Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - La Quinta Holdings Inc. | d577980dex314.htm |

| EX-31.3 - EX-31.3 - La Quinta Holdings Inc. | d577980dex313.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36412

La Quinta Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 99-1032961 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

909 Hidden Ridge, Suite 600

Irving, Texas 75038

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 492-6600

Securities registered pursuant to Section 12(b) of the Act:

|

(Title of each class) |

(Name of each exchange on which registered) | |

| Common Stock, $0.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $1,193.0 million (based upon the closing sale price of the common stock on that date on the New York Stock Exchange).

The number of shares of common stock outstanding on April 23, 2018 was 117,246,097.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

La Quinta Holdings Inc. and its subsidiaries (the “Company,” “we,” “us” and “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 10-K”), originally filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2018, to include the information required by Items 10 through 14 of Part III of the 2017 10-K. This information was previously omitted from the 2017 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from the Company’s definitive proxy statement if such statement is filed no later than 120 days after the Company’s fiscal year-end. This Amendment amends and restates in their entirety Items 10, 11, 12, 13 and 14 of Part III of the 2017 10-K and the exhibit index set forth in Part IV of the 2017 10-K and includes certain exhibits as noted thereon. The cover page of the 2017 10-K is also amended to delete the reference to the incorporation by reference of the Company’s definitive proxy statement.

Except as described above, no other changes have been made to the 2017 10-K, and this Form 10-K/A does not modify, amend or update in any way any of the financial or other information contained in the 2017 10-K. This Amendment does not reflect events occurring after the date of the filing of our 2017 10-K, nor does it amend, modify or otherwise update any other information in our 2017 10-K. Accordingly, this Amendment should be read in conjunction with our 2017 10-K and with our filings with the SEC subsequent to the filing of our 2017 10-K.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Form 10-K/A also contains certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto. Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted.

Terms used but not defined herein are as defined in our 2017 10-K.

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

DIRECTORS

Set forth below is certain information regarding each of our current directors as of April 27, 2018.

| Name |

Age |

Principal Occupation and Other Information | ||

| Keith A. Cline | 48 | Keith A. Cline has served as the Company’s President and Chief Executive Officer since February 18, 2016, after serving as the Company’s Interim President and Chief Executive Officer since September 15, 2015. Mr. Cline has served on the Company’s Board of Directors since September 2015. From January 2013 until November 2015, Mr. Cline was the Company’s Executive Vice President and Chief Financial Officer. From 2011 to 2013, prior to joining the Company, Mr. Cline was Chief Administrative Officer and Chief Financial Officer at Charming Charlie, Inc. and, from 2006 to 2011, Mr. Cline was Senior Vice President of Finance at Express, Inc. Mr. Cline began his career at Arthur Andersen & Company and held financial leadership roles at The J.M. Smucker Company, FedEx Custom Critical and Limited Brands. Mr. Cline is a summa cum laude graduate of the University of Akron with a B.S. in Accounting and a M.B.A. in Finance. | ||

| James R. Abrahamson | 62 | James R. Abrahamson has served on the Company’s Board of Directors since November 2015. Mr. Abrahamson is currently the Chairman of Interstate Hotels & Resorts and previously also served as Interstate’s Chief Executive Officer until March 22, 2017. Prior to joining Interstate in 2011, Mr. Abrahamson held senior leadership positions with InterContinental Hotels Group (“IHG”), Hyatt Corporation, Marcus Corporation and Hilton Worldwide. At IHG, where he served from 2009 to 2011, he was President of the Americas division, and at Hyatt, which he joined in 2004, he was Head of Development for the Americas division. At Marcus, where he served from 2000 to 2004, Mr. Abrahamson led the Baymont Inns and Suites and Woodfield Suites hotels division consisting of approximately 200 properties, both owned and franchised. At Hilton, where he served from 1988 to 2000, Mr. Abrahamson oversaw the Americas region franchise and management contract development for all Hilton brands, and he launched the Hilton Garden Inn brand. Mr. Abrahamson currently serves as Chairman of the board of directors of Vici Properties Inc., a real estate investment trust which owns and develops gaming, hospitality and entertainment destinations which was spun-off from a subsidiary of Caesars Entertainment Corporation. Mr. Abrahamson also serves on the board, and is the immediate past chair, of the American Hotel and Lodging Association and the U.S. Travel Association, where he served as board chair in 2013 and 2014. He holds a degree in Business Administration from the University of Minnesota. | ||

| Glenn Alba | 46 | Glenn Alba has served on the boards of directors of certain of our predecessor entities since 2006 and on the Company’s Board of Directors since 2013. Mr. Alba is President of Opterra Capital, which he founded in December 2017. Until July 2017, Mr. Alba was a Managing Director in the Real Estate Group of Blackstone based in New York. At Blackstone, which Mr. Alba joined in 1997, Mr. Alba was involved in the asset management of a broad range of Blackstone’s real estate investments in the US and Europe including office, hotel, multi-family and industrial assets. While based in the London office from 2001 to 2004, Mr. Alba managed a diverse set of assets in London, Paris and other cities in France as well as portfolio investments across Germany. More recently, Mr. Alba was primarily involved in the hotel sector with management responsibility for various full-service and limited service hotels in the LXR Luxury Resorts portfolio in the U.S. as well as global portfolio management duties. Mr. Alba received a B.S. in Accounting from Villanova University. Mr. Alba currently serves as a member of the President’s Advisory Council and the Real Estate Advisory Council at Villanova University. | ||

1

| Name |

Age |

Principal Occupation and Other Information | ||

| Scott O. Bergren | 71 | Scott O. Bergren has served on the Company’s Board of Directors since June 2015. Mr. Bergren served as Chief Executive Officer (CEO) of both Pizza Hut (Global) and Yum! Innovation until his retirement in December 2014. Prior to becoming CEO at Pizza Hut (Global) at the end of 2013, Mr. Bergren served as CEO of Pizza Hut (U.S.) beginning in 2011. He also had served as CEO of Yum! Innovation since 2011. Mr. Bergren has held many roles across Yum! Brands, Inc. since 2002, including President and Chief Concept Officer of Pizza Hut Inc., Chief Marketing & Food Innovation Officer for Kentucky Fried Chicken and Yum! Brands in Louisville and Chief Concept Officer of Yum! Restaurants International in Dallas. Mr. Bergren also served as President of Chevys, Inc., a full-service Mexican casual dining concept, from 1995 to March 2002, first as part of PepsiCo, and then as part of a management-led buyout of the company. Prior to 1995, he built and operated Pizza Hut and Kentucky Fried Chicken restaurants in Mexico and Central America working for Tricon Global Restaurants, Inc.’s International Division. Mr. Bergren has also served as President/CEO of Round Table Pizza and Peter Piper Pizza. He served on the Board of Directors of Buffalo Wild Wings, Inc. until its acquisition by Arby’s Restaurant Group, Inc. in February 2018. He currently serves on the board of directors of Wawa, Inc., a privately held convenience store chain. Mr. Bergren is a graduate of Northwestern University and served as a First Lieutenant in the U.S. Army. | ||

| Alan J. Bowers | 63 | Alan J. Bowers has served on the boards of directors of certain of our predecessor entities since 2013 and on the Company’s Board of Directors since February 2014. Mr. Bowers most recently served as President, Chief Executive Officer and a board member of Cape Success, LLC from 2001 to 2004 and of Marketsource Corporation from 2000 to 2001. From 1995 to 1999, Mr. Bowers served as President, Chief Executive Officer and a board member of MBL Life Assurance Corporation. Mr. Bowers held various positions, including Audit and Area Managing Partner, at Coopers & Lybrand, L.L.P. where he worked from 1978 to 1995 and also worked at Laventhol & Horwath, CPAs from 1976 to 1978. Mr. Bowers also serves on the boards of directors of Ocwen Financial Corporation and Walker & Dunlop, Inc. Mr. Bowers previously served on the board of Quadel Consulting Corp. from July 2005 to June 2015 and on the boards and as audit committee chairman of American Achievement Corp. from August 2006 to March 2016; Refrigerated Holdings, Inc. from January 2009 to April 2013; Roadlink Inc. from February 2010 to April 2013; and Fastfrate Holdings, Inc. from July 2008 to June 2011, each a privately held company. Mr. Bowers holds a B.S. in Accounting, from Montclair State University and an M.B.A., Finance and Economics, from St. John’s University and is a Certified Public Accountant in New Jersey. | ||

| Henry G. Cisneros | 70 |

Henry G. Cisneros has served on the boards of directors of certain of our predecessor entities since 2013 and on the Company’s Board of Directors since February 2014. Mr. Cisneros currently serves as Chairman of the CityView companies, which he joined in 2003. Mr. Cisneros served as the Secretary of the U.S. Department of Housing and Urban Development from 1992 to 1997 and, prior to that, Mr. Cisneros served four terms as Mayor of San Antonio, Texas. Mr. Cisneros has served as President of the National League of Cities, as Deputy Chair of the Federal Reserve Bank of Dallas and is currently an officer of Habitat for Humanity International. Mr. Cisneros is also currently Chairman of the San Antonio Economic Development Foundation and a member of the advisory boards of the Bill and Melinda Gates Foundation and the Broad Foundation. Mr. Cisneros holds a Bachelor of Arts and a Master’s degree in Urban and Regional Planning from Texas A&M University. Mr. Cisneros also holds a Master’s degree in Public Administration from Harvard University and a Doctorate in Public Administration from George Washington University. | ||

2

| Name |

Age |

Principal Occupation and Other Information | ||

| Giovanni Cutaia | 45 | Giovanni Cutaia has served on the Company’s Board of Directors since November 2014. Mr. Cutaia is a Senior Managing Director and Head of Global Asset Management in the Real Estate Group of Blackstone. Prior to joining Blackstone in 2014, Mr. Cutaia was at Lone Star Funds where he was a Senior Managing Director and Co-Head of Commercial Real Estate Investments Americas from 2009 to 2014. Prior to Lone Star, Mr. Cutaia spent over 12 years at Goldman Sachs in its Real Estate Principal Investments Area as a Managing Director in its New York and London offices. Mr. Cutaia received a B.A. from Colgate University and an M.B.A. from the Tuck School of Business at Dartmouth College. | ||

| Brian Kim | 39 | Brian Kim has served on the Company’s Board of Directors since November 2014. Mr. Kim is a Managing Director in the Real Estate Group of Blackstone. Since joining Blackstone in 2008, Mr. Kim has played a key role in a number of Blackstone’s investments including the take private and subsequent sale of Strategic Hotels & Resorts, the acquisition of Peter Cooper Village / Stuyvesant Town and the creation of BRE Select Hotels Corp, Blackstone’s select service hotel platform. Prior to joining Blackstone, Mr. Kim worked at Apollo Real Estate Advisors, Max Capital Management Corp. and Credit Suisse First Boston. Mr. Kim has served as a board member, Chief Financial Officer, Vice President and Managing Director of BRE Select Hotels Corp since May 2013 and as Head of Acquisitions and Capital Markets of Blackstone Real Estate Income Trust, Inc. since January 2017. Mr. Kim received an AB in Biology from Harvard College where he graduated with honors. | ||

| Mitesh B. Shah | 48 | Mitesh B. Shah has served on the boards of directors of certain of our predecessor entities since 2013 and on the Company’s Board of Directors since February 2014. He has served as Chairperson of the Company’s Board of Directors since November 2014. Mr. Shah currently serves as Chief Executive Officer and Senior Managing Principal of Noble Investment Group, which he founded in 1993 and which specializes in making opportunistic investments in the lodging and hospitality real estate sector. Mr. Shah is a member of the franchise and owners board for Hyatt Hotels Corporation and is a member of the Industry Real Estate Finance Advisory Council of the American Hotel and Lodging Association. Mr. Shah is serving his third term as a member of the Board of Trustees of Wake Forest University. In addition, he is an executive committee member of Woodward Academy. Mr. Shah holds a Bachelor of Arts in Economics from Wake Forest University. | ||

| Gary M. Sumers | 65 | Gary M. Sumers has served on the Company’s Board of Directors since February 2014. Mr. Sumers was most recently a Senior Managing Director and Chief Operating Officer in the Real Estate Group of Blackstone. From joining Blackstone in 1995 until his retirement at the end of 2013, Mr. Sumers’ activities included heading Blackstone Real Estate Advisors’ (BREA) Strategic Asset Management Group, oversight of all financial reporting activities and responsibility for the property disposition activities. From 1993 to 1995, Mr. Sumers was Chief Operating Officer of General Growth Properties, a publicly traded regional mall REIT. Mr. Sumers also serves on the Washington University board of trustees as well as the Washington University Investment Committee Board of Directors. Mr. Sumers received an A.B. from Washington University in St. Louis, received his law degree from Northwestern University and attended the London School of Economics. | ||

3

EXECUTIVE OFFICERS

Set forth below is certain information regarding each of our current executive officers as of April 27, 2018 other than Keith A. Cline, whose biographical information is presented under “Directors” above.

| Name |

Age |

Principal Occupation and Other Information | ||

| John W. Cantele | 57 | John W. Cantele has served as the Company’s Executive Vice President and Chief Operating Officer since April 25, 2016. Prior to joining the Company, Mr. Cantele was most recently Global Head, Select Hotels at the Hyatt Hotel Corporation, where he had served since 2011. In his role as Global Head, Select Hotels, Mr. Cantele managed Hyatt’s owned select service hotels, oversaw Hyatt’s franchised hotels operating under the Hyatt House, Hyatt Place and Summerfield Suites brands and was responsible for corporate operations, sales, revenue management and product design. At Hyatt, he also served in the roles of Senior VP, Select Hotels and Senior VP, Hyatt Summerfield Suites/Hyatt House. Prior to that, from 2000 to 2011, Mr. Cantele served as Senior VP of Operations/Partner at LodgeWorks Hotel Corporation. Beginning in 1988, Mr. Cantele served first as General Manager/Director of Sales, Multi-Property and then as VP of Operations of Summerfield Suites Hotels. He remained with Summerfield Suites Hotels through its acquisition by Wyndham International, Inc., where he continued in the role of VP of Operations from 1998 to 2000. Mr. Cantele graduated from the University of Wisconsin at Stout with a B.S. in hospitality management. | ||

| Julie M. Cary | 52 | Julie M. Cary joined La Quinta in 2006 as Executive Vice President and Chief Marketing Officer. Prior to joining the Company, from 2004 to 2006, Ms. Cary served as Vice President at Brinker International, as Vice President of Marketing at Dean Foods from 2003 to 2004, as Senior Manager of Marketing until promoted to Vice President of Marketing at Gerber Products Company from 1998 to 2003 and as Assistant Brand Manager until promoted to Brand Manager at Ralston Purina from 1991 to 1997. Ms. Cary holds an M.B.A. from Washington University and a bachelor’s degree in business administration from the University of Illinois. | ||

| Mark M. Chloupek | 46 | Mark M. Chloupek joined La Quinta as Executive Vice President and General Counsel in 2006 and was named Secretary in 2013. Prior to joining the Company, from 1999 through 2006, Mr. Chloupek served as Vice President and Senior Vice President and Chief Counsel of Operations for Wyndham International, Inc. Prior to joining Wyndham, from 1996 to 1999, Mr. Chloupek worked for Locke Lord LLP (formerly Locke Purnell Rain Harrell—a professional corporation), a Dallas-based law firm. Additionally, Mr. Chloupek currently serves on the board of the Dallas Chapter of the Juvenile Diabetes Research Foundation and formerly served on the board of The Texas General Counsel Forum. Mr. Chloupek received a B.A. in economics from the College of William and Mary, where he graduated Phi Beta Kappa and summa cum laude, and received a J.D. from the University of Virginia School of Law. | ||

| James H. Forson | 51 | James H. Forson has served as the Company’s Executive Vice President, Chief Financial Officer and Treasurer since February 2016. He previously served as the Company’s Interim Chief Financial Officer from November 2015 until February 2016 and as Senior Vice President, Chief Accounting Officer and Treasurer from 2012 until February 2016. Prior to that role, Mr. Forson was Vice President and Controller from 2010, when he joined La Quinta, to 2012 and also served as Acting Chief Financial Officer from 2012 to 2013. Prior to joining La Quinta, Mr. Forson was Audit Senior Manager with Grant Thornton LLP from 2006 through 2010. Mr. Forson graduated from the University of Virginia’s McIntire School of Commerce with a B.S. degree in Commerce with distinction, and is a Certified Public Accountant in Texas. | ||

| Rajiv K. Trivedi | 55 | Rajiv K. Trivedi joined La Quinta in 2000 and has served as the Company’s Executive Vice President since 2006 and as Executive Vice President and Chief Development Officer since 2009. Prior to joining us, from 1992 to 2000, Mr. Trivedi served as Vice President of Franchise Operations at Cendant Corporation and in a variety of key management roles in the hotel industry, including Cendant Corporation. Mr. Trivedi currently serves on the board and is a member of the real estate committee of Children’s Medical Center of Dallas. He is active in numerous civic and industry organizations including the Asian American Hotel Owners Association (AAHOA). Mr. Trivedi graduated from the Maharaja Sayajirao University of Baroda with an M.S. in Math and Business. | ||

4

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires executive officers and directors, a company’s chief accounting officer and persons who beneficially own more than 10% of a company’s common stock, to file initial reports of ownership and reports of changes in ownership with the SEC and the NYSE. Executive officers, directors, the chief accounting officer and beneficial owners with more than 10% of our common stock are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of copies of such reports and written representations from our executive officers, directors and Blackstone, we believe that our executive officers, directors and Blackstone complied with all Section 16(a) filing requirements during 2017.

CORPORATE GOVERNANCE

Our Board of Directors manages or directs our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board of Directors and four standing committees: the Audit Committee; the Compensation Committee; the Nominating and Corporate Governance Committee; and the Real Estate Committee.

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance include:

| • | our Board of Directors is not classified and each of our directors is subject to re-election annually; |

| • | under our Bylaws and our Corporate Governance Guidelines, directors (other than directors designated pursuant to the stockholders’ agreement) who fail to receive a majority of the votes cast in uncontested elections will be required to submit their resignation to our Board of Directors; |

| • | we have fully independent Audit, Compensation and Nominating and Corporate Governance Committees and our independent directors meet regularly in executive sessions without the presence of our corporate officers or non-independent directors; |

| • | we do not have a stockholder rights plan, and if our Board of Directors were ever to adopt a stockholder rights plan in the future without prior stockholder approval, our Board of Directors would either submit the plan to stockholders for ratification or cause the rights plan to expire within one year; and |

| • | we have implemented a range of other corporate governance best practices, including placing limits on the number of directorships held by our directors to prevent “overboarding” and implementing a robust director education program. |

The stockholders’ agreement described under “Transactions with Related Persons—Stockholders’ Agreement” provides that Blackstone has the right to nominate to our Board of Directors a number of designees approximately equal to the percentage of voting power of all shares of our capital stock entitled to vote generally in the election of directors as collectively beneficially owned by Blackstone. Currently, we have three directors on our Board who are current or former employees of Blackstone and who were recommended by Blackstone as director nominees pursuant to the stockholders’ agreement (Messrs. Alba, Cutaia and Kim), and we have one director on our Board who is a retired employee of Blackstone (Mr. Sumers). The provisions of the stockholders’ agreement regarding the nomination of directors will remain in effect until Blackstone is no longer entitled to nominate a director to our Board of Directors, unless Blackstone requests that they terminate at an earlier date.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and NYSE rules, a director is not independent unless our Board of Directors affirmatively determines that he or she does not have a direct or indirect material relationship with us or any of our subsidiaries.

Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies. Our Corporate Governance Guidelines require our Board of Directors to review the independence of all directors at least annually.

In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, our Board of Directors will determine, considering all relevant facts and circumstances, whether such relationship is material.

Our Board of Directors has affirmatively determined that each of Messrs. Abrahamson, Alba, Bergren, Bowers, Cisneros, Cutaia, Kim, Shah and Sumers is independent under the guidelines for director independence set forth in the Corporate Governance Guidelines and under all applicable NYSE guidelines, including with respect to committee membership. Our Board also has

5

determined that each of Messrs. Bowers, Cisneros and Shah is “independent” for purposes of Section 10A(m)(3) of the Exchange Act, and that each of Messrs. Cutaia, Shah and Sumers is “independent” for purposes of Section 10C(a)(3) of the Exchange Act. In making its independence determinations, our Board of Directors considered and reviewed all information known to it (including information identified through annual directors’ questionnaires).

Executive Sessions

Executive sessions, which are meetings of the non-management members of the Board, are regularly scheduled throughout the year. In addition, at least once a year, the independent directors meet in a private session that excludes management and any non-independent directors. Our Chairperson, Mr. Shah, presides at the executive sessions.

Communications with the Board

As described in our Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with a member or members of our Board of Directors, including the chairperson of our Board of Directors and each of the Audit, Compensation or Nominating and Corporate Governance Committees or with the non-management or independent directors as a group, may do so by addressing such communications or concerns to the General Counsel of the Company, 909 Hidden Ridge, Suite 600, Irving, Texas 75038, who will forward such communication to the appropriate party.

Board Committees

Audit Committee

Our Audit Committee consists of Messrs. Bowers, Cisneros and Shah, with Mr. Bowers serving as chair. All members of the Audit Committee have been determined to be “independent,” consistent with our Audit Committee charter, Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors in general and audit committees in particular. Our Board of Directors also has determined that each of the members of the Audit Committee is “financially literate” within the meaning of the listing standards of the NYSE. In addition, our Board of Directors has determined that Alan J. Bowers qualifies as an audit committee financial expert as defined by applicable SEC regulations.

The duties and responsibilities of the Audit Committee are set forth in its charter, which may be found at www.lq.com under Investor Relations: Corporate Governance: Governance Documents: Audit Committee Charter, and include oversight of the following:

| • | the adequacy and integrity of our financial statements and our financial reporting and disclosure practices; |

| • | the soundness of our system of internal controls regarding finance and accounting compliance; |

| • | the annual independent audit of our combined financial statements; |

| • | the independent registered public accounting firm’s qualifications and independence; |

| • | the engagement of the independent registered public accounting firm; |

| • | the performance of our internal audit function and independent registered public accounting firm; and |

| • | our compliance with legal and regulatory requirements in connection with the foregoing. |

The Audit Committee also prepares the report of the committee required by the rules and regulations of the SEC to be included in our annual proxy statement.

With respect to our reporting and disclosure matters, the responsibilities and duties of the Audit Committee include reviewing and discussing with management and the independent registered public accounting firm our annual audited financial statements and quarterly financial statements prior to inclusion in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q or other public filings in accordance with applicable rules and regulations of the SEC.

The charter of the Audit Committee permits the committee to delegate any or all of its authority to one or more subcommittees. In addition, the Audit Committee has the authority under its charter to engage independent counsel and other advisors as it deems necessary or advisable.

6

Compensation Committee

Our Compensation Committee consists of Messrs. Cutaia, Shah and Sumers, with Mr. Sumers serving as chair. Each of Messrs. Cutaia, Shah and Sumers has been determined to be “independent” as defined by our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors in general and compensation committees in particular.

The duties and responsibilities of the Compensation Committee are set forth in its charter, which may be found at www.lq.com under Investor Relations: Corporate Governance: Governance Documents: Compensation Committee Charter, and include the following:

| • | the establishment, maintenance and administration of compensation and benefit policies designed to attract, motivate and retain personnel with the requisite skills and abilities to contribute to the long term success of the Company; |

| • | oversight of the goals, objectives and compensation of our Chief Executive Officer, including evaluating the performance of the Chief Executive Officer in light of those goals; |

| • | oversight of the compensation of our other executives and non-management directors; |

| • | our compliance with the compensation rules, regulations and guidelines promulgated by the NYSE, the SEC and other laws, as applicable; and |

| • | the issuance of an annual report on executive compensation for inclusion in our annual proxy statement. |

With respect to our reporting and disclosure matters, the responsibilities and duties of the Compensation Committee include overseeing the preparation of the Compensation Discussion and Analysis for inclusion in our annual proxy statement and Annual Report on Form 10-K in accordance with applicable rules and regulations of the SEC.

The charter of the Compensation Committee permits the committee to delegate any or all of its authority to one or more subcommittees and to delegate to one or more of our officers the authority to make awards to team members other than any Section 16 officer under our incentive compensation or other equity-based plan, subject to compliance with the plan and the laws of our state of jurisdiction. In addition, the Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Messrs. Abrahamson, Alba, Bergren and Bowers, with Mr. Alba serving as chair. Each of Messrs. Abrahamson, Alba, Bergren and Bowers has been determined to be “independent” as defined by our Corporate Governance Guidelines and the NYSE listing standards.

The duties and responsibilities of the Nominating and Corporate Governance Committee are set forth in its charter, which may be found at www.lq.com under Investor Relations: Corporate Governance: Governance Documents: Nominating Corporate Governance Committee Charter, and include the following:

| • | advise our Board of Directors concerning the appropriate composition and qualifications of our Board of Directors and its committees; |

| • | identify individuals qualified to become board members; |

| • | recommend to the Board the persons to be nominated by the Board for election as directors at any meeting of stockholders; |

| • | recommend to the Board the members of the board to serve on the various committees of the Board; |

| • | develop and recommend to the Board a set of corporate governance principles and assist the Board in complying with them; and |

| • | oversee the evaluation of the Board, the Board’s committees and management. |

The charter of the Nominating and Corporate Governance Committee permits the committee to delegate any or all of its authority to one or more subcommittees. In addition, the Nominating and Corporate Governance Committee has the authority under its charter to retain outside counsel or other experts as it deems necessary or advisable.

7

Real Estate Committee

Our Real Estate Committee consists of Messrs. Bergren, Bowers, Cline, Cutaia and Shah, with Mr. Cutaia serving as chair. The purpose and responsibilities of the Real Estate Committee are set forth in its charter, which may be found at www.lq.com under Investor Relations: Corporate Governance: Governance Documents: Real Estate Committee Charter, and include reviewing and approving real estate transactions of the Company or its subsidiaries for sale prices in amounts which are no more than $20 million per transaction or series of related transactions.

The charter of the Real Estate Committee permits the committee to delegate any or all of its authority to one or more subcommittees consisting of one or more non-management members.

Committee Charters and Corporate Governance Guidelines

Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe our Board of Directors’ views and policies on a wide range of governance topics. These Corporate Governance Guidelines are reviewed from time to time by our Nominating and Corporate Governance Committee and, to the extent deemed appropriate in light of emerging practices, revised accordingly, upon recommendation to and approval by our Board of Directors.

Our Corporate Governance Guidelines, Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Real Estate Committee charters, and other corporate governance information are available on our website at www.lq.com under Investor Relations: Corporate Governance: Governance Documents. Any stockholder also may request them in print, without charge, by contacting the Secretary of La Quinta Holdings Inc., 909 Hidden Ridge, Suite 600, Irving, Texas 75038.

Code of Business Conduct & Ethics

We maintain a Code of Business Conduct & Ethics that is applicable to all of our directors, officers and employees, including our Chairman, Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and other senior officers. The Code of Business Conduct & Ethics sets forth our policies and expectations on a number of topics, including conflicts of interest, corporate opportunities, confidentiality, compliance with laws (including insider trading laws), use of our assets and business conduct and fair dealing. This Code of Business Conduct & Ethics also satisfies the requirements for a code of ethics, as defined by Item 406 of Regulation S-K promulgated by the SEC. The Code of Business Conduct & Ethics may be found on our website at www.lq.com under Investor Relations: Corporate Governance: Governance Documents: Code of Business Conduct & Ethics.

We will disclose within four business days any substantive changes in or waivers of the Code of Business Conduct & Ethics granted to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on our website as set forth above rather than by filing a Form 8-K. In the case of a waiver for an executive officer or a director, the required disclosure also will be made available on our website within four business days of the date of such waiver.

| Item 11. | Executive Compensation |

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis below with management. Based on its review and discussion with management, the Compensation Committee recommended to the board of directors that the Compensation Discussion and Analysis be included in this Annual Report on Form 10-K/A for the fiscal year ended December 31, 2017.

Submitted by the Compensation Committee of the Board of Directors:

| Gary M. Sumers, Chair | ||||

| Giovanni Cutaia | ||||

| Mitesh B. Shah |

8

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Section Overview

Our executive compensation program is designed to attract and retain individuals with the skills and qualifications to manage and lead the Company effectively. The overarching goal of our program is to motivate our leaders to contribute to the achievement of our financial goals and to focus on long-term value creation for our stockholders.

Our named executive officers, or NEOs, for fiscal 2017 were the following five individuals:

| • | Keith A. Cline, our President and Chief Executive Officer; |

| • | James H. Forson, our Executive Vice President, Chief Financial Officer and Treasurer; and |

| • | Our three other most highly compensated executive officers who served in such capacities at December 31, 2017, namely: |

| • | John W. Cantele, our Executive Vice President and Chief Operating Officer; |

| • | Rajiv K. Trivedi, our Executive Vice President and Chief Development Officer; and |

| • | Mark M. Chloupek, our Executive Vice President, Secretary and General Counsel. |

Executive Summary

Compensation Philosophy and Objectives. Our executive compensation program is designed to implement our compensation philosophy, which is based on the following objectives:

| • | Pay for Performance—The executive compensation program should focus our executive team on the successful achievement of key financial, operating and other goals, such that realized pay is based on performance; |

| • | Promote Core Values—The executive compensation program should support the Company’s core values, which are to enhance our guests’ experience and create enduring relationships by striving for excellence and serving with integrity every day; |

| • | Align with Shareholder Value—The executive compensation program should align the executive team’s incentives with the long-term interests of the Company and its stockholders; |

| • | Market Competitive—The executive compensation program should provide competitive pay opportunities within the labor markets in which we compete to support the attraction and retention of highly qualified executives; and |

| • | Reflect Good Governance—The executive compensation program should reflect sound governance practices and processes, and the Compensation Committee will retain the ability to adapt the program to reflect evolving market practices and governance standards. |

Elements of Compensation. Our executive compensation program has three primary elements:

| Element |

Description and Purpose | |

| Base Salary | • Fixed component of compensation.

• Reviewed annually and adjusted when appropriate.

• Intended to support our market-competitiveness with respect to annual pay for the skills and experience necessary to meet the requirements of the executive’s role. | |

| Annual Cash Bonus | • Variable performance-based component of compensation.

• Designed to reward achievement of financial, operating and other goals for which executives are held accountable. | |

| Long-Term Incentives | • Variable component of compensation focused on long-term performance and value creation.

• Designed to motivate and reward long-term achievement of business objectives, align the interests of our executives with stockholders and support the retention of our executives. | |

9

Each component is designed to support the Company’s compensation philosophy and objectives.

The Compensation Committee evaluates our executive compensation program annually, or more frequently as circumstances require, to maintain a competitive environment for talent and to ensure that our incentive programs are achieving their desired results. We do not adhere to rigid formulas in determining the amount and mix of compensation elements. We will continue to emphasize pay-for-performance and long-term incentive compensation when designing our executive officers’ compensation.

Say on Pay and Say on Frequency Votes. In 2017, the Compensation Committee considered the outcome of the stockholder advisory vote on 2016 executive compensation when making decisions relating to the compensation of our NEOs and our executive compensation program and policies. Our stockholders voted at our 2017 annual meeting, in a non-binding, advisory vote, on the 2016 compensation paid to our NEOs. Approximately 97% of the votes were cast in favor of the Company’s 2016 compensation decisions. Based on this level of support, the Compensation Committee decided that the say on pay vote result did not necessitate any substantive changes to our compensation program.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, stockholders can vote on the frequency of say-on-pay voting once every six years. We expect this vote to next occur at our 2021 annual meeting. Until that time, we expect to hold an advisory, non-binding say-on-pay vote on an annual basis.

Compensation Determination Process

Role of the Compensation Committee. Our Compensation Committee is responsible for making all executive compensation determinations. In reviewing and approving the compensation of our executive officers, including our NEOs, the Compensation Committee considers many factors, including the advice of its compensation consultant, the alignment of pay outcomes with Company performance and stockholder interests and competitive market data.

Role of Management. Mr. Cline works closely with the Compensation Committee in managing the executive compensation program and attends some meetings of the Compensation Committee. He does not participate in the determination of his own compensation.

Role of Compensation Consultants. In late 2014 the Compensation Committee retained the services of Meridian Compensation Partners, LLC (“Meridian”) to serve as its independent compensation consultant. As requested by the Compensation Committee, Meridian has advised and is expected to continue to advise the Compensation Committee with respect to executive officer compensation, including executive compensation programs (including short- and long-term incentive plans), individual compensation levels, the peer companies used to assess compensation levels and marketplace trends in executive compensation. Meridian also assisted with the preparation of this Compensation Discussion and Analysis. Except as set forth above, Meridian does not provide any services to the Company other than advising on executive officer and director compensation and related matters. In April 2018, the Compensation Committee determined that Meridian is independent from management and that Meridian’s work has not raised any conflicts of interest.

Use of Comparative Market Data. Our goal is to compensate our executive officers competitively in the market for executive talent. When determining final target pay levels, the Compensation Committee reviews and considers individual factors, such as the knowledge, experience and capabilities of each executive.

To gain a general understanding of current compensation practices, the Compensation Committee reviews pay of executives serving in similar positions at peer companies with whom we compete for hiring and retaining executive talent. The external market data reviewed for 2017 included target total compensation (i.e. the sum of the base salary, target annual incentive and target long-term incentive) among a group of peer companies. The Compensation Committee reviewed and discussed the external market data, and used the data to inform its compensation decisions.

In 2017, the Compensation Committee, with the assistance of Meridian, selected a group of peer companies, which we refer to as our “Peer Group.” Meridian provided the Compensation Committee with annual (base salary and annual incentive) and long-term (equity and long-term cash incentive) compensation information with respect to the Peer Group.

The criteria used for selecting the Peer Group included industry, lodging property focus, performance, company size (as measured by revenue, enterprise value, number of properties and number of rooms), business mix, geographic location, and those companies for which we believe we compete for shareholder dollars, customers and/or executive talent.

10

The Peer Group for 2017 consisted of the following companies:

| Choice Hotels International Inc. | Host Hotels & Resorts | RLJ Lodging Trust | ||

| Clubcorp Holdings. Inc. | Hyatt Hotels Corp. | Ryman Hospitality Properties, Inc. | ||

| Diamondrock Hospitality Co. | Intercontinental Hotels | Summit Hotel Properties | ||

| Extended Stay America, Inc. | Lasalle Hotel Properties | Vail Resorts | ||

| Hersha Hospitality Trust | Marcus Corp. | Wyndham Worldwide Corporation | ||

The Company also reviewed the structure of the compensation programs of Hilton Worldwide Holdings Inc. and Marriott International, Inc. but did not consider the total target compensation of executives at those companies as compensation at those companies was not considered comparable due to their larger size relative to La Quinta.

Elements of Compensation

There are three main components to our executive compensation program: base salary, annual cash incentive compensation and long-term equity compensation. In 2017, we also granted our NEOs special retention awards to encourage and reward their continued focus and energy on making objective business decisions that are in the best interests of the Company and its stockholders as we pursue the Spin-Off (as defined below). See “—2017 Retention Awards” below.

Base Salary

We believe it is important to provide a competitive fixed level of pay to attract and retain experienced and successful executives. In determining the amount of base salary that each NEO receives, we look to the executive’s current compensation, time in position, any change in the executive’s position or responsibilities and the relation of the executive’s position to those of other executives within the Company and in similar positions at peer companies. Base salaries are reviewed annually or at other times when appropriate and may be increased from time to time pursuant to such review. In March 2017, in connection with our annual review, we determined to increase the salaries of each of our NEOs as follows: Mr. Cline, from $750,000 to $772,500; Mr. Forson, from $400,000 to $425,000; Mr. Cantele, from $475,000 to $495,000; Mr. Trivedi, from $470,000 to $495,000; and Mr. Chloupek, from $365,000 to $400,000. In addition to taking into account the Peer Group information provided by Meridian, the Compensation Committee also considered the Company’s interest in encouraging the NEOs’ continued focus and energy on making objective business decisions that are in the best interests of the Company and its stockholders as we pursue the separation of our real estate business, which will be included in our subsidiary CorePoint Lodging Inc. (“CorePoint”), from our franchise and management businesses (the “Spin-Off”). The following table reflects our NEOs’ base salaries at the end of 2016 and 2017:

| Name |

Base Salary as of December 31, 2016 |

Base Salary as of December 31, 2017 |

||||||

| Keith A. Cline |

$ | 750,000 | $ | 772,500 | ||||

| James H. Forson |

$ | 400,000 | $ | 425,000 | ||||

| John W. Cantele |

$ | 475,000 | $ | 495,000 | ||||

| Rajiv K. Trivedi |

$ | 470,000 | $ | 495,000 | ||||

| Mark M. Chloupek |

$ | 365,000 | $ | 400,000 | ||||

2017 Annual Cash Incentive Compensation

Our annual cash incentive compensation plan for the year ended December 31, 2017 (the “2017 Cash Bonus Plan”) compensated and rewarded successful achievement of both short-term financial and non-financial goals that were closely aligned with the long-term goals of the Company. The payout under the 2017 Cash Bonus Plan was based on the financial performance of the Company or a combination of (1) the financial performance of the Company and (2) individual strategic objectives. For Mr. Cline, the financial performance of the Company composed 100% of his total award opportunity and for each of our other NEOs, the financial performance of the Company composed 80% of the total award opportunity and individual strategic objectives composed 20% of the total award opportunity. For each of the NEOs, the threshold, target and maximum annual bonus opportunity for the year ended December 31, 2017, expressed as a percentage of such NEO’s base salary, was as follows: 50%, 100% and 150%, respectively.

2017 Financial Component Goals and Results

The financial component of each NEO’s annual bonus opportunity was based on (1) Adjusted EBITDA (as defined under Note 17: “Segments” to our Consolidated Financial Statements in Part II, Item 8 of the 2017 10-K), as may be further adjusted for other unusual items as determined by the Compensation Committee) and (2) Net Promoter (as described in our 2017 10-K). For fiscal 2017, for Mr. Cline, Adjusted EBITDA composed 70% of the financial component and Net Promoter composed 30% of the financial

11

component. For each of the other NEOs, Adjusted EBITDA composed 50% of the total award opportunity and Net Promoter composed 30% of the total award opportunity (with the remaining 20% consisting of individual strategic objectives). These financial measures were chosen because they are key indicators of Company profitability and guest satisfaction. The following table sets forth the threshold, target and maximum amounts for each of the financial components, as well as the payout percentages for each category.

| Threshold | Target | Maximum | ||||||||||

| Adjusted EBITDA |

$ | 320 million | $ | 335 million | $ | 350 million | ||||||

| Net Promoter |

43.9 | 44.4 | 44.9 | |||||||||

| Payout Percentage of Target |

50 | % | 100 | % | 150 | % | ||||||

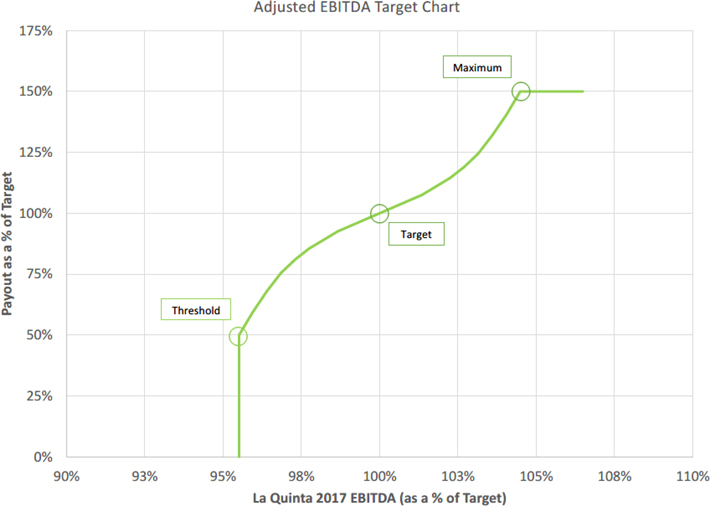

To the extent that actual performance fell between the applicable threshold, target or maximum levels for the Net Promoter component, payouts were determined using linear interpolation. To the extent that actual performance fell between the applicable threshold, target or maximum levels for the Adjusted EBITDA component, payouts were determined based on the curve set forth below.

2017 Individual Strategic Objectives and Results

The remaining 20% of the potential total award opportunity for Messrs. Forson, Cantele, Trivedi and Chloupek was based on their individual performance relative to individual performance criteria. For example, for Mr. Forson, the individual strategic objective criteria consisted of regulatory compliance, and support of the execution of the Spin-Off; for Mr. Cantele, the criteria consisted of the successful execution of 50 hotel repositionings, the design and implementation of a 2017 renovation and repositioning plan for the Company’s Inns and Inns & Suites, and successful achievement of ADR growth goals for the Company’s Inns & Suites; for Mr. Trivedi, the criteria consisted of establishing standard operating procedures for use by franchisee construction and operations

12

teams, commodity purchase goals, goals relating to the franchise operations relaunch of the Company’s “Here for You” campaign, goals relating to visits to recently opened properties, and asset sale goals; for Mr. Chloupek, the criteria consisted of goals relating to compliance assessments, resolving within a certain timeframe certain employee and third party claims, internal compliance goals, and support of the execution of the Spin-Off. Individual performance with respect to these goals was measured at set threshold, target and maximum levels, with corresponding payout percentages at each of these levels (50%, 100% and 150%, respectively) for Messrs. Forson, Cantele, Trivedi and Chloupek.

Determination of 2017 Cash Bonus Plan Payouts

The following table shows the actual results based on the Company’s actual fiscal 2017 performance and the payout percentages with respect to each of the financial components.

| Adjusted EBITDA | Net Promoter | |||||||

| Actual Performance |

$ | 326.9 million | 45.6 | |||||

| Payout Percentage—Messrs. Cline, Forson, |

83.7 | % | 150 | % | ||||

Actual amounts paid under the 2017 Cash Bonus Plan were then calculated by multiplying each NEO’s base salary in effect as of March 6, 2017 by his target bonus percentage. For Mr. Cline, the target bonus potential was then multiplied by a combined achievement factor based on the weighted average of Adjusted EBITDA payout percentage and the Net Promoter payout percentage and, for Messrs. Forson, Cantele, Trivedi and Chloupek, by a combined achievement factor based on the weighted average of Adjusted EBITDA payout percentage, the Net Promoter payout percentage and the individual strategic objective payout percentage. Based on the performance achieved, each of the NEOs earned an annual bonus for 2017 under the 2017 Cash Bonus Plan as follows, which amounts are reflected in the “Non-Equity Incentive Plan Compensation” column of the “Summary Compensation Table”:

| Name |

2017 base salary |

Target bonus as a percentage of base salary |

Target bonus potential |

Achievement factor as a percentage of target |

2017 annual bonus |

|||||||||||||||

| Keith A. Cline |

$ | 772,500 | 100 | % | $ | 772,500 | 103.59 | % | $ | 800,233 | ||||||||||

| James H. Forson |

$ | 425,000 | 100 | % | $ | 425,000 | 116.85 | % | $ | 496,613 | ||||||||||

| John W. Cantele |

$ | 495,000 | 100 | % | $ | 495,000 | 116.85 | % | $ | 578,408 | ||||||||||

| Rajiv K. Trivedi |

$ | 495,000 | 100 | % | $ | 495,000 | 116.85 | % | $ | 578,408 | ||||||||||

| Mark M. Chloupek |

$ | 400,000 | 100 | % | $ | 400,000 | 116.85 | % | $ | 467,400 | ||||||||||

2017 Retention Awards

To encourage and reward the continued focus and energy of certain employees, including our NEOs, on making objective business decisions that are in the best interests of the Company and its stockholders as we pursue the Spin-Off, on January 17, 2017, the Board of Directors adopted and approved the La Quinta Holdings Inc. Retention Bonus Plan (the “2017 Retention Plan”), which provides for the payment of awards to specified eligible employees, including the NEOs, upon the occurrence of a specified date or event.

Under the 2017 Retention Plan, the NEOs were granted awards with the following values: $1,875,000 for Mr. Cline; $750,000 for Mr. Forson; $890,625 for Mr. Cantele; $587,500 for Mr. Trivedi; and $912,500 for Mr. Chloupek. These retention awards are payable 50% in cash and 50% in shares of restricted stock. The shares of restricted stock were granted pursuant to the Amended and Restated La Quinta Holdings Inc. 2014 Omnibus Incentive Plan (the “Omnibus Incentive Plan”) on January 23, 2017, and the number of shares of restricted stock granted was equal to the value of the award payable in restricted shares divided by the per share fair value of the Company’s common stock on January 17, 2017.

The cash portion of a retention award is payable, and shares of restricted stock vest, on the earliest to occur of the following, subject, in each case, to an NEO’s continued employment through such date: (i) April 17, 2018; (ii) the date that is six months from the consummation of a significant corporate event (as defined in the 2017 Retention Plan); (iii) the date of an NEO’s termination of employment (x) by the Company without cause (as defined in the 2017 Retention Plan) at any time following January 17, 2017 or (y) by the NEO with good reason (as defined in the 2017 Retention Plan) within the six months prior to, or on or following, a significant corporate event; or (iv) the date of a change in control (as defined in the 2017 Retention Plan).

13

Long-Term Equity Compensation

The following description of our long-term equity compensation program focuses on our time-vesting and performance-based equity awards, which reflect our current pay for performance philosophy and approach towards compensation.

2017 Equity Awards

In addition to the restricted stock granted to our NEOs under the 2017 Retention Plan in January 2017, in March 2017, in connection with our annual review of our compensation for executives, the Compensation Committee determined to grant to each of our NEOs the following awards under the Omnibus Incentive Plan: (1) time-vesting restricted stock (“time-vesting restricted stock award”) (50% of the total target value of the March 2017 equity awards) and (2) performance-vesting performance share units (“PSUs”) (50% of the total target value of the March 2017 equity awards). The relative mix of these two awards reflects the Compensation Committee’s determination to balance our goals of aligning the interests of our executives with that of stockholders and retaining our executives.

Time-Vesting Restricted Stock. The time-vesting restricted stock awards granted in fiscal 2017 vest in three equal annual installments, with the first one-third of the total number of shares granted vesting on December 31, 2017, the second one-third of the total number of shares granted vesting on December 31, 2018, and the remainder of the number of shares granted vesting on December 31, 2019, subject to the executive’s continued employment through the applicable vesting date.

Performance Share Units (“PSUs”). The PSUs granted in fiscal 2017 are settled after the end of the performance period, which begins on January 1, 2017 and ends on December 31, 2019, based on the Company’s total shareholder return relative to the total shareholder returns of members of a peer company group (“relative total shareholder return”), as defined in the PSU agreement. For a description of the peer company group, see “Narrative to Summary Compensation Table and Fiscal 2017 Grants of Plan-Based Awards—Equity Awards—2017 Equity Awards—Performance Share Units (“PSUs”)” below. The actual value of the PSUs that become vested based on the performance measure (relative total shareholder return) is based on an achievement factor which, in each case, ranges from a 33% payout for threshold performance, to 100% for target performance, to 200% for maximum performance. To the extent that actual performance falls between the applicable threshold, target or maximum levels, payouts will be determined using linear interpolation. In the event that Absolute TSR (as defined below under “Narrative to Summary Compensation Table and Fiscal 2017 Grants of Plan-Based Awards—Equity Awards—2017 Equity Awards—Performance Share Units (“PSUs”)”) has a negative value, the resulting award is capped at 1.5 times the target award.

The table below sets forth the total target value of the equity awards granted to our named executive officers in March 2017 as well as the target value of the PSU award, assuming that the target level of performance is achieved, and the fair market value on the grant date of the time-vesting restricted stock award.

| Name |

Total Target Value |

Time-Vesting Restricted Stock | Target PSU Value |

|||||||||||||

| Value | Number of Shares | |||||||||||||||

| Keith A. Cline |

$ | 3,000,000 | $ | 1,500,000 | 110,214 | $ | 1,500,000 | |||||||||

| James H. Forson |

$ | 850,000 | $ | 425,000 | 31,228 | $ | 425,000 | |||||||||

| John W. Cantele |

$ | 800,000 | $ | 400,000 | 29,391 | $ | 400,000 | |||||||||

| Rajiv K. Trivedi |

$ | 800,000 | $ | 400,000 | 29,391 | $ | 400,000 | |||||||||

| Mark M. Chloupek |

$ | 700,000 | $ | 350,000 | 25,717 | $ | 350,000 | |||||||||

Settlement of Previously Granted PSUs

In February 2018, following the completion of the 3-year performance period of January 1, 2015 through December 31, 2017, we settled the PSU awards that were granted in 2015. Performance goals for the 2015 PSU awards were established by the Compensation Committee in February 2015. At the time the performance goals were established, the metric that was selected was total shareholder return relative to the total shareholder returns of members of a peer company group (“relative TSR”), as defined in the PSU agreement. The actual value of the PSUs that become vested based on relative TSR ranges from a 33% payout for threshold performance, to 100% for target performance, to 200% for maximum performance. The threshold, target and maximum goals for these performance measures and the actual performance are shown in the below table:

| Measurement |

Weighting |

Threshold |

Target |

Maximum |

Actual |

Earned (% of Target) | ||||||

| Relative TSR |

100% | 30th percentile | 50th percentile | 90th percentile | 22nd percentile | 0.0% |

14

Based on the Company’s performance as set forth in the chart above, the actual value of the 2015 PSU award was equal to 0% of the target PSU value for each of our NEOs because the Company did not achieve threshold performance for the performance measure.

Other Benefits and Perquisites

Our executives, including our NEOs, are eligible for specified benefits, such as group health, dental, long- and short-term disability insurance, accidental death and dismemberment insurance and employer-paid basic life insurance premiums. These benefits are intended to provide competitive and adequate protection in case of sickness, disability or death. In addition, we generally provide specified perquisites to our NEOs, when determined to be necessary and appropriate, including employer-paid executive physical examinations. In addition, until March 2017, we provided car allowances to certain of our executives. The value of perquisites and other personal benefits are reflected in the “All Other Compensation” column of the “Summary Compensation Table” and the accompanying footnote. We believe that these benefits are competitive in our industry and consistent with our overall compensation philosophy.

Retirement Benefits

The Company maintains a tax-qualified 401(k) plan in which all of our corporate employees, including our NEOs, are eligible to participate and under which the Company matches each employee’s contributions dollar-for-dollar up to 3% of such employee’s eligible earnings and $0.50 for every $1.00 for the next 2% of the employee’s eligible earnings. The maximum match available under the 401(k) plan is 4% of the employee’s eligible earnings. All matching contributions by us are always fully vested.

Severance Benefits

To encourage and reward our executives’ continued focus and energy on making objective business decisions that are in the best interests of the Company and its stockholders as we pursue the Spin-Off and to provide greater certainty regarding executive pay obligations in the context of planning and negotiating any potential corporate transactions, on January 17, 2017, the Board of Directors adopted and approved the La Quinta Holdings Inc. Executive Severance Plan (the “Severance Plan”) for employees of the Company at the level of Vice President and above, including the NEOs. The Severance Plan provides for payment of severance and other benefits to eligible executives, including the NEOs, in the event of a termination of employment with the Company without cause or for good reason (each as defined in the Severance Plan), or in the event of a termination with the Company as a result of retirement, death, or disability (as such terms are defined in the Severance Plan), in each case, subject to the (i) executive’s execution and non-revocation of a general release of claims in favor of the Company and (ii) continued compliance with the executive’s confidentiality, non-interference and invention assignment obligations to the Company. See “Potential Payments Upon Termination or Change in Control—Executive Severance Plan Adopted in 2017.”

The terms of Mr. Chloupek’s employment agreement also provide severance protection to Mr. Chloupek in the case of specified qualifying termination events. The severance payments under Mr. Chloupek’s employment agreement are contingent upon his execution of a release of claims and compliance with specified post-termination restrictive covenants. While Mr. Chloupek’s employment agreement contains severance terms applicable to him, he is eligible to receive benefits under the Severance Plan only to the extent that any amounts due and payable under the Severance Plan are greater than and in addition to the amount due and payable to Mr. Chloupek under his employment agreement.

In addition, each of our equity award agreements contains severance provisions.

See “Potential Payments Upon Termination or Change in Control” for descriptions of payments to be made under these agreements.

Clawback Policy

We have adopted a clawback policy for incentive compensation plans. The Compensation Committee determined that it may be appropriate to recover annual and/or long-term incentive compensation in specified situations. Under the policy, if the Compensation Committee determines that incentive compensation of its current and former Section 16 officers (or any other employee designated by the Board of Directors or the Compensation Committee) was overpaid, in whole or in part, as a result of a restatement of the reported financial results of the Company or any of its segments due to material non-compliance with financial reporting requirements (unless

15

due to a change in accounting policy or applicable law), and such restatement was caused or contributed, directly or indirectly, by such employee’s fraud, willful misconduct or gross negligence, then the Compensation Committee will determine, in its discretion, whether to seek to recover or cancel any overpayment of incentive compensation paid or awarded during the three-year period preceding the date on which the Company is required to prepare the restatement.

Stock Ownership Policy

We have an executive stock ownership policy for our NEOs, which provides the following guidelines relating to stock ownership by each of our NEOs within five years of the later of (x) the date on which we made our first broad-based equity incentive grants following our initial public offering (which was June 11, 2014) or (y) the date he or she first becomes subject to the stock ownership policy:

| • | Chief Executive Officer: 4 times base salary |

| • | All other executive officers: 2 times base salary |

The NEOs each currently have stock ownership that meets the levels shown above.

Hedging and Pledging Policies

The Company’s Insider Trading Policy requires executive officers and directors to consult the Company’s General Counsel prior to engaging in transactions involving the Company’s securities. In order to protect the Company from exposure under insider trading laws, executive officers and directors are encouraged to enter into pre-programmed trading plans under Exchange Act Rule 10b5-1. The Company’s Insider Trading Policy prohibits directors and executive officers from hedging or monetization transactions including, but not limited to, through the use of financial instruments such as exchange funds, variable forward contracts, equity swaps, puts, calls, and other derivative instruments, or through the establishment of a short position in the Company’s securities. The Company’s Insider Trading Policy limits the pledging of Company securities to those situations approved by the Company’s General Counsel.

Risk Assessment

The Compensation Committee believes that the design and objectives of our executive compensation program provide an appropriate balance of incentives for executives and avoid inappropriate risks. In this regard, our executive compensation program includes, among other things, the following design features:

| • | Balances a mix of fixed versus variable, at-risk compensation; |

| • | Balances a mix of short-term cash and long-term equity incentive compensation; |

| • | Incentive plans establish caps on award payouts; |

| • | Provides that variable compensation is based on a variety of qualitative and quantitative performance goals; |

| • | Provides for a clawback of executive compensation in specified circumstances; and |

| • | Executive stock ownership policy. |

Tax and Accounting Considerations

The Compensation Committee recognizes the tax and regulatory factors that can influence the structure of executive compensation programs. Generally, Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986, as amended (the “Code”) limits the Company’s federal income tax deduction for compensation in excess of $1 million paid to NEOs in any one year. Historically, “performance-based” compensation, within the meaning of Section 162(m) was excluded from the limitation as long as specified requirements were met, and we designed our Omnibus Incentive Plan in a manner intended to allow us to utilize this performance-based exception. For 2017, we considered the application of Section 162(m) in awarding compensation to our NEOs, and designed a portion of the compensation awards granted to our NEOs in a manner intended to qualify as performance-based compensation. However, we did not design our 2017 Retention Plan in a manner intended to comply with the performance-based exception to Section 162(m). Moreover, as a result of the elimination of the performance-based compensation exemption at the end of 2017, subject to certain “grandfathering” rules, we will no longer be permitted to take deductions for performance-based compensation, and therefore, we anticipate that compensation decisions will not be made with as much, if any, focus on the application of Section 162(m).

16

The Compensation Committee also considers the accounting implications of the various elements of our compensation program, including the impact on our financial results and the dilutive impact to stockholders of various forms of compensation.

Compensation Actions taken in 2018

2018 Retention Awards

On January 30, 2018, the Board of Directors adopted and approved the La Quinta Holdings Inc. Project Longhorn Retention Bonus Plan (the “2018 Retention Plan”), effective as of April 18, 2018, which provides for the payment of cash awards to specified eligible employees, including the NEOs, upon the occurrence of a specified date or event.

The Board of Directors adopted and approved the 2018 Retention Plan to encourage and reward the continued focus and energy of certain employees, including the NEOs, on making objective business decisions that are in the best interests of the Company and its stockholders as it pursues the consummation of the proposed merger (the “Merger”) of WHG BB Sub, Inc. (“Merger Sub”), a Delaware corporation and an indirect wholly-owned subsidiary of Wyndham Worldwide Corporation, a Delaware corporation (“Wyndham Worldwide”) with and into the Company in accordance with and subject to the terms of the Agreement and Plan of Merger, dated as of January 17, 2018, by and among the Company, Wyndham Worldwide and Merger Sub.

Under the 2018 Retention Plan, the NEOs were granted cash awards with the following values: $750,000 for Mr. Cline; $300,000 for Mr. Forson; $356,250 for Mr. Cantele; $235,000 for Mr. Trivedi; and $365,000 for Mr. Chloupek. The retention award is payable on the earliest to occur of the following, subject, in each case, to an NEO’s continued employment through such date: (i) October 31, 2018; and (ii) the date of an NEO’s Qualifying Covered Termination (as defined in the 2018 Retention Plan). Any participant in the 2018 Retention Plan (including the NEOs) who begins employment with CorePoint prior to October 31, 2018 will forfeit the value of his or her retention award under the 2018 Retention Plan. The consummation of the Merger will have no effect on the vesting of awards granted under the 2018 Retention Plan.

Employee Matters Agreement

In connection with the Spin-Off, La Quinta entered into an Employee Matters Agreement with CorePoint (the “EMA”), which among other items, provides for the conversion of La Quinta performance share units (“PSUs”) into La Quinta time-vesting restricted stock awards (“RSAs”) upon the Spin-Off. The EMA generally provides that outstanding PSUs issued under the Omnibus Incentive Plan will be converted to RSAs based on deemed satisfaction of applicable performance criteria at (i) the greater of target or actual performance levels in respect of applicable performance periods that have ended on or prior to the end of the fiscal quarter ending immediately prior to the fiscal quarter in which the spin-off occurs (i.e., the portion of the applicable performance period representing the number of fiscal quarters that have elapsed since the commencement of the applicable performance period), and (ii) target performance levels in respect of performance periods that have not ended prior to such fiscal quarter. RSAs received in connection with the conversion of PSUs will continue to be subject to vesting based on the holder’s continued employment with La Quinta or CorePoint, as applicable, through the end of the applicable performance period to which such PSUs relate.

It is currently expected that PSUs which were granted in 2016, other than PSUs granted to Mr. Cantele in 2016, will be converted to RSAs based on deemed satisfaction of the applicable performance criteria at target levels and PSUs that were granted in 2017, as well as those were granted to Mr. Cantele in 2016, will be converted to RSAs based on deemed satisfaction of the applicable performance criteria at actual performance levels.

17

Tabular Executive Compensation Disclosure

Summary Compensation Table

The following table presents summary information regarding the total compensation awarded to, earned by, or paid to each of our NEOs for the fiscal years indicated.

| Name and principal position |

Year | Salary ($)(1) |

Bonus ($) |

Stock Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

|||||||||||||||||||||

| Keith A. Cline |

2017 | 768,555 | — | 4,159,607 | 800,233 | 16,440 | 5,744,835 | |||||||||||||||||||||

| President and Chief |

2016 | 714,984 | 500,000 | 3,785,707 | 337,500 | 15,097 | 5,353,288 | |||||||||||||||||||||

| 2015 | 479,912 | — | 1,252,750 | 227,976 | 14,767 | 1,975,405 | ||||||||||||||||||||||

| James H. Forson |

2017 | 420,616 | — | 1,285,869 | 496,613 | 13,409 | 2,216,507 | |||||||||||||||||||||

| Executive Vice President and |

2016 | 383,607 | 150,000 | 959,100 | 306,000 | 11,742 | 1,810,449 | |||||||||||||||||||||

| 2015 | 272,986 | — | 279,838 | 64,900 | 15,276 | 633,000 | ||||||||||||||||||||||

| John W. Cantele |