Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KAMAN Corp | a3132018form8k.htm |

Investor Presentation

2

Forward Looking Statements

FORWARD-LOOKING STATEMENTS

This presentation contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements also may be included in other publicly available documents issued by the Company and in oral statements made by our officers and

representatives from time to time. These forward-looking statements are intended to provide management's current expectations or plans for our future operating and

financial performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as "anticipate," "intend," "plan," "goal,"

"seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "would," "could," "will" and other words of similar meaning in connection with

a discussion of future operating or financial performance. Examples of forward looking statements include, among others, statements relating to future sales, earnings,

cash flows, results of operations, uses of cash and other measures of financial performance.

Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause the Company's actual results

and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks, uncertainties and other factors include, among

others: (i) changes in domestic and foreign economic and competitive conditions in markets served by the Company, particularly the defense, commercial aviation and

industrial production markets; (ii) changes in government and customer priorities and requirements (including cost-cutting initiatives, government and customer shut-

downs, the potential deferral of awards, terminations or reductions of expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts

resulting from Congressional actions or automatic sequestration); (iii) changes in geopolitical conditions in countries where the Company does or intends to do business;

(iv) the successful conclusion of competitions for government programs (including new, follow-on and successor programs) and thereafter successful contract negotiations

with government authorities (both foreign and domestic) for the terms and conditions of the programs; (v) the timely receipt of any necessary export approvals and/or

other licenses or authorizations from the U.S. Government; (vi) timely satisfaction or fulfillment of material contractual conditions precedents in customer purchase orders,

contracts, or similar arrangements; (vii) the existence of standard government contract provisions permitting renegotiation of terms and termination for the convenience of

the government; (viii) the successful resolution of government inquiries or investigations relating to our businesses and programs; (ix) risks and uncertainties associated

with the successful implementation and ramp up of significant new programs, including the ability to manufacture the products to the detailed specifications required and

recover start-up costs and other investments in the programs; (x) potential difficulties associated with variable acceptance test results, given sensitive production materials

and extreme test parameters; (xi) the receipt and successful execution of production orders under the Company's existing U.S. government JPF contract, including the

exercise of all contract options and receipt of orders from allied militaries, but excluding any next generation programmable fuze programs, as all have been assumed in

connection with goodwill impairment evaluations; (xii) the continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts

inventory and the receipt of orders for new aircraft sufficient to recover our investment in the restart of the K-MAX® production line; (xiii) the accuracy of current cost

estimates associated with environmental remediation activities; (xiv) the profitable integration of acquired businesses into the Company's operations; (xv) the ability to

implement our ERP systems in a cost-effective and efficient manner, limiting disruption to our business, and allowing us to capture their planned benefits while

maintaining an adequate internal control environment; (xvi) changes in supplier sales or vendor incentive policies; (xvii) the effects of price increases or decreases; (xviii)

the effects of pension regulations, pension plan assumptions, pension plan asset performance, future contributions and the pension freeze, including the ultimate

determination of the U.S. Government's share of any pension curtailment adjustment calculated in accordance with CAS 413; (xix) future levels of indebtedness and

capital expenditures; (xx) the continued availability of raw materials and other commodities in adequate supplies and the effect of increased costs for such items; (xxi) the

effects of currency exchange rates and foreign competition on future operations; (xxii) changes in laws and regulations, taxes, interest rates, inflation rates and general

business conditions; (xxiii) the effects, if any, of the UK's exit from the EU; (xxiv) future repurchases and/or issuances of common stock; (xxv) the occurrence of

unanticipated restructuring costs or the failure to realize anticipated savings or benefits from past or future expense reduction actions; and (xxvi) other risks and

uncertainties set forth herein and in our Form 10-K for the year ended December 31, 2017.

Any forward-looking information provided in this presentation should be considered with these factors in mind. We assume no obligation to update any forward-looking

statements contained in this presentation.

3

What is Kaman?

Solving Our Customers’ Critical Problems with Technically

Differentiated Products & Services

Leading Provider of Highly Engineered Aerospace &

Industrial Solutions Serving a Broad Range of End Markets

4

Kaman Corporation Overview

28%

25%

47%

Aerospace

Defense

Fuzing

Commercial

50%

30%

20%

Distribution

Bearings & Mechanical

Power Transmission

Automation

Fluid Power

Full year 2017 actual results

40%

60%

Revenues: $1.8 billion

Aerospace: $725 million

Distribution: $1.1 billion

5

Diverse End Markets

Selected Platforms

Boeing Airbus Fuzing

• 787/777

• 737

• A-10

• A350

• A330

• A320

• JPF

• AMRAAM

• Tomahawk

Bell Helicopter Sikorsky Kaman

• AH-1Z

• Rotor Blades

• UH-60

• CH-53

• SH-2G

• K-MAX®

83%

17%

Aerospace

OEM

Aftermarket 33%

60%

7%

Distribution

OEM

MRO

Other

Selected Industries & Products

Industries Products

• Food and beverage

• Machinery Manufacturing

• Paper manufacturing

• Nonmetallic minerals

• Durable goods

• Primary metal

• Bearings

• Mechanical power

transmission

• Material handling

• Fluid power

• Electric power

• Automation

Full Year 2017 Results

6

Growth Opportunities

Secular trends helping to drive significant long-term growth

opportunities in both Aerospace and Distribution segments

AEROSPACE

• OEM/Tier 1 outsourcing and supplier

consolidation

• Higher bearing content on new platforms

driving bearing sales

• Balance of commercial and defense

programs provides diversity across end

markets

• Expanded geographic footprint

DISTRIBUTION

• Supplier consolidation favors larger national

service providers

• Increased need for value added services

• Large fragmented market provides

consolidation opportunities

• Factory automation trends driving fluid

power and high speed automation solutions

• National accounts

7

Capital Deployment Framework

Capital deployment is focused on growth investments

and return of capital to shareholders

• Strategic acquisitions to create

shareholder value

• High return capital expenditures

including facility expansions, machinery

and equipment, and IT infrastructure

• Quarterly dividend raised 11% in 2017,

or a 43% increase since 2010

• Dividends paid without interruption for

48 years

• $100 million share repurchase

authorization in place to offset dilution

from employee stock plans

Total $960 Million

Period: 2010 to 2017

Acquisitions

56%

Capital

Expenditures

25%

Dividends &

Share

Repurchases

19%

8

40%Aerospace

9

Aerospace Overview

AEROSYSTEMS

SPECIALTY BEARINGS &

ENGINEERED PRODUCTS

FUZING & PRECISION

PRODUCTS

Products • Engineering design and testing

• Tooling design & manufacture

• Advanced machining and composite

aerostructure manufacturing

• Complex assembly

• Helicopter MRO and support

• Self-lube airframe bearings

• Traditional airframe bearings

• Miniature ball bearings

• Flexible drive systems

• Aftermarket engineered

components

• Bomb and missile safe and

arm fuzing devices

• Precision measuring

systems

• Memory products

Customers • Global commercial and defense OEMs

• Supplier Tier I’s to subcontract manufacturers

• Aircraft operators and MRO

• Specialized aerospace distributors

• Industrial and medical manufacturers of high precision equipment

• U.S. and allied militaries

• Weapon system OEMs

Platforms K-MAX® 787 Medical Devices Bearings

777 737 Marine/Hydro

SLAM-ER

AMRAAM

TOMAHAWK

STANDARD MISSILE

AGM-65M

Aftermarket

10

Specialty Bearings and Engineered Products

Positioned for growth

• Differentiated product offerings with best in class application engineers and

material scientists

• Well positioned on a broad range of fixed wing and rotary wing aircraft

• Increased exposure to healthcare and industrial applications

• Strong order rates and solid backlog

Products Markets

11

STANDARD MISSILE

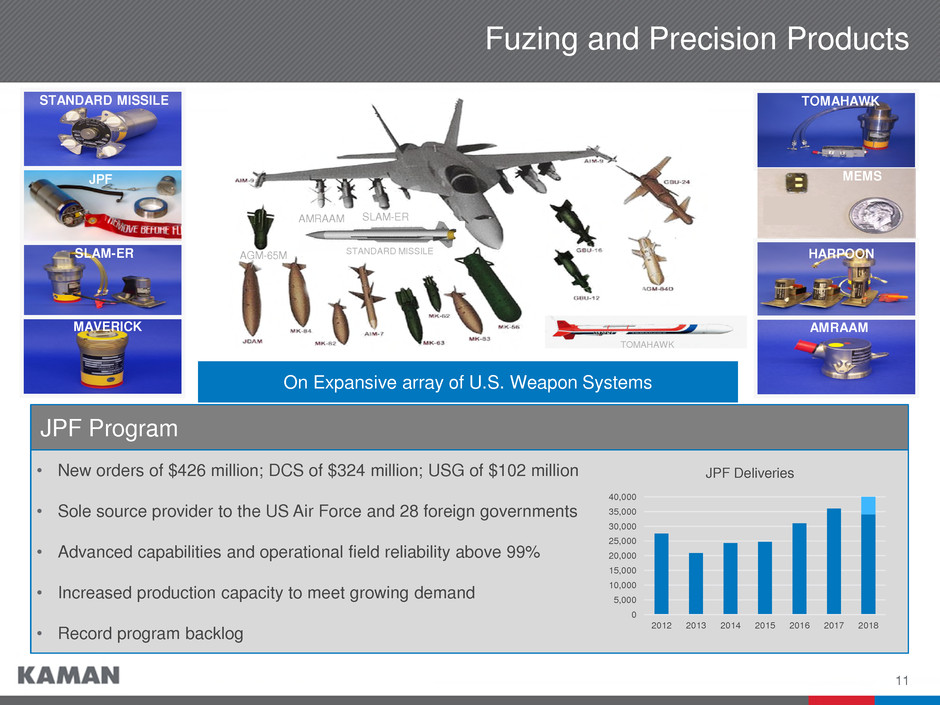

Fuzing and Precision Products

• New orders of $426 million; DCS of $324 million; USG of $102 million

• Sole source provider to the US Air Force and 28 foreign governments

• Advanced capabilities and operational field reliability above 99%

• Increased production capacity to meet growing demand

• Record program backlog

JPF Program

SLAM-ER

HARPOON

MAVERICK

TOMAHAWK

JPF

STANDARD MISSILE

SLAM-ER

SLAM-ERAMRAAM

TOMAHAWK

AGM-65M

AMRAAM

On Expansive array of U.S. Weapon Systems

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

2012 2013 2014 2015 2016 2017 2018

JPF Deliveries

MEMS

• SH-2G

− In service with Egypt, New Zealand, Poland, and Peru

− Fleet will grow 50% since 2014 upon completion of Peru program

− Opportunity to expand and upgrade the capability of Egyptian fleet

• K-MAX®

− Delivered first new production aircraft in 2017

− Unmanned aircraft currently stationed at Marine Operational Test and

Evaluation Squadron One (VMX-1)

• Aftermarket support including spares, repairs and MRO

Air Vehicles and MRO

Unmanned K-MAX®SH-2G Super Seasprite Commercial K-MAX®

13

Significant Programs

HH-60W CRH

787

K-MAX®

A350

AH-1Z

UH-60SH-2JPF

737

A330

Trent 7000 P-8

14

Aircraft Programs/Capabilities

1. Doors

2. Nose landing gear

3. Engine/thrust reverser

4. Flight controls

5. Flaps

6. Main landing gear

7. Rudder

8. Horizontal stabilizer

9. Flexible drive systems

10. Flight control bearings

11. Landing gear bearings

Bearing Products Structural Components

12. Door assemblies

13. Top covers

14. Fixed leading edge

15. Fixed trailing edge

16. Winglets

17. Wing structures, flaps, slats

18. Composite structures (e.g. access

doors, radomes, consoles)

19. Nacelle components

20. Manufacture and subassembly of

major structure

21. Blade manufacture, repair and

overhaul

22.Manufacture of composite structures

1

2 3

4 5

6

7

812 13 14 15

16

1718

19

18

18

9

20

9

10

11

21

20

20 20

20

22

15

Primary Aerospace Locations

1

2

3

4

5

6

7

8

9

10

11

12

14

15

13

16

1. Everett, WA

Engineering

2. Mesa, AZ

Aftermarket Components

3. Wichita, KS

Composites

4. Charleston, SC

Engineering

5. Jacksonville, FL

Assembly & Metallics

6. Orlando, FL

Fuzing

7. Middletown, CT

Fuzing

8. Bloomfield, CT

o Air Vehicles & MRO

o Specialty Bearings

9. Bennington, VT

Composites

10. Chihuahua, Mexico

Metallics

11. Hochstadt, Germany

Specialty Bearings

12. Rimpar, Germany

Specialty Bearings

13. Prachatice, Czech Republic

Specialty Bearings

14. Darwen, UK

Composites

15. Burnley, UK

Tooling

16. Goa, India

Composites (Joint Venture)

= Low cost facility

Diverse locations focused on core competencies

16

Distribution

60%

17

Distribution Overview

PRODUCT

PLATFORM

BEARINGS &

MECHANICAL POWER

TRANSMISSION (BPT)

FLUID POWER AUTOMATION

2017

% of Sales

50% 20% 30%

Estimated

Market Size(1)

$16 Billion $7 Billion $22 Billion

Product

Offerings

• Bearings

• Gearing

• Hose & Fittings

• Hydraulics & Pneumatics

• Linear Motion

• Material Handling

• Power Transmission

• Process Control &

Instrumentation

• Cylinders

• Filters, Regulators, Lubricators

• Hydraulic Motors

• Hydraulic Power Units

• Hoses and Connections

• Pumps & Vacuums

• Valves

• Automation

• Electrical

• Gearing

• Linear Motion

• Motion Control

• OEM Control Panels &

Custom Enclosures

Major Suppliers

(1) Source: Modern Distribution Management

18

Growth in Product Platforms

74%

14%

12%

2009 Salesa of approx. $600M

Through acquisitions and organic growth, Kaman has significantly grown its

Distribution business while greatly expanding its product offering

Bearings & Power Transmission up approximately 20%

Automation up approximately 300%

Fluid Power up approximately 300%

50%30%

20%

2017 Salesa of approx. $1.1B

b

b

b

Sales from continuing operations

Growth in sales from 2009 thru 2017

a

b

19

Adding Leading Brands in Multiple Technologies

PLCs, HMIs

Sensors & Signaling

Machine Safety

Hydraulics

Pneumatics

Fluid Connectors

Motion Control

Servos & Steppers

Linear Motion

Bearings

Power Transmission

Industrial Supplies

V

a

lu

e

-

A

d

d

e

d

T

e

ch

n

o

lo

g

ie

s

2009 2017

20

Distribution Expanded Product Portfolio

System Design &

Build

Fluid Power

Systems

Hose & Coupling

Assemblies

Application

Engineering Belt Fabrication

Maintenance &

Reliability

Value Added Offerings

21

Strong Nationwide Footprint

22

Summary

23

Kaman Investment Highlights

Strategically Positioned

Highly Engineered Products Outstanding portfolio of highly engineered products and proprietary technologies

Best-in-class Vendors Continue to partner with leading brands and enhance product portfolio

Diverse End Markets Broad exposure to diverse products, platforms and customers

Strong Financial Performance

Top Line Growth Shown consistent, reliable performance with ~8% revenue CAGR over the past 10 years

Profitability Gains Focus on scale, product mix, and operational efficiency to enhance profitability

Strong Free Cash Flow Average Free Cash Flow Conversion from 2014 to 2017 well in excess of Net Earnings

Strong Capital Structure Maintain conservative leverage of 2.0x–3.0x net debt / Adjusted EBITDA over the long term

Reliable Business Strategies

Efficient Capital Allocation Deploy capital to drive future growth while returning capital to shareholders

Focus on Innovation Commitment to internal investment to maintain differentiation and drive productivity

Operational Excellence Strategic investments designed to optimize operational efficiency and returns