Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Radius Health, Inc. | rdus1231201710kex32d2.htm |

| EX-32.1 - EXHIBIT 32.1 - Radius Health, Inc. | rdus1231201710kex32d1.htm |

| EX-31.2 - EXHIBIT 31.2 - Radius Health, Inc. | rdus1231201710kex31d2.htm |

| EX-31.1 - EXHIBIT 31.1 - Radius Health, Inc. | rdus1231201710kex31d1.htm |

| EX-23.1 - EXHIBIT 23.1 - Radius Health, Inc. | rdus1231201710kex23d1.htm |

| EX-21.1 - EXHIBIT 21.1 - Radius Health, Inc. | rdus1231201710kex21d1.htm |

| EX-10.15(A) - EXHIBIT 10.15(A) - Radius Health, Inc. | rdus1231201710kex10d15a.htm |

| EX-10.12(A) - EXHIBIT 10.12(A) - Radius Health, Inc. | rdus1231201710kex10d12a.htm |

| EX-10.15 - EXHIBIT 10.15 - Radius Health, Inc. | rdus1231201710kex10d15.htm |

| EX-10.4 - EXHIBIT 10.4 - Radius Health, Inc. | rdus1231201710kex10d4.htm |

| EX-3.2 - EXHIBIT 3.2 - Radius Health, Inc. | rdus1231201710kex3d2.htm |

Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2017 | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission file number: 001-35726

Radius Health, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 80-0145732 (I.R.S. Employer Identification No.) | |

950 Winter Street Waltham, Massachusetts (Address of principal executive offices) | 02451 (Zip Code) | |

617-551-4000

(Registrant's telephone number, including area code)

Securities issued pursuant to Section 12(b) of the Act: Common Stock

Securities issued pursuant to Section 12(g) of the Act: None

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.0001 per share | The NASDAQ Global Market | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Emerging growth company o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant's common stock, $0.0001 par value per share ("Common Stock"), held by non-affiliates of the registrant, based on the last sale price of the Common Stock at the close of business on June 30, 2017 was $1.3 billion. For the purpose of the foregoing calculation only, all directors and executive officers of the registrant are assumed to be affiliates of the registrant.

Number of shares outstanding of the registrant's common stock, par value $0.0001 per share, as of February 26, 2018: 45,076,508

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for its 2018 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Radius Health, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2017

INDEX

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report, including in the sections titled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," contains, in addition to historical information, forward-looking statements. We may, in some cases, use words such as "project," "believe," "anticipate," "plan," "expect," "estimate," "intend," "continue," "should," "would," "could," "potentially," "will," "may" or similar words and expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements in this Annual Report on Form 10-K may include, among other things, statements about:

• | our expectations regarding commercialization of TYMLOSTM in the U.S. and our ability to successfully commercialize TYMLOS in the U.S.; |

• | the therapeutic benefits and effectiveness of TYMLOS and our investigational product candidates; |

• | our ability to obtain U.S. and foreign regulatory approval for our product candidates, and the timing thereof; |

• | our ability to compete with other companies that are or may be developing or selling products that are competitive with TYMLOS or our investigational product candidates; |

• | anticipated trends and challenges in the market in which TYMLOS will compete and in other potential markets in which we may compete; |

• | our plans with respect to collaborations and licenses related to the development, manufacture or sale of TYMLOS and our investigational product candidates; |

• | the progress of, timing of and amount of expenses associated with our research, development and commercialization activities; |

• | the safety profile and related adverse events of TYMLOS and our investigational product candidates; |

• | the ability of our investigational product candidates to meet existing or future regulatory standards; |

• | our expectations regarding federal, state and foreign regulatory requirements; |

• | the success of our clinical studies for our investigational product candidates; |

• | our expectations as to future financial performance, expense levels, future payment obligations and liquidity sources; |

• | our ability to attract, motivate, and retain key personnel; and |

• | other factors discussed elsewhere in this report. |

The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include our financial performance, our ability to attract and retain customers, our development activities and those other factors we discuss in Item 1A of this Annual Report on Form 10-K under the caption "Risk Factors." You should read these factors and the other cautionary statements made in this report as being applicable to all related forward-looking statements wherever they appear in this report. These risk factors are not exhaustive and other sections of this report may include additional factors which could adversely impact our business and financial performance.

1

PART I

ITEM 1. BUSINESS.

Unless otherwise provided in this report, all references in this report to "we," "us," "Radius," "our company," "our," or the "Company" refer to Radius Health, Inc. and our subsidiaries.

Overview

We are a science-driven fully integrated biopharmaceutical company that is committed to developing and commercializing innovative endocrine therapeutics in the areas of osteoporosis and oncology. In April 2017, our first commercial product, TYMLOSTM (abaloparatide) injection, was approved by the U.S. Food and Drug Administration ("FDA") for the treatment of postmenopausal women with osteoporosis at high risk for fracture defined as history of osteoporotic fracture, multiple risk factors for fracture, or patients who have failed or are intolerant to other available osteoporosis therapy. In May 2017, we commenced U.S. commercial sales of TYMLOS and, as of February 2018, TYMLOS was available and covered for approximately 259 million U.S. insured lives, representing approximately 86% of U.S. insured lives. In May 2017, we also announced positive top-line results from our completed 24-month ACTIVExtend clinical trial for TYMLOS, which met all of its primary and secondary endpoints. We submitted a labeling supplement to the FDA in connection with the results from our ACTIVExtend trial in December 2017. In July 2017, we entered into a license and development agreement with Teijin Limited (“Teijin”) for abaloparatide for subcutaneous injection (“abaloparatide-SC”) in Japan. Under this agreement, we are entitled to receive milestone payments upon the achievement of certain regulatory and sales milestones and a fixed low double-digit royalty based on net sales of abaloparatide-SC in Japan during the royalty term, and we have an option to negotiate for a co-promotion agreement with Teijin for abaloparatide-SC in Japan. Our European Marketing Authorisation Application (“MAA”) for abaloparatide-SC is under review by the Committee for Medicinal Products for Human Use (“CHMP”) of the European Medicines Agency (“EMA”) and we expect an opinion from the CHMP regarding the MAA during the first half of 2018. In the first quarter of 2018, we expect to initiate a clinical trial in men with osteoporosis which, if successful, will form the basis of a supplemental new drug application ("NDA") seeking to expand the use of TYMLOS to treat men with osteoporosis at high risk for fracture. In the first half of 2018, we plan to initiate a bone histomorphometry study, which would enroll approximately 25 postmenopausal women with osteoporosis to evaluate the early effects of TYMLOS on tissue-based bone remodeling and structural indices.

We are developing an abaloparatide transdermal patch, or abaloparatide-patch, for potential use in the treatment of postmenopausal women with osteoporosis. In January 2018, we met with the FDA and gained alignment with the agency on a single, pivotal BMD non-inferiority bridging study to support an NDA submission. The FDA agreed that, depending on the study results, a randomized, open label, active-controlled, non-inferiority Phase 3 study of up to 500 patients with postmenopausal osteoporosis at high risk of fracture would be sufficient to gain approval for abaloparatide-patch. The FDA confirmed that the primary endpoint will be change in lumbar spine BMD at 12 months and that the non-inferiority margin must preserve 75% of the active control (abaloparatide-SC) based on the lower bound of the 95% confidence interval. We expect to initiate this pivotal study in mid-2019 and to complete it in 2020. In February 2018, we entered into a scale-up and commercial supply agreement with 3M Company pursuant to which 3M has agreed to exclusively manufacture Phase 3 and global commercial supplies of abaloparatide-patch.

We are also developing our investigational product candidate, elacestrant (RAD1901), a selective estrogen receptor degrader (“SERD”), for potential use in the treatment of hormone-receptor positive breast cancer. We have completed enrollment in our ongoing dose escalation Part A, and dose expansion Part B and C, and in the 18F fluoroestradiol positron emission tomography (“FES-PET”) imaging Phase 1 studies of elacestrant in advanced metastatic breast cancer. In October 2017, the FDA granted Fast Track designation for our elacestrant breast cancer program. Based on feedback from the EMA and the FDA, we now intend to conduct a single, randomized, controlled Phase 2 trial of elacestrant as a third-line monotherapy in approximately 300 patients with ER+/HER2- advanced/metastatic breast cancer. Patients in the study would be randomized to receive either elacestrant or the investigator’s choice of an approved hormonal agent and the primary endpoint of the study will be progression-free survival (“PFS”). The study would also include a planned interim PFS analysis. We believe that, depending on results, this single trial would support applications for global marketing approvals for elacestrant as a third-line monotherapy. In addition, depending on results of the interim analysis, the Company could seek accelerated approval for elacestrant in the United States. We will provide further study details when the Phase 2 study is started, which we expect will be in the second half of 2018.

We are developing our internally discovered investigational product candidate, RAD140, a non-steroidal selective androgen receptor modulator ("SARM") for potential use in the treatment of hormone-receptor positive breast cancer. In September 2017, we initiated a Phase 1 study of RAD140 in patients with locally advanced or metastatic breast cancer. We expect to provide an update on our RAD140 development program by the end of 2018.

2

Our Marketed Product and Investigational Product Candidates

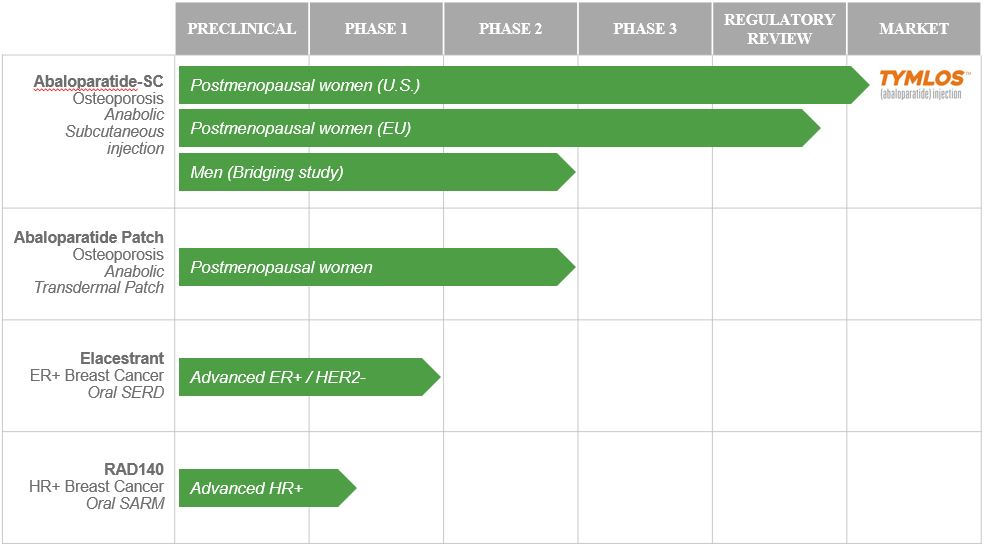

The success of our business is primarily dependent upon our ability to commercialize TYMLOS and to develop and commercialize our current and future product candidates. The following table identifies our commercial product, TYMLOS, and the investigational product candidates in our current product portfolio, their potential indication and stage of development. We hold worldwide commercialization rights for all these product candidates, excluding abaloparatide-SC, for which we hold worldwide commercialization rights, except for Japan, where we have an option to negotiate a co-promotion agreement with Teijin.

Abaloparatide

In April 2017, the FDA approved TYMLOS for the treatment of postmenopausal women with osteoporosis at high risk for fracture defined as history of osteoporotic fracture, multiple risk factors for fracture, or patients who have failed or are intolerant to other available osteoporosis therapy. We are developing two formulations of abaloparatide: abaloparatide-SC, an injectable subcutaneous formulation of abaloparatide, and abaloparatide-patch, a short-wear-time patch formulation of abaloparatide.

TYMLOS (Abaloparatide-SC)

TYMLOS was approved in the United States in April 2017 for the treatment of postmenopausal women with osteoporosis at high risk for fracture. The efficacy of TYMLOS for the treatment of postmenopausal women with osteoporosis was evaluated in an 18-month, randomized, multicenter, double-blind, placebo controlled clinical trial. The study also had an open label teriparatide arm. TYMLOS resulted in a significant reduction in the incidence of new vertebral fractures compared to placebo at 18 months (0.6% TYMLOS compared to 4.2% placebo). The relative risk reduction in new vertebral fractures at 18 months compared to placebo was 86% (p <0.001) for TYMLOS and 80% (p <0.001) for teriparatide. TYMLOS also resulted in a significant reduction in the incidence of nonvertebral fractures at the end of the 18 months of treatment plus one month follow-up where no drug was administered (2.7% for TYMLOS compared to 4.7% for placebo). The relative risk reduction, compared to placebo, in nonvertebral fractures for TYMLOS was 43% (p=0.049) and 28% for teriparatide (p=0.22). There was a 43% (p=0.02) risk reduction in clinical fractures for TYMLOS and a 29% (p=0.11) for teriparatide; a 70% (p<0.001) risk reduction in major osteoporotic fractures for TYMLOS, and 33% (p=0.14) for teriparatide, compared with patients who received placebo. For major osteoporotic fractures, there was a 55% (p=0.03) risk reduction for TYMLOS-treated patients compared to teriparatide.

3

The first commercial sales of TYMLOS in the United States occurred in May 2017 and we are commercializing TYMLOS in the United States through our commercial organization. We have built a distribution network for TYMLOS in the United States, comprised of well-established distributors and specialty pharmacies. Under our distribution model, both the distributors and specialty pharmacies take physical delivery of TYMLOS and the specialty pharmacies dispense TYMLOS directly to patients. As of February 2018, TYMLOS was available and covered for approximately 259 million U.S. insured lives, representing approximately 86% of U.S. insured lives. We hold worldwide commercialization rights to abaloparatide-SC, except for Japan, where we have an option to negotiate a co-promotion agreement with Teijin for abaloparatide-SC.

The combined 25-month fracture data from our Phase 3 clinical trial program for TYMLOS formed the basis of our regulatory submissions in the United States and Europe. In November 2015, we submitted an MAA for abaloparatide-SC to the EMA, which was validated and is currently undergoing active regulatory assessment by the CHMP. In December 2017, the CHMP issued a third Day-180 List of Outstanding Issues. As part of its on-going risk-benefit assessment, the CHMP informed the Company that it intends to refer the MAA to a scientific advisory group for additional advice. We expect that the CHMP may adopt an opinion regarding our MAA during the first half of 2018. We intend to enter into a collaboration for the commercialization of abaloparatide-SC outside of the United States and Japan.

In May 2017, we announced positive top-line results from the completed 24-month ACTIVExtend clinical trial of TYMLOS, which met all of its primary and secondary endpoints. In ACTIVExtend, patients who had completed 18 months of TYMLOS injections or placebo in the ACTIVE Phase 3 trial were transitioned to receive 24 additional months of open-label alendronate. For the subset of ACTIVE trial patients (n=1139) that enrolled in the ACTIVExtend trial, the previous TYMLOS-treated patients had a significant 84% relative risk reduction (p<0.0001) in the incidence of new vertebral fractures compared with patients who received placebo followed by alendronate. They also demonstrated a 39% risk reduction in nonvertebral fractures (p=0.038), a 34% risk reduction clinical fractures (p=0.045) and a 50% risk reduction in major osteoporotic fractures (p=0.011) compared with patients who received placebo followed by alendronate. At the 43-month timepoint, for all patients (n=1645) that enrolled in the ACTIVE trial, TYMLOS-treated patients had a statistically significant risk reduction in new vertebral fractures (p<0.0001), nonvertebral fractures (p=0.038), clinical fractures (p=0.045), and major osteoporotic fractures (p<0.001), compared with patients who received placebo followed by alendronate. While not a pre-specified endpoint, there was also a statistically significant risk reduction in hip fractures (p=0.027) at the 43-month time point in the TYMLOS-treated patients, compared with patients who received placebo followed by alendronate. The adverse events reported during the alendronate treatment period were similar between the previous TYMLOS-treated patients and the previous placebo group. The incidences of cardiovascular adverse events including serious adverse events were similar between groups. There have been no cases of osteonecrosis of the jaw or atypical femoral fracture in the entire TYMLOS development program. The results from the completed ACTIVExtend trial were presented at a major scientific meeting in September 2017 and we submitted a labeling supplement in connection with this data to the FDA in December 2017.

In July 2017, we entered into a license and development agreement with Teijin for abaloparatide-SC in Japan. Pursuant to the agreement, we may receive additional milestone payments upon the achievement of certain regulatory and sales milestones, and a fixed low double-digit royalty based on net sales of abaloparatide-SC in Japan during the royalty term. In addition, we have an option to negotiate for a co-promotion agreement with Teijin for abaloparatide-SC in Japan.

In late 2017, we gained agreement with the FDA on the design of a clinical trial in men with osteoporosis which, if successful, will form the basis of a supplemental NDA seeking to expand the use of TYMLOS to treat men with osteoporosis at high risk for fracture. The study will be a randomized, double-blind, placebo-controlled trial that will enroll approximately 225 men with osteoporosis. The primary endpoint is change in spine BMD at 12 months compared with placebo. In previous clinical trials, TYMLOS has demonstrated increases in BMD in postmenopausal women. The study will include specialized high-resolution imaging of bone structure in a subset of the study participants. We expect to initiate the trial in the first quarter of 2018.

In the first half of 2018, we plan to initiate a bone histomorphometry study, which would enroll approximately 25 postmenopausal women with osteoporosis to evaluate the early effects of TYMLOS on tissue-based bone remodeling and structural indices.

Abaloparatide-patch

We are also developing abaloparatide-patch, based on 3M’s patented Microstructured Transdermal System technology, for potential use as a short wear-time transdermal patch. We hold worldwide commercialization rights to the abaloparatide-patch technology and we are developing abaloparatide-patch toward future global regulatory submissions to build upon the potential success of TYMLOS. Our development strategy for abaloparatide patch is to bridge to the established efficacy and safety of our approved abaloparatide-SC formulation.

4

We commenced a human replicative clinical evaluation of the optimized abaloparatide-patch in December 2015, with the goal of achieving comparability to abaloparatide-SC. In September 2016, we presented results from this evaluation of the first and second abaloparatide-patch prototypes, demonstrating that formulation technology can modify the pharmacokinetic profile of abaloparatide, including Tmax, half-life (“T1/2”), and area under the curve (“AUC”). In March 2018, we announced that through further optimization we had achieved comparability to the abaloparatide-SC profile with a third prototype (the “current abaloparatide-patch”). The current abaloparatide-patch optimized the drug-device combination through process improvements, a finalized formulation, selection of a dose (300 µg), and the introduction of a new clinical applicator. Together these changes, which were designed to improve the ease of use and patient experience, resulted in an increased half-life and AUC (915 pg.hr/ml for the current abaloparatide-patch, compared to 242 pg.hr/ml for the first patch prototype, 645 pg.hr/ml for the second patch prototype, and 936 pg.hr/ml for abaloparatide-SC).

In January 2018, we met with the FDA to align on a regulatory and development path for registration of abaloparatide-patch. We gained alignment with the agency on a single, pivotal BMD non-inferiority bridging study to support an NDA submission. The FDA agreed that, depending on the study results, a randomized, open label, active-controlled, non-inferiority Phase 3 study of up to 500 patients with postmenopausal osteoporosis at high risk of fracture would be sufficient to gain approval for abaloparatide-patch. The FDA confirmed that the primary endpoint will be change in lumbar spine BMD at 12 months and that the non-inferiority margin must preserve 75% of the active control (abaloparatide-SC) based on the lower bound of the 95% confidence interval. We expect to initiate this pivotal study in mid-2019 and to complete it in 2020. On February 27, 2018, we entered into a scale-up and commercial supply agreement with 3M Company pursuant to which 3M has agreed to exclusively manufacture Phase 3 and global commercial supplies of abaloparatide-patch.

Elacestrant (RAD1901)

Elacestrant is a SERD that we are evaluating for potential use as an oral treatment for hormone-receptor positive breast cancer. We hold worldwide commercialization rights to elacestrant. Elacestrant is currently being investigated in women with advanced estrogen receptor positive (“ER-positive”) and human epidermal growth factor receptor 2-negative (“HER2-negative”) breast cancer, the most common subtype of the disease. Studies completed to date indicate that the compound has the potential for use as a single agent, or in combination with other therapies for the treatment of breast cancer. To date, no dose limiting toxicities have been reported in the elacestrant program. We believe that, subject to successful development, regulatory review and approval, elacestrant could have the potential to offer the following advantages compared to current standard of care treatments for ER-positive and HER2-negative breast cancer:

• | ability to degrade the estrogen receptor; |

• | favorable efficacy and tolerability profile; |

• | ability to effectively combine with other agents; |

• | treatment of hormone-resistant breast cancers; and |

• | once a day oral administration. |

We have completed enrollment in our elacestrant FES-PET imaging study and dose-escalation Part A and expansion study parts B and C Phase 1 breast cancer trials. In June 2017, we discussed the data from these ongoing Phase 1 studies with the FDA to gain alignment on defining the next steps for our elacestrant breast cancer program, including the design of a Phase 2 trial. In this meeting, the FDA agreed that a single-arm monotherapy Phase 2 study of up to 200 patients, could be appropriate with the primary endpoint being ORR, coupled with DOR. Depending on the study results, which must demonstrate an improvement over then available therapies, this study could be considered a pivotal study for accelerated approval as long as a confirmatory study is ongoing at the time of our NDA submission. In October 2017, the FDA granted Fast Track designation for our elacestrant breast cancer program. Fast Track is a process the FDA designed to facilitate the development and expedite the review of new therapies to treat serious conditions and fill unmet medical needs.

In February 2018, we received scientific advice from the European Medicines Agency (“EMA”) regarding a potential single-arm monotherapy Phase 2 trial of elacestrant in patients with ER+, HER2- advanced or metastatic breast cancer. In addition, we had a further meeting in February 2018 with the FDA regarding the registrational pathway for elacestrant at which we confirmed FDA’s guidance for a single-arm study and gained alignment with the agency on an alternative potential comparator study design for our monotherapy program. Based on feedback from the EMA and the FDA, we now intend to conduct a single, randomized, controlled Phase 2 trial of elacestrant as a third-line monotherapy in approximately 300 patients with ER+/HER2- advanced/metastatic breast cancer. Patients in the study would be randomized to receive either elacestrant or the investigator’s choice of an approved hormonal agent and the primary endpoint of the study will be progression-free survival (“PFS”). The study would also include a planned interim PFS analysis. We believe that, depending on results, this single trial would support applications for global marketing approvals for elacestrant as a third-line monotherapy. In addition, depending

5

on results of the interim analysis, the Company could seek accelerated approval for elacestrant in the United States. We will provide further study details when the Phase 2 study is started, which we expect will be in the second half of 2018.

Phase 1 - Dose-Escalation and Expansion Study

In December 2014, we commenced a Phase 1, multicenter, open-label, multiple-part, dose-escalation study of elacestrant in postmenopausal women with ER-positive and HER2-negative advanced breast cancer in the United States to determine the recommended dose for a Phase 2 clinical trial and to make a preliminary evaluation of the potential anti-tumor effect of elacestrant. Part A of this Phase 1 study was designed to evaluate escalating doses of elacestrant. The Part B expansion cohort was initiated at 400-mg daily dosing in March 2016 to allow for an evaluation of additional safety, tolerability and preliminary efficacy. The patients enrolled in this study are heavily pretreated ER-positive, HER2-negative advanced breast cancer patients who have received a median of 3 prior lines of therapy including fulvestrant and CDK4/6 inhibitors, and about 50% of the patients had ESR1 mutations. We have completed enrollment in the ongoing dose-escalation Part A and expansion study parts B and C. In December 2017, we initiated enrollment of a Part D cohort in this study to provide additional data on a more homogeneous and genetically defined patient population to support our overall elacestrant clinical development program and anticipated regulatory submissions.

In December 2016 and June 2017, we reported positive results from this ongoing Phase 1 dose-escalation and expansion study. As of the study cut-off date of April 28, 2017, the elacestrant single agent ORR, was 23% with five confirmed partial responses in heavily pre-treated patients with advanced ER-positive breast cancer and in the 400-mg patient group of 26 patients with mature data, the median progression free survival was 4.5 months. These results showed that elacestrant was well-tolerated with the most commonly reported adverse events being low grade nausea and dyspepsia. In December 2017, we reported additional updated data from this ongoing Phase 1 dose-escalation and expansion study, which included mature data from 40 patients treated at the 400 mg dose in this study. As of the study cut-off date of October 30, 2017, the elacestrant single agent ORR, was 27.3% with six confirmed partial responses out of 22 patients with response evaluation criteria in solid tumors ("RECIST") measurable disease. The median progression free survival was 5.4 months and clinical benefit rate at 24 weeks was 47.4%. These results showed that elacestrant was well-tolerated with the most commonly reported adverse events being low grade nausea, dyspepsia and vomiting.

Phase 1 - FES-PET Study

In December 2015, we commenced a Phase 1 FES-PET study in patients with metastatic breast cancer in the European Union, which includes the use of FES-PET imaging to assess estrogen receptor occupancy in tumor lesions following elacestrant treatment. In December 2016, we reported positive results from the Phase 1 FES-PET study. The first three enrolled patients dosed at the 400-mg cohort had a tumor FES-PET signal intensity reduction ranging from 79% to 91% at day 14 compared to baseline. This study enrolled five additional patients in the 400-mg daily oral cohort, followed by eight patients in the 200-mg daily oral cohort.

In December 2017, we reported updated data from the Phase 1 FES-PET study that elacestrant demonstrated robust reduction in tumor ER availability in patients with advanced ER+ breast cancer who progressed on prior endocrine therapy. Seven out of eight patients dosed at the 400-mg cohort, and four out of seven patients dosed at the 200-mg cohort, had a tumor FES-PET signal intensity reduction equal to, or greater than, 75% at day 14 compared to baseline. The reduction in FES uptake supports flexibility for both 200-mg and 400-mg elacestrant dose selection for further clinical development in combination studies with various targeted agents and was similar in patients harboring mutant or wild-type ESR1. The most commonly reported adverse events reported were grade 1 and 2 nausea and dyspepsia.

Potential for use in Combination Therapy

In July 2015, we announced that early but promising preclinical data showed that our investigational drug elacestrant, in combination with Pfizer’s palbociclib, a cyclin-dependent kinase ("CDK 4/6 inhibitor") or Novartis’ everolimus, an mTOR inhibitor, was effective in shrinking tumors. In preclinical patient-derived xenograft breast cancer models with either wild type or mutant ESR1, treatment with elacestrant resulted in marked tumor growth inhibition, and the combination of elacestrant with either agent, palbociclib or everolimus, showed anti-tumor activity that was significantly greater than either agent alone. We believe that this preclinical data suggests that elacestrant has the potential to overcome endocrine resistance, is well-tolerated, and has a profile that is well suited for use in combination therapy.

In December 2017, we announced additional preclinical data that continues to demonstrate elacestrant anti-tumor activity, as a single agent and in combination, in multiple models. In these preclinical models, elacestrant demonstrated marked tumor growth inhibition, as a single agent in models treated with multiple rounds of fulvestrant and in combination with CDK 4/6 inhibitors such as palbociclib and abemaciclib and with a phosphoinositide 3-kinase inhibitor, alpelisib.

6

Collaborations

In July 2016, we entered into a preclinical collaboration with Takeda Pharmaceutical Company Limited to evaluate the combination of elacestrant with Takeda's investigational drug TAK-228, an oral mTORC 1/2 inhibitor in Phase 2b development for the treatment of breast, endometrial and renal cancer, with the goal of potentially exploring such combination in a clinical study. We and Takeda have each agreed to contribute resources and supply compound material necessary for studies to be conducted under the collaboration and will share third party out-of-pocket research and development expenses. Activities under this collaboration are ongoing. Upon completion, both parties will agree upon the appropriate communication of the results.

In January 2016, we entered into a worldwide clinical collaboration with Novartis Pharmaceuticals to evaluate the safety and efficacy of combining elacestrant with Novartis’ investigational agent LEE011 (ribociclib), a CDK 4/6 inhibitor, and BYL719 (alpelisib), an investigational phosphoinositide 3-kinase inhibitor. In January 2018, we terminated this collaboration following the completion of preclinical studies. We are evaluating additional opportunities to collaborate with companies to evaluate the safety and efficacy of combining elacestrant with other agents for the treatment of breast cancer. We believe that such combinations may be suitable in earlier lines of treatment for patients with advanced disease.

Vasomotor Symptoms

In December 2017, following a strategic review, we announced that we decided to discontinue further evaluation of elacestrant for vasomotor symptoms to focus instead on the continued clinical development of the compound as a potential treatment option in breast cancer.

RAD140

RAD140 is an internally discovered SARM. The androgen receptor ("AR") is highly expressed in many ER-positive, ER-negative, and triple-negative receptor breast cancers. Due to its receptor and tissue selectivity, potent activity, oral bioavailability, and long half-life, we believe RAD140 could have clinical potential in the treatment of breast cancer. We hold worldwide commercialization rights to RAD140.

In July 2016, we reported that RAD140 in preclinical xenograft models of breast cancer demonstrated potent tumor growth inhibition when administered alone or in combinations with CDK4/6 inhibitors. It is estimated that approximately 70% of breast cancers express the androgen receptor. Our data suggest that RAD140 activity at the androgen receptor leads to activation of AR signaling pathways including an AR-specific tumor suppressor and suppression of ER signaling. In April 2017, we presented these RAD140 preclinical results at a major scientific congress.

In September 2017, we initiated a Phase 1 study of RAD140 in patients with hormone receptor positive locally advanced or metastatic breast cancer. The clinical trial is designed to evaluate the safety and maximum tolerated dose of RAD140 in approximately 40 patients. Primary safety outcomes from the trial include rate of dose-limiting toxicities, adverse events related to treatment, and tolerability as measured by dose interruptions or adjustments. In addition, pharmacokinetics, pharmacodynamics and tumor response will also be evaluated. We expect to provide an update on our RAD140 development program by the end of 2018.

Our Strategy

To achieve our goal of becoming a leading provider of innovative endocrine therapeutics in the areas of osteoporosis and oncology, we plan to:

• | Become a market leader for anabolic osteoporosis therapies. TYMLOS was approved by the FDA in April 2017, with U.S. commercial sales commencing in May 2017, and are focused on growing our market share in anabolic appropriate patients. We are conducting additional clinical research towards potential additional indications for TYMLOS, including a clinical trial in men with osteoporosis that we expect to initiate in the first quarter of 2018, and which, if successful, will form the basis of a supplemental NDA seeking to expand the use of TYMLOS to treat men with osteoporosis at high risk for fracture. In the first half of 2018, we plan to initiate a bone histomorphometry study, which would enroll approximately 25 postmenopausal women with osteoporosis to evaluate the early effects of TYMLOS on tissue-based bone remodeling and structural indices. |

• | Selectively pursue partnerships or collaborations to commercialize abaloparatide-SC outside the U.S. In July 2017, we entered into a license and development agreement with Teijin for abaloparatide-SC in Japan. Under this agreement, we received an upfront payment and may receive up to an aggregate of $40.0 million upon the achievement of certain regulatory and sales milestones, and a fixed low double-digit royalty based on net sales of abaloparatide-SC in Japan during the royalty term. In addition, we have an option to negotiate for a co-promotion |

7

agreement with Teijin for abaloparatide-SC in Japan. We intend to enter into a collaboration for the commercialization of abaloparatide-SC outside of the United States and Japan.

• | Expand abaloparatide's market potential through the continued development of abaloparatide-patch. We are developing our investigational abaloparatide-patch as a short-wear-time transdermal patch. In January 2018, we met with the FDA and gained alignment with the agency on a single, pivotal BMD non-inferiority bridging study to support an NDA submission. The FDA agreed that, depending on the study results, a randomized, open label, active-controlled, non-inferiority Phase 3 study of up to 500 patients with postmenopausal osteoporosis at high risk of fracture would be sufficient to gain approval for abaloparatide-patch. The FDA confirmed that the primary endpoint will be change in lumbar spine BMD at 12 months and that the non-inferiority margin must preserve 75% of the active control (abaloparatide-SC) based on the lower bound of the 95% confidence interval. We expect to initiate this pivotal study in mid-2019 and to complete it in 2020. In February 2018, we entered into a scale-up and commercial supply agreement with 3M Company pursuant to which 3M has agreed to exclusively manufacture Phase 3 and global commercial supplies of abaloparatide-patch. |

• | Become a leader in the field of hormone-receptor driven cancers. We are developing our investigational product candidate elacestrant as a potential treatment for hormone-receptor positive breast cancer as a single agent and in combination with other therapies. Based on feedback from the EMA and the FDA, we intend to conduct a single, randomized, controlled Phase 2 trial of elacestrant as a third-line monotherapy in approximately 300 patients with ER+/HER2- advanced/metastatic breast cancer. We believe that, depending on results, this single trial would support applications for global marketing approvals for elacestrant as a third-line monotherapy. In addition, depending on results of the interim analysis, the Company could seek accelerated approval for elacestrant in the United States. We will provide further study details when the Phase 2 study is started, which we expect will be in the second half of 2018. We are exploring potential strategic collaborations to broaden development to potentially address earlier lines of treatment in combination with other anti-cancer agents. In addition, we are leveraging our experience with elacestrant to develop a next generation SERD for potential use in the treatment of hormone-drive cancers. We are advancing the development of RAD140 as a potential treatment for hormone-receptor positive breast cancer and in September 2017 we initiated a Phase 1 study of RAD140 in patients with locally advanced or metastatic breast cancer. |

• | Continue to expand our product portfolio. We plan to leverage our drug development expertise to discover and develop additional investigational product candidates focused on osteoporosis, oncology and endocrine diseases and conditions. We may also consider opportunistically expanding our product portfolio within these areas through in-licensing, acquisitions or partnerships. |

Our Opportunity

Osteoporosis

Osteoporosis is a disease characterized by low bone mass and structural deterioration of bone tissue, which leads to greater fragility and an increase in fracture risk. All bones become more fragile and susceptible to fracture as the disease progresses. People tend to be unaware that their bones are getting weaker, and a person with osteoporosis can fracture a bone from even a minor fall. The debilitating effects of osteoporosis have substantial costs. Loss of mobility, admission to nursing homes and dependence on caregivers are all common consequences of osteoporosis. The prevalence of osteoporosis is growing and, per the National Osteoporosis Foundation ("NOF"), is significantly under-recognized and under-treated in the population. While the aging of the population is a primary driver of an increase in cases, osteoporosis is also increasing from the use of drugs that induce bone loss, such as chronic use of glucocorticoids and aromatase inhibitors that are increasingly used for breast cancer and hormone therapies used for prostate cancer.

The NOF has estimated that 10 million people in the United States, composed of eight million women and two million men, already have osteoporosis, and another approximately 44 million have low bone mass placing them at increased risk for osteoporosis. In addition, the NOF has estimated that osteoporosis is responsible for more than two million fractures in the United States each year resulting in an estimated $19 billion in costs annually. The NOF expects that the number of fractures in the United States due to osteoporosis will rise to three million by 2025, resulting in an estimated $25.3 billion in costs each year. Worldwide, osteoporosis affects an estimated 200 million women according to the International Osteoporosis Foundation ("IOF") and causes more than 8.9 million fractures annually, which is equivalent to an osteoporotic fracture occurring approximately every three seconds.

The IOF has estimated that 1.6 million hip fractures occur worldwide each year, and by 2050 this number could reach between 4.5 million and 6.3 million. The IOF estimates that in Europe alone, the annual cost of osteoporotic fractures could surpass €76 billion by 2050. The IOF, in its 2013 Asia-Pacific audit, estimated that osteoporosis affects 10% of the population in Japan over age 40; composed of 9.8 million women and 3 million men. By 2025, it is expected that 25% of Japan’s

8

population will be over 70 years old with an average life expectancy of 87 years, and this is predicted to increase to 32% of Japan’s population in 2050 with an average life expectancy of 92 years. In 2050, it is also expected that over half of the Japanese population will be over 50 years old. The expected increase in the age of its population presents Japan with a significant need to focus on the health of its elderly, including osteoporosis.

In 2017, total sales of branded osteoporosis drugs approximated $7.3 billion, worldwide, of which more than $4.3 billion was attributable to injectable therapies. There are two main types of osteoporosis drugs currently available in the United States, anti-resorptive agents and anabolic agents. Anti-resorptive agents act to prevent further bone loss by inhibiting the breakdown of bone, whereas anabolic agents stimulate bone formation to build new bone.

We believe there is a large unmet need in the market for osteoporosis treatment because existing therapies have been reported to have shortcomings in efficacy, tolerability and convenience. For example, one current standard of care, bisphosphonates, which are anti-resorptive agents, have been associated with infrequent but serious adverse events, such as osteonecrosis of the jaw and atypical fractures, especially of long bones. These side effects, although uncommon, reportedly have created increasing concern with physicians and patients. We believe many physicians are seeking alternatives to bisphosphonates. Forteo/Forsteo® (teriparatide) marketed by Eli Lilly and Company ("Lilly") and Prolia® (denosumab) marketed by Amgen Inc. ("Amgen") are two alternatives to bisphosphonates that are approved for the treatment of osteoporosis. Prolia has also been associated with infrequent but serious adverse events, such as osteonecrosis of the jaw and atypical fractures. In 2017, Forteo/Forsteo had reported worldwide sales of approximately $1.8 billion, $1.0 billion in the United States and $0.8 billion outside of the United States, and Prolia had reported worldwide sales of approximately $2.0 billion, $1.3 billion in the United States and $0.7 billion outside of the United States. In 2016, IMS (now IQVIA) estimated that sales for osteoporosis medicines in Japan were 292 billion yen, or approximately $2.7 billion, of which aggregate sales for anabolic agents (Lilly’s Forteo and Asahi Kasei’s Teribone) comprised 77 billion yen, or $720 million.

We believe there is a significant opportunity for TYMLOS (abaloparatide), an anabolic agent which is approved in the U.S. for the treatment of postmenopausal women with osteoporosis at high risk for fracture defined as history of osteoporotic fracture, multiple risk factors for fracture, or patients who have failed or are intolerant to other available osteoporosis therapy. With the potential addition of new guidelines, expanding research, increased diagnosis effort, greater awareness of the long-term risk associated with osteoporotic fracture, and new, more effective therapies we believe osteoporosis treatment will expand and likewise our potential commercial opportunity. We also believe that there is a significant opportunity for abaloparatide outside the U.S., particularly in Japan, where we have a license and development agreement with Teijin for abaloparatide-SC under which we are entitled to receive payments up to an aggregate of $40.0 million upon the achievement of certain regulatory and sales milestones, a fixed low double-digit royalty based on net sales of abaloparatide-SC in Japan during the royalty term, and have an option to negotiate for a co-promotion agreement with Teijin for abaloparatide-SC in Japan.

Abaloparatide

In April 2017, the FDA approved TYMLOS for the treatment of postmenopausal women with osteoporosis at high risk for fracture defined as history of osteoporotic fracture, multiple risk factors for fracture, or patients who have failed or are intolerant to other available osteoporosis therapy. We are developing two formulations of abaloparatide: abaloparatide-SC and abaloparatide-patch.

Abaloparatide-SC

TYMLOS was approved in the United States in April 2017 for the treatment of postmenopausal women with osteoporosis at high risk for fracture. The first commercial sales of TYMLOS in the United States occurred in May 2017. We are commercializing TYMLOS in the United States through our commercial organization. We have a distribution network of well-established distributors and specialty pharmacies for TYMLOS in the United States. Under our distribution model, both the distributors and specialty pharmacies take physical delivery of TYMLOS and the specialty pharmacies dispense TYMLOS directly to patients. We hold worldwide commercialization rights to abaloparatide-SC, except for Japan, where we have an option to negotiate a co-promotion agreement with Teijin for abaloparatide-SC.

The combined 25-month fracture data from our Phase 3 clinical trial program for TYMLOS formed the basis of our regulatory submissions in the United States and Europe. In November 2015, we submitted an MAA for abaloparatide-SC to the EMA, which was validated and is currently undergoing active regulatory assessment by the CHMP. In December 2017, the CHMP issued a third Day-180 List of Outstanding Issues. As part of its on-going risk-benefit assessment, the CHMP informed the Company that it intends to refer the MAA to a scientific advisory group for additional advice. We expect that the CHMP may adopt an opinion regarding our MAA during the first half of 2018. We intend to enter into a collaboration for the commercialization of abaloparatide-SC outside of the United States and Japan.

In May 2017, we announced positive top-line results from the completed 24-month ACTIVExtend clinical trial of TYMLOS, which met all its primary and secondary endpoints. In ACTIVExtend, patients who had completed 18 months of

9

TYMLOS (abaloparatide) injections or placebo in the ACTIVE Phase 3 trial were transitioned to receive 24 additional months of open-label alendronate. For the subset of ACTIVE trial patients (n=1139) that enrolled in the ACTIVExtend trial, the previous TYMLOS-treated patients had a significant 84% relative risk reduction (p<0.0001) in the incidence of new vertebral fractures compared with patients who received placebo followed by alendronate. They also demonstrated a 39% risk reduction in nonvertebral fractures (p=0.038), a 34% risk reduction clinical fractures (p=0.045) and a 50% risk reduction in major osteoporotic fractures (p=0.011) compared with patients who received placebo followed by alendronate. At the 43-month timepoint, for all patients (n=1645) that enrolled in the ACTIVE trial, TYMLOS-treated patients had a statistically significant risk reduction in new vertebral fractures (p<0.0001), nonvertebral fractures (p=0.038), clinical fractures (p=0.045), and major osteoporotic fractures (p<0.001), compared with patients who received placebo followed by alendronate. While not a pre-specified endpoint, there was also a statistically significant risk reduction in hip fractures (p=0.027) at the 43-month time point in the TYMLOS-treated patients, compared with patients who received placebo followed by alendronate. The adverse events reported during the alendronate treatment period were similar between the previous TYMLOS-treated patients and the previous placebo group. The incidences of cardiovascular adverse events including serious adverse events were similar between groups. There have been no cases of osteonecrosis of the jaw or atypical femoral fracture in the entire TYMLOS development program. The results from the completed ACTIVExtend trial were presented at a major scientific meeting in September 2017 and we submitted a labeling supplement in connection with this data to the FDA in December 2017.

In July 2017, we entered into a license and development agreement with Teijin for abaloparatide-SC in Japan. Pursuant to the agreement, we may receive additional milestone payments upon the achievement of certain regulatory and sales milestones, and a fixed low double-digit royalty based on net sales of abaloparatide-SC in Japan during the royalty term. In addition, we have an option to negotiate for a co-promotion agreement with Teijin for abaloparatide-SC in Japan.

In late 2017, we gained agreement with the FDA on the design of a clinical trial in men with osteoporosis which, if successful, will form the basis of a supplemental NDA seeking to expand the use of TYMLOS to treat men with osteoporosis at high risk for fracture. The study will be a randomized, double-blind, placebo-controlled trial that will enroll approximately 225 men with osteoporosis. The primary endpoint is change in lumbar spine BMD at 12 months compared with placebo. In previous clinical trials, TYMLOS has demonstrated increases in BMD in postmenopausal women. The study will include specialized high-resolution imaging of bone structure in a subset of the study participants. We expect to initiate the trial in the first quarter of 2018.

In the first half of 2018, we plan to initiate a bone histomorphometry study, which would enroll approximately 25 postmenopausal women with osteoporosis to evaluate the early effects of TYMLOS on tissue-based bone remodeling and structural indices.

Abaloparatide-patch

We are also developing abaloparatide-patch, based on 3M’s patented Microstructured Transdermal System technology, for potential use as a short wear-time transdermal patch. We hold worldwide commercialization rights to the abaloparatide-patch technology and we are developing abaloparatide-patch toward future global regulatory submissions to build upon the potential success of TYMLOS. Our development strategy for abaloparatide patch is to bridge to the established efficacy and safety of our approved abaloparatide-SC formulation.

We commenced a human replicative clinical evaluation of the optimized abaloparatide-patch in December 2015, with the goal of achieving comparability to abaloparatide-SC. In September 2016, we presented results from this evaluation of the first and second abaloparatide-patch prototypes, demonstrating that formulation technology can modify the pharmacokinetic profile of abaloparatide, including Tmax, half-life (“T1/2”), and area under the curve (“AUC”). In March 2018, we announced that through further optimization we had achieved comparability to the abaloparatide-SC profile with a third prototype (the “current abaloparatide-patch”). The current abaloparatide-patch optimized the drug-device combination through process improvements, a finalized formulation, selection of a dose (300 µg), and the introduction of a new clinical applicator. Together these changes, which were designed to improve the ease of use and patient experience, resulted in an increased half-life and AUC (915 pg.hr/ml for the current abaloparatide-patch, compared to 242 pg.hr/ml for the first patch prototype, 645 pg.hr/ml for the second patch prototype, and 936 pg.hr/ml for abaloparatide-SC).

In January 2018, we met with the FDA to align on a regulatory and development path for registration of abaloparatide-patch. We gained alignment with the agency on a single, pivotal BMD non-inferiority bridging study to support an NDA submission. The FDA agreed that, depending on the study results, a randomized, open label, active-controlled, non-inferiority Phase 3 study of up to 500 patients with postmenopausal osteoporosis at high risk of fracture would be sufficient to gain approval for abaloparatide-patch. The FDA confirmed that the primary endpoint will be change in lumbar spine BMD at 12 months and that the non-inferiority margin must preserve 75% of the active control (abaloparatide-SC) based on the lower bound of the 95% confidence interval. We expect to initiate this pivotal study in mid-2019. On February 27, 2018, we entered

10

into a scale-up and commercial supply agreement with 3M Company pursuant to which 3M has agreed to exclusively manufacture Phase 3 and global commercial supplies of abaloparatide-patch.

Breast Cancer

According to the World Health Organization, breast cancer is the most common cancer in women and the global incidence is expected to increase in the coming years. The major cause of death from breast cancer is metastases, most commonly to the bone, liver, lung and brain. Approximately 30% of early-stage breast cancer patients develop metastatic disease, and of those patients 90% relapse during the course of their treatment. About 5% of breast cancer patients have distant metastases at the time of diagnosis. Patients with metastatic breast cancer have a five-year survival rate of only 25%, compared with a greater than 90% five-year survival rate for patients with only local disease at diagnosis. Importantly, even patients without metastases at diagnosis are at risk for developing metastases over time.

Approximately 70% of breast cancers express the ER and depend on estrogen signaling for growth and survival. The standard of care for ER+ advanced/metastatic breast cancer calls for endocrine therapy at all stages of treatment, with patients typically cycling through multiple anti-estrogen therapies, such as aromatase inhibitors (“AIs”), selective estrogen receptor modulators (“SERMs”), and selective estrogen receptor degraders (“SERDs”).

These therapies inhibit the ER pathway either by inhibiting estrogen synthesis (AIs) or by directly inhibiting the estrogen receptor (SERMs and SERDs). While both SERMs and SERDs antagonize the estrogen receptor, SERDs function to degrade the receptor. Although many patients initially respond to AIs and SERMs, a majority of patients will have progressive disease and the dependence on ER for tumor growth and sensitivity to other ER-targeting agents is often retained. On the basis of this continued dependence on ER, novel SERDs have gained widespread attention as a means of delivering more durable responses and increasing progression-free survival in this setting. Indeed, SERDs have demonstrated clinical efficacy in patients who have progressed on AIs or SERMs.

Currently only one SERD, fulvestrant, an intramuscular injection, is approved for the treatment of ER-positive metastatic breast cancer. We believe a significant opportunity may exist for new oral therapies that can more effectively treat ER-positive breast cancer.

Elacestrant (RAD1901)

Elacestrant (RAD1901) is a SERD that we are evaluating for potential use as a once daily oral treatment for hormone-receptor positive breast cancer. We hold worldwide commercialization rights to elacestrant, which we licensed from Eisai Co. Ltd. ("Eisai"). Elacestrant is currently being investigated in women with ER-positive and HER2-negative breast cancer, the most common subtype of the disease. Studies completed to date indicate that the compound has the potential for use as a single agent or in combination with other therapies for the treatment of breast cancer. To date, no dose limiting toxicities have been reported in the elacestrant program.

We believe that, subject to successful development, regulatory review and approval, elacestrant could have the potential to offer the following advantages over other current standard of care treatments for ER-positive breast cancer:

• | ability to degrade the estrogen receptor; |

• | favorable efficacy and tolerability profile; |

• | ability to effectively combine with other agents; |

• | treatment of hormone-resistant breast cancers; and |

• | once a day oral administration. |

We have completed enrollment in our 18-F fluoroestradiol positron emission tomography (“FES-PET”) imaging study and dose-escalation Part A and expansion study parts B and C Phase 1 breast cancer trials. In June 2017, we discussed the data from these ongoing Phase 1 studies with the FDA to gain alignment on defining the next steps for our elacestrant breast cancer program, including the design of a Phase 2 trial. In this meeting, the FDA agreed that a single-arm monotherapy Phase 2 study of up to 200 patients, could be appropriate with the primary endpoint being ORR, coupled with DOR. Depending on the study results, which must demonstrate an improvement over then available therapies, this study could be considered a pivotal study for accelerated approval as long as a confirmatory study is ongoing at the time of our NDA submission. In October 2017, the FDA granted Fast Track designation for our elacestrant breast cancer program.

11

In February 2018, we received scientific advice from the European Medicines Agency (“EMA”) regarding a potential single-arm monotherapy Phase 2 trial of elacestrant in patients with ER+, HER2- advanced or metastatic breast cancer. In addition, we had a further meeting in February 2018 with the FDA regarding the registrational pathway for elacestrant at which we confirmed FDA’s guidance for a single-arm study and gained alignment with the agency on an alternative potential comparator study design for our monotherapy program. Based on feedback from the EMA and the FDA, we now intend to conduct a single, randomized, controlled Phase 2 trial of elacestrant as a third-line monotherapy in approximately 300 patients with ER+/HER2- advanced/metastatic breast cancer. Patients in the study would be randomized to receive either elacestrant or the investigator’s choice of an approved hormonal agent and the primary endpoint of the study will be progression-free survival (“PFS”). The study would also include a planned interim PFS analysis. We believe that, depending on results, this single trial would support applications for global marketing approvals for elacestrant as a third-line monotherapy. In addition, depending on results of the interim analysis, the Company could seek accelerated approval for elacestrant in the United States. We will provide further study details when the Phase 2 study is started, which we expect will be in the second half of 2018.

Phase 1 - Dose-Escalation and Expansion Study

In December 2014, we commenced a Phase 1, multicenter, open-label, multiple-part, dose-escalation study of elacestrant in postmenopausal women with ER-positive and HER2-negative advanced breast cancer in the United States to determine the recommended dose for a Phase 2 clinical trial and to make a preliminary evaluation of the potential anti-tumor effect of elacestrant. Part A of this Phase 1 study was designed to evaluate escalating doses of elacestrant. The Part B expansion cohort was initiated at 400-mg daily dosing in March 2016 to allow for an evaluation of additional safety, tolerability and preliminary efficacy. The patients enrolled in this study are heavily pretreated ER-positive, HER2-negative advanced breast cancer patients who have received a median of 3 prior lines of therapy including fulvestrant and CDK4/6 inhibitors, and about 50% of the patients had ESR1 mutations. We have completed enrollment in the ongoing dose-escalation Part A and expansion study parts B and C. In December 2017, we opened a Part D cohort in this study to provide additional data on a more homogeneous and genetically defined patient population to support our overall elacestrant clinical development program and anticipated regulatory submissions.

In December 2016, we reported positive results from this ongoing Phase 1 dose-escalation and expansion study. These results showed that elacestrant was well-tolerated with the most commonly reported adverse events being low grade nausea and dyspepsia. Enrollment in the Part C tablet dosage form cohort was completed in November 2016.

In June 2017, we reported additional positive data from this ongoing Phase 1 dose-escalation and expansion study. As of the study cut-off date of April 28, 2017, the elacestrant single agent ORR, was 23% with five confirmed partial responses in heavily pre-treated patients with advanced ER-positive breast cancer. In the 400-mg patient group of 26 patients with mature data, the median progression free survival was 4.5 months. These results showed that elacestrant was well-tolerated with the most commonly reported adverse events being low grade nausea and dyspepsia.

In December 2017, we reported updated data from this ongoing Phase 1 dose-escalation and expansion study, which included mature data from 40 patients treated at the 400 mg dose in this study. As of the study cut-off date of October 30, 2017, the elacestrant single agent ORR, was 27.3% with six confirmed partial responses out of 22 patients with RECIST measurable disease. The median progression free survival was 5.4 months and clinical benefit rate at 24 weeks was 47.4%. These results showed that elacestrant was well-tolerated with the most commonly reported adverse events being low grade nausea, dyspepsia and vomiting.

Phase 1 - FES-PET Study

In December 2015, we commenced a Phase 1 18-F fluoroestradiol positron emission tomography ("FES-PET") study in patients with metastatic breast cancer in the European Union, which includes the use of FES-PET imaging to assess estrogen receptor occupancy in tumor lesions following elacestrant treatment. In December 2016, we reported positive results from the Phase 1 FES-PET study. The first three enrolled patients dosed at the 400-mg cohort had a tumor FES-PET signal intensity reduction ranging from 79% to 91% at day 14 compared to baseline. This study enrolled 5 additional patients in the 400-mg daily oral cohort, followed by 8 patients in the 200-mg daily oral cohort.

In December 2017, we reported updated data from the Phase 1 FES-PET study that elacestrant demonstrated robust reduction in tumor ER availability in patients with advanced ER+ breast cancer who progressed on prior endocrine therapy. Seven out of eight patients dosed at the 400-mg cohort, and four out of seven patients dosed at the 200-mg cohort, had a tumor FES-PET signal intensity reduction equal to, or greater than, 75% at day 14 compared to baseline. The reduction in FES uptake supports flexibility for both 200-mg and 400-mg elacestrant dose selection for further clinical development in combination studies with various targeted agents and was similar in patients harboring mutant or wild-type ESR1. The most commonly reported adverse events reported were grade 1 and 2 nausea and dyspepsia.

Potential for use in Combination Therapy

12

In July 2015, we announced that early but promising preclinical data showed that our investigational drug elacestrant, in combination with Pfizer’s palbociclib, a cyclin-dependent kinase 4/6 inhibitor, or Novartis’ everolimus, an mTOR inhibitor, was effective in shrinking tumors. In preclinical patient-derived xenograft breast cancer models with either wild type or mutant ESR1, treatment with elacestrant resulted in marked tumor growth inhibition, and the combination of elacestrant with either agent, palbociclib or everolimus, showed anti-tumor activity that was significantly greater than either agent alone. We believe that this preclinical data suggests that elacestrant has the potential to overcome endocrine resistance, is well-tolerated, and has a profile that is well suited for use in combination therapy.

In December 2017, we announced additional preclinical data that continues to demonstrate elacestrant anti-tumor activity, as a single agent and in combination, in multiple models. In these preclinical models, elacestrant demonstrated marked tumor growth inhibition, as a single agent in models treated with multiple rounds of fulvestrant and in combination with CDK 4/6 inhibitors such as palbociclib and abemaciclib and with a phosphoinositide 3-kinase inhibitor, alpelisib.

Collaborations

In July 2016, we entered into a preclinical collaboration with Takeda Pharmaceutical Company Limited to evaluate the combination of elacestrant with Takeda's investigational drug TAK-228, an oral mTORC 1/2 inhibitor in Phase 2b development for the treatment of breast, endometrial and renal cancer, with the goal of potentially exploring such combination in a clinical study. We and Takeda have each agreed to contribute resources and supply compound material necessary for studies to be conducted under the collaboration and will share third party out-of-pocket research and development expenses. Activities under this collaboration are ongoing. Upon completion, both parties will agree upon the appropriate communication of the results.

In January 2016, we entered into a worldwide clinical collaboration with Novartis Pharmaceuticals to evaluate the safety and efficacy of combining elacestrant with Novartis’ investigational agent LEE011 (ribociclib), a CDK 4/6 inhibitor, and BYL719 (alpelisib), an investigational phosphoinositide 3-kinase inhibitor. In January 2018, we terminated this collaboration following the completion of pre-clinical studies. We are evaluating additional opportunities to collaborate with companies to evaluate the safety and efficacy of combining elacestrant with other agents for the treatment of breast cancer. We believe that such combinations may be suitable in earlier lines of treatment for patients with advanced disease.

Our Investigational Drug—RAD140

RAD140 is an internally discovered SARM. The androgen receptor is highly expressed in many ER-positive, ER-negative, and triple-negative receptor breast cancers. Due to its receptor and tissue selectivity, potent activity, oral bioavailability, and long half-life, we believe RAD140 could have clinical potential in the treatment of breast cancer. We hold worldwide commercialization rights to RAD140.

In September 2017, we initiated a Phase 1 study of RAD140 in patients with hormone receptor positive locally advanced or metastatic breast cancer. The clinical trial is designed to evaluate the safety and maximum tolerated dose of RAD140 in approximately 40 patients. Primary safety outcomes from the trial include rate of dose-limiting toxicities, adverse events related to treatment, and tolerability as measured by dose interruptions or adjustments. In addition, pharmacokinetics, pharmacodynamics and tumor response will also be evaluated. We expect to provide an update on our RAD140 development program by the end of 2018.

In July 2016, we reported that RAD140 in preclinical xenograft models of breast cancer demonstrated potent tumor growth inhibition when administered alone or in combinations with CDK4/6 inhibitors. It is estimated that approximately 70% of breast cancers express the androgen receptor. Our data suggest that RAD140 activity at the androgen receptor leads to activation of AR signaling pathways including an AR-specific tumor suppressor and suppression of ER signaling. In April 2017, we presented these RAD140 preclinical results at a major scientific congress.

Manufacturing

We do not own or operate manufacturing facilities for the production of our commercial product, TYMLOS, or any of our investigational product candidates, nor do we have plans to develop our own manufacturing operations in the foreseeable future.

Abaloparatide, the active pharmaceutical ingredient (“API”) for both TYMLOS and abaloparatide-patch, is manufactured for us on a contract basis by Polypeptide Laboratories Holding (PPL) AB (“PPL”), as successor-in-interest to Lonza Group Ltd., using a solid phase peptide synthesis assembly process, and purification by high pressure liquid chromatography. Abaloparatide for TYMLOS is supplied as a liquid in a multi-dose cartridge for use in a pen delivery device. The components of the pen delivery device are manufactured by Ypsomed AG (“Ypsomed”). The multi-dose cartridges and pen delivery device are filled, assembled and packaged by Vetter International GmbH (“Vetter”).

13

Abaloparatide-patch drug product is manufactured by 3M Company and 3M Innovative Properties Company, (together “3M”), based on their patented microneedle technology to administer drugs through the skin, as an alternative to subcutaneous injection.

Elacestrant API and drug product are manufactured for us on a contract basis by Patheon, Inc.

RAD140 API and drug product are manufactured for us on a contract basis by Alcami Corporation.

Manufacturing is subject to extensive regulations that impose various procedural and documentation requirements, which govern the methods used in, and the facilities and controls used for, the manufacture, processing, packing and holding of drugs. FDA and International Conference on Harmonisation ("ICH") current Good Manufacturing Practice (“cGMP”) requirements include those pertaining to record keeping, manufacturing processes and controls, personnel, quality control and quality assurance, among others. Our contract manufacturing organizations are required to manufacture TYMLOS and our investigational product candidates under cGMP conditions. cGMP is a regulatory standard for the production of human pharmaceuticals that imposes extensive substantive, procedural and record keeping requirements on the manufacturing processes, testing methodology, and associated production and testing facilities.

Intellectual Property

As of December 31, 2017, we owned or co-owned 11 issued U.S. patents, as well as 15 pending U.S. patent applications, 4 pending Patent Cooperation Treaty ("PCT") applications, 55 pending foreign patent applications in the European Patent Office and 14 other jurisdictions, and 99 granted foreign patents. As of December 31, 2017, we had licenses to 3 U.S. patents related to compositions and related uses thereof, as well as numerous foreign counterparts to many of these patents and patent applications. We own the federal trademark registration in the United States for Radius® in association with pharmaceuticals. In addition, we have received notices of allowance in the U.S. and in Canada for TYMLOS and for trademarks on potential brand names for our product candidates in the U.S. and in other countries.

We strive to protect the proprietary technology that we believe is important to our business, including seeking and maintaining patents intended to cover our investigational product candidates and compositions, their methods of use and processes for their manufacture and any other inventions that are commercially important to the development of our business. We also rely on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection.

Our success will significantly depend on our ability to obtain and maintain patent and other proprietary protection for commercially important technology and inventions and know-how related to our business, defend and enforce our patents, preserve the confidentiality of our trade secrets, and operate without infringing the valid and enforceable patents and proprietary rights of third parties. We also rely on know-how and continuing technological innovation to develop and maintain our proprietary position.

Abaloparatide

We acquired and maintain exclusive worldwide rights, excluding development and commercialization rights for Japan, to certain patents, data and technical information related to abaloparatide through a license agreement with an affiliate of Ipsen Pharma SAS ("Ipsen"). Composition of matter of abaloparatide was claimed in the United States (U.S. Patent No. 5,969,095), Europe, Australia, Canada, China, Hong Kong, South Korea, New Zealand, Poland, Russia, Singapore, Mexico, Hungary, and Taiwan. These patents and European Patent No. 0847278, which was included in the license from Ipsen and claimed the composition of matter of abaloparatide, expired in 2016. The subcutaneous formulation of abaloparatide for use in treating osteoporosis is covered by Patent No. 7,803,770 until the statutory term expires October 3, 2027, which we expect will be extended to March 26, 2028 (statutory term that may be extended with 175 days of patent term adjustment due to delays in patent prosecution by the United States Patent and Trademark Office, or USPTO) in the United States (not including any patent term extension under the Hatch-Waxman Act). The intended therapeutic formulation for abaloparatide-SC is covered by Patent No. 8,148,333 until 2027 in the United States (not including any patent term extension under the Hatch-Waxman Act). Related patents granted in Europe, Australia, China, Israel, Japan, South Korea, Mexico, New Zealand, Russia, Singapore, and Ukraine, and additional patent applications pending in Brazil, Canada, Europe, Hong Kong, India, South Korea, and Norway, will have a patent expiration date of 2027, not taking into account extension under any applicable laws. A notice to grant the intended therapeutic formulation for abaloparatide-SC and its use for osteoporosis treatment has been received from the European Patent Office in February 2018. When granted, this patent and the granted European Patent No. 2957278 will have a normal expiry of October 3, 2027, not including any issued supplementary patent certificates ("SPC"). We are aware of two oppositions to European Patent No. 2957278 filed before the opposition period expired on February 19, 2018. One opposition was filed on February 16, 2018 by Teva Pharmaceutical Industries Ltd and the other opposition was filed on February 19, 2018 in the name of a patent law firm, Isenbruck Bosl Horschler LLP. Patent applications covering various aspects of abaloparatide for microneedle application have been granted in Australia, Europe, Japan, and New Zealand, and additional patent applications

14

are currently pending in the United States, Europe, Hong Kong, and Japan. The issued patents and any patents that might issue from the pending applications will have statutory expiration dates ranging from 2032 to 2037, not taking into account extension under any applicable laws. We have worldwide rights to commercialize abaloparatide-patch, including in Japan.

Elacestrant (RAD1901)