Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE - NEW JERSEY RESOURCES CORP | pressrelease2q2018final.htm |

| 8-K - 8-K - NEW JERSEY RESOURCES CORP | mayearningsreleaseform8-k.htm |

Second Quarter Fiscal 2018

Update

May 4, 2018

1

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act

of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for forward-looking statements

include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants.

Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking statements

and such forward-looking statements are made based upon management’s current expectations, assumptions and beliefs as of this date concerning future developments and

their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations, assumptions and be liefs or that the

effect of future developments on NJR will be those anticipated by management. Forward-looking statements in this presentation include, but are not limited to, certain statements

regarding NJR’s NFE guidance for fiscal 2018, forecasted contribution of business segments to fiscal 2018 NFE, future NJNG customer growth, future NJR capital expenditures,

infrastructure investments and solar sale leaseback transactions, CEV’s ITC-eligible projects and demand for commercial and residential solar, SREC prices and electricity sales

future base rate cases, earnings and dividend growth, the impact of tax reform on NJR, the ability to close and successfully implement the Adelphia Gateway acquisition, construct

the SRL and PennEast Pipeline projects, and sell Two Dot and our other wind assets.

The factors that could cause actual results to differ materially from NJR’s expectations include, but are not limited to, risks associated with our investments in clean energy

projects, including the availability of regulatory and tax incentives, the availability of viable projects, our eligibility for ITCs and PTCs, the future market for SRECs and electricity

prices, and operational risks related to projects in service; the ability to obtain governmental and regulatory approvals, land-use rights, electric grid connection (in the case of clean

energy projects) and/or financing for the construction, development and operation of our unregulated energy investments, pipeline transportation systems and NJR’s infrastructure

projects, including SRL, NJ RISE, PennEast and Adelphia Gateway in a timely manner; risks associated with acquisitions and the related integration of acquired assets with our

current operations; volatility of natural gas and other commodity prices and their impact on NJNG customer usage, NJNG’s BGSS incentive programs, our Energy Services

segment operations and on our risk management efforts; the level and rate at which NJNG’s costs and expenses are incurred and the extent to which they are approved for

recovery from customers through the regulatory process, including through future base rate case filings; the impact of a disallowance of recovery of environmental-related

expenditures and other regulatory changes; the performance of our subsidiaries; operating risks incidental to handling, storing, transporting and providing customers with natural

gas; access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities for natural gas supply; the regulatory and pricing policies of

federal and state regulatory agencies; timing of qualifying for ITCs due to delays or failures to complete planned solar projects and the resulting effect on our effective tax rate and

earnings; the results of legal or administrative proceedings with respect to claims, rates, environmental issues, gas cost prudence reviews and other matters; risks related to

cyberattack or failure of information technology systems; changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital to our

company; the ability to comply with current and future regulatory requirements; the impact of volatility in the equity and credit markets on our access to capital; the impact to the

asset values and resulting higher costs and funding obligations of our pension and postemployment benefit plans as a result of potential downturns in the financial markets, lower

discount rates, revised actuarial assumptions or impacts associated with the Patient Protection and Affordable Care Act; commercial and wholesale credit risks, including the

availability of creditworthy customers and counterparties, and liquidity in the wholesale energy trading market; accounting effects and other risks associated with hedging activities

and use of derivatives contracts; the ability to optimize our physical assets; any potential need to record a valuation allowance for our deferred tax assets; changes to tax laws and

regulations; weather and economic conditions; the ability to comply with debt covenants; demographic changes in NJR’s service territory and their effect on NJR’s customer

growth; the impact of natural disasters, terrorist activities and other extreme events on our operations and customers; the costs of compliance with present and future

environmental laws, including potential climate change-related legislation; environmental-related and other uncertainties related to litigation or administrative proceedings; risks

related to our employee workforce; and risks associated with the management of our joint ventures and partnerships, and investment in a master limited partnership. The

aforementioned factors are detailed in the “Risk Factors” sections of our Form 10-K that we filed with the Securities and Exchange Commission (SEC) on November 21, 2017,

which is available on the SEC’s website at sec.gov. Information included in this presentation is representative as of today only, and while NJR periodically reassesses material

trends and uncertainties affecting NJR’s results of operations and financial condition in connection with its preparation of management’s discussion and analysis of results of

operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or

revise any particular forward-looking statement referenced herein in light of future events.

.

2

Non-GAAP Financial Measures

This presentation includes the non-GAAP measures, NFE and utility gross margin. As an indicator of the Company’s operating performance, these measures

should not be considered an alternative to, or more meaningful than, GAAP measures, such as cash flow, net income, operating income or earnings per share.

NFE excludes unrealized gains or losses on derivative instruments related to the Company’s unregulated subsidiaries and certain realized gains and losses on

derivative instruments related to natural gas that has been placed into storage at Energy Services, net of applicable tax adjustments, as described below.

Volatility associated with the change in value of these financial and physical commodity contracts is reported in the income statement in the current period. In

order to manage its business, NJR views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses, caused by

changes in value of these financial instruments and physical commodity contracts prior to the completion of the planned transaction because it shows changes in

value currently as opposed to when the planned transaction ultimately is settled. An annual estimated effective tax rate is calculated for NFE purposes and any

necessary quarterly tax adjustment is applied to CEV, as such adjustment is related to tax credits generated by CEV.

NJNG’s utility gross margin represents the results of revenues less natural gas costs, sales and other taxes and regulatory rider expenses, which are key

components of the company’s operations that move in relation to each other. Natural gas costs, sales and other taxes and regulatory rider expense are passed

through to customers and therefore, have no effect on gross margin.

Management uses NFE and utility gross margin as supplemental measures to other GAAP results to provide a more complete understanding of the

Company’s performance. Management believes these non-GAAP measures are more reflective of the Company’s business model, provide

transparency to investors and enable period-to-period comparability of financial performance. In providing fiscal 2018 earnings guidance,

management is aware that there could be differences between reported GAAP earnings and NFE due to matters such as, but not limited to, the

positions of our energy-related derivatives. Management is not able to reasonably estimate the aggregate impact of these items on reported earnings

and therefore is not able to provide a reconciliation to the corresponding GAAP equivalent for its operating earnings guidance without unreasonable

efforts. For a full discussion of our non-GAAP financial measures, please see NJR’s most recent Form 10-K, Item 7. This information has been

provided pursuant to the requirements of SEC Regulation G.

3

Second Quarter Highlights

• Reported net financial earnings (NFE) of $142.1 million, or $1.62 per share

compared with $104.1 million, or $1.21 per share in the second quarter of fiscal

2017

• Energy Services contributed $72.8 million in NFE this quarter, compared to $15.7

million in NFE in the second quarter of fiscal 2017

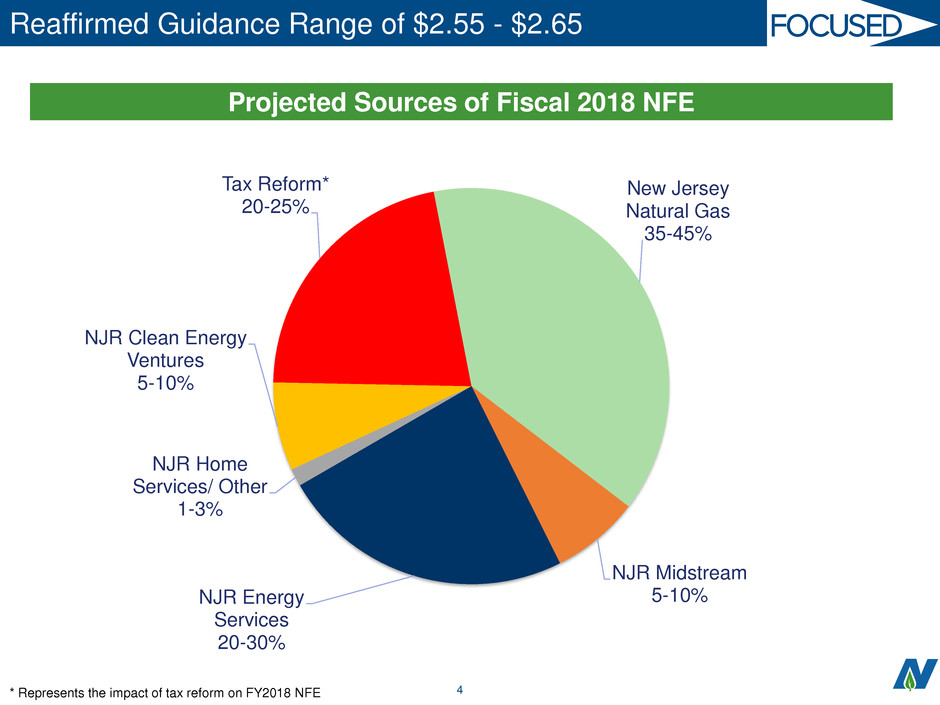

• Reaffirmed our earnings guidance range of $2.55 to $2.65 for fiscal 2018

• New Jersey Natural Gas, Clean Energy Ventures, Midstream and Home Services

performed in line with expectations

• Infrastructure investments are moving forward

* A reconciliation from NFE to net income can be found

in the Appendix on Slide 16.

4

New Jersey

Natural Gas

35-45%

NJR Midstream

5-10%NJR Energy

Services

20-30%

NJR Home

Services/ Other

1-3%

NJR Clean Energy

Ventures

5-10%

Tax Reform*

20-25%

Reaffirmed Guidance Range of $2.55 - $2.65

Projected Sources of Fiscal 2018 NFE

* Represents the impact of tax reform on FY2018 NFE

5

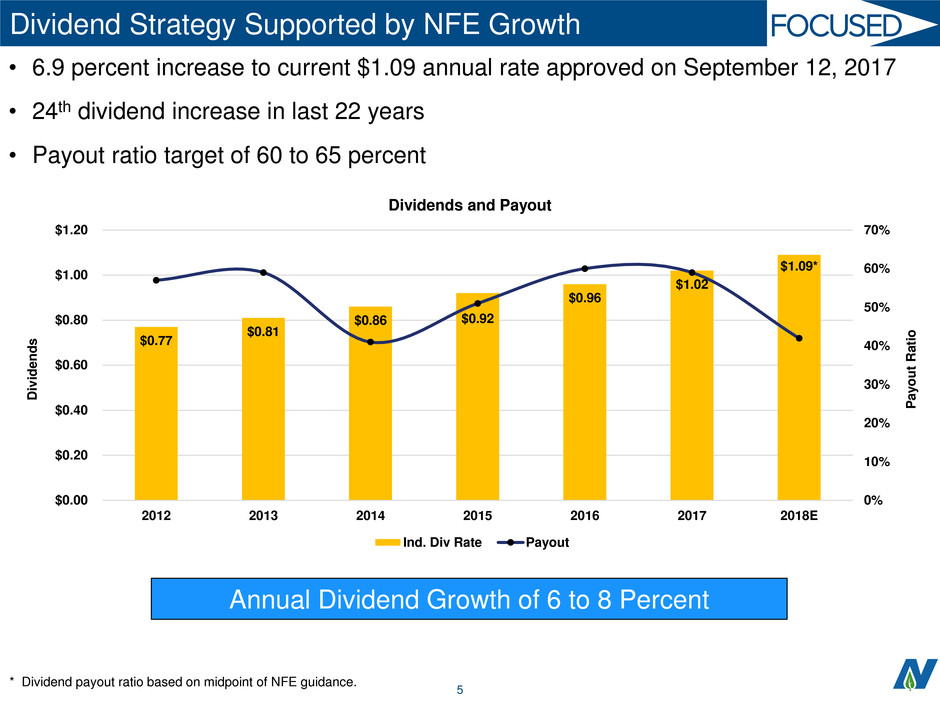

Dividend Strategy Supported by NFE Growth

• 6.9 percent increase to current $1.09 annual rate approved on September 12, 2017

• 24th dividend increase in last 22 years

• Payout ratio target of 60 to 65 percent

* Dividend payout ratio based on midpoint of NFE guidance.

Annual Dividend Growth of 6 to 8 Percent

$0.77

$0.81

$0.86 $0.92

$0.96

$1.02

$1.09*

0%

10%

20%

30%

40%

50%

60%

70%

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

2012 2013 2014 2015 2016 2017 2018E

P

a

y

o

u

t

Ra

ti

o

Di

v

ide

n

d

s

Dividends and Payout

Ind. Div Rate Payout

6

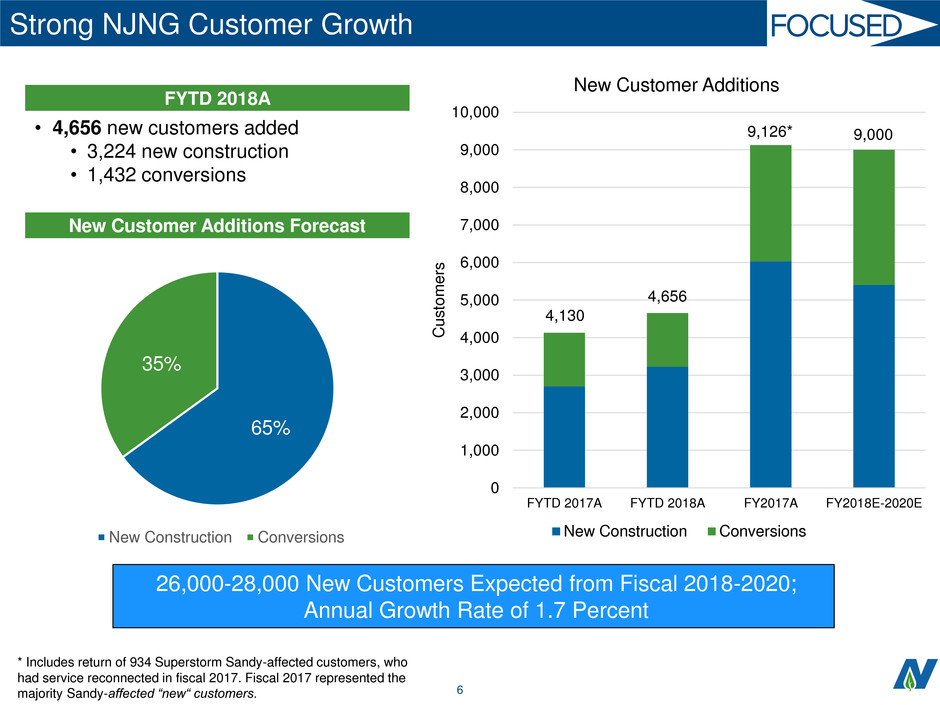

Strong NJNG Customer Growth

26,000-28,000 New Customers Expected from Fiscal 2018-2020;

Annual Growth Rate of 1.7 Percent

* Includes return of 934 Superstorm Sandy-affected customers, who

had service reconnected in fiscal 2017. Fiscal 2017 represented the

majority Sandy-affected “new“ customers.

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

FYTD 2017A FYTD 2018A FY2017A FY2018E-2020E

Cus

to

m

e

rs

New Customer Additions

New Construction Conversions

4,130

4,656

9,126* 9,000

FYTD 2018A

• 4,656 new customers added

• 3,224 new construction

• 1,432 conversions

65%

35%

New Construction Conversions

New Customer Additions Forecast

7

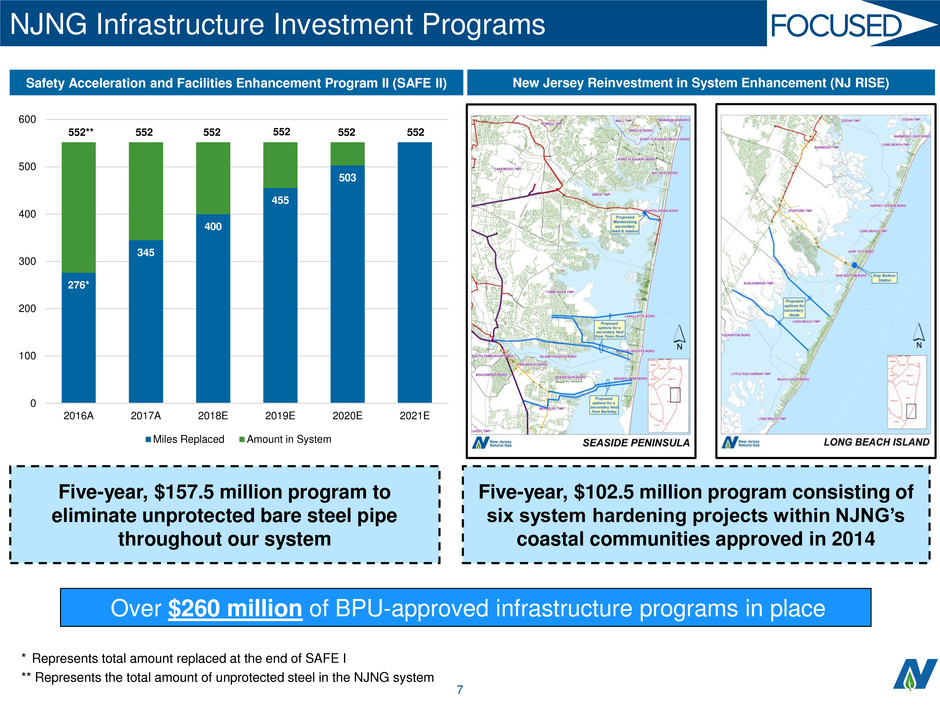

NJNG Infrastructure Investment Programs

Over $260 million of BPU-approved infrastructure programs in place

276*

345

400

455

503

0

100

200

300

400

500

600

2016A 2017A 2018E 2019E 2020E 2021E

Miles Replaced Amount in System

552** 552 552 552 552 552

Safety Acceleration and Facilities Enhancement Program II (SAFE II) New Jersey Reinvestment in System Enhancement (NJ RISE)

Five-year, $157.5 million program to

eliminate unprotected bare steel pipe

throughout our system

Five-year, $102.5 million program consisting of

six system hardening projects within NJNG’s

coastal communities approved in 2014

* Represents total amount replaced at the end of SAFE I

** Represents the total amount of unprotected steel in the NJNG system

8

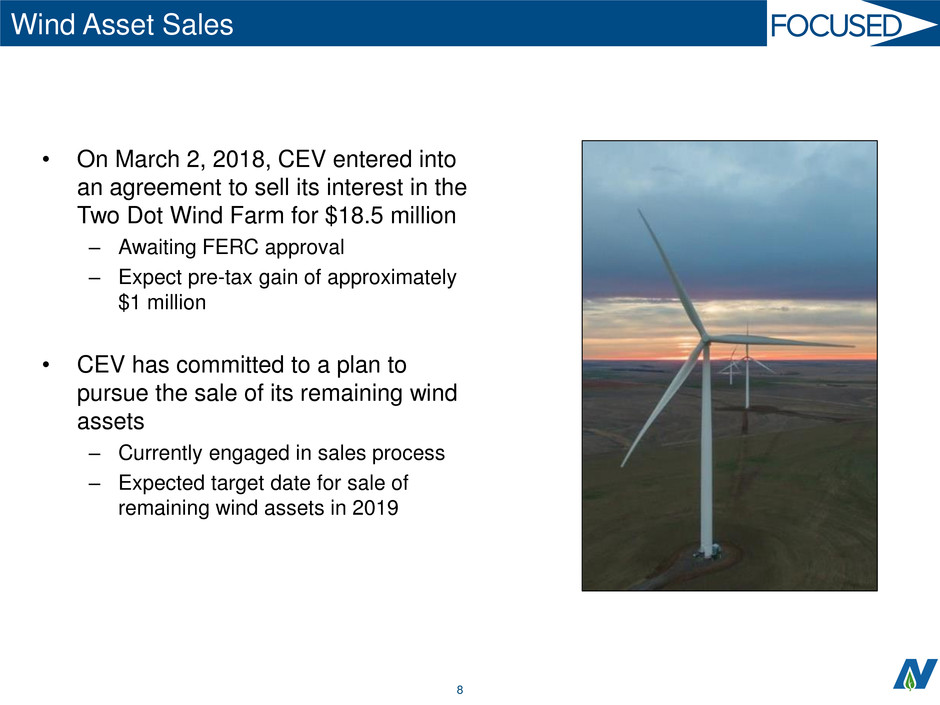

Wind Asset Sales

• On March 2, 2018, CEV entered into

an agreement to sell its interest in the

Two Dot Wind Farm for $18.5 million

– Awaiting FERC approval

– Expect pre-tax gain of approximately

$1 million

• CEV has committed to a plan to

pursue the sale of its remaining wind

assets

– Currently engaged in sales process

– Expected target date for sale of

remaining wind assets in 2019

9

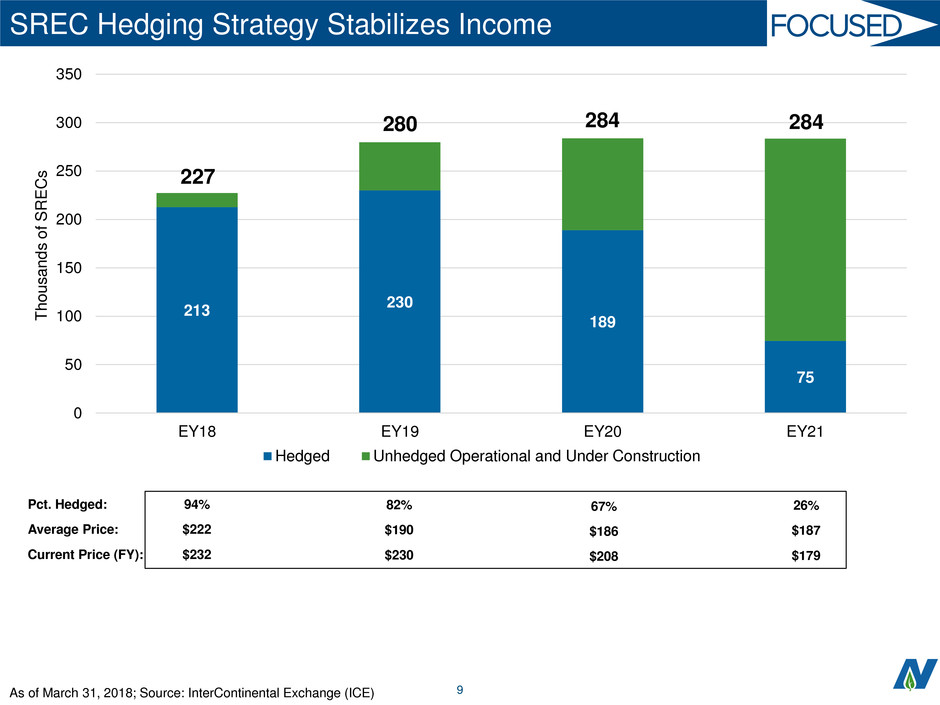

SREC Hedging Strategy Stabilizes Income

As of March 31, 2018; Source: InterContinental Exchange (ICE)

Pct. Hedged:

Average Price:

Current Price (FY):

94%

$222

$232

82%

$190

$230

67%

$186

$208

213

230

189

75

0

50

100

150

200

250

300

350

EY18 EY19 EY20 EY21

T

h

o

u

s

a

n

d

s

o

f

S

REC

s

Hedged Unhedged Operational and Under Construction

227

280 284 284

26%

$187

$179

10

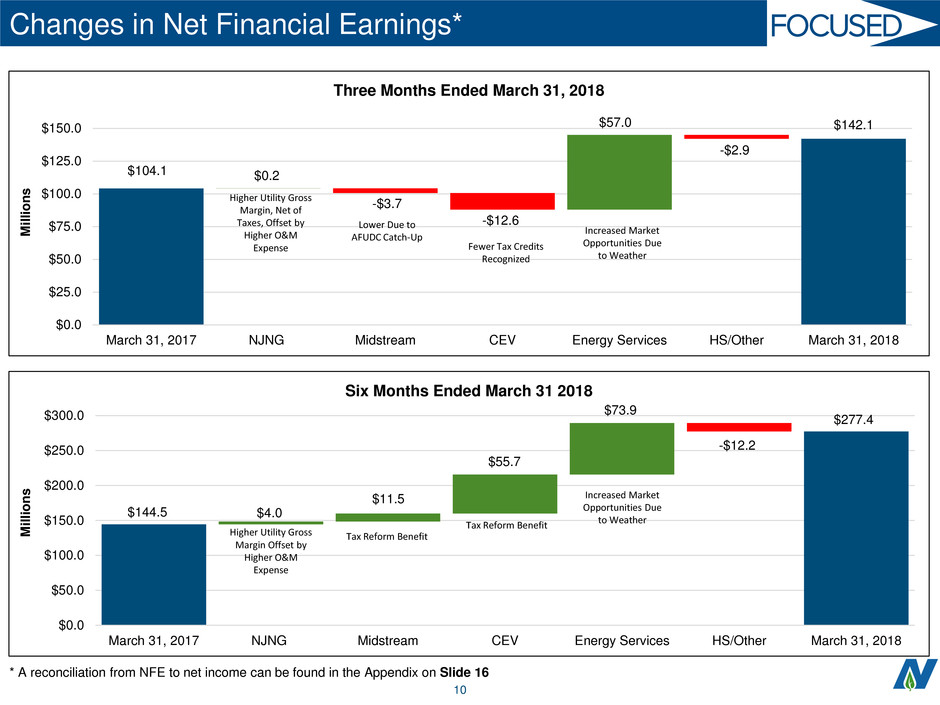

-$12.2

$73.9

$144.5 $4.0

$11.5

$55.7

$277.4

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

March 31, 2017 NJNG Midstream CEV Energy Services HS/Other March 31, 2018

M

ill

io

n

s

Six Months Ended March 31 2018

Increased Market

Opportunities Due

to WeatherTax Reform Benefit

Tax Reform BenefitHigher Utility Gross

Margin Offset by

Higher O&M

Expense

Changes in Net Financial Earnings*

-$2.9

$57.0

$104.1 $0.2

-$3.7

-$12.6

$142.1

$0.0

$25.0

$50.0

$75.0

$100.0

$125.0

$150.0

March 31, 2017 NJNG Midstream CEV Energy Services HS/Other March 31, 2018

M

ill

io

n

s

Three Months Ended March 31, 2018

Fewer Tax Credits

Recognized

Increased Market

Opportunities Due

to Weather

Higher Utility Gross

Margin, Net of

Taxes, Offset by

Higher O&M

Expense

Lower Due to

AFUDC Catch-Up

* A reconciliation from NFE to net income can be found in the Appendix on Slide 16

11

Recent Updates Impacting Timing of Earnings

Event Impact to:

FY2018 NFE

Impact

FY 2019 and

beyond NFE

Impact

PennEast Project

Schedule Update

NJR Midstream AFUDC

SRL Project Schedule

Update

AFUDC

Tax Reform

Lower Tax Rate

SREC Revenues

Recognition of ITCs

12

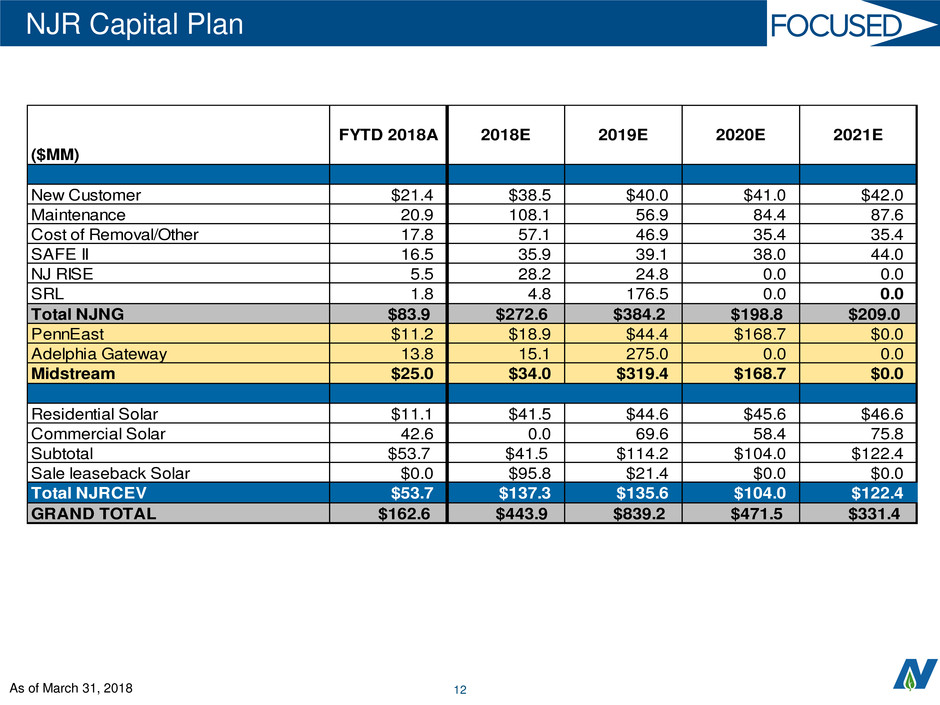

NJR Capital Plan

As of March 31, 2018

($MM)

FYTD 2018A 2018E 2019E 2020E 2021E

New Customer $21.4 $38.5 $40.0 $41.0 $42.0

Maintenance 20.9 108.1 56.9 84.4 87.6

Cost of Removal/Other 17.8 57.1 46.9 35.4 35.4

SAFE II 16.5 35.9 39.1 38.0 44.0

NJ RISE 5.5 28.2 24.8 0.0 0.0

SRL 1.8 4.8 176.5 0.0 0.0

Total NJNG $83.9 $272.6 $384.2 $198.8 $209.0

PennEast $11.2 $18.9 $44.4 $168.7 $0.0

Adelphia Gateway 13.8 15.1 275.0 0.0 0.0

Midstream $25.0 $34.0 $319.4 $168.7 $0.0

Residential Solar $11.1 $41.5 $44.6 $45.6 $46.6

Commercial Solar 42.6 0.0 69.6 58.4 75.8

Subtotal $53.7 $41.5 $114.2 $104.0 $122.4

Sale leaseback Solar $0.0 $95.8 $21.4 $0.0 $0.0

Total NJRCEV $53.7 $137.3 $135.6 $104.0 $122.4

GRAND TOTAL $162.6 $443.9 $839.2 $471.5 $331.4

13

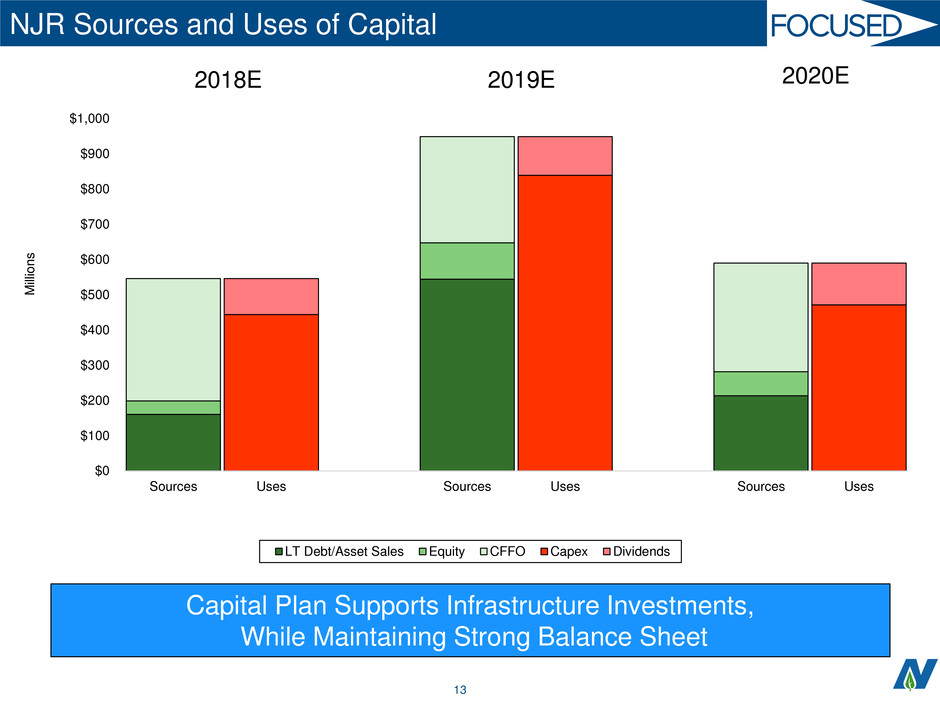

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

Sources Uses Sources Uses Sources Uses

M

ill

io

n

s

LT Debt/Asset Sales Equity CFFO Capex Dividends

2018E 2020E2019E

NJR Sources and Uses of Capital

Capital Plan Supports Infrastructure Investments,

While Maintaining Strong Balance Sheet

14

Appendix

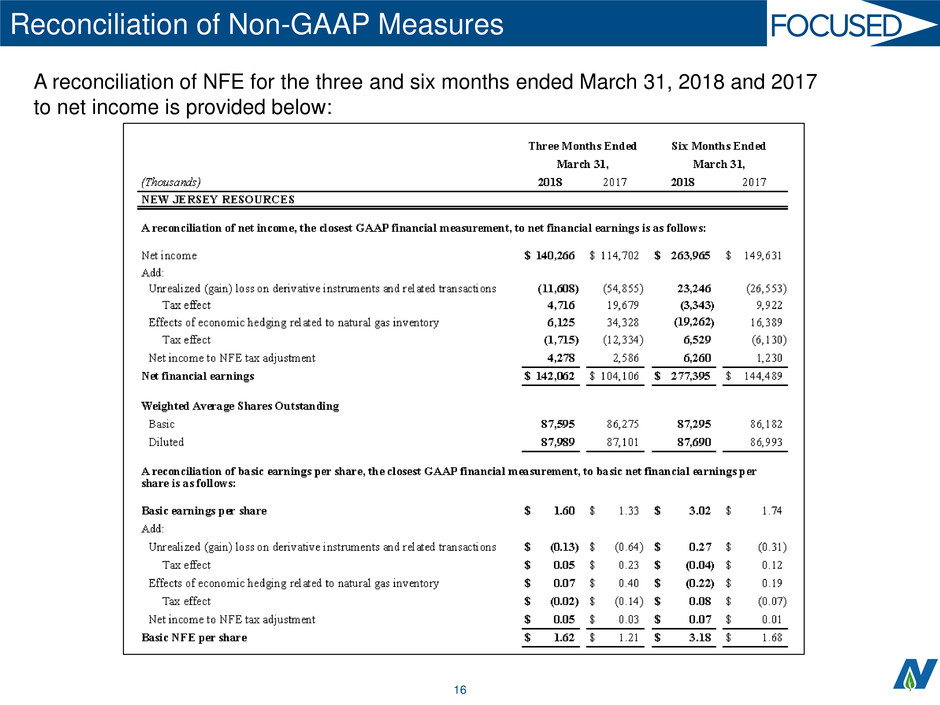

16

Reconciliation of Non-GAAP Measures

A reconciliation of NFE for the three and six months ended March 31, 2018 and 2017

to net income is provided below:

17

Fiscal 2018 Second Quarter and Year-to-Date NFE

Net Financial Earnings ($MM)

Three Months Ended

March 31,

Six Months Ended

March 31,

Company 2018 2017 Variance 2018 2017 Variance

New Jersey Natural Gas $60.4 $60.2 $0.2 $94.6 $90.6 $4.0

NJR Midstream 1.3 5.0 (3.7) 18.8 7.3 11.5

Subtotal $61.7 $65.2 ($3.5) $113.4 $97.9 $15.5

NJR Clean Energy Ventures $10.1 22.7 (12.6) 81.3 25.6 55.7

NJR Energy Services 72.8 15.8 57.0 93.1 19.2 73.9

NJR Home Services/Other (2.5) .4 (2.9) ($10.4) 1.8 (12.2)

Total $142.1 $104.1 $38.0 $277.4 $144.5 $132.9

Per Basic Share $1.62 $1.21 $0.41 $3.18 $1.68 $1.50

18

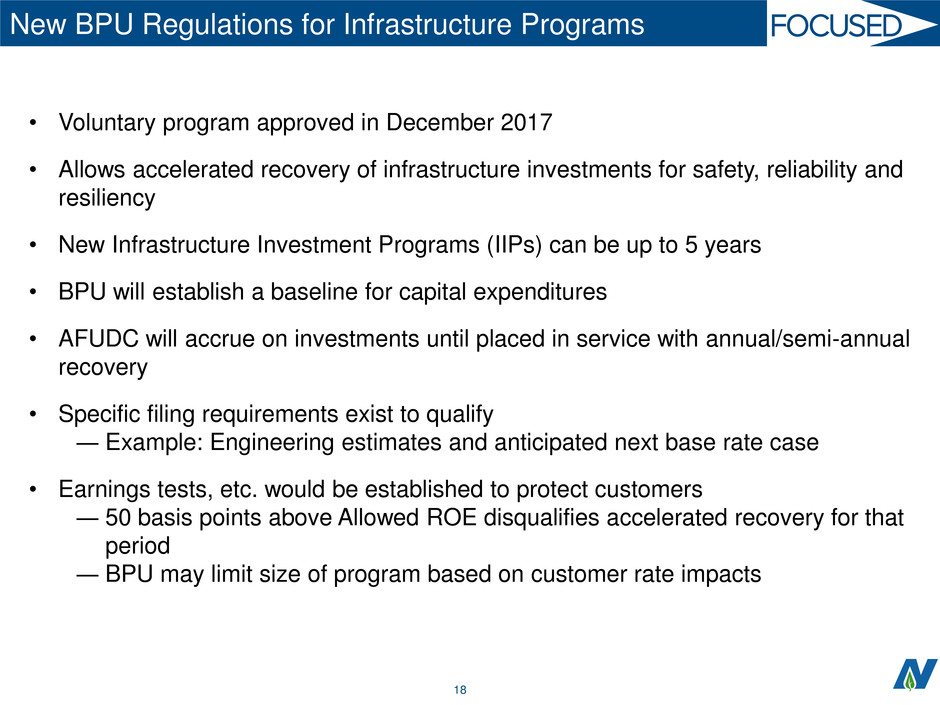

• Voluntary program approved in December 2017

• Allows accelerated recovery of infrastructure investments for safety, reliability and

resiliency

• New Infrastructure Investment Programs (IIPs) can be up to 5 years

• BPU will establish a baseline for capital expenditures

• AFUDC will accrue on investments until placed in service with annual/semi-annual

recovery

• Specific filing requirements exist to qualify

― Example: Engineering estimates and anticipated next base rate case

• Earnings tests, etc. would be established to protect customers

― 50 basis points above Allowed ROE disqualifies accelerated recovery for that

period

― BPU may limit size of program based on customer rate impacts

New BPU Regulations for Infrastructure Programs

19

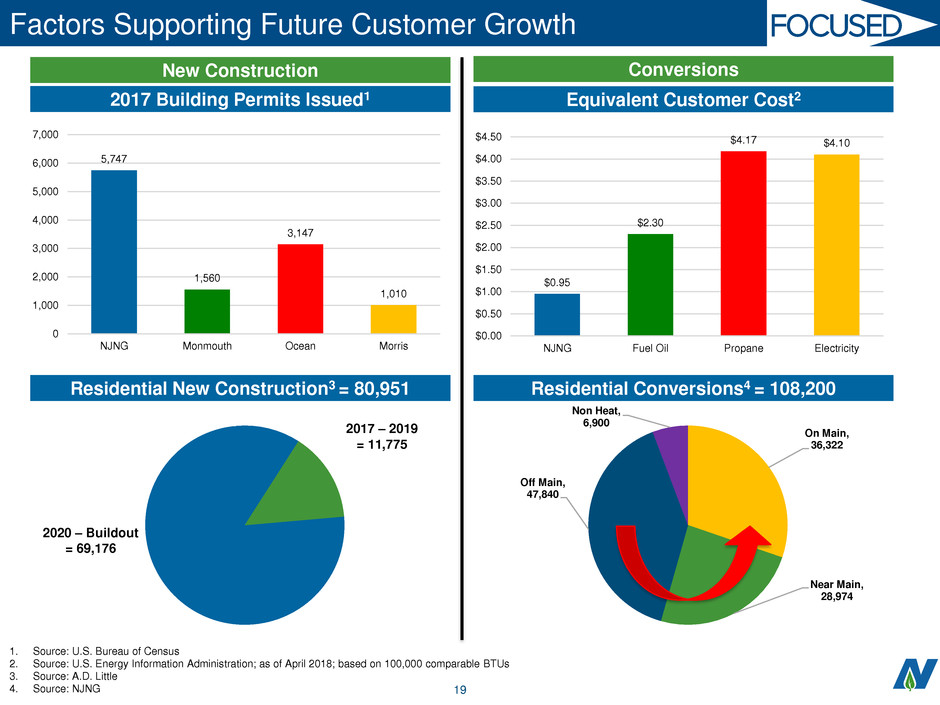

5,747

1,560

3,147

1,010

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

NJNG Monmouth Ocean Morris

$0.95

$2.30

$4.17 $4.10

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

NJNG Fuel Oil Propane Electricity

On Main,

36,322

Near Main,

28,974

Off Main,

47,840

Non Heat,

6,900

Factors Supporting Future Customer Growth

2017 Building Permits Issued1 Equivalent Customer Cost2

Residential New Construction3 = 80,951 Residential Conversions4 = 108,200

2017 – 2019

= 11,775

2020 – Buildout

= 69,176

1. Source: U.S. Bureau of Census

2. Source: U.S. Energy Information Administration; as of April 2018; based on 100,000 comparable BTUs

3. Source: A.D. Little

4. Source: NJNG

New Construction Conversions

20

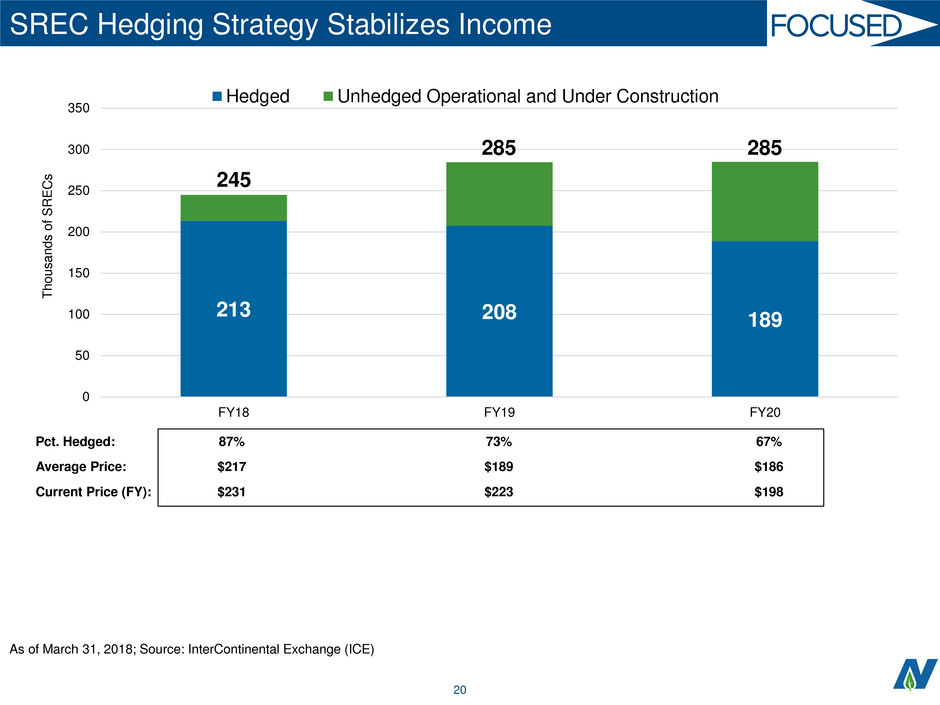

SREC Hedging Strategy Stabilizes Income

As of March 31, 2018; Source: InterContinental Exchange (ICE)

Pct. Hedged:

Average Price:

Current Price (FY):

87%

$217

$231

73%

$189

$223

67%

$186

$198

213 208 189

0

50

100

150

200

250

300

350

FY18 FY19 FY20

T

h

o

u

s

a

n

d

s

o

f

S

R

E

C

s

Hedged Unhedged Operational and Under Construction

245

285 285

21

NJR Projected Cash Flows

($MM) 2018E 2019E 2020E

Cash Flow From Operations $347.3 $301.9 $308.4

Uses of Funds

Capital Expenditures – NJNG/Other ($272.6) ($384.2) ($198.8)

Capital Expenditures – PennEast (18.9) (44.4) (168.7)

Capital Expenditures – CEV (137.3) (135.6) (104.0)

Capital Expenditures - Adelphia (15.1) (275.0) --

Dividends (102.1) (110.0) (118.4)

Total Uses of Funds ($546.0) ($949.2) ($589.9)

Financing Activities

Common Stock Proceeds, Net $38.0 $103.0 $68.0

Debt Proceeds/Other* 159.7 543.9 212.0

Total Financing Activities $197.7 $646.9 $280.0

As of March 31, 2018

* Includes sale leaseback and PennEast project finance