Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Vectrus, Inc. | vec-12312017x8xk991.htm |

| 8-K - 8-K - Vectrus, Inc. | vec-12312017x8xk.htm |

VECTRUS

FOURTH QUARTER 2017 RESULTS

AND ISSUANCE OF 2018 GUIDANCE

CHUCK PROW

PRESIDENT AND CHIEF EXECUTIVE OFFICER

MATT KLEIN

SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

MARCH 1, 2018

SAFE HARBOR STATEMENT

Page 2

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 (THE "ACT"): CERTAIN MATERIAL PRESENTED

HEREIN INCLUDES FORWARD-LOOKING STATEMENTS INTENDED TO QUALIFY FOR THE SAFE HARBOR FROM LIABILITY ESTABLISHED BY THE ACT.

THESE FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS IN 2018 GUIDANCE ABOUT OUR REVENUE,

OPERATING MARGIN, NET INCOME, EPS AND NET CASH PROVIDED BY OPERATING ACTIVITIES FOR 2018 AND OTHER ASSUMPTIONS CONTAINED

THEREIN FOR PURPOSES OF SUCH GUIDANCE, OUR NEW CREDIT FACILITY, DEBT PAYMENTS, EXPENSE SAVINGS, CONTRACT OPPORTUNITIES,

BIDS AND AWARDS, COLLECTIONS, BUSINESS STRATEGY, OUTLOOK, OBJECTIVES, PLANS, INTENTIONS OR GOALS, AND ANY DISCUSSION OF

FUTURE OPERATING OR FINANCIAL PERFORMANCE. WHENEVER USED, WORDS SUCH AS "MAY," "WILL," "LIKELY," "ANTICIPATE," "ESTIMATE,"

"EXPECT," "PROJECT," "INTEND," "PLAN," "BELIEVE," "TARGET," "COULD," "POTENTIAL,” “ARE CONSIDERING,” "CONTINUE," OR SIMILAR

TERMINOLOGY ARE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR

MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES

OF FUTURE PERFORMANCE AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM THE RESULTS CONTEMPLATED BY THE FORWARD-LOOKING STATEMENTS, OUR HISTORICAL EXPERIENCE AND OUR PRESENT

EXPECTATIONS OR PROJECTIONS. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO: OUR DEPENDENCE ON A FEW LARGE

CONTRACTS FOR A SIGNIFICANT PORTION OF OUR REVENUE; COMPETITION IN OUR INDUSTRY; OUR DEPENDENCE ON THE U.S. GOVERNMENT

AND THE IMPORTANCE OF OUR MAINTAINING A GOOD RELATIONSHIP WITH THE U.S. GOVERNMENT; OUR ABILITY TO SUBMIT PROPOSALS FOR

AND/OR WIN POTENTIAL OPPORTUNITIES IN OUR PIPELINE; OUR ABILITY TO RETAIN AND RENEW OUR EXISTING CONTRACTS; PROTESTS OF NEW

AWARDS; ANY ACQUISITIONS, INVESTMENTS OR JOINT VENTURES, INCLUDING THE INTEGRATION OF SENTEL CORPORATION INTO OUR

BUSINESS; OUR INTERNATIONAL OPERATIONS, INCLUDING THE ECONOMIC, POLITICAL AND SOCIAL CONDITIONS IN THE COUNTRIES IN WHICH

WE CONDUCT OUR BUSINESSES; CHANGES IN U.S. GOVERNMENT MILITARY OPERATIONS, INCLUDING ITS OPERATIONS IN AFGHANISTAN;

CHANGES IN, OR DELAYS IN THE COMPLETION OF, U.S. OR INTERNATIONAL GOVERNMENT BUDGETS; GOVERNMENT REGULATIONS AND

COMPLIANCE THEREWITH, INCLUDING CHANGES TO THE DEPARTMENT OF DEFENSE PROCUREMENT PROCESS; CHANGES IN TECHNOLOGY;

INTELLECTUAL PROPERTY MATTERS; GOVERNMENTAL INVESTIGATIONS, REVIEWS, AUDITS AND COST ADJUSTMENTS; CONTINGENCIES

RELATED TO ACTUAL OR ALLEGED ENVIRONMENTAL CONTAMINATION, CLAIMS AND CONCERNS; OUR SUCCESS IN EXPANDING OUR

GEOGRAPHIC FOOTPRINT OR BROADENING OUR CUSTOMER BASE, MARKETS AND CAPABILITIES; OUR ABILITY TO REALIZE THE FULL AMOUNTS

REFLECTED IN OUR BACKLOG; IMPAIRMENT OF GOODWILL; OUR PERFORMANCE OF OUR CONTRACTS AND OUR ABILITY TO CONTROL COSTS;

OUR LEVEL OF INDEBTEDNESS; OUR COMPLIANCE WITH THE TERMS OF OUR CREDIT AGREEMENT; SUBCONTRACTOR AND EMPLOYEE

PERFORMANCE AND CONDUCT; OUR TEAMING ARRANGEMENTS WITH OTHER CONTRACTORS; ECONOMIC AND CAPITAL MARKETS CONDITIONS;

OUR ABILITY TO RETAIN AND RECRUIT QUALIFIED PERSONNEL; OUR MAINTENANCE OF SAFE WORK SITES AND EQUIPMENT; OUR COMPLIANCE

WITH APPLICABLE ENVIRONMENTAL, HEALTH AND SAFETY REGULATIONS; OUR ABILITY TO MAINTAIN REQUIRED SECURITY CLEARANCES; ANY

DISPUTES WITH LABOR UNIONS; COSTS OF OUTCOME OF ANY LEGAL PROCEEDINGS; SECURITY BREACHES AND OTHER DISRUPTIONS TO OUR

INFORMATION TECHNOLOGY AND OPERATIONS; CHANGES IN OUR TAX PROVISIONS INCLUDING UNDER THE TAX CUTS AND JOBS ACT, OR

EXPOSURE TO ADDITIONAL INCOME TAX LIABILITIES; CHANGES IN U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES; ACCOUNTING

ESTIMATES MADE IN CONNECTION WITH OUR CONTRACTS; OUR EXPOSURE TO INTEREST RATE RISK; OUR COMPLIANCE WITH PUBLIC COMPANY

ACCOUNTING AND FINANCIAL REPORTING REQUIREMENTS; TIMING OF PAYMENTS BY THE U.S. GOVERNMENT; RISKS AND UNCERTAINTIES

RELATING TO THE SPIN-OFF FROM OUR FORMER PARENT; AND OTHER FACTORS SET FORTH IN PART I, ITEM 1A, – “RISK FACTORS,” AND

ELSEWHERE IN OUR 2017 ANNUAL REPORT ON FORM 10-K AND DESCRIBED FROM TIME TO TIME IN OUR FUTURE REPORTS FILED WITH THE

SECURITIES AND EXCHANGE COMMISSION. WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A

RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW.

Q4 & FULL-YEAR 2017 HIGHLIGHTS

Page 3

• Q4 2017 financial results

o Revenue of $296 million, up $8 million or 2.6%

o Operating margin of 3.5%

o Diluted EPS of $3.70; adjusted diluted EPS 1 $0.57

• Full-year 2017 financial results

o Revenue of $1,115 million, down $76 million or 6.4%

o Operating margin of 3.7%

o Diluted EPS of $5.31; adjusted diluted EPS 1 $2.17

o Net cash provided by operating activities of $35.4 million

• Developed and began the execution of our strategy to become a leader in the

converged infrastructure market

• Added several new leaders to position Vectrus for future growth

• Negotiated and closed new and expanded credit facility

• Increased backlog 24% to $2.9 billion

• Successfully phased-in several multi-year contracts of approximately $1.4 billion

(1) See appendix for reconciliation of non-GAAP measure. Change in deferred tax liability related to Tax Cuts and Jobs Act.

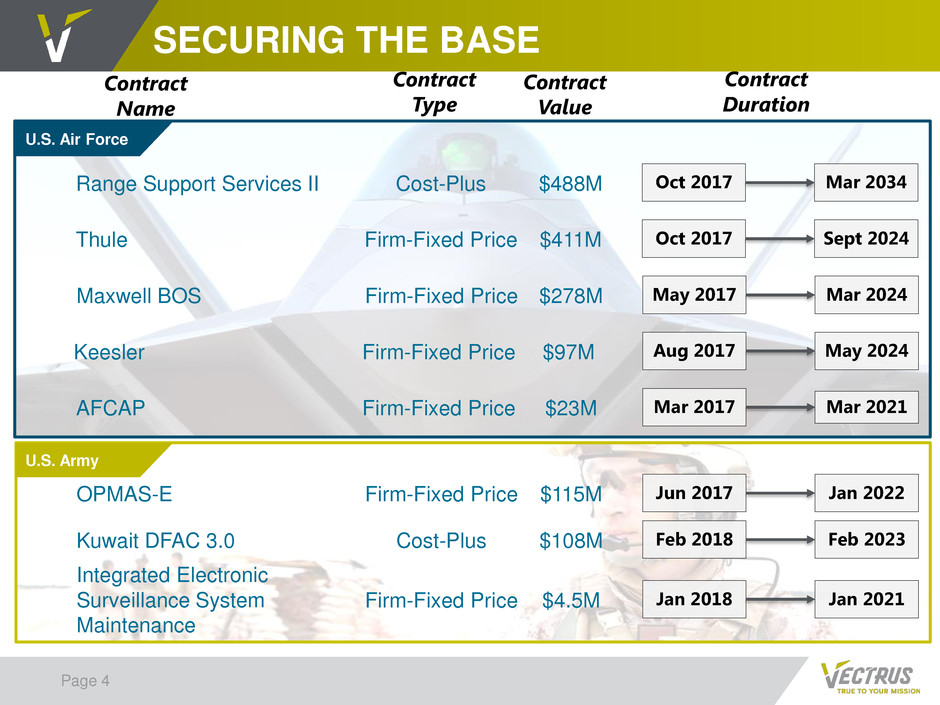

U.S. Air Force

SECURING THE BASE

Page 4

Contract

Name

Contract

Type

Contract

Value

Contract

Duration

Maxwell BOS Firm-Fixed Price $278M May 2017 Mar 2024

Keesler Firm-Fixed Price $97M Aug 2017 May 2024

AFCAP Firm-Fixed Price $23M Mar 2017 Mar 2021

OPMAS-E Firm-Fixed Price $115M Jun 2017 Jan 2022

Kuwait DFAC 3.0 Cost-Plus $108M Feb 2018 Feb 2023

Integrated Electronic

Surveillance System

Maintenance

Firm-Fixed Price $4.5M Jan 2018 Jan 2021

Thule Firm-Fixed Price $411M Oct 2017 Sept 2024

U.S. Army

Range Support Services II Cost-Plus $488M Oct 2017 Mar 2034

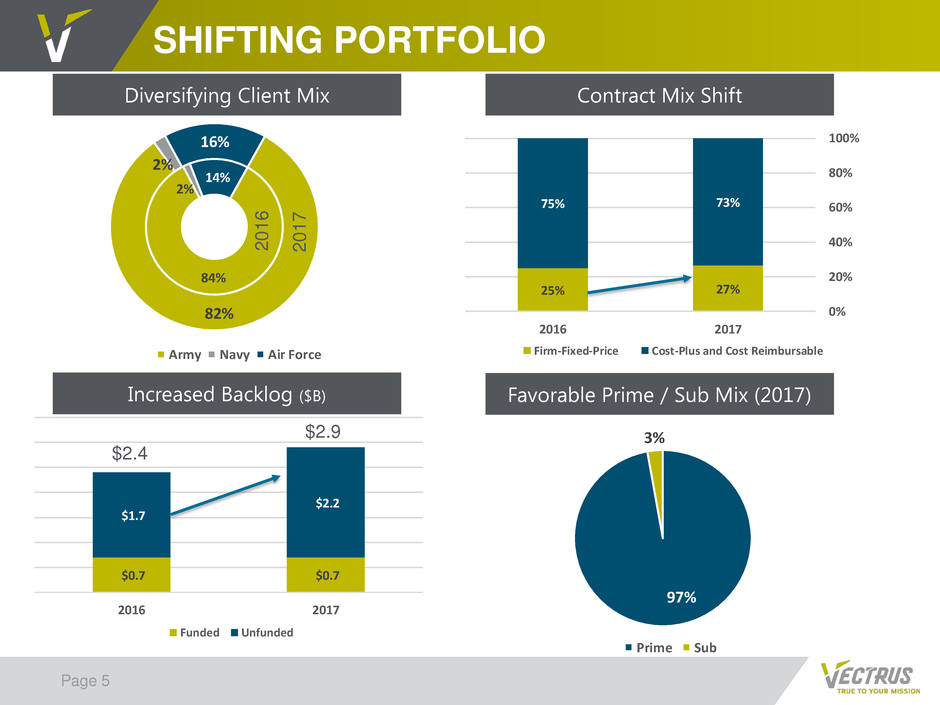

27%25%

73%75%

0%

20%

40%

60%

80%

100%

20172016

Firm-Fixed-Price Cost-Plus and Cost Reimbursable

84%

2%

14%

82%

2%

16%

Army Navy Air Force

$0.7 $0.7

$2.2

$1.7

20172016

Funded Unfunded

SHIFTING PORTFOLIO

Page 5

Contract Mix ShiftDiversifying Client Mix

Increased Backlog ($B) Favorable Prime / Sub Mix (2017)

97%

3%

Prime Sub

2

0

1

7

2

0

1

6

$2.4

$2.9

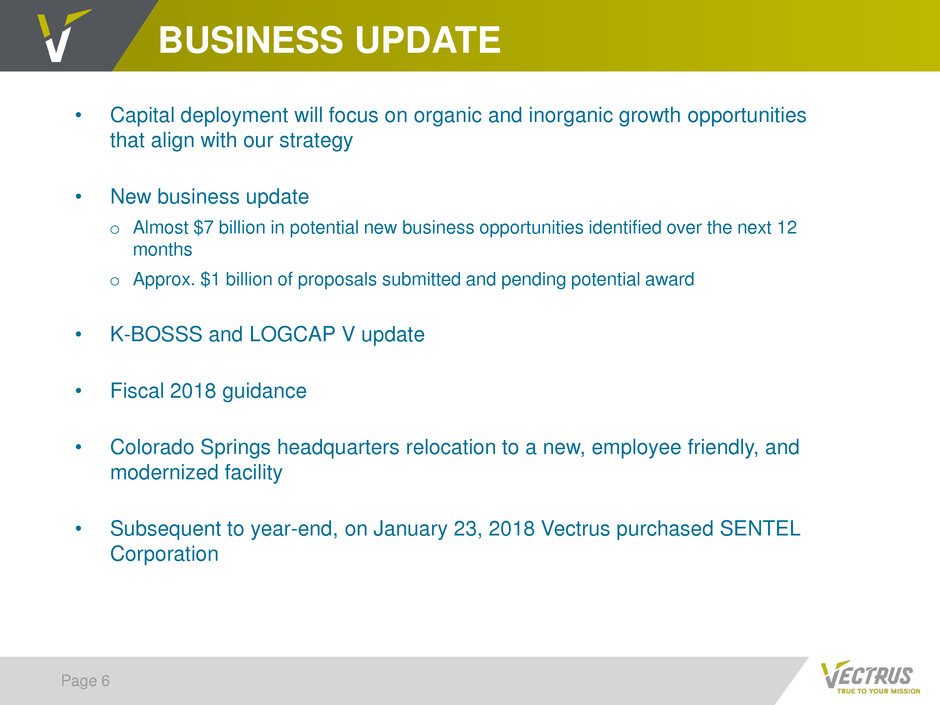

BUSINESS UPDATE

Page 6

• Capital deployment will focus on organic and inorganic growth opportunities

that align with our strategy

• New business update

o Almost $7 billion in potential new business opportunities identified over the next 12

months

o Approx. $1 billion of proposals submitted and pending potential award

• K-BOSSS and LOGCAP V update

• Fiscal 2018 guidance

• Colorado Springs headquarters relocation to a new, employee friendly, and

modernized facility

• Subsequent to year-end, on January 23, 2018 Vectrus purchased SENTEL

Corporation

SENTEL CAPABILITIES

Page 7

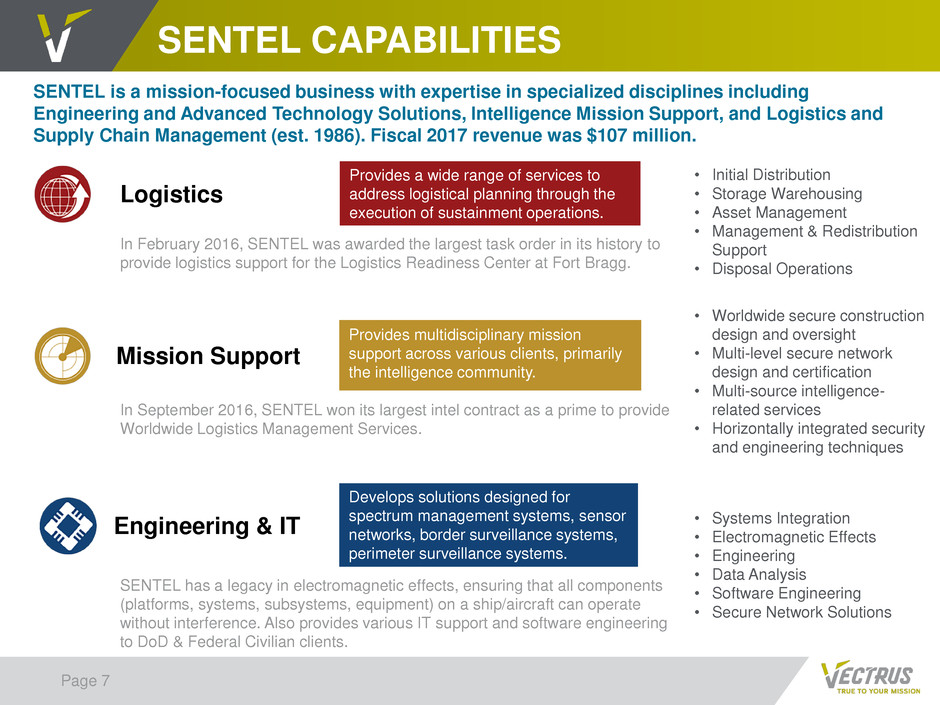

SENTEL is a mission-focused business with expertise in specialized disciplines including

Engineering and Advanced Technology Solutions, Intelligence Mission Support, and Logistics and

Supply Chain Management (est. 1986). Fiscal 2017 revenue was $107 million.

• Worldwide secure construction

design and oversight

• Multi-level secure network

design and certification

• Multi-source intelligence-

related services

• Horizontally integrated security

and engineering techniques

Mission Support

Provides multidisciplinary mission

support across various clients, primarily

the intelligence community.

In September 2016, SENTEL won its largest intel contract as a prime to provide

Worldwide Logistics Management Services.

• Systems Integration

• Electromagnetic Effects

• Engineering

• Data Analysis

• Software Engineering

• Secure Network Solutions

Develops solutions designed for

spectrum management systems, sensor

networks, border surveillance systems,

perimeter surveillance systems.

Engineering & IT

SENTEL has a legacy in electromagnetic effects, ensuring that all components

(platforms, systems, subsystems, equipment) on a ship/aircraft can operate

without interference. Also provides various IT support and software engineering

to DoD & Federal Civilian clients.

• Initial Distribution

• Storage Warehousing

• Asset Management

• Management & Redistribution

Support

• Disposal Operations

Logistics

Provides a wide range of services to

address logistical planning through the

execution of sustainment operations.

In February 2016, SENTEL was awarded the largest task order in its history to

provide logistics support for the Logistics Readiness Center at Fort Bragg.

Page 8

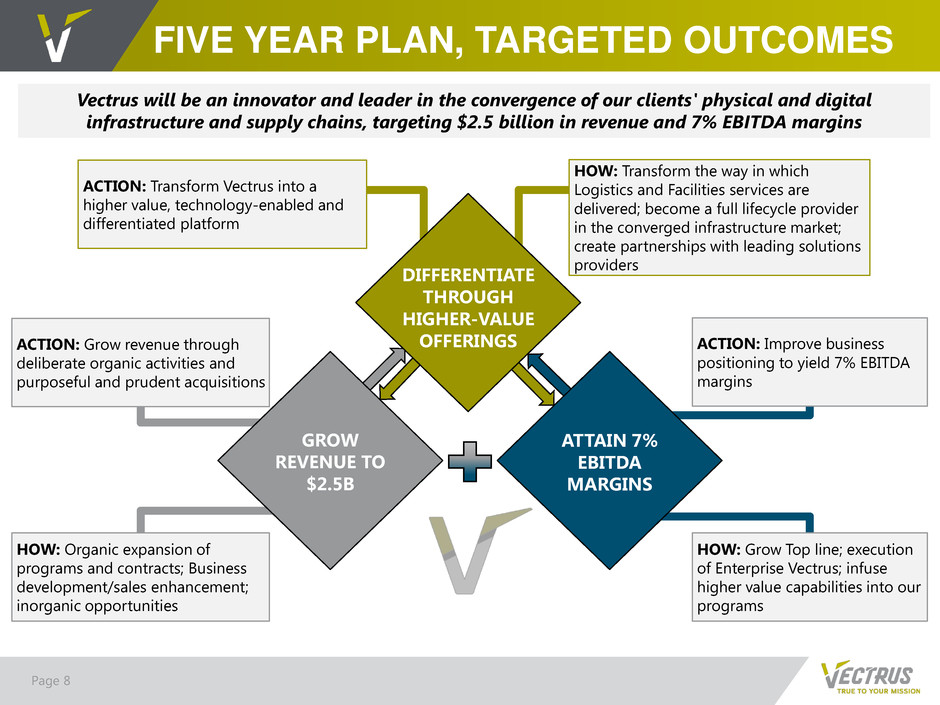

DIFFERENTIATE

THROUGH

HIGHER-VALUE

OFFERINGS

ATTAIN 7%

EBITDA

MARGINS

GROW

REVENUE TO

$2.5B

HOW: Transform the way in which

Logistics and Facilities services are

delivered; become a full lifecycle provider

in the converged infrastructure market;

create partnerships with leading solutions

providers

ACTION: Transform Vectrus into a

higher value, technology-enabled and

differentiated platform

ACTION: Grow revenue through

deliberate organic activities and

purposeful and prudent acquisitions

HOW: Organic expansion of

programs and contracts; Business

development/sales enhancement;

inorganic opportunities

ACTION: Improve business

positioning to yield 7% EBITDA

margins

HOW: Grow Top line; execution

of Enterprise Vectrus; infuse

higher value capabilities into our

programs

Vectrus will be an innovator and leader in the convergence of our clients' physical and digital

infrastructure and supply chains, targeting $2.5 billion in revenue and 7% EBITDA margins

FIVE YEAR PLAN, TARGETED OUTCOMES

2017 FINANCIAL RESULTS

Page 9

(1) See appendix for reconciliation of non-GAAP measure. Change in deferred tax liability related to Tax Cuts and Jobs Act.

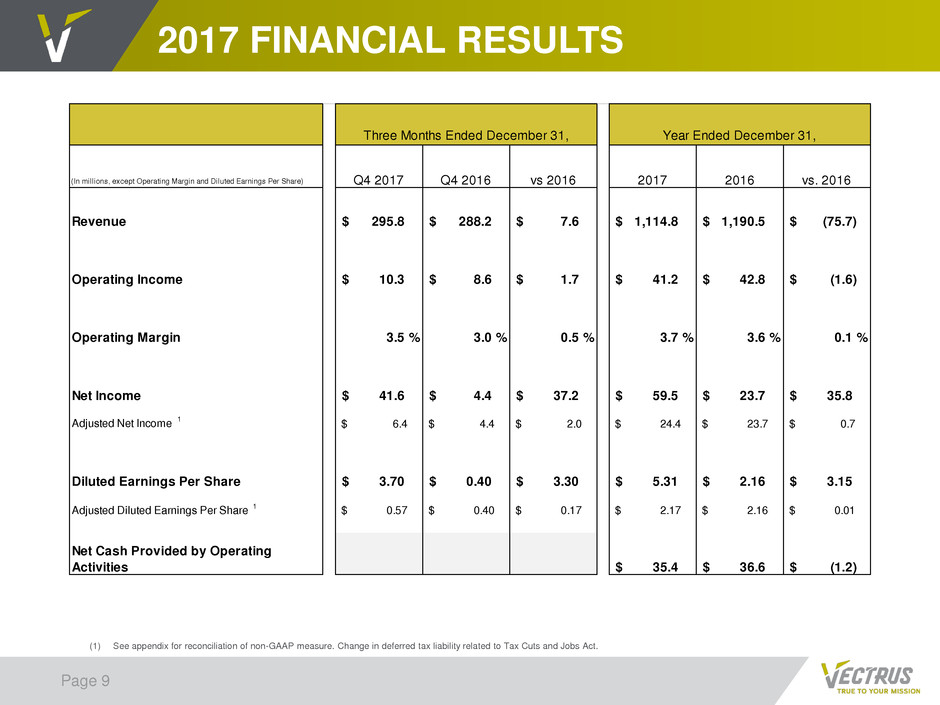

(In millions, except Operating Margin and Diluted Earnings Per Share) Q4 2017 Q4 2016 vs 2016 2017 2016 vs. 2016

Revenue 295.8$ 288.2$ 7.6$ 1,114.8$ 1,190.5$ (75.7)$

Operating Income 10.3$ 8.6$ 1.7$ 41.2$ 42.8$ (1.6)$

Operating Margin 3.5 % 3.0 % 0.5 % 3.7 % 3.6 % 0.1 %

Net Income 41.6$ 4.4$ 37.2$ 59.5$ 23.7$ 35.8$

Adjusted Net Income

1

6.4$ 4.4$ 2.0$ 24.4$ 23.7$ 0.7$

Diluted Earnings Per Share 3.70$ 0.40$ 3.30$ 5.31$ 2.16$ 3.15$

Adjusted Diluted Earnings Per Share

1

0.57$ 0.40$ 0.17$ 2.17$ 2.16$ 0.01$

Net Cash Provided by Operating

Activities 35.4$ 36.6$ (1.2)$

Three Months Ended December 31, Year Ended December 31,

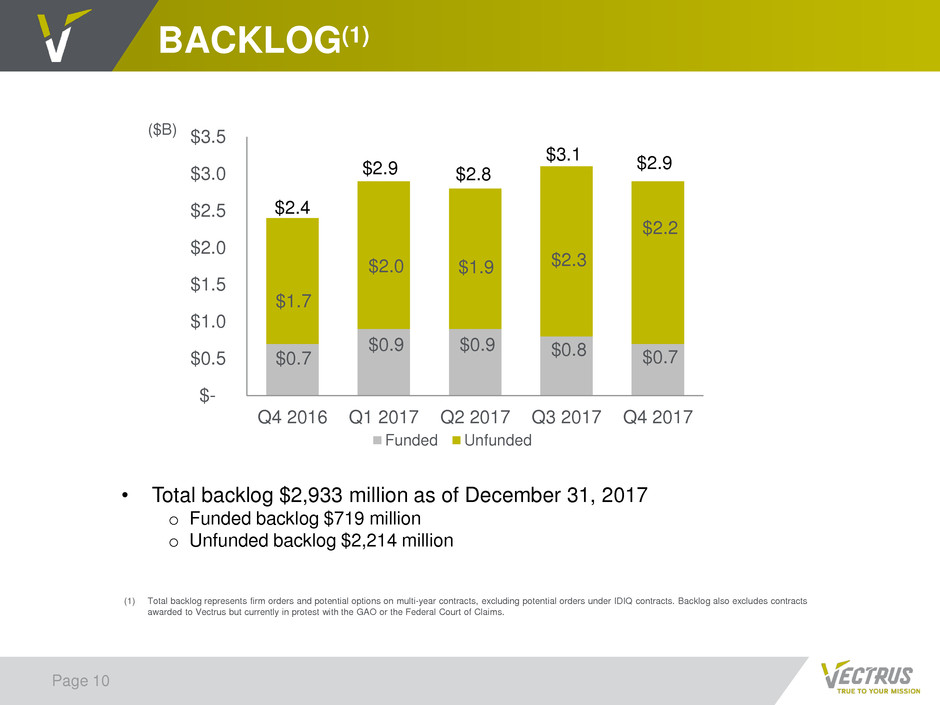

BACKLOG(1)

Page 10

(2)

(1) Total backlog represents firm orders and potential options on multi-year contracts, excluding potential orders under IDIQ contracts. Backlog also excludes contracts

awarded to Vectrus but currently in protest with the GAO or the Federal Court of Claims.

• Total backlog $2,933 million as of December 31, 2017

o Funded backlog $719 million

o Unfunded backlog $2,214 million

$0.7

$0.9 $0.9 $0.8 $0.7

$1.7

$2.0 $1.9 $2.3

$2.2

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017

Funded Unfunded

$2.4

$2.9 $2.8

$3.1 $2.9

($B)

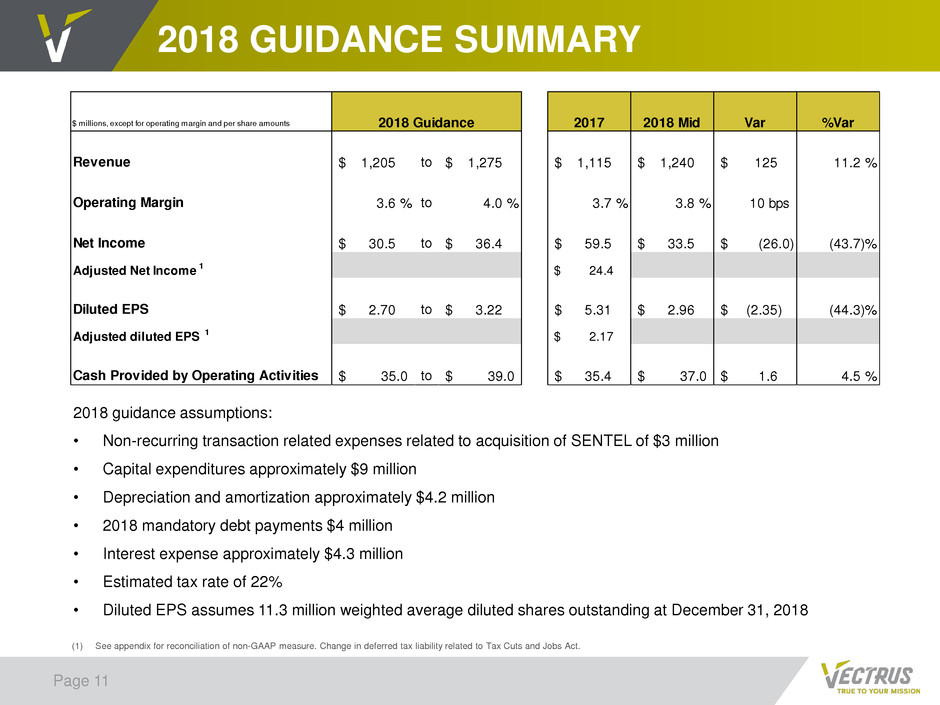

2018 GUIDANCE SUMMARY

Page 11

2018 guidance assumptions:

• Non-recurring transaction related expenses related to acquisition of SENTEL of $3 million

• Capital expenditures approximately $9 million

• Depreciation and amortization approximately $4.2 million

• 2018 mandatory debt payments $4 million

• Interest expense approximately $4.3 million

• Estimated tax rate of 22%

• Diluted EPS assumes 11.3 million weighted average diluted shares outstanding at December 31, 2018

(1) See appendix for reconciliation of non-GAAP measure. Change in deferred tax liability related to Tax Cuts and Jobs Act.

$ millions, except for operating margin and per share amounts 2017 2018 Mid Var %Var

Revenue 1,205$ to 1,275$ 1,115$ 1,240$ 125$ 11.2 %

Operating Margin 3.6 % to 4.0 % 3.7 % 3.8 % 10 bps

Net Income 30.5$ to 36.4$ 59.5$ 33.5$ (26.0)$ (43.7)%

Adjusted Net Income 1 24.4$

Diluted EPS 2.70$ to 3.22$ 5.31$ 2.96$ (2.35)$ (44.3)%

Adjusted diluted EPS 1 2.17$

Cash Provided by Operating Activities 35.0$ to 39.0$ 35.4$ 37.0$ 1.6$ 4.5 %

2018 Guidance

APPENDIX

Page 12

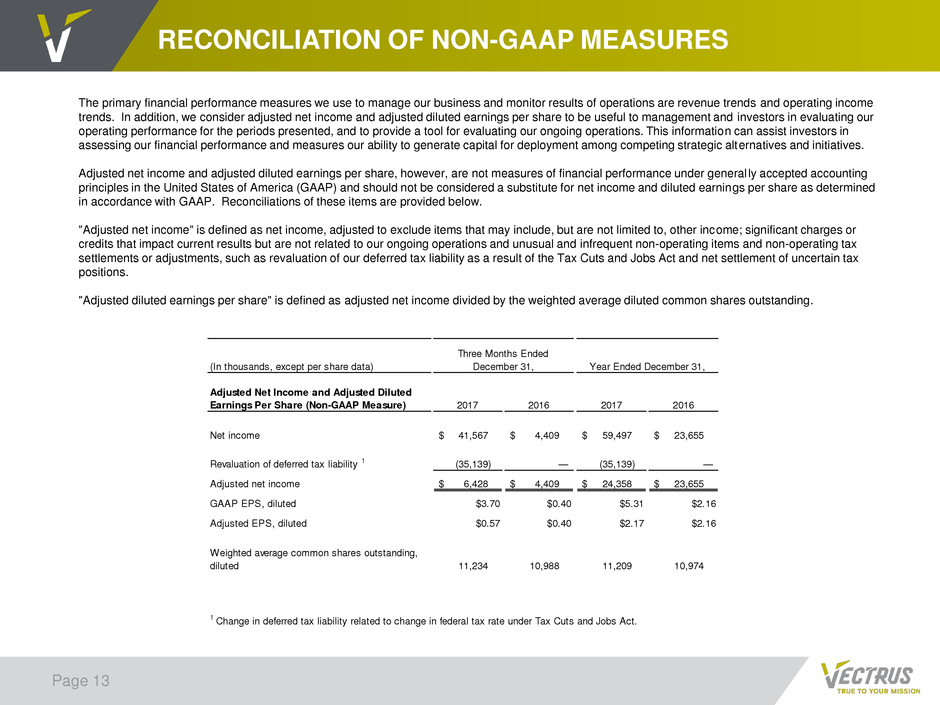

RECONCILIATION OF NON-GAAP MEASURES

Page 13

The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income

trends. In addition, we consider adjusted net income and adjusted diluted earnings per share to be useful to management and investors in evaluating our

operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations. This information can assist investors in

assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives.

Adjusted net income and adjusted diluted earnings per share, however, are not measures of financial performance under general ly accepted accounting

principles in the United States of America (GAAP) and should not be considered a substitute for net income and diluted earnings per share as determined

in accordance with GAAP. Reconciliations of these items are provided below.

"Adjusted net income" is defined as net income, adjusted to exclude items that may include, but are not limited to, other income; significant charges or

credits that impact current results but are not related to our ongoing operations and unusual and infrequent non-operating items and non-operating tax

settlements or adjustments, such as revaluation of our deferred tax liability as a result of the Tax Cuts and Jobs Act and net settlement of uncertain tax

positions.

"Adjusted diluted earnings per share" is defined as adjusted net income divided by the weighted average diluted common shares outstanding.

(In thousands, except per share data)

Adjusted Net Income and Adjusted Diluted

Earnings Per Share (Non-GAAP Measure) 2017 2016 2017 2016

Net income 41,567$ 4,409$ 59,497$ 23,655$

Revaluation of deferred tax liability 1 (35,139) — (35,139) —

Adjusted net income 6,428$ 4,409$ 24,358$ 23,655$

GAAP EPS, dilu e $3.70 $0.40 $5.31 $2.16

Adju t d EPS, dilut d $0.57 $0.40 $2.17 $2.16

Weighted average common shares outstanding,

diluted 11,234 10,988 11,209 10,974

Three Months Ended

December 31, Year Ended December 31,

1 Change in deferred tax liability related to change in federal tax rate under Tax Cuts and Jobs Act.

CHUCK PROW

PRESIDENT AND CHIEF EXECUTIVE OFFICER

MATT KLEIN

SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

VECTRUS

FOURTH QUARTER 2017 RESULTS

AND ISSUANCE 2018 GUIDANCE