Attached files

| file | filename |

|---|---|

| EX-32.1 - Brazil Minerals, Inc. | ex32_1.htm |

| EX-31.2 - Brazil Minerals, Inc. | ex31_2.htm |

| EX-31.1 - Brazil Minerals, Inc. | ex31_1.htm |

| EX-21.1 - Brazil Minerals, Inc. | ex21_1.htm |

| EX-10.7 - Brazil Minerals, Inc. | ex10_7.htm |

| EX-4.4 - Brazil Minerals, Inc. | ex4_4.htm |

| EX-3.20 - Brazil Minerals, Inc. | ex3_20.htm |

| EX-3.19 - Brazil Minerals, Inc. | ex3_19.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☑

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2017

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 000-55191

Brazil Minerals, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

39-2078861

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

Rua Vereador João Alves Praes, nº 95-A

Olhos D'Água, MG 39398-000, Brazil

(Address of principal executive offices)

Issuer's telephone number, including area code: (213) 590-2500

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☑ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or, an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company", and "emerging growth company", in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☑

|

|

(Do not check if smaller reporting company)

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2017, the last business day of the Registrant's most recently completed second fiscal quarter, the aggregate market value of the Registrant's common stock held by non-affiliates (based on the closing sales price of such shares on such date as reported by Nasdaq.com) was approximately $857,603. For the purpose of this report it has been assumed that all officers and directors of the Registrant, as well as all stockholders holding 10% or more of the Registrant's stock, are affiliates of the Registrant.

As of April 8, 2018, there were outstanding 170,228,912 shares of the registrant's common stock.

Documents incorporated by reference: None.

TABLE OF CONTENTS

|

PART I

|

||||

|

Item 1.

|

Description of Business

|

2

|

||

|

Item 1A.

|

Risk Factors

|

5

|

||

|

Item 1B.

|

Unresolved Staff Comments

|

7

|

||

|

Item 2.

|

Properties

|

7

|

||

|

Item 3.

|

Legal Proceedings

|

13

|

||

|

Item 4.

|

Mine Safety Disclosures

|

13

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

14

|

||

|

Item 6.

|

Selected Financial Data

|

15

|

||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

15

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

23

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

23

|

||

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

23

|

||

|

Item 9A.

|

Controls and Procedures

|

23

|

||

|

Item 9B.

|

Other Information

|

24

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

24

|

||

|

Item 11.

|

Executive Compensation

|

25

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

26

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

28

|

||

|

Item 14.

|

Principal Accounting Fees and Services

|

28

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

29

|

||

|

Item 16

|

Form 10-K Summary

|

|||

|

SIGNATURES

|

30

|

|||

|

FINANCIAL STATEMENTS

|

F-1

|

|||

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-looking statements for Brazil Minerals, Inc. reflect current expectations, as of the date of this Annual Report, and involve certain risks and uncertainties. Actual results could differ materially from those anticipated in these forward- looking statements as a result of various factors. Factors that could cause future results to materially differ from the recent results or those projected in forward-looking statements include, among others: unprofitable efforts resulting not only from the failure to discover mineral deposits, but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production; market fluctuations; government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection; competition; the loss of services of key personnel; unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of infrastructure as well as general economic conditions.

PART I

Item 1. Description of Business.

Brazil Minerals, Inc. with its subsidiaries ("Brazil Minerals", the "Company", "we", "us", or "our") has two components to its business model: 1) Growing a portfolio of mineral rights in a wide spectrum of strategic and sought-after minerals, from which equity holdings and/or royalty interests will develop, and 2) Mining certain specific areas for gold, diamonds, and sand.. We consolidate our results in this Annual Report.

Our progress as an exploration project generator has been steady. In early 2013 we owned mineral rights for gold and diamonds. Since then we have grown several-fold our bank of high quality mineral properties (the "BMIX Mineral Bank") to currently include mineral rights for gold, diamonds, cobalt, copper, lithium, manganese, nickel, precious gems (aquamarine, beryl, tourmaline) and sand.

Our first equity holdings from our exploration project generation strategy is Jupiter Gold Corporation ("Jupiter Gold"). Jupiter Gold has been a public company since December 16, 2016, and we own approximately 55.4% of Jupiter Gold's equity.

Emerging Growth Company Status

Until December 31, 2017, we were deemed to be an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act. Since our predecessor was incorporated in December 2011 and completed an initial public offering in June 2012, our status as an emerging growth company expired on December 31, 2017.

Markets

Rough Diamonds

The market for our rough diamonds is local and with demand from various buyers. Prices for rough diamond are set globally in U.S. dollars.

- 2 -

Polished Diamonds

The market for our polished diamonds is global and with prices normally quoted in U.S dollars. Their price is determined by the so-called four C's – color, carat weight, clarity, and cut. All of our exported diamonds to date have been certified and graded at the Gemological Institute of America ("GIA"), considered the premier analytical laboratory. The highest color grade our polished diamonds have obtained from GIA has been "E", the 2nd highest possible grade (the color scale starts at "D"). The best clarity that our polished diamonds have obtained from GIA has been "VVS1", the 2nd best clarity possible. The majority of our polished diamonds have been graded F-G for color and VVS2-VS2 for clarity. Their cut has been round brilliant, and their weight has been between 0.4 and 2.0 carats. The Rapaport valuation of our polished diamonds graded at GIA has been approximately $3,250 per carat. Rapaport is a diamond service provider that publishes well-known, periodic pricing valuations for diamonds based on the four C's, as described above.

Gold

The market for our gold is local with demand from various buyers. The price of our 96%-purity gold bars is determined by the global price for gold and quoted in U.S. dollars.

Sand

The market for our sand is local and priced in Brazilian reais. There are various local buyers for our sand, mostly owners of supply stores that cater to the construction industry. Our sand has been analyzed at a well-regarded analytical laboratory in Brazil and found to have high silica levels and low organic matter, both characteristics of high quality sand.

Demand

When we have diamond and gold for sale, demand for our products has been robust. We have been constrained on supply primarily by equipment malfunction and additionally by need for more working capital to expand operations. Demand for our sand is highly dependent on the health of the Brazilian economy since it is used in construction projects.

Distribution

We have not had material issues or bottlenecks with distribution of our products.

Competition

Diamonds, gold and sand production are difficult fields to penetrate due to regulatory requirements, long wait times for permitting and limited availability of new resource areas. We have had competition from illegal exploration of sand areas along the Jequitinhonha River, and we have notified the local authorities concerning such activities.

Seasonality

Our ability to mine for diamonds and gold is highly seasonal. The local rainy season lasts from December through April during which time open sky mining is reduced or stopped depending on the severity of the rains and storms. We expect that during this period our revenues will be substantially lower than during other periods.

Raw Materials

We do not have any material dependence on any raw material or raw material supplier. All of the raw materials that we need are available from numerous suppliers and at market-driven prices.

Intellectual Property

None which is material.

- 3 -

Government Regulation

Mining Regulation and Compliance

Mining regulation in Brazil is carried out by the mining department, a federal entity, and each state in Brazil has an office of this federal entity. For each mineral right that we own, we file any paperwork related to it in the office of the mining department in the state in which such mineral right is located. We believe that we maintain a good relationship with the mining department and that our methods of monitoring are adequate for our current needs.

The mining department normally inspects our operations once a year via an unannounced visit which is their standard practice. We estimate that it costs $10,000 annually to maintain compliance with various mining regulations.

Environmental Regulation and Compliance

Environmental regulation in Brazil is carried out by a state-level agency, which may have multiple offices, one for each region of the state. For each mineral right that we own, we file any paperwork related to it in the local office of the environmental agency that has the applicable geographical jurisdiction. We maintain a good relationship with the offices of the environmental agency and believe that our methods of monitoring are adequate for our current needs.

The environmental agency normally inspects our operations once every one or two years which is standard practice for companies in good standing. We estimate that it costs $10,000 annually to maintain compliance with various environmental regulations.

Surface disturbance from any open pit mining performed by us is in full compliance with its mining plan as approved the local regulatory agencies. We regularly recuperate areas that have been exploited. The current environmental regulations state that after all mining has ceased (however long that may take), there would still be five years of available time for any necessary recuperation to be performed. Our mining and recovery processing for diamonds and gold does not use any chemical products. Tests are conducted regularly and there are no records of groundwater contamination.

Export Regulation

The export of rough diamonds from Brazil complies with the United Nations Kimberley Process certification system of which Brazil is a signatory country. This system was implemented to prevent entrance to the diamond marketplace of those gems produced in areas where human exploitation and other specific illicit activities exist. To our knowledge, Brazil was never a jurisdiction that had such issues.

Employees and Independent Contractors

As of April 10, 2018, we had 6 full-time employees. We also periodically retain consultants to provide specific services deemed necessary. We consider our employee relations to be very good.

Form and Year of Organization & History to Date

We were incorporated in the State of Nevada on December 15, 2011. From inception until December 2012, we were focused in the software business, which was discontinued when the current management team and business focus began. The Company changed name to Brazil Minerals, Inc. in December 2012.

Available Information

We maintain a website at www.brazil-minerals.com. We make available free of charge, through the Public Filings section of the Investors tab on our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information on our website is not, and shall not be deemed to be, a part hereof or incorporated into this or any of our other filings with the SEC.

Our SEC filings are available from the SEC's internet website at www.sec.gov which contains reports, proxy and information statements and other information regarding issuers that file electronically. These reports, proxy statements and other information may also be inspected and copied at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549.

- 4 -

Item 1A. Risk Factors.

Some, but not all, of our operating risk factors and the risks of any investment in our stock are listed below.

Risks Related to Our Operations

We have a limited operating history.

Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

Our ability to execute our business plan depends primarily on the continuation of a favorable mining environment in Brazil.

Mining operations in Brazil are heavily regulated. Any significant change in mining legislation or other changes in Brazil's current mining environment may slow down or alter our business prospects.

We do not have any reserves compliant with SEC Industry Guide 7.

Vaaldiam, the previous owner of this mining concession, and at that time a publicly-traded Canadian company, performed detailed geological studies leading to the publication of an NI 43-101 technical report in 2007, with an update in 2008, as required by the rules of the Canadian securities administrator and filed in SEDAR. The NI 43-101 report describes the existence of mineralized materials amounting to 1,639,200 cubic meters with the following concentrations: 0.16 carats of diamonds per cubic meter and 182 milligrams of gold per cubic meter. Vaaldiam also submitted a bankable feasibility study to the Brazilian mining department in accordance with local regulations. The NI 43-101 technical report and the bankable feasibility study were not prepared in accordance with the SEC-sanctioned Industry Guide 7 for mining companies. Under such regulation, no assertion can be made about reserves and the term "resources" is not recognized.

We may be unable to find sources of funding if and when needed, resulting in the failure of our business.

As of today, we need additional equity or debt financing beyond our existing cash to operate. This additional financing may not become available and, if available, may not be available on terms that are acceptable to us. If we do obtain acceptable funding, the terms and conditions of receiving such capital would likely result in further dilution. If we are not successful in raising capital or sufficient capital, we will have to modify our business plans and substantially reduce or eliminate operations, or as an extreme measure seek reorganization. In these events, you could lose a substantial part or all of your investment.

Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods.

Our quarterly and annual operating and financial results are difficult to predict and may fluctuate significantly from period to period. Our revenues, net income, and results of operations may fluctuate as a result of a variety of factors that are outside our control including, but not limited to, lack of sufficient working capital, equipment malfunction and breakdowns, inability to timely find spare machines or parts to fix the broken equipment, regulatory or licensing delays, and severe weather phenomena.

We do not intend to pay regular future dividends on our common stock and thus stockholders must look to appreciation of our common stock to realize a gain on their investments.

We have never paid a dividend and we do not have any plans to pay dividends in the foreseeable future. Our future dividend policy is within the discretion of our Board of Directors and will depend upon various factors, including future earnings, if any, our capital requirements and general financial condition, and other factors. Accordingly, stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may not occur, or may occur over a longer timeframe that is less interesting to short-term oriented investors.

- 5 -

We depend upon Marc Fogassa, our Chief Executive Officer and Chairman.

Our success is largely dependent upon the personal efforts of Marc Fogassa. Currently he is our only management team member that is fluent and fully conversant in both Portuguese, the language of Brazil, and English. The loss of the services of Mr. Fogassa would have a material adverse effect on our business and prospects. We maintain key-man life insurance on the life of Mr. Fogassa.

Risks Related to Our Capital Stock

Our Series A Preferred Stock has the effect of concentrating voting control over us in Marc Fogassa, our Chairman and Chief Executive Officer.

One share of our Series A Preferred Stock is issued, outstanding and held since 2012 by Marc Fogassa, our Chairman and Chief Executive Officer. The Certificate of Designations, Preferences and Rights of our Series A Convertible Preferred provides that for so long as Series A Preferred Stock is issued and outstanding, the holders of Series A Preferred Stock shall vote together as a single class with the holders of our Common Stock, with the holders of Series A Preferred Stock being entitled to 51% of the total votes on all matters regardless of the actual number of shares of Series A Preferred Stock then outstanding, and the holders of Common Stock and any other class or series of capital stock entitled to vote with the Common Stock being entitled to their proportional share of the remaining 49% of the total votes based on their respective voting power.

Our stock price may be volatile.

The market price of our Common Stock has been and is likely to continue to be volatile and could fluctuate in price in response to various factors, many of which are beyond our control, including the following:

|

(1)

|

our ability to grow and/or maintain revenue;

|

|

(2)

|

our ability to achieve profitability;

|

|

(3)

|

our ability to raise capital when needed;

|

|

(4)

|

our sales of our common stock;

|

|

(5)

|

our ability to execute our business plan;

|

|

(6)

|

our ability to acquire additional mineral properties;

|

|

(7)

|

legislative, regulatory, and competitive developments; and

|

|

(8)

|

economic and other external factors.

|

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Because our common stock trades on the over-the-counter (OTC) market, you may not be able to buy and sell our common stock at optimum prices and you may face liquidity issues.

The trading of our stock on the OTC imposes, among others, the following risks:

|

·

|

Availability of quotes and order information

|

|

·

|

Liquidity risks

|

|

·

|

Dealer's spreads

|

- 6 -

Our convertible debt securities outstanding may adversely affect the market price for our common stock.

To the extent that any remaining convertible debt securities are converted into our common stock, the existing stockholder percentage ownership will be diluted and any sales in the public market of the common stock underlying such options may adversely affect prevailing market prices for our common stock. A similar situation occurs if our outstanding options and warrants are exercised.

We may seek to raise additional funds, finance acquisitions or develop strategic relationships by issuing capital stock that would dilute your ownership.

We may largely finance our operations by issuing equity securities, which would materially reduce the percentage ownership of our existing stockholders. Furthermore, any newly issued securities could have rights, preferences, and privileges senior to those of our existing common stock. Moreover, any issuances by us of equity securities may be at or below the prevailing market price of our stock and in any event may have a dilutive impact on ownership interest of existing common stockholders, which could cause the market price of stock to decline. We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities or instruments senior to our common shares. The holders of any debt securities or instruments we may issue could have rights superior to the rights of our common stockholders.

Our common stock is currently defined as "penny stock" and the rules imposed on the sale of the shares may affect your ability to resell any shares you may purchase, if at all.

Our common stock has traded below $5 and is therefore defined as a "penny stock" under the Securities Exchange Act of 1934, as amended (the "Exchange Act") and rules of the SEC. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse, or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the SEC. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock and may also affect a stockholder's ability to resell any of our shares in the public markets.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Mineral Properties

Our mineral properties are listed in the following table and summarized below.

- 7 -

|

Project Name

|

Minerals

|

Location (state, country)

|

Area (acres)

|

Status

|

|

Jequitinhonha Valley

|

Diamonds, Gold, Sand

|

Minas Gerais, Brazil

|

27,955

|

active mining

|

|

Goiás

|

Cobalt, Copper, Nickel

|

Goiás, Brazil

|

5,011

|

pre-research planning

|

|

Salinas

|

Lithium, Aquamarine, Beryl,

Tourmaline, Granite, Feldspar

|

Minas Gerais, Brazil

|

288

|

pre-research planning

|

|

Paracatu*

|

Gold

|

Minas Gerais, Brazil

|

795

|

research phase

|

|

Crixás*

|

Gold

|

Goiás, Brazil

|

4,925

|

research phase

|

|

Itabira*

|

Gold

|

Minas Gerais, Brazil

|

4,069

|

research phase

|

|

Diamantina*

|

Manganese

|

Minas Gerais, Brazil

|

4,970

|

research phase

|

|

Serrita*

|

Gold

|

Pernambuco, Brazil

|

14,169

|

pre-research planning

|

|

Amazonas*

|

Gold

|

Amazonas, Brazil

|

69,030

|

pre-research planning

|

* Projects owned by our subsidiary, Jupiter Gold.

Diamond, Gold, Sand – Jequitinhonha Valley

Brazil Minerals, through subsidiaries, has 31 mineral rights for diamond, gold, and sand, on and near the margins of the Jequitinhonha River in the state of Minas Gerais in Brazil. The Jequitinhonha River valley is a well-known area for diamond and gold production; it has hosted alluvial production since the 18th century.

- 8 -

One of our mineral rights, covering 422 acres, is a mining concession for diamond, gold and sand. Our concession, awarded by the Brazilian federal government through the Brazilian mining department, is the highest level of mineral right in Brazil. It permits us to mine in perpetuity provided that environmental licenses are kept current and that mining guidelines are followed.

Mineralization

Vaaldiam, the previous owner of this mining concession, and at that time a publicly-traded Canadian company, performed detailed geological studies leading to the publication of an NI 43-101 technical report in 2007, with an update in 2008, as required by the rules of the Canadian securities administrator and filed in SEDAR. The NI 43-101 report describes the existence of mineralized materials amounting to 1,639,200 cubic meters with the following concentrations: 0.16 carats of diamonds per cubic meter and 182 milligrams of gold per cubic meter. Vaaldiam also submitted a bankable feasibility study to the Brazilian mining department in accordance with local regulations. The NI 43-101 technical report and the bankable feasibility study were not prepared in accordance with the SEC-sanctioned Industry Guide 7 for mining companies. Under such regulation, no assertion can be made about reserves and the term "resources" is not recognized.

Equipment & Processing

Gold and diamonds are present within gravel found in alluvial material in our concession area. Following drilling for identification of mineralized areas, we excavate the chosen perimeters, and gravel is removed and accumulated by excavator and bulldozer working together and later transported by truck to our recovery unit described below.

Recovery Plants

We have two working recovery plants for diamonds and gold. Our subsidiary, Jupiter Gold owns a modular recovery plant which utilizes a large centrifuge for recovery, currently deployed in this concession area. During 2017, this plant was completed, tested and made operational. The plant uses centrifugation as the primary method of gold separation. Material identified as potentially containing diamonds is retrieved and further processed in specific high-precision equipment for detection of diamonds, located in our large plant, as described below.

- 9 -

The modular plant is highly cost-effective and has become our preferred method of gold and diamond recovery. Under an agreement between Brazil Minerals and Jupiter Gold, this modular plant is solely operated by Brazil Minerals which retains 100% of the diamonds and 50% of the gold recovered from it, while the other 50% of gold is for the account of Jupiter Gold. Under U.S. GAAP consolidation of financial results for subsidiaries, any gold revenues obtained by Jupiter Gold are added to the revenues of Brazil Minerals.

Our other plant at this concession is regarded as the largest such type in Latin America and capable of processing upwards of 45 tons of gravel per hour of operation. It was acquired when we took over the concession. From the best information we have, this plant cost $2.5 million and was built by South African mining engineers. We utilize the state-of-the-art diamond recovery facilities from this large plant, following separation of concentrated diamondiferous-yielding material obtained after initial processing in our modular plant. We also utilize the gold laboratory unit of the large plant for final processing of gold obtained from our modular plant.

Fuel & Water

All of our equipment at the concession runs on diesel, purchased from multiple local vendors. Our water comes from lagoons that receive water from the Jequitinhonha River. We do not utilize any chemicals in any processes.

No Chemicals

All of our processing is based on washing auriferous and diamondiferous gravel with water, then applying physical processes such as sieving, shaking, followed by centrifugation. Gold and diamonds are heavy substances, allowing separation by such methods. The final step in diamond recovery uses diffraction differential in light emitted by diamonds versus non-diamonds.

Sand

The mining concession contains a sand bay from which in natura sand is extracted via excavator and sold to truckers. Our sand is of high-quality and sought after locally for civil construction projects.

Logistics

Our mining concession is an approximately one and half hour drive from Montes Claros with a population close to 700,000 people, with all needed services and the regional airport.

- 10 -

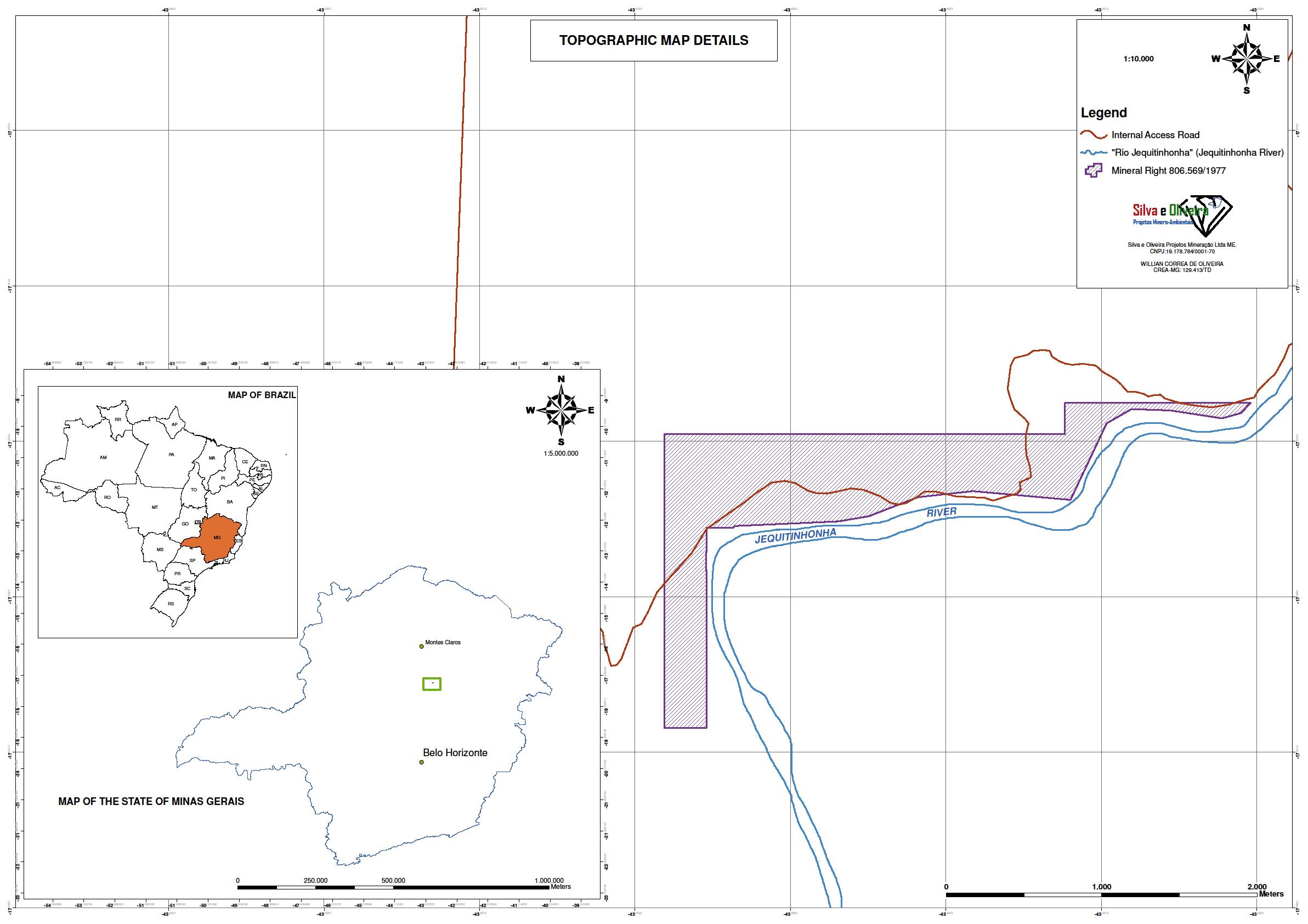

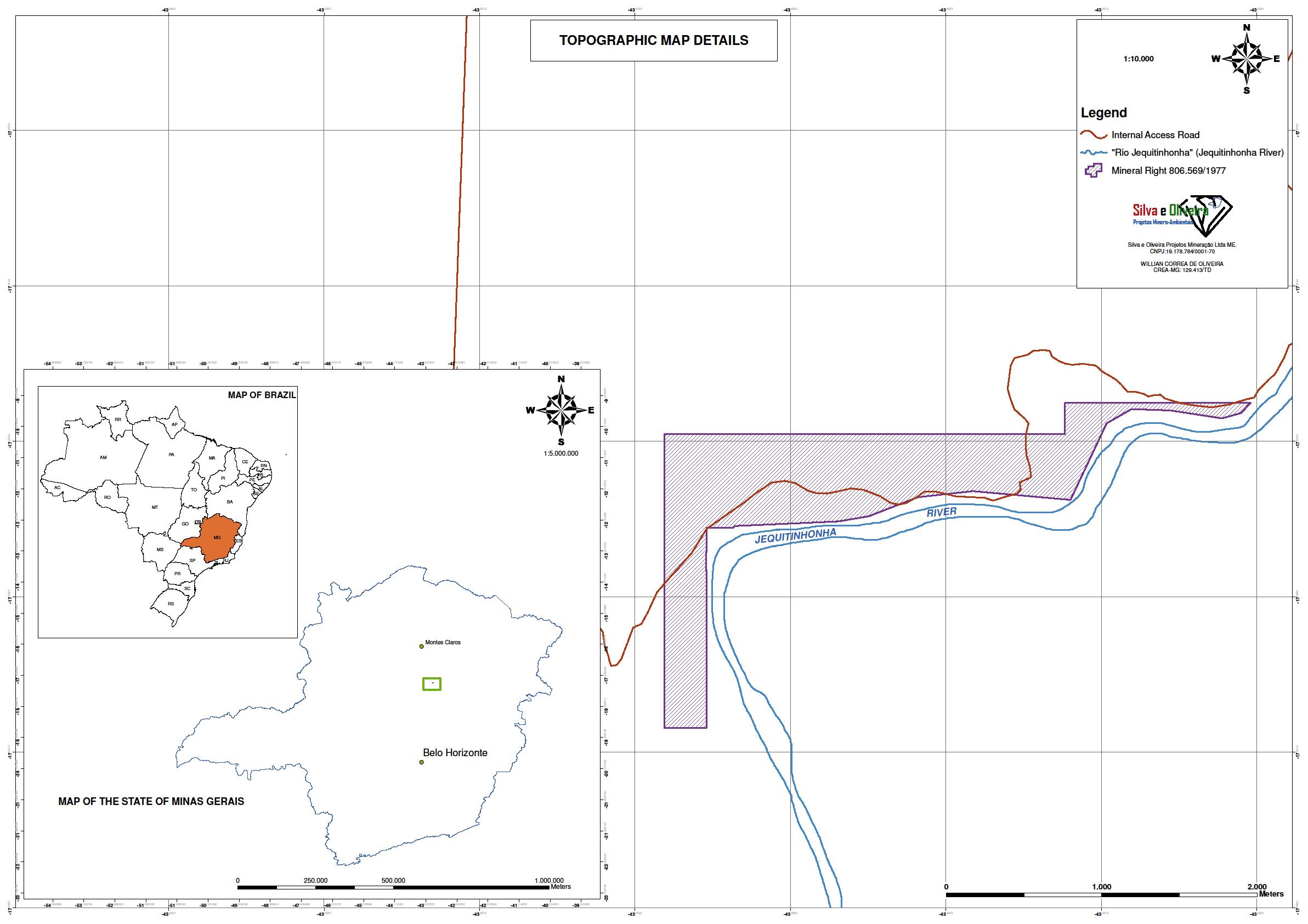

Map

Additional Area

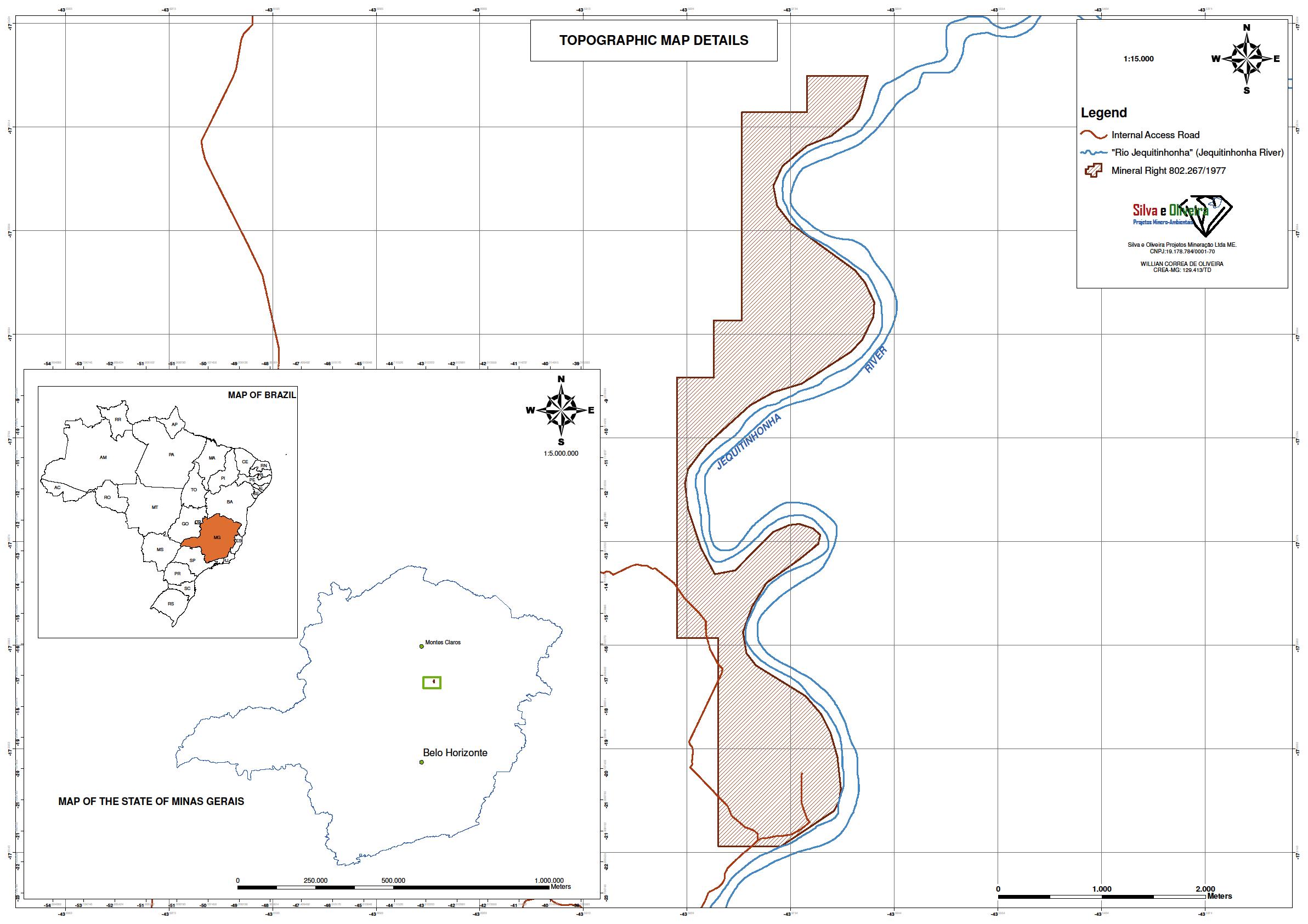

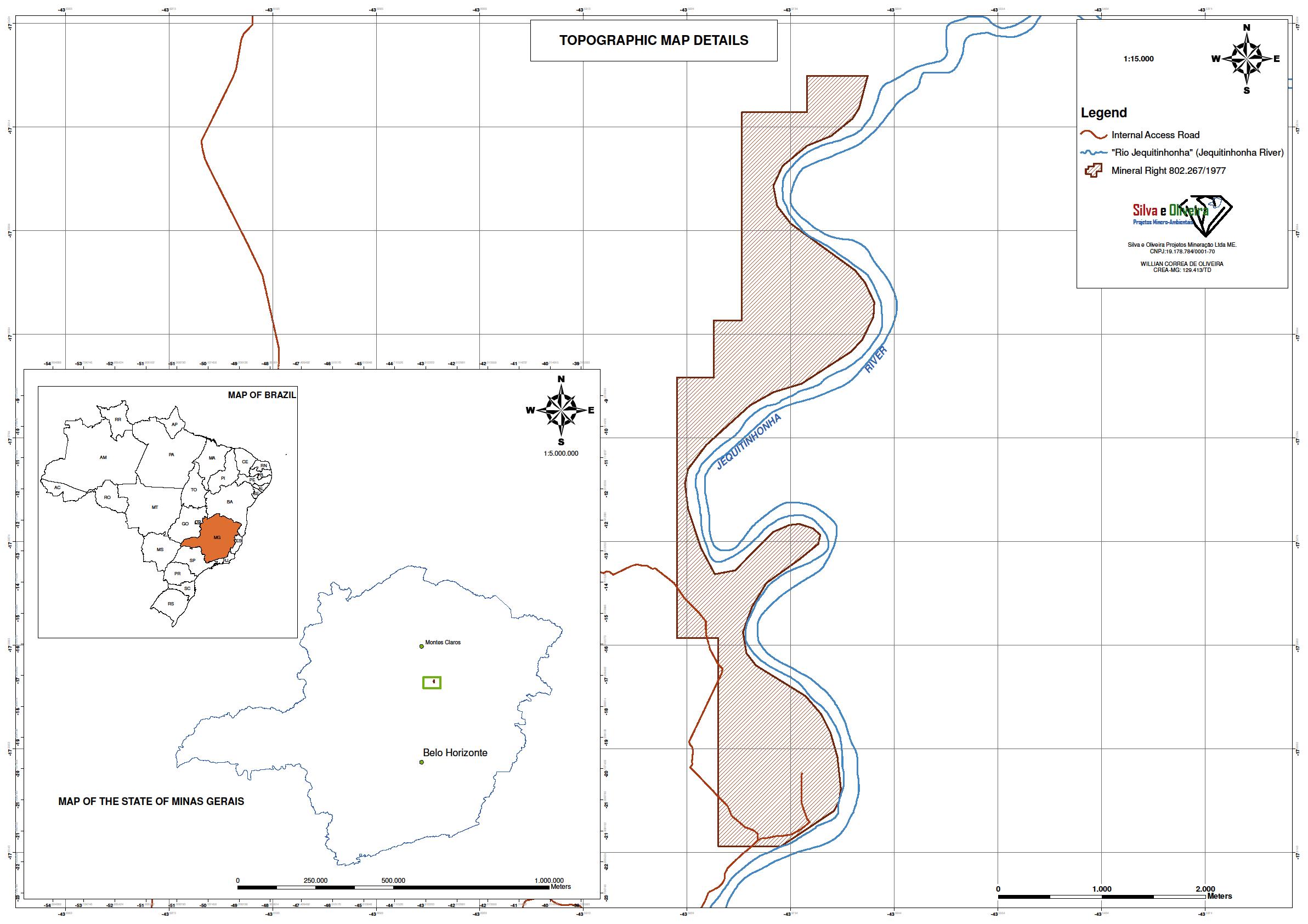

We have obtained an initial permit for mining another mineral right that is located approximately two miles downstream from the mining concession described above. This mineral right has 1,310 acres, and our current authorization covers only a small part of this available surface area. We have drilled this area and identified presence of both gold and diamonds. We intend to move to this area for recovery after further exploitation of the mining concession described above. A map of this area is found below.

Map

- 11 -

Gold – Paracatu

The Paracatu project, held by our subsidiary, Jupiter Gold, consists of a mineral right for gold in this well-known gold district. This area of Brazil was settled in the early 17th century by pioneers searching for gold. Today Paracatu is home to the largest gold mine in Brazil, "Morro do Ouro" (Gold Hill), owned and operated by Kinross Gold, a large global producer. Morro do Ouro is an open-sky mine, with an ore body of 16 million ounces of gold, and annual production of 480,000 ounces, according to publicly-available information. The Paracatu project area is located only a few miles downstream from Morro do Ouro.

The Paracatu project is exploratory and Jupiter Gold intends to begin a drilling study during the second quarter of 2018.

Gold – Crixás

The Crixás project, held by our subsidiary Jupiter Gold, consists of a mineral right for gold in this well-known gold district. This area of Brazil was settled in the 18th century by pioneers searching for gold. Today Crixás is home to the some of the largest gold operations in Brazil, with large gold mines and projects from AngloGold Ashanti and Cleveland Mining. AngloGold Ashanti's operations in Crixás encompass three underground and two open sky mines, with an ore body of greater than 7 million ounces of gold and annual production of 132,000 ounces, according to publicly-available information.

The Crixás project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

Gold – Itabira

The Itabira project, held by our subsidiary Jupiter Gold, consists of a mineral right for gold in a region of Brazil near Itabira called the "Quadrilátero Ferrífero" (Iron Quandrangle) known for large iron mines as well as gold mines.

Manganese – Diamantina

The Diamantina project, held by our subsidiary, Jupiter Gold, consists of two mineral rights for manganese in the region in and surrounding Diamantina where other companies have explored for manganese.

The Diamantina project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

- 12 -

Cobalt, Copper, Nickel – Goiás

The Goiás project, held by our subsidiary Jupiter Gold, consists of two mineral rights for cobalt, copper, and nickel in the region in and surrounding Montes Claros de Goiás, where other companies have explored for these minerals, and some of the largest Brazilian reserves of nickel are located, according to publicly-available information.

The Goiás project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Lithium – Salinas

The Salinas project consists of a mineral right for lithium, aquamarine, beryl, tourmaline, granite, and feldspar in the Salinas district, where other companies have explored for these minerals.

The Salinas project is exploratory, and we intend to study the area or enter into a partnership for its study.

Gold – Serrita

The Serrita project, held by our subsidiary, Jupiter Gold, consists of three mineral rights for gold in the Serrita district, a known gold district.

The Serrita project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Gold – Amazonas

The Amazonas project, held by our subsidiary, Jupiter Gold, consists of three mineral rights for gold in the Apui area, a known gold district.

The Amazonas project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Offices

The Company's principal place of operations and office is in the municipality of Olhos D'Agua in the state of Minas Gerais in Brazil. We also utilize an office in Pasadena, California.

Item 3. Legal Proceedings.

None which are material.

Item 4. Mine Safety Disclosures.

Not applicable.

- 13 -

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information and Current Stockholders

Our common stock is traded under the symbol "BMIX". The following table sets forth, for each of the quarterly periods indicated, the range of high and low sales prices, in U.S. dollars, for our common stock for each quarter in 2016 and 2017. Prices have been proportionally adjusted to reflect a 1 for 500 reverse stock split effective January 27, 2017.

|

|

Year Ended

|

|||||||

|

Quarters

|

December 31, 2016

|

|||||||

|

High

|

Low

|

|||||||

|

2016

|

||||||||

|

First (1/1-3/31)

|

$

|

0.1000

|

$

|

0.0500

|

||||

|

Second (4/1-6/30)

|

$

|

0.1000

|

$

|

0.0500

|

||||

|

Third (7/1-9/30)

|

$

|

0.1000

|

$

|

0.0500

|

||||

|

Fourth (10/1-12/31)

|

$

|

0.1000

|

$

|

0.0500

|

||||

|

|

Year Ended

|

|||||||

|

Quarters

|

December 31, 2017

|

|||||||

|

High

|

Low

|

|||||||

|

2017

|

||||||||

|

First (1/1-3/31)

|

$

|

0.0500

|

$

|

0.0100

|

||||

|

Second (4/1-6/30)

|

$

|

0.0319

|

$

|

0.0100

|

||||

|

Third (7/1-9/30)

|

$

|

0.0360

|

$

|

0.0040

|

||||

|

Fourth (10/1-12/31)

|

$

|

0.0089

|

$

|

0.0035

|

||||

As of April 10, 2018 we had 184 holders of record of our common stock as such term is defined in SEC rules, according to records maintained by our transfer agent.

Dividends

We have not paid any cash dividends since inception and do not expect to declare any cash dividends in the foreseeable future.

Equity Compensation Plan

In 2017, our Board of Directors approved our 2017 Stock Incentive Plan under which we can offer eligible employees, consultants, and non-employee directors cash and stock-based compensation and/or incentives to compensate, attract, retain, or reward such individuals. We have no other equity compensation plan. The table below sets forth certain information as of December 31, 2017 with respect to the 2017 Stock Incentive Plan.

- 14 -

|

Plan Category

|

Number of securities to

be issued upon exercise

of outstanding options,

warrants, and rights

(a)

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

|

Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities

reflected in column "(a)")

(c)

|

|||||||||

|

|

||||||||||||

|

Equity compensation plans approved by security holders

|

0

|

0

|

0

|

|||||||||

|

|

||||||||||||

|

Equity compensation plans not approved by security holders (2017 Stock Incentive Plan)

|

25,000,000

|

$

|

n/a

|

25,000,000

|

||||||||

|

|

||||||||||||

|

Total

|

25,000,000

|

$

|

n/a

|

25,000,000

|

||||||||

Sales of Unregistered Securities

None during the 4th quarter of 2017.

Item 6. Selected Financial Data.

The information to be reported under this Item is not required of smaller reporting companies.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation.

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

This Annual Report contains forward-looking statements. Forward-looking statements for Brazil Minerals, Inc. reflect current expectations, as of the date of this Annual Report, and involve certain risks and uncertainties. Actual results could differ materially from those anticipated in these forward- looking statements as a result of various factors. Factors that could cause future results to materially differ from the recent results or those projected in forward-looking statements include, among others: unprofitable efforts resulting not only from the failure to discover mineral deposits, but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production; market fluctuations; government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection; competition; the loss of services of key personnel; unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of infrastructure as well as general economic conditions.

Overview

Brazil Minerals, Inc. with its subsidiaries ("Brazil Minerals", the "Company", "we", "us", or "our") has two components to its business model: 1) Growing a portfolio of mineral rights in a wide spectrum of strategic and sought-after minerals, from which equity holdings and/or royalty interests will develop, and 2) Mining certain specific areas for gold, diamonds, and sand.. We consolidate our results in this Annual Report.

Our progress as an exploration project generator has been steady. In early 2013 we owned mineral rights for gold and diamonds. Since then we have grown several-fold our bank of high quality mineral properties (the "BMIX Mineral Bank") to currently include mineral rights for gold, diamonds, cobalt, copper, lithium, manganese, nickel, precious gems (aquamarine, beryl, tourmaline) and sand.

Our first equity holdings from our exploration project generation strategy is Jupiter Gold Corporation ("Jupiter Gold"). Jupiter Gold has been a public company since December 16, 2016, and we own approximately 55.4% of Jupiter Gold's equity.

Our mineral properties are listed in the following table and summarized below.

- 15 -

|

Project Name

|

Minerals

|

Location (state, country)

|

Area (acres)

|

Status

|

|

Jequitinhonha Valley

|

Diamonds, Gold, Sand

|

Minas Gerais, Brazil

|

27,955

|

active mining

|

|

Goiás

|

Cobalt, Copper, Nickel

|

Goiás, Brazil

|

5,011

|

pre-research planning

|

|

Salinas

|

Lithium, Aquamarine, Beryl,

Tourmaline, Granite, Feldspar

|

Minas Gerais, Brazil

|

288

|

pre-research planning

|

|

Paracatu*

|

Gold

|

Minas Gerais, Brazil

|

795

|

research phase

|

|

Crixás*

|

Gold

|

Goiás, Brazil

|

4,925

|

research phase

|

|

Itabira*

|

Gold

|

Minas Gerais, Brazil

|

4,069

|

research phase

|

|

Diamantina*

|

Manganese

|

Minas Gerais, Brazil

|

4,970

|

research phase

|

|

Serrita*

|

Gold

|

Pernambuco, Brazil

|

14,169

|

pre-research planning

|

|

Amazonas*

|

Gold

|

Amazonas, Brazil

|

69,030

|

pre-research planning

|

* Projects owned by our subsidiary, Jupiter Gold.

Diamond, Gold, Sand – Jequitinhonha Valley

Brazil Minerals, through subsidiaries, has 31 mineral rights for diamond, gold, and sand, on and near the margins of the Jequitinhonha River in the state of Minas Gerais in Brazil. The Jequitinhonha River valley is a well-known area for diamond and gold production; it has hosted alluvial production since the 18th century.

- 16 -

One of our mineral rights, covering 422 acres, is a mining concession for diamond, gold and sand. Our concession, awarded by the Brazilian federal government through the Brazilian mining department, is the highest level of mineral right in Brazil. It permits us to mine in perpetuity provided that environmental licenses are kept current and that mining guidelines are followed.

Mineralization

Vaaldiam, the previous owner of this mining concession, and at that time a publicly-traded Canadian company, performed detailed geological studies leading to the publication of an NI 43-101 technical report in 2007, with an update in 2008, as required by the rules of the Canadian securities administrator and filed in SEDAR. The NI 43-101 report describes the existence of mineralized materials amounting to 1,639,200 cubic meters with the following concentrations: 0.16 carats of diamonds per cubic meter and 182 milligrams of gold per cubic meter. Vaaldiam also submitted a bankable feasibility study to the Brazilian mining department in accordance with local regulations. The NI 43-101 technical report and the bankable feasibility study were not prepared in accordance with the SEC-sanctioned Industry Guide 7 for mining companies. Under such regulation, no assertion can be made about reserves and the term "resources" is not recognized.

Equipment & Processing

Gold and diamonds are present within gravel found in alluvial material in our concession area. Following drilling for identification of mineralized areas, we excavate the chosen perimeters, and gravel is removed and accumulated by excavator and bulldozer working together and later transported by truck to our recovery unit described below.

Recovery Plants

We have two working recovery plants for diamonds and gold. Our subsidiary, Jupiter Gold owns a modular recovery plant which utilizes a large centrifuge for recovery, currently deployed in this concession area. During 2017, this plant was completed, tested and made operational. The plant uses centrifugation as the primary method of gold separation. Material identified as potentially containing diamonds is retrieved and further processed in specific high-precision equipment for detection of diamonds, located in our large plant, as described below.

- 17 -

The modular plant is highly cost-effective and has become our preferred method of gold and diamond recovery. Under an agreement between Brazil Minerals and Jupiter Gold, this modular plant is solely operated by Brazil Minerals which retains 100% of the diamonds and 50% of the gold recovered from it, while the other 50% of gold is for the account of Jupiter Gold. Under U.S. GAAP consolidation of financial results for subsidiaries, any gold revenues obtained by Jupiter Gold are added to the revenues of Brazil Minerals.

Our other plant at this concession is regarded as the largest such type in Latin America and capable of processing upwards of 45 tons of gravel per hour of operation. It was acquired when we took over the concession. From the best information we have, this plant cost $2.5 million and was built by South African mining engineers. We utilize the state-of-the-art diamond recovery facilities from this large plant, following separation of concentrated diamondiferous-yielding material obtained after initial processing in our modular plant. We also utilize the gold laboratory unit of the large plant for final processing of gold obtained from our modular plant.

Fuel & Water

All of our equipment at the concession runs on diesel, purchased from multiple local vendors. Our water comes from lagoons that receive water from the Jequitinhonha River. We do not utilize any chemicals in any processes.

No Chemicals

All of our processing is based on washing auriferous and diamondiferous gravel with water, then applying physical processes such as sieving, shaking, followed by centrifugation. Gold and diamonds are heavy substances, allowing separation by such methods. The final step in diamond recovery uses diffraction differential in light emitted by diamonds versus non-diamonds.

Sand

The mining concession contains a sand bay from which in natura sand is extracted via excavator and sold to truckers. Our sand is of high-quality and sought after locally for civil construction projects.

Logistics

Our mining concession is an approximately one and half hour drive from Montes Claros with a population close to 700,000 people, with all needed services and the regional airport.

- 18 -

Map

Additional Area

We have obtained an initial permit for mining another mineral right that is located approximately two miles downstream from the mining concession described above. This mineral right has 1,310 acres, and our current authorization covers only a small part of this available surface area. We have drilled this area and identified presence of both gold and diamonds. We intend to move to this area for recovery after further exploitation of the mining concession described above. A map of this area is found below.

Map

- 19 -

Gold – Paracatu

The Paracatu project, held by our subsidiary, Jupiter Gold, consists of a mineral right for gold in this well-known gold district. This area of Brazil was settled in the early 17th century by pioneers searching for gold. Today Paracatu is home to the largest gold mine in Brazil, "Morro do Ouro" (Gold Hill), owned and operated by Kinross Gold, a large global producer. Morro do Ouro is an open-sky mine, with an ore body of 16 million ounces of gold, and annual production of 480,000 ounces, according to publicly-available information. The Paracatu project area is located only a few miles downstream from Morro do Ouro.

The Paracatu project is exploratory and Jupiter Gold intends to begin a drilling study during the second quarter of 2018.

Gold – Crixás

The Crixás project, held by our subsidiary Jupiter Gold, consists of a mineral right for gold in this well-known gold district. This area of Brazil was settled in the 18th century by pioneers searching for gold. Today Crixás is home to the some of the largest gold operations in Brazil, with large gold mines and projects from AngloGold Ashanti and Cleveland Mining. AngloGold Ashanti's operations in Crixás encompass three underground and two open sky mines, with an ore body of greater than 7 million ounces of gold and annual production of 132,000 ounces, according to publicly-available information.

The Crixás project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

Gold – Itabira

The Itabira project, held by our subsidiary Jupiter Gold, consists of a mineral right for gold in a region of Brazil near Itabira called the "Quadrilátero Ferrífero" (Iron Quandrangle) known for large iron mines as well as gold mines.

Manganese – Diamantina

The Diamantina project, held by our subsidiary, Jupiter Gold, consists of two mineral rights for manganese in the region in and surrounding Diamantina where other companies have explored for manganese.

The Diamantina project is exploratory, and Jupiter Gold intends to begin a field study in late 2018.

- 20 -

Cobalt, Copper, Nickel – Goiás

The Goiás project, held by our subsidiary Jupiter Gold, consists of two mineral rights for cobalt, copper, and nickel in the region in and surrounding Montes Claros de Goiás, where other companies have explored for these minerals, and some of the largest Brazilian reserves of nickel are located, according to publicly-available information.

The Goiás project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Lithium – Salinas

The Salinas project consists of a mineral right for lithium, aquamarine, beryl, tourmaline, granite, and feldspar in the Salinas district, where other companies have explored for these minerals.

The Salinas project is exploratory, and we intend to study the area or enter into a partnership for its study.

Gold – Serrita

The Serrita project, held by our subsidiary, Jupiter Gold, consists of three mineral rights for gold in the Serrita district, a known gold district.

The Serrita project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

Gold – Amazonas

The Amazonas project, held by our subsidiary, Jupiter Gold, consists of three mineral rights for gold in the Apui area, a known gold district.

The Amazonas project is exploratory, and Jupiter Gold intends to study the area or enter into a partnership for its study.

- 21 -

Results of Operations

Fiscal Year Ended December 31, 2017 Compared to Fiscal Year Ended December 31, 2016

In 2017, we had revenues of $43,253, as compared to revenues of $13,323 in 2016, an increase of 224.6%. The increase was primarily due to higher processing volumes, albeit mining was very limited because of capital equipment being serviced, which has since been resolved.

Our consolidated cost of goods sold in 2017 was $208,840, comprised primarily of labor and fuel expenses, as well as machine maintenance. Our consolidated cost of goods sold in 2016 was $218,245. The decrease of 4.3% between 2017 and 2016 for the consolidated cost of goods sold is explained by lower labor and fuel expenses despite higher machine maintenance expenses.

Our gross margin in 2017 was ($165,587). By comparison, our gross margin in 2016 was ($204,922). The decrease of 19.2% between 2017 and 2016 for the gross margin is explained by both higher revenues and lower cost of goods sold in 2017.

We had an aggregate of $1,129,717 in operating expense in 2017, as compared to an aggregate of $1,117,699 in operating expenses in 2016, an increase of $12,018 or 1.1%. This increase was mostly due to higher professional fees which more than offset declines in general and administrative expenses and compensation expenses.

In 2017, we had total other expenses of $508,103, as compared to $417,008 in total other expenses in 2016, an increase of $91,095 or 21.8%. This increase was mostly due to higher amortization of debt discounts and other fees, which more than offset lower interest on promissory notes and other expense.

In 2017, we experienced a net loss attributable to Brazil Minerals, Inc. of $1,691,433, as compared to a net loss attributable to Brazil Minerals, Inc. of $1,588,418 in 2016, an increase of $103,015 or 6.5%. On a per share basis (both basic and diluted), the 2017 net loss attributable to Brazil Minerals, Inc. was $0.02 versus $0.08 in 2016.

Net cash used in operating activities was $734,294 in 2017, as compared to $647,406 in 2016, an increase of $86,888 or 13.4%. Net cash used in investing activities was $37,985 in 2017, as compared to $45,883 in 2016, a decline of $7,898 or 17.2%. Net cash provided by financing activities was $852,655 in 2017, as compared to $581,277 in 2016, an increase of $271,378 or 46.7%.

Liquidity and Capital Resources

As of December 31, 2017, we had total current assets of $155,118 compared to total current liabilities of $1,610,227 for a current ratio of 0.10 to 1 and working capital of ($1,455,109). By comparison, on December 31, 2016, we had total current assets of $121,572 compared to current liabilities of $992,704 for a current ratio of 0.12 to 1 and working capital of ($871,132). In both 2017 and 2016, our principal sources of liquidity were issuances of equity and convertible debt.

We believe that financial resources and funds generated from revenues and securities sales will provide cash flow for operations. The Company has no plans for any significant cash acquisitions in 2018 or in the foreseeable future.

Off-Balance Sheet Arrangements

The Company currently has no off-balance sheet arrangements.

Critical Accounting Policies and Estimates

Our financial instruments consist of cash and cash equivalents, loans to a related party, accrued expenses, and an amount due to a director. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in our financial statements. If our estimate of the fair value is incorrect at December 31, 2017, it could negatively affect our financial position and liquidity and could result in our having understated our net loss.

Recent Accounting Pronouncements

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles. Our significant accounting policies are described in Note 1 of the financial statements. We have reviewed all recent accounting pronouncements issued to the date of the issuance of these financial statements, and we do not believe any of these pronouncements will have a material impact on us.

- 22 -

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The information to be reported under this Item is not required of smaller reporting companies.

Item 8. Financial Statements and Supplementary Data.

Our financial statements, including the notes thereto, together with the report from our independent registered public accounting firm are presented beginning at page F-1.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures

The Company's management, with the participation of the Company's Principal Executive Officer and Principal Financial Officer, has evaluated the design, operation, and effectiveness of the Company's disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act as of December 31, 2017. On the basis of that evaluation, management concluded that the Company's disclosure controls and procedures are designed, and are effective, to provide reasonable assurance that the information required to be disclosed in reports filed or submitted pursuant to the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the Commission, and that such information is accumulated and communicated to management, including its Principal Executive Officer and Principal Financial Officer as appropriate, to allow timely decisions regarding required disclosure.

(b) Management's Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). The Company's internal control system is designed to provide reasonable assurance to management and to the Company's Board of Directors regarding the preparation and fair presentation of published financial statements. Under the supervision and with the participation of management, including the Company's Principal Executive Officer and Principal Financial Officer, management conducted an evaluation of the effectiveness of the Company's internal control over financial reporting based on the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on management's evaluation under the framework in Internal Control—Integrated Framework, management concluded that the Company's internal control over financial reporting was effective as of December 31, 2017.

This Annual Report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Since the Company is a non-accelerated filer, management's report is not subject to attestation by the Company's registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002. As a result, this Annual Report contains only management's report on internal controls.

(c) Changes in Internal Control over Financial Reporting

There were no changes in the Company's internal control over financial reporting that occurred in the fourth quarter of 2017 that materially affected, or would be reasonably likely to materially affect, the Company's internal control over financial reporting.

- 23 -

(d) Limitations of the Effectiveness of Internal Controls

The effectiveness of the Company's system of disclosure controls and procedures and internal control over financial reporting is subject to certain limitations, including the exercise of judgment in designing, implementing and evaluating the control system, the assumptions used in identifying the likelihood of future events, and the inability to eliminate fraud and misconduct completely. As a result, there can be no assurance that the Company's disclosure controls and procedures and internal control over financial reporting will detect all errors or fraud. However, the Company's control systems have been designed to provide reasonable assurance of achieving their objectives, and the Company's Principal Executive Officer and Principal Financial Officer have concluded that the Company's disclosure controls and procedures and internal control over financial reporting are effective at the reasonable assurance level. The Company has utilized the 1992 Committee of Sponsoring Organizations of the Treadway Commission's internal control framework.

Item 9B. Other Information.

None.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

The following table sets forth certain information as of April 10, 2018 concerning our directors and executive officers:

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

Marc Fogassa

|

|

51

|

|

Director, Chairman, Chief Executive Officer,

President, Chief Financial Officer, Treasurer and Secretary

|

|

|

|

|

|

|

|

Ambassador Robert F. Noriega

|

|

58

|

|

Director

|

|

|

|

|

|

|

Marc Fogassa, age 51, has been a director and our Chairman and Chief Executive Officer since 2012. He is also the Chairman and CEO of Jupiter Gold Corporation, one of our subsidiaries. He has over 16 years of investment experience in venture capital, and private and public equity investing, and has served on boards of directors of multiple private companies. Mr. Fogassa has been invited numerous times to speak about investment issues, particularly as related to Brazil. Mr. Fogassa double majored at the Massachusetts Institute of Technology (M.I.T.), graduating with two Bachelor of Science degrees in 1990. He later graduated from the Harvard Medical School with a Doctor of Medicine degree in 1995, and also from the Harvard Business School with a Master in Business Administration degree in 1999. Mr. Fogassa was born in Brazil and is fluent in Portuguese and English. We appointed Mr. Fogassa as a director and our Chairman of the Board and President because of his substantial management and fundraising skills, prior experience as a director of several private companies, venture capital and private equity experience, judgment and his knowledge of, and contacts in, Brazil.

Ambassador Roger Noriega, age 58, has been a director since 2012. He has extensive experience in Latin America. Ambassador Noriega was appointed by President George W. Bush and confirmed by the U.S. Congress as U.S. Assistant Secretary of State, and served from July 2003 to October 2005. In that capacity, Ambassador Noriega managed a 3,000-person team of professionals in Washington and in 50 diplomatic posts to design and implement political and economic strategies in Canada, Latin America, and the Caribbean. Prior to this assignment, Ambassador Noriega served as U.S. Ambassador to the Organization of American States ("OAS") from August 2001 to July 2003. Since February 2009 Ambassador Noriega has been the Managing Director of Vision Americas, a Latin America-focused consulting group that he founded. Ambassador Noriega has a Bachelor of Arts degree from Washburn University of Topeka, Kansas. We appointed Ambassador Noriega as a director because of his extensive experience in Latin America, business and government contacts, management skills and judgment.

Ambassador Paul Durand was our director from 2012 to November 24, 2017 when he resigned due to illness. Ambassador Durand unfortunately died a few weeks later.

- 24 -

Board Composition

Our Board of Directors is currently composed of two members, Marc Fogassa and Ambassador Roger Noriega.

There are no family relationships among our directors and executive officers. There is no arrangement or understanding between or among our executive officers and directors pursuant to which any director or officer was or is to be selected as a director or officer, and there is no arrangement, plan, or understanding as to whether non-management shareholders will exercise their voting rights to continue to elect the current board of directors.

Our directors and executive officers have not, during the past ten years:

| · |

had any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer, either at the time of the bankruptcy or within two years prior to that time,

|

| · |

been convicted in a criminal proceeding and is not subject to a pending criminal proceeding,

|

| · |

been subject to any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any court of competent jurisdiction, permanently, or temporarily enjoining, barring, suspending, or otherwise limiting his involvement in any type of business, securities, futures, commodities, or banking activities; or

|

| · |

been found by a court of competent jurisdiction (in a civil action), the Securities Exchange Commission, or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated

|

We do not have standing audit, nominating, or compensation committees. Currently, our entire Board of Directors is responsible for the functions that would otherwise be handled by these committees.

Code of Ethics

Our Board of Directors will adopt a new code of ethics that applies to all of our directors, officers, and employees, including our principal executive officer, principal financial officer, and principal accounting officer. The new code will address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Audit Committee Financial Expert

Our Board of Directors currently acts as our audit committee. We do not currently have an independent member of our Board of Directors who qualifies as an "audit committee financial expert" as defined in Item 407(e)(5) of Regulation S-K.

Item 11. Executive Compensation.

The following table sets forth information concerning cash and non-cash compensation paid by us to our Chief Executive Officer for each of the two years ended December 31, 2016 and December 31, 2017. No other employee or independent contractor received compensation in excess of $100,000 for either of those two years.

- 25 -

Summary Compensation Table

|

Name and

Principal

Position

|

Year

Ended

|

|

Salary

($)

|

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

|

Option

Awards

|

|

|

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

|

Non-Qualified

Deferred

Compensation

Earnings

($)

|

|

|

All

Other

Compensation

($)

|

|

|

Total

($)

|

|

|||||||||||||

|

Marc Fogassa,

as CEO of

|

12/31/2016

|

|

25,000

|

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

25,000

|

|

|||||||||||

| Brazil Minerals |

12/31/2017

|

|

14,000

|

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

14,000

|

||||||||||||

Employment Agreement with Marc Fogassa

Marc Fogassa was hired by the Company as the Company's Chief Executive Officer, Chairman, Chief Financial Officer, Treasurer and Secretary under an Employment Agreement dated December 31, 2012 (the "Agreement"). Under the Agreement, Mr. Fogassa is entitled to receive a salary of $175,000 per annum; however, he has been paid less due to capital availability constraints. Mr. Fogassa is entitled to reimbursement of expenses incurred by him in the performance of his duties, a maximum allowable SEP IRA contribution, four weeks of paid vacation time, and the payment by the Company of certain insurance-related expenses. The agreement further provides that the Company shall pay to Mr. Fogassa severance in case of termination or change in control with demotion.

Director Compensation

The following table sets forth a summary of compensation for the fiscal year ended December 31, 2017 that we paid to each director other than its Chief Executive Officer, whose compensation is fully reflected in the Summary Compensation Table. We do not sponsor a pension benefits plan, a non-qualified deferred compensation plan, or a non-equity incentive plan for directors; therefore, these columns have been omitted from the following table. No other or additional compensation for services were paid to any of the directors.

Director Compensation Table

|

Name

|

Fees

Earned

or Paid

in Cash

($)

|

Option

Awards

($) (1)

|

Stock

Awards

($)

|

Total

($)

|

|||||||||

|

Roger Noriega

|

-

|

$

|

50,000

|

$

|

50,000

|

||||||||

| (1) |

The amounts in this column reflect the aggregate grant date fair value of stock options granted in 2017 to each director calculated in accordance with FASB ASC Topic 718. See the notes to our consolidated financial statements included in this Annual Report on Form 10-K for the year ended December 31, 2017 for a discussion of all assumptions made in the calculation of this amount.

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth information regarding beneficial ownership of our Common Stock and Series A Preferred Stock as of April 9, 2018 by (i) any person or group with more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and each other executive officer whose cash compensation for the most recent fiscal year exceeded $100,000 and (iv) all executive officers and directors as a group. Except as indicated in the footnotes to this table and subject to applicable community property laws, the persons named in the table to our knowledge have sole voting and investment power with respect to all shares of securities shown as beneficially owned by them. The Certificate of Designations, Preferences and Rights of our Series A Convertible Preferred provides that for so long as Series A Preferred Stock is issued and outstanding, the holders of Series A Preferred Stock shall vote together as a single class with the holders of our Common Stock, with the holders of Series A Preferred Stock being entitled to 51% of the total votes on all matters regardless of the actual number of shares of Series A Preferred Stock then outstanding, and the holders of Common Stock being entitled to their proportional share of the remaining 49% of the total votes based on their respective voting power.

- 26 -

|

|

|

|

|

|

|

Percentage of Voting Power

|

|

|||||||

|

|

|

|

|

Shares Beneficially

|

|

|

|

|

|

of all Outstanding Classes

|

|

|||

|

Name and Address (1)

|

|

Office

|

|

Owned (2)

|

|

|

Percent of Class (3)

|

|

|

of Company Stock (4)

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marc Fogassa

|

|

Director, Chairman, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer

|

|

|

114,063,961

|

(5)

|

|

|

44.5%

|

|

|

|

21.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ambassador Roger Noriega

|

|

Director

|

|

|

13,369,897

|

(7)

|

|

|

7.3%

|

|

|

3.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (2 people)

|

|

|

|

|

127,433,858

|

(5)(6)(7)

|

|

|

47.2%

|

|

|

|

23.1%

|

|

|

Lancaster Brazil Fund L.P.

|

|

|

|

|

25,000,000

|

(8) |

|

|

14.7%

|

|

|

|

7.2%

|

|

|

Benjamin Khowong

|

|

|

|

|

9,636,364

|

|

|

5.7%

|

|

|

|

2.8%

|

||

|

Series A Stock

|

|

|

|

|

|

|

|

|

|

|

|