Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AK STEEL HOLDING CORP | form8-kinvestorpresent.htm |

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

C r e a t i n g I n n o v a t i v e S t e e l S o l u t i o n s

First Quarter 2018 Financial Results

April 30, 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 2

AK Steel Executive Management Team

Roger Newport Chief Executive Officer

Kirk Reich President and Chief Operating Officer

Jaime Vasquez Vice President – Finance and Chief Financial Officer

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 3

Forward-Looking Statements

We have made forward-looking statements in this presentation that are based on our management’s beliefs and assumptions and on information available to our management at the time such

statements were made and hereby are identified as “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential

operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and

can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “should” or the

negative of these terms or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in our forward-looking statements. You should not rely on any

forward-looking statements. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include: reduced selling prices, shipments

and profits associated with a highly competitive and cyclical industry; domestic and global steel overcapacity; risks related to U.S. government actions on Section 232 and 301, NAFTA and/or other trade

agreements, treaties or policies; changes in the cost of raw materials, supplies and energy; the company’s significant amount of debt and other obligations; severe financial hardship or bankruptcy of one

or more of the company’s major customers or key suppliers; the company’s significant proportion of sales to the automotive market; reduced demand in key product markets due to competition from

aluminum or other alternatives to steel; excess inventory of raw materials; supply chain disruptions or poor quality of raw materials or supplies; production disruption or reduced production levels; the

company’s healthcare and pension obligations; not reaching new labor agreements on a timely basis; major litigation, arbitrations, environmental issues and other contingencies; regulatory compliance

and changes; climate change and greenhouse gas emissions; conditions in the financial, credit, capital and banking markets; the company’s use of derivative contracts to hedge commodity pricing

volatility; potential permanent idling of facilities; inability to fully realize benefits of margin enhancement initiatives; information technology security threats, cybercrime and exposure of private

information; failure to achieve the expected benefits of the Precision Partners acquisition and/or to integrate Precision Partners successfully; changes in tax laws and regulations.

The risk factors discussed in this presentation and under “Item 1A.—Risk Factors” in AK Holding’s Annual Report on Form 10-K for the year ended December 31, 2017 and under similar headings in AK

Holding’s subsequently filed quarterly reports on Form 10-Q, as well as the other risks that could cause our results to differ materially from those expressed in forward-looking statements. There may be

other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. We expressly disclaim any obligation to

update our forward-looking statements other than as required by law.

Non-GAAP Financial Measures:

Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with generally accepted accounting principles in the

United States of America because management believes such measures are useful to investors. These non-GAAP financial measures include EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Net Income (Loss), and Adjusted Earnings Per Share. Because our calculations of these measures may differ from similar measures used by other companies, you should be careful when comparing our

non-GAAP financial measures to those of other companies. A reconciliation of non-GAAP financial measures to GAAP financial measures is included in the Appendix to this presentation.

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Roger Newport

Chief Executive Officer

April 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 5

Safety Highlights – 2017

Three facilities achieved ZERO OSHA recordables for

1Q 2018

Three facilities achieved ZERO OSHA recordables for

the year 2017

Continue to lead the industry by a wide margin

2.33

2.01

2.45

1.87

1.37

1.70 1.68

1.45 1.53 1.54

0.29 0.25 0.33 0.32 0.26 0.24 0.25

0.45 0.39 0.36

0.61

0.00

1.00

2.00

3.00

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1Q

2018

AISI AK Steel

OSHA Recordable Frequency is number of injuries per 200,000 employee hours

Notes: Based upon most current American Iron and Steel Institute (AISI) data available through 2017.

AK Steel data is through 03/31/18; 2015 and forward includes Dearborn Works.

OSHA Recordable Frequency

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 6

Strategic Progress

$680 million of debt refinanced and maturities extended

Lowered annual cash interest cost by ~$20 million

Enhanced and lowered cost of revolving credit facility

Strengthened

Capital

Structure

Major investment completed at Middletown Works hot-end

New tanks installed on Middletown Works electrogalvanizing line

Mansfield melt shop upgrade and new technology at caster

Enhanced

Core Business

Launched new NEXMET™ AHSS coated products; various customer trials underway

Collaboration with the DOE to develop more efficient electrical steel for motors

Acquired Precision Partners – tool design and build / hot stamping / cold stamping

Expanded

Growth

Platform

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

0

1,000

2,000

3,000

4,000

2010 2011 2012 2013 2014 2015 2016 2017 2018

Annualized

0

30

60

90

120

2012 2013 2014 2015 2016 2017 2018

Annualized

0%

6%

12%

18%

24%

30%

2010 2011 2012 2013 2014 2015 2016 2017 2018

YTD

April 2018 7

Trade Update

Source: U.S. Dept. of Commerce, Enforcement, and Compliance

(000s Metric Tons)

Imports remain elevated

Strongly support the President’s decision to implement

tariffs under Section 232

Dramatic increase in electrical steel imports, which

continue to impact market

Critical that downstream electrical steel products be

adequately addressed

Steel Imports - % of U.S. Consumption

Grain Oriented Electrical Steel ImportsCarbon Coated Imports

(000s Metric Tons)

Source: American Iron and Steel Institute (AISI)

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

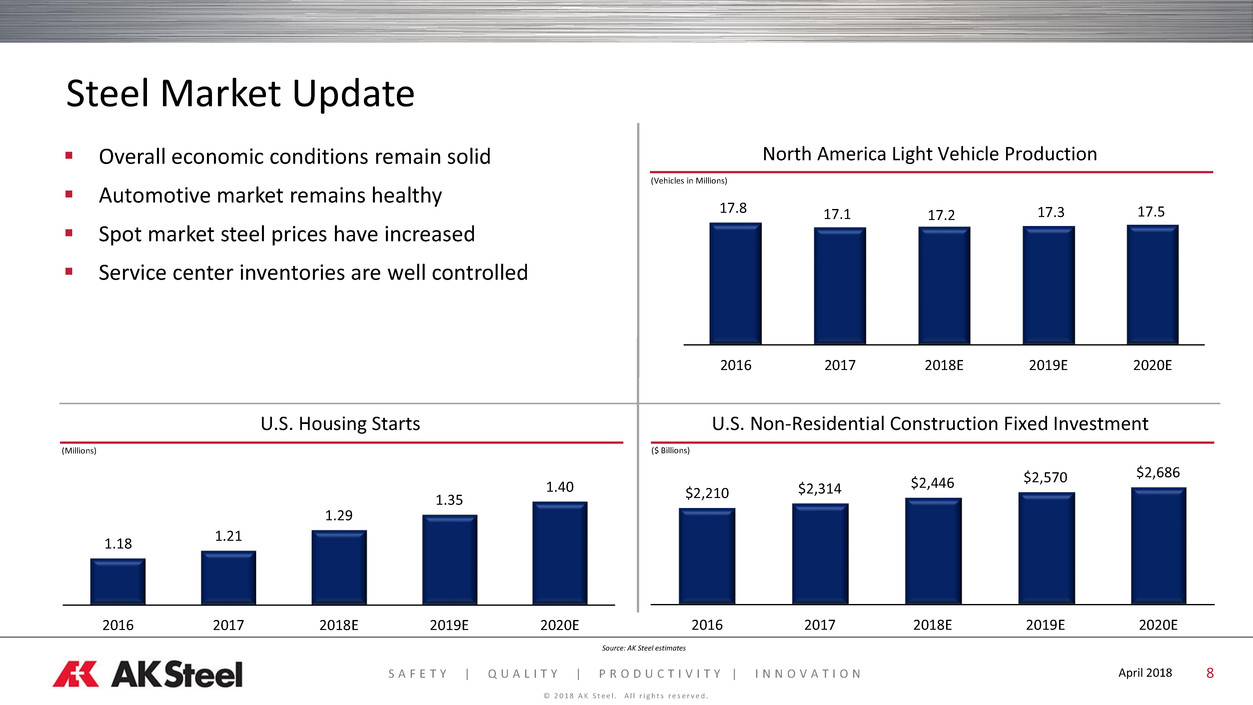

$2,210 $2,314

$2,446 $2,570

$2,686

2016 2017 2018E 2019E 2020E

17.8 17.1 17.2 17.3 17.5

2016 2017 2018E 2019E 2020E

April 2018 8

Steel Market Update

1.18 1.21

1.29

1.35

1.40

2016 2017 2018E 2019E 2020E

(Vehicles in Millions)

($ Billions)(Millions)

Overall economic conditions remain solid

Automotive market remains healthy

Spot market steel prices have increased

Service center inventories are well controlled

North America Light Vehicle Production

U.S. Housing Starts U.S. Non-Residential Construction Fixed Investment

Source: AK Steel estimates

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Kirk Reich

President and Chief Operating Officer

April 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 10

Downstream Expansion Offers Higher Margin Growth Opportunity

Creates a premier integrated supplier to the automotive market

Enhances our product offerings

Leverages research and innovation capabilities

Strengthens our position in the value chain

Accelerates introduction of lightweighting solutions

Robust pipeline of downstream opportunities

Transforming AK Steel into an innovative steel solutions provider

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 11

Operations Update

Steel operations recovered from Middletown

unplanned outage

‒ ~$27 million impact included in 1Q 2018 results

Precision Partners operational improvements and

collaborations progressing as expected

AK Tube 2018 shipments expected to increase ~14%

year over year

AK Tube Annual Shipments

Precision Partners Utilization Levels Precision Partners Press & Weld Efficiency

115 115 122

139

0

50

100

150

2015 2016 2017 2018 Fcst

(Net Tons in 000s)

45%

25%

77%

98%

0%

20%

40%

60%

80%

100%

120%

Hot-Stamping Cells 3,000 Ton Press

2017

2018E

52%

71%

82%

86%

40%

50%

60%

70%

80%

90%

100%

2Q 2017 3Q 2017 4Q 2017 1Q 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 12

Commercial Update

Successful 2Q contract negotiations

‒ Increased pricing

‒ Favorable sourcing on new automotive platforms

Continued progress on advanced high strength steels

Strong spot market conditions

Downstream collaborations gaining momentum

AK Steel Advanced High Strength Steel (AHSS)

Precision Partners Sales Opportunities AK Tube Advanced High Strength Steel (AHSS)

2017 2018 Fcst

(Net Tons Shipped)

2017 2018 Fcst

(Net Tons Shipped)

$0

$300

$600

$900

$1,200

2018E 2019E 2020E 2021E 2022E

($ Millions)

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

AK Steel is Recognized as an Outstanding Steel Supplier

13April 2018

Over the past year, AK Steel has received two prestigious awards from our customers:

Just two weeks ago, AK Steel was named a GM Supplier of the Year for 2017

− The award recognizes quality, execution, innovation and total enterprise cost

− AK Steel was the only North American steel company honored

AK Steel received FCA US’s “Raw Material Supplier of the Year” award in 2017

− The award honors companies that not only provide “the best ideas and cutting-edge technologies,

but also consistently exceed expectations.”

− AK Steel was the only steelmaker recognized

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Jaime Vasquez

Vice President – Finance and Chief Financial Officer

April 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 15

Financial Highlights

Note: See Appendix for reconciliations of non-GAAP financial measures

($ Millions, except per share)

1Q 2017 4Q 2017 1Q 2018

Quarter Over

Quarter % Change

Flat-Rolled Shipments 1,456 1,337 1,431 94 7%

Flat-Rolled Average Selling Price $1,005 $1,024 $1,045 $21 2%

Net Sales $1,533.4 $1,495.6 $1,658.9 $163.3 11%

Net Income (Loss) $84.4 ($80.4) $28.7 $109.1 NC

Adjusted Net Income (Loss) $84.4 ($28.4) $28.7 $57.1 NC

Adjusted EBITDA $178.2 $67.4 $118.7 $51.3 76%

Adjusted EBITDA Margin 11.6% 4.5% 7.2% 2.7 points 60%

Earnings (Loss) Per Share $0.26 ($0.26) $0.09 $0.35 NC

Adjusted EPS $0.26 ($0.09) $0.09 $0.18 NC

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

16

$0

$20

$40

$60

$80

$100

$120

$140

2017 4Q Actual Price/Mix/Volume Raw Materials &

Energy

Mark-to-Market

Hedges

Operations & Other Outages 2018 1Q Actual

Consolidated EBITDA Bridge – 4Q 2017 to 1Q 2018

$18 $16

$119

$67

$42

$43

($ Millions)

Note: See Appendix for reconciliations of non-GAAP financial measures

April 2018

$31

$16

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 17

Balance Sheet and Cash Flow Highlights

$1,281 $1,225

$1,135

$934 $909

$0

$500

$1,000

$1,500

2014 2015 2016 2017 1Q 2018

($ Millions)

Maintain focus on strengthening balance sheet

Roughly one-third of capital investments in 2018 targeted

for margin improvement

Legacy liabilities decreased ~$372 million since 2014

Changed inventory valuation methodology from LIFO to

Average Cost

$81

$99

$128

$153 $160

$0

$50

$100

$150

$200

2014 2015 2016 2017 2018E

($ Millions)

$197

$24

$0

$44 $50 $35

$10

$0

$50

$100

$150

$200

$250

2014 2015 2016 2017 2018E 2019E 2020E

($ Millions)

Pension / OPEB Liabilities

Capital Investments Pension Contributions

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

$1,040 $1,021 $1,024 $1,045

$0

$300

$600

$900

$1,200

2Q 2017 3Q 2017 4Q 2017 1Q 2018

April 2018 18

2Q 2018 Guidance

* Guidance is relative to 1Q 2018 actual results

1,434 1,369 1,337

1,431

0

250

500

750

1,000

1,250

1,500

2Q 2017 3Q 2017 4Q 2017 1Q 2018

10.7%

7.7%

4.5%

7.2%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

2Q 2017 3Q 2017 4Q 2017 1Q 2018

(000s tons)

Second quarter 2018 estimated outlook

– Flat-rolled shipments ~5-7% higher*

– Average flat-rolled selling price ~$1,075 per ton

– Downstream revenue ~$130–150 million

– Planned maintenance outages ~$20-25 million

– Adjusted EBITDA margin ~150-200 basis points higher*

Flat-Rolled Shipments

Flat-Rolled Average Selling Price Per Ton Adjusted EBITDA Margin

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 19

2018 Full Year Guidance Estimates

Capital investments ~$160 million

Planned maintenance outages ~$50 million

Depreciation ~$220 million

Pension and OPEB income ~$32 million*

Minimal cash and book taxes

Working capital expected to be roughly flat for the year

* Includes ~$8 million expense reported in Cost of Products Sold/Selling and Administrative expenses

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Roger Newport

Chief Executive Officer

April 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

21

Strategic Progress

Optimize Assets

Lower Debt

Innovation

- People

- Carbon AHSS

- Electrical

- Stainless

Organic /

Geographic

Growth

- Acquired Dearborn

- AK Tube Mexico

Transformational

Growth

- PPHC Acquisition

Creating Shareholder Value

April 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018

THANK YOU!

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Appendix

April 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Investor Contact

April 2018 24

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 25

Strengthening Our Foundation

Began Portfolio

Optimization

Acquired

Dearborn

Idled Ashland

Hot-end

Operations

2014 2015 2016 2017

Completed Major

Hot-end Operations

Investments

Strengthened

Capital

Structure

Completed

Dearborn AHSS

Investment

Lowered

Interest Costs

Launched New

NEXMET™ AHSS

Products

Opened New

Research and

Innovation Center

Acquired

Precision Partners

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

26

Longer Term Target Metrics

April 2018

Average EBITDA Margin

through a business cycle

>8%

Debt-to-EBITDA

<4.0x

Economic Profit:

Return on Invested Capital

>10.5%

EBITDA Contributions from

Downstream Business

>30%

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 27

High-Value Product Mix With More Predictable Pricing

Flat-Rolled Product Mix Customer Contract Structure

2017

2015

2017

Coated

48%

Cold-rolled

18%

Other

3%

Stainless/

Electrical

13%

Hot-rolled

18%

2015

Coated

53%

Cold-rolled

17%

Other

2%

Stainless/

Electrical

15%

Hot-rolled

13%

Fixed Base

Price Contracts

~62%Steel Index

Based Contracts

~19%

Spot Market

~19%

Fixed Base

Price Contracts

~70%Steel Index

Based Contracts

~16%

Spot Market

~14%

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 28

Significantly Improved Debt Profile

December 31, 2015

$550

$150

$530

$406

$290

$7

$62

$30

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Credit Facility Senior Notes Senior Secured Notes Industrial Revenue Bonds

Total Debt: $2.40 billion

$700

$537

March 31, 2018

$150

$7

$406

$440

$380

$62

$280

$400

$30

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Total Debt: $2.16 billion

$150

$380

($ Millions)

Note: Excludes unamortized debt discount and issuance costs

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 29

Non-GAAP Financial Measures

Reconciliation of Adjusted Net Income

Qtr ended

($ Millions) 2013 2014 2015 2016 2017 03/31/2018

Reconciliation to Net Income (Loss) Attributable to AK Steel Holding Corporation

Net income (loss) attributable to AK Steel Holding Corporation, as reported ($60.2) ($114.2) ($652.3) ($16.8) $103.5 $28.7

Pension and OPEB net corridor and settlement charges 5.5 131.2 68.1

Charges (credit) for termination of pellet agreement and related transportation costs 69.5 (19.3)

Impairment of Magnetation investment 256.3

Impairment of AFSG investment 41.6

Charge for facility idling 28.1

Asset impairment charge 75.6

Non-cash credit for U.S. tax legislation (4.3)

Acquisition-related expenses (net of tax) 31.7

Adjusted net income (loss) attributable to AK Steel Holding ($60.2) ($77.0) ($195.1) $120.8 $155.5 $28.7

Reconciliation to Diluted Earnings (Losses) per Share

Diluted earnings (loss) per share, as reported ($0.44) ($0.77) ($3.67) ($0.07) $0.32 $0.09

Pension and OPEB net corridor charge/settlement loss 0.04 0.74 0.29

Charges (credit) for termination of pellet agreement and related transportation costs 0.30 (0.06)

Impairment of Magnetation investment 1.44

Impairment of AFSG investment 0.23

Charge for facility idling 0.16

Asset impairment charge 0.24

Non-cash credit for U.S. tax legislation (0.01)

Acquisition-related expenses 0.21

Adjusted diluted earnings (loss) per share ($0.44) ($0.52) ($1.10) $0.52 $0.49 $0.09

Flat-rolled Shipments 5,153.7 6,007.2 6,974.0 5,936.4 5,596.2 1,430.9

Flat-rolled Average Selling Price $1,056 $1,058 $929 $955 $1,022 $1,045

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018 30

Non-GAAP Financial Measures

Reconciliation of Adjusted EBITDA

Qtr ended

($ Millions) 2013 2014 2015 2016 2017 03/31/2018

Net income (loss) attributable to AK Steel Holding ($60.2) ($114.2) ($652.3) ($16.8) $103.5 $28.7

Net income (loss) attributable to NCI 64.2 62.8 62.8 66.0 61.4 16.1

Income tax expense (benefit) (42.3) 0.3 (6.3) (16.9) (2.2) (4.9)

Interest expense 127.4 144.7 173.0 163.9 152.3 37.6

Interest income (1.1) (0.7) (1.3) (1.6) (1.5) (0.2)

Depreciation and amortization 200.0 211.0 224.4 221.4 236.4 61.3

EBITDA $288.0 $303.9 ($199.7) $416.0 $549.9 $138.6

Less: EBITDA of NCI (a) 78.3 77.2 77.1 80.8 77.7 19.9

Pension and OPEB net corridor charges / settlement loss 5.5 131.2 68.1

Charges (credit) for termination of pellet agreement and related

transportation costs 69.5 (19.3)

Impairment of Magnetation investment 256.3

Impairment of AFSG investment 41.6

Charge for facility idling 28.1

Asset impairment charge 75.6

Acquisition-related expenses 23.3

Adjusted EBITDA $209.7 $255.5 $180.4 $472.8 $528.5 $118.7

Adjusted EBITDA margin 3.8% 3.9% 2.7% 8.0% 8.7% 7.2%

(a) The reconciliation of EBITDA of noncontrolling interest to net income attributable to noncontrolling interests is as follows:

Net income (loss) attributable to noncontrolling interests $64.2 $62.8 $62.8 $66.0 $61.4 $16.1

Depreciation 14.1 14.4 14.3 14.8 16.3 3.8

EBITDA of noncontrolling interests $78.3 $77.2 $77.1 $80.8 $77.7 $19.9

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

April 2018