Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION OF CEO PERSUANT TO 18 U.S.C. - VIDLER WATER RESOURCES, INC. | picoexhibit32110k2017.htm |

| EX-32.2 - CERTIFICATION OF CFO PURSUANT TO 18 U.S.C. - VIDLER WATER RESOURCES, INC. | picoexhibit32210k2017.htm |

| EX-31.2 - CERTIFICATION OF CFO PER SARBANES-OXLEY ACT - VIDLER WATER RESOURCES, INC. | picoexhibit31210k2017.htm |

| EX-31.1 - CERTIFICATION OF CEO PER SARBANES-OXLEY ACT - VIDLER WATER RESOURCES, INC. | picoexhibit31110k2017.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM - VIDLER WATER RESOURCES, INC. | picoex231consent10k2017.htm |

| EX-21.1 - SUBSIDIARIES OF PICO HOLDINGS, INC. - VIDLER WATER RESOURCES, INC. | picoex211subs10k2017.htm |

| EX-10.8 - PICO HOLDINGS, INC. AMENDED AND RESTATED NONEMPLOYEE DIRECTOR COMPENSATION POLIC - VIDLER WATER RESOURCES, INC. | ex108amendedandrestatednon.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 033-36383

PICO HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or other jurisdiction of incorporation) | 94-2723335 (IRS Employer Identification No.) |

7979 Ivanhoe Avenue, Suite 300 La Jolla, California 92037

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, Including Area Code

(888) 389-3222

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered |

Common Stock, Par Value $0.001 | NASDAQ Stock Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company, ” and “Emerging Growth Company” in Rule 12b-2 of the Exchange Act (check one):

Large accelerated filer ¨ | Accelerated filer ý | Non-accelerated filer ¨ | Smaller reporting company ¨ | Non-accelerated filer ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Act). Yes ¨ No ý

At June 30, 2017, the aggregate market value of shares of the registrant’s common stock held by non-affiliates of the registrant (based upon the closing sale price of such shares on the NASDAQ Global Select Market on June 30, 2017) was $404.9 million, which excludes shares of common stock held in treasury and shares held by executive officers, directors, and stockholders whose ownership exceeds 10% of the registrant’s common stock outstanding at June 30, 2017. This calculation does not reflect a determination that such persons are deemed to be affiliates for any other purposes.

On February 16, 2018, the registrant had 23,152,027 shares of common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the United States Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2018 Annual Meeting of Shareholders, to be filed subsequent to the date hereof, are incorporated by reference into Part III of this Annual Report on Form 10-K.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Page No. | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

2

PART I

Note About “Forward-Looking Statements”

This Annual Report on Form 10-K (including “Management’s Discussion and Analysis of Financial Condition and Results of Operations”) contains “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995, regarding our business, financial condition, results of operations, and prospects, including, without limitation, statements about our expectations, beliefs, intentions, anticipated developments, and other information concerning future matters. Words such as “may”, “will”, “could”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report on Form 10-K.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on current expectations and assumptions and are not guarantees of future performance. Consequently, forward-looking statements are inherently subject to risk and uncertainties, and the actual results and outcomes could differ materially from future results and outcomes expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those discussed under Part I, Item 1A “Risk Factors”, as well as those discussed elsewhere in this Annual Report on Form 10-K and in other filings we may make from time to time with the United States Securities and Exchange Commission (“SEC”) after the date of this report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We undertake no obligation to (and we expressly disclaim any obligation to) revise or update any forward-looking statements, whether as a result of new information, subsequent events, or otherwise, in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, unless otherwise required by law. Readers are urged to carefully review and consider the various disclosures made in this Annual Report on Form 10-K, and the other filings we may make from time to time with the SEC after the date of this report, which attempt to advise interested parties of the risks and uncertainties that may affect our business, financial condition, results of operations, and prospects.

ITEM 1. BUSINESS

Introduction

PICO Holdings, Inc. is a diversified holding company that was incorporated in 1981. In this Annual Report on Form 10-K, PICO and its subsidiaries are collectively referred to as “PICO,” the “Company,” or by words such as “we,” “us,” and “our.”

Our objective is to maximize long-term shareholder value. Currently, we believe the highest potential return to shareholders is from a return of capital. As we monetize assets, rather than reinvest the proceeds, we intend to return capital back to shareholders through a stock repurchase program or by other means such as special dividends.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports, are made available free of charge on our web site (www.picoholdings.com) as soon as reasonably practicable after the reports are electronically filed or furnished with the SEC. Our website also contains other material about our Company. Information on our website is not incorporated by reference into this Annual Report on Form 10-K. Our corporate office is located at 7979 Ivanhoe Avenue, Suite 300, La Jolla, California 92037, and our telephone number is (888) 389-3222.

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto included elsewhere in this Annual Report on Form 10-K. Additional information regarding the performance of and recent developments in our operating segments is included in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Our Business

We are primarily focused on selling our existing water rights and storage credits that we own in Arizona, Colorado, Nevada and New Mexico. The long-term future demand for our existing water assets is driven by population and economic growth relative to currently available water supplies in the southwestern United States. We have developed sources of water for municipal and industrial use, either from existing supplies of water, such as water used for agricultural purposes, acquired unappropriated (previously unused) water, or discovered new water sources based on science and targeted exploration. We are not a water utility, and do not currently intend to enter into regulated utility activities.

3

A water right is the legal right to divert water and put it to beneficial use. Water rights are real property rights which can be bought and sold and are commonly measured in acre-feet (“AF”), which is a measure of the volume of water required to cover an area of one acre to a depth of one foot and is equal to 325,850 gallons. The value of a water right depends on a number of factors, which may include location, the seniority of the right, whether or not the right is transferable, or if the water can be moved from one location to another. We believe we have purchased water rights at prices consistent with their then current use, which was typically agricultural in nature, with the expectation that the value would increase as we converted the water rights through the development process to a higher use, such as municipal and industrial use. We acquired and developed water resources with the expectation that such water resources would be the most competitive source of water (the most economical source of water supply) to support new growth in municipalities or new commercial and industrial projects.

Over the past six years, the population growth of these states also exceeded the national growth rate collectively and individually, with the exception of New Mexico. According to the Census Bureau’s estimate of state population changes for the period April 1, 2010 to July 1, 2017, Nevada’s growth rate was 11.02%, Arizona 9.77%, Colorado 11.49%, and New Mexico 1.4%. These population growth statistics compare to the national total growth rate of 5.5% over the same period.

Historically, a significant portion of the Southwest’s water supplies have come from the Colorado River. The balance is provided by other surface rights, such as rivers and lakes, groundwater (water pumped from underground aquifers), and water previously stored in reservoirs or aquifers. Prolonged droughts (decreased snow pack runoff and the related decreased surface water) and rapid population growth in the past twenty years have exacerbated the region’s general water scarcity.

In December 2012, the U.S. Department of the Interior released a report titled: The Colorado River Basin Water Supply and Demand Study, examining the future water demands on the Colorado River Basin. The report projects water supply and demand imbalances throughout the Colorado River Basin and adjacent areas over the next 50 years. The average imbalance in future supply and demand is projected to be greater than 3.2 million acre-feet per year by 2060. The study projects that the largest increase in demand will come from municipal and industrial users as a result of population growth. The Colorado River Basin currently provides water to some 40 million people, and the study estimates that this number could nearly double to approximately 76.5 million people by 2060, under a rapid growth scenario.

Certain areas of the Southwest confronting long-term growth have insufficient known supplies of water to support their future economic and population growth. The inefficient allocation of available water between agricultural users and municipal or industrial users, the lack of available known water supplies in a particular location, or inadequate infrastructure to fully utilize or store existing and new water supplies provide opportunities for us to apply our water resource development expertise.

The development of our water assets required significant capital and expertise. A complete project, from acquisition, through development, permitting, and sale is typically a long-term endeavor. In the regions in which we operate, new housing, and commercial and industrial developments require an assured, or sustainable, water supply (for example, in Arizona, access to water supplies for at least 100 years is required) before a permit for the development will be issued.

We have acquired or developed water rights and water related assets in Arizona, Idaho, Nevada, Colorado, and New Mexico. We also developed and operated our own water storage facility near Phoenix, Arizona, utilize water storage capacity operated by third parties in Arizona, and “bank,” or store, water with municipalities in Nevada and New Mexico.

We have also entered into “teaming” and joint resource development arrangements with third parties who have water assets but lack the capital or expertise to commercially develop these assets. The first of these arrangements was a water delivery teaming agreement in southern Nevada with the Lincoln County Water District (“Lincoln/Vidler”), which is developing water resources in Lincoln County, Nevada. In northern Nevada, we have also entered into a joint development agreement with Carson City and Lyon County, Nevada to develop and provide water resources in Lyon County as well as a water banking agreement with Washoe County in Reno, Nevada.

4

We generate revenues by:

• | selling our developed water rights to real estate developers, power generating facilities or other commercial and industrial users who must secure rights to an assured, or sustainable, supply of water in order to receive permits for their development projects; |

• | selling our developed water rights to water utilities, municipalities and other government agencies for their specific needs, including to support population growth; |

• | selling our stored water to state agencies, commercial developers or municipalities that have either exhausted their existing water supplies or require reserves for future water obligations, or, in instances where our water represents the most economical source of water, for their commercial projects or communities; and |

• | leasing our water, or land. |

We owned the following significant water resource and water storage assets at December 31, 2017:

Fish Springs Ranch

We own a 51% membership interest in, and are the managing partner of, Fish Springs Ranch, LLC (“FSR”), which owns the Fish Springs Ranch and other properties totaling approximately 7,313 acres in Honey Lake Valley in Washoe County, approximately 40 miles north of Reno, Nevada. FSR also owns 12,984 acre-feet of permitted water rights related to the properties of which 7,984 acre-feet are designated as water credits, transferable to other areas within Washoe County (such as Reno and Sparks) to support community development. Although the additional 5,000 AF has been approved and permitted by the Nevada State Engineer, existing federal rights of way will need to be updated before such water is transferable. To date, we have funded all of the operational expenses, development, and construction costs incurred in this partnership. Certain of the development and construction costs are treated as preferred capital under the partnership agreement which among other things, entitles us to receive interest on the initial balance of the preferred capital and the accumulated interest at the London Inter-Bank Offered Rate (“LIBOR”) plus 450 basis points. The preferred capital and accumulated interest is first in line to be paid out as the partnership generates sufficient revenue. At December 31, 2017 the balance in the preferred capital account including $75 million of accrued interest, was $169.6 million and the associated interest rate was 6.2%.

During 2006, we started construction of a pipeline and an electrical substation to provide the power required to pump the water to the north valleys region of Reno. In July 2008, we completed construction of and dedicated our pipeline and associated infrastructure to Washoe County, Nevada under the terms of an Infrastructure Dedication Agreement (“IDA”) between Washoe County and FSR. Under the provisions of the IDA, Washoe County is responsible for the operation and maintenance of the pipeline and we own the exclusive right to the capacity of the pipeline to allow for the sale of water for future economic development in the north valley area of Reno. Our 7,984 acre-feet of water that has regulatory approval to be imported to the north valleys of Reno is available for sale under a Water Banking Agreement entered into between FSR and Washoe County. Under the Water Banking Agreement, Washoe County holds our water rights in trust. We can sell our water credits to developers, who must then dedicate the water to the local water utility for service. In December 2014, Washoe County Water Utilities merged with the Truckee Meadows Water Authority (“TMWA”), consolidating water supply service in Washoe County. Also effective at the end of 2014, FSR, Washoe County, and TMWA consented to the Assignment of the Water Banking Agreement and the IDA to the Truckee Meadows Water Authority.

Carson/Lyon

The capital of Nevada, Carson City, and Lyon County are located in the western part of the state, close to Lake Tahoe and the border with California. While Carson City’s housing growth has been and is expected to be minimal due to land constraints, there is planned growth for the Dayton corridor, directly east of Carson City. The planned growth in this area is anticipated to be driven by the employment growth at the Tahoe Reno Industrial Center (“TRIC”) and the construction of the extension of the USA Parkway, completed in August 2017, which connects Interstate route 80 to TRIC and the extension connects Interstate route 80 and TRIC to U.S. route 50 near Silver Springs, Lyon County. There are currently few existing water sources to support future growth and development in the Dayton corridor area and we have worked with Carson City and Lyon County for several years on ways to deliver water to support this expected growth.

We have development and improvement agreements with both Carson City and Lyon County to provide water resources for planned future growth in Lyon County and to connect, or “intertie,” the municipal water systems of Carson City and Lyon County. The agreements allow for certain river water rights owned or controlled by us to be conveyed for use in Lyon County. The agreements also allow us to bank water with Lyon County and authorize us to build the infrastructure to upgrade and inter-connect the Carson City and Lyon County water systems.

5

We own or control water rights consisting of both Carson River agriculture designated water rights and certain municipal and industrial designated water rights. We anticipate that we will have up to 4,000 acre-feet available for municipal use in Lyon County for future development, if and when demand occurs, principally by means of delivery through the new infrastructure we constructed.

Vidler Arizona Recharge Facility

We built and received the necessary permits to operate a full-scale water “recharge” facility that allowed us to bank water underground in the Harquahala Valley, Arizona. “Recharge” is the process of placing water into storage underground. When needed, the water will be “recovered,” or removed from storage, by ground water wells. This stored water creates a long term storage credit (“LTSC”).

We hold recharged Colorado River water at this facility, which is a primary source of water for the Lower Basin States of Arizona, California, and Nevada. The water storage facility is strategically located adjacent to the Central Arizona Project (“CAP”) aqueduct, a conveyance canal running from Lake Havasu to Phoenix and Tucson. Our recharged water was purchased from surplus flows of CAP water. Proximity to the CAP provides a competitive advantage as it minimizes the cost of water conveyance of our LTSCs.

Potential users include industrial companies, power-generating companies, developers, and local governmental political subdivisions in Arizona, and out-of-state users such as municipalities and water agencies in Nevada and California. The Arizona Water Banking Authority (“AWBA”) has the responsibility for intrastate and interstate storage of water for governmental entities. To date, we have not stored water at the facility for any third party and there is no longer excess water which can be banked.

While Arizona was the only southwestern state with surplus flows of Colorado River water available for storage, there is little to no surplus flows available to us as drought conditions have reduced the flow of the Colorado River and other water users have fully utilized their water allocations. In the future, we do not anticipate purchasing and storing surplus flows of Colorado River water and we have discontinued using the recharge element of the storage site. At December 31, 2017, we had LTSCs of approximately 251,000 acre-feet of water in storage at the facility. To date, we have not generated any revenue from selling our stored water at this facility.

Phoenix AMA Water Storage

As of December 31, 2017, we owned approximately 54,000 acre-feet of LTSCs stored in the Arizona Active Management Area (“AMA”), approximately 44,000 acre-feet of which is in the Roosevelt Water Conservation District (“RWCD”). For the purposes of storing water, the RWCD is part of the Phoenix AMA, which corresponds to the Phoenix metropolitan area. Accordingly, water stored in the AMA may be recovered and used anywhere in the AMA and could have a variety of uses for commercial developments within the Phoenix metropolitan area. All of the storage sites we utilize within the AMA are operated by third parties.

Harquahala Valley Ground Water Basin

Any new residential development in Arizona must obtain a permit from the Arizona Department of Water Resources certifying a “designated assured water supply” sufficient to sustain the development for at least 100 years. Harquahala Valley groundwater meets the designation of assured water supply.

Under Arizona law, the property and water rights in the Harquahala Valley are located in one of three areas in the state from which groundwater may be withdrawn and transferred from a rural area to a metropolitan area. In July 1998, we were granted approval for the transportation of three acre-feet of groundwater per acre of previously irrigated ground, totaling 3,837 acre-feet of groundwater, from Harquahala Valley into the Phoenix-Scottsdale metropolitan area. During 2011, we were granted approval for 9,877 acre-feet of groundwater, which included the prior 3,837 acre-feet awarded.

At December 31, 2017, we own 1,926 acres of land and have the ability to utilize 6,040 acre-feet of groundwater for development within the Harquahala Basin. The Analysis of Adequate Water Supply for the 6,040 acre-feet must be renewed before December 2021 in order to maintain these rights.

In addition, the area in and around the Harquahala Valley appears to be a desirable area to site natural gas fired and solar power-generating plants. The site’s proximity to energy transmission lines and the high solarity in the region are strengths of the location. The water assets we own in this region could potentially provide a water source for energy plants that might be constructed in this area.

6

Lincoln County, Nevada Water Delivery and Teaming Agreement

Lincoln/Vidler entered into a water delivery teaming agreement to locate and develop water resources in Lincoln County, Nevada for planned projects under the County’s master plan. Under the agreement, proceeds from sales of water will be shared equally after Vidler is reimbursed for the expenses incurred in developing water resources in Lincoln County. Lincoln/Vidler has filed applications for more than 100,000 acre-feet of water rights with the intention of supplying water for residential, commercial, and industrial use, as contemplated by the county’s approved master plan. We believe that this is the only known new source of water for Lincoln County. Although it is uncertain, Vidler currently anticipates that over the long-term, up to 40,000 acre-feet of water rights will ultimately be permitted from these applications, and put to use for planned projects in Lincoln County.

Tule Desert Groundwater Basin

Lincoln/Vidler jointly filed permit applications in 1998 for approximately 14,000 acre-feet of water rights for industrial use from the Tule Desert Groundwater Basin in Lincoln County, Nevada. In November 2002, the Nevada State Engineer awarded Lincoln/Vidler a permit for 2,100 acre-feet of water rights, which Lincoln/Vidler subsequently sold in 2005, and ruled that an additional 7,240 acre-feet could be granted pending additional studies by Lincoln/Vidler (the “2002 Ruling”). Subsequent to the 2002 Ruling and consistent with the Nevada State Engineer’s conditions, we completed these additional engineering and scientific studies.

On April 15, 2010, Lincoln/Vidler and the Nevada State Engineer announced that we entered into a Settlement Agreement with respect to litigation between the parties regarding the amount of water to be permitted in the Tule Desert Groundwater Basin. The Settlement Agreement resulted in the granting to Lincoln/Vidler of the original application of 7,240 acre-feet of water rights with an initial 2,900 acre-feet of water rights available for sale or lease by Lincoln/Vidler. The balance of the water rights (4,340 acre-feet) is the subject of staged pumping and development over the next several years to further refine the modeling of the basin and potential impacts, if any, from deep aquifer pumping in the remote, unpopulated desert valley in Lincoln County, Nevada.

The Tule Desert Groundwater Basin water resources were developed by Lincoln/Vidler to support the Lincoln County Recreation, Conservation and Development Act of 2004 (the “Land Act”) and Vidler’s proposed Toquop Power generation project, as discussed below. The water permitted under the Settlement Agreement is anticipated to provide sufficient water resources to support any development of the Toquop Power generation project and a portion of Land Act properties.

Lincoln County Power Plant Project

We developed the Toquop Power project. We are finalizing the required studies and National Environmental Protection Act (“NEPA”) permits for the project. We continue to engage in discussions with potential energy generation partners capable of building a power generation facility in Lincoln County. We own 100% of this power plant project, as it is not part of the Lincoln/Vidler teaming agreement.

7

Kane Springs

In 2005, Lincoln/Vidler agreed to sell water to a developer of Coyote Springs, a new planned residential and commercial development 60 miles north of Las Vegas, as and when supplies were permitted from Lincoln/Vidler’s existing applications in Kane Springs, Nevada. Lincoln/Vidler currently has priority applications for approximately 17,375 acre-feet of water in Kane Springs for which the Nevada State Engineer has requested additional data before making a determination on the applications from this groundwater basin. The actual permits received may be for a lesser quantity, which cannot be accurately predicted.

Currently, we have an option agreement with a developer to sell our remaining 500 acre-feet of water rights we own in this area at a price of $6,358 per acre-foot that is escalated at 7.5% per year from September 2017. The agreement expires in September 2019 and requires an annual option fee of $60,000 to maintain the rights under the option. To date, the developer has made all required annual option payments.

The following table summarizes our other water rights and real estate assets at December 31, 2017:

Name and location of asset | Brief description | Present commercial use | ||

Nevada: | ||||

Truckee River Water Rights | Approximately 299 acre-feet of Truckee River water rights permitted for municipal use. | Water rights are available to support development through sale, lease, or partnering arrangements. | ||

Dry Lake | Vidler owns 595 acres of agricultural and ranch land in Dry Lake Valley North. Lincoln/Vidler owns the 1,009 acre-feet of permitted agricultural groundwater rights associated with the land. Located in Lincoln County. | Water rights and land are available to support development through sale, lease, or partnering arrangements. | ||

Muddy River | 267 acre-feet of water rights. Located 35 miles east of Las Vegas. | Currently leased to farmers in the Muddy River Irrigation Company. | ||

Dodge Flat | 1,428 acre-feet of permitted municipal and industrial use water rights, and 1,068 acres of land. Located in Washoe County, east of Reno. | Water rights and land are currently under contract. In November 2014, we entered into an option agreement with a solar developer for the potential development of a solar power project of up to 180 megawatts. | ||

Colorado: | ||||

Tunnel | Approximately 155 acre-feet of water rights. Located in Summit County (the Colorado Rockies), near Breckenridge. | 59 acre-feet of water leased under long term leases. 96 acre-feet are available for sale or lease. | ||

New Mexico: | ||||

Campbell Ranch | Application for a new appropriation of 350 acre-feet of ground water. Vidler is in partnership with the land owner. The water rights would be used for a new residential and commercial development. Located 25 miles east of Albuquerque. | In November 2014, our application was denied by the New Mexico State Engineer causing us to record an impairment loss of $3.5 million which reduced the capitalized costs and other assets of this project to zero. We appealed this decision on November 19, 2014. | ||

Lower Rio Grande Basin | Approximately 1,215 acre-feet of agricultural water rights. Located in Dona Ana and Sierra Counties. | Water is available for sale, lease or other partnering opportunities. In 2014, we entered into a long term lease for a portion of these water rights. | ||

Middle Rio Grande Basin | Approximately 99 acre-feet of water rights permitted for municipal use. Located in Santa Fe and Bernalillo Counties. | Water is available for sale, lease, or other partnering opportunities. | ||

8

We also own investments in small businesses which have typically been venture capital-type situations.The most significant at December 31, 2017 is Mindjet Inc. (“Mindjet”), which is a privately held company located in San Francisco, California that provides software to help business innovation. The investment is comprised of common and preferred stock and a convertible debt security. The investment is held at cost and included in investments in our consolidated financial statements while the outstanding loan balance is included in other assets. At December 31, 2017, we controlled 19.3% of the voting stock of the company and the carrying value of our total investment in Mindjet was $2.3 million, comprised of $1.3 million in preferred stock and a loan of $1 million.

It is reasonably possible given the volatile nature of the software industry that circumstances may change in the future which could require us to record impairment losses on our investments included in this segment.

Employees

At December 31, 2017, we had 21 employees.

Executive Officers

The executive officers of PICO are:

Name | Age | Position | ||

Maxim C. W. Webb | 56 | President, Chief Executive Officer and Chairman of the Board | ||

John T. Perri | 48 | Chief Financial Officer and Secretary | ||

Mr. Webb has served as our President, Chief Executive Officer, and as a member of our board of directors since October 2016 and as Chairman of the Board of Directors since December 2016. Mr. Webb has been an officer of Vidler Water Company, Inc. since 2001. He has served in various capacities since joining our company in 2001, including Chief Financial Officer, Treasurer, Executive Vice President and Secretary from 2001 to October 2016 and as a director of UCP, Inc. from 2013 to 2017.

Mr. Perri has served as our Chief Financial Officer and Secretary since October 2016. He has served in various capacities since joining our company in 1998, including Vice President, Chief Accounting Officer from 2010 to October 2016, Financial Reporting Manager, Corporate Controller and Vice President, Controller from 2003 to 2010.

9

ITEM 1A. RISK FACTORS

The following information sets out factors that could cause our actual results to differ materially from those contained in forward-looking statements we have made in this Annual Report on Form 10-K and those we may make from time to time. You should carefully consider the following risks, together with other matters described in this Form 10-K or incorporated herein by reference in evaluating our business and prospects. If any of the following risks occurs, our business, financial condition or operating results could be harmed. In such case, the trading price of our securities could decline, in some cases significantly.

* General economic conditions could have a material adverse effect on our financial results, financial condition and the demand for and the fair value of our assets.

Our operations are sensitive to the general economic conditions of the local markets in which are assets are located although international, national, and regional economic conditions may also impact our markets. General poor economic conditions and the resulting effect of non-existent or slow rates of growth in the markets in which we operate could have a material adverse effect on the demand for our water assets. These poor economic conditions include higher unemployment, inflation, deflation, decreases in consumer demand, changes in buying patterns, a weakened dollar, higher consumer debt levels, higher interest rates, especially higher mortgage rates, and higher tax rates and other changes in tax laws or other economic factors that may affect commercial and residential real estate development.

Specifically, high national, regional, or local unemployment may arrest or delay any significant growth of the residential real estate markets in which we operate, which could adversely affect the demand for our water assets. Any prolonged lack of demand for our water assets could have a significant adverse effect on our revenues, results of operations, cash flows, and the return on our investment from these assets.

Our future revenue is uncertain and depends on a number of factors that may make our revenue, profitability, cash flows, and the fair value of our assets volatile.

Our future revenue and profitability related to our water resource and water storage operations will primarily be dependent on our ability to develop and sell or lease our water assets. In light of the fact that our water resource and water storage operations represent the majority of our overall business at present, our long-term profitability and the fair value of the assets related to our water resource and water storage operations could be affected by various factors, including the drought in the southwest, regulatory approvals and permits associated with such assets, transportation arrangements, and changing technology. We may also encounter unforeseen technical or other difficulties which could result in cost increases with respect to our water resource and water storage development projects. Moreover, our profitability and the fair value of the assets related to our water resource and water storage operations is significantly affected by changes in the market price of water. Future sales and prices of water may fluctuate widely as demand is affected by climatic, economic, demographic and technological factors as well as the relative strength of the residential, commercial, financial, and industrial real estate markets. Additionally, to the extent that we possess junior or conditional water rights, during extreme climatic conditions, such as periods of low flow or drought, our water rights could be subordinated to superior water rights holders. The factors described above are not within our control.

One or more of the above factors in one or more of our operating segments could impact our revenue and profitability, negatively affect our financial condition and cash flows, cause our results of operations to be volatile, and could negatively impact our rate of return on our water assets and cause us to divest such assets for less than our intended return on our investment.

10

* A downturn in the homebuilding and land development sectors in our markets would materially adversely affect our business, results of operations, and the demand for and the fair value of our assets.

The homebuilding industry experienced a significant and sustained downturn in recent years having been impacted by factors that include, but are not limited to, weak general economic and employment growth, a lack of consumer confidence, large supplies of resale and foreclosed homes, a significant number of homeowners whose outstanding principal balance on their mortgage loan exceeds the market value of their home, and tight lending standards and practices for mortgage loans that limit consumers’ ability to qualify for mortgage financing to purchase a home. These factors resulted in an industry-wide weakness in demand for new homes and caused a material adverse effect on the growth of the local economies and the homebuilding industry in the southwestern United States (“U.S.”) markets where a substantial amount of our water assets are located, including the states of Nevada, Arizona, Colorado, and New Mexico. The continuation of the recent improvement in residential and commercial real estate development process and activity is essential for our ability to generate operating income in our water resource and water storage business. We are unable to predict whether and to what extent this recovery will continue or its timing. Any future slow-down in real estate and homebuilding activity could adversely impact various development projects within the markets in which our water assets are located and this could materially affect the demand for and the fair value of these assets and our ability to monetize these assets. Declines and weak conditions in the U.S. housing market have reduced our revenues and created losses in our water resource and water storage, and land development and homebuilding businesses in prior years and could do so in the future. Additionally, the recent tax law changes limiting, among other things, deductibility of mortgage interest and of state and local income taxes may have an impact on the national housing market and in the markets in which we operate, although the Nevada market may be less impacted due to the lack of a state income tax.

We may not be able to realize the anticipated value of our water assets in our projected time frame, if at all.

We expect that the current rate of growth of the economy will continue to have an impact on real estate market fundamentals. Depending on how markets perform both in the short and long-term, the state of the economy, both nationally and locally in the markets where our assets are concentrated, could result in a decline in the value of our existing water assets, or result in our having to retain such assets for longer than we initially expected, which would negatively impact our rate of return on our water assets, cause us to divest such assets for less than our intended return on investment, or cause us to incur impairments on the book values of such assets to estimated fair value. Such events would adversely impact our financial condition, results of operations and cash flows.

The fair values of our water assets are linked to growth factors concerning the local markets in which our assets are concentrated and may be impacted by broader economic issues.

Both the demand for, and fair value of, our water assets are significantly affected by the growth in population and the general state of the local economies where our real estate and water assets are located. The local economies where our real estate and water assets are located, primarily in Arizona and northern Nevada, but also in Colorado and New Mexico, may be affected by factors such as the local level of employment, the availability and cost of financing for real estate development transactions, and affordability of housing. The unemployment rate in these states, as well as issues related to the credit markets, may prolong a slowdown of the local economies where our real estate and water assets are located. This could materially and adversely affect the demand for, and the fair value of, our real estate and water assets and, consequently, adversely affect our growth and revenues, results of operations, cash flows and the return on our investment from these assets.

The fair values of our water assets may decrease which could adversely affect our results of operations with losses from asset impairments.

The fair value of our water resource and water storage assets depends on market conditions. We acquired water resources and land for expansion into new markets and for replacement of inventory and expansion within our current markets. The valuation of real estate and water assets is inherently subjective and based on the individual characteristics of each asset. Factors such as changes in regulatory requirements and applicable laws, political conditions, the condition of financial markets, local and national economic conditions, change in efficiencies of water use, the financial condition of customers, potentially adverse tax consequences, and interest and inflation rate fluctuations subject valuations to uncertainties. In addition, our valuations are made on the basis of assumptions that may not prove to reflect economic or demographic reality. If population growth and, as a result, water and/or housing demand in our markets fails to meet our expectations when we acquired our real estate and water assets, our profitability may be adversely affected and we may not be able to recover our costs when we sell our real estate and water assets. We regularly review the value of our water assets. These reviews have resulted in recording significant impairment losses in prior years to our water resource assets. Such impairments have adversely affected our results of operations and our financial condition in those years.

11

If future market conditions adversely impact the anticipated timing of and amount of sales of our water assets we may be required to record further significant impairments to the carrying value of our water assets, which would adversely affect our results of operations and our financial condition.

* The majority of our remaining assets and operations consist of our existing water resource and water storage operations that are concentrated in a limited number of assets and markets, making our cash flows, profitability and the fair value of those assets difficult to predict and vulnerable to conditions and fluctuations in a limited number of local economies.

We anticipate that a significant amount of our water resource and water storage revenue, results of operations and cash flows will come from a limited number of assets, which primarily consist of our water rights in Nevada and our water storage operations in Arizona. Our two most significant assets are our water storage operations in Arizona and our water rights to serve the north valleys area of Reno, Nevada. As a result of this concentration, we expect our invested capital and results of operations will be vulnerable to the conditions and fluctuations in these local economies, along with changes in local and regional government land use, zoning, permitting approvals and other regulatory action.

Our Arizona Recharge Facility is one of the few private sector water storage sites in Arizona. At December 31, 2017, we had approximately 251,000 acre-feet of water stored at the facility. In addition, we had approximately 53,800 acre-feet of water stored in the Phoenix Active Management Area at December 31, 2017. We have not stored any water on behalf of any customers and as of December 31, 2017, had not generated any material revenue from the recharge facility. We cannot be certain that we will ultimately be able to sell all of the stored water at a price sufficient to provide an adequate economic profit, if at all.

We constructed a pipeline approximately 35 miles long to deliver water from Fish Springs Ranch to the north valleys area of Reno, Nevada. As of December 31, 2017, the total cost of the pipeline project, including our water credits (net of impairment losses incurred to date) carried on our balance sheet was approximately $83.9 million. To date, we have sold only a small amount of the water credits and we cannot provide any assurance that the sales prices we may obtain in the future will provide an adequate economic return, if at all. Any prolonged weak demand or lack of permitting approvals for new homes, residential and commercial development, and, as a result, for our assets in Nevada and Arizona, would have a material adverse effect on our future revenues, results of operations, cash flows, and the return on our investment from those assets. Demand for these water credits is anticipated to primarily come from both local and national developers planning to construct new projects in the north valleys area of Reno, Nevada. The success of these projects is dependent on numerous factors beyond our control, including local government approvals, employment growth in the greater Reno area, and the ability of the developers to finance these projects.

We may suffer uninsured losses or suffer material losses in excess of insurance limits.

We could suffer physical damage to any of our assets at one or more of our different businesses and liabilities resulting in losses that may not be fully recoverable by insurance. In addition, certain types of risks, such as personal injury claims, may be, or may become in the future, either uninsurable or not economically insurable, or may not be currently or in the future covered by our insurance policies or otherwise be subject to significant deductibles or limits. Should an uninsured loss or a loss in excess of insured limits occur or be subject to deductibles, we could sustain financial loss or lose capital invested in the affected asset(s) as well as anticipated future income from that asset. In addition, we could be liable to repair damage or meet liabilities caused by risks that are uninsured or subject to deductibles.

We may not receive all of the permitted water rights we expect from the water rights applications we have filed in Nevada and New Mexico.

We have filed certain water rights applications in Nevada and New Mexico. In Nevada this is primarily as part of the water teaming agreement with Lincoln County. We deploy the capital required to enable the filed applications to be converted into permitted water rights over time as and when we deem appropriate or as otherwise required. We only expend capital in those areas where our initial investigations lead us to believe that we can obtain a sufficient volume of water to provide an adequate economic return on the capital employed in the project. These capital expenditures largely consist of drilling and engineering costs for water production, costs of monitoring wells, legal and consulting costs for hearings with the State Engineer, and other compliance costs. Until the State Engineer in the relevant state permits the water rights we are applying for, we cannot provide any assurance that we will be awarded all of the water that we expect based on the results of our drilling and our legal position and it may be a considerable period of time before we are able to ascertain the final volume of water rights, if any, that will be permitted by the State Engineers. Any significant reduction in the volume of water awarded to us from our original base expectation of the amount of water that may be permitted may result in the write down of capitalized costs which could adversely affect the return on our investment from those assets, our revenues, results of operations, and cash flows.

12

Variances in physical availability of water, along with environmental and legal restrictions and legal impediments, could impact profitability.

We value our water assets, in part, based upon the volume (as measured in acre-feet) of water we anticipate from water rights applications and our permitted water rights. The water and water rights held by us and the transferability of these rights to other uses, persons, and places of use are governed by the laws concerning water rights in the states of Arizona, Colorado, Nevada, and New Mexico. The volumes of water actually derived from the water rights applications or permitted rights may vary considerably based upon physical availability and may be further limited by applicable legal restrictions.

As a result, the volume of water anticipated from the water rights applications or permitted rights may not in every case represent a reliable, firm annual yield of water, but in some cases describe the face amount of the water right claims or management’s best estimate of such entitlement. Additionally, we may face legal restrictions on the sale or transfer of some of our water assets, which may affect their commercial value. If the volume of water yielded from our water rights applications is less than our expectations, or we are unable to transfer or sell our water assets, we may lose some or all of our anticipated returns, which may adversely affect our revenues, profitability and cash flows.

Purchasers of our real estate and water assets may default on their obligations to us and adversely affect our results of operations and cash flow.

In certain circumstances, we finance sales of real estate and water assets, and we secure such financing through deeds of trust on the property, which are only released once the financing has been fully paid off. Purchasers of our real estate and water assets may default on their financing obligations. Such defaults may have an adverse effect on our business, financial condition, and the results of operations and cash flows.

Our sale of water assets may be subject to environmental regulations which would impact our revenues, profitability, and cash flows.

The quality of the water assets we lease or sell may be subject to regulation by the United States Environmental Protection Agency acting pursuant to the United States Safe Drinking Water Act along with other federal, state and local regulations. While environmental regulations may not directly affect us, the regulations regarding the quality of water distributed affects our intended customers and may, therefore, depending on the quality of our water, impact the price and terms upon which we may in the future sell our water assets. If we need to reduce the price of our water assets in order to make a sale to our intended customers, our balance sheet, return on investment, results of operations and financial condition could suffer.

Our water assets may be impacted by legal and political opposition in certain locations.

The water assets we hold and the transferability of these assets and rights to other uses, persons, or places of use are governed by the laws and regulations concerning water rights in the states of Arizona, Nevada, Colorado and New Mexico and may be directly or indirectly affected by other federal, state and local laws and regulations related to water and land use. Our development and sale of water assets is subject to the risks of delay associated with receiving all necessary regulatory approvals and permits. Additionally, the transfer of water resources from one use to another may affect the economic base or impact other issues of a community including development, and will, in some instances, be met with local opposition. Moreover, municipalities who will likely regulate the use of any water we might sell to them in order to manage growth could create additional requirements that we must satisfy to sell and convey water assets.

If we are unable to effectively transfer, sell and convey water resources, our ability to monetize these assets will suffer and our return on investment, revenues and financial condition would decline.

If our businesses or investments otherwise fail or decline in value, our financial condition and the return on our investment could suffer.

Historically, we have acquired and invested in businesses and assets that we believed were undervalued or that would benefit from additional capital, restructuring of operations, strategic initiatives, or improved competitiveness through operational efficiencies. If any previously acquired business, investment or asset fails or its fair value declines, we could experience a material adverse effect on our business, financial condition, the results of operations and cash flows. If we are not successful managing our previous acquisitions and investments, our business, financial condition, results of operations and cash flows could be materially affected. Such business failures, declines in fair values, and/or failure to manage acquisitions or investments, could result in a negative return on equity. We could also lose part or all of our capital in these businesses and experience reductions in our net income, cash flows, assets and equity.

13

Future dispositions of our businesses, assets, operations and investments, if unsuccessful, could reduce the value of our common shares. Any future dispositions may result in significant changes in the composition of our assets and liabilities. Consequently, our financial condition, results of operations and the trading price of our common shares may be affected by factors different from those historically affecting our financial condition, results of operations and trading price at the present time.

* We may need additional capital in the future to fund our business and financing may not be available on favorable terms, if at all, or without dilution to our shareholders.

We currently anticipate that our available capital resources and operating cash flows will be sufficient to meet our expected working capital and capital expenditure requirements for at least the next 12 months. However, we cannot provide any assurance that such resources will be sufficient to fund our business. We may raise additional funds through public or private debt, equity or hybrid securities financings, including, without limitation, through the issuance of securities.

We may experience difficulty in raising necessary capital in view of the recent volatility in the capital markets and increases in the cost of finance, especially for a small capitalization company like ours. Increasingly stringent rating standards could make it more difficult for us to obtain financing. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our shareholders could be significantly diluted, and these newly issued securities may have rights, preferences or privileges senior to those of existing shareholders. Indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. The additional financing we may need may not be available to us, or on favorable terms. If adequate funds are not available or are not available on acceptable terms, if and when needed, our ability to fund our operations or otherwise execute our strategic plan would be significantly limited. In any such case, our business, operating results or financial condition could be materially adversely affected.

* Our ability to utilize net operating loss carryforwards and certain other tax attributes may be limited.

Under Section 382 of the Internal Revenue Code of 1986, as amended, if our Company undergoes an “ownership change” (generally defined as a greater than 50% change (by value) in our equity ownership over a three year period), the ability to use our pre-change net operating loss carryforwards and other pre-change tax attributes to offset our post-change income may be limited. Notwithstanding our adoption of a tax benefit preservation plan which is subject to ratification by our shareholders at our 2018 annual meeting, it is possible that we could experience ownership changes in the future as a result of shifts in our stock ownership. As of December 31, 2017, we had federal and state net operating loss carryforwards of approximately $185.5 million and $174.7 million, respectively, which, depending on our value at the time of any ownership changes, could be limited.

We may not be able to retain key management personnel we need to succeed, which could adversely affect our ability to successfully operate our businesses.

To run our day-to-day operations and to successfully manage our businesses we must, among other things, continue to retain key management. We rely on the services of a small team of key executive officers. If they depart, it could have a significant adverse effect upon our business. Also, increased competition for skilled management and staff employees in our businesses could cause us to experience significant increases in operating costs and reduced profitability.

Analysts and investors may not be able to evaluate us adequately, which may negatively influence the price of our stock.

We own assets that are unique, complex in nature, and difficult to understand. In particular, our water resource business is a developing industry in the United States with very little historical and comparable data, very complex valuation issues and a limited following of analysts. Because our assets are unique, analysts and investors may not be able to adequately evaluate our operations and enterprise as a going concern. This could cause analysts and investors to make inaccurate evaluations of our stock, or to overlook PICO in general. As a result, the trading volume and price of our stock could suffer and may be subject to excessive volatility.

14

Fluctuations in the market price of our common stock may affect your ability to sell your shares.

The trading price of our common stock has historically been, and we expect will continue to be, subject to fluctuations. The market price of our common stock may be significantly impacted by:

• | quarterly variations in financial performance and condition of our various businesses; |

• | shortfalls in revenue or earnings from estimates forecast by securities analysts or others; |

• | changes in estimates by such analysts; |

• | the ability to monetize our water assets for an adequate economic return, including the length of time any such monetization may take; |

• | our competitors’ announcements of extraordinary events such as acquisitions; |

• | litigation; and |

• | general economic conditions and other matters described herein. |

Our results of operations have been subject to significant fluctuations, particularly on a quarterly basis, and our future results of operations could fluctuate significantly from quarter to quarter and from year to year. Causes of such fluctuations may include one time transactions, and impairment losses. Statements or changes in opinions, ratings, or earnings estimates made by brokerage firms or industry analysts relating to the markets in which we do business or relating to us specifically could result in an immediate and adverse effect on the market price of our common stock. Such fluctuations in the market price of our common stock could affect the value of your investment and your ability to sell your shares.

Litigation may harm our business or otherwise distract our management.

Substantial, complex or extended litigation could cause us to incur large expenditures and distract our management. For example, lawsuits by employees, shareholders or customers could be very costly and substantially disrupt our business. Additionally, from time to time we or our subsidiaries will have disputes with companies or individuals which may result in litigation that could necessitate our management’s attention and require us to expend our resources. We may be unable to accurately assess our level of exposure to specific litigation and we cannot provide any assurance that we will always be able to resolve such disputes out of court or on terms favorable to us. We may be forced to resolve litigation in a manner not favorable to us, and such resolution could have a material adverse impact on our consolidated financial condition or results of operations.

* We have been the subject of shareholder activism efforts that could cause a material disruption to our business.

In the past, certain investors took steps to involve themselves in the governance and strategic direction of our Company due to governance and strategic-related disagreements with us. While we have formally settled with certain of such activists, other investors could take steps to involve themselves in the governance and strategic direction of our Company. Such shareholder activism efforts could result in substantial costs and diversion of management’s attention and resources, harming our business and adversely affecting the market price of our common stock.

Anti-takeover provisions in our charter documents and under Delaware law may make an acquisition of us more complicated and the removal and replacement of our directors and management more difficult.

Provisions of our certificate of incorporation and bylaws, as well as provisions of Delaware law, could make it more difficult for a third party to acquire us, even if doing so would benefit our stockholders. These provisions may also make it difficult for stockholders to remove and replace our board of directors and management. For example, these provisions limit who may call a special meeting of stockholders and establish advance notice requirements for nominations for election to the board of directors or for proposing matters that can be acted upon at stockholder meetings. In addition, on July 24, 2017, our board of directors adopted a tax benefits preservation plan designed to preserve our ability to utilize our net operating losses as a result of certain stock ownership changes, which may have the effect of discouraging transactions involving an actual or potential change in our ownership.

If equity analysts do not publish research or reports about our business or if they issue unfavorable commentary or downgrade our common stock, the price of our common stock could decline.

The trading market for our common stock will rely in part on the research and reports that equity research analysts may publish about us and our business. We do not control these analysts. The price of our stock could decline if one or more equity analysts downgrade our stock or if those analysts issue other unfavorable commentary or cease publishing reports about us or our business.

15

Our business could be negatively impacted by cyber security threats.

In the ordinary course of our business, we use our data centers and our networks to store and access our proprietary business information. We face various cyber security threats, including cyber security attacks to our information technology infrastructure and attempts by others to gain access to our proprietary or sensitive information. The procedures and controls we use to monitor these threats and mitigate our exposure may not be sufficient to prevent cyber security incidents. The result of these incidents could include disrupted operations, lost opportunities, misstated financial data, liability for stolen assets or information, increased costs arising from the implementation of additional security protective measures, litigation and reputational damage. Any remedial costs or other liabilities related to cyber security incidents may not be fully insured or indemnified by other means.

THE FOREGOING FACTORS, INDIVIDUALLY OR IN AGGREGATE, COULD MATERIALLY ADVERSELY AFFECT OUR OPERATING RESULTS AND CASH FLOWS AND FINANCIAL CONDITION AND COULD MAKE COMPARISON OF HISTORICAL FINANCIAL STATEMENTS, INCLUDING RESULTS OF OPERATIONS AND CASH FLOWS AND BALANCES, DIFFICULT OR NOT MEANINGFUL.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We lease office space in La Jolla, California where our principal executive office is located, and office space in Carson City, Nevada. We continually evaluate our current and future space capacity in relation to our business needs. We believe that our existing office space is adequate to meet our current business requirements and that suitable replacement and additional space will be available in the future on commercially reasonable terms.

We have significant holdings of real estate and water assets in the southwestern United States as described in“Item 1 - Business.”

ITEM 3. LEGAL PROCEEDINGS

Neither we nor our subsidiaries are parties to any potentially material pending legal proceedings.

We are subject to various litigation matters that arise in the ordinary course of our business. Based upon information presently available, management is of the opinion that resolution of such litigation will not likely have a material effect on our consolidated financial position, results of operations, or cash flows. Because litigation is inherently unpredictable and unfavorable resolutions could occur, assessing contingencies is highly subjective and requires judgments about future events. When evaluating contingencies, we may be unable to provide a meaningful estimate due to a number of factors, including the procedural status of the matter in question, the presence of complex or novel legal theories, and/or the ongoing discovery and development of information important to the matters. In addition, damage amounts claimed in litigation against us may be unsupported, exaggerated or unrelated to possible outcomes, and as such are not meaningful indicators of our potential liability. We regularly review contingencies to determine the adequacy of our accruals and related disclosures. The amount of ultimate loss may differ from these estimates, and it is possible that cash flows or results of operations could be materially affected in any particular period by the unfavorable resolution of one or more of these contingencies. Whether any losses finally determined in any claim, action, investigation or proceeding could reasonably have a material effect on our business, financial condition, results of operations or cash flows will depend on a number of variables, including: the timing and amount of such losses; the structure and type of any remedies; the significance of the impact any such losses, damages or remedies may have on our consolidated financial statements; and the unique facts and circumstances of the particular matter that may give rise to additional factors.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

16

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the NASDAQ Global Select Market under the symbol “PICO.” The following table sets out the quarterly high and low sales prices for the past two years as reported on the NASDAQ Global Select Market. These reported prices reflect inter-dealer prices, without adjustments for retail markups, markdowns, or commissions.

2017 | 2016 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 15.74 | $ | 13.05 | $ | 11.03 | $ | 7.82 | |||||||

Second Quarter | $ | 17.95 | $ | 13.35 | $ | 10.72 | $ | 8.47 | |||||||

Third Quarter | $ | 17.60 | $ | 16.05 | $ | 11.92 | $ | 9.35 | |||||||

Fourth Quarter(1) | $ | 20.20 | $ | 12.30 | $ | 16.20 | $ | 10.51 | |||||||

(1)The lowest stock price during the fourth quarter reflected the $5.00 per share special dividend paid to shareholders on November 21, 2017, while prior periods prices have not been adjusted to reflect the special dividend.

Any future decision to pay dividends on our common stock will be at the discretion of our board of directors and will depend upon, among other factors, our ability to monetize assets, our results of operations, financial condition, capital requirements, and other factors our board of directors may deem relevant.

On February 20, 2018, the closing sale price of our common stock was $12.40 and there were approximately 375 holders of record.

17

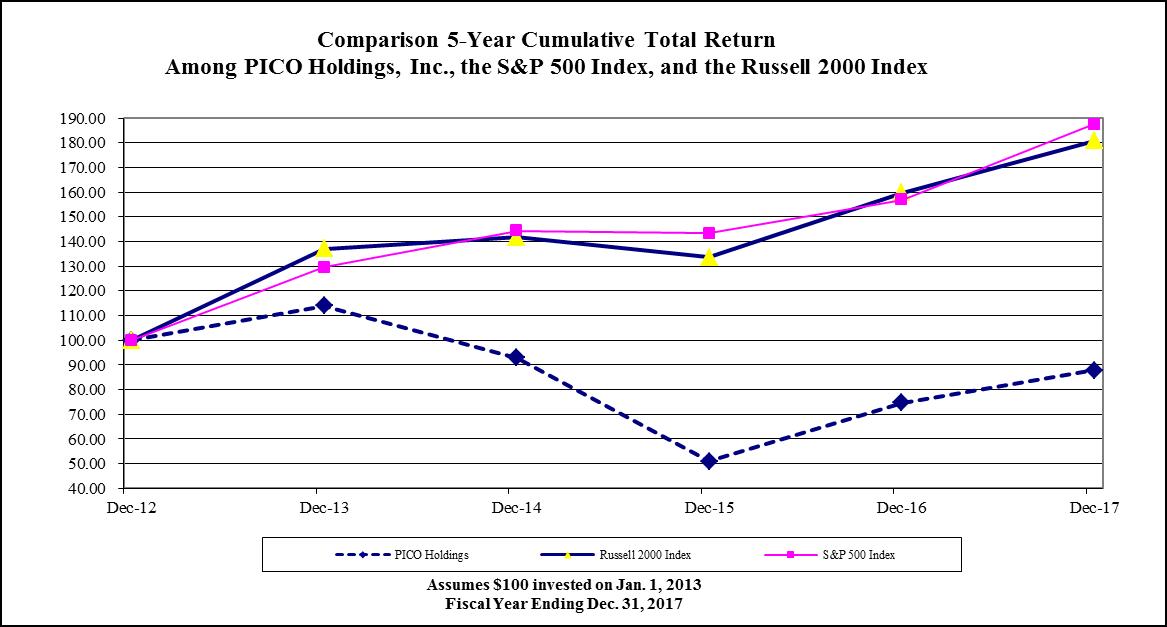

Company Stock Performance Graph

This graph compares the total return on an indexed basis of a $100 investment in PICO common stock, the Standard & Poor’s 500 Index, and the Russell 2000 Index. The measurement points utilized in the graph consist of the last trading day in each calendar year, which closely approximates the last day of our fiscal year in that calendar year.

The stock price performance shown on the graph is not necessarily indicative of future price performance. Additionally, the graph assumes that the $5.00 per share cash dividend paid to shareholders during the fourth quarter of 2017 was reinvested in PICO stock.

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total number of shares purchased | Average Price Paid per Share | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs (1) | |||||||

10/1/2017 - 10/31/17 | — | — | 47,450 | $ | 49,310 | ||||||

11/1/2017 - 11/30/17 | — | — | 47,450 | $ | 49,310 | ||||||

12/1/2017 - 12/31/17 | — | — | 47,450 | $ | 49,310 | ||||||

(1) The stock repurchase program was announced on March 2, 2017. Our Board of Directors authorized up to $50 million to be used under this program and there is no set expiration date.

18

ITEM 6. SELECTED FINANCIAL DATA

The following table presents our selected consolidated financial data. The information set forth below is not necessarily indicative of the results of future operations and should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included elsewhere in this document.

Year Ended December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Operating Results | (In thousands, except per share data) | ||||||||||||||||||

Revenues and other income: | |||||||||||||||||||

Sale of real estate and water assets | $ | 26,388 | $ | 633 | $ | 3,856 | $ | 1,220 | $ | 24,050 | |||||||||

Sale of software | 13,649 | ||||||||||||||||||

Impairment loss on investment in unconsolidated affiliate | (2,170 | ) | (20,696 | ) | (1,078 | ) | |||||||||||||

Other income | 9,888 | 9,471 | 4,472 | 1,077 | 29,435 | ||||||||||||||

Total revenues and other income (loss) | $ | 36,276 | $ | 7,934 | $ | (12,368 | ) | $ | 1,219 | $ | 67,134 | ||||||||

Income (loss) from continuing operations | $ | 7,259 | $ | (25,153 | ) | $ | (37,841 | ) | $ | (35,905 | ) | $ | (1,778 | ) | |||||

Net income (loss) from discontinued operations, net of tax | (5,645 | ) | 12,124 | (43,038 | ) | (23,700 | ) | (27,418 | ) | ||||||||||

Net (income) loss attributable to noncontrolling interests | (1,150 | ) | (8,836 | ) | (979 | ) | 7,180 | 6,896 | |||||||||||

Net loss attributable to PICO Holdings, Inc. | $ | 464 | $ | (21,865 | ) | $ | (81,858 | ) | $ | (52,425 | ) | $ | (22,300 | ) | |||||

Net loss per common share – basic and diluted: | |||||||||||||||||||

Income (loss) from continuing operations | $ | 0.31 | $ | (1.09 | ) | $ | (1.64 | ) | $ | (1.34 | ) | $ | 0.10 | ||||||

Income (loss) from discontinued operations | (0.29 | ) | $ | 0.14 | $ | (1.92 | ) | $ | (0.96 | ) | $ | (1.08 | ) | ||||||

Net loss per common share – basic and diluted | $ | 0.02 | $ | (0.95 | ) | $ | (3.56 | ) | $ | (2.30 | ) | $ | (0.98 | ) | |||||

Weighted average shares outstanding – basic and diluted | 23,122 | 23,054 | 23,014 | 22,802 | 22,742 | ||||||||||||||

As of December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Financial Condition | (In thousands, except per share data) | ||||||||||||||||||

Total assets (1) | $214,402 | $235,105 | $233,279 | $271,177 | $335,055 | ||||||||||||||

Net assets of discontinued operations | $ | 233,123 | $ | 231,352 | $ | 272,675 | $ | 284,762 | |||||||||||

Total liabilities (1) | $ | 7,239 | $ | 40,659 | $ | 30,627 | $ | 32,307 | $ | 54,974 | |||||||||

Total PICO Holdings, Inc. shareholders’ equity | $ | 207,163 | $ | 327,994 | $ | 346,412 | $ | 425,481 | $ | 472,889 | |||||||||

Book value per share (2) | $ | 8.95 | $ | 14.22 | $ | 15.04 | $ | 18.50 | $ | 20.79 | |||||||||

(1) Excludes balances classified as discontinued operations.

(2) Book value per share is computed by dividing total PICO Holdings, Inc. shareholders’ equity by the net of total shares issued less shares held as treasury shares. At December 31, 2017, book value per share reflected the $5.00 per share cash special dividend paid to shareholders during 2017.

19

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

INTRODUCTION

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand our Company. The MD&A should be read in conjunction with our consolidated financial statements and the accompanying notes, presented later in this Annual Report on Form 10-K. The MD&A includes the following sections:

• | Company Summary, Recent Developments, and Future Outlook — a brief description of our operations, the critical factors affecting them, and their future prospects; |

• | Critical Accounting Policies, Estimates and Judgments — a discussion of accounting policies which require critical judgments and estimates. Our significant accounting policies, including the critical accounting policies discussed in this section, are summarized in the notes to the consolidated financial statements; |

• | Results of Operations — an analysis of our consolidated results of operations for the past three years, presented in our consolidated financial statements; and |

• | Liquidity and Capital Resources — an analysis of cash flows, sources and uses of cash, contractual obligations and a discussion of factors affecting our future cash flow. |

COMPANY SUMMARY, RECENT DEVELOPMENTS, AND FUTURE OUTLOOK

Recent Developments:

Northern Nevada

The majority of our water resource assets is located in northern Nevada at FSR and our Carson / Lyon project. FSR’s water credits are able to provide a sustainable water supply in the North Valleys region of Reno, Washoe County, Nevada and the Carson / Lyon water rights are able to provide a sustainable water supply in Lyon County, Nevada. As a result, we are dependent on new residential or commercial development occurring in these regions in order for us to monetize our water resources in northern Nevada. In turn, new development in these regions is highly dependent on the continued robust economic and job growth that is occurring in northern Nevada.

The economic development in the greater Reno region has been concentrated in the Tahoe Reno Industrial Center business park (“TRIC”) which is a 107,000 acre industrial park proximate to Interstate 80 and 15 miles east of Reno, Nevada. Tesla Motors, Inc. (“Tesla”) built its Gigafactory facility in this business park with initial estimates that 6,500 jobs would be created by the Gigafactory project. Currently, the forecast is that more than 10,000 jobs will be created by the project. Many other technology companies have also moved to the area including Apple, Google, Jet.com, and Switch.