Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - DYNEGY INC. | d532160dex314.htm |

| EX-31.3 - EX-31.3 - DYNEGY INC. | d532160dex313.htm |

| EX-23.1 - EX-23.1 - DYNEGY INC. | d532160dex231.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

DYNEGY INC.

(Exact name of registrant as specified in its charter)

| Commission File Number |

State of Incorporation |

I.R.S. Employer Identification No. | ||

| 001-33443 | Delaware | 20-5653152 | ||

| 601 Travis, Suite 1400 | ||||

| Houston, Texas | 77002 | |||

| (Address of principal executive offices) |

(Zip Code) | |||

(713) 507-6400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |||

| Dynegy’s common stock, $0.01 par value | New York Stock Exchange | |||

| Dynegy’s warrants, exercisable for common stock at an exercise price of $35 per share |

New York Stock Exchange | |||

Securities registered pursuant to Section12(g) of the Act:

| None |

||||

| (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company ☐ | |

| (Do not check if a smaller reporting company) | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2017, the aggregate market value of the Dynegy Inc. common stock held by non-affiliates of the registrant was $918,348,807 based on the closing sale price as reported on the New York Stock Exchange.

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

Number of shares outstanding of Dynegy Inc.’s class of common stock, as of the latest practicable date: Common stock, $0.01 par value per share, 0 shares outstanding as of April 26, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

DYNEGY INC.

FORM 10-K/A

| Page | ||||||

| Item 10. |

Directors, Executive Officers and Corporate Governance | 2 | ||||

| Item 11. |

Executive Compensation | 12 | ||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 46 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence | 47 | ||||

| Item 14. |

Principal Accounting Fees and Services | 48 | ||||

| Item 15. |

Exhibits and Financial Statement Schedules | 50 | ||||

| 61 | ||||||

i

Table of Contents

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (“fiscal 2017”) of Dynegy Inc., as originally filed with the Securities and Exchange Commission (“SEC”) on February 22, 2018 (the “Original Form 10-K”). We are filing this Amendment to present the information required by Part III of Form 10-K that was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K because a definitive proxy statement containing such information will not be filed within 120 days after the end of fiscal 2017. This Amendment restates in their entirety Items 10, 11, 12, 13 and 14 of the Original Form 10-K and the exhibit index set forth in Part IV of the Original Form 10-K and includes certain exhibits as noted thereon. The cover page of the Original Form 10-K is also amended to delete the reference to the incorporation by reference of the registrant’s definitive proxy statement.

An amended Exhibit 23.1 is being filed herewith to include the signature of Ernst & Young LLP, which was inadvertently omitted from that exhibit filed with the Original Form 10-K. In addition, Item 15 of Part IV has been amended to include new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 by our principal executive officer and principal financial officer as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted. The certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of our principal executive officer and principal financial officer are filed with this Amendment as Exhibits 31.3 and 31.4 hereto.

Except as expressly set forth herein, this Amendment does not otherwise update information in the Original Form 10-K to reflect facts or events occurring subsequent to the filing date of the Original Form 10-K. This Amendment should be read in conjunction with the Original Form 10-K and with the registrant’s filings with the SEC subsequent to the filing of the Original Form 10-K.

Unless the context indicates otherwise, throughout this report, the terms “Dynegy,” “the Company,” “we,” “us,” “our,” and “ours” are used to refer to Dynegy Inc. and its direct and indirect subsidiaries. Terms used but not defined herein are as defined in the Original Form 10-K.

Merger with and into Vistra Energy & Expected Form 15 Filing

On April 9, 2018 (the “Closing Date”), pursuant to the Merger Agreement, Dynegy merged with and into Vistra Energy Corp. (“Vistra Energy”), with Vistra Energy continuing as the surviving corporation (the “Merger”). The combined company will operate under the name “Vistra Energy Corp.” and will continue to be a Delaware corporation. At the effective time of the Merger (the “Merger Effective Time”), each issued and outstanding share of the Company’s common stock, par value $0.01 per share (“Dynegy Common Stock”) (other than shares owned by Vistra Energy or its wholly owned subsidiaries, held in treasury by the Company or held by a wholly owned subsidiary of the Company, which shares were automatically cancelled and ceased to exist) was automatically converted into the right to receive 0.652 shares of Vistra Energy’s common stock, par value $0.01 per share (“Vistra Energy Common Stock”, and such ratio of Dynegy Common Stock to Vistra Energy Common Stock, the “Exchange Ratio”). Unless the context indicates otherwise, information presented herein is as of April 8, 2018.

As a result of the Merger, Dynegy intends to file a Form 15 with respect to all of its registered classes of securities immediately following the filing of this Amendment to terminate the registration of such securities under Section 12(g) of the Exchange Act and suspend the duty of Dynegy to file reports under Sections 13 and 15(d) of the Exchange Act. As a result of such termination and suspension, Dynegy will no longer be required to file reports under Sections 13 and 15(d) of the Exchange Act. Prior to the filing of such Form 15, SEC rules and regulations require Dynegy to first file this Amendment in order to complete Dynegy’s Original Form 10-K and be current in its Exchange Act reporting obligations. After the filing of this Amendment, Dynegy no longer intends to file any reports under Sections 13 and 15(d) of the Exchange Act.

1

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance

DIRECTORS

As a result of the Merger and pursuant to the Merger Agreement, on April 9, 2018 the Company merged with and into Vistra Energy, with Vistra Energy as the surviving corporation. In connection with the Merger, Hilary E. Ackerman, Paul M. Barbas and John R. Sult were appointed to the Vistra Energy board of directors. The remaining members of the Company’s board of directors ceased serving in such capacity at the Merger Effective Time. Set forth below is certain information concerning each of the Company’s directors as of April 8, 2018.

|

Robert C. Flexon, 59 Director since 2011

|

President and Chief Executive Officer

Current Public Directorship:

Westmoreland Coal Company

Prior Experience:

• UGI Corporation—Chief Financial Officer

• Foster Wheeler AG—Chief Executive Officer, Board Director

• NRG Energy—Chief Financial Officer, Chief Operating Officer

• Hercules and ARCO—various financial roles

Mr. Flexon, who oversaw Dynegy’s turnaround in 2012, brings executive management and operating experience in many areas of the energy business, including wholesale power generation. Mr. Flexon also has a broad background in accounting and finance, and significant corporate financial expertise and management experience as a result of his service as a chief financial officer and other senior financial leadership positions.

Mr. Flexon has served as President and Chief Executive Officer since July 2011 and a director of Dynegy since June 2011. Prior to joining Dynegy, Mr. Flexon served as the Chief Financial Officer of UGI Corporation, a distributor and marketer of energy products and related services from February 2011 to July 2011. Mr. Flexon was the Chief Executive Officer of Foster Wheeler AG from June to October 2010 and the President and Chief Executive Officer of Foster Wheeler USA from November 2009 to May 2010. Prior to joining Foster Wheeler, Mr. Flexon was Executive Vice President and Chief Financial Officer of NRG Energy, Inc. from February to November 2009. Mr. Flexon previously served as Executive Vice President and Chief Operating Officer of NRG Energy from March 2008 to February 2009 and as its Executive Vice President and Chief Financial Officer from 2004 to 2008. Prior to joining NRG Energy, Mr. Flexon held executive positions with Hercules, Inc. and various key positions, including General Auditor, with Atlantic Richfield Company. Mr. Flexon holds a Bachelor of Science degree in Accounting from Villanova University. Mr. Flexon served on the public board of directors of Foster Wheeler from 2006 until 2009 and from May to October 2010 and is currently serving on the Boards of Westmoreland Coal Company and Genesys Works-Houston, an organization that transforms the lives of disadvantaged high school students through meaningful work experience. | |

|

|

2

Table of Contents

|

Pat Wood III, 55 Director since 2012

|

Chairman of the Board

Current Public Directorships:

Quanta Services Inc. and SunPower Corp.

Prior Experience:

• Federal Energy Regulatory Commission—Chairman • Public Utility Commission of Texas—Chairman • Baker Botts L.L.P.—Attorney • Arco Indonesia—Associate Project Engineer

Mr. Wood currently serves as our Board’s non-executive Chairman. Mr. Wood brings significant strategic and operational management experience to the Board. Mr. Wood holds a Bachelor of Science in Civil Engineering and a Juris Doctor degree, and has demonstrated strong leadership skills through ten years of regulatory leadership in the energy sector. Mr. Wood brings a unique perspective from and extensive knowledge with regard to the energy regulatory process and energy policy development at the government level, his years of service as a director of other public and private companies, and his energy infrastructure development expertise.

Mr. Wood is serving as the Board’s non-executive Chairman and has served as a principal of Wood3 Resources, an energy infrastructure developer, since July 2005. From 2001 until July 2005, Mr. Wood served as chairman of the Federal Energy Regulatory Commission. From 1995 until 2001, he chaired the Public Utility Commission of Texas. Prior to 1995, Mr. Wood was an attorney with Baker Botts L.L.P., a global law firm, and an associate project engineer with Arco Indonesia, an oil and gas company, in Jakarta. Mr. Wood currently serves on the public boards of directors of Quanta Services Inc. and SunPower Corp. |

3

Table of Contents

|

Hilary E. Ackermann, 62 Director since 2012

|

Current Private Directorships:

Credit Suisse Holdings (USA), Inc.

Hartford Funds (as detailed below)

Prior Experience:

• Goldman Sachs Bank USA—Chief Risk Officer; Chaired Operational Risk, Credit Risk and Middle Market Loan Committees; Vice Chair of Bank Risk Committee; Chair GS Group level Operational Risk Committee • Goldman Sachs & Co—Managing Director, Credit Risk Management & Advisory • Swiss Bank Corporation—Assistant Department Head • Apollo Investment Corporation—Board Director

Ms. Ackermann brings extensive experience assessing credit for major banking institutions, covering a variety of industries including the power generation, electrical utilities and natural resources sectors, as well as in depth coverage of commodities trading including, oil, natural gas and power as a risk manager. Ms. Ackerman currently serves as our Chair of the Finance and Commercial Oversight Committee and, as chair, she contributes significantly to the review and evaluation of our business strategy, capital structure and risk management goals.

Ms. Ackermann was Chief Risk Officer with Goldman Sachs Bank USA from October 2008 to 2011. In this role, she managed Credit, Market and Operational Risk for Goldman Sachs’s commercial bank; developed the bank’s risk management infrastructure including policies and procedures and processes; maintained ongoing relationship with bank regulators including New York Fed, NY State Banking Department and the FDIC; chaired Operational risk, Credit risk and Middle Market Loan Committees; served as Vice Chair of Bank Risk Committee; was a member of Community Investment, Business Standards and New Activities Committees; was a member of GS Group level Credit Policy and Capital Committees; and chaired GS Group level Operational Risk Committee. Ms. Ackermann served as Managing Director, Credit Department of Goldman, Sachs & Co. from January 2002 until October 2008, as VP, Credit Department from 1989 to 2001, and as an Associate in the Credit Department from 1985 to 1988. Prior to joining Goldman, Sachs, Ms. Ackermann served as Assistant Department Head of Swiss Bank Corporation from 1981 until 1985. Ms. Ackermann currently serves on the private board of directors of Credit Suisse Holdings (USA), Inc. and each of Hartford Series Fund, Inc., Hartford HLS Series Fund II, Inc., The Hartford Mutual Funds, Inc. and The Hartford Mutual Funds II, Inc. and previously served on the public board of directors of Apollo Investment Corporation. |

4

Table of Contents

|

Paul M. Barbas, 61 Director since 2012

|

Current Public Directorship:

El Paso Electric Co.

Prior Experience:

• DPL Inc. and DP&L—President and Chief Executive Officer; Board Director • Chesapeake Utilities Corporation—Executive Vice President & Chief Operating Officer; Vice President; • Chesapeake Service Company—President; • Allegheny Power—Executive Vice President; President of Ventures unit • Pepco Holdings, Inc.—Board Director

Mr. Barbas brings extensive utility, management and oversight experience, having served in executive management positions with various utility and other companies. He also has a broad background in finance and marketing and brings a strong understanding of power operations and energy markets. He contributes significantly to the oversight responsibilities on matters relating to executive compensation and compensation strategy and serves as our Compensation and Human Resources Committee chair.

Mr. Barbas was President and Chief Executive Officer of DPL Inc. and its principal subsidiary, The Dayton Power and Light Company (DP&L), from October 2006 until December 2011. He also served on the board of directors of DPL Inc. and DP&L. He previously served as Executive Vice President and Chief Operating Officer of Chesapeake Utilities Corporation, a diversified utility company engaged in natural gas distribution, transmission and marketing, propane gas distribution and wholesale marketing and other related services from 2005 until October 2006, as Executive Vice President from 2004 until 2005, and as President of Chesapeake Service Company and Vice President of Chesapeake Utilities Corporation, from 2003 until 2004. From 2001 until 2003, he was Executive Vice President of Allegheny Power, responsible for the operational and strategic functions of a $2.7 billion company serving 1.6 million customers with 3,200 employees. He joined Allegheny Energy in 1999 as President of its Ventures unit. Mr. Barbas serves on the board of El Paso Electric Co. and also formerly served on the public board of Pepco Holdings, Inc. | |

|

Richard Lee Kuersteiner, 78 Director since 2012

|

Prior Experience:

• Commander, Navy Judge Advocate General’s Corps; Managing Attorney, Navy Office of the General Counsel; Special Assistant United States Attorney; NASA Attorney; Assistant Florida Attorney General; and earlier, Law Clerk to a U. S. District Court Judge • Franklin Templeton Investments—Associate General Counsel; Director of Restructuring; Managing Corporate Counsel • Dex Media, Inc.—Board Director

Mr. Kuersteiner has a broad background in corporate governance and complex restructuring transactions and has been a long-standing member of the Stanford Institutional Investors Forum. He has employed his more than 40 years of legal experience by facilitating the restructuring of over 100 major corporations and has served on, or chaired, numerous official creditors’ committees, which provides the Board with a unique analytical view from the perspective of a large institutional investor. He leads the Board’s corporate governance review and oversight processes and serves as our Corporate Governance and Nominating Committee chair and as a member of the Compensation and Human Resources Committee.

Mr. Kuersteiner was a member of the Franklin Templeton Investments legal department in San Mateo, California from 1990 until May 2012. At Franklin he served in various capacities including as Associate General Counsel and Director of Restructuring and Managing Corporate Counsel. For many years he also was an officer of virtually all of the Franklin, Templeton and Mutual Series funds. In February 2010 he joined the board of R H Donnelley successor, Dex One Corporation, and served until completion of his term in May 2014. Mr. Kuersteiner also serves on the Town of Hillsborough, CA, Financial Advisory Committee and on its Investment Subcommittee. |

5

Table of Contents

|

Jeffrey S. Stein, 48 Director since 2012

|

Founder and Managing Partner of Stein Advisors LLC

Current Public Directorships:

Ambac Financial Group, Inc.—Chairman of the Board; and Westmoreland Coal Company

Prior Experience:

• Durham Asset Management LLC—Co-Founder and Principal; Co-Director of Research • The Delaware Bay Company, Inc.—Co-Director of Research • Shearson Lehman Brothers—Associate/Assistant Vice President in Capital Preservation & Restructuring Group • Granite Ridge Holdings, LLC, MLR Petroleum LLC, US Power Generating Company and KGen Power Corporation—Board Director

Mr. Stein is an investment professional with over 25 years of experience in the high yield, distressed debt and special situations equity asset classes who has substantial experience investing in the merchant power and regulated electric utility industries. Mr. Stein has invested in numerous power companies representing a broad array of power plants diversified by fuel source, position on the dispatch curve, geographic location and technology. Mr. Stein has been actively involved in the hedging, refinancing, restructuring and sale of various power assets. Mr. Stein has served on the private boards of other merchant power companies, and in such capacity has focused on capital allocation, plant operating and financial performance, capital structure optimization, asset acquisitions and dispositions, corporate strategy, risk management and investor communications.

Mr. Stein is Founder and Managing Partner of Stein Advisors LLC, a financial advisory firm that provides consulting services to institutional investors. Previously Mr. Stein was a Co-Founder and Principal of Durham Asset Management LLC, a global event-driven distressed debt and special situations equity asset management firm. From January 2003 through December 2009, Mr. Stein served as Co-Director of Research at Durham responsible for the identification, evaluation and management of investments for the various Durham portfolios. From July 1997 to December 2002, Mr. Stein served as Co-Director of Research at The Delaware Bay Company, Inc., a boutique research and investment banking firm focused on the distressed debt and special situations equity asset classes. From September 1991 to August 1995, Mr. Stein was an Associate/Assistant Vice President at Shearson Lehman Brothers in the Capital Preservation & Restructuring Group. Mr. Stein currently serves as Chairman of the Board of Ambac Financial Group, Inc. (NASDAQ: AMBC) and as a director on the board of Westmoreland Coal Company (NYSE: WLB). He also serves as a board observer on the board of TORM plc (NASDAQ CPH: TRMD A). Mr. Stein previously served as a director on the boards of Granite Ridge Holdings, LLC, MLR Petroleum LLC, US Power Generating Company and KGen Power Corporation. | |

6

Table of Contents

|

John R. Sult, 58 Director since 2012

|

Current Public Directorship:

Jagged Peak Energy, Inc.

Prior Experience:

• Marathon Oil Corporation—Executive Vice President and Chief Financial Officer

• El Paso Corporation—Executive Vice President and Chief Financial Officer; Senior Vice President and Chief Financial Officer; Senior Vice President and Controller; Chief Accounting Officer • El Paso Pipeline GP Company, L.L.C.—Executive Vice President, Chief Financial Officer and Director; Senior Vice President and Chief Financial Officer; Senior Vice President, Chief Financial Officer and Controller • El Paso Pipeline Group—Senior Vice President, Chief Financial Officer and Controller • Halliburton Energy Services—Vice President and Controller • Arthur Andersen LLP—Audit Partner

Mr. Sult, through his experience in senior executive financial positions with large public companies, brings significant knowledge of accounting, capital structures, finance, financial reporting, strategic planning and forecasting. Mr. Sult has extensive knowledge of the energy industry. Further, he has served as an audit partner at a major accounting firm, which, in addition to his other experience, qualifies him as an “audit committee financial expert.” He currently serves as the chair of the Audit Committee and, as the chair, he contributes significantly to the oversight of the integrity of our financial statements, internal controls and ethics and compliance functions.

Mr. Sult served as Executive Vice President and Chief Financial Officer of Marathon Oil Corporation from September 2013 to August 2016. He was Executive Vice President and Chief Financial Officer of El Paso Corporation from March 2010 until May 2012. He previously served as Senior Vice President and Chief Financial Officer from November 2009 until March 2010, and as Senior Vice President and Controller from November 2005 until November 2009. Mr. Sult served as Executive Vice President, Chief Financial Officer and director of El Paso Pipeline GP Company, L.L.C., the general partner of El Paso Pipeline Partners, L.P., from July 2010 until May 2012, as Senior Vice President and Chief Financial Officer from November 2009 until July 2010, and as Senior Vice President, Chief Financial Officer and Controller from August 2007 until November 2009. Mr. Sult also served as Chief Accounting Officer of El Paso Corporation and as Senior Vice President, Chief Financial Officer and Controller of El Paso’s Pipeline Group from November 2005 to November 2009. Prior to joining El Paso, Mr. Sult served as Vice President and Controller of Halliburton Energy Services from August 2004 until October 2005. Prior to joining Halliburton, Mr. Sult managed an independent consulting practice that provided a broad range of finance and accounting advisory services and assistance to public companies in the energy industry. Prior to private practice, Mr. Sult was an audit partner with Arthur Andersen LLP. Mr. Sult currently serves on the board of directors and as chair of the audit committee of Jagged Peak Energy, Inc. | |

EXECUTIVE OFFICERS

Below is certain information regarding each of Dynegy’s executive officers as of April 8, 2018 other than Robert C. Flexon, whose biographical information is presented under “Directors” above. Each executive officer of the Company, including Mr. Flexon, ceased serving in the positions indicated at the Merger Effective Time.

7

Table of Contents

|

Mario E. Alonso, 47 Served since 2001

|

Executive Vice President and General Manager Plant Operations (ERCOT & CAISO) and Supply Chain

Mr. Alonso has served as Executive Vice President and General Manager, Plant Operations (ERCOT & CAISO) and Supply Chain since October 2016. In the role, he is responsible for optimizing plant operations for Dynegy’s generating assets in Texas and California as well as managing the Company’s Supply Chain function. He previously served as Executive Vice President, Strategic Development from February 2014 to October 2016 and Vice President, Strategic Development from June 2012 to February 2014. Mr. Alonso also served as Vice President and Treasurer from July 2011 to June 2012, Vice President—Strategic Planning from December 2008 to July 2011 and Managing Director—Strategic Planning from June 2007 to December 2008. Prior to June 2007, Mr. Alonso served in various roles within the Company’s Strategic Planning and Treasury Departments. Prior to joining Dynegy in 2001, Mr. Alonso was with Enron Corporation. Mr. Alonso earned his Bachelor of Science in Commerce from the University of Virginia and his MBA from the University of Virginia Darden School of Business. | |

| Carolyn J. Burke, 50 Served since 2011

|

Executive Vice President, Strategy and Administration

Ms. Burke has served as Executive Vice President, Strategy, since October 2016, and Administration since September, 2017. In this role, she leads Dynegy’s strategic planning and Dynegy’s clean technology strategy. She also oversees Human Resources and Information Technology and serves as the Chief Integration Officer, held since October 2014, with overall responsibility for integration management. Ms. Burke served as Executive Vice President, Business Operations and Systems from July 2015 to October 2016 with overall responsibility for Procurement, Safety, Environmental, Information Technology, Construction & Engineering, Outage Services and PRIDE—Dynegy’s signature continuous margin and process improvement program. Ms. Burke served as Executive Vice President and Chief Administrative Officer from August 2011 to October 2014. Prior to joining Dynegy, Ms. Burke served as Global Controller for J.P. Morgan’s Global Commodities business from March 2008 to August 2011. Ms. Burke served as NRG Energy Inc.’s Vice President and Corporate Controller from September 2006 to March 2008 and its Executive Director of Planning and Analysis from April 2004 to September 2006. Early in her career, Ms. Burke held various key financial roles at Yale University, the University of Pennsylvania and at Atlantic Richfield Company (now British Petroleum). Ms. Burke graduated from Wellesley College with a BA in Economics and Political Science and earned her MBA at The University Chicago Booth School of Business. She currently serves on the board of directors for Aqua America. | |

| Julius Cox, 46 Served since 2001

|

Executive Vice President and Chief Transformation Officer

Mr. Cox has served as Executive Vice President and Chief Transformation officer since September, 2017. Mr. Cox is is responsible for leading Dynegy’s earnings and cost improvement efforts focusing on Generation, Supply Chain, Capital Expenditure and Working Capital. He served as Executive Vice President and Chief Administrative Officer from October 2014 to September 2017. Mr. Cox served as Vice President, Human Resources & Business Services from May 2012 to October 2014, Vice President, Human Resources from January 2006 to May 2012 and Managing Director—HR Business Services from May 2004 to January 2006. Prior to 2004, Mr. Cox served in various roles in Dynegy’s HR Business Partner and Compensation functions. Prior to joining Dynegy in 2001, Mr. Cox was a consultant at Arthur Andersen LLP and has also held various roles in human resources at Shell Oil and Neiman Marcus. Mr. Cox earned his Bachelor of Business Administration and a Master of Science in HR Management degrees from Texas A&M University. Mr. Cox serves on the Human Resources Committee of the Collaborative for Children, an organization dedicated to increasing the quality of early education in Greater Houston. |

8

Table of Contents

| Martin W. Daley, 62 Served since 2001

|

Executive Vice President and Chief Operating Officer

Mr. Daley has served as Executive Vice President & Chief Operating Officer since October 2016 and is responsible for all aspects of plant operations, safety and environmental for Dynegy’s national fleet of generating assets. Mr. Daley served as our Executive Vice President—Plant Operations, Gas from April 2015 to October 2016. He also served as Vice President and General Manager, Gas Operations from July 2011 to April 2015, Managing Director, Asset Management—Eastern Region from March 2007 to June 2011, and as Senior Director, Regulatory Affairs & Administrative Services from February 2001 to March 2007. Prior to joining Dynegy in February 2001, Mr. Daley held various positions within Central Hudson Gas & Electric, including Superintendent—General Plant Services, Plant Services Supervisor, Production facilities, and Corporate Environmental Affairs. He earned his Bachelor of Science in Environmental Science from Marist College. | |

| Dean M. Ellis, 48 Served since 2009

|

Executive Vice President, Regulatory and Government Affairs

Mr. Ellis has served as Executive Vice President, Regulatory and Government Affairs since September 2017 and as Senior Vice President, Regulatory and Government Affairs from October 2016 to September 2017. In this role he is responsible for Dynegy’s wholesale and retail market policy as well as environmental policy and government outreach. From June 2012 to October 2016 he led Dynegy’s regulatory affairs efforts for the Company, and from 2009 through June 2012, he worked in asset management and regulatory oversight roles in the Company’s Northeast Region. Prior to joining Dynegy in 2009, Mr. Ellis held various roles in electric power planning, engineering, project management and construction for organizations including the New York Independent System Operator and Central Hudson Gas & Electric. He participates on a variety of boards and holds positions of leadership, earned his Bachelor of Science degree in Electric Power Engineering from Rensselaer Polytechnic Institute, and is a licensed professional engineer. | |

| Clint C. Freeland, 49 Served since 2011

|

Executive Vice President and Chief Financial Officer

Mr. Freeland has served as Executive Vice President and Chief Financial Officer since July 2011. Mr. Freeland is responsible for Dynegy’s financial affairs, including finance and accounting, treasury, tax and banking and credit agency relationships. Prior to joining Dynegy, Mr. Freeland served as Senior Vice President, Strategy & Financial Structure of NRG Energy, Inc. from February 2009 to July 2011. Mr. Freeland served as NRG’s Senior Vice President and Chief Financial Officer from February 2008 to February 2009 and its Vice President and Treasurer from April 2006 to February 2008. Prior to joining NRG, Mr. Freeland held various key financial roles within the energy sector. Mr. Freeland graduated from Sewanee, the University of the South and earned his MBA at Vanderbilt University’s Owen Graduate School of Management. | |

9

Table of Contents

| Catherine C. James, 52 Served since 2011

|

Executive Vice President and General Counsel Ms. James has served as Executive Vice President and General Counsel since September 2011. Ms. James is responsible for all legal affairs, including legal services supporting Dynegy’s operational, commercial and corporate areas, as well as ethics and compliance. Prior to joining Dynegy, Ms. James served as General Counsel for NRG Gulf Coast and Reliant Energy in August 2011. Ms. James served as General Counsel for NRG Texas and Reliant Energy from August 2010 to August 2011 and as General Counsel for NRG Texas from November 2007 to August 2010. Prior to joining NRG Energy, Inc., Ms. James held various key legal roles at Calpine Corporation, Reliant Energy, The Coastal Corporation and Chevron. She is on the Board of Directors of New Hope Housing, an organization that provides life-stabilizing, affordable, and permanent housing with support services for people who live on limited incomes. She is a member of the Junior League of Houston. Ms. James earned a Bachelor of Arts degree from Smith College and Juris Doctor from the University of Texas School of Law. | |

| Henry D. Jones, 57 Served since 2013

|

Executive Vice President and Chief Commercial Officer

Mr. Jones has served as Executive Vice President and Chief Commercial Officer since April 2013. Mr. Jones is responsible for Dynegy’s commercial and asset management functions for its power generation business. In addition, Mr. Jones leads a team that develops and executes both hedging and term contracting options for the entire fleet. Prior to joining Dynegy, Mr. Jones served as Managing Director, North American Power and Gas Sales, and Origination at Deutsche Bank starting in May 2010, and managed Deutsche Bank’s North American Power and Gas trading activity starting in August 2012. Prior to joining Deutsche Bank, Mr. Jones was the Chief Operating Officer and Head of Trading at EDF Trading North America from August 2009 to February 2010, Head of Electricity Trading at EDF Trading Markets Limited from August 2008 to July 2009, and Director of Renewable Fuels Trading from July 2007 to July 2008. Mr. Jones was an investor, co-founder and chairman of Renewable Fuel Supply Limited from December 2003 to July 2007. Prior to 2003, Mr. Jones served in a variety of commercial positions with several domestic and international energy companies, including AEP Energy Services Ltd. and Duke Energy Corporation. He earned his Bachelor of Science degree in Marketing and his MBA from Oklahoma State University. | |

| Sheree M. Petrone, 61 Served since 2013

|

Executive Vice President, Retail

Ms. Petrone has served as our Executive Vice President, Retail since April 2015. Ms. Petrone is responsible for leading and overseeing all aspects of Dynegy’s retail electric sales business, including business development, customer care and operations. Ms. Petrone also serves as President of Dynegy’s retail businesses, Dynegy Retail and Homefield Energy. Ms. Petrone served as Vice President, Retail from August 2013 to April 2015. Prior to joining Dynegy in August 2013, Ms. Petrone held various senior leadership positions within Exelon Corporation from March 1999 to June 2013, including Vice President, Commercial Integration, Energy Trading & Marketing, Vice President, Fuels, Environmental Trading and Marketing, Vice President, Retail Energy Company (Exelon Energy), and Director of Finance and Planning (PECO Energy). Ms. Petrone also held business development roles with Trigen, a cogeneration project developer majority owned by Suez Lyonnaise des Eaux from May 1987 to March 1999. She received an MBA from Drexel University and holds a Bachelor of Arts degree in Chemistry and Art History from the University of Delaware. She serves as a board member for the Illinois State Chamber of Commerce, Magee Rehabilitation Hospital Foundation and the Vox Populi Artist Collective. | |

10

Table of Contents

AUDIT COMMITTEE

As of April 8, 2018, the members of the Audit Committee were: John R. Sult (Chair), Paul Barbas and Hilary Ackerman. Each member of the Audit Committee was independent as such term is defined in the NYSE and SEC rules. The Board had determined that each member of the Audit Committee possessed the necessary level of financial literacy required to enable him or her to serve effectively as an Audit Committee member, and all members qualified as Audit Committee Financial Experts, including our designated Financial Expert, Mr. Sult, our Audit Committee Chair. No Audit Committee member served on more than three audit committees of public companies, including our Audit Committee.

CODE OF BUSINESS CONDUCT AND ETHICS

Our Code of Business Conduct and Ethics applies to all of our directors, officers and employees. The key principles of this code include acting legally and ethically, notifying appropriate persons upon becoming aware of issues, obtaining confidential advice and dealing fairly with our stakeholders.

CODE OF ETHICS FOR SENIOR FINANCIAL PROFESSIONALS

Our Code of Ethics for Senior Financial Professionals applies to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and other designated senior financial professionals. The key principles of this code include acting legally and ethically, promoting honest business conduct and providing timely and meaningful financial disclosures to our stockholders.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than 10% of our equity securities to file reports of ownership and changes in ownership with the SEC and the NYSE. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely upon a review of the copies of such forms furnished to us in 2017 and upon written representations that no Forms 5 were required, we believe that all persons subject to these reporting requirements filed the required reports on a timely basis.

11

Table of Contents

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion should be read together with the compensation tables and disclosures for our named executive officers included under “Executive Compensation.” The following discussion contains statements regarding future company performance targets and goals. These targets and goals are disclosed in the limited context of our compensation programs and should not be considered as statements of our expectations or estimates of results or other guidance; to that end, these targets and goals will not be subject to updates.

INTRODUCTION

This section explains our executive compensation program, including philosophy, policies, practices and key compensation decisions for 2017 as it relates to our named executive officers, or Named Executive Officers. Compensation for our Named Executive Officers is further described in the Summary Compensation Tables and other compensation tables contained in this Amendment No. 1 to the Company’s Annual Report on Form 10-K.

2017 Named Executive Officers

| Name | Title | |

| Robert C. Flexon | President and Chief Executive Officer | |

| Clint C. Freeland | Executive Vice President and Chief Financial Officer | |

| Carolyn J. Burke | Executive Vice President, Strategy & Administration | |

| Catherine C. James | Executive Vice President and General Counsel | |

| Henry D. Jones | Executive Vice President and Chief Commercial Officer |

These Named Executive Officers, together with our other senior executives whose compensation is determined by the Compensation Committee and our Board, are referred to as our “Executive Management Team”.

12

Table of Contents

EXECUTIVE SUMMARY

The Compensation Committee is committed to sound compensation and corporate governance practices. It further believes the decisions regarding 2017 compensation were made to ensure continued alignment of executive compensation with the Company’s results, strategic, operational and financial accomplishments and the long-term interests of our stockholders.

Our long-term incentive, or LTI, awards are substantially performance-based aligned with stockholder interests. Our short-term incentive, or STI, plan is designed to reward the achievement of annual performance objectives critical to Dynegy’s success. These objectives are determined annually based on an in-depth strategic planning process with the Board of Directors and the Executive Management Team and progress is reviewed frequently throughout the year. For 2017, the objectives were categorized across five critical success factors weighted as follows for the purposes of determining STI funding for the year (Operations: 20% weighting; Strengthen the Balance Sheet: 30% weighting; Commercial and Retail: 25% weighting; Regulatory: 20% weighting; and Workforce Positioned to Succeed: 5% weighting).

The Compensation Committee and full Board reviewed LTI performance unit metrics and progress along the above STI objectives throughout the year and the Company’s and Named Executive Officers accomplishments in these areas impacted our compensation decisions and pay outcomes in 2017 as described below:

| ● | Our STI plan achieved a quantitative result equal to 100.5% of target based on results relative to our pre-established goals. |

| ● | The Compensation Committee had continued the use of performance shares as the largest component of the 2017 LTI awards for our Named Executive Officers. |

| ● | The PSUs granted in 2015 (covering the 2015-2017 performance period) resulted in no payment, as the Company’s total stockholder return, or TSR, performance threshold was not achieved. |

| ● | PSUs granted in 2016 and 2017 included a second performance metric: cumulative Free Cash Flow, or FCF. This second metric was added to enhance the line of sight for our management team, further align pay and performance and in response to feedback we received from some of our largest stockholders. |

BUSINESS STRATEGY AND COMPANY PERFORMANCE

The Compensation Committee believes that our compensation plans and policies are well-designed and structured to ensure that the compensation of our Named Executive Officers supports our compensation philosophy and objectives, which focus on pay and performance, alignment with stockholder value and market competiveness. This is especially important as the Compensation Committee balances executive compensation decisions that reward performance, while recognizing the challenges stockholders in the Independent Power Producer, or IPP, industry have faced.

During 2017, we proactively managed aspects of our business that were within our direct control, including strengthening the balance sheet, cost management, operations and portfolio management, and took an active and vocal leadership role on the regulatory front at the state and national level. Notable highlights from the past year include:

| ● | Repaid/refinanced $1.25 billion of the 2019 debt maturity and repriced secured debt twice, reducing LIBOR spread by 1.25% and saving $25 million in interest expense per year. |

| ● | Completed the GENCO subsidiary financial restructuring, eliminating $825 million of unsecured Genco bonds in exchange for a portion of cash, notes and warrants. |

| ● | Closed the Engie acquisition and exceeded the synergy target of $90 million. |

| ● | Achieved top decile safety performance and significantly reduced the severity of injuries (SIF) across the fleet. |

| ● | Exercised cost management measures across the fleet to help mitigate margin losses due to market decline and/or reliability issues. |

13

Table of Contents

| ● | Completed a series of divestitures in order to reduce debt balances resulting in $785 million in proceeds from asset sales. |

| ● | Completed the JOU unwind transactions with AEP and AES to improve operating efficiencies. |

| ● | Completed the Brayton Point decommissioning and sale. |

| ● | Our self-improvement program, PRIDE (Producing Results through Innovation by Dynegy Employees) exceeded the pre-established targets set for 2017, achieving $165 million in balance sheet improvements and $89 million in identified EBITDA enhancements. |

| ● | Initiated our Earnings and Cost Improvement program targeting $100 million in savings for 2018. |

Summary of the Key Features of our Executive Compensation Program

| We Do... | We Do Not... | |||

|

|

|

Pay for Performance

The total compensation for each Named Executive Officer provides reasonable upside potential based on performance as well as risk of no payment when performance objectives are not achieved. Our compensation structure includes a competitive base salary and performance based STI and LTI awards that are aligned with stockholder interests.

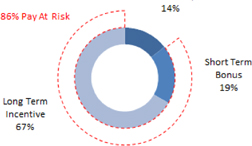

For 2017, the mix of pay across base salary, STI, and LTI for the CEO and the other Named Executive Officers was heavily weighted towards at-risk pay. As the two charts below illustrate, a total of 86% of total compensation allocated to Mr. Flexon, and 71% of the total compensation allocated to the other NEOs, was at-risk.

14

Table of Contents

| 2017 CEO Total Compensation | 2017 Total NEO Total Compensation | |

|

| |

Reported and Realizable Pay

The transformation of our portfolio began in 2013 with the acquisition of Ameren Energy Resources and has been accelerated through a series of acquisitions culminating with the completion of the ENGIE Acquisition in early 2017. During the latter half of this time period, we have seen the continuation of a low commodity price environment, significant shifts in the regulatory environment and a change in the stock price valuation for companies in the IPP sector. Over the course of this time period, the Compensation Committee has sought to structure our executive compensation programs to reward our Named Executive Officers for the accomplishment of strategic and annual business objectives, while demonstrating alignment with sustainable long-term stockholder value.

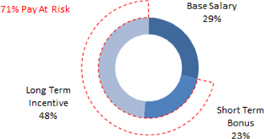

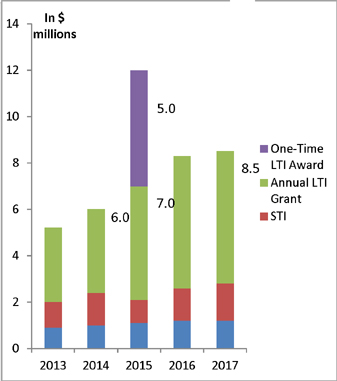

Reported Pay. In the first quarter of each year, the Compensation Committee establishes the annual compensation opportunities for the Named Executives. Decisions regarding base salary, annual STI targets and LTI awards are based on competitive pay levels and practices, Dynegy’s prior year performance, the executives’ individual performance, and progress on the execution of the Company’s strategic plan. Since our emergence from bankruptcy in 2012, Dynegy has made significant progress in enhancing the Company’s ability to generate long-term value for stockholders. The impact of acquisitions and other portfolio management decisions, cost reduction efforts, the realization of operational efficiencies and other actions within management’s control has positioned the Company for future success. Chart 1 illustrates the nearly 5X growth in Adjusted EBITDA1 and generation capacity since 2013. In recognition of these results, during this time period the Compensation Committee has made moderate increases to Mr. Flexon’s annual total compensation (excluding the one-time equity grant made in May 2015 in connection with execution of his amended employment contract), as shown in Chart 2.

1 We define Adjusted EBITDA as EBITDA adjusted to exclude (i) gains or losses on the sale of certain assets, (ii) the impacts of mark-to-market changes on derivatives related to our generation portfolio, as well as warrants, (iii) the impact of impairment charges: certain amounts such as those associated with the acquisitions, dispositions, and restructurings (v) non-cash compensation expenses (vi) gains or losses related to modification or extinguishment of debt, and (vii) other material or unusual items. For a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP financial measure, for fiscal years 2015, 2016 and 2017, see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” of the Original Form 10-K and for a reconciliation of Adjusted EBITDA to net income for fiscal years 2013 and 2014, see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” of our Annual Report on Form 10-K for the fiscal year ended 2014.

15

Table of Contents

| Chart 1 - Growth in Generation Capacity and Adjusted EBITDA

|

Chart 2 - 2013-2017 – Reported CEO Compensation | |

|

|

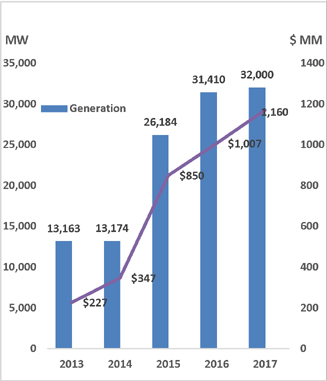

Realizable Pay. The Compensation Committee believes that both the mix and design of LTI award vehicles delivered to the Named Executive Officers establish strong alignment with stockholders, and such awards are working as intended. The average realizable value of these awards is approximately 40% of their reported value, as measured on December 31, 2017.

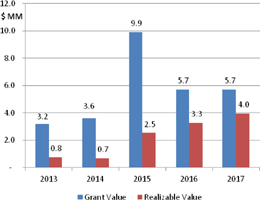

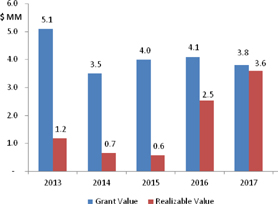

| Chart 1 - Grant Value of LTI Previously Awarded to the CEO vs. Realizable Value (as of Dec 31, 2017)

|

Chart 2 – Average Grant Value of LTI Previously Awarded to the other NEOs vs. Realizable Value (as of Dec 31, 2017) | |

|

|

16

Table of Contents

Note: Realizable Pay is defined using the following facts and assumptions:

| (1) | Dynegy closing stock price of $11.85 as of December 31, 2017. |

| (2) | 2013, 2014 and 2015 PSUs resulted in no payment. |

| (3) | Assumes 2016 and 2017 PSUs vest at target |

| (4) | Chart 1 includes a one-time RSU grant to Mr. Flexon in May 2015 in connection with the renewal of his employment agreement. |

EXECUTIVE COMPENSATION PROGRAM OVERVIEW

Philosophy and Objectives of our Executive Compensation Programs

The executive compensation program, administered by the Compensation Committee, is designed to attract, motivate and retain a highly qualified Executive Management Team capable of effectively managing and growing our business. Our executive compensation program reflects a fundamental belief that rewards should be competitive, both in elements and amount, with the broad labor market in which we compete for executive talent and commensurate with the Company and the individual executive’s performance. The primary objectives of our executive compensation program are:

| ● | Pay for Performance—Our total compensation for each individual provides reasonable upside potential for exceptional performance; as well as risk of no payment, with respect to incentive compensation, when performance objectives are not achieved. Our variable pay programs are designed as forward-looking incentives that reflect individual and corporate performance during the year under review. |

| ● | Alignment with Stockholder Value—Our LTI awards encourage share price improvement and a strong link to stockholder interests. Our compensation programs are designed and administered to maximize stockholder value. |

| ● | Market Competiveness—Our overall compensation strategy recognizes that attraction and retention of key talent is critical. A market competitive pay program is necessary to the attainment of our stated business goals and objectives and to the creation of value for our stockholders. |

The Compensation Committee considers these objectives in making decisions regarding the design of our executive compensation program, as well as the level and structure of pay for our Named Executive Officers.

Elements of our Executive Compensation Program

The Compensation Committee strives to promote a pay for performance culture. The executive compensation program was designed to incorporate three primary elements: base salary, STI, and LTI awards.

| Element | Key Characteristics | Pay at Risk | ||

| Base Salary |

● Reflects each Named Executive Officer’s scope, experience, qualifications, and impact on the Company’s business results |

No | ||

| Short-Term Incentive Awards |

● Designed to motivate the achievement of short-term business results critical to our success and achievement of long-term value creation for our stockholders ● Based on annual performance against specific identified financial, strategic, and operational goals |

Yes; payout is based on achievement of pre-established company goals and individual performance factors; no payout occurs if threshold performance goals are not achieved |

17

Table of Contents

| Element | Key Characteristics | Pay at Risk | ||

|

Long-Term Incentive Awards |

● Structured to achieve multiple objectives, including: the attraction and retention of executive talent; alignment of executives’ financial interests with the interests of stockholders; and rewarding the achievement of long-term strategic performance ● Delivered through a mix of award vehicles |

Yes; payout strongly linked to Dynegy’s stock price performance; decline in stock price will reduce the value of LTI awards and an increase in stock price will enhance the value of LTI awards | ||

|

Performance Share Units |

● Largest portion of total LTI mix ● Performance measured over a 3-year period, across two metrics: ● 50% based on TSR relative to peers ● 50% based on Dynegy’s cumulative FCF2 ● Award payouts are capped if Dynegy’s absolute TSR is negative |

Yes; value linked to Dynegy’s TSR relative to peers and FCF | ||

|

Restricted Stock Units |

● Subject to three-year vesting |

Yes; value linked to Dynegy’s stock price | ||

|

Stock Options |

● Subject to three-year vesting |

Yes; value present only when Dynegy’s stock price increases above the strike price (stock price on the day of grant) |

Peer Group and Benchmarking

The Compensation Committee uses compensation benchmarking data to provide a competitive market context to its decisions regarding compensation for the Named Executive Officers. To assist the Compensation Committee with setting 2017 target compensation levels, Meridian Compensation Partners, LLC, or Meridian, prepared a benchmarking review to assess the competitiveness of each element of compensation for the Named Executive Officers, and to provide information regarding incentive plan designs and pay practices within the energy industry.

The Compensation Committee reviewed and discussed the benchmarking data, and used the data to inform its compensation decisions. The Compensation Committee believes the combination of these two data perspectives offers an appropriate and credible basis for benchmarking the compensation of the Named Executive Officers. The Committee will continue to evaluate this approach and available data sources, and make changes as appropriate.

2 We define Free Cash Flow in the 2017 award agreements as cash flow from operations less non-discretionary maintenance and environmental capital expenditures, the cash impact of acquisition-related fees and financing costs plus the return of restricted cash. Free Cash Flow also includes receipts or payments related to interest rate swaps, excludes the impact of changes in collateral and working capital and excludes certain capital costs related to compliance with environmental requirements.

18

Table of Contents

The benchmarking approach for the 2017-2018 benchmarking cycle uses two sources of market data to assess the competitiveness of Dynegy’s executive compensation program—information contained in the public disclosures of a selected group of peer companies, and data from the 2017 Equilar Executive Compensation Survey database.

Selection of the peer companies presents certain challenges due to the limited number of directly comparable companies. Dynegy operates in competitive wholesale and retail markets as an IPP. Given the relatively small number of direct competitors, the Committee has expanded the peer group to include companies from three segments of the power generation industry—publicly traded independent power producers, electric utilities and multi-utilities who both possess competitive power generation operations— to provide a more robust and statistically significant peer group. Specific factors considered in selection of the peer group include:

| ● | Financial and Operational Metrics—assets, revenues, market capitalization, enterprise value; |

| ● | Operational Scope—merchant generation capacity, industry segment, commercial, retail and commodity focus; |

| ● | Market-Based Factors—labor market requirements (e.g., finance, operations, commercial), competition for executive talent, comparability of pay data; and |

| ● | External stockholder and governance evaluations of Dynegy’s pay levels and practices. |

The resulting selection of peer companies attempts to balance the above considerations with the need to identify companies that similarly face the unique challenges of the power generation market. The 2017 peer group consists of nine companies, plus Dynegy, that operate merchant power businesses, with revenues ranging from $1.4 billion to $28.6 billion (median revenues of $10.2 billion).

| Peer Companies | ||||

| IPPs | Electric Utilities | Multi-Utilities | ||

|

● AES Corporation ● Calpine Corporation ● Capital Power Corporation ● NRG Energy Inc. ● TransAlta Corporation |

● Entergy Corporation ● Exelon Corporation ● First Energy Corporation |

● Public Service Enterprise Group Inc. | ||

In 2017, one company was removed from the peer group (Talen Energy), while one firm was added (TransAlta Corporation). These changes were intended to further refine the benchmarking group, however our peer group is still comprised of companies that vary with respect to their core business model. The IPP peers operate portfolios that generate power in competitive, deregulated markets, while the utility peer companies operate portfolios that are also supported by a regulated rate base. Additionally, the increase in state regulatory actions, that in some instances have resulted in out-of-market subsidies for utility-owned generation facilities, have further contributed to uneven competitive landscape across the companies that comprise our peer group.

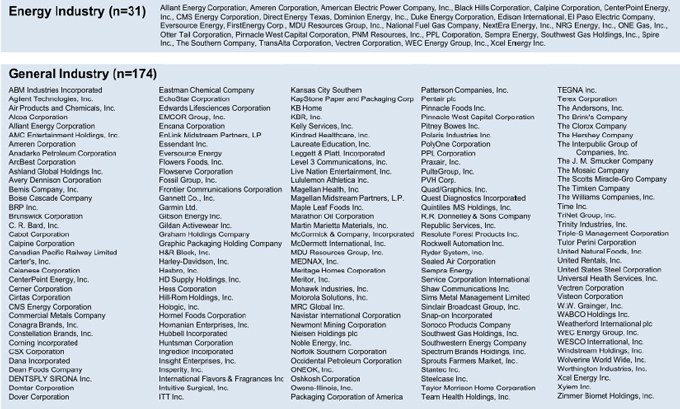

The Compensation Committee reviews benchmark compensation data for the Named Executive Officers, based on position matches developed from analyses of publicly-disclosed data from the peer group companies and supplemental benchmark data derived from the Equilar Executive Compensation Survey. This survey analysis included data from 32 energy industry companies with median revenues of $6.6 billion and 187 general industry companies with median revenues of $4.7 billion. A listing of the companies included in the survey data is provided in the table in Annex A.

The Compensation Committee does not target specific percentiles within the benchmark data provided by these sources when making compensation decisions. Rather, the Compensation Committee determines the appropriate competitive positioning for each Named Executive Officer based on a variety of factors including market data, individual expertise and individual performance and corporate performance.

19

Table of Contents

Stockholder Outreach and Say on Pay Results

Dynegy has maintained regular, year-round engagement with top stockholders through investor relations activities involving several members of our executive management team. These activities include quarterly earnings calls, conferences, face-to-face visits and other communication channels. Our outreach efforts, which covered updates to our strategic focus, executive compensation and overall governance practices, included discussions with several of our largest stockholders. These discussions provided feedback, on a number of areas, in support of the overall structure of our executive compensation program, and also highlighted the need to continue to more clearly explain the link between our business results with executive compensation decisions. We focused on such suggested disclosures and incorporated a number of suggested changes herein. We designed 2017 pay to address some stockholder concerns resulting in 80% Say on Pay results in 2017.

The primary participants in these discussions were our Compensation Committee Chair, our Chief Administrative Officer and members of our Human Resources, Legal and Investor Relations teams.

2017 COMPENSATION

Base Salary

The Compensation Committee considers job responsibilities, external benchmark data, internal pay equity, and individual performance to determine the level of base salary for each Named Executive Officer. In early 2017, the Compensation Committee reviewed these factors and base salaries for the Named Executive Officers and approved increases as indicated below:

| Percentage | ||||||||

| Named Executive Officer |

2016 Base Salary | 2017 Base Salary | Increase | |||||

|

Robert Flexon |

$1,200,000 | $1,240,000 | 3 | % | ||||

|

Clint Freeland |

$587,000 | $602,000 | 3 | % | ||||

|

Carolyn Burke |

$530,000 | $547,000 | 3 | % | ||||

|

Catherine James |

$525,000 | $542,000 | 3 | % | ||||

|

Henry Jones |

$527,100 | $560,000 | 6 | % | ||||

The Compensation Committee recommended increases for Mr. Flexon, Mr. Freeland, Ms. Burke, Ms. James, and Mr. Jones consistent with the merit adjustment budget that was provided to non-represented employees and comparable to the peer market levels relative to their individual performance. The Compensation Committee sought to adjust Mr. Jones’s salary upward in the competitive benchmark range commensurate with his experience and performance, and as such recommended a base salary adjustment, which was subsequently approved by the full Board.

Short-Term Incentive (STI) Plan

The Dynegy Inc. Incentive Compensation Plan, or STI Plan, serves as a variable, at-risk mechanism to reward our Named Executive Officers and other eligible employees for the achievement of annual performance objectives critical to our success. The STI Plan emphasizes pay for performance by providing cash awards for the achievement of pre-determined levels of Company performance. Annual STI awards are paid from a performance-based bonus pool designed to fund STI awards paid to our Named Executive Officers and other executives as determined through the STI Plan, and to allow for full tax deductibility of such STI awards.

20

Table of Contents

Individual STI Targets. The Compensation Committee reviews the STI target bonus opportunities for each Named Executive Officer on an annual basis, and may make adjustments to reflect changes in an individual role or to maintain competitive alignment. The Compensation Committee believes the target STI opportunities for 2017 were appropriately positioned relative to competitive benchmark levels and remain unchanged from 2016. The 2017 STI targets for each of the Named Executive Officers, expressed as a percentage of base salary, were as follows:

| Named Executive Officer | Target STI Opportunity (percent of base pay) | |

| Robert Flexon |

125% | |

| Clint Freeland |

75% | |

| Carolyn Burke |

75% | |

| Catherine James |

75% | |

| Henry Jones |

75% |

21

Table of Contents

The design of the STI Plan provided each of our Named Executive Officers with the opportunity to earn up to a maximum of 200% of their individual STI target, based on the Company’s performance relative to pre-established performance components and levels of achievement.

STI Performance Objectives. Each year, the Board of Directors, the Executive Management Team, and internal and external subject matter experts convene to review, discuss and determine the Company’s five-year Strategic Plan. The key priorities required to accomplish our strategic plan form the basis for our annual business objectives, which we refer to as Critical Success Factors. Each of the Critical Success Factors is weighted, and performance is measured against year-end performance to determine the overall funding for the STI program.

For 2017, the Committee approved five Critical Success Factors that were identified in the Strategic Plan to form the basis of performance goals under the STI Plan (see table below). These Critical Success Factors were focused on being the safest, most reliable, lowest-cost platform in the industry while optimizing the portfolio through PRIDE, strengthening the balance sheet, and reducing debt. Performance goals under Strengthen Balance Sheet, Commercial & Retail, Operations, and Workforce Positioned to Succeed (which collectively had an 80% weighting) included quantifiable performance metrics. In contrast, the performance goals under Regulatory (which had a 20% weighting) included subjective performance metrics. At the start of the year, the Committee established specific goals that defined threshold, target and maximum performance levels. Details regarding the specific performance goals are provided below in the section called “2017 STI Results”.

| Critical Success Factors | Weighting | |

| Strengthen Balance Sheet |

30% | |

| Operations |

20% | |

| Commercial & Retail |

25% | |

| Regulatory |

20% | |

| Workforce Positioned to Succeed |

5% |

Throughout the year, the Compensation Committee was provided with updates on progress against these performance goals. At the end of the year, the Compensation Committee reviewed achieved performance and determines the percentage of target payout earned as a result of this performance.

STI Funding Gate. In order for our annual STI Plan to be funded at any performance level, a minimum level of performance must be first achieved. In the first quarter of each year, the Compensation Committee established this “funding gate” based on a key financial performance metric. If this funding gate metric is not achieved, the STI program will not be funded, resulting in no STI payout to any employee, including our Named Executive Officers. For 2017, the Compensation Committee approved the funding gate of $47 million of FCF.

2017 STI Results. In February 2018, the Compensation Committee determined that the 2017 funding gate had been successfully achieved. The Compensation Committee then reviewed the Company’s performance relative to the 2017 Critical Success Factors and performance metrics and certified the quantitative result as 100.5% of target. The performance results were reviewed and confirmed by the Company’s Internal Audit team. The detailed performance results relative to the Critical Success Factors are summarized below:

22

Table of Contents

| Strengthen the Balance Sheet (30%) | Weight | Achievement | ||||||||||

| Financial Performance (40%) |

|

Adjusted EBITDA - $1,170MM | 50.0 | % | 50.0 | % | ||||||

|

FCF - $417MM | 50.0 | % | 200.0 | % | |||||||

| Liability Management Part I (30%) |

|

Closed sale of Armstron, Troy, Milford, MA, Dighton, and Lee generating $785MM, Brayton Pt $8MM, Cash benefit avoidance $62MM | 100.0 | % | 100.0 | % | ||||||

| Liability Management Part II (30%) |

|

GENCO/IPH consolidation completed as of Feb 2017. JOU swap and AEP complete, FERC approval for JOU rationalization with AES; Two tranches of PJM Capacity Forward Sale executed; Big three spending delayed two years improving 2017 and 2018 cash flow by $178M. | 100.0 | % | 150.0 | % | ||||||

| Operations (20%) | Weight | Achievement | ||||||||||

| Safety (includes ENGIE plants) (30%) |

|

Above target (25 OSHA recordables) performance | 60.0 | % | 150.0 | % | ||||||

|

Above target (4 VPP applications) completion | 10.0 | % | 150.0 | % | |||||||

|

Maximum achievement with 11 GAP Assessments completed | 10.0 | % | 200.0 | % | |||||||

|

100% of safety action plans submitted for Dynegy and ENGIE | 10.0 | % | 200.0 | % | |||||||

|

All quarterly reports completed | 10.0 | % | 150.0 | % | |||||||

|

Above target performance with 4 notice of violations at Dynegy plants | 25.0 | % | 150.0 | % | |||||||

| Environmental, NERC & CCB (10%) |

|

Above target performance with 3 notice of violations at ENGIE plants | 25.0 | % | 150.0 | % | ||||||

|

Coal Combustion Byproducts recycled at 79.4% - target | 50.0 | % | 100.0 | % | |||||||

| Achieve targeted reliability performance across the fleet (includeds ENGIE) (30%) |

|

LOC - $72.6MM, below target | 100.0 | % | 75.0 | % | ||||||

| Achieve Maximo performance metric (10%) |

|

Above target; entire fleet had 90% of critical performance metrics completed | 100.0 | % | 150.0 | % | ||||||

|

PRIDE - $87 MM EBITDA (maximum achievement) | 25.0 | % | 200.0 | % | |||||||

| Achieve targeted PRIDE performance on EBITDA and Balance Sheet (10%) |

|

PRIDE - $165MM Balance Sheet (maximum achievement) | 25.0 | % | 200.0 | % | ||||||

|

ENGIE - $91MM EBITDA (target achievement) | 25.0 | % | 100.0 | % | |||||||

|

ENGIE - $29MM Balance sheet (target achievement) | 25.0 | % | 100.0 | % | |||||||

| Improve strategic sourcing capabilities by effectively classifying all direct spend (~ $726M); includes ENGIE (10%) |

|

Achieved increased spend capture from current levels (5%) to target level (75%) | 100.0 | % | 100.0 | % | ||||||

| Commercial & Retail (25%) | Weight | Achievement | ||||||||||

|

Total MISO bilateral contracts, origination, exports PY 17/18 auction and/or incremental 2017 retail capacity sales above threshold at $64MM | 50.0 | % | 50.0 | % | |||||||

| Capacity Sales (50%) |

|

Total ISO-NE bilateral contracts and/or origination capacity sales below threshold at $21MM | 30.0 | % | 0.0 | % | ||||||

|

Total PJM bilateral contracts and/or origination capacity sales below threshold at $0 | 20.0 | % | 0.0 | % | |||||||

| Energy Sales (15%) |

|

Energy Sales Below Target | 100.0 | % | 50.0 | % | ||||||

| Fuel Procurement (excludes ENGIE) (10%) |

|

Fuel Procurement 60% of firm transportation and/or delivered natural gas is now secured | 100.0 | % | 150.0 | % | ||||||

| Retail (25%) |

|

EBITDA - below target by ($21MM) Variances driven by lower volumes due to weather and price competition especially IL. Lower volumes and the liquidation of excess hedge levels | 50.0 | % | 0.0 | % | ||||||

|

Forward sales at 54.7 MM TWh exceeding target by 4.7TWh | 50.0 | % | 150.0 | % | |||||||

23

Table of Contents

| Regulatory (20%) | Weight | Achievement | ||||||||||

| Out-of-Market Subsidies (40%) |

|

DYN is actively funding campaigns in CT, NJ, PA, OH. NY and IL litigation under apeal | 100.0 | % | 100.0 | % | ||||||

| Market Design (40%) |

|

PJM & ISONE: DYN actively participating in stakeholder processes on the capacity and energy market reforms | 100.0 | % | 100.0 | % | ||||||

| Actively engage in Federal policy development and implementation (20%) |

|

DYN actively worked to obtain a stay and reconsideration on the ELG rule; in addition, DYN is continuing to work wih the Illinois EPA staff on a combined Illinois MPS group | 100.0 | % | 100.0 | % | ||||||

|

Workforce Positioned to Succeed (5%)

|

Weight

|

Achievement

|

||||||||||

| Conduct Inspired Energy sessions (50%) |

|

Training on culture shaping initiative 100% completed at all locations | 100.0 | % | 100.0 | % | ||||||

| Conduct live ethics and compliance sessions (50%) |

|

Live ethics and compliance training sessions were conducted at 10 ENGIE plants | 100.0 | % | 100.0 | % | ||||||

The table below summarizes the actual achievement under each Critical Success Factor and the resulting weighted performance factor.

| Critical Success Factors | Target Weighting |

Actual Achievement |

Weighted Performance Factor |

|||||||||

|

Operations |

20 | % | 123.0 | % | 24.6 | % | ||||||

|

Strengthen the Balance Sheet |

30 | % | 125.0 | % | 37.50 | % | ||||||

|

Commercial & Retail |

25 | % | 53.80 | % | 13.40 | % | ||||||

|

Regulatory |

20 | % | 100.0 | % | 20.0 | % | ||||||

|

Worforce Positioned to Succeed |

5 | % | 100.0 | % | 5.0 | % | ||||||

|

Total Achievement Result |

100.5 | % | ||||||||||

|

Compensation Committee Recommendation |

100.0 | % | ||||||||||

Approved 2017 STI Awards. In February 2017, the Compensation Committee approved the STI awards for our Named Executive Officers as set forth in the below table. The awards for Mr. Freeland, Ms. Burke, Ms. James and Mr. Jones were recommended by Mr. Flexon and reviewed and approved by the Compensation Committee. The award levels reflect the contributions each made relative to the 2017 Critical Success Factors and assessment of their individual performance during the year. Mr. Flexon’s award was recommended by the Compensation Committee and approved by the full Board. All awards for the Named Executive Officers were above target and the quantitative result. The Compensation Committee and Board’s review of individual performance and contributions resulted in final payouts above the 100% funding percentage.

Robert Flexon: As Chief Executive Officer, Mr. Flexon led the organization through its efforts to grow the business in what we believe are the most attractive competitive markets. Additional accomplishments in 2017 included:

| ● | Drove the balance sheet improvement through multiple debt refinancings, $785 million in asset sales, and $87 million and $165 million in EBITDA and Balance Sheet improvements, respectively. |

| • | Negotiated and reached agreement with the Genco creditor group which resulted in the extinguishment of over $600 million in debt. |

| • | Led and directed the Vistra negotiations and activities which led to overwhelming shareholder approval. |

| • | Responsible for our culture shaping efforts, including safety programs. Safety performance in 2017 was the best performing year since 2010. |

Clint Freeland:

As EVP and Chief Financial Officer, Mr. Freeland leads the finance organization, which achieved the following in 2017:

| • | Successfully provided financing and financial integration of the ENGIE acquisition and the financial framework and analysis for Vistra transaction and for IPH/Genco restructuring. |

| • | Orchestrated the repayment/refinancing of $1.25 billion of the 2019 debt maturity. |

24

Table of Contents

| • | Led repricing DYN’s ~$2 billion secured debt twice, saving $25MM/yr. in interest expense. |

| • | Supported PRIDE and ECI initiatives and analysis. |

Carolyn Burke:

As EVP, Strategy & Administration, Ms. Burke leads the Company’s strategic planning activities. She has also taken on additional responsibilities of administration functions including Human Resources and Information Technology. Other accomplishments included:

| • | Led Dynegy’s M&A activities, including the Vistra combination analysis and synergy identification. |

| • | Successful integration of ENGIE capturing $90+mm in synergies. |

| • | Completed asset sales of Lee, Dighton, Milford, Armstrong and Troy and JOU rationalization. |

| • | Established robust strategic planning process that clearly delineated strategic priorities. |

| • | Developed culture of project management supported by sponsored project management teams. |

Catherine James: