Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - IBERIABANK CORP | a8-k41918strategicgoalsxdo.htm |

| 8-K - 8-K - IBERIABANK CORP | a8-k41918strategicgoalsxco.htm |

2020 Strategic Goals

2 0 1 8

S u s t a i n a b l e , P r o f i t a b l e G r o w t h

Exhibit 99.2

Forward-Looking Statements And

Non-GAAP Financial Measures

2

To the extent that statements in this PowerPoint presentation relate to future plans, objectives, financial results or

performance of IBERIABANK Corporation, these statements are deemed to be forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements, which are based on management’s current information, estimates

and assumptions and the current economic environment, are generally identified by the use of the words “plan”, “believe”, “expect”,

“intend”, “anticipate”, “estimate”, “project” or similar expressions. The Company’s actual strategies, results and financial condition in

future periods may differ materially from those currently expected due to various risks and uncertainties. Forward-looking statements

are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial

condition to differ materially from those expressed in or implied by such statements. Consequently, no forward-looking statement

can be guaranteed. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or

update publicly any forward-looking statement for any reason.

This PowerPoint presentation contains financial information determined by methods other than in accordance with GAAP.

The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance. These

measures typically adjust GAAP performance measures to exclude the effects of the amortization of intangibles and include the tax

benefit associated with revenue items that are tax-exempt, as well as adjust income available to common shareholders for certain

significant activities or transactions that in management’s opinion can distort period-to-period comparisons of the Company’s

performance. Since the presentation of these GAAP performance measures and their impact differ between companies, management

believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper

understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a

substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance

measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP disclosures are included as tables in the

Company’s press release dated April 19, 2018 and Annual Report on Form 10-K for the fiscal year ended December 31, 2017. Refer to

the supplemental tables in the press release and Annual Report for these reconciliations.

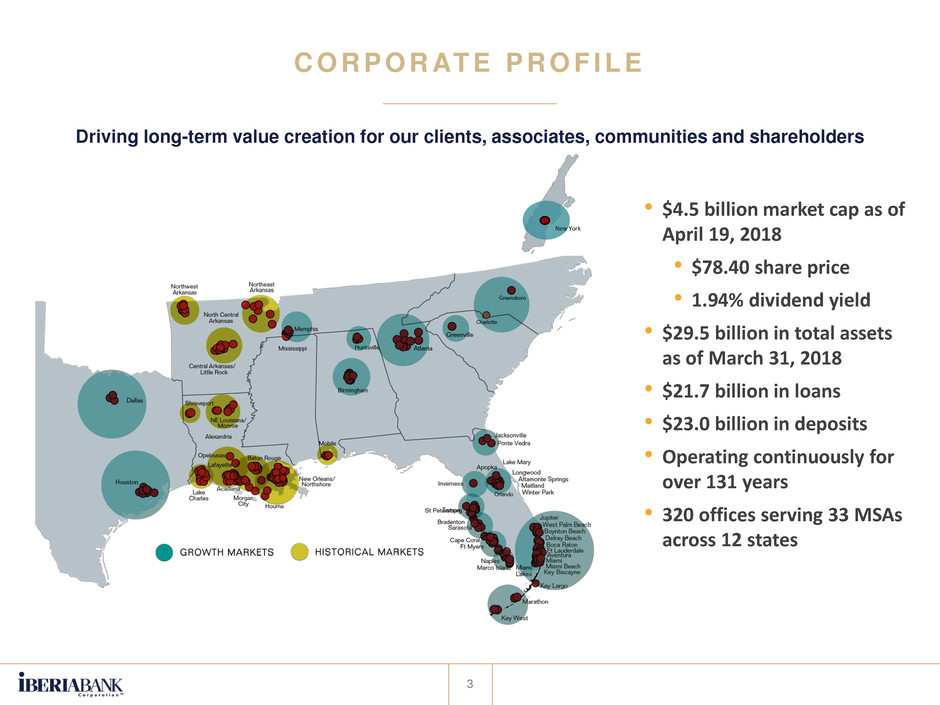

Driving long-term value creation for our clients, associates, communities and shareholders

C O R P O R AT E P R O F I L E

3

New York

• $4.5 billion market cap as of

April 19, 2018

• $78.40 share price

• 1.94% dividend yield

• $29.5 billion in total assets

as of March 31, 2018

• $21.7 billion in loans

• $23.0 billion in deposits

• Operating continuously for

over 131 years

• 320 offices serving 33 MSAs

across 12 states

4

IBERIABANK’s Mission Statement

• Provide exceptional value-based client

services

• Great place to work

• Growth that is consistent with high

performance

• Shareholder-focused

• Strong sense of community

IBERIABANK’s Strategy

• Relationship-driven commercial and

private banking business

• Market-centric, people-driven approach

in attractive Southeastern markets

• Building long-term A-list client

relationships through service and care

• “Branch-lite” delivery model with focus

on operating efficiency

• Diversification across asset classes,

business lines and geographies

C O R P O R AT E P R O F I L E

Driving long-term value creation for our clients, associates, communities and shareholders

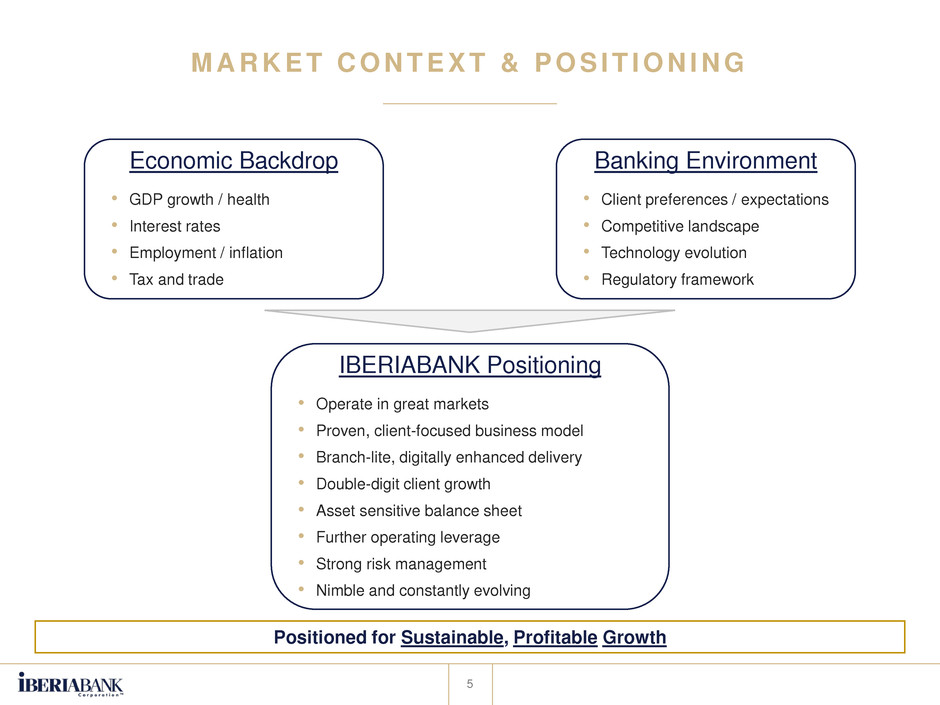

M A R K E T C O N T E X T & P O S I T I O N I N G

5

Economic Backdrop

Positioned for Sustainable, Profitable Growth

Banking Environment

• GDP growth / health

• Interest rates

• Employment / inflation

• Tax and trade

• Client preferences / expectations

• Competitive landscape

• Technology evolution

• Regulatory framework

IBERIABANK Positioning

• Operate in great markets

• Proven, client-focused business model

• Branch-lite, digitally enhanced delivery

• Double-digit client growth

• Asset sensitive balance sheet

• Further operating leverage

• Strong risk management

• Nimble and constantly evolving

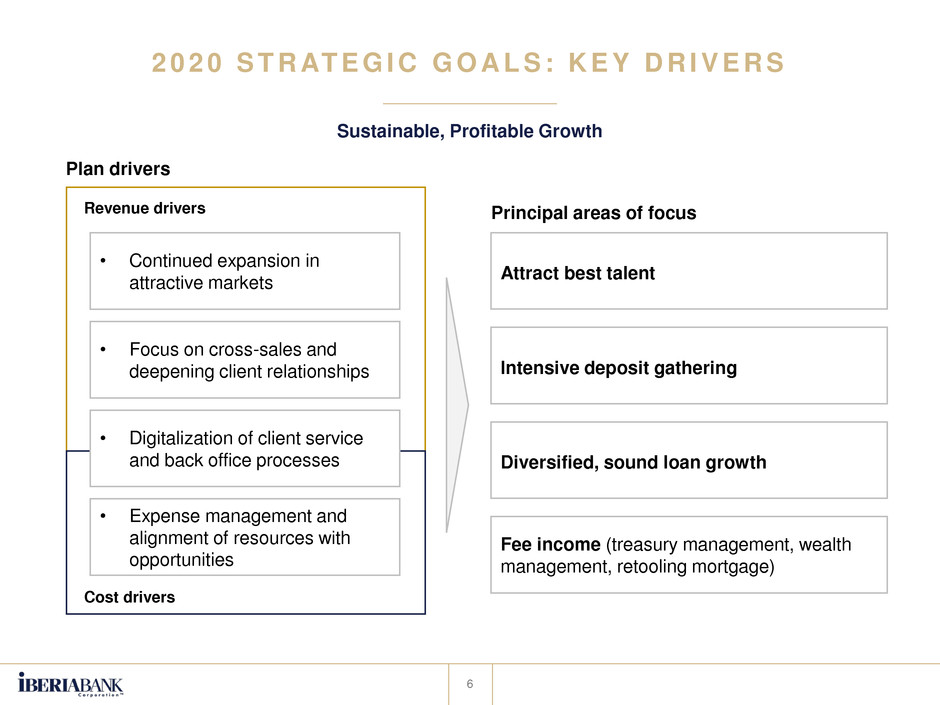

2 0 2 0 S T R AT E G I C G O A L S : K E Y D R I V E R S

6

Revenue drivers

Cost drivers

• Continued expansion in

attractive markets

• Focus on cross-sales and

deepening client relationships

• Digitalization of client service

and back office processes

• Expense management and

alignment of resources with

opportunities

Plan drivers

Principal areas of focus

Fee income (treasury management, wealth

management, retooling mortgage)

Diversified, sound loan growth

Intensive deposit gathering

Attract best talent

Sustainable, Profitable Growth

>1.30% Core ROAA (%)

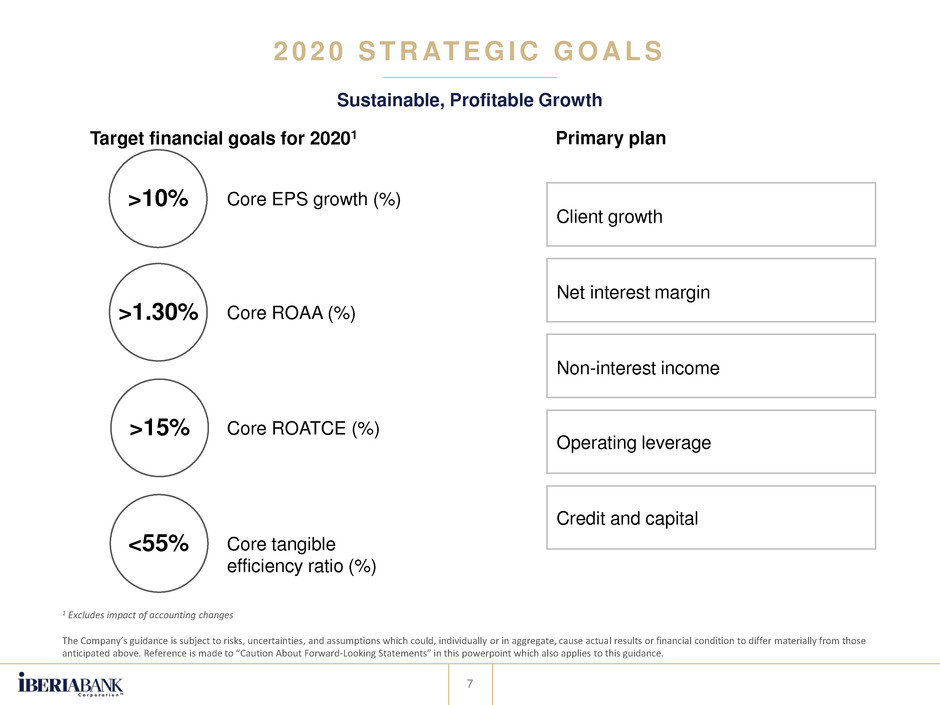

2 0 2 0 S T R AT E G I C G O A L S

7

>15%

<55%

Primary planTarget financial goals for 20201

Core ROATCE (%)

Core tangible

efficiency ratio (%)

Sustainable, Profitable Growth

>10% Core EPS growth (%)

Operating leverage

Non-interest income

Net interest margin

Client growth

Credit and capital

1 Excludes impact of accounting changes

The Company’s guidance is subject to risks, uncertainties, and assumptions which could, individually or in aggregate, cause actual results or financial condition to differ materially from those

anticipated above. Reference is made to “Caution About Forward-Looking Statements” in this powerpoint which also applies to this guidance.

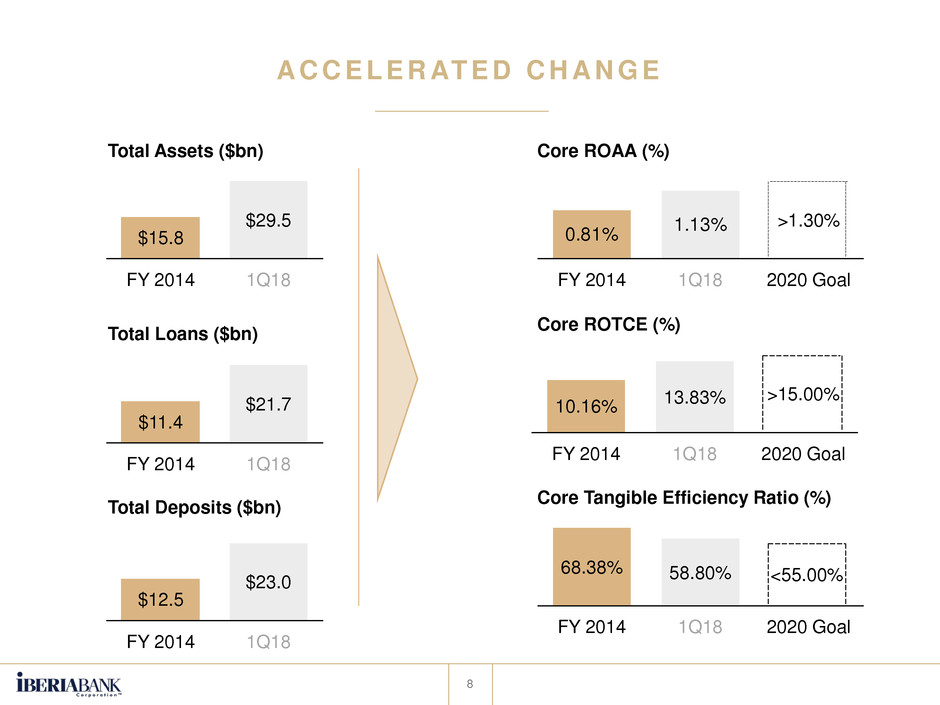

A C C E L E R AT E D C H A N G E

8

1Q18

$29.5

FY 2014

$15.8

Total Assets ($bn)

Total Loans ($bn)

Total Deposits ($bn)

0.81%

1.13%

1Q18FY 2014

>1.30%

2020 Goal

Core ROAA (%)

1Q18

13.83%

FY 2014

10.16%

2020 Goal

>15.00%

Core ROTCE (%)

1Q18

58.80%

FY 2014

68.38%

2020 Goal

<55.00%

Core Tangible Efficiency Ratio (%)

1Q18

$21.7

FY 2014

$11.4

1Q18

$23.0

FY 2014

$12.5