Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - SIEBERT FINANCIAL CORP | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - SIEBERT FINANCIAL CORP | ex31_1.htm |

| EX-21.1 - EXHIBIT 21.1 - SIEBERT FINANCIAL CORP | ex21_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended: December 31, 2017

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from______________to________________

Commission file number 0-5703

Siebert Financial Corp. (Exact name of registrant as specified in its charter) |

| New York | 11-1796714 |

| (State or other

jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| 120 Wall Street,

New York, NY (Address of principal executive offices) |

10005 (Zip Code) |

| (212) 644-2400 | ||

| Registrant’s telephone number, including area code | ||

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

| COMMON STOCK, PAR VALUE $.01 PER SHARE | THE NASDAQ CAPITAL MARKET |

Securities registered under Section 12(g) of the Exchange Act:

NONE

(Title of class)

Indicate by check mark if the registrant is a well- known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

The aggregate market value of the Common Stock held by non-affiliates of the registrant (based upon the last sale price of the Common Stock reported on the NASDAQ Capital Market as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2017), was $8,265,501.

The number of shares of the registrant’s outstanding Common Stock, as of March 31, 2018, was 27,157,188 shares.

Documents Incorporated by Reference: None.

Special Note Regarding Forward-Looking Statements

Statements in this Annual Report on Form 10-K, as well as oral statements that may be made by the Company or by officers, directors or employees of the Company acting on the Company’s behalf, that are not statements of historical or current fact constitute “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve risks and uncertainties and known and unknown factors that could cause the actual results of the Company to be materially different from historical results or from any future results expressed or implied by such forward looking statements, including without limitation: changes in general economic and market conditions; changes and prospects for changes in interest rates; fluctuations in volume and prices of securities; changes in demand for brokerage services; competition within and without the brokerage business, including the offer of broader services; competition from electronic discount brokerage firms offering greater discounts on commissions than the Company; the prevalence of a flat fee environment; the method of placing trades by the Company’s customers; computer and telephone system failures; the level of spending by the Company on advertising and promotion; trading errors and the possibility of losses from customer non-payment of amounts due; other increases in expenses and changes in net capital or other regulatory requirements. We undertake no obligation to publicly release the results of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date when such statements were made or to reflect the occurrence of unanticipated events. An investment in us involves various risks, including those mentioned above and those which are detailed from time to time in our Securities and Exchange Commission filings.

| 2 |

PART I

Item 1. BUSINESS

General

Siebert Financial Corp., a New York corporation, incorporated in 1934, is a holding company that conducts its retail discount brokerage (“SFC”, “Siebert” or the “Company”) business through its wholly-owned subsidiary, Muriel Siebert & Co., Inc., (“MSCO”) a Delaware corporation and a registered broker-dealer, and its investment advisory business through its wholly-owned subsidiary Siebert AdvisorNXT, Inc. (“AdvisorNXT”) a New York corporation which is registered with the Securities and Exchange Commission as a Registered Investment Advisor (“RIA”) under the Investment Advisers Act of 1940, as amended. We terminated the registration of our former RIA subsidiary, Siebert Investment Advisors in 2017. For purposes of this Annual Report on Form 10-K, the terms “Siebert,” “Company,” “we,” “us” and “our” refer to Siebert Financial Corp., MSCO and AdvisorNXT collectively, unless the context otherwise requires.

Our principal offices are located at 120 Wall Street, New York, New York 10005, and our phone number is (212) 644-2400. Our Internet address is www.siebertnet.com. Our SEC filings are available through our website at www.siebertnet.com, where you are able to obtain copies of the Company’s public filings free of charge. Our common stock, par value $.01 per share (the “Common Stock”) trades on the NASDAQ Capital Market under the symbol “SIEB.”

In December 2016, pursuant to the terms of an Acquisition Agreement, dated September 1, 2016, as amended (the “Acquisition Agreement”) by and among SFC, Kennedy Cabot Acquisition, LLC (“KCA”), a Nevada limited liability company and the Estate of Muriel F. Siebert (the “Majority Shareholder”), KCA acquired 677,283 shares of Common Stock in a cash tender offer and 19,310,000 shares of Common Stock owned by the Majority Shareholder (the “Acquisition”). As a result of the Acquisition, effective December 16, 2016, KCA became the owner of approximately 90% of the Company’s outstanding Common Stock in accordance with Rule 144. Since December 2016 KCA has distributed approximately 15,000,000 of the shares of our restricted Common Stock that it acquired to its members. See discussion under “Historical Developments - Change in Control.”

Effective December 16, 2016, upon the closing of the Acquisition Agreement, the prior directors resigned as directors and Gloria E. Gebbia, Charles A. Zabatta, Francis Cuttita and Andrew H. Reich were appointed as directors. Effective December 29, 2016, Jerry Schneider, CPA, was appointed as a director of the Company and Chairman of the Audit Committee.

Effective February 7, 2017, John J. Gebbia, Gloria E. Gebbia’s husband, was appointed as an unsalaried special advisor to the Company’s board of directors. John J. Gebbia commenced his employment in the brokerage industry in 1959. In 1962, Mr. Gebbia became an executive vice president of Walston & Company. After becoming CEO of Jesup & Lamont, an institutional brokerage firm, Mr. Gebbia purchased the company in 1983. Thereafter, Mr. Gebbia owned or controlled various brokerage firms including Kennedy Cabot & Co. which was sold in 1997 to Toronto Dominion Bank for $160,000,000. Mr. Gebbia through the Gebbia Family controlled various companies in the insurance, sports management and home building industries.

Following the Acquisition, the Company’s new owners and management have been focusing on improving the Company’s results of operations by reducing costs, introducing new products and developing new business opportunities.

Recent Developments

As previously disclosed in a Current Report on Form 8-K, filed on June 28, 2017, SFC, MSCO, and StockCross Financial Services, Inc. (“StockCross”), entered into an Asset Purchase Agreement, dated June 26, 2017 (the “Agreement”), pursuant to which MSCO acquired certain retail broker-dealer assets of StockCross (the “Assets”). StockCross is a self-clearing discount broker that has may business lines that are similar to MSCO’s. StockCross is an affiliate of the Company which is controlled by the Gebbia family.

| 3 |

The Asset acquisition was completed during the last quarter of 2017 and as consideration for the Assets, SFC issued 5,072,062 shares of its restricted Common Stock to StockCross. The shares of restricted Common Stock issued to StockCross are subject to a two year lock-up period during which StockCross may not sell or transfer the shares except to its shareholders provided that any such shares transferred to StockCross’ shareholders remain subject to the lock-up restrictions.

In connection with the Asset acquisition, MSCO and StockCross entered into a clearing agreement pursuant to which StockCross acts as one of MSCO’s clearing brokers, with respect to certain accounts transferred from StockCross to MSCO in the Asset acquisition.

Exclusive Financial Services Advertising Agreement

In February 2018, the Company entered into an exclusive financial services advertising agreement (the “Advertising Agreement”) with tZERO, Inc., the fintech subsidiary of Overstock.com, Inc. (Nasdaq symbol: OSTK)(“Overstock”) and Speedroute LLC, the routing services subsidiary tZERO, for the advertisement of MSCO’s retail brokerage services, including discounted online trading, on the Overstock FinanceHubTM website.

The Overstock website allows any investor in America who accesses the MSCO portal through FinanceHubTM the opportunity to conduct trades in US equities at discounted prices. Members of Overstock’s Club O Gold loyalty club will be charged $1.99 per trade, while non-Club O Gold members will be charged $2.99 per trade through the platform FinanceHubTM.

Pursuant to the Advertising Agreement, MSCO and Speedroute will share revenue generated from trades by investors who become MSCO customers through FinanceHubTM. New and existing customers utilizing the portal gain access to an array of Siebert retail brokerage products and services.

Through the Advertising Agreement, management believes that MSCO will gain online visibility to millions of Overstock customers for MSOC’s discount trading platform, while benefitting from tZERO’s digital and technological expertise.

MSCO commenced generating new accounts through the Advertising Agreement during the first quarter of 2018 and MSCO expects the Advertising Agreement to produce additional new accounts and business going forward.

Acquisition of Insurance Company

As of March 1, 2018, SFC reached an agreement in principal to acquire all of the issued and outstanding shares of Park Wilshire Companies, Inc. (“Park Wilshire”) from its owners, Messrs. David, Richard and John M. Gebbia. Park Wilshire will be a wholly owned subsidiary of the Company. The proposed acquisition was approved by SFC’s board of directors. In addition, the board’s Audit Committee reviewed the transaction and determined that the Company’s purchase of Park Wilshire was not material and that obtaining valuations under the circumstances where the purchase price equaled the cash on hand in Park Wilshire’s bank account(s) (and there being no liabilities) did not necessitate a valuation, as same was not material.

The proposed purchase price for Park Wilshire is the amount of cash held in Park Wilshire’s bank account which was estimated at approximately $111,000 on February 28, 2018. In addition, the sellers further agreed to indemnify and hold the Company harmless from all liability attendant to the prior business activities of Park Wilshire. David J. Gebbia will continue as the unpaid CEO of Park Wilshire.

Following the purchase of Park Wilshire, SFC intends to operate Park Wilshire as a wholly owned subsidiary and to develop its insurance business activities particularly in fixed annuities. To date there have been no insurance commissions or fees earned.

Cost Improvement Efforts

Steps taken to increase cost efficiencies during 2017 include closing the Company’s offices located at 885 Third Avenue, New York, NY at the end of the lease for that location and relocating most of the functions that were located there to newly leased space at 15 Exchange Place, Suite 615, Jersey City, New Jersey 07302 and moving our principal executive offices to a space located at 120 Wall Street, New York, New York 10005.

| 4 |

Our management is continuing its analysis of various vendor contracts with a view to reducing costs, increasing revenue and building new technological infrastructure to serve its customers as new fintech is introduced to the securities industry.

In connection with such analysis and determination, Richard Gebbia and John M. Gebbia, Gloria E. Gebbia’s sons, have both become registered as general securities principals of MSCO and remain in their executive roles at StockCross. Richard Gebbia is a Director and the CEO and President of StockCross and John M. Gebbia is a Director and the Executive Vice President of StockCross.

New Advisory Platform

The Company’s RIA, AdvisorNXT, has commenced marketing in the first quarter of 2018 of its “Robo” investment advisor platform which utilizes a proprietary trading algorithm licensed from an affiliate, KCA Technologies, LLC (“KCA Technologies”), a wholly-owned subsidiary of KCA.

The Company believes that its Robo investment advisor platform will provide clients with a cost-efficient, competitively priced, easy to use automated wealth management solution intended to maximize portfolio returns based on a client’s specific risk tolerance. The platform utilizes Nobel Prize winning Modern Portfolio Theory techniques to create optimal portfolios for each client. AdvisorNXT will provide web and smartphone based tools to enable clients that have established advisory accounts with AdvisorNXT to monitor and interact with the Robo investment advisor platform’s automated portfolio manager application. The Company believes that its customers will be interested in the Robo investment advisor platform’s advisory and investment services that replace the subjective personal choices of trading with non-subjective algorithmic based and directed trading replacing human bias and subjective determinations with non-emotional calculable precision. In addition, it is intended that clients utilizing the Robo investment advisor platform will also have access to traditional wealth managers to either enhance or replace the Robo investment advisor platform where appropriate.

Modern Portfolio Theory optimizes expected portfolio returns for specific levels of risk. The technique is referred to as Mean Variance Optimization (MVO) and it requires a series of highly complicated calculations in which all possible combinations of the potential asset classes are evaluated to determine the optimal blend of allocations for each individual client. Due to the complexity of the analysis, services like this have historically only been available to clients with large account balances who were willing to pay high fees in excess of 1% of assets under management. By combining state-of-the-art technology with rigorous quantitative research, we intend to provide the same quality of service to clients with smaller account sizes at lower cost.

Research shows that historically, risk-optimized, diversified portfolios containing uncorrelated asset classes outperform individual holdings. The Robo investment advisor platform selects low-cost, well-managed exchange traded funds (ETF’s) and exchanged trade notes (ETN’s) that represent the asset classes that we believe will provide our clients the necessary risk-adjusted exposure given current market conditions. In order to determine a client’s risk tolerance, a prospective client answers a series of objective questions posed in the form of an interactive digital interview. Once a client’s risk tolerance is determined, the Robo investment advisor platform algorithm will utilize “Modern Portfolio Theory” to create a theoretically optimal allocation across a diverse selection of assets classes, thus tailoring a portfolio to a client’s specific investment objectives and risk tolerance. The Robo investment advisor platform program will continuously monitor client accounts and periodically adjust portfolios to address changes in market and economic conditions.

The Robo investment advisor platform is in beta testing. The costs of developing the Robo investment advisor platform to date have been borne by KCA and KCA Technologies and the Company expects that licensing and related fees and expenses will be charged by KCA and KCA Technologies to AdvisorNXT. Although specific licensing and related fees and expenses have not yet been determined, they are expected to be consistent with industry norms.

| 5 |

Business Overview

Muriel Siebert & Co., Inc.

Discount Brokerage and Related Services. MSCO became a discount broker on May 1, 1975 and MSCO has been in business and a member of The New York Stock Exchange, Inc. (the “NYSE”) longer than any other discount broker. In 1998, MSCO began to offer its customers access to their accounts through SiebertNet, its Internet website. MSCO’s focus in its discount brokerage business is to serve retail clients seeking a wide selection of quality investment services, including traditional trading through a broker on the telephone, through a wireless device or via the Internet, at commissions that are substantially lower than those of full-commission firms. MSCO clears a part of its securities transactions on a fully disclosed basis through National Financial Services Corp. (“NFS”), a wholly owned subsidiary of Fidelity Investments. MSCO’s contract with NFS expired this past summer. Management intends to negotiate a new contract with NFS and management expects to realize economic benefit if and assuming, of which no assurance can be given, a new contract with NFS is finalized. MSCO also clears a part of its securities transactions on a fully disclosed basis through its affiliate StockCross.

MSCO serves customers who generally make their own equity investment decisions and seeks to assist its customers in their investment decisions by offering a number of value added services, including easy access to account information. MSCO’s representatives are available to assist customers with information via toll-free 800 service Monday through Friday between 7:30 a.m. and 7:30 p.m. Eastern Time. Customers also have 24-hour access to MSCO’s services through wireless devices and over the Internet through SiebertNet.

Independent Retail Execution Services. MSCO, and its clearing firms, StockCross and NFS monitor order flow in an effort to ensure that customers are getting the best possible trade executions. MSCO does not make markets in securities, nor does it take positions against customer orders.

MSCO’s equity orders are routed by NFS and StockCross in a manner intended to afford MSCO’s customers the opportunity for price improvement on all orders. MSCO also offers customers execution services through various market centers for an additional fee, providing customers access to numerous market centers before and after regular market hours.

Customers may also indicate online interest in buying or selling fixed income securities, including municipal bonds, corporate bonds, mortgage-backed securities, government sponsored enterprises, unit investment trusts or certificates of deposit. These transactions are serviced by MSCO’s registered representatives.

Retail Customer Service. Siebert believes that superior customer service enhances its ability to compete with larger discount brokerage firms and therefore provides retail customers with personal service via toll-free access to dedicated customer support personnel for all of its products and services. Customer service personnel are located in each of Siebert’s offices. Siebert has retail offices in Jersey City, New Jersey, Boca Raton, Florida, Beverly Hills, Calabasas and Seal Beach, California, Dallas and Houston, Texas, Horsham, Pennsylvania, and New York, New York. Siebert uses a proprietary Customer Relationship Management System that enables representatives, no matter where located, to view a customer’s service requests and the response thereto. Siebert’s telephone system permits the automatic routing of calls to the next available qualified agent having the appropriate skill set.

Retirement Accounts. Siebert offers customers a variety of self-directed retirement accounts for which it acts as agent on all transactions. Custodial services are provided through an affiliate of NFS and StockCross, the firm’s clearing agents, who also serve as trustees for such accounts. Each IRA, SEP IRA, ROTH IRA, 401(k) and KEOGH account can be invested in mutual funds, stocks, bonds and other investments in a consolidated account.

Customer Financing. Customer margin accounts are carried through NFS and StockCross who lend customers a portion of the market value of certain securities held in the customer’s account. Margin loans are collateralized by these securities. Customers also may sell securities short in a margin account, subject to minimum equity and applicable margin requirements, and the availability of such securities to be borrowed. In permitting customers to engage in margin, short sale or any other transaction, Siebert assumes the risk of its customers’ failure to meet their obligations in the event of adverse changes in the market value of the securities positions. Siebert, NFS and StockCross reserve the right to set margin requirements higher than those established by the Federal Reserve Board.

| 6 |

MSCO has established policies with respect to maximum purchase commitments for new customers or customers with inadequate collateral to support a requested purchase. Managers have some flexibility in the allowance of certain transactions. When transactions occur outside normal guidelines, Siebert monitors accounts closely until their payment obligations are completed; if the customer does not meet the commitment, Siebert takes steps to close out the position and minimize any loss. In the last five years, Siebert has not had any significant losses as a result of customers failing to meet commitments.

Information and Communications Systems. MSCO relies heavily on the data technology platform provided by its clearing agents, NFS and StockCross. These platforms offer interfaces to NFS’ and StockCross’ service provider’s main frame computing system where all customer account records are kept and is accessible through Siebert’s data technology platform. Siebert’s systems also utilize browser based access and other types of data communications. Siebert’s representatives use NFS systems, by way of Siebert’s data technology platform, to perform daily operational functions which include trade entry, trade reporting, clearing related activities, risk management and account maintenance.

Siebert’s data technology platform offers services used in direct relation to customer related activities as well as support for corporate use. Some of these services include email and messaging, market data systems and third party trading systems, business productivity tools and customer relationship management systems. Siebert’s offices are connected to the office in Jersey City, New Jersey. Siebert’s data network is designed with redundancy in case a significant business disruption occurs.

Siebert’s voice network offers a call center feature that can route and queue calls for certain departments within the organization. Additionally, the system’s call manager offers reporting and tracking features which enable staff to determine how calls are being managed, such as time on hold, call duration and total calls by agent.

To ensure reliability and to conform to regulatory requirements related to business continuity, Siebert maintains backup systems and backup data. However, in the event of a wide-spread disruption, such as a massive natural disaster, Siebert’s ability to satisfy the obligations to customers and other securities firms could be significantly hampered or completely disrupted. For more information regarding MSCO’s Business Continuity Plan, please review the Business Continuity Statement on our website at www.siebertnet.com or write to us at Muriel Siebert & Co., Inc., Compliance Department, 15 Exchange Place, Jersey City, NJ 07302.

Website. The MSCO website has design, navigation, and functionality features such as:

| ▪ | Informative trading screens: Customers can stay in touch while trading, double-check balances, positions and order status, see real time quotes, intraday and annual charts and news headlines – automatically – as they place orders. |

| ▪ | Multiple orders: Customers can place as many as 10 orders at one time. |

| ▪ | Tax-lot trading: Our online equity order entry screen allows customers to specify tax lots which display with cost basis and current gain/loss on a real-time positions page. |

| ▪ | Trailing stop orders: Customers can enter an order that trails the market as a percentage of share price or with a flat dollar value and the system will execute their instructions automatically. |

| ▪ | Contingent orders: Customers can place One-Triggers-Two Bracket and One-Cancels-Other Bracket orders. |

MSCO receives order flow payments from market participants in conformity with industry practices, providing best execution for its customers.

Advertising, Marketing and Promotion

Siebert develops and maintains its retail customer base through its reputation and social media. Additionally, a significant number of the firm’s new accounts are developed directly from referrals by satisfied customers. The Company expects that the exclusive advertising relationship with Overstock will result in a material number of new accounts.

| 7 |

Competition

MSCO encounters significant competition from full-comission, online and discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations, many of which are significantly larger and better capitalized than Siebert. Although there has been consolidation in the industry in both the online and traditional brokerage business during recent years, Siebert believes that additional competitors such as banks, insurance companies, providers of online financial and information services and others will continue to be attracted to the online brokerage industry. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than Siebert. Some of these firms are offering their services over the Internet and have devoted more resources to and have more elaborate websites than Siebert. Siebert competes with a wide variety of vendors of financial services for the same customers. Siebert believes that its main competitive advantages are high quality customer service, responsiveness, cost and products offered, the breadth of product line and excellent executions.

Regulation

The securities industry in the United States is subject to extensive regulation under both Federal and state laws. The Securities and Exchange Commission (“SEC”) is the Federal agency charged with administration of the Federal securities laws. MSCO is registered as a broker-dealer with the SEC, and is a member of the New York Stock Exchange (“NYSE”) and the Financial Industry Regulatory Authority (“FINRA”). Much of the regulation of broker-dealers has been delegated to self-regulatory organizations, principally FINRA and national securities exchanges such as the NYSE, which is MSCO’s primary regulator with respect to financial and operational compliance. These self-regulatory organizations adopt rules (subject to approval by the SEC) governing the industry and conduct periodic examinations of broker-dealers. Securities firms are also subject to regulation by state securities authorities in the states in which they do business. MSCO is registered as a broker-dealer in 50 states, and the District of Columbia.

The principal purpose of regulation and discipline of broker-dealers is the protection of customers and the securities markets, rather than protection of creditors and stockholders of broker-dealers. The regulations to which broker-dealers are subject cover all aspects of the securities business, including training of personnel, sales methods, trading practices among broker-dealers, uses and safekeeping of customers’ funds and securities, capital structure of securities firms, record keeping, fee arrangements, disclosure to clients, and the conduct of directors, officers and employees. Additional legislation, changes in rules promulgated by the SEC and by self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules may directly affect the method of operation and profitability of broker-dealers. The SEC, self-regulatory organizations and state securities authorities may conduct administrative proceedings which can result in censure, fine, cease and desist orders or suspension or expulsion of a broker-dealer, its officers or its employees.

As a registered broker-dealer and FINRA member organization, MSCO is required by Federal law to belong to the Securities Investor Protection Corporation (“SIPC”) which provides, in the event of the liquidation of a broker-dealer, protection for securities held in customer accounts held by the firm of up to $500,000 per customer, subject to a limitation of $250,000 on claims for cash balances. SIPC is principally funded through assessments on registered broker-dealers. In addition, MSCO’s clearing firm NFS, has purchased from private insurers additional account protection in the amount of $1 billion dollars in the event of liquidation up to the net asset value, as defined, of each account. MSCO’s other clearing firm, StockCross, maintains $50 million dollars additional account protection above SIPC coverage. Equities, bonds, mutual funds and money market funds are included at net asset value for purposes of SIPC protection and the additional protection. Neither SIPC protection nor the additional protection insures against fluctuations in the market value of securities.

MSCO is also authorized by the Municipal Securities Rulemaking Board (the “MSRB”) to effect transactions in municipal securities on behalf of its customers and has obtained certain additional registrations with the SEC and state regulatory agencies necessary to permit it to engage in certain other activities incidental to its brokerage business.

Margin lending arranged by MSCO through third parties is subject to the margin rules of the Board of Governors of the Federal Reserve System and the NYSE. Under such rules, broker-dealers are limited in the amount they may lend in connection with certain purchases and short sales of securities and are also required to impose certain maintenance requirements on the amount of securities and cash held in margin accounts. In addition, those rules and rules of the Chicago Board Options Exchange govern the amount of margin customers must provide and maintain in writing uncovered options.

| 8 |

AdvisorNXT Group is registered with the SEC as an investment adviser pursuant to the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Advisers Act, together with the SEC’s regulations and interpretations thereunder, is a highly prescriptive regulatory statute. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from fines and censures to termination of an adviser’s registration and, in the case of willful violations, can refer a matter to the Unites States Department of Justice for criminal prosecution.

Under the Advisers Act, an investment adviser (whether or not registered under the Advisers Act) owes fiduciary duties to its clients. These duties impose standards, requirements and limitations on, among other things, trading for proprietary, personal and client accounts; allocations of investment opportunities among clients; use of “soft dollars,” a practice that involves using client brokerage commissions to purchase research or other services that help managers make investment decisions; execution of transactions; and recommendations to clients.

As a RIA, AdvisorNXT is subject to additional requirements that cover, among other things, disclosure of information about its business to clients; maintenance of written policies and procedures; maintenance of extensive books and records; restrictions on the types of fees AdvisorNXT may charge; custody of client assets; client privacy; advertising; and solicitation of clients. The SEC has legal authority to inspect any investment adviser and typically inspects a registered adviser periodically to determine whether the adviser is conducting its activities in compliance with (i) applicable laws and regulations, (ii) disclosures made to clients and (iii) adequate systems, policies and procedures reasonably designed to prevent and detect violations.

Under the Advisers Act, AdvisorNXT’s investment management agreements may not be assigned without the client’s consent. The term “assignment” is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a controlling interest in AdvisorNXT.

Section 28(e) of the Exchange Act provides a “safe harbor” to investment managers who use commission dollars generated by their advised accounts to obtain investment research and brokerage services that provide lawful and appropriate assistance to the manager in the performance of investment decision-making responsibilities. AdvisorNXT, as a matter of policy, does not use “soft dollars” and so it has no incentive to select or recommend a broker or dealer based on any interest in receiving research or related services. Rather, AdvisorNXT when not using its affiliates, selects brokers based on its clients’ interests in receiving best execution.

Net Capital Requirements

As a registered broker-dealer MSCO is subject to the requirements of the Securities Exchange Act of 1934 (the “Exchange Act”) relating to broker-dealers, including, among other things, minimum net capital requirements under the SEC Uniform Net Capital Rule (Rule 15c3-1), “best execution” requirements for client trades under SEC guidelines and FINRA rules and segregation of fully paid client funds and securities under the SEC Customer Protection Rule (Rule 15c3-3), administered by the SEC and FINRA.

Net capital rules are designed to protect clients, counterparties and creditors by requiring a broker-dealer to have sufficient liquid resources available to satisfy its financial obligations. Net capital is a measure of a broker-dealers readily available liquid assets, reduced by its total liabilities other than approved subordinated debt. Under the Uniform Net Capital Rule, a broker-dealer may not repay any subordinated borrowings, pay cash dividends or make any unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount below required levels. Failure to maintain the required regulatory net capital may subject a firm to suspension or expulsion by the NYSE and FINRA, certain punitive actions by the SEC and other regulatory bodies which ultimately could require a firm’s liquidation.

Under applicable regulations, MSCO is required to maintain regulatory net capital of at least $250,000. At December 31, 2017 MSCO had net capital of $4,439,000. At December 31, 2016 MSCO had net capital of $1,100,000. During the last quarter of 2016 the Company paid cash dividends of approximately $4.5 million to its shareholders. The source of the dividend payment was MSCO. The Company paid no dividends in 2017. MSCO claims exemption from the reserve requirement under Section 15c3-3(k)(2)(ii).

| 9 |

As explained in SEC guidelines and FINRA rules, brokers are required to seek the “best execution” reasonably available for their clients’ orders. In part, this requires brokers to use reasonable diligence so that the price to the client is as favorable as possible under prevailing market conditions. MSCO sends client orders to a number of market centers, including market makers and exchanges, which encourages competition and ensures redundancy. For non-directed client orders, it is our policy to route orders to market centers based on a number of factors that are more fully discussed in the Supplemental Materials of FINRA Rule 5310, including, where applicable, but not necessarily limited to, speed of execution, price improvement opportunities, differences in price disimprovement, likelihood of executions, the marketability of the order, size guarantees, service levels and support, the reliability of order handling systems, client needs and expectations, transaction costs and whether the firm will receive remuneration for routing order flow to such market centers. Price improvement is available under certain market conditions and for certain order types and we regularly monitor executions to test for such improvement if available.

Cybersecurity

Cybersecurity presents significant challenges to the business community in general, as well as to the financial services industry. Increasingly, bad actors, both domestically and internationally, attempt to steal personal data and/or interrupt the normal functioning of businesses through accessing individuals’ and companies’ files and equipment connected to the Internet. Recent incidents have reflected the increasing sophistication of intruders and their intent to steal personally identifiable information as well as funds and securities sometimes through instructions seemingly from authorized parties but in fact from parties intent on attempting to steal and in other instances through bypassing normal safeguards and disrupting or stealing significant amounts of information and then either releasing it to the internet in general or holding it for ransom. Regulators are increasingly requiring companies to provide increased levels of sophisticated defenses. The Company maintains vigilance and ongoing planning and systems to prevent any such attack from disrupting its services to clients as well as to prevent any loss of data concerning its clients, their financial affairs, as well as Company privileged information. The Company has contracted vendors to oversee detection and defense from such attacks. See “Risk Factors – The Company may be exposed to damage to its business or its reputation by cybersecurity breaches” in Item 1A.

Employees

As of March 2018, we had approximately 80 employees, one of whom was a corporate officer. None of our employees are represented by a union, and we believe that relations with our employees are good.

Historical Developments

Former Capital Markets Division

Prior to November 2014, we operated a division referred to as Siebert Capital Markets Group (“SCM”), through which the Company acted as a co-manager, underwriting syndicate member, or selling group member on a wide spectrum of securities offerings for corporations and Federal agencies and we held a 49% membership interest in Siebert Brandford Shank & Co., LLC (“SBS”). The principal activities of SBS were municipal investment banking.

On November 9, 2015, the Company sold its 49% membership investment in SBSF back to SBSF for $8,000,000 of which $4,000,000 was paid in cash and the balance of which was paid in the form of a secured junior subordinated promissory note of $4,000,000 (the “SBSF Junior Note”). The sale of the investment in SBSF, which was accounted for by the equity method, represented a strategic shift for the Company based on its significance to the Company’s financial condition and results of operations and the major effect it had on the Company’s operations and financial results and, accordingly, the Company’s share of operating results of the investment were reflected as discontinued operations in the 2015 statement of operations. The investment was sold for approximately $448,000 less than the carrying value of the investment at November 9, 2015, after adjusting the carrying value of the investment for the Company’s equity in SBSF’s results of operations through such date.

The Company no longer has a relationship with its former affiliate, Siebert Cisneros Shank Financial, LLC.

| 10 |

Change in Control

In December 2016, pursuant to the terms of an acquisition agreement, dated September 1, 2016 (the “Acquisition Agreement”), by and among the Company, Kennedy Cabot Acquisition, LLC (“KCA”), a Nevada limited liability company and the Estate of Muriel F. Siebert (the “Majority Shareholder”), KCA acquired 677,283 shares of Common Stock in a cash tender offer (the “Tender Offer Shares”) and 19,310,000 shares of Common Stock owned by the Majority Shareholder (the “Majority Shares”). As a result of the acquisition of the Tender Offer Shares and Majority Shares, effective December 16, 2016, KCA became the owner of 19,987,283 shares of Common Stock representing approximately 90% of the Company’s outstanding Common Stock.

The purchase price paid by KCA in the tender offer to the minority shareholders for the Tender Offer Shares was approximately $812,740. The purchase paid by KCA to the Majority Shareholder for the Majority Shares was approximately $6,994,342 (the “Majority Share Purchase Price”).

In addition, pursuant to the Acquisition Agreement, SFC’s Board of Directors declared a special dividend in the amount of $.20 per share of outstanding Common Stock (an aggregate of $4,492,735) payable on October 24, 2016, to the shareholders of record on October 13, 2016.

In accordance with the Acquisition Agreement, pursuant to the terms of an assignment agreement (the “Assignment”) dated December 16, 2016, SFC assigned to the Majority Shareholder, among other things, all of SFC’s rights to receive the remaining amounts of the SBSF Receivables and the remaining amounts payable pursuant to the SBSF Junior Note. The Company received approximately $610,000 from the Majority Shareholder to adjust for the non-Estate controlled shares.

| Item1A. | RISK FACTORS |

Securities market volatility and other securities industry risk could adversely affect our business

Most of our revenues are derived from our securities brokerage business. Like other businesses operating in the securities industry, our business is directly affected by volatile trading markets, fluctuations in the volume of market activity, economic and political conditions, upward and downward trends in business and finance at large, legislation and regulation affecting the national and international business and financial communities, currency values, inflation, market conditions, the availability and cost of short-term or long-term funding and capital, the credit capacity or perceived credit-worthiness of the securities industry in the marketplace and the level and volatility of interest rates. We also face risks relating to trading losses, losses resulting from the ownership or underwriting of securities, counterparty failure to meet commitments, customer fraud, employee fraud, issuer fraud, errors and misconduct, failures in connection with the processing of securities transactions and litigation. A reduction in our revenues or a loss resulting from our ownership of securities or sales or trading of securities could have a material adverse effect on our business, results of operations and financial condition. In addition, as a result of these risks, our revenues and operating results may be subject to significant fluctuations from quarter to quarter and from year to year.

Lower price levels in the securities markets may reduce our profitability.

Lower price levels of securities may result in (i) reduced volumes of securities, options and futures transactions, with a consequent reduction in our commission revenues, and (ii) losses from declines in the market value of securities we hold in investment. In periods of low volume, our levels of profitability are further adversely affected because certain of our expenses remain relatively fixed. Sudden sharp declines in market values of securities and the failure of issuers and counterparties to perform their obligations can result in illiquid markets which, in turn, may result in our having difficulty selling securities. Such negative market conditions, if prolonged, may lower our revenues. A reduction in our revenues could have a material adverse effect on our business, results of operations and financial condition.

There is intense competition in the brokerage industry.

We encounter significant competition from full-commission, online and other discount brokerage firms, as well as from financial institutions, mutual fund sponsors and other organizations many of which are significantly larger and better capitalized than we are. Over the past several years, price wars and lower commission rates in the discount brokerage business in general have strengthened our competitors. We believe that such changes in the industry will continue to strengthen existing competitors and attract additional competitors such as banks, insurance companies, providers of online financial and information services, and others. Many of these competitors are larger, more diversified, have greater capital resources, and offer a wider range of services and financial products than we do. We compete with a wide variety of vendors of financial services for the same customers. We may not be able to compete effectively with current or future competitors.

| 11 |

Some competitors in the discount brokerage business offer services which we may not. In addition, some competitors have continued to offer flat rate execution fees that are lower than some of our published rates. Industry-wide changes in trading practices are expected to cause continuing pressure on fees earned by discount brokers for the sale of order flow. Continued or increased competition from ultra-low cost, flat fee brokers and broader service offerings from other discount brokers could limit our growth or lead to a decline in our customer base which would adversely affect our business, results of operations and financial condition.

Failure to protect client data or prevent breaches of our information systems could expose us to liability or reputational damage.

We are dependent on information technology networks and systems to securely process, transmit and store electronic information and to communicate among our locations and with our clients and vendors. As the breadth and complexity of this infrastructure continues to grow, the potential risk of security breaches and cyber-attacks increases. As a financial services company, we are continuously subject to cyber-attacks by third parties. Any such security breach could lead to shutdowns or disruptions of our systems and potential unauthorized disclosure of confidential information. In addition, vulnerabilities of our external service providers and other third parties could pose security risks to client information. The secure transmission of confidential information over public networks is also a critical element of our operations.

In providing services to clients, we manage, utilize and store sensitive and confidential client data, including personal data. As a result, we are subject to numerous laws and regulations designed to protect this information, such as U.S. federal and state laws governing the protection of personally identifiable information. These laws and regulations are increasing in complexity and number, change frequently and sometimes conflict. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to client data, or otherwise mismanages or misappropriates that data, we could be subject to significant monetary damages, regulatory enforcement actions, fines and/or criminal prosecution in one or more jurisdictions. Unauthorized disclosure of sensitive or confidential client data, whether through systems failure, employee negligence, fraud or misappropriation, could damage our reputation and cause us to lose clients. Similarly, unauthorized access to or through our information systems, whether by our employees or third parties, including a cyber-attack by third parties who may deploy viruses, worms or other malicious software programs, could result in negative publicity, significant remediation costs, legal liability, and damage to our reputation and could have a material adverse effect on our results of operations. In addition, our liability insurance might not be sufficient in type or amount to cover us against claims related to security breaches, cyber-attacks and other related breaches.

The Company may be exposed to damage to its business or its reputation by cybersecurity breaches.

As the world becomes more interconnected through the use of the Internet and users rely more extensively on the Internet and the cloud for the transmission and storage of data, such information becomes more susceptible to incursion by hackers and other parties intent on stealing or destroying data on which the Company or customers of MSCO and AdvisorNXT rely. We face an evolving landscape of cybersecurity threats in which hackers use a complex array of means to perpetrate cyber-attacks, including the use of stolen access credentials, malware, ransomware, phishing, structured query language injection attacks, and distributed denial-of-service attacks, among other means. These cybersecurity incidents have increased in number and severity and it is expected that these trends will continue. Should the Company be affected by such an incident, we may incur substantial costs and suffer other negative consequences, which may include:

• remediation costs, such as liability for stolen assets or information, repairs of system damage, and incentives to customers or business partners in an effort to maintain relationships after an attack;

• increased cybersecurity protection costs, which may include the costs of making organizational changes, deploying additional personnel and protection technologies, training employees, and engaging third party experts and consultants;

• lost revenues resulting from the unauthorized use of proprietary information or the failure to retain or attract customers following an attack;

• litigation and legal risks, including regulatory actions by state and federal regulators; and

• loss of reputation.

| 12 |

Increasingly, intruders attempt to steal significant amounts of data, including personally identifiable data and either hold such data for ransom or release it onto the internet, exposing our clients to financial or other harm and thereby significantly increasing the liability of the Company in such cases. Our regulators have introduced programs to review our protections against such incidents which, if they determined that our systems do not reasonably protect our clients assets and their data, could result in enforcement activity and sanctions.

The Company has and continues to introduce systems and software to prevent any such incidents and reviews and increases its defenses to such issues through the use of various services, programs and outside vendors. The Company also reviews and revises its cybersecurity policy to ensure that it remains up to date. In the event that the Company experiences a material cybersecurity incident or identifies a material cybersecurity threat, the Company will make all reasonable efforts to properly disclose it in a timely fashion. It is impossible, however, for the Company to know when or if such incidents may arise or the business impact of any such incident.

As a result of such risks, the Company has and is likely to incur significant costs in preparing its infrastructure and maintaining it to resist any such attacks.

Our advisory services subject us to additional risks.

We have provided investment advisory services to investors in the past. Through our registered RIA, AdvisorNXT, we will offer Robo advisory and investment services. The risks associated with these investment advisory activities include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence, inadequate disclosure and fraud. Realization of these risks could lead to liability for client losses, regulatory fines, civil penalties and harm to our reputation and business.

We are subject to extensive government regulation.

Our business is subject to extensive regulation in the United States, at both the Federal and state level. We are also subject to regulation by self–regulatory organizations and other regulatory bodies in the United States, such as the SEC, the NYSE, FINRA and the MSRB. MSCO is registered as a broker-dealer in 50 states and the District of Columbia. The regulations to which MSCO is subject as a broker-dealer cover all aspects of the securities business including: training of personnel, sales methods, trading practices, uses and safe keeping of customers’ funds and securities, capital structure, record keeping, fee arrangements, disclosure and the conduct of directors, officers and employees.

AdvisorNXT is registered as an investment adviser with the SEC under the Advisers Act and its business is highly regulated. The Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary, record keeping, operational and disclosure obligations. Moreover, the Advisers Act grants broad administrative powers to regulatory agencies such as the SEC to regulate investment advisory businesses. If the SEC or other government agencies believe that AdvisorNXT has failed to comply with applicable laws or regulations, these agencies have the power to impose fines, suspensions of a registrant and individual employees or other sanctions, which could include revocation of AdvisorNXT’s registration under the Advisers Act. AdvisorNXT is also subject to the provisions and regulations of ERISA to the extent that AdvisorNXT acts as a “fiduciary” under ERISA with respect to certain of its clients. ERISA and the applicable provisions of the federal tax laws, impose a number of duties on persons who are fiduciaries under ERISA and prohibit certain transactions involving the assets of each ERISA plan which is a client, as well as certain transactions by the fiduciaries (and certain other related parties) to such plans. Additionally, like other investment advisors, AdvisorNXT also faces the risks of lawsuits by clients. The outcome of regulatory proceedings and lawsuits is uncertain and difficult to predict. An adverse resolution of any regulatory proceeding or lawsuit against AdvisorNXT could result in substantial costs or reputational harm to AdvisorNXT and, therefore, could have an adverse effect on the ability of AdvisorNXT to retain key investment advisors, and wealth managers, and to retain existing clients or attract new clients, any of which could have a material adverse effect on our business, financial condition, results of operations and prospects.

| 13 |

The laws, rules and regulations, as well as governmental policies and accounting principles, governing our business and the financial services and banking industries generally have changed significantly over recent years and are expected to continue to do so. We cannot predict which changes in laws, rules, regulations, governmental policies or accounting principles will be adopted. Any changes in the laws, rules, regulations, governmental policies or accounting principles relating to our business could materially and adversely affect our business, results of operations and financial condition.

Legislation has and may continue to result in changes to rules and regulations applicable to our business, which may negatively impact our business and financial results.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), enacted in 2010, requires many federal agencies to adopt new rules and regulations applicable to the financial services industry and also calls for many studies regarding various industry practices. In particular, the Dodd-Frank Act gives the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail customers. The U.S. Department of Labor (“DOL”) has enacted regulations changing the definition of who is an investment advice fiduciary under the Employee Retirement Income Security Act of 1974 (ERISA) and how such advice can be provided to account holders in retirement accounts such as 401(k) plans and Individual Retirement Arrangements (IRAs). The DOL regulations will deem many of the investment, rollover and asset management recommendations from us to our clients regarding their retirement accounts fiduciary “investment advice” under ERISA. One of the most significant impacts on our business from the DOL regulations and related prohibited transaction exemptions will be the impact on our fee and compensation practices. For example, the regulations make investment advisors to retirement account clients subject to an ERISA fiduciary duty standard and the exemptions seek to reduce conflicts of interest stemming from fee differentials and compensation incentives that could lead to a misalignment of the interests of advisors and their retirement investor clients. The exemptions, when used, will also require certain new client contracts, adherence to “impartial conduct standards” (including a requirement to act in the “best interest” of retirement clients when providing investment advice), the adoption of related policies and procedures and the making of extensive website and other disclosures to retirement investors and the DOL. One way to comply is to use the best interest contract exemption in connection with certain advice activities, which will subject us to an increased risk of class actions and other litigation and regulatory risks. Additional rulemaking or legislative action could negatively impact our business and financial results. While we have not yet been required to make other material changes to our business or operations as a result of the Dodd-Frank Act or other rulemaking or legislative action, it is not certain what the scope of future rulemaking or interpretive guidance from the SEC, FINRA, DOL, banking regulators and other regulatory agencies may be, how the courts and regulators might interpret these rules and what impact this will have on our compliance costs, business, operations and profitability.

Our profitability could also be affected by new or modified laws that impact the business and financial communities generally, including changes to the laws governing banking, the securities market, fiduciary duties, conflicts of interest, taxation, electronic commerce, client privacy and security of client data.

We are subject to net capital requirements.

The SEC, FINRA, and various other securities and commodities exchanges and other regulatory bodies in the United States have rules with respect to net capital requirements which affect us. These rules have the effect of requiring that at least a substantial portion of a broker-dealer’s assets be kept in cash or highly liquid investments. Our compliance with the net capital requirements could limit operations that require intensive use of capital, such as underwriting or trading activities. These rules could also restrict our ability to withdraw our capital, even in circumstances where we have more than the minimum amount of required capital, which, in turn, could limit our ability to implement growth strategies. In addition, a change in such rules, or the imposition of new rules, affecting the scope, coverage, calculation or amount of such net capital requirements, or a significant operating loss or any unusually large charge against net capital, could have similar adverse effects.

| 14 |

Our customers may fail to pay us.

A principal credit risk to which we are exposed on a regular basis is that our customers may fail to pay for their purchases or fail to maintain the minimum required collateral for amounts borrowed against securities positions maintained by them. We cannot assure you that our practices and/or the policies and procedures we have established will be adequate to prevent a significant credit loss.

An increase in volume on our systems or other events could cause them to malfunction.

Most of our trade orders are received and processed electronically. This method of trading is heavily dependent on the integrity of the electronic systems supporting it. While we have never experienced a significant failure of our trading systems, heavy stress placed on our systems during peak trading times could cause our systems to operate at unacceptably low speeds or fail altogether. Any significant degradation or failure of our systems or the systems of third parties involved in the trading process (e.g., online and Internet service providers, record keeping and data processing functions performed by third parties, and third party software), even for a short time, could cause customers to suffer delays in trading. These delays could cause substantial losses for customers and could subject us to claims from these customers for losses. There can be no assurance that our network structure will operate appropriately in the event of a subsystem, component or software failure. In addition, we cannot assure you that we will be able to prevent an extended systems failure in the event of a power or telecommunications failure, an earthquake, terrorist attack, fire or any act of God. Any systems failure that causes interruptions in our operations could have a material adverse effect on our business, financial condition and operating results.

We rely on information processing and communications systems to process and record our transactions.

Our operations rely heavily on information processing and communications systems. Our system for processing securities transactions is highly automated. Failure of our information processing or communications systems for a significant period of time could limit our ability to process a large volume of transactions accurately and rapidly. This could cause us to be unable to satisfy our obligations to customers and other securities firms, and could result in regulatory violations. External events, such as an earthquake, terrorist attack or power failure, loss of external information feeds, such as security price information, as well as internal malfunctions such as those that could occur during the implementation of system modifications, could render part or all of these systems inoperative.

Rapid market or technological changes may render our technology obsolete or decrease the attractiveness of our products and services to our clients.

We must continue to enhance and improve our technology and electronic services. The electronic financial services industry is characterized by significant structural changes, increasingly complex systems and infrastructures, changes in clients’ needs and preferences and new business models. If new industry standards and practices emerge and our competitors release new technology before us, our existing technology, systems and electronic trading services may become obsolete or our existing business may be harmed. Our future success will depend on our ability to:

| • | enhance our existing products and services; |

| • | develop and/or license new products and technologies that address the increasingly sophisticated and varied needs of our clients and prospective clients; |

| • | continue to attract highly-skilled technology personnel; and |

| • | respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. |

Developing our electronic services, our implementation and utilization of AdvisorNXT’s Robo investment advisor platform and other technology entails significant technical and business risks. We may use new technologies ineffectively or we may fail to adapt our electronic trading platform, information databases and network infrastructure to client requirements or emerging industry standards. If we face material delays in introducing new services, products and enhancements, our clients may forego the use of our products and use those of our competitors.

| 15 |

Further, the adoption of new Internet, networking or telecommunications technologies may require us to devote substantial resources to modify and adapt our services. We cannot assure you that we will be able to successfully implement new technologies or adapt our proprietary technology and transaction-processing systems to client requirements or emerging industry standards. We cannot assure you that we will be able to respond in a timely manner to changing market conditions or client requirements.

We depend on our ability to attract and retain key personnel.

We are dependent upon our new and continuing senior management for our success and the loss of the services of any of these individuals could significantly harm our business, financial condition and operating results.

We may be unable to realize the anticipated benefits of our cost cutting efforts or it may take longer than anticipated for us to realize any benefits from increased cost efficiencies or economies of scale, if at all.

Our realization of the benefits anticipated as a result of cost cutting efforts and other business efforts and changes will depend in part on the ability of our management team, to implement the Company’s business plan (See Recent Developments). We cannot assure shareholders that there will not be substantial costs associated with these activities, the Company’s new products or other negative consequences as a result of these changes. These effects, including, but not limited to, incurring unexpected costs or delays in connection with implantation of a modified business model, or the failure of our business to perform as expected, could harm our results of operations.

Our principal shareholder has the ability to control key decisions submitted to a vote of our shareholders.

Gloria E. Gebbia, who is a director of the Company, and the managing member of KCA, has along with other family members the power to elect the entire Board of Directors and, except as otherwise provided by law or our Certificate of Incorporation or by-laws, to approve any action requiring shareholder approval without a shareholders meeting.

There may be no public market for our common stock.

Only 2,142,406 shares of common stock, or approximately 8% of our shares of Common Stock outstanding, are currently held by the public. Although our Common Stock is traded in The NASDAQ Capital Market, there can be no assurance that an active public market will continue.

Our future ability to pay dividends to holders of our Common Stock is subject to the discretion of our board of directors and will be limited by our ability to generate sufficient earnings and cash flows.

Payment of future cash dividends on our Common Stock will depend on our ability to generate earnings and cash flows. However, sufficient cash may not be available to pay such dividends. Payment of future dividends, if any, will be at the discretion of our board of directors and will depend upon a number of factors that the board of directors deems relevant, including future earnings, the success of our business activities, capital requirements, the general financial condition and future prospects of our business and general business conditions. If we are unable to generate sufficient earnings and cash flows from our business, we may not be able to pay dividends on our Common Stock.

Our ability to pay cash dividends on our common stock is also dependent on the ability of our subsidiaries to pay dividends to SFC. MSCO is subject to requirements of the SEC and FINRA relating to liquidity, capital standards and the use of client funds and securities, which may limit funds available for the payment of dividends to SFC.

| 16 |

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

Siebert currently maintains 10 retail discount brokerage offices. Customers can visit these offices to obtain market information, place orders, open accounts, deliver and receive checks and securities, and obtain related customer services in person. Nevertheless, most of Siebert’s activities are conducted on the Internet or by telephone and mail.

Siebert operates its business out of the following leased offices:

| Location | Approximate Office Area in Square Feet | Expiration Date* of Current Lease | ||||||

| Corporate Headquarters / Retail Office | ||||||||

| 120 Wall Street | ||||||||

| New York, NY 10005 | 250 | 9/2018 | ||||||

| Retail Offices | ||||||||

| 15 Exchange Place, Suite 615 | ||||||||

| Jersey City, NJ 07302 | 5,000 | 9/2018 | ||||||

| 4400 North Federal Highway, Suite 122 | ||||||||

| Boca Raton, FL 33431 | 1,600 | 7/2020 | ||||||

| 3020 Old Ranch Pkwy | ||||||||

| Seal Beach, CA 90740 | 250 | 12/2018 | ||||||

| 24005 Ventura Blvd. | ||||||||

| Calabasas, CA 91302 | 3,200 | 1/2019 | ||||||

| 9464 Wilshire Blvd. | ||||||||

| Beverly Hills, CA 90212 | 4,000 | Month to Month | ||||||

| 190 North Canon Drive | ||||||||

| Beverly Hills, CA 90210 | 900 | 7/2019 | ||||||

| 4925 Greenville Ave., Suite 200 | ||||||||

| Dallas, TX 75206 | 250 | 5/2018 | ||||||

| 601 Dredher Road | ||||||||

| Horsham, PA 19044 | 2,000 | 7/2021 | ||||||

| 1900 St. James Place, Suite 120 | ||||||||

| Houston, TX 77056 | 3,200 | 12/2021 | ||||||

*There are no renewal terms for any of the leases.

| Item 3. | LEGAL PROCEEDINGS |

The Company is party to certain claims, suits and complaints arising in the ordinary course of business. In the opinion of management, all such matters are without merit, or involve amounts which would not have a significant effect on the financial position of the Company.

| Item 4. | MINE SAFETY DISCLOSURES |

Not applicable

| 17 |

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock traded on the NASDAQ Global Market until June 29, 2011 when our common stock started trading on the NASDAQ Capital Market, under the symbol “SIEB”. The high and low sales prices of our common stock reported by NASDAQ during the following calendar quarters were:

| High | Low | |||||||

| First Quarter – 2016 | $ | 1.40 | $ | 1.15 | ||||

| Second Quarter – 2016 | $ | 1.34 | $ | 1.17 | ||||

| Third Quarter – 2016 | $ | 2.20 | $ | 1.00 | ||||

| Fourth Quarter – 2016 | $ | 3.25 | $ | 1.19 | ||||

| First Quarter - 2017 | $ | 3.77 | $ | 2.16 | ||||

| Second Quarter - 2017 | $ | 4.70 | $ | 3.27 | ||||

| Third Quarter - 2017 | $ | 4.29 | $ | 3.60 | ||||

| Fourth Quarter - 2017 | $ | 21.61 | $ | 3.60 | ||||

On March 31, 2018, the closing price of our common stock on the NASDAQ Capital Market was $8.43 per share.

On March 15, 2018 there were 90 holders of record of our common stock and approximately 2,150 beneficial owners of our common stock.

Dividend Policy

Our Board of Directors periodically considers whether to declare dividends. In considering whether to pay such dividends, our Board of Directors will review our earnings capital requirements, economic forecasts and such other factors as are deemed relevant. Some portion of our earnings will be retained to provide capital for the operation and expansion of our business.

Pursuant to the Acquisition Agreement, our Board of Directors declared a special dividend in the amount of $.20 per share of outstanding Common Stock (an aggregate of $4,492,735) payable on October 24, 2016, to the shareholders of record on October 13, 2016. This dividend was a one-time event made pursuant to the terms of the Acquisition Agreement. No other special dividends are currently contemplated.

| 18 |

Our Performance

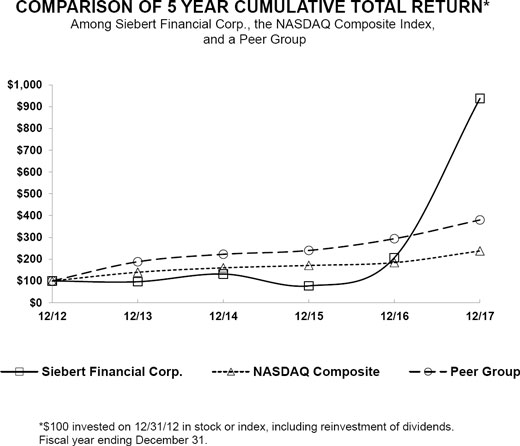

The graph below compares our performance from December 31, 2012 through December 31, 2017 against the performance of the NASDAQ Composite Index and a peer group. The peer group consists of Ameritrade Holding Corporation, E*Trade Financial Corporation and the Charles Schwab Corporation.

| Cumulative Total Return | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||||||||||||

| Siebert Financial Corp. | 100.00 | 96.41 | 131.74 | 77.25 | 206.99 | 937.73 | ||||||||||||||||||

| Nasdaq Composite | 100.00 | 139.83 | 160.08 | 171.08 | 184.07 | 237.57 | ||||||||||||||||||

| Peer Group | 100.00 | 187.99 | 222.30 | 239.90 | 293.86 | 379.85 | ||||||||||||||||||

| 19 |

| Item 6. | SELECTED FINANCIAL DATA |

(In thousands except share and per share data)

The

Following Selected Financial Information Should Be Read In Conjunction with Our Consolidated

Financial Statements and the Related Notes Thereto.

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Income statement data: | ||||||||||||||||||||

| Total Revenues | $ | 13,110 | $ | 9,812 | $ | 10,096 | $ | 15,815 | $ | 16,401 | ||||||||||

| Net income/(loss) | $ | 2,157 | $ | (5,578 | ) | $ | (2,869 | ) | $ | (6,557 | ) | $ | (5,912 | ) | ||||||

| Net income/(loss) per share of common stock | ||||||||||||||||||||

| Basic | $ | .10 | $ | (.25 | ) | $ | (0.13 | ) | $ | (0.30 | ) | $ | (0.27 | ) | ||||||

| Diluted | $ | .10 | $ | (.25 | ) | $ | (0.13 | ) | $ | (0.30 | ) | $ | (0.27 | ) | ||||||

| Weighted average shares outstanding (basic) | 22,507,798 | 22,085,126 | 22,085,126 | 22,085,126 | 22,087,324 | |||||||||||||||

| Weighted average shares outstanding (diluted) | 22,507,798 | 22,085,126 | 22,085,126 | 22,085,126 | 22,087,324 | |||||||||||||||

| Statement of financial condition data (at year end): | ||||||||||||||||||||

| Total assets | $ | 6,025 | $ | 3,816 | $ | 17,785 | $ | 20,728 | $ | 27,970 | ||||||||||

| Total liabilities excluding subordinated borrowings | $ | 813 | $ | 1,563 | $ | 2,102 | $ | 2,176 | $ | 2,861 | ||||||||||

| Stockholders’ equity | $ | 5,212 | $ | 2,253 | $ | 15,683 | $ | 18,552 | $ | 25,109 | ||||||||||

| Cash dividends declared on common shares | $ | 0 | $ | .20 | $ | 0 | $ | 0 | $ | 0 | ||||||||||

| 20 |

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This discussion should be read in conjunction with our audited Consolidated Financial Statements and the Notes thereto contained elsewhere in this Annual Report.

The following table sets forth certain metrics as of December 31, 2017 and 2016, which we use in evaluating our business.

| For the Twelve Months ended December 31, | ||||||||

| Retail Customer Activity: | 2017 | 2016 | ||||||

| Total retail trades: | 221,282 | 229,720 | ||||||

| Average commission per retail trade: | $ | 19.87 | $ | 20.27 | ||||

| As of December 31, | ||||||||

| 2017 | 2016 | |||||||

| Retail customer balances: | ||||||||

| Retail customer net worth (in billions): | $ | 11.5 | $ | 7.0 | ||||

| Retail customer money market fund value (in billions): | $ | 0.8 | $ | 1.0 | ||||

| Retail customer margin debit balances (in millions): | $ | 333.0 | $ | 214.0 | ||||

| Retail customer credit balances (in millions): | $ | 505.0 | $ | 72.0 | ||||

| Retail customer accounts with positions: | 43,540 | 28,430 | ||||||

Description:

| • | Total retail trades represents retail trades that generate commissions. |

| • | Average commission per retail trade represents the average commission generated for all types of retail customer trades. |

| • | Retail customer net worth represents the total value of securities and cash in the retail customer accounts before deducting margin debits. |

| • | Retail customer money market fund value represents all retail customers accounts invested in money market funds. |