Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10‑K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 0‑26056

Image Sensing Systems, Inc.

(Exact name of registrant as specified in its charter)

|

Minnesota |

|

41-1519168 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

500 Spruce Tree Centre, 1600 University Avenue West |

|

|

|

St. Paul, MN |

|

55104 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(651) 603‑7700

(Registrant’s telephone number, including area code)

Not applicable.

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.01 par value The NASDAQ Capital Market

Preferred Stock Purchase Rights The NASDAQ Capital Market

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b‑2 of the Exchange Act. (Check one):

|

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☒ |

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes ☐ No ☒

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non‑affiliates of the registrant was $13,865,180 based on the closing sale price as reported on The NASDAQ Capital Market. The number of shares outstanding of the registrant’s $0.01 par value common stock as of February 28, 2018 was 5,210,448 shares.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document |

|

Parts Into Which Incorporated |

|

Proxy Statement for the 2018 Annual Meeting of Shareholders (Proxy Statement) |

|

Part III |

| i |

General

Image Sensing Systems, Inc. (referred to in this Annual Report on Form 10-K as “we,” “us,” “our” and the “Company”) develops and markets video and radar processing products for use in traffic applications such as intersection control, highway, bridge and tunnel traffic management and traffic data collection.

We are a leading provider of above-ground detection products and solutions for the intelligent transportation systems (“ITS”) industry. Our family of products, which we market as Autoscope® video or video products (“Autoscope”), and RTMS® radar or radar products (“RTMS”), provides end users with the tools needed to optimize traffic flow and enhance driver safety. Our technology analyzes signals from sophisticated sensors and transmits the information to management systems and controllers or directly to users. Our products provide end users with complete solutions for the intersection and transportation markets.

Our technology is a process in which software, rather than humans, examines outputs from various types of sophisticated sensors to determine what is happening in a field of view. In the ITS industry, this process is a critical component of managing congestion and traffic flow. In many cities, it is not possible to build roads, bridges and highways quickly enough to accommodate the increasing congestion levels. On average, United States commuters spend 42 hours a year stuck in traffic, and congestion costs motorists $160 billion a year. We believe this growing use of vehicles will make our ITS solutions increasingly necessary to complement existing and new roadway infrastructure to manage traffic flow and optimize throughput.

We believe our solutions are technically superior to those of our competitors because they have a higher level of accuracy, limit the occurrence of false detection, are generally easier to install with lower costs of ownership, work effectively in a multitude of light and weather conditions, and provide end users the ability to manage inputs from a variety of sensors for a number of tasks. It is our view that the technical advantages of our products make our solutions well suited for use in ITS markets.

We believe the strength of our distribution channels positions us to increase the penetration of our technology‑driven solutions in the marketplace. We market our Autoscope video products in the United States, Mexico, Canada and the Caribbean through exclusive agreements with Econolite Control Products, Inc. (“Econolite”), which we believe is the leading distributor of ITS intersection control products in these markets.

We market the RTMS radar systems to a network of distributors, and on a limited basis directly to end users, worldwide. We market our Autoscope video products outside of the United States, Mexico, Canada and the Caribbean through a combination of distribution and direct sales channels, through our offices in Spain and Romania. Our end users primarily include governmental agencies and municipalities.

Industry Overview

The Intelligent Transportation Systems Market. ITS encompasses a broad range of information processing and control electronics technologies that, when integrated into roadway infrastructure, help monitor and manage traffic flow, reduce congestion and enhance driver safety. The ITS market has been built around the detection of conditions that impact the proper operation of roadway infrastructure. ITS applications include a wide array of traffic management systems, such as traffic signal control, tolling and variable messaging signs. ITS technologies include video vehicle detection, inductive loop detection, sensing technologies (such as radar), floating cellular data, computational technologies and wireless communications.

In traffic management applications, vehicle detection products are used for automated vehicle detection and are a primary data source upon which ITS solutions are built. Traditionally, automated vehicle detection is performed using inductive wire loops buried in the pavement. However, in‑pavement loop detectors are costly to install, difficult to maintain, expensive to repair and not capable of either wide‑area vehicle detection without installations of multiple loops.

| 1 |

Above‑ground detection solutions for ITS offer several advantages to in‑pavement loop detectors. Above‑ground detection solutions tend to have a lower total cost of ownership than in‑pavement loop detectors because above‑ground solutions are non‑destructive to road surfaces, do not require closing roadways to install or repair, and are capable of wide‑area vehicle detection with a single device, thus enabling one input device to do the work of many in‑pavement loops. Due to their location above-ground, these solutions have no exposure to the wear and tear associated with expanding and contracting pavement and generally less exposure to the vibration and compaction caused by traffic. Furthermore, in the event of malfunction or product failure, above‑ground detection solutions can be serviced and repaired without shutting down the roadway. Each of these factors results in greater up‑time and increased reliability of above‑ground detection solutions compared to in‑pavement loop detectors. These technology solutions also offer a broader set of detection capabilities and a wider field of view than in‑pavement loop detectors. In addition, a single unit video‑ or radar‑based system can detect and measure a variety of parameters, including vehicle presence, counts, speed, length, time occupancy, headway and flow rate as well as environmental factors and obstructions to the roadway. An equivalent installation using loops would require many installations per lane.

We believe that several trends are driving the growth in ITS and adjacent market segments:

Proliferation of Traffic. In many countries, there has been a surge in the number of vehicles on roadways. Due to the growth of emerging economies and elevated standards of living, more people desire and are able to afford automobiles. The number of vehicles utilizing the world’s roadway infrastructure is growing at a quicker pace than new roads, bridges and highways are being constructed. According to the Federal Highway Administration, American drivers put a record 3.22 trillion miles on public roads and highways in 2016, an increase of 2.8% from 3.1 trillion miles in 2015. Overall, the growth in roadway infrastructure is failing to match the surge in the number of vehicles using it. Above-ground detection based traffic management and control systems address the problem by monitoring high traffic areas and analyzing data that can be used to mitigate traffic problems.

The Demographics of Urbanization. Accelerated worldwide urbanization drives the creation and expansion of middle classes and produces heightened demand for automobiles. Currently, there are at least 500 cities in the world with over 1 million people. Because automobiles can be introduced to a metropolitan area faster than roadway infrastructure can be constructed, the result is continuously worsening traffic. Expanding the roadway infrastructure is slow and costly to implement, and often environmentally undesirable, so government agencies are increasingly turning to technology‑based congestion solutions that optimize performance and throughput of existing and new roadway infrastructure. Detection is the requisite common denominator for any technology‑based solution.

The Melding of Large City Service Domains. Large cities require a wide range of service domains, including traffic. These cities are increasingly turning to centralized management of these service domains, employing a command and control model that requires sharing and integrating data across service domains to operate effectively and lower total cost. For example, data collected for the traffic management service domain is relevant to all of the other service domains. This means that each sensor can supply information to multiple domain services. In turn, the sharing of detection information across service domains should increase the level of sophistication required to process and interpret that information. Additionally, above-ground detection products are more capable of performing certain complicated tasks than humans. This makes the concepts of “rich sensing” and “instrumenting the city” through above-ground detection solutions cost effective, which we believe will result in the extensive proliferation of sophisticated sensors and detection devices.

Solutions for Adjacent Markets. We believe that the adjacent markets of ITS and security/surveillance are converging, and that this convergence will accelerate as above-ground detection systems become more cost‑effective now that a single sensor can be used for multiple purposes. Because the technologies involved are closely related, our sensor technology can be adapted to or is already capable of addressing these adjacent markets.

Our Competitive Strengths

We are a leading provider of above-ground detection products and solutions for the ITS industry. We have the following competitive strengths that we expect will continue to enhance our leadership position:

Leading Proprietary Technologies. Over the last two decades, we have developed or acquired a proprietary portfolio of complex software algorithms and applications that we have continuously enhanced and refined. These algorithms, which include our advanced signal processing technologies, allow our video and radar products to capture and analyze objects in diverse weather and lighting conditions and to balance the accuracy of positive detection and the avoidance of false detections. Due to the strength of our proprietary technologies, we believe we command premium pricing. Above-ground detection technologies similar to ours are also difficult to develop and refine in a commercially viable manner. We are therefore well positioned to quickly introduce innovative next‑generation products to market.

| 2 |

Proven Ability to Develop, Enhance and Market New Products. We are continually developing and enhancing our product offerings. Over the last two decades, we have demonstrated our ability to lead the market with new products and product enhancements. For example, the Autoscope Solo system was the first fully integrated color camera, zoom lens and machine vision processor in the above-ground detection market. Our RTMS Radar business unit was one of the first to introduce radar‑based technology solutions for ITS applications, and we continue to lead the market with technology enhancements and new products. Furthermore, our next generation video product, Autoscope Vision, is an example of development driven by the voice of our customers. We have developed a high definition video detection solution with increased accuracy, performance, and ease of use. We have successfully collaborated with our long‑term channel partners to market these products. We believe that developing, enhancing and marketing new products with our partners can translate into strong organic revenue growth and high levels of profitability.

Leading Distribution Channel. Since 1991, we have maintained a relationship with Econolite, which has the exclusive right to manufacture, market and distribute our Autoscope video products in the United States, Mexico, Canada and the Caribbean. We believe that Econolite is the leading distributor of ITS control products in North America and the Caribbean. This relationship enhances our ability to commercialize and market new products and allows us to focus more resources on developing advanced signal processing software algorithms.

Broad Product Portfolio. Our product portfolio leverages our core software‑based algorithms to enable end users to detect and monitor objects in a designated field of view. We believe that our family of Autoscope video and RTMS radar products allows us to offer a broad product portfolio that meets the needs of our end users.

Experienced Management Team and Engineering Staff. Our management team and engineering staff are highly experienced in the ITS and software industries. Additionally, the continuity of our engineering staff should allow the uninterrupted development of new or improved products.

Our Growth Strategy

As part of our growth strategy, we seek to:

Enhance and Extend Our Technology Leadership in ITS. We believe we have established ourselves as a leading provider of technology in the ITS market segment. We believe that we continue to have an opportunity to accelerate our growth. We plan to do this by improving the accuracy and functionality of our products and opportunistically expanding our product offering into adjacent markets, as well as expanding our portfolio and channels through licensing. Having developed and introduced our next-generation video product, we expect to take advantage of our technical leadership in ITS and further differentiate us from our competitors.

Expand into Adjacent Markets. Our core skill is the implementation of above-ground detection products and solutions. Over the past two decades, we have been developing and refining our complex signal processing software algorithms. We should be able to effectively utilize our core software skills more broadly as markets converge. We believe that a driver of this convergence is that above-ground detection systems will become more cost‑effective when a single sensor can be used for multiple purposes. As a result, our objective is to become the leading supplier of critical detection components to third party management systems, particularly those that exploit the convergence of traffic. To do this, we are integrating this concept into our long‑range engineering development road‑map and will evaluate the use of technology licensing and channel strategies that support this vision.

Increase the Scope of Our Distribution and Direct Sales. We have made substantial investments in product adjustments to tailor our solutions to the differing needs of our international end users and in new product acquisitions for both domestic and international markets. We have also invested in sales and marketing expansion, with a focus on our European subsidiaries. Markets in Eastern Europe, the Asia/Pacific region, the Middle East, Africa and South America, which have historically lagged North America and Western Europe in their use of above-ground detection, have begun to increase the adoption of detection technology in their traffic systems. We intend to take advantage of the accelerated pace of the adoption of above-ground detection throughout the developing world by increasing end user awareness of our products and applications as well as improve user aptitude.

Our Products and Solutions

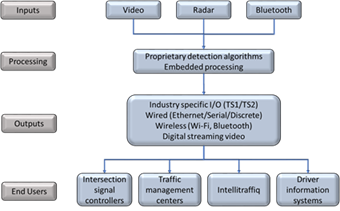

Our vehicle and traffic detection products are critical components of many ITS applications. Our Autoscope video systems and RTMS radar systems convert sensory input collected by video cameras and radar units into vehicle detection and traffic data used to operate, monitor and improve the efficiency of roadway infrastructure. At the core of each product line are proprietary digital signal processing algorithms and sophisticated embedded software that analyze sensory input and deliver actionable data to integrated applications. We invested approximately $4.1 million and $4.6 million on research and development in 2017 and 2016, respectively, to develop and enhance our product technology. Our digital signal processing software algorithms represent a foundation on which to support additional product development into the automatic incident detection (AID) market. A diagram displaying our fundamental product architecture is shown below.

| 3 |

The Image Sensing Product Architecture

Autoscope Video. Our Autoscope video system processes video input from a traffic scene in real time and extracts the required traffic data, including vehicle presence, bicycle presence/differentiation, counts, speed, length, time occupancy (percent of time the detection zone is occupied), turning movements (quantifying the movement of vehicles ) and flow rate (vehicles per hour per lane). Autoscope supports a variety of standard video cameras or can be purchased with an integrated high-definition video camera. For intersections, the system communicates with the intersection signal controller, which changes the traffic lights based on the data provided. In highway applications, the system gathers vehicle count and flow rates. In any application, the data may also be transmitted to a traffic management center via the internet or other standard communication means and processed in real time to assist in traffic management and stored for later analysis for traffic planning purposes.

The Autoscope system comes in two varieties. Autoscope Vision is our flagship integrated product that includes a color high-definition, zoom camera and a machine vision processing computer contained in a compact housing that is our leading offering in the North American market. Autoscope Pn-520 is our card only machine vision processing computer that is located in an intersection signal controller, control hub, incident management center or traffic management center that receives video from a separate camera. The Pn-520 and its variants are our top selling Autoscope products in international markets. Autoscope rack-based products offer digital MPEG‑4 video streaming, high speed Ethernet interface, web browser maintenance and data and video over power line communications. The Autoscope Vision product offers digital streaming video, built-in WiFi for quick and easy setup, cost-effective three-wire cable and full screen object detection and motion tracking algorithm technology for best in class detection accuracy.

RTMS Radar. Our RTMS radar systems use radar to measure vehicle presence, volume, occupancy, speed and classification information for roadway monitoring applications. Data is transmitted to a central computer at a traffic management center via standard communication means, including wireless. Data can be processed in real time to assist in traffic management and stored for later analysis for traffic planning purposes.

RTMS radar is an integrated radar transmitter/receiver and embedded processor contained in a compact, self‑contained unit. The unit is typically situated on roadway poles and side‑fired, making it especially well-suited for highway detection applications.

The RTMS radar system come in a few different varieties. RTMS Sx-300 is our base, non-intrusive radar for detection and measurement of traffic on roadways and is our leading offering in both North America and the Middle East. The RTMS Sx-300 HDCAM has a high-definition camera that provides the user with visual setup confirmation, data capture and real-time traffic surveillance. The Sx-300 HDCAM has been widely deployed in North America for various applications such as ramp metering and wrong way driver detection. The RTMS Sx-300 BT is an integrated Sx-300 with dual channel Bluetooth sensor and is ideal for providing the most accurate travel time and origin/destination information. We also offer a wrong way module that interfaces with the Sx-300 HDCAM digital video stream and leverages our video detection algorithms to detect occurrences of vehicles driving the incorrect direction. The event is captured and sent to the end users via SMS and email in parallel with actuation or roadside or in-pavement warning systems.

| 4 |

Distribution, Sales and Marketing

We market and sell our products globally. Together with our partners, we offer a combination of high‑performance detection technology and experienced local support. Our end users primarily consist of federal, state, city and county departments of transportation, port, highway, tunnel and other transportation authorities. The decision‑makers within these entities typically are traffic planners and engineers, who in turn often rely on consulting firms that perform planning and feasibility studies. Our products sometimes are sold directly to system integrators or other suppliers of systems and services who are operating under subcontracts in connection with major road construction contracts.

Sales of Autoscope Video in the United States, Mexico, Canada and the Caribbean. We have granted Econolite an exclusive right to manufacture, market and distribute the Autoscope video system in the United States, Mexico, Canada and the Caribbean. The agreement with Econolite grants it a first refusal right that arises when we make a proposal to Econolite to extend the license to additional products in the United States, Mexico, Canada and the Caribbean and a first negotiation right that arises when we make a proposal to Econolite to include rights corresponding to Econolite’s rights under our current agreements in countries not in these territories. Econolite provides the marketing and technical support needed for its sales in these territories. Econolite pays us a royalty on the revenue derived from its sales of the Autoscope system. We cooperate in marketing Autoscope video products with Econolite for the United States, Mexico, Canada and the Caribbean and provide second‑tier technical support. We have the right to terminate our agreements with Econolite if it does not meet minimum annual sales levels or if Econolite fails to make payments as required by the agreements. In 2008, the term of the original agreement with Econolite, as amended, was extended to 2031. The agreements can be terminated by either party upon three years’ notice.

Sales of RTMS Radar in North America, the Caribbean and Latin America. We market the RTMS radar systems to a network of distributors covering countries in North America, the Caribbean and Latin America. On a limited basis, we sell directly to the end user. We provide technical support to these distributors from our various North American locations.

Sales in Europe, Asia, the Middle East and Africa. We market our Autoscope video and RTMS radar product lines of products to a network of distributors covering countries in Europe, the Middle East, Africa and Asia through our wholly‑owned subsidiaries that have offices in Europe. On a limited basis, we sell directly to the end user. Technical support to these distributors is provided by our wholly‑owned subsidiaries in Europe, with second‑tier support provided by our engineering groups. From time to time, we may grant exclusive rights to Econolite for markets outside of our significant markets for certain jurisdictions or product sales based on facts and circumstances related to the opportunities.

Competition

We compete with companies that develop, manufacture and sell traffic management devices using video and radar sensing technologies as well as other above‑ground detection technologies based on laser, infrared and acoustic sensors. For ITS applications, we also compete with providers of in‑pavement loop detectors and estimate that more than 60% of the traffic management systems currently in use in the U.S. use in‑pavement loop detectors. For competition with other above‑ground detection products, we typically compete on performance and functionality, and to a lesser extent on price. When competing against providers of loop detectors, we compete principally on ease of installation and the total cost of ownership over a multi‑year period, and to a lesser extent on functionality.

Among the companies that provide direct competition to Autoscope video worldwide are Iteris, Inc., Wavetronix, LLC, FLIR Systems, Inc., Signal Group Inc. (Peek), Citilog S.A., Sensys Inc., and Smartmicro Inc. Among the companies that provide direct competition to RTMS radar worldwide are Wavetronix, LLC, Houston Radar, LLC, MS Sedco Inc., Smartmicro Sensors GmbH, and TraffiCast. To our knowledge, Autoscope video and RTMS radar have the largest number of installations as compared to their direct competitors. In addition, there are smaller local companies providing direct competition in specific markets throughout the world. We are aware that these and other companies will continue to develop technologies for use in traffic management applications. One or more of these technologies could in the future provide increased competition for our systems.

Other potential competitors of which we are aware include Siemens AG, Cognex Corp., Augusta Technologie AG, Matsushita Electric Industrial Co., Ltd. (Panasonic), Sumitomo Corporation and Omron Electronics LLC. These companies have machine vision or radar capabilities and have substantially more financial, technological, marketing, personnel and research and development resources than we have.

| 5 |

Manufacturing

Autoscope video products for sale under the Econolite license agreement are manufactured through agreements with Econolite and Wireless Technology, Inc. Econolite is responsible for setting warranty terms and must provide all service required under this warranty. In Europe and Asia, we engage contract manufacturers to manufacture the Autoscope family of products.

We engage Wireless Technology, Inc. to manufacture our radar products and perform warranty and post-warranty repairs for all radar units sold.

We typically provide a two to five-year warranty on our products.

Most of the hardware components used to manufacture our products are standard electronics components that are available from multiple sources. Although some of the components used in our products are obtained from single‑source suppliers, we believe other component vendors are available should the necessity arise. The European Parliament has enacted a directive for the restriction of the use of certain hazardous substances in electrical and electronic equipment (“RoHS”). To our knowledge, our contract manufacturing and component vendors in Europe and Asia comply with the European directive on RoHS.

Intellectual Property

To protect our rights to our proprietary know‑how, technology and other intellectual property, it is our policy to require all employees and consultants to sign confidentiality agreements that prohibit the disclosure of confidential information to any third parties. These agreements also require disclosure and assignment to us of any discoveries and inventions made by employees and consultants while they are devoted to our business activities. We also rely on trade secret, copyright and trademark laws to protect our intellectual property. We have also entered into exclusive and non‑exclusive license and confidentiality agreements relating to our own and third‑party technologies. We aggressively protect our processes, products, and strategies as proprietary trade secrets. Our efforts to protect intellectual property and avoid disputes over proprietary rights include ongoing review of third‑party patents and patent applications.

Environmental Matters

We believe our operations are in compliance with all applicable environmental regulations within the jurisdictions in which we operate.

Employees

As of December 31, 2017, we had 59 employees, consisting of 49 employees in North America and 10 employees in Europe. None of our employees are represented by a union.

Information Regarding Forward‑Looking Statements

This Annual Report on Form 10‑K contains forward‑looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange of 1934, as amended. Forward‑looking statements represent our expectations or beliefs concerning future events and can be identified by the use of forward‑looking words such as “believes,” “may,” “will,” “should,” “intends,” “plans,” “estimates,” or “anticipates” or other comparable terminology. Forward‑looking statements are subject to risks and uncertainties that may cause our actual results to differ materially from the results discussed in the forward‑looking statements. Some factors that might cause these differences include the factors listed below. Although we have attempted to list these factors comprehensively, we wish to caution investors that other factors may prove to be important in the future and may affect our operating results. New factors may emerge from time to time, and it is not possible to predict all of these factors, nor can we assess the effect each factor or combination of factors may have on our business.

We further caution you not to unduly rely on any forward‑looking statements because they reflect our views only as of the date the statements were made. We undertake no obligation to publicly update or revise any forward‑looking statements whether as a result of new information, future events or otherwise.

| 6 |

If governmental entities elect not to use our products due to budgetary constraints, project delays or other reasons, our revenue may fluctuate severely or be substantially diminished.

Our products are sold primarily to governmental entities. We expect that we will continue to rely substantially on revenue and royalties from sales of our systems to governmental entities. In addition to normal business risks, it often takes considerable time before governmental initiated projects are developed to the point at which a purchase of our systems would be made, and a purchase of our products also may be subject to a time‑consuming approval process. Additionally, governmental budgets and plans may change without warning. Other risks of selling to governmental entities include dependence on appropriations and administrative allocation of funds, changes in governmental procurement legislation and regulations and other policies that may reflect political developments, significant changes in contract scheduling, competitive bidding and qualification requirements, performance bond requirements, intense competition for government business and termination of purchase decisions for the convenience of the governmental entity. Substantial delays in purchase decisions by governmental entities, or governmental budgetary constraints, could cause our revenue and income to drop substantially or to fluctuate significantly between fiscal periods.

A majority of our gross profit has been generated from sales of our Autoscope family of products, and if we do not maintain the market for these products, our business will be harmed.

Historically, a majority of our gross profit has been generated from sales of, or royalties from the sales of, Autoscope products. Gross profit from Autoscope sales accounted for approximately 74% of our gross profit in 2017 and 78% in 2016. We anticipate that gross profit from the sale of Autoscope systems will continue to account for a substantial portion of our gross profit for the foreseeable future. As such, any significant decline in sales of our Autoscope system would have a material adverse impact on our business, financial condition and results of operations.

If Econolite’s sales volume decreases or if it fails to pay royalties to us in a timely manner or at all, our financial results will suffer.

We have agreements with Econolite under which Econolite is the exclusive distributor of the Autoscope video system in the United States, Mexico, Canada and the Caribbean. Our current agreements grant Econolite a first refusal right that arises when we make a proposal to Econolite to extend the license to additional products in the United States, Mexico, Canada and the Caribbean. In addition, the agreements grant Econolite a first negotiation right that arises when we make a proposal to Econolite to include rights corresponding to Econolite’s rights under our current agreements in countries not in these territories. In exchange for its rights under the agreements, Econolite pays us royalties for sales of the Autoscope video system. Since 2002, a substantial portion of our revenue has consisted of royalties resulting from sales made by Econolite, including 59% in 2017 and 55% in 2016. Econolite’s account receivable represented 77% of our accounts receivable at December 31, 2017 and 61% of our accounts receivable at December 31, 2016. We expect that Econolite will continue to account for a significant portion of our revenue for the foreseeable future. Any decrease in Econolite’s sales volume could significantly reduce our royalty revenue and adversely impact earnings. A failure by Econolite to make royalty payments to us in a timely manner or at all will harm our financial condition. In addition, we believe sales of our products are a material part of Econolite’s business, and any significant decrease in Econolite’s sales of the other products it sells could harm Econolite, which could have a material adverse effect on our business and prospects.

As a result of our continuing review of our business, we may have to undertake further restructuring plans that would require additional charges, including incurring facility exit and restructuring charges.

We continue to evaluate our business, which may result in restructuring activities. We may choose to divest certain business operations based on management's assessment of their strategic value to our business, consolidate or close certain facilities or outsource certain functions. Decisions to eliminate or limit certain business operations in the future could involve the expenditure of capital, consumption of management resources, realization of losses, transition and wind-up expenses, reduction in workforce, impairment of assets, facility consolidation and the elimination of revenues along with associated costs, any of which could cause our operating results to decline and may fail to yield the expected benefits. For more information regarding our restructuring and divestiture activities in 2017 and 2016, see the discussion in Note 2 and Note 14 of our Notes to Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K.

The features and functions in our products have not been as widely utilized as traditional products offered by our competitors, and the failure of our end users to accept the features and functions in our products could adversely affect our business and growth prospects.

Video and radar technologies have not been utilized in the traffic management industry as extensively as other more traditional technologies, mainly in‑pavement loop detectors. Our financial success and growth prospects depend on the continued development of the market for advanced technology solutions for traffic detection and management and the acceptance of our current Autoscope video and RTMS radar and also future systems we may develop as reliable, cost‑effective alternatives to traditional vehicle detection systems. We cannot assure you that we will be able to utilize our technology profitably in other products or markets. If our end users do not continue to increase their acceptance of the features and functions provided by our current systems or other systems we may develop in the future, our business and growth prospects could be adversely affected.

| 7 |

Our operating costs tend to be fixed, while our revenue tends to be seasonal, thereby resulting in operating results that fluctuate from quarter to quarter.

Our expense levels are based in part on our product development efforts and our expectations regarding future revenues and, in the short‑term, are generally fixed. Our quarterly revenues, however, have varied significantly in the past, with our first quarter historically being the weakest due to weather conditions in parts of North America, Europe and Asia that make roadway construction more difficult. Additionally, our international revenues have a significant large project component, resulting in a varying revenue stream. We expect the seasonality of our revenue and the fixed nature of our operating costs to continue in the foreseeable future. Therefore, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall. As a result, if anticipated revenues in any quarter do not occur or are delayed, our operating results for the quarter would be disproportionately affected. Operating results also may fluctuate due to factors such as the demand for our products; product life cycle; the development, introduction and acceptance of new products and product enhancements by us or our competitors; changes in the mix of distribution channels through which our products are offered; changes in the level of operating expenses; end user order deferrals in anticipation of new products; competitive conditions in the industry; and economic conditions generally. No assurance can be given that we will be able to achieve or maintain profitability on a quarterly or annual basis in the future.

Increased competition may make it difficult for us to acquire and retain end users. If we are unsuccessful in developing new applications and product enhancements, our products may become noncompetitive or obsolete.

Competition in ITS is continuing to grow. Some of the companies that may compete with us in the business of developing and implementing traffic control and related security systems have substantially more financial, technological, marketing, personnel and research and development resources than we have. Therefore, they may be able to respond more quickly than we can to new or changing opportunities, technologies, standards or end user requirements. If we are unable to compete successfully with these companies, the market share for our products will decrease, and competitive pressures may seriously harm our business.

Additionally, the market for vehicle detection is continuously seeking more advanced technological solutions to problems. Technologies such as embedded loop detectors, pressure plates, pneumatic tubes, radars, lasers, magnetometers, acoustics and microwaves that have been used as traffic sensing devices in the past are being enhanced for use in the traffic management industry, and new technologies may be developed. We are aware of several companies that are developing traffic management devices using machine vision technology or other advanced technology. Floating vehicle and/or radio frequency identification (RFID) tagged license plate initiatives are under consideration and may be implemented. We expect to face increasingly competitive product developments, applications and enhancements. New technologies or applications in traffic control systems from other companies or the development of new and emerging technologies and applications, including vehicle-to-vehicle (VTV) communications, mobile applications, and new algorithms or sensor technologies, may provide our end users with alternatives to our products and could render our solutions noncompetitive or obsolete. If we are unable to increase the number of our applications and develop and commercialize product enhancements and applications in a timely and cost-effective manner that respond to changing technology and satisfy the needs of our end users, our business and financial results will suffer.

We may not achieve our growth plans for the expansion of our business.

In addition to market penetration, our long‑term success depends on our ability to expand our business through new product development, mergers and acquisitions, and/or geographic expansion.

New product development would require that we maintain our ability to improve existing products, continue to bring innovative products to market in a timely fashion, and adapt products to the needs and standards of current and potential customers. Our products and services may become less competitive or eclipsed by technologies to which we do not have access or which render our solutions obsolete.

Geographic expansion would be primarily outside of the U.S. and hence will be disproportionately subject to the risks of international operations discussed in this Annual Report on Form 10-K.

Mergers and acquisitions would be accompanied by risks which may include:

● difficulties identifying suitable acquisition candidates at acceptable costs;

● unavailability of capital to conduct acquisitions;

● failure to achieve the financial and strategic goals for the acquired and combined businesses;

● difficulty assimilating the operations and personnel of the acquired businesses;

| 8 |

● disruption of ongoing business and distraction of management from the ongoing business;

● dilution of existing shareholders and earnings per share;

● unanticipated, undisclosed or inaccurately assessed liabilities, legal risks and costs; and

● difficulties retaining our key vendors, customers or employees or those of the acquired business.

In addition, acquisitions of businesses having a significant presence outside the U.S. will increase our exposure to the risks of international operations discussed in this Annual Report on Form 10-K.

Our dependence on third parties for manufacturing and marketing our products may prevent us from meeting customers’ needs in a timely manner.

We do not have, and do not intend to develop in the near future, internal capabilities to manufacture our products. We have entered into agreements with Econolite and Wireless Technology, Inc. (“WTI”) to manufacture the Autoscope system, the RTMS radar products and related products for sales in the United States, Mexico, Canada and the Caribbean. We work with suppliers, most of whom are overseas, to manufacture the rest of our products. We also need to comply with the European Union’s regulatory RoHS directive restricting the use of certain hazardous substances in electrical and electronic equipment. If Econolite, WTI, or our other suppliers are unable to manufacture our products in the future, we may be unable to identify other manufacturers able to meet product and quality demands in a timely manner or at all. Our inability to find suitable manufacturers for our products could result in delays or reductions in product shipments, which in turn may harm our business reputation and results of operations. In addition, we have granted Econolite the exclusive right to market the Autoscope video system and related products in the United States, Mexico, Canada and the Caribbean. Consequently, our revenue depends to a significant extent on Econolite’s marketing efforts. Econolite’s inability to effectively market the Autoscope video system, or the disruption or termination of that relationship, could result in reduced revenue and market share for our products.

We and our third party manufacturers obtain some of the components of our products from a single source, and an interruption in the supply of those components may prevent us from meeting customers’ needs in a timely manner and could therefore reduce our sales.

Although substantially all of the hardware components incorporated into our products are standard electronics components that are available from multiple sources, we and our third party manufacturers obtain some of the components from a single source. The loss or interruption of any of these supply sources could force us or our manufacturers to identify new suppliers, which could increase our costs, reduce our sales and profitability, or harm our customer relations by delaying product deliveries.

Regulations related to the use of conflict‑free minerals may increase our costs and cause us to incur additional expenses.

The Dodd‑Frank Wall Street Reform and Consumer Protection Act contains provisions to improve the transparency and accountability of the use by public companies in their products of minerals mined in certain countries and to prevent the sourcing of such “conflict” minerals. As a result, the Securities and Exchange Commission enacted annual disclosure and reporting requirements for public companies who use these minerals in their products, which apply to us. Under the final rules, we are required to conduct due diligence to determine the source of any conflict minerals used in our products. Although we expect to file the required report on a timely basis, our supply chain is broad‑based and complex, and we may not be able to easily verify the origins for all minerals used in our products. To the extent that any information furnished to us by our suppliers is inaccurate or inadequate, we could face reputational and enforcement risks. In addition, the conflict mineral rules could reduce the number of suppliers who provide components and products containing conflict‑free minerals and thus could disrupt our supply chain or that of our manufacturers and increase the cost of the components used in manufacturing our products and the costs of our products to us. Any increased costs and expenses could have a material adverse impact on our financial condition and results of operations.

Some of our products are covered by our warranties and, if the cost of fulfilling these warranties exceeds our warranty allowance, it could adversely affect our financial condition and results of operations.

Unanticipated warranty and other costs for defective products could adversely affect our financial condition and results of operations and our reputation. We generally provide a two to five year warranty on our product sales. These warranties require us to repair or replace faulty products, among other customary warranty provisions. Although we monitor our warranty claims and provide an allowance for estimated warranty costs, unanticipated claims in excess of the allowance could have a material adverse impact on our financial condition and results of operations. Additionally, we rely on our third party manufacturers to fulfill our warranty repair obligations to our customers. Adverse changes in these parties’ abilities to perform these repairs could cause a delay in repairs or require us to source other parties to perform the repairs and could adversely affect impact our financial condition and results of operations. In addition, the need to repair or replace products with design or manufacturing defects could adversely affect our reputation.

| 9 |

We may face increased competition if we fail to adequately protect our intellectual property rights, and any efforts to protect our intellectual property rights may result in costly litigation.

Our success depends in large measure on the protection of our proprietary technology rights. We rely on trade secret, copyright and trademark laws, confidentiality agreements with employees and third parties, and patents, all of which offer only limited protection. We cannot assure you that the scope of these protective measures will exclude competitors or provide competitive advantages to us. We also cannot assure you that we will become aware of all instances in which others develop similar products, duplicate any of our products, or reverse engineer or misappropriate our proprietary technology. If our proprietary technology is misappropriated, our business and financial results could be adversely affected. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. In addition, we may be the subject of lawsuits by others who claim we violate their intellectual property rights.

Intellectual property litigation is very costly and could result in substantial expense and diversions of our resources, either of which could adversely affect our business and financial condition and results of operations. In addition, there may be no effective legal recourse against infringement of our intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

We have not applied for patent protection in all countries in which we market and sell our products. Consequently, our proprietary rights in the technology underlying our systems in countries other than the U.S. will be protected only to the extent that trade secret, copyright or other non‑patent protection is available and to the extent we are able to enforce our rights. The laws of other countries in which we market our products may afford little or no effective protection of our proprietary technology, which could harm our business.

We plan to continue introducing new products and technologies and may not realize the degree or timing of benefits we initially anticipated, which could adversely affect our business and results of operations.

We regularly invest substantial amounts in research and development efforts that pursue advancements in a range of technologies, products and services. Our ability to realize the anticipated benefits of these advancements depends on a variety of factors, including meeting development, production, certification and regulatory approval schedules; the execution of internal and external performance plans; the availability of supplier‑produced parts and materials; the performance of suppliers and vendors; achieving cost efficiencies; the validation of innovative technologies; and the level of end user interest in new technologies and products. These factors involve significant risks and uncertainties. We may encounter difficulties in developing and producing these new products and may not realize the degree or timing of benefits initially anticipated. In particular, we cannot predict with certainty whether, when or in what quantities our current or potential end users will have a demand for products currently in development or pending release. Moreover, as new products are announced, sales of current products may decrease as end users delay making purchases until such new products are available. Any of the foregoing could adversely affect our business and results of operations.

Our business could be adversely affected by product liability and commercial litigation.

Our products or services may be claimed to cause or contribute to personal injury or property damage to our customers’ employees or facilities. Additionally, we are, at times, involved in commercial disputes with third parties, such as customers, distributors, vendors and others. See Note 16 of our Notes to Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K. The ensuing claims may arise singularly, in groups of related claims, or in class actions involving multiple claimants. Such claims and litigation are frequently expensive and time‑consuming to resolve and may result in substantial liability to us, which liability and related costs and expenses may not be recoverable through insurance or any other forms of reimbursement.

Our business could be affected by various legal and regulatory compliance risks, including those involving antitrust, environmental, anti-bribery or anti-corruption laws and regulations.

We are subject to various legal and regulatory requirements and risks in the U.S. and other countries in which we have facilities or sell our products involving compliance with antitrust, environmental, anti-bribery and anti-corruption laws and regulations, including the U.S. Foreign Corrupt Practices Act and the U.K. Anti-Bribery Act. Although we have internal policies and procedures with the intention of assuring compliance with these laws and regulations, our employees, contractors, agents and licensees involved in our international sales may take actions in violation of such policies. Any future adverse development, ruling or settlement could result in charges that could have an adverse effect on our results of operations or cash flows.

We price a segment of our product portfolio at a premium compared to other technologies. As such, we may not be able to quickly respond to emerging low‑cost competitors, and our inability to do so could adversely affect revenue and profitability.

We price segment of our product portfolio at a premium as compared to products using less sophisticated technologies. As the technological sophistication of our competitors and the size of the market increase, competing low‑cost developers of machine vision products for traffic are likely to emerge and grow stronger. If end users prefer low‑cost alternatives over our products, our revenue and profitability could be adversely affected.

| 10 |

Our revenue could be adversely affected by the emergence of local competitors and local biases in international markets.

Our experience indicates that local officials that purchase traffic management products in the international markets we serve favor products that are developed and manufactured locally. As local competitors to our products emerge, local biases could erode our revenue in Europe and Asia and adversely affect our sales and revenue in those markets.

Our failure to predict technological convergence could harm our business and could reduce our sales.

Within our product families, we currently utilize only certain detection technologies available in the ITS field. If we fail to predict convergence of technology preferences in the market for ITS, or fail to identify and acquire complementary businesses or products that broaden our current product offerings, we may not capture certain segments of the market, which could harm our business and reduce our sales.

We sell our products internationally and are subject to various risks relating to such international activities, which could harm our international sales and profitability.

Sales outside of the United States, including export sales from our U.S. business locations, accounted for approximately 17% of our total revenue in 2017 and 18% of our total revenue in 2016. By doing business in international markets, we are exposed to risks separate and distinct from those we face in our U.S. operations. Our international business may be adversely affected by changing political and economic conditions in foreign countries. Additionally, fluctuations in currency exchange rates could affect demand for our products or otherwise negatively affect profitability. Engaging in international business inherently involves a number of other difficulties and risks, including:

• export restrictions and controls relating to technology;

• pricing pressure that we may experience internationally;

• exposure to the risk of currency value fluctuations where payment for products is denominated in a currency other than U.S. dollars;

• variability in the U.S. dollar value of foreign currency‑denominated assets, earnings and cash flows;

• required compliance with existing and new foreign regulatory requirements and laws;

• laws and business practices favoring local companies;

• longer payment cycles;

• difficulty of enforcing agreements, including patent and trademarks, and collecting receivables through foreign legal systems;

• disputes with parties outside of the U.S., which may be more difficult, expensive and time-consuming to resolve than disputes with parties located in the U.S.;

• political and economic instability, including volatility in the economic environment of the European Union caused by the ongoing sovereign debt crisis in Europe;

• tax rates in certain foreign countries that exceed those in the U.S. and the imposition of withholding requirements on foreign earnings;

• higher danger of terrorist activity, war or civil unrest compared to domestic operations;

• difficulties and costs of staffing and managing foreign operations; and

• difficulties in enforcing intellectual property rights.

| 11 |

Our exposure to each of these risks may increase our costs, lengthen our sales cycle and require significant management attention. One or more of these factors may harm our business.

Our inability to comply with European and Asian regulatory restrictions over hazardous substances and electronic waste could restrict product sales in those markets and reduce profitability in the future.

The European Union’s Waste Electrical and Electronic Equipment (“WEEE”) directive makes producers of electrical goods financially responsible for specified collection, recycling, treatment and disposal of past and future covered products. This directive must be enacted and implemented by individual European Union governments, and certain producers will be financially responsible under the WEEE legislation. This may impose requirements on us, which, if we are unable to meet them, could adversely affect our ability to market our products in European Union countries, and our sales revenues and profitability would suffer as a consequence. In addition, the European Parliament has enacted a directive for the restriction of the use of certain hazardous substances in electrical and electronic equipment. This RoHS legislation restricts the use of substances such as mercury, lead, cadmium and hexavalent cadmium. If we are unable to have our products manufactured in compliance with the RoHS directive, we would be unable to market our products in European Union countries, and our revenues and profitability would suffer. In addition, various Asian governments could adopt their own versions of environment‑friendly electronic regulations similar to the European directives, RoHS and WEEE. This could require new and unanticipated manufacturing changes, product testing and certification requirements, thereby increasing cost, delaying sales and lowering revenue and profitability.

Our inability to manage growth effectively could seriously harm our business.

Growth and expansion of our business could significantly strain our capital resources as well as the time and abilities of our management personnel. Our ability to manage growth effectively will require continued improvement of our operational, financial and management systems and the successful training, motivation and management of our employees. If we are unable to manage growth successfully, our business and operating results will suffer.

Our business operations will be severely disrupted if we lose key personnel or if we fail to attract and retain qualified personnel.

Our technology depends upon the knowledge, experience and skills of our key management and scientific and technical personnel. Additionally, our ability to continue technological developments and to market our products, and thereby develop a competitive edge in the marketplace, depends in large part on our ability to attract and retain qualified scientific and technical personnel. Competition for qualified personnel is intense, and we cannot assure you that we will be able to attract and retain the individuals we need, especially if our business expands and requires us to employ additional personnel. In addition, the loss of personnel or our failure to hire additional personnel could materially and adversely affect our business, operating results and ability to expand. The loss of key personnel, or our inability to hire and retain qualified personnel, would harm our business.

We may not be successful in integrating any acquired companies into our business, which could materially and adversely affect our financial condition and operating results.

Part of our business strategy has been to acquire or invest in companies, products or technologies that complement our current products, enhance our market coverage or technical capabilities or offer growth opportunities. For any acquisition, a significant amount of management’s time and financial resources may be required to complete the acquisition and integrate the acquired business into our existing operations. Even with this investment of management time and financial resources, an acquisition may not produce the revenue, earnings or business synergies anticipated. Acquisitions involve numerous other risks, including the assumption of unanticipated operating problems or legal liabilities; problems integrating the purchased operations, technologies or products; the diversion of management’s attention from our core businesses; restrictions on the manner in which we may use purchased companies or assets imposed by acquisition agreements; adverse effects on existing business relationships with suppliers and customers; incorrect estimates made in the accounting for acquisitions and amortization of acquired intangible assets that would reduce future reported earnings (such as goodwill impairments); ensuring acquired companies’ compliance with the requirements of the U.S. federal securities laws and accounting rules; and the potential loss of customers or key employees of acquired businesses. We cannot assure you that any acquisitions, investments, strategic alliances or joint ventures will be completed or integrated in a timely manner or achieve anticipated synergies, will be structured or financed in a way that will enhance our business or creditworthiness, or will meet our strategic objectives or otherwise be successful.

We may be required to recognize impairment charges for long‑lived assets.

As of December 31, 2017, the net carrying value of our long‑lived assets (property and equipment, deferred tax assets and other intangible assets) totaled approximately $4.0 million. In accordance with U.S. generally accepted accounting principles, we periodically assess these assets to determine if they are impaired. Significant negative industry or economic trends, a significant and sustained decline in our stock price, disruptions to our businesses, significant unexpected or planned changes in our use of assets, divestitures and market capitalization declines may result in impairments to our goodwill and other long‑lived assets. Future impairment charges could significantly affect our results of operations in the periods recognized.

| 12 |

Our stock is thinly traded and our stock price is volatile.

Our common stock is thinly traded, with 3,880,439 shares of our 5,210,448 outstanding shares held by non‑affiliates as of February 28, 2018. Based on the trading history of our common stock and the nature of the market for publicly traded securities of companies in evolving high‑tech industries, we believe there are several factors that have caused and are likely to continue to cause the market price of our common stock to fluctuate substantially. The fluctuations may occur on a day‑to‑day basis or over a longer period of time. Factors that may cause fluctuations in our stock price include announcements of large orders obtained by us or our competitors, substantial cutbacks in government funding of highway projects or of the potential availability of alternative technologies for use in traffic control and safety, quarterly fluctuations in our financial results or the financial results of our competitors, consolidation among our competitors, fluctuations in stock market prices and volumes, and the volatility of the stock market.

Difficult and volatile conditions in the capital, credit and commodities markets and in the overall economy could continue to adversely affect our financial position, results of operations and cash flows, and we do not know if these conditions will improve in the near future.

Our financial position, results of operations and cash flows could continue to be adversely affected by difficult conditions and significant volatility in the capital, credit and commodities markets and in the overall worldwide economy. Although certain economic conditions in the United States have improved, economic growth has been slow and uneven and may not be sustained. During economic downturns, governmental entities in particular, which constitute most of our end users, reduce or delay their purchase of our products, which has had and may continue to have an adverse effect on our business. Any uncertainty about the federal budget in the U.S. could have a negative effect on the U.S. and global economy. The continuing impact that these factors might have on us and our business is uncertain and cannot be estimated at this time. Current economic conditions have accentuated each of these risks and magnified their potential effect on us and our business. The difficult conditions in these markets and the overall economy affect our business in a number of ways. For example:

| • | Although we believe we have sufficient liquidity under our financing arrangements to run our business, under extreme market conditions, there can be no assurance that such funds would be available or sufficient, and, in such a case, we may not be able to successfully obtain additional financing on favorable terms, or at all. | |

| • |

Continuing market volatility has exerted downward pressure on our stock price, which could make it more difficult or unfavorable for us to raise additional capital in the future. | |

| • |

Economic conditions could result in customers in our markets continuing to experience financial difficulties, including limited liquidity and their inability to obtain financing or electing to limit spending because of the economy which may result, for example, in customers’ inability to pay us at all or on a timely basis and in declining tax revenue for our customers that are governmental entities, which in turn could result in decreased sales and earnings for us. |

We do not know if market conditions or the state of the overall economy will improve in the near future, when improvement will occur or if any improvement will benefit our market segment.

Our articles of incorporation and bylaws, Minnesota law and our shareholder rights plan may inhibit a takeover that shareholders consider favorable.

Provisions of our articles of incorporation and bylaws and applicable provisions of Minnesota law may delay or discourage transactions involving an actual or potential change in our control or change in our management, including transactions in which shareholders might otherwise receive a premium for their shares or transactions that our shareholders might otherwise deem to be in their best interests. These provisions:

| • | permit our board of directors to issue up to 5,000,000 shares of preferred stock with any rights, preferences and privileges as it may designate, including the right to approve an acquisition or other change in our control; | |

| • |

provide that the authorized number of directors may be increased by resolution of the board of directors; | |

| • |

provide that all vacancies, including newly‑created directorships, may, except as otherwise required by law, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum; and | |

| • | eliminate cumulative voting rights, therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose. |

| 13 |

Section 302A.671 of the Minnesota Business Corporation Act (“MBCA”) generally limits the voting rights of a shareholder acquiring a substantial percentage of our voting shares in an attempted takeover or otherwise becoming a substantial shareholder of our company unless holders of a majority of the voting power of all outstanding shares and the disinterested shares approve full voting rights for the substantial shareholder. Section 302A.673 of the MBCA generally limits our ability to engage in any business combination with certain persons who own 10% or more of our outstanding voting stock or any of our associates or affiliates who at any time in the past four years have owned 10% or more of our outstanding voting stock. These provisions of the MBCA may have the effect of entrenching our management team and may deprive shareholders of the opportunity to sell their shares to potential acquirers at a premium over prevailing market prices. This potential inability to obtain a control premium could reduce the price of our common stock.

In addition, in June 2013, we adopted a shareholder rights plan and declared a dividend to our shareholders of one preferred share purchase right for each outstanding share of common stock. In August 2016, our Board of Directors amended the shareholder rights plan to preserve the value of certain deferred tax benefits to the Company, including those generated by net operating losses. Generally, the shareholder rights plan, as amended, provides that if a person or group acquires 4.99% or more of our outstanding shares of common stock, subject to certain exceptions and under certain circumstances, the rights may be exchanged by us for common stock or the holders of the rights, other than the acquiring person or group, could acquire additional shares of our capital stock at a discount of the then current market price. Such exchanges or exercise of rights could cause substantial dilution to a particular acquirer and discourage the acquirer from pursuing the Company. The mere existence of a shareholder rights plan often delays or makes a merger, tender offer or other acquisition more difficult to complete. In March 2018, our Board of Directors extended the shareholder rights plan to continue to preserve the value of certain deferred tax assets, subject to shareholder approval at the Company's next annual meeting.

We can issue shares of preferred stock without shareholder approval, which could adversely affect the rights of common shareholders.

Our articles of incorporation permit our board of directors to establish the rights, privileges, preferences and restrictions, including voting rights, of future series of our preferred stock and to issue such stock without approval from our shareholders. The rights of holders of our common stock may suffer as a result of the rights granted to holders of preferred stock that may be issued in the future. In addition, we could issue preferred stock to prevent a change in control of our Company, depriving common shareholders of an opportunity to sell their stock at a price in excess of the prevailing market price.

We do not intend to declare cash dividends on our stock in the foreseeable future.

We currently intend to retain any and all future earnings for the operation and expansion of our business and, therefore, do not anticipate declaring or paying cash dividends on our common stock in the foreseeable future. Any payment of cash dividends on our common stock will be at the discretion of our board of directors and will depend upon our operating results, earnings, current and anticipated cash needs, capital requirements, financial condition, future prospects, any contractual restrictions and any other factors deemed relevant by our board of directors. Therefore, shareholders should not expect to receive dividend income from shares of our common stock.

| 14 |

Item 1B. Unresolved Staff Comments

None.

We currently lease and occupy approximately 26,775 square feet in St. Paul, Minnesota for our headquarters. In February 2014, we entered into an amendment to the lease for our headquarters which expanded the leased space from approximately 20,000 square feet to approximately 26,775 square feet, extended the term of the lease to July 2020, and gave us the right to further extend the term of the lease for one additional five year term. We also lease smaller facilities in Canada, Spain and Romania.

We believe that our current space is generally adequate to meet our current expected needs, and we do not intend to lease significantly more space in 2018.

We are involved from time to time in various legal proceedings arising in the ordinary course of our business, including primarily commercial, product liability, employment and intellectual property claims. In accordance with United States generally accepted accounting principles, we record a liability in our Consolidated Financial Statements with respect to any of these matters when it is both probable that a liability has been incurred and the amount of the liability can be reasonably estimated. With respect to any currently pending legal proceedings, we have not established an estimated range of reasonably possible additional losses either because we believe that we have valid defenses to claims asserted against us or the proceeding has not advanced to a stage of discovery that would enable us to establish an estimate. We currently do not expect the outcome of these matters to have a material effect on our consolidated results of operations, financial position or cash flows. Litigation, however, is inherently unpredictable, and it is possible that the ultimate outcome of one or more claims asserted against us could adversely impact our results of operations, financial position or cash flows. We expense legal costs as incurred.

On May 5, 2016, Econolite, our exclusive North American manufacturer and distributor, served a complaint on us for a lawsuit filed by Econolite in the Superior Court of the State of California for the County of Orange. The complaint asserted claims against us under the Manufacturing, Distributing and Technology License Agreement, as amended, with Econolite (the “Econolite Agreement”) for breach of contract and breach of implied covenant of good faith and fair dealing and sought specific performance related to the transition of North American RTMS sales and marketing activities from Econolite to us in July 2014. In the complaint, Econolite requested damages from us in an amount to be proven at trial and sought certain other remedies. On May 27, 2016, we removed the case to the Federal District Court, District of Central California. On November 15, 2016, Econolite and the Company entered into an Arbitration Agreement. On November 16, 2016, Econolite voluntarily dismissed all of its claims against the Company in the U.S. District Court but filed a demand for arbitration with JAMS (which is an alternative dispute resolution provider), asserting the same claims against the Company that it had asserted in the lawsuit. Arbitration commenced on November 16, 2016. On January 23, 2018, the Company received the arbitrator's final decision concerning this matter. As a result of the arbitrator's decision, the Company is to pay to Econolite $262,000 for unused RTMS inventory and $246,000 for RTMS royalties. The Company was awarded $205,000 for RTMS royalties already paid to Econolite. As a result, the Company recorded $303,000 of expense in its financial statements as of and for the quarter ended December 31, 2017.

Item 4. Mine Safety Disclosures

Not applicable.

| 15 |

Market Information