Attached files

| file | filename |

|---|---|

| 8-K - OKE Q1 2018 EARNINGS RELEASE - ONEOK INC /NEW/ | okeq12018earningsrelease.htm |

-more-

May 1, 2018 Analyst Contact: Megan Patterson

918-561-5325

Media Contact: Stephanie Higgins

918-591-5026

ONEOK Announces Higher

First-quarter 2018 Financial Results

Volume Growth Drives More Than 30 Percent Increase in

Operating Income Compared with 2017

TULSA, Okla. - May 1, 2018 - ONEOK, Inc. (NYSE: OKE) today announced higher

first-quarter 2018 financial results, compared with the first quarter 2017. Results primarily

benefited from volume growth in the STACK and SCOOP areas and the Williston and Permian

basins, and higher optimization and marketing activities in the natural gas liquids segment.

SUMMARY

• First-quarter 2018 operating income and adjusted earnings before interest, taxes, depreciation

and amortization (EBITDA) increased 32 and 24 percent, respectively, compared with the

first quarter 2017;

• First-quarter 2018 net income attributable to ONEOK totaled $264.5 million, or 64 cents per

diluted share;

• First-quarter 2018 dividend coverage ratio was 1.37 times;

• Debt-to-EBITDA ratio of 3.8 times as of March 31, 2018, on a trailing 12-month basis;

• First-quarter 2018 natural gas volumes processed increased 23 percent, natural gas liquids

(NGL) volumes fractionated increased 21 percent, and NGL volumes gathered increased 12

percent, compared with the first quarter 2017; and

• ONEOK maintains 2018 financial guidance.

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 2

-more-

FIRST-QUARTER 2018 FINANCIAL HIGHLIGHTS

Three Months Ended

March 31,

2018 2017

(Millions of dollars, except per share

and dividend coverage ratio amounts)

Net income attributable to ONEOK $ 264.5 $ 87.4

Net income per diluted share $ 0.64 $ 0.41

Adjusted EBITDA (a) $ 570.3 $ 459.6

DCF (a) $ 432.0 $ 324.2

Dividend coverage ratio (a) 1.37 1.46

Operating income $ 419.7 $ 317.1

Operating costs $ 210.3 $ 189.3

Depreciation and amortization $ 104.2 $ 99.4

Equity in net earnings from investments $ 40.2 $ 39.6

Capital expenditures $ 264.5 $ 112.7

(a) Adjusted EBITDA; distributable cash flow (DCF); and dividend coverage ratio are non-GAAP measures. Reconciliations to

relevant GAAP measures are included in this news release.

“Increased producer activity and drilling efficiencies across our operating footprint drove

volume growth and higher financial results in the first quarter 2018, compared with the first

quarter 2017,” said Terry K. Spencer, ONEOK president and chief executive officer.

“Our focus for 2018 continues to be executing on our more than $4 billion of announced

capital-growth projects to provide the services our customers need, and maintaining our strong

balance sheet,” Spencer added. “We continue to return value to shareholders through our recent

dividend increase while achieving a dividend coverage ratio of nearly 1.4 times for the quarter.”

FIRST-QUARTER 2018 FINANCIAL PERFORMANCE

ONEOK’s operating income and adjusted EBITDA increased 32 percent and 24 percent,

respectively, in the first quarter 2018, compared with the first quarter 2017. Higher results were

driven primarily by natural gas and NGL volume growth in ONEOK’s natural gas gathering and

processing and natural gas liquids segments, higher optimization and marketing activities in the

natural gas liquids segment and the impact of $7 million in costs related to the ONEOK and

ONEOK Partners merger transaction in the first quarter 2017.

Results were offset partially by higher operating costs associated with employee-related

costs in all three segments, the growth of ONEOK’s operations in the natural gas gathering and

processing segment and the timing of routine maintenance projects in the natural gas liquids

segment. Operating income was also impacted by higher depreciation expense in the first quarter

2018, compared with the first quarter 2017, due to projects placed in service.

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 3

-more-

EARNINGS PRESENTATION AND KEY STATISTICS:

Additional financial and operating information that will be discussed on the first-quarter

2018 conference call is accessible on ONEOK’s website, www.oneok.com, or from the links

below.

> View earnings presentation

> View earnings tables

FINANCIAL HIGHLIGHTS:

• Maintaining 2018 net income guidance of $955 million to $1,155 million, adjusted EBITDA

guidance of $2,215 million to $2,415 million and distributable cash flow guidance of $1,615

million to $1,815 million;

• Declaring in April 2018 a quarterly dividend of 79.5 cents per share, or $3.18 per share on an

annualized basis, an increase of nearly 30 percent compared with the same period in 2017;

• Debt-to-EBITDA ratio of 3.8 times as of March 31, 2018, on a trailing 12-month basis;

• Having no outstanding commercial paper and $2.5 billion of borrowing capacity available

under its $2.5 billion credit agreement; and

• First-quarter 2018 operating income was $419.7 million compared with $397.8 million for

the fourth quarter 2017, a 6 percent increase.

BUSINESS-SEGMENT RESULTS:

Key financial and operating statistics are listed in the tables.

Natural Gas Liquids Segment

The natural gas liquids segment’s first-quarter 2018 adjusted EBITDA increased 23

percent, compared with the same period in 2017, due primarily to increased volumes, including

higher ethane recovery, in the STACK and SCOOP areas, and increased volumes in the Williston

and Permian Basins, and higher earnings from optimization and marketing activities.

First-quarter 2018 NGLs gathered and fractionated increased 12 percent and 21 percent

respectively, compared with the same period in 2017.

As total NGL volumes increased on ONEOK’s system, ethane volumes also increased

approximately 50,000 barrels per day (bpd) in the first quarter 2018, compared with the same

period in 2017. Ethane rejection levels on ONEOK’s system averaged more than 140,000 bpd in

the first quarter 2018, compared with more than 150,000 bpd in the first quarter 2017, despite an

increase in overall NGL volumes. ONEOK expects ethane rejection levels on its system to

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 4

-more-

decrease to approximately 70,000 bpd by the end of 2018 as world-scale petrochemical facilities

continue to come online and NGL exporters increase volumes.

Three Months Ended

March 31,

Natural Gas Liquids Segment 2018 2017

(Millions of dollars)

Adjusted EBITDA $ 342.1 $ 278.2

Capital expenditures $ 124.9 $ 20.5

The increase in first-quarter 2018 adjusted EBITDA, compared with the first quarter

2017, primarily reflects:

• A $43.4 million increase in exchange services due to increased volumes, including higher

ethane recovery, primarily in the STACK and SCOOP areas, and increased volumes in

the Williston and Permian Basins, offset partially by lower volumes in the Barnett Shale

and the impact of severe winter weather in 2018;

• A $24.9 million increase in optimization and marketing due primarily to wider location

price differentials and the sale of NGL inventory previously held; and

• A $2.7 million increase in equity in net earnings from investments due primarily to higher

volumes delivered to Overland Pass Pipeline from ONEOK’s Bakken NGL Pipeline;

offset partially by

• A $10.2 million increase in operating costs due primarily to higher employee-related

costs, the timing of routine maintenance projects and higher property taxes.

Natural Gas Gathering and Processing Segment

The natural gas gathering and processing segment’s first-quarter 2018 adjusted EBITDA

increased 26 percent, compared with the same period in 2017, primarily from higher volumes

due to increased drilling activity and improved producer efficiencies.

Volume growth due to new supply in the Williston Basin and STACK and SCOOP areas

contributed to a 23 percent increase in natural gas volumes processed in the first quarter 2018,

compared with the same period in 2017. Volume growth was partially offset by natural

production declines on existing wells.

The segment also continues to benefit from higher fee-based earnings, with an average

fee rate of 88 cents per Million British thermal units (MMBtu) in the first quarter 2018,

compared with 83 cents per MMBtu in the first quarter 2017.

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 5

-more-

Three Months Ended

March 31,

Natural Gas Gathering and Processing Segment 2018 2017

(Millions of dollars)

Adjusted EBITDA $ 130.6 $ 104.0

Capital expenditures $ 111.7 $ 63.2

First-quarter 2018 adjusted EBITDA increased, compared with the first quarter 2017,

which primarily reflects:

• A $41.5 million increase due primarily to natural gas volume growth in the Williston

Basin and the STACK and SCOOP areas, offset partially by natural production declines;

offset partially by

• A $17.1 million increase in operating costs due primarily to increased materials and

supplies and outside services expenses related to the growth of ONEOK’s operations and

higher employee-related costs.

Natural Gas Pipelines Segment

The natural gas pipelines segment’s first-quarter 2018 adjusted EBITDA increased 13

percent, compared with the same period in 2017. Increased transportation and storage services

contributed to the segment’s results.

Three Months Ended

March 31,

Natural Gas Pipelines Segment 2018 2017

(Millions of dollars)

Adjusted EBITDA $ 93.6 $ 83.0

Capital expenditures $ 19.9 $ 25.0

The increase in adjusted EBITDA for the first quarter 2018, compared with the first

quarter 2017, primarily reflects:

• A $4.8 million increase from higher transportation services due primarily to increased

interruptible transportation volumes;

• A $4.8 million increase from natural gas storage services; and

• A $3.2 million increase from net retained fuel due primarily to higher natural gas

volumes retained; offset partially by

• A $1.6 million increase in operating costs due primarily to higher employee-related costs;

and

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 6

-more-

• A $1.1 million decrease in equity in net earnings from investments due primarily to lower

settled rates on Northern Border Pipeline.

CAPITAL-GROWTH ACTIVITIES:

Since June 2017, ONEOK has announced approximately $4.2 billion of organic capital-

growth projects to support increasing production across ONEOK’s operating footprint. These

projects are expected to generate adjusted EBITDA multiples of four to six times and are backed

by a combination of long-term fee-based contracts, volume commitments or acreage dedications.

Since June 2017, the natural gas liquids segment has announced more than $3.6 billion of

capital-growth projects, which include the following:

Project Scope

Approximate Cost

(Millions of dollars)

Expected

Completion

West Texas LPG

Pipeline expansion

120-mile pipeline lateral extension with 110,000 bpd of

capacity in the Delaware Basin

$160 (a) Third quarter

2018

Sterling III expansion

60,000 bpd pipeline expansion from the Mid-Continent to

the Gulf Coast, which increases capacity to 250,000 bpd

$130

Fourth quarter

2018

Elk Creek Pipeline

project

900-mile pipeline from the Williston Basin to the Mid-

Continent with initial capacity up to 240,000 bpd

$1,400

Fourth quarter

2019

Arbuckle II Pipeline

530-mile pipeline from the Mid-Continent to the Gulf

Coast with initial capacity of 400,000 bpd

$1,360

First quarter

2020

MB-4 fractionator

125,000 bpd fractionator and related infrastructure in Mont

Belvieu, Texas

$575

First quarter

2020

(a) Represents ONEOK’s 80 percent ownership interest

Since June 2017, the natural gas gathering and processing segment has announced

approximately $560 million of capital-growth projects, which include the following:

Project Scope

Approximate Cost

(Millions of dollars)

Expected

Completion

Canadian Valley

expansion

200 million cubic feet per day (MMcf/d) processing plant

expansion in the STACK, which increases capacity to more

than 400 MMcf/d

$160

Fourth quarter

2018

Demicks Lake plant and

infrastructure

200 MMcf/d processing plant and related infrastructure in

the core of the Williston Basin

$400

Fourth quarter

2019

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 7

-more-

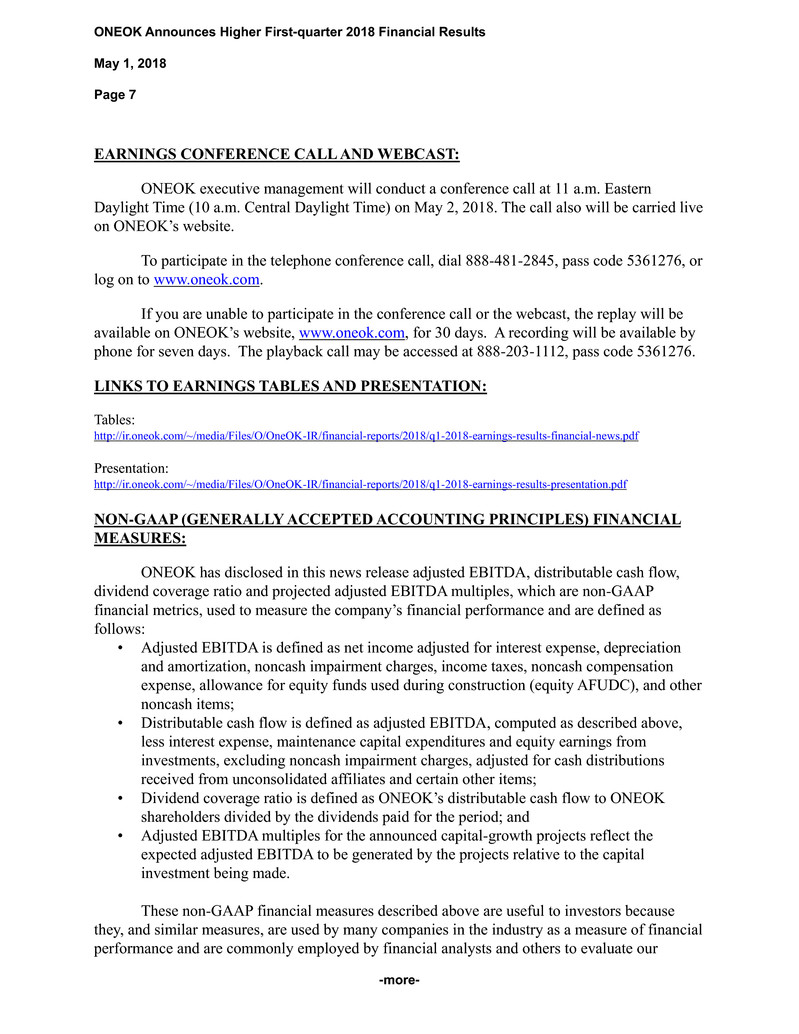

EARNINGS CONFERENCE CALL AND WEBCAST:

ONEOK executive management will conduct a conference call at 11 a.m. Eastern

Daylight Time (10 a.m. Central Daylight Time) on May 2, 2018. The call also will be carried live

on ONEOK’s website.

To participate in the telephone conference call, dial 888-481-2845, pass code 5361276, or

log on to www.oneok.com.

If you are unable to participate in the conference call or the webcast, the replay will be

available on ONEOK’s website, www.oneok.com, for 30 days. A recording will be available by

phone for seven days. The playback call may be accessed at 888-203-1112, pass code 5361276.

LINKS TO EARNINGS TABLES AND PRESENTATION:

Tables:

http://ir.oneok.com/~/media/Files/O/OneOK-IR/financial-reports/2018/q1-2018-earnings-results-financial-news.pdf

Presentation:

http://ir.oneok.com/~/media/Files/O/OneOK-IR/financial-reports/2018/q1-2018-earnings-results-presentation.pdf

NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL

MEASURES:

ONEOK has disclosed in this news release adjusted EBITDA, distributable cash flow,

dividend coverage ratio and projected adjusted EBITDA multiples, which are non-GAAP

financial metrics, used to measure the company’s financial performance and are defined as

follows:

• Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation

and amortization, noncash impairment charges, income taxes, noncash compensation

expense, allowance for equity funds used during construction (equity AFUDC), and other

noncash items;

• Distributable cash flow is defined as adjusted EBITDA, computed as described above,

less interest expense, maintenance capital expenditures and equity earnings from

investments, excluding noncash impairment charges, adjusted for cash distributions

received from unconsolidated affiliates and certain other items;

• Dividend coverage ratio is defined as ONEOK’s distributable cash flow to ONEOK

shareholders divided by the dividends paid for the period; and

• Adjusted EBITDA multiples for the announced capital-growth projects reflect the

expected adjusted EBITDA to be generated by the projects relative to the capital

investment being made.

These non-GAAP financial measures described above are useful to investors because

they, and similar measures, are used by many companies in the industry as a measure of financial

performance and are commonly employed by financial analysts and others to evaluate our

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 8

-more-

financial performance and to compare our financial performance with the performance of other

companies within our industry. Adjusted EBITDA, distributable cash flow and dividend

coverage ratio should not be considered in isolation or as a substitute for net income, earnings

per share or any other measure of financial performance presented in accordance with GAAP.

These non-GAAP financial measures exclude some, but not all, items that affect net

income. Additionally, these calculations may not be comparable with similarly titled measures

of other companies. Reconciliations of net income to adjusted EBITDA, distributable cash flow

and dividend coverage ratio are included in the tables. A reconciliation of estimated adjusted

EBITDA multiples to GAAP net income is not provided because the GAAP net income

generated by the projects is not available without unreasonable efforts.

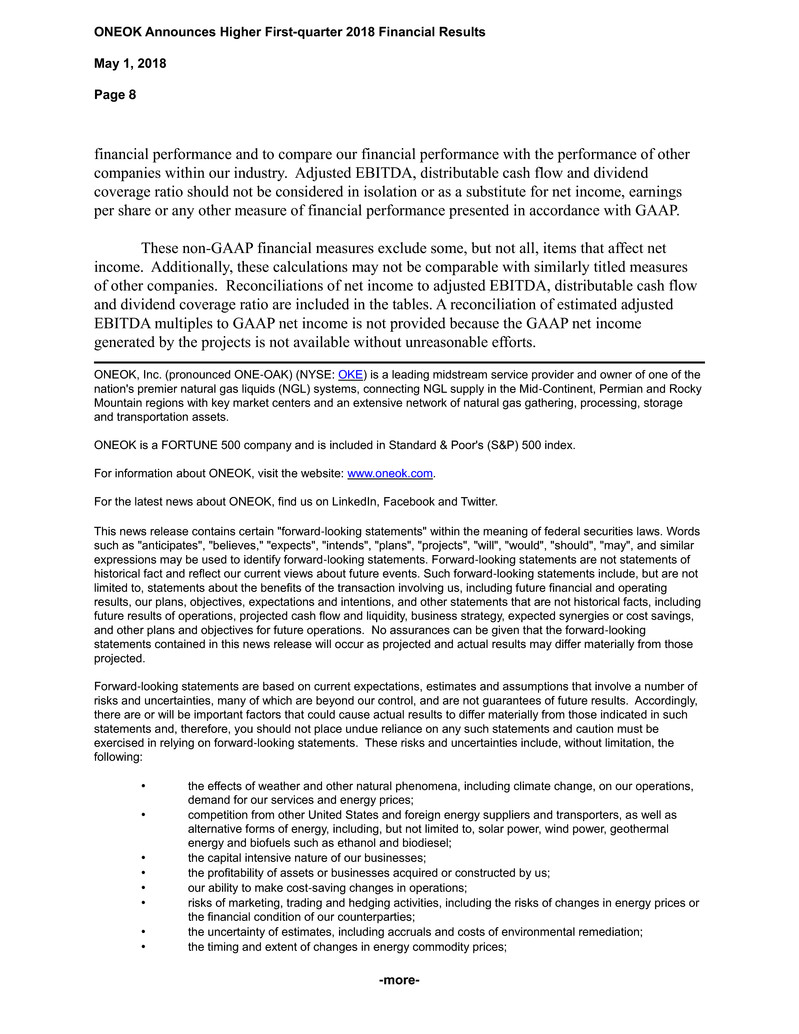

ONEOK, Inc. (pronounced ONE-OAK) (NYSE: OKE) is a leading midstream service provider and owner of one of the

nation's premier natural gas liquids (NGL) systems, connecting NGL supply in the Mid-Continent, Permian and Rocky

Mountain regions with key market centers and an extensive network of natural gas gathering, processing, storage

and transportation assets.

ONEOK is a FORTUNE 500 company and is included in Standard & Poor's (S&P) 500 index.

For information about ONEOK, visit the website: www.oneok.com.

For the latest news about ONEOK, find us on LinkedIn, Facebook and Twitter.

This news release contains certain "forward-looking statements" within the meaning of federal securities laws. Words

such as "anticipates", "believes," "expects", "intends", "plans", "projects", "will", "would", "should", "may", and similar

expressions may be used to identify forward-looking statements. Forward-looking statements are not statements of

historical fact and reflect our current views about future events. Such forward-looking statements include, but are not

limited to, statements about the benefits of the transaction involving us, including future financial and operating

results, our plans, objectives, expectations and intentions, and other statements that are not historical facts, including

future results of operations, projected cash flow and liquidity, business strategy, expected synergies or cost savings,

and other plans and objectives for future operations. No assurances can be given that the forward-looking

statements contained in this news release will occur as projected and actual results may differ materially from those

projected.

Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of

risks and uncertainties, many of which are beyond our control, and are not guarantees of future results. Accordingly,

there are or will be important factors that could cause actual results to differ materially from those indicated in such

statements and, therefore, you should not place undue reliance on any such statements and caution must be

exercised in relying on forward-looking statements. These risks and uncertainties include, without limitation, the

following:

• the effects of weather and other natural phenomena, including climate change, on our operations,

demand for our services and energy prices;

• competition from other United States and foreign energy suppliers and transporters, as well as

alternative forms of energy, including, but not limited to, solar power, wind power, geothermal

energy and biofuels such as ethanol and biodiesel;

• the capital intensive nature of our businesses;

• the profitability of assets or businesses acquired or constructed by us;

• our ability to make cost-saving changes in operations;

• risks of marketing, trading and hedging activities, including the risks of changes in energy prices or

the financial condition of our counterparties;

• the uncertainty of estimates, including accruals and costs of environmental remediation;

• the timing and extent of changes in energy commodity prices;

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 9

-more-

• the effects of changes in governmental policies and regulatory actions, including changes with

respect to income and other taxes, pipeline safety, environmental compliance, climate change

initiatives and authorized rates of recovery of natural gas and natural gas transportation costs;

• the impact on drilling and production by factors beyond our control, including the demand for

natural gas and crude oil; producers' desire and ability to obtain necessary permits; reserve

performance; and capacity constraints on the pipelines that transport crude oil, natural gas and

NGLs from producing areas and our facilities;

• difficulties or delays experienced by trucks, railroads or pipelines in delivering products to or from

our terminals or pipelines;

• changes in demand for the use of natural gas, NGLs and crude oil because of market conditions

caused by concerns about climate change;

• the impact of unforeseen changes in interest rates, debt and equity markets, inflation rates,

economic recession and other external factors over which we have no control, including the effect

on pension and postretirement expense and funding resulting from changes in equity and bond

market returns;

• our indebtedness and guarantee obligations could make us vulnerable to general adverse

economic and industry conditions, limit our ability to borrow additional funds and/or place us at

competitive disadvantages compared with our competitors that have less debt, or have other

adverse consequences;

• actions by rating agencies concerning our credit;

• the results of administrative proceedings and litigation, regulatory actions, rule changes and receipt

of expected clearances involving any local, state or federal regulatory body, including the Federal

Energy Regulatory Commission (FERC), the National Transportation Safety Board, the Pipeline

and Hazardous Materials Safety Administration (PHMSA), the U.S. Environmental Protection

Agency (EPA) and the U.S. Commodity Futures Trading Commission (CFTC);

• our ability to access capital at competitive rates or on terms acceptable to us;

• risks associated with adequate supply to our gathering, processing, fractionation and pipeline

facilities, including production declines that outpace new drilling or extended periods of ethane

rejection;

• the risk that material weaknesses or significant deficiencies in our internal controls over financial

reporting could emerge or that minor problems could become significant;

• the impact and outcome of pending and future litigation;

• the ability to market pipeline capacity on favorable terms, including the effects of:

– future demand for and prices of natural gas, NGLs and crude oil;

– competitive conditions in the overall energy market;

– availability of supplies of Canadian and United States natural gas and crude oil; and

– availability of additional storage capacity;

• performance of contractual obligations by our customers, service providers, contractors and

shippers;

• the timely receipt of approval by applicable governmental entities for construction and operation of

our pipeline and other projects and required regulatory clearances;

• our ability to acquire all necessary permits, consents or other approvals in a timely manner, to

promptly obtain all necessary materials and supplies required for construction, and to construct

gathering, processing, storage, fractionation and transportation facilities without labor or contractor

problems;

• the mechanical integrity of facilities operated;

• demand for our services in the proximity of our facilities;

• our ability to control operating costs;

• acts of nature, sabotage, terrorism or other similar acts that cause damage to our facilities or our

suppliers' or shippers' facilities;

• economic climate and growth in the geographic areas in which we do business;

• the risk of a prolonged slowdown in growth or decline in the United States or international

economies, including liquidity risks in United States or foreign credit markets;

• the impact of recently issued and future accounting updates and other changes in accounting

policies;

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 10

-more-

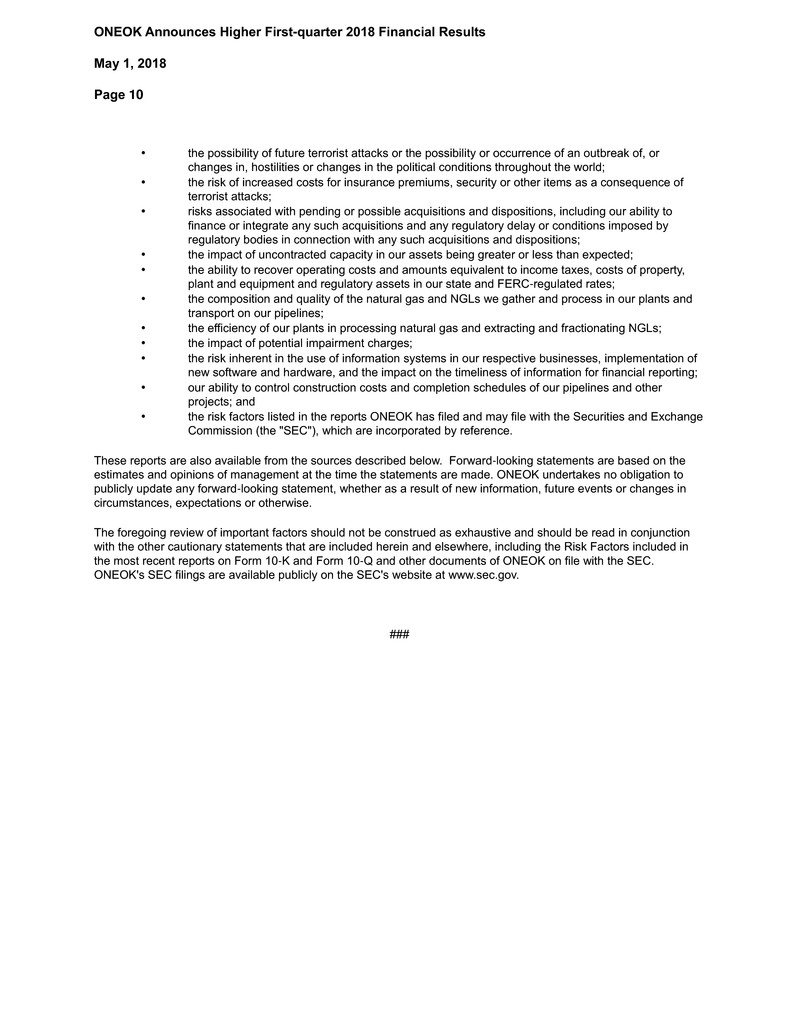

• the possibility of future terrorist attacks or the possibility or occurrence of an outbreak of, or

changes in, hostilities or changes in the political conditions throughout the world;

• the risk of increased costs for insurance premiums, security or other items as a consequence of

terrorist attacks;

• risks associated with pending or possible acquisitions and dispositions, including our ability to

finance or integrate any such acquisitions and any regulatory delay or conditions imposed by

regulatory bodies in connection with any such acquisitions and dispositions;

• the impact of uncontracted capacity in our assets being greater or less than expected;

• the ability to recover operating costs and amounts equivalent to income taxes, costs of property,

plant and equipment and regulatory assets in our state and FERC-regulated rates;

• the composition and quality of the natural gas and NGLs we gather and process in our plants and

transport on our pipelines;

• the efficiency of our plants in processing natural gas and extracting and fractionating NGLs;

• the impact of potential impairment charges;

• the risk inherent in the use of information systems in our respective businesses, implementation of

new software and hardware, and the impact on the timeliness of information for financial reporting;

• our ability to control construction costs and completion schedules of our pipelines and other

projects; and

• the risk factors listed in the reports ONEOK has filed and may file with the Securities and Exchange

Commission (the "SEC"), which are incorporated by reference.

These reports are also available from the sources described below. Forward-looking statements are based on the

estimates and opinions of management at the time the statements are made. ONEOK undertakes no obligation to

publicly update any forward-looking statement, whether as a result of new information, future events or changes in

circumstances, expectations or otherwise.

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction

with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in

the most recent reports on Form 10-K and Form 10-Q and other documents of ONEOK on file with the SEC.

ONEOK's SEC filings are available publicly on the SEC's website at www.sec.gov.

###

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 11

-more-

ONEOK, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME

Three Months Ended

March 31,

(Unaudited) 2018 2017

(Thousands of dollars, except per

share amounts)

Revenues

Commodity sales $ 2,820,004 $ 2,216,717

Services 282,073 532,894

Total revenues 3,102,077 2,749,611

Cost of sales and fuel (exclusive of items shown separately below) 2,368,026 2,143,843

Operations and maintenance 181,181 162,052

Depreciation and amortization 104,237 99,419

General taxes 29,023 27,153

(Gain) loss on sale of assets (89 ) 7

Operating income 419,699 317,137

Equity in net earnings from investments 40,187 39,564

Allowance for equity funds used during construction 230 13

Other income 738 4,341

Other expense (3,309 ) (3,467 )

Interest expense (net of capitalized interest of $2,038, and $1,441, respectively) (115,725 ) (116,462 )

Income before income taxes 341,820 241,126

Income taxes (75,771 ) (54,941 )

Net income 266,049 186,185

Less: Net income attributable to noncontrolling interests 1,541 98,824

Net income attributable to ONEOK 264,508 87,361

Less: Preferred stock dividends 275 —

Net income available to common shareholders $ 264,233 $ 87,361

Basic earnings per common share $ 0.65 $ 0.41

Diluted earnings per common share $ 0.64 $ 0.41

Average shares (thousands)

Basic 409,676 211,619

Diluted 412,173 213,602

Dividends declared per share of common stock $ 0.77 $ 0.615

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 12

-more-

ONEOK, Inc. and Subsidiaries

CONSOLIDATED BALANCE SHEETS

March 31, December 31,

(Unaudited) 2018 2017

Assets (Thousands of dollars)

Current assets

Cash and cash equivalents $ 17,474 $ 37,193

Accounts receivable, net 844,218 1,202,951

Materials and supplies 98,695 90,301

Natural gas and natural gas liquids in storage 185,298 342,293

Commodity imbalances 38,993 38,712

Other current assets 106,067 53,008

Total current assets 1,290,745 1,764,458

Property, plant and equipment

Property, plant and equipment 15,838,443 15,559,667

Accumulated depreciation and amortization 2,960,254 2,861,541

Net property, plant and equipment 12,878,189 12,698,126

Investments and other assets

Investments in unconsolidated affiliates 997,380 1,003,156

Goodwill and intangible assets 990,485 993,460

Deferred income taxes 116,120 205,907

Other assets 159,428 180,830

Total investments and other assets 2,263,413 2,383,353

Total assets $ 16,432,347 $ 16,845,937

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 13

-more-

ONEOK, Inc. and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(Continued)

March 31, December 31,

(Unaudited) 2018 2017

Liabilities and equity (Thousands of dollars)

Current liabilities

Current maturities of long-term debt $ 932,650 $ 432,650

Short-term borrowings — 614,673

Accounts payable 773,054 1,140,571

Commodity imbalances 124,687 164,161

Accrued interest 97,525 135,309

Other current liabilities 122,922 179,971

Total current liabilities 2,050,838 2,667,335

Long-term debt, excluding current maturities 7,091,751

8,091,629

Deferred credits and other liabilities

Deferred income taxes 53,805 52,697

Other deferred credits 366,701 348,924

Total deferred credits and other liabilities 420,506 401,621

Commitments and contingencies

Equity

ONEOK shareholders’ equity:

Preferred stock, $0.01 par value:

issued 20,000 shares at March 31, 2018 and December 31, 2017 —

—

Common stock, $0.01 par value:

authorized 1,200,000,000 shares, issued 445,016,234 shares and outstanding

411,073,529 shares at March 31, 2018; issued 423,166,234 shares and outstanding

388,703,543 shares at December 31, 2017 4,450

4,232

Paid-in capital 7,735,173 6,588,878

Accumulated other comprehensive loss (174,692 ) (188,530 )

Retained earnings — —

Treasury stock, at cost: 33,942,705 shares at March 31, 2018, and

34,462,691 shares at December 31, 2017 (863,485 ) (876,713 )

Total ONEOK shareholders’ equity 6,701,446 5,527,867

Noncontrolling interests in consolidated subsidiaries 167,806 157,485

Total equity 6,869,252 5,685,352

Total liabilities and equity $ 16,432,347 $ 16,845,937

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 14

-more-

ONEOK, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS Three Months Ended

March 31,

(Unaudited) 2018 2017

(Thousands of dollars)

Operating activities

Net income $ 266,049 $ 186,185

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 104,237 99,419

Equity in net earnings from investments (40,187 ) (39,564 )

Distributions received from unconsolidated affiliates 41,095 39,520

Deferred income taxes 74,890 53,397

Share-based compensation expense 7,203 5,907

Pension and postretirement benefit expense, net of contributions (8,393 ) (5,018 )

Allowance for equity funds used during construction (230 ) (13 )

(Gain) loss on sale of assets (89 ) 7

Changes in assets and liabilities:

Accounts receivable 358,733 137,586

Natural gas and natural gas liquids in storage 149,825 (53,305 )

Accounts payable (361,008 ) (122,843 )

Commodity imbalances, net (39,755 ) 1,888

Settlement of exit activities liabilities (1,580 ) (4,119 )

Accrued interest (37,784 ) (22,363 )

Risk-management assets and liabilities 34,387 45,977

Other assets and liabilities, net (52,072 ) (53,571 )

Cash provided by operating activities 495,321 269,090

Investing activities

Capital expenditures (less allowance for equity funds used during construction) (264,467 ) (112,737 )

Contributions to unconsolidated affiliates (147 ) (4,422 )

Distributions received from unconsolidated affiliates in excess of cumulative earnings 8,721 7,400

Proceeds from sale of assets 241 296

Cash used in investing activities (255,652 ) (109,463 )

Financing activities

Dividends paid (316,408 ) (129,842 )

Distributions to noncontrolling interests (1,500 ) (136,680 )

Borrowing (repayment) of short-term borrowings, net (614,673 ) 180,452

Repayment of long-term debt (501,913 ) (1,951 )

Issuance of common stock 1,182,117 3,722

Other (7,011 ) (13,395 )

Cash used in financing activities (259,388 ) (97,694 )

Change in cash and cash equivalents (19,719 ) 61,933

Cash and cash equivalents at beginning of period 37,193 248,875

Cash and cash equivalents at end of period $ 17,474 $ 310,808

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 15

-more-

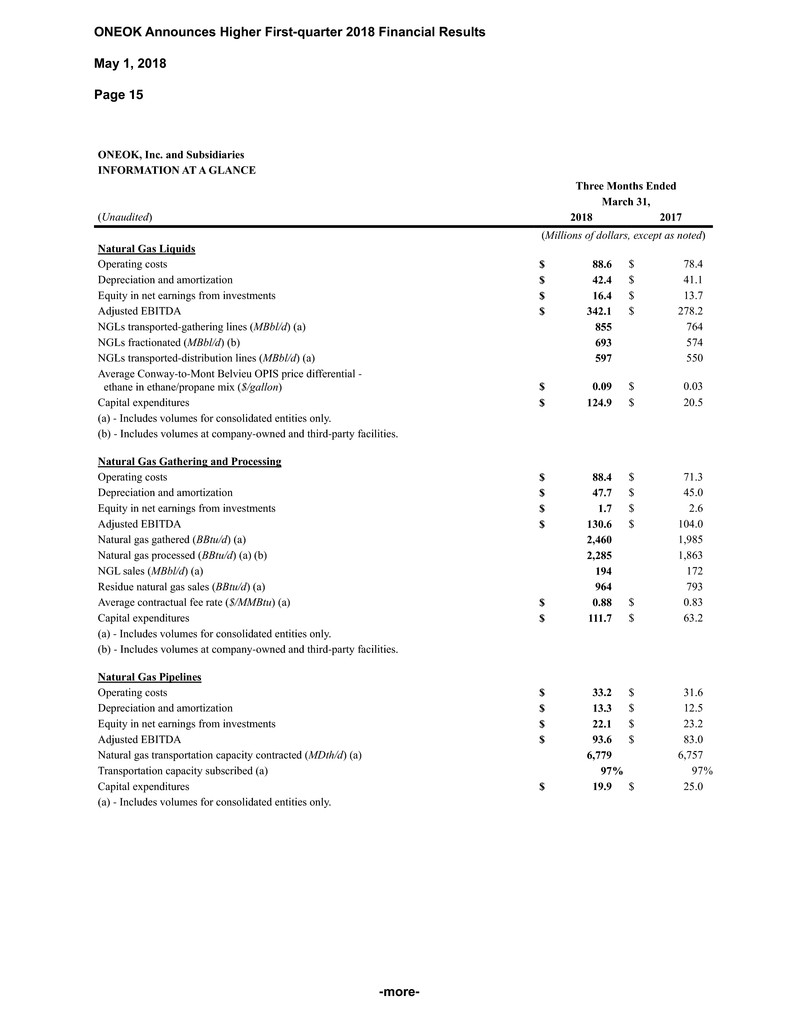

ONEOK, Inc. and Subsidiaries

INFORMATION AT A GLANCE

Three Months Ended

March 31,

(Unaudited) 2018 2017

(Millions of dollars, except as noted)

Natural Gas Liquids

Operating costs $ 88.6 $ 78.4

Depreciation and amortization $ 42.4 $ 41.1

Equity in net earnings from investments $ 16.4 $ 13.7

Adjusted EBITDA $ 342.1 $ 278.2

NGLs transported-gathering lines (MBbl/d) (a) 855 764

NGLs fractionated (MBbl/d) (b) 693 574

NGLs transported-distribution lines (MBbl/d) (a) 597 550

Average Conway-to-Mont Belvieu OPIS price differential -

ethane in ethane/propane mix ($/gallon) $ 0.09

$ 0.03

Capital expenditures $ 124.9 $ 20.5

(a) - Includes volumes for consolidated entities only.

(b) - Includes volumes at company-owned and third-party facilities.

Natural Gas Gathering and Processing

Operating costs $ 88.4 $ 71.3

Depreciation and amortization $ 47.7 $ 45.0

Equity in net earnings from investments $ 1.7 $ 2.6

Adjusted EBITDA $ 130.6 $ 104.0

Natural gas gathered (BBtu/d) (a) 2,460 1,985

Natural gas processed (BBtu/d) (a) (b) 2,285 1,863

NGL sales (MBbl/d) (a) 194 172

Residue natural gas sales (BBtu/d) (a) 964 793

Average contractual fee rate ($/MMBtu) (a) $ 0.88 $ 0.83

Capital expenditures $ 111.7 $ 63.2

(a) - Includes volumes for consolidated entities only.

(b) - Includes volumes at company-owned and third-party facilities.

Natural Gas Pipelines

Operating costs $ 33.2 $ 31.6

Depreciation and amortization $ 13.3 $ 12.5

Equity in net earnings from investments $ 22.1 $ 23.2

Adjusted EBITDA $ 93.6 $ 83.0

Natural gas transportation capacity contracted (MDth/d) (a) 6,779 6,757

Transportation capacity subscribed (a) 97 % 97 %

Capital expenditures $ 19.9 $ 25.0

(a) - Includes volumes for consolidated entities only.

ONEOK Announces Higher First-quarter 2018 Financial Results

May 1, 2018

Page 16

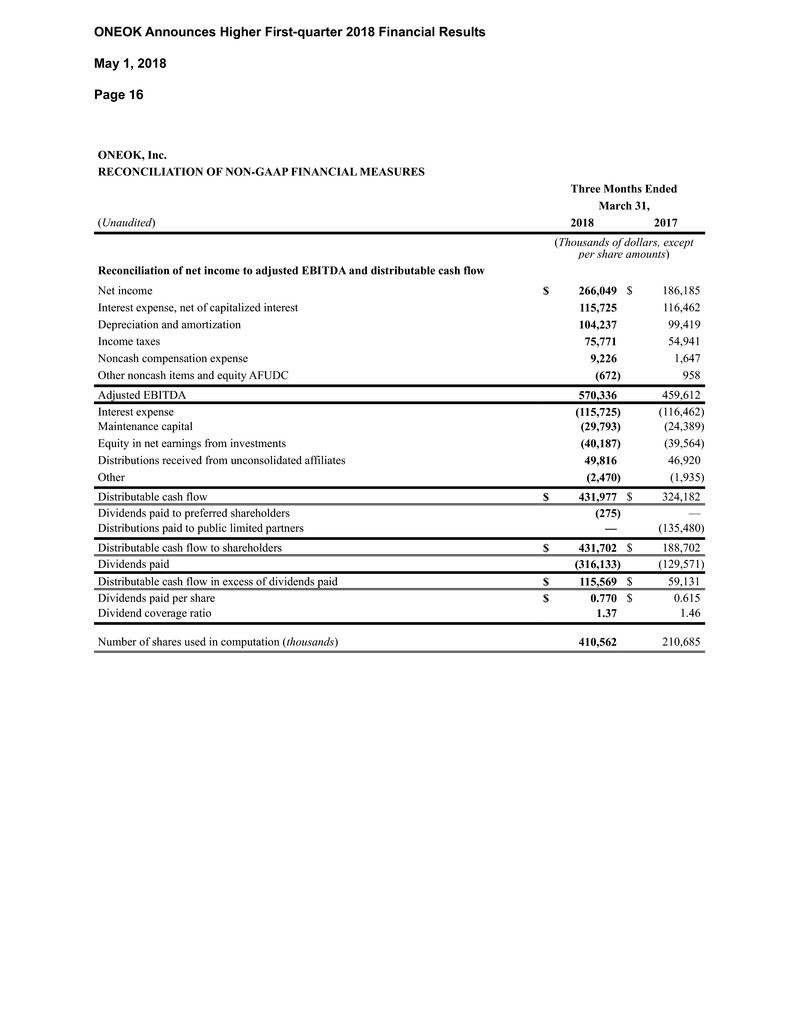

ONEOK, Inc.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Three Months Ended

March 31,

(Unaudited) 2018 2017

(Thousands of dollars, except

per share amounts)

Reconciliation of net income to adjusted EBITDA and distributable cash flow

Net income $ 266,049 $ 186,185

Interest expense, net of capitalized interest 115,725 116,462

Depreciation and amortization 104,237 99,419

Income taxes 75,771 54,941

Noncash compensation expense 9,226 1,647

Other noncash items and equity AFUDC (672 ) 958

Adjusted EBITDA 570,336 459,612

Interest expense (115,725 ) (116,462 )

Maintenance capital (29,793 ) (24,389 )

Equity in net earnings from investments (40,187 ) (39,564 )

Distributions received from unconsolidated affiliates 49,816 46,920

Other (2,470 ) (1,935 )

Distributable cash flow $ 431,977 $ 324,182

Dividends paid to preferred shareholders (275 ) —

Distributions paid to public limited partners — (135,480 )

Distributable cash flow to shareholders $ 431,702 $ 188,702

Dividends paid (316,133 ) (129,571 )

Distributable cash flow in excess of dividends paid $ 115,569 $ 59,131

Dividends paid per share $ 0.770 $ 0.615

Dividend coverage ratio 1.37 1.46

Number of shares used in computation (thousands) 410,562

210,685