Attached files

| file | filename |

|---|---|

| EX-31.2 - Resolute Energy Corp | c91121_ex31-2.htm |

| EX-31.1 - Resolute Energy Corp | c91121_ex31-1.htm |

| EX-21.1 - Resolute Energy Corp | c91121_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from | to |

Commission file number: 001-34464

RESOLUTE ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 27-0659371 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1700 Lincoln Street, Suite 2800 Denver, CO |

80203 | |

| (Address of principal executive offices) | (Zip code) |

(303) 534-4600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

| Common Stock, par value $0.0001 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | o | Accelerated Filer | x |

| Non-Accelerated Filer | o (Do not check if a smaller reporting company) | Smaller Reporting Company | o |

| Emerging Growth Company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Registrant’s Common Stock held by non-affiliates on June 30, 2017, computed by reference to the price at which the Common Stock was last sold as posted on the New York Stock Exchange, was $629.0 million.

As of April 25, 2018, 23,160,664 shares of the Registrant’s $0.0001 par value Common Stock were outstanding.

The following documents are incorporated by reference herein: None.

Explanatory Note

This Amendment No. 1 to Form 10-K (this “Form 10-K/A”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2017 originally filed with the Securities and Exchange Commission (the “SEC”) on March 12, 2018 (the “Original Report”) by Resolute Energy Corporation (the “Company,” “we,” “our” or “us”). We are filing this Form 10-K/A to present the information required by Part III of the Form 10-K as we will not file a definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2017. This Form 10-K/A amends and restates in their entirety Items 10, 11, 12, 13 and 14 of part III of the Original Report and the exhibit index set forth in Part IV of the Original Report and includes certain exhibits as noted thereon. Terms previously defined in the Original Report have the same meanings in this Form 10-K/A.

Pursuant to the rules of the SEC, this Form 10-K/A contains the currently dated certifications from the Company’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s principal executive officer and principal financial officer are attached to this 10-K/A as Exhibits 31.1 and 31.2, respectively. Because no financial statements have been included in this 10-K/A and this 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. Additionally, we are not including the certificate under Section 906 of the Sarbanes-Oxley Act of 2002 as no financial statements are being filed with this Form 10-K/A. The cover page of the Original Report is also amended to delete the reference to the incorporation by reference of the Company’s definitive proxy statement.

Except as described above, no other changes have been made to the Original Report. Other than the information specifically amended and restated herein, this Form 10-K/A does not reflect events occurring after March 12, 2018, the date of the Original Report, or modify or update those disclosures that may have been affected by subsequent events. Accordingly, this Form 10-K/A should be read in conjunction with our Original Report and our other filings made with the SEC subsequent to the filing of the Original Report.

The section of this Form 10-K/A entitled “Compensation Committee Report” is not deemed to be part of or incorporated by reference by any general statement incorporating by reference this Form 10K/A into any filing under the Securities Act or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed “soliciting material” or “filed” under either the Securities Act or the Exchange Act.

RESOLUTE ENERGY CORPORATION

AMENDMENT NO. 1 TO ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED

December 31, 2017

TABLE OF CONTENTS

| i |

FORWARD-LOOKING STATEMENTS

This Form 10-K/A includes forward-looking statements. These forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management, and involve external risks and uncertainties, including, but not limited to, those described under “Risk Factors” in our Original Report. Forward-looking statements may include information and statements preceded by, followed by or that include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in these forward-looking statements. Factors that could cause actual results to differ from these forward-looking statements include, but are not limited to, those discussed elsewhere in this Form 10-K/A. You should not put undue reliance on any forward-looking statements. Except as required by applicable law or regulation, we do not have any intention or obligation to update forward-looking statements.

| ii |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

DIRECTORS AND EXECUTIVE OFFICERS

The Board of Directors (the “Board” or “Board of Directors”) and the executive officers of the Company are:

| Name | Director Class | Age | Position | |||

| Nicholas J. Sutton | III | 73 | Executive Chairman of the Board | |||

| Richard F. Betz | I | 56 | Chief Executive Officer and Director | |||

| Tod C. Benton | II | 61 | Director | |||

| James E. Duffy | I | 67 | Director | |||

| Thomas O. Hicks, Jr. | II | 40 | Director | |||

| Gary L. Hultquist | III | 74 | Director | |||

| Janet W. Pasque | III | 60 | Director | |||

| William K. White | I | 76 | Director | |||

| Theodore Gazulis | — | 63 | Executive Vice President and Chief Financial Officer | |||

| Michael N. Stefanoudakis | — | 47 | Executive Vice President, Corporate Development / Strategy, General Counsel and Secretary | |||

| Bob D. Brady, Jr. | — | 60 | Executive Vice President, Operations | |||

| James A. Tuell | — | 58 | Senior Vice President and Chief Accounting Officer |

Our certificate of incorporation provides that members of the Board are to be divided into three classes. The Board currently consists of three Class I directors (Richard F. Betz, James E. Duffy and William K. White), two Class II directors (Thomas O. Hicks, Jr. and Tod C. Benton) and three Class III directors (Nicholas J. Sutton, Gary L. Hultquist and Janet W. Pasque). The term of the Class III directors will expire at the 2018 annual meeting of stockholders. The term of the Class I directors will expire at the 2019 annual meeting of stockholders, and the term of the Class II directors will expire at the 2020 annual meeting of stockholders. Our certificate of incorporation provides that successors to the class of directors whose terms expire at an annual meeting shall be elected for three-year terms. Our certificate of incorporation and applicable rules of the New York Stock Exchange (the “NYSE”) contemplate that the number of directors in each class will be as nearly equal in number as possible.

Set forth below is biographical information about each of the Company’s executive officers and directors.

Nicholas J. Sutton has been Executive Chairman of the Board of the Company since January 2017. Prior to that he was Chairman of the Board and Chief Executive Officer since the Company’s formation in July 2009. Mr. Sutton was the Chief Executive Officer of the predecessor to Resolute Energy Corporation and its various subsidiaries and affiliates (collectively referred to as “Predecessor Resolute”) since the formation of these entities beginning in 2004 and remains on the boards of directors and boards of managers of those entities. Mr. Sutton was a co-founder, Chairman and Chief Executive Officer of HS Resources, a NYSE-listed company, from 1987 until the company’ s successful sale to Kerr-McGee Corporation in late 2001 for $1.8 billion (or $66 per share). From 2002 until the formation of Predecessor Resolute in 2004, Mr. Sutton was a director of Kerr-McGee Corporation. From 2006 until 2014, Mr. Sutton served as a director of Tidewater, Inc. Mr. Sutton earned his undergraduate degree in engineering from Iowa State University and his law degree from the University of California, Hastings College of the Law. He also is a graduate of the Owner/President Management Program at the Harvard University Graduate Business School. As an engineer, Mr. Sutton worked for one of the leading technology companies in the Silicon Valley. While in law school he interned for the United States Attorney for the Northern District of California and for the Presiding Justice of the California Court of Appeal, Division I. After law school he worked as a law clerk to the Chief Justice of the California Supreme Court. Following that he worked for a large law firm until co-founding the

| 1 |

predecessor of HS Resources in 1979. Additionally, Mr. Sutton served our country as a U.S. Army officer in Vietnam. Mr. Sutton is also a member of the Society of Petroleum Engineers and of the American Association of Petroleum Geologists and he also is a member of the California Bar Association (inactive status). In determining Mr. Sutton’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in the oil and gas industry and his track record in growing public oil and gas companies, including managing acquisition programs, as well as his role in the founding of Predecessor Resolute, including his role in the September 25, 2009 business combination with Hicks Acquisition Company I, Inc. (the “Resolute Transaction”). The Board has also considered his experience serving on the boards of directors of other public companies in the oil and gas industry. In addition, the Board has considered that Mr. Sutton has degrees in engineering and law, and he graduated from the Owner/President Management program at the Harvard University Graduate Business School, giving him expertise in many of the areas of importance to the Company.

Richard F. Betz has been Chief Executive Officer and Director of the Company since January 2017. Mr. Betz was Chief Operating Officer from March 2012 until December 2016, was Senior Vice President, Strategy and Planning of the Company from September 2009 to March 2012, and was Vice President—Business Development of the Company from July 2009 to September 2009. He had been Vice President, Business Development of Predecessor Resolute since their founding in 2004. From September 2001 to January 2004, Mr. Betz was involved in various financial consulting activities related to the energy industry. Prior to that, Mr. Betz spent 17 years with Chase Securities and successor companies, where he was involved primarily in oil and gas corporate finance. Mr. Betz was a Managing Director in the oil and gas investment banking coverage group with primary responsibility for mid-cap exploration and production companies as well as leveraged finance and private equity. In that capacity, Mr. Betz worked with the HS Resources management team for approximately 12 years. Mr. Betz received a B.S. in Finance from Villanova University and an MBA from the Wharton School at the University of Pennsylvania. In determining Mr. Betz’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in the finance, banking and operational aspects of the oil and gas industry.

Tod C. Benton was appointed to the Board in August 2017. Mr. Benton has been a member of the Compensation Committee and the Audit Committee since August 2017. Mr. Benton served as a Vice Chair for the Energy Group of BMO Capital Markets in the U.S. from February 2014 through July 2017. As a Vice Chair, Mr. Benton served primarily as a senior relationship contact for key relationships. Mr. Benton retired from BMO Capital Markets effective July 31, 2017. From February 2007 through January 2014, Mr. Benton was Head of Energy Investment Banking in the U.S. for BMO Capital Markets. Mr. Benton managed the Energy Investment Banking team, with coverage of approximately 100 energy clients. During that time, Mr. Benton was involved in numerous M&A, A&D, equity and debt capital markets transactions. During this time, Mr. Benton initiated a banking relationship with Resolute and served as the primary coverage banker. From July 2004 through January 2007, Mr. Benton was Head of Corporate Banking for Energy, Utilities and Chemicals at Deutsche Bank. As head of the group, Mr. Benton managed a team of corporate bankers with a focus on the energy sector. During this time, Deutsche Bank initiated a relationship with Resolute that was managed by Mr. Benton. Mr. Benton was a Managing Director at JP Morgan and predecessor companies from November 1987 through July 2004. During that time, Mr. Benton worked predominately with oil and gas companies as an advisor and capital raising partner. As a senior member of the leveraged finance group, Mr. Benton was involved in acquisition finance and general capital-raising for small to large cap energy companies. During this time, Mr. Benton worked closely with the HS Resources management team on a number of transactions. Mr. Benton holds a B.S. in Civil Engineering from Youngstown State University and an M.B.A. in Finance from the University of Houston. In determining Mr. Benton’s qualifications to serve on the Board, the Board has considered among other things, his broad experience and expertise in finance and his broad knowledge of the oil and gas sector.

James E. Duffy was elected to the Board in September 2009. Mr. Duffy has been a member of the Compensation and Audit Committees since September 2009, and between September 2009 and December 2009 was also a member of the Corporate Governance/Nominating Committee. He is a co-founder and, since 2003, Chairman of ReadyMax, Inc. (f/k/a StreamWorks Products Group, Inc.), a private consumer products development company that manufactures products for the industrial safety, specialty tool and outdoor recreation industries. From 1990 to 2001, he served as Chief Financial Officer and director of HS Resources until its sale to Kerr-McGee Corporation. Prior to that time, he served as Chief Financial Officer and Director of a division of Tidewater, Inc. He was also a general partner in a boutique investment banking business specializing in the oil and gas business, and began his career with Arthur Young & Co. in San Francisco. He is a certified public accountant. In determining Mr. Duffy’s

| 2 |

qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in oil and gas finance, accounting and banking, as well as his position as chief financial officer of two public oil and gas companies and his service as an audit manager for a major accounting firm with engagement responsibility for public and private entities.

Thomas O. Hicks, Jr. was elected to the Board in September 2009. Mr. Hicks has been a member of the Corporate Governance/Nominating Committee since September 2009. Between September 2009 and December 2009, he was also a member of the Compensation Committee. Mr. Hicks is a Partner of Hicks Holdings LLC, having joined at its inception in 2005. Hicks Holdings LLC is a Dallas-based family holding company for the Hicks family and a private investment firm which owns and manages real estate assets and makes corporate acquisitions. Mr. Hicks was a vice president of Hicks Acquisition Company I, Inc. from February 2007 through September 2009 and was its secretary from August 2007 to September 2009. He also served as Secretary and Vice President of Hicks Acquisition Company II, Inc. from October 2010 to July 2011. Mr. Hicks is a Founding Partner of Scout SSG, LLC, an investment firm looking primarily to deploy capital into distressed and other special situations. Mr. Hicks is Chairman of America First Action PAC. He is also Chairman of America First Policies and on the national advisory board for Turning Point USA. Mr. Hicks has been a director of Drilling Tools International Holdings, Inc. since January 2012, and was a director of Sight Sciences, Inc. from October 2015 to July 2017, Replacement Parts Holdings LLC, the parent of Standard Industrial Manufacturing Partners LLC d/b/a Standard Pump, from July 2016 to June 2017 and also served as a director of Carol’s Daughter Holding, LLC from April 2014 to November 2014. He also served several roles for the Texas Rangers Baseball Club and the Dallas Stars Hockey Club from 2004 through 2011. From 2001 to 2003, Mr. Hicks was an analyst at Greenhill & Co. LLC, a New York-based merchant banking firm. On May 24, 2010, Texas Rangers Baseball Partners filed a voluntary petition for bankruptcy and on May 28, 2010, a group of creditors filed an involuntary bankruptcy petition against Rangers Equity Holdings, L.P. and Rangers Equity Holdings GP, LLC. In determining Mr. Hicks’s qualifications to serve on the Board, the Board has considered, among other things, his wide-ranging business experience and expertise in sales, banking and management.

Gary L. Hultquist was appointed to the Board in February 2014. Mr. Hultquist has been a member of the Compensation Committee and the Corporate Governance/Nominating Committee since February 2014, and a member of the Audit Committee since March 2015. Mr. Hultquist has served as Chair of the Compensation Committee since 2015. Mr. Hultquist has been a Director of NYSE-listed Kinder Morgan, Inc. (KMI) since December 2014. Prior to the merger of KMI and Kinder Morgan Energy Partners, L.P. (KMP) in November 2014 (the “Merger”), Mr. Hultquist had been a Director of Kinder Morgan G.P., Inc., the General Partner of KMP, since 1999, where he served as Lead Independent Director, Chair of the Compensation Committee and Member of the Audit Committee and Nominating and Governance Committee. He also served as Chair of the Special Committee of Independent Directors of KMP for the $44 billion Merger. KMI has extensive oil and gas operations in the Permian Basin. KMI also operates crude oil and gas liquids pipelines in the Permian Basin and is currently building and operating the Gulf Coast Express Pipeline. From 1995 to 1997, Mr. Hultquist served on the Board of Directors and as Chair of the Audit Committee of OnTrak Systems, Inc. during its IPO and subsequent merger with NASDAQ-listed Lam Research for over $400 million. He also served as board member and advisor to Rodel, Inc. during its acquisition by Rohm and Haas. Mr. Hultquist has also served on the boards of directors of several private companies. From 1986 to 2017, he served as an international investment banker and strategic advisor to public and private corporate clients in the U.S., Europe and Asia, handling corporate financings, mergers and acquisitions. Previously, Mr. Hultquist practiced law in San Francisco and Silicon Valley for over 13 years. Currently, Mr. Hultquist is President of Kriisa Research, Inc., a development-stage company pursuing renewable energy technology for the Energy Harvesting, Internet of Things and Smart Devices markets. Mr. Hultquist holds securities licenses 7, 63 and 24 (General Securities Principal) from FINRA and is a member of the California Bar Association (inactive status). He received his B.S. degree in Accounting-Finance from Northwest Missouri State University and serves as a Director of the Northwest Foundation, Inc., which develops and stewards philanthropic resources for the benefit of the University and its students. He received a J.D. degree from the University of Missouri Law School and attended the George Washington University Law School’s LLM in Taxation program. Additionally, Mr. Hultquist served over four years on active duty as an officer in the U.S. Army, including a tour of duty in Vietnam. In determining Mr. Hultquist’s qualifications to serve on the Board, the Board has considered, among other things his board experience in the energy industry, which includes Board oversight of extensive oil and natural gas operations in the Permian Basin and experience as Chair of a Compensation Committee, Lead Independent Director and Chair of a Special Committee of Independent Directors, his experience and expertise in the legal and finance aspects of the

| 3 |

energy industry, his independence and his performance and contributions during his service to the Board generally and as Chair of the Company’s Compensation Committee.

Janet W. Pasque was appointed to the Board in August 2017. Ms. Pasque has been a member of the Compensation Committee and the Corporate Governance/Nominating Committee since August 2017. Ms. Pasque was identified by members of the Board and executive management as a desirable candidate to the Board based on her extensive industry experience and history with the Company. Ms. Pasque has been involved in various consulting activities related to the energy industry from January 2011 to December 2016. Ms. Pasque was Senior Vice President, Land and Development of the Company from September 2009 to December 2010, and was Vice President–Land of the Company from July 2009 to September 2009. Prior to that time, she was Vice President, Land of Predecessor Resolute since its founding in 2004. Ms. Pasque served as a land consultant from 2003 until the founding of Resolute Holdings in 2004. Following the acquisition of HS Resources by Kerr-McGee in 2001 until 2003, Ms. Pasque managed the land functions at Kerr-McGee Rocky Mountain Corp. From 1993 until the acquisition of the company in 2001, Ms. Pasque was a Vice President of HS Resources where she had responsibility for the land department and joint responsibility for the company’s exploration activities. Prior to joining HS Resources in 1993, Ms. Pasque was a consultant to a privately funded drilling venture focused on exploration in the Rocky Mountain region. Ms. Pasque also worked for Champlin Petroleum Company and Texaco Inc. focused on land acquisitions and drilling agreements in California, Alaska and the Rocky Mountain region. Ms. Pasque received a B.S. in Business Administration with a concentration in Finance and Real Estate from Colorado State University. In determining Ms. Pasque’s qualifications to serve on the Board, the Board considered, among other things, her experience and expertise in land management, business development and the exploration aspects of the oil and gas industry, her diverse and relevant skills, her familiarity with Resolute, her independence and her performance and contributions during her service to Resolute.

William K. White was elected to the Board in April 2014. Mr. White has been a member of the Compensation Committee and the Corporate Governance/Nominating Committee since April 2014, and a member of the Audit Committee since March 2015. Mr. White, a retired oil and gas executive, also serves as Chairman of the Audit Committee and Audit Committee financial expert. Since April 17, 2017, Mr. White has served on the Board of Directors of Vantage Energy Acquisition Corp. (“VEAC”) and as a member of the Audit Committee and Chairman of the Compensation Committee. VEAC is a Special Purpose Acquisition Company formed to acquire oil and gas assets and/or entities. He was a Director of the General Partner of Eagle Rock Energy Partners, L.P. from October 2006 to October 2015, at which time the company was merged into another entity. While a Director of Eagle Rock, he served as Chairman of the Audit Committee and was a member of the Compensation and Conflicts committees at several points in time. In December 2012, Mr. White joined the Board of Directors of NGP Capital Resource Company as an Independent Director, where he also served on the Compensation, Audit, Conflicts and Nominating and Governance Committees. In the fourth quarter of 2014, NGP Capital Resource Company changed investment managers and Mr. White, along with the existing directors, resigned from the Board of Directors as part of the transaction. From September 1996 to November 2002, Mr. White was Vice President, Finance and Administration and Chief Financial Officer for Pure Resources, Inc., an NYSE-listed independent oil and gas producer. In determining Mr. White’s qualifications to serve on the Board, the Board has considered, among other things, his experience and expertise in oil and gas finance, accounting and banking, as well as his previous senior executive officer and director positions at several public oil and gas companies.

Theodore Gazulis has been Executive Vice President and Chief Financial Officer since March 2012, was Senior Vice President and Chief Financial Officer of the Company from September 2009 to March 2012, and was Vice President of Finance, Chief Financial Officer and Treasurer of the Company from July 2009 to September 2009. He was Vice President—Finance, Chief Financial Officer, Treasurer and Assistant Secretary of Predecessor Resolute since their founding in 2004. Mr. Gazulis served as a Vice President of HS Resources from 1984 until its merger with Kerr-McGee Corporation in 2001. Mr. Gazulis had primary responsibility for HS Resources’ capital markets activity and for investor relations and information technology. Subsequent to HS Resources’ acquisition by Kerr-McGee Corporation and prior to the formation of Predecessor Resolute, Mr. Gazulis was a private investor and also undertook assignments with two privately-held oil and gas companies. Prior to joining HS Resources, he worked for Amoco Production Company and Sohio Petroleum Company. Mr. Gazulis received an AB with Distinction from Stanford University and an MBA from the UCLA Anderson Graduate School of Management. Mr. Gazulis is a member of the American Association of Petroleum Geologists.

| 4 |

Michael N. Stefanoudakis has been Executive Vice President, Corporate Development/Strategy, General Counsel and Secretary since November 1, 2017 and prior to that time was Executive Vice President, General Counsel and Secretary since February 7, 2017. From July 2010 to February 6, 2017, he served as Senior Vice President, Secretary and General Counsel of the Company. From April 2009 until June 2010, Mr. Stefanoudakis served as Senior Vice President, Secretary and General Counsel of StarTek, Inc., an NYSE-listed company in the business processing outsourcing industry. From 2006 to 2008, Mr. Stefanoudakis was Vice President and General Counsel at BioFuel Energy Company, a NASDAQ-listed company in the ethanol production industry. From 2004 to 2006, Mr. Stefanoudakis served as Vice President and General Counsel of Patina Oil & Gas Corporation, an NYSE listed oil and gas exploration company, until its merger with Noble Energy, Inc. Prior to his public company experience, Mr. Stefanoudakis spent eight years as a practicing attorney, most recently at the legal firm Hogan & Hartson LLP (now Hogan Lovells). Mr. Stefanoudakis graduated from the University of San Diego with a B.A. in Economics in 1993 and from Harvard Law School with a J.D. in 1996. He is admitted to the practice of law in Colorado and is a member of local, state and national bar associations.

Bob D. Brady, Jr. has been Executive Vice President, Operations of the Company since November 1, 2017, and prior to that was Senior Vice President, Operations since May 2015. From June 2010 until May 2015, Mr. Brady held the position of Vice President and served as the Company’s Operations Manager from March 2006 until May 2010. Mr. Brady previously served as Drilling Manager and Engineer for El Paso Production Company and Medicine Bow Energy Corporation (acquired by El Paso) from February 2004 until March 2006. Mr. Brady was Vice President of Engineering and Operations for Double Eagle Petroleum Company from April 2002 until February 2004. Prior to working for Double Eagle, Mr. Brady was Operations Manager for Prima Oil & Gas Company from November 2000 until April 2002. Prior to working for Prima, Mr. Brady was Vice President of Engineering and Operations for Evergreen Operating Company. He has 34 years of experience in oil and gas industry operations. He graduated from the Colorado School of Mines in 1984 with a Bachelor of Science degree in Petroleum Engineering. He has been a member of the Society of Petroleum Engineers since 1982.

James A. Tuell has been Senior Vice President and Chief Accounting Officer of the Company since May 2015, and prior to that was Vice President and Chief Accounting Officer since June 2010. From December 2009 until May 2010, Mr. Tuell served as the Company’s Interim Chief Accounting Officer. Prior to joining Resolute, Mr. Tuell owned and operated an accounting and finance consultancy which served Resolute and numerous other independent energy companies from January 2009 through December 2009 and from July 2001 to February 2004. Mr. Tuell served as a director of Infinity Energy Resources, Inc. from April 2005 until June 2008. He also served in various officer capacities with Infinity Energy Resources, Inc. from March 2005 through August 2007, including as President, Chief Operating Officer, Chief Executive Officer, Principal Financial and Accounting Officer and Executive Vice President. Mr. Tuell also served as President of Infinity Oil & Gas of Wyoming, Inc. and Infinity Oil and Gas of Texas, Inc., wholly-owned subsidiaries of Infinity Energy Resources, Inc., from February 2004 and June 2004, respectively, until May 2007. From 1996 through July 2001, Mr. Tuell served as Controller and Chief Accounting Officer of Basin Exploration, Inc. From 1994 through 1996, he served as Vice President and Controller of Gerrity Oil & Gas Corporation. Mr. Tuell was employed by the independent accounting firm of Price Waterhouse from 1981 through 1994, most recently as a Senior Audit Manager. He earned a B.S. in accounting from the University of Denver and is a certified public accountant.

Family Relationships

There are no family relationships among any of the Company’s directors and executive officers.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of our Common Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock. To our knowledge, based solely on a review of the copies of such reports available to us and written representations from our executive officers and directors that no other reports were required, we believe that all reporting obligations of our officers, directors and greater than ten percent stockholders under Section 16(a) were satisfied during the year ended December 31, 2017.

| 5 |

CODE OF ETHICS

The Company has adopted a code of ethics that applies to its directors, officers and employees that complies with the rules and regulations of the NYSE and the SEC. The Company’s Code of Business Conduct and Ethics is posted on the Company’s website, at www.resoluteenergy.com, under the “Investor Relations” tab, subheading “Corporate Governance.” All amendments to, and waivers granted under, the Company’s code of ethics will be disseminated on the Company’s website in the manner required by SEC and NYSE rules.

CORPORATE GOVERNANCE

General

The Company’s business is managed under the direction the Board. In connection with its oversight of the Company’s operations and governance, the Board has adopted, among other things, the following:

| • | Corporate Governance Guidelines to implement certain policies regarding the governance of the Company; |

| • | a Code of Business Conduct and Ethics to provide guidance to directors, officers and employees with regard to certain ethical and compliance issues; |

| • | Charters of the Audit Committee, the Compensation Committee, and the Corporate Governance/Nominating Committee of the Board; |

| • | an Insider Trading Policy to facilitate compliance with insider trading regulations; |

| • | an Audit Committee Whistleblower Policy (i) to allow directors, officers and employees to make confidential anonymous submissions regarding concerns with respect to accounting or auditing matters and (ii) which provides for the receipt of complaints regarding accounting, internal controls or auditing; and |

| • | a Stockholder and Interested Parties Communications Policy pursuant to which holders of our securities and other interested parties can communicate with the Board, Board Committees and/or individual directors. |

Other than the Insider Trading Policy, each of these documents can be viewed on the Company’s website, at www.resoluteenergy.com, under the “Investor Relations” tab, subheading “Corporate Governance.” The Company’s website and the information contained on or connected to its website are not incorporated by reference herein and its web address is included as an inactive textual reference only. Copies of the foregoing documents and disclosures are available without charge to any person who requests them. Requests should be directed to Resolute Energy Corporation, Attn: Secretary, 1700 Lincoln Street, Suite 2800, Denver, Colorado 80203.

The Board meets regularly to review significant developments affecting the Company and to act on matters requiring its approval. The Board held sixteen meetings in 2017 and acted an additional seven times by written consent. No director attended fewer than 75% of the total number of meetings of the Board and committees on which he or she served during his or her period of service in 2017.

Directors are encouraged, but not required, to attend the annual meeting of stockholders. Messrs. Sutton, Betz (in his capacity as an executive officer) and Piccone attended the 2017 annual stockholders’ meeting, and Messrs. Duffy, Hicks, Hultquist and White participated telephonically.

Board Committees

The composition and primary responsibilities of the Audit Committee, the Compensation Committee and the Corporate Governance/Nominating Committee are described below.

| 6 |

Audit Committee

The Company has a separately designated Audit Committee, the members of which are Messrs. Hultquist, Duffy, Benton and White, with Mr. White serving as Chairman. The primary function of the Audit Committee is to assist the Board in its oversight of the Company’s financial reporting process. Among other things, the committee is responsible for overseeing our internal audit function and our oil and gas reserve determination process, reviewing and selecting our independent registered public accounting firm and reviewing our accounting practices and policies, and to serve as an independent and objective party to monitor the financial reporting process. The Board has determined that each of Messrs. Hultquist, Duffy, Benton and White qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC Regulation S-K and that each member of the committee is independent under applicable NYSE rules and for purposes of SEC Rule 10A-3, and “financially literate” for purposes of applicable NYSE rules. See “Directors and Executive Officers” for a summary of the business experience of each member of the committee. During 2017, the Audit Committee held seven meetings.

Compensation Committee

The Company has a separately designated Compensation Committee, which currently consists of Ms. Pasque and Messrs. Duffy, Hultquist, Benton and White, with Mr. Hultquist serving as Chairman. The Compensation Committee’s primary function is to discharge the Board’s responsibilities relating to the compensation of our Chief Executive Officer and to make recommendations to the Board regarding the compensation of our other executive officers. Among other things, the committee reviews and approves corporate goals and objectives for setting Chief Executive Officer compensation, evaluates the performance of the Chief Executive Officer in light of those goals and objectives and sets the compensation of the Chief Executive Officer and the Executive Chairman. In February 2012, the Compensation Committee initially engaged Longnecker and Associates (“L&A”) as its independent compensation consultant and L&A remains in that capacity currently. The Board has determined that each member of the committee is (i) independent under applicable NYSE rules, (ii) a “non-employee director” as defined in Rule 16b-3 under the Exchange Act and (iii) other than Ms. Pasque, an “outside director” as defined in Section 162(m) of the Internal Revenue Code (the “Code”). During 2017, the Compensation Committee held nine meetings and acted one time by written consent.

Corporate Governance/Nominating Committee

The Company has a separately designated Corporate Governance/Nominating Committee, the current members of which are Ms. Pasque and Messrs. Hicks, Hultquist and White, with Mr. Hicks serving as Chairman. The primary function of the Corporate Governance/Nominating Committee is (i) to assist the Board with identifying, evaluating and recommending to the Board qualified candidates for election or appointment to the Board, (ii) reviewing, evaluating and recommending changes to the Company’s corporate governance guidelines and (iii) monitoring and overseeing matters of corporate governance, including the evaluation of Board and management performance and the “independence” of directors. The Board has determined that each member of the committee is independent under applicable NYSE rules. During 2017, the Corporate Governance/Nominating Committee held eight meetings and acted one time by written consent.

Director Nominations

The charter of the Corporate Governance/Nominating Committee provides that director candidates recommended by security holders will be considered on the same basis as candidates recommended by other persons. A security holder who wishes to recommend a candidate should send complete information regarding the candidate to Resolute Energy Corporation, Attn: Secretary, 1700 Lincoln Street, Suite 2800, Denver, Colorado 80203. The information provided with respect to the nominee should include five years of professional background, academic qualifications, whether the nominee has been subject to any legal proceedings in the past ten years, the relationship between the security holder and the nominee, and any other specific experience, qualifications, attributes or skills that qualify the nominee for the Board. The committee will assess each candidate, including candidates recommended by security holders, by evaluating all factors it considers appropriate, which may include career specialization, relevant technical skills or financial acumen, diversity of viewpoint and industry knowledge. The charter provides that nominees must meet certain minimum qualifications. In particular, a nominee must:

| • | have displayed the highest personal and professional ethics, integrity and values and sound business judgment; |

| 7 |

| • | be highly accomplished in his or her field, with superior credentials and recognition and broad experience at the administrative or policy-making level in business, government, education, technology or public interest; |

| • | have relevant expertise and experience and be able to offer guidance and advice to the chief executive officer based on that expertise and experience; |

| • | with respect to a majority of directors, be independent and able to represent all stockholders and be committed to enhancing long-term stockholder value; and |

| • | have sufficient time available to devote to the activities of the Board and to enhance his or her knowledge of the Company’s business. |

The committee does not have a formal policy with respect to the consideration of diversity when assessing director nominees, but considers diversity as part of its overall assessment of the Board’s functioning and needs.

Non-Management Sessions

The Board generally schedules regular executive sessions involving exclusively non-management directors, as required by NYSE rules, generally at the time of each in-person Board meeting. Our Lead Independent Director presides at all such executive sessions. Mr. Duffy is our Lead Independent Director.

Stockholder and Interested Parties Communications Policy

In recognition of the importance of providing all interested parties, including but not limited to the holders of Resolute securities, with the ability to communicate with members of the Board, including non-management directors, the Board has adopted a Stockholder and Interested Parties Communications Policy, a copy of which is available on our website at www.resoluteenergy.com. Pursuant to the policy, interested parties may direct correspondence to the Board, or to any individual director and the Lead Independent Director by mail to the following address: Resolute Energy Corporation, Attn: Lead Independent Director, 1700 Lincoln Street, Suite 2800, Denver, CO 80203.

Communications should not exceed 1,000 words in length and should indicate (i) the type and amount of Resolute securities held by the person submitting the communication, if any, the date of acquisition of such and/or the nature of the person’s interest in Resolute, (ii) any personal interest the person has in the subject matter of the communication and (iii) the person’s mailing address, e-mail address and telephone number. Unless the communication relates to an improper topic (e.g., it contains offensive content or advocates that we engage in illegal activities) or it fails to satisfy the procedural requirements of the policy, we will deliver it to the person(s) to whom it is addressed.

Stockholder Proposals

Any proposal that a stockholder wishes to include in proxy materials for our 2019 annual meeting of stockholders must be received no later than 120 days before the date of the Company’s proxy statement released to stockholders in connection with the Company’s 2018 annual meeting, and must be submitted in compliance with SEC Rule 14a-8. Proposals should be directed to Resolute Energy Corporation, Attn: Secretary, 1700 Lincoln Street, Suite 2800, Denver, CO 80203.

Any proposal or nomination for director that a stockholder wishes to propose for consideration at the 2019 annual meeting of stockholders, but does not seek to include in our proxy statement under applicable SEC rules, must be submitted in accordance with Section 2.7 or 3.2, as applicable, of our bylaws, and must be received by the Secretary at the principal executive offices of the Company not later than the close of business on the 90th day nor earlier than the opening of business on the 120th day before the anniversary date of the immediately preceding annual meeting of stockholders; provided, however, that if the annual meeting is called for a date that is not within 45 days before or after such anniversary date, notice by the stockholder to be timely must be so received not earlier than the opening of business on the 120th day before the meeting and not later than the later of (x) the close of

| 8 |

business on the 90th day before the meeting or (y) the close of business on the 10th day following the day on which public announcement of the date of the annual meeting is first made by the Company. All such proposals must be an appropriate subject for stockholder action under applicable law and must otherwise comply with our bylaws.

Board Leadership Structure and Risk Management

The Board currently consists of eight directors, all of whom, other than Messrs. Sutton and Betz, have been determined to be “independent directors” under the rules of the NYSE. Mr. Sutton has served as Chairman of the Board since the Company became a public company in September 2009. Mr. Sutton was also Chief Executive Officer until December 31, 2016. Effective January 1, 2017, Mr. Sutton retired from the position of Chief Executive Officer and Mr. Betz was appointed to that position. Mr. Sutton is currently Executive Chairman and presides over meetings of the Board of Directors. Mr. Sutton was Chairman and Chief Executive Officer of Predecessor Resolute from its inception in 2004, and was instrumental in the completion of the Resolute Transaction. He is most familiar with the Company’s properties and, based on his years as chairman and chief executive officer of HS Resources from 1987 to 2001, has demonstrated skills in building and leading a public oil and gas company. Accordingly, the Board believes that he is uniquely qualified to be the person who sets the agenda for, and leads discussion of, strategic issues for the Company. Our Lead Independent Director presides over executive sessions of the independent directors, which generally occur at the time of each in-person Board meeting, and also presides over any Board meetings at which Mr. Sutton is not present. The Lead Independent Director reviews agendas for Board meetings, reviews annual goals and objectives for the Company and consults with the Board and the Compensation Committee regarding their evaluation of the performance of the Chief Executive Officer. The Board believes that its supermajority of independent directors and other aspects of its governance provide appropriate independent oversight to Board decisions.

The Board oversees the risks involved in the Company’s operations as part of its general oversight function, integrating risk management into the Company’s compliance policies and procedures. While the Board has the ultimate oversight responsibility for the risk management process, the Audit Committee has certain specific responsibilities relating to risk management. Among other things, the Audit Committee, pursuant to its charter, addresses Company policies with respect to risk assessment and risk management, and reviews major risk exposures (whether financial, operating or otherwise) and the guidelines and policies that management has put in place to govern the process of assessing, controlling, managing and reporting such exposures. While the charters of the Compensation and Corporate Governance/Nominating Committees do not assign specific risk-related responsibilities to those committees, the committees nevertheless consider risk and risk management issues in the course of performing their duties with respect to compensation and governance issues, respectively.

| 9 |

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis is designed to provide insight into our compensation philosophy, practices, plans and decisions. This Compensation Discussion and Analysis (“CD&A”) is intended to be read in conjunction with the tables beginning on page 29, which provide detailed historical compensation information for the Company’s Named Executive Officers (“NEOs”). For 2017, our NEOs were:

| Name | Title | |

| Richard F. Betz | Chief Executive Officer | |

| James M. Piccone(1) | President | |

| Theodore Gazulis | Executive Vice President, Chief Financial Officer | |

| Michael N. Stefanoudakis(2) | Executive Vice President, Corporate Development/Strategy, General Counsel and Secretary | |

| Bob D. Brady, Jr.(3) | Executive Vice President, Operations |

| (1) | In connection with the previously disclosed Aneth Disposition, on January 1, 2018 Mr. Piccone resigned from his position as President and as a member of the Board of Directors of the Company and from all other officer and board positions of the Company’s subsidiaries. |

| (2) | Effective November 1, 2017, Mr. Stefanoudakis’ title changed to Executive Vice President, Corporate Development/Strategy, General Counsel and Secretary. |

| (3) | Effective November 1, 2017, Mr. Brady was promoted from Senior Vice President, Operations to Executive Vice President, Operations. |

Executive Summary

Operational, Financial and Strategic Achievements for 2017

Among Resolute’s operational, financial and strategic accomplishments for 2017, the Company achieved the following material items that were all considered by the Compensation Committee and the Board in determining 2017 performance under its short-term incentive plan and in setting compensation for 2018:

| • | Production. Full year production for 2017 increased 77% to 9,156 MBoe, or 25,086 Boe per day, from the 5,182 MBoe, or 14,157 Boe per day, during 2016. Full year production was approximately at the midpoint of the Company’s updated guidance, as announced on November 6, 2017. |

| • | Operational Results. Resolute drove production growth in 2017 with its successful drilling program in the Delaware Basin targeting the Wolfcamp formation, increasing its development pace with the addition of a second rig focused on high rate of return horizontal drilling. The Company completed drilling operations on 25 wells and had an additional three wells drilling over year end, compared to an original plan which called for the drilling of 22 wells during the year. Resolute expanded its 2017 drilling program using essentially the same number of rig days, demonstrating the efficiencies its operations team was able to achieve over the course of the 2017 drilling program. During 2017, the Company set spud to total depth records of 14 days for mid length laterals in Mustang and 17 days for long laterals in Appaloosa. During 2017, the Company completed and placed on production 27 wells including six drilled but uncompleted wells acquired in the Delaware Basin Bronco Acquisition (described below). Over the course of the year initial peak 24 hour rates on the Company’s Wolfcamp A and Upper B wells averaged between 2,400 and 2,800 barrels equivalent per day. |

| • | Adjusted EBITDA Growth. During 2017, as a result of higher production volumes and improved commodity prices, Resolute generated $172.8 million of Adjusted EBITDA (a non-GAAP measure—see “Reconciliation |

| 10 |

of Non-GAAP Measures” below), a 23% increase from the prior year period during which Resolute generated $140.8 million of Adjusted EBITDA.

| • | LOE and G&A. Resolute was below the midpoint of its updated guidance for lease operating expense at $79.3 million for 2017, or $8.66 per Boe, down 30% from 2016 at $12.29 per Boe. |

Cash-based general and administrative expense (a non-GAAP measure—see “Reconciliation of Non-GAAP Measures” below) for 2017 was $29.9 million or $3.27 per Boe, down 36% from 2016 at $5.13 per Boe (excluding one-time costs associated with the Aneth Disposition).

| • | Reserves. Year-end 2017 estimated proved reserves were 53.4 MMBoe, compared to year-end 2016 proved reserves of 60.3 MMBoe, after reducing proved reserves by 23.0 MMBoe for dispositions in Aneth and New Mexico and 9.1 MMBoe for production during 2017. Permian Basin reserves grew by 51% from 35.4 MMBoe to 53.4 MMBoe as a direct result of Resolute’s successful Delaware Basin drilling program. |

| • | Aneth Disposition. In November 2017, the Company successfully transformed to a Permian Basin pure-play company when it closed the sale of its Aneth Field properties located in the Paradox Basin in Southeast Utah (the “Aneth Disposition”) for total consideration of up to $195 million, comprised of $160 million, and up to an additional $35 million if oil prices exceed certain levels in the three years following the closing. |

| • | Delaware Basin Bronco Acquisition. In May 2017, Resolute acquired from CP Exploration II, LLC and Petrocap CPX, LLC certain producing and undeveloped oil and gas properties in the Delaware Basin in Reeves County, Texas (the “Delaware Basin Bronco Acquisition”). The Company acquired these properties for $161.3 million, which it financed substantially with proceeds received from the Incremental Senior Notes (described below). The acquired properties significantly expanded the Company’s footprint in the core of its Wolfcamp development program, including approximately 4,600 net acres in Reeves County, Texas, which were considered predominantly unproved, consisting of 2,187 net acres adjacent to the Company’s existing operating area in Reeves County and 2,400 net acres in southern Reeves County. |

| • | Senior Notes Offering. In May 2017, Resolute consummated a private placement of senior notes totaling $125 million aggregate principal amount of the Company’s 8.50% incremental senior notes due 2020 (the “Incremental Senior Notes”). The net proceeds of the offering of the Incremental Senior Notes were approximately $125.1 million and were used in part to fund the Delaware Basin Bronco Acquisition. |

| • | Midstream Transaction. In April 2017, Resolute consummated a series of related agreements with Caprock Midstream, LLC and its affiliates (“Caprock”), pursuant to which Caprock agreed to construct gathering systems, pipelines and other infrastructure for the gathering of crude oil from the Company’s Mustang and Appaloosa operating areas in exchange for customary fees based on the volume of crude oil produced and delivered. Resolute agreed to dedicate and deliver all crude oil produced from its acreage in Mustang and Appaloosa to Caprock for gathering for a term through July 31, 2031, coterminous with our other commercial agreements with Caprock. |

| • | Closing of New Mexico Asset Sale. In February 2017, Resolute closed on the sale of its Denton and South Knowles properties in the Northwest Shelf project area in Lea County, New Mexico, for approximately $14.5 million in cash, subject to customary purchase price adjustments. The sale of these assets in New Mexico, as well as the sale of the Utah assets in the Aneth Disposition, helped to significantly improve the Company’s cost structure and strengthen its balance sheet. |

| • | Retirement of Second Lien Credit Facility. From a portion of the proceeds from the Company’s Common Stock offering that closed in December 2016, in January 2017, Resolute paid approximately $132 million constituting all amounts due under the Company’s Secured Term Loan Facility (including prepayment fees of $3.5 million). |

| 11 |

Our Compensation Programs in 2017

Following a year of strong operational performance in 2016, a more stable commodity price environment, and in order to retain key employees and properly incentivize executives in the highly competitive market for talent in which the Company operates, the Board of Directors and Compensation Committee approved two primary changes for 2017 from our 2016 compensation program:

| • | Reset annual short-term incentive (“STI”) targets and long-term incentive (“LTI”) targets for its NEOs and other senior employees to market competitive levels consistent with the Company’s compensation philosophy and based upon the recommendations of L&A. |

| • | Reinstated grants of time-vested and performance-vested restricted stock for our LTI program and discontinued the use of long-term cash awards. |

Our Executive Compensation Practices

Below we highlight certain executive compensation practices, both the practices we have implemented to drive performance, and the practices we have not implemented because we do not believe they would serve our stockholders’ interests.

| Compensation Best Practices Resolute Follows | |

|

Pay for Performance—We tie pay to performance. A significant portion of total compensation to executives is at risk and not guaranteed. We have established clear financial goals for corporate performance and differentiate based on individual achievement. In establishing goals, we select performance metrics that drive both our short-term and long-term corporate strategy in accordance with our strategic plan. |

|

Conservative Executive Compensation Increases—Historically, the intent of the Committee is to provide overall increases in total compensation for the executives which are well within market appropriate ranges. |

|

External Benchmarking—We use competitive compensation data based on an appropriate group of peers and other relevant survey data to make compensation decisions, including the use of two relevant peer groups for purposes of establishing market compensation levels and evaluating share price performance. |

|

Mitigate Undue Risk—We mitigate undue risk associated with compensation, including utilizing caps on potential payments, retention provisions, multiple performance targets and robust board and management processes to identify risk. |

|

Double Trigger—All employment agreements and incentive award agreements for NEOs and other senior executives require a change in control followed by a termination of employment before cash severance benefits are triggered. |

|

No Perquisites—We do not provide perquisites to our executive officers. All other compensation values included in the Summary Compensation Table are related to cost of benefits. |

|

Regular Review of Share Utilization—We evaluate share utilization by reviewing overhang levels (dilutive impact of equity compensation on our shareholders) and annual run rates (the aggregate shares awarded as a percentage of total outstanding shares). |

|

Equity Ownership Guidelines—We require our directors and executive officers to acquire and maintain prescribed levels of ownership of our stock in order to align their interest with those of our stockholders. |

|

No SERP Program—We do not offer SERPs to our current executives. |

|

Minimum Vesting Requirements—We have instituted minimum vesting requirements for all equity-based compensation awards. |

|

Independent Compensation Consulting Firm—The Compensation Committee benefits from its utilization of an independent compensation consulting firm, Longnecker & Associates (“L&A”), which provides no other services to the Company. |

| 12 |

|

Annual Say on Pay Votes—We hold an annual say on pay vote, and the Compensation Committee considers the results of such non-binding vote in making prospective compensation decisions. |

|

Policies Against Hedging and Pledging Stock—We have policies in place that prohibit our executives and directors from hedging Company securities and prohibit executives and directors from pledging Company securities as collateral for a loan without first obtaining pre-clearance from the Company’s Compliance Officer. |

|

Clawback—“Clawback” provisions are applicable to all NEOs and other senior executives through the terms of their employment agreements. |

| Unfavored Practices Resolute Does Not Follow | |

|

No Excise Tax Gross-Ups Upon Change in Control |

|

No Repricing of Underwater Stock Options |

|

No Hedging Transactions or Short Sales by Executive Officers or Directors Permitted |

|

No Guaranteed Bonus or Retention Bonus for Executive Officers |

|

Severance Multipliers not Greater than 3x for any Executive Officer |

Compensation Philosophy—Resolute Pays for Performance

The core principle of our executive compensation philosophy is to pay for performance. The Company believes that the most effective compensation program is one that rewards all employees, not just executives, for the achievement of short-term and long-term strategic goals that are aligned with the stockholders’ interests. As a result, the Company’s compensation philosophy is to provide all employees with cash incentives or a combination of cash and equity-based incentives that foster the continued growth and overall success of the Company and encourage employees to maximize stockholder value.

The Company implements its executive compensation philosophy through the following specific objectives:

| • | To attract, retain and motivate highly qualified and experienced individuals; |

| • | To provide financial incentives through an appropriate mix of fixed and variable pay components to achieve the organization’s key financial and operational objectives; |

| • | To ensure that a significant portion of total compensation is performance-based compensation; and |

| • | To offer competitive compensation packages that are consistent with the Company’s core values, including the balance of fairness to the individual and the organization, and the demand for commitment and dedication in the performance of the job. |

We consider an inability to attract or retain qualified motivated employees to be a significant risk for the Company as we operate in a highly competitive industry for talent. In approving elements of the compensation program, the Compensation Committee and the Board prefer a balancing of factors, so that no single performance metric becomes an overriding influence. For that reason, the incentive compensation program described below balances a number of metrics. Our STI compensation program measures annual operational performance while our LTI compensation program generally measures relative stock performance over a multi-year period. With respect to performance-vested shares granted under our LTI compensation program, vesting is based on achievement of total

| 13 |

shareholder return goals over a one-, two- and three- year period, in order to discourage a short-term focus at the expense of long-term results by our senior executives, including the NEOs.

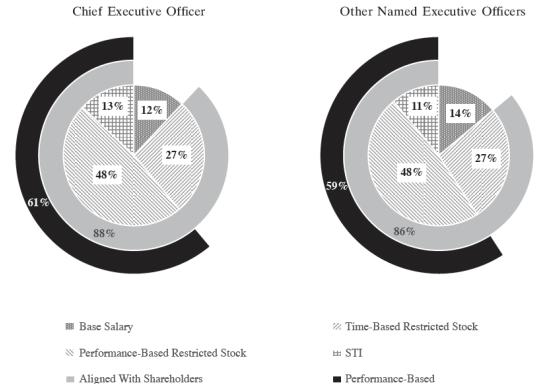

Accordingly, our executive compensation program is heavily weighted toward performance-based compensation. In 2017, 88% of total direct compensation to our CEO was provided through incentive-based compensation, while 86% of NEO compensation was incentive-based, based on compensation information contained in the Summary Compensation Table below.

The following charts display the mix of total compensation components of Resolute for the CEO and the other NEOs in 2017. This includes 2017 base salaries, annual incentive cash bonuses, time and performance-based long-term incentives, and all other compensation. As Resolute is focused on the alignment of the interests of its executives with the interests of stockholders, a significant majority of compensation is provided through incentive-based compensation, with metrics intended to drive long-term Company growth. Any value to be realized by these awards is contingent upon the Company’s operational performance and stock price performance, and as such is both aligned with stockholder interests and “at -risk”.

The chart also displays the performance-based STI and LTI components (including time-vested and performance-vested restricted stock):

2017 TOTAL COMPENSATION MIX

In 2017, the Compensation Committee and the Board established the composition of the long-term incentive grants to the CEO and other NEOs such that 100% of the long-term incentive grants were granted in the form of restricted stock, consisting of a combination of time-vesting restricted stock, performance-vesting restricted stock, and outperformance awards. For the CEO’s and NEOs’ 2017 awards, 50% were in the form of time-vesting restricted stock and 50% performance-vesting restricted stock. We believe the performance-vesting component of the restricted stock awards maintained a substantial “at- risk” portion of CEO and NEO compensation, thereby aligning total compensation to stockholder returns.

| 14 |

Performance in 2017

While the Resolute management team was able to deliver strong operational results in 2017 and accomplish several strategic imperatives, certain of its STI metrics fell below target. When measuring the actual results of metrics specifically assigned to our annual STI Compensation Program, overall performance was above target on LOE (where performance exceeded the stretch level) and was below target with respect to production, G&A expense and capital effectiveness (see tables on page 22). This resulted in an average Company metric performance of approximately 85.3%. The Compensation Committee and the Board took this Company performance into account when assessing individual performance under our STI plan and determined that individual awards for executive officers would also be at approximately 85.3% of target. As a result, STI awards to the NEOs were paid out at 85.3% of target.

Favorable Equity Award Concentration Ratios

Over 51% of our equity awards in each of 2015, 2016 and 2017 were granted to employees other than our NEOs, and grants to our CEO in each of those years comprised less than 20% of the overall awards.

Process for Establishing Executive Compensation

Role of the Board and the Compensation Committee

The Board has the responsibility to maintain an executive compensation program that fairly and appropriately compensates the Company’s executive officers while providing value to the stockholders. This value depends substantially on the performance of our executive officers and other key employees. The loss of any member of the senior management team or other key employees could negatively affect our ability to execute our business strategy. We believe that our key executives have played a vital role in guiding the Company through the volatile commodity price cycle to date and the retention of those key executives is crucial to continue the growth in stockholder value.

The Board also has responsibility for establishing, implementing and continually monitoring adherence with the Company’s compensation philosophy, as described above under “Compensation Philosophy—Resolute Pays for Performance.” The Board has delegated its responsibilities with respect to development of a compensation program and primary implementation of that program to the Compensation Committee, which consists entirely of independent directors and meets regularly (nine times in 2017). The Compensation Committee reviews the Company’s executive compensation programs no less frequently than annually to ensure that the program is consistent with the objectives described above. The Compensation Committee is solely responsible for determining the compensation of the Chief Executive Officer and also makes recommendations to the Board regarding the compensation of the other executive officers. The Compensation Committee has also retained the responsibility for determining the compensation of the Executive Chairman in light of his past service as Chief Executive Officer. The Compensation Committee also makes recommendations to the Board regarding awards under the 2009 Performance Incentive Plan, as amended (the “Incentive Plan”). Generally, the types of compensation and benefits provided to the Company’s executive officers are similar to those provided to the Company’s other officers and employees, although the LTI awards to officers and senior employees are subject to performance requirements not applicable to other employees. The Company does not have any compensation plans that are solely for executive officers.

Importance of Shareholder Feedback

The Company values and carefully considers the feedback it receives from stockholders. At our 2017 annual meeting of stockholders, the compensation of our named executive officers was approved by approximately 87% of the votes cast on that proposal (excluding broker non-votes). We engage in regular discussions with our stockholders on many aspects of our business, including compensation matters. In 2017 we met with several of our largest stockholders and received favorable feedback on our compensation programs. We believe that the reinstatement of STI and LTI target percentages in 2017 was warranted based on our strong operational performance in 2016 and into 2017 as well as the stabilized commodity price environment. We will continue to dedicate significant efforts to ensure our executive compensation programs remain appropriate and properly reward and retain executives for performance, particularly in a volatile commodity price environment, and in a manner consistent with feedback received from stockholders, compensation programs of industry peers and advice from compensation experts.

| 15 |

Role of Management

The Chief Executive Officer plays a key role in determining executive compensation for the other NEOs and other officers. The Chief Executive Officer generally attends the meetings of the Compensation Committee at which executive compensation other than his own is being discussed and makes recommendations to the Compensation Committee. In arriving at his recommendations, the Chief Executive Officer evaluates the performance of each executive and solicits input from the peers of such executives and others, if necessary. This evaluation is shared with the Compensation Committee and forms the basis for his recommendation. These recommendations are considered by the Compensation Committee and the Board, along with other relevant data, in determining the base salary, annual cash incentives, long-term equity incentives, and benefits and perquisites for such executives.

Role of Independent Compensation Consultant

The Compensation Committee has sole authority to select, retain and terminate any compensation consulting firm to assist in deliberations regarding executive compensation. The Compensation Committee has retained L&A since 2012.

L&A provides various executive compensation services to the Compensation Committee. Generally, these services include advising the Compensation Committee on the principles of our executive compensation program and providing market information and analysis regarding the competitiveness of our program design and the compensation awarded in relationship to performance. The NYSE has adopted guidelines for compensation committees to consider when identifying Compensation Committee advisor independence. The Compensation Committee has reviewed these guidelines and determined that L&A is an independent consultant under these guidelines. This independence was confirmed in writing by L&A. L&A performs no services for the Company other than those specific to assignments requested by the Board and Compensation Committee regarding executive and non-employee director compensation. Our management communicates with L&A and provides data to L&A regarding our employees and executive officers, but does not direct L&A’s activities.

During late 2016 and early 2017, the Compensation Committee engaged L&A to assist in providing a comprehensive assessment of our compensation programs for 2017. The Compensation Committee sought advice from L&A regarding base salary, annual bonus, the nature and amount of long-term incentives, performance measures for short-term and long-term incentives, identification of representative peer groups and general market data. Specifically, L&A performed the following services for the Committee:

| • | Conducted an evaluation of the total compensation for our Executive Chairman and Chief Executive Officer; |

| • | Conducted an evaluation of the total compensation for our non-employee directors; |

| • | Conducted an evaluation of the total compensation for our executive officers and a certain number of employees, including our NEOs; |

| • | Advised the Compensation Committee on current trends in executive compensation programs among energy companies in a more stabilized commodity price environment, particularly with respect to the STI and LTI compensation programs; |

| • | Presented information regarding regulatory developments affecting executive compensation programs in our market; |

| • | Assisted with the analysis and selection of peer group companies for compensation purposes; |

| • | Assisted in the development of the structure of the 2017 LTI compensation program; |

| • | Reviewed the annual STI plan; and |

| 16 |

| • | Assisted in the drafting and review of the 2017 Compensation Discussion and Analysis and compensation tables for the annual proxy statement. |

At the conclusion of its work, L&A recommended a continued focus on total direct compensation as a means to achieve the compensation objectives outlined above, while remaining competitive with the external market.

Benchmarking and Peer Group Comparison

Consistent with our goal of providing competitive compensation to incentivize and retain executive talent, the Compensation Committee compares each element of compensation of our NEOs to that of similarly situated executives at peer companies and other companies within our industry that we believe are reflective of our business and with which we compete for talent. When setting executive compensation levels, the Compensation Committee aims to pay base salaries near the midpoint of such peer and industry companies, although adjustments are made for such things as experience, market factors or exceptional performance, among other factors. The Compensation Committee aims to provide a total compensation, including annual incentive compensation and long-term incentive compensation, between the 50th and 75th percentile of total compensation at comparable companies if performance targets are met and at or above the 75th percentile if targets are significantly exceeded.

The Compensation Committee sets the compensation peer group annually based upon the group of companies with which the Company competes for talent, and makes modifications as required to accommodate new companies or consolidations in the oil and gas exploration and production industry in the areas where the Company operates. With the assistance of L&A and management, the Compensation Committee established the following peer group for compensation purposes for 2017:

| 2017 Peer Group | ||||||||||||||

| Company Name | Company Ticker |

Revenue1 | Assets1 | Market Cap1 | Enterprise Value1 | |||||||||

| RSP Permian, Inc. | RSPP | $ | 803.7 | $ | 6,270.2 | $ | 6,451.8 | $ | 7,883.8 | |||||

| Centennial Resource Development, Inc. | CDEV | $ | 429.9 | $ | 3,616.6 | $ | 5,152.5 | $ | 5,520.5 | |||||

| Matador Resources Company | MTDR | $ | 544.3 | $ | 2,145.7 | $ | 3,376.0 | $ | 4,016.4 | |||||

| PDC Energy, Inc. | PDCE | $ | 921.6 | $ | 4,419.9 | $ | 3,367.6 | $ | 4,287.5 | |||||

| Jagged Peak Energy Inc. | JAG | $ | 187.8 | $ | 946.3 | $ | 3,360.0 | $ | 3,391.1 | |||||

| Laredo Petroleum, Inc. | LPI | $ | 822.2 | $ | 2,023.3 | $ | 2,539.2 | $ | 3,959.3 | |||||

| SM Energy Company | SM | $ | 1,129.4 | $ | 6,176.8 | $ | 2,464.7 | $ | 4,928.6 | |||||

| Extraction Oil & Gas, Inc. | XOG | $ | 604.3 | $ | 3,384.7 | $ | 2,462.0 | $ | 3,437.4 | |||||

| Callon Petroleum Company | CPE | $ | 366.5 | $ | 2,693.3 | $ | 2,452.3 | $ | 2,985.8 | |||||

| QEP Resources, Inc. | QEP | $ | 1,622.9 | $ | 7,394.8 | $ | 2,305.7 | $ | 3,547.7 | |||||

| SRC Energy Inc. | SRCI | $ | 326.3 | $ | 2,079.6 | $ | 2,058.6 | $ | 2,263.5 | |||||

| Carrizo Oil & Gas, Inc. | CRZO | $ | 745.9 | $ | 2,778.3 | $ | 1,733.4 | $ | 3,643.1 | |||||

| Halcón Resources Corporation | HK | $ | 378.0 | $ | 1,643.6 | $ | 1,120.9 | $ | 949.3 | |||||

| Resolute Energy Corporation | REN | $ | 303.5 | $ | 641.9 | $ | 695.0 | $ | 1,339.3 | |||||

| Bill Barrett Corporation | BBG | $ | 252.8 | $ | 1,390.7 | $ | 566.2 | $ | 1,079.5 | |||||

| Approach Resources, Inc. | AREX | $ | 105.3 | $ | 1,099.6 | $ | 268.7 | $ | 643.9 | |||||

| (1) | As of 12/31/2017 |

L&A compiled compensation data for the peer group from the summary compensation tables within peer group proxy statements, as well as narrative disclosures in the CD&A sections. The consultant also provided published survey compensation data from multiple sources, including the following surveys: Economic Research Institute, Mercer, Inc. Energy Survey, Kenexa, Towers Watson and L&A’s Energy LTI Survey. For each survey, L&A adjusted the data to appropriately reflect companies of a similar size to the Company.