Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PRECIGEN, INC. | d545876dex991.htm |

| 8-K - FORM 8-K - PRECIGEN, INC. | d545876d8k.htm |

2017 Recap Call March 1, 2018 Exhibit 99.2

Safe Harbor Statement Some of the statements made in this presentation are forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon Intrexon’s current expectations and projections about future events and generally relate to Intrexon’s plans, objectives and expectations for the development of Intrexon’s business and include target revenues, target EBITDA, and discussion of anticipated clinical trials and future collaborations. Although management believes that the plans and objectives reflected in or suggested by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and actual future results may be materially different from the plans, objectives and expectations expressed in this presentation. These risks and uncertainties include, but are not limited to, (i) Intrexon’s current and future subsidiaries, collaborations and joint ventures; (ii) Intrexon’s ability to successfully enter new markets or develop additional products, whether with its collaborators or independently; (iii) actual or anticipated variations in Intrexon’s operating results; (iv) actual or anticipated fluctuations in Intrexon’s competitors’ or its collaborators’ operating results or changes in their respective growth rates; (v) Intrexon’s cash position; (vi) market conditions in Intrexon’s industry; (vii) the volatility of Intrexon’s stock price; (viii) Intrexon’s ability, and the ability of its collaborators, to protect Intrexon’s intellectual property and other proprietary rights and technologies; (ix) Intrexon’s ability, and the ability of its collaborators, to adapt to changes in laws or regulations and policies; (x) the outcomes of pending and future litigation; (xi) the rate and degree of market acceptance of any products developed by Intrexon, its subsidiaries, collaborations or joint ventures; (xii) Intrexon’s ability to retain and recruit key personnel; (xiii) Intrexon’s expectations related to the use of proceeds from its public offerings and other financing efforts; and (xiv) Intrexon’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Intrexon’s actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in Intrexon’s Annual Report on Form 10-K filed with the Securities and Exchange Commission. All information in this presentation is as of the date of the release, and Intrexon undertakes no duty to update this information unless required by law. © 2018 Intrexon Corp. All rights reserved. Intrexon Corporation is sharing the following materials for informational purposes only. Such materials do not constitute an offer to sell or the solicitation of an offer to buy any securities of Intrexon. Any offer and sale of Intrexon’s securities will be made, if at all, only upon the registration and qualification of such securities under all applicable federal and state securities laws or pursuant to an exemption from such requirements. The attached information has been prepared in good faith by Intrexon. However, Intrexon makes no representations or warranties as to the completeness or accuracy of any such information. Any representations or warranties as to Intrexon shall be limited exclusively to any agreements that may be entered into by Intrexon and to such representations and warranties as may arise under law upon distribution of any prospectus or similar offering document by Intrexon. Forward-Looking Statements

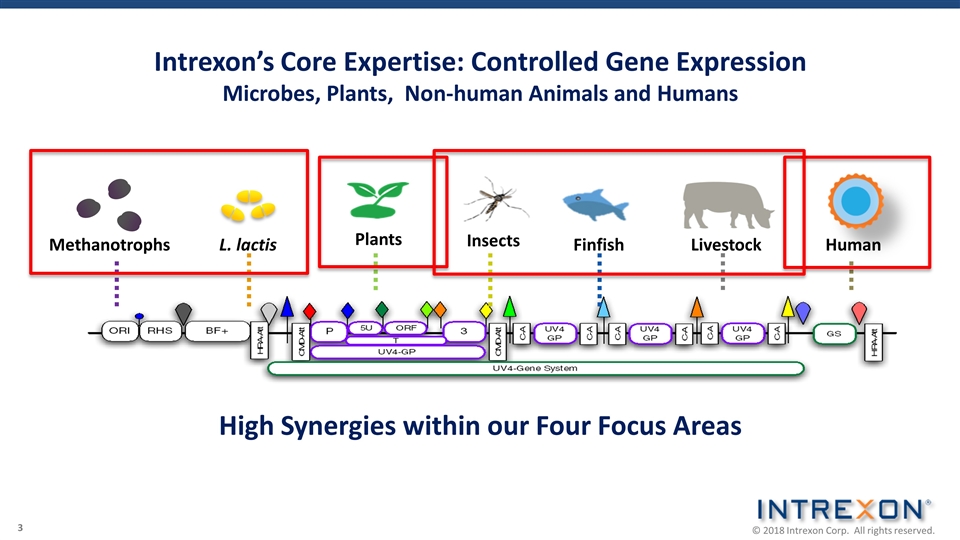

Intrexon’s Core Expertise: Controlled Gene Expression Microbes, Plants, Non-human Animals and Humans L. lactis Insects Methanotrophs Plants Finfish Livestock Human High Synergies within our Four Focus Areas

Intrexon in 2017 – A Year of Steady Progress Intrexon continued to focus on internal development of our products while de-emphasizing the ECC model. The move is expected to lead to significantly greater value from internally developed products. We still expect to partner many of our assets, but this activity is expected to occur at later stages. Several new projects were initiated and most important programs steadily advanced along their development pathways in 2017. A few projects were discontinued. Intrexon structured its principal healthcare assets into two separately managed business units. Precigen, Inc. - Developing gene and cell therapy. ActoBio Therapeutics, Inc. - Delivering ActoBiotics® to the site of disease. Representative list of areas; not complete list

Autoimmune Disease Heart Failure Oncology Cell and Gene Therapy is Now Precigen Precigen now houses Intrexon’s internal efforts in engineering therapeutic human cells and manages our ongoing ECCs in the cell and gene therapy space. Management team is in place with deep expertise in clinical phase development led by Helen Sabzevari, PhD. Broad pipeline of internal & partnered programs. Focus on cell and vaccine mediated therapeutics for oncology, autoimmune and infectious disease. Focus on multigenic approaches in areas where single gene approaches have partially de-risked the landscape. Representative list of areas; not complete list Rare Disease Infectious Disease

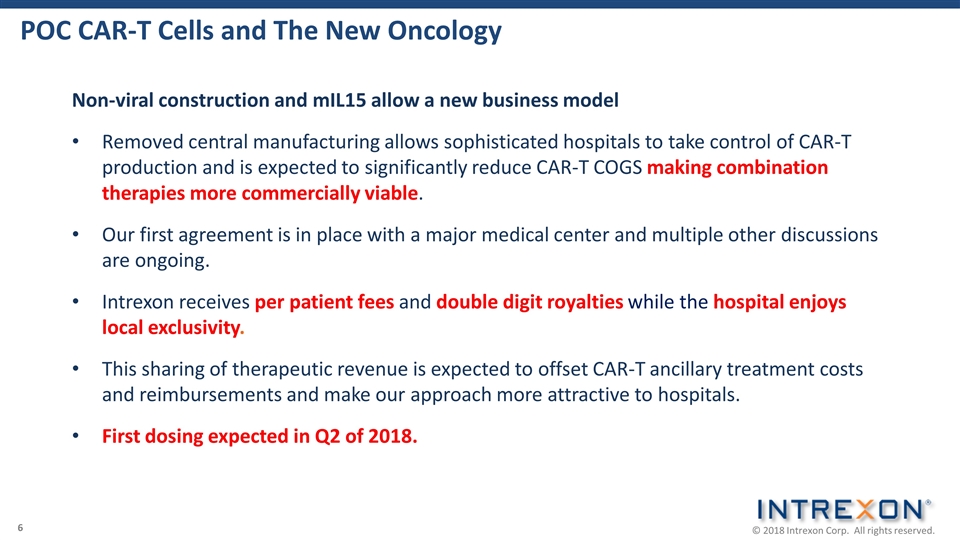

POC CAR-T Cells and The New Oncology Non-viral construction and mIL15 allow a new business model Removed central manufacturing allows sophisticated hospitals to take control of CAR-T production and is expected to significantly reduce CAR-T COGS making combination therapies more commercially viable. Our first agreement is in place with a major medical center and multiple other discussions are ongoing. Intrexon receives per patient fees and double digit royalties while the hospital enjoys local exclusivity. This sharing of therapeutic revenue is expected to offset CAR-T ancillary treatment costs and reimbursements and make our approach more attractive to hospitals. First dosing expected in Q2 of 2018.

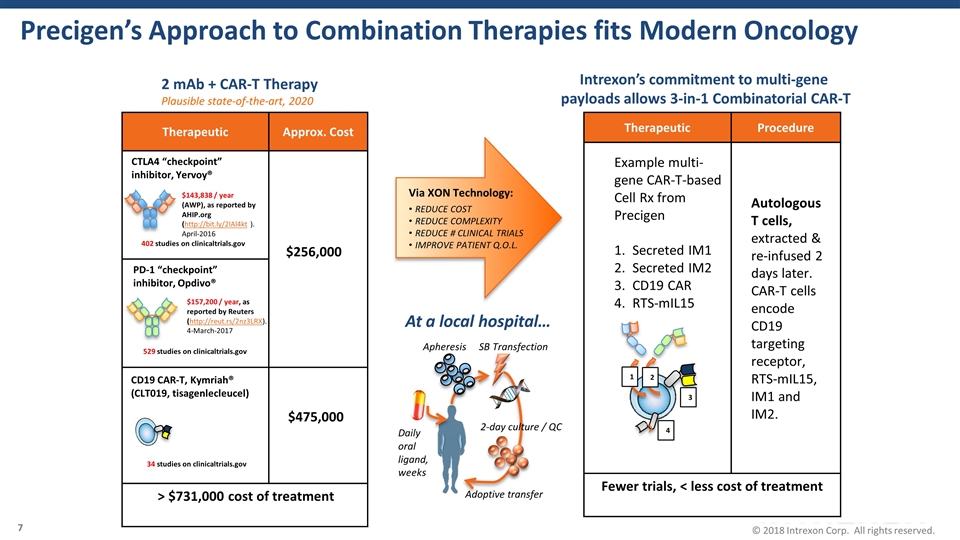

Precigen’s Approach to Combination Therapies fits Modern Oncology Therapeutic Approx. Cost > $731,000 cost of treatment CTLA4 “checkpoint” inhibitor, Yervoy® PD-1 “checkpoint” inhibitor, Opdivo® CD19 CAR-T, Kymriah® (CLT019, tisagenlecleucel) $475,000 402 studies on clinicaltrials.gov 529 studies on clinicaltrials.gov 34 studies on clinicaltrials.gov Therapeutic Procedure Fewer trials, < less cost of treatment Example multi-gene CAR-T-based Cell Rx from Precigen Secreted IM1 Secreted IM2 CD19 CAR RTS-mIL15 Autologous T cells, extracted & re-infused 2 days later. CAR-T cells encode CD19 targeting receptor, RTS-mIL15, IM1 and IM2. $143,838 / year (AWP), as reported by AHIP.org (http://bit.ly/2lAl4kt ). April-2016 2 mAb + CAR-T Therapy Intrexon’s commitment to multi-gene payloads allows 3-in-1 Combinatorial CAR-T $157,200 / year, as reported by Reuters (http://reut.rs/2nz3LRX). 4-March-2017 $256,000 Plausible state-of-the-art, 2020 2 3 4 1 Via XON Technology: REDUCE COST REDUCE COMPLEXITY REDUCE # CLINICAL TRIALS IMPROVE PATIENT Q.O.L. Apheresis SB Transfection 2-day culture / QC Adoptive transfer Daily oral ligand, weeks At a local hospital…

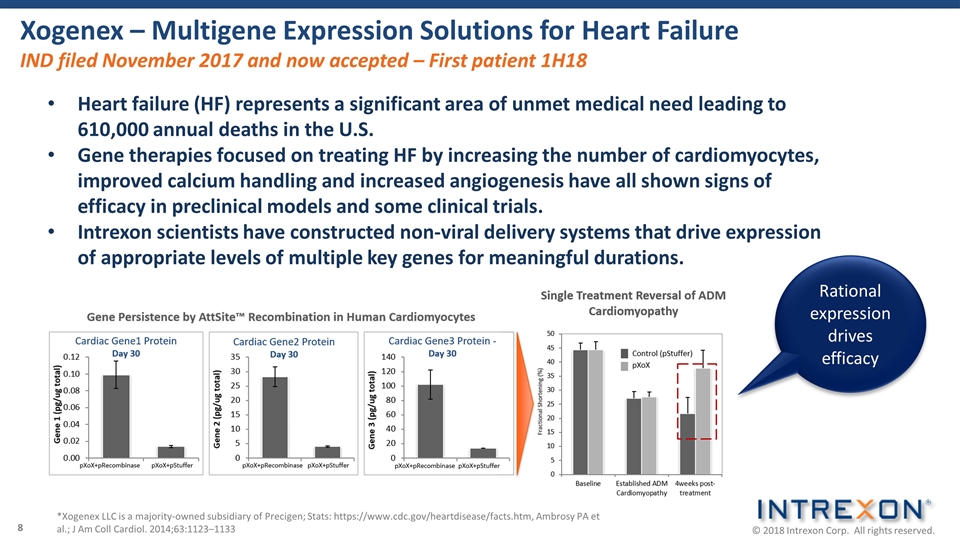

Xogenex – Multigene Expression Solutions for Heart Failure IND filed November 2017 and now accepted – First patient 1H18 *Xogenex LLC is a majority-owned subsidiary of Precigen; Stats: https://www.cdc.gov/heartdisease/facts.htm, Ambrosy PA et al.; J Am Coll Cardiol. 2014;63:1123–1133 Heart failure (HF) represents a significant area of unmet medical need leading to 610,000 annual deaths in the U.S. Gene therapies focused on treating HF by increasing the number of cardiomyocytes, improved calcium handling and increased angiogenesis have all shown signs of efficacy in preclinical models and some clinical trials. Intrexon scientists have constructed non-viral delivery systems that drive expression of appropriate levels of multiple key genes for meaningful durations. Rational expression drives efficacy

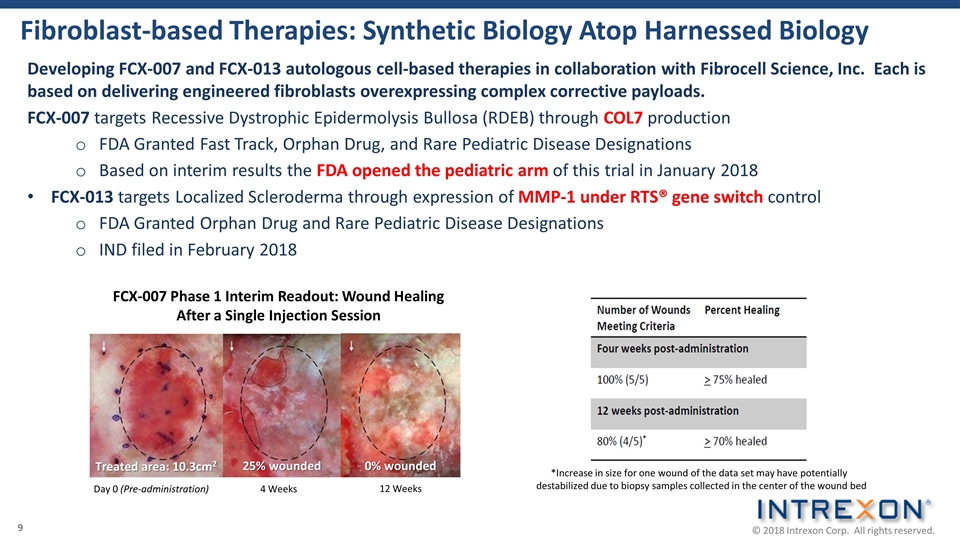

Fibroblast-based Therapies: Synthetic Biology Atop Harnessed Biology Developing FCX-007 and FCX-013 autologous cell-based therapies in collaboration with Fibrocell Science, Inc. Each is based on delivering engineered fibroblasts overexpressing complex corrective payloads. FCX-007 targets Recessive Dystrophic Epidermolysis Bullosa (RDEB) through COL7 production FDA Granted Fast Track, Orphan Drug, and Rare Pediatric Disease Designations Based on interim results the FDA opened the pediatric arm of this trial in January 2018 FCX-013 targets Localized Scleroderma through expression of MMP-1 under RTS® gene switch control FDA Granted Orphan Drug and Rare Pediatric Disease Designations IND filed in February 2018 *Increase in size for one wound of the data set may have potentially destabilized due to biopsy samples collected in the center of the wound bed 4 Weeks FCX-007 Phase 1 Interim Readout: Wound Healing After a Single Injection Session Day 0 (Pre-administration) 12 Weeks Treated area: 10.3cm2 25% wounded 0% wounded

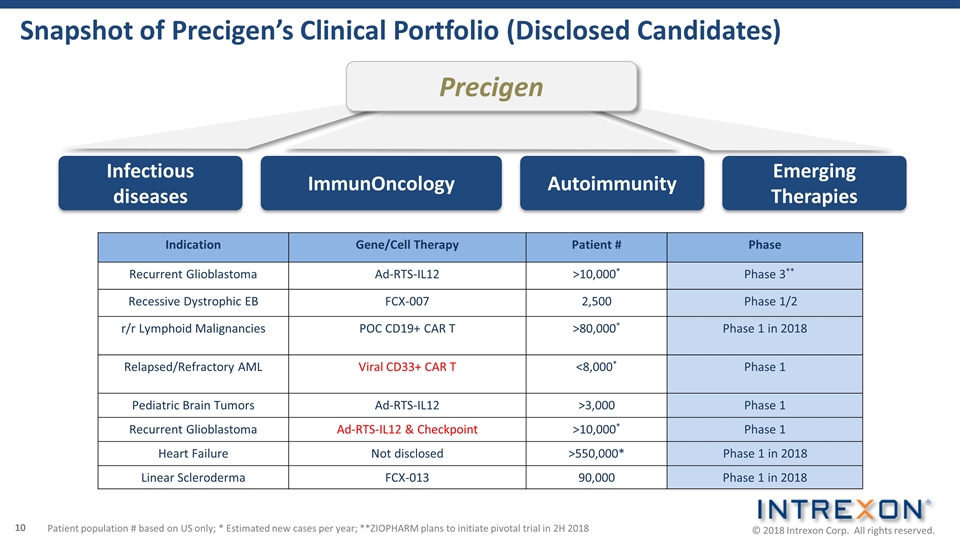

Infectious diseases ImmunOncology Precigen Emerging Therapies Autoimmunity Snapshot of Precigen’s Clinical Portfolio (Disclosed Candidates) Indication Gene/Cell Therapy Patient # Phase Recurrent Glioblastoma Ad-RTS-IL12 >10,000* Phase 3** Recessive Dystrophic EB FCX-007 2,500 Phase 1/2 r/r Lymphoid Malignancies POC CD19+ CAR T >80,000* Phase 1 in 2018 Relapsed/Refractory AML Viral CD33+ CAR T <8,000* Phase 1 Pediatric Brain Tumors Ad-RTS-IL12 >3,000 Phase 1 Recurrent Glioblastoma Ad-RTS-IL12 & Checkpoint >10,000* Phase 1 Heart Failure Not disclosed >550,000* Phase 1 in 2018 Linear Scleroderma FCX-013 90,000 Phase 1 in 2018 Patient population # based on US only; * Estimated new cases per year; **ZIOPHARM plans to initiate pivotal trial in 2H 2018

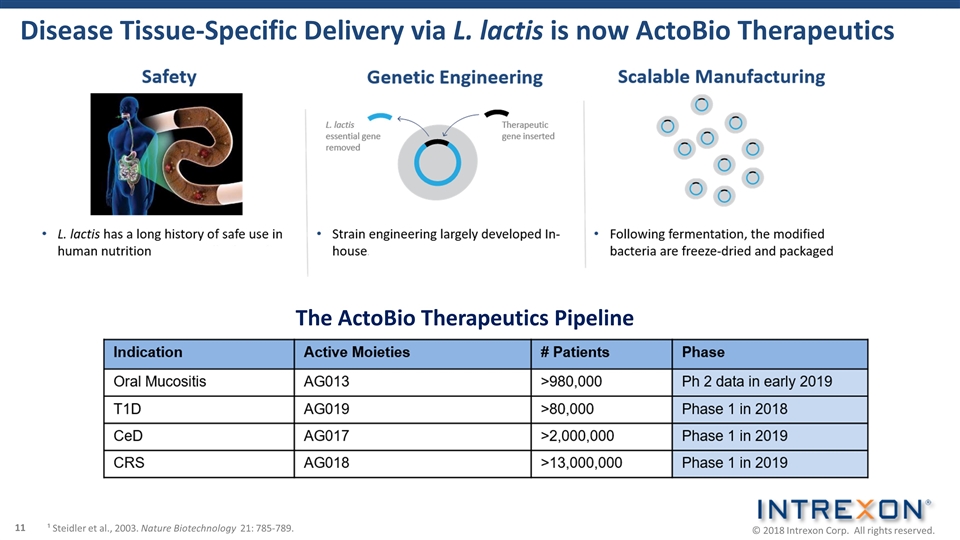

Disease Tissue-Specific Delivery via L. lactis is now ActoBio Therapeutics ¹ Steidler et al., 2003. Nature Biotechnology 21: 785-789. The ActoBio Therapeutics Pipeline

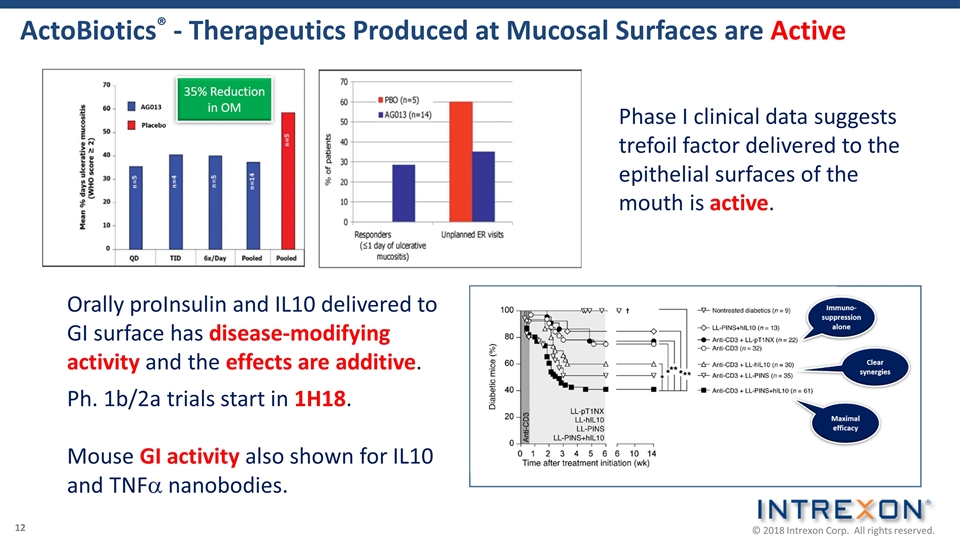

ActoBiotics® - Therapeutics Produced at Mucosal Surfaces are Active Orally proInsulin and IL10 delivered to GI surface has disease-modifying activity and the effects are additive. Ph. 1b/2a trials start in 1H18. Mouse GI activity also shown for IL10 and TNFa nanobodies. Phase I clinical data suggests trefoil factor delivered to the epithelial surfaces of the mouth is active.

Updated Scorecard - Healthcare Precigen and ActoBio Therapeutics organized and staffed throughout 2017. NCI CRADA to explore Sleeping Beauty technology to target tumor neoantigens. First medical center partnership deal signed for POC CD19 CAR-T. Xogenex HF IND Filed November 2017, lead hospital selected. Ziopharm initiated a CD33 CAR-T AML trial and a pediatric IL-12 GBM trial. Fibrocell initiated Phase 2 pediatric RDEB arm and filed localized scleroderma IND. ActoBio Therapeutics started a phase 2 OM trial and filed an IND for trials in T1D. GenVec acquisition completed potentiating multi-genic therapeutics franchise.

Intrexon’s Methane Bioconversion Platform (MBP) Engineering Microbes for Industrial Applications

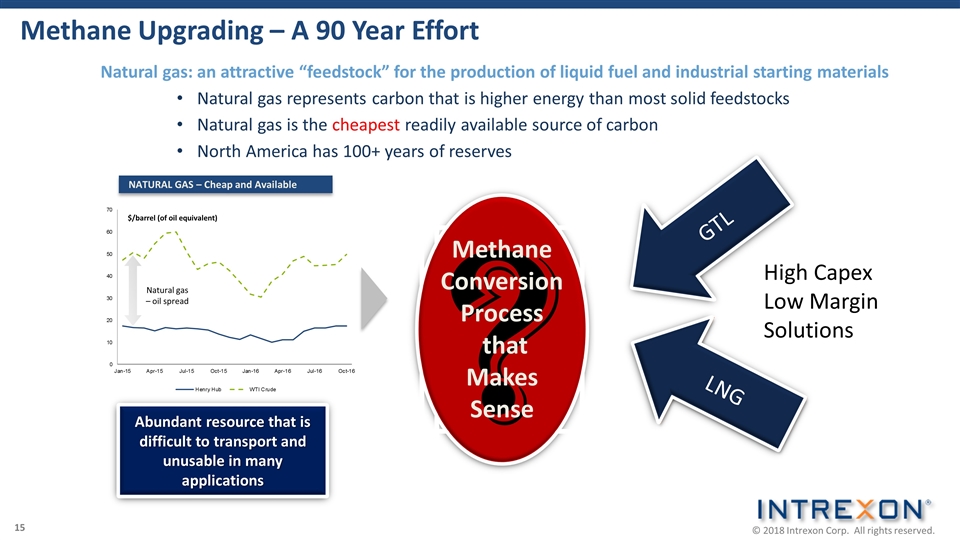

Methane Upgrading – A 90 Year Effort NATURAL GAS – Cheap and Available Abundant resource that is difficult to transport and unusable in many applications ? Methane Conversion Process that Makes Sense LNG Fun while it lasted! GTL LNG $/barrel (of oil equivalent) Natural gas – oil spread Natural gas: an attractive “feedstock” for the production of liquid fuel and industrial starting materials Natural gas represents carbon that is higher energy than most solid feedstocks Natural gas is the cheapest readily available source of carbon North America has 100+ years of reserves High Capex Low Margin Solutions 15

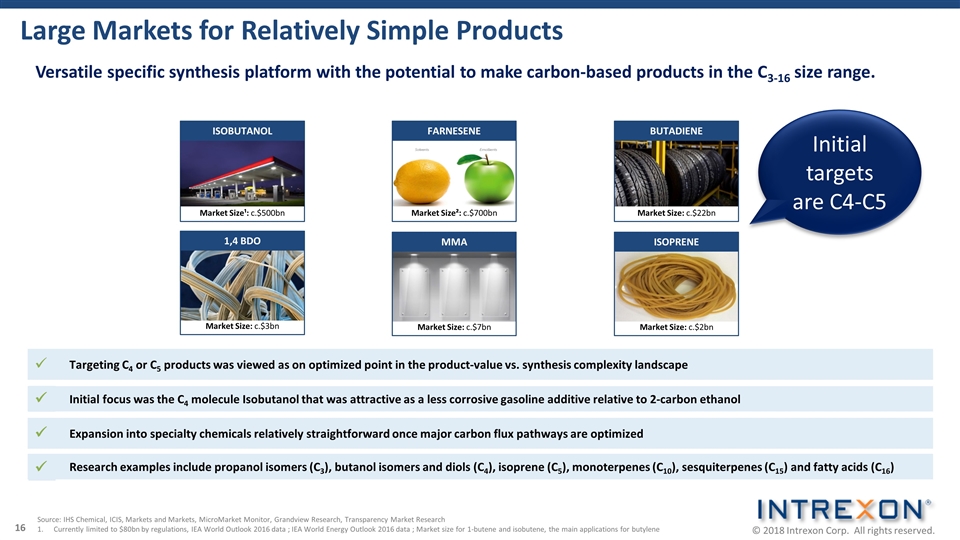

Source: IHS Chemical, ICIS, Markets and Markets, MicroMarket Monitor, Grandview Research, Transparency Market Research Currently limited to $80bn by regulations, IEA World Outlook 2016 data ; IEA World Energy Outlook 2016 data ; Market size for 1-butene and isobutene, the main applications for butylene Large Markets for Relatively Simple Products Versatile specific synthesis platform with the potential to make carbon-based products in the C3-16 size range. Market Size¹: c.$500bn ISOBUTANOL Market Size: c.$22bn BUTADIENE Market Size²: c.$700bn FARNESENE Market Size: c.$3bn 1,4 BDO Market Size: c.$7bn MMA Market Size: c.$2bn ISOPRENE Targeting C4 or C5 products was viewed as on optimized point in the product-value vs. synthesis complexity landscape ü Initial focus was the C4 molecule Isobutanol that was attractive as a less corrosive gasoline additive relative to 2-carbon ethanol ü Research examples include propanol isomers (C3), butanol isomers and diols (C4), isoprene (C5), monoterpenes (C10), sesquiterpenes (C15) and fatty acids (C16) ü Expansion into specialty chemicals relatively straightforward once major carbon flux pathways are optimized ü Initial targets are C4-C5

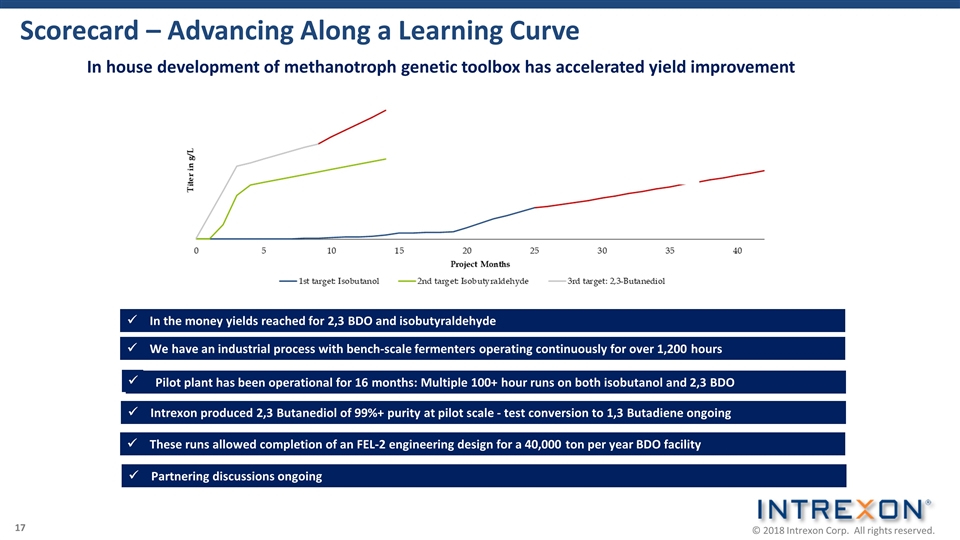

Scorecard – Advancing Along a Learning Curve We have an industrial process with bench-scale fermenters operating continuously for over 1,200 hours ü Intrexon produced 2,3 Butanediol of 99%+ purity at pilot scale - test conversion to 1,3 Butadiene ongoing ü These runs allowed completion of an FEL-2 engineering design for a 40,000 ton per year BDO facility ü Pilot plant has been operational for 16 months: Multiple 100+ hour runs on both isobutanol and 2,3 BDO ü In house development of methanotroph genetic toolbox has accelerated yield improvement Partnering discussions ongoing ü In the money yields reached for 2,3 BDO and isobutyraldehyde ü

Genetic Engineering in Plants – Three Key Platforms Intrexon Crop Protection – Two Key Platforms Oxitec Regulatory Status Engineering Microbes, Plants and Insects

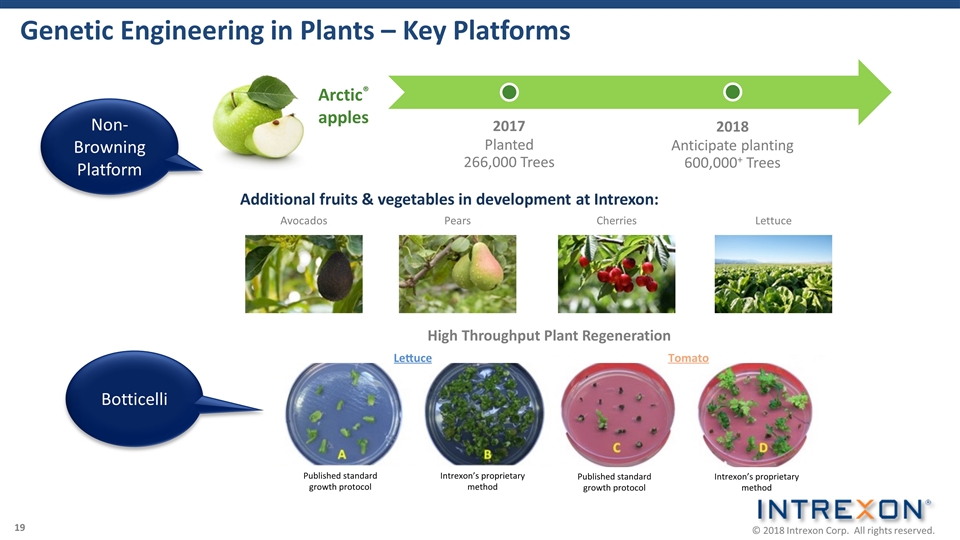

Genetic Engineering in Plants – Key Platforms Additional fruits & vegetables in development at Intrexon: Cherries Pears Lettuce Avocados Non-Browning Platform Botticelli Arctic® apples 2017 Planted 266,000 Trees 2018 Anticipate planting 600,000+ Trees High Throughput Plant Regeneration 19

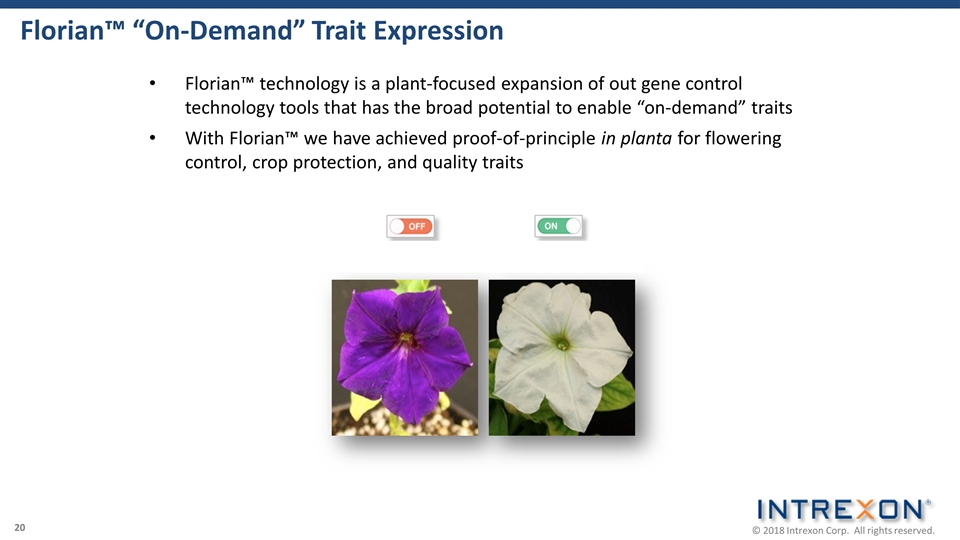

Florian™ “On-Demand” Trait Expression Florian™ technology is a plant-focused expansion of out gene control technology tools that has the broad potential to enable “on-demand” traits With Florian™ we have achieved proof-of-principle in planta for flowering control, crop protection, and quality traits Nos Activator 35S FS 3A ChsA ChsA 20

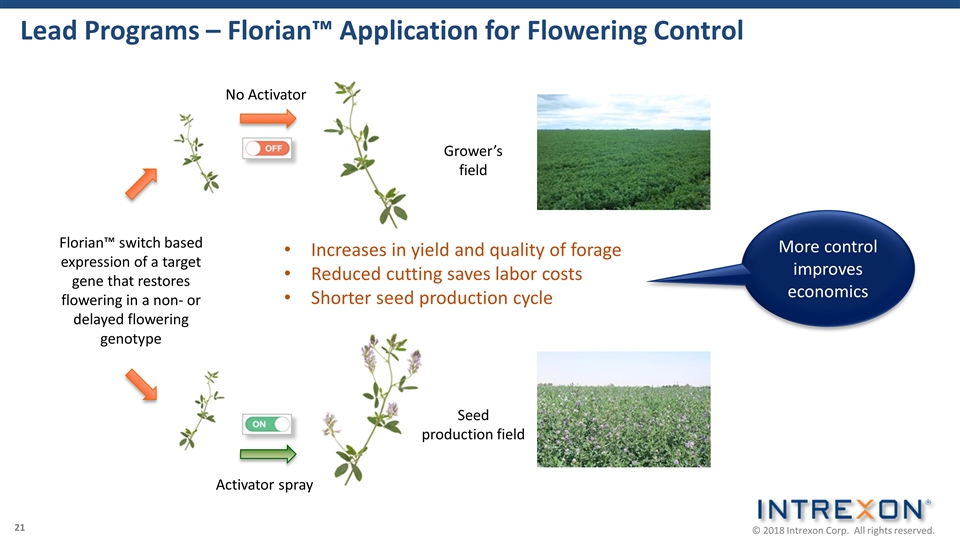

Lead Programs – Florian™ Application for Flowering Control Grower’s field Seed production field Florian™ switch based expression of a target gene that restores flowering in a non- or delayed flowering genotype Activator spray Increases in yield and quality of forage Reduced cutting saves labor costs Shorter seed production cycle No Activator More control improves economics 21

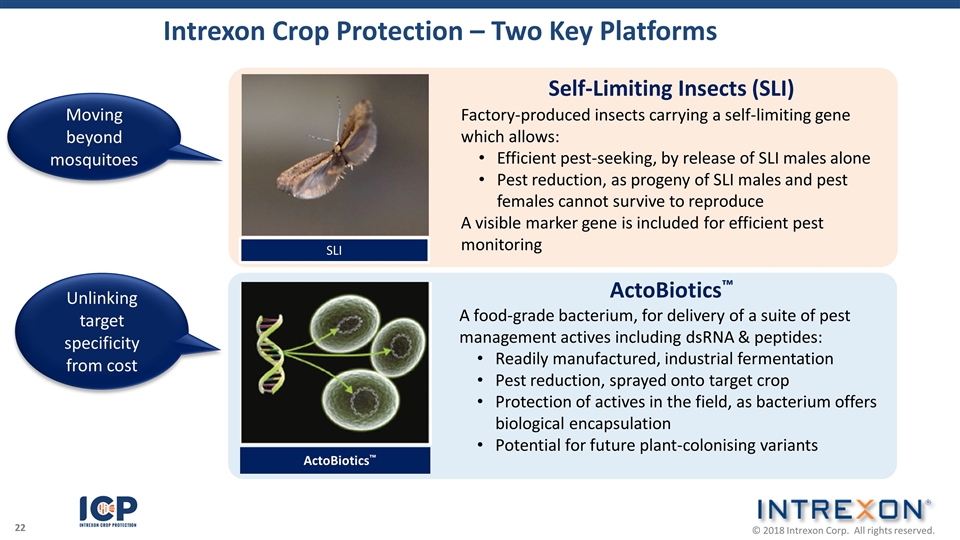

SLI ActoBiotics™ Factory-produced insects carrying a self-limiting gene which allows: Efficient pest-seeking, by release of SLI males alone Pest reduction, as progeny of SLI males and pest females cannot survive to reproduce A visible marker gene is included for efficient pest monitoring A food-grade bacterium, for delivery of a suite of pest management actives including dsRNA & peptides: Readily manufactured, industrial fermentation Pest reduction, sprayed onto target crop Protection of actives in the field, as bacterium offers biological encapsulation Potential for future plant-colonising variants Self-Limiting Insects (SLI) ActoBiotics™ Intrexon Crop Protection – Two Key Platforms Moving beyond mosquitoes Unlinking target specificity from cost

Updated Scorecard Third non-browning apple approved - Arctic® Fuji apple approved in the U.S. and Canada Our apple tree program gained momentum as we planted 266,000 trees Florian and Botticelli partnering talks in progress with multiple partners Four SLI-derived insects green-lighted for field trials Partner milestone for an SLI-base approach for controlling fall armyworm Friendly™ Aedes mosquito regulatory process moved to EPA – multipath regulatory submissions ongoing Other News: Intrexon and Darling initiated construction of the largest BSF plant in the U.S. Intrexon and Arch Pharmalabs signed a deal for fermentative production of an active pharmaceutical ingredients .