Attached files

| file | filename |

|---|---|

| EX-99.1 - EARNINGS RELEASE DATED APRIL 12, 2018 - BlackRock Inc. | blk-ex991_71.htm |

| 8-K - 8-K - BlackRock Inc. | blk-8k_20180412.htm |

Q1 2018 Earnings Earnings Release Supplement April 12, 2018 7/13/2017 10:27 AM BlackRock Exhibit 99.2

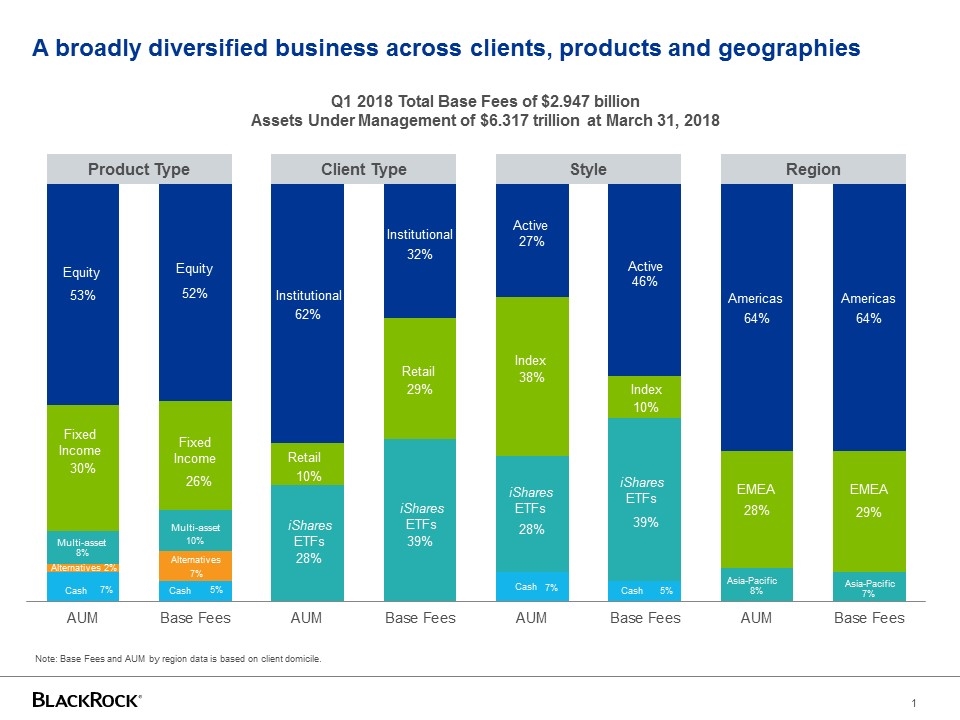

A broadly diversified business across clients, products and geographies Q1 2018 Total Base Fees of $2.947 billion Assets Under Management of $6.317 trillion at March 31, 2018 Note: Base Fees and AUM by region data is based on client domicile. Equity 53% 51% 62% 32% 28% 48% 64% 65% Institutional Active Americas Fixed income Retail Index EMEA Multi-asset iShares ETFs Alternatives Cash Asia-Pacific 30% 27% 11% 31% 38% 10% 29% 28% 27% 37% 7% 5% 2% 6% 8% Aum Base fees 1

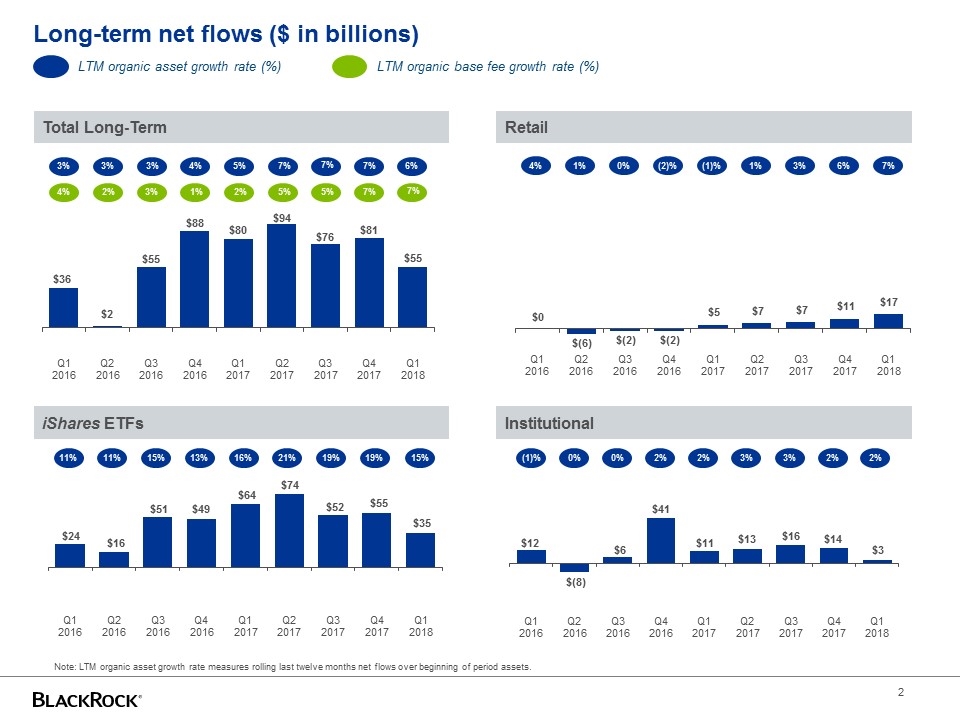

7% 7% 6% 3% 3% 3% 4% 7% Long-term net flows ($ in billions) Total Long-Term Retail iShares ETFs Institutional LTM organic asset growth rate (%) LTM organic base fee growth rate (%) 7% 4% 1% 0% (2)% (1)% 1% 3% 6% 11% 11% 15% 13% 16% 21% 19% 19% (1)% 0% 0% 2% 2% 3% 3% 2% Note: LTM organic asset growth rate measures rolling last twelve months net flows over beginning of period assets. 5% 4% 2% 3% 1% 2% 5% 5% 7% 7% 15% 2% 2 Q2 Q3 Q4 Q1 2015 2016 2017 $(7) $35 $54 $36 $2 $55 $88 $80 $94 $11 $7 $7 $0 ($6) $(2) $(2) $5 $7 $11 $23 $60 $24 $16 $51 $49 $64 $74 $(29) $5 $(13) $12 $(8) $6 $41 $11 $13

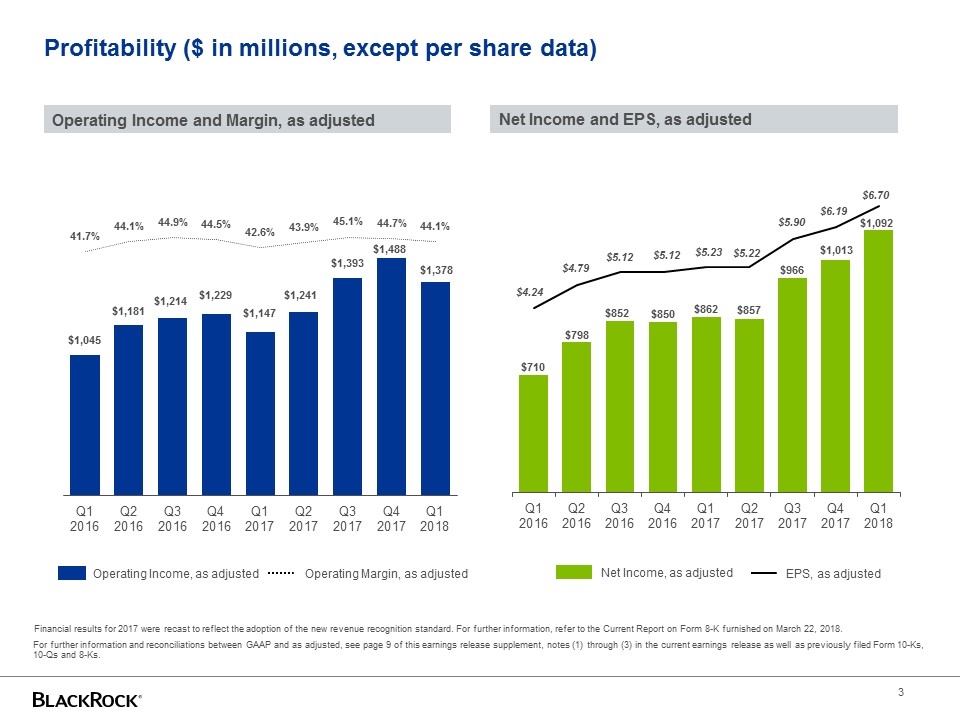

Profitability ($ in millions, except per share data) Net Income and EPS, as adjusted Operating Income and Margin, as adjusted For further information and reconciliations between GAAP and as adjusted, see page 9 of this earnings release supplement, notes (1) through (3) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks. Operating Income, as adjusted Operating Margin, as adjusted Net Income, as adjusted EPS, as adjusted 3 Financial results for 2017 were recast to reflect the adoption of the new revenue recognition standard. For further information, refer to the Current Report on Form 8-K furnished on March 22, 2018.

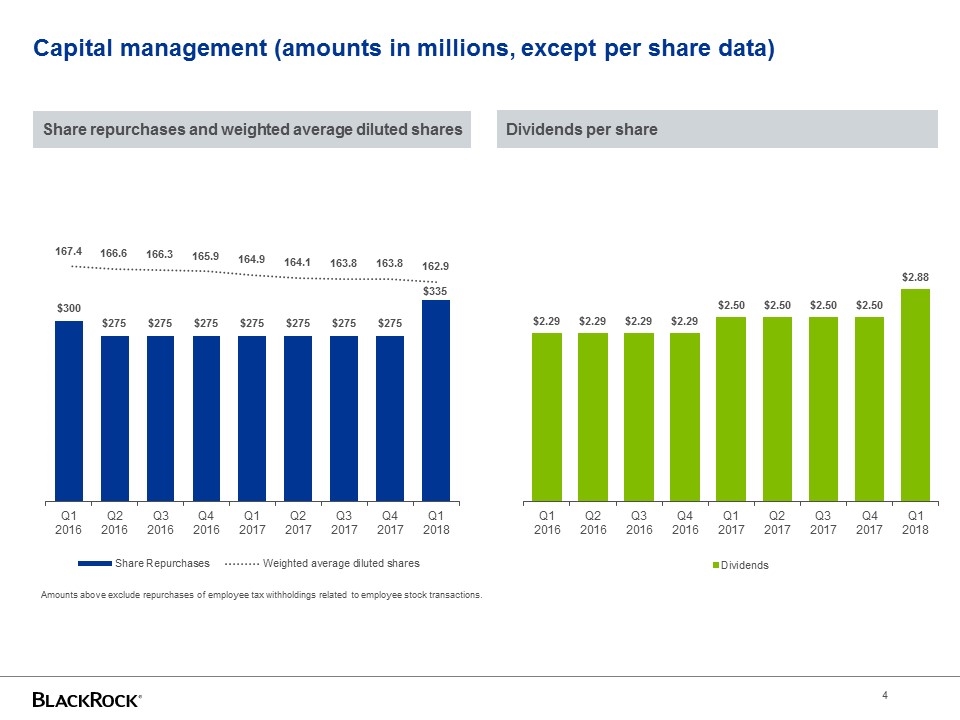

Capital management (amounts in millions, except per share data) Amounts above exclude repurchases of employee tax withholdings related to employee stock transactions. Share repurchases and weighted average diluted shares Dividends per share 4

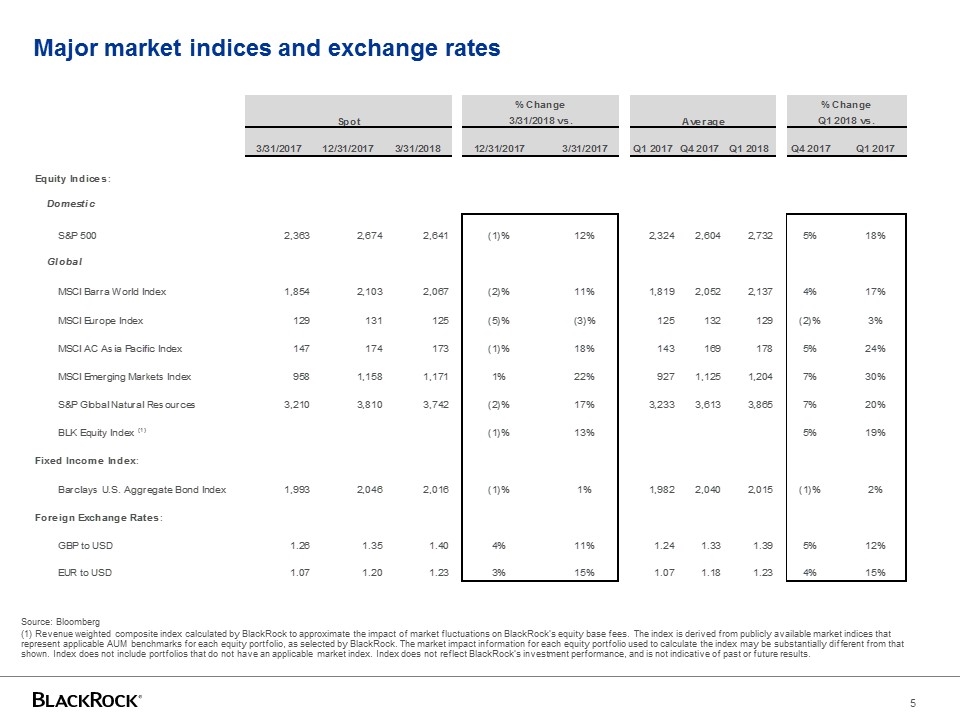

Major market indices and exchange rates 5 Source: Bloomberg (1) Revenue weighted composite index calculated by BlackRock to approximate the impact of market fluctuations on BlackRock’s equity base fees. The index is derived from publicly available market indices that represent applicable AUM benchmarks for each equity portfolio, as selected by BlackRock. The market impact information for each equity portfolio used to calculate the index may be substantially different from that shown. Index does not include portfolios that do not have an applicable market index. Index does not reflect BlackRock’s investment performance, and is not indicative of past or future results. Spot % Change Average % Change 3/31/2018 vs. Q1 2018 vs. 42825 43100 43190 43100 42825 Q1 2017 Q4 2017 Q1 2018 Q4 2017 Q1 2017 Equity Indices: Domestic S&P 500 2,363 2,674 2,641 -1.2341062079281975E-2 0.11764705882352941 2324 2,604 2,732 4.9155145929339478E-2 0.17555938037865748 Global MSCI Barra World Index 1,854 2,103 2,067 -1.7118402282453638E-2 0.11488673139158576 1819 2,052 2,137 4.1423001949317736E-2 0.17482133040131942 MSCI Europe Index 129 131 125 -4.5801526717557252E-2 -3.1007751937984496E-2 125 132 129 -2.2727272727272728E-2 3.2000000000000001E-2 MSCI AC Asia Pacific Index 147 174 173 -5.7471264367816091E-3 0.17687074829931973 143 169 178 5.3254437869822487E-2 0.24475524475524477 MSCI Emerging Markets Index 958 1,158 1,171 1.1226252158894647E-2 0.22233820459290188 927 1,125 1,204 7.0222222222222228E-2 0.29881337648327938 S&P Global Natural Resources 3,210 3,810 3,742 -1.7847769028871391E-2 0.16573208722741434 3233 3,613 3,865 6.974813174647107E-2 0.19548407052273431 BLK Equity Index (1) -0.01 0.13 0.05 0.19 Fixed Income Index: Barclays U.S. Aggregate Bond Index 1,993 2,046 2,016 -1.466275659824047E-2 1.1540391369794281E-2 1982 2,040 2,015 -1.2254901960784314E-2 1.6649848637739658E-2 Foreign Exchange Rates: GBP to USD 1.26 1.35 1.4 3.7037037037036903E-2 0.11111111111111104 1.24 1.33 1.39 4.5112781954887091E-2 0.12096774193548381 EUR to USD 1.07 1.2 1.23 2.5000000000000022E-2 0.14953271028037374 1.07 1.18 1.23 4.2372881355932243E-2 0.14953271028037374

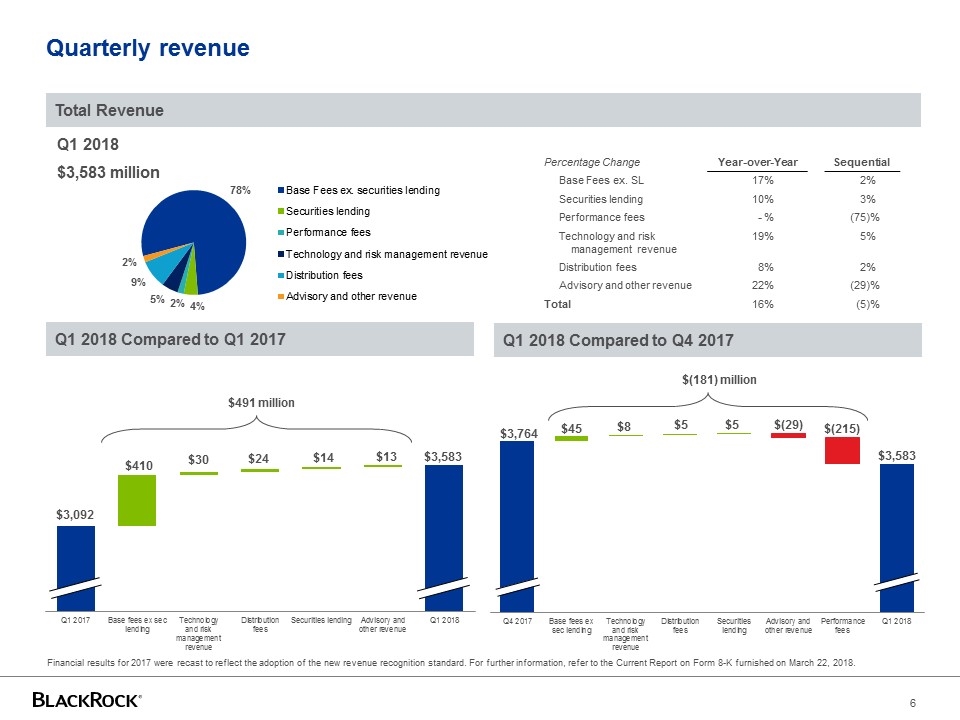

Quarterly revenue Q1 2018 Compared to Q1 2017 $491 million Total Revenue Q1 2018 Compared to Q4 2017 $(181) million Percentage Change Year-over-Year Sequential Base Fees ex. SL 17% 2% Securities lending 10% 3% Performance fees - % (75)% Technology and risk management revenue 19% 5% Distribution fees 8% 2% Advisory and other revenue 22% (29)% Total 16% (5)% Q1 2018 $3,583 million 6 Financial results for 2017 were recast to reflect the adoption of the new revenue recognition standard. For further information, refer to the Current Report on Form 8-K furnished on March 22, 2018.

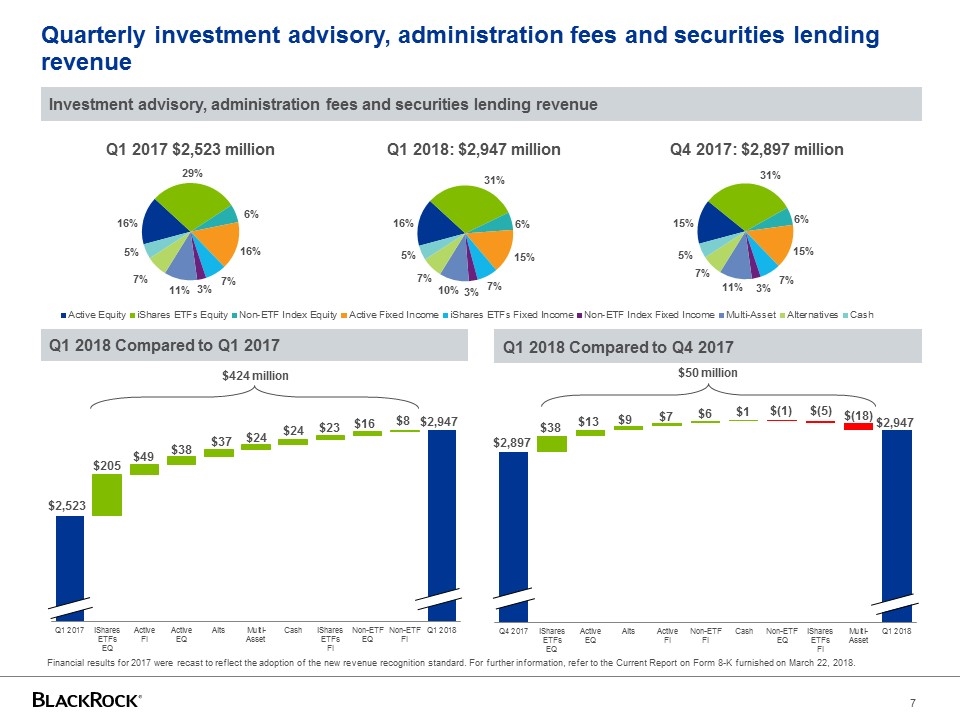

Quarterly investment advisory, administration fees and securities lending revenue Q1 2018 Compared to Q1 2017 Investment advisory, administration fees and securities lending revenue $424 million Q1 2018 Compared to Q4 2017 $50 million Q1 2018: $2,947 million Q1 2017 $2,523 million Q4 2017: $2,897 million 7 Financial results for 2017 were recast to reflect the adoption of the new revenue recognition standard. For further information, refer to the Current Report on Form 8-K furnished on March 22, 2018.

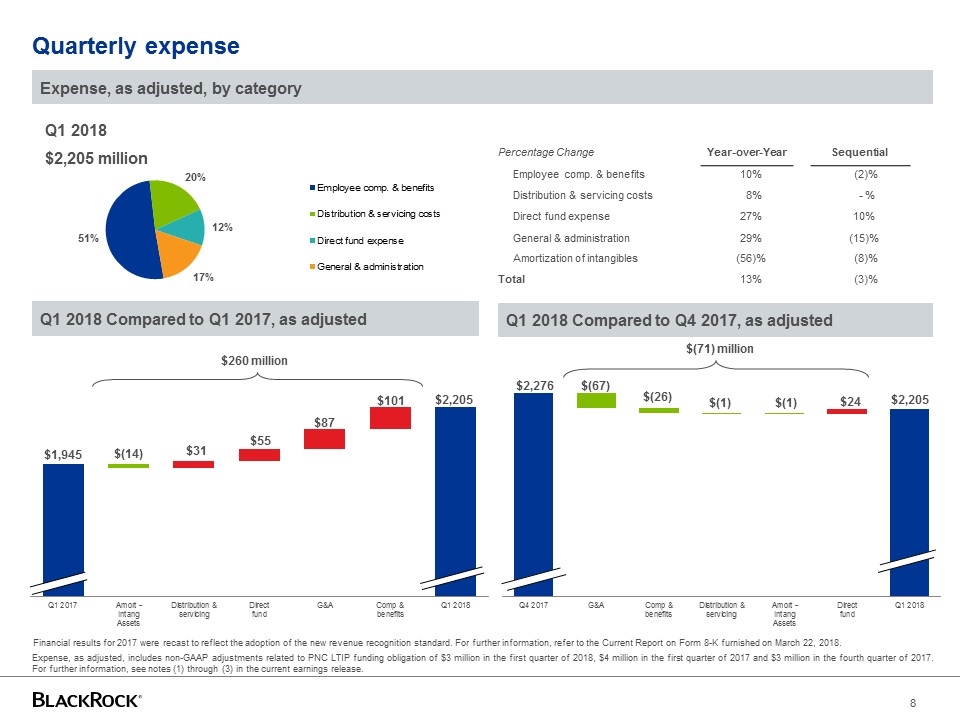

Quarterly expense Expense, as adjusted, by category Q1 2018 Compared to Q1 2017, as adjusted Expense, as adjusted, includes non-GAAP adjustments related to PNC LTIP funding obligation of $3 million in the first quarter of 2018, $4 million in the first quarter of 2017 and $3 million in the fourth quarter of 2017. For further information, see notes (1) through (3) in the current earnings release. $260 million Q1 2018 Compared to Q4 2017, as adjusted $(71) million Percentage Change Year-over-Year Sequential Employee comp. & benefits 10% (2)% Distribution & servicing costs 8% - % Direct fund expense 27% 10% General & administration 29% (15)% Amortization of intangibles (56)% (8)% Total 13% (3)% Q1 2018 $2,205 million 8 Financial results for 2017 were recast to reflect the adoption of the new revenue recognition standard. For further information, refer to the Current Report on Form 8-K furnished on March 22, 2018.

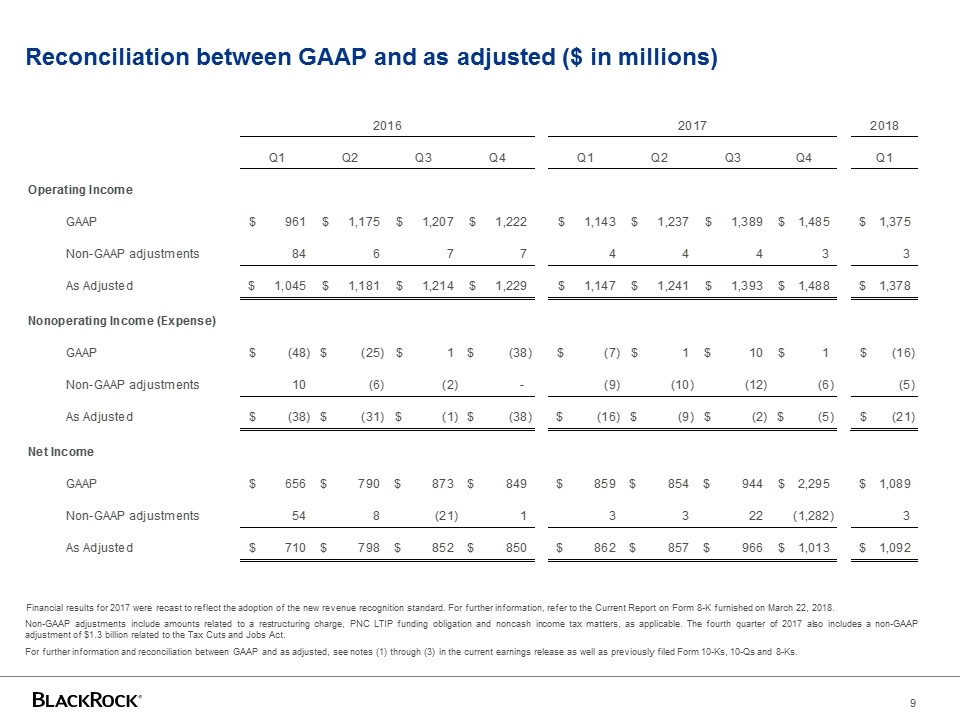

Reconciliation between GAAP and as adjusted ($ in millions) Non-GAAP adjustments include amounts related to a restructuring charge, PNC LTIP funding obligation and noncash income tax matters, as applicable. The fourth quarter of 2017 also includes a non-GAAP adjustment of $1.3 billion related to the Tax Cuts and Jobs Act. For further information and reconciliation between GAAP and as adjusted, see notes (1) through (3) in the current earnings release as well as previously filed Form 10-Ks, 10-Qs and 8-Ks. 9 Financial results for 2017 were recast to reflect the adoption of the new revenue recognition standard. For further information, refer to the Current Report on Form 8-K furnished on March 22, 2018. 2016 2017 2018 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Operating Income GAAP $961 $1,175 $1,207 $1,222 $1,143 $1,237 $1,389 $1,485 $1,375 Non-GAAP adjustments 84 6 7 7 4 4 4 3 3 As Adjusted $1,045 $1,181 $1,214 $1,229 $1,147 $1,241 $1,393 $1,488 $1,378 Nonoperating Income (Expense) GAAP $-48 $-25 $1 $-38 $-7 $1 $10 $1 $-16 Non-GAAP adjustments 10 -6 -2 - -9 -10 -12 -6 -5 As Adjusted $-38 $-31 $-1 $-38 $-16 $-9 $-2 $-5 $-21 Net Income GAAP $656 $790 $873 $849 $859 $854 $944 $2,295 $1,089 Non-GAAP adjustments 54 8 -21 1 3 3 22 -1,282 3 As Adjusted $710 $798 $852 $850 $862 $857 $966 $1,013 $1,092

Important Notes This presentation, and other statements that BlackRock may make, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to BlackRock’s future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to and does not undertake to update forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance. BlackRock has previously disclosed risk factors in its Securities and Exchange Commission (“SEC”) reports. These risk factors and those identified elsewhere in this earnings release, among others, could cause actual results to differ materially from forward-looking statements or historical performance and include: (1) the introduction, withdrawal, success and timing of business initiatives and strategies; (2) changes and volatility in political, economic or industry conditions, the interest rate environment, foreign exchange rates or financial and capital markets, which could result in changes in demand for products or services or in the value of assets under management; (3) the relative and absolute investment performance of BlackRock’s investment products; (4) the impact of increased competition; (5) the impact of future acquisitions or divestitures; (6) the unfavorable resolution of legal proceedings; (7) the extent and timing of any share repurchases; (8) the impact, extent and timing of technological changes and the adequacy of intellectual property, information and cyber security protection; (9) the potential for human error in connection with BlackRock’s operational systems; (10) the impact of legislative and regulatory actions and reforms and regulatory, supervisory or enforcement actions of government agencies relating to BlackRock or PNC; (11) changes in law and policy and uncertainty pending any such changes; (12) terrorist activities, international hostilities and natural disasters, which may adversely affect the general economy, domestic and local financial and capital markets, specific industries or BlackRock; (13) the ability to attract and retain highly talented professionals; (14) fluctuations in the carrying value of BlackRock’s economic investments; (15) the impact of changes to tax legislation, including income, payroll and transaction taxes, and taxation on products or transactions, which could affect the value proposition to clients and, generally, the tax position of the Company; (16) BlackRock’s success in negotiating distribution arrangements and maintaining distribution channels for its products; (17) the failure by a key vendor of BlackRock to fulfill its obligations to the Company; (18) any disruption to the operations of third parties whose functions are integral to BlackRock’s ETF platform; (19) the impact of BlackRock electing to provide support to its products from time to time and any potential liabilities related to securities lending or other indemnification obligations; and (20) the impact of problems at other financial institutions or the failure or negative performance of products at other financial institutions. This presentation also includes non-GAAP financial measures. You can find our presentations on the most directly comparable GAAP financial measures calculated in accordance with GAAP and our reconciliations on page 9 of this earnings release supplement, our current earnings release dated April 12, 2018, and BlackRock’s other periodic reports, which are available on BlackRock’s website at www.blackrock.com. 10