Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DTE ENERGY CO | a8-kinvestormeetings5718.htm |

EXHIBIT 99.1 Business Update May 7, 2018

Safe Harbor Statement Many factors impact forward-looking statements including, but not limited to, the following: impact of regulation by the EPA, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; the cost of protecting assets against, or damage due to, cyber crime and terrorism; volatility in the short-term natural gas storage markets impacting third-party storage revenues related to DTE Energy; impact of volatility of prices in the oil and gas markets on DTE Energy's gas storage and pipelines operations; impact of volatility in prices in the international steel markets on DTE Energy's power and industrial projects operations; volatility in commodity markets, deviations in weather, and related risks impacting the results of DTE Energy's energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power or reduce power consumption; changes in the financial condition of DTE Energy's significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; employee relations and the impact of collective bargaining agreements; the risk of a major safety incident at an electric distribution or generation facility and, for DTE Energy, a gas storage, transmission, or distribution facility; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; contract disputes, binding arbitration, litigation, and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward- looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the Forward-Looking Statements section of the joint DTE Energy and DTE Electric 2017 Form 10-K and 2018 Forms 10-Q (which section is incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric. 2

• Overview • Long-Term Growth Update • Summary 3

DTE Energy overview Leader in ~$19B Winner market cap of 6 consecutive continuous Gallup Great Workplace Awards improvement 10,000 employees Fortune 300 company 100+ years of continuous dividend payments Top quartile in residential customer satisfaction for both DTE Electric & Michigan’s largest investor DTE Gas in and producer of DTE headquarters DTE operations renewable energy 4

Growth driven by strong, stable utilities and complementary non-utility businesses 75% - 80% Utility 20% - 25% Non-utility Growth driven by investments aimed at Growth driven by strategic opportunities improving reliability DTE Electric Gas Storage & Pipelines (GSP) Electric generation Transport, store and and distribution gather natural gas Power & Industrial Projects (P&I) Own and operate DTE Gas energy related Natural gas assets transmission, storage and Energy Trading distribution Gas and power marketing 5

Employee and customer focus provides a solid framework for success Employee Customer Safety Engagement Satisfaction st* AGA’s Safety Achievement Gallup’s Great Workplace Both utilities ranked 1 by Award Award business customers* th ...2nd consecutive year …6 consecutive year Both utilities ranked 2nd in …ranked in top 4% residential customer of the world satisfaction** National Safety Council’s Ranked 7th top 2% on Indeed’s list of Increased investment in of companies surveyed in Best Places to Work reliability infrastructure and safety culture in Fortune 500 enhanced customer channels * J.D. Power 2017 Electric and Gas Utility Business Customer Satisfaction Study. Visit jdpower.com ** J.D. Power 2017 Electric and Gas Utility Residential Midwest Customer Satisfaction Study. Visit jdpower.com 6

2018 has started out strong and we remain confident in delivering on our financial plan Operating EPS • On track to achieve 2018 operating EPS* guidance range of $5.57 to $5.99 +9% • Targeting 5% - 7% operating EPS growth through 2022 $5.78 $5.68 • Growing dividend 7% through 2020** $5.59 $5.31 • Filed plan to double renewable energy capacity by early 2020s • Business update ‒ DTE Electric received approval to build 1,100 MW natural gas plant ‒ DTE Gas is proposing to increase the pace of main renewal 2017 2017 2018 2018 ‒ Gas Storage & Pipelines and Power & Original Actual Early Guidance guidance outlook midpoint Industrial Projects continue to midpoint midpoint progress on their growth plans and are starting the year off strong * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 7 ** Subject to Board approval

DTE has a track record of delivering long-term value to its shareholders DTE Operating EPS* Total Shareholder Return** DTE outperforms S&P 500 utilities $5.59 309% $4.60 $3.94 DTE Energy S&P 500 Utilities $2.82 163% 82% 59% 43% 28% 20072007 20122012 20142014 20172017 3-YR 5-YR 10-YR * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 8 ** Source: Bloomberg as of 3/31/2018

• Overview • Long-Term Growth Update • Summary 9

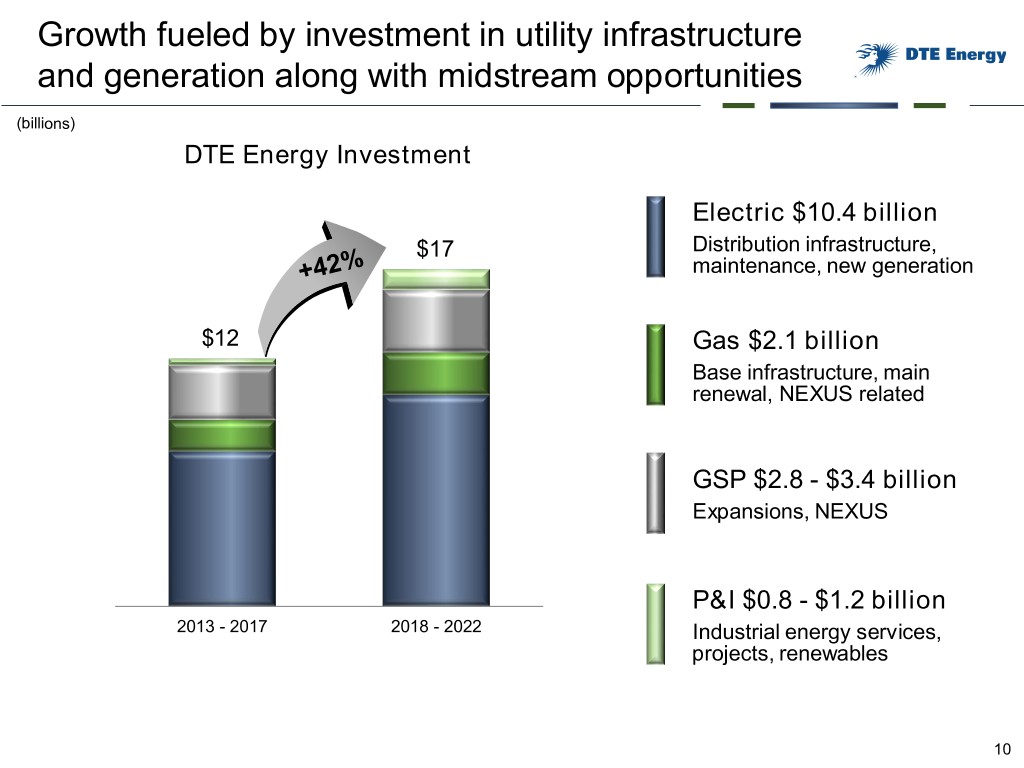

Growth fueled by investment in utility infrastructure and generation along with midstream opportunities (billions) DTE Energy Investment Electric $10.4 billion $17 Distribution infrastructure, maintenance, new generation $12 Gas $2.1 billion Base infrastructure, main renewal, NEXUS related GSP $2.8 - $3.4 billion Expansions, NEXUS P&I $0.8 - $1.2 billion 2013 - 2017 2018 - 2022 Industrial energy services, projects, renewables 10

DTE Electric overview Upgrading Transitioning to distribution lines cleaner energy DTE Electric service territory $16.5B ~11,000 2017 rate megawatt system 2.2M base capacity customers $10.4B Founded 5-year capital plan 1886 (2018-2022) 11

Strong track record of cost management is a direct result of our focus on continuous improvement Average annual percentage change in O&M costs 2008 – 2016 Electric utility* Controlling costs while improving the customer experience Continuous improvements 3% Productivity enhancements 1% DTE Peers Technology innovations Automation Gas utility** Infrastructure replacements Transition to cleaner energy 2% -1% DTE Peers * Source: SNL Financial, FERC Form 1; major US electric utilities with O&M greater than $800 million excluding fuel and purchased power ** Source: SNL Financial, FERC Form 2; gas distribution companies with greater than 300,000 customers; excluding production expense 12

Maintaining customer affordability while investing in our utilities DTE Electric 2012 2017 2012 2017 Average annual residential bill Average industrial rate DTE Gas 2012 2017 2012 2017 Average annual residential bill Average industrial rate 13

Generation and distribution infrastructure replacement will continue to improve service (billions) DTE Electric Investment New generation Transitioning generation portfolio to more sustainable energy $10.4 Distribution infrastructure $7.8 Progress to best in class in reliability Base infrastructure Reduce costs through productivity and efficiency investments 2013 - 2017 2018 - 2022 14

Transitioning portfolio to cleaner more sustainable generation by reducing CO2 emissions CO 2 30% by ~2022 45% by 2030 75% by 2040 > 80% by 2050 reduction plan* Planned River St. Trenton Belle Monroe Rouge Clair Channel River Retirements** 2020 2030 2040 2050 Planned additions*** A steady march toward zero-emitting and low-emitting resources * CO2 percentage reductions from 2005 levels ** ~3,300 MW retired between 2020-2030 and ~3,100 MW retired by 2040 *** ~4,000 MW of renewable and ~3,500 MW of natural gas capacity 15

Increasing reliability and customer satisfaction with distribution investments Infrastructure Improves circuit reliability up to 70% resilience Addresses substation load growth Infrastructure and aging infrastructure redesign Technology Targets 100% remote monitoring enhancement Tree Improves distribution reliability trimming 16

DTE Gas overview Renewing 4,000 miles of cast iron and unprotected distribution main DTE Gas service territory $2.1B 139 Bcf 5-year capital plan storage 1.3M (2018-2022) capacity customers Founded $4.0B 2017 rate base 1849 19,000 miles distribution main 17

Improving service to customers through infrastructure renewal and replacement (billions) DTE Gas Investment NEXUS related Compression $2.1 Infrastructure renewal Proposing accelerated 15 year main renewal cycle $1.6 Base infrastructure Transmission, compression, distribution, storage 2013 - 2017 2018 - 2022 18

Replacing aging infrastructure achieves a fundamental shift in performance, cost and productivity Minimizes leaks - reducing costs and improving customer Main satisfaction - Filed proposal to increase renewal pace of main renewal Reduces manual meter reading – improving Meter operational efficiencies and move out customer satisfaction Strengthens the system - Pipeline decreasing the potential for system issues integrity 19

GSP overview 5 pipelines, 1,600 miles ??? of pipe and Transport, store gathering lines and gather natural gas $2.8B – $3.4B 91 Bcf 5-year capital plan of storage (2018-2022) Serves markets in Midwest, Northeast, Mid-Atlantic, and Southeast 20

Expanding strategic footprint in the most prolific dry gas geology in the country Michigan Northeast Gathering Ontario Market Bluestone Birdsboro Midwest Link Lateral & Gathering Mid-Atlantic & LNG Southeast Gulf 21

GSP is focused on continued success • Continuing progress on NEXUS Growth Plan ‒ Finalizing agreements with two new industrial Operating earnings* customers 2022 target ‒ Completing pipeline construction milestones $280 - $290 million ‒ Active contract negotiations with additional Capital investment shippers 2018 - 2022 ‒ Targeting in-service late 3Q 2018 $2.8 - $3.4 billion • Executing on Link ‒ Finished gathering and transport agreement with a producer, doubling their capacity ‒ Continued future investment • Expanding Bluestone and Millennium pipelines ‒ Progressing on expansions; both on track for 2H 2018 in-service 22 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

P&I overview Geographic diversity Industrial energy services, renewable energy, and reduced emissions fuel $0.8B – $1.2B 5-year capital plan (2018-2022) Leading developer of energy related businesses in North America 191 MW renewable plant capacity 23

P&I is focused on progress toward long-term growth Growth Plan • Continued development of industrial energy projects Operating earnings* ‒ Beginning stages of construction on Ford Motor 2022 target Company complex $65 - $75 million ‒ Advancing discussions on new CHP plant ‒ Pursuing strong pipeline of additional CHP projects Capital investment 2018 - 2022 • Focus on RNG opportunities $0.8 - $1.2 billion ‒ Integrated two recent acquisitions ‒ Finalizing agreement on new project ‒ Pursuing strong pipeline of additional RNG projects • Maximizing performance and value of reduced emissions fuel projects through 2021 24 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

• Overview • Long-Term Growth Update • Summary 25

Summary • Strong start to the year gives us confidence in achieving 2018 operating EPS* guidance • Driving utility growth through infrastructure investments focused on improving reliability and the customer experience • Expanding non-utility businesses through strategic and sustainable growth • Continuing to deliver strong EPS and dividend growth that drive premium total shareholder return 26 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Appendix 27

Confident in achieving 2018 operating EPS* guidance (millions, except EPS) 1Q 2018 2018 Actuals Guidance DTE Electric $142 $648 - $662 DTE Gas 111 152 - 160 Gas Storage & Pipelines 62 185 - 195 Power & Industrial Projects 42 115 - 135 Corporate & Other (16) (100) - (90) Growth segments** $341 $1,000 - $1,062 Growth segments operating EPS $1.91 $5.54 - $5.88 Energy Trading $1 $5 - $20 DTE Energy $342 $1,005 - $1,082 Operating EPS $1.91 $5.57 - $5.99 Avg. Shares Outstanding 180 181 * Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix 28 ** Growth segments exclude Energy Trading

Issuing $300 million of equity in 2018 while maintaining strong cash flow and balance sheet Leverage* Target 50% - 54% • Issue $800 million of equity 2018-2020 51% ‒ $300 million in 2018 using internal mechanisms • $1.4 billion of available liquidity at 2017 2018-2020E March 31, 2018 • Maintain strong BBB credit rating Funds from Operations** / Debt* Target 18% - 19% 20% 2017 2018-2020E * Debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes and 100% of the convertible equity units as equity 29 ** Funds from Operations (FFO) is calculated using operating earnings, reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

Both utilities increase customer reliability with investment plans over the next 5 years (millions) DTE Electric DTE Gas Targeting 6% - 7% growth Targeting 7% - 8% growth $10,400 $2,100 $10 NEXUS related $2,000 New generation Main $1,140 renewal $4,300 Distribution infrastructure Base $4,100 Base $950 infrastructure infrastructure 2018E - 2022E 2018E - 2022E 2017 2022 2017 2022 Depreciation $750M ~$1,076M Depreciation $122M ~$172M YE Rate Base* $16.5B ~$22.9B YE Rate Base** $4.0B ~$5.7B 30 * Includes working capital and rate base associated with surcharges ** Includes working capital

2018 cash flow and capital expenditures guidance (billions) (millions) Cash Flow Capital Expenditures 2018 2018 Guidance Guidance Cash From Operations* $2.0 DTE Electric Base Infrastructure $750 Capital Expenditures (3.6) New Generation 340 Free Cash Flow ($1.6) Distribution Infrastructure 810 $1,900 Asset Sales & Other - DTE Gas Dividends (0.6) Base Infrastructure $257 Net Cash ($2.2) NEXUS Related 13 Main Renewal 190 Debt Financing: $460 Issuances $2.3 Non-Utility $1,100-$1,300 Redemptions (0.1) Change in Debt $2.2 Total $3,460-$3,660 31 * Includes $0.3 billion of equity issued for employee benefit programs

Utility regulatory update DTE Electric DTE Gas • General rate order - April 2018 (U-18255) • General rate case - November 2017 (U-18999) – Effective: May 1 – Prior to tax reform, requested rate – Rate recovery: $65 million recovery: $85 million ($57 million net of infrastructure recovery mechanism) – ROE: 10% – Final order: September 2018 – Capital structure: 50% debt, 50% equity • Expect to file rate cases every ~2 years – Rate base: $15 billion • Capacity charge case - April 2017 (U-18248) – March 2018 MPSC staff report indicated adequate capacity – Local clearing requirements determined 2H 2018 • 5 year electric distribution plan (U-20147) – Final plan filed January 2018 • Certificate of Necessity filing - July 2017 (U-18419) – Received order April 2018 • Next rate case filing 2H 2018 32

Reconciliation of reported to operating earnings Full Year 2007, 2012 and 2014 Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Net Income (millions)* EPS 2007 2012 2014 2007 2012 2014 DTE Energy Report Earnings $ 971 $ 610 $ 905 $ 5.70 $ 3.55 $ 5.10 DTE Electric Detroit Thermal loss reserve 17 0.10 Regulatory asset surcharge 6 0.04 DTE Gas Performance Excellence Process 6 0.04 GCR disallowance 6 0.03 Gas Storage & Pipelines Power & Industrial Projects Performance Excellence Process 1 - Sale of joint venture - Crete (5) (0.03) Coke oven gas settlement 7 0.04 Chicago Fuels Terminal sale 2 0.01 Pet coke mill impairment 1 0.01 Energy Trading Antrim sale 21 0.12 Certain mark-to-market transactions (102) (0.57) Corporate & Other Antrim sale (566) (3.31) Investment impairment 5 0.03 NY state tax law change 8 0.04 Discontinued operations Synfuel (205) (1.20) Unconventional Gas Production** 228 56 1.33 0.33 DTE Energy Operating Earnings $ 480 $ 676 $ 816 $ 2.82 $ 3.94 $ 4.60 * Total tax impact of adjustments to reported earnings: 2007: ($254 million), 2012: $35 million, 2014: ($58 million) ** 2007 operating adjustments of $211 million and $17 million, or $1.23 and $0.10 diluted earnings per share, related to the Antrim sale and Barnett impairment, respectively. 33

1st quarter 2018 reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. Net Income (millions)* Gas Power & 1Q 2018 DTE Storage & Industrial Corporate Growth Energy DTE After tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $140 $104 $62 $45 ($21) $330 $31 $361 Deferred tax remeasurement true-up 8 8 5 21 21 System implementation costs 1 1 2 2 Benefits expense reimbursement (7) (2) (3) (12) (12) Certain mark-to-market transactions (30) (30) Operating Earnings $142 $111 $62 $42 ($16) $341 $1 $342 EPS Gas Power & 1Q 2018 DTE Storage & Industrial Corporate Growth Energy DTE After tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $0.78 $0.58 $0.34 $0.25 ($0.12) $1.83 $0.17 $2.00 Deferred tax remeasurement true-up 0.04 0.04 0.05 0.13 0.13 System implementation costs 0.01 0.01 0.02 0.02 Benefits expense reimbursement (0.04) (0.01) (0.02) (0.07) (0.07) Certain mark-to-market transactions (0.17) (0.17) Operating Earnings $0.79 $0.62 $0.34 $0.23 ($0.07) $1.91 - $1.91 34 * Total tax impact of adjustments to reported earnings: ($13 million)

Reconciliation of 2017 reported to operating earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. Net Income (millions)* Gas Power & 2017 DTE Storage & Industrial Corporate Growth Energy DTE After tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $606 $146 $275 $138 ($103) $1,062 $72 $1,134 PSCR disallowance 10 10 10 System implementation costs 6 3 9 9 Deferred tax remeasurement (5) (115) (21) 34 (107) 2 (105) Impairment 7 7 7 Certain mark-to-market transactions (54) (54) Operating Earnings $617 $149 $160 $124 ($69) $981 $20 $1,001 EPS Gas Power & 2017 DTE Storage & Industrial Corporate Growth Energy DTE After tax items: Electric DTE Gas Pipelines Projects & Other Segments Trading Energy Reported Earnings $3.38 $0.81 $1.53 $0.77 ($0.57) $5.92 $0.40 $6.32 PSCR disallowance 0.06 0.06 0.06 System implementation costs 0.03 0.02 0.05 0.05 Deferred tax remeasurement (0.03) (0.64) (0.12) 0.20 (0.59) 0.01 (0.58) Impairment 0.04 0.04 0.04 Certain mark-to-market transactions (0.30) (0.30) Operating Earnings $3.44 $0.83 $0.89 $0.69 ($0.37) $5.48 $0.11 $5.59 * Total tax impact of adjustments to reported earnings: ($17 million) 35

Reconciliation of reported to operating earnings (non-GAAP) Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to- market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to- market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. 36