Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ANNALY CAPITAL MANAGEMENT INC | d580338dex991.htm |

| 8-K - FORM 8-K - ANNALY CAPITAL MANAGEMENT INC | d580338d8k.htm |

Annaly Capital Management, Inc. to Acquire MTGE Investment Corp. May 2, 2018 Exhibit 99.2

Safe Harbor Forward-Looking Statements This presentation includes forward-looking statements. These forward-looking statements generally can be identified by phrases such as “will,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. Similarly, statements herein that describe the proposed transaction, including its financial and operational impact, and other statements of management’s beliefs, intentions or goals also are forward-looking statements. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of Annaly Capital Management, Inc. (“Annaly”) or MTGE Investment Corp. (“MTGE”) stock. These forward-looking statements involve certain risks and uncertainties, many of which are beyond the parties’ control, that could cause actual results to differ materially from those indicated in such forward-looking statements, including but not limited to the ability of the parties to consummate the proposed transaction on a timely basis or at all and the satisfaction of the conditions precedent to consummation of the proposed transaction, including at least a majority of MTGE’s common shares being validly tendered into the exchange offer; that required regulatory approvals for the proposed transaction may not be obtained in a timely manner, if at all; business disruption following the merger; and the other risks and important factors contained and identified in Annaly’s and MTGE’s filings with the Securities and Exchange Commission (“SEC”), such as their respective Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K, any of which could cause actual results to differ materially from the forward-looking statements. The forward-looking statements included in this presentation are made only as of the date hereof. Neither Annaly nor MTGE undertakes any obligation to update the forward-looking statements to reflect subsequent events or circumstances, except as required by law. Additional Information and Where to Find It The exchange offer referenced in this presentation has not yet commenced. This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for the exchange offer materials that Annaly and its merger subsidiary will file with the SEC. At the time the exchange offer is commenced, Annaly and its merger subsidiary will file a tender offer statement on Schedule TO, Annaly will file a registration statement on Form S-4, and MTGE will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the exchange offer. THE EXCHANGE OFFER MATERIALS (INCLUDING AN OFFER TO EXCHANGE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION. MTGE STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF MTGE SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. The Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of MTGE common stock at no expense to them. The exchange offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Annaly’s Investor Relations department at 1-888-8Annaly (1-888-826-6259). In addition to the Offer to Exchange, the related Letter of Transmittal and certain other exchange offer documents, as well as the Solicitation/Recommendation Statement, Annaly and MTGE file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Annaly and MTGE at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Annaly’s and MTGE’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

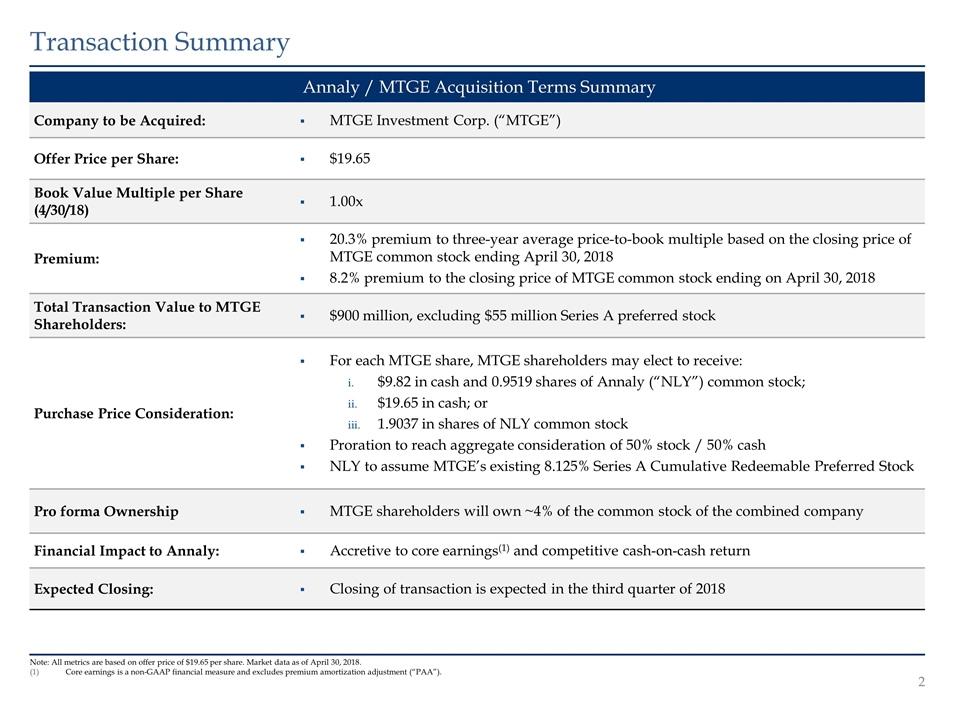

Note: All metrics are based on offer price of $19.65 per share. Market data as of April 30, 2018. Core earnings is a non-GAAP financial measure and excludes premium amortization adjustment (“PAA”). Transaction Summary Annaly / MTGE Acquisition Terms Summary Company to be Acquired: MTGE Investment Corp. (“MTGE”) Offer Price per Share: $19.65 Book Value Multiple per Share (4/30/18) 1.00x Premium: 20.3% premium to three-year average price-to-book multiple based on the closing price of MTGE common stock ending April 30, 2018 8.2% premium to the closing price of MTGE common stock ending on April 30, 2018 Total Transaction Value to MTGE Shareholders: $900 million, excluding $55 million Series A preferred stock Purchase Price Consideration: For each MTGE share, MTGE shareholders may elect to receive: $9.82 in cash and 0.9519 shares of Annaly (“NLY”) common stock; $19.65 in cash; or 1.9037 in shares of NLY common stock Proration to reach aggregate consideration of 50% stock / 50% cash NLY to assume MTGE’s existing 8.125% Series A Cumulative Redeemable Preferred Stock Pro forma Ownership MTGE shareholders will own ~4% of the common stock of the combined company Financial Impact to Annaly: Accretive to core earnings(1) and competitive cash-on-cash return Expected Closing: Closing of transaction is expected in the third quarter of 2018

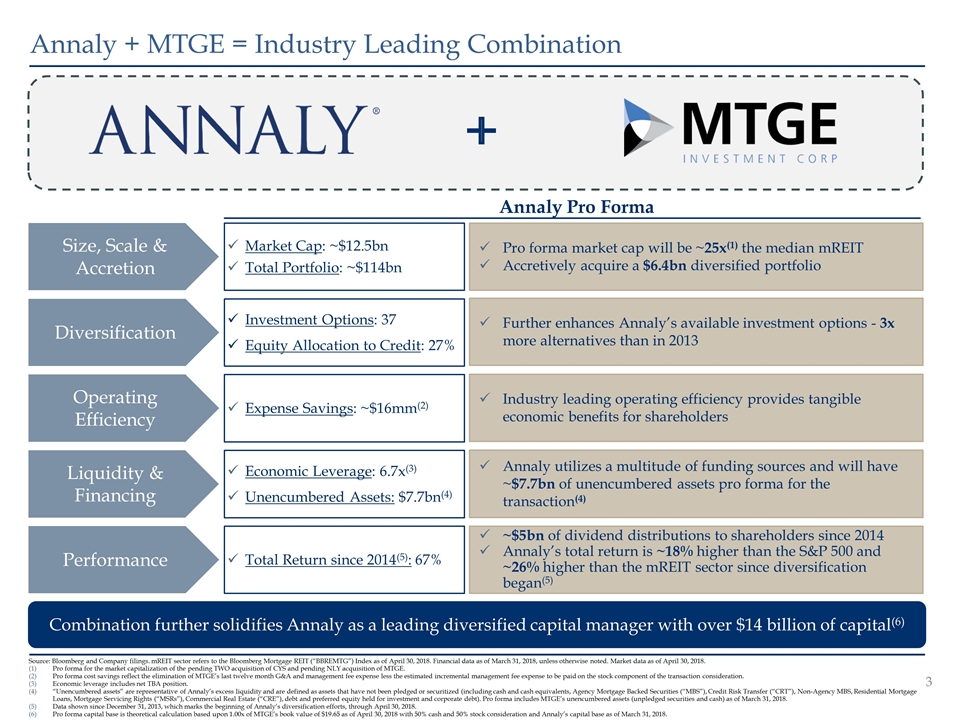

Annaly + MTGE = Industry Leading Combination Source: Bloomberg and Company filings. mREIT sector refers to the Bloomberg Mortgage REIT (“BBREMTG”) Index as of April 30, 2018. Financial data as of March 31, 2018, unless otherwise noted. Market data as of April 30, 2018. Pro forma for the market capitalization of the pending TWO acquisition of CYS and pending NLY acquisition of MTGE. Pro forma cost savings reflect the elimination of MTGE’s last twelve month G&A and management fee expense less the estimated incremental management fee expense to be paid on the stock component of the transaction consideration. Economic leverage includes net TBA position. “Unencumbered assets” are representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (including cash and cash equivalents, Agency Mortgage Backed Securities (“MBS”), Credit Risk Transfer (“CRT”), Non-Agency MBS, Residential Mortgage Loans, Mortgage Servicing Rights (“MSRs”), Commercial Real Estate (“CRE”), debt and preferred equity held for investment and corporate debt). Pro forma includes MTGE’s unencumbered assets (unpledged securities and cash) as of March 31, 2018. Data shown since December 31, 2013, which marks the beginning of Annaly’s diversification efforts, through April 30, 2018. Pro forma capital base is theoretical calculation based upon 1.00x of MTGE’s book value of $19.65 as of April 30, 2018 with 50% cash and 50% stock consideration and Annaly’s capital base as of March 31, 2018. Market Cap: ~$12.5bn Total Portfolio: ~$114bn Size, Scale & Accretion Diversification Investment Options: 37 Equity Allocation to Credit: 27% Expense Savings: ~$16mm(2) Operating Efficiency Combination further solidifies Annaly as a leading diversified capital manager with over $14 billion of capital(6) Total Return since 2014(5): 67% Performance Pro forma market cap will be ~25x(1) the median mREIT Accretively acquire a $6.4bn diversified portfolio Further enhances Annaly’s available investment options - 3x more alternatives than in 2013 Industry leading operating efficiency provides tangible economic benefits for shareholders ~$5bn of dividend distributions to shareholders since 2014 Annaly’s total return is ~18% higher than the S&P 500 and ~26% higher than the mREIT sector since diversification began(5) Annaly Pro Forma Economic Leverage: 6.7x(3) Unencumbered Assets: $7.7bn(4) Liquidity & Financing Annaly utilizes a multitude of funding sources and will have ~$7.7bn of unencumbered assets pro forma for the transaction(4)

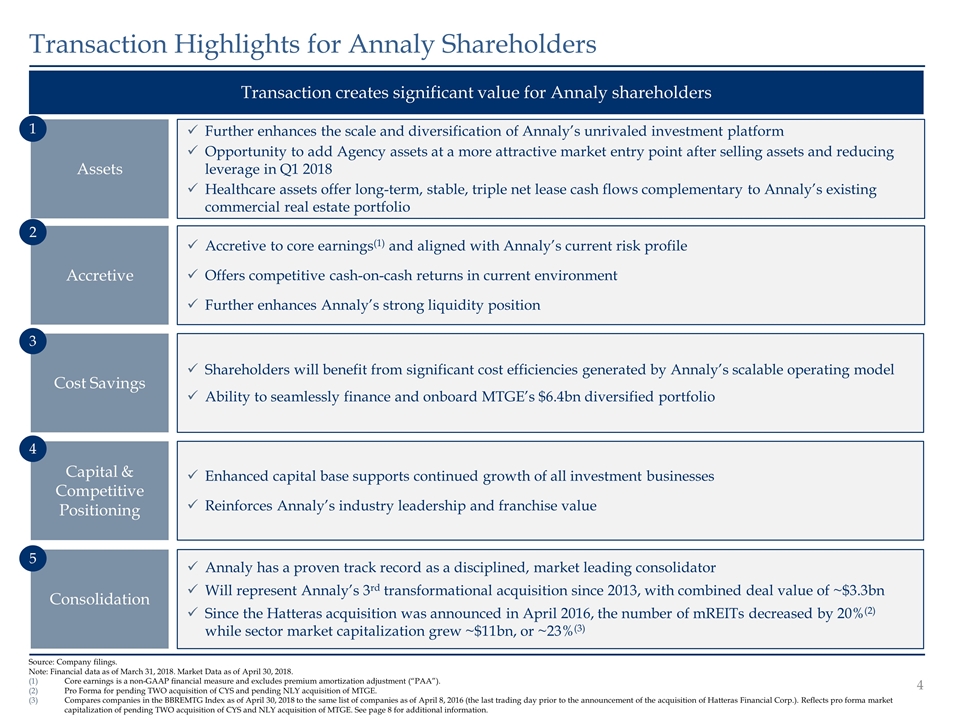

Transaction creates significant value for Annaly shareholders Accretive Transaction Highlights for Annaly Shareholders Assets Cost Savings Capital & Competitive Positioning 1 2 3 4 Further enhances the scale and diversification of Annaly’s unrivaled investment platform Opportunity to add Agency assets at a more attractive market entry point after selling assets and reducing leverage in Q1 2018 Healthcare assets offer long-term, stable, triple net lease cash flows complementary to Annaly’s existing commercial real estate portfolio Accretive to core earnings(1) and aligned with Annaly’s current risk profile Offers competitive cash-on-cash returns in current environment Further enhances Annaly’s strong liquidity position Shareholders will benefit from significant cost efficiencies generated by Annaly’s scalable operating model Ability to seamlessly finance and onboard MTGE’s $6.4bn diversified portfolio Enhanced capital base supports continued growth of all investment businesses Reinforces Annaly’s industry leadership and franchise value Source: Company filings. Note: Financial data as of March 31, 2018. Market Data as of April 30, 2018. Core earnings is a non-GAAP financial measure and excludes premium amortization adjustment (“PAA”). Pro Forma for pending TWO acquisition of CYS and pending NLY acquisition of MTGE. Compares companies in the BBREMTG Index as of April 30, 2018 to the same list of companies as of April 8, 2016 (the last trading day prior to the announcement of the acquisition of Hatteras Financial Corp.). Reflects pro forma market capitalization of pending TWO acquisition of CYS and NLY acquisition of MTGE. See page 8 for additional information. Consolidation 5 Annaly has a proven track record as a disciplined, market leading consolidator Will represent Annaly’s 3rd transformational acquisition since 2013, with combined deal value of ~$3.3bn Since the Hatteras acquisition was announced in April 2016, the number of mREITs decreased by 20%(2) while sector market capitalization grew ~$11bn, or ~23%(3)

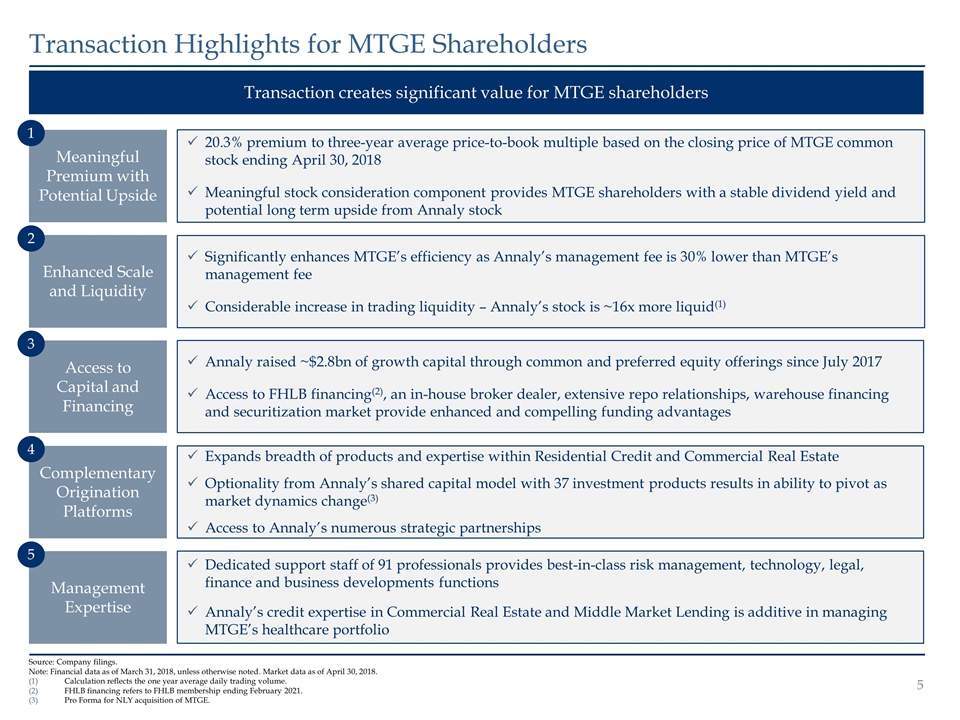

Transaction creates significant value for MTGE shareholders Enhanced Scale and Liquidity Transaction Highlights for MTGE Shareholders Meaningful Premium with Potential Upside Access to Capital and Financing Complementary Origination Platforms Management Expertise 1 2 3 4 5 20.3% premium to three-year average price-to-book multiple based on the closing price of MTGE common stock ending April 30, 2018 Meaningful stock consideration component provides MTGE shareholders with a stable dividend yield and potential long term upside from Annaly stock Significantly enhances MTGE’s efficiency as Annaly’s management fee is 30% lower than MTGE’s management fee Considerable increase in trading liquidity – Annaly’s stock is ~16x more liquid(1) Annaly raised ~$2.8bn of growth capital through common and preferred equity offerings since July 2017 Access to FHLB financing(2), an in-house broker dealer, extensive repo relationships, warehouse financing and securitization market provide enhanced and compelling funding advantages Expands breadth of products and expertise within Residential Credit and Commercial Real Estate Optionality from Annaly’s shared capital model with 37 investment products results in ability to pivot as market dynamics change(3) Access to Annaly’s numerous strategic partnerships Dedicated support staff of 91 professionals provides best-in-class risk management, technology, legal, finance and business developments functions Annaly’s credit expertise in Commercial Real Estate and Middle Market Lending is additive in managing MTGE’s healthcare portfolio Source: Company filings. Note: Financial data as of March 31, 2018, unless otherwise noted. Market data as of April 30, 2018. Calculation reflects the one year average daily trading volume. FHLB financing refers to FHLB membership ending February 2021. Pro Forma for NLY acquisition of MTGE.

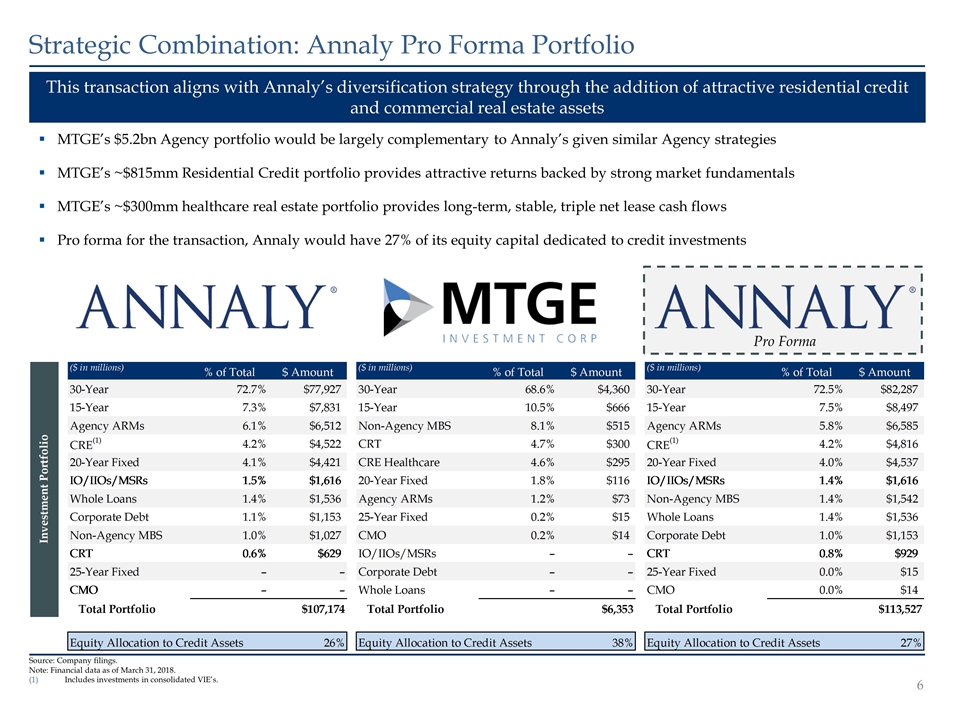

Source: Company filings. Note: Financial data as of March 31, 2018. Includes investments in consolidated VIE’s. Strategic Combination: Annaly Pro Forma Portfolio MTGE’s $5.2bn Agency portfolio would be largely complementary to Annaly’s given similar Agency strategies MTGE’s ~$815mm Residential Credit portfolio provides attractive returns backed by strong market fundamentals MTGE’s ~$300mm healthcare real estate portfolio provides long-term, stable, triple net lease cash flows Pro forma for the transaction, Annaly would have 27% of its equity capital dedicated to credit investments This transaction aligns with Annaly’s diversification strategy through the addition of attractive residential credit and commercial real estate assets Pro Forma

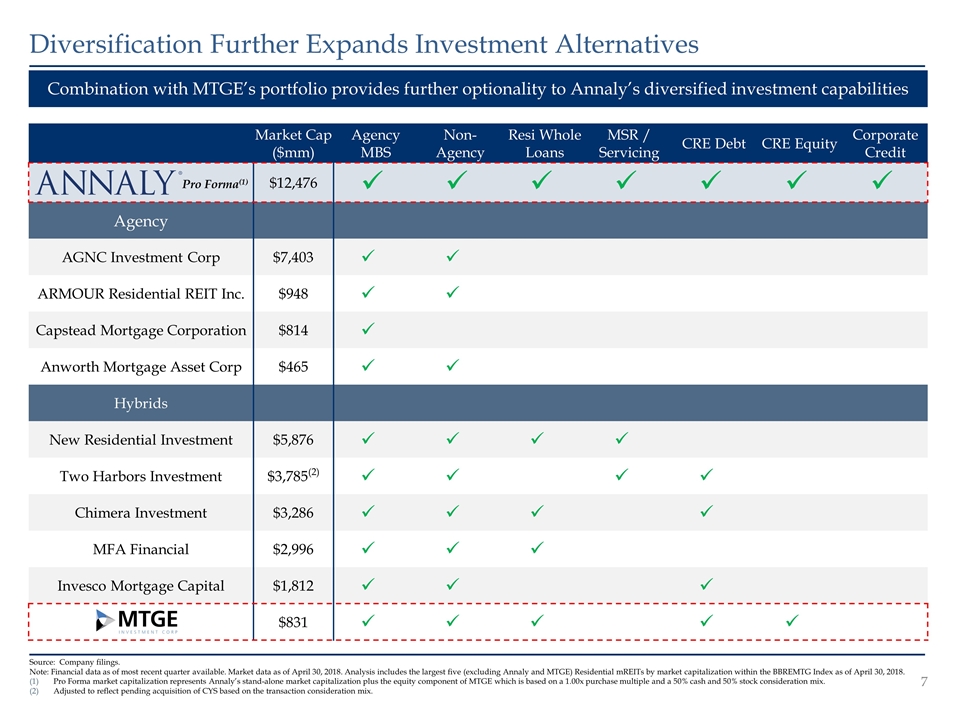

Diversification Further Expands Investment Alternatives Source: Company filings. Note: Financial data as of most recent quarter available. Market data as of April 30, 2018. Analysis includes the largest five (excluding Annaly and MTGE) Residential mREITs by market capitalization within the BBREMTG Index as of April 30, 2018. Pro Forma market capitalization represents Annaly’s stand-alone market capitalization plus the equity component of MTGE which is based on a 1.00x purchase multiple and a 50% cash and 50% stock consideration mix. Adjusted to reflect pending acquisition of CYS based on the transaction consideration mix. Combination with MTGE’s portfolio provides further optionality to Annaly’s diversified investment capabilities Market Cap ($mm) Agency MBS Non-Agency Resi Whole Loans MSR / Servicing CRE Debt CRE Equity Corporate Credit $12,476 Agency AGNC Investment Corp $7,403 ARMOUR Residential REIT Inc. $948 Capstead Mortgage Corporation $814 Anworth Mortgage Asset Corp $465 Hybrids New Residential Investment $5,876 Two Harbors Investment $3,785(2) Chimera Investment $3,286 MFA Financial $2,996 Invesco Mortgage Capital $1,812 $831 Pro Forma(1)

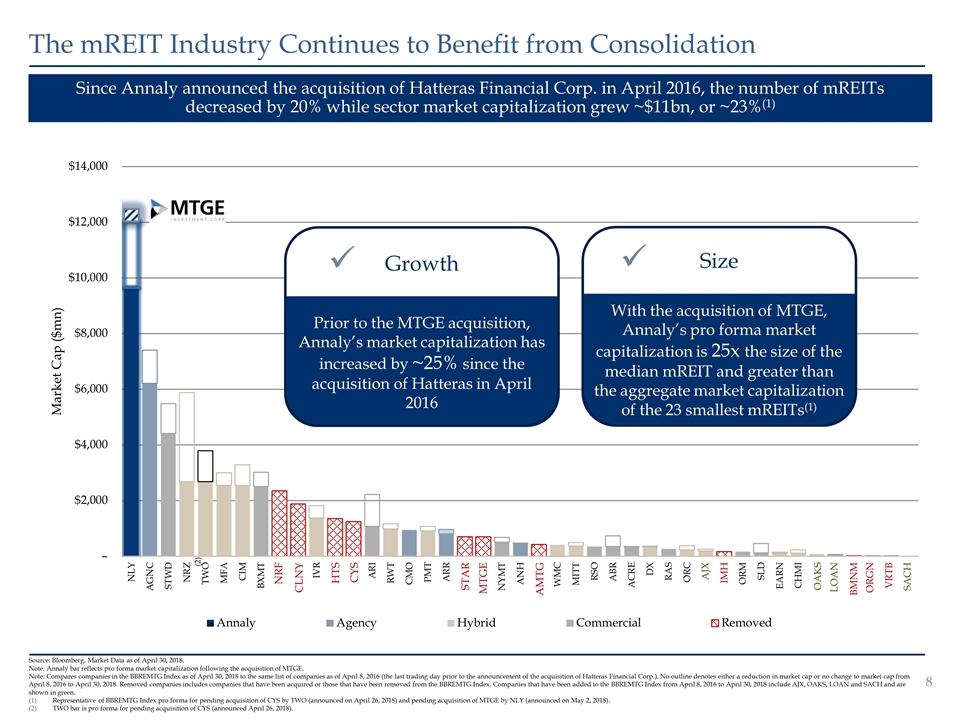

Since Annaly announced the acquisition of Hatteras Financial Corp. in April 2016, the number of mREITs decreased by 20% while sector market capitalization grew ~$11bn, or ~23%(1) The mREIT Industry Continues to Benefit from Consolidation Source: Bloomberg. Market Data as of April 30, 2018. Note: Annaly bar reflects pro forma market capitalization following the acquisition of MTGE. Note: Compares companies in the BBREMTG Index as of April 30, 2018 to the same list of companies as of April 8, 2016 (the last trading day prior to the announcement of the acquisition of Hatteras Financial Corp.). No outline denotes either a reduction in market cap or no change to market cap from April 8, 2016 to April 30, 2018. Removed companies includes companies that have been acquired or those that have been removed from the BBREMTG Index. Companies that have been added to the BBREMTG Index from April 8, 2016 to April 30, 2018 include AJX, OAKS, LOAN and SACH and are shown in green. Representative of BBREMTG Index pro forma for pending acquisition of CYS by TWO (announced on April 26, 2018) and pending acquisition of MTGE by NLY (announced on May 2, 2018). TWO bar is pro forma for pending acquisition of CYS (announced April 26, 2018). Prior to the MTGE acquisition, Annaly’s market capitalization has increased by ~25% since the acquisition of Hatteras in April 2016 Growth ü NRF CLNY HTS STAR AMTG IMH AJX ORGN VRTB OAKS LOAN SACH BMNM MTGE With the acquisition of MTGE, Annaly’s pro forma market capitalization is 25x the size of the median mREIT and greater than the aggregate market capitalization of the 23 smallest mREITs(1) Size ü CYS (2)

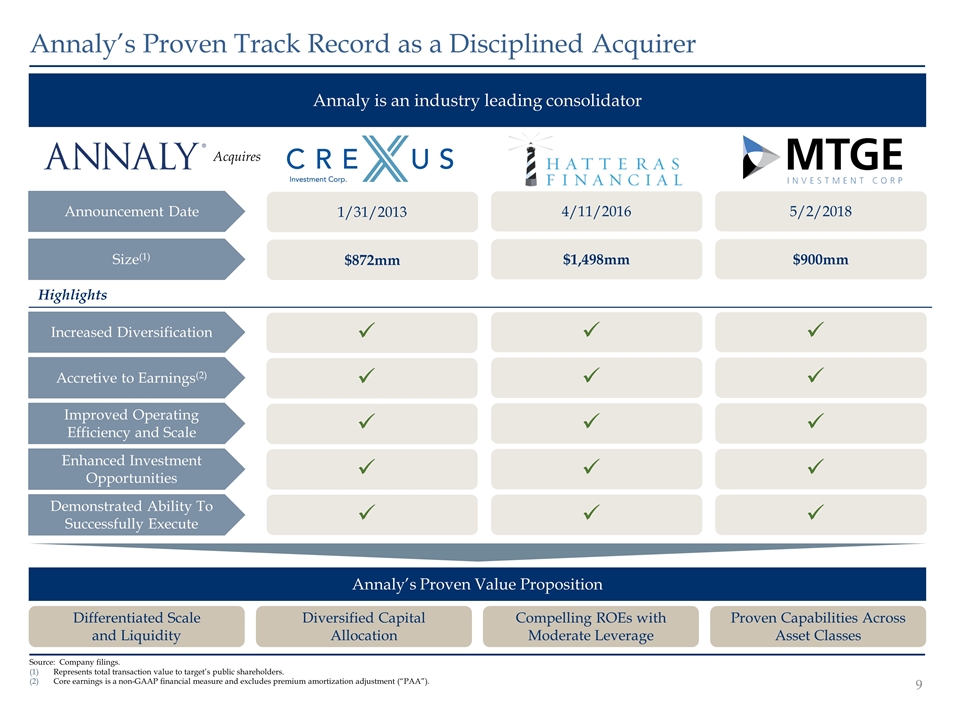

Differentiated Scale and Liquidity Diversified Capital Allocation Proven Capabilities Across Asset Classes Compelling ROEs with Moderate Leverage Annaly’s Proven Track Record as a Disciplined Acquirer Announcement Date Size(1) 4/11/2016 5/2/2018 $1,498mm $900mm Highlights Increased Diversification Accretive to Earnings(2) Improved Operating Efficiency and Scale Enhanced Investment Opportunities Demonstrated Ability To Successfully Execute Annaly’s Proven Value Proposition Annaly is an industry leading consolidator 1/31/2013 $872mm Acquires Source: Company filings. Represents total transaction value to target’s public shareholders. Core earnings is a non-GAAP financial measure and excludes premium amortization adjustment (“PAA”).

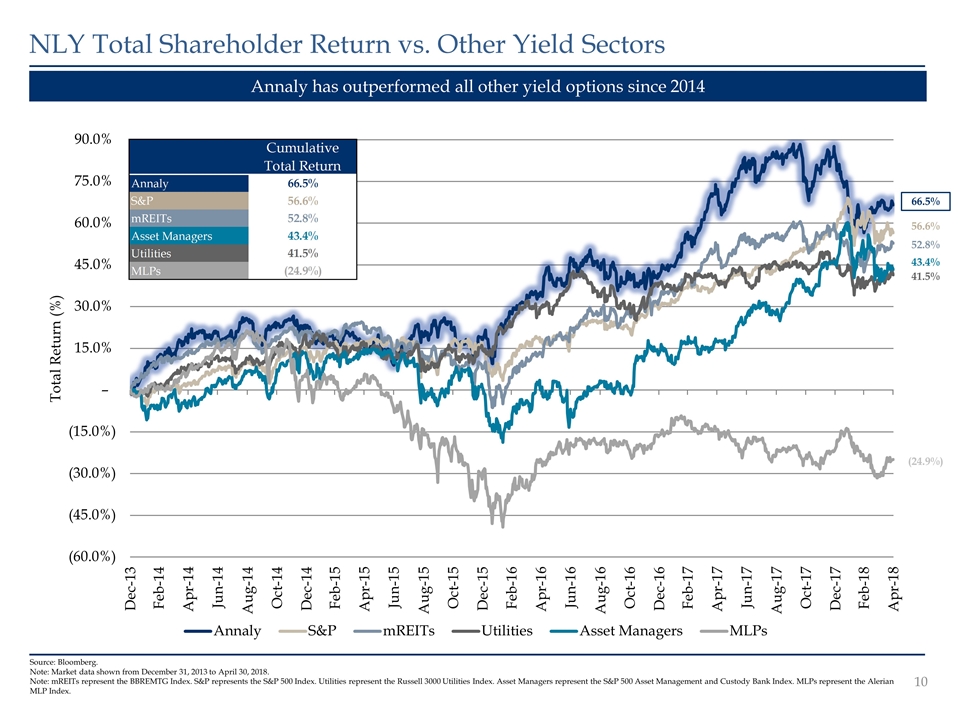

Source: Bloomberg. Note: Market data shown from December 31, 2013 to April 30, 2018. Note: mREITs represent the BBREMTG Index. S&P represents the S&P 500 Index. Utilities represent the Russell 3000 Utilities Index. Asset Managers represent the S&P 500 Asset Management and Custody Bank Index. MLPs represent the Alerian MLP Index. NLY Total Shareholder Return vs. Other Yield Sectors (24.9%) 52.8% 56.6% 66.5% 43.4% 41.5% Annaly has outperformed all other yield options since 2014

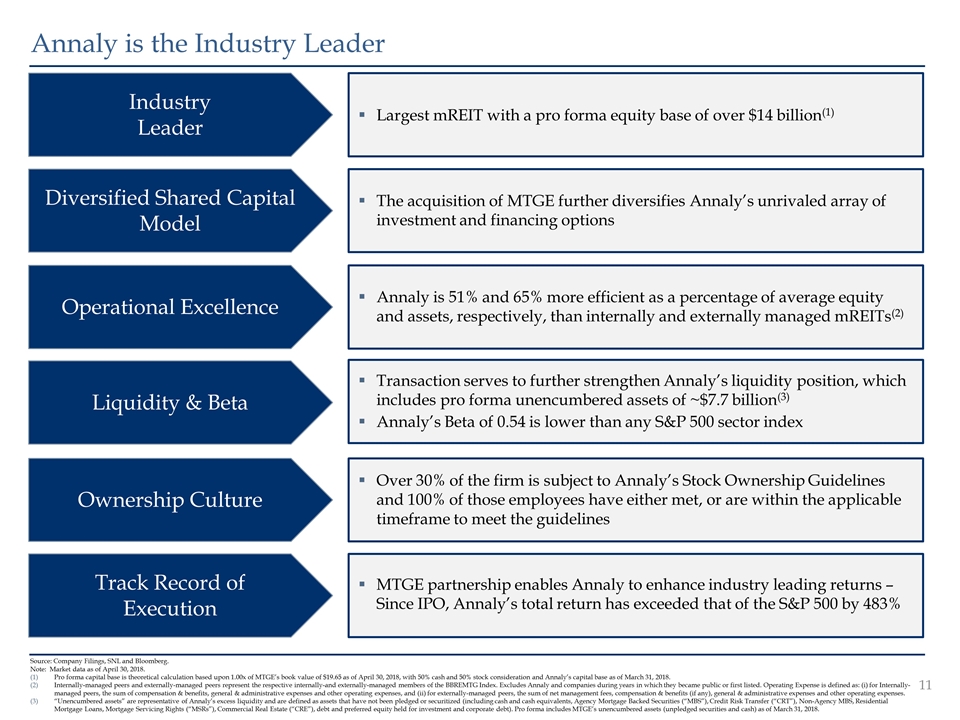

Annaly is the Industry Leader Source: Company Filings, SNL and Bloomberg. Note: Market data as of April 30, 2018. Pro forma capital base is theoretical calculation based upon 1.00x of MTGE’s book value of $19.65 as of April 30, 2018, with 50% cash and 50% stock consideration and Annaly’s capital base as of March 31, 2018. Internally-managed peers and externally-managed peers represent the respective internally-and externally-managed members of the BBREMTG Index. Excludes Annaly and companies during years in which they became public or first listed. Operating Expense is defined as: (i) for Internally-managed peers, the sum of compensation & benefits, general & administrative expenses and other operating expenses, and (ii) for externally-managed peers, the sum of net management fees, compensation & benefits (if any), general & administrative expenses and other operating expenses. “Unencumbered assets” are representative of Annaly’s excess liquidity and are defined as assets that have not been pledged or securitized (including cash and cash equivalents, Agency Mortgage Backed Securities (“MBS”), Credit Risk Transfer (“CRT”), Non-Agency MBS, Residential Mortgage Loans, Mortgage Servicing Rights (“MSRs”), Commercial Real Estate (“CRE”), debt and preferred equity held for investment and corporate debt). Pro forma includes MTGE’s unencumbered assets (unpledged securities and cash) as of March 31, 2018. Largest mREIT with a pro forma equity base of over $14 billion(1) Transaction serves to further strengthen Annaly’s liquidity position, which includes pro forma unencumbered assets of ~$7.7 billion(3) Annaly’s Beta of 0.54 is lower than any S&P 500 sector index MTGE partnership enables Annaly to enhance industry leading returns – Since IPO, Annaly’s total return has exceeded that of the S&P 500 by 483% Industry Leader Liquidity & Beta Track Record of Execution Over 30% of the firm is subject to Annaly’s Stock Ownership Guidelines and 100% of those employees have either met, or are within the applicable timeframe to meet the guidelines Ownership Culture Diversified Shared Capital Model The acquisition of MTGE further diversifies Annaly’s unrivaled array of investment and financing options Annaly is 51% and 65% more efficient as a percentage of average equity and assets, respectively, than internally and externally managed mREITs(2) Operational Excellence