Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ASPEN INSURANCE HOLDINGS LTD | a992-ahlq118.htm |

| EX-99.1 - EXHIBIT 99.1 - ASPEN INSURANCE HOLDINGS LTD | a991-ahlq118.htm |

| 8-K - 8-K - ASPEN INSURANCE HOLDINGS LTD | form8-kq12018.htm |

AHL: NYSE

INVESTOR PRESENTATION

FIRST QUARTER 2018

Aspen Insurance Holdings Limited

Exhibit 99.3

Aspen

2 May 2018

AHL: NYSE

SAFE HARBOR DISCLOSURE

This slide presentation is for information purposes only. It should be read in conjunction with our financial supplement posted on our website on the Investor Relations page and with other documents filed or to be filed by

Aspen Insurance Holdings Limited (the “Company” or “Aspen”) with the United States Securities and Exchange Commission (the "SEC").

Non-GAAP Financial Measures: In presenting Aspen's results, management has included and discussed certain “non-GAAP financial measures.” Management believes these non-GAAP financial measures, which may

be defined differently by other companies, better explain Aspen's results of operations in a manner that allows for a more complete understanding of the underlying trends in Aspen's business. However, these measures

should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures is

included herein or in the financial supplement, as applicable, which can be obtained from the Investor Relations section of Aspen's website at www.aspen.co.

Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995: This presentation contains written or oral "forward-looking statements" within the meaning of the U.S. federal securities laws.

These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current

facts, and can be identified by the use of words such as “expect,” “assume,” “objective,” “intend,” “plan,” “believe,” “do not believe,” “aim,” “project,” “anticipate,” “seek,” “will,” “likely,” “estimate,” “may,” “continue,” “guidance,”

“outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” "on track" and similar expressions of a future or forward-looking nature. All forward-looking statements address matters that involve risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in the forward-looking statements. Aspen believes these factors include, but are not limited to: the

actual development of losses and expenses impacting estimates for Hurricanes Harvey, Irma and Maria and the earthquakes in Mexico that occurred in the third quarter of 2017; the impact of complex and unique causation

and coverage issues associated with the attribution of losses to wind or flood damage or other perils such as fire or business interruption relating to such events; potential uncertainties relating to reinsurance recoveries,

reinstatement premiums and other factors inherent in loss estimation; our ability to successfully develop and execute our operating effectiveness and efficiency program; our ability to successfully implement steps to further

optimize the business portfolio, ensure capital efficiency and enhance investment returns; the possibility of greater frequency or severity of claims and loss activity, including as a result of natural or man-made (including

economic and political risks) catastrophic or material loss events, than our underwriting, reserving, reinsurance purchasing or investment practices have anticipated; the assumptions and uncertainties underlying reserve

levels that may be impacted by future payments for settlements of claims and expenses or by other factors causing adverse or favorable development, including our assumptions on inflation costs associated with long-

tail casualty business which could differ materially from actual experience; the United Kingdom’s decision to withdraw from the European Union; the reliability of, and changes in assumptions to, natural and man-made

catastrophe pricing, accumulation and estimated loss models; decreased demand for our insurance or reinsurance products; cyclical changes in the insurance and reinsurance industry; the models we use to assess our

exposure to losses from future catastrophes contain inherent uncertainties and our actual losses may differ significantly from expectations; our capital models may provide materially different indications than actual results;

increased competition from existing (re)insurers and from alternative capital providers and insurance-linked funds and collateralized special purpose insurers on the basis of pricing, capacity, coverage terms, new capital,

binding authorities to brokers or other factors and the related demand and supply dynamics as contracts come up for renewal; our ability to execute our business plan to enter new markets, introduce new products and

teams and develop new distribution channels, including their integration into our existing operations; our acquisition strategy; changes in market conditions in the agriculture industry, which may vary depending upon

demand for agricultural products, weather, commodity prices, natural disasters, and changes in legislation and policies related to agricultural products and producers; termination of, or changes in, the terms of the U.S.

Federal Multiple Peril Crop Insurance Program or the U.S. Farm Bill, including modifications to the Standard Reinsurance Agreement put in place by the Risk Management Agency of the U.S. Department of Agriculture;

the recent consolidation in the (re)insurance industry; loss of one or more of our senior underwriters or key personnel; our ability to exercise capital management initiatives, including capital available to pursue our share

repurchase program at various levels or to declare dividends, or to arrange banking facilities as a result of prevailing market conditions, the level of catastrophes or other losses or changes in our financial results; changes

in general economic conditions, including inflation, deflation, foreign currency exchange rates, interest rates and other factors that could affect our financial results; the risk of a material decline in the value or liquidity of

all or parts of our investment portfolio; the risks associated with the management of capital on behalf of investors; a failure in our operational systems or infrastructure or those of third parties, including those caused by

security breaches or cyber attacks; evolving issues with respect to interpretation of coverage after major loss events; our ability to adequately model and price the effects of climate cycles and climate change; any intervening

legislative or governmental action and changing judicial interpretation and judgments on insurers’ liability to various risks; the risks related to litigation; the effectiveness of our risk management loss limitation methods,

including our reinsurance purchasing; changes in the availability, cost or quality of reinsurance or retrocessional coverage; changes in the total industry losses or our share of total industry losses resulting from events,

such as catastrophes, that have occurred in prior years or may occur and, with respect to such events, our reliance on loss reports received from cedants and loss adjustors, our reliance on industry loss estimates and

those generated by modeling techniques, changes in rulings on flood damage or other exclusions as a result of prevailing lawsuits and case law; the impact of one or more large losses from events other than catastrophes

or by an unexpected accumulation of attritional losses and deterioration in loss estimates; the impact of acts of terrorism, acts of war and related legislation; any changes in our reinsurers’ credit quality and the amount

and timing of reinsurance recoverables; the continuing and uncertain impact of the current depressed lower growth economic environment in many of the countries in which we operate; our reliance on information and

technology and third-party service providers for our operations and systems; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; a decline in our operating subsidiaries’

ratings with S&P, A.M. Best or Moody’s; the failure of our reinsurers, policyholders, brokers or other intermediaries to honor their payment obligations; our reliance on the assessment and pricing of individual risks by third

parties; our dependence on a few brokers for a large portion of our revenues; the persistence of heightened financial risks, including excess sovereign debt, the banking system and the Eurozone crisis; changes in

government regulations or tax laws in jurisdictions where we conduct business; changes in accounting principles or policies or in the application of such accounting principles or policies; increased counterparty risk due

to the credit impairment of financial institutions; and Aspen or Aspen Bermuda Limited becoming subject to income taxes in the United States or the United Kingdom. For a more detailed description of these uncertainties

and other factors, please see the “Risk Factors” section in Aspen’s Annual Report on Form 10-K for the year ended December 31, 2017 as filed with the SEC. Aspen undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

dates on which they are made.

In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants, market intelligence,

initial tentative loss reports and other sources. The actuarial range of reserves and management's best estimate represents a distribution from our internal capital model for reserving risk based on our then current state

of knowledge and explicit and implicit assumptions relating to the incurred pattern of claims, the expected ultimate settlement amount, inflation and dependencies between lines of business. Due to the complexity of factors

contributing to the losses and the preliminary nature of the information used to prepare these estimates, there can be no assurance that Aspen's ultimate losses will remain within the stated amount. Furthermore, seismic

events, such as the Mexico earthquakes, generally have longer development periods than windstorm events, which may be amplified in this instance by dynamics such as the risk of geological liquefaction and the potential

for uncertainty in claims adjudication. In respect of Hurricane Maria, recovery efforts are ongoing and expanding, with power outages, infrastructure damage, communications disruptions and other issues complicating loss

mitigation and estimation. Accordingly, our actual net negative impact from all events noted above, both individually and in the aggregate, will vary from these preliminary estimates, perhaps materially.

2

AHL: NYSE

CONTENTS

Overview │ 4

Operating Segments │ 6

Aspen Re │ 6

Aspen Insurance │ 7

Operational Effectiveness and Efficiency │ 8

Investments │ 9

Reserving and Risk Management │ 10

Financial Highlights │ 12

3

AHL: NYSE

ASPEN - AT A GLANCE

Reinsurance Insurance

46% 54%

4

(1) All data points other than total assets and market capitalization are as of or for the trailing twelve months ended March 31, 2018; Market capitalization as at May

1, 2018

Gross Written Premium by

Segment (1) Highlights

(1)

Ticker: AHL

Gross Written Premium $3.5 billion

Total Assets $13.2 billion

Dividend (per ordinary

share) $0.96

Market Capitalization $2.5 billion

Countries / Offices 9 / 39

AHL: NYSE

STRONG AND DIVERSIFIED FRANCHISE

Global, underwriting expertise-led company writing complex and diversified

insurance and reinsurance risks

Well-balanced business portfolio, stable investment returns and efficient use of

capital

Deep underwriting talent with exceptional quantitative and analytical

capabilities to deliver best-in-class solutions and services

High quality, industry-respected, experienced executive management team

Strong balance sheet built upon robust reserve position backed by prudent

reserving philosophy

Financial strength ratings of A (S&P), A2 (Moody's) and A Excellent (A.M. Best)

for Aspen's operating subsidiaries

5

AHL: NYSE

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Q1 2018

88.0%

70.4%

88.2%

125.4%

85.4%

76.4% 77.6% 80.4%

90.0%

125.1%

90.1%

Specialty Other Property

Casualty Property Cat

40%

21%

20%

19%

6

• Diversified portfolio with strong performance track record

• Significant industry experience and focused on providing expertise and exceptional

solutions to clients

• Maintaining scale and relevance in chosen major products and regions allows us

to better access regional business and benefit quickly from localized market

changes; our regional strategy has driven top-line growth and consistent, long-

term profitability

• Utilize multi-line capabilities and Aspen Capital Markets to leverage third-party

capital ($550 MM under management at end 2017)

• Recently sold AgriLogic and acquired a 23.2% stake in a new company (Crop Re),

providing the opportunity to reinsure a larger, more diversified and fast growing

portfolio of business

Strong Global Product Offering via Key Locations Average 10-year Combined Ratio: 90.6%

Shanghai

Sydney

Singapore

Dubai

California

BermudaGeorgiaFlorida

London

Zurich Connecticut

New York

Illinois

GWP (1) BY BUSINESS LINE

$1.61 BN

ASPEN RE: GLOBAL FRANCHISE WITH CONSISTENT PROFITABILTY

Dublin

Beijing

Hub Office

(1) Trailing Twelve Months ended March 31, 2018.

AHL: NYSE

U.S.

Regional

U.K.

Regional

Professional

Lines and

Management

Liability

Marine

Excess

Casualty

Energy

Other Global

Specialty

Products (3)

20%

14%

17%12%

8%

6%

23%

Strong Global Product Offering

via Key Locations(4)

Singapore

California

Georgia

Florida

Chelmsford

Croydon

Manchester

Glasgow

Birmingham

London

Bristol

Dublin

Illinois

Massachusetts

Connecticut

New York

New Jersey

Pennsylvania

Maryland

Bermuda

Puerto Rico

Texas

• Specialty insurer offering creative, customized solutions to complex risks, deep underwriting expertise, and superior

claims handling abilities

• Robust and globally-aligned marketing and distribution model that empowers experienced leaders to actively engage key

broker partners to drive optimal results

• Business transformed over last five years through organic growth, primarily in the U.S., and expansion of product lines

and strong underwriting teams

• Global presence with 12 global products lines, complemented by two regional businesses (predominantly Property and

Casualty business in the U.S. and U.K.)

• Repositioned, focused portfolio

• Repositioned lines and exited accounts; added new products and deployed existing products in new markets

• Increased use of outwards (pro-rata) reinsurance; expected to enhance underwriting stability over time(1)

ASPEN INSURANCE: LEADING SPECIALTY INSURER

GWP(2) BY BUSINESS LINE

$1.87 BN

(1) See "Safe Harbor Disclosure" slide 2. (2) Trailing Twelve Months ended March 31, 2018 (3) Other Global Specialty Products include: Aviation, Environmental

Liability, Credit & Political Risk, Cyber, Surety, Accident & Health, Crisis Management and Railroad. (4) Certain U.S. offices have more than one office in each state.

7

AHL: NYSE

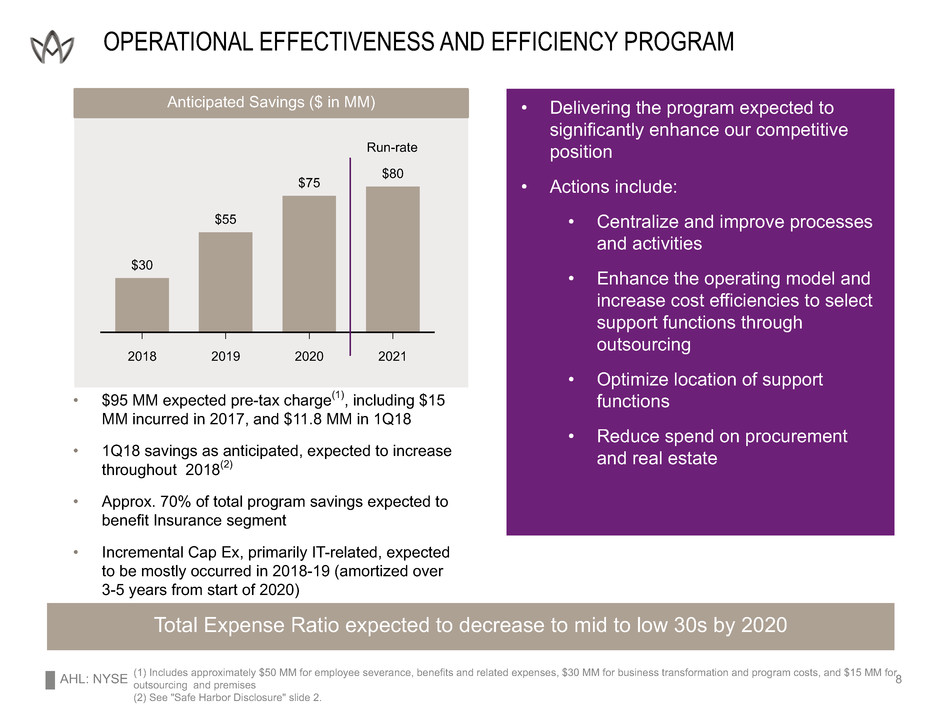

• Delivering the program expected to

significantly enhance our competitive

position

• Actions include:

• Centralize and improve processes

and activities

• Enhance the operating model and

increase cost efficiencies to select

support functions through

outsourcing

• Optimize location of support

functions

• Reduce spend on procurement

and real estate

• $95 MM expected pre-tax charge(1), including $15

MM incurred in 2017, and $11.8 MM in 1Q18

• 1Q18 savings as anticipated, expected to increase

throughout 2018(2)

• Approx. 70% of total program savings expected to

benefit Insurance segment

• Incremental Cap Ex, primarily IT-related, expected

to be mostly occurred in 2018-19 (amortized over

3-5 years from start of 2020)

Total Expense Ratio expected to decrease to mid to low 30s by 2020

OPERATIONAL EFFECTIVENESS AND EFFICIENCY PROGRAM

2018 2019 2020 2021

$30

$55

$75 $80

Run-rate

Anticipated Savings ($ in MM)

(1) Includes approximately $50 MM for employee severance, benefits and related expenses, $30 MM for business transformation and program costs, and $15 MM for

outsourcing and premises

(2) See "Safe Harbor Disclosure" slide 2.

8

AHL: NYSE

STRONG AND CONSISTENT INVESTMENT RETURNS OVER THE LONG-TERM

• Total investments and cash of $8.2 billion

• Fixed income portfolio:

• Duration of 3.98 years

• Average credit quality of AA-

• Book yield of 2.63%

• Sold $491 MM of equities in 1Q18, leaving

4.2%(3) of the portfolio invested in risk assets

(4.1% in BBB emerging market debt) as at

March 31, 2018

(1) See "Safe Harbor Disclosure" slide 2.

(2) Excludes amounts attributable to variable interest entities; may not add to 100% due to rounding.

(3) Risk assets include 4.1% in BBB emerging market debt, and the remainder in cash allocated to these strategies.

outsourcing and premises

9

• Conservative but tactical approach to investment management

• Achieve high quality, non-volatile investment income and total return that contribute significantly to operating ROE

and BVPS growth through all market cycles(1)

• Overall portfolio strategy focused on high-quality fixed-income investments in multiple jurisdictions and currencies;

tactically invest in liquid risk assets to build total return

• Maintain adequate liquidity to meet operational, claims paying, and capital management needs

Portfolio Allocations (as at March 31, 2018) (2)

Investment Grade Credit

U.S. Treasury

Agency MBS

Cash & Short-Term

Sovereign

Non-U.S. Agency

U.S. Agency

Non-U.S. Govt. Guaranteed

Munis

ABS

42%

18%

14%

13%

6%

4%

1%

1%

1%

0.3%

Portfolio Highlights (as at March 31, 2018)

AHL: NYSE

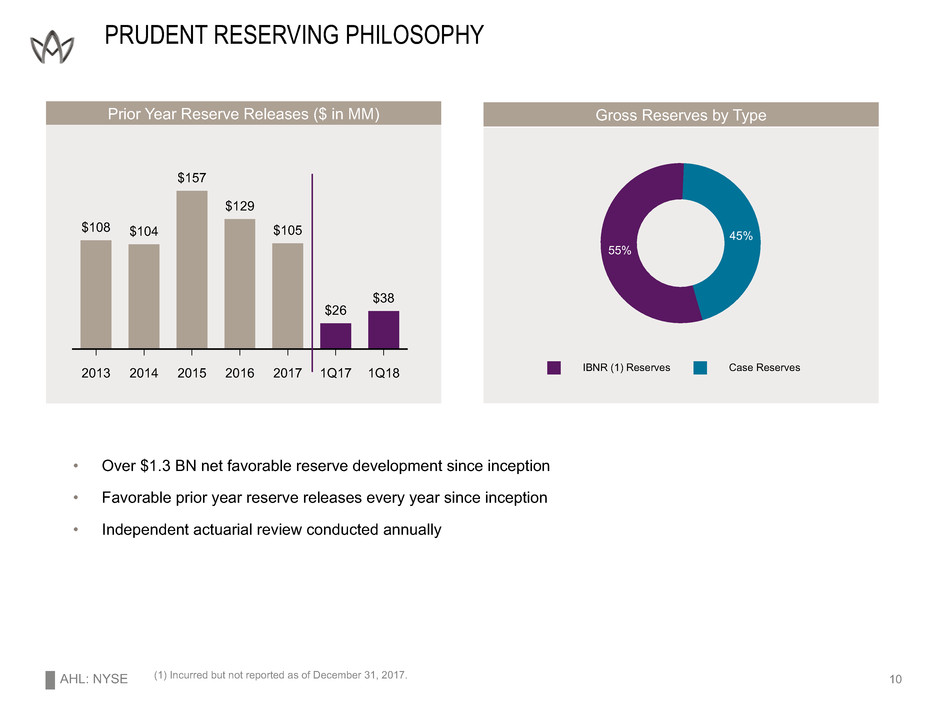

PRUDENT RESERVING PHILOSOPHY

Prior Year Reserve Releases ($ in MM) Gross Reserves by Type

2013 2014 2015 2016 2017 1Q17 1Q18

$108 $104

$157

$129

$105

$26

$38

IBNR (1) Reserves Case Reserves

55%

45%

• Over $1.3 BN net favorable reserve development since inception

• Favorable prior year reserve releases every year since inception

• Independent actuarial review conducted annually

(1) Incurred but not reported as of December 31, 2017. 10

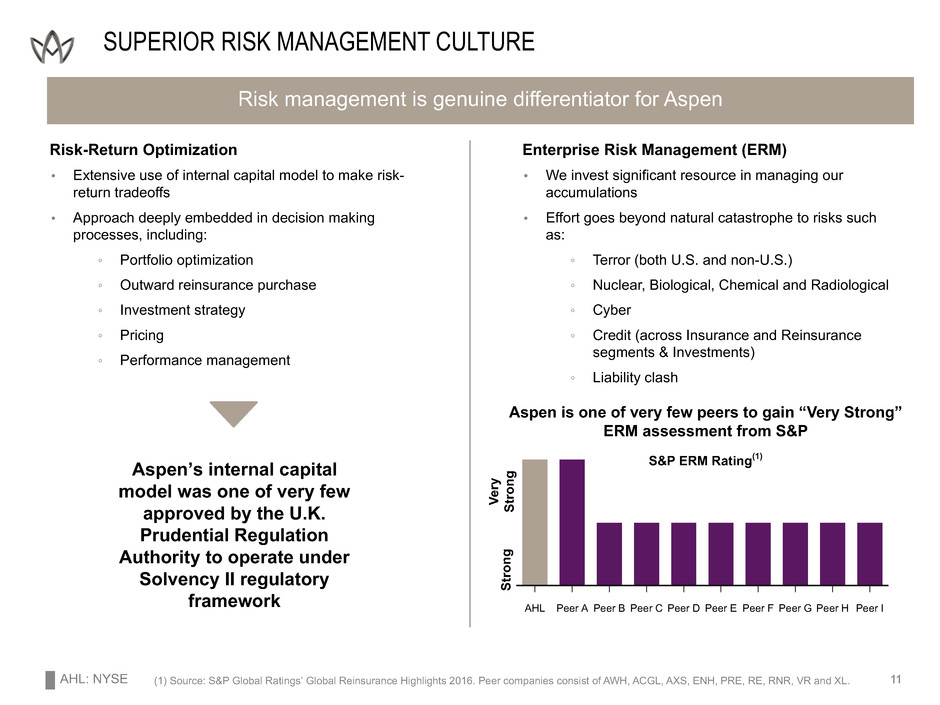

AHL: NYSE

Risk management is genuine differentiator for Aspen

SUPERIOR RISK MANAGEMENT CULTURE

Aspen’s internal capital

model was one of very few

approved by the U.K.

Prudential Regulation

Authority to operate under

Solvency II regulatory

framework

Risk-Return Optimization

• Extensive use of internal capital model to make risk-

return tradeoffs

• Approach deeply embedded in decision making

processes, including:

◦ Portfolio optimization

◦ Outward reinsurance purchase

◦ Investment strategy

◦ Pricing

◦ Performance management

Enterprise Risk Management (ERM)

• We invest significant resource in managing our

accumulations

• Effort goes beyond natural catastrophe to risks such

as:

◦ Terror (both U.S. and non-U.S.)

◦ Nuclear, Biological, Chemical and Radiological

◦ Cyber

◦ Credit (across Insurance and Reinsurance

segments & Investments)

◦ Liability clash

Aspen is one of very few peers to gain “Very Strong”

ERM assessment from S&P

S&P ERM Rating(1)

Stron

g

Ver

y

Stron

g

(1) Source: S&P Global Ratings’ Global Reinsurance Highlights 2016. Peer companies consist of AWH, ACGL, AXS, ENH, PRE, RE, RNR, VR and XL. 11

AHL Peer A Peer B Peer C Peer D Peer E Peer F Peer G Peer H Peer I

AHL: NYSE

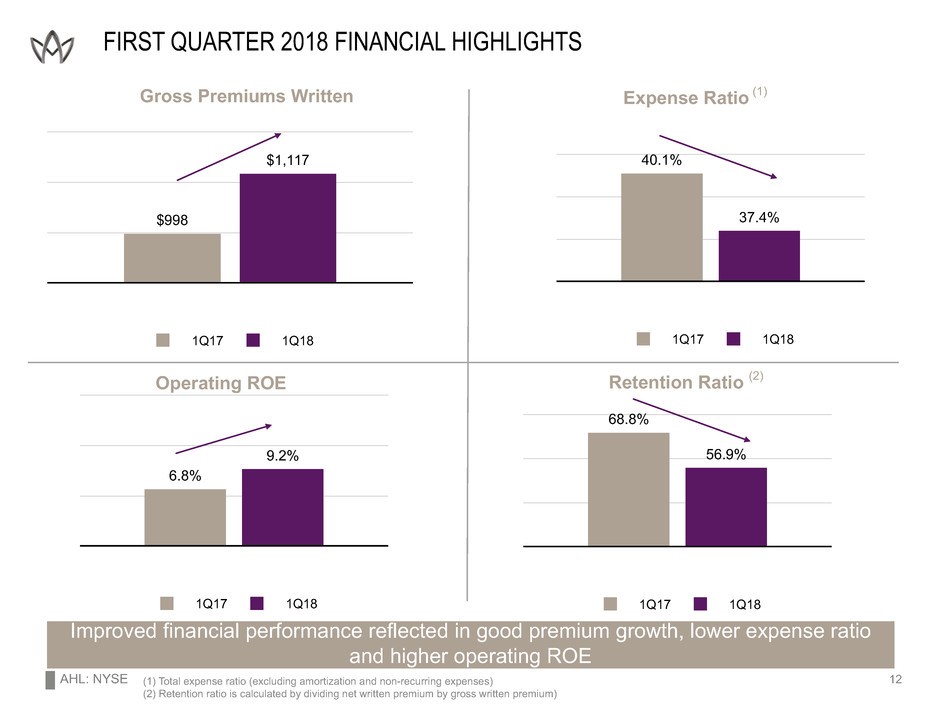

1Q17 1Q18

68.8%

56.9%

1Q17 1Q18

6.8%

9.2%

1Q17 1Q18

40.1%

37.4%

1Q17 1Q18

$998

$1,117

FIRST QUARTER 2018 FINANCIAL HIGHLIGHTS

Gross Premiums Written Expense Ratio (1)

12

Operating ROE

(1) Total expense ratio (excluding amortization and non-recurring expenses)

(2) Retention ratio is calculated by dividing net written premium by gross written premium)

Retention Ratio (2)

Improved financial performance reflected in good premium growth, lower expense ratio

and higher operating ROE

AHL: NYSE

INVESTOR PRESENTATION

FIRST QUARTER 2018

Aspen Insurance Holdings Limited