Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number: 000-55576

YANGTZE RIVER PORT AND LOGISTICS LIMITED

(Exact name of registrant as specified in its charter)

| Nevada | 27-1636887 | |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |

| 41 John Street, Suite 2A, New York, NY | 100038 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (646) 861-3315

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “accelerated filer,” “large accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer | ☒ | Accelerated Filer | ☐ | |||

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | |||

| Emerging Growth Company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter:

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2017, the last business day of the registrant’s last completed second quarter, based upon the closing price of the common stock of $13.4540 on such date , is $1,034,739,686.

Number of the issuer’s common stock outstanding as of March 8, 2018: 172,344,446.

Documents incorporate by reference: None.

TABLE OF CONTENTS

| i |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

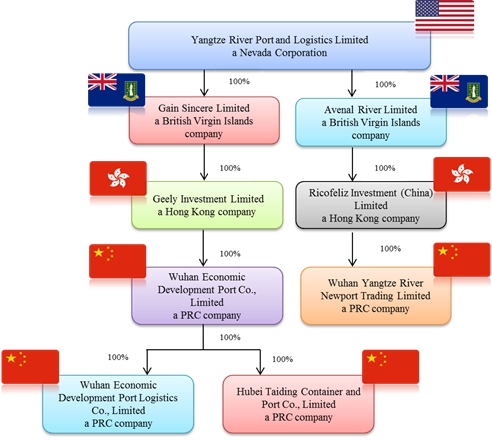

USE OF CERTAIN DEFINED TERMS

In this Report, unless otherwise noted or as the context otherwise requires, “Yangtze River”, the “Company,” “YRIV,” “we,” “us,” and “our” refers to the combined business of Yangtze River Port and Logistics Limited, a corporation formed under the laws of the State of Nevada, Energetic Mind Limited (“Energetic Mind”), which is our wholly-owned subsidiary formed under the laws of the British Virgin Islands (“BVI”), Energetic Mind’s wholly-owned subsidiary, Ricofeliz Capital (HK) Ltd (“Ricofeliz Capital”), a company formed under the laws of Hong Kong, and Ricofeliz Capital’s wholly-owned subsidiary, Wuhan Yangtze River Newport Logistics Co., Ltd (“Wuhan Newport”), a wholly foreign-owned enterprise formed under the laws of the People’s Republic of China (“China” or the “PRC”). The aforementioned terms also include our wholly-owned subsidiary, Avenal River Limited (in the process of changing its name to Yangtze River Blockchain Logistics Limited), a corporation formed under the laws of British Virgin Islands, its wholly-owned subsidiary, Ricofeliz Investment (China) Limited, a company formed under the laws of Hong Kong, and Wuhan Yangtze River Newport Trading Limited, a company formed under the laws of China and the wholly-owned subsidiary of Ricofeliz Investment (China) Limited.

| ii |

Overview

Yangtze River Port and Logistics Limited is a Nevada holding corporation. We operate through our wholly-owned subsidiary, Energetic Mind Limited (“Energetic Mind”), a British Virgin Islands corporation, which in turn operates through its wholly-owned subsidiary, Ricofeliz Capital (HK) Limited (“Ricofeliz Capital”), a Hong Kong corporation. Ricofeliz Capital which operates through its wholly-owned subsidiary, Wuhan Yangtze River Newport Logistics Co., Ltd (“Wuhan Newport”), a wholly foreign-owned enterprise incorporated in the People’s Republic of China that primarily engages in the business of real estate and infrastructural development and operating a port logistics center (“Logistics Center”) located in Wuhan, Hubei Province in the People’s Republic of China (“PRC”).

Situated in the middle reaches of the Yangtze River, Wuhan Newport is a large infrastructure development project implemented under China’s latest “One Belt One Road” initiative. We believe that it is strategically positioned in the anticipated “Pilot Free Trade Zone” of the Wuhan Port, an important trading locale for the PRC, the Middle East and Europe. To be fully developed upon completion, the Logistics Center will comprise six operating zones: port operation area, warehouse and distribution area, cold chain logistics area, rail cargo loading area, exhibition area and business related area. The Logistics Center is also expected to provide a number of shipping berths for cargo ships of various sizes. Wuhan Newport expects to provide domestic and foreign businesses direct access to the anticipated Pilot Free Trade Zone in Wuhan. The project will include commercial buildings, professional logistic supply chain centers, direct access to the Yangtze River, Wuhan-Xinjiang-Europe Railway and ground transportation, storage and processing centers, and IT supporting services, among others.

We anticipate that income generated from the use of the warehouses, cargo loading and unloading, railway and highway transportation and logistics services and other logistics supporting services will comprise the main source of our income. It is also expected that income from real estate sales and leasing will be a relatively minor portion of our expected income since we are planning to sell or lease only a small portion of our real estate properties such as office spaces. We will begin construction on the Logistics Center once we are able to raise funds for it.

In the meantime, we have been developing a commercial building project called the Wuhan Centre China Grand Steel Market (Phase 1) Commercial Building (“Phase 1 Project”) located in the south of Hans Road, Wuhan Yangluo Economic Development Zone which covers an approximate construction area of 222,496.6 square meters. We have been financing the Phase 1 Project with bank loans and shareholder advances. The Phase 1 Project comprises 7 buildings, four of which covering 35,350,4 square meters have been completed and three of which covering an approximate area of 57,450.4 square meters are still under construction as of December 31, 2017. We have sold approximately 22,780 square meters of commercial building space.

We plan to use the majority of our real estate properties for the development of our Logistics Center, from which our main source of expected income will be derived.

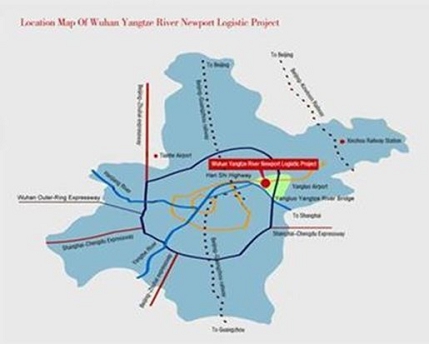

Wuhan Yangtze River Newport Logistics Center

The Logistics Center will be an extensive complex located in Wuhan Newport Yangluo Port. Wuhan, the capital of the Hubei Province in the People’s Republic of China is a major transportation hub city with access to numerous railways, roads and expressways passing through the city and connecting to major cities in China, as well as other international centers of commerce and business.

The Logistics Center will be on the upper stream of the Yangtze River, and close to the northern base of Wuhan Iron and Steel, China’s first mega-sized iron and steel production complex. The Logistics Center is expected to include a port terminal that will be located approximately 26.5km from the Wuhan Guan and 5.5km from the Yangluo Yangtze River Bridge. The operation area of the port is expected to consist of a riverbank of 1,039 meters with eight 5,000-to-10,000-ton berths, two of which are multi-purpose berths and the other six are general cargo berths. It is designed to be able to handle up to 5,000,000 tons of cargo annually, including up to 100,000 TEU for annual container throughput (including 20,000 TEU in freezer areas), 1,000,000 tons of iron and steel and 3,000,000 tons of general cargo.

Within the Logistics Center, functional areas will be divided into six operating zones: a port operation area, a warehouse and distribution area, a cold chain supply logistics area, a rail cargo loading area, an exhibition area and a business related area. The Logistics Center will also be complemented with container storage areas, multi-functional areas, general storage areas, a multi-functional warehouse and infrastructural development, including new roads, gas stations, parking areas, gas and water pipes, electricity lines and all other facilities and equipment to operate the Logistics Center.

Aside from being situated in the Wuhan Yangluo Comprehensive Bonded Zone, the Yangluo development area is among the third group of China’s Pilot Free Trade Zone (“FTZ”) applicants to submit FTZ applications to the State Council. As of the date hereof, approvals have been granted to Shanghai, Tianjin, Guangdong and Fujian. Corporations within the approved free-trade zones are typically entitled to a series of favorable regulations and policies that could help the businesses grow and succeed.

| 1 |

The Logistics Center is expected to occupy approximately 1,918,000 square meters, for which the construction and development are expected to be completed in three phases in three years and reach its target maximum annual profit by the end of 2022 assuming the entire funding required for construction of the Logistics Center of $1.03 billion is in place by 2021 and the Logistics Center is in operation per our business plan. We have updated our original time-frame and the following table illustrates the anticipated timeframe of our investment and construction progress.

| Time | Phase of Investment/Construction | Percentage of Total Anticipated Investment/ Construction (1) | Production Capacity (2) | |||||||

| 1st Year (2018) | 1st Phase | 40 | % | 30 | % | |||||

| 2nd Year (2019) | 2nd Phase | 70 | % | 40 | % | |||||

| 3rd Year (2020) | 3rd Phase | 100 | % | 60 | % | |||||

| 4th Year (2021) | Completed | 100 | % | 75 | % | |||||

| 5th Year (2022) | Completed | 100 | % | 100 | % | |||||

| (1) | The percentage of construction in a certain phase reflects the anticipated contribution of the investment in such particular phase. For example, contribution of 40% of the total investment in Phase 1 will lead to construction of 40% of total value of the Logistics Center. |

| (2) | The percentage of Production Capacity shows the fraction of the target maximum annual profit to be earned when the Wuhan Project is fully operational. We target to reach its maximum annual profit by the end of 2021 assuming the entire funding required for construction of the Logistics Center of $1.03 billion is in place by 2020 and the Logistics Center is in operation according to our business plan. |

Wuhan Newport has signed a twenty-year lease agreement effective April 27, 2015, the maximum number of years permitted by the applicable PRC laws, with rights to renew, at its sole discretion, for another twenty-years, to lease approximately 1,200,000 square meters of land for building logistics warehouses in support of the Logistics Center. The warehouses are expected to be comprised port terminal zones, warehouse logistics zones, cold chain supply zones and railroad loading and unloading zones. The warehouses, once constructed, will connect the port terminal along the Yangtze River and the railway leading to Europe, satisfying the requirement of China’s latest “One Belt, One Road” initiative. It will also be able to support large logistics companies in Wuhan and other nearby provinces which will rent the warehouses, terminals and offices within the Logistics Center.

Logistics Center Highlights:

| ● | The shipping center will be implemented under China’s latest “One Belt, One Road” initiative to promote the “Yangtze River Economic Belt”; |

| ● | Wuhan Newport is part of the Yangluo port, which is part of the area that is currently seeking approval for status as a “Free-Trade Zone”; |

| ● | Wuhan Newport is part of the “Yangluo Comprehensive Bonded Zone”, which allows the enterprises in the zone to receive certain favorable tax treatments such as export tax rebates and less or free of value-added tax and consumption tax. |

| 2 |

Wuhan Economic Development Port Limited

On December 26, 2017,we entered into a purchase agreement (the “Purchase Agreement”) with the shareholders (the “Wuhan Port Shareholders”) of Wuhan Economic Development Port Limited (the “Wuhan Port”) to acquire all the equity interests of Wuhan Port (the “Wuhan Port Acquisition”). In exchange, the Wuhan Shareholders will acquire all the ordinary shares of Energetic Mind and in turn, Ricofeliz Capital, Wuhan Newport and the abovementioned plans for the Logistics Center.

The closing of the transaction, which shall be no later than March 31, 2018 and is conditioned upon satisfactory due diligence, the completion of auditing of the financial statements of Wuhan Port, and the approval of relevant regulatory agencies.

In addition to the exchange of Energetic Mind for Wuhan Port, we will also have to pay RMB 600 million (approximately, US$91 million) to the Wuhan Port Shareholders (“Additional Consideration”). The Additional Consideration is to be paid as follows: (i) a refundable deposit of RMB 30 million upon the issuance of an initial due diligence report and audit and (ii) the remaining RMB 570 million on closing in cash or in the form of a 7% convertible note. Our Board of Directors and majority shareholders have approved this transaction.

Wuhan Port owns all the equity interests in Hubei Taiding Container Port Limited (“Hubei Taiding”) and Wuhan Economic Development Port Logistics Limited (“Wuhan Economic Development”). It has the following major operations: (i) its owns 7,060 meters of the Yangtze River shoreline located in the Hannan District Port, Wuhan City. Currently three berths along the 330 meters of the coastline has been completed and in operation. Additional six berths have been approved by the local government and waiting to be built. Also, more than ten berths are pending approval by the local government; (ii) its owns a total of 1,371,960 square meters of industrial land near the Hannan District Port for the construction of logistics warehouses and supporting office buildings. A warehouse totaling 11,340 square meters has been built and is in operation; (iii) its owns an office building comprising 4,575.7 square meters if office space; and (iv) it has received a registration certificate issued by China Wuhan Customs. The total value of its fixed assets plus intangible assets as of December 31, 2017 was RMB 3 billion, or approximately USD$454M, based on an assessment report issued by a local appraisal company.

If the Wuhan Port Acquisition were to be consummated, we would be divested of our interests in Energetic Mind and correspondingly, our interests in Wuhan Newport and the Logistics Center and will assume the business of Wuhan Port. Conversely, if the Wuhan Port Acquisition were to fail to be consummated, then we shall continue our plans to develop the Logistics Center.

The “One Belt, One Road” Initiative.

According to the Vision and Actions on Jointly Building Belt and Road issued by the National Development and Reform Commission, Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China, with State Council authorization in March 2015, “One Belt, One Road” (the “Initiative”) is a infrastructural development concept initiated by the leaders of the Chinese government in 2013. It refers to the New Silk Road Economic Belt, which will link China with Europe through Central and Western Asia, and the 21st Century Maritime Silk Road, which will connect China with Southeast Asian countries, Africa and Europe through the Pacific and Indian Ocean. Neither the belt, nor the road, follows a designated route, but serves as a conceptual roadmap for China’s plan to expand its presence commercially to the regions outside of the country and strengthen its economic relationships with the nations in these regions.

| 3 |

The “Belt” and the “Road” run through the continents of Asia, Europe and Africa, connecting the vibrant East Asian economic circle on one end and developed European economic circle on the other, and encompassing countries with huge potential for economic development. The Silk Road Economic Belt focuses on bringing together China, Central Asia, Russia and Europe (the Baltic), linking China with the Persian Gulf and the Mediterranean Sea through Central Asia and West Asia, and connecting China with Southeast Asia, South Asia and the countries along the Indian Ocean. The 21st-Century Maritime Silk Road is designed to go from China’s coast to Europe through the South China Sea and the Indian Ocean in one route, and from China’s coast through the South China Sea to the South Pacific in the other.

On land, the Initiative is expected to focus on jointly building a new Eurasian Land Bridge and developing China-Mongolia-Russia, China-Central Asia-West Asia and China-Indochina Peninsula economic corridors by taking advantage of international transport routes, relying on core cities along the Belt and Road and using key economic industrial parks as cooperation platforms. At sea, the Initiative is expected to focus on jointly building smooth, secure and efficient transportation routes connecting major sea ports along the Belt and the Road. The China-Pakistan Economic Corridor and the Bangladesh-China-India-Myanmar Economic Corridor are closely related to the Belt and Road Initiative, and therefore require closer cooperation and greater progress. (Source: http://en.ndrc.gov.cn/newsrelease/201503/t20150330_669367.html; National Development and Reform Commission, Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China, with State Council authorization).

Corporate History

On December 23, 2009, we were incorporated under the laws of the State of Nevada under the name of “Ciglarette International, Inc.”.

On March 1, 2011, we completed a reverse acquisition transaction through a share exchange with Kirin China Holding, a British Virgin Islands company (“Kirin China”), whereby acquired all of the issued and outstanding shares of Kirin China in exchange for 18,547,297 shares of common stock, which represented approximately 98.4% of the total shares outstanding immediately following the closing of this share exchange (the “First Share Exchange”). Upon consummation of the First Share Exchange, we changed our name to “Kirin International Holding, Inc.” and traded under the symbol “KIRI” on OTC Markets. As a result of the First Share Exchange, Kirin China became a wholly-owned subsidiary. We ceased the smokeless cigarette business and became a holding company, through various controlled entities in the China, engaged in the development and operation of real estate in China. Through Kirin China, we engaged in private real estate development focusing on residential and commercial real estate development in “tier-three” cities in China. Tier-three cities are provincial capital cities with ordinary economic development and prefecture cities with relatively strong economic development.

On December 19, 2015, we entered into certain share exchange agreements with Energetic Mind and all the shareholders of Energetic Mind whereby the Company acquired 100% of the issued and outstanding ordinary shares of Energetic Mind (the “Second Share Exchange”). Pursuant to the terms of the agreements for the Second Share Exchange, in exchange for 100% of the issued and outstanding ordinary shares of Energetic Mind, we agreed to issue to (i) the shareholders of Energetic Mind an aggregate of one hundred fifty-one million (151,000,000) shares of Company’s common stock and (2) a certain related party an additional 8% convertible promissory note in the principal amount of one hundred fifty million dollars ($150,000,000), with a conversion price of $10.00 per share.

On December 31, 2015, we disposed all of our interests in i) Brookhollow Lake, LLC, ii) Newport Property Holding, LLC, iii) Kirin China, iv) Kirin Hopkins Real Estate Group LLC, v) Archway Development Group LLC, vi) Specturm International Enterprise, LLC and vii) wholly-owned subsidiary HHC-6055 Centre Drive LLC. The sale of Kirin China also effectively terminated Company’s contractual relationship with Hebei Zhongding Real Estate Development Co. Ltd and Xingtai Zhongding Jiye Real Estate Development Co., Ltd, both of which are companies formed under the laws of the People’s Republic of China and were deemed Company’s variable interest entities prior to this sale (“Subsidiaries Sale”).

As a result of the Second Share Exchange and the Subsidiaries Sale, the Company currently operates its business solely through its wholly-owned subsidiary Energetic Mind, which is the sole shareholder of Ricofeliz, which engages its business through its wholly-owned subsidiary, Wuhan Newport.

| 4 |

On January 13, 2016, we filed a Certificate of Amendment to our Articles of Incorporation (the “Amendment”) with the Secretary of the State of the State of Nevada, to change our name from “Kirin International Holding, Inc.” to “Yangtze River Development Limited”. Effective January 22, 2016, Company changed its stock symbol from “KIRI” to “YERR”.

The Company, by and among Armada Enterprises GP (“Armada”) and Wight International Construction, LLC (“Wight”), entered into (i) a Contribution, Conveyance and Assumption Agreement (“Contribution Agreement”) dated October 3, 2016, first and second addendums, dated October 3, 2016 and November 30, 2016, respectively, and (ii) an Amended and Restated Limited Liability Company Agreement dated November 16, 2016 (collectively with the Contribution Agreement, the “Agreement”), whereby the Company acquired 100 million preferred B membership units of Wight, which would ultimately convert into 100 million LP units in Armada Enterprises LP. In exchange, the Company issued a $500 million convertible promissory note (“Note”) and 50,000,000 shares of the Company’s common stock to Wight. As a result of the Agreement and the conversion of the Note on November 17, 2016, Wight owned 100,000,000 shares of the Company’s common stock representing 36.73% of the Company’s voting power and the Company owned 100 million preferred B membership units in Wight representing a 62.5% non-voting equity interest in Wight.

Under the terms of the Agreement, at the first closing, Wight was required to provide an aggregate total of $200 million, including $50 million in working capital and $150 million in construction funding (the “Funding”) to the Company, by January 18, 2017. Wight did not provide the Funding on January 18, 2017 and the Company provided to Wight a “Notice of Default and Request for Cure”. Wight proposed to provide $50 million in working capital funding on or before February 15, 2017 and secure $150 million in construction funding on or before March 15, 2017. Wight failed to provide the $50 million in working capital funding as proposed by February 15, 2017. Therefore, the Company, on February 24, 2017 decided to terminate the Agreement for non-performance by Wight. Pursuant to the Agreement, the termination thereof calls for the immediate return of the 100,000,000 shares of common stock issued by the Company to Wight.

On February 27, 2017, the Company issued a “Termination and Demand” letter to Wight which terminated the Agreement with Wight and Armada and demanded the return of the 100,000,000 shares of common stock.

On March 1, 2017, the 100,000,000 shares of the Company’s common stock were canceled and returned by Wight, and were subsequently returned to the Company’s treasury.

The Company reserves the right to pursue any further legal action with respect to Armada’s and Wight’s default under the Agreement.

On April 19, 2017, our common stock commenced trading on the NASDAQ Capital Market under the symbol of “YERR”. On August 18, 2017, our common stock started trading on the NASDAQ Global Select Market under the same symbol.

On February 8, 2018, we filed a Certificate of Amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada, to change our name from “Yangtze River Development Limited” to “Yangtze River Port and Logistics Limited” (the “Name Change”). In connection with the Name Change, our trading symbol was changed from “YERR” to “YRIV”.

Organization & Subsidiaries

Upon completion of the Second Share Exchange and Subsidiaries Sale described above in “Corporate History”, we hold 100% of the ordinary shares of our wholly owned subsidiary, Energetic Mind. Energetic Mind in turn operates through its wholly-owned subsidiary, Ricofeliz Capital and Ricofeliz Capital operates through its wholly-owned subsidiary, Wuhan Newport. Wuhan Newport primarily engages in the business of real estate and infrastructural development and operating the Logistics Center.

On January 30, 2018, we incorporated Avenal River Limited in the British Virgin Islands. Avenal River Limited owns all of the shares of Ricofeliz Investment (China) Limited, a Hong Kong company, which in turn owns 100% of the equity interest of Wuhan Yangtze River Newport Trading Limited, a PRC company.

| 5 |

The following diagram illustrates our current corporate structure:

However, if the Wuhan Port Acquisition were to be consummated and Energetic Mind divested to the Wuhan Port Shareholders, our corporate structure will be altered as follows:

Office Complex Project

Taking into consideration the Comprehensive Bonded Zone and Free Trade Zone status of the Logistic Center, Wuhan Newport has obtained the land use rights to own approximately 500,000 square meters of commercial lands on which Wuhan Newport will build a mixed residential and office complex of approximately 700,000 square meters. As of the date of this Annual Report, mixed-use complex totaling approximately 100,000 square meters have been completed and there are outstanding 600,000 square meters to be constructed in three phases within the next five (5) years.

| 6 |

To support the office complex, a light railway from downtown Wuhan to the complex is undergoing construction, for which the complex will be accessible by two stations along the light railway line. In addition, an expressway along the north shore of the Yangtze River in Wuhan is currently under construction; the completion of the highway is also expected to provide direct ground access between Wuhan city center and the Logistics Center and cut down the commute time to only 20 minutes.

Upon completion of the construction of the office buildings, Wuhan Newport plans to sell half of the complex while leasing out the remaining half for long-term income. It is Company’s goal to recover the initial investment costs through sale of half of the complex and generate a stable return based on rent of the other half complex upon completion of the project.

Transportation and Logistics Services

Taking the regional advantage of the highways, railways and waterways in Yangluo area, We plan to develop a shipping hub with access to all types of cargo transportation and offer complementary services to businesses within this logistics center. We intend to create an efficient, reliable and comprehensive logistics service system by utilizing the third-party service providers with offices within the Logistics Center to provide professional logistics services.

We are currently constructing the port terminal which will be the focal point of the Yangtze River Economic Belt. The Yangtze River riverbank within our properties measures 1,039 meters, where we plan to complete eight cargo berths handling ships ranging from 5,000 to 10,000 tons.

A cargo transportation railway invested by the government has been built next to the Logistic Center. The railway is known as the Wuhan-Xinjiang-Europe (“WXE”) Railway in the Silk Road Economic Zone as it is in the “One Belt, One Road” initiative introduced by the Chinese government. The WXE Freight Train sets out from Wuhan to Xinjiang and finally ends in Mainland Europe. Wuhan Newport’s terminal is therefore an important component of the “Silk Road Economic Belt” under the “One Belt, One Road” framework.

The customs facility at the Yangluo Comprehensive Bonded Area allows cargo vessels ranging from 5,000 to 10,000 tons to set out from Shanghai downstream via the Yangtze River in order to transport “Made in China” commodities to the Pacific Ocean and further to any other ports across the Indian Ocean. In return, transporting commodities from other countries will be shipped directly back to Wuhan and then distributed throughout rest of the Mainland China. Aside from being situated in the Wuhan Yangluo Comprehensive Bonded Zone, the Yangluo development area is amongst the third group of China’s Free-Trade Zone applicants to submit FTZ applications to the State Council through the Wuhan municipal government for approval. Approvals have so far been granted to Shanghai, Tianjin, Guangdong and Fujian. Enterprises within the approved free-trade zones are typically entitled to a series of favorable regulations and policies that could help the businesses grow and succeed.

Cold Chain Logistics Services

A cold chain is a temperature-controlled supply chain. An unbroken cold chain is an uninterrupted series of storage and distribution activities which maintain a given temperature range. It is used to help extend and ensure the shelf life of products such as fresh agricultural produce, seafood and frozen food.

Within the Logistics Center, we will be able to provide extensive storage and processing services to its customers. Meanwhile, a cold chain logistics service system will be established to better help our clients’ processing needs for their frozen foods, meats and other products that need special processing and handling. In addition, we will offer professional services with temperature control, sorting, processing, packaging and delivery to ensure the reliability and safety of the logistics process.

| 7 |

Information Platform

To adapt to the needs of modern logistics service and meet the standards of the industry worldwide, we will establish comprehensive automated management systems, as well as develop an operation system, enquiry system and decision-making systems for all types of business information such as warehouse, storage, trade, distribution and transportation, movable assets supervision and freight forwarding. We plan to launch an integrated and information-sharing platform geared towards the demand of its targeted markets and potential clients.

We will establish a uniform information platform including an internet-based logistics information portal and an e-commerce platform to provide our clients with services such as logistics services tracking, service rating, online operation, electronic transaction, etc. We expect this information portal to be equally reliable for both service providers and their respective clients.

We will also establish an e-commerce system based on the logistics information portal and we will provide clients with many updated services such as online transactions, online payments, online inquiries and business information communication. This will create a comprehensive service system and a business model with high integration of information flow, capital flow, trade flow and goods flow.

Portside Service

We also plan to provide incentives for companies that specialize in IT, production of new material and high-end equipment and manufacturing companies to station nearby the Logistics Center so that these companies can grow with the Logistics Center, leveraging each other’s specialization to serve each other’s business needs.

Logistics Financing

Logistics financing is mainly based on using supplies as collateral to obtain financing for supply chains to improve its overall economic efficiency. Developing an innovative logistics financing is significant because traditionally mortgages or loans are concentrated in real estate and logistics financing provides a lower systematic risk for lenders.

Compared to developed countries, we believe that logistics financing is a rather new field in China. The driving force for logistics financial service in western countries is mainly attributable to financial institutions as opposed to third-party private logistics companies in China who would occasionally provide financing options.

Logistics financial services became a popular investment vehicle among these third-party lenders. However, the business of logistics financing has become more complex for these private lenders to handle as they will need professionals to guide them through the process and thus safeguard their investments.

Even though the history of logistics financing has been relatively short in China, the appetite for this is expected to grow as the Free Trade Zones in Shanghai, Tianjin and soon-to-be Wuhan will likely attract more business and international financial institutions. Logistics financing not only provides businesses with a new alternative to meet their capital needs, but also opens a new channel for commercial banks to reach small and mid-size businesses. While interest income generated from logistics financing transaction is often an important source of income for many multinational logistics companies, companies who are able to provide financing are often the industry leaders. Because logistics financing can be an effective channel for the Company to reach its targeted market, we plan to capture this first-mover advantage when logistics financing is still in its development stage in China.

In light of this market opportunity, we plan to establish and utilize e-commerce platforms to offer online booking, online dealing and online exhibiting services to provide professional transaction services for electronic products, commodity, foods and metals. We also plan to provide comprehensive support services to complement logistics financing. Maritime insurance and training services will be offered within the Logistic Center. We plan to help our clients to raise construction capital through Build-Transfer (“BT”), Build-Operate-Transfer (“BOT”), corporate debt and equity financing. Finally, we plan to collaborate and develop strategic alliances with other logistics or cargo shipping centers around the world.

| 8 |

Sales and Marketing

We plan to sell our properties by forming strategic alliances with CMST Development (Hankou) Co. Ltd. (“CMST-Hankou”), the Shanxi Chamber of Commerce in Hubei (“SCCH”) and the Wuhan Coal Business Association (“WCBA”).

Partnership with CMST

CMST-Hankou is a regional subsidiary of the CMST Development Co. Ltd, which is a state-owned enterprise that principally engages in the logistics and import & export businesses. CMST-Hankou’s core business includes warehouse storage, sale and distribution of commodities, and freight forwarding. Pursuant to the Memorandum of Understanding executed with CMST-Hankou on August 20, 2015, CMST-Hankou has agreed to transfer all of its warehouse storage and processing division, distribution service division and other existing businesses to the premises of the Logistics Center. In addition, CMST-Hankou has agreed to move its warehouse for steel trading business with the Shanghai Future Exchange to the Logistics Center. In consideration, we have agreed to offer CMST-Hankou a 5% discount on all services provided within the Logistics Center, including those within the warehouses, port terminal, and railway operating zones. In addition, CMST-Hankou has agreed to assist the Company with the establishment of an online commodity exchange platform to provide a comprehensive support system through the supply chain and provide necessary personnel to help with the management of the warehouse operations within the Logistics Center. Though at a slight discount, the Company is expected to receive fees based on CMST-Hankou’s large volume of commodities that need to be stored and use of complementary services at the warehouse facilities and operating areas, as well as rental income and/or property sales generated from the office complex. However, the partnership is subject to the terms and conditions of a definitive agreement between CMST-Hankou and the Company. No assurances can be provided at this point that such a definitive agreement will be executed.

Partnership with SCCH

SCCH is a non-profit business coalition with 252 businesses across various industries as members. Pursuant to the Memorandum of Understanding executed with SCCH on July 27, 2015, SCCH has agreed to move its headquarters to the office complex within the Logistics Center by purchasing or leasing certain units. In consideration of a 7% discount to the purchase price of $2,729 per square meter of our properties, approximately 50 businesses within the organization plan to open offices in the Logistics Center and purchase at least 100,000 square meters of space within the office complex. SCCH, on behalf of 50 businesses, also executed a letter of intent to purchase approximately 100,000 square meters of storefront. In addition, because we expect the 50 businesses to have a total annual turnover of commodities of more than 5,000,000 tons, we have agreed to offer members of SCCH a 5% discount on all services provided within the Logistics Center, including those within the warehouses, port terminal, and railway operating zones. However, the partnership is subject to the terms and conditions of a definitive agreement between SCCH and the Company. No assurances can be provided at this point that such a definitive agreement will be executed.

Partnership with WCBA

WCBA is a non-profit business coalition with more than 300 businesses within the coal mining industry as members. Pursuant to the Memorandum of Understanding executed with WCBA on September 17, 2015, WCBA has agreed to move its headquarters to the office complex within the Logistics Center by purchasing or leasing certain units. We have agreed to offer WCBA member businesses a 5% discount to the purchase price of $2,729 per square meter of our properties. In addition, because we expect WCBA members to have a total annual turnover of coal-related commodities of more than 20,000,000 tons and will use the Company’s warehouse storage for at least 3,000,000 tons, we have agreed to offer members of WCBA a 5% discount on all services provided within the Logistics Center, including those within the warehouses, port terminal, and railway operating zones. However, the partnership is subject to the terms and conditions of a definitive agreement between WCBA and the Company. No assurances can be provided at this point that such a definitive agreement will be executed.

| 9 |

Market Opportunity for Logistics Finance

Logistics financing provides financial services such as financing, clearance and insurance to support the logistics industry. It evolves as the logistics industry develops. Not only can logistics financing services improve the service capability and increase the profitability of third party logistics companies; it can also expand financing channels, decrease financing cost and increase the capital efficiency.

The major target clients for logistics finance services are small and medium sized companies, which are an important sector of China’s economy and have great weight in the market. One of the biggest hurdles in the life cycle of these small and medium sized companies is lack of cash flow, which can become the “bottle neck” of their development and prevent progress. The need for logistics financing results from the lack of available credit financing facilities and the difficulty of obtaining financing on the capital markets. Therefore, logistics financing services protect against the financing problems by allowing these small and medium companies to use their raw materials and commodities as collateral to borrow money. Logistics financing increases the liquidity of cash flow, lowers the clearance risks and improves the efficiency of the economic operation. Upon completion of the Logistics Center, we expect to house many small and mid-size logistics companies. The offering of logistics financing will therefore become an important component of the business, as these businesses are expected to have financing needs as they grow their businesses.

Market Overview of Wuhan

Located in the middle reaches of the Yangtze River, Wuhan has been regarded as the gateway to nine provinces nearby. Beijing-Guangzhou Railway and the Yangtze River converge in Wuhan and also Beijing-Jiulong Railway and Beijing-Guangzhou Railway intersect in it, thus forming a railway network linking North China, Southwest China, Central South China and East China. Moreover, Beijing-Zhuhai Expressway and Shanghai-Chengdu Expressway converge in Wuhan and a high-speed railway along the Yangtze River will be completed here soon. Therefore, a “flexible multimodal transportation system” combining expressways, high-speed railways and water transportation on the Yangtze River will give greater prominence to Wuhan’s position of strategic importance as a junction of water and land transportation in China (Source: http://www.maxxelli-blog.com/introduction-to-wuhan/).

Wuhan is the largest inland logistics and cargo distribution center in China, with its service covering approximately a 400 million population in the five neighboring provinces including Hunan, Jiangxi, Anhui, Henan and Sichuan. At present, there are over 10,000 commercial organizations, 105,000 commodity networks, four commercial listed enterprises as well as eight comprehensive shopping centers on the list of China Top 100 Retail Shopping Centers (Source: http://www.maxxelli-blog.com/introduction-to-wuhan/).

China is thoroughly implementing the strategy of coordinated regional development, expanding domestic demand, innovation-driven development and new urbanization, and building a new economic support belt relying on the Yangtze River. As a central city in the central region and the middle reach of the Yangtze River, and the country’s major transportation hub and science and technology base, Wuhan faces multiple overlapping strategic opportunities. Location, transportation, science, education, market and other advantages will be further enhanced and fully released and more quickly transformed into development and competitive advantage (Source: http://www.maxxelli-blog.com/introduction-to-wuhan/).

Wuhan is a major transportation hub of China situated at the midstream of the Yangtze River. Going west alongside the Yangtze, upstream are the cities in Chongqing, Sichuan, Yunnan and Qinghai. Going east downstream are provinces of Hunan, Anhui and Jiangsu, as well as the cities of Nanjing and Shanghai, until finally arriving at the sea. The railway runs north bound to Harbin, westbound to Urumqi, east bound to Shanghai and south bound to the Shenzhen Highway and expressways that stretch in all directions ensuring easy and convenient transportation to all provinces in China. Likewise, Wuhan is largest economic city in central China with an annual GDP beyond 1,000 billion RMB. In 2015, the China State Council introduced and implemented the Midstream Yangtze River City Group Development Plan headed by Wuhan. In fact, the city was once called “The Oriental Chicago” by the US Harper’s Magazine back in 1918.

With the rapid development of inland water shipping in China, logistics and port management industry has grown significantly. Wuhan is one of the major inland water ports in China. In 2014, Wuhan government released an Opinion On Accelerating The Establishment Of Shipping Center In The Middle Reach Of Yangtze River, and indicated that the government will help the Wuhan shipping center to be a well-equipped, surrounding industry developed internationally with a scaled and intelligent inland water shipping center with highly concentrated port and shipping resources . In the Development Plan On Wuhan Logistics Space (2012-2020), Wuhan is strategically positioned as the critical joint of the global supply chain and the logistics transportation hub and information center of China.

| 10 |

However, in Wuhan, logistics for domestic trade operate separately from that for international trade and all resources are scattered and not concentrated enough to form a well-organized and well-managed international supply chain. It is very difficult for Wuhan to realize the synergy of business, logistics, money and information. In addition, a majority of the current logistics companies in Wuhan focus on traditional cargo transportation and storage services. Therefore, there exists an opportunity for an efficient, comprehensive and modern logistics service center to facilitate the channel of both regional and global logistics.

Competitive Advantages

The following factors reflect our advantages over our competitors:

| ● | Experienced Logistics Management Team. We have a professional team with significant experience in logistics management. Members of the Company’s team have had work experience with well-known logistics management companies in different cities. In addition, the management members are well educated with degrees from top universities such as Huazhong University of Science and Technology, Wuhan University, University of British Columbia and the Chinese Academy of Social Sciences. |

| ● | Encouraging Policy Environment. Under China’s latest “One Belt, One Road” initiative, we are strategically positioned in the anticipated “Pilot Free Trade Zone” of the Wuhan Port, a crucial trading window between China, the Middle East and Europe. In May 2015, the China State Council approved the nation’s economic strategic plan, the Vigorous Development Plan of Yangtze River Economic Belt. The Yangtze River Economic Belt has sharpened the focus on the Wuhan New Port Yangluo Terminal, where the port project that we are currently developing is located. |

| ● | Unique Transportation Network. Wuhan is located in the middle reaches of the Yangtze River, east facing south-eastern coastal economic developed area and west linking north-western raw material base. The distance to metropolitan cities, such as Beijing, Shanghai, Hong Kong and Chongqing are within 1,200 kilometers. As a central city in mainland China, Wuhan is capable of reaching over 30 provinces like Yunnan Province, Henan Province, Sichuan Province, Shanxi Province, Jiangxi Province and Hunan Province and 600 cities and counties in China. |

| ● | Highway: The Logistics Center is in close proximity to the Beijing-Zhuhai expressway, the Shanghai-Chengdu Expressway, and the Jiangbei Expressway. |

| ● | Waterway: The project adjacent to the Yangluo deep-water port, has eight 5,000-ton berths, directly leading to Jianghai. Yangluo Port is the largest national shipping port in Central China and the largest container port in the upper reaches of the Yangtze River. We will be strategically located for international procurement, distribution and delivery. |

| ● | Railway: The Beijing-Guangzhou, Beijing-Kowloon Railway, the Beijing-Guangzhou railway extension line and special railway lines offer direct access to the Logistics Center. The Logistics Center will, through the Jiangbei railway- Xianglushan station, connect all of the domestic railway freight stations, and through the construction of the “Chinese new Europe” railway, throughout the Continent. |

| ● | Airport: 30 kilometers from the Wuhan Tianhe airport. |

| ● | Light-rail transit: By 2018, two light rail stations are expected to be completed next to the Logistics Center, cutting the commute to downtown Wuhan to only 20 minutes. |

| 11 |

| ● | Jiangbei Expressway: After the completion of Jiangbei Expressway, commute by car from downtown Wuhan to the Logistics Centers is expected to be only about 20 minutes. |

The following map shows the location of the proposed Logistics Center and surrounding transportation network:

Employees

As of the date of this Report, we have a total of 20 employees, including our executive officers. The following table sets forth the number of our employees by function as of the same date:

| Functional Area | Number of Employees | % of Total | ||||||

| Management | 3 | 15 | % | |||||

| Engineer | 3 | 15 | % | |||||

| Sales | 7 | 35 | % | |||||

| Administrative | 3 | 15 | % | |||||

| Property management | 1 | 5 | % | |||||

| Accounting | 3 | 15 | % | |||||

| Total | 20 | 100 | % | |||||

Our employees are not represented by any collective bargaining agreement and we have never experienced a work stoppage. We believe we have good relations with our employees.

Competition

The real estate and logistics industries in the PRC are both highly competitive. Many of our competitors are well capitalized and have greater financial, marketing, and other resources than we do. Some of our competitors also have larger land banks, greater economies of scale, broader name recognition, a longer track record, and more established relationships in certain markets.

Intellectual Property

Trademark

We are currently applying for trademark protection in China for our Company’s logo and we anticipate that we will be able to obtain the trademark within the next 12 months.

Set forth below is a detailed description of our trademark under application.

| Country | Trademark | Application Number | Classes | Our Ref | Status |

|

Mainland China |

|

18367978 | 39* |

TMZC18367978ZCSL01 |

In process |

*Class 39

Transport; packaging and storage of goods; travel arrangement.

Domain Names

We have added the domain names i) www.yerr.com.cn; ii) www.cjxgwl.com; and iii) www.cjxgwl.cn to the Internet Content Provider License that we currently hold and we have received the updated ICP License covering the foregoing domain name. The ICP record number is 15016982.

Customers/Suppliers

Until the Logistics Center is built and operational, we do not currently have customers or suppliers.

| 12 |

Where You Can Find More Information

We are subject to the reporting obligations of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These obligations include filing an annual report under cover of Form 10-K, with audited financial statements, unaudited quarterly reports on Form 10-Q and the requisite proxy statements with regard to annual stockholder meetings. The public may read and copy any materials the Company files with the Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Risks Relating to Our Business

MAJORITY OF OUR BUSINESS, ASSETS AND OPERATIONS ARE LOCATED IN THE PEOPLE’S REPUBLIC OF CHINA.

The majority of our business, assets and operations are located in the People’s Republic of China. The economy of the PRC differs from the economies of most developed countries in many respects. The economy of the PRC has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC’s government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in the PRC is still owned by the PRC’s government. In addition, the PRC’s government continues to play a significant role in regulating industry by imposing industrial policies. The PRC’s government exercises significant control over the PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of the PRC, but may have a negative effect on us.

ACTIONS OF GOVERNMENT OR CHANGE OF POLICIES MAY ADVERSELY AFFECT OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

We are at risk from significant and rapid change in the legal systems, regulatory controls, and practices in areas in which we operate. These affect a wide range of areas including the real estate development approval system, employment practices, transportation, cargo storage, logistics, financing and sale of the buildings; our property rights; data protection; environment, health and safety issues; macro-economic policies, central government directions and instructions, China’s Five Year Plan, “One Belt One Road” initiative; and accounting, taxation and stock exchange regulation. Accordingly, changes to, or violation of, these systems, controls or practices could increase costs and have material and adverse impacts on the reputation, performance and financial condition of our development and operation.

IF WE NEED ADDITIONAL CAPITAL TO FUND OUR FUTURE OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

If adequate additional financing is not available on reasonable terms, we may not be able to undertake ongoing real estate construction or continue to develop and expand the services of our Logistics Center, which may as a result impact our cash flow and we would have to modify our business plans accordingly. We will not be able to fully implement our business plan unless the $1 billion funding (as described in the prospectus summary) is in place by 2021 and we do not have any definitive agreement nor letter of intent for such financing except for this offering. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the development of competitive projects undertaken by our competition; and (iii) the level of our investment in construction and development. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to: (i) limit our operations and expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could have a materially adverse effect on our business and our ability to compete.

| 13 |

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving such additional capital that are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the common stock offered hereof. We cannot give you any assurances that any additional financing will be available to us, or if available, will be on terms favorable to us.

WE HAVE SUSTAINED SIGNIFICANT RECURRING OPERATING LOSSES AND EXPERIENCED NEGATIVE CASH FLOW FOR OPERATIONS SINCE INCEPTION.

We have sustained recurring losses and experienced negative cash flow from operations since inception. Since inception, we have focused on developing and implementing our business plan. As of December 31, 2017, we have generated cumulative losses of approximately $41,238,467 since inception, and we expect to continue to incur losses until 2020. We believe that our existing cash resources will not be sufficient to sustain operations during the next twelve months. We need to generate revenue and raise funding in order to sustain our operations and continue to implement our business plan. If we are unable to obtain additional funds when they are needed or if such funds cannot be obtained on terms acceptable to us, we would likely be unable to execute upon the business plan or pay expenses as they are incurred, which would have a material, adverse effect on our business, financial condition and results of operations. The amount of future losses and when, if ever, we will achieve profitability are uncertain.

WE BELIEVE THAT WE WILL DERIVE THE MAJORITY OF OUR REVENUE FROM SALES IN THE PRC AND ANY DOWNTURN IN THE CHINESE ECONOMY COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS AND FINANCIAL CONDITION.

The majority of our revenues are expected to be generated from sales of our properties and services in the PRC and we anticipate that revenue from such sales will continue to represent the substantial portion of our total revenue in the near future. Our sales and earnings can also be affected by changes in the general economy. Our success is influenced by a number of economic factors which affect consumer income, such as employment levels, business conditions, interest rates, oil and gas prices and taxation rates. Adverse changes in these economic factors, among others, may restrict consumer spending, thereby negatively affecting our sales and profitability.

WE ARE SUBJECT TO EXTENSIVE GOVERNMENT REGULATION THAT COULD CAUSE US TO INCUR SIGNIFICANT LIABILITIES OR RESTRICT OUR BUSINESS ACTIVITIES.

Regulatory requirements could cause us to incur significant liabilities and operating expenses and could restrict our business activities. We are subject to statutes and rules regulating, among other things, certain developmental matters, building and site design, and matters concerning the protection of health and the environment. Our operating expenses may be increased by governmental regulations, such as building permit allocation ordinances and impact and other fees and taxes that may be imposed to defray the cost of providing certain governmental services and improvements. For example, our proposed Wuhan Port Acquisition will require approvals from local State Administration for Industry and Commerce. Any delay or refusal from government agencies to grant us necessary licenses, permits, and approvals could have an adverse effect on our operations or our ability to implement on business plans.

OUR SALES WILL BE AFFECTED IF MORTGAGE FINANCING BECOMES MORE COSTLY OR OTHERWISE BECOMES LESS ATTRACTIVE.

Certain purchasers of our properties are expected to rely on mortgages to finance their purchases. An increase in interest rates may significantly increase the cost of mortgage financing, thus affecting the affordability of our properties. The PRC’s government and commercial banks may also increase the down payment requirement, impose other conditions or otherwise change the regulatory framework in a manner that would make mortgage financing unavailable or unattractive to potential property purchasers. If the availability or attractiveness of mortgage financing is reduced or limited, many of our prospective customers may not be able to purchase our properties and, as a result, our business, liquidity and results of operations could be adversely affected.

| 14 |

THE PRACTICE OF PRE-SELLING PROJECTS MAY EXPOSE US TO SUBSTANTIAL LIABILITIES.

It is common practice by property developers in China to pre-sell properties (while still under construction), which involves certain risks. For example, we may fail to complete a property development that may have been fully or partially pre-sold, which would leave us liable to purchasers of pre-sold units for losses suffered by them without adequate resources to pay the liability if funds have been used on the project. In addition, if a pre-sold property development is not completed on time, the purchasers of pre-sold units may be entitled to compensation for late delivery. If the delay extends beyond a certain period, the purchasers may be entitled to terminate the pre-sale agreement and pursue a claim for damages that exceeds the amount paid and our ability to recoup the resulting liability from future sales.

WE ARE DEPENDENT ON THIRD-PARTY SUBCONTRACTORS, MANUFACTURERS, AND DISTRIBUTORS FOR ALL ARCHITECTURE, ENGINEERING AND CONSTRUCTION SERVICES, AND CONSTRUCTION MATERIALS. A DISCONTINUED SUPPLY OF SUCH SERVICES AND MATERIALS WILL ADVERSELY AFFECT OUR PROJECTS.

We are dependent on third-party subcontractors, manufacturers, and distributors for all architecture, engineering and construction services, and construction materials. A discontinued supply of such services and materials will adversely affect our construction projects and the success of the Company.

WE MAY BE ADVERSELY AFFECTED BY FLUCTUATIONS IN THE PRICE OF RAW MATERIALS AND SELLING PRICES OF OUR PROPERTIES.

The land and raw materials that are used in our projects have experienced significant price fluctuations in the past. There is no assurance that they will not be subject to future price fluctuations or pricing control. The land and raw materials that are used in our projects may experience price volatility caused by events such as market fluctuations or changes in governmental programs. The market price of land and raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These price changes may ultimately result in increases in the selling prices of our properties, and may, in turn, adversely affect our sales volume, sales, operating income, and net income.

WE FACE INTENSE COMPETITION FROM OTHER REAL ESTATE DEVELOPERS AND/OR LOGISTICS COMPANIES.

The real estate and logistics industries in the PRC are both highly competitive. Many of our competitors are well capitalized and have greater financial, marketing, and other resources than we do. Some of our competitors also have larger land banks, greater economies of scale, broader name recognition, a longer track record, and more established relationships in certain markets. Competition among property developers may result in increased costs for the acquisition of land for development, increased costs for raw materials, shortages of skilled contractors, oversupply of properties, decrease in property prices in certain parts of the PRC, a slowdown in the rate at which new buildings are approved and/or reviewed by the relevant government authorities and an increase in administrative costs for hiring or retaining qualified personnel, any of which may adversely affect our business and financial condition. Furthermore, property developers that are better capitalized than we are may be more competitive in acquiring land through the auction process. If we cannot respond to changes in market conditions as promptly and effectively as our competitors or effectively compete for land acquisition through the auction systems and acquire other factors of production, our business and financial condition will be adversely affected.

OVER-SUPPLY OF REAL ESTATE PROPERTIES COULD HAVE A MATERIAL ADVERSE AFFECT ON OUR RESULTS OF OPERATIONS.

Most of our assets consist of real estate properties within the premise of our Logistics Center. While our business will primarily revolve around the services provided by the Logistics Center, we expect to sell and/or lease properties to other businesses to generate revenue. Although we expect the value of our real estate properties to appreciate upon Yangluo Port’s obtaining the approval of the “Free Trade Zone” status, risk of property over-supply is increasing in parts of China on a macro-level, where property investment, trading and speculation have become overly active. We are exposed to the risk that in the event of actual or perceived over-supply, property prices may fall drastically, and our revenue and profitability will be adversely affected. If we cannot sell or lease our properties at a favorable price, we may not have the necessary capital resources to fully execute our business plan and therefore our results of operations will be adversely affected.

| 15 |

WE MAY NOT HAVE SUFFICIENT EXPERIENCE AS A COMPANY CONDUCTING STORAGE AND PROCESSING SERVICES, INFORMATION SERVICES AND LOGISTICS FINANCING, OR IN OTHER AREAS REQUIRED FOR THE SUCCESSFUL IMPLEMENTATION OF OUR BUSINESS PLAN.

We may not have sufficient experience as a company in conducting storage and processing services, information services, logistics financing or other areas required for the successful implementation of our business plan. This may result in the Company experiencing difficulty in adequately operating and growing its business. If our operating or management abilities consistently perform below expectations, then our business is unlikely to thrive.

WE ARE HEAVILY DEPENDENT UPON THE SERVICES OF EXPERIENCED PERSONNEL WHO POSSESS SKILLS THAT ARE VALUABLE IN OUR INDUSTRY, AND WE MAY HAVE TO ACTIVELY COMPETE FOR THEIR SERVICES.

We are heavily dependent upon our ability to attract, retain and motivate skilled personnel to serve our customers. Many of our personnel possess skills that would be valuable to all companies engaged in our industry. Consequently, we expect that we will have to actively compete for these employees. Some of our competitors may be able to pay our employees more than we are able to pay to retain them. Our ability to profitably operate is substantially dependent upon our ability to locate, hire, train and retain our personnel. There can be no assurance that we will be able to retain our current personnel, or that we will be able to attract and assimilate other personnel in the future. If we are unable to effectively obtain and maintain skilled personnel, the development and quality of our services could be materially impaired.

DEFAULTING ON BANK LOANS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS

We plan to develop a full-service logistics center using the properties we have obtained land-use rights to. To finance the development, part of Company’s properties held for development and land lots under development have been pledged as collateral for financial institution loans. As of December 31, 2017, we have an outstanding loan payable to China Construction Bank totaling $44,211,399. The loan has a maturity date of May 29, 2020. The loan is a floating rate loan whose rate (2017: 6% per annum and 2016: 6% per annum) is set at 5% above the over 5 years base borrowing rate stipulated by the People’s Bank of China. The secured bank loan with China Construction Bank contains certain protective contractual provisions that limit our activities in order to protect the lender. The risk of default may increase in the event of an economic downturn or due to our failure to successfully execute our business plan. Defaulting on our bank loans could result in loss of our collateralized assets and cause a material adverse effect on our results of operations.

WE HAVE LIMITED INSURANCE COVERAGE AGAINST DAMAGES OR LOSS WE MIGHT SUFFER.

We do not carry business interruption insurance and therefore any business disruption or natural disaster could result in substantial damages or losses to us. In addition, there are certain types of losses (such as losses from forces of nature) that are generally not insured because either they are uninsurable or insurance cannot be obtained on commercially reasonable terms. Should an uninsured loss or a loss in excess of insured limits occur, our business could be materially adversely affected. If we were to suffer any losses or damages to our properties, our business, financial condition and results of operations would be materially and adversely affected.

OUR OPERATING COMPANIES MUST COMPLY WITH ENVIRONMENTAL PROTECTION LAWS THAT COULD ADVERSELY AFFECT OUR PROFITABILITY.

We are required to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Some of these regulations govern the level of fees payable to government entities providing environmental protection services and the prescribed standards relating to construction. Although construction technologies allow us to efficiently control the level of pollution resulting from our construction process, due to the nature of our business, wastes are unavoidably generated in the process. If we fail to comply with any of the environmental laws and regulations of the PRC, depending on the type and severity of the violation, we may be subject to, among other things, warnings from relevant authorities, imposition of fines, specific performance and/or criminal liability, forfeiture of profits made, or an order to close down our business operations and suspension of relevant permits.

THE OPERATING HISTORIES OF OUR OPERATING COMPANIES MAY NOT SERVE AS ADEQUATE BASES TO JUDGE OUR FUTURE PROSPECTS AND RESULTS OF OPERATIONS.

The operating history of Wuhan Newport may not provide a meaningful basis for evaluating our business following consummation of the Second Share Exchange. We cannot guarantee that we can achieve profitability or that we will have net profit in the future. We will encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

| ● | obtain sufficient working capital to support our development and construction; |

| 16 |

| ● | manage our expanding operations and continue to meet customers’ demands; | |

| ● | maintain adequate control of our expenses allowing us to realize anticipated income growth; | |

| ● | implement, adapt and modify our property development, sales, and business strategies as needed; | |

| ● | successfully integrate any future acquisitions; and | |

| ● |

anticipate and adapt to changing conditions in the real estate industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of the foregoing risks, our business may be materially and adversely affected.

WE MAY NOT BE ABLE TO SUCCESSFULLY EXECUTE OUR BUSINESS STRATEGY, WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS AND RESULTS OF OPERATIONS.

Since China is a large and diverse market, consumer trends and demands can vary significantly by region and Wuhan Newport’s experience in the markets in which it currently operates may not be applicable in other parts of China. As a result, we may not be able to leverage Wuhan Newport’s experience to fully execute our business strategy and plan. When we enter new markets, we may face intense competition from companies with greater experience or a more established presence in the targeted geographical areas or from other companies with similar business strategies. Therefore, we may not be able to adequately grow our sales due to intense competitive pressures and/or the substantial costs involved.

OUR FAILURE TO EFFECTIVELY MANAGE GROWTH MAY CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE AT THE LEVELS WE EXPECT.

In order to maximize potential growth in Wuhan Newport’s current and potential markets, we believe that we must be able to sell our properties and obtain clients to use the services provided by our Logistics Center to ensure the sustainable development capability of the Company and to maintain our operations. This strategy may place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to effectively manage our operations could prevent us from generating the revenues we expect and therefore have a material adverse effect on the results of our operations.

| 17 |

WE MAY NEED ADDITIONAL EMPLOYEES TO MEET OUR OPERATIONAL NEEDS.

Our future success also depends upon our ability to attract and retain highly qualified personnel. We may need to hire additional managers and employees with industry experience from time to time, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. There can be no assurance that we will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the real estate and logistics industries is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

WE WILL INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS.