Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Air Transport Services Group, Inc. | a2018form8kcovermar21seapo.htm |

The global leader in midsize wide-body

leasing and operating solutions

Seaport Global Securities LLC

2018 Transports & Industrials Conference

Miami, Florida

March 21, 2018

Joe Hete

President & CEO

joe.hete@atsginc.com

Quint Turner

CFO

quint.turner@atsginc.com

(937) 366-2303

Joe Roux

Treasurer

Joe.roux@atsginc.com

Cautionary Statement Regarding Forward-Looking Statements

2

Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements

as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve risks and

uncertainties that are inherently difficult to predict. Words such as “projects,” “believes,” “anticipates,” “will,” “estimates,” “plans,”

“expects,” “intends” and similar words and expressions are intended to identify forward-looking statements. These forward-

looking statements are based on expectations, estimates and projections as of the date of this presentation and address

activities events or developments that we expect, believe or anticipate will or may occur in the future. Although we believe our

estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that

are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. We caution all

readers that the forward-looking statements contained in this presentation are not guarantees of future performance, and we

cannot assure any reader that those statements will be realized or the forward-looking events and circumstances will occur.

There are a number of important factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ

materially from those indicated by such forward-looking statements. These factors include, but are not limited to, changes in

market demand for our assets and services; our operating airlines' ability to maintain on-time service and control costs; the cost

and timing with respect to which we are able to purchase and modify aircraft to a cargo configuration; fluctuations in ATSG's

traded share price, which may result in mark-to-market charges on certain financial instruments; the number, timing and

scheduled routes of our aircraft deployments to customers, and other factors (including those listed under the heading “Risk

Factors”) that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange Commission, including its

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should

not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information,

plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements

to reflect changes in underlying assumptions or factors, new information, future events or other changes.

2

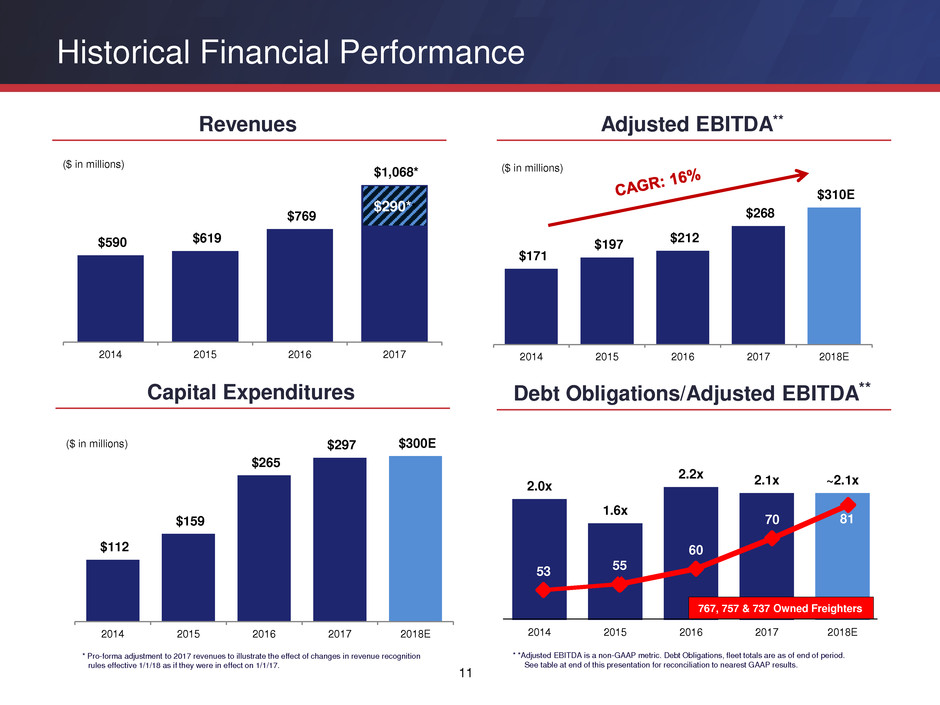

$197

$212

$268

$310E

2015 2016 2017 2018E

$619

$769

$1,068

2015 2016 2017

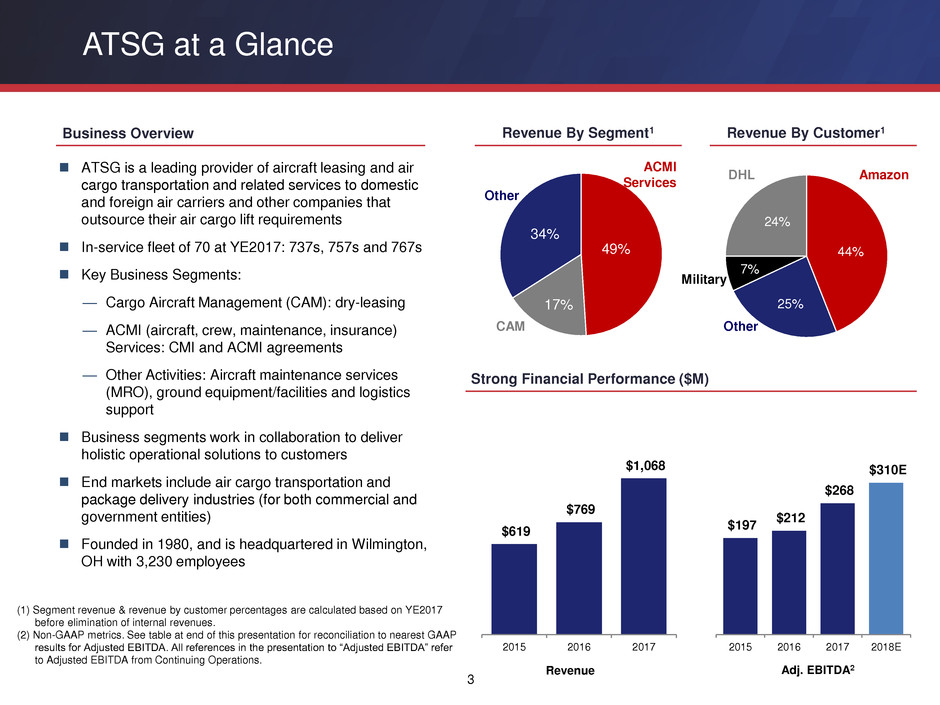

ATSG at a Glance

3

ATSG is a leading provider of aircraft leasing and air

cargo transportation and related services to domestic

and foreign air carriers and other companies that

outsource their air cargo lift requirements

In-service fleet of 70 at YE2017: 737s, 757s and 767s

Key Business Segments:

— Cargo Aircraft Management (CAM): dry-leasing

— ACMI (aircraft, crew, maintenance, insurance)

Services: CMI and ACMI agreements

— Other Activities: Aircraft maintenance services

(MRO), ground equipment/facilities and logistics

support

Business segments work in collaboration to deliver

holistic operational solutions to customers

End markets include air cargo transportation and

package delivery industries (for both commercial and

government entities)

Founded in 1980, and is headquartered in Wilmington,

OH with 3,230 employees

(1) Segment revenue & revenue by customer percentages are calculated based on YE2017

before elimination of internal revenues.

(2) Non-GAAP metrics. See table at end of this presentation for reconciliation to nearest GAAP

results for Adjusted EBITDA. All references in the presentation to “Adjusted EBITDA” refer

to Adjusted EBITDA from Continuing Operations.

Revenue Adj. EBITDA2

Revenue By Segment1 Revenue By Customer1 Business Overview

Strong Financial Performance ($M)

34%

17%

49%

ACMI

Services

CAM

Other

24%

44%

25%

7%

Amazon DHL

Other

Military

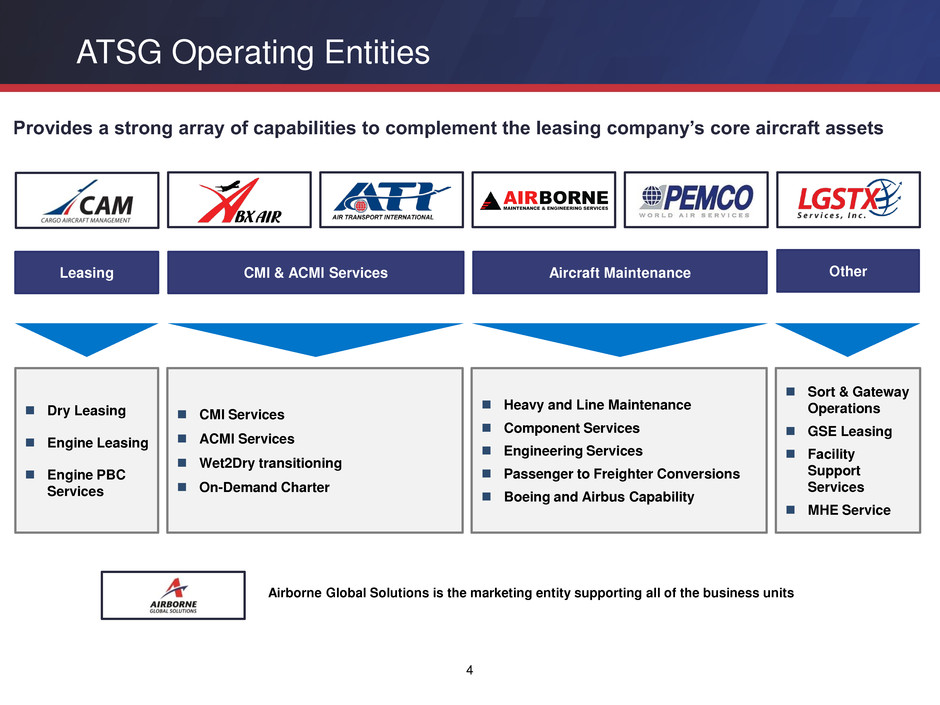

ATSG Operating Entities

Dry Leasing

Engine Leasing

Engine PBC

Services

CMI Services

ACMI Services

Wet2Dry transitioning

On-Demand Charter

Heavy and Line Maintenance

Component Services

Engineering Services

Passenger to Freighter Conversions

Boeing and Airbus Capability

Sort & Gateway

Operations

GSE Leasing

Facility

Support

Services

MHE Service

Leasing CMI & ACMI Services Aircraft Maintenance

Provides a strong array of capabilities to complement the leasing company’s core aircraft assets

Airborne Global Solutions is the marketing entity supporting all of the business units

Other

4

Cargo Aircraft Deployments at YE 2017

Boeing 767-300F - 25 in service

In-service fleet projected at:

— 35 by YE2018

— 21 dry leased to DHL,

Amazon, NAC, Amerijet,

Cargojet, 6-8 yr. terms

Boeing 757s – 8 in service

4 757-200Fs under ACMI

agreements with DHL

4 757-200 combis under

ACMI agreements with

U.S. Military

Boeing 737-400F – 1 in service

One more to be

deployed at end of

Q1 2018

Boeing 767-200F - 36 in service

29 currently dry leased to

Amazon, DHL, Amerijet,

Cargojet, Raya, West

Atlantic, 3-5 year terms

5

Portfolio of leased and operated assets offer customer flexibility, incremental returns

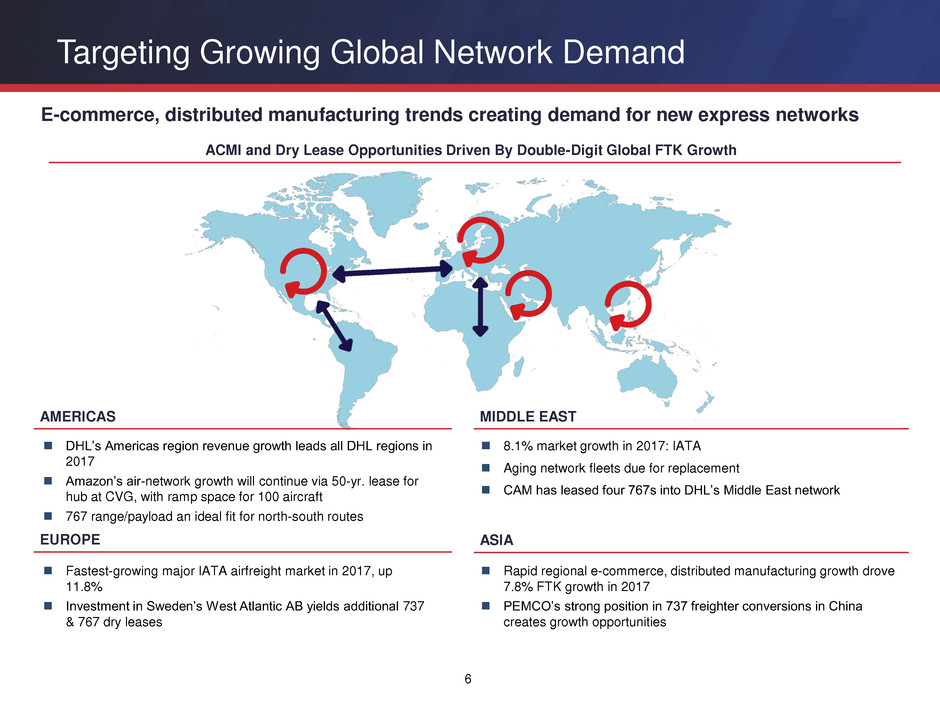

Targeting Growing Global Network Demand

6

8.1% market growth in 2017: IATA

Aging network fleets due for replacement

CAM has leased four 767s into DHL’s Middle East network

DHL’s Americas region revenue growth leads all DHL regions in

2017

Amazon’s air-network growth will continue via 50-yr. lease for

hub at CVG, with ramp space for 100 aircraft

767 range/payload an ideal fit for north-south routes

E-commerce, distributed manufacturing trends creating demand for new express networks

ACMI and Dry Lease Opportunities Driven By Double-Digit Global FTK Growth

MIDDLE EAST

ASIA

AMERICAS

EUROPE

Rapid regional e-commerce, distributed manufacturing growth drove

7.8% FTK growth in 2017

PEMCO’s strong position in 737 freighter conversions in China

creates growth opportunities

Fastest-growing major IATA airfreight market in 2017, up

11.8%

Investment in Sweden’s West Atlantic AB yields additional 737

& 767 dry leases

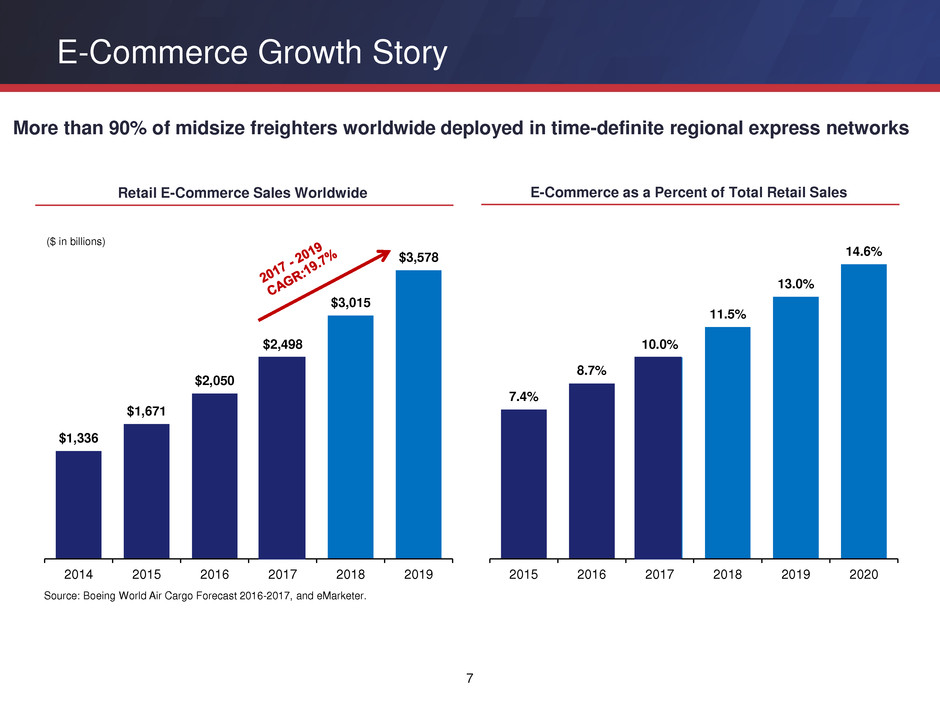

$1,336

$1,671

$2,050

$2,498

$3,015

$3,578

2014 2015 2016 2017 2018 2019

7.4%

8.7%

10.0%

11.5%

13.0%

14.6%

2015 2016 2017 2018 2019 2020

E-Commerce Growth Story

7

Source: Boeing World Air Cargo Forecast 2016-2017, and eMarketer.

($ in billions)

More than 90% of midsize freighters worldwide deployed in time-definite regional express networks

Retail E-Commerce Sales Worldwide E-Commerce as a Percent of Total Retail Sales

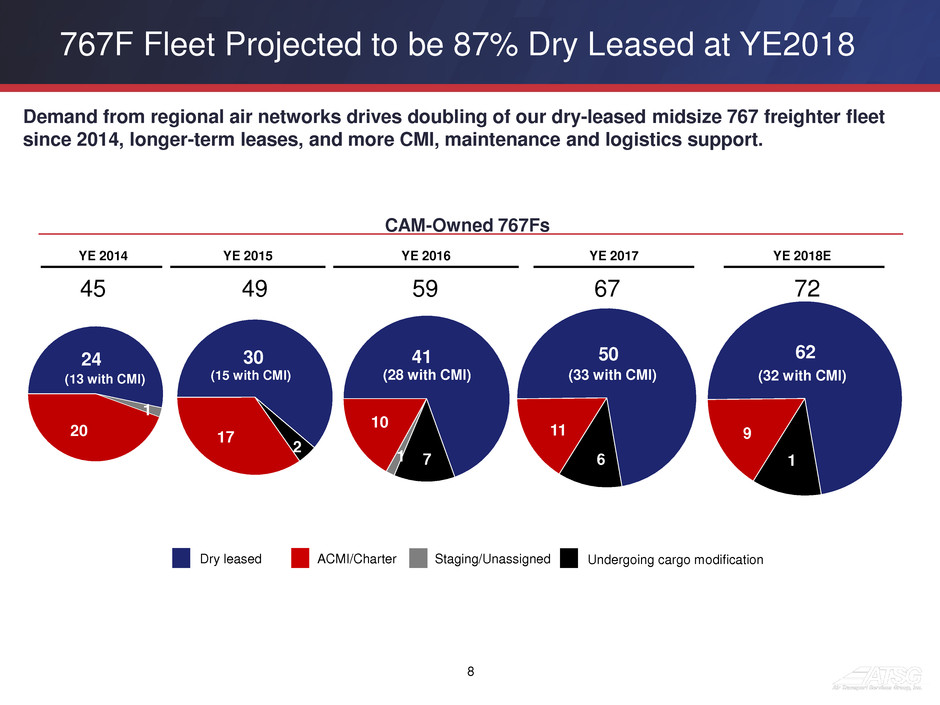

767F Fleet Projected to be 87% Dry Leased at YE2018

8

17

30

2

(15 with CMI)

Dry leased ACMI/Charter Staging/Unassigned Undergoing cargo modification

11

50

6

(33 with CMI)

10

41

7

(28 with CMI)

1

8

20

24

1

(13 with CMI)

2

Demand from regional air networks drives doubling of our dry-leased midsize 767 freighter fleet

since 2014, longer-term leases, and more CMI, maintenance and logistics support.

CAM-Owned 767Fs

YE 2014 YE 2015 YE 2016 YE 2017

9

62

1

(32 with CMI)

YE 2018E

45 49 59 67 72

In March 2016, entered into contract with CAM to lease twenty B767

freighter aircraft

— 12 B767-200 freighters under 5-year contracts

— 8 B767-300 freighters under 7-year contracts

Five-year CMI agreement to operate aircraft

All 20 aircraft now leased; final lease started in August 2017

LGSTX Services subsidiary provides gateway services

Long-term contracts since August 2003

CAM leases of sixteen 767 freighter aircraft under long-term and

short-term leases

ACMI and CMI agreements to operate 757 and 767 aircraft

Americas remains fastest growing region for DHL Express;

2017 revenues up 15.8% in Americas ex currency effects

Long-term Relationships with Key Customers

9

Provide 757 Combi aircraft to serve passenger and freight requests

Sole provider of combi service to military for 20+ years

Contract renewed effective January 2018 through December 2021

DHL

Amazon

U.S. Military

Other Business

10

6 large hangars, 600,000+ sq. ft. in OH & FL

Heavy maintenance

Narrowbody / widebody support of Boeing, Airbus &

regional aircraft types

Established relationships with major carriers in U.S. and

abroad

Contracts with Delta, American & Frontier for fleet

maintenance

PEMCO

— Pax to Freighter 737 Conversions: -300s, -400s

— 70% China market share in B737s

— 737-700 Next Gen P-to-F under development

Precision Joint Venture

— Developing Airbus A321 Program:

— ~1,400 passenger A321s in service

— B757 capacity, B737 efficiency

— targeting 2019 deployment

— CAM, other carriers likely prospects

Ongoing ground support for selected Amazon gateway

facilities in U.S.

Manages five regional sort facilities for US Postal

Service

Ground support equipment leasing

Facility Support Services

MHE Service

MRO Capacity & Capabilities

Logistics Services

P-to-F Conversions

2.0x

1.6x

2.2x 2.1x ~2.1x

2014 2015 2016 2017 2018E

53 55

60

70 81

* *Adjusted EBITDA is a non-GAAP metric. Debt Obligations, fleet totals are as of end of period.

See table at end of this presentation for reconciliation to nearest GAAP results.

767, 757 & 737 Owned Freighters

11

$171

$197

$212

$268

$310E

2014 2015 2016 2017 2018E

Adjusted EBITDA** Revenues

Historical Financial Performance

($ in millions)

Capital Expenditures

($ in millions)

Debt Obligations/Adjusted EBITDA**

($ in millions)

$590 $619

$769

$1,068*

2014 2015 2016 2017

$112

$159

$265

$297 $300E

2014 2015 2016 2017 2018E

$290**

* Pro-forma adjustment to 2017 revenues to illustrate the effect of changes in revenue recognition

rules effective 1/1/18 as if they were in effect on 1/1/17.

$212

$268

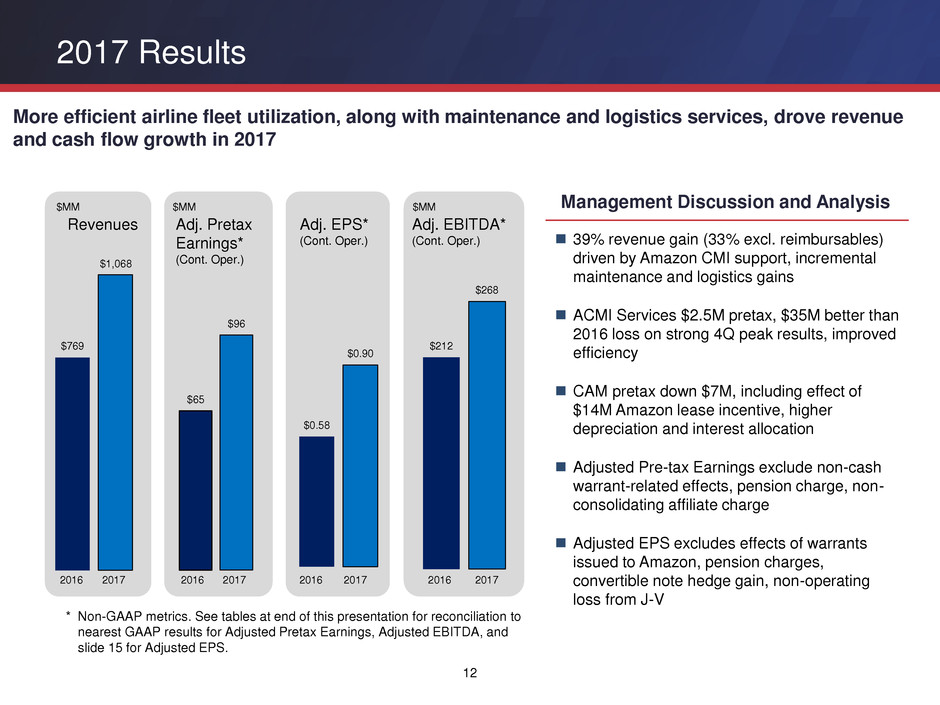

2017 Results

12

39% revenue gain (33% excl. reimbursables)

driven by Amazon CMI support, incremental

maintenance and logistics gains

ACMI Services $2.5M pretax, $35M better than

2016 loss on strong 4Q peak results, improved

efficiency

CAM pretax down $7M, including effect of

$14M Amazon lease incentive, higher

depreciation and interest allocation

Adjusted Pre-tax Earnings exclude non-cash

warrant-related effects, pension charge, non-

consolidating affiliate charge

Adjusted EPS excludes effects of warrants

issued to Amazon, pension charges,

convertible note hedge gain, non-operating

loss from J-V

Revenues Adj. Pretax

Earnings*

(Cont. Oper.)

Adj. EPS*

(Cont. Oper.)

Adj. EBITDA*

(Cont. Oper.)

2017

* Non-GAAP metrics. See tables at end of this presentation for reconciliation to

nearest GAAP results for Adjusted Pretax Earnings, Adjusted EBITDA, and

slide 15 for Adjusted EPS.

$MM $MM $MM

More efficient airline fleet utilization, along with maintenance and logistics services, drove revenue

and cash flow growth in 2017

Management Discussion and Analysis

$769

$65

$96

$0.58

$0.90

2016 2016 2017 2016 2017 2016 2017

$1,068

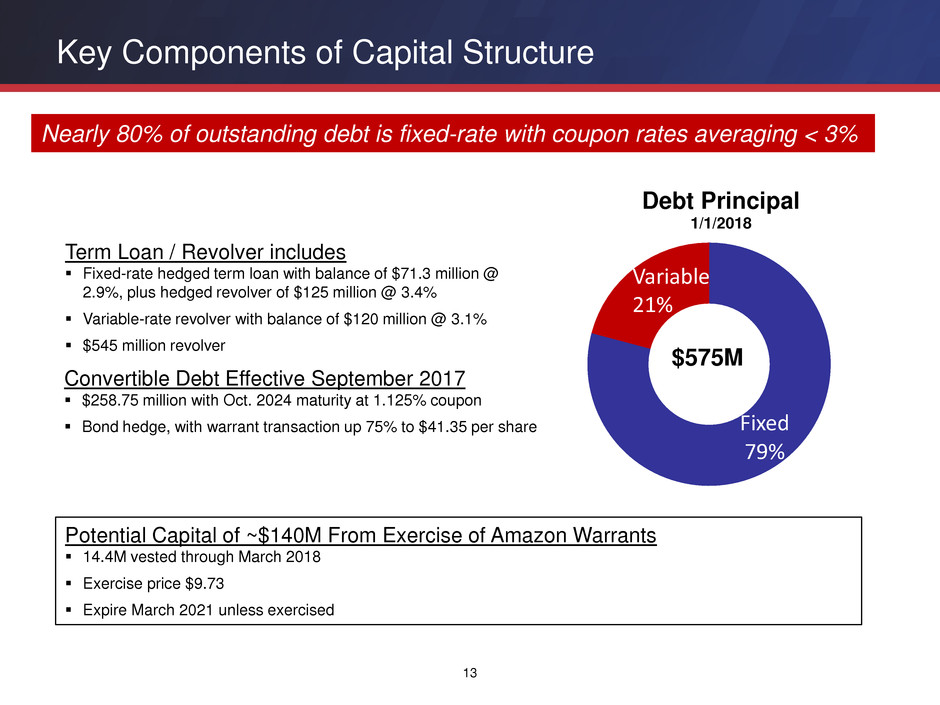

Key Components of Capital Structure

Term Loan / Revolver includes

Fixed-rate hedged term loan with balance of $71.3 million @

2.9%, plus hedged revolver of $125 million @ 3.4%

Variable-rate revolver with balance of $120 million @ 3.1%

$545 million revolver

Fixed

79%

Debt Principal

1/1/2018

Convertible Debt Effective September 2017

$258.75 million with Oct. 2024 maturity at 1.125% coupon

Bond hedge, with warrant transaction up 75% to $41.35 per share

Variable

21%

$575M

Nearly 80% of outstanding debt is fixed-rate with coupon rates averaging < 3%

Potential Capital of ~$140M From Exercise of Amazon Warrants

14.4M vested through March 2018

Exercise price $9.73

Expire March 2021 unless exercised

13

Conclusion - Investment Highlights

14

Growth Closely

Linked to Global

E-Commerce Trends

Long-Term

Relationships with

Key Customers

Leadership in

Midsized Freighters

for Regional Express

Networks

Highly Experienced

Management Team

Lease-Driven

Sustained Cash Flow

Backs Strong

Balance Sheet

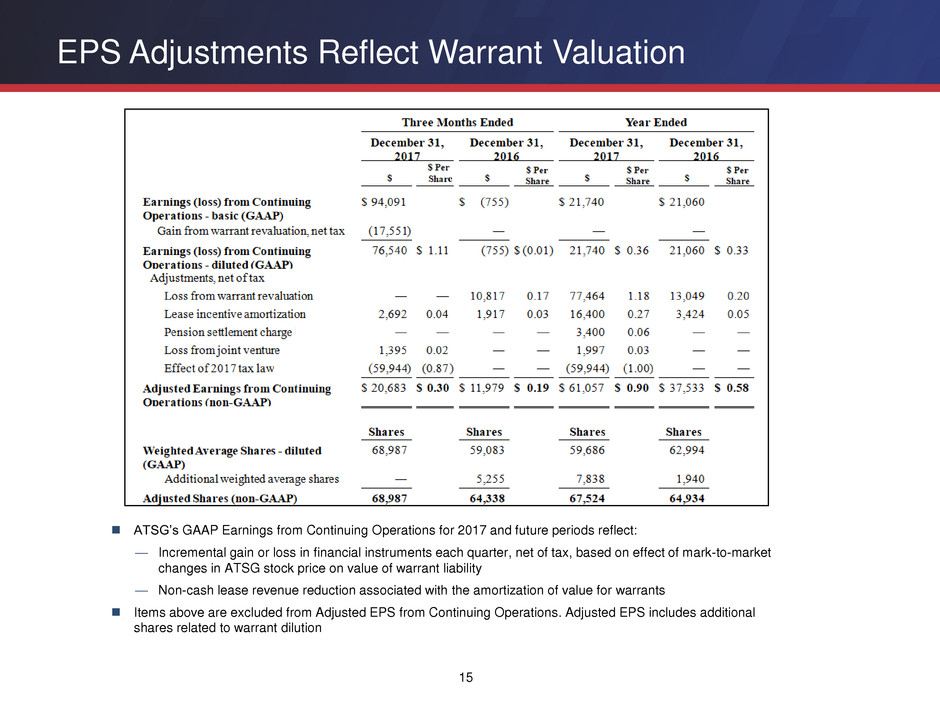

EPS Adjustments Reflect Warrant Valuation

15

ATSG’s GAAP Earnings from Continuing Operations for 2017 and future periods reflect:

— Incremental gain or loss in financial instruments each quarter, net of tax, based on effect of mark-to-market

changes in ATSG stock price on value of warrant liability

— Non-cash lease revenue reduction associated with the amortization of value for warrants

Items above are excluded from Adjusted EPS from Continuing Operations. Adjusted EPS includes additional

shares related to warrant dilution

e

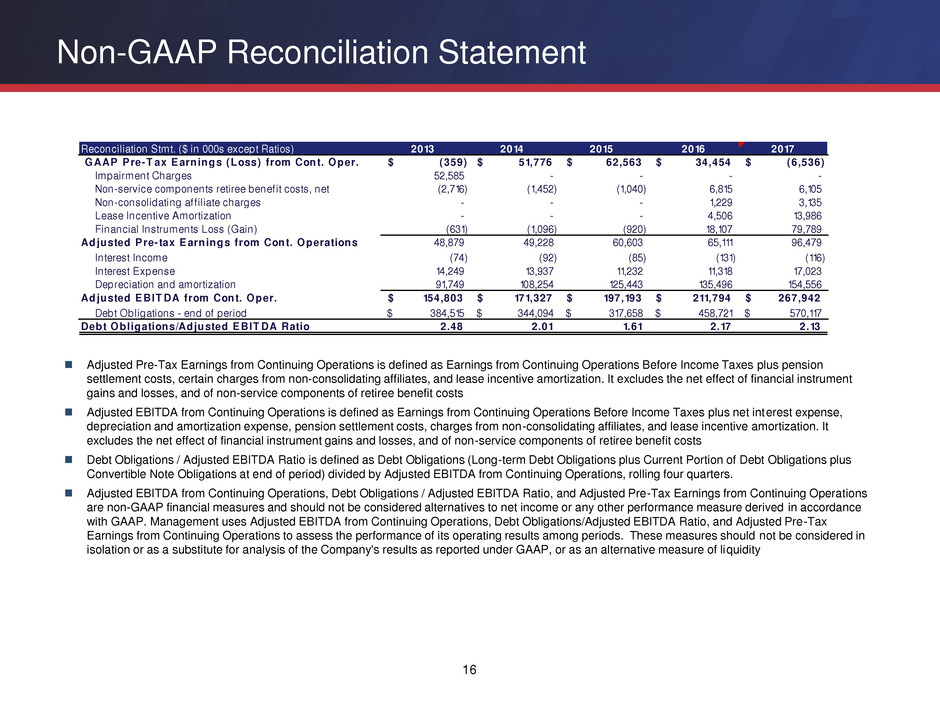

Non-GAAP Reconciliation Statement

16

Adjusted Pre-Tax Earnings from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus pension

settlement costs, certain charges from non-consolidating affiliates, and lease incentive amortization. It excludes the net effect of financial instrument

gains and losses, and of non-service components of retiree benefit costs

Adjusted EBITDA from Continuing Operations is defined as Earnings from Continuing Operations Before Income Taxes plus net interest expense,

depreciation and amortization expense, pension settlement costs, charges from non-consolidating affiliates, and lease incentive amortization. It

excludes the net effect of financial instrument gains and losses, and of non-service components of retiree benefit costs

Debt Obligations / Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations plus

Convertible Note Obligations at end of period) divided by Adjusted EBITDA from Continuing Operations, rolling four quarters.

Adjusted EBITDA from Continuing Operations, Debt Obligations / Adjusted EBITDA Ratio, and Adjusted Pre-Tax Earnings from Continuing Operations

are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance

with GAAP. Management uses Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio, and Adjusted Pre-Tax

Earnings from Continuing Operations to assess the performance of its operating results among periods. These measures should not be considered in

isolation or as a substitute for analysis of the Company's results as reported under GAAP, or as an alternative measure of liquidity

2013 2014 2015 2016 2017

(359)$ 51,776$ 62,563$ 34,454$ (6,536)$

Impairment Charges 52,585 - - - -

Non-service components retiree benefit costs, net (2,716) (1,452) (1,040) 6,815 6,105

Non-consolidating aff iliate charges - - - 1,229 3,135

Lease Incentive Amortization - - - 4,506 13,986

Financial Instruments Loss (Gain) (631) (1,096) (920) 18,107 79,789

48,879 49,228 60,603 65,111 96,479

Interest Income (74) (92) (85) (131) (116)

Interest Expense 14,249 13,937 11,232 11,318 17,023

Depreciation and amortization 91,749 108,254 125,443 135,496 154,556

154,803$ 171,327$ 197,193$ 211,794$ 267,942$

384,515$ 344,094$ 317,658$ 458,721$ 570,117$

2.48 2.01 1.61 2.17 2.13

Reconciliation Stmt. ($ in 000s except Ratios)

Debt Obligations/Adjusted E BIT DA Ratio

GAAP P re-T ax E arnings (Loss) f rom Cont. Oper.

Adjusted E BIT DA from Cont. Oper.

Debt Obligations - end of period

Adjusted P re- tax E arnings f rom Cont. Operations