Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Iridium Communications Inc. | irdm10-q033118exx321.htm |

| EX-31.2 - EXHIBIT 31.2 - Iridium Communications Inc. | irdm10-q033118exx312.htm |

| EX-31.1 - EXHIBIT 31.1 - Iridium Communications Inc. | irdm10-q033118exx311.htm |

| EX-10.4 - EXHIBIT 10.4 - Iridium Communications Inc. | irdm10-q033118exx104.htm |

| EX-10.3 - EXHIBIT 10.3 - Iridium Communications Inc. | irdm10-q033118exx103.htm |

| EX-10.2 - EXHIBIT 10.2 - Iridium Communications Inc. | irdm10-q033118exx102.htm |

| EX-4.1 - EXHIBIT 4.1 - Iridium Communications Inc. | irdm10-q033118exx41.htm |

| 10-Q - 10-Q - Iridium Communications Inc. | irdm10-q033118.htm |

EXECUTION VERSION

Exhibit 10.1

SUPPLEMENTAL AGREEMENT | |

dated 09 March 2018 | |

between IRIDIUM COMMUNICATIONS INC. as Parent and IRIDIUM SATELLITE LLC as Borrower and THE GUARANTORS and SOCIÉTÉ GÉNÉRALE the BPIAE Agent relating to a BPIAE Facility Agreement dated 4 October 2010 as amended from time to time and as further amended and restated on the Effective Date (as defined herein) | |

Allen & Overy LLP |

0080105-0000405 PA:20489646.8 CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

CONTENTS

Clause | Page | |||

1. | Interpretation | 1 | ||

2. | Permitted HY Issuance | 2 | ||

3. | Representations | 4 | ||

4. | Fees, Costs and Expenses | 6 | ||

5. | Consents | 6 | ||

6. | Security | 6 | ||

7. | Miscellaneous | 7 | ||

8. | Governing law | 7 | ||

9. | Enforcement | 7 | ||

Schedule | ||||

1. | Conditions Precedent | 9 | ||

2. | Description of Notes | 12 | ||

3. | Amended and Restated Facility Agreement | 62 | ||

Signatories | ||||

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

THIS AGREEMENT is dated ______ March 2018

BETWEEN:

(1) | IRIDIUM COMMUNICATIONS INC., a Delaware corporation (the Parent); |

(2) | IRIDIUM SATELLITE LLC, a Delaware limited liability company, as borrower (the Borrower); |

(3) | THE GUARANTORS under and as defined in the Facility Agreement (defined below); and |

(4) | SOCIÉTÉ GÉNÉRALE as agent of the other Finance Parties (in this capacity the BPIAE Agent). |

BACKGROUND

(A) | We refer to the Facility Agreement. |

(B) | On and subject to the terms of this Agreement, the Parent intends to enter into the Permitted HY Issuance (as defined below). |

(C) | BPIAE and the Lenders have consented to the entry into by the Parent of the Permitted HY Issuance on and subject to the terms of this Agreement, and the amendments to the Facility Agreement in relation thereto contemplated by this Agreement. |

(D) | Accordingly, the BPIAE Agent is authorised to execute this Agreement on behalf of the Finance Parties. |

IT IS AGREED as follows:

1. | INTERPRETATION |

1.1 | Definitions |

(a) | In this Agreement: |

Amended and Restated Facility Agreement means the Facility Agreement as amended and restated by this Agreement and attached hereto as Schedule 3 (Amended and Restated Facility Agreement).

Description of Notes means the description of notes in relation to the Permitted HY Issuance attached hereto as Schedule 2 (Description of Notes).

Effective Date has the meaning given to it in Clause 2.1(a) (Conditions to Permitted HY Issuance and Amendment and Restatement upon Permitted HY Issuance).

Facility Agreement means the Facility Agreement between among others the Parent, the Borrower, the Guarantors and the BPIAE Agent dated 4 October 2010.

Funds Flow Memorandum means a funds flow memorandum prepared by or on behalf of the Parent showing the anticipated flow of funds in respect of the Permitted HY Issuance and TAS Payment Instruments on the Effective Date.

HoldCo means Iridium Holdings LLC.

0080105-0000405 PA:20488617.7 | 1 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

Parent Notes means the notes issued by the Parent in connection with the Permitted HY Issuance.

Parent Notes Indenture means the indenture to be entered into by the Parent in connection with the issuance of the Parent Notes.

Permitted HY Documents means:

(a) the Parent Notes;

(b) the Parent Notes Indenture; and

(c) any other transaction documentation relating to the Permitted HY Issuance.

Permitted HY Issuance means the issuance by the Parent of unsecured high yield notes pursuant to the Permitted HY Documents as permitted under this Agreement, the terms of such Permitted HY Documents which are substantially consistent with the Description of Notes, those notes being in an amount equal to the Permitted HY Issuance Amount, with the proceeds thereof applied in accordance with Clause 2.2 (Application of Permitted HY Issuance proceeds) (the Original Issuance) or any refinancing or replacement of such notes by the issuance by the Parent of unsecured high yield notes with a maturity date no earlier than 12 months after the Final Maturity Date on terms no more onerous for the NEXT Group and the Senior Credit Group than the terms of the Original Issuance and in an amount not greater than the principal amount of the notes then outstanding plus the aggregate amount of interest, fees, premiums and expenses payable in connection with such refinancing or replacement.

Permitted HY Issuance Amount means an aggregate principal amount of $360,000,000.

Satellite Supply Contract Amendment Agreement means amendment agreement no. 32 entered into on or about the date of this Agreement in relation to the Satellite Supply Contract between the Borrower and TAS.

(b) | Capitalised terms defined in the Facility Agreement have, unless expressly defined in this Agreement, the same meaning in this Agreement. |

1.2 | Construction |

The principles of construction set out in clause 1.2 of the Facility Agreement will have effect as if set out in this Agreement.

2. | PERMITTED HY ISSUANCE |

2.1 | Conditions to Permitted HY Issuance and Amendment and Restatement upon Permitted HY Issuance |

(a) | At any time prior to 31 July 2018, the Parent may enter into and complete the Permitted HY Issuance provided that, at the time of consummation of the Permitted HY Issuance (such date being the Effective Date): |

0080105-0000405 PA:20488617.7 | 2 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(i) | the BPIAE Agent has notified the Borrower and the Lenders that it has received all of the documents and evidence set out in Schedule 1 (Conditions Precedent) in form and substance satisfactory to it (acting on the instructions of all Lenders); |

(ii) | no Default is continuing or would result from the execution, delivery and performance of the Parent Notes Indenture and the issuance of the Parent Notes; and |

(iii) | the representations and warranties which are then to be made or deemed to be repeated by each Obligor under this Agreement and the Facility Agreement (including, as applicable, on the Effective Date and under the Amended and Restated Facility Agreement) are true in all material respects. |

(b) | The Parent shall notify the BPIAE Agent promply upon: |

(i) | consummation by the Parent of the Permitted HY Issuance as permitted under (a) above; and |

(ii) | gross proceeds in an amount equal to the Permitted HY Issuance Amount (net of the amounts set forth in Clause 2.2(a)) being made unconditionally available to the Parent. |

(c) | The Facility Agreement will be amended from the Effective Date so that it reads as if it were restated in the form set out in Schedule 3 (Amended and Restated Facility Agreement) provided that if the Effective Date has not occurred by 31 July 2018, the Facility Agreement will not be amended in the manner contemplated by this Agreement. |

2.2 | Application of Permitted HY Issuance proceeds |

(a) | The Parent must immediately upon such proceeds becoming available on the Effective Date apply the aggregate gross proceeds of the Permitted HY Issuance (net of costs, fees, discounts and expenses, including initial purchaser fees and discounts and counsel fees and expenses, incurred in connection with the Permitted HY Issuance in accordance with the Funds Flow Memorandum) by way of equity capital contribution directly or indirectly to HoldCo. |

(b) | HoldCo must immediately apply the aggregate gross proceeds of the Permitted HY Issuance (as contributed to it directly or indirectly by the Parent) by way of equity capital contribution to the Borrower. |

(c) | The Borrower must apply the aggregate gross proceeds of the Permitted HY Issuance (as contributed to it by HoldCo) as follows: |

(i) | in immediate payment of such amount as required to make the amount on deposit in or credited to the Debt Service Reserve Account equal to at least $189,000,000; |

(ii) | in immediate prepayment of all amounts payable under the TAS Payment Instruments outstanding as of the Effective Date (or such lower amount agreed by the Borrower and TAS so as to procure immediate cancellation of such TAS Payment Instruments), being in an aggregate amount of no more than $59,935,870 in any event; |

0080105-0000405 PA:20488617.7 | 3 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(iii) | in payment when due of amounts owing to TAS corresponding to milestones 142-2, 124, 126, 105 and 130 as identified in the Satellite Supply Contract Amendment Agreement, being in an aggregate amount of no more than $44,410,159,924 in any event; |

(iv) | in payment of costs, fees and expenses incurred in connection with this Agreement and legal costs incurred in connection with the cancellation of the TAS Payment Instruments in accordance with the Funds Flow Memorandum; and |

(v) | the remainder for general corporate purposes. |

(d) | The Borrower may, following payment in full of all amounts referenced in paragraphs (c)(i) to (c)(iv) above (inclusive), elect to apply remaining proceeds of the Permitted HY Issuance (as contributed to it by HoldCo) in acquisition of or subscription for [***], provided that the consideration for such acquisition or subscription (as applicable) is in an aggregate amount of no more than $[***] and provided further that the Borrower must grant first ranking Security over the acquired [***] in favour of the Security Agent (for and on behalf of the Secured Parties) promptly upon completion of the acquisition or subscription. |

(e) | Any transfer made pursuant to this Clause between two entities may be made in part via intermediate entities, as appropriate. |

3. | REPRESENTATIONS |

3.1 | Representations |

The representations set out in this Clause are made by each Obligor to each Finance Party on:

(a) | the date of this Agreement; and |

(b) | the Effective Date, |

other than the representations set out at Clause 3.7 (Permitted HY Issuance) which are made only on the Effective Date.

3.2 | Powers and authority |

It has the power to enter into, perform and deliver, and has taken all necessary action to authorise the entry into, performance and delivery of, this Agreement and the transactions contemplated by this Agreement (as applicable, including the Permitted HY Issuance).

3.3 | Legal validity |

Subject to the Legal Reservations, the obligations expressed to be assumed by it in this Agreement to which it is a party are legal, valid, binding and enforceable obligations.

3.4 | Non-conflict |

The entry into and performance by it of, and the transactions contemplated by, this Agreement (as applicable, including the Permitted HY Issuance) do not and will not conflict with:

0080105-0000405 PA:20488617.7 | 4 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(a) | any law or regulation applicable to it; |

(b) | its constitutional documents; or |

(c) | any agreement or instrument binding upon it or any of its assets or constitute a default or termination event (however described) under any such agreement or instrument where such circumstance has or is reasonably likely to have a Material Adverse Effect (provided that nothing in this paragraph (c) shall prejudice the generality of the representation given under paragraph (b) of Clause 3.7 (Permitted HY Issuance) on the Effective Date). |

3.5 | Authorisations |

All authorisations required by it in connection with the entry into, performance, validity and enforceability of, and the transactions contemplated by, this Agreement (as applicable, including the Permitted HY Issuance) have been obtained or effected (as appropriate) and are in full force and effect.

3.6 | Governing law and enforcement |

(a) | Subject to the Legal Reservations, the choice of governing law of this Agreement will be recognised and enforced in its Relevant Jurisdictions. |

(b) | Subject to the Legal Reservations, any judgment obtained in relation to this Agreement will be recognised and enforced in its Relevant Jurisdictions. |

3.7 | Permitted HY Issuance |

(a) | The terms of the Parent Notes Indenture and the Parent Notes are substantially consistent with the Description of Notes, except as otherwise agreed in writing between the BPIAE Agent (acting on the instructions of the Lenders) and the Borrower. |

(b) | The execution and delivery of the Parent Notes Indenture and the Parent Notes do not and the performance by the Parent of its obligations thereunder will not, result in any conflict with the terms of the Facility Agreement (as amended and restated under this Agreement). |

(c) | No term of the Parent Notes Indenture or the Parent Notes is more onerous for the NEXT Group and the Senior Credit Group than the terms of the Facility Agreement (as amended and restated under this Agreement), except as otherwise agreed in writing between the BPIAE Agent (acting on the instructions of the Lenders) and the Borrower. |

(d) | In the case of the Parent, it does not trade, carry on any business, own any assets or incur any liabilities except in respect of the Permitted Parent Business. |

(e) | In the case of HoldCo, it does not trade, carry on any business, own any assets or incur any liabilities except in respect of the Permitted HoldCo Business. |

3.8 | Credit Agreement |

Unless a representation and warranty set out in clause 20 (Representations) of the Facility Agreement is expressed to be given at a specific date, each Obligor makes the representations and warranties set

0080105-0000405 PA:20488617.7 | 5 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

out in clause 20 (Representations) of the Facility Agreement (other than the representations and warranties in clauses 20.14(a), (b) and (c) (Original Financial Statements), 20.18 (Taxation) and 20.24 (Shares and Material Companies) of the Facility Agreement) on:

(a) | the date of this Agreement; and |

(b) | the Effective Date, |

in each case as if references to the Facility Agreement are references to the Facility Agreement, as amended and restated by this Agreement, with reference to the facts and circumstances then existing, provided that, in the case of those representations and warranties contained in clause 20.13 (No misleading information) of the Facility Agreement, such representations and warranties are made with respect to any information delivered under or in connection with this Agreement.

4. | FEES, COSTS AND EXPENSES |

(a) The Borrower must, on the date of this Agreement, pay to the BPIAE Agent:

(i) | for the account of the BPIAE Agent, all costs and expenses incurred by the BPIAE Agent in relation to this Agreement; and |

(ii) | for the account of each Lender, a waiver fee in the amount of [***]% of its Commitment. |

(b) | The Borrower must pay to the BPIAE Agent all costs and expenses incurred by it in relation to this Agreement arising after the date of this Agreement and on or prior to the Effective Date (without duplication of amounts paid pursuant to paragraph (a) above). |

(c) | The Borrower must, on the Effective Date, pay to the BPIAE Agent for the account of BPIAE, any additional BPIAE premium which BPIAE determines is payable in relation to the amendments contemplated by this Agreement (as notified to the Borrower by the BPIAE Agent in writing). The Borrower acknowledges that the amount of BPIAE premium paid under this paragraph is not refundable for any reason whatsoever except with the specific approval of BPIAE. |

5. | CONSENTS |

Each Obligor:

(a) | agrees to the amendment and restatement of the Facility Agreement as contemplated by this Agreement; and |

(b) | with effect from the Effective Date, confirms that any guarantee or security given by it or created under a Finance Document will: |

(i) | continue in full force and effect; and |

(ii) | extend to the liabilities and obligations of the Obligors to the Finance Parties under the Finance Documents as amended by this Agreement. |

6. | SECURITY |

0080105-0000405 PA:20488617.7 | 6 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(a) | On the Effective Date, each Obligor confirms that: |

(i) | any Security (as defined in the Transaction Security Documents) in favour of the Secured Parties created by it under the Transaction Security Documents extends to the obligations of the Obligors under the Finance Documents (including the Amended and Restated Facility Agreement) subject to any limitations set out in the Transaction Security Documents; |

(ii) | the obligations of the Obligors arising under the Amended and Restated Facility Agreement are included in the Secured Liabilities (as defined in the Transaction Security Documents) subject to any limitations set out in the Transaction Security Documents; and |

(iii) | the Security (as defined in the Transaction Security Documents) in favour of the Secured Parties created under the Transaction Security Documents continue in full force and effect on the terms of the respective Transaction Security Documents. |

(b) | No part of this Agreement will create, creates or is intended to create, a registrable Security (as defined in the Transaction Security Documents). |

7. | MISCELLANEOUS |

(a) | Each of this Agreement and the Amended and Restated Facility Agreement is a Finance Document. |

(b) | Subject to the terms of this Agreement, the Facility Agreement will remain in full force and effect and, from the Effective Date, the Facility Agreement and this Agreement will be read and construed as one document. |

(c) | Except to the extent expressly stated in this Agreement, no waiver is given by this Agreement, and the Finance Parties expressly reserve all their rights and remedies in respect of any breach of, or other Default under, a Finance Document. |

(d) | Each Finance Party reserves any other right or remedy it may have now or subsequently. This Agreement does not constitute a waiver of any right or remedy other than in relation to the specific waiver expressly given under this Agreement. |

(e) | Nothing in this Agreement shall affect the rights of any Finance Party in respect of the occurrence of any other Default or Event of Default which is continuing and which has not been remedied or waived in accordance with the terms of the Finance Documents or which arises on or after the date of this Agreement. |

8. | GOVERNING LAW |

This Agreement and any non-contractual obligations arising out of or in connection with it are governed by English law.

9. | ENFORCEMENT |

9.1 | Jurisdiction of English courts |

0080105-0000405 PA:20488617.7 | 7 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(a) | The courts of England have exclusive jurisdiction to settle any dispute arising out of or in connection with this Agreement (including a dispute relating to the existence, validity or termination of this Agreement) (a Dispute). |

(b) | The Parties agree that the courts of England are the most appropriate and convenient courts to settle Disputes and accordingly no Party will argue to the contrary. |

(c) | This Clause 9.1 is for the benefit of the Finance Parties and Secured Parties only. As a result, no Finance Party or Secured Party shall be prevented from taking proceedings relating to a Dispute in any other courts with jurisdiction. To the extent allowed by law, the Finance Parties and Secured Parties may take concurrent proceedings in any number of jurisdictions. |

9.2 | Arbitration |

(a) | Notwithstanding the above terms of this Clause, if the BPIAE Agent so elects in writing, any dispute, difference, claim or controversy arising out of or in connection with this Agreement, including any question regarding its existence, validity, interpretation, breach or termination, shall be referred to and finally resolved by arbitration under the London Court of International Arbitration Rules (for the purposes of this Subclause, the Rules). |

(b) | The Rules are incorporated by reference into this Clause and capitalised terms used in this Clause which are not otherwise defined in this Agreement, have the meaning given to them in the Rules. Any requirement in the Rules to take account of the nationality of a person considered for appointment as an arbitrator shall be disapplied and a person shall be nominated or appointed as an arbitrator (including as Chairman) regardless of his or her nationality. |

(c) | The number of arbitrators shall be three. The parties agree that the London Court of International Arbitration shall appoint the Arbitral Tribunal without regard to any party's nomination. |

(d) | Each Obligor and each Finance Party: |

(i) | expressly agrees and consents to this procedure for nominating and appointing the Arbitral Tribunal; and |

(ii) | irrevocably and unconditionally waives any right to choose its own arbitrator. |

(e) | The seat, or legal place of arbitration, shall be London. The language used in the arbitral proceedings shall be English. |

9.3 | Waiver of trial by jury |

Each party waives any right it may have to a jury trial of any claim or cause of action in connection with any finance document or any transaction contemplated by any finance document. This agreement may be filed as a written consent to trial by the court.

This Agreement has been entered into on the date stated at the beginning of this Agreement.

0080105-0000405 PA:20488617.7 | 8 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

Schedule 1

CONDITIONS PRECEDENT

1. | Corporate documentation |

(a) | A copy of the constitutional documents of each Obligor (it being understood and agreed that the copies of the constitutional documents of any Obligor previously delivered to the BPIAE Agent on or prior to the date of this Agreement shall not be required to be redelivered pursuant to this paragraph (A)(1)). |

(b) | A copy of a resolution of the board of directors or members (as applicable) of each Obligor: |

(i) | approving the terms of, and the transactions contemplated by, this Agreement and the Amended and Restated Facility Agreement and resolving that it execute, deliver and perform the Amended and Restated Facility Agreement and the Agreement; |

(ii) | authorising a specified person or persons to execute this Agreement on its behalf; and |

(iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with the Amended and Restated Facility Agreement and the Agreement. |

(c) | A specimen of the signature of each person authorised on behalf of an Obligor to enter into the Agreement or to sign or send any document or notice in connection with the Amended and Restated Facility Agreement and the Agreement (unless previously delivered to the BPIAE Agent on or prior to the date of this Agreement). |

(d) | A certificate of an authorised officer of each Obligor certifying that: |

(i) | each copy document specified in paragraph (1)(a) of this Schedule delivered by such Obligor is true and complete as in effect on the date of such certificate, or if previously delivered to the BPIAE Agent, a certification that such documents previously delivered to the BPIAE Agent have not been amended, supplemented or otherwise modified (except for those amendments, modifications, waivers, supplements thereto for which true and complete copies have been provided to the BPIAE Agent) and such documents previously delivered (together with any amendments, modifications, waivers or supplements thereto delivered to the BPIAE Agent, if applicable) remain true and complete copies; |

(ii) | each copy document specified in paragraph (1)(b) of this Schedule delivered by such Obligor is true and complete and has not been amended, annulled, rescinded or revoked and there exist no other resolutions of the Obligor relating to the matters set forth therein; and |

(iii) | borrowing or guaranteeing or securing, as appropriate, the Total Commitments would not cause any borrowing, guarantee, security or similar limit binding on it to be exceeded. |

(e) | A certificate of an authorised signatory of the Parent: |

(i) | confirming that entering into the Permitted HY Issuance would not cause any borrowing, guaranteeing, securing or similar binding limit on it to be breached; |

0080105-0000405 PA:20488617.7 | 9 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(ii) | certifying that each copy document specified in this Schedule is correct, complete and in full force and effect as at a date no earlier than the date of this Agreement; and |

(iii) | certifying that the Parent Notes Indenture and the Parent Notes are substantially consistent with the Description of Notes except as otherwise agreed in writing between the BPIAE Agent (acting on the instructions of the Lenders) and the Borrower. |

2. | Legal opinion |

(a) | A no conflict legal opinion of Milbank under English law addressed to the BPIAE Agent (for itself and for the benefit of the Lenders) in form and substance reasonably satisfactory to the BPIAE Agent (acting on the instructions of the Lenders). |

(b) | A reliance opinion addressed to the BPIAE Agent (for itself and for the benefit of the Lenders) in form and substance reasonably satisfactory to the BPIAE Agent (acting on the instructions of the Lenders) in relation to the legal opinion of Milbank under New York law addressed to Deutsche Bank Securities Inc. (as representative of the several initial purchasers of the Parent Notes) in relation to the Parent Notes. |

(c) | A capacity legal opinion of Milbank under New York law in relation to the Obligors addressed to the BPIAE Agent (for itself and for the benefit of the Lenders) in form and substance reasonably satisfactory to the BPIAE Agent (acting on the instructions of the Lenders). |

3. | TAS Payment Instruments |

(a) | A copy of the omnibus termination agreement in relation to the TAS Payment Instruments, Security and Intercreditor Agreement and certain Control Agreements, executed by the Borrower, TAS, [***] and the BPIAE Agent. |

(b) | A copy of the Satellite Supply Contract Amendment Agreement. |

(c) | A notice of assignment from the Borrower to the Excluded Company in agreed form. |

(d) | An acknowledgment of notice of assignment from the Excluded Company to the Borrower, the Security Agent and the BPIAE Agent in agreed form. |

4. | BPIAE Insurance Policy |

Confirmation by BPIAE that: (a) following issuance of the high yield bond by the Parent as contemplated in the notifications under the BPIAE Policy dated 29 January 2018 and 22 February 2018 (the BPIAE Notifications) it will issue and execute an amendment to the BPIAE Insurance Policy consistent with the terms of the BPIAE Notifications; and (b) until execution of such amendment by BPIAE and all Lenders, the BPIAE Insurance Policy in its current form (as supplemented by the BPIAE Notifications) shall continue in full force and effect in accordance with its terms.

5. | Other documents and evidence |

(a) | An amended Base Case, substantially in the form provided to the BPIAE Agent (acting on behalf of the Lenders) on or about 15 February 2018. |

0080105-0000405 PA:20488617.7 | 10 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

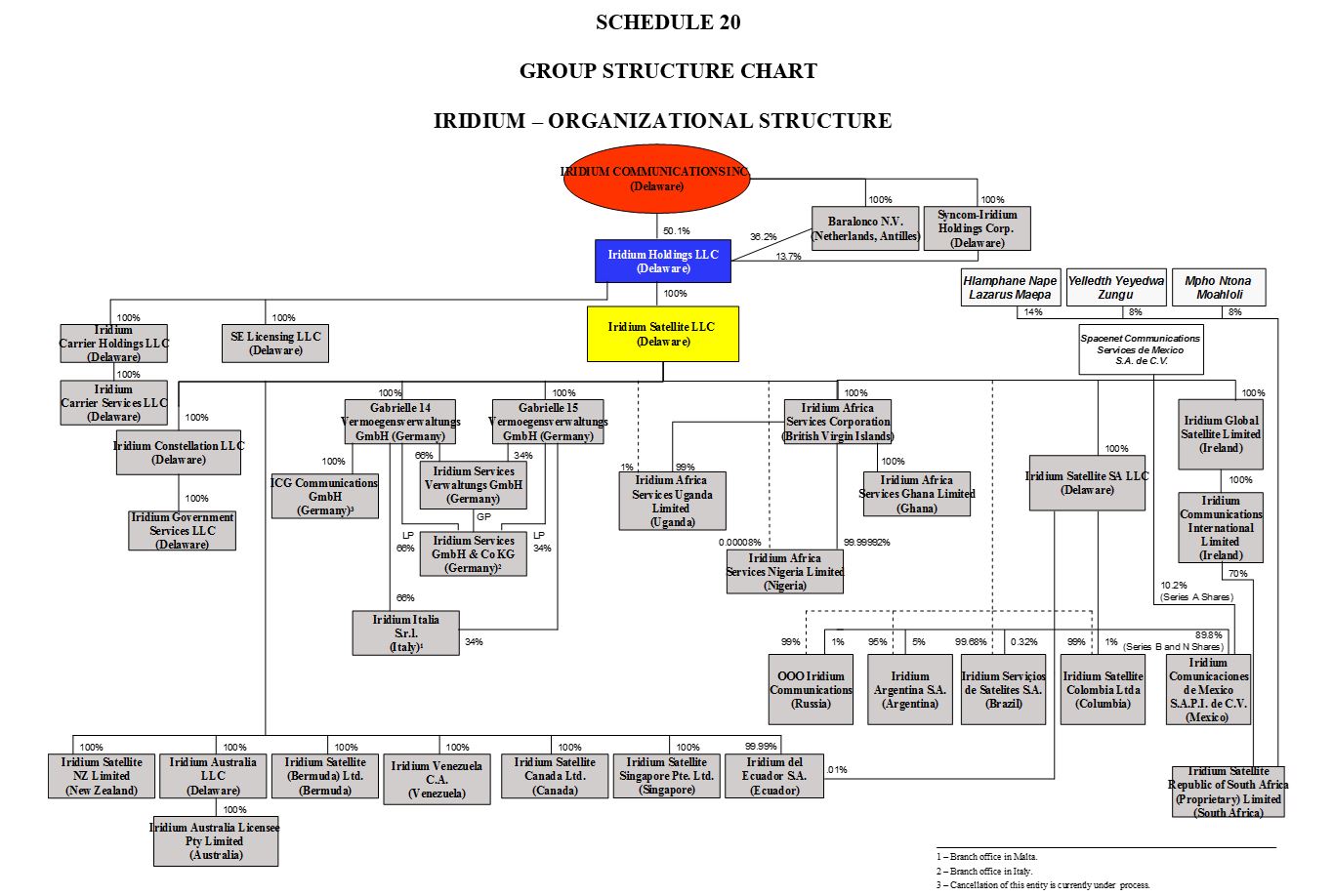

(b) | An updated Group structure chart. |

(c) | Evidence that all fees, costs and expenses then due and payable from the Borrower under this Agreement have been paid. |

(d) | A copy of any other Authorisation or other document, opinion or assurance which the BPIAE Agent considers to be necessary or desirable (if it has notified the Borrower accordingly) in connection with the entry into and performance of the transactions contemplated by, this Agreement or for the validity and enforceability of this Agreement. |

(e) | A copy of the Funds Flow Memorandum. |

0080105-0000405 PA:20488617.7 | 11 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

SCHEDULE 2

DESCRIPTION OF NOTES

0080105-0000405 PA:20488617.7 | 12 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

DESCRIPTION OF THE NOTES

Iridium Communications Inc., a Delaware corporation (the “Issuer”), will issue the notes under an indenture between the Issuer and U.S. Bank, National Association, as trustee (in such capacity, together with any successor trustee, the “Trustee”).

In this description, references to the “Issuer” refer only to Iridium Communications Inc. and not to any of its Subsidiaries.

The following description is a summary of the material provisions of the indenture. It does not restate that agreement in its entirety. The Issuer urges you to read the indenture because it, and not this description, defines your rights as holders of the notes. Copies of the indenture are available as set forth below under “—Additional Information.” Certain defined terms used in this description but not defined below under “—Certain Definitions” have the meanings assigned to them in the indenture.

The registered holder of a note will be treated as the owner of it for all purposes. Only registered holders will have rights under the indenture.

Brief Description of the Notes

The Notes

The notes will be senior unsecured obligations of the Issuer and will:

• | rank contractually equally in right of payment with all future senior Indebtedness of the Issuer; |

• | rank contractually senior in right of payment to all future Subordinated Indebtedness of the Issuer; |

• | be effectively subordinated to any existing and future secured obligations of the Issuer (including the Issuer’s guarantee of the Opco Credit Agreement), to the extent of the value of the collateral securing such obligations; and |

• | be structurally subordinated to all future liabilities of any Subsidiaries of the Issuer that do not guarantee the notes, including Indebtedness under the Opco Credit Agreement. |

The Issuer is a holding company that directly and indirectly owns Iridium Holdings LLC (“Intermediate Holdco”) and its Subsidiaries, including Iridium Satellite LLC (“Opco”) and its Subsidiaries. The operations of the Issuer are conducted through Intermediate Holdco and its Subsidiaries and, therefore, the Issuer depends on the cash flow of Intermediate Holdco and its Subsidiaries to meet its obligations, including its obligations under the notes. There can be no assurance that sufficient funds will be available when necessary to make any required cash payments under the notes. Further, the ability of the Issuer’s Subsidiaries to pay dividends or make loans or other payments or distributions is subject to restrictions under the Opco Credit Agreement. In particular, the terms of the Opco Credit Agreement restrict the Issuer’s Subsidiaries from making dividends or other payments to the Issuer if there is a default under the Opco Credit Agreement. If this occurs, the Issuer would be unable to satisfy its obligations under the notes unless it can timely cure the default.

Any right of the Issuer to receive assets of any of its Subsidiaries upon that Subsidiary’s bankruptcy, liquidation or reorganization (and the consequent right of the holders of the notes to participate in those assets) will be effectively subordinated to the claims of that Subsidiary’s creditors, except to the extent that the Issuer is itself reorganized as a creditor of that Subsidiary, in which case the claims of the Issuer would still be subordinate in right of payment to any security in the assets of the Subsidiary and any indebtedness of that Subsidiary senior to that held by the Issuer. After giving effect to the issuance of the notes offered hereby and the use of proceeds therefrom, the Issuer’s Subsidiaries accounted for approximately 100% of its total revenue for the twelve months ended December 31, 2017, and held 97.9% of its total assets and approximately 88.6% of its total liabilities as of December 31, 2017 (other than the notes offered hereby).

0080105-0000405 PA:20488617.7 | 13 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

As indicated above, payments on the notes will be structurally subordinated to all indebtedness and other liabilities of the Issuer’s Subsidiaries unless such Subsidiaries are required to guarantee the notes in the future pursuant to the terms of the Indenture. See “Risk Factors—Risks Related to the Notes—Because we are the sole obligor of the Notes, and our subsidiaries will not guarantee our obligations under the Notes, the Notes will be structurally subordinated to the debt and other liabilities of our subsidiaries, and the assets of those subsidiaries may not be available to make payments on the Notes.” Additionally, the notes will be unsecured and effectively subordinated to any future secured indebtedness of the Issuer.” Although the indenture contains limitations on the amount of additional Indebtedness that the Issuer’s Subsidiaries may incur, under certain circumstances the indenture will permit the Issuer’s Subsidiaries to incur additional indebtedness and the amount of such indebtedness could be substantial. See “—Certain Covenants—Incurrence of Indebtedness and Issuance of Disqualified Stock or Preferred Stock” below.

As of the date of the indenture, all of the Issuer’s Subsidiaries are expected to be “Restricted Subsidiaries.” However, under the circumstances described under “—Certain Covenants,” the Issuer will be permitted to designate certain of its Subsidiaries as “Unrestricted Subsidiaries.” The Unrestricted Subsidiaries will not be subject to any of the restrictive covenants in the indenture and will not guarantee the notes.

The indenture will not be qualified under the TIA, and the TIA shall not apply to or in any way govern the terms of the indenture. As a result, no provisions of the TIA will be incorporated into the indenture unless expressly incorporated pursuant to this “Description of the Notes.”

Principal, Maturity and Interest

The Issuer will issue $360 million aggregate principal amount of senior notes in this offering. The notes will mature on April 15, 2023. Subject to compliance with the covenant described below under the caption “—Certain Covenants—Incurrence of Indebtedness and Issuance of Disqualified Stock or Preferred Stock,” the Issuer may issue additional notes from time to time after this offering under the indenture (“Additional Notes”). The notes offered hereby and any Additional Notes and subsequently issued under the indenture shall be treated as a single class for all purposes under the indenture, including waivers, amendments, redemptions and offers to purchase; provided, however, that any Additional Notes that are not fungible with the notes offered hereby for U.S. federal income tax purposes will have a separate CUSIP. Unless the context requires otherwise, references to “notes” for all purposes of the indenture and this “Description of the Notes” include any Additional Notes that are actually issued.

Each note will bear interest at a rate of 10.250% per annum from the Issue Date or from the most recent date to which interest has been paid or provided for, payable semiannually on April 15 and October 15 of each year (each such date, an “Interest Payment Date”), commencing with October 15, 2018, to holders of record at the close of business on April 1 and October 1 (whether or not such date is a business day) immediately preceding each Interest Payment Date. Interest will be paid on the basis of a 360-day year consisting of twelve 30-day months. The notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. Interest on the notes shall be payable entirely in cash on the then outstanding principal amount of the notes.

Methods of Receiving Payments on the Notes

All payments on the notes will be made at the office or agency of the paying agent within the continental United States unless the Issuer elects to make interest payments due on an interest payment date by check mailed to the persons entitled thereto at their address set forth in the register of holders; provided that if a holder of notes has given wire transfer instructions to the paying agent at least fifteen (15) business days prior to an interest payment date, the Issuer will pay all interest on that holder’s notes due on an Interest Payment Date in accordance with those instructions. All payments on global notes will be made in accordance with applicable DTC procedures.

Paying Agent and Registrar for the Notes

The Trustee will initially act as paying agent and registrar. The Issuer may change the paying agent or registrar without prior notice to the holders of the notes, and the Issuer or any of its Subsidiaries may act as paying agent or registrar.

Transfer and Exchange

0080105-0000405 PA:20488617.7 | 14 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

A holder may transfer or exchange notes in accordance with the provisions of the indenture. The registrar and the Trustee may require a holder, among other things, to furnish appropriate endorsements and transfer documents in connection with a transfer of notes. Holders of the notes will be required to pay all taxes due on transfer. The Issuer will not be required to transfer or exchange any note selected for redemption, except the unredeemed portion of any note being redeemed in part. Also, the Issuer will not be required to transfer or exchange any note for a period of fifteen (15) days before the mailing of a notice of redemption of notes to be redeemed.

Note Guarantees

On the Issue Date, the notes will not be guaranteed by any of the Issuer’s Subsidiaries.

If after the Issue Date the notes become guaranteed, each Note Guarantee will be a continuing guarantee and, subject to the next succeeding paragraph, shall:

(1) remain in full force and effect until payment in full of all the Guaranteed Obligations;

(2) be binding upon each such Guarantor and its successors and assigns; and

(3) inure to the benefit of and be enforceable by the Trustee, the holders and their successors, transferees and assigns.

A Note Guarantee of a Guarantor will be automatically and unconditionally released and discharged upon:

(a) the sale, exchange, disposition or other transfer (including through merger or consolidation) of (x) the Capital Stock of such Guarantor to a Person that is not (either before or after giving effect to such transaction) the Issuer or a Restricted Subsidiary of the Issuer, if after such transaction the Guarantor is no longer a Restricted Subsidiary, or (y) all or substantially all the assets of such Guarantor if such sale, exchange, disposition or other transfer is made in compliance with the indenture;

(b) the Issuer designating such Guarantor to be an Unrestricted Subsidiary in accordance with the provisions set forth under “—Certain Covenants—Restricted Payments” and the definition of “Unrestricted Subsidiary;”

(c) in the case of any Restricted Subsidiary that after the Issue Date is required to guarantee the notes pursuant to the covenant described under “—Certain Covenants—Future Guarantees,” the release or discharge of the guarantee by such Restricted Subsidiary of Indebtedness of the Issuer or any Restricted Subsidiary or the repayment of the Indebtedness or Disqualified Stock, in each case, that resulted in the obligation to guarantee the notes, except if a release or discharge is by or as a result of payment in connection with the enforcement of remedies under such other guarantee;

(d) the Issuer’s exercise of its legal defeasance option or covenant defeasance option as described under “—Legal Defeasance and Covenant Defeasance,” or if the Issuer’s Obligations under the indenture are discharged in accordance with the terms of the indenture;

(e) the release or discharge of the Obligations of such Guarantor that required the Guarantor to provide the Note Guarantee, except a discharge or release by or as a result of payment in connection with the enforcement of remedies under such guarantee of direct obligation; or

(f) such Guarantor ceasing to be a Wholly-Owned Domestic Subsidiary of the Issuer or the dissolution of such Guarantor.

Optional Redemption

At any time prior to April 15, 2020, the Issuer may on any one or more occasions redeem up to 40% of the aggregate principal amount of notes (calculated after giving effect to the issuance of any Additional Notes) issued under the indenture at the redemption price of 110.250% of the principal amount of notes redeemed, plus accrued and unpaid interest, if any, to the date of redemption (subject to the right of holders of notes on a relevant record date to

0080105-0000405 PA:20488617.7 | 15 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

receive interest on an interest payment occurring on or prior to the redemption date), with the net cash proceeds of an Equity Offering; provided that:

(1) at least 60% of the aggregate principal amount of notes issued under the indenture (including any Additional Notes, but excluding notes held by the Issuer, any direct or indirect parent of the Issuer or any of the Issuer’s Subsidiaries) remain outstanding immediately after the occurrence of such redemption; and

(2) the redemption occurs within 180 days of the date of the closing of such Equity Offering.

In addition, at any time prior to April 15, 2020, the Issuer may on any one or more occasions redeem all or a portion of the notes at a redemption price equal to 100% of the principal amount of the notes redeemed, plus the Applicable Premium as of, and accrued and unpaid interest to, the date of redemption, subject to the rights of holders of notes on a relevant record date to receive interest due on an interest payment date occurring on or prior to the redemption date.

The Issuer will have the right to redeem the notes at 101% of the principal amount thereof following the consummation of a Change of Control if at least 90% of the notes outstanding prior to such consummation are purchased pursuant to a Change of Control Offer with respect to such Change of Control.

Except pursuant to the preceding paragraphs, the notes will not be redeemable at the Issuer’s option prior to April 15, 2020.

On or after April 15, 2020, the Issuer may on any one or more occasions redeem all or a portion of the notes at the redemption prices (expressed as percentages of principal amount) set forth below, plus accrued and unpaid interest, if any, on the notes redeemed, to the applicable date of redemption, if redeemed during the 12-month period beginning on April 15 of the years indicated below, subject to the rights of holders of notes on a relevant record date to receive interest due on an interest payment date occurring on or prior to the redemption date:

Year | Percentage | |

2020 | 105.125 | % |

2021 | 102.563 | % |

2022 and thereafter | 100.000 | % |

In connection with any redemption of notes (including with net cash proceeds of an Equity Offering), any such redemption may, at the Issuer’s discretion, be subject to one or more conditions precedent, including, but not limited to, consummation of any related Equity Offering, consummation of a Change of Control or consummation of a refinancing of any Indebtedness. In addition, if such redemption or notice is subject to satisfaction of one or more conditions precedent, such notice shall state that, in the Issuer’s discretion, the redemption date may be delayed until such time as any or all such conditions shall be satisfied (or waived by the Issuer in its sole discretion), or such redemption may not occur and such notice may be rescinded in the event that any or all such conditions shall not have been satisfied (or waived by the Issuer in its sole discretion) by the redemption date, or by the redemption date so delayed.

Unless the Issuer defaults in the payment of the redemption price, interest will cease to accrue on the notes or portions thereof called for redemption on the applicable redemption date.

Mandatory Redemption

The Issuer is not required to make mandatory redemption or sinking fund payments with respect to the notes.

Selection and Notice

0080105-0000405 PA:20488617.7 | 16 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

If less than all of the notes are to be redeemed at any time, the notes shall be selected for redemption by lot. If the notes are represented by global notes, interests in such global notes will be selected for redemption by DTC in accordance with its applicable procedures.

No notes of $2,000 or less can be redeemed in part. Notices of redemption will be mailed by first class mail (or with respect to global notes, to the extent permitted or required by applicable DTC procedures or regulations, sent electronically) at least 30 but not more than 60 days before the redemption date to each holder of notes to be redeemed at its registered address, except that redemption notices may be mailed or sent more than 90 days prior to a redemption date if the notice is issued in connection with a defeasance of the notes or a satisfaction and discharge of the indenture.

If any note is to be redeemed in part only, the notice of redemption that relates to that note will state the portion of the principal amount of that note that is to be redeemed. A new note in principal amount equal to the unredeemed portion of the original note will be issued in the name of the holder of notes upon cancellation of the original note (or transferred by book entry). Notes called for redemption become due on the date fixed for redemption. Unless the Issuer defaults in the payment of the redemption price on and after the redemption date, interest will cease to accrue on notes or portions of notes called for redemption.

Repurchase at the Option of Holders

Change of Control

If a Change of Control occurs, each holder of notes will have the right to require the Issuer to repurchase all or any portion (equal to a minimum denomination of $2,000 or an integral multiple of $1,000 in excess thereof) of that holder’s notes pursuant to a Change of Control Offer on the terms set forth in the indenture; provided that any unpurchased portion of a note must be in a minimum denomination of $2,000. In the Change of Control Offer, the Issuer will offer a Change of Control Payment in cash equal to 101% of the aggregate principal amount of notes repurchased, plus accrued and unpaid interest, if any, on the notes repurchased to the date of purchase (the “Change of Control Payment Date”), subject to the rights of holders of notes on a relevant record date to receive interest due on an interest payment date occurring on or prior to the Change of Control Payment Date. Within 30 days following any Change of Control, except to the extent the Issuer has delivered notice to the Trustee of its intention to redeem notes as described above under “—Optional Redemption,” the Issuer will mail (or with respect to global notes to the extent permitted or required by applicable DTC procedures or regulations, send electronically) a notice to each holder, with a copy to the Trustee, describing the transaction or transactions that constitute the Change of Control and offering to repurchase notes on the Change of Control Payment Date specified in the notice, which date will be no earlier than 30 days and no later than 90 days from the date such notice is mailed or sent, pursuant to the procedures required by the indenture and described in such notice. The Issuer will comply with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws and regulations thereunder to the extent those laws and regulations are applicable in connection with the repurchase of the notes as a result of a Change of Control. To the extent that the provisions of any securities laws or regulations conflict with the Change of Control provisions of the indenture, the Issuer will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations under the Change of Control provisions of the indenture by virtue of such compliance.

On the Change of Control Payment Date, the Issuer will, to the extent lawful:

(1) accept for payment all notes or portions of notes properly tendered pursuant to the Change of Control Offer;

(2) deposit with the paying agent an amount equal to the Change of Control Payment in respect of all notes or portions of notes properly tendered; and

(3) deliver or cause to be delivered to the Trustee the notes properly accepted together with an Officer’s Certificate stating the aggregate principal amount of notes or portions of notes being purchased by the Issuer.

The paying agent will promptly deliver to each holder of notes properly tendered the Change of Control Payment for such notes, and the Trustee will promptly authenticate and mail (or cause to be transferred by book entry) to each holder a new note equal in principal amount to any unpurchased portion of the notes surrendered, if any. The Issuer

0080105-0000405 PA:20488617.7 | 17 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

will publicly announce the results of the Change of Control Offer on or as soon as practicable after the Change of Control Payment Date.

The provisions described above that require the Issuer to make a Change of Control Offer following a Change of Control will be applicable whether or not any other provisions of the indenture are applicable. Except as described above with respect to a Change of Control, the indenture will not contain provisions that permit the holders of the notes to require that the Issuer repurchase or redeem the notes in the event of a takeover, recapitalization or similar transaction.

The Issuer will not be required to make a Change of Control Offer upon a Change of Control if (1) a third party makes the Change of Control Offer in the manner, at the times and otherwise in compliance with the requirements set forth in the indenture applicable to a Change of Control Offer made by the Issuer and purchases all notes properly tendered and not withdrawn under the Change of Control Offer, or (2) notice of redemption has been given to the Trustee pursuant to the indenture as described above under “—Optional Redemption,” unless and until there is a default in payment of the applicable redemption price. Notwithstanding anything to the contrary contained herein, a Change of Control Offer may be made in advance of a Change of Control, or conditioned upon the consummation of such Change of Control, if a definitive agreement is in place for the Change of Control at the time the Change of Control Offer is made.

The definition of Change of Control includes a phrase relating to the direct or indirect sale, lease, transfer, conveyance or other disposition of “all or substantially all” of the properties or assets of the Issuer and its Subsidiaries taken as a whole. Although there is a limited body of case law interpreting the phrase “substantially all,” there is no precise established definition of the phrase under applicable law. Accordingly, the ability of a holder of notes to require the Issuer to repurchase its notes as a result of a sale, lease, transfer, conveyance or other disposition of less than all of the assets of the Issuer and its Subsidiaries taken as a whole to another Person or group may be uncertain.

The Issuer’s obligation to make a Change of Control Offer may be waived or modified or terminated with the written consent of the Holders of a majority in principal amount of the Notes then outstanding (including consents obtained in connection with a tender offer or exchange offer for the Notes) prior to the occurrence of such Change of Control.

Asset Sales

The Issuer will not, and will not permit any of its Restricted Subsidiaries to, consummate an Asset Sale unless:

(1) the Issuer (or the Restricted Subsidiary, as the case may be) receives consideration at the time of the Asset Sale at least equal to the Fair Market Value (measured as of the date of the definitive agreement with respect to such Asset Sale) of the assets or Equity Interests issued or sold or otherwise disposed of; and

(2) at least 75% of the consideration received in the Asset Sale by the Issuer or such Restricted Subsidiary is in the form of cash or Cash Equivalents. For purposes of this provision, each of the following will be deemed to be cash:

(a) any liabilities (other than liabilities that are by their terms subordinated to the notes) of the Issuer or such Restricted Subsidiary (as shown on the Issuer’s or such Restricted Subsidiary’s most recent consolidated balance sheet or in the notes thereto) that are assumed by the transferee of any such assets pursuant to a customary novation or indemnity agreement that releases the Issuer or such Restricted Subsidiary from or indemnifies against further liability;

(b) any securities, notes, other obligations or assets received by the Issuer or such Restricted Subsidiary from such transferee that are, within 180 days, converted by the Issuer or such Restricted Subsidiary into cash or Cash Equivalents, to the extent of the cash or Cash Equivalents received in that conversion; and

(c) any Designated Non-cash Consideration received by the Issuer or such Restricted Subsidiary in such Asset Sale having an aggregate Fair Market Value, taken together with all other Designated Non-cash Consideration received pursuant to this clause (c) that is at that time outstanding, not to exceed $25.0 million

0080105-0000405 PA:20488617.7 | 18 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(with the Fair Market Value of each item of Designated Non-cash Consideration being measured at the time received and without giving effect to subsequent changes in value).

Within 365 days after the receipt of any Net Proceeds from an Asset Sale, the Issuer (or the applicable Restricted Subsidiary, as the case may be) may apply such Net Proceeds:

(1) to repay any Indebtedness of a Restricted Subsidiary of the Issuer (other than Indebtedness owed to the Issuer or another Restricted Subsidiary), including the Opco Credit Agreement and any other Indebtedness that is Guaranteed by the Issuer;

(2) to repay Indebtedness or other Obligations of the Issuer that rank pari passu with the notes; provided that the Issuer shall equally and ratably redeem or repurchase the notes as described above under “—Optional Redemption,” or by making an offer (in accordance with the procedures set forth below for an Asset Sale Offer) to all holders to purchase the notes at 100% of the principal amount thereof, plus accrued and unpaid interest, if any, to but not including the date of repayment;

(3) to acquire all or substantially all of the assets of, or any Capital Stock of, a Permitted Business, if, after giving effect to any such acquisition, of such assets or Capital Stock, the Permitted Business is or becomes a Restricted Subsidiary of the Issuer or additional Capital Stock of an existing non-Wholly Owned Restricted Subsidiary;

(4) to make a capital expenditure;

(5) to acquire other assets that are used or useful in a Permitted Business; or

(6) any combination of the foregoing.

The Issuer will be deemed to have complied with the provisions set forth in clause (3), (4), (5) or (6) of the preceding paragraph if, within 365 days after the Asset Sale that generated the Net Proceeds, the Issuer (or the applicable Restricted Subsidiary) has entered into and not abandoned or rejected a binding agreement to acquire all or substantially all of such assets of, or any Capital Stock of, another Permitted Business or to make a capital expenditure or acquire such other assets that are used or useful in a Permitted Business and that acquisition or capital expenditure is thereafter completed within 180 days after the end of such 365-day period.

Pending the final application of any such amount of Net Proceeds, the Issuer or any Restricted Subsidiary may temporarily reduce Indebtedness under a revolving credit facility, if any, or otherwise invest or utilize such Net Proceeds in any manner not prohibited by the indenture. Any Net Proceeds from Asset Sales that are not applied or invested as provided in the second paragraph of this covenant will constitute “Excess Proceeds”; provided that any amount of proceeds offered to holders in accordance with clause (2) of the second paragraph of this covenant or pursuant to an Asset Sale Offer (as defined below) made at any time after the Asset Sale shall be deemed to have been applied as required and shall not be deemed to be Excess Proceeds without regard to the extent to which such offer is accepted by the holders. When the aggregate amount of Excess Proceeds exceeds $50.0 million, the Issuer will make an offer (an “Asset Sale Offer”) to all holders of the notes and Indebtedness of the Issuer or any Guarantor that ranks pari passu with the notes and containing provisions similar to those set forth in the indenture with respect to offers to purchase, prepay or redeem with the proceeds of sales of assets to purchase, prepay or redeem on a pro rata basis the maximum principal amount (or accreted value, if applicable) of notes and such other pari passu Indebtedness (plus all accrued interest on the Indebtedness and the amount of all fees and expenses, including premiums, incurred in connection therewith) that may be purchased, prepaid or redeemed out of the Excess Proceeds. The offer price in any Asset Sale Offer will be equal to 100% of the principal amount, plus accrued and unpaid interest, if any, to but not including the date of purchase, prepayment or redemption, subject to the rights of holders of notes on a relevant record date to receive interest due on an interest payment date occurring on or prior to the Issue Date, and will be payable in cash. The Issuer may satisfy the foregoing obligations with respect to such Net Proceeds from an Asset Sale by making an Asset Sale Offer with respect to such Net Proceeds at any time prior to the expiration of the application period or by electing to make an Asset Sale Offer with respect to such Net Proceeds.

0080105-0000405 PA:20488617.7 | 19 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

If any Excess Proceeds remain after consummation of an Asset Sale Offer, including any such offer made pursuant to clause (2) of the second paragraph of this covenant (any such amount, “Retained Declined Proceeds”), the Issuer may use those Retained Declined Proceeds for any purpose not otherwise prohibited by the indenture. If the aggregate principal amount of notes and other pari passu Indebtedness tendered in (or required to be prepaid or redeemed in connection with) such Asset Sale Offer exceeds the amount of Excess Proceeds, the Issuer will select the notes and such other pari passu Indebtedness to be purchased on a pro rata basis, based on the amounts tendered or required to be prepaid or redeemed and thereafter the Trustee will select the notes to be purchased on a pro rata basis (subject to applicable DTC procedures with respect to the global notes) based on the principal amount tendered (with, in each case, such adjustments as may be deemed appropriate by the Issuer or the Trustee, as applicable, so that only notes in minimum denominations of $2,000, or an integral multiple of $1,000 in excess thereof, will be purchased; provided that any unpurchased portion of a note must be in a minimum denomination of $2,000). Upon completion of each Asset Sale Offer, the amount of Excess Proceeds will be reset at zero.

The Issuer will comply with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws and regulations thereunder to the extent those laws and regulations are applicable in connection with each repurchase of notes pursuant to an Asset Sale Offer. To the extent that the provisions of any securities laws or regulations conflict with the Asset Sale provisions of the indenture, the Issuer will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations under the Asset Sale provisions of the indenture by virtue of such compliance.

The agreements governing our existing Indebtedness, including the Opco Credit Agreement, contain, and future agreements may contain, prohibitions of certain events, including events that would constitute a Change of Control or an Asset Sale. The exercise by the holders of notes of their right to require the Issuer to repurchase the notes upon a Change of Control or an Asset Sale could cause a default under these other agreements, even if the Change of Control or Asset Sale itself does not cause a default, due to the financial effect of such repurchases on us. In the event a Change of Control or Asset Sale occurs at a time when the Issuer is prohibited from purchasing notes, we could seek the consent of lenders under the Opco Credit Agreement or such other Indebtedness to the purchase of notes or could attempt to refinance the borrowings that contain such prohibition. If we do not obtain consent or repay those borrowings, the Issuer will remain prohibited from purchasing notes. In that case, the Issuer’s failure to purchase tendered notes would constitute an Event of Default under the indenture, which could, in turn, constitute a default under the Opco Credit Agreement and such other Indebtedness. Finally, the Issuer’s ability to pay cash to the holders of notes upon a repurchase may be limited by the Issuer’s then existing financial resources. See “Risk Factors—Risks Relating to the Notes—We are a holding company with no operations, and unless we receive dividends or other payments from our subsidiaries, we may be unable to meet our obligations under the Notes and fulfill our other cash obligations.”

Because the Opco Credit Agreement is secured by substantially all of the Issuer’s and its Subsidiaries that are guarantors under the Opco Credit Agreement’s properties and assets, and since the definition of “Net Proceeds” excludes all amounts in respect of any Asset Sale that are used to repay any Indebtedness that is secured by property or assets that are the subject of such Asset Sale, it is unlikely that any meaningful amount of Net Proceeds will be generated from any Asset Sale so long as the Opco Credit Agreement remains outstanding.

Certain Covenants

Restricted Payments

The Issuer will not, and will not permit any of its Restricted Subsidiaries to, directly or indirectly:

(1) declare or pay any dividend or make any other payment or distribution on account of the Issuer’s or any of its Restricted Subsidiaries’ Equity Interests (including, without limitation, any payment in connection with any merger or consolidation involving the Issuer or any of its Restricted Subsidiaries) (other than dividends or distributions payable in Equity Interests (other than Disqualified Stock) of the Issuer and other than dividends or distributions payable to the Issuer or a Restricted Subsidiary of the Issuer);

0080105-0000405 PA:20488617.7 | 20 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

(2) purchase, redeem or otherwise acquire or retire for value (including, without limitation, in connection with any merger or consolidation involving the Issuer) any Equity Interests of the Issuer or any direct or indirect parent of the Issuer;

(3) make any voluntary or optional payment on or with respect to, or purchase, redeem, defease or otherwise acquire or retire for value any Indebtedness of the Issuer or any Guarantor that is contractually subordinated to the notes or to any Note Guarantee, except a payment of interest when due or principal at the Stated Maturity thereof or the purchase, redemption, repurchase, defeasance, acquisition or retirement for value of any such Indebtedness within 365 days of the Stated Maturity thereof; or

(4) make any Restricted Investment (all such payments and other actions set forth in these clauses (1) through (4) above being collectively referred to as “Restricted Payments”), unless, at the time of and after giving effect to such Restricted Payment:

(a) no Default or Event of Default has occurred and is continuing or would occur as a consequence of such Restricted Payment;

(b) in the case of any Restricted Payment by the Issuer or any of its Restricted Subsidiaries, the Issuer would, at the time of such Restricted Payment and after giving pro forma effect thereto as if such Restricted Payment had been made at the beginning of the applicable four-quarter period, have been permitted to incur at least $1.00 of additional Indebtedness pursuant to the Consolidated Total Leverage Ratio test set forth in the first paragraph of the covenant described below under “—Incurrence of Indebtedness and Issuance of Disqualified Stock or Preferred Stock”; and

(c) such Restricted Payment, together with the aggregate amount of all other Restricted Payments made by the Issuer or its Restricted Subsidiaries since the Issue Date (excluding Restricted Payments permitted by clauses (1), (2), (4), (5), (6), (7), (8), (10), (11), (12) and (13) of the next succeeding paragraph) is less than the sum, without duplication of:

(1) 50% of the Consolidated Net Income of the Issuer for the period (taken as one accounting period) beginning with the fiscal quarter in which the Issue Date occurs to the end of the most recently ended fiscal quarter for which internal financial statements of the Issuer are available at the time of such Restricted Payment (or, if such Consolidated Net Income for such period is a deficit, less 100% of such deficit); plus

(2) 100% of the aggregate net proceeds, including cash and Fair Market Value of property other than cash (as determined in accordance with the second succeeding paragraph), received by the Issuer since the Issue Date as a contribution to its common equity capital or from the issue or sale of Qualifying Equity Interests of the Issuer or any direct or indirect parent of the Issuer (excluding, without duplication, Designated Preferred Stock and Excluded Contributions), or from the issue or sale of Disqualified Stock of the Issuer or debt securities of the Issuer, in each case that have been converted into or exchanged for Qualifying Equity Interests of the Issuer (other than Qualifying Equity Interests and convertible or exchangeable Disqualified Stock or debt securities sold to a Subsidiary of the Issuer); plus

(3) (a) 100% of the aggregate amount of cash and the Fair Market Value of property other than cash (as determined in accordance with the second succeeding paragraph) received by the Issuer or a Restricted Subsidiary of the Issuer from the sale or disposition (other than to the Issuer or a Restricted Subsidiary of the Issuer) of Restricted Investments made after the Issue Date and from repurchases and redemptions of such Restricted Investments from the Issuer and its Restricted Subsidiaries by any Person (other than the Issuer or its Restricted Subsidiaries) and from repayments of loans or advances that constituted Restricted Investments made after the Issue Date and (b) to the extent that any Restricted Investment that was made on or after the Issue Date is made in an entity that subsequently becomes a Restricted Subsidiary, 100% of the Fair Market Value of the Restricted Investment of the Issuer in such Restricted Subsidiary as of the date such entity becomes a Restricted Subsidiary; plus

(4) in the event that any Unrestricted Subsidiary of the Issuer designated as such after the Issue Date is redesignated as a Restricted Subsidiary or has been merged or consolidated with or into or transfers or conveys

0080105-0000405 PA:20488617.7 | 21 | |

CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE

COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY

REQUEST. OMISSIONS ARE DESIGNATED [***]. A COMPLETE VERSION OF THIS EXHIBIT

HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

its assets to, or is liquidated into, the Issuer or a Restricted Subsidiary of the Issuer, in each case after the Issue Date, 100% of the Fair Market Value of the Issuer’s Restricted Investment in such Subsidiary (as determined in accordance with the second succeeding paragraph) as of the date of such redesignation, combination or transfer (or of the assets transferred or conveyed, as applicable), after deducting any Indebtedness associated with the Unrestricted Subsidiary so designated or combined or any Indebtedness associated with the assets so transferred or conveyed (other than in each case to the extent that the designation of such Subsidiary as an Unrestricted Subsidiary constituted a Permitted Investment).

The preceding provisions will not prohibit:

(1) the payment of any dividend (or, in the case of any partnership or limited liability company, any similar distribution) by a Restricted Subsidiary of the Issuer to the holders of its Equity Interests so long as the Issuer or a Restricted Subsidiary receives at least its pro rata share of such dividend or distribution;

(2) the making of any Restricted Payment in exchange for, or out of or with the net cash proceeds of the substantially concurrent sale (within 90 days of such sale) (other than to a Subsidiary of the Issuer) of, Equity Interests of the Issuer (other than Disqualified Stock) or from the substantially concurrent contribution (within 90 days of such contribution) of common equity capital to the Issuer; provided that the amount of any such net cash proceeds that are utilized for any such Restricted Payment will not be considered to be net proceeds of Qualifying Equity Interests for purposes of clause (c)(2) of the immediately preceding paragraph;

(3) the payment of any dividend or the consummation of any redemption within 60 days after the date of declaration of the dividend or giving of the redemption notice, as the case may be, if at the date of declaration or notice, the dividend or redemption payment would have complied with the provisions of the indenture;

(4) the repurchase, redemption, defeasance or other acquisition or retirement for value of Indebtedness of the Issuer or any Guarantor that is contractually subordinated to the notes or to any Note Guarantee with the net cash proceeds from a substantially concurrent incurrence of Refinancing Indebtedness;

(5) the repurchase, retirement or other acquisition (or the declaration and payment of dividends to, or the making of loans to, any direct or indirect parent of the Issuer, to finance any such repurchase, retirement or other acquisition) for value of Equity Interests of the Issuer, any direct or indirect parent of the Issuer or any Restricted Subsidiary of the Issuer held by any future, present or former employee, director or consultant of the Issuer, any direct or indirect parent of the Issuer or any Subsidiary of the Issuer (or any such Person’s estates or heirs) pursuant to any management equity plan or stock option plan or any other management or employee benefit plan or other employment agreement or similar arrangements; provided that the aggregate amounts paid under this clause (5) do not exceed $2.0 million in any calendar year (with unused amounts in any calendar year being permitted to be carried over the next two succeeding calendar years); provided, further, that such amount in any calendar year may be increased by an amount not to exceed: