Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - SendGrid, Inc. | a2235159zex-23_1.htm |

| EX-10.15 - EX-10.15 - SendGrid, Inc. | a2235159zex-10_15.htm |

| EX-5.1 - EX-5.1 - SendGrid, Inc. | a2235159zex-5_1.htm |

| EX-1.1 - EX-1.1 - SendGrid, Inc. | a2235159zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on April 3, 2018.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SendGrid, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7372 (Primary Standard Industrial Classification Code Number) |

27-0554600 (I.R.S. Employer Identification Number) |

1801 California Street, Suite 500

Denver, CO 80202

(888) 985-7363

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive offices)

Sameer Dholakia

Chief Executive Officer

1801 California Street, Suite 500

Denver, CO 80202

(888) 985-7363

(Name, address, including zip code and telephone number,

including area code, of agent for service)

| Copies to: | ||||

Michael L. Platt Eric C. Jensen Matthew P. Dubofsky Cooley LLP 380 Interlocken Crescent, Suite 900 Broomfield, CO 80021 (720) 566-4000 |

Michael Tognetti General Counsel SendGrid, Inc. 1801 California Street, Suite 500 Denver, CO 80202 (888) 985-7363 |

Sarah K. Solum Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, CA 94025 (650) 752-2000 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2)(3) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.001 par value per share |

7,188,650 | $28.00 | $201,282,200 | $25,060 | ||||

|

||||||||

- (1)

- Includes

shares the underwriters have the option to purchase from certain of the selling stockholders.

- (2)

- Estimated

solely for purposes of computing the amount of the registration fee pursuant to Rule 457(c) under the Securities Act, as amended, on the basis of

the average high and low sales price of the Registrant's common stock as reported by The New York Stock Exchange on March 29, 2018.

- (3)

- Includes the aggregate offering price of additional shares that the underwriters have the option to purchase from certain of the selling stockholders.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued April 3, 2018

6,251,000 Shares

COMMON STOCK

SendGrid, Inc. is offering 600,000 shares of its common stock and the selling stockholders identified in this prospectus are offering 5,651,000 shares of our common stock. We will not receive any of the proceeds from the shares of common stock sold by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol "SEND." On March 29, 2018, the last reported sale price of our common stock as reported on the New York Stock Exchange was $28.14 per share.

We are an "emerging growth company" as defined under the federal securities laws. Investing in our common stock involves risks. See "Risk Factors" beginning on page 13.

PRICE $ A SHARE

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to SendGrid |

Proceeds to Selling Stockholders |

||||

|---|---|---|---|---|---|---|---|---|

Per Share |

$ | $ | $ | $ | ||||

Total |

$ | $ | $ | $ |

- (1)

- See "Underwriters" for a description of the compensation payable to the underwriters.

Certain of the selling stockholders have granted the underwriters the right to purchase up to an additional 937,650 shares of common stock to cover over-allotments.

The Securities and Exchange Commission and any state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on , 2018.

| Morgan Stanley | J.P. Morgan |

| William Blair | KeyBanc Capital Markets | Piper Jaffray | Stifel | Canaccord Genuity |

, 2018

Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses we have prepared. We and the selling stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus or the date of the applicable document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

For investors outside the United States: Neither we, the selling stockholders, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

i

This summary highlights information contained in greater detail elsewhere in this prospectus and in the documents incorporated by reference. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus and the documents incorporated by reference carefully before making an investment in our common stock. You should carefully consider, among other things, our consolidated financial statements and related notes incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2017, or our 2017 Annual Report, and the sections titled "Risk Factors" included in this prospectus and incorporated by reference from our 2017 Annual Report and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in our 2017 Annual Report and incorporated by reference in this prospectus. Unless the content otherwise requires, the terms "SendGrid," "company," "our," "us," and "we" in this prospectus refer to SendGrid, Inc. and where appropriate our consolidated subsidiaries.

Overview

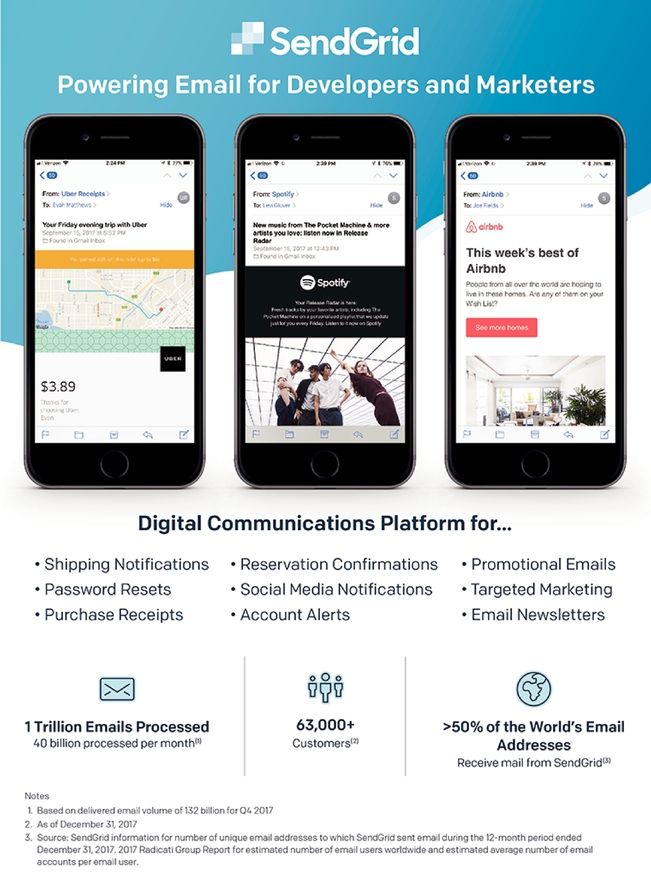

We are a leading digital communication platform, enabling businesses to engage with their customers via email reliably, effectively and at scale. Our cloud-based platform allows for frictionless adoption and immediate value creation for businesses, providing their developers and marketers with the tools to seamlessly and effectively reach their customers using email. Since our inception we have processed more than one trillion emails.

Increasingly, today's transactions are digital. They happen online and are often automatic and recurring. Consumers want a seamless experience and have come to expect that their online activity will be recorded in their email inbox. Email serves as the system of record for a consumer's digital life, delivering purchase receipts, shipping notifications, account information, social media updates, reservations and website login data. Email is the primary communication channel in the digital world, with an estimated 125 billion commercial emails sent every day, according to a 2017 Radicati Group report. Email is also a trusted marketing tool for businesses. An email-based promotion can reach the right user at the right time, with a high degree of certainty that the user will see it. According to The Inbox Report 2017, in 2016 nearly 80% of Americans checked their email daily. According to a 2015 Direct Marketing Association report, email demonstrated the highest return on investment among all forms of digital communication, generating $38 in revenue for every $1 invested.

While email offers a compelling value proposition for businesses, effective email delivery at scale is complex and difficult. Inbox service providers, including Google Gmail, Microsoft Outlook and Yahoo! Mail, evaluate incoming email and block the delivery of harmful or unwanted email. However, these filters can also prevent the delivery of wanted email. According to a 2017 Return Path report, only 80% of wanted email reached its intended recipient. To manage email delivery on their own, businesses must understand the complexities associated with both sending millions or billions of transactional and marketing emails and the unique dynamics of numerous inbox service providers. Dedicated servers and databases, domain expertise, continuous monitoring of email protocols, and a team of people are all necessary to maintain a robust internally-developed email communications system. The use of developer resources in this effort can reduce businesses' investment in product innovation and other priorities. Without an effective, easy to use system, marketers seeking to reach customers via email can also expend significant time and resources without accomplishing their marketing goals.

SendGrid was founded by developers who were frustrated with their own experiences in managing email delivery. They wanted to build a system "that just worked" for developers and allowed them to focus on strategic business activities. They developed a robust technology platform incorporating their domain expertise and created an application programming interface, or API, that allowed for easy integration by businesses. We built our business model around serving the developer, including self-service adoption and

1

a frictionless user experience. We have extended this platform over time to serve the similar email delivery needs of marketers.

We offer our customers three services: our Email API; Marketing Campaigns; and Expert Services. Our Email API service allows developers to use our API in their preferred development framework to leverage our platform to add email functionality to their applications within minutes. This service enables businesses to send thousands or billions of emails, all with the same high level of service and reliability, and incorporates proprietary technology and domain expertise to significantly improve deliverability rates. Our Marketing Campaigns service allows marketers to upload and manage customer contact lists, create and test email templates, and then execute and analyze multi-faceted email campaigns that engage customers and drive growth. Our Expert Services help businesses further optimize their email delivery. With our platform, businesses can achieve industry leading email deliverability that translates into higher brand engagement with their customers.

Our category leadership, self-service model and company culture have enabled us to attract and retain customers and employees, and continue to develop innovative solutions for email delivery. We deliver our services through a self-service cloud-based subscription model, where businesses primarily sign up for our services through our website. We offer transparent and affordable pricing, generally on a per month basis by volume of email and typically paid by credit card. In addition, we have robust documentation for onboarding and ongoing usage. This self-service delivery model has enabled us to rapidly attract customers while operating our business efficiently.

Businesses of all sizes and across industries depend on our digital communication platform. As of December 31, 2017, we had over 63,000 customers globally, an increase of 39% year over year. We believe a relatively small number of businesses have more than one unique paying account with us, and we count each of these accounts as a separate customer. While we serve large enterprises, we primarily serve small and midmarket businesses, or SMBs, that rely on email to power their businesses and are rapidly adopting cloud services. Our self-service model has allowed us to efficiently acquire SMB customers that historically have not been a focus for companies that depend on large enterprise sales forces. Our robust platform and the increasing breadth of our services allow us to scale with our customers as they grow.

Industry Trends

Email Is the Primary Commercial Communications Channel in the Digital World

Businesses increasingly interact with their customers through digital channels. Many emerging businesses are digital first. They primarily engage with customers through online and mobile channels. Customers of these businesses rarely interact with sales people, collect paper receipts, track orders over the phone or mail in their bills. These customers depend on automatic email notification of their transactions and rely on email as their system of record for their transactions.

Businesses engage with their customers through email because they can reach a wide audience and personalize interactions, while trusting emails will reach their target recipients. Businesses now analyze demographic information, buying behavior and preferences generated by the digital footprints of consumers in order to create unique digital experiences. These dynamics have created the opportunity for more frequent customer engagement through more personalized, targeted marketing.

Email Is Highly Effective at Driving Customer Engagement and Revenue

Email accounts are widespread and each is personal to its owner and consistent across time, making email a highly effective method of communication between businesses and consumers. Individuals with email accounts check their email throughout the day, every day. The use of smartphones for always-on access has only increased this effectiveness.

2

Effective Email Delivery Is Difficult

While email offers a compelling value proposition, businesses struggle to achieve effective email delivery due to a number of factors.

The Email Recipient's Side

Inbox service providers, including Google Gmail, Microsoft Outlook and Yahoo! Mail, use sophisticated filters to analyze incoming email and prevent the delivery of harmful or unwanted email, often blocking wanted email as well. The cost of delivery failure includes not only the infrastructure expense associated with processing the email, but more importantly, the lost revenue for a business from a new or existing customer.

The Email Sender's Side

Maintaining an email delivery system is complex. Domain expertise, dedicated resources and the need to satisfy complex technical requirements are all required to operate an effective email delivery system, particularly at scale.

To deliver email at scale, businesses need expertise and dedicated resources. The complexities of email delivery include building and maintaining a sender reputation and navigating that reputation across inbox service providers, spam houses, blacklist managers and industry watchdogs. Email delivery at scale also requires dedicated infrastructure and management of contact lists as well as an understanding of protocols to communicate with the recipient servers.

Businesses Are Adopting Cloud Services to Reduce Complexity and Focus on Core Functions

Technological innovation has enabled businesses to improve efficiency, but it has also lowered barriers to entry. Businesses of all sizes must adapt quickly to changing market needs in order to grow and compete. As a result, businesses are turning to cloud services to manage complex and costly parts of their IT infrastructure and operations. Cloud services can seamlessly provide many of the critical, but non-core, components for a business, allowing it to maximize the value of internal resources by focusing on its core differentiating competencies.

Frictionless, Self-Service Models Are Driving High Adoption of Cloud Services

The ease of cloud service delivery is driving a move from multi-million-dollar capital purchases of on-premises IT infrastructure to recurring lower-cost subscriptions for cloud services. This change has increased the influence of line of business owners, developers and marketers in technology purchasing decisions compared to a traditional CIO-led purchasing process. With cloud services, developers and marketers exert greater control over how they allocate their resources.

Businesses Need to Effectively and Efficiently Send Wanted Email at Scale

Email is critical to building and growing customer relationships but requires significant resources and expertise to manage the complex underlying infrastructure. The developers and marketers who are driving purchasing decisions of cloud services need a transactional and marketing email solution that possesses the following characteristics:

- •

- Reliability: continuous uptime to

send secure emails at any time

- •

- Effectiveness: high delivery

rates and high consumer engagement

- •

- Scalability: ability to send billions of emails across a range of customer use cases, with the same level of effectiveness

3

- •

- Ease of Adoption and

Integration: self-service onboarding and integration

- •

- Affordability: lower, predictable

cost versus an internal system and accessible to businesses of all sizes

- •

- Platform

Extensibility: integrated transactional and marketing email capabilities

- •

- Services and Support: expert help to obtain desired outcomes and enhance email marketing capabilities

Our Market Opportunity

We estimate our total addressable market for both transactional and marketing emails was $11 billion in 2017. See the sections titled "Market and Industry Data" and "Our Market Opportunity".

Benefits of Our Solution

Key benefits of our solution include:

Platform Reliability

Businesses rely on our platform to power their customer email communications. We utilize a robust global infrastructure that includes multiple co-located data centers and public cloud resources to host our platform. In 2017, our platform was available for our customers to send email 99.995% of the time.

Proprietary Technology and Domain Expertise Enables Effective Email Delivery

We significantly improve email deliverability through embedded intellectual property in our platform and industry-leading domain expertise. Our platform is designed to operate at scale across multiple inbox service providers. In 2017, we estimate that we achieved a delivery rate of 94%, as compared to a general delivery rate for wanted email of 80% for the 12-month period ended June 30, 2017, as reported by Return Path in 2017. Our delivery rates for 2015 and 2016 were consistent with our delivery rate for 2017. We also offer Expert Services to help our customers achieve the best outcomes for their individual needs.

Ability to Scale With Customers As They Grow

Our communication platform provides the same high-quality service to a wide range of businesses, from startups to large enterprises that send significant email volumes. Our Email API service starts with entry-level pricing that supports up to 40,000 emails per month and scales up from there. Our largest customers send more than one billion emails per month.

Frictionless Adoption for Developers and Marketers

We make it easy for developers and marketers to adopt our platform using a self-service model. We provide a flexible API setup to easily add email functionality to their applications, as well as comprehensive documentation to help developers write code in their preferred development framework. We have a community of over 2.9 million active users that serves as a resource for questions about our platform. Once a business is using our API for transactional email delivery, it is simple for that business to also use our platform for promotional and personalized email marketing.

Affordable and Accessible to Businesses of All Sizes

We offer our Email API service as a monthly subscription, with pricing based on email volume. Businesses can tailor the use of our services for their individual needs, without the need to commit to expensive, multi-year contracts. Our cloud-based services generally provide significant cost savings compared to an internally-developed system and free up internal resources for other tasks.

4

Extensible Communications Platform

Our platform incorporates extensible technology that allows our customers to expand their use cases to improve their customer communications. Our customers benefit from having a single platform for transactional and marketing email, enabling them to manage their customer contact data in a single place, leverage universal design templates and testing systems, and ensure high email deliverability.

Competitive Strengths

Our competitive strengths include:

Easy to Adopt, Self-Service Model

Our Email API and Marketing Campaigns services are designed to be accessed from our website and immediately useable. By reducing the friction that typically accompanies the purchase of business software and eliminating the need for complicated and costly implementation and training, we believe we attract more customers to try, buy and derive value from our platform. Our self-service model has allowed us to grow our customer base while avoiding the expensive customer acquisition costs typical of high-touch enterprise sales models.

Market Leadership in Email Service with Strong Brand Association

We pioneered the market for a cloud-based email API service and continue to invest significant resources to extend our technology leadership and brand awareness in our industry. We believe that the SendGrid brand has become synonymous with email delivery and is recognized as the industry standard for scalability, reliability and deliverability.

Significant Domain Expertise Around Email

We have processed over one trillion emails since inception, including over 450 billion emails in 2017. We have longstanding relationships and integrations with all major inbox service providers and email industry organizations. These relationships provide us with real-time intelligence and performance feedback that enable us to optimize the deliverability of the emails that we send and anticipate changes in email handling policies.

Large, Growing and Happy Global Customer Base

As of December 31, 2017, we had over 63,000 customers globally. Our broad customer base provides us with insight into digital communication trends and activity and results in word-of-mouth recognition that drives traffic to our website.

Our Growth Strategies

Key components of our growth strategy include:

Continue to Add Customers to Our Platform

We believe there is substantial opportunity to expand our customer base both in the United States and internationally as the ubiquity of email and the digital transformation of businesses continue to drive market adoption of our services.

Expand Platform Features and Functionality and Grow Our Marketing Campaigns Service

We intend to grow our Marketing Campaigns service by cross-selling into our existing Email API service customer base, acquiring new customers and adding new capabilities and features. Furthermore,

5

while we do not currently provide services in other emerging communications channels, such as messaging/chat platforms, in-app messages, online ads, browser and push notifications, and SMS, we believe that the proliferation of these channels creates further potential growth opportunities over time for us to help our customers optimize their communications across those channels.

Expand our Strategic Partner Channel

We have built and plan to continue investing in channel relationships with our strategic partners in order to complement the reach of our own customer acquisition efforts.

Continue to Grow Internationally

We generated more than 36% of our revenue in each of the last three years from customers located in international geographies despite having limited international infrastructure and no product localization. We intend to add more physical infrastructure as well as localized platform content and support that will enhance our attractiveness to international customers.

Pursue Select Acquisitions to Augment Our Features and Functionality

We intend to continue pursuing acquisitions that we believe will be complementary. For example, we may pursue acquisitions that we believe will enhance our services, accelerate customer acquisition, introduce different distribution channels and add talent and expertise to our organization.

Selected Risks Affecting Our Business

Investing in our common stock involves risk. You should carefully consider all of the information in this prospectus and in the documents incorporated by reference prior to investing in our common stock. These risks are discussed more fully in the section titled "Risk Factors" beginning on page 13 immediately following this prospectus summary and in our 2017 Annual Report, which is incorporated by reference in this prospectus. These risks and uncertainties include, but are not limited to, the following:

- •

- Our recent growth may not be indicative of our future growth and, if we continue to grow, we may not be able to manage our growth effectively.

- •

- If we are unable to sustain our revenue growth rate, we may not achieve or maintain profitability in the future.

- •

- If we are unable to attract new customers, retain existing customers or increase sales both to new and existing customers, our business and

results of operations will be affected adversely.

- •

- Our limited operating history in new and developing markets and our rapid growth make it difficult to evaluate our current business and future

prospects.

- •

- If we are unable to increase adoption of our platform through our self-service model, our business, results of operations and financial

condition may be adversely affected.

- •

- Our growth depends in part on the success of our strategic relationships with third parties to sell our services.

- •

- Our future success depends in part on our ability to continue to drive adoption of our platform and services by international customers, and

our international operations and sales to customers with international operations expose us to risks inherent in international sales.

- •

- If we are not able to maintain and enhance our brand and maintain and increase market awareness of our company and services, then our business, results of operations and financial condition may be adversely affected.

6

- •

- The market in which we participate is highly competitive and, if we do not compete effectively, our operating results could be harmed.

- •

- If our security measures are breached or unauthorized access to our or our customers' private or proprietary data is otherwise obtained, our

platform or services may be perceived as not being secure, our reputation may be severely harmed, customers may reduce the use of or stop using our platform or services, we may incur significant

liabilities and we may lose the ability to offer our customers a credit card payment option.

- •

- Our customers' and other users' violation of our policies or other misuse of our platform to transmit offensive or illegal messages, spam,

website links to harmful applications or for other fraudulent activity could damage our reputation, and we may face liability for unauthorized, inaccurate or fraudulent information distributed via our

platform.

- •

- We have experienced losses in the past, and we may not achieve or sustain profitability in the future.

- •

- Our quarterly results may fluctuate significantly, and if we fail to meet the expectations of analysts or investors, our stock price could decline substantially.

SendGrid.org

SendGrid.org is a division of SendGrid and not a separate legal entity. Its mission is to support nonprofit organizations. To that end, we have reserved 466,571 shares of our common stock to fund and support operations of SendGrid.org, which represented 1% of our outstanding capital stock on the date it was approved by our board of directors. In this offering, we are selling 46,657 shares of our common stock to fund and support the operations of SendGrid.org, and the number of reserved shares will be reduced accordingly.

Corporate Information

We were incorporated in Delaware in July 2009. Our principal executive offices are located at 1801 California Street, Suite 500, Denver, CO 80202, and our telephone number is (888) 985-7363.

Our website address is http://sendgrid.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus.

"SendGrid," the SendGrid logo and other trademarks or service marks of SendGrid appearing in this prospectus are our property. This prospectus contains additional trade names, trademarks, and service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other companies' trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

Our Initial Public Offering

In November 2017, we completed an initial public offering, or IPO, in which we sold 9,430,000 shares of our common stock at public offering price of $16.00 per share. We received net proceeds of $136.3 million after deducting underwriting discounts and offering expenses. Our common stock began trading on the New York Stock Exchange on November 15, 2017. In connection with the closing of our IPO, (1) all shares of our convertible preferred stock were converted into common stock at a ratio of one to one and (2) a warrant to purchase shares of our convertible preferred stock was converted into a warrant to purchase shares of our common stock.

7

Implications of Being an Emerging Growth Company

The Jumpstart Our Business Startups Act, or the JOBS Act, was enacted in April 2012 with the intention of encouraging capital formation in the United States and reducing the regulatory burden on newly public companies that qualify as "Emerging Growth Companies." We are an emerging growth company within the meaning of the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from various public reporting requirements, including the requirement that our internal control over financial reporting be audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, certain requirements related to the disclosure of executive compensation in this prospectus and in our periodic reports and proxy statements, and the requirement that we hold a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an emerging growth company. Section 107 of the JOBS Act provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have elected to take advantage of the extended transition period to comply with new or revised accounting standards and to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of the accounting standards election, we are not subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies, which may make comparison of our financials to those of other public companies more difficult. Additionally, because we have taken advantage of certain reduced reporting requirements, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

We will remain an emerging growth company until the earliest to occur of (i) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (ii) the date we qualify as a "large accelerated filer," with at least $700 million of equity securities held by non-affiliates; (iii) the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year ending after the fifth anniversary of the completion of our initial public offering.

8

Common stock offered by us |

600,000 shares | |

Common stock offered by the selling stockholders |

5,651,000 shares |

|

Underwriters' over-allotment option to purchase additional shares offered by certain of the selling stockholders |

Certain of the selling stockholders have granted the underwriters an option to purchase up to an additional 937,650 shares to cover over-allotments. |

|

Common stock to be outstanding after this offering |

43,365,378 shares |

|

Use of proceeds |

We estimate that the net proceeds from the sale of shares of our common stock that we are selling in this offering will be approximately $15.2 million, based on an assumed public offering price of $28.14 per share, the last reported sale price of our common stock on the New York Stock Exchange on March 29, 2018, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. In addition, selling stockholders are selling 5,651,000 shares of common stock, assuming the underwriters do not exercise their over-allotment option to purchase the additional shares. We will not receive any of the proceeds from the sale of shares to be offered by the selling stockholders. |

|

|

The principal purposes of this offering are to increase our capitalization and financial flexibility, facilitate an orderly distribution of shares for the selling stockholders and increase our public float. We intend to use the net proceeds we receive from this offering for working capital and other general corporate purposes. We may also use a portion of the net proceeds to make acquisitions or strategic investments, although we do not have any agreements or commitments for such acquisitions or investments. We will also reserve the net proceeds from the sale of 46,657 shares to fund and support the operations of SendGrid.org. See the section titled "Use of Proceeds" for additional information. |

|

Concentration of Ownership |

Our officers, directors and their affiliated funds and each of our stockholders who own greater than 5% of our outstanding common stock and their affiliates, in the aggregate, will beneficially own an aggregate of approximately 52.64% of our outstanding common stock following this offering, assuming no exercise of the underwriters' option to purchase additional shares. As a result, if some of these persons or entities act together, they will have significant influence over the outcome of matters submitted to our stockholders for approval. |

|

New York Stock Exchange symbol |

"SEND" |

9

The number of shares of our common stock that will be outstanding after this offering is based on 42,175,647 shares of our common stock outstanding as of December 31, 2017, and excludes:

- •

- 12,217,721 shares of our common stock issuable upon the exercise of stock options outstanding as of December 31, 2017 under our equity

incentive plans, with a weighted average exercise price of $4.79 per share, of which 589,731 shares will be issued upon the exercise of options by some of the selling stockholders and will be sold in

this offering and are included in shares of our common stock to be outstanding after this offering;

- •

- 5,000 shares of our common stock issuable upon the exercise of a non-plan option grant outstanding as of December 31, 2017, with

an exercise price of $2.18 per share;

- •

- 466,571 shares of our common stock reserved for issuance to fund and support the operations of SendGrid.org, of which none were issued and

outstanding as of December 31, 2017, and of which 46,657 shares are being sold by us in this offering and are included in shares of our common stock to be outstanding after this offering;

- •

- 656,854 shares of our common stock issuable upon the vesting and settlement of Restricted Stock Units, or RSUs, outstanding as of

December 31, 2017;

- •

- 3,503,521 shares of our common stock reserved and available for future issuance under our 2017 Equity Incentive Plan, or 2017 Plan, as of

December 31, 2017, as well as:

- •

- any shares of our common stock issuable upon the exercise or settlement of outstanding stock awards under our 2012 Equity

Incentive Plan, or 2012 Plan, and our 2009 Equity Incentive Plan, or 2009 Plan, that will be added to our 2017 Plan available reserve upon expiration or termination of such awards, plus

- •

- any automatic increases in the number of shares of our common stock reserved for future issuance under our 2017 Plan, including

the additional 2,108,782 shares of our common stock that were automatically added to our 2017 Plan share reserve on January 1, 2018; and

- •

- 791,833 shares of our common stock reserved for issuance under our 2017 Employee Stock Purchase Plan, or 2017 ESPP, as of December 31, 2017, as well as any automatic increases in the number of shares of common stock reserved for issuance thereunder, including the additional 421,756 shares of our common stock that were automatically added to our 2017 ESPP share reserve on January 1, 2018.

Except as otherwise indicated, all information in this prospectus assumes:

- •

- no exercise of outstanding stock options and no settlement of outstanding RSUs after December 31, 2017, except for the shares of our

common stock to be issued upon the exercise of options by some of the selling stockholders and sold in this offering; and

- •

- no exercise by the underwriters of their option to purchase up to an additional 937,650 shares of our common stock from certain of the selling stockholders to cover over-allotments.

10

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our historical consolidated financial data. We have derived the historical consolidated statements of operations data for the years ended December 31, 2015, 2016, and 2017, and the historical consolidated balance sheet data as of December 31, 2017, from our audited consolidated financial statements included in our 2017 Annual Report, which is incorporated by reference in this prospectus. The following summary consolidated financial data should be read in conjunction with the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our 2017 Annual Report, which is incorporated by reference in this prospectus, and our consolidated financial statements and related notes included elsewhere in this prospectus or incorporated by reference in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

| |

For the Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2016 | 2017 | |||||||

| |

(In thousands, except per share amounts) |

|||||||||

Consolidated Statements of Operations Data: |

||||||||||

Revenue |

$ | 58,476 | $ | 79,929 | $ | 111,888 | ||||

Cost of revenue |

18,961 | 21,605 | 29,507 | |||||||

| | | | | | | | | | | |

Gross profit |

39,515 | 58,324 | 82,381 | |||||||

| | | | | | | | | | | |

Operating expenses: |

||||||||||

Research and development |

18,959 | 21,178 | 29,643 | |||||||

Selling and marketing |

13,737 | 21,800 | 28,185 | |||||||

General and administrative |

12,477 | 18,920 | 30,101 | |||||||

Loss on disposal of assets |

1 | 27 | 22 | |||||||

| | | | | | | | | | | |

Total operating expenses |

45,174 | 61,925 | 87,951 | |||||||

| | | | | | | | | | | |

Loss from operations |

(5,659 | ) | (3,601 | ) | (5,570 | ) | ||||

Other income (expense), net |

(195 | ) | (307 | ) | (683 | ) | ||||

Net loss before provision for income taxes |

(5,854 | ) | (3,908 | ) | (6,253 | ) | ||||

Provision for income taxes |

— | — | — | |||||||

| | | | | | | | | | | |

Net loss |

$ | (5,854 | ) | $ | (3,908 | ) | $ | (6,253 | ) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted average shares used in computing net loss per share, basic and diluted(1) |

7,091 | 7,521 | 8,499 | |||||||

Net loss per share, basic and diluted(1) |

$ | (0.83 | ) | $ | (0.52 | ) | $ | (0.74 | ) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- See Note 13 to our consolidated financial statements in our 2017 Annual Report, which is incorporated by reference in this prospectus, for an explanation of the method used to calculate basic and diluted net loss per common share attributable to common stockholders.

11

| |

As of December 31, 2017 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(1)(2) | |||||

| |

(In thousands) |

||||||

Consolidated Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 175,496 | $ | 191,930 | |||

Working capital |

168,498 | 184,932 | |||||

Property and equipment, net |

29,192 | 29,192 | |||||

Total assets |

223,283 | 239,717 | |||||

Total stockholders' equity |

179,774 | 196,208 | |||||

- (1)

- The

as adjusted column in the consolidated balance sheet data table above reflects the receipt of (i) $15.2 million in net proceeds from our sale of

600,000 shares of common stock in this offering at an assumed public offering price of $28.14 per share, the last reported sale price of our common stock on the New York Stock Exchange on March 29,

2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and (ii) $1.2 million in aggregate net proceeds received by us in

connection with the exercise of options to purchase an aggregate of 589,731 shares of our common stock by certain of the selling stockholders in order to sell those shares in this offering. The net

proceeds we will receive in this offering from the sale of 46,657 shares will be reserved to fund and support the operations of SendGrid.org, and the number of shares of our common stock that are

reserved for that purpose will be reduced by 46,657.

- (2)

- A $1.00 increase or decrease in the assumed public offering price of $28.14 per share; the last reported sale price of our common stock on the New York Stock Exchange on March 29, 2018, would increase or decrease our as adjusted amount of each of cash and cash equivalents, working capital, total assets, and total stockholders' equity (deficit) by approximately $0.6 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each 1,000,000 share increase or decrease in the number of shares offered by us would increase or decrease the as adjusted amount of each of cash and cash equivalents, working capital, total assets, and total stockholders' equity (deficit) by approximately $26.8 million, assuming that the assumed offering price of $28.14 remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

12

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, as well as those set forth under the heading "Risk Factors" in our 2017 Annual Report, which is incorporated by reference in this prospectus. Our business, operating results, financial condition or prospects could be materially and adversely affected by any of these risks and uncertainties. In that case, the trading price of our common stock could decline and you might lose all or part of your investment. In addition, the risks and uncertainties discussed below are not the only ones we face. Our business, operating results, financial condition or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material, and these risks and uncertainties could result in a complete loss of your investment. In assessing the risks and uncertainties described below, you should also refer to the other information contained in this prospectus (as supplemented or amended) and the documents incorporated by reference in this prospectus, including our consolidated financial statements and the related notes thereto, before making a decision to invest in our common stock.

Risks Related to This Offering and Ownership of Our Common Stock

As a new investor, you will experience immediate and substantial dilution in the book value of the shares that you purchase in this offering.

The assumed public offering price is substantially higher than the net tangible book value per share of our common stock immediately following this offering based on the total value of our tangible assets less our total liabilities. Therefore, if you purchase shares of our common stock in this offering, at the assumed public offering price of $28.14 per share, the last reported sale price of our common stock on the New York Stock Exchange on March 29, 2018, you will experience immediate dilution of $23.69 per share, the difference between the price per share you pay for our common stock and our net tangible book value per share as of December 31, 2017, after giving effect to the issuance of shares of our common stock in this offering. See "Dilution."

Substantial future sales of shares of our common stock could cause the market price of our common stock to decline.

The market price of our common stock could decline as a result of substantial sales of our common stock, particularly sales by our directors, executive officers and significant stockholders, a large number of shares of our common stock becoming available for sale or the perception in the market that holders of a large number of shares intend to sell their shares. After this offering, there will be 43,365,378 shares of our common stock outstanding, based on the number of shares outstanding as of December 31, 2017, including all of the shares to be sold by us and any shares sold by selling stockholders following the exercise of options in this offering, which may be resold in the public market immediately.

In connection with our IPO, we and all of our directors and officers, as well as the other holders of substantially all of our common stock and securities convertible into or exercisable or exchangeable for our common stock outstanding immediately prior to the completion of that offering, agreed with Morgan Stanley & Co. LLC on behalf of the underwriters in our IPO, that until May 14, 2018, subject to certain exceptions, we and they will not, directly or indirectly, dispose of any of our common stock or securities convertible into or exercisable or exchangeable for our common stock. Morgan Stanley & Co. LLC, on behalf of the underwriters in our IPO, has consented to the release of these lock-up restrictions with respect to the shares of our common stock to be sold by us and the selling stockholders in this offering.

In connection with this offering, all of our executive officers, directors and the selling stockholders selling shares in this offering, as well as certain of our other large stockholders, have agreed with Morgan Stanley & Co. LLC on behalf of the underwriters in this offering, that for 90 days after the date of this prospectus, subject to certain exceptions, we and they will not, directly or indirectly, dispose of any of our common stock or securities convertible into or exercisable or exchangeable for our common stock.

13

Upon completion of this offering, based on the number of shares outstanding as of December 31, 2017, we will have 43,365,378 shares of common stock outstanding, assuming no exercise of outstanding options or settlement of outstanding RSUs, other than the exercise of options to purchase 589,731 shares in connection with this offering, which are included in our shares of common stock to be outstanding upon completion of this offering. Of these shares, all shares of common stock sold in our IPO and in this offering are freely tradable without restriction or further registration under the Securities Act, unless held by our "affiliates," as that term is defined in Rule 144 under the Securities Act, or subject to lock-up agreements.

Subject to the provisions of Rules 144 and 701 under the Securities Act and applicable lock-up agreements, our remaining shares of common stock will be available for sale in the public market as follows:

- •

- 3,725,906 shares will become eligible for sale in the public market beginning on May 14, 2018 (the date on which the lock-up agreements

related to our IPO expire);

- •

- 2,080,289 shares will become eligible for sale in the public market beginning on June 3, 2018 (the date on which lock-up agreements

entered into in connection with this offering with certain of our stockholders who are not selling in this offering and certain of our directors affiliated with those stockholders will expire with

respect to 20% of such stockholders' and directors' aggregate holdings of our common stock); and

- •

- 22,503,183 shares will become eligible for sale in the public market beginning on the 91st day following the date of this prospectus upon expiration of lock-up agreements entered into in connection with this offering, as described below.

In addition, as of December 31, 2017, there were 12,222,721 shares of common stock subject to outstanding options and 656,854 shares of common stock to be issued upon the vesting and settlement of outstanding RSUs. We have registered 19,731,311 shares of common stock issuable (i) upon exercise of outstanding options, (ii) upon the vesting and settlement of outstanding RSUs and (iii) upon exercise or settlement of any options or other equity incentives we may grant in the future for public resale under the Securities Act. Accordingly, these shares may be freely sold in the public market upon issuance as permitted by any applicable vesting requirements, subject to the lock-up agreements described above and compliance with applicable securities laws.

In addition, certain holders of shares of our common stock have rights, subject to some conditions and the lock-up arrangements described above, to require us to file registration statements for public resale or to include such shares in registration statements that we may file for ourselves or other stockholders. See "Shares Eligible for Future Sale—Registration Rights." Further, we may issue shares of our common stock or securities convertible into our common stock from time to time in connection with a financing, acquisition, investment or otherwise. Any such issuance could result in substantial dilution to our existing stockholders and cause the trading price of our common stock to decline.

Our management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways that increase the value of your investment.

We intend to use the net proceeds we receive in this offering for working capital and other general corporate purposes, including developing and enhancing our technical infrastructure, platform, and services, expanding our research and development efforts and selling and marketing operations, meeting the increased compliance requirements associated with our transition to and operation as a public company, satisfying the cash obligations in connection with withholding taxes due on the vesting of RSUs for our chief executive officer and expanding into new markets. We may also use a portion to make acquisitions or investments. However, we do not have any agreements or commitments for any acquisitions or strategic investments at this time. We will also reserve the net proceeds from the sale of 46,657 shares to

14

fund and support the operations of SendGrid.org. Our management generally will have broad discretion to use the net proceeds we receive in this offering, and you will be relying on the judgment of our management regarding the application of these proceeds. Our management might not apply the net proceeds in ways that increase the value of your investment. Until we use the net proceeds to us from this offering, we plan to invest them, and these investments may not yield a favorable rate of return. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

Concentration of ownership among our officers, directors, significant stockholders and their affiliates may prevent new investors, including purchasers in this offering, from influencing corporate decisions.

Our officers, directors and their affiliated funds and each of our stockholders who own greater than 5% of our outstanding common stock and their affiliates, in the aggregate, will beneficially own an aggregate of approximately 52.64% of the outstanding shares of our common stock following this offering, assuming no exercise of the underwriters' over-allotment option to purchase additional shares. As a result, if some of these persons or entities act together, they will have significant influence over the outcome of matters submitted to our stockholders for approval, including the election of directors and approval of significant corporate transactions, such as a merger or other sale of our company or our assets. This concentration of ownership could limit the ability of other stockholders to influence corporate matters and may have the effect of delaying or preventing a change of control of our company. Some of these persons or entities may have interests different from yours. For example, because many of these stockholders purchased their shares at prices substantially below the price at which shares are being sold in this offering and have held their shares for a relatively longer period, they may be more interested in selling the company to an acquirer than other investors.

If the estimates and assumptions we have used to calculate the size of our total addressable target market are inaccurate, our future growth rate may be limited.

We have estimated the size of our total addressable target market based on data published by third parties and on internally generated data and assumptions. While we believe our market size information is generally reliable, such information is inherently imprecise, and relies on our and third parties' projections, assumptions and estimates within our target market, which are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in this prospectus. If third-party or internally generated data prove to be inaccurate or we make errors in our assumptions based on that data, including how current customer data and trends may apply to potential future customers and the number and type of potential customers, our future growth rate may be lower than what we currently estimate or our stock price may decline. In addition, these inaccuracies or errors may cause us to misallocate capital and other business resources, which could divert resources from more valuable alternative projects and harm our business. Further, not every business covered by our total addressable market estimates will necessarily buy third-party services at all, and some or many of those businesses may choose to continue using legacy tools, in-house options or services offered by our competitors. It is impossible to build every product feature that every customer wants, and our competitors may develop and offer features that our solutions do not offer. Additionally, the variables that go into the calculation of our total addressable market are subject to change over time, and there is no guarantee that any particular number or percentage of the businesses covered by our total addressable market will purchase our services at all or generate any particular level of revenues for us.

Even if our target market meets our size estimates, we may not grow our business. Our growth is subject to many factors, including our success in expanding our international operations, continuing to promote the use of our services by our customers for their marketing needs and otherwise implementing our business strategy, which are subject to many risks and uncertainties. Accordingly, the information regarding the size of our total addressable market included in this prospectus should not be taken as indicative of our future growth.

15

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus, particularly in the sections titled "Prospectus Summary" and "Risk Factors" in this prospectus and the sections titled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business" in our 2017 Annual Report, which is incorporated by reference in this prospectus, contain forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus and in the documents incorporated by reference in this prospectus, including statements regarding our future financial condition, results of operations, business strategy and plans and objectives of management for future operations, as well as statements regarding industry trends, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "believe," "will," "may," "estimate," "continue," "anticipate," "intend," "should," "plan," "expect," "predict," "could," "potentially" or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions described under the section titled "Risk Factors" in this prospectus and in our 2017 Annual Report, which is incorporated by reference in this prospectus, and elsewhere in this prospectus and in the documents incorporated by reference in this prospectus, regarding, among other things:

- •

- our ability to effectively sustain and manage our growth and future expenses, and our ability to achieve and maintain future profitability;

- •

- our ability to attract new customers and to maintain and expand our existing customer base;

- •

- our dependence on our self-service model;

- •

- our ability to scale and update our platform to respond to customers' needs and rapid technological change;

- •

- our reliance on third parties, including for strategic relationships to sell our services and for network connectivity, hosting and other

services;

- •

- the effects of increased competition on our market and our ability to compete effectively;

- •

- our ability to expand our operations and increase adoption of our platform internationally;

- •

- our ability to maintain, protect and enhance our brand;

- •

- our customers' and other platform users' violation of our policies or misuse of our platform;

- •

- the sufficiency of our cash and cash equivalents to satisfy our liquidity needs;

- •

- our failure or the failure of our platform of services to comply with applicable industry standards, laws and regulations;

- •

- our ability to maintain our corporate culture;

- •

- our ability to hire, retain and motivate qualified personnel;

- •

- our ability to identify targets for, execute on and realize the benefits of potential acquisitions;

- •

- our ability to estimate the size and potential growth of our target market; and

- •

- our ability to maintain proper and effective internal controls.

These risks are not exhaustive. Other sections of this prospectus and the documents incorporated by reference in this prospectus may include additional factors that could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our

16

management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason.

You should read this prospectus, the documents incorporated by reference in this prospectus and the documents that we have filed as exhibits to the registration statement on Form S-1, of which this prospectus is a part, that we have filed with the SEC with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect.

17

Unless otherwise indicated, information contained in this prospectus and in the documents incorporated by reference in this prospectus concerning our industry and the market in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, including data from the NAICS Association regarding the number of businesses with five or more employees, data from the Small Business Administration, or the SBA, regarding the percentage of businesses with a web presence and our own internal data on our average customer revenue, on assumptions that we have made that are based on that data and other similar sources, including the appropriateness and applicability of that data for our use, and on our knowledge of the markets for our services. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity and market size information included in this prospectus and in the documents incorporated by reference is generally reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled "Risk Factors" in this prospectus and in our 2017 Annual Report, which is incorporated by reference in this prospectus, and elsewhere in this prospectus and in the documents incorporated by reference in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

Certain information in the text of this prospectus and in the documents incorporated by reference in this prospectus is contained in independent industry publications. The sources of these independent industry publications are provided below:

- •

- 2017 Deliverability Benchmark Report: Analysis of Worldwide Inbox Placement Rates, Return Path, June 2017;

- •

- Email Marketing Benchmarks 2016 Relevancy, Frequency, Deliverability and Mobility, eMarketer, September 2016;

- •

- Email Statistics Report 2017-2021, The Radicati Group, Inc., February 2017;

- •

- National Client Email Report 2015, The Direct Marketing Association (UK) LTD, 2015; and

- •

- The Inbox Report 2017: Consumer Perceptions of Email, Fluent, 2017.

18

We believe there is a large market opportunity for scalable email delivery as a cloud service. Businesses of all sizes and across industries use email to communicate with customers and can benefit from an easy to use, highly effective email service. While we have customers of various sizes, the majority of our customers today are SMBs that are digital first and rely on cloud services to operate their businesses.

Our digital communications platform serves both the transactional and marketing email markets through our Email API and Marketing Campaigns services. We estimate our total addressable market for both services was $11 billion in 2017. To calculate our total addressable market, we first derived our total number of potential customers by multiplying the total number of global businesses with five or more employees, based on independent industry data from the NAICS Association, by the percentage of U.S.-based small businesses expected to have an online presence in 2014 according to the SBA. The SBA estimated in 2014 that 53% of small businesses had an online presence, which we used as a proxy for the percentage of global businesses with five or more employees that require email services. We then multiplied the total number of these potential customers by our average revenue per customer in 2017 for customers who used both our Email API service and our Marketing Campaigns service.

19

We estimate that the net proceeds we will receive from this offering will be approximately $15.2 million, based on the assumed public offering price of $28.14 per share, the last reported sale price of our common stock on the New York Stock Exchange on March 29, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will reserve the net proceeds we will receive in this offering from the sale of 46,657 shares to fund and support the operations of SendGrid.org, and the number of shares of our common stock that are reserved for that purpose will be reduced accordingly. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

A $1.00 increase (decrease) in the assumed public offering price of $28.14 per share, the last reported sale price of our common stock on the New York Stock Exchange on March 29, 2018, would increase (decrease) the net proceeds that we receive from this offering by approximately $0.6 million, assuming that the number of shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1,000,000 shares in the number of shares of our common stock offered by us would increase (decrease) the net proceeds to us from this offering by approximately $26.8 million, assuming the assumed public offering price of $28.14 per share remains the same, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

The principal purposes of this offering are to increase our capitalization and financial flexibility, facilitate an orderly distribution of shares for the selling stockholders and increase our public float. Although we have not yet determined with certainty the manner in which we will allocate the net proceeds of this offering, we intend to use the net proceeds from this offering for working capital and other general corporate purposes, including to fund and support the operations of SendGrid.org, developing and enhancing our technical infrastructure, platform and services, expanding our research and development efforts and selling and marketing operations, meeting the increased compliance requirements associated with our transition to and operation as a public company, satisfying the cash obligations in connection with withholding taxes due on the vesting of RSUs for our chief executive officer and expanding into new markets.

We may also use a portion of the net proceeds to make acquisitions of or invest in businesses, products, services or technologies that we believe to be complementary. We do not have any agreements or commitments for any such acquisitions or investments at this time.

The expected use of net proceeds from this offering represents our intentions based upon our present plans and business conditions. We cannot predict with certainty all of the particular uses for the proceeds of this offering or the amounts that we will actually spend on the uses set forth above. Accordingly, we will have broad discretion in the application of the net proceeds, and investors will be relying on the judgment of our management regarding the application of the net proceeds of this offering.

20

Shares of our common stock commenced trading on the New York Stock Exchange under the symbol "SEND" on November 15, 2017. Prior to that date, there was no public market for our common stock. The following table summarizes the high and low sale prices of our common stock as reported by the New York Stock Exchange:

| |

Low | High | |||||

|---|---|---|---|---|---|---|---|

Fiscal Year 2017 |

|||||||

Fourth Quarter (beginning November 15, 2017 through December 31, 2017) |

$ | 17.50 | $ | 24.45 | |||

Fiscal Year 2018 |

|||||||

First Quarter |

$ | 20.42 | $ | 32.03 | |||

On March 29, 2018, the last reported sale price of our common stock on the New York Stock Exchange was $28.14 per share. As of December 31, 2017, we had 169 holders of record of our common stock. This figure does not reflect the beneficial ownership or shares held in nominee name.

21

We have never declared or paid dividends on our capital stock. We currently intend to retain all available funds and any future earnings to support operations and to finance the growth and development of our business. We do not intend to declare or pay cash dividends on our common stock in the foreseeable future. The terms of our outstanding credit facility also restrict our ability to pay dividends, and we may also enter into credit agreements or other borrowing arrangements in the future that will restrict our ability to declare or pay cash dividends on our capital stock.

22

The following table sets forth our cash and cash equivalents and our capitalization as of December 31, 2017, on:

- •

- an actual basis; and

- •

- an as adjusted basis to give effect to (i) the sale and issuance of 600,000 shares of our common stock offered by us in this offering based on the assumed public offering price of $28.14 per share, the last reported sale price of our common stock on the New York Stock Exchange on March 29, 2018, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (ii) the issuance of 589,731 shares of our common stock to certain selling stockholders upon the exercise of stock options in order to sell such shares in this offering, including net proceeds of $1.2 million received by us in connection with the exercise of such options.

The as adjusted information below is illustrative only, and our capitalization following the completion of this offering will be adjusted based on the actual public offering price and other final terms of the offering.

You should read this table together with the sections of this prospectus titled "Summary Consolidated Financial Data," and "Description of Capital Stock" and the sections titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Selected Consolidated Financial Data" and our audited consolidated financial statements and related notes in our 2017 Annual Report, which is incorporated by reference in this prospectus.

| |

As of December 31, 2017 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(1) | |||||

| |

(in thousands, except share and per share data) |

||||||

Cash and cash equivalents |

$ | 175,496 | $ | 191,930 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Stockholders' equity (deficit): |

|||||||

Preferred stock, par value $0.001 per share; 10,000,000 shares authorized, issued or outstanding, actual; 10,000,000 shares authorized, no shares issued and outstanding, as adjusted |

— | — | |||||

Common stock, par value $0.001 per share, 250,000,000 shares authorized, 42,175,647 shares issued and outstanding, actual; 250,000,000 shares authorized, 43,365,378 shares issued and outstanding, as adjusted |

39 | 41 | |||||

Additional paid-in-capital |

229,594 | 246,026 | |||||

Accumulated other comprehensive income (loss) |

(2 | ) | (2 | ) | |||

Accumulated deficit |

(49,857 | ) | (49,857 | ) | |||

| | | | | | | | |

Total stockholders' equity |

179,774 | 196,208 | |||||

| | | | | | | | |

Total capitalization |

$ | 179,774 | $ | 196,208 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- (1)