Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - Diversicare Healthcare Services, Inc. | dvcrex32certificationofthe.htm |

| EX-31.2 - EXHIBIT 31.2 - Diversicare Healthcare Services, Inc. | dvcrex312cfocertification1.htm |

| EX-31.1 - EXHIBIT 31.1 - Diversicare Healthcare Services, Inc. | dvcrex311ceocertification1.htm |

| EX-23.1 - EXHIBIT 23.1 - Diversicare Healthcare Services, Inc. | dvcrex231-123117.htm |

| EX-21 - EXHIBIT 21 - Diversicare Healthcare Services, Inc. | dvcrex21-subsidiarieslisti.htm |

| EX-10.62 - EXHIBIT 10.62 - Diversicare Healthcare Services, Inc. | dvcrex1062-thirdamendmentt.htm |

| EX-10.61 - EXHIBIT 10.61 - Diversicare Healthcare Services, Inc. | dvcrex1061-fifthamendmentt.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 10-K

________________________________

CHECK ONE:

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file No.: 1-12996

________________________________

Diversicare Healthcare Services, Inc.

(exact name of registrant as specified in its charter)

________________________________

Delaware | 62-1559667 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

1621 Galleria Boulevard, Brentwood, TN | 37027 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (615) 771-7575

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each Exchange on which registered |

Common Stock, $0.01 par value per share | The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company þ

Emerging growth company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ |

The aggregate market value of Common Stock held by non-affiliates on June 30, 2017 (based on the closing price of such shares on the NASDAQ Capital Market) was approximately $38,398,000. For purposes of the foregoing calculation only, all directors, named executive officers and persons known to the registrant to be holders of 5% or more of the registrant's Common Stock have been deemed affiliates of the registrant.

On February 15, 2018, 6,455,487 shares of the registrant's $0.01 par value Common Stock were outstanding.

Documents Incorporated by Reference

Registrant's definitive proxy materials for its 2018 annual meeting of shareholders are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Form 10-K.

Table of Contents | |||

Page | |||

Part I | |||

Item 1. | Business | ||

Item 1A. | Risk Factors | ||

Item 1B. | Unresolved Staff Comments | ||

Item 2. | Properties | ||

Item 3. | Legal Proceedings | ||

Item 4. | Mine Safety Disclosures | ||

Part II | |||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 24 | |

Item 6. | Selected Consolidated Financial Data | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 27 | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | ||

Item 8. | Financial Statements and Supplementary Data | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | ||

Item 9A. | Controls and Procedures | ||

Item 9B. | Other Information | ||

Part III | |||

Item 10. | Directors, Executive Officers and Corporate Governance | ||

Item 11. | Executive Compensation | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | ||

Item 14. | Principal Accountant Fees and Services | ||

Part IV | |||

Item 15. | Exhibits and Financial Statement Schedules | ||

Item 16. | Form 10-K Summary | ||

PART 1

ITEM 1. BUSINESS

Introductory Summary.

Diversicare Healthcare Services, Inc. provides post-acute care services to skilled nursing facilities, referred to as"skilled nursing centers," "nursing centers," or "centers," patients and residents in ten states, primarily in the Southeast, Midwest, and Southwest United States. Unless the context indicates otherwise, references herein to “Diversicare,” “the Company,” “we,” “us” and “our” include Diversicare Healthcare Services, Inc. and all of our consolidated subsidiaries. Diversicare Healthcare Services, Inc. was incorporated as a Delaware corporation in 1994.

The post-acute care profession encompasses a broad range of non-institutional and institutional services. For those among the aging, infirmed, or disabled requiring temporary or limited special services, a variety of home care options exist. As the need for assistance in activities of daily living develop, assisted living centers become the most viable and cost effective option. For those amongst the aging, disabled, or infirmed requiring more extensive assistance and intensive care, skilled nursing center care may become the only viable option. We have chosen to focus our business primarily on the skilled nursing centers sector and to specialize in this aspect of the post-acute care continuum.

Principal Address and Website.

Our principal executive offices are located at 1621 Galleria Boulevard, Brentwood, Tennessee 37027. Our telephone number at that address is 615.771.7575, and our facsimile number is 615.771.7409. Our website is located at www.dvcr.com. The information on our website does not constitute part of this Annual Report on Form 10-K.

Operating and Growth Strategy.

Our operating objective is to optimize market position in the delivery of health care and related services to the patients and residents in need of post-acute care in the communities in which we operate. Our strategic operations development plan focuses on (i) providing a broad range of high quality, cost-effective post-acute care services; (ii) improving skilled mix in our nursing centers via enhanced capabilities for rehabilitation and transitional care; (iii) building clinical competencies and programs consistent with marketplace needs; and (iv) clustering our operations on a regional basis. Interwoven into our objectives and operating strategy is our mission:

• Improve Every Life We Touch

• Provide Exceptional Healthcare

• Exceed Expectations

• Increase Shareholder Value

Strategic operating initiatives. Our key strategic operating initiatives include improving skilled mix in our nursing centers by enhancing our staffing complement to address the increased medical complexity of certain patients, increasing clinical competencies, and adding clinical programs. The investments in nursing and clinical care have been implemented in concert with additional investments in nursing center-based sales representatives to cultivate referral and Managed Care relationships. These investments have positioned us and are expected to continue to position us to be a destination for patients covered by Medicare and Managed Care as well as certain private pay individuals. These enhancements and investments have positioned us to admit higher acuity patients.

Another strategic operating initiative was to implement an Electronic Medical Records (“EMR”) platform. See description of our EMR implementation below. We completed the implementation of Electronic Medical Records in all our nursing centers in December 2011, and implement EMR at all new centers near the time we commence operations.

To achieve our objectives, we:

Provide a broad range of quality cost-effective services. Our objective is to provide a variety of services to meet the needs of the increasing post-acute care population requiring skilled nursing and rehabilitation care. Our service offerings currently include skilled nursing, comprehensive rehabilitation services, programming for Life Steps and Memory Care units (described below) and other specialty programming. By addressing varying levels of acuity, we work to meet the needs of the population we serve. We seek to establish a reputation as the provider of choice in each of our markets. Furthermore, we believe we are able to deliver quality services cost-effectively, compared to other healthcare providers along the spectrum of care, thereby expanding the population base that can benefit from our services.

1

Improve skilled mix in our nursing centers. By enhancing our registered nurse coverage and adding specialized clinical care, we believe we can admit patients with more medically complex conditions, thereby improving skilled mix and reimbursement. The investments in nursing and clinical care are being conducted in concert with additional investments in nursing center-based sales representatives to develop referral and Managed Care relationships. These investments will better attract quality payor sources for patients covered by Medicare, Managed Care and Medicare replacement payors as well as certain private pay individuals. We will also continue our program for the renovation and improvement of our nursing centers to attract and retain patients and residents.

Cluster operations on a regional basis. We have developed regional concentrations of operations in order to achieve operating efficiencies, generate economies of scale and capitalize on marketing opportunities created by having multiple operations in a regional market area.

Key elements of our growth strategy are to:

Increase revenues and profitability at existing nursing centers. Our strategy includes increasing center revenues and profitability through improving payor mix, providing an increasing level of higher acuity care, obtaining appropriate reimbursement for the care we provide, and providing high quality patient care. Ongoing investments are being made in expanded nursing and clinical care. We continue to enhance center-based marketing initiatives to promote higher occupancy levels and improved skilled mix at our nursing centers.

Development of additional specialty services. Our strategy includes the development of additional specialty units and programming in nursing centers that could benefit from these services. The specialty programming will vary depending on the needs of the specific market, and may include complex medical and rehabilitation services, as well as memory care units and other specialty programming. These services allow our centers to meet market needs while improving census and payor mix. A center specific assessment of the market and the current programming being offered is conducted related to specialty programming to determine if unmet needs exist as a predictor of the success of particular niche offerings and services.

Acquisition, leasing and development of new centers. We continue to pursue and investigate opportunities to acquire, lease or develop new centers, focusing primarily on opportunities that can leverage our existing infrastructure.

Nursing Centers and Services.

Diversicare provides a broad range of post-acute care services to patients and residents including skilled nursing, ancillary health care services and assisted living. In addition to the nursing and social services usually provided in long-term care centers, we offer a variety of rehabilitative, nutritional, respiratory, and other specialized ancillary services. As of December 31, 2017, our continuing operations consist of 76 nursing centers with 8,456 licensed skilled nursing beds. Our nursing centers range in size from 48 to 320 licensed nursing beds. The licensed nursing bed count does not include 489 licensed assisted living beds. Our continuing operations include centers in Alabama, Florida, Indiana, Kansas, Kentucky, Mississippi, Missouri, Ohio, Tennessee, and Texas.

2

The following table summarizes certain information with respect to the nursing centers we own or lease as of December 31, 2017:

Number of Centers | Licensed Nursing Beds (1) | Available Nursing Beds (1) | ||||||

Operating Locations: | ||||||||

Alabama | 20 | 2,385 | 2,318 | |||||

Florida | 1 | 79 | 79 | |||||

Indiana | 1 | 158 | 158 | |||||

Kansas | 6 | 464 | 464 | |||||

Kentucky | 13 | 1,127 | 1,123 | |||||

Mississippi | 9 | 1,039 | 1,004 | |||||

Missouri | 3 | 339 | 339 | |||||

Ohio | 5 | 403 | 393 | |||||

Tennessee | 5 | 617 | 551 | |||||

Texas | 13 | 1,845 | 1,662 | |||||

76 | 8,456 | 8,091 | ||||||

Classification: | ||||||||

Owned | 18 | 1,607 | 1,404 | |||||

Leased | 58 | 6,849 | 6,687 | |||||

Total | 76 | 8,456 | 8,091 | |||||

____________

(1) | The number of Licensed Nursing Beds is based on the regulatory licenses for the nursing center. The Company reports its occupancy based on licensed nursing beds. The number of Available Nursing Beds represents Licensed Nursing Beds reduced by beds removed from service. Available Nursing Beds is subject to change based upon the needs of the centers, including configuration of patient rooms, common usage areas and offices, status of beds (private, semi-private, ward, etc.) and renovations. The number of Licensed and Available Nursing Beds does not include 489 Licensed Assisted Living/Residential Beds, all of which are also available, and the number of centers excludes one stand-alone Assisted Living Facility in Ohio. These beds are excluded from the bed counts as our operating statistics such as occupancy are calculated using Nursing Beds only. |

Our nursing centers provide skilled nursing health care services, including nutrition services, recreational therapy, social services, housekeeping and laundry services. Skilled nursing care is provided for post-acute patients and residents with comorbidities. This care includes assessment using evidence based tools; individualized care plan development based on identified areas of risk and care needs; and skilled interventions such as IV services. We also provide for the delivery of ancillary medical services at the nursing centers we operate. These specialty services include rehabilitation therapy services, such as audiology, speech, occupational and physical therapies, which are provided through licensed therapists and registered nurses, and the provision of medical supplies, nutritional support, infusion therapies and related clinical services. The majority of these services are provided using our internal resources and clinicians.

Within the framework of a nursing center, we may provide other specialty care, including:

Transitional Care Unit. Many of our nursing centers have units designated as transitional care units, our designation for patients requiring transitional care following an acute stay in the hospital. These units specialize in short-term nursing and rehabilitation with the goal of returning the patient to their highest potential level of functionality. These units provide enhanced services with emphasis on upgraded amenities. The design and programming of the units generally appeal to the clinical and hospitality needs of individuals as they progress to the next appropriate level of care. Specialized therapeutic treatment regimens include orthopedic rehabilitation, neurological rehabilitation and complex medical rehabilitation. While these patients generally have a shorter length of stay, the intensive level of nursing and rehabilitation required by these patients typically results in higher levels of reimbursement.

Memory Care Unit. Like our transitional care units, many of our nursing centers have memory care units, our designation for advanced care for dementia-related disorders including Alzheimer's disease. The goal of the units is to provide a safe, homelike and supportive environment for cognitively impaired patients, utilizing an interdisciplinary team approach. Family and community involvement complement structured programming in the secure environment instrumental in fostering as much resident independence and purposeful quality of life as long as possible despite diminished capacity.

3

Enhanced Therapy Services. We have complemented our traditional therapy services with programs that provide electrotherapy, vital stimulation, ultrasound and shortwave diathermy therapy treatments that promote pain management, wound healing, muscle strengthening, and/or contractures management, improving outcomes for our patients and residents receiving therapy treatments.

Other Specialty Programming. We implement other specialty programming based on a center's specific needs. We have developed two adult day care centers on nursing center campuses. We have developed specialty programming for bariatric patients (generally, patients weighing more than 350 pounds) at one of these centers as these individuals have unique psychosocial and equipment needs.

Quality Assurance and Performance Improvement. We have in place a Quality Assurance and Performance Improvement (“QAPI”) program, which is focused on monitoring and improving all aspects of the care provided in a center by identifying outcomes and acting on areas of improvement. The QAPI program in our centers addresses all systems of care and management practices. Key quality indicators are determined and performance goals and benchmarks are established based on industry research standards via a Balanced Scorecard. Gaps and opportunities in performance versus benchmarks are addressed with analysis and performance improvement plans. Outcomes from each center in the areas of quality, employee workplace, customer satisfaction, and stewardship are collected monthly and overseen by regional and company quality committees.

Utilization of Electronic Medical Records. We successfully completed the full implementation of EMR in our nursing centers. EMR improves our ability to accurately record the care provided to our patients and quickly respond to areas of need. We now implement the use of EMR near the time of acquisition for new centers. EMR improves customer and employee satisfaction, nursing center regulatory compliance and provides real-time monitoring and scheduling of care delivery. We believe our EMR system supports our quality initiatives and positions us for higher acuity service offerings. Our EMR system is comprehensive in its functionality, providing key components, such as:

• | Tracking Activities of Daily Living (“ADLs”). ADLs are the functions that each person must perform on a daily basis including, but not limited to, getting dressed, bathing, and eating. ADL tracking allows us to capture the provision of care provided by our nursing, dietary and housekeeping staff in assisting with ADLs quickly, efficiently and electronically. |

• | Progress Notes. Progress notes are an important component of our medical records. Licensed nursing professionals provide documentation reflecting assessment of each patient's condition and intervention of skilled care provided. The EMR system provides means for a comprehensive chronological record resulting in improved capture, monitoring and review of documentation of condition and care provided. |

• | Medications. Our patients receive a number of daily medications. This module assists with electronic tracking and documenting of required medications and treatments. This provides a more accurate and efficient care system for our nurses and patients. |

• | Wound Module. This allows for an evidence-based risk assessment to drive patient specific interventions to prevent skin breakdown. When skin abnormalities are present, it provides for accurate depiction of anatomical location and description which drives individualized care treatments. |

• | Incident Module. Allows for capturing any event, such as a fall, and provides quality assurance steps for root cause and patient-specific care plans. |

For all modules, the EMR system provides a dashboard that can be reviewed at a number of kiosks throughout the nursing center, allowing our staff to securely access a list of upcoming patient care tasks and providing supervisors a tool to help manage and monitor staff performance. We believe the EMR system provides better support, efficiency, and improves the quality of care for our patients. We originally invested approximately $112,000 per nursing center to deploy EMR in all our centers at the time of implementation. We currently implement EMR at each of the centers we acquire or at which time we assume operations during the transition process.

Organization. Our nursing centers are currently organized into ten regions, each of which is supervised by a regional vice president. The regional vice president is generally supported by specialists in several functions, including clinical, human resources, marketing, revenue cycle management and administration, all of whom are employed by us. The day-to-day operations of each of our nursing centers are led by an on-site, licensed administrator. The administrator of each nursing center is supported by other professional personnel, including a medical director, who assists in the medical management of the nursing center, and a director of nursing, who supervises a team of registered nurses, licensed practical nurses and nurse aides. Other personnel include those providing therapy, dietary, activities and social service, housekeeping, laundry, maintenance and office services. The majority of personnel at our nursing centers, including the administrators, are our employees.

4

Marketing.

We believe that skilled nursing care is fundamentally a local business in which both patients and their referral sources are typically based in the immediate geographic area in which the nursing center is located. Our marketing plan and related support activities emphasize the role and contributions of the administrators, admissions coordinators and clinical liaisons of each nursing center, all of whom are responsible for developing relationships with various referral sources such as doctors, hospitals, hospital case managers and discharge planners, and various healthcare and community organizations. Training, sales tools and job aids are provided for the sales and marketing teams for the product knowledge, market knowledge, and selling skills necessary to support their efforts in the field. As part of our business strategy, we have dedicated sales and marketing personnel who develop strong partnerships with physicians and hospital executives as well as Accountable Care Organizations ("ACO"), Bundled Payments for Care Improvement ("BPCI"), and Managed Care organizations. We believe these relationships will be mutually beneficial, providing the community with high quality healthcare while helping customers to navigate choices, manage transitions, and control costs.

At the local level, our sales and marketing efforts are designed to:

•Identify and develop strong healthcare partnerships

•Help facilitate smooth transitions between care settings

•Promote collaboration with ACOs, BPCIs, and healthcare organizations

•Educate referral sources and community on our key differentiators and capabilities

•Position ourselves as a valuable resource and healthcare partner

•Enhance the customer experience

•Contribute to a strong community presence

•Promote higher occupancy levels

•Foster optimal payor mix

In addition to soliciting admissions from current and potential referral sources, we emphasize involvement in community and healthcare events and opportunities to promote a public awareness of our nursing centers and services. Activities include ongoing family councils and community based “family night” functions, providing the opportunity to educate the public on various topics such as Medicare benefits, powers of attorney, and other topics of interest. We also promote a positive customer experience, best practices, strong surveys, and a high Star Rating; we seek feedback through third-party resident and family surveys. We host tour and “open house” opportunities, where members of the local community are invited to visit the center to see any improvements or to better understand our environment and services. We look for ways to offer increased clinical capabilities and services to better meet the needs of the community and referral sources. In addition, we have regional oversight to support the overall marketing strategies in each local center, in order to promote higher occupancy levels and improved payor and case mixes at our nursing centers. We offer the resources and metrics for strong healthcare partnerships with our referral sources, including ACOs and other Managed Care partners. Our support center marketing personnel support regional and local marketing personnel and efforts.

We have monthly marketing programs and ongoing marketing initiatives, developed internally, that focus on educating and meeting the needs of our customers while growing our business. Resources are also available to assist each nursing center administrator in analysis of local demographics and competition with a view toward complementary service development. We consider the primary referral area in long-term care to generally lie within a five-to-fifteen-mile radius of each nursing center depending on population density; consequently, we focus on local marketing efforts rather than broad-based advertising.

Acquisitions, Significant Transactions and Divestitures.

Acquisitions

Effective July 1, 2017, the Company acquired a 103-bed skilled nursing center in Selma, Alabama, for an aggregate purchase price of $8,750,000, pursuant to an Asset Purchase Agreement with Park Place Nursing and Rehabilitation Center, LLC, Dunn Nursing Home, Inc., Wood Properties of Selma LLC, and Homewood of Selma, LLC.

On February 26, 2016, the Company exercised its purchase options to acquire the real estate assets for Diversicare of Hutchinson in Hutchinson, Kansas and Clinton Place in Clinton, Kentucky for $4,250,000 and $3,300,000, respectively. The Company has operated these centers since February 2015 and April 2012, respectively. Hutchinson is an 85-bed skilled nursing center and Clinton is an 88-bed skilled nursing center.

Golden Living Transaction

On August 15, 2016, the Company entered into an Operation Transfer Agreement with Golden Living (the "Lessor") to assume the operations of 22 centers in Alabama and Mississippi. On October 1, 2016, the Company entered into a Master Lease Agreement (the "Lease") with Golden Living to directly lease 8 centers located in Mississippi from the Lessor. The Company also assumed

5

individual leases of two centers in Mississippi from third parties. On November, 1 2016, the Company amended and restated the Lease ("Amended Lease") with the Lessor to directly lease an additional twelve centers located in Alabama. Refer to the chart below for a complete listing of these centers' locations and number of licensed beds.

Lease Agreements and Assumption of Operations

During 2016, the Company assumed operations at 22 centers comprising a total increase of 2,574 licensed beds. The Company did not enter into any lease agreements to assume operations during 2017. See table below for details of the 2016 operations acquired by the Company:

Center | Location | Effective Date | Licensed Bed Count | |

Diversicare of Amory | Amory, Mississippi | October 1, 2016 | 152 | |

Diversicare of Batesville | Batesville, Mississippi | October 1, 2016 | 130 | |

Diversicare of Brookhaven | Brookhaven, Mississippi | October 1, 2016 | 58 | |

Diversicare of Carthage | Carthage, Mississippi | October 1, 2016 | 99 | |

Diversicare of Eupora | Eupora, Mississippi | October 1, 2016 | 119 | |

Diversicare of Meridian | Meridian, Mississippi | October 1, 2016 | 120 | |

Diversicare of Ripley | Ripley, Mississippi | October 1, 2016 | 140 | |

Diversicare of Southaven | Southaven, Mississippi | October 1, 2016 | 140 | |

Diversicare of Tupelo | Tupelo, Mississippi | October 1, 2016 | 120 | |

Diversicare of Tylertown | Tylertown, Mississippi | October 1, 2016 | 60 | |

Diversicare of Arab | Arab, Alabama | November 1, 2016 | 87 | |

Diversicare of Bessemer | Bessemer, Alabama | November 1, 2016 | 180 | |

Diversicare of Riverchase | Birmingham, Alabama | November 1, 2016 | 132 | |

Diversicare of Boaz | Boaz, Alabama | November 1, 2016 | 100 | |

Diversicare of Foley | Foley, Alabama | November 1, 2016 | 154 | |

Baron House of Hueytown | Hueytown, Alabama | November 1, 2016 | 50 | |

Diversicare of Lanett | Lanett, Alabama | November 1, 2016 | 85 | |

Diversicare of Montgomery | Montgomery, Alabama | November 1, 2016 | 138 | |

Diversicare of Oneonta | Oneonta, Alabama | November 1, 2016 | 120 | |

Diversicare of Oxford | Oxford, Alabama | November 1, 2016 | 173 | |

Diversicare of Pell City | Pell City, Alabama | November 1, 2016 | 94 | |

Diversicare of Winfield | Winfield, Alabama | November 1, 2016 | 123 | |

Lease Terminations

Effective September 30, 2017, the Company entered into an Agreement with Trend Health and Rehab of Carthage, LLC ("Trend Health") to terminate the lease and the Company's right of possession of the center in Carthage, Mississippi. In consideration of the early termination of the lease, Trend Health provided the Company with a $250,000 cash termination payment.

Effective May 31, 2016, the Company entered into an Agreement with Avon Ohio, LLC to amend the original lease agreement, thus terminating the Company's right of possession of the center. As a result, the Company incurred lease termination costs of $2,008,000 in the second quarter of 2016. Under the amended agreement, the Company is required to pay $300,000 per year through the term of the original lease agreement, July 31, 2024.

Under current accounting guidance, these transactions were not reported as discontinued operations, as the disposals did not represent a strategic shift that has (or will have) a major effect on the Company's operations and financial results.

Pharmacy Partnership

Effective October 28, 2016, the Company and its partners entered into an asset purchase agreement to sell the pharmacy joint venture. The sale resulted in a $1,366,000 gain in the fourth quarter of 2016. Subsequently, we recognized an additional gain of $733,000 in the first quarter of 2017, related to the continuing liquidation of remaining net assets affiliated with the partnership.

6

Nursing Center Industry.

We believe there are a number of significant trends within the post-acute care industry that will support the continued growth of the nursing center profession. These trends are also likely to impact our business. These factors include:

Demographic trends. The primary market for our post-acute health care services is comprised of persons aged 75 and older. This age group is one of the fastest growing segments of the United States population. As the number of persons aged 75 and over continues to grow, we believe that there will be corresponding increases in the number of persons who need skilled nursing care.

Cost containment pressures. In response to rapidly rising health care costs, governmental and other third-party payors have adopted cost-containment measures to reduce admissions and encourage reduced lengths of stays in hospitals and other acute care settings. As a result, hospitals are discharging patients earlier and referring elderly patients, who may be too sick or frail to manage their lives without assistance, to nursing centers where the cost of providing care is typically lower than hospital care.

Limited supply of centers. As the nation's population of seniors continues to grow, life expectancy continues to expand, and there continues to be limitations on granting Certificates of Need (“CON”) in most states for new skilled nursing centers, so we believe that there will be continued demand for skilled nursing beds in the markets in which we operate. CON laws generally require a state agency to determine public need for any construction or expansion of healthcare facilities. We believe that the CON process tends to restrict the supply and availability of licensed skilled nursing center beds. High construction costs, limitations on state and federal government reimbursement for the full costs of construction, and start-up expenses also act to restrict growth in the supply for such centers.

Reduced reliance on family care. Historically, the family has been the primary provider of care for seniors. We believe that the increase in the percentage of dual income families, the reduction of average family size and the increased mobility in society will reduce the role of the family as the traditional care-giver for aging parents. We believe that this trend will make it necessary for many seniors to look outside the family for assistance as they age.

Competition.

The post-acute care business is highly competitive. We face direct competition for additional centers, and our centers face competition for employees and patients. Some of our present and potential competitors for acquisitions are significantly larger and have or may obtain greater financial and marketing resources. Competing companies may offer new or more modern centers or new or different services that may be more attractive to patients than some of the services we offer.

The nursing centers operated by us compete with other centers in their respective markets, including rehabilitation hospitals and other skilled and personal care residential centers. In the few urban markets in which we operate, some of the long-term care providers with which our centers compete are significantly larger and have or may obtain greater financial and marketing resources than our centers. Some of these providers are not-for-profit organizations with access to sources of funds not available to our centers. Construction of new long-term care centers near our existing centers could adversely affect our business. We believe that the most important competitive factors in the long-term care business are: a nursing center's local reputation with referral sources, such as acute care hospitals, physicians, religious groups, other community organizations, Managed Care organizations, and a patient's family and friends; physical plant condition; the ability to identify and meet particular care needs in the community; the availability of qualified personnel to provide the requisite care; and the rates charged for services. There is limited, if any, price competition with respect to Medicaid and Medicare patients, since revenues for services to such patients are strictly controlled and are based on fixed rates and cost reimbursement principles. Although the degree of success with which our centers compete varies from location to location, we believe that our centers generally compete effectively with respect to these factors.

7

Revenue Sources

We classify our revenues earned from patients and residents into four major categories: Medicaid, Medicare, managed care, and private pay and other. Medicaid revenues are those received under the traditional Medicaid program, which provides benefits to those in need of financial assistance in the securing of medical services. Medicare revenues include revenues received under both Part A and Part B. Managed Care revenues are received from insurance entities, including third-party plans that administer Medicare benefits, known as Medicare Advantage plans. The private pay and other revenues are composed primarily of individuals or parties who directly pay for their services. Included in the private pay and other category are patients who are hospice beneficiaries as well as the recipients of Veterans Administration benefits. Veterans Administration payments are made pursuant to renewable contracts negotiated with these payors.

The following table sets forth net patient revenues related to our continuing operations by payor source for the periods presented (dollar amounts in thousands):

Year Ended December 31, | ||||||||||||||||||||

2017 | 2016 | 2015 | ||||||||||||||||||

Medicaid | $ | 300,926 | 52.4 | % | $ | 215,381 | 50.6 | % | $ | 188,323 | 48.6 | % | ||||||||

Medicare | 149,020 | 25.9 | % | 117,143 | 27.5 | % | 112,305 | 29.0 | % | |||||||||||

Managed Care | 42,673 | 7.4 | % | 29,066 | 6.8 | % | 27,856 | 7.2 | % | |||||||||||

Private Pay and other | 82,175 | 14.3 | % | 64,473 | 15.1 | % | 59,111 | 15.2 | % | |||||||||||

Total | $ | 574,794 | 100.0 | % | $ | 426,063 | 100.0 | % | $ | 387,595 | 100.0 | % | ||||||||

The following table sets forth average daily skilled nursing census, or average number of patients per day, by payor source for our continuing operations for the periods presented:

Year Ended December 31, | |||||||||||||||||

2017 | 2016 | 2015 | |||||||||||||||

Medicaid | 4,681 | 69.1 | % | 3,448 | 68.1 | % | 3,104 | 67.1 | % | ||||||||

Medicare | 760 | 11.2 | % | 591 | 11.7 | % | 577 | 12.5 | % | ||||||||

Managed Care | 265 | 3.9 | % | 178 | 3.5 | % | 173 | 3.7 | % | ||||||||

Private Pay and other | 1,072 | 15.8 | % | 844 | 16.7 | % | 772 | 16.7 | % | ||||||||

Total | 6,778 | 100.0 | % | 5,061 | 100.0 | % | 4,626 | 100.0 | % | ||||||||

Consistent with the nursing center industry in general, changes in the mix of a center's patient population among Medicaid, Medicare, Managed Care, and private pay and other can significantly affect the profitability of the center's operations. We will attempt to increase revenues from non-governmental sources to the extent capital is available to do so. However, private payors, including managed care payors, are increasingly demanding that providers accept discounted fees or assume all or a portion of the financial risk for the delivery of health care services. Such measures may include capitated payments, which can result in significant losses to health care providers if patients require expensive treatment not adequately covered by the capitated rate.

Medicare and Medicaid Reimbursement

A significant portion of our revenues are derived from government-sponsored health insurance programs, primarily Medicare and Medicaid. We employ third-party specialists in reimbursement and also use these services to monitor regulatory developments to comply with reporting requirements and to ensure that proper payments are made to our operated nursing centers.

Medicare

Medicare is a federally-funded and administered health insurance program for the aged and for certain chronically disabled individuals. Part A of the Medicare program covers certain services furnished by skilled nursing centers and other institutional providers and inpatient hospital services. Part B covers physician services, durable medical equipment, various outpatient services and certain ancillary services. Medicare generally covers skilled nursing center services for beneficiaries who require nursing care or rehabilitation services after a qualifying hospital stay. Medicare pays a per diem rate for each beneficiary, adjusted for patient acuity and additional factors such as geographic differences in wage rates. The payment rates are set forth under a prospective payment system that uses nursing and therapy indexes to assign a payment rate to each beneficiary. The Centers for Medicare &

8

Medicaid Services (“CMS”) updates the rates annually. The payment rates cover all services to be provided to a beneficiary, including room and board, skilled nursing care, therapy, and medications.

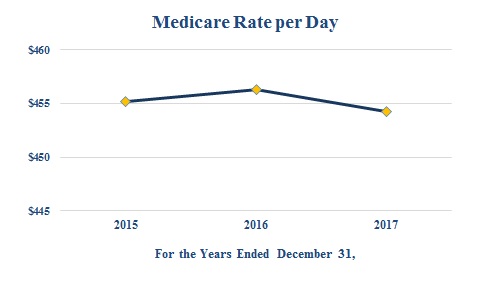

In August 2017, CMS issued its final rule outlining Medicare payment rates and policies for skilled nursing centers for federal fiscal year 2018, which began October 1, 2017. CMS projects that aggregate payments to skilled nursing centers will increase by a net 1.0% for federal fiscal year 2018. This reflects a 1.0% market basket increase, as required by the Medicare Access and CHIP Reauthorization Act of 2015 (“MACRA”). The payment rates for federal fiscal year 2017, which were projected to increase aggregate payments to skilled nursing centers by 2.4%, reflected a 2.7% market basket increase with a 0.3 percentage point productivity reduction required by the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 (collectively, “Affordable Care Act”).

In addition to the adjustments described above, payment rates are reduced pursuant to ongoing sequestration. The Budget Control Act of 2011 (“BCA”) requires automatic spending reductions to reduce the federal deficit, including Medicare spending reductions of up to 2% per fiscal year, with a uniform percentage reduction across all Medicare programs. CMS began imposing a 2% reduction on Medicare claims in April of 2013. These reductions have been extended through 2027.

CMS has increasingly introduced policies intended to shift Medicare to value-based payment methodologies, tying reimbursement to quality of care rather than quantity. For example, CMS has implemented the Quality Reporting Program, under which skilled nursing centers are required to report quality data. Beginning in federal fiscal year 2018, skilled nursing centers that fail to submit required data will be subject to a 2% reduction to the annual market basket update. Beginning in federal fiscal year 2019, the Skilled Nursing Facility Value-Based Purchasing (“SNF VBP”) Program will make incentive payments available to skilled nursing centers based on their past performance on a specified quality measure related to hospital readmissions. CMS will fund the SNF VPB Program incentive payment pool by withholding 2% of skilled nursing center payments and then redistributing the withheld payments. Data from the calendar year 2017 performance period will be used to calculate incentive payments for federal fiscal year 2019; data from the federal fiscal year 2018 performance period will be used to calculate incentive payments for federal fiscal year 2020. CMS will publish rankings based on performance scores on the Nursing Home Compare website beginning in 2018.

The Nursing Home Compare website is intended to assist the public in finding and comparing skilled care providers. Under the Five-Star Quality Rating System, each nursing home is given a rating between 1 and 5 stars, which is published on the Nursing Home Compare website. An overall star rating is determined based on three components (information from the last three years of health inspections, staffing information, and quality measures), each of which also has its own five-star rating. The ratings are based, in part, on the quality data nursing centers are required to report. For example, nursing centers must report the percentage of short-stay residents who are successfully discharged into the community and the percentage who had an outpatient emergency department visit. We remain diligent in continuing to provide outstanding patient care to achieve high rankings for our centers, as well as assuring that our rankings are correct and appropriately reflect our quality results.

MACRA required the establishment of the Quality Payment Program (“QPP”), a payment methodology intended to reward high-quality patient care. Beginning in 2017, physicians and certain other clinicians are required to participate in one of two QPP tracks. Under both tracks, performance data collected in 2017 will affect Medicare payments in 2019, and performance data collected in 2018 will affect Medicare payments in 2020. The Advanced Alternative Payment Model (“Advanced APM”) track makes incentive payments available for participation in specific innovative payment models approved by CMS. A provider with sufficient participation in an Advanced APM is exempt from the reporting requirements and payment adjustments imposed under the second track, the Merit-Based Incentive Payment System (“MIPS”). Providers electing to participate in MIPS will receive either payment incentives or be subject to payment reductions based on their performance with respect to clinical quality, resource use, clinical improvement activities, and meaningful use of electronic health records. MIPS consolidates components of previously established incentive programs, including the Value-Based Payment Modifier program and the Physician Quality Reporting System.

Therapy Services. Reimbursement for physical therapy, occupational therapy, and speech-language pathology services covered under Medicare Part B is determined according to the Medicare Physician Fee Schedule ("MPFS"), which is updated annually. Under MACRA, the MPFS reimbursement rate increases 0.5% in calendar year 2018. If a beneficiary receives multiple therapy treatments in one day, Medicare Part B pays the full rate for the therapy unit of service that has the highest Practice Expense ("PE") component. A multiple procedure payment reduction is applied to the second and subsequent therapy units, reducing reimbursement to 50% of the applicable PE component.

The Bipartisan Budget Act of 2018 repealed the annual per-beneficiary payment limits on therapy services covered under Medicare Part B for services provided after December 31, 2017. Instead, targeted medical reviews will be performed when expenses for a beneficiary exceed a threshold of $3,000 for physical and speech therapy services combined or $3,000 for occupational therapy services alone. Deductible and coinsurance amounts paid by the beneficiary for therapy services count toward the amount applied to the limit. Claims above the threshold may be subject to post-payment review of medical necessity documentation by Supplemental Medical Review Contractors.

9

10

Medicaid

Medicaid is a medical assistance program for the indigent that is funded jointly by the federal and state governments and administered by the states. Federal law requires states to cover certain nursing center services for Medicaid-eligible individuals when other payment options are unavailable. However, Medicaid eligibility requirements and benefits vary by state, and states may impose limitations on nursing services. States may also establish levels of service or payment methodologies by acuity or specialization of a nursing center.

The Affordable Care Act, as currently structured, requires states to expand Medicaid coverage by adjusting eligibility requirements such as income thresholds. However, the Presidential administration and certain members of Congress continue to attempt to repeal or significantly modify the Affordable Care Act, which may result in changes to Medicaid. Further, states may opt out of the Medicaid expansion. Some states use or have applied to use waivers granted by CMS to implement expansion, impose different eligibility or enrollment restrictions, or otherwise implement programs that vary from federal standards.

For example, effective February 1, 2015, the Company began participating in Indiana's Upper Payment Limit ("UPL") supplemental payment program, which provides supplemental Medicaid payments for skilled nursing centers that are licensed to non-state government entities such as county hospital districts. One skilled nursing center previously operated by the Company entered into a transaction with one such hospital district participating in the UPL program, providing for the transfer of the license from the Company to the hospital district. The Company's operating subsidiary retained the management of the center on behalf of the hospital district. The agreement between the hospital district and the Company is terminable by either party.

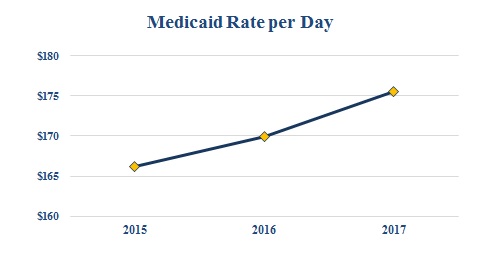

We receive the majority of our annual Medicaid rate increases during the third quarter of each year. The rate changes received in 2017 and 2016, along with increased Medicaid acuity in our acuity based states, were the primary contributor to our 3.3% increase in average rate per day for Medicaid patients in 2017 compared to 2016. Based on the rate changes received during the third quarter of 2017, we expect a favorable impact to our rate per day for Medicaid patients as we move into 2018 due to modest rate increases in many of the states within which we operate.

Several states in which we operate face budget shortfalls, which could result in reductions in Medicaid funding for nursing centers. Pressures on state budgets are expected to continue in the future. Certain of the states in which we operate are actively seeking ways to reduce Medicaid spending for nursing center care by such methods as capitated payments and substantial reductions in reimbursement rates. Some states are promoting alternatives such as community and home-based services. CMS administrators have indicated that they intend to increase state flexibility in the administration of Medicaid programs. We are unable to predict what, if any, reform proposals or reimbursement limitations will be implemented in the future, or the effect such changes would have on our operations. For the year ended December 31, 2017, we derived 25.9% and 52.4% of our total patient revenues related to continuing operations from the Medicare and Medicaid programs, respectively. Any health care reforms that significantly limit rates of reimbursement under these programs could, therefore, have a material adverse effect on our financial position and profitability.

Employees.

As of February 2, 2018, we employed approximately 8,800 employees, referred to as "team members," in connection with our continuing operations, approximately 6,300 of which are considered full-time team members. We believe that our team member relations are good. Approximately 842 of our team members are represented by a labor union.

Although we believe we are able to employ sufficient nurses and therapists to provide our services, a shortage of health care professional personnel in any of the geographic areas in which we operate could affect our ability to recruit and retain qualified team members and could increase our operating costs. We compete with other health care providers for both professional and non-professional team members and with non-health care providers for non-professional team members. This competition contributed to a significant increase in the salaries that we had to pay to hire and retain these team members. As is common in the health care industry, we expect the salary and wage increases for our skilled healthcare providers will continue to be higher than average salary and wage increases nationally.

Supplies and Equipment.

We purchase drugs, solutions and other materials and lease certain equipment required in connection with our business from many suppliers. We have not experienced, and do not anticipate that we will experience, any significant difficulty in purchasing supplies or leasing equipment from current suppliers. In the event that such suppliers are unable or fail to sell us supplies or lease equipment, we believe that other suppliers are available to adequately meet our needs at comparable prices. National purchasing contracts are in place for all major supplies, such as food, linens and medical supplies. These contracts assist in maintaining quality, consistency and efficient pricing. Based on contract pricing for food and other supplies, we expect cost increases in 2018 to be relatively the same or slightly lower than the increases we experienced in 2017.

11

Government Regulation.

The health care industry is subject to numerous laws and regulations of federal, state and local governments. These laws and regulations include, but are not necessarily limited to, matters such as licensure, accreditation, government health care program participation requirements, reimbursement for patient services, quality of patient care and Medicare and Medicaid fraud and abuse. Over the last several years, government activity has increased with respect to investigations and allegations concerning possible violations by health care providers of a number of statutes and regulations, including those regulating fraud and abuse, false claims , patient privacy and quality of care issues. Violations of these laws and regulations could result in exclusion from government health care programs together with the imposition of significant fines and penalties, as well as significant repayments for patient services previously billed. Compliance with such laws and regulations is subject to ongoing government review and interpretation, as well as regulatory actions in which government agencies seek to impose fines and penalties. The Company is involved in regulatory actions of this type from time to time.

Licensure and Certification.

All our nursing centers must be licensed by the state in which they are located in order to accept patients, regardless of payor source. In most states, nursing centers are subject to Certificate of Need ("CON") laws, which require us to obtain government approval for the construction of new nursing centers or the addition of new licensed beds to existing centers. Our nursing centers must comply with detailed statutory and regulatory requirements on an ongoing basis in order to qualify for licensure, as well as for certification as a provider eligible to receive payments from the Medicare and Medicaid programs. Generally, the requirements for licensure and Medicare/Medicaid certification are similar and relate to quality and adequacy of personnel, quality of medical care, record keeping, dietary services, patient rights, and the physical condition of the nursing center and the adequacy of the equipment used therein. Failure to comply with applicable laws and regulations could result in exclusion from the Medicare and Medicaid programs, which could have an adverse impact on our business, financial condition, or results of operations.

In 2016, CMS published a comprehensive update to the health and safety standards applicable to long-term care facilities participating in the Medicare or Medicaid programs. These revisions are aimed at improving quality of life, care and services in long-term care facilities, optimizing resident safety, and reflecting current professional standards. For example, CMS added requirements related to infection prevention and control, compliance and ethics programs, staff training. and QAPI programs. To allow facilities time to achieve compliance, CMS is implementing the requirements in three phases, over a three year period. We are in substantial compliance with the Phase 1 and Phase 2 requirements, and expect to be in substantial compliance with the Phase 3 requirements by the deadline of November 28, 2019. The total costs associated with implementing the requirements is not known at this time.

Each center is subject to periodic inspections, known as “surveys” by health care regulators, to determine compliance with all applicable licensure and certification standards. Such requirements are both subjective and subject to change. If the survey concludes that there are deficiencies in compliance, the center is subject to various sanctions, including but not limited to monetary fines and penalties, suspension of new admissions, non-payment for new admissions and loss of licensure or certification. Generally, however, once a center receives written notice of any compliance deficiencies, it may submit a written plan of correction and is given a reasonable opportunity to correct the deficiencies. There can be no assurance that, in the future, we will be able to maintain such licenses and certifications for our centers or that we will not be required to expend significant sums in order to comply with regulatory requirements.

Health care and health insurance reform.

In recent years, the U.S. Congress and some state legislatures have considered and enacted significant legislation concerning health care and health insurance. The most prominent of these efforts, The Affordable Care Act affects how health care services are covered, delivered and reimbursed. As currently structured, the Affordable Care Act expands coverage through a combination of public program expansion and private sector reforms, provides for reduced growth in Medicare program spending, and promotes initiatives that tie reimbursement to quality and care coordination. Some of the provisions, such as the requirement that large employers provide health insurance benefits to full-time employees, have increased our operating expenses. The Affordable Care Act expands the role of home-based and community services, which may place downward pressure on our sustaining population of Medicaid patients. Reforms that we believe may have a material impact on the long-term care industry and on our business include, among others, possible modifications to the conditions of qualification for payment, bundling of payments to cover both acute and post-acute care and the imposition of enrollment limitations on new providers. However, there is considerable uncertainty regarding the future of the Affordable Care Act. The Presidential administration and certain members of Congress have expressed

their intent to repeal or make significant changes to the law, its implementation or its interpretation. For example, in 2017, Congress eliminated the financial penalty associated with the individual mandate, effective January 1, 2019.

Skilled nursing centers are required to bill Medicare on a consolidated basis for certain items and services that they furnish to patients, regardless of the cost to deliver these services. This consolidated billing requirement essentially makes the skilled nursing center responsible for billing Medicare for all care services delivered to the patient during the length of stay. CMS has instituted a number of test programs designed to extend the reimbursement and financial responsibilities under consolidated billing beyond the traditional discharge date to include a broader set of bundled services. Such examples may include, but are not exclusive to, home health, durable medical equipment, home and community based services, and the cost of re-hospitalizations during a specified bundled period. Currently, these test programs for bundled reimbursement are confined to a small set of clinical conditions, but CMS has indicated that it is developing additional bundled payment models. This bundled form of reimbursement could be extended to a broader range of diagnosis related conditions in the future. The potential impact on skilled nursing center utilization and reimbursement is currently unknown. The process for defining bundled services has not been fully determined by CMS and therefore is subject to change during the rule making process.

Health Insurance Portability and Accountability Act of 1996 Compliance.

The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) has mandated an extensive set of regulations to standardize electronic patient health, administrative and financial data transactions and to protect the privacy of individually identifiable health information. We have a HIPAA compliance committee and designated privacy and security officers.

The HIPAA transaction standards are intended to simplify the electronic claims process and other healthcare transactions by encouraging electronic transmission rather than paper submission. These regulations provide for uniform standards for data reporting, formatting and coding that we must use in certain transactions with health plans. The HIPAA security regulations establish requirements for safeguarding protected health information that is electronically transmitted or electronically stored. Some of the security regulations are technical in nature, while others are addressed through policies and procedures.

The HIPAA regulations related to privacy establish comprehensive federal standards relating to the use and disclosure of individually identifiable health information (“protected health information”). The privacy regulations establish limits on the use and disclosure of protected health information, provide for patients' rights, including rights to access, to request amendment of, and to receive an accounting of certain disclosures of protected health information, and require certain safeguards for protected health information. In addition, each covered entity must contractually bind individuals and entities that furnish services to the covered entity or perform a function on its behalf, and to which the covered entity discloses protected health information, to restrictions on the use and disclosure of that protected health information. In general, the HIPAA regulations do not supersede state laws that are more stringent or grant greater privacy rights to individuals. Thus, we must reconcile the HIPAA regulations and other state privacy laws.

Although we believe that we are in material compliance with these HIPAA regulations, inadvertent violations of these regulations may occur in the course of our business. For this and other reasons, the HIPAA regulations are expected to continue to impact us operationally and financially and may pose increased regulatory risk.

Self-Referral and Anti-Kickback Legislation.

The health care industry is subject to state and federal laws that regulate the relationships of providers of health care services, physicians and other clinicians. These self-referral laws impose restrictions on physician referrals to any entity with which they have a financial relationship, which is a broadly defined term. We believe our relationships with physicians are in compliance with the self-referral laws. Failure to comply with self-referral laws could subject us to a range of sanctions, including civil monetary penalties and possible exclusion from government reimbursement programs. There are also federal and state laws making it illegal to offer anyone anything of value in return for referral of patients. These laws, generally known as “anti-kickback” laws, are broad and subject to interpretations that are highly fact dependent. Given the lack of clarity of these laws, there can be no absolute assurance that any health care provider, including us, will not be found in violation of the anti-kickback laws in any given factual situation. Strict sanctions, including fines and penalties, exclusion from the Medicare and Medicaid programs and criminal penalties, may be imposed for violation of the anti-kickback laws.

Reporting Obligations under Section 111 of the Medicare, Medicaid and SCHIP Extension Act of 2007 (“MMSEA”).

The MMSEA expanded the Medicare Secondary Reporting Act. Since January 1, 2010, we have reported specific information regarding all claimants and claim settlements involving Medicare participants so CMS can recover Medicare funds expended to provide healthcare treatment to the claimant. The requirements are to ensure that CMS is notified so that it may recoup the amounts paid for services from the settlement proceeds. This does not result in us making additional payments to CMS for these services

12

provided and does not result in an incremental cost to us. Strict sanctions, including fines and penalties, exclusion from the Medicare and Medicaid programs and criminal penalties, may be imposed for non-compliance with these reporting obligations.

Available Information.

We file reports with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. Copies of our reports filed with the SEC may be obtained by the public at the SEC's Public Reference Room located at 100 F Street, NE, Washington, DC 20549 on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains electronic versions of the Company's reports on its website at www.sec.gov. We also make available, free of charge through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other materials filed with the SEC as soon as reasonably practical after such material is electronically filed with or furnished to the SEC via a link to the SEC's EDGAR system. Our website address is www.dvcr.com. The information provided on our website is not part of this report, and is therefore not incorporated by reference unless such information is otherwise specifically referenced elsewhere in this report.

In addition, copies of the Company's annual report will be made available, free of charge, upon written request.

Corporate Governance Principles.

The Company has adopted Corporate Governance Principles relating to the conduct and operations of the Board of Directors. The Corporate Governance Principles are posted on the Company's website (www.dvcr.com) and are available in print to any stockholder who requests a copy.

Committee Charters.

The Board of Directors has an Audit Committee, Compensation Committee, Corporate Governance Committee, Risk Management Committee, and Executive Committee. The Board of Directors has adopted written charters for each committee, except for the Executive Committee, which are posted on the Company's website (www.dvcr.com) and are available in print to any stockholder who requests a copy.

ITEM 1A. RISK FACTORS

There have been a number of material developments both within the Company and the long-term care industry. These developments have had and are likely to continue to have a material impact on us. This section summarizes these developments, as well as other risks that should be considered by our shareholders and prospective investors.

Risks Related to our Operations

We are substantially self-insured and have significant potential professional liability exposure.

The provision of health care services entails an inherent risk of liability. Participants in the health care industry are subject to an increasing number of lawsuits alleging malpractice, negligence, product liability or related legal theories, many of which involve large claims and significant defense costs. Like many other companies engaged in the long-term care profession in the United States, we have numerous pending liability claims, disputes and legal actions for professional liability and other related issues. We expect to continue to be subject to such suits as a result of the nature of our business. We have professional liability insurance coverage for our nursing centers that, based on historical claims experience, is likely to be substantially less than the amount required to satisfy claims that are expected to be incurred. See “Item 3. Legal Proceedings” for further descriptions of pending claims and see “Item 7. Management's Discussion and Analysis of Financial Condition - Accounting Policies and Judgments - Professional Liability and Other Self-Insurance Reserves” for discussion of our reserve for self-insured claims and of our ability to meet our anticipated cash needs.

We may have substantial adjustments to our accrual for professional liability claims which could cause significant changes in our net earnings.

Each year, we record adjustments to our accrual for self-insured risks associated with professional liability claims. While these adjustments to the accrual result in changes to reported expenses and income, they are not directly related to changes in cash because the accrual is not funded. These self-insurance reserves are assessed on a quarterly basis, with changes in estimated losses being recorded in the consolidated statements of operations in the period identified. Any increase in the accrual decreases income in the period, and any reduction in the accrual increases income during the period. Our actual professional liabilities may vary significantly from the accrual due to an increase in the number of claims asserted or claim costs in excess of estimates, and the amount of the accrual has and may continue to fluctuate by a material

13

amount in any given quarter. For the years ended December 31, 2017, 2016 and 2015, we recorded professional liability expense of $10.8 million, $8.5 million and $8.1 million, respectively.

Our outstanding indebtedness is subject to various financial covenants and floating rates of interest which could be subject to fluctuations based on changing interest rates.

We have long-term indebtedness of $88.1 million at December 31, 2017. Certain of our debt agreements contain various financial covenants, the most restrictive of which relate to minimum cash deposits, cash flow and debt service coverage ratios. As of December 31, 2017, we were in compliance with these financial covenants. Our failure to comply with those covenants could result in an event of default, which, if not cured or waived, could result in the acceleration of some or all of our debts. Such non-compliance could result in a material adverse impact to our financial position, results of operations and cash flows. See “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” for additional discussion of our covenants.

In connection with the refinancing transaction in February 2016 discussed in “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources,” we entered into an interest rate swap with respect to a portion of the mortgage loan to mitigate the floating interest rate risk of such borrowing. The interest rate swap converted the variable rate on our mortgage indebtedness to a fixed interest rate for the five year term of this indebtedness, decreasing our exposure to risks of variable rates of interest. While limiting our risk to increases in interest rates by utilizing the interest rate swap, we forgo benefits that might result from downward fluctuations in interest rates. We also are exposed to the risk that our counterpart to the swap agreement will default on its obligations.

Our accrual for professional liability claims is not funded, and if a material judgment is entered against us in any lawsuit, we may lack adequate cash to pay the judgment.

As of December 31, 2017, we are engaged in 72 professional liability lawsuits. Although we work diligently to limit the cash required to settle and defend professional liability claims, a significant judgment entered against us in one or more legal actions could have a material adverse impact on our cash flows and could result in our being unable to meet all of our cash needs as they become due.

The U.S. Department of Justice has commenced an investigation of our practices related to the provision of therapy and the completion of certain resident admission forms, which could adversely affect our operations and financial condition.

Our business is currently under investigation for potential civil and criminal violations of the federal False Claims Act ("FCA") and other laws governmental health care benefit programs. See Legal Proceedings for further information regarding this investigation. Any finding that we are not in compliance with these laws could require us to change our operations or could subject us to treble damages, penalties and/or make us ineligible to participate in certain government funded healthcare programs, any of which could in turn significantly harm our business and financial condition.

Our operational and strategic flexibility is limited due to the number of our centers that are leased from third parties.

A substantial majority of our centers are leased from third parties. The loss or deterioration of our relationship with any of our landlords may adversely affect our business. The terms of such leases generally require us to operate such centers as skilled nursing centers, and generally do not allow us to assign the lease to a third party without the applicable landlord’s consent. Therefore, our ability to divest such leased properties is limited, and we may be forced to continue operating such centers as skilled nursing centers even if doing so becomes unprofitable.

While we expect to renew or extend our leases in the normal course of business, there can be no assurance that these rights will be exercised in the future or that we will be able to satisfy the conditions precedent to exercising any such renewal or extension, to the extent that such provisions exist in our leases. In addition, if we are unable to renew or extend any of our master leases, we may lose all of the facilities subject to that master lease agreement. If we are not able to renew or extend our leases at or prior to the end of the existing lease terms, or if the terms of such options are unfavorable or unacceptable to us, our business, financial condition and results of operation could be adversely affected.

14

Our failure to pay rent or otherwise comply with the provisions of any of our Master Lease Agreements could materially adversely affect our business, financial position, results of operations, and liquidity.

Many of our facilities are under a Master Lease Agreement. Our failure to pay the rent or otherwise comply with the provisions of any of our lease agreements could result in an “event of default” under such lease agreement and also could result in a cross default under other master lease agreements and the agreements for our indebtedness. Upon an event of default, remedies available to our landlords generally include, without limitation, terminating such lease agreement, repossessing and reletting the leased properties and requiring us to remain liable for all obligations under such lease agreement, including the difference between the rent under such lease agreement and the rent payable as a result of reletting the leased properties, or requiring us to pay the net present value of the rent due for the balance of the term of such lease agreement. The exercise of such remedies would have a material adverse effect on our business, financial position, results of operations and liquidity. An event of default under any of our Master Lease Agreements could result in a default under the Credit Facilities and, if repayment of the borrowings under the Credit Facilities were accelerated, the payments under the indentures governing our outstanding notes could also be accelerated. The exercise of remedies by any of our landlords could have a material adverse effect on our business, financial position, results of operations, and liquidity.

We are highly dependent on reimbursement by third-party payors and delays in reimbursement for any reason may cause liquidity problems.

Substantially all of our nursing center revenues are directly or indirectly dependent upon reimbursement from third-party payors, including the Medicare and Medicaid programs and private insurers. For the year ended December 31, 2017, our patient revenues from continuing operations derived from Medicaid, Medicare, Managed Care and private pay (including private insurers) sources were approximately 52.4%, 25.9%, 7.4%, and 14.3%, respectively. Changes in the mix of our patients among Medicare, Medicaid, Managed Care and private pay categories and among different types of private pay sources may affect our net revenues and profitability. Our net revenues and profitability are also affected by the continuing efforts of all payors to contain or reduce the costs of health care. Efforts to impose reduced payments, greater discounts and more stringent cost controls by government and other payors are expected to continue.

The federal government makes frequent changes to the reimbursement provided under the Medicare program. Future changes to payment rates or methodology could significantly reduce the reimbursement we receive. Also, a number of state governments, including several of the states in which we operate, face projected budget shortfalls and/or deficit spending situations. Because Medicaid is typically a substantial part of a state’s budget, many states are considering or have implemented strategies to reduce Medicaid spending or decrease spending growth. Some states are exploring or implementing alternatives to traditional long-term care, including community and home-based nursing services.