Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DiamondRock Hospitality Co | exhibit9911q2018.htm |

| 8-K - 8-K - DiamondRock Hospitality Co | drh_8kx3312018.htm |

INVESTOR PRESENTATION May 2018

DiamondRock at a Glance KEY STATISTICS RAISED 2018 GUIDANCE Hotels (Rooms) 30 (9.9K) • Raised 2018 Full-Year Guidance: Enterprise Value $3.0B − Comparable RevPAR Growth of 1.5% to 2.5% Market Cap $2.2B Enterprise Value / Key ~$300K − Adj. EBITDA of $254M - $263M Dividend Yield 4.5% − Adj. FFO per share of $1.01 - $1.05 YE18 Net Debt/EBITDA(1) 3.4x Market data as of 5/2/18. Note: RevPAR excludes Frenchman’s Reef and Havana Cabana for all periods. Guidance pro forma for acquisition of the Landing Resort & Spa and Palomar Phoenix. URBAN AND RESORT HOTELS IN TOP MARKETS(2) RECENT ACQUISITIONS ADDING VALUE Other 4% San Fran. 1% San Diego 5% Washington, DC 5% Destination Resorts Denver 5% 32% Other CBD The Landing Lake Tahoe Hotel Palomar Phoenix 12% New York 10% Boston 15% Chicago 11% (1) Based on PF 2018 EBITDA at guidance midpoint and current pro form net debt. L’Auberge De Sedona Orchards Inn Sedona (2) Based on 2017 EBITDA. Pro forma for acquisitions of the Landing Tahoe, Phoenix Palomar, L’Auberge de Sedona and Orchards Inn Sedona for full-year. Includes Frenchman’s Reef and Havana Cabana budget pre-hurricane. 2

Why DiamondRock? 1 Top Tier Quality Portfolio & Growth • Top tier quality portfolio as measured by ADR • Top tier growth with 2017 RevPAR growth of 2.5% (top two of peer set) 2 Compelling Valuation • 12.1x 2018 Consensus EBITDA multiple 1.0x discount to 13.1x peer average • $300K EV per key ~30% discount to replacement cost • Trading at large discount to Company’s NAV estimate 3 Internal Growth Opportunities • Frenchman’s Reef hurricane impact creates opportunities • Chicago Gwen Repositioning: >$3M EBITDA upside • Hotel Rex San Francisco 2018 repositioning to Viceroy: $1.2M EBITDA upside The Gwen, A Luxury Collection Hotel • Completed Sonoma, Charleston, Worthington, and Shorebreak renovations to continue to drive growth from $37M in repositionings • Havana Cabana Key West opened April 2018: ~$1M in EBITDA upside • Vail Marriott Resort upgrade renovation to close luxury rate gap with potential ~$5M in stabilized EBITDA upside 4 External Growth Driving Value • The Landing Resort & Spa in Lake Tahoe, CA for $42M • The Hotel Palomar Phoenix for $80M • L’Auberge de Sedona and Orchards Inn grew combined RevPAR >19% in 2017 and exceeded underwriting by $1.2M in EBITDA with $2.1M YoY EBITDA growth 5 Portfolio Well-Positioned for 2018 • Increased 2018 full-year RevPAR and EBITDA guidance Vail Marriott Mountain Resort • Renovations paying off: several strategic renovations and repositionings throughout portfolio from ‘17-’18 to continue to drive growth and long-term value • Resort concentration: resort markets to continue to outperform (450bps of outperformance in 2017) 3

High Quality Portfolio in Key Gateway Markets Approximately 2/3 of DRH’s portfolio EBITDA is concentrated in top, gateway markets. 4

Strong Resort Market Presence DRH’s Resort Portfolio represents 1/3 of its pro forma EBITDA concentration. 5

Top-Tier Performance 2017 RevPAR Growth Among Best in Peer Group 3.6% 2.5% 2.3% 1.4% 1.3% 0.7% Peer Average: 0.5% -0.5% -1.8% -2.2% Top Tier -2.4% SHO DRH HT XHR HST PK RLJ LHO PEB CHSP • DRH comparable 2017 RevPAR growth of 2.5% among best in peer group - Portfolio gained 2.6 percentage points of market share during the year - EBITDA margins approximately flat excluding property taxes • Fourth quarter comparable RevPAR growth of 3.8% - Business transient up 11.2% and group up 6.8% - Resorts up 8.4% in the fourth quarter Source: Company Filings as of Q4 2017. 6

Top-Tier Portfolio Quality 2017 Portfolio Average Daily Rate $246 $243 $229 $227 $225 $220 $211 $209 Peer Average: $215 $202 $171 PEB LHO DRH HST CHSP HT SHO XHR PK RLJ Top Tier Source: Company Filings as of Q4 2017. 7

Compelling Valuation 2018 Consensus EBITDA Multiple Trading at 1.0x Discount to SHO… 13.1 +1.0x 12.1 14.9 14.6 14.3 13.8 13.1 Peer Average: 13.1x DRH SHO 12.2 Valuation at SHO’s multiple would translate 12.1 12.0 into ~$12.26 share price or >10% premium 11.4 11.4 to current price. …Despite Relative Strength in Portfolio DRH SHO Diff. 2017 ADR $229.06 $211.30 $17.76 2017 RevPAR $183.99 $175.17 $8.82 2017 Hotel EBITDA 31.2% 30.9% 27bps PEB LHO CHSP HT SHO HST DRH XHR PK RLJ Margins Lower-Tier Midpoint of 2018 2.0% 1.0%(1) 100bps RevPAR Guidance • DRH currently trading at 1.0x discount to peer group (1) As of Q4 2017 earnings call. Source: Baird, FactSet. Data as of 5/2/18. Valuation at PEB’s offer for LHO would translate into ~$15.64 per share or ~40% premium to current price. 8

Diverse Operator Base Drives Best Practices More than half of portfolio is subject to short-term or terminable management agreements. HEI 16% Recent Operator Changes Driving Value Interstate 8% • Two Roads Hospitality brought in as new operator for L’Auberge de Sedona and Orchards Inn in Highgate 7% December 2017 • Viceroy Hotels brought in as new operator for Hotel Davidson 6% Rex in October 2017 Marriott 40% Sage 5% • Courtyard Midtown East converted to franchise and Marriott replaced with HEI Hotels as operator in August 2017 Vail 5% • DRH recently exercised its right to terminate Marriott at Frenchman’s Reef and unencumber hotel Two Roads 4% Kimpton 4% Viceroy Ocean 1% Properties 4% (1) Based on 2017 EBITDA for all properties. Pro forma for acquisition of The Landing Tahoe, Palomar Phoenix, L’Auberge de Sedona and Orchards Inn Sedona for the full-year. Excludes Frenchman’s Reef. 9

Recent Acquisitions Driving Value

The Landing Resort & Spa (Lake Tahoe, CA) $42M Acquisition of Luxury Hotel in Premier Resort Market • Numerous awards including 2018 TripAdvisor Traveler’s Choice Award as a Top 25 Hotel in the US and 2016 Conde Nast Readers’ Choice #1 Northern California resort • Beachfront location and walking distance to Heavenly Ski Resort (Vail Resorts) and both Harrah’s and Hard Rock casino resorts • Attractive Deal Metrics: ‒ 13.5x multiple on 2017 EBITDA ‒ 10.4x stabilized EBITDA multiple • Nearby casinos and nightlife includes Hard Rock and Harrah’s • South Lake Tahoe RevPAR grew at 9.2% CAGR from ’13 -‘17 • Proximity to Northern California, San Francisco, Silicon Valley and Reno EBITDA Upside Opportunities 11

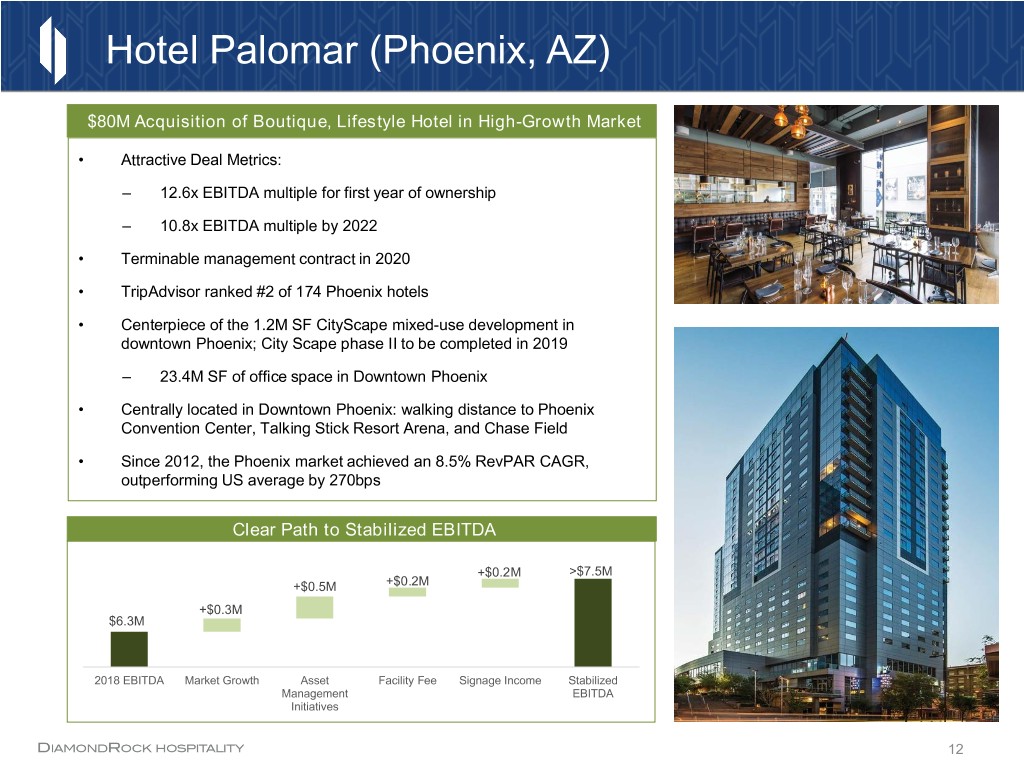

Hotel Palomar (Phoenix, AZ) $80M Acquisition of Boutique, Lifestyle Hotel in High-Growth Market • Attractive Deal Metrics: ‒ 12.6x EBITDA multiple for first year of ownership ‒ 10.8x EBITDA multiple by 2022 • Terminable management contract in 2020 • TripAdvisor ranked #2 of 174 Phoenix hotels • Centerpiece of the 1.2M SF CityScape mixed-use development in downtown Phoenix; City Scape phase II to be completed in 2019 ‒ 23.4M SF of office space in Downtown Phoenix • Centrally located in Downtown Phoenix: walking distance to Phoenix Convention Center, Talking Stick Resort Arena, and Chase Field • Since 2012, the Phoenix market achieved an 8.5% RevPAR CAGR, outperforming US average by 270bps Clear Path to Stabilized EBITDA +$0.2M >$7.5M +$0.5M +$0.2M +$0.3M $6.3M 2018 EBITDA Market Growth Asset Facility Fee Signage Income Stabilized Management EBITDA Initiatives 12

DRH Resort Portfolio Overview

DRH’s Differentiated Resort Portfolio Resort Portfolio Overview Hotels 12 Rooms 2,536 2017 RevPAR $193 2017 EBITDA $90 Million EBITDA Multiple on Investment 9.2 L’Auberge De Sedona Orchards Inn Sedona Shorebreak Hotel 1 Low-to-zero supply in majority of resort markets 2 Diversified demand drivers Sonoma Renaissance The Landing Lake Tahoe Vail Marriott Shift to experience-based travel driving long-term 3 market demand Low seasonality in consolidated resort portfolio 4 (beach, skiing and other seasonal drivers) Westin Ft. Lauderdale Havana Cabana Key West Key West Suites Beach 5 Non-union markets 6 Multiple asset management and ROI initiatives Frenchman’s Reef Charleston Renaissance Hilton Vermont - Burlington 14

DRH Resorts Have Proven Successful DRH Resort RevPAR Has Outperformed Broader Portfolio by Average of 300bps… 8.4% 8.8% 4.0% 3.1% 3.3% 1.9% 2.5% 0.8% 3.8% 1.7% 0.8% (0.3%) 2.9% 1.9% 2.0% Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 (2.1%) Total DRH Resort Outperformance Note: Historical RevPAR for ten resort properties. RevPAR excludes resorts under renovation during quarter of renovation and resorts affected by natural disasters during quarter affected by natural disaster. … Diversified With Strong Base of Group …With Clear RevPAR Premium… and BT Business $192.74 Group 23% Business Leisure Transient 56% $183.05 18% Contract / Other 3% 2017A Resort RevPAR Note: Historical RevPAR and EBITDA results pro forma for acquisitions for full period. Segmentation and RevPAR charts represent full-year 2017 data. Excludes resort affected by natural disasters. 15

Strong Return on Investment DRH’s resort portfolio EBITDA multiple has improved approximately five turns since acquisition with over $280M of NAV created. EBITDA Multiple @ EBITDA Increase Investment ($M) Purchase YE 2017 $M Burlington Hilton $61.6 16.5x 8.9x $3.7 Charleston Renaissance $41.1 11.9x 7.8x(2) $2.0 Fort Lauderdale Westin $156.4 14.8x 9.7x $6.0 Key West Suites $94.4 14.9x 11.6x $1.8 The Landing Resort & Spa(1) $42.0 13.5x 10.4x $1.8 Sedona - L'Auberge $66.0 15.8x 10.8x $1.9 Sedona - Orchards Inn $31.0 13.7x 11.0x $0.5 Shorebreak $62.4 14.6x 14.8x(2) $0.2 Sonoma Renaissance $38.2 10.7x 7.1x(2) $2.4 Vail Marriott Mountain Resort $71.7 13.4x 5.9x $7.4 Total Resort $664.9 14.2x 9.2x $27.9 DRH values its resort portfolio at a 6.5% cap rate, which implies over $280M of NAV value over investment. Note: Historical RevPAR and EBITDA results pro forma for acquisitions for full period year prior to acquisition. Frenchman’s Reef and Havana Cabana excluded due to natural disaster closure. Landing uses stabilized EBITDA as proxy for multiple. (1) Landing uses stabilized EBITDA as proxy for multiple and EBITDA increase for current year given acquired in 2018. (2) Renovation disruption in 2017. 16

Westin Fort Lauderdale Beach Resort & Spa Asset Overview Location Fort Lauderdale, FL Rooms 432 Acquisition Date December 4th, 2014 Meeting Space (SF) 40,000 Operator HEI Hotels Purchase Price $149 million Purchase price per key $344,000 • Increased NAV by $44M • Investment currently represents a 9.7x multiple on 2017 EBITDA and 9.6% NOI cap rate • Has exceeded underwriting by over $5M in EBITDA to date • Eliminated over $5M of annual expenses in first year of ownership with continued asset management overhaul of expense structure and operations in subsequent years Performance Since Acquisition 2014 2017 Increase RevPAR $148.94 $162.31 9.0% EBITDA $9.6M $16.1M 68.0% EBITDA Margin 21.9% 35.9% 1395bps EBITDA Multiple(1) 14.8 9.7 53% NAV(2) $156M $200M 28% (1) EBITDA multiple on current investment basis. (2) NAV based on internal estimates. 17

2018 Highlights

2018 DRH Key Market Drivers Market 2018 Outlook DRH / Market Commentary: (% of 2017 EBITDA) Chicago The Gwen to outperform off of renovation tailwinds; final phase of Chicago Marriott renovation completed in Q1. (11%) Strong Chicago citywide calendar in 2018 (+25%) combined group pace up 13% for remainder of year. Sedona Sedona market to continue to be one of fastest-growing markets; significant AM upside. (3%) Charleston Completed 2017 rooms renovation to drive performance. (2%) Huntington Beach F&B and Lobby renovation yielding strong market share gains. (2%) Sonoma Outperformance from 2017 renovation tailwinds; recovery following wildfires. (2%) Lake Tahoe High-ADR, fast-growing resort market; EBITDA upside due to asset management initiatives. (2%) Phoenix High-growth, Western market with significant asset management upside. (2%) San Francisco Hotel Rex comprehensive renovation planned in 2018 with Viceroy in as new manager; Citywide performance to improve (1%) relative to 2017. Boston Strong transient demand; Seaport district continues to expand. (15%) Ft. Lauderdale Stabilization from 2017 challenges (Supply, Miami weakness due to convention center and Zika); guestroom renovation (6%) in 2018. San Diego Citywide Calendar up 9% in rooms. (5%) Denver Continuing to absorb high supply, but expect stabilization of Cherry Creek submarket. (5%) Courtyard Denver recently renovated lobby and meeting space. Ft. Worth, TX Planned meeting space renovation in 2018. (5%) Washington, DC Tough Q1 Comps due to Inauguration / Women’s March. (5%) New York City NYC supply to peak in 2018 and stabilize thereafter; Waldorf-Astoria closure a catalyst for Midtown East. (10%) Lexington gaining market share with refocused rev. mgmt. and in beta program for new $25 facility fee. 19

Unique Drivers to Enhance NAV 1 Chicago Marriott 4 Westin Fort Lauderdale • $110M renovation substantially • 2018 guestroom upgrade completed • Opened popular, new restaurant Lona • Scope included 1,200 guestrooms and all 60K SF of meeting space • Elevated product to drive market share • Post-renovation group pace +12% 2 Havana Cabana Key West 5 Hotel Rex San Francisco • Comprehensive renovation post- • Boutique hotel in heart of Union Square hurricane damage will close for last four months of 2018 to position for big 2019 • Reopened April 2019 • Relaunch as Viceroy hotel Havana Cabana Key West • Refreshed theme and identity • $1.2M in incremental EBITDA post- • Stabilized EBITDA to increase by $1M renovation on $9M renovation 3 Vail Marriott 6 JW Marriott Denver • Comprehensive 2018 renovation of • Renovating hotel’s guestrooms, public hotel’s guestrooms and meeting space space, and meeting space following ski season • Cements position as the high-end hotel in • Reno to luxury standard; currently $175 Cherry Creek district ADR gap with luxury comp set • New restaurant / bar area to drive ROI • Every incremental $1 of rate yields ~$30K in annual EBITDA profit • $750K EBITDA upside following renovation from F&B repositioning Westin Fort Lauderdale Beach Resort 20

Frenchman’s Reef Update • Iconic location in Virgin Islands • Strong historical performance (1) • 2017 forecast of $16.7M EBITDA • 2018 pre-hurricane budget of $19.6M EBITDA • Impacted by hurricanes in September 2017 - Closed through at least 2019 - Remediation and stabilization ongoing (2) • Covered under $361M Insurance Policy • Currently negotiating with insurance companies - 2018 Guidance includes $20M of business interruption for all natural disaster impacted hotels - Insurance entitles DRH to business interruption compensation until re-opened - If rebuilt, unique opportunity to create one of the most popular Caribbean resorts • DRH recently exercised its right to terminate Marriott at Frenchman’s Reef and unencumber hotel (1) Based on pre-hurricane forecast as of July 2017. (2) $361M insurance coverage per event. 21

Intense Asset Management

Focus Asset Management Areas Labor Management Energy Food Cost • Working with third-party to reduce • Conducting comprehensive hands- • Opportunities for food cost savings labor expenses and improve on energy efficiency audits through purchasing management productivity throughout the portfolio and operational optimization • Study historical productivity and - Direct bidding with energy - Invoice Monitoring benchmark against other suppliers and LED lighting comparable hotels conversions - Menu Pricing / Menu Reengineering • Complete new staffing standards • $1.3M of annual cost savings and implement new labor identified across 17 hotels - Annual Operating Audits management system to maximize efficiency • 53% IRR and two-year payback - Specs vs Brand • Range of potential expense • Energy reduction of up to 78% for - Compliance Metrics savings: the least efficient assets - Labor Productivity - Boston Westin ($421K - $673K) • Case Study: Worthington Improvement Renaissance LED conversion - Lexington ($626K - $965K) • 150bps of F&B margin - Estimated First Year Electric improvement would yield $1.7M in - Chicago Marriott ($352 - $761K) Savings: $183K (22%) savings 23

Fortress Balance Sheet

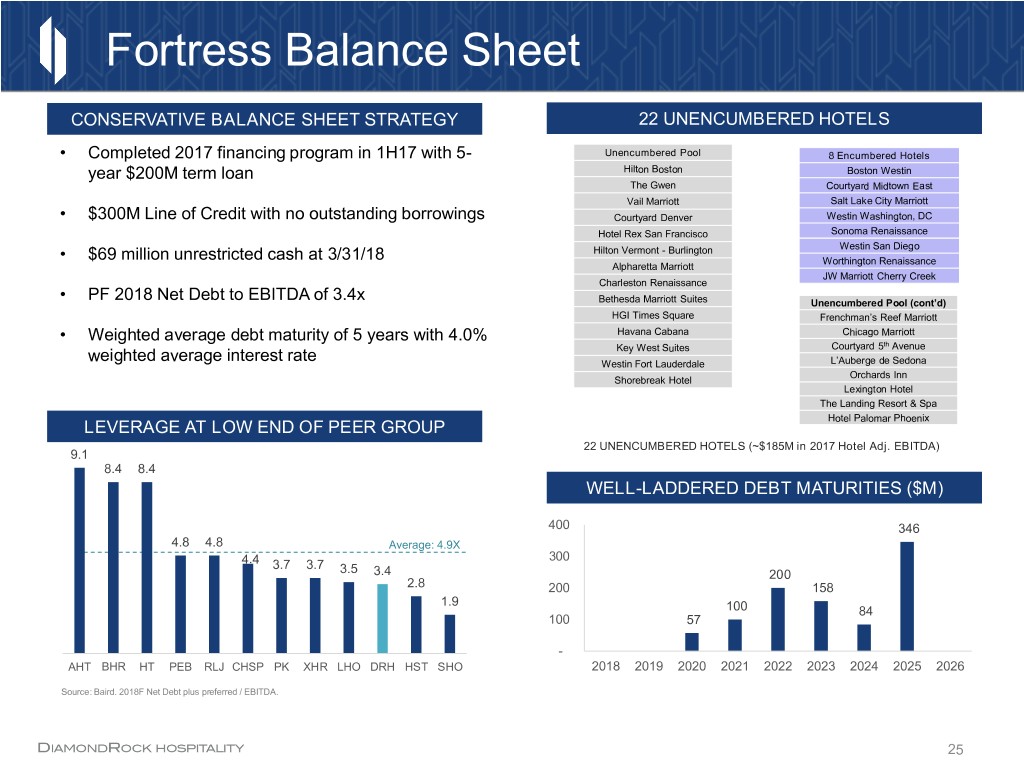

Fortress Balance Sheet CONSERVATIVE BALANCE SHEET STRATEGY 22 UNENCUMBERED HOTELS • Completed 2017 financing program in 1H17 with 5- Unencumbered Pool 8 Encumbered Hotels year $200M term loan Hilton Boston Boston Westin The Gwen Courtyard Midtown East Vail Marriott Salt Lake City Marriott • $300M Line of Credit with no outstanding borrowings Courtyard Denver Westin Washington, DC Hotel Rex San Francisco Sonoma Renaissance Hilton Vermont - Burlington Westin San Diego • $69 million unrestricted cash at 3/31/18 Worthington Renaissance Alpharetta Marriott JW Marriott Cherry Creek Charleston Renaissance • PF 2018 Net Debt to EBITDA of 3.4x Bethesda Marriott Suites Unencumbered Pool (cont’d) HGI Times Square Frenchman’s Reef Marriott • Weighted average debt maturity of 5 years with 4.0% Havana Cabana Chicago Marriott Courtyard 5th Avenue weighted average interest rate Key West Suites Westin Fort Lauderdale L’Auberge de Sedona Orchards Inn Shorebreak Hotel Lexington Hotel The Landing Resort & Spa Hotel Palomar Phoenix LEVERAGE AT LOW END OF PEER GROUP 22 UNENCUMBERED HOTELS (~$185M in 2017 Hotel Adj. EBITDA) 9.1 8.4 8.4 WELL-LADDERED DEBT MATURITIES ($M) 400 346 4.8 4.8 Average: 4.9X 300 4.4 3.7 3.7 3.5 3.4 200 2.8 200 158 1.9 100 84 100 57 - AHT AHPBHR HT PEB RLJ CHSP PK XHR LHO DRH HST SHO 2018 2019 2020 2021 2022 2023 2024 2025 2026 Source: Baird. 2018F Net Debt plus preferred / EBITDA. 25

Key Takeaways Top-Tier Portfolio as Measured by Quality and Growth Trading at Significant Discount to Peers, Replacement Cost, and Company’s NAV Est. L’Auberge de Sedona Internal Growth Enhanced by Significant Investment in Portfolio over Last Five Years ($500M) Many Strategic Repositionings Recently The Gwen Chicago Completed and More Potential ROI Opportunities Ahead Opportunistic Balance Sheet Capacity Key West Suites 26

Forward Looking Statements Certain statements made during this presentation are forward-looking statements that are subject to risks and uncertainties. Forward-looking statements generally include the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “project,” “will,” “intend” or other similar expressions. Forward-looking statements include, without limitation, statements regarding, industry outlook, results of operations, cash flows, business strategies, growth and value opportunities, capital and other expenditures, financing plans, expense reduction initiatives and projected dispositions. Factors that could cause actual results to materially differ from those contained in the forward-looking statements include, without limitation, those risks and uncertainties discussed in the Company’s most recent Annual Report on Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission, all of which you should carefully review. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account all information currently available to us. Actual results could differ materially from the forward-looking statements made during this presentation. The forward-looking statements made during this presentation are subject to the safe harbor of the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All information in this presentation is as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company's expectations. This presentation contains statistics and other data that has been obtained or compiled from information made available by third-party service providers. 27