Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TRIMBLE INC. | d573173dex991.htm |

| EX-2.1 - EX-2.1 - TRIMBLE INC. | d573173dex21.htm |

| 8-K - FORM 8-K - TRIMBLE INC. | d573173d8k.htm |

Creates the industry’s most complete construction management solution INVESTOR PRESENTATION, APRIL 23, 2018 Trimble to Acquire Viewpoint Exhibit 99.2

This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the planned Viewpoint acquisition and the timing and financing thereof, the impact of the Viewpoint acquisition on Trimble’s financial results and construction management solutions, the benefits to Viewpoint’s current and future customers from Trimble’s portfolio and expertise, the benefits to contractors of the combined Trimble and Viewpoint solution portfolio, the effects on Trimble’s growth and plans to bring Viewpoint solutions to civil and building contractors and the international market. These forward-looking statements are subject to change, and actual results may materially differ from those set forth in this presentation due to certain risks and uncertainties. Factors that could cause or contribute to changes in such forward-looking statements include, but are not limited to (i) failure to realize the anticipated benefits of the acquisition, (ii) Trimble's inability to successfully integrate Viewpoint’s solutions with Trimble’s construction solutions to deliver enhanced product offerings, (iii) unexpected expenditures or assumed liabilities that may be incurred as a result of the acquisition, (iv) loss of key employees or customers following the acquisition, (v) unanticipated difficulties in conforming business practices, including accounting policies, procedures, internal controls, and financial records of Viewpoint with Trimble, (vi) inability to accurately forecast the performance of Viewpoint resulting in unforeseen adverse effects on Trimble’s operating results, (vii) failure to satisfy the conditions to the completion of the acquisition on the anticipated schedule, or at all, (viii) failure to obtain long-term financing for the acquisition on favorable terms, or at all, and (ix) synergies between Viewpoint and Trimble as well as purchase price accounting, including the impact of ASC 606 and the reduction of deferred revenue, being estimated and may be materially different from actual results. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements set forth in reports filed with the SEC, including Trimble's quarterly reports on Form 10-Q and its annual report on Form 10-K, such as statements regarding changes in economic conditions and the impact of competition. Undue reliance should not be placed on any forward-looking statement contained herein. These statements reflect Trimble’s position as of the date of this presentation. Trimble expressly disclaims any undertaking to release publicly any updates or revisions to any statements to reflect any change in Trimble’s expectations or any change of events, conditions, or circumstances on which any such statement is based. Safe Harbor

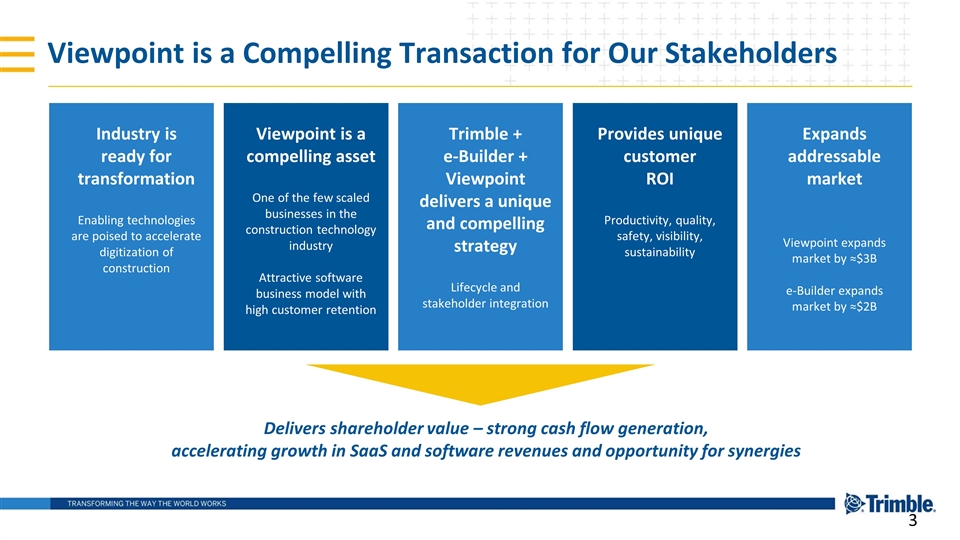

Viewpoint is a Compelling Transaction for Our Stakeholders Industry is ready for transformation Enabling technologies are poised to accelerate digitization of construction Delivers shareholder value – strong cash flow generation, accelerating growth in SaaS and software revenues and opportunity for synergies Viewpoint is a compelling asset One of the few scaled businesses in the construction technology industry Attractive software business model with high customer retention Trimble + e-Builder + Viewpoint delivers a unique and compelling strategy Lifecycle and stakeholder integration Provides unique customer ROI Productivity, quality, safety, visibility, sustainability Expands addressable market Viewpoint expands market by ≈$3B e-Builder expands market by ≈$2B

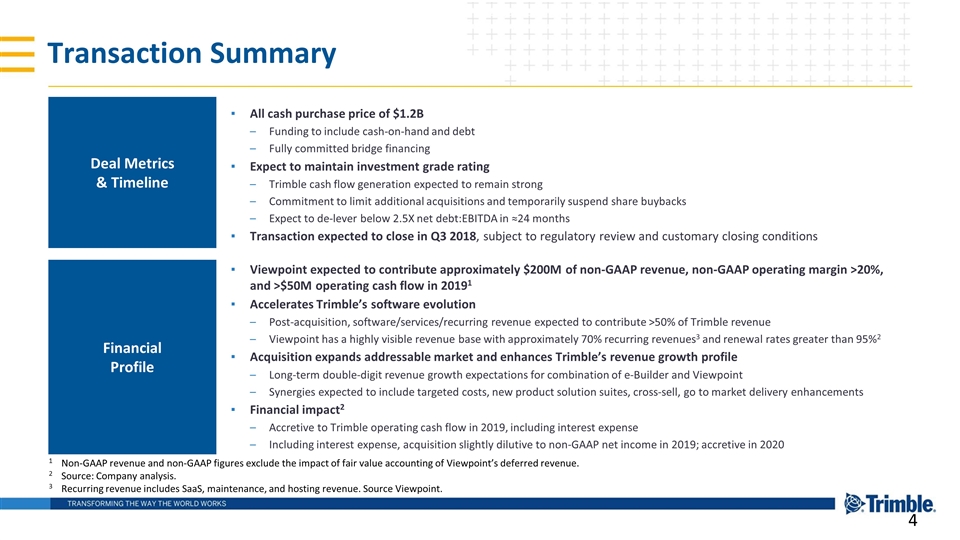

Deal Metrics & Timeline Financial Profile Transaction Summary All cash purchase price of $1.2B Funding to include cash-on-hand and debt Fully committed bridge financing Expect to maintain investment grade rating Trimble cash flow generation expected to remain strong Commitment to limit additional acquisitions and temporarily suspend share buybacks Expect to de-lever below 2.5X net debt:EBITDA in ≈24 months Transaction expected to close in Q3 2018, subject to regulatory review and customary closing conditions Viewpoint expected to contribute approximately $200M of non-GAAP revenue, non-GAAP operating margin >20%, and >$50M operating cash flow in 20191 Accelerates Trimble’s software evolution Post-acquisition, software/services/recurring revenue expected to contribute >50% of Trimble revenue Viewpoint has a highly visible revenue base with approximately 70% recurring revenues3 and renewal rates greater than 95%2 Acquisition expands addressable market and enhances Trimble’s revenue growth profile Long-term double-digit revenue growth expectations for combination of e-Builder and Viewpoint Synergies expected to include targeted costs, new product solution suites, cross-sell, go to market delivery enhancements Financial impact2 Accretive to Trimble operating cash flow in 2019, including interest expense Including interest expense, acquisition slightly dilutive to non-GAAP net income in 2019; accretive in 2020 1Non-GAAP revenue and non-GAAP figures exclude the impact of fair value accounting of Viewpoint’s deferred revenue. 2Source: Company analysis. 3 Recurring revenue includes SaaS, maintenance, and hosting revenue. Source Viewpoint.

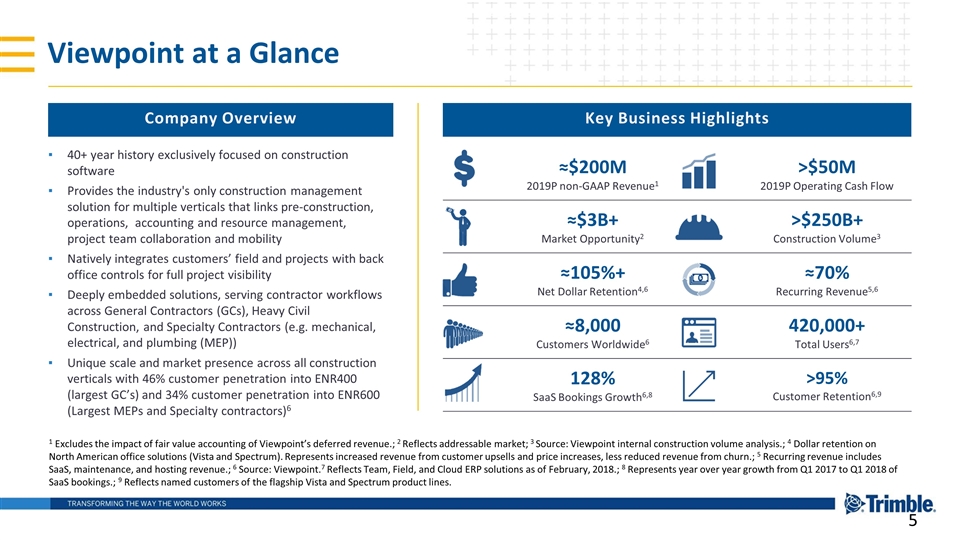

1 Excludes the impact of fair value accounting of Viewpoint’s deferred revenue.; 2 Reflects addressable market; 3 Source: Viewpoint internal construction volume analysis.; 4 Dollar retention on North American office solutions (Vista and Spectrum). Represents increased revenue from customer upsells and price increases, less reduced revenue from churn.; 5 Recurring revenue includes SaaS, maintenance, and hosting revenue.; 6 Source: Viewpoint.7 Reflects Team, Field, and Cloud ERP solutions as of February, 2018.; 8 Represents year over year growth from Q1 2017 to Q1 2018 of SaaS bookings.; 9 Reflects named customers of the flagship Vista and Spectrum product lines. Company Overview Key Business Highlights ≈$200M 2019P non-GAAP Revenue1 >$50M 2019P Operating Cash Flow ≈$3B+ Market Opportunity2 >$250B+ Construction Volume3 ≈105%+ Net Dollar Retention4,6 ≈70% Recurring Revenue5,6 ≈8,000 Customers Worldwide6 420,000+ Total Users6,7 128% SaaS Bookings Growth6,8 >95% Customer Retention6,9 Viewpoint at a Glance 40+ year history exclusively focused on construction software Provides the industry's only construction management solution for multiple verticals that links pre-construction, operations, accounting and resource management, project team collaboration and mobility Natively integrates customers’ field and projects with back office controls for full project visibility Deeply embedded solutions, serving contractor workflows across General Contractors (GCs), Heavy Civil Construction, and Specialty Contractors (e.g. mechanical, electrical, and plumbing (MEP)) Unique scale and market presence across all construction verticals with 46% customer penetration into ENR400 (largest GC’s) and 34% customer penetration into ENR600 (Largest MEPs and Specialty contractors)6

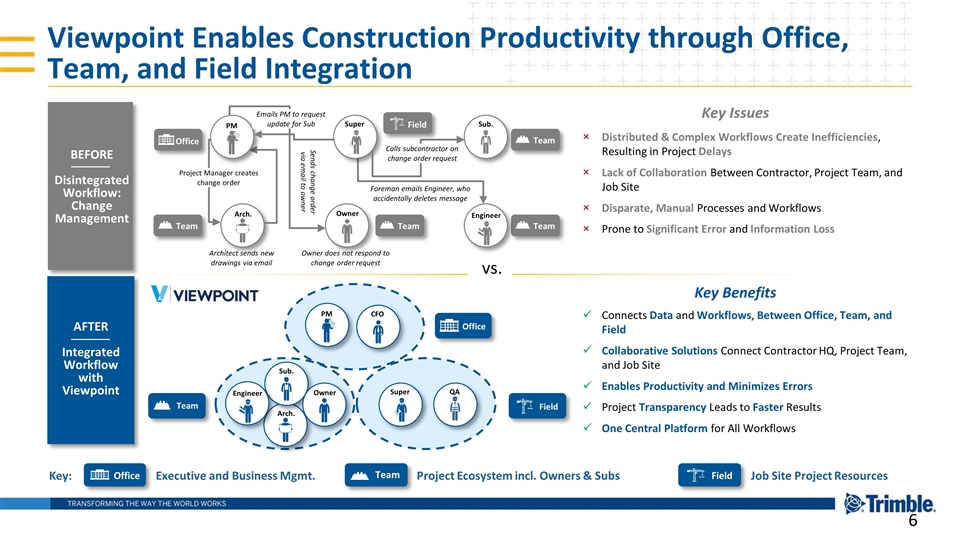

Viewpoint Enables Construction Productivity through Office, Team, and Field Integration vs. Distributed & Complex Workflows Create Inefficiencies, Resulting in Project Delays Lack of Collaboration Between Contractor, Project Team, and Job Site Disparate, Manual Processes and Workflows Prone to Significant Error and Information Loss Key Issues Connects Data and Workflows, Between Office, Team, and Field Collaborative Solutions Connect Contractor HQ, Project Team, and Job Site Enables Productivity and Minimizes Errors Project Transparency Leads to Faster Results One Central Platform for All Workflows Owner Sub. Arch. Super Project Manager creates change order PM Sends change order via email to owner Calls subcontractor on change order request Foreman emails Engineer, who accidentally deletes message Owner does not respond to change order request Architect sends new drawings via email Emails PM to request update for Sub Field Office Team Team Team Team Key Benefits Arch. Sub. Engineer PM Office Team Field Super CFO QA Office Executive and Business Mgmt. Team Project Ecosystem incl. Owners & Subs Field Job Site Project Resources Key: BEFORE Disintegrated Workflow: Change Management AFTER Integrated Workflow with Viewpoint Engineer Owner

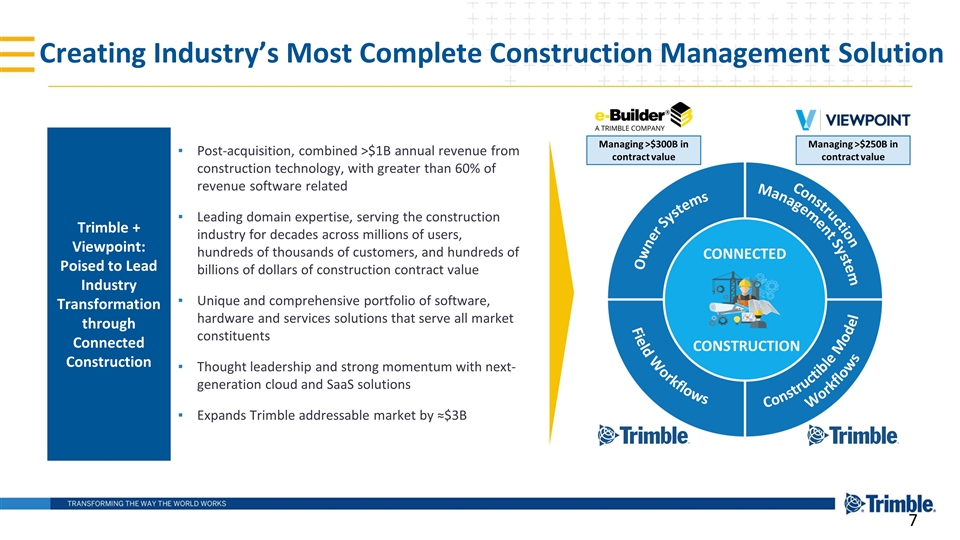

Creating Industry’s Most Complete Construction Management Solution Trimble + Viewpoint: Poised to Lead Industry Transformation through Connected Construction Post-acquisition, combined >$1B annual revenue from construction technology, with greater than 60% of revenue software related Leading domain expertise, serving the construction industry for decades across millions of users, hundreds of thousands of customers, and hundreds of billions of dollars of construction contract value Unique and comprehensive portfolio of software, hardware and services solutions that serve all market constituents Thought leadership and strong momentum with next-generation cloud and SaaS solutions Expands Trimble addressable market by ≈$3B Owner Systems Construction Management System Constructible Model Workflows Field Workflows CONNECTED CONSTRUCTION Managing >$250B in contract value Managing >$300B in contract value

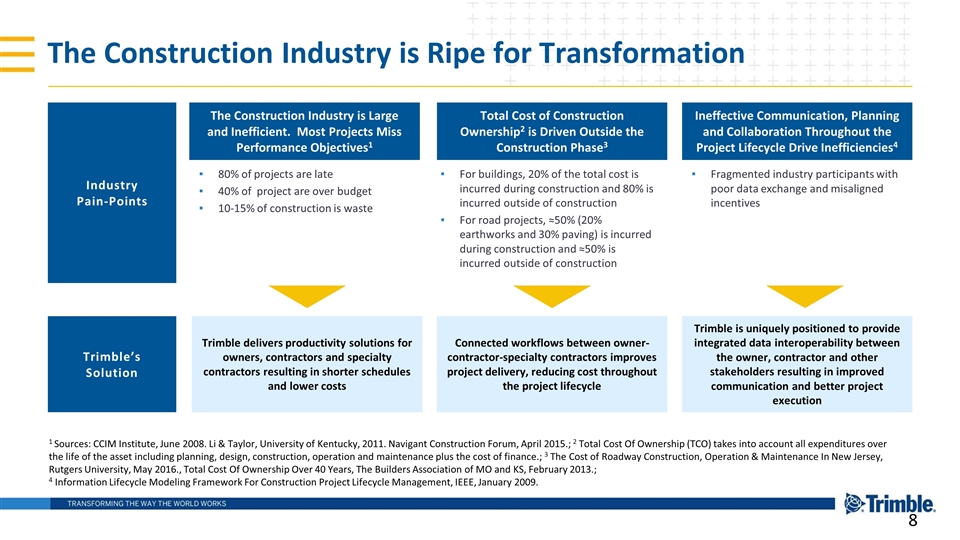

The Construction Industry is Ripe for Transformation For buildings, 20% of the total cost is incurred during construction and 80% is incurred outside of construction For road projects, ≈50% (20% earthworks and 30% paving) is incurred during construction and ≈50% is incurred outside of construction Industry Pain-Points Trimble’s Solution The Construction Industry is Large and Inefficient. Most Projects Miss Performance Objectives1 80% of projects are late 40% of project are over budget 10-15% of construction is waste Trimble delivers productivity solutions for owners, contractors and specialty contractors resulting in shorter schedules and lower costs Total Cost of Construction Ownership2 is Driven Outside the Construction Phase3 Connected workflows between owner-contractor-specialty contractors improves project delivery, reducing cost throughout the project lifecycle Ineffective Communication, Planning and Collaboration Throughout the Project Lifecycle Drive Inefficiencies4 Fragmented industry participants with poor data exchange and misaligned incentives Trimble is uniquely positioned to provide integrated data interoperability between the owner, contractor and other stakeholders resulting in improved communication and better project execution 1 Sources: CCIM Institute, June 2008. Li & Taylor, University of Kentucky, 2011. Navigant Construction Forum, April 2015.; 2 Total Cost Of Ownership (TCO) takes into account all expenditures over the life of the asset including planning, design, construction, operation and maintenance plus the cost of finance.; 3 The Cost of Roadway Construction, Operation & Maintenance In New Jersey, Rutgers University, May 2016., Total Cost Of Ownership Over 40 Years, The Builders Association of MO and KS, February 2013.; 4 Information Lifecycle Modeling Framework For Construction Project Lifecycle Management, IEEE, January 2009.

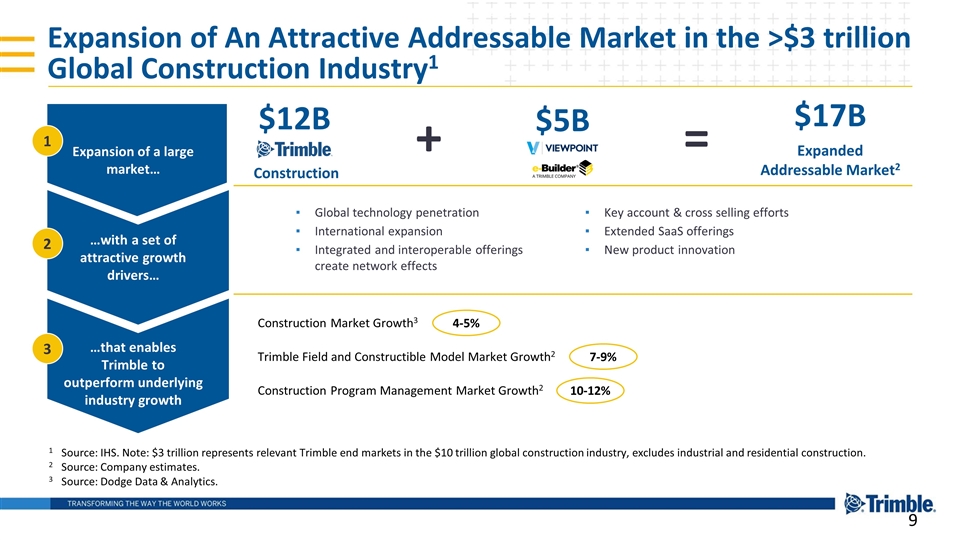

Expansion of An Attractive Addressable Market in the >$3 trillion Global Construction Industry1 1Source: IHS. Note: $3 trillion represents relevant Trimble end markets in the $10 trillion global construction industry, excludes industrial and residential construction. 2Source: Company estimates. 3Source: Dodge Data & Analytics. $17B Expanded Addressable Market2 + = $5B $12B Construction Global technology penetration International expansion Integrated and interoperable offerings create network effects Key account & cross selling efforts Extended SaaS offerings New product innovation Construction Market Growth3 4-5% Construction Program Management Market Growth2 10-12% Trimble Field and Constructible Model Market Growth2 7-9% Expansion of a large market… 1 …with a set of attractive growth drivers… 2 …that enables Trimble to outperform underlying industry growth 3

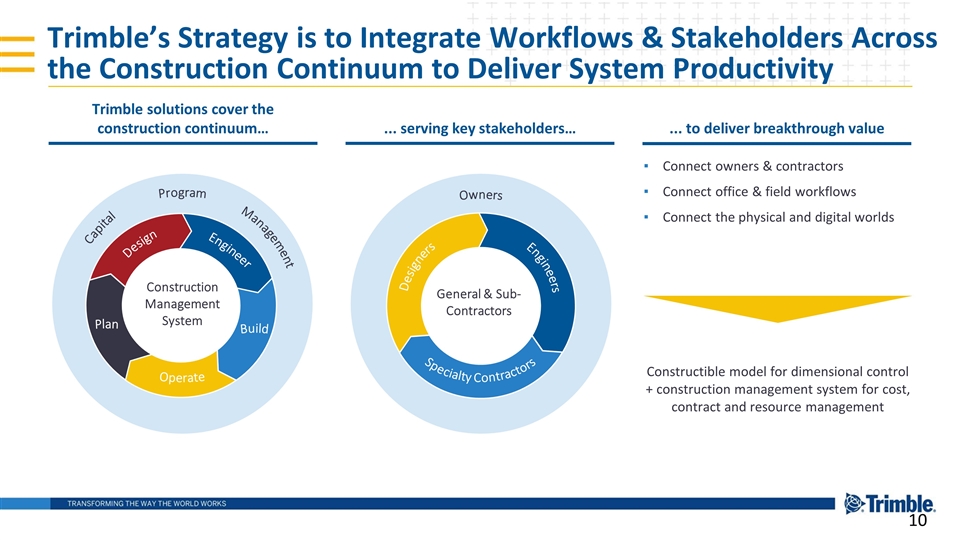

Trimble’s Strategy is to Integrate Workflows & Stakeholders Across the Construction Continuum to Deliver System Productivity ... to deliver breakthrough value Trimble solutions cover the construction continuum… ... serving key stakeholders… Connect owners & contractors Connect office & field workflows Connect the physical and digital worlds Constructible model for dimensional control + construction management system for cost, contract and resource management Program Capital Management Build Operate Plan Construction Management System Engineer Design Owners Specialty Contractors Designers General & Sub-Contractors Engineers

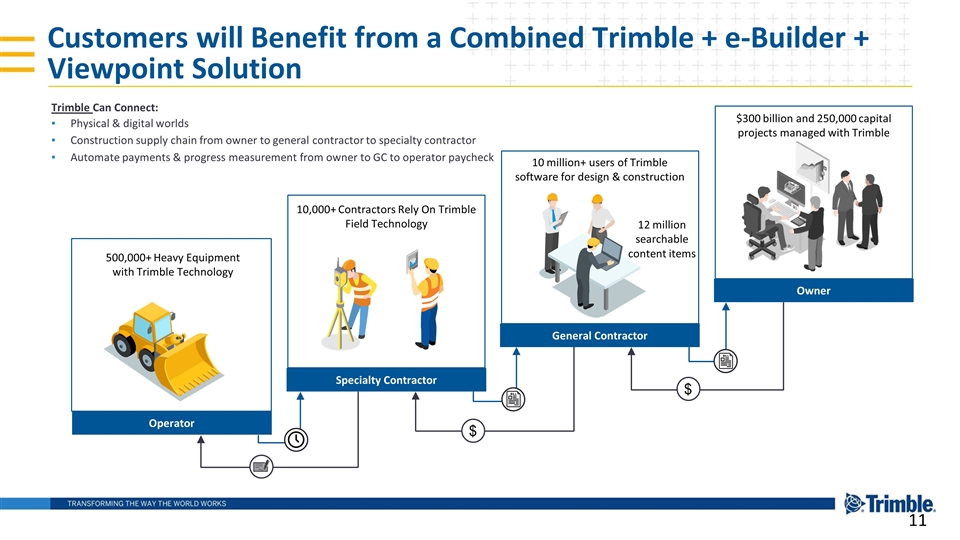

Customers will Benefit from a Combined Trimble + e-Builder + Viewpoint Solution Trimble Can Connect: Physical & digital worlds Construction supply chain from owner to general contractor to specialty contractor Automate payments & progress measurement from owner to GC to operator paycheck 10,000+ Contractors Rely On Trimble Field Technology Specialty Contractor 500,000+ Heavy Equipment with Trimble Technology Operator $300 billion and 250,000 capital projects managed with Trimble 10 million+ users of Trimble software for design & construction General Contractor Owner 12 million searchable content items $ $

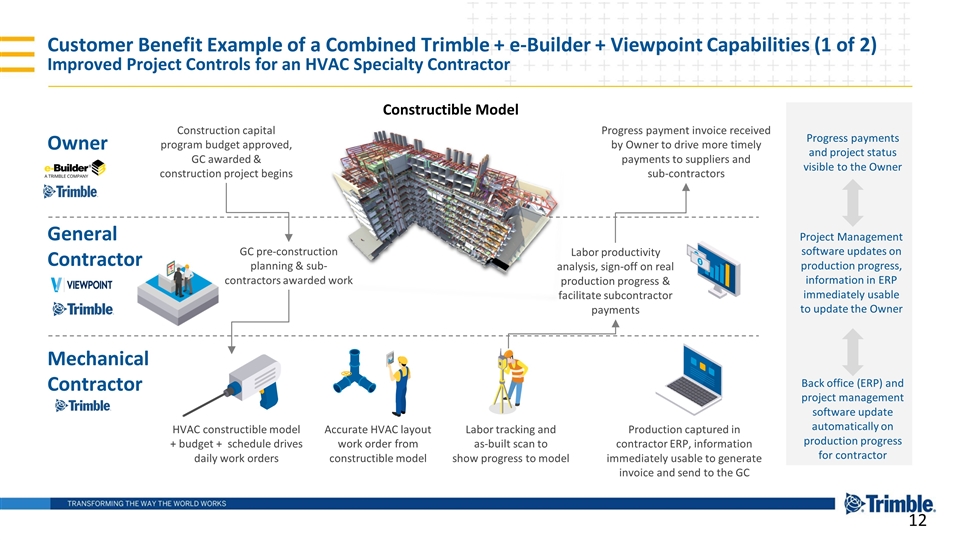

Customer Benefit Example of a Combined Trimble + e-Builder + Viewpoint Capabilities (1 of 2) Improved Project Controls for an HVAC Specialty Contractor Accurate HVAC layout work order from constructible model HVAC constructible model + budget + schedule drives daily work orders Owner General Contractor Mechanical Contractor Labor tracking and as-built scan to show progress to model Construction capital program budget approved, GC awarded & construction project begins GC pre-construction planning & sub-contractors awarded work Labor productivity analysis, sign-off on real production progress & facilitate subcontractor payments Progress payment invoice received by Owner to drive more timely payments to suppliers and sub-contractors Project Management software updates on production progress, information in ERP immediately usable to update the Owner Back office (ERP) and project management software update automatically on production progress for contractor Production captured in contractor ERP, information immediately usable to generate invoice and send to the GC Constructible Model Progress payments and project status visible to the Owner

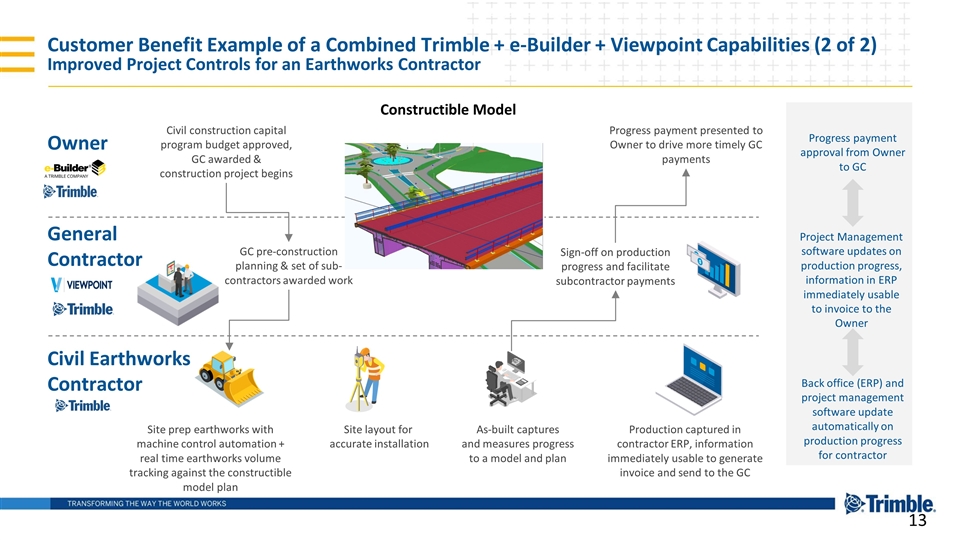

Customer Benefit Example of a Combined Trimble + e-Builder + Viewpoint Capabilities (2 of 2) Improved Project Controls for an Earthworks Contractor Site layout for accurate installation Site prep earthworks with machine control automation + real time earthworks volume tracking against the constructible model plan Owner General Contractor Civil Earthworks Contractor As-built captures and measures progress to a model and plan Civil construction capital program budget approved, GC awarded & construction project begins GC pre-construction planning & set of sub-contractors awarded work Sign-off on production progress and facilitate subcontractor payments Progress payment presented to Owner to drive more timely GC payments Project Management software updates on production progress, information in ERP immediately usable to invoice to the Owner Back office (ERP) and project management software update automatically on production progress for contractor Production captured in contractor ERP, information immediately usable to generate invoice and send to the GC Constructible Model Progress payment approval from Owner to GC

Combined Offering Would be Competitively Unique and Differentiated Through the Integration of Hardware and Software, as Well as Office and Field Workflows Representative Peers Trimble Differentiation Design & Construction Documentation Project Management & Document Management Equipment OEMs With Viewpoint, Trimble will link and integrate construction financial, project team, and job site solutions to manage contracts, cost and resources With e-Builder, Trimble provides information flow between the owner, contractor and subcontractor where job cost, progress and financial performance are connected Construction Market Approaches Design and construction documentation are inputs into Trimble constructible model workflows With Viewpoint, Trimble integrates job cost and resource management solutions with the design and operational solutions that building and civil contractors (and subcontractors) need to quote, perform, and track work Contractors operate mixed fleets and need a provider who can coordinate machines off a constructible model that is integrated with the business system to enable management of labor, equipment and materials Trimble’s vision of machine autonomy couples the machine with a constructible model + cost model + schedule + construction management planning software to plan, optimize and execute an autonomous workflow

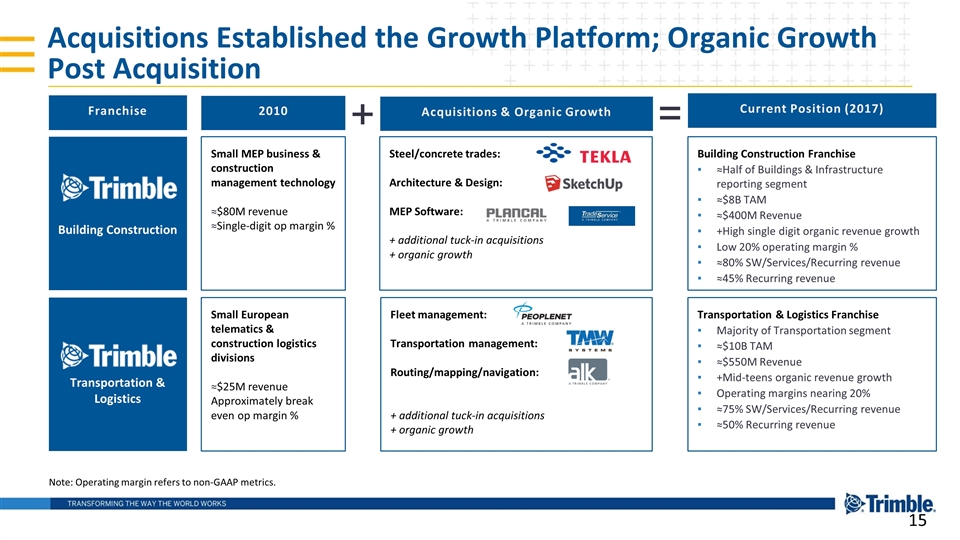

Acquisitions Established the Growth Platform; Organic Growth Post Acquisition Fleet management: Transportation management: Routing/mapping/navigation: + additional tuck-in acquisitions + organic growth Steel/concrete trades: Architecture & Design: MEP Software: + additional tuck-in acquisitions + organic growth 2010 Transportation & Logistics Building Construction Acquisitions & Organic Growth Current Position (2017) + = Franchise Small MEP business & construction management technology ≈$80M revenue ≈Single-digit op margin % Building Construction Franchise ≈Half of Buildings & Infrastructure reporting segment ≈$8B TAM ≈$400M Revenue +High single digit organic revenue growth Low 20% operating margin % ≈80% SW/Services/Recurring revenue ≈45% Recurring revenue Small European telematics & construction logistics divisions ≈$25M revenue Approximately break even op margin % Transportation & Logistics Franchise Majority of Transportation segment ≈$10B TAM ≈$550M Revenue +Mid-teens organic revenue growth Operating margins nearing 20% ≈75% SW/Services/Recurring revenue ≈50% Recurring revenue Note: Operating margin refers to non-GAAP metrics.

To help investors understand Trimble’s past financial performance and future results, as well as its performance relative to competitors, Trimble supplements the financial results that the company provides in accordance with generally accepted accounting principles, or GAAP, with non-GAAP financial measures. These non-GAAP measures can be used to evaluate Trimble’s historical and prospective financial performance, as well as its performance relative to competitors. The company’s management regularly uses supplemental non-GAAP financial measures internally to understand, manage and evaluate the business, and to make operating decisions. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Trimble believes that these non-GAAP financial measures reflect an additional way of viewing aspects of the company’s operations that, when viewed with the GAAP results, provide a more complete understanding of factors and trends affecting the business. Further, Trimble believes some of the company’s investors track “core operating performance” as a means of evaluating performance in the ordinary, ongoing, and customary course of the company’s operations. Core operating performance excludes items that are non-cash, not expected to recur or not reflective of ongoing financial results. Management also believes that looking at Trimble’s core operating performance provides a supplemental way to provide consistency in period to period comparisons. The method the company uses to produce non-GAAP results is not computed according to GAAP and may differ from the methods used by other companies. Trimble’s non-GAAP results are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with Trimble’s consolidated financial statements prepared in accordance with GAAP. Additional financial information about Trimble’s use of non-GAAP results can be found on the Investor Relations page of the Trimble website at: http://investor.trimble.com. When Trimble provides its expectations for the impact its Viewpoint acquisition will have on Trimble's non-GAAP revenue and non-GAAP operating margins, as well as its net debt to Adjusted EBITDA ratio and non-GAAP net income, on a forward-looking basis, a reconciliation of the differences between these non-GAAP expectations and the corresponding GAAP measures (GAAP revenue and GAAP operating margins) is not available without unreasonable effort because Trimble has not estimated the fair value of the assets and liabilities expected to be acquired in the transaction. Nor has the company determined the fair value of acquired intangible assets and related annual amortization expense that would be required in order to provide the corresponding GAAP measure. The variability of the items that have not yet been determined may have a significant, and potentially unpredictable, impact on Trimble’s future GAAP results. Trimble expects that the reduction of deferred revenue as a result of the acquisition will be material to GAAP results and believes such a reconciliation would imply a degree of precision that would be confusing or misleading to investors. Use of Non-GAAP Financial Information

Q&A