Attached files

| file | filename |

|---|---|

| EX-95 - EXHIBIT 95 - Tronox Holdings plc | s002093x1_ex95.htm |

| EX-32.2 - EXHIBIT 32.2 - Tronox Holdings plc | s002093x1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Tronox Holdings plc | s002093x1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Tronox Holdings plc | s002093x1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Tronox Holdings plc | s002093x1_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Tronox Holdings plc | s002093x1_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Tronox Holdings plc | s002093x1_ex21-1.htm |

| EX-12.1 - EXHIBIT 12.1 - Tronox Holdings plc | s002093x1_ex12-1.htm |

| EX-10.41 - EXHIBIT 10.41 - Tronox Holdings plc | s002093x1_ex10-41.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Year ended December 31, 2017

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

1-35573

(Commission file number)

TRONOX LIMITED

(ACN 153 348 111)

(Exact name of registrant as specified in its charter)

|

Western Australia, Australia

|

98-1026700

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

263 Tresser Boulevard, Suite 1100

Stamford, Connecticut 06901 |

Lot 22 Mason Road

Kwinana Beach WA 6167 Australia |

Registrant’s telephone number, including area code: (203) 705-3800

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Class A Ordinary Shares, par value $0.01 per share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☒

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

|

Emerging growth company

|

o

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☒

The aggregate market value of the ordinary shares held by non-affiliates of the registrant as of June 30, 2017 was approximately $1,797,488,386.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No o

As of January 31, 2018, the registrant had 92,660,776 shares of Class A ordinary shares and 28,729,280 shares of Class B ordinary shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2018 annual general meeting of shareholders are incorporated by reference in this Form 10-K in response to Part III Items 10, 11, 12, 13 and 14.

TRONOX LIMITED

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

INDEX

|

Form 10-K Item Number

|

Page

|

|||

|

PART I

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

PART II

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

PART III

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

|

|

|||

|

PART IV

|

|

|

|

|

|

|

|

|||

|

|

|

|||

|

|

|

|||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements under the captions “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and in other sections of this Form 10-K that are forward-looking statements. Forward-looking statements also can be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties outlined in “Risk Factors.”

These risks and uncertainties are not exhaustive. Other sections of this Form 10-K may include additional factors, which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this Form 10-K to conform our prior statements to actual results or revised expectations and we do not intend to do so.

We are committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, we use our website to convey information about our businesses, including the anticipated release of quarterly financial results, quarterly financial and statistical and business-related information. Investors can link to the Tronox Limited website through http://www.tronox.com. Our website and the information contained therein or connected thereto shall not be deemed to be incorporated into this Form 10-K.

ii

PART I

For the purposes of this discussion, references to “we,” “us,” and, “our” refer to Tronox Limited, together with its consolidated subsidiaries (collectively referred to as “Tronox”), when discussing the business following the completion of the Exxaro Transaction, and to Tronox Incorporated, together with its consolidated subsidiaries (collectively referred to as “Tronox Incorporated”), when discussing the business prior to the completion of the Exxaro Transaction.

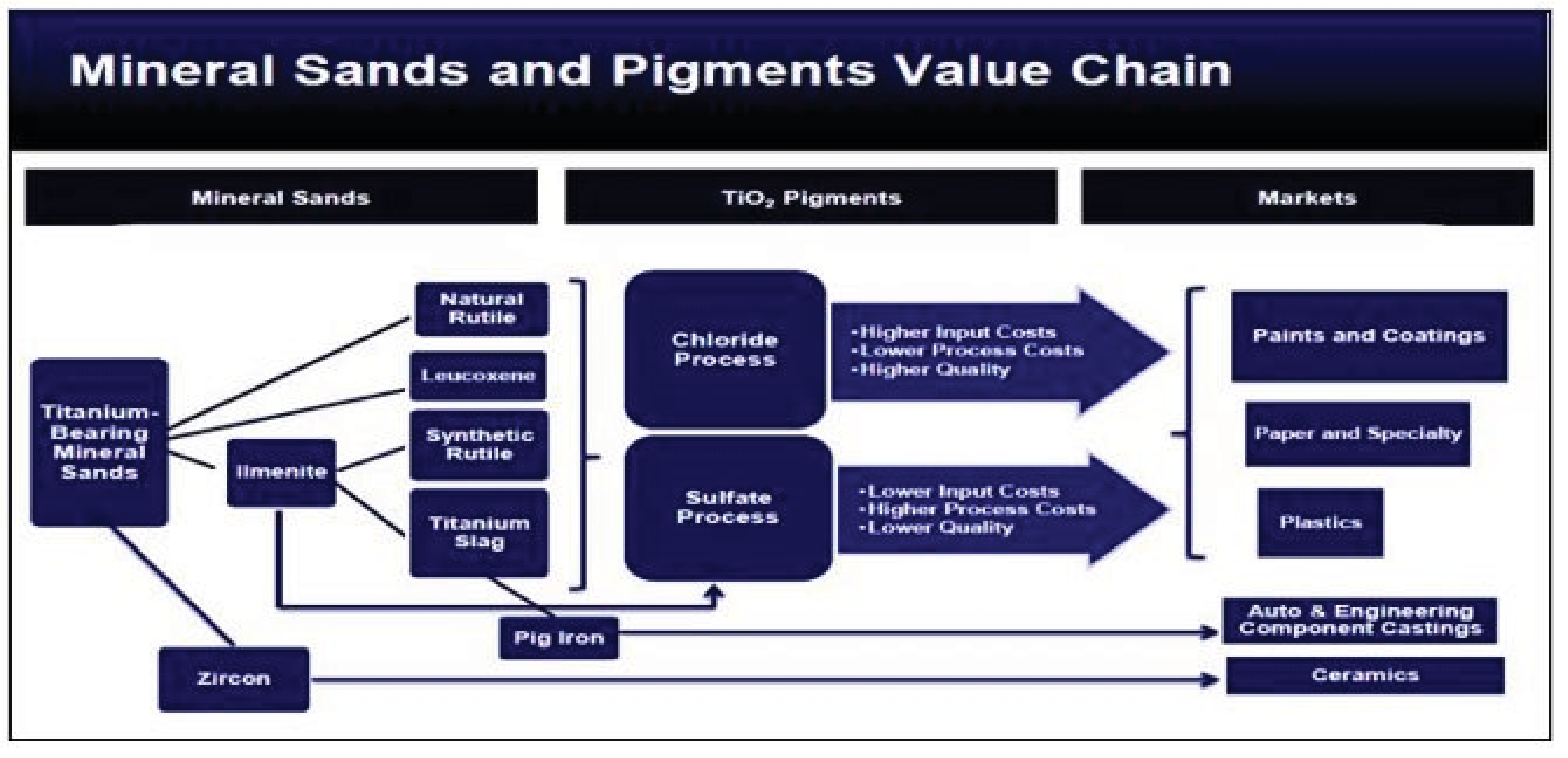

Tronox is a public limited company registered under the laws of the State of Western Australia. We are a global leader in the mining of titanium bearing mineral sands and the production of titanium dioxide (“TiO2”) pigment. Our TiO2 products are critical components of everyday applications such as paint and other coatings, plastics, paper, and other uses. Products we derive from mineral sands include titanium feedstock, zircon, and pig iron. Zircon, a hard, glossy mineral, is used for the manufacture of ceramics, refractories, TV screen glass, and a range of other industrial and chemical products. Pig iron is a metal material used in the steel and metal casting industries to create wrought iron, cast iron, and steel. Titanium feedstock is primarily used to manufacture TiO2 pigment.

On February 21, 2017, Tronox Limited, The National Titanium Dioxide Company Ltd., a limited company organized under the laws of the Kingdom of Saudi Arabia (“Cristal”), and Cristal Inorganic Chemicals Netherlands Coöperatief W.A., a cooperative organized under the laws of the Netherlands and a wholly owned subsidiary of Cristal (“Seller”), entered into a Transaction Agreement (the “Transaction Agreement”), pursuant to which we agreed to acquire Cristal’s titanium dioxide business for $1.673 billion in cash, subject to a working capital adjustment at closing (the “Cash Consideration”), plus 37,580,000 Class A ordinary shares (“Class A Shares”), par value $0.01 per share, of Tronox Limited (the “Cristal Transaction”). Following the closing of the Cristal Transaction, the Seller will own approximately 24% of the outstanding ordinary shares (including both Class A and Class B) of Tronox Limited. On March 1, 2018, Tronox, Cristal and Seller entered into an Amendment to the Transaction Agreement (the “Amendment”) that extends the termination date under the Transaction Agreement to June 30, 2018, with automatic 3-month extensions to March 31, 2019, if necessary based on the status of outstanding regulatory approvals.

In 2012, our Class B ordinary shares (“Class B Shares”) were issued to Exxaro Resources Limited (“Exxaro”) and one of its subsidiaries in consideration for 74% of Exxaro’s South African mineral sands business (the “Exxaro Transaction”). On March 8, 2017, Exxaro announced its intention to begin pursuing a path to monetize its ownership stake in Tronox over time. On October 10, 2017, Exxaro sold 22,425,000 Class A ordinary shares (“Class A Shares”) in an underwritten registered offering (the “Exxaro Share Transaction”). At December 31, 2017 and December 31, 2016, Exxaro held approximately 24% and 44%, respectively, of the voting securities of Tronox Limited. Presently, Exxaro intends to sell the remainder of its Tronox shares in a staged process over time pursuant to the existing registration statement, subject to market conditions. Exxaro’s sale of Class A Shares does not impact its 26% ownership interest in each of our Tronox KZN Sands (Pty) Ltd. and Tronox Mineral Sands (Pty) Ltd. subsidiaries. See Notes 1 and 21 of notes to the consolidated financial statements for additional information regarding Exxaro transactions.

Principal Business Segment

On September 1, 2017, we completed the previously announced sale of our wholly owned subsidiary Tronox Alkali Corporation (“Alkali”) to Genesis Energy, L.P. for proceeds of $1.325 billion in cash (the “Alkali Sale”). As a result of the Alkali Sale, Alkali’s results of operations have been reported as discontinued operations and we now operate under one operating and reportable segment, TiO2. See Notes 3 and 22 of notes to consolidated financial statements for additional information.

TiO2 is used in a wide range of products due to its ability to impart whiteness, brightness, and opacity. TiO2 is used extensively in the manufacture of paint and other coatings, plastics and paper, and in a wide range of other applications, including inks, fibers, rubber, food, cosmetics, and pharmaceuticals. Moreover, it is a critical component of everyday consumer applications due to its superior ability to cover or mask other materials effectively and efficiently relative to alternative white pigments and extenders. TiO2 is considered to be a quality

1

of life product, and some research indicates that consumption generally increases as disposable income increases. At present, it is our belief that there is no effective mineral substitute for TiO2 because no other white pigment has the physical properties for achieving comparable opacity and brightness, or can be incorporated as cost effectively.

Our TiO2 business includes the following:

| • | exploration, mining, and beneficiation of mineral sands deposits; |

| • | production of titanium feedstock (including chloride slag, slag fines, rutile, synthetic rutile and leucoxene), pig iron, and zircon; |

| • | production and marketing of TiO2; and |

| • | electrolytic manganese dioxide manufacturing and marketing, which is primarily focused on advanced battery materials and specialty boron products. |

Exploration, Mining and Beneficiation of Mineral Sands Deposits

“Mineral sands” refers to concentrations of heavy minerals in an alluvial environment (sandy or sedimentary deposits near a sea, river or other water source). Mineral sands are the most important source of raw material for manufacture of pigment-grade TiO2. Our exploration, mining and beneficiation of mineral sands deposits are comprised of the following:

| • | Our KwaZulu-Natal (“KZN”) Sands operations located in South Africa consist of the Fairbreeze mine, a concentration plant, a mineral separation plant, and a smelter complex with two furnaces; |

| • | Our Namakwa Sands operations located in South Africa include the Namakwa Sands mine, a primary concentration plant, a secondary concentration plant, a mineral separation plant, and a smelter complex with two furnaces; and |

| • | Our Western Australia operations, which consist of the Cooljarloo mine and concentration plant and the Chandala processing plant, which includes a mineral separation plant, and a synthetic rutile plant. |

Exploration

Ilmenite - Ilmenite is the most abundant titanium mineral, with naturally occurring ilmenite having a titanium dioxide content ranging from approximately 45% to 65%, depending on its geological history. The weathering of ilmenite in its natural environment results in oxidation of the iron, which increases titanium content.

Rutile - Rutile is essentially composed of crystalline titanium dioxide and, in its pure state, would contain close to 100% titanium dioxide. Naturally occurring rutile, however, usually contains minor impurities and therefore, commercial concentrates of this mineral typically contain approximately 94% to 96% titanium dioxide.

Leucoxene - Leucoxene is a natural alteration of ilmenite with a titanium dioxide content ranging from approximately 65% to 90%. The weathering process is responsible for the alteration of ilmenite to leucoxene, which results in the removal of iron, leading to an upgrade in titanium dioxide content.

Titanium Slag - The production of titanium slag involves smelting ilmenite in an electric arc furnace under reducing conditions, normally with anthracite (coal) used as a reducing agent. Slag, containing the bulk of the titanium and impurities other than iron, and a high purity pig iron are both produced in this process. The final quality of the slag is highly dependent on the quality of the original ilmenite and the ash composition of the anthracite used in the furnace. Titanium slag has a titanium dioxide content of approximately 75% to 91%. Our slag typically contains 86% to 89% titanium dioxide.

Titanium Slag Fines - For titanium slag to be suitable for use in the chloride process, it needs to be milled down to a particle size range, which allows it to be processed effectively during the chlorination step of the chloride process. The milling of titanium slag results in the generation of a smaller size than can readily be used by chloride producers, which is separated and sold as a separate product, mostly to pigment producers who operate the sulfate process.

2

Synthetic Rutile - A number of processes have been developed for the beneficiation of ilmenite into products containing between approximately 90% and 95% titanium dioxide. These products are known as synthetic rutile or upgraded ilmenite. The processes employed vary in terms of the extent to which the ilmenite grain is reduced, and the precise nature of the reducing reaction and the conditions used in the subsequent removal of iron. All of the existing commercial processes are based on the reduction of ilmenite in a rotary kiln, followed by leaching under various conditions to remove the iron from the reduced ilmenite grains. Our synthetic rutile has a titanium dioxide content of approximately 90% to 93%.

Zircon - Zircon is often, but not always, found in the mineral sands deposits containing ilmenite. It is extracted, alongside ilmenite and rutile, as part of the initial mineral sands beneficiation process.

Mining

The mining of mineral sands deposits is conducted either “wet,” by dredging or hydraulic water jets, or “dry,” using earth-moving equipment to excavate and transport the sands. Dredging, as used at the Cooljarloo mine, is generally the favored method of mining mineral sands, provided that the ground conditions are suitable and water is readily available. In situations involving hard ground, discontinuous ore bodies, small tonnage, high slimes contents or very high grades, dry mining techniques are generally preferred.

Dredge Mining - Dredge mining, or wet mining, is best suited to ore reserves located below the water table. A floating dredge removes the ore from the bottom of an artificial pond through a large suction pipe. The bulk sand material is fed as slurry through a primary, or “wet,” concentrator that is typically towed behind the dredge unit. The dredge slowly advances across the pond and deposits clean sand tailings behind the pond for subsequent revegetation and rehabilitation. Because of the high capital cost involved in the manufacturing and location, dredge mining is most suitable for large, long-life deposits. The dredging operations at Cooljarloo use two large floating dredges in a purpose-built pond. The slurry is pumped to a floating concentrator, which recovers heavy minerals from the sand and clay.

Hydraulic Mining - At our Fairbreeze mine in KZN, we employ a hydraulic mining method for mineral sands due to the topography of the ore body and the ore characteristics. A jet of high-pressure water is aimed at the mining face, thereby cutting into and loosening the sand so that it collapses on the floor. The water acts as a carrier medium for the sand, due to the high fines (mineral particles that are too fine to be economically extracted and other materials that remain after the valuable fraction of an ore has been separated from the uneconomic fraction) content contained in the ore body. The slurry generated by the hydraulic monitors flows to a collection sump where oversize material is removed and the slurry is then pumped to the primary concentration plant.

Dry Mining - Dry mining is suitable where mineral deposits are shallow, contain hard bands of rock, or are in a series of unconnected ore bodies. Dry mining is performed at Namakwa Sands, which is located in an arid region on the west coast of South Africa. The ore is mined with front end loaders in a load and carry operation, dumping the mineral bearing sands onto a conveyor belt system that follows behind the mining face. The harder layers are mined using hydraulic excavators in a backhoe configuration or by bulldozer. Namakwa Sands does not use blasting in its operations. The mined material is transported by trucks to the mineral sizers where primary reduction takes place.

Processing and Mineral Separation

Processing - Both wet and dry mining techniques utilize wet concentrator plants to produce a high grade of heavy mineral concentrate (typically approximately 90% to 98% heavy mineral content). Screened ore is first deslimed, a process by which slimes are separated from larger particles of minerals, and then washed through a series of spiral separators that use gravity to separate the heavy mineral sands from lighter materials, such as quartz. Residue from the concentration process is pumped back into either the open pits or slimes dams for rehabilitation and water recovery. Water used in the process is recycled into a clean water dam with any additional water requirements made up from pit dewatering or rainfall.

Mineral Separation - The non-magnetic (zircon and rutile) and magnetic (ilmenite) concentrates are passed through a dry separation process, known as the “dry mill” to separate out the minerals. Electrostatic and dry magnetic methods are used to further separate the ilmenite, rutile and zircon. Electrostatic separation relies on the difference in surface conductivity of the materials to be separated. Conductive minerals (such as ilmenite, rutile

3

and leucoxene) behave differently from non-conductive minerals (such as zircon) when subjected to electrical forces. Magnetic separation techniques are dependent on the iron content of a mineral. Magnetic minerals (such as ilmenite) will separate from non-magnetic minerals (such as rutile and leucoxene) when subjected to a magnetic field. A combination of gravity and magnetic separation is used to separate zircon from the non-magnetic portion of the heavy mineral concentrate. The heavy mineral concentrate at KZN Sands and Namakwa Sands is passed through wet high-intensity magnetic separation to produce a non-magnetic fraction and a magnetic fraction.

Production of titanium feedstock, pig iron, and zircon

Our TiO2 operations have a combined annual production capacity of approximately 721,000 metric tons (“MT”) of titanium feedstock, which is comprised of 91,000 MT of rutile and leucoxene, 220,000 MT of synthetic rutile, and 410,000 MT of titanium slag. Our TiO2 operations also have the capability to produce approximately 220,000 MT of zircon and 221,000 MT of pig iron.

Synthetic Rutile Production - Ilmenite may also be upgraded into synthetic rutile. Synthetic rutile, or upgraded ilmenite, is a chemically modified form of ilmenite that has the majority of the ferrous, non-titanium components removed, and is also suitable for use in the production of titanium metal or TiO2 using the chloride process. Ilmenite is converted to synthetic rutile in a two-stage pyrometallurgical and chemical process. The first stage involves heating ilmenite in a large rotary kiln. Coal is used as a heat source and, when burned in an oxygen deficient environment, it produces carbon monoxide, which promotes a reducing environment that converts the iron oxide contained in the ilmenite to metallic iron. The intermediate product, called reduced ilmenite, is a highly magnetic sand grain due to the presence of the metallic iron. The second stage involves the conversion of reduced ilmenite to synthetic rutile by removing the metallic iron from the reduced ilmenite grain. This conversion is achieved through aeration (oxidation), accelerated through the use of ammonium chloride as a catalyst, and acid leaching of the iron to dissolve it out of the reduced ilmenite. Activated carbon is also produced as a co-product of the synthetic rutile production process.

Titanium Feedstock - Ilmenite, rutile, leucoxene, titanium slag and synthetic rutile are all used primarily as feedstock for the production of TiO2. Titanium feedstock can be segmented based on the level of titanium contained within the feedstock, with substantial overlap between each segment. Different grades of titanium feedstock have similar characteristics. As such, TiO2 producers generally source and supply a variety of feedstock grades, and often blend them into one feedstock. The lower amount of titanium used in the TiO2 manufacturing process, the more feedstock required and waste material produced. Naturally occurring high-grade titanium minerals required for the production of TiO2 are limited in supply. Two processes have been developed commercially: one for the production of titanium slag and the other for the production of synthetic rutile. Both processes use ilmenite as a raw material, and involve the removal of iron oxides and other non-titanium material.

Titanium Slag - Ilmenite at KZN Sands and Namakwa Sands is processed further through direct current arc furnaces to produce titanium slag with a titanium content of approximately 86% to 89%. The smelting process comprises the reduction of ilmenite to produce titanium slag and pig iron. Ilmenite and anthracite are fed in a tightly controlled ratio into an operating furnace where the endothermic reduction of ilmenite occurs. The resultant titanium slag has a lower density than the iron, and separation of the two liquid products occurs inside the furnace. The slag and iron are tapped periodically from separate sets of tapholes located around the circumference of the furnace. Slag is tapped into steel pots and cooled for several hours in the pots before the slag blocks are tipped out. The blocks are subsequently transported to the blockyard where they are cooled under water sprays for a number of days. They are then crushed, milled, and separated according to size fractions, as required by the customers. The tapped pig iron is re-carburized, de-sulfurized, and cast into ingots or “pigs”.

High Purity Pig Iron - The process by which ilmenite is converted into titanium slag results in the production of high purity iron containing low levels of manganese. When iron is produced in this manner, the molten iron is tapped from the ilmenite furnace during the smelting process, alloyed by adding carbon and silicon and treated to reduce the sulfur content, and is then cast into pigs. The pig iron produced as a co-product of our titanium slag production is known as low manganese pig iron.

Zircon - Zircon (ZrSiO4) is a co-product of mining mineral sands deposits for titanium feedstock. Zircon is primarily used as an additive in ceramic glazes to add hardness, which makes the ceramic glaze more water, chemical and abrasion resistant. It is also used for the production of zirconium metal and zirconium chemicals, in refractories, as molding sand in foundries, and for TV screen glass, where it is noted for its structural stability at

4

high temperatures and resistance to abrasive and corrosive conditions. Zircon typically represents a relatively low proportion of the in-situ heavy mineral sands deposits, but has a relatively higher value compared to other heavy mineral products. Refractories containing zircon are expensive and are only used in demanding, high-wear and corrosive applications in the glass, steel and cement industries. Foundry applications use zircon when casting articles of high quality and value where accurate sizing is crucial, such as aerospace, automotive, medical, and other high-end applications.

Competitive Conditions

Globally, there are a small number of large mining companies or groups that are involved in the production of titanium feedstock and these are dominated by close relationships between miners and consumers (predominately pigment producers).

Production and Marketing of TiO2

We operate three TiO2 pigment facilities at the following locations: Hamilton, Mississippi; Botlek, the Netherlands; and Kwinana, Western Australia, representing an aggregate annual TiO2 production capacity of 465,000 MT.

Production

TiO2 is produced using a combination of processes involving the manufacture of base pigment particles followed by surface treatment, drying and milling (collectively known as finishing). Two commercial production processes are used by manufacturers: the chloride process and the sulphate process. All of our TiO2 is produced using the chloride process. We are one of a limited number of TiO2 producers in the world with chloride production technology. We believe that we are one of the largest global producers and marketers of TiO2 manufactured via chloride technology. TiO2 produced using the chloride process is preferred for some of the largest end-use applications.

In the chloride process, high quality feedstock (slag, synthetic rutile, natural rutile or, in limited cases, high titanium content ilmenite ores) are reacted with chlorine (the chlorination step) and carbon to form titanium tetrachloride (“TiCl4”) in a continuous fluid bed reactor. Purification of TiCl4 to remove other chlorinated products is accomplished using a distillation process. The purified TiCl4 is then oxidized in a vapor phase form to produce raw pigment particles and chlorine gas. The latter is recycled back to the chlorination step for reuse. Raw pigment is then typically slurried with water and dispersants prior to entering the finishing step. The chloride process currently accounts for substantially all of the industry-wide TiO2 production capacity in North America, and approximately 46% of industry-wide capacity globally.

Commercial production of TiO2 results in one of two different crystal forms: rutile, which is manufactured using either the chloride process or the sulphate process, or anatase, which is only produced using the sulfate process. All of our global production capacity utilizes the chloride process to produce rutile TiO2. Rutile TiO2 is preferred over anatase TiO2 for many of the largest end-use applications, such as coatings and plastics, because its higher refractive index imparts better hiding power at lower quantities than the anatase crystal form and it is more suitable for outdoor use because it is more durable. Although rutile TiO2 can be produced using either the chloride process or the sulphate process, some customers prefer rutile produced using the chloride process because it typically has a bluer undertone and greater durability.

The primary raw materials used in the production of TiO2 include titanium feedstock, chlorine and coke. Chemicals used in the production of TiO2 include oxygen and nitrogen. Other chemicals used in the production of TiO2 are purchased from various companies under long-term supply contracts. In the past, we have been, and we expect that we will continue to be, successful in obtaining short-term and long-term extensions to these and other existing supply contracts prior to their expiration. We expect the raw materials purchased under these contracts, and contracts that we may enter into in the near term, to meet our requirements over the next several years.

Marketing

We supply and market TiO2 under the brand name TRONOX® to approximately 700 customers in approximately 100 countries, including market leaders in each of the key end-use markets for TiO2, and we have supplied each of our top ten customers with TiO2 for more than 10 years. For information regarding 2017 sales volume by geography and end-use market, see section “Segment and Geographic Revenue Information”.

5

In addition to price and product quality, we compete on the basis of technical support and customer service. Our direct sales and technical service organizations execute our sales and marketing strategy, and work together to provide quality customer service. Our direct sales staff is trained in all of our products and applications. Due to the technical requirements of TiO2 applications, our technical service organization and direct sales offices are supported by a regional customer service staff located in each of our major geographic markets.

Our three TiO2 production facilities are strategically positioned in key geographies. The Hamilton facility located in Mississippi USA, is one of the largest TiO2 production facilities in the world, and has the size and scale to service customers in North America and around the globe. Our Kwinana plant, located in Australia, is well positioned to service the growing demand from Asia. Our Botlek facility, located in the Netherlands, services our European customers and certain specialized applications globally.

Our sales and marketing strategy focuses on effective customer management through the development of strong relationships. We develop customer relationships and manage customer contact through our sales team, technical service organization, research and development team, customer service team, plant operations personnel, supply chain specialists, and senior management visits. We believe that multiple points of customer contact facilitate efficient problem solving, supply chain support, formula optimization and co-development of products.

The global market in which our TiO2 business operates is highly competitive. Competition is based on a number of factors such as price, product quality, and service. We face competition not only from chloride process pigment producers, but from sulfate process pigment producers as well. Moreover, because transportation costs are minor relative to the cost of our product, there is also competition between products produced in one region versus products produced in another region.

We face competition from competitors with facilities in multiple regions, including Chemours, Cristal Global, Venator and Kronos Worldwide Inc. In addition to the major competitors discussed above, we compete with numerous regional producers, including producers in China such as Lomon Billions, CNNC and Blue Star.

Electrolytic Manganese Dioxide Manufacturing and Marketing

Our electrolytic and other chemical products operations are primarily focused on advanced battery materials and specialty boron products.

Electrolytic manganese dioxide (“EMD”) - EMD is the active cathode material for alkaline batteries used in flashlights, electronic games, and medical and industrial devices. We believe that we are one of the largest producers of EMD for the global alkaline battery industry. EMD quality requirements for alkaline technology are much more demanding than for zinc carbon technology and, as a result, alkaline-grade EMD commands a higher price than zinc carbon-grade EMD. The United States (“U.S.”) primary battery market, predominantly based on alkaline-grade EMD, is the largest in the world followed by China and Japan according to publicly available industry reports. As such, we expect demand for alkaline-grade EMD to be flat as the demand stabilizes for devices using primary batteries.

Boron - Specialty boron product end-use applications include semiconductors, pharmaceuticals, high-performance fibers, specialty ceramics and epoxies, as well as igniter formulations. According to publicly available industry reports, we are one of the leading suppliers of boron trichloride, along with JSC Aviabor, Sigma-Aldrich Corporation, and several Asian manufacturers. We anticipate demand for boron trichloride will remain positive, driven primarily by the growth of the semiconductor industry.

Research and Development

We have research and development facilities that service our products, and focus on applied research and development of both new and existing processes. Our research and development facilities supporting our mineral sands business are located in South Africa, while the majority of scientists supporting our pigment and electrolytic research and development efforts are located in Oklahoma City, Oklahoma, USA.

New process developments are focused on increased throughput, efficiency gains and general processing equipment-related improvements. Ongoing development of process technology contributes to cost reduction, enhanced production flexibility, increased capacity, and improved consistency of product quality. In 2017, our product development and commercialization efforts were focused on several TiO2 products that deliver added value to customers across all end use segments by way of enhanced properties of the pigment.

6

Patents, Trademarks, Trade Secrets and Other Intellectual Property Rights

Protection of our proprietary intellectual property is important to our business. At December 31, 2017, we held 38 U.S. patents, 6 patent applications, and approximately 217 in foreign counterparts, including both issued patents and pending patent applications. Our U.S. patents have expiration dates ranging through 2035. Additionally, we have 5 trademark registrations in the U.S., as well as 54 trademark counterpart registrations in foreign jurisdictions.

We rely upon, and have taken steps to secure our unpatented proprietary technology, know-how and other trade secrets. The substantial majority of business patents relate to our chloride products and production technology. Our proprietary chloride production technology is an important part of our overall technology position. However, much of the fundamental intellectual property associated with both chloride and sulfate pigment production is no longer subject to patent protection. At Namakwa Sands, we rely on intellectual property for our smelting technology, which was granted to us in perpetuity by Anglo American South Africa Limited for use on a worldwide basis, pursuant to a non-exclusive license.

We protect the trademarks that we use in connection with the products we manufacture and sell, and have developed value in connection with our long-term use of our trademarks; however, there can be no assurance that the trademark registrations will provide meaningful protection against the use of similar trademarks by competitors, or that the value of our trademarks will not be diluted. The same can be said for our patents and patent applications, which may in the future be the subject of a challenge regarding validity as well as ownership, requiring a defense of the patent/application through legal proceedings, which inherently introduce a degree of business uncertainty and risk. We also use and rely upon unpatented proprietary knowledge, continuing technological innovation and other trade secrets to develop and maintain our competitive position. We conduct research activities and protect the confidentiality of our trade secrets through reasonable measures, including confidentiality agreements and security procedures. While certain patents held for our products and production processes are important to our long-term success, more important is the operational knowledge we possess.

Employees

As of December 31, 2017, Tronox had approximately 3,400 employees worldwide, of which 700 are located in the U.S., 600 in Australia, 1,800 in South Africa, and 300 in the Netherlands and other international locations. Our TiO2 segment employees in the U.S. are not represented by a union or collective bargaining agreement. In South Africa, approximately 73% of our workforce belongs to a union. In Australia, most employees are not currently represented by a union, but approximately 46% are represented by a collective bargaining agreement. In the Netherlands, approximately 49% of our employees are represented by a collective bargaining agreement and 27% are members of a union. We consider relations with our employees and labor organizations to be good.

Environmental, Health and Safety Authorizations

Mining

Our facilities and operations are subject to extensive general and industry-specific environmental, health and safety regulations in South Africa and Australia. These regulations include those relating to mine rehabilitation, liability provision, water management, the handling and disposal of hazardous and non-hazardous materials, and occupational health and safety. The various legislation and regulations are subject to a number of internal and external audits. We believe our mineral sands operations are in compliance, in all material respects, with existing health, safety and environmental legislation and regulations.

Regulation of the Mining Industry in South Africa

There are numerous mining-related laws and regulatory authorizations that may impact the performance of our business. These include but are not limited to: the Mineral and Petroleum Resources Royalty Act, which imposes a royalty on refined and unrefined minerals payable to the South African government; the Mineral and Petroleum Resources Development ACT (the “MPRDA”), which governs the acquisition, use and disposal of mineral rights; the South African Minerals Act, which requires each new mine to prepare an Environmental Management Program Report for approval by the South African Department of Mineral Reserves (DMR); the Revised South African Mining Charter, effective September 2010, which requires, among other conditions, that mining entities achieve a 26% historically disadvantaged persons ownership of mining assets and the Black

7

Economic Empowerment (“BEE”) legislation in South Africa. The DMR has proposed changes to the mining charter that would make requirements more stringent. These changes are being challenged by the Chamber of Mines, an industry employers’ organization representing South African mining companies, the outcome of which is uncertain. See Item 1A. Risk Factors.

Regulation of the Mining Industry in Australia

Mining operations in Western Australia are subject to a variety of environmental protection regulations including but not limited to: the Environmental Protection Act (the “EPA”), the primary source of environmental regulation in Western Australia, and, the Environment Protection and Biodiversity Conservation Act 1999 (Cth), which established the federal environment protection regime and prohibits the carrying out of a “controlled action” that may have a significant impact on a “matter of national environmental significance.”

Prescriptive legislation regulates health and safety at mining workplaces in Western Australia. The principal general occupational health and safety legislation and regulations are the Occupational Safety and Health Act 1984 (WA), the Occupational Health and Safety Regulations 1996 (WA) and the guidelines. The Mines Safety and Inspection Act 1994 (WA) and Mines Safety and Inspection Regulations 1995 (WA) and guidelines provide the relevant legislation for mining operations in Western Australia. The Dangerous Goods Act 2004 (WA) applies to the safe storage, handling and transport of dangerous goods.

Each Australian state and territory has its own legislation regulating the exploration for and mining of minerals. Our operations are principally regulated by the Western Australian Mining Act 1978 (WA) and the Mining Regulations 1981 (WA).

State Agreements are contracts between the State of Western Australia and the proponents of major resources projects, and are intended to foster resource development and related infrastructure investments. These agreements are approved and ratified by the Parliament of Western Australia. The State Agreement relevant to our Australian operations and our production of mineral sands is the agreement authorized by the Mineral Sands (Cooljarloo) Mining and Processing Agreement Act 1988 (WA). State Agreements may only be amended by mutual consent, which reduces the sovereign risk and increases the security of tenure, however Parliament may enact legislation that overrules or amends the particular State Agreement.

Regulation of Finished Product Manufacturing

Our business is subject to extensive regulation by federal, state, local and foreign governments. Governmental authorities regulate the generation and treatment of waste and air emissions at our operations and facilities. At many of our operations, we also comply with worldwide, voluntary standards developed by the International Organization for Standardization (“ISO”), a nongovernmental organization that promotes the development of standards and serves as a bridging organization for quality and environmental standards, such as ISO 9002 for quality management and ISO 14001 for environmental management.

Chemical Registration

The European Union (the “EU”) adopted a regulatory framework for chemicals in 2006 known as Registration, Evaluation and Authorization of Chemicals (“REACH”). Manufacturers and importers of chemical substances must register information regarding the properties of their existing chemical substances with the European Chemicals Agency. The timeline for existing chemical substances to be registered is based on volume and toxicity. The first group of chemical substances was required to be registered in 2010, with additional registrations due in 2013 and 2018. We registered those products requiring registration by the 2010 and 2013 deadlines. The REACH regulations also require chemical substances, which are newly imported or manufactured in the EU to be registered before being placed on the market. We are now focused on the authorization phase of the REACH process, and are making efforts to address “Substances of Very High Concern” and evaluating potential business implications. As a chemical manufacturer with global operations, we are also actively monitoring and addressing analogous regulatory regimes being considered or implemented outside of the EU, for example, in Korea and Taiwan.

8

In May 2016, France’s competent authority under REACH submitted a proposal to the European Chemicals Agency (“ECHA”) that would classify TiO2 as carcinogenic to humans by inhalation. The Company together with other companies and trade associations representing the TiO2 industry and industries consuming our products, submitted comments opposing the classification, based on evidence from epidemiological and other scientific studies. On October 12, 2017, ECHA’s Committee for Risk Assessment (“RAC”) released a written opinion dated September 14, 2017 stating that based on the scientific evidence it reviewed, there is sufficient grounds to classify TiO2 under the EU’s Classification, Labelling and Packaging Regulation (“CLP”) as a Category 2 Carcinogen, but only with a hazard statement describing the risk by inhalation. The European Commission will review the RAC’s formal recommendation to determine what regulatory measures, if any, should be taken. If the European Commission decides to adopt this classification, it could require that products manufactured with TiO2 be classified as containing carcinogenic materials, which could impact our business by inhibiting the marketing of products containing TiO2 to consumers, and subject our manufacturing operations to new regulations that could increase costs. Any classification, use restriction or authorized requirement for use imposed by the ECHA could have additional effects under other EU laws (e.g., those affecting medical and pharmaceutical applications, cosmetics, food packaging and food additives) and/or trigger heightened regulatory scrutiny in countries and local jurisdictions outside the EU based on health and safety grounds. It is also possible that heightened regulatory scrutiny would lead to claims by consumers or those involved in the production of such products alleging adverse health impacts. See Item 1A. Risk Factors.

Greenhouse Gas Regulation

Globally, our operations are subject to regulations that seek to reduce emissions of “greenhouse gases” (“GHGs”). We currently report and manage GHG emissions as required by law for sites located in areas requiring such managing and reporting (EU/Australia). While the U.S. has not adopted any federal climate change legislation, the U.S. Environmental Protection Agency (“EPA”) has introduced some GHG programs. For example, under the EPA’s GHG “Tailoring Rule,” expansions or new construction could be subject to the Clean Air Act’s Prevention of Significant Deterioration requirements. Some of our facilities are currently subject to GHG emissions monitoring and reporting. Changes or additional requirements due to GHG regulations could impact our capital and operating costs; however, it is not possible at the present time to estimate any financial impact to these U.S. operating sites. Also, some in the scientific community believe that increasing concentrations of GHGs in the atmosphere may result in climatic changes. Depending on the severity of climatic changes, our operations could be adversely affected. See Item 1A. Risk Factors.

Segment and Geographic Revenue Information

The tables below summarize Tronox Limited 2017 sales volume by geography and end-use market:

|

2017 Sales Volume by Geography

|

|

|

|

|

North America

|

|

40

|

%

|

|

Latin America

|

|

5

|

%

|

|

Europe

|

|

28

|

%

|

|

Asia-Pacific

|

|

27

|

%

|

|

|

|

|

|

|

2017 Sales Volume by End-Use Market

|

|

|

|

|

Paints and Coatings

|

|

79

|

%

|

|

Plastics

|

|

17

|

%

|

|

Paper and Specialty

|

|

4

|

%

|

Financial information by segment and geographic region is set forth in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 22 of Notes to consolidated financial statements.

Available Information

Our public internet site is http://www.tronox.com. The content of our internet site is available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this annual report unless expressly noted. We make available, free of charge, on or through the investor relations section of our internet site, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

9

Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers, as well as any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the “SEC”).

We file current, annual and quarterly reports, proxy statements and other information required by the Exchange Act with the SEC. You may read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, USA, or by calling +1-800-SEC-0330. Our SEC filings are also available to the public from the SEC’s internet site at http://www.sec.gov.

10

You should carefully consider the risk factors set forth below, as well as the other information contained in this Form 10-K, including our consolidated financial statements and related notes. This Form 10-K contains forward-looking statements that involve risks and uncertainties. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations.

Our pending acquisition of the Cristal TiO2 Business may not be consummated, and failure to complete the Cristal TiO2 Business acquisition could impact our stock price and financial results.

On February 21, 2017, we entered into a transaction agreement to acquire the titanium dioxide business of The National Titanium Dioxide Co. Limited (“Cristal”) and on March 1, 2018, we amended the Transaction Agreement to provide for revised terms with respect to such acquisition in certain respects (the “Cristal Transaction”). Completion of the Cristal Transaction is subject to certain closing conditions, including certain regulatory approvals.

On December 5, 2017, the U.S. Federal Trade Commission (“FTC”) announced that it would not approve the Cristal Transaction as proposed and filed an administrative action to prevent the parties from consummating the transaction. On December 21, 2017, the European Commission announced that after its initial review, it would pursue a more in-depth investigation (commonly called a “Phase II investigation”) of the Cristal Transaction before reaching a decision to approve it, with or without conditions. The transaction agreement provides for customary representations, warranties and covenants that are subject, in some cases, to specified exceptions and qualifications contained in the transaction agreement. There can be no assurance, however, that all closing conditions for the Cristal Transaction will be satisfied and, if they are satisfied, that they will be satisfied in time for the closing to occur by June 30, 2018 (subject to automatic 3-month extensions to March 31, 2019 if necessary based on the status of outstanding regulatory approvals), at which time either party to the transaction agreement may mutually agree to extend the closing date or terminate the transaction agreement if the Cristal Transaction has not closed by such time.

The Cristal Transaction is conditioned on the Company obtaining financing sufficient to fund the cash consideration, and the transaction agreement provides that the Company must pay to Cristal a termination fee of $100 million if all conditions to closing, other than the financing condition, have been satisfied and the transaction agreement is terminated because closing of the Cristal Transaction has not occurred by June 30, 2018 (subject to automatic 3-month extensions to March 31, 2019 if necessary based on the status of outstanding regulatory approvals). In the event that such termination by Tronox is (i) on or after January 1, 2019, and Tronox elects to terminate the Transaction Agreement if it determines that the outstanding regulatory approvals are not reasonably likely to be obtained; or (ii) if regulatory approval has not been obtained by March 31, 2019 and Tronox or Cristal elects to terminate the Transaction Agreement; then Tronox is required to pay Cristal a $60 million termination fee. Tronox completed its refinancing during the third quarter of 2017. See Note 15 of notes of consolidated financial statements.

The cash portion of the consideration in the Cristal Transaction will be funded through a combination of proceeds from the Alkali Sale, which was completed on September 1, 2017, the refinancing of our debt, including the Blocked Term Loan and cash on hand. See Note 15 of notes to the consolidated financial statements.

If the acquisition of the Cristal TiO2 business is not completed, our ongoing business and financial results may be adversely affected and we will be subject to a number of risks, including the following:

| • | depending on the reasons for the failure to complete the Cristal Transaction we could be liable to Cristal for a termination fee or other damages in connection with the termination or breach of the transaction agreement; |

| • | we have dedicated and we expect we will continue to commit significant time and resources, financial and otherwise, in planning for the acquisition and the associated integration; and |

| • | while the transaction agreement is in effect prior to closing the Cristal Transaction, we are subject to certain restrictions on the conduct of our business, which may adversely affect our ability to execute certain of our business strategies. |

11

In addition, if the Cristal Transaction is not completed or is completed subject to conditions or remedies, we may experience negative reactions from the financial markets and from our customers and employees and/or lose the anticipated benefits of owning all or portions of Cristal’s TiO2 business. If the acquisition is not completed, these risks may materialize and may adversely affect our business, results of operations, cash flows, as well as the price of our Class A Shares.

Concentrated ownership of our ordinary shares by Cristal and Exxaro may prevent minority shareholders from influencing significant corporate decisions and may result in conflicts of interest.

Following the closing of the Cristal Transaction, Cristal Inorganic Chemicals Netherlands Coöperatief W.A. (“Cristal Inorganic”), a wholly-owned subsidiary of Cristal, will own approximately 24% of the outstanding ordinary shares (including both our Class A Shares and Class B Shares) of the Company. Following the closing of the Cristal Transaction and assuming that Exxaro does not engage in additional sales of its Class B Shares, Exxaro will own approximately 18% of the Company’s outstanding ordinary shares (including both our Class A Shares and Class B Shares).

Cristal Inorganic and Exxaro may be able to influence fundamental corporate matters and transactions, including mergers or acquisitions (subject to prior board approval); the sale of all or substantially all of our assets; in certain circumstances, the amendment of our Constitution; and our winding up and dissolution. This concentration of ownership, may delay, deter or prevent acts that would be favored by our other shareholders. The interests of Cristal Inorganic and Exxaro may not always coincide with our interests or the interests of our other shareholders. Also, Cristal Inorganic and Exxaro may seek to cause us to take courses of action that, in its judgment, could enhance its investment in us, but which might involve risks to our other shareholders or adversely affect us or our other shareholders.

In addition, under the shareholders agreement, to be entered into upon the closing of the Cristal Transaction (the “Cristal Shareholders Agreement”), among the Company, on the one hand, and Cristal, Cristal Inorganic and the three shareholders of Cristal, on the other hand (collectively, the “Cristal Shareholders”), as long as the Cristal Shareholders, collectively, beneficially own at least 24,900,000 or more of Class A Shares, they will have the right to designate for nomination two Class A Directors of the Board (defined below) and, as long as they beneficially own at least 12,450,000 Class A Shares but less than 24,900,000 Class A Shares, they will have the right to designate for nomination one Class A director of the Board. The Cristal Shareholders Agreement also will provide that as long as the Cristal Shareholders own at least 11,743,750 Class A Shares, they will be granted certain preemptive rights. Also under the Cristal Shareholders Agreement, the Company has agreed to file promptly after the closing of the acquisition a registration statement covering approximately four percent of the then-outstanding ordinary shares of the Company, which may be sold as soon as such registration statement is effective. Other than with respect to those shares, the Cristal Shareholders Agreement will include restrictions on Cristal Inorganic’s ability to transfer any of its Class A Shares for a period of two years after the closing of the acquisition other than to certain permitted transferees after the later of eighteen months and the resolution of all indemnification claims under the Transaction Agreement subject to certain further limitations. The Cristal Shareholders Agreement will also contain certain demand and piggyback registration rights, which commence after the transfer restriction period expires. Exxaro’s rights under our Constitution and Shareholder’s Deed will remain unchanged following the Cristal Transaction.

As a result of these or other factors, the market price of our Class A Shares could decline. In addition, this concentration of share ownership may adversely affect the trading price of our Class A Shares because investors may perceive disadvantages in owning shares in a company with significant shareholders.

We may not be able to realize anticipated benefits of the Cristal Transaction, including expected synergies, earnings per share accretion or earnings before interest, taxes, depreciation and amortization (“EBITDA”) and free cash flow growth and we will be subject to business uncertainties that could adversely affect our business.

The success of the pending Cristal Transaction will depend, in part, on our ability to realize anticipated cost synergies, earnings per share accretion or EBITDA and free cash flow growth. Our success in realizing these benefits, and the timing of this realization, depends on the successful integration of our business and operations with the acquired business and operations. Even if we are able to integrate the acquired businesses and operations successfully, this integration may not result in the realization of the full benefits of the pending Cristal Transaction that we currently expect within the anticipated time frame or at all.

12

There is also the possibility that:

| • | the acquisition may result in our assuming unexpected liabilities; |

| • | we may experience difficulties integrating operations and systems, as well as company policies and cultures; |

| • | we may fail to retain and assimilate employees of the acquired business; and |

| • | problems may arise in entering new markets in which we have little or no experience. |

Uncertainty about the effect of the Cristal Transaction on employees, customers and suppliers may have an adverse effect on our business. These uncertainties may impair our ability to attract, retain and motivate key personnel until the Cristal Transaction is consummated and for a period of time thereafter, and could cause our customers, suppliers and other business partners to delay or defer certain business decisions or to seek to change existing business relationships with us. The occurrence of any of these events could have a material adverse effect on our operating results, particularly during the period immediately following the closing of the Cristal Transaction.

Market conditions, as well as global and regional economic downturns that adversely affect the demand for our end-use products could adversely affect the profitability of our operations and the prices at which we can sell our products, negatively impacting our financial results.

Our TiO2 revenue and profitability is dependent on direct sales of TiO2 to end user customers and sales of TiO2 feedstock to TiO2 producers. TiO2 is a chemical used in many “quality of life” products for which demand historically has been linked to global, regional and local GDP and discretionary spending, which can be negatively impacted by regional and world events or economic and market conditions. Such events can cause a decrease in demand for our products and market prices to fall, which may have an adverse effect on our results of operations and financial condition. A substantial portion of our products and raw materials are commodities that reprice as market supply and demand fundamentals change. Accordingly, product margins and the level of our profitability tend to vary with changes in the business cycle. Our TiO2 prices may do so in the near term as ore prices and pigment prices are expected to fluctuate in the short term and over the next few years.

A significant portion of the demand for our products comes from manufacturers of paint and plastics, and other industrial customers. Companies that operate in the industries that these industries serve, including the automotive and construction, may experience significant fluctuations in demand for their own end products because of economic conditions, changes in consumer demand, or increases in raw material and energy costs. In addition, many large end users of our products depend upon the availability of credit on favorable terms to make purchases of raw materials such as TiO2. As interest rates increase or if our customers’ creditworthiness deteriorates, this credit may be expensive or difficult to obtain. If these customers cannot obtain credit on favorable terms, they may be forced to reduce their purchases. These and other factors may lead some customers to seek renegotiation or cancellation of their arrangements with our businesses, which could have a material adverse effect on our results of operations. Additionally, Chinese producers are significant participants in the TiO2 market and Chinese exports can also affect demand and the price for our products.

TiO2 pigment and feedstock prices have been and in the future may be volatile. Price declines for our products will negatively affect our financial position and results of operations.

Additionally, historically, the global market and, to a lesser extent, the domestic market for TiO2 pigment and feedstock have been volatile, and those markets are likely to remain volatile in the future. Prices for TiO2 pigment and feedstock may fluctuate in response to relatively minor changes in the supply of and demand for these products, market uncertainty and other factors beyond our control.

Factors that affect the price of our products include, among other things:

| • | overall economic conditions; |

| • | the level of customer demand, including in the paint, paper and plastics industries; |

| • | the level of production and exports of our products globally; |

| • | the level of production and cost of materials used to produce TiO2, including synthetic materials, globally; |

13

| • | the cost of energy consumed in the production of TiO2, including the price of natural gas, electricity and coal; |

| • | the impact of competitors increasing their capacity and exports; |

| • | domestic and foreign governmental relations, regulations and taxes; and |

| • | political conditions or hostilities and unrest in regions where we export our TiO2 products. |

TiO2 pigment pricing pressure can make it difficult to predict the cash we may have on hand at any given time, and a prolonged period of price declines may materially and adversely affect our financial position, liquidity, ability to finance planned capital expenditures and results of operations.

The markets for many of our TiO2 products have seasonally affected sales patterns.

The demand for TiO2 during a given year is subject to seasonal fluctuations. Because TiO2 is widely used in paint and other coatings, titanium feedstocks are in higher demand prior to the painting season in the Northern Hemisphere (spring and summer), and pig iron is in lower demand during the European summer holidays, when many steel plants and foundries undergo maintenance. Zircon generally is a non-seasonal product; however, it is negatively impacted by the winter and Chinese New Year celebrations due to reduced zircon demand from China. We may be adversely affected by existing or future cyclical changes, and such conditions may be sustained or further aggravated by anticipated or unanticipated changes in regional weather conditions. For example, poor weather conditions in a region can lead to an abbreviated painting season, which can depress consumer sales of paint products that use TiO2.

Our results of operations may be adversely affected by fluctuations in currency exchange rates.

The financial condition and results of operations of our operating entities outside the U.S. are reported in various foreign currencies, primarily the South African Rand, Australian Dollars and Euros, and then converted into U.S. dollars at the applicable exchange rate for inclusion in the financial statements. As a result, any volatility of the U.S. dollar against these foreign currencies creates uncertainty for and may have a negative impact on reported sales and operating margin. We have made a U.S. dollar functional currency election for both Australian financial reporting and federal income tax purposes. On this basis, our Australian entities report their results of operations on a U.S. dollar basis. In addition, our operating entities often need to convert currencies they receive for their products into currencies in which they purchase raw materials or pay for services, which could result in a gain or loss depending on fluctuations in exchange rates.

In order to manage this risk, we may, from time to time, enter into forward contracts to buy and sell foreign currencies.

Our operations may be negatively impacted by inflation.

Our profits and financial condition could be adversely affected when cost inflation is not offset by devaluation in operating currencies or an increase in the price of our products. Our operations have been affected by inflation in the countries in which they have operated in recent years. Working costs and wages in South Africa and Australia have increased in recent years, resulting in significant cost pressures for the mining industry.

As an emerging market, South Africa poses a challenging array of long-term political, economic, financial and operational risks.

South Africa has continued undergoing political and economic challenges. Changes to or instability in the economic or political environment in South Africa, especially if such changes create political instability, actual or potential shortages of production materials or labor unrest, could result in production delays and production shortfalls, and materially impact our production and results of operations.

In South Africa, our mining and smelting operations depend on electrical power generated by Eskom, the state-owned sole energy supplier. South African electricity prices have risen during the past few years, and future increases are likely. Additionally, our KZN Sands operations currently use approximately 328,000 gigajoules of Sasol gas, which is available only from Sasol Limited; however, we could replace approximately 30% to 44% of our current Sasol gas usage with furnace off-gas produced by KZN Sands, if necessary.

14

We use significant amounts of water in our operations, which could impose significant costs. Use of water in South Africa is governed by water-use licenses. Our KZN mining operation in South Africa uses water to transport the slimes or sand from reclaimed areas to the processing plant and to the tailings facilities. Additionally, South Africa is currently experiencing a drought resulting in water restrictions being imposed in certain areas, most notably recently in the Western Cape where our Namakwa Sands operations are located. A prolonged drought in a region of South Africa may lead to continued, or more severe water restrictions, either of which could have a material adverse effect on our business, financial condition or results of operations. Under South African law, our South African mining operations are subject to water-use licenses that govern each operation. These licenses require, among other conditions, that mining operations achieve and maintain certain water quality limits for all water discharges, where applicable. Our South African operations that came into existence after the adoption of the National Water Act, No. 36 of 1998 have applied for and been issued the required water-use licenses. However, changes to water-use licenses could affect our operational results and financial condition. On May 13, 2016, the Department of Water and Sanitation of the Republic of South Africa announced water restrictions affecting users of the fresh water supply to our Namakwa Sands operations. On December 12, 2017 the Department of Water and Sanitation published a notice in terms of the National Water Act (1998) curtailing water usage by 45% for residential and commercial users and 60% for agricultural users. Saldanha Bay Municipality, where our Namakwa Sands Smelter is located, is currently on Level 5 water restrictions and tariffs. While these restrictions have not curtailed our mining or processing operations to date, the reservoirs that store water for the system, which also supplies fresh water to the residents of the City of Cape Town, are at historically low levels and there can be no assurance that further use restrictions or supply curtailments may have a materially adverse impact on our operations at Namakwa Sands and as a result the financial condition and results of operations of our business. Namakwa Sands operations continues to implement freshwater consumption reduction initiatives and finding alternative sources of water to reduce reliance on the city’s water system.

The South African government may intervene in mining through various means including increased taxation, greater control and conditions on the distribution of mineral rights, poverty alleviation, and job creation. Such measures have not yet been defined, and the impact the measures may have on our business remains uncertain.

Changes to the revised MPRDA have been incorporated into the 2013 MPRDA amendment, and are awaiting consideration by the South African Parliament before being promulgated. Some of the proposed changes may have an adverse effect on our business, operating results and financial condition. Although we expect the bulk of the original act to remain intact, there could be substantial changes, based on the current draft. This could have adverse effects on our business, operating results and financial condition.

South Africa’s exchange control regulations require resident companies to obtain the prior approval of the South African Reserve Bank to raise capital in any currency other than the Rand, and restrict the export of capital from South Africa. While the South African government has relaxed exchange controls in recent years, it is difficult to predict whether or how it will further change or abolish exchange control measures in the future. These exchange control restrictions could hinder our financial and strategic flexibility, particularly our ability to use South African capital to fund acquisitions, capital expenditures, and new projects outside of South Africa.

Our operations in South Africa are reliant on services provided by the state agency, Transnet, for limited rail transport services at Namakwa Sands. Furthermore, they provide extensive dockside services at both the ports of Richards Bay and Saldanha Bay. Delays, particularly those caused by industrial actions, could have a negative impact on our business, operating results and financial condition.

South African law governs the payment of compensation and medical costs to a compensation fund against which mining employees and other people at sites where ancillary mining activities are conducted can claim for mining activity-related illnesses or injuries. Should claims against the compensation fund rise significantly due to our mining activity or if claims against us are not covered by the compensation fund, the amount of our contribution or liability to claimants may increase, which could adversely impact our financial condition. In addition, the HIV/AIDS epidemic in South Africa poses risks to our South African operations in terms of potentially reduced productivity, and increased medical and other costs. If there is a significant increase in the incidence of HIV/AIDS infection and related diseases among the South African workforce over the next several years, our operations, projects and financial condition may be adversely affected.

15

Our flexibility in managing our labor force may be adversely affected by labor and employment laws in the jurisdictions in which we operate, many of which are more onerous than those of the U.S.; and some of our labor force has substantial workers' council or trade union participation, which creates a risk of disruption from labor disputes and new laws affecting employment policies.

Labor costs constituted approximately 29% of our production costs in 2017. The majority of our employees are located outside the U.S. In most of those countries, labor and employment laws are more onerous than in the U.S. and, in many cases, grant significant job protection to employees, including rights on termination of employment.

In South Africa, over 73% of our workforce belongs to a union. In Australia, most employees are not currently represented by a union, but approximately 46% are represented by a collective bargaining agreement. In the Netherlands, approximately 49% of our employees are represented by a collective bargaining agreement and 27% are members of a union.

Our South African operations have entered into various agreements regulating wages and working conditions at our mines. There have been periods when various stakeholders have been unable to agree on dispute resolution processes, leading to threats of disruptive labor disputes, although only two strikes have ever occurred in the history of these operations. Due to the high level of employee union membership, our South African operations are at risk of production stoppages for indefinite periods due to strikes and other labor disputes. Although we believe that we have good labor relations with our South African employees, we may experience labor disputes in the future.