Attached files

| file | filename |

|---|---|

| EX-10.24 - FIRST MODIFICATION OF PROMISSORY NOTE, DATED DECEMBER 11, 2017, BETWEEN THE COMP - SPORTS FIELD HOLDINGS, INC. | f10k2017ex10-24_sportsfield.htm |

| EX-32.2 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2017ex32-2_sportsfield.htm |

| EX-32.1 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2017ex32-1_sportsfield.htm |

| EX-31.2 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2017ex31-2_sportsfield.htm |

| EX-31.1 - CERTIFICATION - SPORTS FIELD HOLDINGS, INC. | f10k2017ex31-1_sportsfield.htm |

| EX-10.23 - FIRST MODIFICATION OF BUSINESS LOAN AGREEMENT, DATED DECEMBER 11, 2017, BETWEEN - SPORTS FIELD HOLDINGS, INC. | f10k2017ex10-23_sportsfield.htm |

| EX-10.22 - SETTLEMENT AGREEMENT, DATED JANUARY 26, 2018, BETWEEN THE COMPANY AND MONTREAT C - SPORTS FIELD HOLDINGS, INC. | f10k2017ex10-22_sportsfield.htm |

| EX-10.14 - FORM OF AMBASSADOR PROGRAM REPRESENTATIVE AGREEMENT - SPORTS FIELD HOLDINGS, INC. | f10k2017ex10-14_sportsfield.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2017

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-54883

SPORTS FIELD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 46-0939465 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1020 Cedar Ave, Suite 200

St. Charles, IL 60174

(Address of principal executive offices)

978-914-7570

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Non-accelerated filer | ☐ | ||

| Accelerated filer | ☐ | Smaller reporting company | ☒ | ||

| Emerging growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2017, based on a closing price of $0.49 was $8,434,865. As of March 31, 2018, the registrant had 17,403,527 shares of its common stock, par value $0.00001 per share, outstanding.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this Annual Report on Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

Our Corporate History

We were incorporated on February 8, 2011, as Anglesea Enterprises, Inc. Initially, our activities consisted of providing marketing and web-related services to small businesses, including the design and development of original websites, creative writing and graphics, virtual tours, audio/visual services, marketing analysis and search engine optimization. On June 16, 2014, Anglesea, Merger Sub, Sports Field Private Co, and the majority shareholders, entered into the Merger Agreement pursuant to which the Merger Sub was merged with and into Sports Field Private Co, with Sports Field Private Co surviving as a wholly-owned subsidiary of Anglesea. Anglesea acquired, through a reverse triangular merger, all of the outstanding capital stock of Sports Field Private Co in exchange for issuing Sports Field Private Co’s shareholders 11,914,275 shares of Anglesea’s common stock.

Upon completion of the Merger on June 16, 2014, Anglesea merged with Sports Field Private Co in a short-form merger transaction. Upon completion of the Short Form Merger, the Company became the parent company of the Sport Field Private Co’s then wholly owned subsidiaries, Sports Field Contractors LLC, FirstForm, Inc. (formerly SportsField Engineering, Inc.) and Athletic Construction Enterprises, Inc. In connection with the Short Form Merger, Anglesea changed its name to Sports Field Holdings, Inc. on June 16, 2014.

Overview

Sports Field, through its wholly owned subsidiary FirstForm, is an innovative product development company engaged in the design, engineering and construction of athletic fields and facilities and sports complexes and the sale of customized synthetic turf products and synthetic track systems.

According to Applied Market Information (AMI), over 2,000 athletic field projects were constructed in the U.S. in 2015, creating a $1.8 billion synthetic turf market. These statistics are supported by the number of square meters of synthetic turf manufactured and installed in the U.S. in 2015, based on an average size of 80,000 square feet per project. We believe synthetic turf fields have become the field of choice for public and private schools, municipal parks, and recreation departments, non-profit and for profit sports venue businesses, residential and commercial landscaping and golf related venues. We believe this choice is due to the spiraling costs associated with maintaining natural grass athletic fields and the demand for increased playing time, durability of the playing surface and the ability to play on that surface in any weather conditions.

Although synthetic turf athletic fields and synthetic turf have become a viable alternative to natural grass fields over the past several years, there are a number of technical and environmental issues that have arisen through the evolution of the development of turf and the systems designed around its installation. Sports Field has focused on addressing the main technical issues that still remain with synthetic turf athletic fields and synthetic turf, including but not limited to environmental and safety concerns related to infill used in synthetic turf fields as well the reduction of surface heat, and G-max levels (the measure of how much force the surface absorbs and, in return, how much is deflected back to the athlete) as well drainage issues related to the base construction of turf installation.

In addition to the increased need for available playing space, collegiate athletic facilities have become an attractive recruiting tool for many institutions. The competition for athletes and recruiting has resulted in a multitude of projects to build new, or upgrade existing, facilities. These projects include indoor fields, bleachers, press boxes, lighting and concession stands as well, as locker rooms and gymnasiums. We believe that our position in the sports facilities design, construction and turf sales industry allows us to benefit from this increased demand because we are able to compete for the sale of turf as well as the design and construction on such projects, whereas our competitors can typically only compete for the turf components or the construction, but not both. According to an IBIS report, there are no national firms competing in these sectors that have a 5% market share.

| 1 |

Through our strategic operations design, we have the ability to operate throughout the U.S., providing high quality synthetic turf systems focused on player safety and performance and construct those facilities for our clients using local subcontracted labor. Due to our ability to design, estimate, engineer, general contract and install our solutions, we can spend more of every owner dollar on product rather than margin and overhead, thereby delivering a premium product at competitive rates for our customers. Since inception, we have completed a variety of projects from the design, engineering and build of entire football stadiums to the installation of a specialized turf track systems. Members of our management team have also designed, engineered and installed baseball stadiums, soccer and lacrosse fields, indoor soccer facilities, softball fields and running tracks for private sports venues, public and private high schools and public and private universities. In addition, members of our team have designed, engineered and constructed concession stands with full kitchen facilities, restroom structures, press boxes, baseball dugouts, bleacher seating, ticket booths, locker room facilities and gymnasium expansion projects.

Lines of Business

Sports Field, through its wholly owned subsidiary, FirstForm, has two primary lines of business which are all integral parts of the organization’s overall business model. Our primary revenue generation comes from the sale and installation of our PrimePlay® line of synthetic turf products. Our secondary source of revenue is generated as a result of the design, engineering and construction management of athletic facilities and sports complexes. The construction management process is led by John Rombold and Scott Allen. Mr. Rombold is a licensed General Contractor as well as an experienced Project Manager. Scott Allen is a licensed Architect. Projects are bid and estimates for those bids are handled by both Mr. Rombold and Mr. Allen, taking into consideration the scope of the work and cost of materials and labor. Once the Company is awarded a project based, Mr. Rombold will manage the fields being installed. For project involving design, engineering, constructing, and construction management of athletic facilities and sports complexes, Mr. Allen manages the Field Site Manager that the Company hires for each project. We bid all work done on each site to at least 3 subcontracted labor companies that meet our high standard of quality. The combination of these two business units allow for the business to operate as a Turn-Key Athletic Facilities provider for a truly “one-stop-shop” simplified customer experience.

Historically, approximately 80% of the Company’s gross revenues are from synthetic turf surfacing products and systems sales. Sports facilities design, engineering and construction management have represented approximately 20% of the Company’s gross revenue. Projecting forward in the current year, the percentage of turf systems sales to construction related revenues should be approximately 70% to 30% respectively. Our goal is to continue to increase design, engineering and construction management revenues in order to create a more even mix between revenue streams in order to insulate the total revenue from fluctuations in the turf sales or construction markets.

Target Markets

Our main target market is the more than 60,000 colleges, universities, high schools and primary schools in the United States with athletic programs, both public and private. Municipal parks and recreations departments, commercial and residential landscaping as well as golf and golf related activities also represent significant market opportunities for the Company.

Additionally, we target private club sports associations and independent athletic training facilities, including all major sports, such as football, soccer, baseball, softball, lacrosse, field hockey, rugby, and track and field.

We also intend to market our unique design-build services to public youth sports leagues and all semi-professional and professional sports leagues.

Growth Strategy

Our primary goal is to be a leading provider of unique turn-key services that combine our strengths in safe and high performance synthetic turf systems, athletic facilities design, engineering and construction expertise. The key elements of our strategy include:

| 2 |

Expand our sales organization and increase marketing. Our sales structure is comprised of three discrete units: direct sales representatives, deal finders and sports ambassadors. We currently have three sales territories within the U.S.: East, Central, and West, with each territory containing its own dedicated sales professional. We are currently contracted with fifteen commission only deal finders who have extensive contacts in the sports industry and are making introductions for our direct sales team members to key decision makers around the U.S. Once a project lead is established, our distribution partners and deal finders bring in the local territory representative and drive the sales to close together as a team. We intend to continue to expand our highly-trained direct sales organization to secure contracts in every major region of the United States. By securing contracts and establishing Sports Field in all major regions of the country, the Company intends to seek to leverage those client relationships and successful projects to aggressively market to all potential clients in these regions.

Develop

and broaden high profile relationships to increase sales and drive revenues. In addition to installing a football/lacrosse

field, in December 2015, we entered into a four-year marketing agreement with IMG Academy in Bradenton, Florida (“IMG”),

a world renowned school and athletic training destination. IMG’s nationally recognized sports programs attract premier athletes

from all over the globe. Our official supplier agreement with IMG allows us to utilize their logo in our marketing materials,

perform site visits with clients to see our products as well as allow space for our 14,000 square foot research and development

installation, which has allowed us to conduct research in an effort to consistently update our product offerings and to make

sure we put out what we believe to be the safest and highest performing products in the market. In addition, we are allowed to

utilize IMG athletes to conduct product testing to ensure performance and safety for up to four times each year.

We hope to continue to develop high profile strategic relationships that will allow for greater awareness of our products and services with institutions that are focused on athlete safety and athletic performance.

Drive adoption and awareness of our eco-friendly turf and infill products among coaches, athletic directors, administrators, and athletes. We intend to educate coaches, athletic directors, administrators and athletes on the compelling case for our two infill products. The Company currently offers two infill products, OrganiteTM and TerraSportTM. Organite is our eco-friendly infill product that consists of Zeolite, Walnut Shell (Non-Allergenic Organic Shells) and ethylene propylene diene monomer (EPDM) rubber. EPDM is a virgin rubber that contains no metals of any kind or known carcinogens in any color except black. On occasion, Organite contains minimal levels of Black EPDM which is sometimes known to contain carbon black, a potential inhalation hazard during manufacturing; however, we are not aware of any data showing any health hazards related to ingestion and therefore we strongly believe that EPDM is a much safer alternative to SBR crumb rubber. TerraSportTM is eco-friendly and has absolutely no rubber at all and contains a proprietary mix of materials that are completely inert or biodegradable. Due to pricing competition, we keep Organite available for clients more concerned with cost, but we believe that our “rubberless” product will resonate amongst owners and drive additional demand for our products. Our infills are free from lead, chromium and all other potential cancer causing agents that are commonly found in fields all across the U.S. Our PrimePlay® synthetic turf products are free from the polyurethane backing, which cannot be recycled, that is commonly present in the majority of turf installations today.

| 3 |

Environmentally friendly, ecologically-safe, recyclable products and coating materials are available and we are using them in our current products. We believe our products perform, in all respects, as well or better than the ecologically-challenged products traditionally considered and currently used by many of our competitors. Due to our turn-key design-build process, we are able to offer our customers fields with ecologically friendly and safer materials at a price that is competitive with the traditional products. We believe that increased awareness of the benefits of our eco-friendly infill will favorably impact our sales.

Develop new technology products and services. Since inception, we have been in pursuit of developing a turf system that is comprised of synthetic fiber, turf backing, infill and shock/drainage pad that would allow us to market a product that virtually eliminates all of the current problems plaguing the industry. To date, we have studied and developed a high performing infill product that is free from any potential carcinogens and is capable of reducing field temperatures, designed a turf stitch pattern that will both reduce infill migration and prevent injury, removed polyurethane from our backing to allow for recycling, tested and provided a shock pad system from a third party supplier which will allow for high performance while reducing impact injuries due to lower G-max, and engineered drainage design plans that allow the system to be free from standing water even in the event of major downpours. All of these improvements to the system are being continuously challenged and tested at our research and development site located on the campus at IMG in Bradenton, Florida.

Our goal is to permanently staff a research and development office so that we can use everything we have learned about existing products and continue to create new products that will continue to improve performance while remaining safe for the players and the environment.

Pursue opportunities to enhance our product offerings. We may also opportunistically pursue the licensing or acquisition of complementary products and technologies to strengthen our market position or improve product margins. We believe that the licensing or acquisition of products would only strengthen our existing portfolio.

Lessen our dependency on third party manufacturers. As part of our long-term plans, we are exploring the possibility of reducing our reliance on third party manufacturers by bringing certain manufacturing, service and research and development functions in-house, which could include the acquisition of equipment and other fixed assets or the acquisition or lease of a manufacturing facility.

Operational Strengths

Highly Experienced Management and Key Personnel. We have assembled a senior management team and key personnel which includes Jeromy Olson, CEO; Scott Allen, Director of Architecture & Engineering; John Rombold, Director of Project Management; and Jacques Roman, Director of Sales. This current leadership team is comprised of individuals with significant experience in sales, design, architecture, engineering and construction industry.

Diversified Project Classes. The diversity of project types that are within our capabilities is a strength that we can exploit if there is an economic slowdown on any one particular sector. Our architectural design, engineering and construction expertise along with our surfacing product sales can support the company revenue streams in two discrete ways.

Specialized Market Approach. We are currently winning project bids at prices above our competitors that use crumb rubber due to customer demand for safer products. When other companies are forced to offer solutions similar to ours, we are already competitively priced. Much of the reason for our success is that we save money by employing our own project management, architecture and engineering, which ultimately lowers our overhead as compared to other companies that are not turn-key. We believe that, by targeting and maintaining this type of expertise in athletic facilities, the Company is more insulated from general economic downturn than general construction companies. This specialization is less susceptible to customers driving normal price points lower through mass competition.

Infrastructure built for growth. Current staffing levels have positioned the Company with excess operational capacity capable of doubling project execution without a significant impact on overhead.

| 4 |

Featured Products and Services

PrimePlay® Synthetic Turf Systems. All synthetic turf systems and products are marketed as our PrimePlay® line of products to service the athletic facilities market. Within this line are the synthetic turf and track products, infill materials and shock/drainage pads.

| * | Represents our turf system from the stone base under the field, shockpad, turf, and infill |

PrimePlay® Replicated Grass™. Our flagship synthetic turf system, Replicated Grass™, is designed with a shorter tuft-height and higher face-weight which combine to produce a surface with almost three times the blade-density of leading competitors. The result is a surface with increased infill stability. Because our infill is so stable and does not displace under normal use, there is no change in performance characteristics over time and the infill does not require replacement on as regular a basis as some of our competitor’s products that use crumb rubber. This increased density also offers athletes natural “ball-action”, or “ball roll”, and “natural foot-feel”, or “foot action” so it feels like they are playing on a real, lush grass surface. Replicated Grass™ also contains our “rubberless” TerraSportTM, which is composed entirely of naturally occurring materials. These infill materials offer no risk of cancer or other related health risks as well as many other valuable characteristics.

Product Features

Safe Alternative to Crumb Rubber. In February of 2016, four federal agencies — the U.S. Environmental Protection Agency (EPA), the Centers for Disease Control and Prevention (CDC), Agency for Toxic Substances and Disease Registry (ATSDR), and the U.S. Consumer Product Safety Commission (CPSC) — launched a joint initiative to study key safety and environmental human health questions related to the use of SBR crumb rubber in synthetic turf athletic fields, and any potential link to cancer. Sports Field has never used crumb rubber since its inception. The Company currently offers two infill products, Organite and our TerraSportTM. Organite is our eco-friendly infill product that consists of Zeolite, Walnut Shell (Non-Allergenic Organic Shells) and ethylene propylene diene monomer (EPDM) rubber. EPDM is a virgin rubber that contains no metals of any kind or known carcinogens in any color except black. On occasion, Organite contains minimal levels of Black EPDM, which is sometimes known to contain carbon black, a potential inhalation hazard during manufacturing; however, we are not aware of any data showing any health hazards related to ingestion and, therefore, we strongly believe that EPDM is a much safer alternative to SBR crumb rubber. TerraSportTM is eco-friendly and has absolutely no rubber at all and contains a proprietary mix of materials that are completely inert or biodegradable. Due to pricing competition, we keep Organite available for clients more concerned with cost but we believe that our “rubberless” product will resonate amongst owners and drive additional demand for our products.

Heat Reduction. An often overlooked health risk associated with artificial turf is the extremely high temperatures that can exist above the playing surface due to absorption of heat from the sun. When using rubber infills, the reflectivity of an artificial turf system is generally lower than natural grass (darker colors absorb more electromagnetic radiation) due to the exposure of dark infill. Further, artificial turf and rubber infill do not naturally contain and hold moisture, which provide evaporative cooling such as natural grass and soils do. Our product uses zeolite, which is light in color to absorb less heat and is a porous material capable of holding up to 55% of its weight in water. This moisture is released as temperatures rise to create an evaporative cooling effect on the field. Our internal data and testing has shown that our surfaces on average are 30 to 50 degrees cooler than that of most competitors.

| 5 |

Shock Attenuation. Rubber infills all have the same inherent problem: they break down and compact after prolonged exposure to UV light. As this breakdown happens over time, the surfaces get harder and harder as the rubber loses its elasticity. This process increases the risk of impact injuries for athletes.

The National Football League’s (the “NFL”) recent attention to head injuries is reflected in its adoption of new standards for impact forces. New NFL guidelines require that NFL fields have a G-Max value (G-Max is a measurement of how much force the surface will absorb, the higher the G-Max rating the less absorption of force by the surface) that is not greater than 100 (based on the “Clegg” method of calculating G-Max). We believe that this criterion will eventually trickle-down and apply to all sports surfaces. We believe that eventually all artificial turf fields will have to maintain a G-Max below 115 (indoor) and 125 (outdoor) (Clegg) for the life of the product.

Therefore, we developed a system and a TerraSportTM with no rubber and integrated the use of a third-party manufactured proprietary shock/drainage pad to be utilized under the playing surface. As a result, our system produces G-Max scores under 90 for the life of the product, which is well below the NFL minimum and the average new installation of sand and crumb rubber fields, which average around G-max of 110.

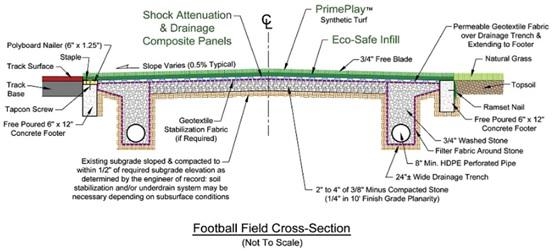

Base Construction. One of the key elements of any reliable turf athletic facility is the base construction. Conventional free-draining stone bases incorporate an inherent engineering conflict – drainage capacity vs. grade stability. In addition, the infiltration rate of the stone base cannot be accurately measured or predicted and degrades over time. To help eliminate these issues, we customize our drainage methodologies to meet specific project requirements and then we lay down our Replicated Grass products over the customized base. Our drainage methodology virtually eliminates engineering conflicts, practically eliminates invasive excavation, greatly reducing material import and export.

Below is an illustration of a typical installation design:

Warranty

The Company generally provides a warranty on products installed for up to 8 years with certain limitations and exclusions based upon the manufacturer’s product warranty.

| 6 |

Sales and Marketing

Our current sales structure is comprised of three (3) discrete units: our direct sales representatives, deal finders and our sports ambassadors. We currently have three (3) sales territories; East, Central and West, with each territory containing its own dedicated sales professional. We are currently contracted with fifteen (15) commission only deal finders who have extensive contacts in the sports industry and are making introductions for our direct sales team members to key decision makers around the U.S. Once a project lead is established, our deal finders bring in the local territory rep and drive the sales to close together as a team. We intend to continue to expand our direct sales organization in an effort to secure contracts in every major region of the United States. By securing contracts and establishing FirstForm® in all major regions of the country, the Company will seek to leverage those client relationships and successful projects to aggressively market to all potential clients in these regions.

We have initiated an ambassador program that includes current and former professional athletes from the sports in which they played. We currently have agreements with Thurman Thomas and Ray Lewis, both future Hall of Fame retired NFL players, Rick Honeycutt, former MLB pitcher and current pitching coach of the Los Angeles Dodgers and Chris Wingert, current 12-year veteran Major League Soccer player who most recently played with the Salt Lake City Real (collectively our “Sports Ambassadors”). These professionals maintain high level contacts with the NFL, Major League Baseball, professional soccer leagues, and major universities and colleges. These contacts have introduced the Company to NFL owners, professional athletes, college presidents and athletic directors, head coaches and other important industry contacts.

Our complete sales team, including our Sports Ambassadors, are active through the United States and will continue to call on relationships with their contacts. The efforts of this group of twenty-two (22) professionals comprise a major component of the Company’s sales and marketing initiatives and these contacts in the professional and collegiate sports industries represent a significant asset as the Company looks to continue its growth.

The Company has also engaged in targeted and innovative direct marketing to athletic directors, school business managers, college and high school athletic programs, high school football coaches, landscape architects, engineering firms, and municipal parks and recreation departments. This plan has its focus on our innovative products and construction methodologies.

In 2016, in advance of a full scale marketing campaign, we completely rebranded the company, which included a renaming that would allow us to market to our strengths in the industry and speak more directly to the values we represent. Effective April 4, 2016, Sports Field Engineering, Inc., our wholly-owned subsidiary, changed its name to FirstForm, Inc. This name change along with a new iconic logo and branding campaign includes a new brand development phase and roll out through every form of market communication.

Since then, we have created new tools as part of a comprehensive marketing plan that includes a brand new website with a focused SEO plan, creation of our new trade show booth exhibit materials, professional collateral sales literature and Power Point. It also includes the automation of our sales process through the adoption of a new customer relationship management software and mobile sales tools, engaging the market with the use of technology in concert with our high level professional sales team.

We intend continued expansion of our highly-trained direct sales organization to secure contracts in every major region of the United States. By securing contracts and establishing Sports Field in all major regions of the country, the Company will seek to leverage those client relationships and successful projects to aggressively market to all potential clients in these regions.

Competition

The competitive landscape with respect to manufacturing is very well-established, with seven companies selling the majority of synthetic turf products. Based on management’s experience and knowledge of the synthetic turf industry, Field Turf is the leading manufacturer of synthetic turf athletic fields and synthetic turf products, with what we believe is roughly 45% of the overall market and is one of the only companies operating in this space that we characterize as a true manufacturer. Shaw Sports, Astroturf, Sprint Turf and Hellas Construction are all purveyors of synthetic turf athletic fields with varying degrees of manufacturing and assembly. We estimate that these four companies account for approximately 20% of synthetic turf athletic field sales. There remains over 20 other distributors and to varying degrees, manufacturers and assemblers of synthetic turf products that account for the remaining 35% of the synthetic turf athletic fields market. These applications run the entire gamut of synthetic turf from residential and commercial landscaping, to golf applications, parks and recreation, private parks, airports, highway medians, downhill skiing, and other applications.

| 7 |

The competitive landscape from an installation and construction perspective looks very different when compared to the landscape of the manufacturing side of the industry. In regard to installation and construction of artificial turf fields and athletic facilities, the industry is very much fragmented. There are no clear national leaders from the perspective of facilities construction. The bulk of the construction is provided by local or regional general contracting firms that specialize in certain phases of synthetic turf athletic fields and facility construction, but, to our knowledge, no competitors with significant market share offer a true turn-key operation or include their own in-house engineering staff. Sports Field offers full service design and engineering services with forensic studies of athletic facilities to properly prepare and recommend custom specifications based on specific circumstances unique to every facility. In addition, the Company will provide full service turn-key construction services for the facility depending on a client’s needs, or simply provide project management services for a particular project.

Trademarks

We have two registered trademarks and one pending trademark with the United States Patent and Trademark Office, which include FirstForm®, PrimePlay® and TerraSportTM respectively. Since TerraSportTM has been released and is currently being marketed, the Company is seeking a registered trademark for this product.

We also believe we have certain common law rights with respect to the prior and continued usage of the names “Replicated Grass” and “Organite”.

Replicated Grass is our signature synthetic turf product.

Service Mark

The Company’s service mark is “Building the Best Comes First”, which stands for the Company’s commitment to research and development as well as quality workmanship.

Employees

We have 10 full time employees. Additionally, the Company employs 22 independent contractors, including 20 contract employees for sales and two for accounting and investor relations services. None of our employees are represented by a labor union.

Properties

Our principal office is located at 1020 Cedar Avenue, Suite 230 St. Charles, IL 60174. This office has approximately 1,400 sq. ft. office space rented at a rate of $1,367 per month. This space is utilized for office purposes and it is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our business activities. We do not foresee any significant difficulties in obtaining additional facilities if deemed necessary.

Where You Can Find More Information

Our website address is www.firstform.com. We do not intend our website address to be an active link or to otherwise incorporate by reference the contents of the website into this Report. The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549 or at https://sportsfieldholdingsinc.com/news-%2F-events. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

| 8 |

RISK FACTORS

RISKS RELATED TO OUR COMPANY

WE ARE NOT YET PROFITABLE AND MAY NEVER BE PROFITABLE.

Since inception through December 31, 2017, Sports Field has raised approximately $10,593,909 in capital. During this same period, we have recorded net accumulated losses totaling $15,823,096. As of December 31, 2017, we had a working capital deficit of $4,491,915. Our net losses for the two most recent fiscal years ended December 31, 2017 and 2016 have been $1,865,516 and $3,688,062, respectively. Our ability to achieve profitability depends upon many factors, including the ability to develop and commercialize products. There can be no assurance that we will ever achieve profitable operations.

WE HAVE RECEIVED A GOING CONCERN OPINION FROM OUR AUDITORS.

As reflected in the financial statements, we have received a going concern opinion from our auditors. As of December 31, 2017, the Company has cash of $281,662 and a working capital deficit of $4,491,915. Furthermore, the Company had a net loss and net cash provided from operations of ($1,865,516) and $444,406, respectively, for the year ended December 31, 2017, and an accumulated deficit totaling $15,823,096. Accordingly, these factors raise substantial doubt about the Company’s ability to continue as a going concern or complete some or all of its projects.

The ability of the Company to continue its operations as a going concern is dependent on management’s plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements.

WE HAVE A LIMITED OPERATING HISTORY.

We have been in existence for approximately five years. Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) develop and commercialize our products; (ii) achieve market acceptance of our products; or (iii) respond to competition. Additionally, even if we do implement our business plan, we may not be successful. No assurances can be given as to exactly when, if at all, we will be able to recognize profits high enough to sustain our business. We face all the risks inherent in a new business, including the expenses, difficulties, complications, and delays frequently encountered in connection with conducting operations, including capital requirements. Given our limited operating history, we may be unable to effectively implement our business plan which could materially harm our business or cause us to cease operations.

WE MAY SUFFER LOSSES IF OUR REPUTATION IS HARMED.

Our ability to attract and retain customers and employees may be adversely affected to the extent our reputation is damaged. If we fail, or appear to fail, to deal with various issues that may give rise to reputational risk, we could harm our business prospects. These issues include, but are not limited to, appropriately dealing with potential conflicts of interest, legal and regulatory requirements, ethical issues, money-laundering, privacy, record-keeping, sales and trading practices, and the proper identification of the legal, reputational, credit, liquidity, and market risks inherent in our business. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines, and penalties.

WE DEPEND ON OUR CHIEF EXECUTIVE OFFICER AND THE LOSS OF HIS SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

We place substantial reliance upon the efforts and abilities of Jeromy Olson, Chief Executive Officer. Though no individual is indispensable, the loss of the services of Mr. Olson could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the life of Mr. Olson.

Our success depends on attracting and retaining qualified personnel and subcontractors in a competitive environment.

The success of our business is dependent on our ability to attract, develop and retain qualified personnel advisors and subcontractors. Changes in general or local economic conditions and the resulting impact on the labor market may make it difficult to attract or retain qualified individuals in the geographic areas where we perform our work. If we are unable to provide competitive compensation packages, high-quality training programs and attractive work environments or to establish and maintain successful partnerships, our ability to profitably execute our work could be adversely impacted.

Accounting for our revenues and costs involves significant estimates.

Accounting for our contract-related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial position and results of operations.

| 9 |

WE COMPLETED A DEBT FINANCING WHICH IS secured by the grant of a security interest in all of our assets and upon a default the lender may foreclose on all of our assets.

In July 2016, we entered into the Loan Agreement with Genlink, pursuant to which Genlink made available to the Company a Revolving Loan. Pursuant to the Loan Agreement, the Company issued the Genlink Note up to an aggregate principal amount of One Million Dollars ($1,000,000), of which the Company has borrowed $1,000,000 to date, which is payable on December 20, 2017. Additionally, pursuant to the Loan Agreement, the Company and Genlink entered into the Security Agreement, pursuant to which the Company granted Genlink a senior security interest in substantially all of the Company’s assets as security for repayment of the Revolving Loan. In the event of the Company’s failure to make payments or to otherwise comply with the terms of the Revolving Loan under the Security Agreement or the Genlink Note, Genlink can declare a default and seek to foreclose on the Company’s assets. If the Company is unable to repay or refinance such indebtedness it may be forced to cease operations and the holders of the Company’s securities may lose their entire investment. In December 2017, this Loan Agreement was extended through January 25, 2019 and converted to a term loan bearing interest at 15% with monthly payments of $20,833 in principal plus interest with a balloon payment of $729,167 due on the maturity date. The Company incurred $10,000 in debt issuance costs as part of the modification which are recorded as debt discount and amortized over the agreement. Debt discount at December 31, 2017 is $10,000.

Our contract backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings.

We cannot guarantee that the revenues projected in our contract backlog will be realized or, if realized, will be profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects.

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR SECURITIES.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result of our small size, any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital.

We currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely gather, analyze and report information relative to the financial statements. As a result, our management has concluded that as of December 31, 2017, we have material weaknesses in our internal control procedures and our internal control over financial reporting was ineffective.

Because of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation of duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting in a situation where limitations on segregation of duties exist. In order to remedy this situation, we would need to hire additional staff. Currently, the Company has begun to hire additional staff to facilitate greater segregation of duties. Management intends to begin documenting and formalizing controls and procedures.

PENDING AND THREATENED CLAIMS.

Claims have been brought or threatened against the Company, and additional legal claims may arise from time to time. The Company may not be successful in the defense or prosecution of our current or future legal proceedings, which could result in settlement or damages that could significantly impact the Company’s business, financial conditions, results of operations and reputation. Please see the further discussion in “Legal Proceedings” and Note 11 in the accompanying consolidated financial statements.

PENDING AND THREATENED CLAIMS RELATING TO DEFAULT UNDER THE COMPANY’S OUTSTANDING NOTES.

As described in the notes to the Company’s consolidated financial statements, the Company was not compliant with the repayment terms of some of its notes. The Company is currently conducting good faith negotiations with the relevant note holders to further extend the maturity dates, however, there can be no assurance that any such extensions will be granted. At this time, no further action has been taken by the respective note holders in connection with the Company’s noncompliance with the repayment terms of the notes. It is possible that the Company’s results of operations, cash flows or financial position could be materially adversely affected by any unfavorable outcome or settlement of this matter. Additionally, resolution of this matter, through litigation or otherwise, may require significant expenditures of time and other resources. To the extent that litigation is pursued as a means of resolving this matter, litigation is inherently uncertain, and the Company could experience significant adverse results, including but not limited to adverse publicity surrounding the litigation and significant reputational harm.

| 10 |

RISKS RELATING TO OUR INDUSTRY

THE INSTALLATION OF SYNTHETIC TURF IS A HIGHLY COMPETITIVE INDUSTRY.

The installation of synthetic turf is a highly competitive and highly fragmented industry. Competing companies may be able to beat our bids for the more desirable projects. As a result, we may be forced to lower bids on projects to compete effectively, which would then lower the fees we can generate. We may compete for the management and installation of synthetic turf with many entities, including nationally recognized companies. Many competitors may have substantially greater financial resources than we do. In addition, certain competitors may be willing to accept lower fees for their services.

THE SUCCESS OF OUR BUSINESS IS SIGNIFICANTLY RELATED TO GENERAL ECONOMIC CONDITIONS AND, ACCORDINGLY, OUR BUSINESS COULD BE HARMED BY THE ECONOMIC SLOWDOWN AND DOWNTURN IN FINANCING OF PUBLIC WORKS CONTRACTS.

Our business is closely tied to general economic conditions. As a result, our economic performance and the ability to implement our business strategies may be affected by changes in national and local economic conditions. During an economic downturn funding for public contracts tends to decrease significantly thereby limiting the growth and opportunities available for new and established businesses in the synthetic turf industry. An economic downturn may limit the number of projects that we are able to bid on and limit the opportunities we have to penetrate the synthetic turf industry, stunting the Company’s growth prospects and having a material adverse effect on our business.

THE COMPANY’S BUSINESS MAY BE SUBJECT TO THE EFFECTS OF ADVERSE PUBLICITY AND NEGATIVE PUBLIC PERCEPTION RELATED TO SYNTHETIC TURF PRODUCTS.

Negative public perception regarding our industry resulting from, among other things, concerns raised by advocacy groups or the public in general about synthetic turf fields and the potential impact on human health related to certain chemical compounds found in the infill of such fields may negatively impact the sales of synthetic turf products. Despite not using any toxic or known harmful materials in our products, there can be no assurance that the Company will not be subject to adverse publicity or negative public perception surrounding the impact on human health of synthetic turf and related products in the future or that such negative public perception would not have an adverse or material negative impact on its financial position, results of operations or cash flows.

IF WE ARE UNABLE TO OBTAIN RAW MATERIALS IN A TIMELY MANNER OR IF THE PRICE OF RAW MATERIALS INCREASES SIGNIFICANTLY, PRODUCTION TIME AND PRODUCT COSTS COULD INCREASE, WHICH MAY ADVERSELY AFFECT OUR BUSINESS.

Synthetic turf made to our specifications can be purchased from a variety of manufacturers, there are several sources of all of our infill products and two manufacturers from which we can purchase expanded polypropylene shock and drainage pads. We do not anticipate any supply issues due to the fact that the raw materials to develop these products are readily available and currently not scarce. We do not have any exclusive supplier contracts for our products. We buy our pad, infill components and turf from manufacturers at the best price we can negotiate based on volume discounts but if the prices of the raw materials necessary to make these products, including the yarn, backing and infill in our products, rise significantly, we may be unable to pass on the increased cost to our customers. Our results of operations could be adversely affected if we are unable to obtain adequate supplies of raw materials in a timely manner or at reasonable cost. In addition, from time to time, we may need to reject raw materials that do not meet our specifications, resulting in potential delays or declines in output. Furthermore, problems with our raw materials may give rise to compatibility or performance issues in our products, which could lead to an increase in customer returns or product warranty claims. Errors or defects may arise from raw materials supplied by third parties that are beyond our detection or control, which could lead to additional customer returns or product warranty claims that may adversely affect our business and results of operations.

Failure to maintain safe work sites could result in significant losses.

Construction and maintenance sites are potentially dangerous workplaces and often put our employees and others in close proximity with mechanized equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials. On many sites, we are responsible for safety and, accordingly, must implement safety procedures. If we fail to implement these procedures or if the procedures we implement are ineffective, we may suffer the loss of or injury to our employees, as well as expose ourselves to possible litigation. Our failure to maintain adequate safety standards could result in reduced profitability or the loss of projects or clients, and could have a material adverse impact on our financial position, results of operations, cash flows and liquidity.

An inability to obtain bonding could have a negative impact on our operations and results.

We may be required to provide surety bonds securing our performance for some of our public and private sector contracts. Our inability to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

| 11 |

Design-build contracts subject us to the risk of design errors and omissions.

Design-build is increasingly being used as a method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We generally do not subcontract design responsibility as we have our own architects and engineers in-house. In the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case, we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity.

Many of our contracts have penalties for late completion.

In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a certain date. If we subsequently fail to complete the project as scheduled we may be held responsible for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages. To the extent these events occur, the total cost of the project could exceed our original estimate and we could experience reduced profits or a loss on that project.

Strikes or work stoppages could have a negative impact on our operations and results.

Some of our projects require union labor and although we have not experienced strikes or work stoppages in the past, such labor actions could have a significant impact on our operations and results if they occur in the future.

Failure of our subcontractors to perform as anticipated could have a negative impact on our results.

We subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher-risk subcontractors. In this case we may be responsible for the failures on the part of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In addition, the total costs of a project could exceed our original estimates and we could experience reduced profits or a loss for that project, which could have an adverse impact on our financial position, results of operations, cash flows and liquidity.

WE MUST ANTICIPATE AND RESPOND TO RAPID TECHNOLOGICAL CHANGE.

The market for our products and services is characterized by technological developments and evolving industry standards. These factors will require us to continually improve the performance and features of our products and services and to introduce new products and services, particularly in response to offerings from our competitors, as quickly as possible. As a result, we might be required to expend substantial funds for and commit significant resources to the conduct of continuing product development. We may not be successful in developing and marketing new products and services that respond to competitive and technological developments, customer requirements, or new design and production techniques. Any significant delays in product development or introduction could have a material adverse effect on our operations.

FAILURE TO PROTECT OUR INTELLECTUAL PROPERTY OR TECHNOLOGY OR OBTAIN RIGHTS TO USE OTHERS’ INTELLECTUAL PROPERTY OR TECHNOLOGY COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS.

We take steps to protect our intellectual property rights such as filing for patent protection where we deem appropriate. However, there is no guarantee that any technology we seek to protect will, in fact, be granted patent protection or any other form of intellectual property protection. Consequently, if we are unable to secure exclusive rights in such technology, our competitors may be free to use such technology as well. We may at times also be subject to the risks of claims and litigation alleging infringement of the intellectual property rights of others. There is no guarantee that we will be able to resolve such claims or litigations favorably, and may, as a result, be exposed to adverse decisions in such litigations which may require us to pay damages, cease using certain technologies or products, or license certain technology, which licenses may not be available to us on commercially reasonable terms or at all. Moreover, intellectual property litigation, regardless of the ultimate outcomes, is time-consuming and expensive and can result in the distraction of management personnel and expenditure of consider resources in defending against any such infringement claims.

| 12 |

WE RELY UPON THIRD-PARTY MANUFACTURERS AND SUPPLIERS, WHICH PUTS US AT RISK FOR THIRD-PARTY BUSINESS INTERRUPTIONS.

We rely on third-party manufactures and suppliers for the individual products that we use to create our system which we then sell to owners. We have dozens of tufting companies to choose from in manufacturing our specific design for turf and bid them out often. We also have multiple suppliers for all of our infill contents as well as several shock pad suppliers of which we have used two to three of each historically. The success for our business depends in part on our ability to retain such third-party manufacturers and suppliers to provide subparts for our products and materials for the services we provide. If manufacturers and suppliers fail to perform, our ability to market products and to generate revenue would be adversely affected. Our failure to deliver products and services in a timely manner could lead to customer dissatisfaction and damage to our reputation, cause customers to cancel contracts and to stop doing business with us.

LOWER THAN EXPECTED DEMAND FOR OUR PRODUCTS AND SERVICES WILL IMPAIR OUR BUSINESS AND COULD MATERIALLY ADVERSELY AFFECT OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Currently, there are approximately 11,000 synthetic turf fields installed in the U.S. and approximately 1,000 new fields installed every year, according to the Synthetic Turf Council. Given that there are approximately 50,000 colleges and high schools in the U.S. with athletic programs, in so far as athletic fields are concerned, at some point in the future, saturation will slow the growth of the industry. If we meet a lower demand for our products and services than we are expecting, our business results and operations and financial condition are likely to be materially adversely affected. Moreover, overall demand for synthetic turf products and services in general may grow slowly or decrease in upcoming quarters and years because of unfavorable general economic conditions, decreased spending by schools and municipalities in need of synthetic turf products or otherwise. This may reflect a saturation of the market for synthetic turf. To the extent that there is a slowdown in the overall market for synthetic turf, our business, results of operations and financial condition are likely to be materially adversely affected.

WE MAY BE SUBJECT TO THE RISK OF SUBSTANTIAL ENVIRONMENTAL LIABILITY AND LIMITATIONS ON OUR OPERATIONS BROUGHT ABOUT BY THE REQUIREMENTS OF ENVIRONMENTAL LAWS AND REGULATIONS.

We may be subject to various federal, state and local environmental, health and safety laws and regulations concerning issues such as, wastewater discharges, solid and hazardous materials and waste handling and disposal, landfill operation and closure. While Sports Field believes that it is and will continue to manufacture products in compliance with all applicable environmental laws and regulations, the risks of substantial additional costs and liabilities related to compliance with such laws and regulations are an inherent part of our business.

Risks Relating to Ownership of our SECURITIES

WE CURRENTLY DO NOT INTEND TO PAY DIVIDENDS ON OUR COMMON STOCK. AS A RESULT, YOUR ONLY OPPORTUNITY TO ACHIEVE A RETURN ON YOUR INVESTMENT IS IF THE PRICE OF OUR COMMON STOCK APPRECIATES.

We currently do not expect to declare or pay dividends on our common stock. In addition, our Revolving Loan with Genlink restricts our ability to declare or pay dividends on our common stock so long as it remains outstanding. As a result, your only opportunity to achieve a return on your investment will be if the market price of our common stock appreciates and you sell your shares and shares underlying your warrants at a profit.

| 13 |

YOU MAY EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST DUE TO THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK.

We are in a highly competitive business and we might not have sufficient funds to finance the growth of our business or to support our projected capital expenditures. As a result, we will require additional funds from future equity or debt financings, including potential sales of preferred shares or convertible debt, to complete the development of new projects and pay the general and administrative costs of our business. We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of holders of our common stock. We are currently authorized to issue 250,000,000 shares of common stock and 20,000,000 shares of preferred stock. We may also issue additional shares of common stock or other securities that are convertible into or exercisable for common stock in future public offerings or private placements for capital raising purposes or for other business purposes. The future issuance of a substantial number of common stock into the public market, or the perception that such issuance could occur, could adversely affect the prevailing market price of our common shares. A decline in the price of our common stock could make it more difficult to raise funds through future offerings of our common stock or securities convertible into common stock.

Our Certificate of Incorporation allows for our board of directors to create new series of preferred stock without further approval by our stockholders, which could have an anti-takeover effect and could adversely affect holders of our common stock.

Our authorized capital includes preferred stock issuable in one or more series. Our board of directors has the authority to issue preferred stock and determine the price, designation, rights, preferences, privileges, restrictions and conditions, including voting and dividend rights, of those shares without any further vote or action by stockholders. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. The issuance of preferred stock, while providing desirable flexibility in connection with possible financings and acquisitions and other corporate purposes, could make it more difficult for a third party to acquire a majority of the voting power of our outstanding voting securities, which could deprive our holders of common stock to purchase common stock at a premium that they might otherwise realize in connection with a proposed acquisition of our company.

IF AND WHEN A LARGER TRADING MARKET FOR OUR SECURITIES DEVELOPS, THE MARKET PRICE OF SUCH SECURITIES IS STILL LIKELY TO BE HIGHLY VOLATILE AND SUBJECT TO WIDE FLUCTUATIONS, AND YOU MAY BE UNABLE TO RESELL YOUR SECURITIES AT OR ABOVE THE PRICE AT WHICH YOU ACQUIRED THEM.

The stock market in general has experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may not be able to sell your securities that you purchase in at or above the price you paid for such securities. The market price for our securities may be influenced by many factors that are beyond our control, including, but not limited to:

| ● | variations in our revenue and operating expenses; | |

| ● | market conditions in our industry and the economy as a whole; | |

| ● | actual or expected changes in our growth rates or our competitors’ growth rates; | |

| ● | developments in the financial markets and worldwide or regional economies; | |

| ● | variations in our financial results or those of companies that are perceived to be similar to us; | |

| ● | announcements by the government relating to regulations that govern our industry; | |

| ● | sales of our common stock or other securities by us or in the open market; | |

| ● | changes in the market valuations of other comparable companies; | |

| ● | general economic, industry and market conditions; and | |

| ● | the other factors described in this “Risk Factors” section. |

| 14 |

The trading price of our shares might also decline in reaction to events that affect other companies in our industry, even if these events do not directly affect us. Each of these factors, among others, could harm the value of your investment in our securities. In the past, following periods of volatility in the market, securities class-action litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could materially and adversely affect our business, operating results and financial condition.

If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock and warrants will be influenced by the research and reports that industry or securities analysts may publish about us, our business, our market or our competitors. If any of the analysts who may cover us change their recommendation regarding our stock adversely, or provide more favorable relative recommendations about our competitors, our securities price would likely decline. If any analyst who may cover us were to cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

Item 1B. Unresolved Staff Comments.

Not applicable.

Our principal office is located at 1020 Cedar Avenue, Suite 230 St. Charles, IL 60174. This office has approximately 1,400 sq. ft. office space rented at a rate of $1,367 per month. This space is utilized for office purposes and it is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our business activities. We do not foresee any significant difficulties in obtaining additional facilities if deemed necessary.

Except as set forth below, there are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is adverse to the Company or any of our subsidiaries or has a material interest adverse to the Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years.

On October 18, 2017, a letter was sent to the board of directors and the CEO of the Company on behalf of one of the Company’s note holders, demanding that the Company repay its outstanding debt in the principal aggregate amount of $200,000, plus accrued interest, issued pursuant to a convertible note dated May 7, 2015. The Company has not been named in any legal proceeding relating to this matter and is in discussions with the note holder to resolve this matter. However, no assurance can be given that the Company will be able to resolve this matter or the timing of any such resolution.

On January 26, 2018, the Company and one of its historical clients executed a Settlement Agreement, pursuant to which the Company is obligated to remediate a track which was improperly installed by one of the Company’s subcontractors. No later the July 15, 2018, the Company is obligated to complete installment of a replacement track which is of the same or comparable specifications as in the original contract. Upon completion of the installation, the client is obligated to release from escrow a retainage amount of $110,000. During construction, the Company’s insurance company is obligated to release from escrow funds to cover the expected construction costs of $370,000; the remediation will be entirely funded with insurance proceeds.

On December 30, 2016, the Company entered into a mutual general release and settlement agreement (the “Settlement Agreement”) with the former employee. Pursuant to the Settlement Agreement, the Company agreed to pay the former employee $45,000, payable in six equal installments of $7,500 on the first day of each month, beginning January 1, 2017 (the “Settlement Amount”). The Settlement Agreement also contains a general release by the former employee of the Company relating to the Claim, such release however is predicated on the Company making payments pursuant to the Settlement Agreement. As of December 31, 2017, the outstanding balance on this obligation was $0.

Item 4. Mine Safety Disclosures.

Not applicable.

| 15 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

Our shares of Common Stock are quoted on the OTCQB under the symbol “SFHI.” The OTCQB is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (“OTC”) equity securities. An OTCQB equity security is not listed or traded on a national securities exchange.

The following table sets forth the high and low bid price for our common stock for each quarter during the 2017 and 2016 fiscal years. The prices reflect inter-dealer quotations, do not include retail mark-ups, markdowns or commissions and do not necessarily reflect actual transactions.

| Fiscal 2017 | High | Low | ||||||

| First Quarter (January 1 – March 31) | $ | 0.49 | $ | 0.25 | ||||

| Second Quarter (April 1 – June 30) | $ | 0.50 | $ | 0.25 | ||||

| Third Quarter (July 1 – September 30) | $ | 0.50 | $ | 0.27 | ||||

| Fourth Quarter (October 1 – December 31) | $ | 0.50 | $ | 0.30 | ||||

| Fiscal 2016 | High | Low | ||||||

| First Quarter (January 1 – March 31) | $ | 1.48 | $ | 0.11 | ||||

| Second Quarter (April 1 – June 30) | $ | 1.45 | $ | 0.35 | ||||

| Third Quarter (July 1 – September 30) | $ | 0.75 | $ | 0.31 | ||||

| Fourth Quarter (October 1 – December 31) | $ | 0.49 | $ | 0.23 | ||||

(b) Holders of Common Equity

As of March 31, 2018, there were 238 stockholders of record. An additional number of stockholders are beneficial holders of our Common Stock in “street name” through banks, brokers and other financial institutions that are the record holders.

(c) Dividend Information

We have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Rule 10B-18 Transactions

During the year ended December 31, 2017, there were no repurchases of the Company’s common stock by the Company.

Recent Sales of Unregistered Securities

During the year ended December 31, 2017, we have issued the following securities which were not registered under the Securities Act and not previously disclosed in the Company’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. Unless otherwise indicated, all of the share issuances described below were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act for transactions not involving a public offering:

Issuance of Common Stock in Exchange for Services

During the period January 1, 2017 through December 31, 2017, the Company issued 130,466 shares of its common stock at a fair value of $55,433 to a consultant pursuant to his agreement with the Company and service in such capacity. The shares were valued based upon the quoted closing trading price on the date of issuance.

During the period January 1, 2017 through December 31, 2017, the Company issued 95,000 shares of common stock to three sales consultants, for services rendered at a fair value of $35,200. The shares were valued based upon the quoted closing trading price on the date of issuance.

During the period January 1, 2017 through December 31, 2017, the Company issued 40,000 shares of common stock to NexPhase Global, a consulting firm owned in part by Mr. Olson, for services rendered at a fair value of $17,000. The shares were valued based upon the quoted closing trading price on the date of issuance.

On July 27, 2017, the Company issued 40,000 shares of its common stock at a fair value of $16,800 to a firm to provide investor relations and services in such capacity. The shares were valued based upon the quoted closing trading price on the date of issuance.

During the period January 1, 2017 through December 31, 2017, the Company issued 7,500 shares of its common stock at a fair value of $3,000 to an employee for services. The shares were valued based upon the quoted closing trading price on the date of issuance.

| 16 |

Issuance of Stock Options for Services

On May 15, 2017, the Company issued 200,000 common stock options to a board member for his services at a fair value of $4,015. The options vest ratably over a two-year period and have a $1 strike price.

On July 11, 2017, the Company issued 100,000 common stock options to a consultant for investor relations services at a fair value of $13,286. The options immediately vested and have a $0.35 strike price.

Item 6. Selected Financial Data.

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Summary of Statements of Operations for the Years Ended December 31, 2017 and 2016:

| Year Ended | ||||||||

| December 31, 2017 | December 31, 2016 | |||||||

| Revenue | $ | 7,045,892 | $ | 3,225,277 | ||||

| Gross profit | $ | 1,091,962 | $ | 311,533 | ||||

| Operating expenses | $ | (2,821,994 | ) | $ | (3,474,349 | ) | ||

| Loss from operations | $ | (1,730,032 | ) | $ | (3,162,816 | ) | ||

| Other income (expense) | $ | (135,484 | ) | $ | (525,246 | ) | ||

| Net loss | $ | (1,865,516 | ) | $ | (3,688,062 | ) | ||

| Loss per common share - basic and diluted | $ | (0.11 | ) | $ | (0.23 | ) | ||

Revenue

Revenue was $7,045,892 for the year ended December 31, 2017, as compared to $3,225,277 for the year ended December 31, 2016, an increase of $3,820,615. The substantial increase in revenue was primarily due to contracts entered into during prior year that had substantial work completed during 2017.

Gross Profit