Attached files

| file | filename |

|---|---|

| 8-K - 1ST QTR 2018 EARNINGS PRESENTATION - FIRST MERCHANTS CORP | a8-k1q18earningsreleasesli.htm |

1

1st Quarter Earnings Highlights

April 26, 2018

Forward-Looking Statement

This presentation contains forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”,

“project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, would”, “should”, “could”, “might”,

“can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, statements relating to First Merchants’ goals,

intentions and expectations; statements regarding the First Merchants’ business plan and growth strategies; statements regarding the asset quality of

First Merchants’ loan and investment portfolios; and estimates of First Merchants’ risks and future costs and benefits. These forward-looking

statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-

looking statements, including, among other things: possible changes in economic and business conditions; the existence or exacerbation of general

geopolitical instability and uncertainty; the ability of First Merchants to integrate recent acquisitions and attract new customers; possible changes in

monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and

other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of

loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory

requirements of federal and state agencies applicable to bank holding companies and banks like First Merchants’ affiliate bank; continued availability

of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; changes in market, economic, operational, liquidity,

credit and interest rate risks associated with the First Merchants’ business; and other risks and factors identified in each of First Merchants’ filings

with the Securities and Exchange Commission. First Merchants undertakes no obligation to update any forward-looking statement, whether written

or oral, relating to the matters discussed in this presentation or press release. In addition, the company’s past results of operations do not necessarily

indicate its anticipated future results.

NON-GAAP FINANCIAL MEASURES

These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the

registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have

the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the

statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to

adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented.

In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, First

Merchants Corporation has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly

comparable GAAP financial measure.

2

1st Quarter 2018 Highlights

Earnings Per Share of $ .74, a 32.1% Increase over 1Q2017

$36.7 Million of Net Income, a 58.1% Increase over 1Q2017

Total Assets of $9.5 Billion Grew by 29.3% over 1Q2017

Annualized Organic Loan & Deposit Growth of Nearly 9%

1.57% Return on Average Assets; 11.21% Return on Average Equity

51.33% Efficiency Ratio

3

Mark K. Hardwick

EXECUTIVE VICE PRESIDENT

CHIEF F INANCIAL OFFICER AND CHIEF OPERATING OFFICER

4

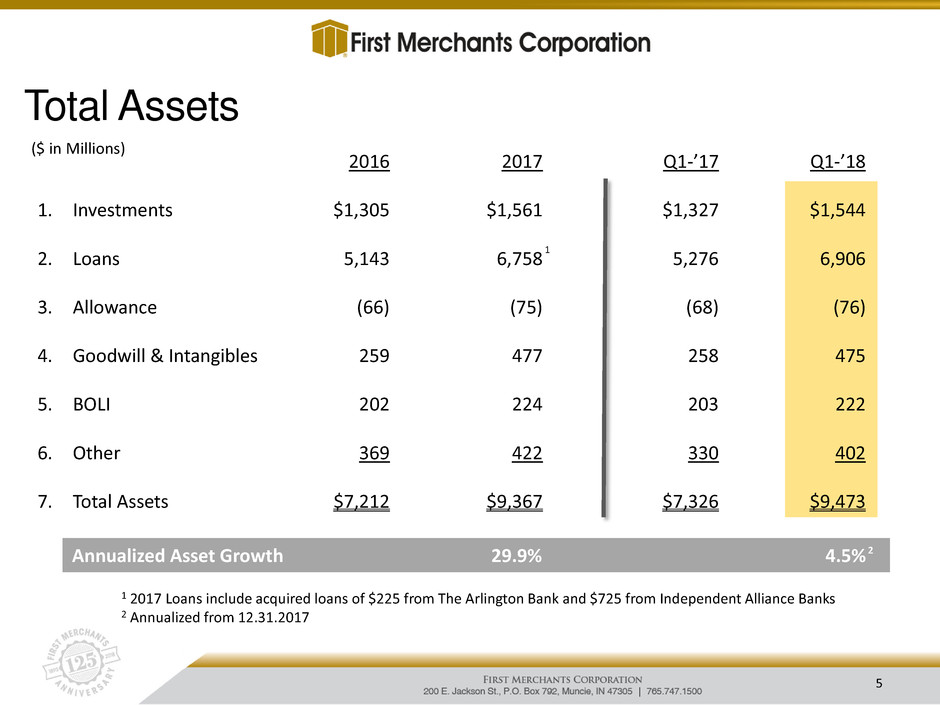

Total Assets

($ in Millions)

1 2017 Loans include acquired loans of $225 from The Arlington Bank and $725 from Independent Alliance Banks

2 Annualized from 12.31.2017

Annualized Asset Growth 29.9% 4.5%

1

2

5

2016 2017 Q1-’17 Q1-’18

1. Investments $1,305 $1,561 $1,327 $1,544

2. Loans 5,143 6,758 5,276 6,906

3. Allowance (66) (75) (68) (76)

4. Goodwill & Intangibles 259 477 258 475

5. BOLI 202 224 203 222

6. Other 369 422 330 402

7. Total Assets $7,212 $9,367 $7,326 $9,473

Loan and Yield Detail

(as of 3/31/2018)

Commercial &

Industrial

22.5%

Commercial

Real Estate

Owner-Occupied

10.3%

Commercial

Real Estate

Non-Owner

Occupied

25.5%

Construction Land

& Land

Development

8.5%

Agricultural

Land

3.5%

Agricultural

Production

1.4%

Public

Finance/Other

Commercial

5.8%

Residential

Mortgage

13.8%

Home

Equity

7.4%

Other

Consumer

1.3%

YTD Yield = 4.86%

Total Loans = $6.9 Billion

6

Investment Portfolio

(as of 3/31/2018)

Mortgage-Backed

Securities

23%

Collateralized

Mortgage

Obligations

26%

U. S. Agencies

2%

Corporate

Obligations

2%

Tax-Exempt

Municipals

47%

$1.5 Billion Portfolio

Modified duration of 5.5 years

Tax equivalent yield of 3.47%

Net unrealized loss of $10.3 Million

7

Total Liabilities and Capital

2016 2017 Q1-’17 Q1-’18

1. Customer Non-Maturity Deposits $4,428 $5,741 $4,426 $5,850

2. Customer Time Deposits 747 1,051 789 1,137

3. Brokered Deposits 381 381 420 341

4. Borrowings 572 701 587 644

5. Other Liabilities 60 57 53 55

6. Hybrid Capital 122 133 122 133

7. Common Equity 902 1,303 929 1,313

8. Total Liabilities and Capital $7,212 $9,367 $7,326 $9,473

($ in Millions)

1 2017 includes acquired Non-Maturity Deposits of $169 from The Arlington Bank and $719 from Independent Alliance Banks

2 2017 includes acquired Time Deposits of $84 from The Arlington Bank and $143 from Independent Alliance Banks

1

2

8

Deposit Detail

(as of 3/31/2018)

YTD Cost = .65%

Total = $7.3 Billion

Demand

Deposits

51%

Savings

Deposits

29%

Certificates &

Time Deposits of

>$100,000

7%

Certificates &

Time Deposits of

<$100,000

8% Brokered

Deposits

5%

9

Capital Ratios

11.42% 11.39%

11.05% 11.10%

11.16%

11.11% 11.03% 11.00% 11.04%

9.26%

9.43% 9.48%

9.24%

9.50% 9.68%

9.39% 9.30% 9.32%

14.79% 14.67%

14.18% 14.21% 14.24%

14.01%

13.76% 13.69% 13.69%

7.00%

8.00%

9.00%

10.00%

11.00%

12.00%

13.00%

14.00%

15.00%

16.00%

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18

Total Risk-Based Capital Ratio (Target = 13.50%)

Common Equity Tier 1 Capital Ratio (Target = 10.00%)

Tangible Common Equity Ratio (TCE) (Target = 8.50%)

10

Net Interest Margin

3.83%

3.86%

3.94% 3.90%

3.98% 3.95%

4.03%

4.10%

3.92%

2.80%

3.00%

3.20%

3.40%

3.60%

3.80%

4.00%

4.20%

$48

$52

$56

$60

$64

$68

$72

$76

$80

$84

Q1 - '16 Q2 - '16 Q3 - '16 Q4 - '16 Q1 - '17 Q2 - '17 Q3 - '17 Q4 - '17 Q1 - '18

Net Interest Income - FTE ($millions) Net Interest Margin

Q1 - '16 Q2 - '16 Q3 - '16 Q4 - '16 Q1 - '17 Q2 - '17 Q3 - '17 Q4 - '17 Q1 - '18

Net Interest Income - FTE ($millions) $ 57.6 $ 59.2 $ 61.1 $ 62.1 $ 64.9 $ 67.2 $ 78.9 $ 83.5 $ 82.5

Fair Value Accretion $ 2.5 $ 3.2 $ 3.8 $ 2.9 $ 4.3 $ 2.3 $ 3.2 $ 4.1 $ 3.2

Tax Equivalent Yield on Earning Assets 4.28% 4.30% 4.37% 4.32% 4.42% 4.44% 4.56% 4.67% 4.57%

Cost of Supporting Liabilities 0.45% 0.44% 0.43% 0.42% 0.44% 0.49% 0.53% 0.57% 0.65%

Net Interest Margin 3.83% 3.86% 3.94% 3.90% 3.98% 3.95% 4.03% 4.10% 3.92%

Fair Value Accretion Effect 0.17% 0.21% 0.24% 0.18% 0.26% 0.14% 0.17% 0.20% 0.15%

11

Reflects 13 bps impact of Tax Cuts and Jobs Act

Non-Interest Income

2016 2017 Q1-’17 Q1-’18

1. Service Charges on Deposit Accounts $17.8 $ 18.7 $ 4.2 $ 4.8

2. Wealth Management Fees 12.6 14.7 3.4 3.8

3. Card Payment Fees 15.0 16.1 3.7 4.6

4. Cash Surrender Value of Life Ins 4.3 6.6 0.9 1.2

5. Gains on Sales of Mortgage Loans 7.1 7.6 1.3 1.8

6. Gains on Sales of Securities 3.4 2.6 0.6 1.6

7. Other 5.0 4.7 0.8 1.8

8. Total Non-Interest Income $65.2 $71.0 $14.9 $19.6

($ in Millions)

12

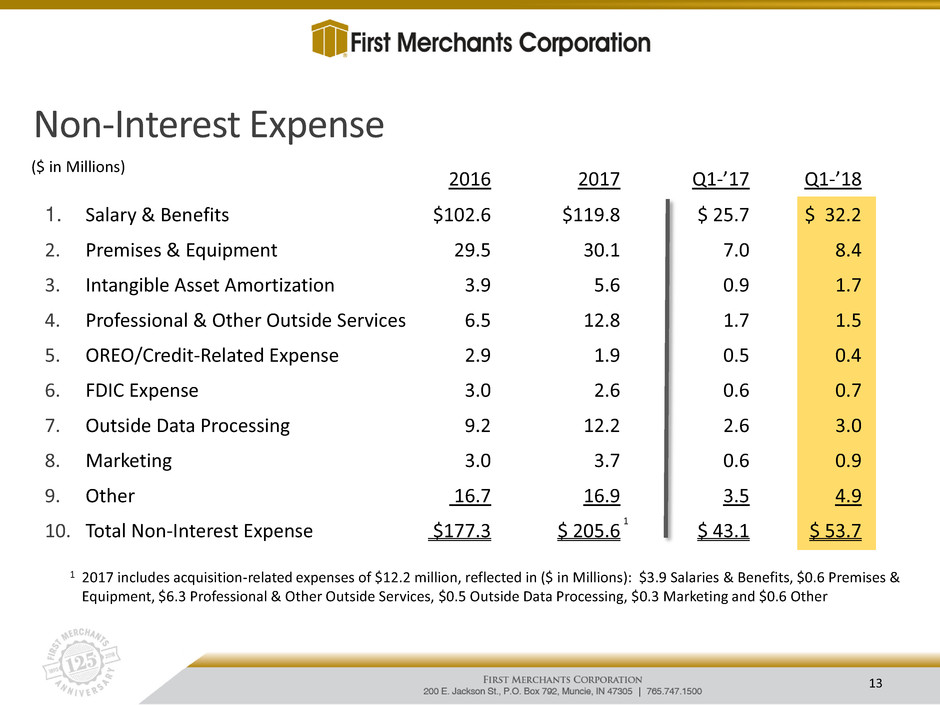

Non-Interest Expense

($ in Millions)

2016 2017 Q1-’17 Q1-’18

1. Salary & Benefits $102.6 $119.8 $ 25.7 $ 32.2

2. Premises & Equipment 29.5 30.1 7.0 8.4

3. Intangible Asset Amortization 3.9 5.6 0.9 1.7

4. Professional & Other Outside Services 6.5 12.8 1.7 1.5

5. OREO/Credit-Related Expense 2.9 1.9 0.5 0.4

6. FDIC Expense 3.0 2.6 0.6 0.7

7. Outside Data Processing 9.2 12.2 2.6 3.0

8. Marketing 3.0 3.7 0.6 0.9

9. Other 16.7 16.9 3.5 4.9

10. Total Non-Interest Expense $177.3 $ 205.6 $ 43.1 $ 53.7

1

1 2017 includes acquisition-related expenses of $12.2 million, reflected in ($ in Millions): $3.9 Salaries & Benefits, $0.6 Premises &

Equipment, $6.3 Professional & Other Outside Services, $0.5 Outside Data Processing, $0.3 Marketing and $0.6 Other

13

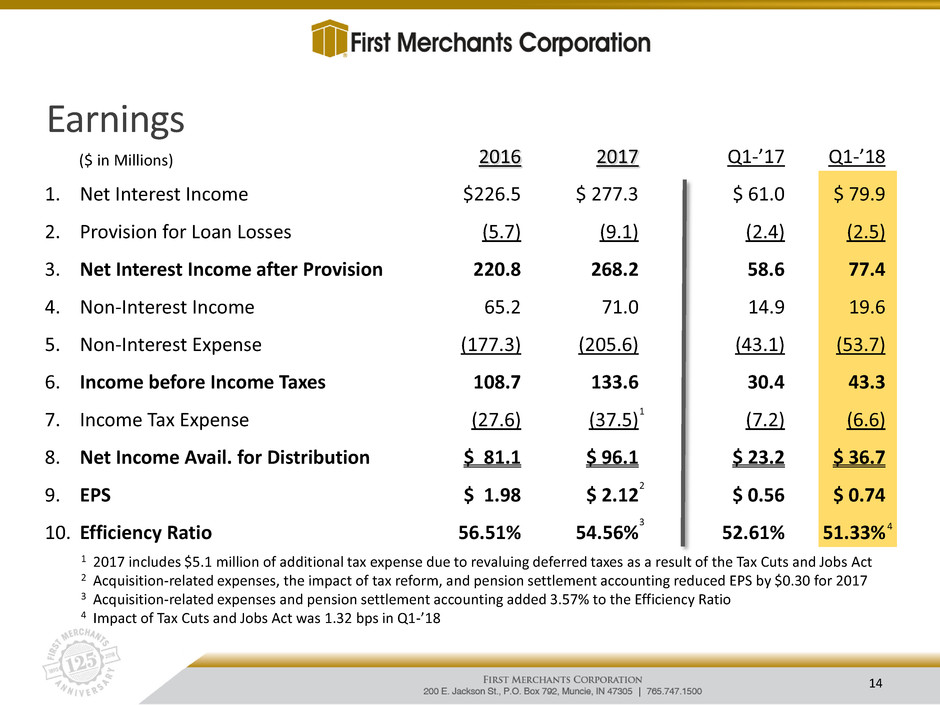

Earnings

2016 2017 Q1-’17 Q1-’18

1. Net Interest Income $226.5 $ 277.3 $ 61.0 $ 79.9

2. Provision for Loan Losses (5.7) (9.1) (2.4) (2.5)

3. Net Interest Income after Provision 220.8 268.2 58.6 77.4

4. Non-Interest Income 65.2 71.0 14.9 19.6

5. Non-Interest Expense (177.3) (205.6) (43.1) (53.7)

6. Income before Income Taxes 108.7 133.6 30.4 43.3

7. Income Tax Expense (27.6) (37.5) (7.2) (6.6)

8. Net Income Avail. for Distribution $ 81.1 $ 96.1 $ 23.2 $ 36.7

9. EPS $ 1.98 $ 2.12 $ 0.56 $ 0.74

10. Efficiency Ratio 56.51% 54.56% 52.61% 51.33%

($ in Millions)

1

2

3

1 2017 includes $5.1 million of additional tax expense due to revaluing deferred taxes as a result of the Tax Cuts and Jobs Act

2 Acquisition-related expenses, the impact of tax reform, and pension settlement accounting reduced EPS by $0.30 for 2017

3 Acquisition-related expenses and pension settlement accounting added 3.57% to the Efficiency Ratio

4 Impact of Tax Cuts and Jobs Act was 1.32 bps in Q1-’18

14

4

Per Share Results

2017 Q1 Q2 Q3 Q4 Total

1. Earnings Per Share $ .56 $ .57 $ .50 $ .49 $ 2.12

2. Dividends $ .15 $ .18 $ .18 $ .18 $ .69

3. Tangible Book Value $16.49 $16.97 $16.62 $16.96

2018 Q1 Q2 Q3 Q4 Total

1. Earnings Per Share $ .74 – – – $ .74

2. Dividends $ .18 – – – $ .18

3. Tangible Book Value $17.14 – – –

15

Dividends and Tangible Book Value

$9.21 $9.64

$10.95

$12.17

$13.65

$14.68

$15.85

$16.96 $17.14

.01

.03

.05

.08

.11

.14

.15

0.00

0.02

0.04

0.06

0.08

0.10

0.12

0.14

0.16

0.18

1.73%

Forward

Dividend

Yield

24.3%

Dividend

Payout Ratio

Quarterly Dividends Tangible Book Value

.18

16

EXECUTIVE VICE PRESIDENT AND CHIEF CREDIT OFFICER

17

John J. Martin

Loan Portfolio Trends

18

($ in Millions)

2016 2017 Q1-'17 Q1-'18 $ % $ %

1. Commercial & Industrial 1,195$ 1,494$ 1,259$ 1,554$ 60$ 4.0% 295$ 23.4%

2. Construction, Land and

Land Development 419 612 337 590 (22) (3.6%) 253 75.1%

3. CRE Non-Owner Occupied 1,272 1,618 1,423 1,760 142 8.8% 337 23.7%

4. CRE Owner Occupied 531 700 549 709 9 1.3% 160 29.1%

5. Agricultural Production 80 122 77 98 (24) (19.7%) 21 27.3%

6. Agricultural Land 149 244 146 245 1 0.4% 99 67.8%

7. Residential Mortgage 742 970 739 953 (17) (1.8%) 214 29.0%

8. Home Equity 419 514 424 511 (3) (0.6%) 87 20.5%

9. Public Finance/Other

Commercial 258 397 244 398 1 0.3% 154 63.1%

10. Other Consumer 78 87 78 88 1 1.1% 10 12.8%

11. Total Loans 5,143$ 6,758$ 5,276$ 6,906$ 148$ 2.2% 1,630$ 30.9%

12. Construction Concentration1 52% 60% 41% 57%

13. Investment RE Concentration1 211% 219% 215% 226%

1As a % of Risk Based Capital

Change Change Q1

Linked Quarter 2018 Over 2017

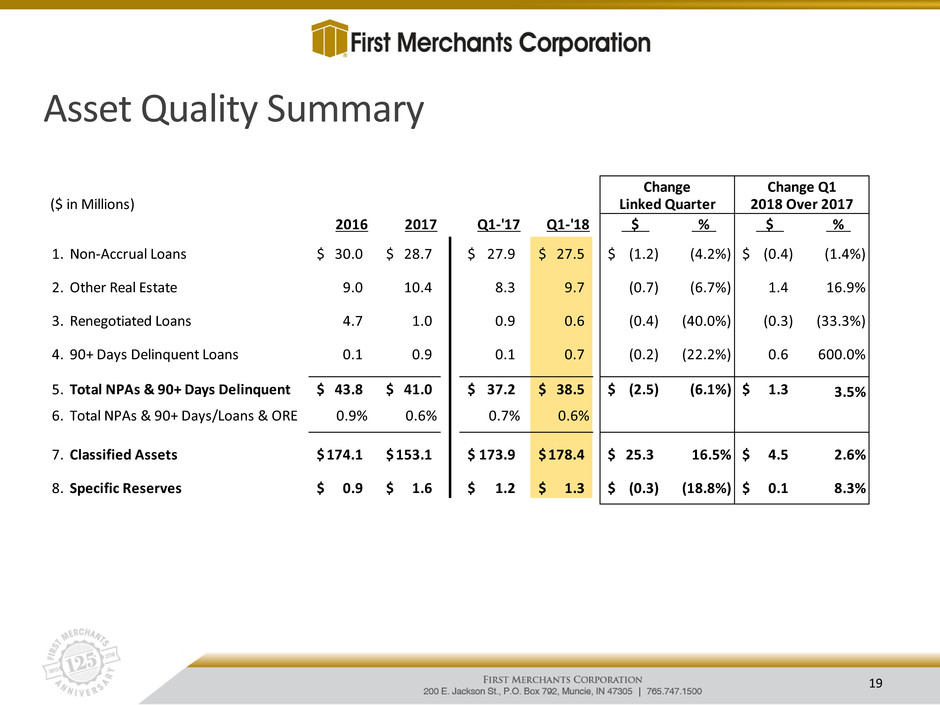

Asset Quality Summary

19

($ in Millions)

2016 2017 Q1-'17 Q1-'18 $ % $ % 186.1

1. Non-Accrual Loans 30.0$ 28.7$ 27.9$ 27.5$ (1.2)$ (4.2%) (0.4)$ (1.4%)

2. Other Real Estate 9.0 10.4 8.3 9.7 (0.7) (6.7%) 1.4 16.9%

3. Renegotiated Loans 4.7 1.0 0.9 0.6 (0.4) (40.0%) (0.3) (33.3%)

4. 90+ Days Delinquent Loans 0.1 0.9 0.1 0.7 (0.2) (22.2%) 0.6 600.0%

5. Total NPAs & 90+ Days Delinquent 43.8$ 41.0$ 37.2$ 38.5$ (2.5)$ (6.1%) 1.3$ 3.5%

6. Total NPAs & 90+ Days/Loans & ORE 0.9% 0.6% 0.7% 0.6%

7. Classified Assets 174.1$ 153.1$ 173.9$ 178.4$ 25.3$ 16.5% 4.5$ 2.6%

8. Specific Reserves 0.9$ 1.6$ 1.2$ 1.3$ (0.3)$ (18.8%) 0.1$ 8.3%

Change Change Q1

Linked Quarter 2018 Over 2017

Non-Performing Asset Reconciliation

20

($ in Millions) Q2-'17 Q3-'17 Q4-'17 Q1-'18

1. Beginning Balance NPAs & 90+ Days Delinquent 37.2$ 40.3$ 45.2$ 41.0$

Non-Accrual

2. Add: New Non-Accruals 10.0 12.7 4.9 4.8

3. Less: To Accrual/Payoff/Renegotiated (2.3) (6.1) (7.3) (4.1)

4. Less: To OREO (6.8) (0.6) (0.2) (0.1)

5. Less: Charge-offs (1.4) (1.1) (1.0) (1.8)

6. Increase / (Decrease): Non-Accrual Loans (0.5) 4.9 (3.6) (1.2)

Other Real Estate Owned (ORE)

7. Add: New ORE Properties 6.8 0.6 0.2 0.1

8. Less: ORE Sold (2.8) (0.3) (1.5) (0.7)

9. Less: ORE Losses (write-downs) (0.4) (0.3) (0.2) (0.1)

10. Increase / (Decrease): ORE 3.6 0.0 (1.5) (0.7)

11. Increase / (Decrease): 90+ Days Delinquent 0.5 (0.2) 0.5 (0.2)

12. Increase / (Decrease): Renegotiated Loans (0.5) 0.2 0.4 (0.4)

13. Total NPAs & 90+ Days Delinquent Change 3.1 4.9 (4.2) (2.5)

14. Ending Balance NPAs & 90+ Days Delinquent 40.3$ 45.2$ 41.0$ 38.5$

ALLL and Fair Value Summary

21

($ in Millions) Q2-'17 Q3-'17 Q4-'17 Q1-'18

1. Beginning Allowance for Loan Losses (ALLL) 68.2$ 70.5$ 73.4$ 75.0$

2. Net Charge-offs (Recoveries) 0.6 (0.8) 0.2 1.1

3. Provision Expense 2.9 2.1 1.8 2.5

4. Ending Allowance for Loan Losses (ALLL) 70.5$ 73.4$ 75.0$ 76.4$

5. ALLL/Non-Accrual Loans 257.7% 227.4% 261.2% 277.9%

6. ALLL/Non-Purchased Loans 1.45% 1.44% 1.36% 1.32%

7. ALLL/Loans 1.25% 1.13% 1.11% 1.11%

8. Fair Value Adjustment (FVA) 29.7$ 50.4$ 46.3$ 43.1$

9. Total ALLL plus FVA 100.2 123.8 121.3 119.5

10. Purchased Loans plus FVA 792.6 1,445.8 1,304.7 1,179.8

11. FVA/Purchased Loans plus FVA 3.74% 3.49% 3.55% 3.65%

Portfolio Summary

22

Strong quarterly loan growth of $148 million, led by CRE and C&I loans

Construction and CRE portfolios are 57% and 226% of risk-based capital,

respectively; well beneath regulatory guidelines

Non-Accrual Loans and ORE both declined for the quarter, while Total NPAs &

90+ Days remained low at 0.6% of Loans and ORE

Classified Assets increased to $178.4 million, at a historically consistent level

Net charge-offs were $1.1 million for the quarter with provision expense of

$2.5 million

ALLL to Loans of 1.11% and to Non-Purchased Loans of 1.32%

Michael C. Rechin

PRESIDENT AND CHIEF EXECUTIVE OFFICER

23

FMC Strategy and Tactics Overview

Looking Forward . . .

Build market presence and cultivate the First Merchants’ Brand in former Arlington Bank and

Independent Alliance Bank communities

Capitalize on talent opportunities from performance and preferred employer recognitions

Build out of specialty finance businesses in sponsor finance, public finance, asset-based lending,

and loan syndications

Complete checking account migration to new product set and streamline front and back-office

processes; continue implementation of workflow technologies for operating leverage

Manage net-interest margin upside with next interest rate moves

Assess M&A opportunities for strategic fit as we prepare to cross the $10 Billion asset level

“Responsive, Knowledgeable, High-Performing”

24

Contact Information

First Merchants Corporation common stock is

traded on the NASDAQ Global Select Market

under the symbol FRME.

Additional information can be found at

www.FIRSTMERCHANTS.COM

Investor inquiries:

Nicole M. Weaver

Investor Relations

Telephone: 765.521.7619

nweaver@firstmerchants.com

25

Appendix

26

Appendix – Non-GAAP Reconciliation

27

CAPITAL RATIOS (dollars in thousands):

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18

Total Risk-Based Capital Ratio

Total Stockholders' Equity (GAAP) 867,263 887,550 900,865 901,657 929,470 1,035,116 1,283,120 1,303,463 1,313,073

Adjust for Accumulated Other Comprehensive (Income) Loss 1 (2,066) (7,035) (3,924) 13,581 3,722 (1,384) 6,358 3,534 21,725

Less: Preferred Stock (125) (125) (125) (125) (125) (125) (125) (125) (125)

Add: Qualifying Capital Securities 55,236 55,296 55,355 55,415 55,474 55,534 65,864 65,919 65,975

Less: Tier 1 Capital Deductions (1,999) (1,828) (1,440) (376) (80) (166) - - -

Less: Disallowed Goodwill and Intangible Assets (250,367) (249,932) (249,541) (249,104) (250,493) (300,307) (462,080) (464,066) (467,518)

Less: Disallowed Servicing Assets

Total Tier 1 Capital (Regulatory) 664,944$ 681,183$ 699,029$ 720,484$ 737,648$ 788,003$ 893,137$ 908,725$ 930,536$

Qualifying Subordinated Debentures 65,000 65,000 65,000 65,000 65,000 65,000 65,000 65,000 65,000

Allowance for Loan Losses includible in Tier 2 Capital 62,086 62,186 63,456 66,037 68,225 70,471 73,354 75,032 76,420

Total Risk-Based Capital (Regulatory) 792,030$ 808,369$ 827,485$ 851,521$ 870,873$ 923,474$ 1,031,491$ 1,048,757$ 1,071,956$

Net Risk-Weighted Assets (Regulatory) 5,355,827$ 5,511,557$ 5,836,806$ 5,993,381$ 6,114,112$ 6,592,710$ 7,497,321$ 7,660,604$ 7,831,727$

Total Risk-Based Capital Ratio (Regulatory) 14.79% 14.67% 14.18% 14.21% 14.24% 14.01% 13.76% 13.69% 13.69%

Common Equity Tier 1 Capital Ratio

Total Tier 1 Capital (Regulatory) 664,944$ 681,183$ 699,029$ 720,484$ 737,648$ 788,003$ 893,137$ 908,725$ 930,536$

Less: Qualified Capital Securities (55,236) (55,296) (55,355) (55,415) (55,474) (55,534) (65,864) (65,919) (65,975)

Add: Additional Tier 1 Capital Deductions 1,999 1,828 1,440 376 80 166 - - -

Less: Preferred Stock

Net Risk-Weighted Assets (Regulatory) 5,355,827$ 5,511,557$ 5,836,806$ 5,993,381$ 6,114,112$ 6,592,710$ 7,497,321$ 7,660,604$ 7,831,727$

Common Equity Tier 1 Capital Ratio (Regulatory) 11.42% 11.39% 11.05% 11.10% 11.16% 11.11% 11.03% 11.00% 11.04%

1 Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting

guidance for defined benefit and other postretirement plans.

Appendix – Non-GAAP Reconciliation

28

TANGIBLE COMMON EQUITY RATIO (dollars in thousands):

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18

Total Stockholders' Equity (GAAP) 867,263$ 887,550$ 900,865$ 901,657$ 929,470$ 1,035,116$ 1,283,120$ 1,303,463$ 1,313,073$

Less: Preferred Stock (125) (125) (125) (125) (125) (125) (125) (125) (125)

Less: Intangible Assets (261,799) (260,822) (259,844) (258,866) (257,963) (309,686) (478,558) (476,503) (474,777)

Tangible Common Equity (non-GAAP) 605,339$ 626,603$ 640,896$ 642,666$ 671,382$ 725,305$ 804,437$ 826,835$ 838,171$

Total Assets (GAAP) 6,798,539$ 6,906,418$ 7,022,352$ 7,211,611$ 7,326,193$ 7,805,029$ 9,049,403$ 9,367,478$ 9,472,796$

Less: Intangible Assets (261,799) (260,822) (259,844) (258,866) (257,963) (309,686) (478,558) (476,503) (474,777)

Tangible Assets (non-GAAP) 6,536,740$ 6,645,596$ 6,762,508$ 6,952,745$ 7,068,230$ 7,495,343$ 8,570,845$ 8,890,975$ 8,998,019$

Tangible Common Equity Ratio (non-GAAP) 9.26% 9.43% 9.48% 9.24% 9.50% 9.68% 9.39% 9.30% 9.32%ANGIBLE COMMON EQUITY PER SHARE (dollars in thousands):

4Q10 4Q11 4Q12 4Q13 4Q14 4Q15 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18

Total Stockholders' Equity (GAAP) 454,408$ 514,467$ 552,236$ 634,923$ 726,827$ 850,509$ 901,657$ 929,470$ 1,035,116$ 1,283,120$ 1,303,463$ 1,313,073$

Less: Preferred Stock (67,880) (90,783) (90,908) (125) (125) (125) (125) (125) (125) (125) (125) (125)

Less: Intangible Assets (154,019) (150,471) (149,529) (202,767) (218,755) (259,764) (258,866) (257,963) (309,686) (478,558) (476,503) (474,777)

Tax Benefit 2,907 2,224 2,249 4,973 6,085 6,278 5,930 5,659 6,941 12,510 6,788 6,043

Tangible Common Equity, Net of Tax (non-GAAP) 235,416$ 275,437$ 314,048$ 437,004$ 514,032$ 596,898$ 648,596$ 677,041$ 732,246$ 816,947$ 833,623$ 844,214$

0

Shares Outstanding 25,574,251 28,559,707 28,692,616 35,921,761 37,669,948 40,664,258 40,912,697 41,047,543 43,153,509 49,140,594 49,158,238 49,243,096

Tangible Common Equity per Share (non-GAAP) 9.21$ 9.64$ 10.95$ 12.17$ 13.65$ 14.68$ 15.85$ 16.49$ 16.97$ 16.62$ 16.96$ 17.14$

Appendix – Non-GAAP Reconciliation

29

EFFICIENCY RATIO (dollars in thousands):

2016 1Q17 2017 1Q18

Non Interest Expense (GAAP) 177,359$ 43,099$ 205,556$ 53,687$

Less: Intangible Asset Amortization (3,910) (903) (5,647) (1,726)

Less: OREO and Foreclosure Expenses (2,877) (531) (1,903) (402)

Adjusted Non Interest Expense (non-GAAP) 170,572 41,665 198,006 51,559

Net Interest Income (GAAP) 226,473 60,999 277,284 79,916

Plus: Fully Taxable Equivalent Adjustment 13,541 3,950 17,270 2,584

Net Interest Income on a Fully Taxable Equivalent Basis (non-GAAP) 240,014 64,949 294,554 82,500

Non Interest Income (GAAP) 65,203 14,846 71,009 19,561

Less: Investment Securities Gains (Losses) (3,389) (598) (2,631) (1,609)

Adjusted Non Interest Income (non-GAAP) 61,814 14,248 68,378 17,952

Adjusted Revenue (non-GAAP) 301,828 79,197 362,932 100,452

Efficiency Ratio (non-GAAP) 56.51% 52.61% 54.56% 51.33%

FORWARD DIVIDEND YIELD

1Q18

Most rece t quarter's dividend per share 0.18$

Most recent quarter's dividend per share - Annualized 0.72$

Stock Price at 3/31/18 41.70$

Forward Dividend Yield 1.73%

DIVIDEND PAYOUT RATIO

2018

Dividends per share 0.18$

Earnings Per Share 0.74$

Dividend Payout Ratio 24.3%

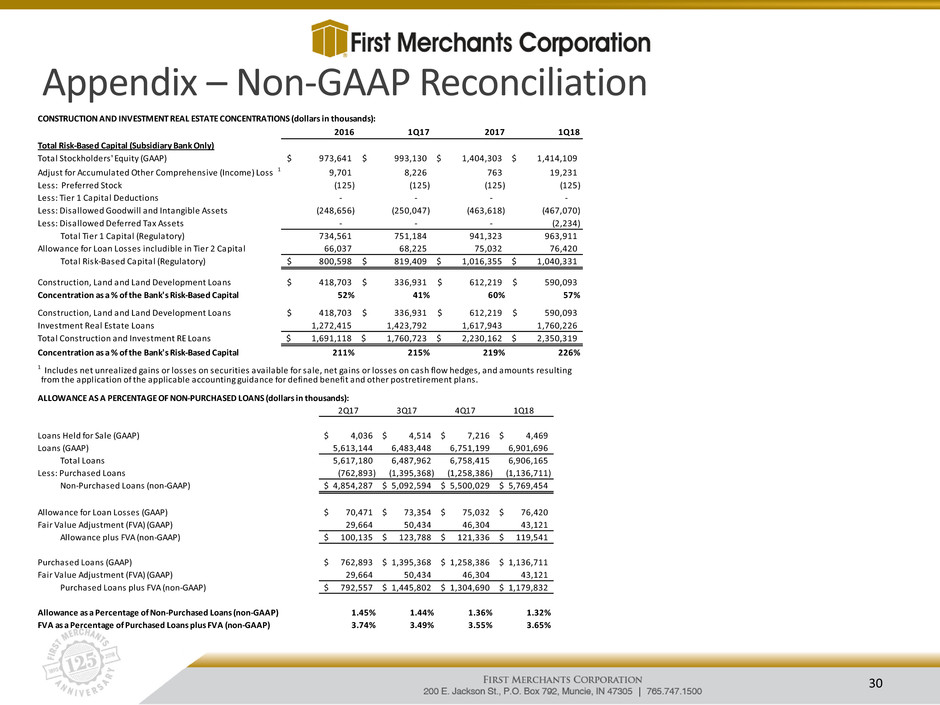

Appendix – Non-GAAP Reconciliation

30

CONSTRUCTION AND INVESTMENT REAL ESTATE CONCENTRATIONS (dollars in thousands):

2016 1Q17 2017 1Q18

Total Risk-Based Capital (Subsidiary Bank Only)

Total Stockholders' Equity (GAAP) 973,641$ 993,130$ 1,404,303$ 1,414,109$

Adjust for Accumulated Other Comprehensive (Income) Loss 1 9,701 8,226 763 19,231

Less: Preferred Stock (125) (125) (125) (125)

Less: Tier 1 Capital Deductions - - - -

Less: Disallowed Goodwill and Intangible Assets (248,656) (250,047) (463,618) (467,070)

Less: Disallowed Deferred Tax Assets - - - (2,234)

Total Tier 1 Capital (Regulatory) 734,561 751,184 941,323 963,911

Allowance for Loan Losses includible in Tier 2 Capital 66,037 68,225 75,032 76,420

Total Risk-Based Capital (Regulatory) 800,598$ 819,409$ 1,016,355$ 1,040,331$

Construction, Land and Land Development Loans 418,703$ 336,931$ 612,219$ 590,093$

Co centration as a % f the Bank's Risk-Based Capital 52% 41% 60% 57%

Construction, Land and Land Development Loans 418,703$ 336,931$ 612,219$ 590,093$

Investment Real Estate Loans 1,272,415 1,423,792 1,617,943 1,760,226

Total Construction and Investment RE Loans 1,691,118$ 1,760,723$ 2,230,162$ 2,350,319$

Concentration as a % of the Bank's Risk-Based Capital 211% 215% 219% 226%

1 Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting

from the application of the applicable accounting guidance for defined benefit and other postretirement plans.

LLOWANCE AS A PERCENTAGE OF NON-PURCHASED LOANS (dollars in thousands):

2Q17 3Q17 4Q17 1Q18

L ans Held for S le (GAAP) 4,036$ 4,514$ 7,216$ 4,469$

L ans (GAAP) 5,613,144 6,483,448 6,751,199 ,901,696

Total Loans 5,617,180 6,487,962 6,758,415 6,906,165

Less: Purchased Loans (762,893) (1,395,368) (1,258,386) (1,136,711)

Non-Purchased Loans (non-GAAP) 4,854,287$ 5,092,594$ 5,500,029$ 5,769,454$

Allowa ce for Loan Losses (GAAP) 70,471$ 73,354$ 75,032$ 76,420$

Fair Value Adjustment (FVA) (GAAP) 29,664 50,434 46,304 43,121

Allowance plus FVA (non-GAAP) 100,135$ 123,788$ 121,336$ 119,541$

Purchased Loans (GAAP) 762,893$ 1,395,368$ 1,258,386$ 1,136,711$

Fair Value Adjustment (FVA) (GAAP) 29,664 50,434 46,304 43,121

Purchased Loans plus FVA (non-GAAP) 792,557$ 1,445,802$ 1,304,690$ 1,179,832$

Allowance as a Percentage of Non-Purchased Loans (non-GAAP) 1.45% 1.44% 1.36% 1.32%

FVA as a Percentage of Purchased Loans plus FVA (non-GAAP) 3.74% 3.49% 3.55% 3.65%