Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Actua Corp | exhibit322q42017.htm |

| EX-32.1 - EXHIBIT 32.1 - Actua Corp | exhibit321q42017.htm |

| EX-31.2 - EXHIBIT 31.2 - Actua Corp | exhibit312q42017.htm |

| EX-31.1 - EXHIBIT 31.1 - Actua Corp | exhibit311q42017.htm |

| EX-23.1 - EXHIBIT 23.1 - Actua Corp | exhibit231q42017.htm |

| EX-21.1 - EXHIBIT 21.1 - Actua Corp | exhibit211q42017.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For Fiscal Year Ended December 31, 2017 | |

or | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission File Number 001-16249

Actua Corporation (Exact Name of Registrant as Specified in Its Charter) |

Delaware | 23-2996071 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

555 East Lancaster Ave., Suite 640, Radnor, PA | 19087 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (610) 727-6900 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common stock, par value .001 per share | OTC Markets QB | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act Yes ¨ No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-T is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ý | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Emerging growth company | ¨ | |||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of 29,305,150 shares of common stock held by non-affiliates of the Registrant as of June 30, 2017 was $411.7 million, based upon the closing price of $14.05 per share on the last business day of the Registrant's most recently completed second fiscal quarter, June 30, 2017. (The Registrant has excluded the market value of all shares of its common stock held by its executive officers and directors; such exclusion shall not be deemed to constitute an admission that any such person is an "affiliate" of the Registrant.)

The number of shares of the Company’s common stock, $0.001 par value per share, outstanding as of March 28, 2018 was 31,949,234 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement and/or an amendment to this Form 10-K, in either case, to be filed with the U.S. Securities and Exchange Commission within 120 days after December 31, 2017 are incorporated by reference into Part III of this Form 10-K.

ACTUA CORPORATION

FORM 10-K

DECEMBER 31, 2017

INDEX

PAGE NO | ||||

PART I | ||||

ITEM 1. | ||||

ITEM 1A. | ||||

ITEM 1B. | ||||

ITEM 2. | ||||

ITEM 3. | ||||

ITEM 4. | ||||

PART II | ||||

ITEM 5. | ||||

ITEM 6. | ||||

ITEM 7. | ||||

ITEM 7A. | ||||

ITEM 8. | ||||

ITEM 9. | ||||

ITEM 9A. | ||||

ITEM 9B. | ||||

PART III | ||||

ITEM 10. | ||||

ITEM 11. | ||||

ITEM 12. | ||||

ITEM 13. | ||||

ITEM 14. | ||||

PART IV | ||||

ITEM 15. | ||||

ITEM 16. | ||||

1

Availability of Reports and Other Information

Our Internet website address is www.actua.com. Unless this Annual Report on Form 10-K (this "Report") explicitly states otherwise, neither the information on our website, nor the information on the websites of any of our businesses, is incorporated by reference into this Report.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K (including, in each case, those filed by ICG Group, Inc. (NASDAQ: ICGE) prior to our corporate name change to Actua Corporation (NASDAQ: ACTA) in September 2014) and all amendments to those reports filed by us with the U.S. Securities and Exchange Commission (the "SEC") pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are accessible free of charge through our website as soon as reasonably practicable after we electronically file those documents with, or otherwise furnish them to, the SEC.

The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information that publicly-traded companies file electronically with the SEC.

Forward-Looking Statements

Forward-looking statements made with respect to our financial condition, results of operations and business in this Report, and those made from time to time by us through our senior management, are made pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Those forward-looking statements are based on our current expectations and projections about future events but are subject to known and unknown risks, uncertainties and assumptions about us and our companies that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by those forward-looking statements.

Factors that could cause our actual results, levels of activity, performance or achievements to differ materially from those anticipated in forward-looking statements (including the additional amounts distributed to our stockholders, if any) include, but are not limited to, factors discussed elsewhere in this Report and include, among other things:

• | the accuracy of our estimates regarding the expenses associated with our obligations, liabilities and claims, including pending litigation and the expenses associated with our anticipated dissolution and liquidation; |

• | potential new claims being asserted against us and/or our directors and officers; |

• | the net proceeds we receive for our non‑cash property and assets; |

• | potential additional proceeds that we may receive in connection with prior sales of our businesses; |

• | the timing and amount of any additional stockholder distributions; |

• | the approval by stockholders of our plan of dissolution; |

• | U.S. federal income tax treatment of any distributions; and |

• | our ability to obtain relief from certain reporting requirements under the Exchange Act. |

In light of those risks, uncertainties and assumptions, the forward-looking events discussed in this Report might not occur. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "would," "expect," "plan," "anticipate," "believe," "estimate," "continue" or the negative of such terms or other similar expressions. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements included in this Report. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

2

PART I

ITEM 1. Business

Overview

Actua Corporation (f/k/a ICG Group, Inc.) (referred to in this Report as "Actua", the "Company," "we," "our," or "us") was formed on March 4, 1996 and is headquartered in Radnor, Pennsylvania. Prior to Actua’s recent sale of its interests in its three majority-owned businesses, VelocityEHS Holdings, Inc. ("Velocity"), BOLT Solutions Inc. ("Bolt") and Folio Dynamics Holdings, Inc. ("FolioDynamix"), which together constituted substantially all of Actua’s assets (such sales together, the "Transactions"), Actua was a multi-vertical cloud technology company with software and service offerings that Actua believes created unique and compelling value for its customers and provided transformative efficiency to vertical markets.

Actua’s common stock was traded on The NASDAQ Global Select Market under the symbol "ACTA" until Actua voluntarily delisted its common stock, effective as of February 7, 2018. Actua’s common stock is currently trading on the OTCQB Market under the symbol "ACTA."

Following stockholder approval of the Transactions, the sale of Actua’s interests in Velocity and Bolt (the "Velocity/Bolt Sale") was completed on December 12, 2017, and the sale of FolioDynamix was completed on January 2, 2018. In light of the Transactions and the previous sale of GovDelivery Holdings, Inc. ("GovDelivery") to an affiliate of Vista Equity Partners ("Vista") on October 18, 2016 (the "GovDelivery Sale"), our results of operations for these companies are being presented as discontinued operations as of December 31, 2017 and for all comparable periods.

Whenever Actua completes an acquisition or disposition, it evaluates the impact of the transaction on its reportable segments. Due to the Transactions, Actua no longer has separate operating segments. For information regarding the results of operations, see "Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations" and "Item 8—Financial Statements and Supplementary Data," including our Consolidated Financial Statements; that information is incorporated herein by reference.

On January 18, 2018, the Actua Board of Directors (the "Board") approved a formal plan of dissolution (the "Plan of Dissolution"), subject to stockholder approval. At a special meeting of Actua’s stockholders to be held on April 18, 2018, Actua’s stockholders will be asked to approve the voluntary dissolution and liquidation of Actua pursuant to the Plan of Dissolution. If the Plan of Dissolution is approved by the requisite vote of Actua’s stockholders, Actua will file a Certificate of Dissolution with the Delaware Secretary of State and, thereafter, conduct only business activities relating to winding up and liquidating its business and affairs, including but not limited to the following:

• | the receipt of amounts due to Actua and/or resulting from the sale, exchange or other disposition of all or substantially all of Actua’s non-cash property and assets, in one transaction or in several transactions, including: |

◦ | proceeds from the disposition of its minority ownership stakes (generally less than 10%) in several private companies, including: |

▪ | InstaMed Holdings, Inc. (a cloud-based healthcare payments network) ("InstaMed"); |

• | Parchment Inc. (a provider of cloud-based technology for education credentials) ("Parchment"); |

• | Savana, Inc. (a provider of financial process automation technology); |

• | Relay Holdings, LLC (a provider of a mobile customer communications platform); |

• | Stage2 Capital Ventures Associates, L.P. (an investor in technology businesses); and |

• | Audyssey Laboratories, Inc., Blurb, Inc. and Solarflare Communications, Inc. (each of which is a technology business in which Actua acquired a stake through the wind-down and liquidation of Anthem Ventures Fund, L.P. and Anthem Annex Fund, L.P.) (collectively, the "Minority Investments"); and |

◦ | proceeds, if any, from the Client Consent Adjustment Amount (as such term is defined in that certain Agreement and Plan of Merger, dated September 25, 2017, among FolioDynamix, Envestnet, Inc. ("Envestnet"), FCD Merger Sub, Inc., a wholly-owned subsidiary of Envestnet, and Actua USA Corporation, a wholly-owned subsidiary of Actua, as the representative of FolioDynamix’s stockholders, the merger agreement underlying Actua’s sale of its interests in FolioDynamix to Envestnet (such agreement, the "Folio |

3

Sale Agreement")), pursuant to which Actua may realize approximately $11.6 million in additional cash proceeds in the second quarter of 2018 if and to the extent that FolioDynamix is able to meet an agreed-upon threshold under a previously disclosed purchase price adjustment mechanism relating to client consents (all such future amounts received (including from the sale of Minority Investments), collectively, the "Potential Additional Proceeds");

• | the defense, resolution and/or settlement of any litigation against Actua (including the previously disclosed lawsuit in the Court of Chancery of the State of Delaware captioned Inter-Atlantic Fund II, L.P. and Neurone II Investments G.P. Ltd. v. Actua Corporation et al., Case No. 2017-0858-JTL (and any other lawsuit, action or claim from any Bolt stockholder relating to Actua’s ownership or sale of Bolt or any subsequent sale of Bolt), along with any indemnification claims against Actua or other obligations related thereto (collectively, the "Bolt Litigation")), as well as any potential claims for indemnification in connection with sales of Actua’s businesses, and the making of reasonable provision to pay insurance retentions and legal fees in connection with any such lawsuit or claim; |

• | the payment of or the making of reasonable provision to pay all known claims and obligations, including all contingent, conditional or un-matured contractual claims known to Actua; |

• | the making of such provision as will be reasonably likely to be sufficient to satisfy any claim against Actua which is the subject of a pending action, suit or proceeding to which Actua is a party; |

• | the making of such provision as will be reasonably likely to be sufficient to satisfy any claims that have not been made known to Actua or that have not arisen but that, based on facts known to Actua, are likely to arise or become known to Actua within ten years after the date of dissolution; |

• | the setting aside of a reserve consisting of cash and/or property to satisfy such claims and contingent obligations; |

• | the payment of any additional liquidating distribution to Actua’s stockholders; and |

• | the pro rata distribution to Actua’s stockholders, or the transfer to one or more liquidating trustees for the benefit of Actua’s stockholders under a liquidating trust, of the remaining assets of Actua after payment or provision for payment of claims against and obligations of Actua. |

Under Delaware law, Actua will continue to exist for three years after Actua’s dissolution or for such longer period as the Delaware Court of Chancery directs, or as may be required to resolve any pending litigation matters, for the purpose of prosecuting and defending suits against Actua and enabling Actua gradually to close its business, to dispose of its property, to discharge its liabilities and to distribute any remaining assets to its stockholders. The Plan of Dissolution also provides for the appointment, at the Board’s discretion, of a manager to oversee the sale of Actua’s assets and Actua’s liquidation and wind up (such individual, or any successor person(s) as the Board may later designate, the "Manager").

The proportionate interests of all of Actua’s stockholders will be fixed on the basis of their respective stock holdings at the close of business on the date the Certificate of Dissolution is filed with the Delaware Secretary of State as determined by the Board, which date is referred to herein as the "Final Record Date". Actua intends to discontinue recording transfers of shares of its common stock on the Final Record Date, and thereafter certificates representing shares of Actua’s common stock will not be assignable or transferable on Actua’s books except by will, intestate succession or operation of law. After the Final Record Date, any distributions made by Actua will be made solely to the stockholders of record as of the close of business on the Final Record Date, except as may be necessary to reflect subsequent transfers recorded on Actua’s books as a result of any assignments by will, intestate succession or operation of law. In light of the dissolution, Actua intends to request permission from the SEC to suspend certain of Actua's reporting obligations under the Exchange Act, and ultimately to terminate the registration of its common stock.

On February 1, 2018, Actua distributed to each holder of its common stock an amount equal to $14.89 per share (the "Transaction Distribution"); such distribution is intended to be a liquidating distribution assuming approval of the Plan of Dissolution. If funds are available and to the extent permitted by Delaware law, Actua intends to make additional liquidating distributions to its stockholders from time to time following the effective date of the filing of the Certificate of Dissolution. Actua is unable to predict the precise amount or timing of any additional liquidating distributions (or whether any additional liquidating distributions will occur at all), however, as many of the factors influencing the amount of cash distributed to Actua’s stockholders in additional liquidating distribution(s) and/or the timing of such distributions cannot be currently quantified with certainty and are subject to change. Total actual distributions, if any, could be higher or lower, than Actua's previously disclosed estimates or there may not be any additional liquidating distributions at all. It is possible that any distribution could be followed in the future by additional

4

distributions if it is determined that any reserved amounts no longer need to be reserved or if Actua realizes more Potential Additional Proceeds than expected as part of the liquidation process. The actual amounts and timing of any additional liquidating distributions may vary substantially, depending on, among other things, the actual operating expenses Actua incurs during the dissolution and wind-down process, Actua’s ability to successfully defend, resolve and/or settle the Bolt Litigation and any other litigation matters that may arise (and the timing of any such successful defense, resolution or settlement), whether Actua becomes subject to additional liabilities or claims, including potential claims for indemnification relating to sales of Actua’s businesses (and the speed with which Actua is able to defend, resolve or discharge any such liabilities or claims), whether Actua incurs unexpected or greater than expected losses with respect to presently unknown, contingent and/or conditional liabilities, and the extent to which (and the speed with which) Actua is able to realize proceeds from the sale of Minority Investments and/or receive any other Potential Additional Proceeds.

That certain Membership Interest Purchase Agreement, dated as of September 23, 2017, among Actua, Actua Holdings, Inc. (“Actua Holdings”), Bolt Holdings LLC (f/k/a Arsenal Acquisition Holdings, LLC) (“Bolt Holdings”) and Velocity Holdco III Inc. (f/k/a Arsenal Buyer Inc.), an affiliate of CVC Growth Fund (“CVC”) (such agreement, as amended on March 22, 2018, the “Velocity/Bolt Sale Agreement”), provides that if a sale of Bolt meeting certain requirements occurs pursuant to a definitive agreement executed prior to March 30, 2018 (any such sale, a “Bolt Sale”), Actua Holdings would be entitled to receive a portion of the net proceeds paid in that Bolt Sale, subject to certain adjustments. Since no definitive agreement providing for or contemplating a Bolt Sale has been executed prior to March 30, 2018, Actua Holdings is not entitled under the Velocity/Bolt Sale Agreement to receive any proceeds in connection with a Bolt Sale.

Employees

Corporate headcount at Actua as of the date of this Report was 14.

Financial Information About Geographic Areas

As of December 31, 2017, all of Actua's revenue is earned, and all of its operations are located, in the United States.

ITEM 1A. Risk Factors

Our business involves a number of risks, some of which are beyond our control. You should carefully consider each of the risks and uncertainties we describe below and all of the other information in this Report before deciding to invest in our stock. The risks and uncertainties we describe below are not the only ones we face. Additional risks and uncertainties about which we currently do not know or that we currently believe to be immaterial may also adversely affect our businesses, financial condition or operating results.

The amounts distributed in the future to Actua’s stockholders, if any, may be substantially less than Actua's estimates.

At present, the Board cannot determine with certainty the amount of any future distribution to Actua’s stockholders. The amount of cash ultimately distributed to Actua’s stockholders in any additional liquidating distribution depends on, among other things, the amount of Actua’s liabilities, obligations and expenses and claims against Actua, and the amount of the reserves that Actua establishes during the liquidation process. Actua’s estimates of these amounts may be inaccurate. Factors that could negatively impact Actua’s estimates include the following:

• | if any of Actua’s estimates regarding the Plan of Dissolution, including the expenses to satisfy outstanding obligations, liabilities and claims during the liquidation process, are inaccurate; |

• | if any of Actua’s estimates regarding the expected costs associated with defending, resolving or settling any litigation matters, including the Bolt litigation as reflected in reserves which Actua has established, are inaccurate; |

• | if other litigation is brought against Actua and/or its directors and officers; |

• | if unforeseen claims are asserted against Actua, Actua must defend or resolve such claims or establish a reasonable reserve before making distributions to its stockholders; |

• | if the net proceeds received by Actua for its non‑cash property and assets, including the Minority Investments, or any other Potential Additional Proceeds are significantly lower than Actua’s estimates; |

• | if any of Actua’s estimates regarding the expenses to be incurred in the liquidation process, including expenses of personnel required and other operating expenses (including legal, accounting and other professional fees) necessary to dissolve and liquidate Actua, are inaccurate; and |

• | if Actua is unable to obtain relief from certain reporting requirements under the Exchange Act and must incur significant expenses related to ongoing reporting obligations. |

5

If any of the foregoing occurs, the amount distributed to Actua’s stockholders may be substantially less than the amount Actua currently estimates.

In addition, under Delaware law, claims and demands may be asserted against Actua at any time during the three years following the effective date of the filing of the Certificate of Dissolution. Accordingly, the Board may obtain and maintain insurance coverage for such potential claims. Actua has reserved approximately $10.6 million of cash for unknown, contingent and/or conditional liabilities, including liabilities relating to the Bolt Litigation or to potential claims for indemnification in connection with sales of Actua's businesses, and may also set aside additional amounts of cash (including all or a portion of the net proceeds of any sale of the Minority Investments and any other Potential Additional Proceeds) or other assets as a reserve to satisfy claims against and obligations of Actua that may arise during the three-year period following the effective date of the filing of the Certificate of Dissolution. As a result of these factors, Actua may retain for distribution at a later date some or all of the estimated amounts that it expects to distribute to stockholders.

Actua may not be able to settle all of its obligations, which may delay or reduce additional liquidating distributions to Actua’s stockholders.

Actua has current and future obligations to third parties, some of which are contingent. Actua’s estimated remaining distributions to its stockholders take into account all of Actua’s known liabilities and certain possible contingent liabilities and the Board’s best estimate of the amount reasonably required to satisfy such liabilities. As part of the wind-down process, Actua intends to discharge all of its obligations to third parties. Actua cannot assure you that unknown liabilities that that have not been accounted for will not arise, that Actua will be able to settle all of its liabilities or that Actua’s liabilities can be settled for the amounts Actua has estimated for purposes of calculating the range of distribution to its stockholders. If Actua is unable to reach an agreement with a third party relating to a liability, that third party may bring a lawsuit against Actua. Amounts required to settle liabilities or to defend, resolve or settle lawsuits in excess of the amounts estimated will reduce the amount of net proceeds available for distribution to stockholders.

Actua may not be able to sell Actua’s minority holdings during the expected time frame, for amounts projected or otherwise on desirable terms, which may delay or reduce additional liquidating distributions to Actua’s stockholders.

In connection with the dissolution process, Actua intends to attempt to monetize its remaining holdings, which consist largely of the Minority Investments, and to distribute its other cash assets. However, these holdings are largely illiquid, such that it may be difficult or impossible for Actua to monetize them during the expected time frame, for amounts projected or otherwise on desirable terms, and there can be no assurance as to how long this process will take.

Actua may not receive some or all of certain cash inflows it currently expects to receive during the identified time frame, or the actual amounts Actua receives in connection therewith may be substantially less than Actua currently expects, which may delay or reduce additional liquidating distributions to Actua’s stockholders.

Actua’s current estimates of the amounts it will have available to fund the reserve for payment of its expenses and liabilities during the three-year period following the effective date of the filing of the Certificate of Dissolution and the amounts it will have available for additional liquidating distributions to its stockholders are based on, among other things, certain assumptions with respect to the receipt of the Potential Additional Proceeds. If the Potential Additional Proceeds actually received are significantly lower than Actua’s estimates, or if Actua does not receive the Potential Additional Proceeds during the identified time frame, the amount distributed to Actua’s stockholders may be substantially less than the amount Actua currently estimates. For instance, since a definitive agreement for a Bolt Sale was not executed prior to March 30, 2018, Actua will not receive additional proceeds with respect to a Bolt sale. Additionally, one of FolioDynamix’s clients had a certain time period following the consummation of the sale of Actua’s interest in FolioDynamix to provide or withhold a required waiver of a termination right (or allow such right to expire), and if such client elects to exercise this termination right, Actua will not receive additional proceeds with respect to the Client Consent Adjustment Amount (as defined in the Folio Sale Agreement).

6

The Board may abandon or delay implementation of the Plan of Dissolution even if approved by Actua’s stockholders.

Even if Actua’s stockholders approve the Plan of Dissolution, the Board has reserved the right, in its discretion, to the extent permitted by Delaware law, to abandon or delay implementation of the Plan of Dissolution if such action is determined to be in the best interests of Actua and its stockholders, in order, for example, to permit Actua to pursue strategic alternatives. Any such decision to abandon or delay implementation of the Plan of Dissolution may result in Actua incurring additional operating costs and liabilities, which could reduce the amount available for additional liquidating distributions to Actua’s stockholders. Additionally, if Actua’s stockholders approve the Plan of Dissolution, Actua may, subject to approval by the Board but without further stockholder approval, make an assignment for benefit of its creditors under applicable state law, and thereby liquidate and wind up its affairs through such an assignment for benefit of creditors proceeding under applicable law, as further described below.

The payment of additional liquidating distributions, if any, to Actua’s stockholders could be delayed.

Although the Board has not established a firm timetable for additional liquidating distributions to Actua’s stockholders, the Board intends, subject to contingencies inherent in winding down Actua’s business, to make such additional liquidating distributions, if any, from time to time following the filing of the Certificate of Dissolution in light of when creditor claims and contingent liabilities are paid or settled. However, Actua is currently unable to predict the precise timing of any such additional liquidating distributions or whether any additional liquidating distributions will occur at all. The timing of any such additional liquidating distributions will depend on and could be delayed by, among other things, the outcome of the Bolt Litigation and any settlements of obligations to third parties, including any potential claims for indemnification in connection with sales of Actua's businesses. Additionally, a creditor could seek an injunction against the making of such distributions to Actua’s stockholders on the basis that the amounts to be distributed were needed to provide for the payment of Actua’s liabilities and expenses. Any action of this type could delay or substantially diminish the amount available for such distribution to Actua’s stockholders.

Actua will continue to incur claims, liabilities and expenses that will reduce the amount available for distribution.

Claims, liabilities and expenses from operations, such as operating costs, salaries, directors’ and officers’ insurance, payroll and local taxes, legal, accounting and consulting fees and miscellaneous office expenses, will continue to be incurred as Actua winds down. These expenses could be much higher than currently anticipated and will reduce the amount of assets available for ultimate distribution to stockholders.

If Actua fails to create an adequate reserve for payment of its expenses and liabilities, each stockholder receiving liquidating distributions could be held liable for payment to Actua’s creditors of his, her or its pro rata share of amounts owed to creditors in excess of the reserve, up to the amount actually distributed to such stockholder in connection with the dissolution.

If the Plan of Dissolution is approved by Actua’s stockholders, Actua expects to file a Certificate of Dissolution with the Delaware Secretary of State dissolving Actua. Pursuant to Delaware law, Actua will continue to exist for three years after its dissolution or for such longer period as the Delaware Court of Chancery shall direct, or as may be required to resolve any pending litigation matters, for the purpose of prosecuting and defending suits against Actua and enabling Actua to gradually close its business, dispose of its property, discharge its liabilities and to distribute to its stockholders any remaining assets. In the event Actua fails to create during this three-year period an adequate reserve for payment of its expenses and liabilities (and, after accounting for its receipt of the net proceeds of any sale of the Minority Investments and any other Potential Additional Proceeds, otherwise does not have sufficient assets for payment of its expenses and liabilities), creditors of Actua may be able to pursue claims against Actua’s stockholders directly to an extent they have claims co‑extensive with such stockholders’ receipt of liquidating distributions. Although the liability of any stockholder is limited to the amounts previously received by such stockholder from Actua (and from any liquidating trust or trusts) pursuant to the Plan of Dissolution, this means that a stockholder could be required to return all liquidating distributions previously made to such stockholder and receive nothing from Actua under the Plan of Dissolution. Moreover, in the event a stockholder has paid taxes on amounts previously received, a repayment of all or a portion of such amount could result in a stockholder incurring a net tax cost if the stockholder’s repayment of an amount previously distributed does not cause a commensurate reduction in taxes payable. There can be no guarantee that the reserves established by Actua will be adequate to satisfy all such expenses and liabilities.

7

Further stockholder approval will not be required in connection with the implementation of the Plan of Dissolution, including for the sale of all or substantially all of Actua’s non-cash assets, if any, as contemplated in the Plan of Dissolution.

The approval of the Plan of Dissolution by Actua’s stockholders will also authorize, without further stockholder approval, the Board and, if applicable, the Manager to take such actions as they deem necessary, appropriate or desirable to implement the Plan of Dissolution and the transactions contemplated thereby. Accordingly, Actua may dispose of its non-cash assets without further stockholder approval.

Actua intends to seek relief from certain reporting requirements under the Exchange Act, which may substantially reduce publicly-available information about Actua. If Actua fails to obtain such relief, Actua will continue to bear the expense of being a public reporting company despite having no significant source of revenue.

Actua’s common stock is currently registered under the Exchange Act, which requires that Actua, and its officers and directors with respect to Section 16 of the Exchange Act, comply with certain public reporting and proxy statement requirements thereunder. Compliance with these requirements is costly and time-consuming. Actua anticipates that, in order to curtail expenses, it will request relief from the SEC to suspend certain of its reporting obligations under the Exchange Act. If such relief is granted, publicly-available information about Actua will be substantially reduced. However, the SEC may not grant such relief at all or on a timely basis, in which case Actua would be required to continue to incur substantial accounting, legal and other expenses associated with being a public company despite having no significant source of revenue.

Although the Board will be responsible for overseeing the Plan of Dissolution, the Board’s authority could effectively be transferred to a liquidating trustee or some other party.

Under Delaware law, a company’s board of directors retains ultimate decision-making authority following a company’s dissolution, and therefore the Board would initially be responsible for overseeing the Plan of Dissolution. However, pursuant to the Plan of Dissolution, a liquidating trust could be used to complete the dissolution, or, under Delaware law, any director, creditor, stockholder or other party showing good cause could seek court appointment of a trustee or receiver to complete the dissolution.

Interests of Actua’s stockholders in Actua after the Final Record Date, and interests of Actua’s stockholders in any liquidating trust Actua may establish pursuant to the Plan of Dissolution, may not be assignable or transferable.

Actua intends to discontinue recording transfers of shares of its common stock on the Final Record Date, and thereafter certificates representing shares of Actua’s common stock will not be assignable or transferable on Actua’s books except by will, intestate succession or operation of law. In addition, if Actua were to establish a liquidating trust, the interests of its stockholders in such liquidating trust would similarly not be assignable or transferable except by will, intestate succession or operation of law, which could adversely affect its stockholders’ ability to realize the value of such interests. Furthermore, given that Actua’s stockholders will be deemed to have received a liquidating distribution equal to their pro rata share of the value of the net assets distributed to any entity which is treated as a liquidating trust for tax purposes, the distribution of non-transferable interests would result in tax liability to the stockholders without them being readily able to realize the value of such interest to pay such taxes or otherwise.

Actua may be subject to U.S. federal income tax on the distribution of any property other than cash.

If Actua distributes any property other than cash in an additional liquidating distribution to its stockholders, Actua will recognize gain or loss as if such property were sold to the stockholders at its fair market value. Accordingly, Actua may be subject to U.S. federal income tax on a distribution of its property (other than cash), which may reduce the amount of cash available to distribute to its stockholders. The Internal Revenue Service (the “IRS”) may challenge Actua’s valuation of any distributed property. As a result of such a challenge, the amount of gain or loss recognized by Actua and its stockholders on the property distribution might change.

If Actua’s stockholders do not approve the Plan of Dissolution, they may be subject to less favorable tax consequences on the receipt of the Transaction Distribution.

The Transaction Distribution will be treated as a non-liquidating distribution for U.S. federal income tax purposes if Actua’s stockholders do not approve the Plan of Dissolution. Non-liquidating distributions would be taxable as dividends for U.S. federal income tax purposes to the extent paid out of Actua’s current or accumulated earnings and profits and may be subject to tax at rates that are higher than those applicable to liquidating distributions. Furthermore, Actua’s stockholders would not be able to reduce their adjusted tax basis in their shares of Actua’s common stock prior to recognizing non-liquidating distributions that are taxable as dividends in income for U.S. federal income tax purposes.

8

In addition, foreign stockholders receiving non-liquidating distributions treated as dividends for U.S. federal income tax purposes may be subject to withholding tax at a rate of 30% or such lower rate as is established under an applicable treaty. Until the Plan of Dissolution is approved, Actua has withheld tax at a rate of 30% from the Transaction Distribution made to foreign stockholders. If the Plan of Dissolution is ultimately approved by Actua’s stockholders, Actua will distribute the previously withheld amounts to foreign stockholders, as applicable.

The tax treatment of any liquidating distributions may vary from stockholder to stockholder, and the discussions in this Report regarding such tax treatment are general in nature. You should consult your own tax advisor instead of relying on the discussions of tax treatment in this Report for tax advice.

Actua has not requested a ruling from the IRS with respect to the anticipated tax consequences of the Plan of Dissolution, and will not seek an opinion of counsel with respect to the anticipated tax consequences of any liquidating distributions. If any of the anticipated tax consequences of the Plan of Dissolution described in this Report proves to be incorrect, the result could be increased taxation at the corporate and/or stockholder level, thus reducing the benefit to Actua’s stockholders and Actua from the liquidation and distributions. Tax considerations applicable to particular stockholders may vary with and be contingent upon the stockholder’s individual circumstances.

Third party attempts to breach, or an actual breach of our networks or data security or the existence of any other security vulnerabilities could damage our reputation and materially adversely affect our business, financial condition and operating results.

Although we have adopted a number of measures to enhance our cybersecurity protection at Actua, there can be no assurance that our information will not be subject to cyberattacks, computer break-ins, theft and other improper activity that could jeopardize the security of information or cause interruptions in the operations of our business. In addition, third parties that use or have access to our sensitive business information could experience security breaches that could adversely impact our reputation.

Our security measures or those of third parties that use or have access to our sensitive information may be breached as a result of third-party action, including intentional misconduct by computer hackers, employee error, malfeasance or otherwise, and result in someone obtaining unauthorized access to our data. Additionally, third parties may attempt to fraudulently induce employees into disclosing sensitive information in order to gain access to our data or information technology systems. Because the techniques used to obtain unauthorized access or to sabotage systems change frequently and are generally not recognized until launched against a target, we may not be able to anticipate these techniques or to implement adequate preventative measures. Actual or perceived security vulnerabilities could cause us to incur significant additional costs to alleviate problems caused by any such actual or perceived vulnerabilities. Those costs could reduce our operating margins and expose us to litigation, loss of customers, reputation damage and other business harm that could result in a material adverse effect on our results of operations, business and financial condition.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

As of the date of this Report, our corporate headquarters is located at 555 East Lancaster Avenue, Suite 640 in an office facility located in Radnor, Pennsylvania, where we lease approximately 7,300 square feet.

ITEM 3. Legal Proceedings

Actua is involved in various claims and legal actions arising in the ordinary course of business.

9

On December 1, 2017, plaintiffs Inter-Atlantic Fund II, L.P. and Neurone II Investments G.P. Ltd. (the "Plaintiffs") filed a Verified Complaint against the Company, Actua Holdings, Bolt Holdings, CVC and certain of its affiliates, and certain directors of Bolt (collectively, the "Defendants") in the Court of Chancery of the State of Delaware. Plaintiffs are minority stockholders of Bolt. The lawsuit asserts claims related to, among other things, the Velocity/Bolt Sale. Plaintiffs allege that the Company and the Bolt directors have breached fiduciary duties in connection with the Velocity/Bolt Sale, including a planned secondary sale of Bolt. They further allege that the Company and the Bolt directors breached fiduciary duties with the management of Bolt, including with respect to various financing transactions. Plaintiffs have alleged claims for breach of an alleged right of first refusal in Bolt’s Fifth Amended and Restated Stockholder Rights Agreement, breach of fiduciary duties, and aiding and abetting breach of fiduciary duty and seek, among other things, injunctive relief, specific performance, and damages. On December 5, 2017, the Court denied Plaintiffs’ motion for expedited proceedings and motion for a temporary restraining order and preliminary injunction seeking to restrain the consummation of the Velocity/Bolt Sale, including the sale of Bolt. The Velocity/Bolt Sale was thereafter consummated on December 12, 2017. On January 31, 2018, Defendants filed motions to dismiss the Verified Complaint. The parties have not yet briefed those motions.

In the opinion of management, the amount of the ultimate liability with respect to any legal claims or actions, either individually or in the aggregate, will not materially affect the financial position, or, results of operations of Actua or its consolidated business.

ITEM 4. Mine Safety Disclosures

Not applicable.

10

PART II

ITEM 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information. Until February 8, 2018, our common stock was traded on The NASDAQ Global Select Market under the symbol "ACTA". The price range per share reflected in the table below is the highest and lowest sale price for our common stock, as reported by The NASDAQ Global Select Market during each quarterly period of the years ended December 31, 2017 and 2016, respectively.

Effective February 8, 2018, our common stock was delisted by the NASDAQ and began trading on the OTCQB market under ticker symbol "ACTA". The Transaction Distribution of $14.89 per share was made on February 1, 2018. Our common stock has traded subsequent to February 1, 2018 through the date of this Report in the range of $0.68 per share to $1.25 per share.

2017 | 2016 | |||||||||||||||||||||||||||||||

Quarter Ended | Mar. 31 | Jun. 30 | Sep. 30 | Dec. 31 | Mar. 31 | Jun. 30 | Sep. 30 | Dec. 31 | ||||||||||||||||||||||||

High | $ | 14.80 | $ | 14.82 | $ | 15.50 | $ | 15.95 | $ | 11.43 | $ | 10.57 | $ | 13.07 | $ | 15.28 | ||||||||||||||||

Low | $ | 13.25 | $ | 13.70 | $ | 11.85 | $ | 15.20 | $ | 7.28 | $ | 8.56 | $ | 8.63 | $ | 11.20 | ||||||||||||||||

Holders. As of March 15, 2018, there were approximately 430 holders of record of our common stock; there is a much larger number of beneficial owners of our common stock.

Dividends. Prior to February 2018, we had never declared or paid cash dividends or other distributions on our common stock. Following the consummation of the Transactions, on February 1, 2018, Actua paid the Transaction Distribution of $14.89 per share to its stockholders. We intend to make additional liquidating distributions in connection with the wind-down, however, we are unable to predict the precise amount or timing of any additional liquidating distributions (or whether any additional liquidating distributions will occur at all).

Securities Authorized for Issuance Under Equity Compensation Plans. For certain information concerning securities authorized for issuance under our equity compensation plan, see Note 11—"Equity-Based Compensation."

11

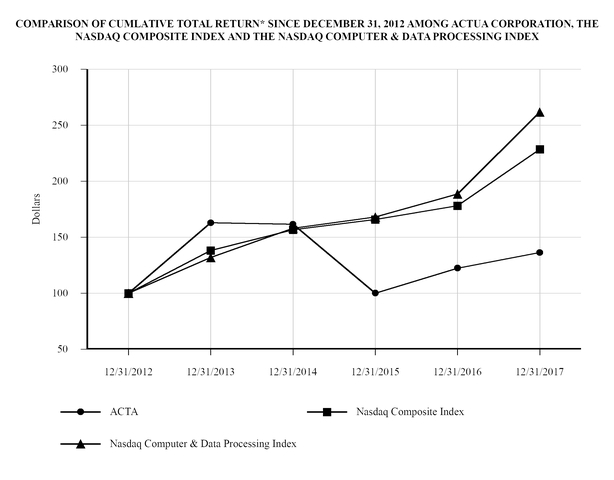

Stock Performance Graph. The following graph presents a comparison of the performance of our common stock with that of the NASDAQ Composite Index and the NASDAQ Computer & Data Processing Index from December 31, 2012 to December 31, 2017. The graph shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under that section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act.

12/31/2017 | 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | |||||||||||||||||||

ACTA | $ | 136.48 | $ | 122.48 | $ | 100.17 | $ | 161.59 | $ | 162.99 | $ | 100.00 | ||||||||||||

Nasdaq Composite Index | $ | 228.63 | $ | 178.28 | $ | 165.84 | $ | 156.85 | $ | 138.32 | $ | 100.00 | ||||||||||||

Nasdaq Computer & Data Processing Index | $ | 261.81 | $ | 188.67 | $ | 168.05 | $ | 158.17 | $ | 131.94 | $ | 100.00 | ||||||||||||

* $100 invested at closing prices on December 31, 2012 in our common stock or in a stock index, including reinvestment of dividends.

12

Issuer Purchases of Equity Securities. Actua maintains a share repurchase program under which it may, from time to time, repurchase shares of our common stock in the open market, including pursuant to trading plans meeting the requirements of Rule 10b5-1 under the Exchange Act, in privately negotiated transactions or pursuant to one or more issuer tender offers. The program was expanded in September 2013 and again in October 2016 to allow for the repurchase of up to $189.8 million of shares of Actua's common stock. The table below contains information relating to the repurchases of Actua's common stock that occurred under the share repurchase program from the program’s inception on July 31, 2008 through March 28, 2018. Although $30.5 million is available under the program for future repurchases, Actua does not intend to make additional repurchases under the program.

Period | Total Number of Shares Purchased (1) | Average Price Paid per Share (2) | Total Number of Shares Purchased as Part of Publicly Announced Program (1) | Approximate Dollar Value That May Yet Be Purchased Under the Program | ||||||||||

Repurchased during the year ended 12/31/2008 | 1,948,158 | $ | 4.75 | 1,948,158 | $ | 15.7 | million | |||||||

Repurchased during the year ended 12/31/2009 | 492,242 | $ | 5.45 | 492,242 | $ | 13.1 | million | |||||||

Repurchased during the year ended 12/31/2010 | — | $ | — | — | $ | 13.1 | million | |||||||

Repurchased during the year ended 12/31/2011 | 841,027 | $ | 10.17 | 841,027 | $ | 29.5 | million | |||||||

Repurchased during the year ended 12/31/2012 | 930,225 | $ | 8.94 | 930,225 | $ | 21.2 | million | |||||||

Repurchased during the year ended 12/31/2013 | 906,285 | $ | 13.23 | 906,285 | $ | 109.2 | million | |||||||

Repurchased during the year ended 12/31/2014 | 773,635 | $ | 16.52 | 773,635 | $ | 96.4 | million | |||||||

Repurchased during the year ended 12/31/2015 | 96,277 | $ | 17.66 | 96,277 | $ | 94.7 | million | |||||||

Repurchased during the year ended 12/31/2016 | 5,598,094 | $ | 13.17 | 5,598,094 | $ | 60.8 | million | |||||||

1/1/2017 to 1/31/2017 | 78,015 | $ | 13.99 | 78,015 | $ | 59.7 | million | |||||||

2/1/2017 to 2/28/2017 | 310,133 | $ | 13.97 | 310,133 | $ | 55.4 | million | |||||||

3/1/2017 to 3/31/2017 | 507,639 | $ | 13.88 | 507,639 | $ | 48.3 | million | |||||||

4/1/2017 to 4/30/2017 | 333,078 | $ | 13.99 | 333,078 | $ | 43.7 | million | |||||||

5/1/2017 to 5/31/2017 | 517,604 | $ | 14.00 | 517,604 | $ | 36.4 | million | |||||||

6/1/2017 to 6/30/2017 | 79,062 | $ | 14.00 | 79,062 | $ | 35.3 | million | |||||||

7/1/2017 to 7/31/2017 | 349,737 | $ | 13.94 | 349,737 | $ | 30.5 | million | |||||||

8/1/2017 to 12/31/2017 | — | $ | — | — | $ | 30.5 | million | |||||||

1/1/2018 to 3/28/2018 | — | $ | — | — | $ | 30.5 | million | |||||||

Total | 13,761,211 | $ | 11.58 | 13,761,211 | $ | 30.5 | million | |||||||

(1) | All shares were purchased in open market transactions, excluding 4,588,094 shares repurchased in December 2016 at a price per share of $14.00 pursuant to an Offer to Purchase that was filed with the SEC on November 7, 2016. |

(2) | Average price paid per share excludes commissions and fees. |

13

ITEM 6. Selected Financial Data

The following table summarizes certain selected historical consolidated financial information that has been derived from our audited Consolidated Financial Statements as of December 31, 2017 and 2016, and for the years ended December 31, 2017, 2016, and 2015; the selected historical consolidated financial information as of December 31, 2015, 2014, and 2013, and for the years ended December 31, 2014 and 2013, are presented for comparative purposes only and are unaudited. The financial information may not be indicative of our future performance and should be read in conjunction with "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and our Consolidated Financial Statements and the related Notes thereto included in this Report. During the year ended December 31, 2013, Channel Intelligence, Inc., InvestorForce Holdings, Inc. and Procurian, Inc. were sold. During the year ended December 31, 2016, GovDelivery was sold. During the year ended December 31, 2017, Actua sold its interests in Velocity and Bolt. On January 2, 2018, Actua sold its interests in FolioDynamix. Accordingly, we have recast the selected historical consolidated financial information to conform to the current period presentation; those seven businesses are presented as discontinued operations for all periods presented.

(in thousands, except per share data) | Year Ended December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

Consolidated Statements of Operations Data: | ||||||||||||||||||||

Revenue | $ | — | $ | — | $ | — | $ | — | $ | 429 | ||||||||||

Operating expenses | ||||||||||||||||||||

Cost of revenue | — | — | — | — | 70 | |||||||||||||||

Sales and marketing | — | — | — | — | 58 | |||||||||||||||

General and administrative | 28,474 | 24,040 | 34,634 | 35,674 | 20,157 | |||||||||||||||

Amortization of intangibles assets | 700 | — | — | — | 72 | |||||||||||||||

Impairment related and other | 11,239 | 42 | (85 | ) | 1,114 | 3,080 | ||||||||||||||

Total operating expenses | 40,413 | 24,082 | 34,549 | 36,788 | 23,437 | |||||||||||||||

Operating income (loss) | (40,413 | ) | (24,082 | ) | (34,549 | ) | (36,788 | ) | (23,008 | ) | ||||||||||

Other income (loss), net | 5,880 | 2,988 | 1,532 | 5,427 | (4,102 | ) | ||||||||||||||

Interest income | 710 | 248 | 97 | 434 | 171 | |||||||||||||||

Interest expense | — | — | — | — | (1 | ) | ||||||||||||||

Income (loss) from continuing operations before income taxes, equity loss and noncontrolling interests | (33,823 | ) | (20,846 | ) | (32,920 | ) | (30,927 | ) | (26,940 | ) | ||||||||||

Income tax benefit (expense) | 11,489 | 7,296 | 144 | 2,170 | 11,062 | |||||||||||||||

Equity income (loss) | — | — | — | (776 | ) | (2,963 | ) | |||||||||||||

Income (loss) from continuing operations | (22,334 | ) | (13,550 | ) | (32,776 | ) | (29,533 | ) | (18,841 | ) | ||||||||||

Income (loss) from discontinued operations | 193,877 | 79,399 | (67,569 | ) | 1,713 | 220,882 | ||||||||||||||

Net income (loss) | 171,543 | 65,849 | (100,345 | ) | (27,820 | ) | 202,041 | |||||||||||||

Less: Net income (loss) attributable to the non-controlling interests | (2,415 | ) | (4,236 | ) | (4,265 | ) | (4,264 | ) | (7,018 | ) | ||||||||||

Net income (loss) attributable to Actua Corporation | $ | 173,958 | $ | 70,085 | $ | (96,080 | ) | $ | (23,556 | ) | $ | 209,059 | ||||||||

Basic and Diluted Income (Loss) Per Share Attributable to Actua Corporation: | ||||||||||||||||||||

Income (loss) from continuing operations | $ | (0.72 | ) | $ | (0.37 | ) | $ | (0.89 | ) | $ | (0.80 | ) | $ | (0.52 | ) | |||||

Income (loss) from discontinued operations | 6.29 | 2.28 | (1.70 | ) | 0.17 | 6.24 | ||||||||||||||

Basic and diluted income (loss) per share | $ | 5.57 | $ | 1.91 | $ | (2.59 | ) | $ | (0.63 | ) | $ | 5.72 | ||||||||

Shares used in computation of basic and diluted income (loss) per share | 31,218 | 36,672 | 37,080 | 37,130 | 36,536 | |||||||||||||||

Consolidated Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 334,984 | $ | 76,530 | $ | 54,352 | $ | 88,652 | $ | 324,367 | ||||||||||

Working capital (1) | $ | 324,726 | $ | 73,454 | $ | 52,731 | $ | 87,079 | $ | 322,205 | ||||||||||

Total assets | $ | 535,304 | $ | 453,718 | $ | 351,404 | $ | 437,355 | $ | 461,017 | ||||||||||

Total Actua Corporation stockholders' equity | $ | 500,489 | $ | 353,340 | $ | 343,104 | $ | 431,938 | $ | 450,161 | ||||||||||

(1) Calculation excludes assets and liabilities classified as held for sale or discontinued operations for all periods.

14

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth elsewhere in this Report and discussed in our other SEC filings. The following discussion should be read in conjunction with our audited Consolidated Financial Statements and the related Notes thereto included in this Report.

The Consolidated Financial Statements include the consolidated accounts of Actua Corporation, a company incorporated in Delaware, and its subsidiaries, both wholly-owned and consolidated (Actua Corporation and all such subsidiaries are collectively hereafter referred to as "Actua," the "Company," "we," "our," or "us"), and have been prepared in accordance with generally accepted accounting principles ("GAAP").

Executive Summary

Actua Corporation was formed on March 4, 1996 and is headquartered in Radnor, Pennsylvania. Prior to the consummation of the Transactions, Actua was a multi-vertical cloud technology company with software and service offerings that Actua believed created unique and compelling value for its customers and provided transformative efficiency to vertical markets.

Actua’s common stock was traded on The NASDAQ Global Select Market under the symbol "ACTA" until Actua voluntarily delisted its common stock, effective as of February 7, 2018. Actua’s common stock is currently trading on the OTCQB Market under the symbol “ACTA.”

Following stockholder approval of the Transactions, the sale of Actua’s interests in Velocity and Bolt was completed on December 12, 2017, and the sale of FolioDynamix was completed on January 2, 2018. In light of the Transactions and the GovDelivery Sale, our results of operations for these companies are being presented as discontinued operations as of December 31, 2017 and for all comparable periods.

Whenever Actua completes an acquisition or disposition, it evaluates the impact of the transaction on its reportable segments. Due to the Transactions, Actua no longer has separate operating segments. For information regarding the results of operations, see "Item 8-Financial Statements and Supplementary Data," including our Consolidated Financial Statements; that information is incorporated herein by reference.

On January 18, 2018, the Board approved the Plan of Dissolution, subject to stockholder approval. At a special meeting of Actua’s stockholders to be held on April 18, 2018, Actua’s stockholders will be asked to approve the voluntary dissolution and liquidation of Actua pursuant to the Plan of Dissolution. If the Plan of Dissolution is approved by the requisite vote of Actua’s stockholders, Actua will file a Certificate of Dissolution with the Delaware Secretary of State and, thereafter, conduct only business activities relating to winding up and liquidating its business and affairs, including but not limited to the following:

• | the receipt of Potential Additional Proceeds; |

• | the defense, resolution and/or settlement of any litigation against Actua (including the Bolt Litigation), as well as any potential claims for indemnification in connection with sales of Actua’s businesses, and the making of reasonable provision to pay insurance retentions and legal fees in connection with any such lawsuit or claim; |

• | the payment of or the making of reasonable provision to pay all known claims and obligations, including all contingent, conditional or un-matured contractual claims known to Actua; |

• | the making of such provision as will be reasonably likely to be sufficient to satisfy any claim against Actua which is the subject of a pending action, suit or proceeding to which Actua is a party; |

• | the making of such provision as will be reasonably likely to be sufficient to satisfy any claims that have not been made known to Actua or that have not arisen but that, based on facts known to Actua, are likely to arise or become known to Actua within ten years after the date of dissolution; |

• | the setting aside of a reserve consisting of cash and/or property to satisfy such claims and contingent obligations; |

• | the payment of any additional liquidating distribution to Actua’s stockholders; and |

15

• | the pro rata distribution to Actua’s stockholders, or the transfer to one or more liquidating trustees for the benefit of Actua’s stockholders under a liquidating trust, of the remaining assets of Actua after payment or provision for payment of claims against and obligations of Actua. |

Under Delaware law, Actua will continue to exist for three years after Actua’s dissolution or for such longer period as the Delaware Court of Chancery directs, or as may be required to resolve any pending litigation matters, for the purpose of prosecuting and defending suits against Actua and enabling Actua gradually to close its business, to dispose of its property, to discharge its liabilities and to distribute any remaining assets to its stockholders. The Plan of Dissolution also provides for the appointment, at the Board’s discretion, of a Manager to oversee the sale of Actua’s assets and Actua’s liquidation and wind up.

The proportionate interests of all of Actua’s stockholders will be fixed on the basis of their respective stock holdings at the close of business on the Final Record Date. Actua intends to discontinue recording transfers of shares of its common stock on the Final Record Date, and thereafter certificates representing shares of Actua’s common stock will not be assignable or transferable on Actua’s books except by will, intestate succession or operation of law. After the Final Record Date, any distributions made by Actua will be made solely to the stockholders of record as of the close of business on the Final Record Date, except as may be necessary to reflect subsequent transfers recorded on Actua’s books as a result of any assignments by will, intestate succession or operation of law. In light of the dissolution, Actua intends to request permission from the SEC to suspend certain of Actua's reporting obligations under the Exchange Act, and ultimately to terminate the registration of its common stock.

On February 1, 2018, Actua distributed the Transaction Distribution of $14.89 per share to its stockholders; such distributions are intended to be a liquidating distribution assuming approval of the Plan of Dissolution. If funds are available and to the extent permitted by Delaware law, Actua intends to make additional liquidating distributions to its stockholders from time to time following the effective date of the filing of the Certificate of Dissolution. Actua is unable to predict the precise amount or timing of any additional liquidating distributions (or whether any additional liquidating distributions will occur at all), however, as many of the factors influencing the amount of cash distributed to Actua’s stockholders in additional liquidating distribution(s) and/or the timing of such distributions cannot be currently quantified with certainty and are subject to change. Actua cannot predict with certainty the amount of any additional liquidating distributions to its stockholders. Total actual distributions, if any, could be higher or lower, than Actua's previously disclosed estimates or there may not be any additional liquidating distributions at all. It is possible that any distribution could be followed in the future by additional distributions if it is determined that any reserved amounts no longer need to be reserved or if Actua realizes more Potential Additional Proceeds than expected as part of the liquidation process. The actual amounts and timing of any additional liquidating distributions may vary substantially, depending on, among other things, the actual operating expenses Actua incurs during the dissolution and wind-down process, Actua’s ability to successfully defend, resolve and/or settle the Bolt Litigation and any other litigation matters that may arise (and the timing of any such successful defense, resolution or settlement), whether Actua becomes subject to additional liabilities or claims, including potential claims for indemnification relating to sales of Actua’s businesses (and the speed with which Actua is able to defend, resolve or discharge any such liabilities or claims), whether Actua incurs unexpected or greater than expected losses with respect to presently unknown, contingent and/or conditional liabilities, and the extent to which (and the speed with which) Actua is able to realize proceeds from the sale of Minority Investments and/or receive any other Potential Additional Proceeds.

The Velocity/Bolt Sale Agreement provides that if a Bolt Sale occurs pursuant to a definitive agreement executed prior to March 30, 2018, Actua Holdings would be entitled to receive a portion of the net proceeds paid in that Bolt Sale, subject to certain adjustments. Since no definitive agreement providing for or contemplating a Bolt Sale has been executed prior to March 30, 2018, Actua Holdings is not entitled under the Velocity/Bolt Sale Agreement to receive any proceeds in connection with a Bolt Sale.

Liquidity and Capital Resources

As of December 31, 2017, our principal source of liquidity was cash and cash equivalents totaling $335.0 million. On January 2, 2018, the sale of FolioDynamix was consummated resulting in cash proceeds to Actua of approximately $164.8 million. On February 1, 2018, we made an approximately $476.0 million (i.e., $14.89 per share) distribution to our stockholders which significantly reduced our cash and cash equivalents balances. Our cash and cash equivalents are comprised primarily of money market funds. We fund our operations with cash on hand and proceeds from sales of businesses and other assets. We expect that these sources of liquidity will be sufficient to fund our cash requirements over the next twelve months.

In connection with the dissolution process, we intend to attempt to monetize our remaining holdings, which consist largely of the Minority Investments, and to distribute our other cash assets. However, these holdings are largely illiquid, such that it may be difficult or impossible for us to monetize them for amounts projected or otherwise on desirable terms, and there can be no assurance as to how long this process will take.

16

We have current and future obligations to third parties, some of which are contingent. Our estimated remaining distributions to stockholders take into account all of our known liabilities and certain possible contingent liabilities and the Board’s best estimate of the amount reasonably required to satisfy such liabilities. As part of the wind-down process, we intend to discharge all of our obligations to third parties. Unknown liabilities that that have not been accounted for may arise. Additionally, we may not be able to settle all of our liabilities and we may not be able to settle our liabilities that can be settled for the amounts we have estimated for purposes of calculating the previously disclosed range of distribution to our stockholders. Amounts required to settle liabilities or to defend, resolve or settle lawsuits in excess of the amounts estimated will reduce the amount of net proceeds available for distribution to stockholders.

Our current estimates of the amounts we will have available to fund the reserve for payment of our expenses and liabilities during the three-year period following the effective date of the filing of the Certificate of Dissolution and the amounts we will have available for additional liquidating distributions to our stockholders are based on, among other things, certain assumptions with respect to the receipt of the Potential Additional Proceeds. If the Potential Additional Proceeds actually received are significantly lower than our estimates, or if we do not receive the Potential Additional Proceeds during the identified time frame, the amount distributed to our stockholders may be substantially less than the amount we currently estimate.

Our cash flows from operating, investing and financing activities of continuing operations, as reflected in the Consolidated Statements of Cash Flows, are summarized in the following table:

(in thousands) | Year ended December, 31 | ||||||||||

2017 | 2016 | 2015 | |||||||||

Cash (used in) provided by operating activities | $ | (29,088 | ) | $ | (12,700 | ) | (8,960 | ) | |||

Cash (used in) provided by investing activities | 333,941 | 125,221 | 121 | ||||||||

Cash (used in) provided by financing activities | (46,399 | ) | (90,343 | ) | (25,461 | ) | |||||

Operating activities

Income (loss) from continuing operations is adjusted for non-cash and other items that include (1) depreciation and amortization, (2) equity-based compensation charges, (3) impairment related and other and (4) other income (loss) associated with the disposal of ownership interests in businesses. During the year ended December 31, 2017, cash used in operating activities increased compared to the equivalent period in 2016, due to an increase in the loss from continuing operations and changes in working capital, partially offset by the change in non-cash and other items.

Investing activities

Cash generated from investing activities for the years ended December 31, 2017 and 2016 was mainly due to the sale of majority- owned businesses. This was partially offset by capital expenditures, as well as further investments in one of our cost method businesses.

Financing activities

Cash used in financing activities decreased for the year ended December 31, 2017 compared to the equivalent period in 2016, primarily due to a decrease in stock repurchases and financing activities with our discontinued operations, partially offset by an increase in tax withholdings related to equity-based awards.

Working capital and other considerations

Our working capital as of December 31, 2017, excluding assets and liabilities of discontinued operations, was $324.7 million, which increased from working capital excluding assets and liabilities of discontinued operations of $73.5 million as of December 31, 2016, primarily due to the distributions received from the Velocity/Bolt Sale. Our working capital balance is considerably less after the February 1, 2018 Transaction Distribution of approximately $476.0 million.

From time to time, we and our businesses are involved in various claims and legal actions arising in the ordinary course of business.

17

On December 1, 2017, plaintiffs Inter-Atlantic Fund II, L.P. and Neurone II Investments G.P. Ltd. filed a Verified Complaint against the Company, Actua Holdings, Arsenal Holdings, CVC Capital Partners Advisory (U.S.), Inc. and certain of its affiliates, and certain directors of Bolt in the Court of Chancery of the State of Delaware. Plaintiffs are minority stockholders of Bolt. The lawsuit asserts claims related to, among other things, the Velocity/Bolt Sale. Plaintiffs allege that the Company and the Bolt directors have breached fiduciary duties in connection with the Velocity/Bolt Sale, including the planned secondary sale of Bolt. They further allege that the Company and the Bolt directors breached fiduciary duties with the management of Bolt, including with respect to various financing transactions. Plaintiffs have alleged claims for breach of an alleged right of first refusal in Bolt’s Fifth Amended and Restated Stockholder Rights Agreement, breach of fiduciary duties, and aiding and abetting breach of fiduciary duty and seek, among other things, injunctive relief, specific performance, and damages. On December 5, 2017, the Court denied Plaintiffs’ motion for expedited proceedings and motion for a temporary restraining order and preliminary injunction seeking to restrain the consummation of the Velocity/Bolt Sale, including the sale of Bolt. The Velocity/Bolt Sale was thereafter consummated on December 12, 2017. On January 31, 2018, Defendants filed motions to dismiss the Verified Complaint. The parties have not yet briefed those motions. We do not expect any liability with respect to any legal claims or actions, either individually or in the aggregate, that would materially affect our financial position.

Results of Operations

Below are our results of operations for the year ended December 31, 2017 compared with the year ended December 31, 2016 and the year ended December 31, 2016 compared with the year ended December 31, 2015.

(in thousands) | Year Ended December 31, | 2017 vs 2016 Change | 2016 vs 2015 Change | |||||||||||||||||||||||

2017 | 2016 | 2015 | $ Change | % Change | $ Change | % Change | ||||||||||||||||||||

Revenue | $ | — | $ | — | $ | — | $ | — | — | % | $ | — | — | % | ||||||||||||

Operating expenses | ||||||||||||||||||||||||||

General and administrative | 28,474 | 24,040 | 34,634 | 4,434 | 18 | % | (10,594 | ) | (31 | )% | ||||||||||||||||

Amortization of intangible assets | 700 | — | — | 700 | 100 | % | — | — | % | |||||||||||||||||

Impairment related and other | 11,239 | 42 | (85 | ) | 11,197 | NM | 127 | (149 | )% | |||||||||||||||||

Total operating expenses | 40,413 | 24,082 | 34,549 | 16,331 | 68 | % | (10,467 | ) | (30 | )% | ||||||||||||||||

Operating income (loss) | (40,413 | ) | (24,082 | ) | (34,549 | ) | (16,331 | ) | 68 | % | 10,467 | (30 | )% | |||||||||||||

Other income (loss), net | 5,880 | 2,988 | 1,532 | 2,892 | 97 | % | 1,456 | 95 | % | |||||||||||||||||

Interest income | 710 | 248 | 97 | 462 | 186 | % | 151 | 156 | % | |||||||||||||||||

Income (loss) from continuing operations before income taxes and noncontrolling interests | (33,823 | ) | (20,846 | ) | (32,920 | ) | (12,977 | ) | 62 | % | 12,074 | (37 | )% | |||||||||||||

Income tax benefit (expense) | 11,489 | 7,296 | 144 | 4,193 | 57 | % | 7,152 | NM | ||||||||||||||||||

Income (loss) from continuing operations | (22,334 | ) | (13,550 | ) | (32,776 | ) | (8,784 | ) | 65 | % | 19,226 | (59 | )% | |||||||||||||

Income (loss) from discontinued operations, including gain on sale, net of tax | 193,877 | 79,399 | (67,569 | ) | 114,478 | 144 | % | 146,968 | (218 | )% | ||||||||||||||||

Net income (loss) | $ | 171,543 | $ | 65,849 | $ | (100,345 | ) | $ | 105,694 | 161 | % | $ | 166,194 | (166 | )% | |||||||||||

NM - not meaningful

Year Ended December 31, 2017 Compared to Year Ended December 31, 2016

General and administrative expenses

General and administrative expenses increased for the year ended December 31, 2017 compared to the year ended December 31, 2016, primarily due to the acceleration of employee equity awards as a result of the closing of the Velocity/Bolt Sale.

Amortization of intangible assets

Actua’s intangible assets includes two domain names that as a result of Actua’s announcement of its intent to wind down its operations, were reassessed to a useful life of three months as of September 30, 2017. As of December 31, 2017, the intangible assets were fully amortized. There was no amortization recorded for these intangible assets for the year ended December 31, 2016.

18

Impairment related and other

Impairment related and other increased for the year ended December 31, 2017 compared to the year ended December 31, 2016, primarily due to the recording of one-time employee involuntary termination benefit in the amount of $11.0 million as a result of the Transactions.

Other income (loss), net

Other income (loss) pertains to gains on sales/distributions of ownership interests. Other income increased for the year ended December 31, 2017 compared to the year ended December 31, 2016, primarily due to the receipt of cash distributions from a cost method investment.

Interest income

Interest income increased for the year ended December 31, 2017 compared to the year ended December 31, 2016 due to our increased cash balances at the end of 2017 resulting from the Velocity/Bolt Sale.

Income tax benefit (expense)

Included in the current federal income tax benefit recognized in the year ended December 31, 2017 is $11.8 million which is offset by tax expense in discontinued operations as there were losses recognized in continuing operations and income from discontinued operations as a result of the Velocity/Bolt Sale.

Income (loss) from discontinued operations

Income from discontinued operations for the year ended December 31, 2017 increased significantly from the year ended December 31, 2016 due to the Velocity/Bolt Sale.

Year Ended December 31, 2016 Compared to Year Ended December 31, 2015

General and administrative expenses

General and administrative expenses decreased from the year ended December 31, 2015 to the year ended December 31, 2016 primarily due to higher equity-based compensation charges in the 2015 period.

Impairment related and other

Impairment related and other increased remained relatively consistent for the year ended December 31, 2016 compared to the 2015 period.