Attached files

| file | filename |

|---|---|

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - SUNBURST ACQUISITIONS V INC | f10k2017ex21-1_sunburstacq5.htm |

| EX-32.2 - CERTIFICATION - SUNBURST ACQUISITIONS V INC | f10k2017ex32-2_sunburstacq5.htm |

| EX-32.1 - CERTIFICATION - SUNBURST ACQUISITIONS V INC | f10k2017ex32-1_sunburstacq5.htm |

| EX-31.2 - CERTIFICATION - SUNBURST ACQUISITIONS V INC | f10k2017ex31-2_sunburstacq5.htm |

| EX-31.1 - CERTIFICATION - SUNBURST ACQUISITIONS V INC | f10k2017ex31-1_sunburstacq5.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

SUNBURST ACQUISITIONS V, INC.

(Exact name of registrant as specified in its charter)

| Colorado | 84-1461844 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

Room 2305A, 23/F, World-Wide House, 19 Des Voeux Road, Central, Hong Kong |

NA | |

| (Address of Principal Executive Offices) | (Zip Code) |

Issuer’s telephone number: (852) 2231 9629

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which | |

| to be so registered | each class is to be registered | |

| None. | None. |

Securities to be registered pursuant to Section 12(g) of the Act:

| Common Stock, no par value per share |

| (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☐ Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non- accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, “non-accelerated filer”, “smaller reporting company” and “emerging growth” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| (do not check if smaller reporting company) | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s Knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒ Yes ☐ No

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

The number of shares of the Registrant’s common stock, $0.0001 par value per share, issued and outstanding as of April 17, 2018, was 27,735,000.

EXPLANATORY NOTE

As used in this Annual Report, the terms “we,” “us,” “our,” and words of like import, and the “Company” refers to Sunburst Acquisitions V, Inc. and all of our subsidiaries unless the context indicates otherwise.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements and information that are based on the beliefs of our management as well as assumptions made by and information currently available to us. Such statements should not be unduly relied upon. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts or that are not present facts or conditions. Forward-looking statements and information can generally be identified by the use of forward-looking terminology or words, such as “anticipate,” “approximately,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “intend,” “may,” “ongoing,” “pending,” “perceive,” “plan,” “potential,” “predict,” “project,” “seeks,” “should,” “views” or similar words or phrases or variations thereon, or the negatives of those words or phrases, or statements that events, conditions or results “can,” “will,” “may,” “must,” “would,” “could” or “should” occur or be achieved and similar expressions in connection with any discussion, expectation or projection of future operating or financial performance, costs, regulations, events or trends. The absence of these words does not necessarily mean that a statement is not forward-looking.

Forward-looking statements and information are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions. There are important factors that could cause actual results to vary materially from those described in this Annual Report as anticipated, estimated or expected, including, but not limited to, those factors and conditions described under “Item 1A. Risk Factors” as well as general conditions in the economy, petrochemicals industry and capital markets, Securities and Exchange Commission (the “SEC”) regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future. Depending on the market for our stock and other conditional tests, a specific safe harbor under the Private Securities Litigation Reform Act of 1995 may be available. Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

TABLE OF CONTENTS

i

PART I

Unless the context requires otherwise, all references to the “Company,” “we,” “us” and “our” refer to Sunburst Acquisitions V, Inc. and its subsidiaries.

Overview.

Sunburst Acquisitions V, Inc., a Colorado corporation (the “Company”) was incorporated under the laws of the State of Colorado on April 30, 1998, and is in the early developmental and promotional stages. On August 11, 2005, Onping Limited, a British Virgin Islands Corporation, wholly owned by Mr. Terence Ho, purchased an aggregate of 2,464,000 shares or approximately 90% of the issued and outstanding common stock of the Company from five of the Company’s then shareholders, pursuant to a purchase agreement dated June 21, 2005 (the “Onping Purchase Agreement”). Upon the closing of the transactions underlying the Onping Purchase Agreement and pursuant thereto, Mr. Terence Ho became the CEO and a director of the Company.

On October 26, 2016, the Company entered into a Stock Purchase Agreement (the “Sea Treasure Agreement”) with Sea Treasure Holdings Limited (“Sea Treasure”), a related party controlled by Mr. Ho, pursuant to which the Company issued an aggregate of 25,000,000 shares of common stock (the “Sea Treasure Purchase”), or approximately 91% of the Company’s issued and outstanding common stock to Sea Treasure, at an aggregate purchase price of approximately $250,000. Sea Treasure used its cash on hand to purchase the stock. Following the closing of the Sea Treasure Purchase, Mr. Ho held approximately 99% of the Company’s issued and outstanding common stock.

On December 8, 2016, the Company filed Articles of Amendment to its Amended Articles of Incorporation (the “Certificate of Amendment”) with the Secretary of State of the State of Colorado effecting an increase in the number of authorized shares of stock to 720,000,000, of which 700,000,000 are designated common stock and 20,000,000 are designated preferred stock.

The Company was a blank check company until the Company completed a reverse take-over transaction on November 13, 2017.

On November 13, 2017, a Share Exchange Agreement (the “Success Green Agreement”) was entered into by and among the Company, Success Green (Group) Limited, a British Virgin Islands business company (“Success Green BVI”) and Mr. Ho, being the beneficial owner of 27,464,000 shares of the Company’s common stock and also the sole shareholder of all of the issued share capital of Success Green BVI (the “SG Stock”).

Pursuant to the Share Exchange Agreement, upon surrender by Mr. Ho and the cancellation by Success Green BVI of the certificates evidencing the SG Stock as registered to Mr. Ho, and pursuant to the registration of the Company in the register of members maintained by Success Green BVI as the new holder of the SG Stock and the issuance of the certificates evidencing the aforementioned registration of the SG Stock in the name of the Company, the Company issued 72,265,000 shares (the “Acquisition Stock”) of the Company’s common stock to Mr. Ho. The Acquisition Stock collectively represents 72.27% of the issued and outstanding common stock of the Company immediately after the Closing, in exchange for the SG Stock, representing 100% of the issued share capital of Success Green BVI in a reverse merger, or the “RTO”. Following the RTO, Mr. Ho continues to be the majority beneficial owner of the Company’s common stock, holding 99.73% equity interest in the Company, and Success Green BVI and its subsidiary became wholly owned subsidiaries of the Company. As such, the Company is the 100% owner of ZhaoQing NengCheng Import and Export Co., Ltd. (“Nengcheng”), an operating company incorporated on July 3, 2012 under the laws of the PRC, through Success Green BVI.

Accounting Treatment of the RTO

For financial reporting purposes, the Share Exchange represents a business combination under common control where the sole shareholder of Success Green BVI is the beneficial shareholder of Sunburst Acquisitions V, Inc. Consequently, the assets and liabilities and the operations of Success Green BVI and its subsidiaries have been presented at their carrying values at the date of the transaction, the stockholders’ equity of the Company has been retrospectively restated to reflect the acquisition as recapitalization of the Company. The consolidated financial statements after completion of the Share Exchange will include the assets and liabilities of the Company and Success Green BVI, and the historical operations of Success Green BVI and operations of the combined entities (Sunburst Acquisition V and its wholly owned subsidiary Success Green BVI) from the closing date of the Share Exchange.

Through Nengcheng, we are a one-stop import service provider for third-party manufacturers who have needs for the import of various types of raw materials and half-finished goods. In the fiscal year of 2017, our primary revenues were generated from importing various types of cowhides and rubberwood square. In the fiscal years of 2015 and 2016, our primary revenues were generated from importing various types of cowhides such as wet blue cowhide, rawhide, and wet-salted cowhide, which accounted for, in the aggregate, approximately 88.97% and 87.91% of our total revenues, respectively, and less significantly, scrap plastic which accounted for approximately 5.36% and 1.04% of our total revenues, respectively. For a service fee, we negotiate and enter into import supply orders with overseas suppliers on behalf of our customers, assist our customers to settle foreign exchange payments to suppliers, receive and inspect the imported raw material and goods once overseas suppliers ship them to seaports, clear customs on behalf of the customers and coordinate transportation of the raw material and goods from sea ports to our manufacturer customers. By utilizing our one-stop import services, our customers are able to access quality raw material and goods in the international market, without increasing administrative cost and expenses for obtaining and maintaining import and customs related licenses and permits.

1

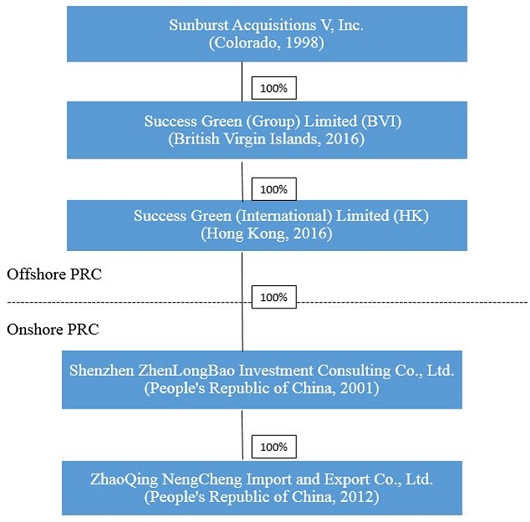

Corporate History and Structure

We were incorporated in Colorado on April 30, 1998.

We became the 100% equity owner of Success Green BVI and its subsidiaries, Success Green HK, WOFE and Nengcheng, pursuant to the Success Green Agreement.

Success Green BVI was incorporated in British Virgin Islands on October 26, 2016, and is the 100% shareholder of Success Green International Limited, a Hong Kong corporation (“Success Green HK”); Success Green HK was incorporated on September 24, 2007.Success Green HK is the 100% owner of Shenzhen ZhenLongBao Investment Consulting Co., Ltd. (the “WOFE”), a company incorporated in the PRC as a wholly owned foreign enterprise on April 21, 2011.

As of March 14 2017, the two then shareholders of Nengcheng, Mr. Guangxiang He and Mr. Zhanling Lei, transferred to WOFE, 100% of the then issued and outstanding shares of Nengcheng, in exchange for a consideration of RMB 10 million (approximately $1,500,000) (the “Nengcheng Acquisition”). Pursuant to the Nengcheng Acquisition, Success Green BVI effectively assumed management of the business activities of Nengcheng and has the right to appoint all executives and senior management and the members of the board of directors of Nengcheng. Additionally, at the closing of the Nengcheng Acquisition, Mr. He continues to lead Nengcheng’s operations. Nengcheng was incorporated on July 3, 2012 under the laws of the PRC.

The following diagram illustrates our corporate structure as of the date of this Annual Report:

2

Our principal executive office is located at Room 2305A, 23/F, World-Wide House, 19 Des Voeux Road, Central, Hong Kong.

Our Services

As a one-stop import service provider, we procure, import, settle foreign exchange payments, clear customs, and set up delivery logistics for our customers, for raw materials, or half-finished products such as various types of cowhides, and various scrap plastics or other materials from overseas to the PRC market. Our customers of various cowhides such as wet blue cowhide, salt wet cowhide, and rawhide are located throughout China, while our scrap plastics and other recyclable materials customers are primarily located in the Guangdong province. During the fourth quarter of fiscal year ended December 31, 2017, we expanded our service offerings to include processed plastics. We believe the demand for processed plastics in the PRC market will continue to grow.

We provide our services to PRC manufacturer customers who have needs to minimize their cost in raw materials. The raw materials and half-finished goods that we procure from overseas on behalf of our clients typically are of higher quality than those available in the PRC market, while the ultimate costs of sourcing overseas including tariffs and other import taxes, and shipping expenses typically are cheaper than sourcing from the PRC market. For various types of cowhides, after our customers designate their preferred overseas suppliers, who are usually located in America, Central and South America, and Europe, we then negotiate with such overseas suppliers. Additionally, we are able to source scrap plastics from countries that have better recycling and waste sorting regulations and practices which in turn, produce better quality scrap plastics than those available in the PRC domestic market.

Our customers do not need to obtain or maintain the requisite import licenses and can rely on our services to import the raw materials and half-finished goods they need. Therefore, by engaging our services, our customers can access the international market for high quality raw materials and half-finished goods on a cost-effective basis.

Our typical sales cycle begins when our customers contact our sales team to engage our service in managing and completing the entire process of importing a specific product. After we are engaged, we then negotiate with our overseas supply partners or overseas suppliers preferred by our customers regarding the specific order of the raw materials, or half-finished products, for an import supply order with a price agreed upon by the overseas supplier and our customer.

Upon execution of the import supply order, as an import service provider, we then assist our customers in settling the foreign exchange payment, so the goods can be shipped by the overseas suppliers.

For our import logistics, we usually designate the goods to be shipped to the ports in Hong Kong, which clears customs faster than those in mainland China. After the goods clear customs in Hong Kong, they are shipped to the various seaports in mainland China that are closer and most cost-effective to each of our customers.

After the imported goods reach the ports in mainland China, our customs clearing team will settle any relevant customs tariff or tax in each port for our clients.

We provide logistics service to customers who need to transport the imported goods from the ports to their facilities. For those customers who have self-arranged to transport the imported goods, we provide liaison services to either store the goods in a port warehouse to be picked up, or contact the transportation arranged by our customers about the completion of customs clearing.

Competitive Advantage

We believe that the following competitive strengths enhance our position in the PRC market:

| ● | Our one-stop import service is more efficient than our competitors. Our management team and employees have extensive experiences in providing one-stop import services and have created our own business process that maximizes our efficiency to allow us to serve our customers. With our service, our customers are able to clear customs 2-3 days faster, on average compared to our competitors. | |

| ● | Our service is more cost-effective than our competitors. We charge a lower rate for our services than our similar competitors, as our experiences of over 20 years in coordinating international supply processes and customs clearing allow us to develop cost-effective and efficient business processes. | |

| ● | Word of mouth reputation. We have generated a significant amount of our business through word-of-mouth referrals from past and current customers. We expect to continue to generate substantial future revenues through word of mouth referrals. |

Growth Plan

While we have established a close and stable working relationship with many of our customers, we have been growing the range of our services from various types of cowhides, to include scrap plastics in 2015. However, due to the PRC government’s recent restriction on the import of scrap plastics in 2016, we have transitioned away from customers needing scrap plastics, and have endeavored to build our customer base for those needing processed plastics, which we believe will see a steady rise in demand in the near future. Beginning in the fourth quarter of 2017, we have been engaged by a few well-established plastics producers including Guangdong Xiongsu Technology Group Co., Ltd., Midea Group Co. Ltd., and China Lesso Group Holdings Ltd. to provide import services to them.

Our long-term objective is to establish our company as the regional leader in providing one-stop import services in the processed plastics industry while continuing to steadily expand our supplier and customer base for the goods offering we currently provide, such as various types of cowhides.

3

As of the date of this filing, we expect to achieve this objective through the following strategies, although general market conditions and our financial results may require us to delay these strategies or establish alternative strategies:

| ● | Between the years of 2018 and 2020, we plan to reinforce our processed plastics customer base in Guangdong province and expand our customer base in Fujian province; add to our sales personnel; and establish working relationships with additional overseas suppliers. | |

| ● | Between the years of 2021 and 2023, we plan to expand our customer base to other provinces with significant demand for processed plastics such as Zhejiang, Hebei and Shandong; hire additional sales personnel; and establish working relationship with more overseas suppliers; we hope that by the end of fiscal 2023, we have relationships with at least 30 more overseas suppliers than we do as of the date of this filing. |

Industry

The most significant product we have imported in 2017 were rubber wood timber, blue wet cowhide and raw cowhide. The most significant product we have imported in 2015 and 2016 were various types of cowhides. According to China Leather Industry Information Center (the “Leather Report”), in 2016, the PRC leather industry imported raw cowhides from 35 countries, with America, Australia and Canada as the top three countries. According to the Leather Report, the PRC regions that imported the greatest volume of raw cowhides are the following provinces: Hebei, Shandong, Fujian, Jiangsu, and Guangdong. For our various types of cowhides, our customers are located throughout the PRC market.

Because our customers are third-party manufacturers of leather furniture and particularly leather couches, the demand and supply of leather couches in the PRC market impacts our business more significantly than the demand and supply of cowhides in the global market. According to the Leather Report, the PRC market of leather couches and other soft couches account for 50% of the global product of similar couches in 2016, according to China Intelligence Website, which predicts that the PRC market will continue to grow. Therefore, we believe that our customers who are third-party manufacturers of leather furniture and particularly leather couches will continue to engage our services.

Competition

Virtually all of our services are provided to customers located in the PRC market. Our major competitors are PRC-based import and export agency companies that are mainly located in such seaport cities as Tianjin, Qingdao, Xiamen of Fujian Province, and Guangdong. We primarily compete with other import and export comprehensive service companies such as Shenzhen Yidatong Enterprise Service Limited Company, Seacamels Network Inc. in the industry of import and export. Some of our competitors are import and export comprehensive service companies with online platforms, such as Tus-sound Environmental Resources Co., Ltd. which operates the online platform Yizaisheng O20, who are much larger than us in operation and sales revenue, have greater financial capabilities and longer operating history. The principal factors on which we compete are cost of service and efficiency of custom clearance. The demand for our one-stop services is significantly dependent on the general economy in the PRC and the PRC domestic demand for each of the goods in our offerings.

Suppliers

We enter into short-term supply orders in the ordinary course of business with the suppliers on behalf of our customers who are located outside of the PRC, pursuant to a form of supply order typically for a short term such as three-month term or less, at a fixed price. Though the fixed price of short-term orders does not entirely protect us and our customers against volatility in raw material prices, it nevertheless suits the business needs of our customers, who agree to such fixed prices. We enter into supply orders for the raw materials and half-finished goods that we import on behalf of our customers. Suppliers are either designated by our customers, or, for our scrap plastic and now processed plastics, are chosen by us depending on whether they supply goods that match the specifications of our customers.

In fiscal year 2017, the primary supply we sourced were arious types of cowhides and rubber wood timber. Major suppliers were Xiangxiang Trade Co. Ltd, who supplied blue wet cowhide and raw cowhide to us, respectively, and accounted for 91% of our purchases on behalf of our customers in 2017. In fiscal years 2015 and 2016, the primary supply we sourced were various types of cowhides. For our offerings such as various types of cowhides, we do not rely on any primary suppliers since our customers request us to source from their preferred suppliers. A major supplier preferred by our cowhides customers is Xiangxiang Trade Ltd., which supplied blue wet cowhide and raw cowhide, and accounted for 77.09% and 74.58% of our cost of supply in fiscal year 2015 and fiscal year 2016, respectively.

For our scrap plastic and processed plastics, we have working relationship with suppliers located in Southeast Asia, and are in the process of searching and negotiating with additional suppliers to expand our supplier base.

4

Marketing and Customers

We currently generate new businesses primarily through word of mouth referrals from past and current customers. We intend to expand our sales and marketing team to accommodate our growing operation in providing processed plastics related services.

We enter into import service agreements with our customers when they first become our customer. The import service agreements stipulate our service fees, our duties and responsibilities and other customary terms and conditions.

Our top customers in fiscal year 2016 and fiscal year 2017 have been furniture manufacturing companies that use leather as part of their product components. In fiscal year 2016, our top 5 customers were Huizhou City Bowei Leather Product Limited Company, whom we mainly represented to import wet-salted horse leather, blue wet cowhide and raw cowhide; Fujian province Jinjiang City An’hai Qiuxia Leather Limited Company, whom we mainly represented to import blue wet cowhide; Zhaoqing City Huangcheng Leather Limited Company, whom we mainly represented to import wet-salted cowhide and raw cowhide; Guangzhou City Xinchi Leather Limited Company, whom we mainly represented to import blue wet cowhide and raw cowhide; Huaiyang County Luhui Textile Limited Company, whom we mainly represented to import raw cowhide. Our top 5 customers collectively accounted for 37.11% of our revenues in fiscal year 2016.

In fiscal year 2017, our top 5 customers were Kuang Ye Trading Company Limited, Foshan City Shunde District Lecong Town Kui Xiang Timber Sales Office, Foshan City Hong De Kai Trading Company Limited, Shao Xun Hua, Foshan City Xin Tai Wood Supply Chain Management Company Limited. Our top 5 customers collectively accounted for 86% of our revenues in fiscal year 2017.

We primarily enter into purchase orders with our top customers. Each purchase order governs each transaction or order that our customers place with us. Purchase orders are typically short term based, effective from the time of the orders are placed until our services are delivered. We do not renew our purchase orders with our top customers, and they each place a new order with us for each new transaction. Our form of purchase order includes our service fee, which is a percentage of the total payment of the goods imported. Our form of purchase order also indicates that payment in full is due within 15 days of the completion of our services.

In our processed plastics service offering, we have been engaged by Guangdong Xiongsu Technology Group Co., Ltd., Midea Group Co., Ltd., and China Lesso Group Holdings Ltd. in fiscal year 2017.

Research and Development

We have not incurred any cost or expenses in research and development in the fiscal years ended December 31, 2016 and 2017. In light of our objective to strengthen our position as a one-stop import service provider that has a significantly strong practice in processed plastics, we intend to increase spending in research and development to identify overseas suppliers of processed plastics that will meet the specific specifications, quality and cost requirements of our customers.

Facilities/Properties

For Nengcheng’s operation, we lease an office space from a third-party in Dasha Town, City of Sihui Guangdong province, for an annual rent of RMB 10,000 (approximately $1,500). We have an unlimited term under this lease and can lease the premise for as long as we wish, and can terminate the lease without penalty.

We believe our facility is sufficient for our current operation.

Employees

As of the date of report, we had approximately 23 employees, 3 of which are full-time, and 20 of which are part-time. There is no labor union. We believe our relations with our employees are good.

Legal Proceedings

Except for the disclosure below, we are not currently a party to any litigation the outcome of which, if determined adversely to us, would individually or in the aggregate be reasonably expected to have a material adverse effect on our business, operating results, cash flows or financial condition.

5

SEC Revokes Registration Of Securities Of Sunburst Acquisitions V, Inc. For Failure To Make Required Periodic Filings

On April 26, 2017, the SEC instituted public administrative proceedings to determine whether to revoke or suspend for a period not exceeding twelve months the registration of each class of our securities for failure to make required periodic filings with the SEC. In this Order, the Division of Enforcement (“Division”) alleged that the Company was delinquent in its required periodic filings with the Commission. The SEC informed the Company that pursuant to Section 12(j), Securities Exchange Act of 1934, as amended (the “Exchange Act”) a hearing would be scheduled before an Administrative Law Judge. At the hearing, the judge would hear evidence from the Division and the Company to determine whether the allegations of the Division contained in the Order, which the Division alleged constituted failures to comply with Exchange Act Section 13(a) and Rules 13a-1 and 13a-13 thereunder, were true. The Judge in the proceeding then determined whether the registrations pursuant to Exchange Act Section 12 of each class of our securities should be revoked or suspended for a period not exceeding twelve months. The SEC ordered that the Judge issue an initial decision not later than 120 days from the date of service of the order instituting proceeding.

On October 4, 2017, the SEC revoked the registration of each class of our registered securities pursuant to Section 12(j) of the Exchange Act for failure to comply with Section 13(a) of the Exchange Act and Rules 13a-1 and 13a-13 thereunder by failing to make required periodic filings with the SEC.

We filed a Registration Statement on Form 10 to re-register our common stock under Section 12(g) of the Exchange Act on November 13, 2017, as amended on January 18, 2018 and February 28, 2018 and such Registration Statement became effective automatically on January 12, 2018, 60 days following the initial filing of the Form 10.

Tax

Nengcheng, as a PRC entity, is subject to enterprise income tax (“EIT”) according to applicable PRC tax rules and regulations.

PRC enterprises are required to prepay the EIT on a monthly or quarterly basis and to file provisional EIT returns with the tax authorities within 15 days of the end of each quarter based on actual monthly or quarterly profits. Enterprises that have difficulty in paying monthly or quarterly tax based on actual monthly or quarterly profits may make payments based on the monthly or quarterly average taxable income in the preceding calendar year, or by any other methods approved by the relevant tax authorities. Nengcheng has filed all quarterly EIT returns based on actual quarterly profits since its inception.

Final settlement of tax liability must be made within five months of the end of each calendar year, and all EIT returns shall be based on Chinese GAAP.

Regulations and Governmental Approvals

The following summarizes the principal PRC regulations related to our business operations.

Import Related Regulations

We are required to comply with the Customs Law established by the PRC, which establishes regulations related to import/export of merchandise from or to China. The regulations define the criteria for the supervision of the transport of merchandise to and from China.

To qualify as an entity permitted to import goods into the PRC, the entity is required to include foreign trade in the scope of business of its business permit, and must hold currently valid permits such as Registration Form for Foreign Trade Manager, Registration of Declaration Entities. Continuing qualification requires an entity to file the requisite annual records with the relevant bureaus of administration of industry and commerce, the ministry of the foreign trade and economic cooperation and the PRC Customs. Since Nengcheng’s scope of operation is foreign trade, and Nengcheng holds the required and currently valid permits such as Registration Form for Foreign Trade Manager, Registration of Declaration Entities, Nengcheng is permitted to engage in import business activities.

To maintain ongoing compliance of our import business activities, we are required to file annual records with or subject to annual inspection from PRC regulatory procedures such registering with the Administration of Commerce and Industry, Ministry of Foreign Trade and Economic Cooperation, Foreign Trade and Economics Department, and PRC Customs.

6

To import various types of cowhides, we comply with the PRC regulations and do not import from countries on the banned list of import of animal and animal products. For import of raw cowhides, we obtain the raw cowhide import permit from the Entry-Exit Inspection and Quarantine, Office of Animal and Botanical Quarantine Inspection, from the province that the ports are located.

The import of our scrap plastic and processed plastic is subject to the regulation of Solid Waste Import Management Regulations. Pursuant to the Solid Waste Import Management Regulations, import of recyclable plastic requires environmental protection permits. Nengcheng holds all requisite permits as of the date of this annual report.

Provisions on Foreign Investment

All limited liability companies and joint stock limited companies incorporated and operating in the PRC are governed by the Company Law of the People’s Republic of China, or the Company Law, which was amended and promulgated by the Standing Committee of the National People’s Congress on December 28, 2013 and came into effect on March 1, 2014. In the latest amendment, paid-in capital registration, minimum requirement of registered capital and timing requirement of capital contribution were abolished. Foreign invested projects must also comply with the Company Law, with exceptions as specified in foreign investment laws.

With respect to the establishment and operation of wholly foreign-owned projects, or WFOE, the MOFCOM, and the National Development and Reform Commission, or NDRC, promulgated the Catalogue of Industries for Guiding Foreign Investment, or the Catalogue, as amended from time to time and the latest amendment was on June 28, 2017, which took effect on July 28, 2017 (“Catalogue (2017)”) and replaced the previous amendment (“Catalogue (2015)”). The Catalogue serves as the main basis for management and guidance for the MOFCOM to manage and supervise foreign investments. The Catalogue divides industries for foreign investment into three categories: encouraged, restricted and prohibited. Those industries not set out in the Catalogue shall be classified as industries permitted for foreign investment. According to the Catalogue (2015) and the Catalogue (2017), the provision of import related services is neither restricted nor prohibited.

On September 3, 2016, the Standing Committee of the National People’s Congress promulgated the Decision of the Standing Committee of the National People’s Congress on Amending Four Laws Including the Law of the People’s Republic of China on Wholly Foreign-owned Enterprises (the “Decision”), which provides record-filing in lieu of administrative approval for the establishments and alterations of foreign invested enterprises (the “FIEs”) not subject to special administrative measures. On October 8, 2016, the MOFCOM issued the Interim Measures for Record-filing for the Establishment and Alteration of Foreign-invested Enterprises (the “Interim Measure”), and the MOFCOM and the NDRC jointly issued a statement (the “Joint Statement”), clarifying that the special administrative measures in this case are implemented by referencing the Catalogue. To be specific, the special administrative measures to be implemented are the restricted and prohibited industry categories as well as encouraged industry categories having shareholding and executive management requirements prescribed in the Catalogue. Since then, FIE establishments and alterations that are not subject to special administrative measures have been changed from a pre-approval system to a more standardized and convenient filing process. On June 30, 2017, the MOFCOM further revised the “Interim Measures.” The modification includes among others that where a non-foreign-invested enterprise changes into a foreign-invested enterprise due to acquisition, consolidation by merger or otherwise, which is subject to record-filing as stipulated in the Measures, it shall complete the record-filing formalities for incorporation and submit the Incorporation Application in accordance with Paragraph 1 hereof mutatis mutandis.

Nengcheng has completed the registration as a wholly owned foreign enterprise on March 14, 2017 and the Administrative Bureau for Industry and Commerce of Shanxi Province has issued Nengcheng the relevant business license on the same date.

Regulations on Foreign Exchange

Foreign Exchange Settlement

The Circular of the State Administration of Foreign Exchange on Reforming the Management Approach regarding the Settlement of Foreign Exchange Capital of Foreign-invested Enterprises, which was promulgated by the SAFE on March 30, 2015 and became effective as of June 1, 2015, adopts the approach of discretional foreign exchange settlement, under which the foreign exchange capital in the capital account of a foreign-invested enterprise for which the foreign-invested enterprise has obtained confirmation by the local SAFE branches regarding the rights and interests of monetary contribution (or the book-entry registration of monetary contribution by the banks) can be settled at the banks based on the actual operation needs of such foreign-invested enterprise. The capital in Renminbi obtained by the foreign-invested enterprise from the discretionary settlement of foreign exchange capital shall be managed under the account pending for foreign exchange settlement payment. The proportion of discretionary settlement of foreign exchange capital is temporarily determined as 100%, subject to the adjustment of the SAFE.

7

Regulations Relating to Employment and Social Insurance

Pursuant to the PRC Labor Law effective as of January 1, 1995 (as amended on August 27, 2009), and the PRC Labor Contract Law effective as of January 1, 2008 (as amended on December 28, 2012), a written labor contract shall be executed by employer and an employee when the employment relationship is established, and an employer is under an obligation to sign an unlimited-term labor contract with any employee who has worked for the employer for ten consecutive years. Further, if an employee requests or agrees to renew a fixed-term labor contract that has already been entered into twice consecutively, the resulting contract must have an unlimited term, with certain exceptions. All employers are required to establish a system for labor safety and sanitation, strictly abide by state rules and standards and provide employees with appropriate workplace safety training. Moreover, all PRC enterprises are generally required to implement a standard working time system of eight hours a day and forty hours a week, and if the implementation of such standard working time system is not appropriate due to the nature of the job or the characteristics of business operation, the enterprise may implement a flexible working time system or comprehensive working time system after obtaining approvals from the relevant authorities.

Pursuant to the Social Insurance Law of China effective from July 1, 2011, and the Housing Fund Regulation which was amended and became effective on March 24, 2002, employers in China shall pay contributions to the social insurance plan and the housing fund plan for their employees, and such contribution amount payable shall be calculated based on the employee actual salary in accordance with the relevant regulations.

Regulations on Tax

PRC Enterprise Income Tax Law

In January 2008, the PRC Enterprise Income Tax Law, or the EIT Law, took effect (revised and took effect on February 24, 2017). The EIT Law applies a uniform 25% enterprise income tax rate to both foreign-invested enterprises and domestic enterprises, except where tax incentives are granted to special industries and projects. An enterprise established outside China with “de facto management bodies” within China is considered a “resident enterprise” for PRC enterprise income tax purposes and is generally subject to a uniform 25% enterprise income tax rate on its worldwide income. According to the EIT Law and its implementation regulations, certain high and new technology enterprises which have proprietary intellectual property rights and simultaneously meet the prescribed requirements as stipulated in the implementation regulations of the EIT Law and other relevant regulations are permitted to enjoy a reduced EIT rate of 15%.

Under the EIT Law and its implementation regulations, dividends generated from the business of a PRC subsidiary after January 1, 2008 and payable to its foreign investor may be subject to a withholding tax rate of 10% if the PRC tax authorities determine that the foreign investor is a non-resident enterprise, unless there is a tax treaty with China that provides for a preferential withholding tax rate. Distributions of earnings generated before January 1, 2008 are exempt from PRC withholding tax.

Under the PRC Enterprise Income Tax Law, an enterprise established outside China with “de facto management bodies” within China is considered a “resident enterprise” for PRC enterprise income tax purposes and is generally subject to a uniform 25% enterprise income tax rate on its worldwide income. The implementing regulations of the EIT Law define the term “de facto management bodies” as a management body which substantially manages, or has control over the business, personnel, finance and assets of an enterprise. On April 22, 2009, the State Administration of Taxation, or SAT issued the Circular on Issues Concerning the Identification of Chinese-Controlled Overseas Registered Enterprises as Resident Enterprises in Accordance With the Actual Standards of Organizational Management, or Circular 82, which provides certain specific criteria for determining whether the “de facto management bodies” of a PRC-controlled enterprise that is incorporated offshore is located in China. However, there are no further detailed rules or precedents governing the procedures and specific criteria for determining “de facto management body.”

PRC Value-added Tax Law

Pursuant to the Interim Regulations on Value-added Tax of China, or VAT Regulations which was promulgated by the State Council on December 13, 1993 and became effective as of January 1, 1994 and further amended on November 10, 2008 and February 6, 2016, and the last amendment of which became effective on February 6, 2016, all units and individuals engaging in the sale of goods, provision of processing, repair and fitting services, and importation of goods within the territory of China are taxpayers of value-added tax( or VAT), and shall pay VAT in accordance with the VAT Regulations. According to the VAT Regulations, a VAT tax rate at 13% or 17% applies to the Chinese enterprises unless otherwise exempted or reduced according to the VAT Regulations and other relevant regulations.

8

We have abided by the relevant PRC tax laws in our operation.

Seasonality

We believe our operation and sales do not experience seasonality.

An investment in our common stocks involves significant risks. You should carefully consider all of the information in this report, including the risks and uncertainties described below, before making an investment in our common stocks. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our common stocks could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

We have a limited operating history with our current business model, which makes it difficult to predict our future prospects and financial performance.

We have a short operating history with our current business model, since Nengcheng was established in 2012. Our business has generated limited gross revenues, and may not produce significant gross revenues in the near term, or at all, which may harm our ability to obtain additional financing and may require us to reduce or discontinue our operations. You must consider our business and prospects in light of the risks and difficulties we may encounter as an early-stage operating company in a new and rapidly evolving industry. We may not be able to successfully address these risks and difficulties, which could significantly harm our business, operating results and financial condition.

We have incurred operating losses in the past, expect to incur operating losses in the future and may never achieve or maintain profitability.

We began operations in 2012 and for all of our history we have experienced net losses and negative cash flows from operations. As of December 31, 2017, the Company had accumulated deficits of $1,981,384 and working capital deficit of current liabilities exceeding current assets by approximately $10.6 million due to the substantial losses in operation in previous periods. We expect our operating expenses to increase in the future as we expand our operations. If our revenue and gross profit do not grow at a greater rate than our operating expenses, we will not be able to achieve and maintain profitability. We expect to incur significant losses in the future for a number of reasons, including without limitation the other risks and uncertainties described herein. Additionally, we may encounter unforeseen operating or legal expenses, difficulties, complications, delays and other factors that may result in losses in future periods. If our expenses exceed our revenue, we may never achieve or maintain profitability and our business may be harmed.

For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to accounting standards and disclosure about our executive compensation, that apply to other public companies.

In April 2012, President Obama signed into law the JOBS Act. We are classified as an “emerging growth company” under the JOBS Act. For as long as we are an emerging growth company, which may be up to five full fiscal years, unlike other public companies, we will not be required to, among other things, (i) provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act, (ii) comply with any new requirements adopted by the PCAOB requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer, (iii) provide certain disclosure regarding executive compensation required of larger public companies or (iv) hold nonbinding advisory votes on executive compensation. We will remain an emerging growth company for up to five years, although we will lose that status sooner if we have more than $1.0 billion of revenues in a fiscal year, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period.

To the extent that we rely on any of the exemptions available to emerging growth companies, you will receive less information about our executive compensation and internal control over financial reporting than issuers that are not emerging growth companies. If some investors find our common stock to be less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

9

We incur increased costs as a result of being a public company, particularly after we cease to qualify as an “emerging growth company.”

We recently become a public company on January 12, 2018 upon automatic effectiveness of our registration statement on Form 10, and as such, we now expect to incur significant legal, accounting and other expenses that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, impose various requirements on the corporate governance practices of public companies. As an “emerging growth company” pursuant to the JOBS Act, we may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. We expect these rules and regulations to increase our legal and financial compliance costs and to make some corporate activities more time-consuming and costly. After we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with increased disclosure requirements.

We may not be able to manage our business expansion and strategic acquisitions effectively.

We plan to continue to expand our presence through organic growth and strategic acquisitions. In particular, to support our continued growth and to strengthen our market share, we may acquire similar service companies in other regions to expand geographically. This will result in substantial demands on our management and on our operational, technological and other resources. To manage our expected growth, we will be required to expand our existing managerial, operational, technological and financial systems. We also need to expand, train, manage and retain our growing employee base. Significant financial resources may also be needed to support our planned growth. We cannot assure you that our current and planned managerial, operational, technological and financial systems will be adequate to support our future operations, or that we will be able to effectively and efficiently manage the growth of our operations or recruit and retain qualified personnel. There is no assurance that we will be able to obtain financial resources at commercial terms that are acceptable to us on a timely basis, or at all, to support our planned growth. Any failure to effectively and efficiently manage our expansion may materially and adversely affect our ability to capitalize on new business opportunities, which in turn may have a material adverse effect on our financial condition and results of operations.

In addition, as a core part of our growth strategy, we intend to pursue selective strategic acquisitions and maximize synergies through integration of acquired entities. Our strategic acquisitions involve substantial risks and uncertainties, including:

| ● | our ability to identify and acquire targets in a cost-effective manner; | |

| ● | our ability to obtain approval from relevant government authorities for the acquisitions and to comply with applicable rules and regulations for acquisitions; | |

| ● | our ability to obtain financing to support our acquisitions; | |

| ● | our ability to obtain financing to support our acquisitions; | |

| ● | our ability to generate sufficient revenue to offset the costs and expenses of acquisitions, including the possibility of failure to achieve the intended revenue and other benefits expected from the acquisitions; | |

| ● | our ability to generate sufficient revenue to offset the costs and expenses of acquisitions, including the possibility of failure to achieve the intended revenue and other benefits expected from the acquisitions; | |

| ● | potential ongoing financial obligations in connection with the acquisitions, including any expenses in connection with impairment of goodwill recognized in connection with the acquisitions and potential unforeseen or hidden liabilities of any acquired entity, such as litigation claims or tax liabilities; | |

| ● | potential ongoing financial obligations in connection with the acquisitions, including any expenses in connection with impairment of goodwill recognized in connection with the acquisitions and potential unforeseen or hidden liabilities of any acquired entity, such as litigation claims or tax liabilities; | |

| ● | the diversion of resources and management attention from our existing businesses; and | |

| ● | the diversion of resources and management attention from our existing businesses; and | |

| ● | potential loss of, or harm to, employee or customer relationships as a result of ownership changes in the acquired entities. | |

| ● | potential loss of, or harm to, employee or customer relationships as a result of ownership changes in the acquired entities. |

If any one or more of these risks or uncertainties materializes or if any of the strategic objectives we contemplate are not achieved, our strategic acquisitions may not be beneficial to us and may have a material adverse effect on our business, financial condition and results of operations.

10

We may not be able to successfully integrate businesses that we acquire, which may cause us to lose anticipated benefits from such acquisitions and to incur significant additional expenses.

We may not successfully integrate our operations and the operations of Nengcheng that we have acquired in a timely manner, or at all, and we may not realize the anticipated benefits or synergies of the acquisitions to the extent, or in the timeframe, we anticipated, which may have a material adverse effect on our business, financial condition and results of operations. The main challenges involved in integrating acquired entities include the following:

| ● | consolidating service offerings; | |

| ● | retaining qualified education professionals of any acquired entity; | |

| ● | consolidating and integrating corporate information technology and administrative infrastructure; | |

| ● | ensuring and demonstrating to customers that the acquisitions will not result in any adverse changes to our brand image, reputation, service quality or standards; | |

| ● | preserving strategic, marketing or other important relationships of any acquired entity and resolving potential conflicts that may arise with our key relationships; and | |

| ● | minimizing the diversion of our management’s attention from ongoing business concerns. |

If we fail to successfully execute our growth strategies, our business and prospects may be materially and adversely affected.

Our growth strategies include further promoting our one-stop import service program to customers that require import services throughout the PRC market, expanding our additional raw materials and half-finished goods offerings and establishing working relationship with additional ports that we currently do not operate in. We may not succeed in executing these growth strategies due to a number of factors, including the following:

| ● | we may fail to further promote our one-stop import service program; | |

| ● | we may not be successful in effectively expanding our customer base is to outside of the region we are currently operating, or build additional sources of revenues from adding the import of new raw materials or half-finished goods; | |

| ● | we may not be able to establish a good working relationship with additional ports that would be most convenient and cost-effective for our customers; | |

| ● | we may not be able to identify suitable targets for acquisitions and partnership. |

If we fail to successfully execute our growth strategies, we may not be able to maintain our growth rate and our business and prospects may be materially and adversely affected as a result.

We rely on overseas cargo agents to provide services to us and to our customers, and our ability to conduct business successfully may be affected if we are unable to maintain our relationships with these overseas cargo agents.

We rely on the services of independent cargo agents, who may also be providing services to our competitors, which may include consolidating and deconsolidating various shipments. Although we believe our relationships with our cargo agents are satisfactory, we may not be able to maintain these relationships. If we were unable to maintain these relationships or develop new relationships, our service levels, operating efficiency, future freight volumes and operating profits may be reduced which will adversely impact our results of operations in future periods.

We incur significant credit risks in the operation of our business which could reduce our operating profits.

Various aspects of import services involve significant credit risks. As part of our service, we first pay the cost of customs clearance, such as tarrifs and other taxes, on behalf of our customers, before we bill our customers for the cost. We endeavor to maintain tight credit controls and to avoid doing business with customers we believe may not be creditworthy. While we have not yet encountered incurring losses for customers to whom we extended credit and either delayed their payments to us or became unable or unwilling to pay our invoices after we completed shipment of their goods or rendered other services to them, we cannot guarantee that we will not incur such losses in the future.

We may not be able to adequately protect our intellectual property.

Unauthorized use of any of our intellectual property may adversely affect our business and reputation. We rely on a combination of copyright, trademark and trade secrets laws to protect our intellectual property rights. Nevertheless, third-parties may obtain and use our intellectual property without due authorization. The practice of intellectual property rights enforcement action by Chinese regulatory authorities is in its early stage of development and is subject to significant uncertainty. We may also need to resort to litigation and other legal proceedings to enforce our intellectual property rights. Any such action, litigation or other legal proceedings could result in substantial costs and diversion of our management’s attention and resources and could disrupt our business. In addition, there is no assurance that we will be able to enforce our intellectual property rights effectively or otherwise prevent others from the unauthorized use of our intellectual property. Failure to adequately protect our intellectual property could materially and adversely affect our business, financial condition and results of operations.

11

We may encounter disputes from time to time relating to our use of intellectual property of third parties.

We cannot be certain that third parties will not claim that our business infringes upon or otherwise violates patents, copyrights or other intellectual property rights that they hold. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate, divert our management’s attention and resources or result in the loss of goodwill associated with our brand. If a lawsuit against us is successful, we may be required to pay substantial damages and/or enter into royalty or license agreements that may not be based upon commercially reasonable terms, or we may be unable to enter into such agreements at all.

We may not be able to achieve the benefits we expect from recent and future acquisitions, and recent and future acquisitions may have an adverse effect on our ability to manage our business.

We have made and intend to continue to make acquisitions or equity investments in additional businesses that complement our existing business. We may not be able to successfully integrate acquired businesses and we may not have control over the businesses or operations of our minority equity investments, the value of which may decline over time. As a result, our business and operating results could be harmed. In addition, if the businesses we acquire or invest in do not subsequently generate the anticipated financial performance or if any goodwill impairment test triggering event occurs, we may need to revalue or write down the value of goodwill and other intangible assets in connection with such acquisitions or investments, which would harm our results of operations. In addition, we may be unable to identify appropriate acquisition or strategic investment targets when it is necessary or desirable to make such acquisition or investment to remain competitive or to expand our business. Even if we identify an appropriate acquisition or investment target, we may not be able to negotiate the terms of the acquisition or investment successfully, finance the proposed transaction or integrate the relevant businesses into our existing business and operations.

If our senior management is unable to work together effectively or efficiently or if we lose their service, our business may be severely disrupted.

Our success heavily depends upon the continued services of our management. In particular, we rely on the expertise and experience of Mr. Terence Ho, our CEO and Chairman. If Mr. Ho or one or more of our senior management were unable or unwilling to continue in their present positions, we might not be able to replace them easily or at all, and our business, financial condition and results of operations may be materially and adversely affected. If Mr. Ho or any of our senior management joins a competitor or forms a competing business, we may lose our employees, and other key professionals and staff members. If any dispute arises between our officers and us, we may have to incur substantial costs and expenses in order to enforce such agreements in China or we may be unable to enforce them at all.

We have limited insurance coverage for our operations in China, which could expose us to significant costs and business disruption.

We do not maintain any liability insurance or property insurance policies covering equipment and facilities for injuries, death or losses due to fire, earthquake, flood or any other disaster. Consistent with customary industry practice in China, we do not maintain business interruption insurance, nor do we maintain key-man life insurance. We maintain medical insurance for our management in China. As the insurance industry in China is still in an early stage of development, insurance companies in China currently offer limited business-related insurance products. We do not maintain business interruption insurance. We cannot assure you that our insurance coverage is sufficient to prevent us from any loss or that we will be able to successfully claim our losses under our current insurance policy on a timely basis, or at all. If we incur any loss that is not covered by our insurance policies, or the compensated amount is significantly less than our actual loss, our business, financial condition and results of operations could be materially and adversely affected.

12

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets have previously experienced extreme volatility and disruption, including, among other things, extreme volatility in securities prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining valuations of others. Governments have taken unprecedented actions intended to address extreme market conditions that have included severely restricted credit and declines in real estate values. In some cases, the markets have exerted downward pressure on availability of liquidity and credit capacity for certain issuers. While historically these conditions have not impaired our ability to utilize our current credit facilities and finance our operations or obtaining advances from our shareholders, there can be no assurance that there will not be deterioration in financial markets and confidence in major economies such that our ability to access credit markets and finance our operations might be impaired. Without sufficient liquidity, we may be forced to curtail our operations and any planned expansion. Adverse market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. The tightening of credit in financial markets could adversely affect the ability of our customers to obtain financing for purchases of our products and could result in a decrease in or cancellation of orders for our products. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets.

We are in the process of engaging a broker-dealer to quote our stock on the OTC market. If and when our stock is quoted to trade on the OTC market, our stock price may be negatively affected if we become subject to the recent scrutiny, criticism and negative publicity involving U.S. listed Chinese companies.

Recently, U.S. publicly reporting companies that have substantially all of their operations in China, particularly companies like us which have completed share exchanges or reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors, financial commentators and regulatory agencies, such as the SEC. Much of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly traded stock of many U.S.-listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless. Many of these companies are now subject to shareholder lawsuits and SEC enforcement actions, and are conducting internal and external investigations into the allegations. It is not clear what effect this sector-wide scrutiny, criticism and negative publicity will have on our Company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our company. This situation will be costly and time consuming and distract our management from growing our company. If such allegations are not proven to be groundless, our company and business operations will be severely negatively affected and your investment in our stock could be rendered worthless.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As of December 31, 2017, the Company had accumulated deficits of $ 1,981,384 and working capital deficit of current liabilities exceeding current assets by approximately $10.6 million due to the substantial losses in operation in previous periods. The future of our company is dependent upon future profitable operations from Nengcheng and the continuing financial support from our stockholders or other capital sources. Our management will need to seek additional financing in the future. In addition, the presence of the going concern explanatory paragraph may have an adverse impact on our relationship with third parties with whom we do business, including our customers, vendors and employees and could make it challenging and difficult for us to raise additional debt or equity financing to the extent needed, all of which could have a material adverse impact on our business, results of operations and financial condition. These conditions raise substantial doubt about our company’s ability to continue as a going concern. Although there are no assurances that our plans will be realized, our management believes that we will be able to continue operations in the future.

Additionally, we cannot assure you that we will be able to generate net profits or positive cash flow from operating activities in the future. Our ability to achieve profitability will depend in large part on our ability to increase our operating margin, either by growing our revenues at a rate faster than our operating expenses increase, or by reducing our operating expenses, especially our sales and market expenses, as a percentage of our net revenues. As a result of the foregoing, we believe that we may continue to incur net losses for a period of time in the future.

13

Risks Relating to Our Corporate Structure

The draft Foreign Investment Law proposes sweeping changes to the PRC foreign investment legal regime and will likely to have a significant impact on businesses in China controlled by foreign invested enterprises primarily through contractual arrangements, such as our business.

On January 19, 2015, MOFCOM published a draft of the PRC Law on Foreign Investment (Draft for Comment), or the Foreign Investment Law, which is open for public comments until February 17, 2015. At the same time, MOFCOM published an accompanying explanatory note of the draft Foreign Investment Law, or the Explanatory Note, which contains important information about the draft Foreign Investment Law, including its drafting philosophy and principles, main content, plans to transition to the new legal regime and treatment of business in China controlled by foreign invested enterprises, or FIEs, primarily through contractual arrangements. The draft Foreign Investment Law is intended to replace the current foreign investment legal regime consisting of three laws: the Sino-Foreign Equity Joint Venture Enterprise Law, the Sino-Foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-Invested Enterprise Law, as well as detailed implementing rules. The draft Foreign Investment Law proposes significant changes to the PRC foreign investment legal regime and may have a material impact on Chinese companies listed or to be listed overseas. The proposed Foreign Investment Law is to regulate FIEs the same way as PRC domestic entities, except for those FIEs that operate in industries deemed to be either “restricted” or “prohibited” in a “Negative List.” Because the Negative List has yet to be published, it is unclear whether it will differ from the current list of industries subject to restrictions or prohibitions on foreign investment (including our industry). The draft Foreign Investment Law also provides that only FIEs operating in industries on the Negative List will require entry clearance and other approvals that are not required of PRC domestic entities. As a result of the entry clearance and approvals, certain FIE’s operating in industries on the Negative List may not be able to continue to conduct their operations through contractual arrangements.

There is substantial uncertainty regarding the draft Foreign Investment Law, including, among others, what the actual content of the law will be as well as the adoption timeline or effective date of the final form of the law. While such uncertainty exists, we cannot determine whether the new foreign investment law, when it is adopted and becomes effective, will not have a material positive or negative impact on our corporate structure and business.

RISKS RELATED TO DOING BUSINESS IN CHINA

Substantially all of our assets are located in the PRC and substantially all of our revenues are derived from our operations in China, and changes in the political and economic policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.

Our business operations may be adversely affected by the current and future political environment in the PRC. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under the current government leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activities and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without advance notice.

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in China. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to, governmental approvals required for conducting business and investments, laws and regulations governing the battery industry, national security-related laws and regulations and export/import laws and regulations, as well as commercial, antitrust, patent, product liability, environmental laws and regulations, consumer protection, and financial and business taxation laws and regulations.

The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

14

PRC regulations relating to acquisitions of PRC companies by foreign entities may create regulatory uncertainties that could restrict or limit our ability to operate, including our ability to pay dividends. Our failure to obtain the prior approval of the China Securities Regulatory Commission, or the CSRC, for any offering of our common stock could have a material adverse effect on our business, operating results, reputation and trading price of our common stock.