Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HYSTER-YALE MATERIALS HANDLING, INC. | d512876d8k.htm |

Exhibit 99

Hyster-yale materials handling 2017

Annual Report

Solutions That Drive Productivity

Hyster-Yale maintains leading market share positions in the Americas and worldwide Contents About the Company 1 Selected Financial and Operating Data 2 Letter to Stockholders 4 Form 10-K 17 Directors and Officers 114 Corporate Information Inside Back Cover Cover Photo Captions Inside Back Cover Mission Statement: To be a leading, globally integrated designer, manufacturer and marketer of a complete range of lift truck solutions by leveraging its high-quality, application-tailored lift trucks, attachments and power solutions to offer the lowest cost of ownership and the best overall value. The Hyster® Jumbo Truck production line in Nijmegen, The Netherlands.

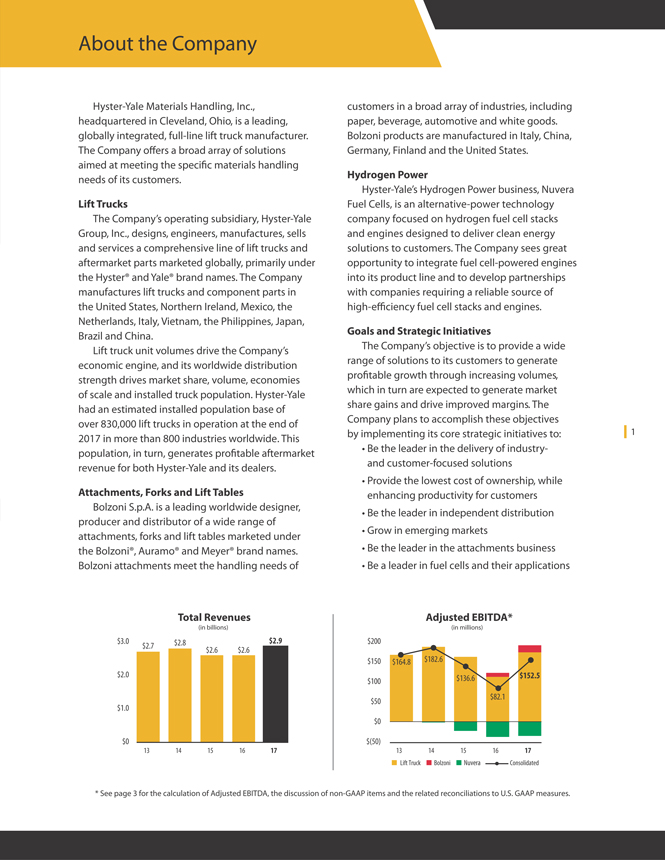

|| 1 About the Company Hyster-Yale Materials Handling, Inc., headquartered in Cleveland, Ohio, is a leading, globally integrated, full-line lift truck manufacturer. The Company officers a broad array of solutions aimed at meeting the specific materials handling needs of its customers. Lift Trucks The Company’s operating subsidiary, Hyster-Yale Group, Inc., designs, engineers, manufactures, sells and services a comprehensive line of lift trucks and aftermarket parts marketed globally, primarily under the Hyster® and Yale® brand names. The Company manufactures lift trucks and component parts in the United States, Northern Ireland, Mexico, the Netherlands, Italy, Vietnam, the Philippines, Japan, Brazil and China. Lift truck unit volumes drive the Company’s economic engine, and its worldwide distribution strength drives market share, volume, economies of scale and installed truck population. Hyster-Yale had an estimated installed population base of over 830,000 lift trucks in operation at the end of 2017 in more than 800 industries worldwide. This population, in turn, generates profitable aftermarket revenue for both Hyster-Yale and its dealers. Attachments, Forks and Lift Tables Bolzoni S.p.A. is a leading worldwide designer, producer and distributor of a wide range of attachments, forks and lift tables marketed under the Bolzoni®, Auramo® and Meyer® brand names. Bolzoni attachments meet the handling needs of customers in a broad array of industries, including paper, beverage, automotive and white goods. Bolzoni products are manufactured in Italy, China, Germany, Finland and the United States. Hydrogen Power Hyster-Yale’s Hydrogen Power business, Nuvera Fuel Cells, is an alternative-power technology company focused on hydrogen fuel cell stacks and engines designed to deliver clean energy solutions to customers. The Company sees great opportunity to integrate fuel cell-powered engines into its product line and to develop partnerships with companies requiring a reliable source of high-efficiency fuel cell stacks and engines. Goals and Strategic Initiatives The Company’s objective is to provide a wide range of solutions to its customers to generate profitable growth through increasing volumes, which in turn are expected to generate market share gains and drive improved margins. The Company plans to accomplish these objectives by implementing its core strategic initiatives to: • Be the leader in the delivery of industry and customer-focused solutions • Provide the lowest cost of ownership, while enhancing productivity for customers • Be the leader in independent distribution • Grow in emerging markets • Be the leader in the attachments business • Be a leader in fuel cells and their applications * See page 3 for the calculation of Adjusted EBITDA, the discussion of non-GAAP items and the related reconciliations to U.S. GAAP measures. Total Revenues (in billions) 17 $2.9 $0 $1.0 $2.0 $3.0 13 $2.7 14 $2.8 15 $2.6 16 $2.6 Adjusted EBITDA* (in millions) 13 14 15 16 17 $(50) $0 $50 $100 $150 $200 _ Lift Truck _ Bolzoni _ Nuvera Consolidated $152.5 $164.8 $182.6 $136.6 $82.1

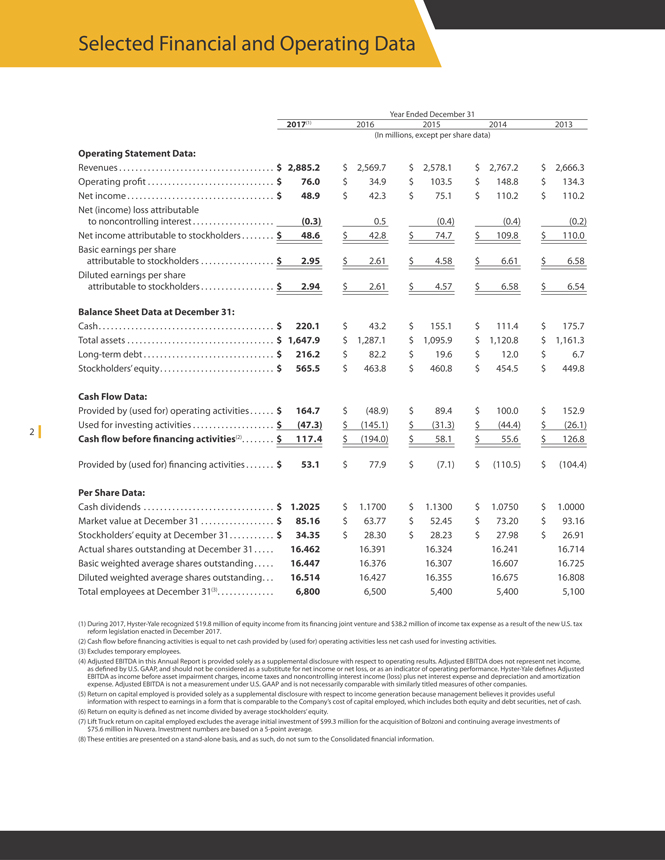

2 || Selected Financial and Operating Data Operating Statement Data: Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net (income) loss attributable to noncontrolling interest . . . . . . . . . . . . . . . . . . . . Net income attributable to stockholders . . . . . . . . Basic earnings per share attributable to stockholders . . . . . . . . . . . . . . . . . . Diluted earnings per share attributable to stockholders . . . . . . . . . . . . . . . . . . Balance Sheet Data at December 31: Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cash Flow Data: Provided by (used for) operating activities . . . . . . Used for investing activities . . . . . . . . . . . . . . . . . . . . Cash flow before financing activities(2) . . . . . . . . Provided by (used for) financing activities . . . . . . . Per Share Data: Cash dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Market value at December 31 . . . . . . . . . . . . . . . . . . Stockholders’ equity at December 31 . . . . . . . . . . . Actual shares outstanding at December 31 . . . . . Basic weighted average shares outstanding . . . . . Diluted weighted average shares outstanding . . . Total employees at December 31(3) . . . . . . . . . . . . . . $ 2,569.7 $ 34.9 $ 42.3 0.5 $ 42.8 $ 2.61 $ 2.61 $ 43.2 $ 1,287.1 $ 82.2 $ 463.8 $ (48.9) $ (145.1) $ (194.0) $ 77.9 $ 1.1700 $ 63.77 $ 28.30 16.391 16.376 16.427 6,500 $ 2,885.2 $ 76.0 $ 48.9 (0.3) $ 48.6 $ 2.95 $ 2.94 $ 220.1 $ 1,647.9 $ 216.2 $ 565.5 $ 164.7 $ (47.3) $ 117.4 $ 53.1 $ 1.2025 $ 85.16 $ 34.35 16.462 16.447 16.514 6,800 $ 2,578.1 $ 103.5 $ 75.1 (0.4) $ 74.7 $ 4.58 $ 4.57 $ 155.1 $ 1,095.9 $ 19.6 $ 460.8 $ 89.4 $ (31.3) $ 58.1 $ (7.1) $ 1.1300 $ 52.45 $ 28.23 16.324 16.307 16.355 5,400 $ 2,767.2 $ 148.8 $ 110.2 (0.4) $ 109.8 $ 6.61 $ 6.58 $ 111.4 $ 1,120.8 $ 12.0 $ 454.5 $ 100.0 $ (44.4) $ 55.6 $ (110.5) $ 1.0750 $ 73.20 $ 27.98 16.241 16.607 16.675 5,400 $ 2,666.3 $ 134.3 $ 110.2 (0.2) $ 110.0 $ 6.58 $ 6.54 $ 175.7 $ 1,161.3 $ 6.7 $ 449.8 $ 152.9 $ (26.1) $ 126.8 $ (104.4) $ 1.0000 $ 93.16 $ 26.91 16.714 16.725 16.808 5,100 Year Ended December 31 2017(1) 2016 2015 2014 2013 (In millions, except per share data) (1) During 2017, Hyster-Yale recognized $19.8 million of equity income from its financing joint venture and $38.2 million of income tax expense as a result of the new U.S. tax reform legislation enacted in December 2017. (2) Cash flow before financing activities is equal to net cash provided by (used for) operating activities less net cash used for investing activities. (3) Excludes temporary employees. (4) Adjusted EBITDA in this Annual Report is provided solely as a supplemental disclosure with respect to operating results. Adjusted EBITDA does not represent net income, as defined by U.S. GAAP, and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. Hyster-Yale defines Adjusted EBITDA as income before asset impairment charges, income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense. Adjusted EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. (5) Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash. (6) Return on equity is defined as net income divided by average stockholders’ equity. (7) Lift Truck return on capital employed excludes the average initial investment of $99.3 million for the acquisition of Bolzoni and continuing average investments of $75.6 million in Nuvera. Investment numbers are based on a 5-point average. (8) These entities are presented on a stand-alone basis, and as such, do not sum to the Consolidated financial information. Hyster-Yale Materials Handling I 2017 Annual Report

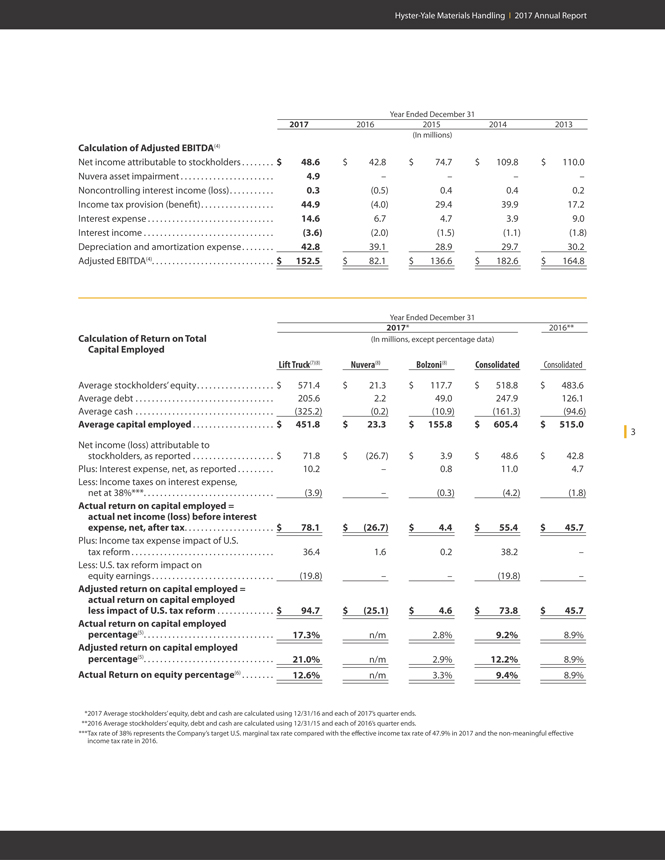

|| 3 Calculation of Adjusted EBITDA(4) Net income attributable to stockholders . . . . . . . . Nuvera asset impairment . . . . . . . . . . . . . . . . . . . . . . . Noncontrolling interest income (loss) . . . . . . . . . . . Income tax provision (benefit) . . . . . . . . . . . . . . . . . . Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Depreciation and amortization expense . . . . . . . . Adjusted EBITDA(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 42.8 – (0.5) (4.0) 6.7 (2.0) 39.1 $ 82.1 $ 48.6 4.9 0.3 44.9 14.6 (3.6) 42.8 $ 152.5 $ 74.7 – 0.4 29.4 4.7 (1.5) 28.9 $ 136.6 $ 109.8 – 0.4 39.9 3.9 (1.1) 29.7 $ 182.6 $ 110.0 – 0.2 17.2 9.0 (1.8) 30.2 $ 164.8 Year Ended December 31 2017 2016 2015 2014 2013 (In millions) * **2017 Average stockholders’ equity, debt and cash are calculated using 12/31/16 and each of 2017’s quarter ends. ***2016 Average stockholders’ equity, debt and cash are calculated using 12/31/15 and each of 2016’s quarter ends. *** Tax rate of 38% represents the Company’s target U.S. marginal tax rate compared with the effective income tax rate of 47.9% in 2017 and the non-meaningful effective income tax rate in 2016. Calculation of Return on Total Capital Employed Average stockholders’ equity . . . . . . . . . . . . . . . . . . . Average debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Average cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Average capital employed . . . . . . . . . . . . . . . . . . . . Net income (loss) attributable to stockholders, as reported . . . . . . . . . . . . . . . . . . . . Plus: Interest expense, net, as reported . . . . . . . . . Less: Income taxes on interest expense, net at 38%*** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Actual return on capital employed = actual net income (loss) before interest expense, net, after tax . . . . . . . . . . . . . . . . . . . . . . Plus: Income tax expense impact of U.S. tax reform . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: U.S. tax reform impact on equity earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Adjusted return on capital employed = actual return on capital employed less impact of U.S. tax reform . . . . . . . . . . . . . . Actual return on capital employed percentage(5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Adjusted return on capital employed percentage(5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Actual Return on equity percentage(6) . . . . . . . . Consolidated $ 518.8 247.9 (161.3) $ 605.4 $ 48.6 11.0 (4.2) $ 55.4 38.2 (19.8) $ 73.8 9.2% 12.2% 9.4% Lift Truck(7)(8) $ 571.4 205.6 (325.2) $ 451.8 $ 71.8 10.2 (3.9) $ 78.1 36.4 (19.8) $ 94.7 17.3% 21.0% 12.6% Nuvera(8) $ 21.3 2.2 (0.2) $ 23.3 $ (26.7) – – $ (26.7) 1.6 – $ (25.1) n/m n/m n/m Bolzoni(8) $ 117.7 49.0 (10.9) $ 155.8 $ 3.9 0.8 (0.3) $ 4.4 0.2 – $ 4.6 2.8% 2.9% 3.3% Consolidated $ 483.6 126.1 (94.6) $ 515.0 $ 42.8 4.7 (1.8) $ 45.7 – – $ 45.7 8.9% 8.9% 8.9% Year Ended December 31 2017* 2016** (In millions, except percentage data)

4 || To Our Stockholders Introduction 2017 was a much improved year for Hyster-Yale, which operates three separate businesses: its core Lift Truck business, its Attachment business, Bolzoni, and its Hydrogen Power business, Nuvera. The markets in which the Company competes were robust and each of Hyster-Yale’s business units experienced growth. The Company achieved positive momentum in all of its strategic initiatives and many of the headwinds that had reduced the financial results in 2016 abated. The Company maintained its focus on a carefully paced ramp-up in production and achievement of price goals through sales of a richer mix of products, while maintaining a healthy backlog to achieve production efficiencies. Overall lift truck unit shipments increased by 10% to 93,400 units while consolidated revenues grew 12% to $2.9 billion, including a 16% growth in revenues at Bolzoni, which was acquired in early 2016. Operating profit increased 118% to $76 million. Both the Lift Truck and Attachment businesses ended the year with strong bookings and backlog, which exceeded the Company’s expectations. In late December, Congress enacted new U.S. tax reform legislation that resulted in the Company taking a discrete tax charge of $38.2 million. However, this unfavorable effect was partially offset by the favorable effect of this legislation on the Company’s financing joint venture through the recognition of $19.8 million of additional equity earnings. Including the effects of tax reform, the Company’s 2017 consolidated net income increased 13.6% to $48.6(1) million from $42.8 million in 2016. The markets in which the Company competes were robust and each of Hyster-Yale’s business units experienced growth in 2017. While the Company’s operating results improved substantially, 2017 was not without challenges. Material cost inflation was a drag on earnings in both the Lift Truck and Attachment businesses. Also, while the Hydrogen Power business made significant progress, the Company pushed out the Nuvera break-even target to within the next two years. In this context, an asset impairment review of long-lived assets resulted in a $4.9 million Left: A Hyster® H40FT pneumatic-tire, internal combustion engine lift truck with a trucking application mast loads pallets onto a trailer. Right: A European Yale® MO25 multi-level order picker used in warehousing and distribution applications is capable of lifting up to 2.5 tons. (1) For purposes of this annual report, discussions about net income refer to net income attributable to stockholders.

Hyster-Yale Materials Handling I 2017 Annual Report || 5 non-cash impairment charge during the fourth quarter. Nevertheless, the Company believes that significant value was added to the Hydrogen Power business in 2017 and remains upbeat regarding the prospects for this business over the medium term with momentum building around Nuvera’s fuel cell stack and engine solutions. In May 2017, the Company entered into a new $200 million Term Loan facility to provide more appropriate long-term capitalization of the Bolzoni acquisition, which was completed using cash on hand and borrowings on the Company’s shortterm revolving credit facility, and to pay down the Company’s revolving credit facility. The remaining Term Loan proceeds are available for strategic investments and future bolt-on acquisitions, including the recently announced, but not yet completed, acquisition of a 75% interest in Zhejiang Maximal Forklift Company Limited (“Maximal”). Corporate Themes • Innovation • Quality Culture • Pricing and Cost Leadership • Services Excellence • Develop People Capabilities for the Future Throughout 2017, Hyster-Yale continued to look for investments that would strengthen its ability to serve its customers, either by expanding the Company’s already broad product portfolio into adjacent industries, expanding the breadth and depth of the Company’s geographic footprint or investing in new technologies that would enhance customers’ productivity. In May 2017, the Company invested $5.6 million in a French automation company, Balyo, and in December 2017 announced the intention to invest $90 million to acquire a 75% interest in Maximal, a privately held, Chinese manufacturer of utility and standard lift trucks and specialized material handling equipment, located near Hangzhou. This transaction, expected to close during the second quarter of 2018, is subject to customary closing conditions and required regulatory approvals. In addition, new investments are being made to develop premium and standard platforms in core product ranges of Hyster-Yale’s lift truck portfolio. The Company also announced plans for an Emerging Market Development Center based in China to focus on the development of a broader range of utility and standard products. A more in-depth understanding of the Company is best achieved by focusing on each of its three independently managed businesses as outlined below. Our Lift Truck Business Hyster-Yale is a leading, globally integrated designer, manufacturer and marketer of a complete range of lift truck solutions that leverages highquality, application-tailored lift trucks, attachments and power solutions to offer the lowest cost of ownership, enhanced customer productivity and the best overall value. Hyster-Yale has established six key strategic initiatives, which are designed to increase sustained profitability and market share growth, and are reinforced by the Company’s corporate themes of innovation, quality culture, pricing and cost leadership, services excellence and developing people capabilities for the future. During 2017, the global lift truck market grew 18% to 1.4 million units, setting record levels in many areas of the world. The Japan, Asia-Pacific, India and China (“JAPIC”) region grew 29% in 2017, primarily because of a 39% increase in the China market. The Americas market grew 12% during the year, with double-digit growth in North America and Latin America, as well as a 46% increase in demand in Brazil. The Europe, Middle East and Africa (“EMEA”) region experienced growth of 11%, driven primarily by strong Western Europe growth. All product classes demonstrated year-over-year growth, but increases were strongest in the lowervalue Class 3 segment. Looking forward, after a much stronger than expected market in 2017, the overall global lift truck market is expected to remain strong in 2018 but be comparable to last year, with an anticipated modest decrease in the China market offset by moderate growth in the Americas, EMEA and other Asia-Pacific markets. The Company is encouraged with the

6 || progress made on its strategic initiatives during 2017 and their positive effect on results, but there is room for further progress. In this context, Hyster-Yale is optimistic it can grow in 2018 and gain market share. Strategic Initiatives • Be the leader in the delivery of industry and customer-focused solutions • Provide the lowest cost of ownership, while enhancing productivity for customers • Be the leader in independent distribution • Grow in emerging markets • Be the leader in the attachments business • Be a leader in fuel cells and their applications The Lift Truck business achieved return on capital employed (“ROTCE”) of 17.3% despite the onetime unfavorable tax reform impact. Excluding the impact of tax reform, ROTCE was 21.0%. In addition, Lift Truck operating profit improved more than 50% to $112.2 million in 2017. The Company made progress in increasing the operating profit margin from 3.0% in 2016 to 4.1% in 2017. However, this is still 2.9 percentage points below the Company’s Lift Truck target operating margin of 7%. The Company remains focused on closing this gap over the medium term through aggressive execution of its strategic initiatives. In early 2018, the Company restructured its key strategic initiatives, which are outlined below, to bring them more in alignment with the current priorities and focus of its businesses. Leadership in Delivering Industry- and Customer-Focused Solutions: The Company is focused on providing a full range of differentiated products and solutions for specific industry and customer applications. To implement this, Hyster- Yale is reorganizing and increasing the size of its sales and marketing teams around greater levels of industry specialization. These changes are aimed at ensuring that customers benefit from working with a partner which fully understands their pain points and which will work to bring them value solutions. Delivering Lowest Cost of Ownership and Enhanced Productivity to Customers: Hyster-Yale’s product portfolio spans all five major product classes. The Company continues to invest in broadening its product range and has focused on designing and developing utility, standard and From left to right: A Yale® GC050VX Veracitor® cushion-tire, internal combustion engine lift truck with a basic lifting capacity of 5,000 pounds, a Hyster® W45Z walkie pallet truck with a capacity of 4,500 pounds and a Hyster® S50FT Fortis® cushion-tire, internal combustion engine lift truck load trailers in a shipping area.

Hyster-Yale Materials Handling I 2017 Annual Report || 7 premium products for its electric-rider, warehouse, internal combustion engine (“ICE”) and Big Truck product lines in all appropriate market segments. The Company currently offers over 280 different lift truck models with a full range of power options, including various battery-powered and fuel cell engine power options for its electric trucks, and an array of gas- and fuel-powered engine options for its ICE trucks. Having the right product at the right price for each application allows the Company to provide products that consistently meet the specific, but varied needs of customers at appropriate margins, give customers the ability to move goods in a more e_cient and cost-effective manner and lower the life-cycle cost of operating their trucks. In most markets around the world, electricpowered trucks are gaining in popularity, due mainly to growth of the retail, warehousing and distribution market segments, particularly in North America and Western Europe during 2017, but also in part due to environmental concerns. Hyster-Yale launched new versions of the Class 3 electric-stacker warehouse truck in EMEA, and a new enclosed endrider warehouse truck in both the United States and Europe. In this context, sales of electric lift trucks accounted for 29% of Hyster-Yale’s revenues in 2017, up from 27% in 2016. In 2018, the Company expects to introduce new electric models and a greater array of lithium-ion-powered solutions in all markets. The Company also expects that Nuvera products will help the Lift Truck business increase sales in heavy-duty applications, which are a good fit for fuel cell-powered lift truck solutions. In 2016, the Company introduced its new 2.0 to 3.0 ton standard Class 5 ICE lift truck, which has been exceptionally well received by customers. In 2017, the Company launched its new ReachStacker Big Truck model dedicated solely to container-handling applications, and production began on a new 11-ton empty container handler Big Truck with a taller mast for higher stacking and double container handling. The Company is also working with a customer to test a 52-ton Big Truck powered by a lithium-ion battery Above: The new Hyster® XT 2.0 to 3.0 ton standard pneumatic-tire, internal combustion engine lift truck series is designed to fit into almost any application or industry needing a hard-working lift truck. Below left: A Yale® MPR080VG enclosed end-rider truck capable of transporting multiple pallets at one time can be used in warehousing applications. Below right: Hyster-Yale’s new “state-of-the-art” automated parts distribution system at the Company’s Nijmegen Parts Distribution Center.

8 || and expects to begin working on fuel cell-powered Big Trucks soon. Finally, Hyster- Yale is expanding its range of Big Trucks with the addition of Class 4 Big Trucks manufactured by RICO, an Ohio-based manufacturer of large cushion-tire trucks, explosionproof trucks and die- and mold-handling trucks. These new products, as well as those recently launched, and the introduction of other new products in the pipeline, including trucks with Nuvera battery box replacements (“BBRs”), are expected to contribute to market share gains, improve revenues and enhance operating margins in 2018 and in the long term. In developing these products, Hyster-Yale continues to focus on reducing the life-cycle cost of operating its trucks and enhancing the productivity of its customers. The Company has also focused on enhancing ergonomics for the operator, reducing fuel consumption in internal combustion engine trucks, and improving the energy efficiency and controllability of its electric trucks, all of which reduce customers’ direct operating costs. The Company has also introduced automation and telematics capabilities in its lift trucks to reduce customers’ operating costs further. Specifically, Hyster-Yale has had substantial growth in the use of telematics on its trucks and now has approximately 30,000 active devices. In addition, substantially more trucks are now being fitted with telematics before leaving the plant than just a few years ago when the majority of the installations were occurring as retrofits in the field. An increased safety focus and a shortage of skilled labor has led to an increase in automation, particularly in warehouse industries, and the Company believes the demand for automated and driverless lift trucks will continue to increase. The Company has been responding to this trend and has achieved early success in developing automated solutions using a combination of its own capabilities and those of its partners. The electronic The Hyster® E50XN Next Gen 4-wheel, cushion-tire, counterbalanced electric truck, shown moving barrels at a winery, has a basic lifting capacity of 5,000 pounds. Above: A European Hyster® moving-mast Reach Truck shown with an enclosed cabin for working in cold storage has a basic lifting capacity of 1.4 to 2.5 tons.

Hyster-Yale Materials Handling I 2017 Annual Report || 9 architecture of many of the Company’s electric trucks is automation-ready and certain warehouse trucks have been converted to automated trucks in conjunction with Balyo, Hyster-Yale’s primary automation partner. These trucks give customers the flexibility of using a lower-cost automation solution for the majority of their work, but retaining the ability to manually drive the trucks when necessary. The Company continues to strengthen its exclusive, independent distribution network. Strengthening Independent Distribution: The Company believes that having an entrepreneurial, exclusive, independent dealer network committed to investments in technology, personnel development, facilities and equipment will provide superior customer satisfaction and a distinct competitive advantage, while enhancing the ability to maintain the Lift Truck business’s high ROTCE. Hyster-Yale works closely with its dealer partners on excellence initiatives designed to strengthen their functional capabilities in areas such as new equipment sales, aftermarket support, asset management, rental fleet effectiveness, and service excellence, all of which contribute to profitable dealer growth. The Company also continues to strengthen its exclusive, independent distribution network through dealer consolidations, recapitalizations or competitor dealer conversions, and through the Company’s dual-brand representation strategy, in certain markets, which is based on economies of scale and strong balance sheets to drive pro_table growth. In 2017, a significant number of dealer transitions resulted in a stronger overall network. In EMEA, a new Hyster® dealer was appointed in Spain and a new Yale® dealer was appointed in Portugal. In the Americas, the Company increased dualbrand coverage within the North America market and helped facilitate an important generational ownership transfer of a key dealer. Also during the year, the Company worked with its dealers to enhance the selling process on a global basis by introducing enhanced sales tools. Growing in Emerging Markets: Hyster-Yale is focused on expanding in all markets but is dedicating particular focus to faster-growing emerging markets. The Company continues to add sales resources and appoint new, stronger dealers in these regions. Attention is also being given to expanding the product range, as well as the competitiveness of the products produced, to serve these markets. As previously mentioned, in December 2017, the Company announced its intent to acquire a controlling interest in Maximal, a privately held, Chinese manufacturer of utility and standard lift trucks and specialized material handling equipment. While Hyster-Yale has participated in the China market for a number of years, the Company’s market share has been limited and focused in the premium segment. Maximal has achieved success in the utility and standard segments in China and in a A Yale® OS030 warehouse order picker, which has a basic lifting capacity of 3,000 pounds, is designed for time-sensitive, orderpicking operations that demand reliability.

10 || Above: A Maximal Rough Terrain lift truck is available in 2- and 4-wheel drive, with lifting capacities ranging from 1.8 to 5 tons. Hyster-Yale intends to introduce similar products to its range, supplied by the proposed joint venture. number of export markets. This joint venture will allow the Company to start reaching an expanded customer base and more effectively meet customers’ needs by broadening its product offerings, expanding the Company’s low-cost, global manufacturing capabilities, and bringing the design and production of Hyster-Yale’s UTILEV® product in-house. Overall, the acquisition of Maximal lays the groundwork for increasing the Company’s participation in the China market and in the growing global utility and standard market segments. Further, this joint venture is also expected to help Hyster-Yale’s current China division operate at the scale needed for long-term success. Upon completion of the acquisition, the Company intends to establish larger production and sourcing capabilities in China, which will leverage China’s low-cost supply chain to support the design and manufacture of standard and utility products that complement Hyster-Yale’s current standard and premium products. The Company also believes that, by building on Maximal’s existing local strengths, it can leverage its expertise in manufacturing technology, product development, sales processes and distribution to realize synergies to provide a set of capabilities that will enhance the Company’s ability to deliver a full range of economic solutions to meet global customer needs, as well as accelerate pro_table share growth. To accomplish this, the Company will establish a new Emerging Market Development Center based in China. In the near term, the Emerging Market Development Center’s focus will be on launching the next generation of UTILEV® trucks and filling critical product gaps to permit expansion of the Company’s customer base. The Emerging Market Development Center will have engineers in China, at Hyster-Yale’s facilities in India, and at other global development centers to accelerate execution of these projects. t Below left: The new Yale® 50MX standard pneumatic-tire, internal combustion engine lift truck has a basic lifting capacity of 5,000 pounds and is designed to fit into almost any application or industry needing a hard-working forklift. • Below right: Hyster® R30 Order Pickers, with basic capacities of 3,000 pounds, shown at work in a large warehouse and fulfillment center.

Hyster-Yale Materials Handling I 2017 Annual Report || 11 Our Attachment Business One of the Company’s core strategic initiatives is to build its leadership in the attachments business through Bolzoni, a stand-alone company under Hyster-Yale’s umbrella. Bolzoni is committed to meeting the product and handling solutions needs of a broad range of lift truck customers, which include many of the leading global lift truck manufacturers. Bolzoni expects to achieve leadership through the design, production and distribution of a wide range of products utilized in industrial materials handling, including integral and hook-on sideshifters, fork positioners, push pulls, multi-pallet handlers, rotators, paper roll clamps, bale and carton clamps, forks and lift tables. Bolzoni made solid progress in 2017, finishing the year strong with a 16% increase in revenues to $177.2 million and net income of $3.9 million compared with a net loss of $0.3 million in 2016. For many customers, the attachment purchase is the most important aspect of a lift truck purchase because the attachment is what is directly handling their goods. Bolzoni is focused on ensuring that the attachment has all the appropriate characteristics to move those goods around facilities undamaged and with greater efficiency. Many of Bolzoni’s intelligent lift truck attachments include its iMove technology, which has the capability to analyze loads and apply the appropriate pressure to ensure products are not damaged in transport. Bolzoni finished 2017 strong with a 16% increase in revenues. While maintaining the independence of Bolzoni from Hyster-Yale is critical to Bolzoni’s customer relationships, the Company still has many opportunities to create synergies and improve results going forward. Bolzoni, through its research and development facilities, is focused on innovation and providing customized solutions for its customers. The combination of these innovative qualities with Hyster-Yale’s, and the ability to match the attachment and forklift truck through the integration of attachment sourcing for the Lift Truck business, creates signi_cant opportunities for joint future growth. Since the acquisition, Hyster-Yale has continued to implement several key strategic programs for enhancing attachment sales, including increased awareness of Bolzoni’s products among end users and offering customers the option to have Bolzoni attachments installed on trucks as part of the manufacturing process. These programs, in addition to the implementation of other joint Lift Truck and Bolzoni programs, primarily related to supplier and material cost synergies, are expected to generate growth in revenues and a substantial increase in operating profit and net income over time, including in 2018, by taking advantage of the operating leverage of sales growth. As these programs mature, the Company expects Bolzoni to exceed its 7% operating profit margin target, excluding the ongoing non-cash charges associated with acquisition accounting. t Above: A Hyster® E50XN Next Gen four-wheel, cushion-tire, electric counterbalanced lift truck, equipped with a Bolzoni® carton clamp for handling non-palletized loads, has a basic lifting capacity of 5,000 pounds.

12 || Our Hydrogen Power Business Hyster-Yale also has a strategic initiative focused on being a leader in fuel cells and their applications. The Company’s acquisition of Nuvera was driven by its view that having fuel cell power options for lift truck markets had significant growth opportunities and could be a product differentiator. This view has now been reinforced by the strong interest shown in Nuvera® products by customers, dealers and potential partners. Hyster-Yale also believes that the commercialization of the Nuvera fuel cell-related technologies is an investment that will reinforce other core strategic initiatives that will help drive additional lift truck unit market share growth. It also positions the Company with an expanded power solution portfolio offering best-in-class energy solutions to customers by optimizing the performance and energy efficiency of the total lift truck system in the context of the customer application. The Company expects that once Nuvera’s technology is fully commercialized, participation in the fuel cell market could be a significant market share and profit generator. The Company expects that once Nuvera’s technology is fully commercialized, participation in the fuel cell market could be a signi_cant market share and profit generator. Currently, more than 175,000 electric trucks are sold each year in the North America market and more than 850,000 are sold worldwide. The Company estimates that a signi_cant percentage of these electric-truck users could use fuel cell-powered lift trucks to make their operations more cost-effiective and efficient. Currently, Nuvera offers a fuel cell engine that is a direct replacement for a lead-acid battery, referred to as a battery box replacement (“BBR”) unit. While commercialization of these products is taking longer than anticipated, the Company is pleased with the design innovation in Nuvera’s core technologies, as well as in its current generation of BBRs. However, production costs for these units currently remain higher than target costs. Nuvera and Hyster-Yale are focused on reducing the mean time between failure rates in Nuvera’s fuel cell BBRs to industry-leading levels and reducing the manufacturing costs per unit as production increases. Substantial progress is being made in both these areas. Once production increases, greater economies of scale can be achieved, but it will take time to reach the target cost structure. As a result of the current high cost structure and low volumes, Nuvera reported a net loss of $26.7 million in 2017, which includes the $4.9 million pre-tax asset impairment charge discussed previously. Due to the relatively high cost position and limited product range of currently available BBRs, Above: A Yale® ERC50VG four-wheel, cushion-tire, electric counterbalanced lift truck powered by a Nuvera® fuel cell battery box replacement.

Hyster-Yale Materials Handling I 2017 Annual Report || 13 the Company is taking a measured approach to developing its customer base by focusing on building relationships with customers that are willing to pay a premium for the high power density of the current Nuvera BBR solution and the product support now offered through the Lift Truck business. In addition, the Company believes the business will qualify for the fuel cell federal tax credit, which was recently extended for a five-year term retroactive to January 1, 2017. Nuvera expects to take advantage of this to help reduce its losses during the industry’s startup period, while keeping prices competitive with other power options. Shipments of BBRs increased to over 110 units in 2017. Nuvera expects shipments to continue to increase gradually throughout 2018. Hyster-Yale is currently preparing to roll out its BBRs to other geographic markets. In 2016, the Company announced an organizational realignment designed to enhance the overall strategic positioning and operational e_ectiveness of its Hydrogen Power business, with Nuvera focused on fuel cell stacks, engines and associated components and the Lift Truck business focused on complete battery box replacements and integrated engine solutions. This realignment was completed as of December 31, 2017, with the exception of the transition of manufacturing of the current BBRs from Nuvera to the Lift Truck business. By early 2019, production is expected to begin at the Lift Truck business’s manufacturing plant in Greenville, North Carolina, with a steady ramp-up in demand anticipated. In that same time frame, BBR manufacturing at Nuvera’s Billerica facility will be phased out. With the phase-out of battery box replacement production in Billerica, Nuvera will focus on the design, manufacture and sales and marketing of fuel cell stacks and engines. In addition to growing demand for fuel cell engines used in BBRs, Nuvera is seeing significant interest for its stacks and fuel cell engines in applications outside of the BBR market and believes this will become a significant and profitable growth opportunity across a broad spectrum of industries and applications. The Company’s current target is to achieve breakeven within the next two years, although this target could be achieved earlier or later depending on both achievement of its cost reduction targets and on the level of sales volumes for fuel cell-powered lift trucks, as well as sales in other markets. t Looking Forward The Company maintains a long-term view and believes that the necessary strategic initiatives are in place to help the Company achieve its long-term business objectives. Underlying Hyster-Yale’s overall strategic planning process is a broad program designed to ensure sound corporate responsibility. The Company believes that embracing social, environmental and economic health in every part of the organization will serve the long-term best interests of the Company’s stockholders, while contributing to strengthening the Company’s customers and the communities in which it operates. Hyster-Yale has established specific cost-effective corporate responsibility targets through its 2026 Vision program that will minimize the Company’s impact on the environment and conserve natural resources. Hyster-Yale’s Corporate Responsibility report is available at www.hyster-yale.com and A Yale® NR040 Reach Truck, designed for warehouse applications, with a fore/aft stance, laser-height selector and a basic lifting capacity of 4,000 pounds, is shown moving pallets at a coffee manufacturer.

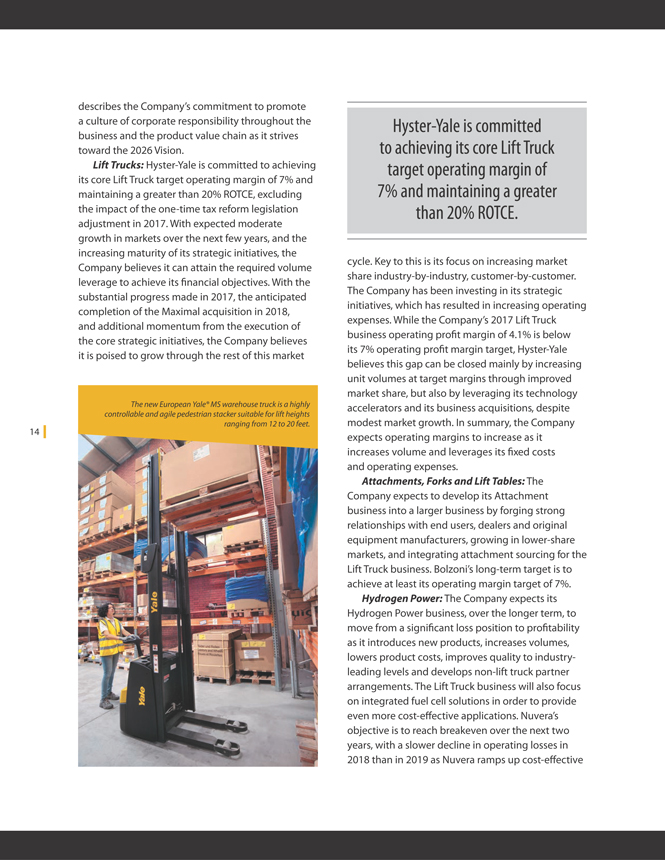

14 || describes the Company’s commitment to promote a culture of corporate responsibility throughout the business and the product value chain as it strives toward the 2026 Vision. Lift Trucks: Hyster-Yale is committed to achieving its core Lift Truck target operating margin of 7% and maintaining a greater than 20% ROTCE, excluding the impact of the one-time tax reform legislation adjustment in 2017. With expected moderate growth in markets over the next few years, and the increasing maturity of its strategic initiatives, the Company believes it can attain the required volume leverage to achieve its financial objectives. With the substantial progress made in 2017, the anticipated completion of the Maximal acquisition in 2018, and additional momentum from the execution of the core strategic initiatives, the Company believes it is poised to grow through the rest of this market Hyster-Yale is committed to achieving its core Lift Truck target operating margin of 7% and maintaining a greater than 20% ROTCE. cycle. Key to this is its focus on increasing market share industry-by-industry, customer-by-customer. The Company has been investing in its strategic initiatives, which has resulted in increasing operating expenses. While the Company’s 2017 Lift Truck business operating profit margin of 4.1% is below its 7% operating profit margin target, Hyster-Yale believes this gap can be closed mainly by increasing unit volumes at target margins through improved market share, but also by leveraging its technology accelerators and its business acquisitions, despite modest market growth. In summary, the Company expects operating margins to increase as it increases volume and leverages its fixed costs and operating expenses. Attachments, Forks and Lift Tables: The Company expects to develop its Attachment business into a larger business by forging strong relationships with end users, dealers and original equipment manufacturers, growing in lower-share markets, and integrating attachment sourcing for the Lift Truck business. Bolzoni’s long-term target is to achieve at least its operating margin target of 7%. Hydrogen Power: The Company expects its Hydrogen Power business, over the longer term, to move from a significant loss position to profitability as it introduces new products, increases volumes, lowers product costs, improves quality to industryleading levels and develops non-lift truck partner arrangements. The Lift Truck business will also focus on integrated fuel cell solutions in order to provide even more cost-effective applications. Nuvera’s objective is to reach breakeven over the next two years, with a slower decline in operating losses in 2018 than in 2019 as Nuvera ramps up cost-effective The new European Yale® MS warehouse truck is a highly controllable and agile pedestrian stacker suitable for lift heights ranging from 12 to 20 feet.

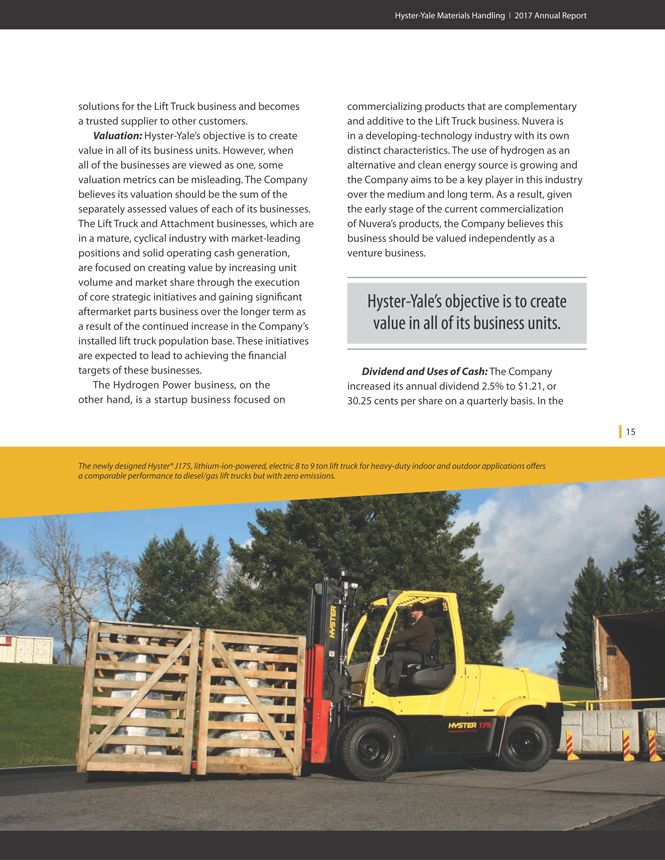

Hyster-Yale Materials Handling I 2017 Annual Report || 15 solutions for the Lift Truck business and becomes a trusted supplier to other customers. Valuation: Hyster-Yale’s objective is to create value in all of its business units. However, when all of the businesses are viewed as one, some valuation metrics can be misleading. The Company believes its valuation should be the sum of the separately assessed values of each of its businesses. The Lift Truck and Attachment businesses, which are in a mature, cyclical industry with market-leading positions and solid operating cash generation, are focused on creating value by increasing unit volume and market share through the execution of core strategic initiatives and gaining significant aftermarket parts business over the longer term as a result of the continued increase in the Company’s installed lift truck population base. These initiatives are expected to lead to achieving the financial targets of these businesses. The Hydrogen Power business, on the other hand, is a startup business focused on commercializing products that are complementary and additive to the Lift Truck business. Nuvera is in a developing-technology industry with its own distinct characteristics. The use of hydrogen as an alternative and clean energy source is growing and the Company aims to be a key player in this industry over the medium and long term. As a result, given the early stage of the current commercialization of Nuvera’s products, the Company believes this business should be valued independently as a venture business. Hyster-Yale’s objective is to create value in all of its business units. Dividend and Uses of Cash: The Company increased its annual dividend 2.5% to $1.21, or 30.25 cents per share on a quarterly basis. In the The newly designed Hyster® J175, lithium-ion-powered, electric 8 to 9 ton lift truck for heavy-duty indoor and outdoor applications offers a comparable performance to diesel/gas lift trucks but with zero emissions.

16 || future, the Company may consider additional dividend increases or share repurchases at prices attractive to its stockholders. We

are a customer-focused and solutionsoriented business. We have strategies in place to gain market share in all segments and in all markets, and we have made investments in growth and gamechanging technologies to help us achieve our goal of becoming

a broader lift truck solutions partner to the materials handling market, one industry and one customer at a time. We believe that our business strategy, combined with a strong balance sheet, financial flexibility, a solid cash position and solid

returns on capital employed in our core business, reinforces our commitment to stockholder returns over time and makes Hyster-Yale a compelling longterm investment opportunity. By clearly articulating and executing our core strategies in each of our

businesses, we believe an enhanced market multiple valuation will be reasonable in the future. We have great confidence in the ability of our management team to achieve the Company’s market share and financial objectives in the years ahead as

our many experienced and highly motivated professionals build on the Company’s strong 2017 financial results. t t t In closing, we would like to recognize Joe Loughrey, who did not stand for re-election

this past May, for his service as a director and as chair of our Audit Review Committee. Joe brought unique and valuable perspective to the Board as a result of his experiences in the internal combustion engine business over many years. We

appreciate his many contributions and wish him well. We would also like to welcome H. Vincent Poor, Distinguished Professor of Electrical Engineering of Princeton University, who joined our Board of Directors in April 2017. We are privileged to have

him as a Director. Finally, we would like to take this opportunity to thank all of our customers, dealers and suppliers and all of the Hyster-Yale stockholders for their continued support. We also want to thank all of our employees most sincerely

for their hard work and commitments to achieving our long-term goals. We are pleased with our 2017 results and look forward to continuing to execute our strategic plan in 2018. We have a decades-old business

with strong brands that have earned the trust of our customers who depend upon the performance of our products and solutions every day. We look forward to building successfully on this legacy for many years to come. Alfred M. Rankin, Jr. Chairman,

President and Chief Executive Officer, Hyster-Yale Materials Handling, Inc. and Chairman, Hyster-Yale Group, Inc. Colin Wilson President and Chief Executive Officer, Hyster-Yale Group, Inc. We have strategies in place to gain market share in all

segments and in all markets, and we have made investments in growth and game-changing technologies to help us achieve our goal of becoming a broader lift truck solutions partner. This annual report to stockholders contains forward-looking

statements. For a discussion of the factors that may cause the Company’s actual results to differ from these forward-looking statements, please see page 34 in the attached Form 10-K.

Directors and Officers

Officers: Alfred M. Rankin, Jr. Chairman, President and Chief Executive Officer Colin Wilson President and Chief Executive Officer, Hyster-Yale Group, Inc. Gregory J. Breier Vice President, Tax Brian K. Frentzko Vice President, Treasurer Amy E. Gerbick Associate General Counsel, Director of Corporate Compliance and Assistant Secretary Jennifer M. Langer Vice President, Controller Lauren E. Miller Senior Vice President, Chief Marketing Officer Kenneth C. Schilling Senior Vice President and Chief Financial Officer Suzanne S. Taylor Senior Vice President, General Counsel and Secretary Directors: J.C. Butler, Jr. President and Chief Executive Officer, NACCO Industries, Inc. President and Chief Executive Officer of The North American Coal Corporation Carolyn Corvi Retired Vice President and General Manager – Airplane Programs of The Boeing Company John P. Jumper Retired Chief of Staff, United States Air Force Dennis W. LaBarre Retired Partner, Jones Day H. Vincent Poor Distinguished Professor of Electrical Engineering of Princeton University Alfred M. Rankin, Jr. Chairman, President and Chief Executive Officer of Hyster-Yale Materials Handling, Inc. Chairman of Hyster-Yale Group, Inc. Non-Executive Chairman of NACCO Industries, Inc. Executive Chairman of Hamilton Beach Brands Holding Company Claiborne R. Rankin Manager of NCAF Management, LLC, the managing member of North Coast Angel Fund, LLC John M. Stropki Retired Executive Chairman of Lincoln Electric Holdings, Inc. Britton T. Taplin Self-employed (personal investments) Eugene Wong Professor Emeritus of the University of California at Berkeley Anthony J. Salgado Senior Vice President, Japan, Asia-Pacific, India and China Harry Sands Senior Vice President, Managing Director, Europe, Middle East and Africa Kenneth C. Schilling Senior Vice President and Chief Financial Officer Roberto Scotti President and Chief Executive Officer of Bolzoni S.p.A. Gopichand Somayajula Vice President, Global Product Development Jon C. Taylor President and Chief Executive Officer of Nuvera Fuel Cells, LLC Suzanne S. Taylor Senior Vice President, General Counsel and Secretary Mark H. Trivett Vice President Finance, Europe, Middle East and Africa Raymond C. Ulmer Vice President Finance, Americas Alfred M. Rankin, Jr. Chairman Colin Wilson President and Chief Executive Officer Gregory J. Breier Vice President, Tax Brian K. Frentzko Vice President, Treasurer Amy E. Gerbick Associate General Counsel, Director of Corporate Compliance and Assistant Secretary Stephen J. Karas Vice President, Global Supply Chain Jennifer M. Langer Vice President, Controller Lauren E. Miller Senior Vice President, Chief Marketing Officer Charles F. Pascarelli Senior Vice President, President, Americas Rajiv K. Prasad Chief Product and Operations Officer Directors and Officers of Hyster-Yale Materials Handling, Inc. Executives and Officers of Hyster-Yale Group, Inc. and its Subsidiary Companies

Corporate Information Independent Registered Public Accounting Firm Ernst & Young LLP 950 Main Avenue, Suite 1800 Cleveland,

Ohio 44113 Stock Exchange Listing The New York Stock Exchange Symbol: HY Investor Relations Contact Investor questions may be addressed to: Investor Relations Hyster-Yale Materials Handling, Inc. 5875 Landerbrook Drive, Suite 300 Cleveland, Ohio

44124 (440) 229-5168 E-mail: ir@hyster-yale.com Hyster-Yale Materials Handling, Inc. Website Additional inforation on Hyster-Yale may be found at the corporate website,

www.hyster-yale.com. The Company considers this website to be one of the primary sources of information for investors and other interested parties. Hyster Global: www.hyster.com Yale Global: www.yale.com

Nuvera Fuel Cells: www.nuvera.com Bolzoni: www.bolzonigroup.com Annual Meeting The Annual Meeting of Stockholders of Hyster-Yale Materials Handling, Inc. will be held on

May 9, 2018, at 9:00 a.m. at the corporate office located at: 5875 Landerbrook Drive, Cleveland, Ohio 44124 Form 10-K Additional copies of the Company’s Form

10-K filed with the Securities and Exchange Commission are available free of charge through Hyster-Yale’s website (www.hyster-yale.com) or by request to: Investor Relations Hyster-Yale Materials Handling,

Inc. 5875 Landerbrook Drive, Suite 300 Cleveland, Ohio 44124 (440) 229-5168 Stock Transfer Agent and Registrar Stockholder Correspondence: Computershare P.O. Box 505000 Louisville, KY 40233-5000 Overnight

Correspondence: Computershare 462 South 4th St., Suite 1600 Louisville, KY 40202 (877) 373-6374 (U.S., Canada and Puerto Rico) (781) 575-2879 (International) Legal

Counsel Jones Day North Point 901 Lakeside Avenue Cleveland, Ohio 44114 On the Cover: Top Right: Hyster’s H90FT Fortis® internal combustion engine, pneumatic-tire lift truck has a basic lifting capacity of up to 9,000 pounds and is equipped

with a Bolzoni® paper roll attachment. Top Left: A Yale® NR040 Reach Truck for use in warehouse applications is available in basic lifting capacities between 3,500 and 4,000 pounds. Bottom Right: A Yale® ERC50VG four-wheel, cushion-tire,

electric counterbalanced lift truck powered by a Nuvera® fuel cell battery box replacement. Bottom Left: A Hyster® H115OHD-CH Dedicated Container Handler, equipped with a wide axle and capable of

stacking containers six high, is shown positioning a container at a port operation in California.

5875 Landerbrook Drive, Suite 300 | Cleveland, Ohio 44124 | www.hyster-yale.com An Equal Opportunity Employer