Company

7550 Ogden Dale Road S.E.

Calgary, Alberta T2C 4X9

Registration Statement on Form S-3ASR (File No. 333-209819)

Ladies and Gentlemen:

We have acted as special counsel to Canadian Pacific Railway Company, a corporation amalgamated under the laws of Canada (the “Company”), and Canadian Pacific Railway Limited, a corporation incorporated under the laws of Canada (the “Guarantor”), in connection with the Registration Statement on Form S-3ASR (File No. 333-209819) (the “Registration Statement”), which became effective on February 29, 2016. You have asked us to furnish our opinion as to the legality of $500,000,000 aggregate principal amount of the Company’s 4.000% Notes due 2028 (the “Notes” or the “Debt Securities”), including the guarantee (the “Guarantee”) of such Debt Securities by the Guarantor, which are registered under the Registration Statement and which are being sold today pursuant to an Underwriting Agreement dated May 14, 2018 (the “Underwriting Agreement”), by and among Morgan Stanley & Co. LLC, Barclays Capital Inc. and Wells Fargo Securities, LLC, as representatives of the underwriters named on Schedule II thereto (the “Underwriters”), the Company and the Guarantor.

The Debt Securities and the related Guarantee are to be issued under an indenture, dated as of September 11, 2015 (the “Indenture”), by and between the Company and Wells Fargo Bank, National Association, as trustee (the “Trustee”), as supplemented by the Third Supplemental Indenture thereto, dated as of May 16, 2018, by and among the Company, the Guarantor and the Trustee (the “Supplemental Indenture”) and pursuant to resolutions adopted on October 27, 2015, February 15, 2018 and May 9, 2018 as authorized by the Company’s and the Guarantor’s respective Boards of Directors.

In connection with the furnishing of this opinion, we have examined originals, or copies certified or otherwise identified to our satisfaction, of the following documents:

1. the Registration Statement;

2. the preliminary prospectus supplement dated May 14, 2018 (the “Preliminary Final Prospectus”);

3. the pricing term sheet dated May 14, 2018 (the “Term Sheet”);

4. the final prospectus supplement dated May 14, 2018 (the “Final Prospectus”);

5. the Underwriting Agreement;

6. the Indenture;

7. the Supplemental Indenture (including the Guarantee of the Guarantor set forth therein); and

8. the Note issued on the date of this letter (including the Guarantee).

We have assumed, without independent investigation (i) that each of the Company and the Guarantor is validly existing and in good standing under the laws of its jurisdiction of organization, (ii) that each of the Company and the Guarantor has all necessary corporate power to execute, deliver and perform its obligations under the Underwriting Agreement, the Indenture, the Supplemental Indenture and the Notes, as applicable, (iii) that the execution, delivery and performance of the Underwriting Agreement, the Indenture, the Supplemental Indenture and the Notes, as applicable, have been duly authorized by all necessary corporate action and do not violate the Company’s or the Guarantor’s organizational documents or the laws of their respective jurisdictions of organization and (iv) the due execution and delivery of the Underwriting Agreement, the Indenture, the Supplemental Indenture and the Notes, as applicable, under the laws of the Company’s and the Guarantor’s respective jurisdictions of organization. We have also assumed that the Indenture and the Supplemental Indenture constitute legal, valid and binding obligations of the Trustee and the due authentication of the Notes by the Trustee in the manner described in the certificate of the Trustee.

We have also relied upon oral and written statements of officers and representatives of the Company, the representations and warranties of the Company made in the Underwriting Agreement as to factual matters and upon certificates of public officials and the officers of the Company.

In our examination of the documents referred to above, we have assumed, without independent investigation, the genuineness of all signatures, the legal capacity of all individuals who have executed any of the documents reviewed by us, the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as certified, photostatic, reproduced or conformed copies of valid existing agreements or other documents, the authenticity of all such latter documents and that the statements regarding matters of fact in the certificates, records, agreements, instruments and documents that we have examined are accurate and complete.

Based upon the above, and subject to the stated assumptions, exceptions and qualifications, we are of the opinion that:

1. The Debt Securities, when duly authenticated by the Trustee, and duly issued and delivered by the Company against payment as provided in the Underwriting Agreement, will constitute legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms, except that the enforceability of the Debt Securities may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and possible judicial action giving effect to governmental action relating to persons or transactions or foreign laws affecting creditors’ rights and subject to general principles of equity (regardless of whether enforceability is considered in a proceeding in equity or at law).

2. When the Debt Securities are duly issued and delivered by the Company against payment as provided in the Underwriting Agreement, the Guarantee will constitute a legal, valid and binding obligation of the Guarantor, enforceable against the Guarantor in accordance with its terms, except that enforceability of the Guarantee may be subject to bankruptcy, insolvency, reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and possible judicial action giving effect to governmental action relating to persons or transactions or foreign laws affecting creditors’ rights and subject to general principles of equity (regardless of whether enforcement is considered in a proceeding in equity or at law).

The opinions expressed above are limited to the laws of the State of New York. Our opinions are rendered only with respect to the laws, and the rules, regulations and orders under those laws, that are currently in effect.

We hereby consent to use of this opinion as an exhibit to the Registration Statement and to the use of our name under the heading “Legal Matters” in the base prospectus included in the Registration Statement and in the Final Prospectus. In giving this consent, we do not hereby admit that we come within the category of persons whose consent is required by the Securities Act of 1933, as amended, or the rules and regulations of the Securities and Exchange Commission thereunder.

Very truly yours,

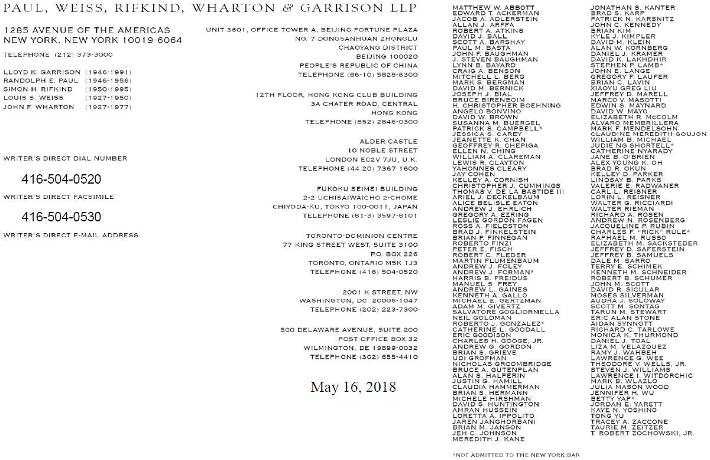

/s/ Paul, Weiss, Rifkind, Wharton & Garrison LLP

PAUL, WEISS, RIFKIND, WHARTON & GARRISON LLP