Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Great Ajax Corp. | exhibit991-ye.htm |

| 8-K - FORM 8-K - Great Ajax Corp. | form8-k.htm |

Fourth Quarter and Year-End 2017

Investor Presentation

March 6, 2018

Safe Harbor Disclosure

2

We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking

statements include information about possible or assumed future results of our business, financial condition, liquidity, results

of operations, cash flow and plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,”

“plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements.

Statements regarding the following subjects, among others, may be forward-looking: market trends in our industry, interest

rates, real estate values, the debt financing markets or the general economy or the demand for and availability of residential

and small-balance commercial real estate loans; our business and investment strategy; our projected operating results;

actions and initiatives of the U.S. government and changes to U.S. government policies and the execution and impact of these

actions, initiatives and policies; the state of the U.S. economy generally or in specific geographic regions; economic trends and

economic recoveries; our ability to obtain and maintain financing arrangements; changes in the value of our mortgage

portfolio; changes to our portfolio of properties; impact of and changes in governmental regulations, tax law and rates,

accounting guidance and similar matters; our ability to satisfy the REIT qualification requirements for U.S. federal income tax

purposes; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the

future; general volatility of the capital markets and the market price of our shares of common stock; and degree and nature of

our competition.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking

into account all information currently available to us. Forward-looking statements are not predictions of future events. These

beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to

us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those

expressed in our forward-looking statements. Furthermore, forward-looking statements are subject to risks and uncertainties,

including, among other things, those described under Item 1A of our Annual Report on Form 10-K for the year ended

December 31, 2016, which can be accessed through the link to our SEC filings on our website (www.great-ajax.com) or at the

SEC's website (www.sec.gov). Other risks, uncertainties, and factors that could cause actual results to differ materially from

those projected may be described from time to time in reports we file with the SEC, including reports on Forms 10-Q, 10-K

and 8-K. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over

time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not

obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise. Unless stated otherwise, financial information included in this presentation is as of December 31,

2017.

Business Overview

3

Leverage long-standing relationships to acquire mortgage loans through privately

negotiated transactions from a diverse group of customers

– Over 90% of our acquisitions since inception have been privately negotiated

– Acquisitions made in 226 transactions since inception. 12 transactions in Q4 2017

Use our manager’s proprietary analytics to price each pool on an asset-by-asset basis

Adjust individual loan bid price to accumulate clusters of loans in attractive demographic

metropolitan areas

– Typical acquisition contains 25 – 100 loans with total market value between $5 – $20

million

Our affiliated servicer services the loans asset-by-asset and borrower-by-borrower

Objective is to maximize returns for each asset by utilizing a full menu of loss mitigation

and asset optimization techniques

Use moderate non-mark-to-market leverage

Highlights – Quarter Ended December 31, 2017

4

Purchased $219.2 million of re-performing mortgage loans (“RPL”) with an aggregate unpaid principal

balance (“UPB”) of $241.3 million and underlying collateral value of $363.9 million, including $177.3

million of RPLs in a joint venture with a new third party institutional partner. Loans on balance sheet for a

weighted average of 23 days for the quarter

Originated $1.7 million of small-balance commercial mortgage loans (“SBC”)

Raised $332.4 million, net, in three separate fixed rate secured borrowings including gross proceeds of

$88.9 million of secured debt consolidated on our balance sheet that is held by a joint venture partner.

Called two securitizations that resulted in accelerated amortization of the deferred issuance costs of $0.9

million

Portfolio interest income of $24.4 million; net interest income of $13.0 million

Net income attributable to common stockholders of $6.2 million

Basic earnings per share (“EPS”) of $0.34

Taxable income of $0.11 per share

Book value per share of $15.45 at December 31, 2017

Held $53.7 million of cash and cash equivalents at December 31, 2017

$48.1 million of cash collections in Q4 2017

Portfolio Overview – as of December 31, 2017

5

$1,465 MM

RPL: $1,412 MM

NPL: $53 MM

$1,984.6 MM

RPL: $1,891.3 MM

NPL: $ 63.3 MM

REO & Rental: $ 29.9 MM

95%

3%

2%

Property Value2

RPL

NPL

REO

1 Includes $193.2MM UPB in re-performing loans included in a 50/50 joint venture with an institutional third party that is required to be consolidated for GAAP

2REO and Rental Property value is presented at estimated property fair value less expected liquidation costs

96%

4%

Unpaid Principal Balance1

RPL

NPL

Portfolio Growth

6

Re-performing Loans

Re-performing loan UPB as of 12/31/2017 includes 0.9% of small-balance commercial originations, which are performing loans. Includes $193.2MM UPB included in a 50/50 joint

venture with an institutional third party that is required to be consolidated for GAAP

Re-performing loan status stays constant based on initial purchase status

$64

$617

$994

$1,412

$73

$710

$1,210

$1,891

$49

$469

$785

$1,172

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Initial Assets (07/08/14) 12/31/2015 12/31/2016 12/31/2017

M

ill

io

n

s

UPB

Property Value

Price

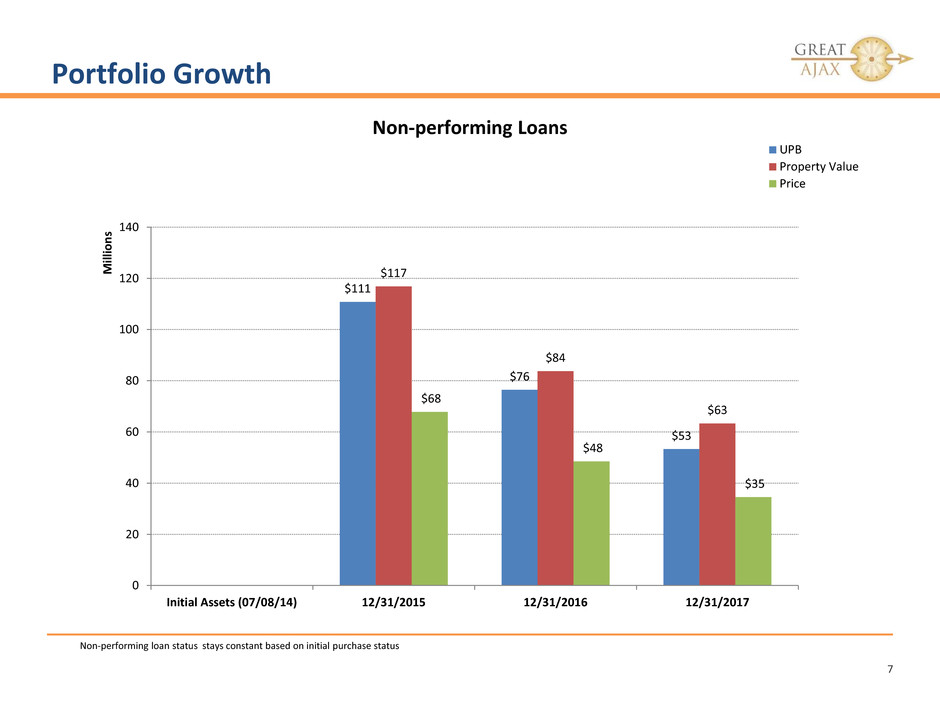

Portfolio Growth

7

Non-performing loan status stays constant based on initial purchase status

$111

$76

$53

$117

$84

$63

$68

$48

$35

0

20

40

60

80

100

120

140

Initial Assets (07/08/14) 12/31/2015 12/31/2016 12/31/2017

M

ill

io

n

s

UPB

Property Value

Price

Non-performing Loans

Portfolio Concentrated in Attractive Markets

8

Clusters of loans in attractive, densely populated markets

Stable liquidity and home prices

Over 80% of the portfolio in our target markets

Target States

Target Markets

Los Angeles

San Diego

Dallas

Portland

Phoenix

Washington DC Metro Area

Chicago

Atlanta

Orlando

Tampa Miami,

Ft. Lauderdale,

W. Palm Beach

New York /

New Jersey Metro Area

Las Vegas

REIT, Servicer & Manager

Headquarters

Property Management

Business Management

Houston

Portfolio Migration

9

24 for 24: Loan that has made 24 full payments in the last 24 months

12 for 12: Loan that has made 12 full payments in the last 12 months

7 for 7: Loan that has made 7 full payments in the last 7 months

NPL: <1 full payment in the last three months

$649.1 million of purchased UPB is 12 for 12 or better based on the payment history of the loans post

service transfer to Gregory Funding LLC, our affiliated servicer

For loans acquired at 7 for 7 or less, current status excludes borrower payment history prior to the date the

loan was serviced by Gregory Funding LLC to the extent the prior history would result in the borrower

having an acquisition status of better than 7 for 7. Including prior servicer history for these loans would

result in a considerably higher number of loans that are 12 for 12 or better

Count UPB Count UPB

Liquidated - - 996 199,911

24for24 318 58,923 1607 365,476

12for12 150 32,479 1316 283,636

7for7 2939 661,651 937 220,064

4f4-6f6 1320 290,270 549 113,904

Less than 4f4 1566 328,461 730 150,733

REO - - 149 40,025

NPL 496 122,195 533 125,629

Purchased REO 34 8,074 6 2,675

6,823 1,502,053 6,823 1,502,053

Total Pre 4Q2017 Acquisitions ($$ in thousands)

Acquisition Current Based on

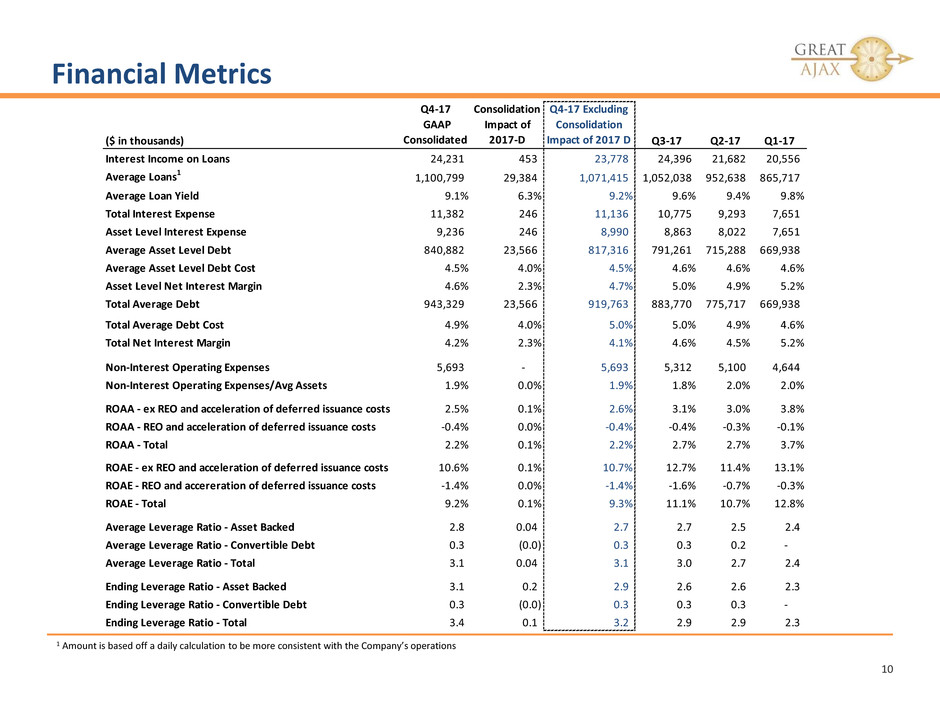

Financial Metrics

10

1 Amount is based off a daily calculation to be more consistent with the Company’s operations

($ in thousands)

Q4-17

GAAP

Consolidated

Consolidation

Impact of

2017-D

Q4-17 Excluding

Consolidation

Impact of 2017 D Q3-17 Q2-17 Q1-17

Interest Income on Loans 24,231 453 23,778 24,396 21,682 20,556

Average Loans1 1,100,799 29,384 1,071,415 1,052,038 952,638 865,717

Average Loan Yield 9.1% 6.3% 9.2% 9.6% 9.4% 9.8%

Total Interest Expense 11,382 246 11,136 10,775 9,293 7,651

Asset Level Interest Expense 9,236 246 8,990 8,863 8,022 7,651

Average Asset Level Debt 840,882 23,566 817,316 791,261 715,288 669,938

Average Asset Level Debt Cost 4.5% 4.0% 4.5% 4.6% 4.6% 4.6%

Asset Level Net Interest Margin 4.6% 2.3% 4.7% 5.0% 4.9% 5.2%

Total Average Debt 943,329 23,566 919,763 883,770 775,717 669,938

Total Average Debt Cost 4.9% 4.0% 5.0% 5.0% 4.9% 4.6%

Total Net Interest Margin 4.2% 2.3% 4.1% 4.6% 4.5% 5.2%

Non-Interest Operating Expenses 5,693 - 5,693 5,312 5,100 4,644

Non-Interest Operating Expenses/Avg Assets 1.9% 0.0% 1.9% 1.8% 2.0% 2.0%

ROAA - ex REO and acceleration of deferred issuance costs 2.5% 0.1% 2.6% 3.1% 3.0% 3.8%

ROAA - REO and acceleration of deferred issuance costs -0.4% 0.0% -0.4% -0.4% -0.3% -0.1%

ROAA - Total 2.2% 0.1% 2.2% 2.7% 2.7% 3.7%

ROAE - ex REO and acceleration of deferred issuance costs 10.6% 0.1% 10.7% 12.7% 11.4% 13.1%

ROAE - REO and accereration of deferred issuance costs -1.4% 0.0% -1.4% -1.6% -0.7% -0.3%

ROAE - Total 9.2% 0.1% 9.3% 11.1% 10.7% 12.8%

Average Leverage Ratio - Asset Backed 2.8 0.04 2.7 2.7 2.5 2.4

Average Leverage Ratio - Convertible Debt 0.3 (0.0) 0.3 0.3 0.2 -

Average Leverage Ratio - Total 3.1 0.04 3.1 3.0 2.7 2.4

Ending Leverage Ratio - Asset Backed 3.1 0.2 2.9 2.6 2.6 2.3

Ending Leverage Ratio - Convertible Debt 0.3 (0.0) 0.3 0.3 0.3 -

Ending Leverage Ratio - Total 3.4 0.1 3.2 2.9 2.9 2.3

Subsequent Events

11

1 While these acquisitions are expected to close, there can be no assurance that these acquisitions will close or that the terms thereof may not change

2 Some of the acquisitions may close through a joint venture with an institutional third party

On January 26, 2018, we agreed to acquire an 8% ownership interest in Great Ajax Financial Services LLC (“GAFS”), the parent of our

servicer, Gregory Funding LLC, in a two-step transaction. On January 26, 2018, the initial closing, we acquired a 4.9% interest in

GAFS and three warrants, each exercisable for a 2.45% interest in GAFS, in exchange for $1.1 million and 45,938 shares of our

common stock. At the date of an additional closing, expected to take place approximately 121 days from January 26, we expect to

acquire an additional 3.1% interest in GAFS and three warrants, each exercisable for a 1.55% interest in GAFS, in exchange for $0.7

million and shares of our common stock with a value of approximately $0.4 million

A dividend of $0.30 per share will be payable on March 30, 2018 to our stockholders of record as of March 15, 2018

SBC

UPB: $2.7MM

Collateral Value: $3.9MM

Price/UPB: 98.4%

Price/Collateral Value: 67.8%

2 loans in 2 transactions

January Acquisitions

RPL

UPB: $18.5MM

Collateral Value: $30.8MM

Price/UPB: 89.5%

Price/Collateral Value: 53.8%

83 loans in 1 transaction

February Acquisitions

RPL

UPB: $0.38MM

Collateral Value: $0.47MM

Price/UPB: 79.1%

Price/Collateral Value: 63.5%

2 loans in 2 transactions

Pending Acquisitions1,2

RPL

UPB: $91.6MM

Collateral Value: $157.3MM

Price/UPB: 95.8%

Price/Collateral Value: 55.8%

422 loans in 5 transactions

SBC

One multi-family 32 unit building

Collateral Value: $3.45MM

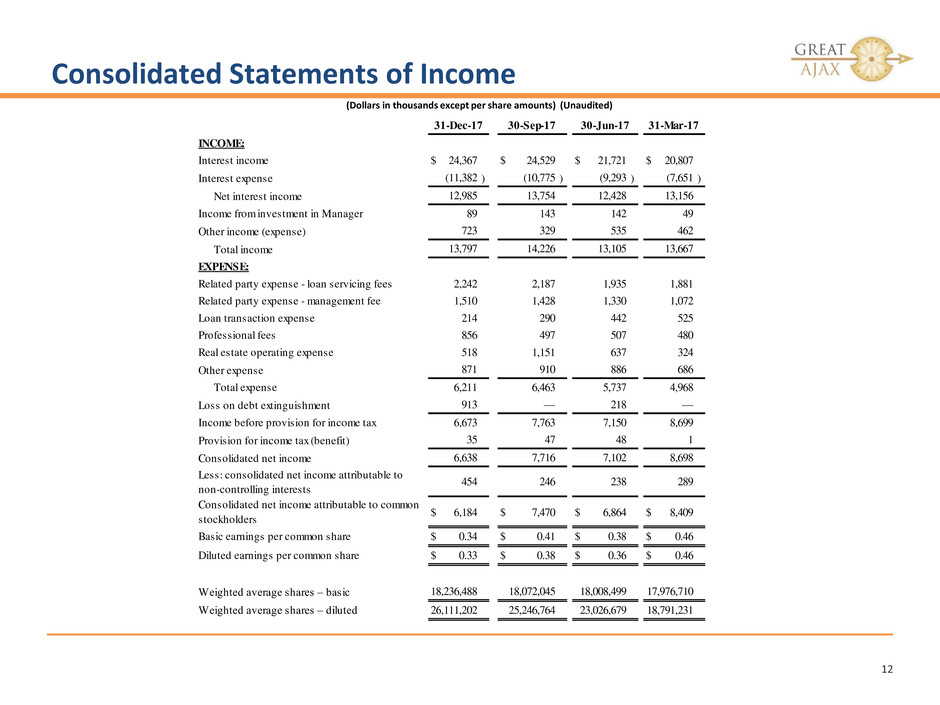

Consolidated Statements of Income

12

(Dollars in thousands except per share amounts) (Unaudited)

INCOME:

Interest income $ 24,367 $ 24,529 $ 21,721 $ 20,807

Interest expense ) ) ) )

Net interest income

Income from investment in Manager

Other income (expense)

Total income

EXPENSE:

Related party expense - loan servicing fees

Related party expense - management fee

Loan transaction expense

Professional fees

Real estate operating expense

Other expense

Total expense

Loss on debt extinguishment

Income before provision for income tax

Provision for income tax (benefit)

Consolidated net income

Less: consolidated net income attributable to

non-controlling interests

Consolidated net income attributable to common

stockholders

$ 6,184 $ 7,470 $ 6,864 $ 8,409

Basic earnings per common share $ 0.34 $ 0.41 $ 0.38 $ 0.46

Diluted earnings per common share $ 0.33 $ 0.38 $ 0.36 $ 0.46

Weighted average shares – basic

Weighted average shares – diluted

18,236,488 18,072,045 18,008,499 17,976,710

26,111,202 25,246,764 23,026,679 18,791,231

454 246 238 289

35 47 48 1

6,638 7,716 7,102 8,698

913 — 218 —

6,673 7,763 7,150 8,699

871 910 886 686

6,211 6,463 5,737 4,968

856 497 507 480

518 1,151 637 324

1,510 1,428 1,330 1,072

214 290 442 525

2,242 2,187 1,935 1,881

13,797 14,226 13,105 13,667

89 143 142 49

723 329 535 462

12,985 13,754 12,428 13,156

(11,382 (10,775 (9,293 (7,651

31-Dec-17 30-Sep-17 30-Jun-17 31-Mar-17

Consolidated Balance Sheets

13

(1) Mortgage loans includes $969,463 and $598,643 of loans at December 31, 2017 and December 31, 2016, respectively, transferred to securitization trusts that are variable interest entities (“VIEs”) , these loans can only be used to settle

obligations of the VIEs. Secured borrowings consist of notes issued by VIEs that can only be settled with the assets and cash flows of the VIEs. The creditors do not have recourse to the primary beneficiary (Great Ajax Corp).

(2) Property held for sale, net, includes valuation allowances of $1,784 and $1,620 at December 31, 2017 , and December 31, 2016, respectively.

(3) Secured borrowings and Convertible senior notes are presented net of deferred issuance costs

(4) Mortgage loans, net include $177.1 million, Secured borrowings, net of deferred costs include $88.4 million, and Non-controlling interests includes $14.0 million from a 50% owned joint venture, which we consolidate under GAAP

(Dollars in thousands except per share amounts)

ASSETS Dec-17

Consolidation

Impact of

2017-D

12/31/2017

Excluding

Consolidation

Impact of 2017-D Sep-17 Jun-17 Mar-17 Dec-16

Cash and Cash Equivalents 53,721 53,721 43,086 42,040 29,840 35,723

Cash Held In Trust 301 301 1,075 29 714 1,185

Mortgage Loans 1,253,541 88,565 1,164,976 1,053,285 1,044,745 856,756 869,091

Property held-for-sale 24,947 24,947 27,342 28,278 27,339 23,882

Rental property, net 1,284 1,284 1,921 1,969 1,552 1,289

Investment in debt securities 6,285 6,285 6,306 6,303 6,255 6,323

Receivable from servicer 17,005 17,005 12,930 16,067 13,695 12,481

Investment in affiliates 7,020 7,020 7,079 1,862 4,324 4,253

Loans purchase deposit 26,740 13,345 13,395 50 50 50 50

Prepaid expenses and other assets 4,894 702 4,192 4,339 4,779 1,587 3,125

Total Assets 1,395,738 102,613 1,293,125 1,157,413 1,146,122 942,112 957,402

LIABILITIES AND EQUITY

Liabilities:

Secured borrowings, net 694,040 88,381 605,659 496,342 522,706 428,168 442,670

Borrowings under repurchase agreements 276,385 276,385 258,402 245,526 222,797 227,440

Convertible senior notes, net 102,571 102,571 102,383 82,083 - -

Management fee payable 750 750 750 750 750 750

Accured expenses and other liabilities 4,554 232 4,322 4,027 2,697 3,253 3,819

Total Liabilities 1,078,300 88,613 989,687 861,904 853,762 654,968 674,679

Equity:

Preferred stock - - - - - -

Common stock 186 186 183 182 181 181

Additional paid in capital 254,847 254,847 249,936 248,803 245,436 244,880

Retained earnings 35,556 35,556 34,875 32,880 31,104 27,231

Accumulated other comprehensive loss (233) (233) (170) (131) (140) -

Equity attributable to common stockholders 290,356 - 290,356 284,824 281,734 276,581 272,292

Non-controlling interest 27,082 14,000 13,082 10,685 10,626 10,563 10,431

Total equity 317,438 14,000 303,438 295,509 292,360 287,144 282,723

Total equity and liabilities 1,395,738 102,613 1,293,125 1,157,413 1,146,122 942,112 957,402