Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - XPLOSION Inc | xplosion_ex321.htm |

| EX-31.1 - CERTIFICATION - XPLOSION Inc | xplosion_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED OCTOBER 31, 2017

Commission File Number 333-215568

|

Xplosion Incorporated | |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

30-0942823 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

| |

|

Suite 223 468 North Camden Drive |

|

|

|

Beverly Hills, CA |

|

90410 |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

1-310-601-3080 | |

|

(Registrant’s telephone number, including area code) |

|

Securities registered pursuant to Section 12(b) of the Act: | ||

|

| ||

|

Title of each class |

|

Name of each exchange on which registered |

|

n/a |

|

n/a |

|

Securities registered pursuant to Section 12(g) of the Act: | |

|

Common Stock, Par Value $0.001 | |

|

(Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and nonvoting common equity held by nonaffiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of April 30, 2017, the aggregate market value of the voting and nonvoting common equity held by nonaffiliates of the issuer was $4,618,750

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of April 27, 2018, registrant had 49,560,600 shares of issued and outstanding common stock, par value $0.001.

DOCUMENTS INCORPORATED BY REFERENCE: None.

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains statements about the future, sometimes referred to as “forward-looking” statements. Forward-looking statements are typically identified by use of the words “believe,” “may,” “could,” “should,” “expect,” “anticipate,” “estimate,” “project,” “propose,” “plan,” “intend,” and similar words and expressions. Statements that describe our future strategic plans, goals, or objectives are also forward-looking statements.

Readers of this report are cautioned that any forward-looking statements, including those regarding our management’s current beliefs, expectations, anticipations, estimations, projections, proposals, plans, or intentions, are not guarantees of future performance or results of events and involve risks and uncertainties. The forward-looking information is based on present circumstances and on our predictions respecting events that have not occurred, that may not occur, or that may occur with different consequences from those now assumed or anticipated. Actual events or results may differ materially from those discussed in the forward-looking statements as a result of various factors. The forward-looking statements included in this report are made only as of the date of this report. We are not obligated to update such forward-looking statements to reflect subsequent events or circumstances.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our” and “our company” refer to Xplosion Incorporated

| 3 |

| Table of Contents |

PART I

Background

We were incorporated in the State of Nevada on October 6, 2015. We are a development stage company engaged in the sales, marketing and distribution of innovative lifestyle enhancement products and complimentary goods that target millennials and progressive thinkers of Generation X and Y. On December 7, 2015, we entered into an Exclusive Global Rights Agreement, since amended to non-exclusive rights, with Interactive Holdings Limited pursuant to which we acquired the exclusive global distribution license for the sales, marketing and distribution of the Sayber X line of self-stimulation devices for men and couples. Our initial flagship products are the Sayber X automated self-stimulation device for men and the X-Ring controller, which together anchor our first lifestyle enhancement offering being the current Sayber X line of products. The Sayber X is a wearable, automated, blue tooth and software integrated sexual stimulation device which enables the user to engage in self-stimulation either alone, or with a partner using the X-Ring controller remote control device and related software.

From October 6, 2015 (date of inception) to the year ended October 31, 2016, we had no revenues and realized a net loss of $362,941. As at October 31, 2017, we had realized revenues of $497,804 and an accumulated deficit of $940,057. We intend to continue to generate our revenues from the distribution of our products to sub-distributors, wholesalers, and/or third-party retailers, as well as from the direct sale of our products to consumers via various online platforms or third-party websites. Payment for direct on-line sales will be made through online integrated shopping carts on the manufacturer website or on those of third-party retailers that accept a wide range of online payment methods, including PayPal and credit cards. As at October 31, 2016 and October 31, 2017, we had total assets of $625,396 and $147,644, respectively. Over the next 12 months, we intend to accelerate the marketing and sale of our Sayber X line of products. We also intend to seek and pursue other opportunities that can in turn lead to the development, acquisition, sales or distribution of further lifestyle enhancement products to add to our overall offering.

Our executive offices are currently located at Suite 223 – 468 North Camden Drive, Beverly Hills, CA 90210. Our phone number is 1-310-601-3080. Our fiscal year end is October 31. Our registered and records office is the address of our corporate resident agent in Nevada, GKL Registered Agents/Filings, Inc., located at 3064 Silver Sage Drive, Suite 150, Carson City, NV 89701 (Telephone: 1 (775) 841-0644, Facsimile 1 (775) 841-2065.

Our auditors have issued an audit opinion which includes a statement describing their doubts about whether we will continue as a going concern.

Our Company and Our Business

We were incorporated in the State of Nevada on October 6, 2015. We are a development stage company engaged in the sale, marketing and distribution of innovative lifestyle enhancement products and complimentary goods that target millennials and progressive thinkers of Generation X and Y. We have acquired the URL address www.xplosionx.com. We plan to continue to generate our revenues from the distribution of our products to sub-distributors, wholesalers, and/or third party retailers, as well as from the direct sale of our products to consumers via link to the manufacturer website at www.SayberX.com, or via various other online affiliate or third-party websites. Payment for direct on-line sales will be made through online integrated shopping carts on the manufacturer website or on those of third-party retailers that accept a wide range of online payment methods, including PayPal and credit cards. Our flagship products are the Sayber X automated self-stimulation device for men and the X-Ring controller, which together anchor our first lifestyle enhancement offering being the complete Sayber X line of products. The Sayber X is a wearable, automated, blue tooth and software integrated sexual stimulation device which enables the user to engage in self-stimulation either alone or with a partner using the X-Ring controller remote control device and related software.

| 4 |

| Table of Contents |

On December 7, 2015, we entered into an Exclusive Global Rights Agreement with Interactive Holdings Limited pursuant to which we acquired the exclusive global distribution license for the sales, marketing and distribution of the Sayber X line of products for men and couples. The agreement was subsequently amended on July 27, 2016 and September 27, 2017 and is now non-exclusive. In consideration of the license, we paid an aggregate of $400,000, plus an additional $100,000 which was advanced as an interest bearing loan to Interactive Holdings Limited, with the $500,000 total funding provided to be used to finance the development and commercialization of the Sayber X and X Ring. The loan portion of the investment will accrue interest at the rate of 2% per month, subject to applicable default interest should the principal and accrued interest due not be paid at the maturity (due) date. The loan was due January 31, 2017 and is currently in default. Interest has been calculated in accordance with the default provisions of the loan agreement – 10% for the first 30 days of default; 15% for the second 30 days of default; and 20% for the third 30 days of default. The loan receivable of $100,000 and accrued interest of $31,122 have been expensed as a bad debt in the year ended October 31, 2017 and we have determined that the remaining unamortized value of the distribution agreement has become impaired, resulting in the recognition of an impairment loss of $216,671 in the year ended October 31, 2017

The initial term of the license is four years with an end date of December 31, 2019, following which we will have a right of first refusal to purchase an additional 5 year license exercisable by giving notice to the licensor not less than 90 days prior to the expiration of the term. Neither the duration of the license nor the right of first refusal to extend the license is subject to any minimum purchase targets or quotas; we must only make any minimum purchases in order to maintain the agreement. It was understood that minimum sales targets were to be set and mutually agreed upon between the manufacturer and our Company, under the initial exclusive agreement, but no such targets were ever formally established and now that the agreement has been amended to a non-exclusive status no such targets shall exist. The original exclusive agreement provided that our gross profit on wholesale sales of SayberX must be limited to 10% of our wholesale cost, but since amendment to non-exclusive no such 10% cap on profit exists. There is no similar cap, nor has there ever been, for direct sales made through our website. For as long as we are not in default of payment under the agreement, we may terminate our license by with not less than 90 days’ notice. The manufacturer is entitled to terminate the agreement by giving 30 days’ notice in the event of our monetary breach in excess of $5,000, 45 days’ notice in the event of our uncured, non-monetary material breach, 60 days’ notice in the event that we unintentionally provide inaccurate sales information, or without notice in the event that we intentionally provide inaccurate sales information.

As additional conditions of the license, we agreed to engage Mr. Andrew Smith and Mr. James Proctor, the principals of the licensor, as sales and distribution consultants for a term of 3 years. In consideration for their consulting services we will pay to each Mr. Smith and Mr. James a fee of 7.5% of our annual gross profits derived from the sale of the Sayber X products, plus a bonus of 2.5% of annual gross profits if certain sales targets are reached. Sales targets were to be mutually determined by the parties, however no targets were actually established. The consultants’ duties included, among others, website and stock management system design, development and maintenance, product management and distribution, ancillary product and instruction development and marketing, trade shows, and sales and sales staff management. During the year ended October 31, 2017 the agreement engaging Mr. Andrew Smith and Mr. James Proctor was terminated. Upon termination the Company paid the consultants in full for their commissions due.

| 5 |

| Table of Contents |

On February 8, 2016, we entered into a Consulting Agreement with Throb LLC, a firm with expertise in the pre-marketing and development of infrastructure channels in the sex toy industry. Pursuant to the agreement, we engaged Throb LLC, for a term of nine months to assist with our various sales and marketing efforts. Throb LLC’s services included assistance in our preparation for the pre-order soft launch of Sayber X products. In consideration of the services, we paid to Throb LLC an aggregate of $44,000. The agreement terminated on November 8, 2016. Pursuant to the agreement, we also agreed to pay to Throb LLC 8.5% of any gross profit derived during the 9 months ending August 8, 2017 from the sale of Sayber X products in North America, or from any information (such as mailing lists, vendor referrals or similar information) supplied by the consultant during the provision of services. To date no gross profit has been earned nor was due to be paid to the consultant.

On August 30, 2016, we entered into an Exclusive Distribution Agreement with Vibe 9 Ventures Ltd., pursuant to which we granted to Vibe 9 Ventures, as sub-distributor, the exclusive right to market, distribute and sell the Sayber X line of products in the territories of China, (including Hong Kong) Japan, and Taiwan, until December 31, 2019. Thereafter Vibe 9 Ventures shall have a right of first refusal to renew for an additional five (5) year term upon the terms proposed by Xplosion, subject to Vibe 9 Ventures’ compliance with the terms of the agreement. During the initial term Vibe 9 Ventures was to have annual target quotas, including minimum sales requirements of $2,125,000 during year 1, increasing by 66% in year 2, and by an additional 60% in year 3. We have not received any consideration from Vibe 9 Ventures in exchange for the distribution rights granted. This agreement was terminated on September 26, 2017. During the duration of the agreement, Vibe 9 Ventures paid a total of $450,000 (which is included in our gross revenue for the year ended October 31, 2017) for and received 3,000 units.

On October 1, 2016 we entered into a Consulting Agreement with Panasia Consulting Corp. for business development and marketing services.. Pursuant to the agreement we have retained the services of Panasia Consulting for a term of 15 months (ending on December 31, 2017) to assist our Company with the identification and development of sales distribution channels and strategic partnerships. We were to pay an aggregate of $150,000 ($10,000 per month) to Panasia Consulting in consideration of the services. $30,000 was paid on execution of the agreement specifically to cover months 1, 14, and 15 of service. The balance was paid in monthly installments of $10,000 due by the first 15 days of months 2 through 13 of the term. The contract was paid in full by the Company to the end of the term and the Company and the Consultant have now extended the contract for an additional 12 months starting February 1, 2018 with a further 12 month renewal option under the same fee structure ($10,000 per month).

From October 6, 2015 (date of inception) to the year ended October 31, 2016, we had not generated any revenues and realized a net loss of $362,941. For the year ended October 31, 2017 we had recorded revenue of $497,804, gross profit of $52,375, and an accumulated deficit of $940,057. We intend to generate our revenues from the distribution of our products to sub-distributors, wholesalers, and/or third party retailers, as well as from the direct sale of our products to consumers via various online platforms or third-party websites. To date our revenues have consisted of $47,804 from direct e-commerce sales (9.6% of revenues) and $450,000 in wholesale sales (90.4% of total revenues). Our exclusive global license agreement with Interactive Holdings initially limited our gross margin from wholesale sales to 10% of product cost, however revised as a non-exclusive agreement no such cap exists. There is no contractual cap on our gross margin from direct sales. Payment for our direct on-line sales is made through online integrated shopping carts managed by the manufacturer, online affiliates or third-party retailers that accept a wide range of online payment methods, including PayPal and credit cards. On October 31, 2017, we had total assets of $147,644 which included current assets of $147,644. Over the next 12 months, we intend to accelerate the marketing and sale of our Sayber X line of products. We also intend to seek and pursue other opportunities that can in turn lead to the development, acquisition, sales or distribution of further lifestyle enhancement products to add to our overall offering.

| 6 |

| Table of Contents |

On November 1, 2016 we entered into a Loan Agreement with Best Uni Peak Services Inc. pursuant to which we obtained an interest-bearing revolving loan facility of up to $150,000. The loan, due on or before October 31, 2018, is unsecured and with interest of 2% per month, calculated based on the amount of principal outstanding at the end of each month, due on repayment. If the total principal outstanding and accrued interest is not paid at maturity we are required to make a Default Payment consisting of 4.49% of the total of issued and outstanding shares of our Company at that date. A net of $147,680 has been advanced through October 31, 2017. To date, $85,000 of the proceeds of this loan facility have been deposited in partial payment for the manufacture and delivery of 1,000 product units, described below. $25,500 of the loan proceeds have been advanced to Interactive Holdings Ltd. as part of a $100,000 interest bearing loan. The balance of the loan proceeds has been applied to general and administrative expenses. We intend to apply any future proceeds advanced under the Loan Agreement toward the purchase of additional product units, for marketing expenses, and for general and administrative expenses, as required from time to time.

As of October 31, 2017 we have paid for, and taken delivery of, 1,000 units of inventory. The total purchase price of the units is $149,990 ($149.99 per complete package set inclusive of a SayberX unit and a SayberX ring). We had a total of 757 units on hand as at October 31, 2017 with 243 units sold.

Our offices are currently located at Suite 223 – 468 North Camden Drive, Beverly Hills, CA 90210, and our telephone number is 1-310-601-3080. Our fiscal year end is October 31. Our corporate resident agent in Nevada is GKL Registered Agents/Filings, Inc. located at 3064 Silver Sage Drive, Suite 150, Carson City, NV 89701 (Telephone: (775) 841-0644, Facsimile (775) 841-2065.

Products and Services

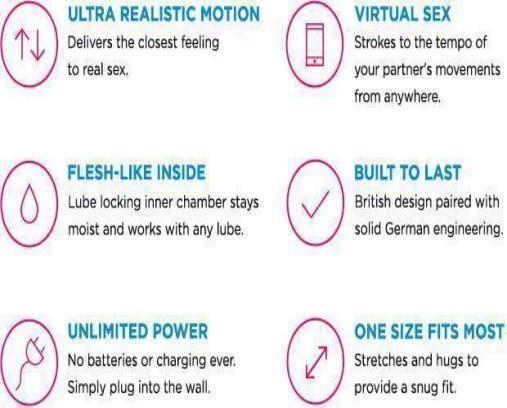

Our flagship products are the Sayber X automated self-stimulation device for men and the X Ring controller, which together anchor our first lifestyle enhancement offering, being the complete Sayber X line of products. The Sayber X is a wearable, automated, blue tooth and software integrated sexual stimulation device which enables the user to engage in self-stimulation either alone, or with a partner using the X-Ring controller remote control device and related software.

Below Figures 1 through 19 are marketing and instructional images and captions illustrating the design, features and operation of the Sayber X and X Ring controller, and well as our planned customer service and fulfillment policies.

Figure 1. Sayber X Marketing Image

| 7 |

| Table of Contents |

Development of the Sayber X

Planning and development of the Sayber X line of products began in early 2014. By November 2015 a team consisting of an electronics engineer, an industrial product designer, software developers, prototyping specialists, and manufacturing partners had refined the proof of concept and completed extensive prototyping, simulation and stress testing, engineering evaluation, and design refinement in order to optimize performance and durability. By January 2016, component suppliers and manufacturers had been identified and assessed for quality control by an assembly factory team, after which tooling of factory parts and assembly of units was completed for additional testing and quality control evaluation. Through the Spring and Summer of 2016 a second round of extensive simulation, stress testing, and refinement of parts tooling were completed. Manufacturing & safety certifications were also obtained for targeted sales markets. In September, 2016 a successful pre-mass production assembly run of 100 units was completed to test the consistency of build quality and the parts supply chain. Ongoing durability was performed to the 100 unit pre-production assembly run units, and as of November 2016, the design was approved for full scale production.

Figure 2. The soft, flesh-like inner chamber strokes up-and-down automatically.

| 8 |

| Table of Contents |

Figure 3. The motion tracking X Ring remotely controls your stroke.

| 9 |

| Table of Contents |

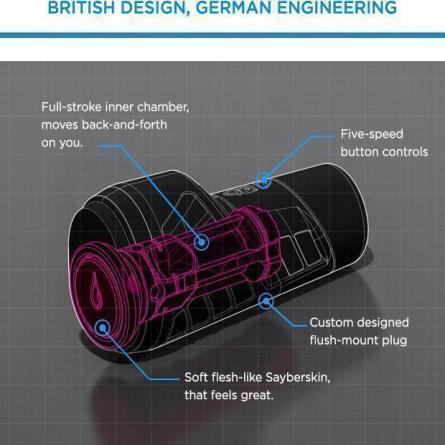

Figure 4. Design Features and Function of the Sayber X.

| 10 |

| Table of Contents |

Figure 5. Operation of the Sayber X.

| 11 |

| Table of Contents |

Figure 6. X Ring Features

Two stretchable ring bands for finger sizes S/M, and M/L, plus an extra band that fits on your favorite sex toy.

Share screen names and authorize the connection with the free app available on iOS and Android, to safely enjoy remote intimacy with anyone you like.

| 12 |

| Table of Contents |

Figure 7. Custom design & precision engineered from the inside out, better than batteries, the high-torque brushless motor runs on wall power, allowing unlimited run-time to make sure you're satisfied.

|

Power |

12 volt DC (plugs into the wall - no battery) |

|

Motor |

The custom made high-torque, high-power, brushless motor drives a fixed wheel piston in the wave guide, converting rotational motion into powerful stroking action. |

|

Metal Chassis |

Powder Coated Steel |

|

Connectivity |

Bluetooth |

|

SayberSkin |

High quality Silicone (safe and phthalate-free) thermoplastic rubber (TPR). Safe with water-based, silicon-based, and any other lubes. |

|

App Compatibility |

iOS, Android |

Figure 8. Design Features of Sayber X

| 13 |

| Table of Contents |

Figure 9. Production Images of Sayber X.

FREQUENTLY ASKED QUESTIONS

Can I use the app anonymously?

The privacy level is up to you.

You connect via screen name only, and can approve or deny any request.

How durable is it?

The brushless motor is rated for more than 5,000 hours of use.

Can I use any ring with any Sayber X?

Any X Ring can control any Sayber X(es) that grants permission.

Figure 10. Marketing Image, Frequently Asked Questions about Sayber X.

| 14 |

| Table of Contents |

|

What is it? |

High-power, automatic sexual simulator for men, with motion tracking remote control that works over the internet. |

|

Who created it? |

Brain-child of a product designer and mechanical engineer working directly with a global development team of over 20 technical experts. |

|

How much does it cost? |

Starting at Retail pricing of $249 USD for the Sayber X and $49 USD for the remote control X Ring. |

|

What do we get when we order? |

Sayber X Solo includes a free sample lube (GUNOIL), power cable, quick guide instructions. Upgrade to the Sayber X Complete Package to receive the X-Ring, too. |

Figure 11. Marketing Image, About Sayber X.

|

Why does the device have a power cable rather than running on batteries? |

The motor is custom made with such high torque that it would require very large batteries that would have to be frequently changed/charged. |

|

What lubrication should I use? |

You can use ANY silicon or water-based lubricants; (however, we recommend GUN OIL products so much that we include them with your order). |

|

Can I use the male device on its own? |

Yes, can be used on its own with the control buttons, or motion controlled by a partner from anywhere in the world using the ring. |

|

What sizes do you offer? |

One size accommodates 90% of men. |

|

Is it comfortable / attractive / discreet? |

Sayber X feels great, is easy to handle and is designed with style. It doesn't look like a sex toy or anything else on the market. |

|

Which option is best for me? |

The Complete Package has all you need for solo and interactive play. The Sayber X and X-Ring are a perfect pair. |

Figure 12. Marketing Image, Sayber X Features Explained.

|

How do I adjust the X Ring band to fit my finger? |

There are 2 stretchy ring bands included for S/M and M/L finger sizes and 1 jumbo band for toys and more. |

|

How do I turn the X Ring on and off? |

As soon as you move the X Ring, it turns on and connects via Bluetooth. If no movement is detected after 5 minutes, the X Ring shuts off. |

|

Can I purchase the X-Ring on its own? |

Yes. |

|

How do I replace the battery? |

Simply remove the casing at the back of the ring, replace the battery, and then refit the casing. |

|

How do I know what the battery power level is? |

There is a battery level indicator in the app when the ring is connected. |

|

How do I know that the X Ring is turned on? |

When you connect to the app and select "Pair Device," you'll see your ring name in the section under the label of "X Ring." |

|

Is the Ring waterproof? |

The X Ring is splash-resistant, but please take appropriate care. |

|

How do I purchase just the Ring on its own? |

Rings and new straps are available. |

|

How long is the warranty on the X Ring? |

1 Year worldwide warranty on electronic parts. |

|

Does the X Ring vibrate? |

The X Ring does not vibrate but it can be attached to sex toys that do vibrate. |

| 15 |

| Table of Contents |

Figure 13. Marketing Image, X Ring Features Explained.

|

What is the tech breakthrough of Sayber X? |

The synchronized movement between the X Ring and the Sayber X paired with the unique drive mechanism delivers the closest feeling to real sex - feel what you see. |

|

What is the battery life? Hours of continuous use? How to charge? |

There is NO Battery at all. The Sayber X plugs in and never runs out of power. |

|

What are the dimensions and weight? |

262 x 140 x 83 mm (10.3 x 5.5 x 3.3 in), 1.3 kg (2.9 lbs) |

|

How does it work? |

The soft flesh-like inner chamber strokes for your pleasure in time with the motions of the control ring. |

|

What kind of sensors are you using? |

Sayber X uses a custom designed Bluetooth and accelerometer tracking for real time motion control. |

|

Will there be updates to the app in the future? |

Yes, frequently - there are a lot of new features that we are excited to roll out. |

|

How does it connect? |

The device connects to your phone via Bluetooth, and uses your phone connection to securely connect to the Internet, finding other Sayber X devices. |

|

Is it waterproof? |

The inner chamber pops-out with two clicks, and is waterproof for easy washing. The main unit is not waterproof as it plugs in. |

Figure 14. Marketing Image, Sayber X Technology Explained.

|

I can't find my Ring but want to control a Sayber X. Is this possible? |

Yes, you can choose to use the app manually without the X Ring. Users are able to control the speed by pressing "faster" or "slower." |

|

Is the app free? Which phones does it work with? |

Yes, the free app is available for iOS and Android phones with Bluetooth 4.0 or later. |

|

When will the app be available? |

The free app is already available for iOS in the App store and coming soon to Android app markets. |

|

Is my account anonymous? |

The privacy level is up to you. You connect via Screen name only, and can approve or deny any request. |

|

How does the device connect to the app? |

Via Bluetooth. |

|

Will there be updates available through the app? |

Users get free updates for life to the Sayber X app as they become available |

|

When my device is being controlled by a partner can I adjust the speed and/or stop the device motion? |

Yes, you can override your device when it's being controlled by a partner by pressing the speed buttons, or stop by pressing the power button. |

|

Can I use the app and use video/audio calling software at the same time on the same device? |

Yes you can. |

| 16 |

| Table of Contents |

Figure 15. Marketing Image, Sayber X Software Application Explained.

|

How do I set it up? |

Connect to the power cord, lubricate your erect penis and power on. Select your desired speed or connect with another users X Ring. |

|

What if it feels too good? |

Pressing the power button quick-stops the unit at any time. You can also slow it down to prolong your pleasure. |

|

How do I remove the inner sleeve from the device for cleaning? |

Use the quick release clips to eject the shell and easily remove the inner sleeve for cleaning. |

|

How long should the inner sleeve last before needing replacement? |

At least 50 uses, more if used and cleaned with care. |

Figure 16. Marketing Image, Sayber X Operation Explained.

|

How old do I have to be to order? |

18+ only. |

|

Where can I use it? |

Anywhere private, near a plug. |

|

What safety certifications do you have? |

Sayber X has been extensively tested for safety. It presently has full and complete UL/FCC/CE/CI Safety Certifications to cover product sales in the North American and European markets. |

|

How durable is it? |

The brushless motor is rated for more 5,000 hours continuous use. |

|

How is my privacy protected? |

All you provide is an email address; you choose your username and password. We also use our own server with built in security. |

|

Can someone watch or listen to me? |

Only if you let them through a separate video or audio application. |

| 17 |

| Table of Contents |

Figure 17. Marketing Image, Sayber X Safety and Regulation explained.

|

Will my order be packaged discreetly? |

Yes, the Sayber X will be shipped with discreet packaging. |

|

When does shipping begin? |

Shipping began in February, 2017 |

|

When can we expect it to reach our doorsteps? |

Depending on when you order it will be delivered within 30 to 45 days, subject to availability of inventory. |

|

Where can I have it delivered? |

Worldwide, excluding countries where sex toys are illegal. |

|

How much is shipping? |

$10 USA, $25 Worldwide |

|

Do I have to pay VAT / GST? |

No, all taxes are included. |

Figure 18. Marketing Image, Sayber X Shipping Facts Explained.

|

Is there a warranty? |

6 month mechanical and 24 month unconditional warranty on the motor, and electronic parts. (on manufacturing defects) |

|

Are my card and personal details protected when I provide them to you for payment? |

Yes, they are secured with encryption and HTTPS. |

Figure 19. Marketing Image, Sayber X Customer Service Explained

Sales and Marketing Strategy

The Company undertood a number of initial specific marketing initiatives. Following the execution of the original Exclusive Global license Agreement, the Company entered into consultant agreements with the founders of Sayber X products to manage and oversee the marketing activities of Xplosion Incorporated.

In January 2016 the Sex Toy Expos were attended by Xplosion consultants with a view to gaining interest from the CAM Model industry, Online retailers and Industry advisors.

On February 8, 2016, we entered into a Consulting Agreement with Throb LLC, a firm with expertise in the pre-marketing and development of infrastructure channels in the sex toy industry. Pursuant to the agreement , we engaged Throb LLC, for a term of nine months to assist the Company and its other consultants with our various sales and marketing efforts. Throb LLC’s services included assistance in our preparation for the pre-order soft launch of Sayber X products

| 18 |

| Table of Contents |

During April 2016 through June 2016, Xplosion, together with its consultants, conducted the following marketing activities:

|

|

· |

Our consultants met and demonstrated the Sayber X products with various online and print publications, Journalists, Adult industry companies, Celebrities, Major traffic influencers, Adult marketing companies, Affiliate experts, Sex Toy retailers and distributors all of whom expressed a potential interest in working with Sayber X products in some form. |

|

|

· |

We conducted surveys to fine tune our messaging for pre-product launch paid advertisements to be distributed to mailing lists; |

|

|

· |

A competition was trialed using a social platform “Queue”. It was a social sharing competition for points there were 2300 participants to the competition First prize being a Sayber X unit, 2nd prize being X-rings (5) and the 3rd prize was to a 1000 runner up competitors who were eligible for an additional 5% discount on the pre order cost of the products. |

|

|

· |

We tested creative advertisements on social media platforms to gain traffic, awareness, wait list sign ups and pre order conversions |

|

|

· |

Discreet advertisements aimed at long distance couple and singles were placed on social media platform Facebook. This content is non adult, and non-graphic in nature due to Facebook content restrictions. |

|

|

· |

Paid advertisements were tested across adult platforms to gather data on converting traffic from the adult sites to our indiegogo page and Sayber X.com website and analyzing data and conversion rates. |

|

|

· |

In May 2016 the public relations firm, Lotus 823 contracted with Xplosion to work on Public relations for the Sayber X products. With Lotus 823 we designed and, in September 2016, launched, a campaign on the crowdfunding website, Indiegogo.com. Xplosion proceeded to successfully accept nearly $20,000 USD in pre-sales orders through the Indiegogo campaign, exceeding our campaign target of $16,000 USD in pre-sales. |

|

|

· |

Assisted the manufacturer to design and launch it’s primary product website, SayberX.com. |

|

|

· |

During May through August 2016, a three minute presentation video was shot, edited and re-edited to Final Cut to be included on the Indiegogo campaign page and SayberX.com. All footage is proprietary and the property of our Company and may be used for future versions. |

In addition to the above described prior consulting arrangements, we intend to employ a range of ongoing, complimentary marketing tools and initiatives going forward. These initiatives include but and not limited to the use of the following tools and strategies:

Search Engine Optimization (SEO)

Search engine optimization (SEO) is the process of maximizing the number of visitors to a particular website by ensuring that the site appears high on the list of results returned by a search engine. Among other techniques, optimizing a website may involve editing its content, HTML and associated coding to both increase its relevance to specific keywords and to remove barriers to the indexing activities of search engines. Optimization of our website is an ongoing process as we are working on fine tuning our messaging and looking at what keywords will work best to establish our SEO strategies and progress.

| 19 |

| Table of Contents |

Microsite

A microsite is an individual web page or a small cluster of pages that act as a separate entity for a brand. The microsite's main landing page can have a separate domain from the main brand website or can be a subdomain of the main brand website. We intend to develop microsites associated with our products in order to drive traffic to our online retail sites.

Conversion optimization

Conversion optimization is the process of designing websites to encourage visitors to take an action that you want them to take, such as signing up for an email newsletter, creating an account with a login and password, making a purchase, or downloading an app. We collect and analyze user data from our website on an ongoing basis to optimize user experience and conversion.

Affiliate programs

Affiliate marketing is a type of performance-based marketing in which a business rewards one or more affiliates for each visitor or customer brought by the affiliate's own marketing efforts. We have conducted preliminary beta testing on affiliate programs and intend to thoroughly explore this strategy once we are able to ship our products immediately following sale. The current lag between product sale and shipping would require us to pay affiliate commission before products have been shipped. Therefore we do not anticipate relying on affiliate programs until our cash flow is sufficient to accommodate pre-payment of commissions.

Mainstream adult paid advertising

We have tested mainstream adult paid advertising and, although the traffic and click through rates have been very promising due to the nature of the type of user targeted, conversion into sales has been limited due to extended shipping and delivery times. We now intend to use the data collected and resume this exercise as Sayber X production has ramped up and can now expectedly be shipped in an acceptable time window during 2018.

Using multiple domains as review sites to generate traffic

Using multiple, related internet domains to drive traffic to a single website is a common method of increasing website traffic. However, this strategy requires funding to produce or acquire and maintain domain content. Although we believe that a multiple domain strategy will be beneficial in the long term, we do not intend to invest in multiple domains until we have established an online retail presence.

Moving Forward

We have now taken delivery of sufficient inventory to fulfill pre order sales, and any near-term direct to consumer shipping sales to be made. Until additional inventory is available, we are focused on promoting the product using direct to consumer on line marketing efforts and through the placement of additional inventory to our sub-distribution channels. We continue to test additional marketing channels and to fine tune the messaging for our Sayber X product offering. We will look to achieve sales growth during 2018, build awareness and engage with our target market and the adult industry.

| 20 |

| Table of Contents |

Potential Partnerships

Adult content Platform

The Company itself has now began direct conversations regarding collaborative business efforts to market and distribute the SayberX product with another of the largest on line service providers in the adult sector.

This potential partnership could give Xplosion access to a vast number of the Cam company’s target users in the adult market to generate sales. However, as at the date of this filing, no definitive agreement has been reached.

Gun Oil personal lubricants

Interactive Holdings, the manufacturer of Sayber X, has itself directly entered into a partnership with the manufacturer of the personal lubricant, Gun OilR, such that each Sayber X product package will include a package of Gun Oil for the duration of the partnership. This is an ongoing partnership which aligns the Sayber X product with a credible and established lubricant company.

Online retail partners

Xplosion has already begun to approach some of the largest online retailers in the adult toy online space and a majority of them have expressed great interest in learning more about the products and in the potential of using such on-going dialogue as means to working towards being able to negotiate terms for selling and marketing the products through their channels at some time in the future.

We intend to maintain and implement an on-going diversified media marketing strategy that continues to always build upon product and brand awareness, consumer engagement, product adoption, and sustained sales and growth. We anticipate that our marketing strategy will include following components:

Phase 1--Awareness

|

· |

Electronic Media Buying (adult webcam sites, video sites, online forums and communities) | |

|

· |

Email partnership (email list purchases, product placement) | |

|

· |

Sponsorships (adult performer sponsorships, event sponsorships) | |

|

· |

Social Media Campaigns | |

|

· |

Digital Press Releases | |

|

· |

Review Key Performance Indicators including media reach, website visitors, email click-through rate & email open rate) |

Phase 2—Engagement

|

· |

Web & Mobile interaction with customers | |

|

· |

Email communications with customers | |

|

· |

Review Key Performance Indicators including website click-through rate analysis, frequency of email subscriptions, user registration & download rates, user bounce rate (represents the percentage of visitors who enter the site and then leave or "bounce", rather than continuing on to view other pages within the same site). |

| 21 |

| Table of Contents |

Phase 3—Adoption

|

· |

Purchases | |

|

· |

Email sign ups | |

|

· |

Subscriptions | |

|

· |

Review Key Performance Indicators including purchases, email sign ups, subscriptions. |

Phase 4—Advocacy

|

· |

Creative Advertising Campaigns | |

|

· |

Viral advertising through social networking platforms | |

|

· |

Digital Press Releases | |

|

· |

Review Key Performance Indicators including social networking referral rate, growth of social networking profile, and social networking mentions. |

Data from each phase will be collected, collated and segmented in order to calibrate our marketing tools, plan media campaigns, adjust sales procedures, and refine customer service, all toward the end of improving business relationships with customers, assisting in customer retention and driving sales.

Distribution and Fulfillment

Our Global Rights Agreement with Interactive Holdings Limited grants our Company a global distribution license for the sales, marketing and distribution of the Sayber X line of products. In that regard, we aim to distribute the SayberX line of products globally, in any jurisdictions where they may be legally sold. However, we currently endeavor primarily to target consumer markets in the United States, Canada, China, Japan, the UK and continental Europe.

The Company will employ a variety of wholesale and retail distribution strategies adapted to the manufacturing strategies of the product manufacturer, which may vary over time. The bare basics of order fulfillment include customer order processing and distribution from a supply chain. In other words, a customer places an order for a product or service with a supplier. When the supplier delivers the product or service, this is called order fulfillment.

Regarding the shipping and inventory of our products, as at the date of this report, the Company takes delivery of substantially all manufactured products at one of two fulfillment warehouse locations either in Los Angeles or Hong Kong, respectively. These facilities are leased on a month to month basis from third party fulfillment distribution service providers. The current manufacturer of our products also provides warehousing services at our request, provided that we assume ownership and risk of any goods stored on our behalf. In the future, as the product inventory needs increase, the Company may seek to have its own in-house warehousing facility. Products ordered by consumers via on-line purchase will be shipped directly to them from one of the Company’s fulfillment warehouses. The purchasers will pay for the costs of shipping of each individual unit. For large purchase orders made by the Company or by the sub-distributors, units will be priced FOB (free on board) from the Licensor production location, such that the Company or the sub-distributors will then pay for the shipping to their ultimate destinations, whether by air, ocean and land transport. Xplosion assumes ownership and risk for all products shipped directly to sub-distributors from the Licensor production location.

In terms of the actual sales distribution, products will be sold in some form of blend of the following:

Wholesalers

A sound method of distribution for the Company will be to use a wholesaler (sub-Distributor). The Company is targeting relationships is various countries and territories to engage sub-distributors that in turn will be able to themselves either sell direct to consumers in such markets, or else in many cases work with existing retailers (traditional brick and mortar store front type operations).

Retail Outlets

We anticipate that our wholesaler strategy, described above, will provide Xplosion access to one of the most common ways to sell a product which is to place it an existing retail outlet for sale to the public.

| 22 |

| Table of Contents |

Online Sales

We will also aim to capitalize on the growing trend of online shopping by marketing products for direct online sales through the manufacturer and/or others third-party sites. Through direct online sales, the Company can take orders, receive payments and send confirmation all at once using a variety of turnkey e-commerce systems available to sellers. The Company initially stocks inventory and fulfills orders through its third party fulfillment service providers in Los Angeles and Hong Kong. If sales volumes demand, the Company intends to engage additional fulfillment providers, or establish in-house warehousing and fulfillment infrastructure.

Fulfillment

Fulfillment companies will often have different strengths that give them a unique logistical advantage. Some are more focused on speed, such as processing and shipping orders out the same day they are received. Others may focused on very high degrees of order accuracy and facility security. Some will be very well versed in the complexities of international shipping while others will have a focus on customer experience and offer high degrees of packaging customization. As of the date of this report, the fulfillment providers that the Company presently uses, PB&J in Los Angeles for service of the North American market, and EasyShip in Hong Kong for service to the Asian and European markets, offer the Company the warehousing, shipping, inventory management reporting, and overall pricing and billing services it deems fair and appropriate to facilitate it’s current flow of business and orders.

Government Regulation

We are directly and indirectly subject to a wide variety of laws and regulations which we expect will have a material effect on our business.

The Sayber X products have passed, and received safety numbers for the following safety and certification standards:

|

· |

UL Standard for Cord Sets and Power-Supply Cords: UL is a globally recognized safety certification for power supply chords, among other devices. The product manufacture of Sayber X uses only UL certified power supply chords. | |

|

| ||

|

· |

FCC: The FCC Declaration of Conformity or the FCC label or the FCC mark is a certification mark employed on electronic products manufactured or sold in the United States which certifies that the electromagnetic interference from the device is under limits approved by the Federal Communications Commission. | |

|

| ||

|

· |

CSA: CSA International certification marks indicate that a product, process or service has been tested to a Canadian or U.S. standard and it meets the requirements of an applicable CSA standard or another recognized document used as a basis for certification. | |

|

| ||

|

· |

CE: CE marking is a mandatory conformity marking for certain products sold within the European Economic Area (EEA) since 1985. The CE marking is also found on products sold outside the EEA that are manufactured in, or designed to be sold in, the EEA. This makes the CE marking recognizable worldwide even to people who are not familiar with the European Economic Area. It is in that sense similar to the FCC Declaration of Conformity used on certain electronic devices sold in the United States. |

| 23 |

| Table of Contents |

General application of Regulation to Wholesaler-distributors and Product Manufacturers

We are a product wholesaler & distributor. Wholesaler-distributors, as well as manufacturers, can be subject to a wide variety of laws and regulations governing product liability. Bodily injury and property damage losses may arise from the product itself, the product packaging, instructions for use, labels, warnings and other "on product" messages. Usually, the manufacturer and not the wholesaler-distributor is held responsible for injury arising from a defective product, because the wholesaler-distributor generally has no control over the design, assembly or quality of the item. However, wholesaler-distributors may be held liable for product defects under certain circumstances, including:

|

· |

wholesaler-distributors that modify, repackage or re-label products may assume a greater liability than those who don't. Modification of the product can include any modification of instructions or warranties; | |

|

| ||

|

· |

repackaging under the wholesaler-distributor's name may increase the exposure substantially; | |

|

| ||

|

· |

when a wholesaler-distributor imports products from a foreign manufacturer who does not carry U.S. product liability coverage, they can assume the product liability exposure; | |

|

| ||

|

· |

if the manufacturer is insolvent or otherwise unavailable (foreign manufacturers with no coverage inside the U.S. for example) the wholesaler-distributor can be held liable for any defect in the product; | |

|

| ||

|

· |

when the wholesaler-distributor is directly responsible for the defective condition, i.e. if they have damaged the product while repackaging, or by making product modifications, they may be held liable for product liability; | |

|

| ||

|

· |

if a wholesaler-distributor had knowledge of the defective condition prior to the sale and did nothing, they can be held accountable; | |

|

| ||

|

· |

if a wholesaler-distributor recommended an unsuitable product for the job they may be liable.

(source: National Association of Wholesaler-Distributors) |

Market and Competition

According to the Adult Novelty Manufacturers Expo (ANMIE), adult sex toys constituted a $15 billion industry in 2014 and was projected to surpass $50 billion by 2020. According to the independent research firm Technovio, the global sex toys market was estimated at USD 20.82 billion in 2015 and will reach USD 29.07 billion by 2020. Globally, men were the primary buyers of adult toys in 2015, but the trend is changing with the growing acceptance of such products among women. Based on sales from various distribution channels, three out of 10 men purchase sex toys while only one out of 10 women purchase sex toys.

Accordingly, the marketplace for adult sex toys and, in particular, vibrators and other pleasure devices, is intensely competitive. In that regard we will aim to compete with small and large vendors, including self-distributing manufacturers, pure wholesaler-distributors, and online and storefront retailers. These competitors will include such mainstream retailers as Walmart, Rite Aid, CVS Pharmacy, GNC and Walgreens, and prominent manufacturers and distributors of adult sex products such as Bestgreen industrial, BMS factory, Diamond products, Fun Factory, LELO, We-Vibe, Ann Summers, California Exotic Novelties, Crave, Holistic Wisdom, Jimmyjane, Jopen, Love Life Products, MinnaLife, OhMiBod, Vibratex, and Vixen Creations, to name a few. We aim to compete with the online businesses of the aforementioned retailers, as well as pure play e-commerce businesses such as Amazon, Overstock.com Drugstore.com.

| 24 |

| Table of Contents |

Sayber X Competitors

The following section describes some of the most significant producers of self-stimulation devices for men with whom we will aim to compete for market-share.

Fleshlight

|

· |

Description: Manual motion simulated vagina sex toys; | |

|

| ||

|

· |

Distinction between this product and the Sayber X: | |

|

|

Fleshlight has no automation by motor and electronics - just manual stimulation. Fleshlight does have a product partnership called V- stroker that attaches to a Fleshlight and communicates the speed of the manual movement and interacts with pre-recorded pornographic films which speed up or slow down at the speed at which one masturbates. Fleshlight has also partnered with kiiroo (see below)- Fleshlight provides the inner sleeves for Kiiroo, and Kiiroo products are available on the Fleshlight website. |

Tenga

Tenga Inc. was established on March 25, 2005. Tenga offers several product categories. Disposable "Cup" series which are intended for one-time use only (which can be reused if washed correctly. "Flip" series that split open to be easily washable and reusable, compact "Egg" series which resemble Easter eggs and stretch when in use, and "Tenga 3D" series which are intended to be reversed when not in use, showing its geometric patterns. Other accessories include lotions (lubricants), electrical "Tenga Warmers", and "Hole Warmers" (a stick-shaped hand warmer that uses supersaturated sodium acetate).

Tenga

|

· |

Description: Manual motion simulated vagina sex toys | |

|

| ||

|

· |

Main differences between Tenga and Sayber X: Tenga is not automated and has no Bluetooth, or iOS or android apps. Tenga does offer more products than just masturbators. Their offerings include condoms, vibrators, and hole warmers, among others. Their products are characterized by very technical design, and notably, advanced inner sleeve design. |

Autoblow 2

|

· |

Description: | |

|

|

Like a fleshlight but with an inner sleeve that’s more like a thick condom, Autoblow has spring loaded beads that are driven by an electric motor, wheel and rods and rolls up and down the sleeve for the stimulation. | |

|

|

Very noisy, the producer has described the noise level himself as “Car windshield wipers”. (Source: Frequently Asked Questions. (n.d.). Retrieved March 10, 2017, from http://www.autoblow2.com/faq)) |

|

· |

Main difference between Autoblow and Sayber X: Autoblow does not provide a thrusting motion, only lateral pressure. Not integrated with any software or external devices. |

| 25 |

| Table of Contents |

Kiiroo

|

· |

Partnered with Fleshlight to provide the inner sleeves and add some credibility to the brand and utilise Fleshlights traffic (available on fleshlight store) and also adult stars for additional promotion | |

|

|

· |

Description: Like a Fleshlight but with electronic squeezing rings that provide a simulated motion of up and down by squeezing in a sequence. Can be paired by software with a sensor-equipped vibrator remote control: stimulus applied to the vibrator is roughly reproduced by the Kiroo. |

|

|

· |

Main difference between Kiroo and Sayber X: Kiroo does not provide a stoking motion, it squeezes in a sequence. If the squeeze is not a sufficient substitute for a stroke the user must manually produce a stroking motion. This can also be done with a Fleshlight or a Tenga, which significantly less expensive than a Kiroo. |

Overall Competitive Advantage

We believe that our Sayber X line of products is positively distinguished from directly competitive products due to its technological sophistication, elegant design, and superior performance. It is unique among popular sex toys in the way it operates, and in its use of the motion tracking ring control. We also believe that the Sayber X is at the forefront of personal stimulation device technology, with few comparable products offering online or in person multi-user possibilities.

Employees

Currently, we do not have any employees other than our sole director and officer. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our development programs.

Description of Property and Facilities

Our executive, administrative, and operating offices are located at Suite 223 – 468 North Camden Drive, Beverly Hills, CA 90210.. We believe these facilities are adequate for our current needs. The offices are currently provided to us at a cost of $199/USD/ month. We believe that our office space and facilities are sufficient to meet our present needs and do not anticipate any difficulty securing alternative or additional space, as needed, on terms acceptable to us.

Subsidiaries

We do not have any subsidiaries.

Intellectual Property

On December 7, 2015, we entered into an Exclusive Global Rights Agreement (amended on July 27, 2016 and further amended on September 29, 2017 to a Non-Exclusive Agreement) with Interactive Holdings Limited pursuant to which we acquired a global distribution license for the Sayber X line of sexual stimulation products. Our license includes the right to market and sell products incorporating the proprietary Sayber X design, or using the Sayber XTM, X RingTM, and related marks.

| 26 |

| Table of Contents |

LEGAL PROCEEDINGS

On or about February 9, 2018, the Company received notice that it has been served as a co-defendant in a Complaint for Infringement of US Patent 6,368,268. The Complaint alleges that the Company and the co-defendant, Interactive Holdings Limited, have infringed on the Plaintiff’s patent and seek a permanent injunction plus an award of damages.

Emerging Growth Company

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

|

(A) |

the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more; | |

|

| ||

|

(B) |

the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title; | |

|

| ||

|

(C) |

the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or | |

|

| ||

|

(D) |

the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto. |

Section 404(a)of Sarbanes Oxley requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. Section 404(b) of Sarbanes Oxley requires that the registered accounting firm of the Issuer shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

Before making an investment decision, prospective investors should carefully consider, along with other matters referred to in this 10K annual report the following risk factors, which have set forth all of the material risks inherent in and affecting our business. Please consider the following risk factors before deciding to invest in our common stock:

| 27 |

| Table of Contents |

Risks Associated with Our Financial Condition

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

We incurred a net loss of $577,116 for the year ended October 31, 2017 as compared to a loss of $360,369 for the year ended to October 31, 2016. As at October 31, 2017 we had cash on hand of $1,562. To satisfy our financial requirements during the 12 month period beginning November 1, 2017, we intend to rely initially on funding available to us from shareholders of our Company. We are in the development stage and have yet to attain profitable operations and in their report on our financial statements for the year ended October 31, 2017, our independent auditors included an explanatory paragraph regarding the substantial doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that led to this disclosure by our independent auditors.

If we are unable to obtain financing in the amounts and on terms and dates acceptable to us, we may not be able to execute our business plan, and so may be forced to modify, scale back or cease operations, and you could lose your entire investment.

We require approximately $750,000 to carry out our planned business activities over the next 12 months and had approximately $1,562 in cash on hand as of October 31, 2017. To satisfy our financial requirements during the 12-month period beginning November 1, 2017 we intend to rely initially on the proceeds of sales of equity or the acquisition of third-party loans or on any revenues from the sale of our products, if any. We do not currently have any arrangements for additional financing. We will have to raise additional funds for the development of our business and the marketing of our products. Such additional funds may be raised through the sale of additional stock, stockholder and director advances and/or commercial borrowing. There can be no assurance that a financing will continue to be available if necessary to meet these continuing development costs or, if the financing is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us will result in a significant dilution in the equity interests of our stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may not be able to execute our business plan, and so may be forced to modify, scale back or cease our operations, and you could lose your entire investment. In the event we are unable to secure additional capital, based upon our current cash position, and without considering potential revenues from the sale of our products, we estimate that we will be able to sustain nominal operations for a period of 12 months from the date of this prospectus.

Risks Associated with Our Business

We will depend on third parties to manufacture our products and develop our business, and therefore, if they do not perform, or are unwilling to participate we may not be able to effectively market and sell our products.

To generate significant sales volume and repeat purchases by individuals and retailers, which we believe are crucial to obtaining sufficient revenues, we must maintain adequate inventory, and establish customer trust in the quality and safety of our products, and timeliness of our product shipping. If for any reason any of our suppliers fails to perform, we may not be able to service our customers effectively and thereby may lose customers or damage our reputation. In addition, the success of our business requires that we establish relationships with professionals in strategic regions around the world who can, through their expertise, source and nurture relationships to develop our business. If we are unable to establish such relationships, we may be unable to procure goods or on terms acceptable to us, and our business may fail.

| 28 |

| Table of Contents |

We may not be able to compete effectively against other companies that have existed for a longer period and have greater financial resources.

We compete in a market that is highly competitive and expect competition to intensify in the future. We will seek to compete with a variety of developing and established companies, including those specialized exclusively in the sale of personal sexual wellness products like our initial product offering the Sayber X, as well as those engaged in the sale of broader portfolios of lifestyle enhancement products that target millennials and progressive thinkers of Generation X and Y. Many of our prospective competitors have significantly greater financial, technical, and marketing resources than our company, and many have established consumer brands, preferential supplier relationship, and developed retail distribution networks, both traditional and online.

We may not be able to compete successfully against these competitors. If we are unable to effectively compete in the sexual wellness and adult lifestyle markets, our results would be negatively affected, we may be unable to implement our business plan, and our business may ultimately fail.

Our products or our company may be subject to product liability claims which may be detrimental to our reputation and financial condition.

Although we are a distributor and not a manufacturer of products, and therefore not directly responsible for potential flaws or defects in any of the goods which we intend to sell, we may become implicated in product liability claims as a result of alleged or actual harm related to the use of our products by end users. Whether we are directly implicated as a named defendant in such a civil claim, or indirectly implicated by association as a product distributor, we may suffer reputational and economic harm to the extent that the safety or quality of our products is called into question. Additionally, if we are directly named as a defendant in such a civil claim, we expect to incur significant legal expense and, if we our held responsible for injury arising from any of our products, significant additional financial liability. Although we intend to carry product liability insurance to safeguard against potential claims, any such claims could irreparably harm our reputation, our financial condition, and ultimately cause our business to fail.

We expect to be directly affected by fluctuations in the general economy.

Demand for discretionary lifestyle enhancement products is affected by the general global economic conditions. When economic conditions are favorable and discretionary income increases, purchases of non-essential items like our proposed products generally increase. When economic conditions are less favorable, product sales decline in kind. In addition, we may experience more competitive pricing pressure during economic downturns. Therefore, any significant economic downturn or any future changes in consumer spending habits could have a material adverse effect on our financial condition and results of operations.

We expect our products to be subject to changes in customer taste.

The markets for our products are subject to changing customer tastes and the need to create and market new products. Demand for products targeting lifestyle tastes and choice is influenced by the popularity of certain themes, cultural and demographic trends, marketing and advertising expenditures and general economic conditions. Because these factors can change rapidly, customer demand also can shift quickly. Some goods appeal to customers for only a limited time. The success of new product introductions depends on various factors, including product selection and quality, sales and marketing efforts, timely production and delivery and customer acceptance. We may not always be able to respond quickly and effectively to changes in customer taste and demand due to the amount of time and financial resources that may be required to bring new products to market. The inability to respond quickly to market changes could have a material adverse effect on our financial condition and results of operations.

| 29 |

| Table of Contents |

If we are unable to successfully manage growth, our operations could be adversely affected, and our business may fail.

Our progress is expected to require the full utilization of our management, financial and other resources. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including our financial and management information systems, and to recruit, train and manage sales personnel. There can be no assurance that management will be able to manage growth effectively.

Because we do not have sufficient insurance to cover our business losses, we might have uninsured losses, increasing the possibility that you may lose your investment.

We may incur uninsured liabilities and losses as a result of the conduct of our business. We do not currently maintain any comprehensive liability or property insurance. Even if we obtain such insurance in the future, we may not carry sufficient insurance coverage to satisfy potential claims. We do not carry any business interruption insurance.

We may have liabilities to affiliated or unaffiliated third parties incurred in the regular course of our business.

We plan to do business with third party vendors, customers, suppliers and other third parties and thus we are always subject to the risk of litigation from customers, employees, suppliers or other third parties because of the nature of our business. Litigation could cause us to incur substantial expenses and, negative outcomes of any such litigation could add to our operating costs which would reduce the available cash from which we could fund our ongoing business operations.

Our market is characterized by rapid technological change, and if we fail to develop and market new technologies rapidly, we may not become profitable in the future.

Although we believe that our Sayber X product offering is the forefront of popularly available technology, this industry sector is characterized by rapid technological change that could ultimately render our flagship product offering generic or obsolete. If our management is unable, for technical, legal, financial, or other reasons, to adapt in a timely manner in response to changing market conditions or customer requirements, we may never become profitable which may result in the loss of all or part of your investment.

Our manufacturing, sales and distribution networks are vulnerable to interruption and damage that may be costly and time-consuming to resolve and may harm our business and reputation.

A disaster could interrupt the manufacturing, sales, or distribution of our products for an indeterminate length of time and severely damage our business, prospects, financial condition and results of operations. The systems and operations of our third party contractors and our company are vulnerable to damage or interruption from fire, floods, network failure, hardware failure, software failure, power loss, telecommunication failures, break-ins, terrorism, war or sabotage, computer viruses, denial of service attacks, penetration of our network by unauthorized computer users and “hackers” and other similar events, and other unanticipated problems.

| 30 |

| Table of Contents |

We may not have developed or implemented adequate protections or safeguards to overcome any of these events. We may also not have anticipated or addressed many of the potential events that could threaten or undermine our technology network. Any of these occurrences could cause material interruptions or delays in our business, result in the loss of data or render us unable to provide services to our customers. In addition, if anyone can circumvent our security measures, he or she could destroy or misappropriate valuable information or disrupt our operations. Our insurance, if any, may not be adequate to compensate us for all the losses that may occur as a result of a catastrophic system failure or other loss, and our insurers may decline to do so for a variety of reasons.

If we fail to address these issues in a timely manner, we may lose the confidence of our customers, and our revenue may decline and our business could suffer.

Our sole officer and director will allocate some portion of his time to other businesses thereby causing conflicts of interest in his determination as to how much time to devote to our affairs as well as other matters.

Nicholas Galan, our current sole executive officer and director, resides in the Philippines and is not required to commit his full time to our affairs, which could create a conflict of interest when allocating his time between our operations and his other commitments. He is not obligated to devote any specific number of hours to our affairs, but it is estimated that he will devote approximately 20 hours per week on our business.

Mr. Galan is an entrepreneur and is involved in other ventures in fields that do not compete with our business. However, if his other activities require him to devote more substantial amounts of time to them, it could limit his ability to devote time to our affairs and could have a negative impact on our ability to pursue our business plan. Additionally, Mr. Galan and future company officers and directors may become aware of business opportunities that may be appropriate for presentation to us and the other entities to which they owe fiduciary duties. Accordingly, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. We cannot assure anyone that these conflicts will be resolved in our favor.

We depend on uncompensated executives to implement our business plan.

We have paid management fees of $5,065 during the year ended October 31, 2017 to Mr. Galan for his services to the Company. We intend to compensate him when we generate revenues. However, there is no guarantee that we will be able to generate revenues or that Mr. Galan will continue to serve our Company until it generates revenues. If Mr. Galan chooses to leave the Company, our plan of operations will be materially delayed.