Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVB FINANCIAL CORP | d633320d8k.htm |

| EX-99.8 - EX-99.8 - CVB FINANCIAL CORP | d633320dex998.htm |

| EX-2.2 - EX-2.2 - CVB FINANCIAL CORP | d633320dex22.htm |

| EX-2.1 - EX-2.1 - CVB FINANCIAL CORP | d633320dex21.htm |

Merger with Community Bank February 26, 2018 Exhibit 99.9

Forward Looking Statements Certain matters set forth herein (including the exhibits hereto) constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to our current business plans and expectations and our future financial position and operating results. Words such as “will likely result”, “aims”, “anticipates”, “believes”, “could”, “estimates”, “expects”, “hopes”, “intends”, “may”, “plans”, “projects”, “seeks”, “should”, “will,” “strategy”, “possibility”, and variations of these words and similar expressions help to identify these forward looking statements, which involve risks and uncertainties. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance and/or achievements to differ materially from those projected. These risks and uncertainties include, but are not limited to, local, regional, national and international economic and market conditions and political events and the impact they may have on us, our customers and our assets and liabilities; our ability to attract deposits and other sources of funding or liquidity; supply and demand for real estate and periodic deterioration in real estate prices and/or values in California or other states where we lend, including both residential and commercial real estate; a sharp or prolonged slowdown or decline in real estate construction, sales or leasing activities; changes in the financial performance and/or condition of our borrowers, depositors, key vendors or counterparties; changes in our levels of delinquent loans, nonperforming assets, allowance for loan losses and charge-offs; the costs or effects of our pending merger with Community Bank or other mergers, acquisitions or dispositions we may make, whether we are able to obtain any required governmental approvals in connection with any such acquisitions or dispositions, and/or our ability to realize the contemplated financial or business benefits associated with any such acquisitions or dispositions; our ability to realize cost savings and business synergies in connection with our agreement to merge with Community Bank within expected time frames or at all; the effect of changes in laws, regulations and applicable judicial decisions (including laws, regulations and judicial decisions concerning financial reforms, taxes, banking capital levels, allowance for loan losses, consumer, commercial or secured lending, securities and securities trading and hedging, bank operations, compliance, fair lending, employment, executive compensation, insurance, cybersecurity, vendor management and information technology) with which we and our subsidiaries must comply or believe we should comply or which may otherwise impact us; the effects of additional legal and regulatory requirements to which we may become subject in the event our total assets exceed $10 billion; changes in estimates of future reserve requirements and minimum capital requirements based upon the periodic review thereof under relevant regulatory and accounting requirements, including changes in the Basel Committee framework establishing capital standards for credit, operations and market risk; the accuracy of the assumptions and estimates and the absence of technical error in implementation or calibration of models used to estimate the fair value of financial instruments or expected credit losses or delinquencies; inflation, changes in market interest rates, securities market and monetary fluctuations; changes in government-established interest rates or monetary policies; changes in the amount and availability of deposit insurance; disruptions in the infrastructure that supports our business and the communities where we are located, which are concentrated in California, involving or related to physical site access and/or communication facilities; cyber incidents; or theft or loss of Company or customer data or money; political uncertainty or instability; acts of war or terrorism, or natural disasters, such as earthquakes, drought, or the effects of pandemic diseases; the timely development and acceptance of new banking products and services and the perceived overall value of these products and services by our customers and potential customers; the Company’s relationships with and reliance upon vendors with respect to the operation of certain of the Company’s key internal and external systems and applications; changes in commercial or consumer spending, borrowing and savings preferences or behaviors; technological changes and the expanding use of technology in banking and financial services (including the adoption of mobile banking and funds transfer applications); our ability to retain and increase market share, retain and grow customers and control expenses; changes in the competitive environment among financial and bank holding companies, banks and other financial service and technology providers; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies, volatility in the credit and equity markets and its effect on the general economy or local or regional business conditions or on the Company’s customers; fluctuations in the price of the Company’s common stock or other securities; and the resulting impact on the Company’s ability to raise capital or make acquisitions, the effect of changes in accounting policies and practices, as may be adopted from time-to-time by our regulatory agencies, as well as by the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard-setters; changes in our organization, management, compensation and benefit plans, and our ability to retain or expand our workforce, management team and/or our board of directors; the costs and effects of legal, compliance and regulatory actions, changes and developments, including the initiation and resolution of legal proceedings (including securities, bank operations, consumer or employee class action litigation), the possibility that any settlement of any putative class action lawsuits may not be approved by the relevant court or that significant numbers of putative class members may opt out of any settlement; regulatory or other governmental inquiries or investigations, and/or the results of regulatory examinations or reviews; our ongoing relations with our various federal and state regulators, including the SEC, Federal Reserve Board, FDIC and California DBO; our success at managing the risks involved in the foregoing items and all other factors set forth in the Company's public reports, including its Annual Report on Form 10-K for the year ended December 31, 2016, and particularly the discussion of risk factors within that document. The Company does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect occurrences or unanticipated events or circumstances after the date of such statements except as required by law. Any statements about future operating results, such as those concerning accretion and dilution to our earnings or shareholders, are for illustrative purposes only, are not forecasts, and actual results may differ. The terms the “Company,” “we,” “us,” or “our” refer to CVB Financial Corp. on a consolidated basis.

Additional Information In connection with the proposed merger, CVBF will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of CVBF and Community and a Prospectus of CVBF, as well as other relevant documents concerning the proposed transaction. The final proxy statement/prospectus will be distributed to the shareholders of CVBF and Community in connection with their vote on the proposed transaction. SHAREHOLDERS OF CVBF AND COMMUNITY ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The Proxy Statement/Prospectus and other relevant materials (when they become available), and any other documents CVBF filed with the SEC may be obtained free of charge at the SEC’s website, http://www.sec.gov, at the investor relations portion of CVBF’s website, https://www.cbbank.com, by contacting Myrna DiSanto, Investor Relations, CVB Financial Corp., 701 N Haven Avenue, Ontario, CA 91764 or by telephone at (909) 980-4030 or by contacting David R. Misch, Chief Executive Officer, Community Bank, 460 Sierra Madre Villa Avenue, Pasadena, CA 91107 or by telephone at (800) 788-9999. CVBF and Community and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of CVBF and Community in connection with the merger. Information about the directors and executive officers of CVBF and their ownership of CVBF common stock is set forth in CVBF’s proxy statement filed with the SEC on April 6, 2017. Information about the directors and executive officers of Community will be set forth in the Proxy Statement/Prospectus regarding the proposed transaction. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

Two organizations that have stood the test of time Similar Cultures – Competitors become partners All-Star Team of Employees – Deeper Bench Expanded Product Offering Enhanced Asset Mix Enhanced Funding Mix Geographic Overlap – Anticipated Cost Synergies Combination of Historic Community Banks

Transaction Rationale Complementary business banking models with similar core values and corporate cultures Long history for each institution through multiple economic cycles Combined company of approximately $12 billion in total assets pro forma Efficiency and scale is expected to result in better operating leverage and offset the cost of crossing over the $10 billion threshold Increase deposit market share and geographic reach in key operating markets Leverage excess capital while maintaining strong regulatory capital ratios Enhance CVBF’s long-term shareholder value

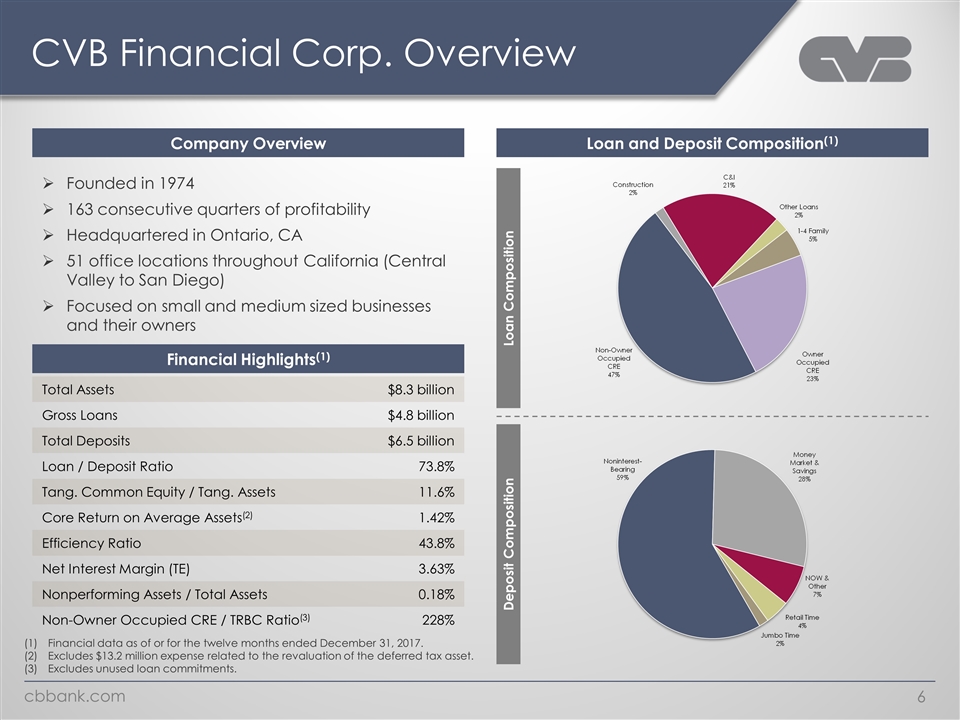

CVB Financial Corp. Overview Financial data as of or for the twelve months ended December 31, 2017. Excludes $13.2 million expense related to the revaluation of the deferred tax asset. Excludes unused loan commitments. Company Overview Loan and Deposit Composition(1) Financial Highlights(1) Founded in 1974 163 consecutive quarters of profitability Headquartered in Ontario, CA 51 office locations throughout California (Central Valley to San Diego) Focused on small and medium sized businesses and their owners Total Assets $8.3 billion Gross Loans $4.8 billion Total Deposits $6.5 billion Loan / Deposit Ratio 73.8% Tang. Common Equity / Tang. Assets 11.6% Core Return on Average Assets(2) 1.42% Efficiency Ratio 43.8% Net Interest Margin (TE) 3.63% Nonperforming Assets / Total Assets 0.18% Non-Owner Occupied CRE / TRBC Ratio(3) 228% Loan Composition Deposit Composition

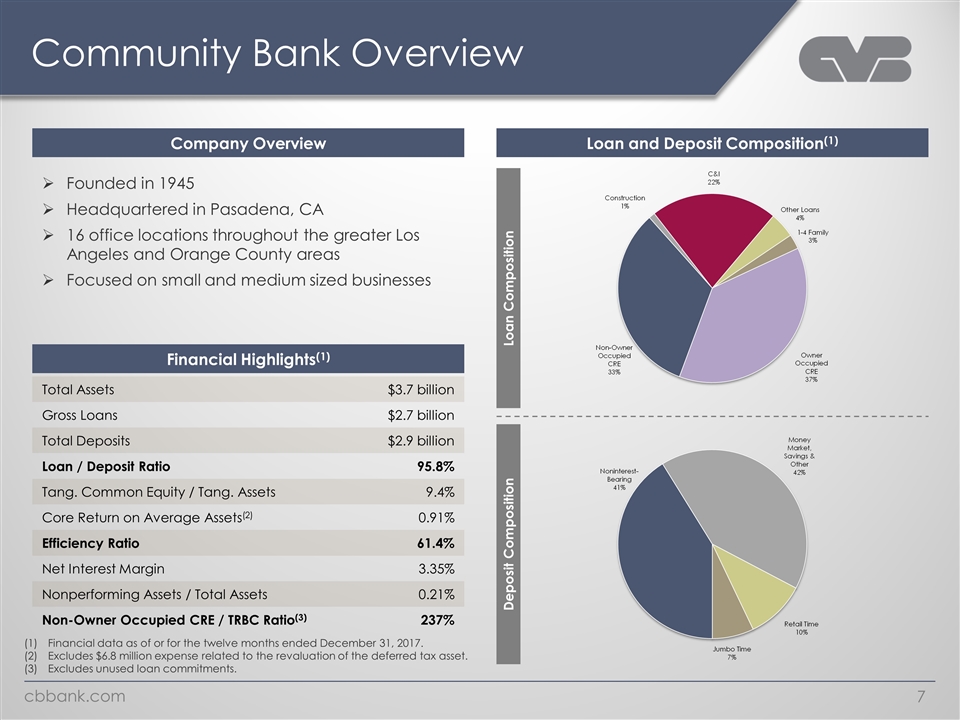

Community Bank Overview Financial data as of or for the twelve months ended December 31, 2017. Excludes $6.8 million expense related to the revaluation of the deferred tax asset. Excludes unused loan commitments. Company Overview Loan and Deposit Composition(1) Financial Highlights(1) Founded in 1945 Headquartered in Pasadena, CA 16 office locations throughout the greater Los Angeles and Orange County areas Focused on small and medium sized businesses Total Assets $3.7 billion Gross Loans $2.7 billion Total Deposits $2.9 billion Loan / Deposit Ratio 95.8% Tang. Common Equity / Tang. Assets 9.4% Core Return on Average Assets(2) 0.91% Efficiency Ratio 61.4% Net Interest Margin 3.35% Nonperforming Assets / Total Assets 0.21% Non-Owner Occupied CRE / TRBC Ratio(3) 237% Loan Composition Deposit Composition

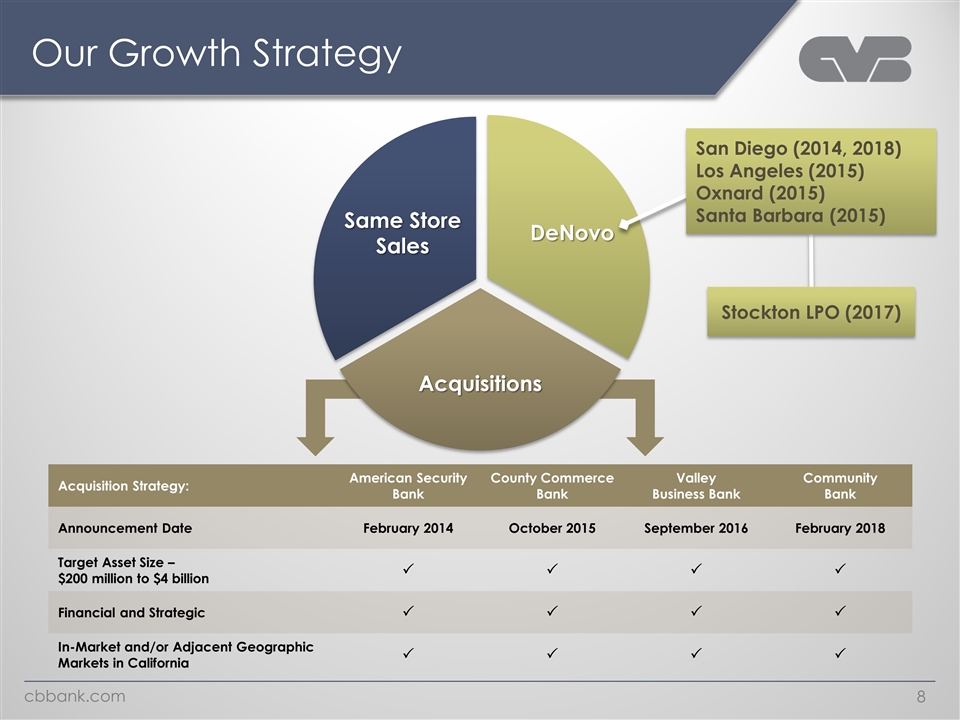

Acquisitions Our Growth Strategy San Diego (2014, 2018) Los Angeles (2015) Oxnard (2015) Santa Barbara (2015) Stockton LPO (2017) Acquisition Strategy: American Security Bank County Commerce Bank Valley Business Bank Community Bank Announcement Date February 2014 October 2015 September 2016 February 2018 Target Asset Size – $200 million to $4 billion P P P P Financial and Strategic P P P P In-Market and/or Adjacent Geographic Markets in California P P P P

Largest Bank Holding Companies in CA Source: SNL Financial. Bank only, no holding company. Excludes purchase accounting and other merger-related adjustments. Estimated pro forma for the pending acquisition of Grandpoint Capital, Inc. (announced on 2/12/2018). Rank Institution Total Assets (MRQ) 1 Wells Fargo & Company $1,951,757 2 First Republic Bank(1) $87,781 3 SVB Financial Group $51,214 4 East West Bancorp $37,150 5 PacWest Bancorp $24,995 6 Cathay General Bancorp $15,639 7 Hope Bancorp, Inc. $14,207 Pro Forma CVBF(2) $12,018 8 Pacific Premier Bancorp, Inc.(2)(3) $11,218 9 Banc of California, Inc. $10,328 10 CVB Financial Corp. $8,271 In millions

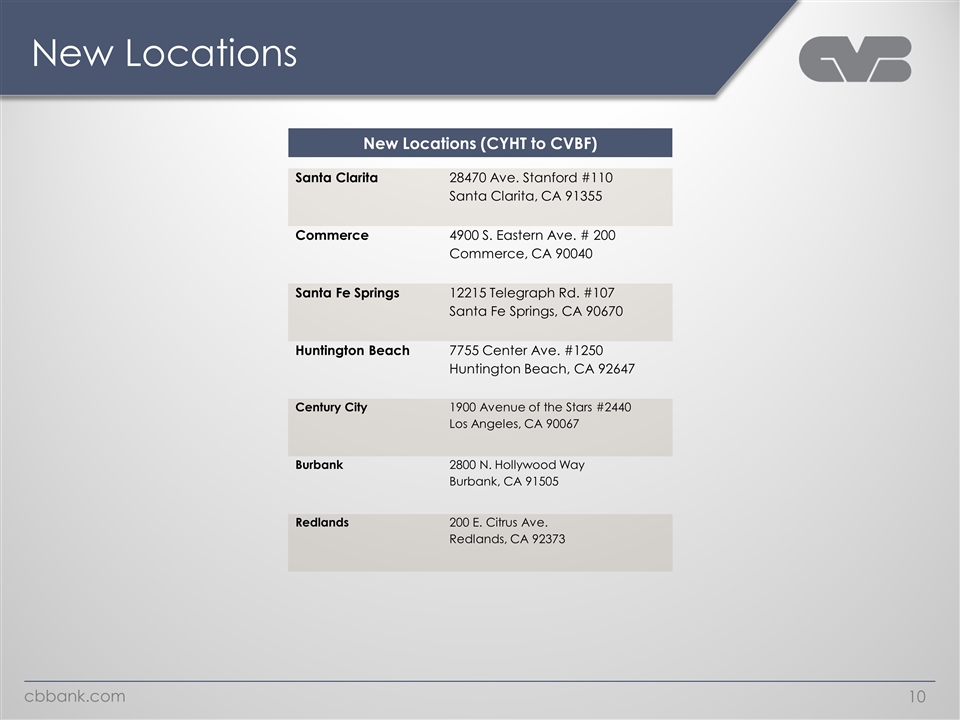

New Locations Santa Clarita 28470 Ave. Stanford #110 Santa Clarita, CA 91355 Commerce 4900 S. Eastern Ave. # 200 Commerce, CA 90040 Santa Fe Springs 12215 Telegraph Rd. #107 Santa Fe Springs, CA 90670 Huntington Beach 7755 Center Ave. #1250 Huntington Beach, CA 92647 Century City 1900 Avenue of the Stars #2440 Los Angeles, CA 90067 Burbank 2800 N. Hollywood Way Burbank, CA 91505 Redlands 200 E. Citrus Ave. Redlands, CA 92373 New Locations (CYHT to CVBF)

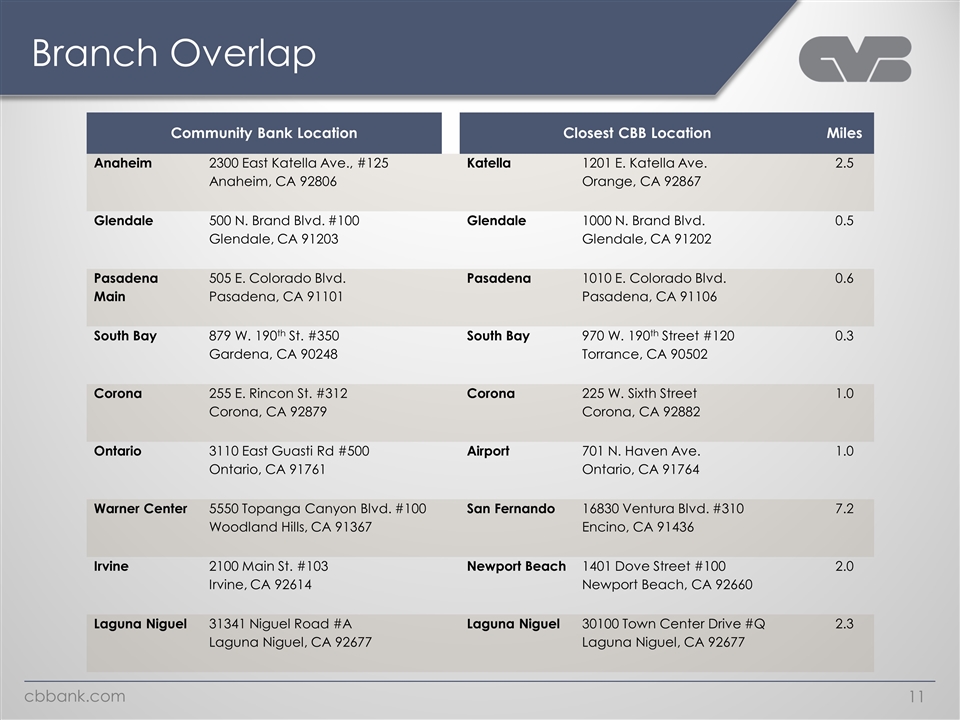

Branch Overlap Community Bank Location Closest CBB Location Miles Anaheim 2300 East Katella Ave., #125 Anaheim, CA 92806 Katella 1201 E. Katella Ave. Orange, CA 92867 2.5 Glendale 500 N. Brand Blvd. #100 Glendale, CA 91203 Glendale 1000 N. Brand Blvd. Glendale, CA 91202 0.5 Pasadena Main 505 E. Colorado Blvd. Pasadena, CA 91101 Pasadena 1010 E. Colorado Blvd. Pasadena, CA 91106 0.6 South Bay 879 W. 190th St. #350 Gardena, CA 90248 South Bay 970 W. 190th Street #120 Torrance, CA 90502 0.3 Corona 255 E. Rincon St. #312 Corona, CA 92879 Corona 225 W. Sixth Street Corona, CA 92882 1.0 Ontario 3110 East Guasti Rd #500 Ontario, CA 91761 Airport 701 N. Haven Ave. Ontario, CA 91764 1.0 Warner Center 5550 Topanga Canyon Blvd. #100 Woodland Hills, CA 91367 San Fernando 16830 Ventura Blvd. #310 Encino, CA 91436 7.2 Irvine 2100 Main St. #103 Irvine, CA 92614 Newport Beach 1401 Dove Street #100 Newport Beach, CA 92660 2.0 Laguna Niguel 31341 Niguel Road #A Laguna Niguel, CA 92677 Laguna Niguel 30100 Town Center Drive #Q Laguna Niguel, CA 92677 2.3

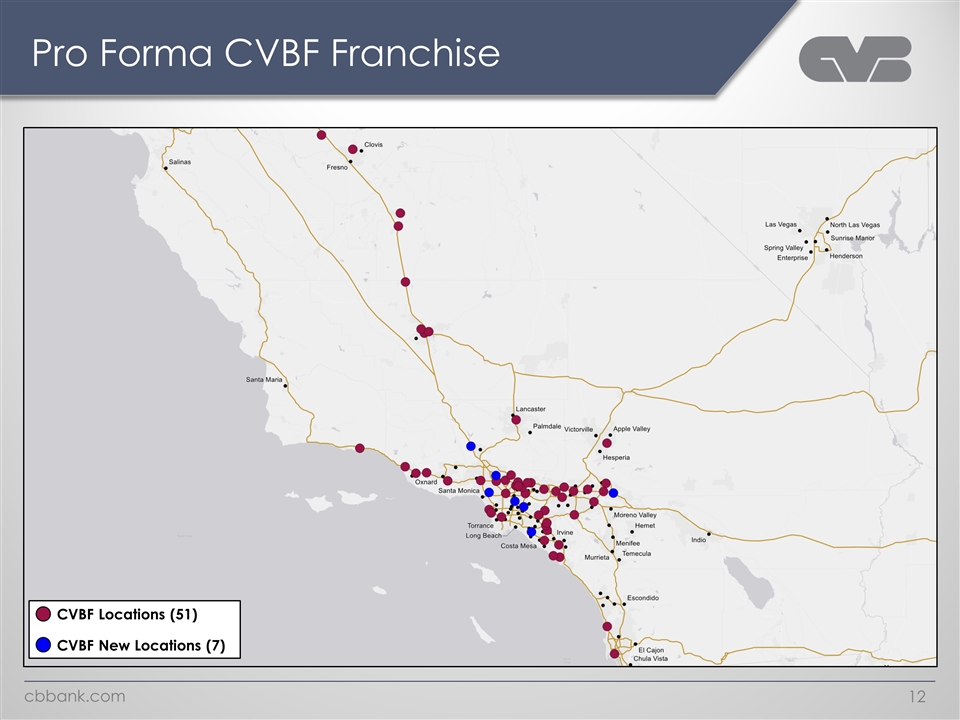

Pro Forma CVBF Franchise CVBF Locations (51) CVBF New Locations (7)

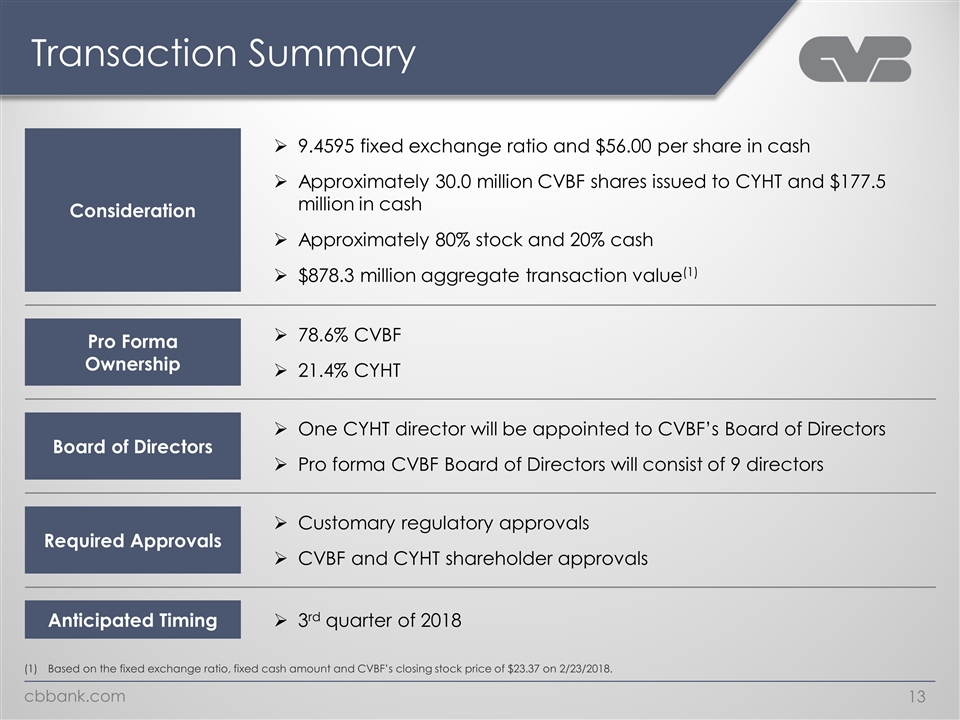

Transaction Summary Based on the fixed exchange ratio, fixed cash amount and CVBF’s closing stock price of $23.37 on 2/23/2018. Consideration 9.4595 fixed exchange ratio and $56.00 per share in cash Approximately 30.0 million CVBF shares issued to CYHT and $177.5 million in cash Approximately 80% stock and 20% cash $878.3 million aggregate transaction value(1) Pro Forma Ownership 78.6% CVBF 21.4% CYHT Board of Directors One CYHT director will be appointed to CVBF’s Board of Directors Pro forma CVBF Board of Directors will consist of 9 directors Required Approvals Customary regulatory approvals CVBF and CYHT shareholder approvals Anticipated Timing 3rd quarter of 2018

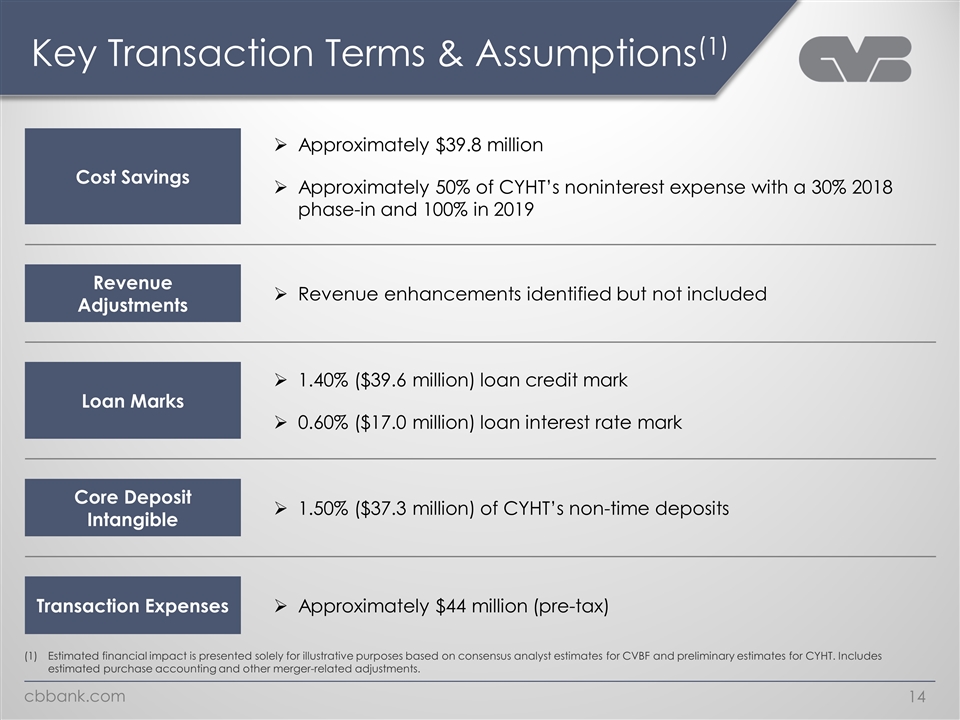

Key Transaction Terms & Assumptions(1) Estimated financial impact is presented solely for illustrative purposes based on consensus analyst estimates for CVBF and preliminary estimates for CYHT. Includes estimated purchase accounting and other merger-related adjustments. Cost Savings Transaction Expenses Approximately $39.8 million Approximately 50% of CYHT’s noninterest expense with a 30% 2018 phase-in and 100% in 2019 Approximately $44 million (pre-tax) Loan Marks 1.40% ($39.6 million) loan credit mark 0.60% ($17.0 million) loan interest rate mark Core Deposit Intangible 1.50% ($37.3 million) of CYHT’s non-time deposits Revenue Adjustments Revenue enhancements identified but not included

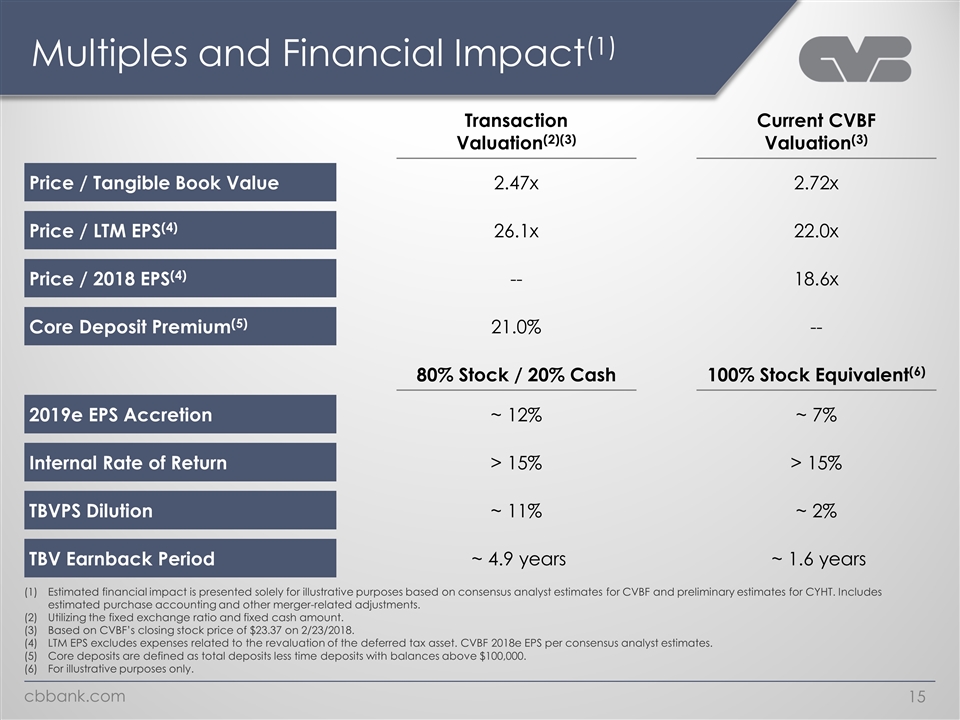

Multiples and Financial Impact(1) Estimated financial impact is presented solely for illustrative purposes based on consensus analyst estimates for CVBF and preliminary estimates for CYHT. Includes estimated purchase accounting and other merger-related adjustments. Utilizing the fixed exchange ratio and fixed cash amount. Based on CVBF’s closing stock price of $23.37 on 2/23/2018. LTM EPS excludes expenses related to the revaluation of the deferred tax asset. CVBF 2018e EPS per consensus analyst estimates. Core deposits are defined as total deposits less time deposits with balances above $100,000. For illustrative purposes only. Price / Tangible Book Value Transaction Valuation(2)(3) Current CVBF Valuation(3) Price / LTM EPS(4) Price / 2018 EPS(4) Core Deposit Premium(5) 2.47x 2.72x 26.1x 22.0x -- 18.6x 21.0% -- 80% Stock / 20% Cash 100% Stock Equivalent(6) 2019e EPS Accretion ~ 12% ~ 7% Internal Rate of Return TBVPS Dilution TBV Earnback Period > 15% ~ 2% ~ 1.6 years > 15% ~ 11% ~ 4.9 years

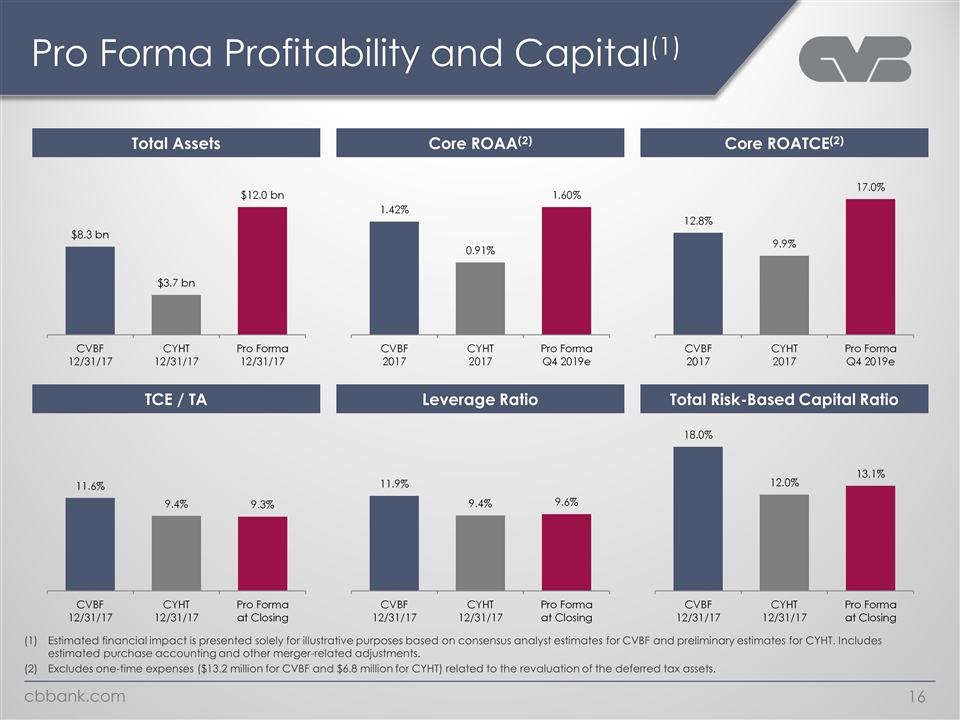

Pro Forma Profitability and Capital(1) Estimated financial impact is presented solely for illustrative purposes based on consensus analyst estimates for CVBF and preliminary estimates for CYHT. Includes estimated purchase accounting and other merger-related adjustments. Excludes one-time expenses ($13.2 million for CVBF and $6.8 million for CYHT) related to the revaluation of the deferred tax assets. TCE / TA Total Risk-Based Capital Ratio Leverage Ratio Total Assets Core ROATCE(2) Core ROAA(2)

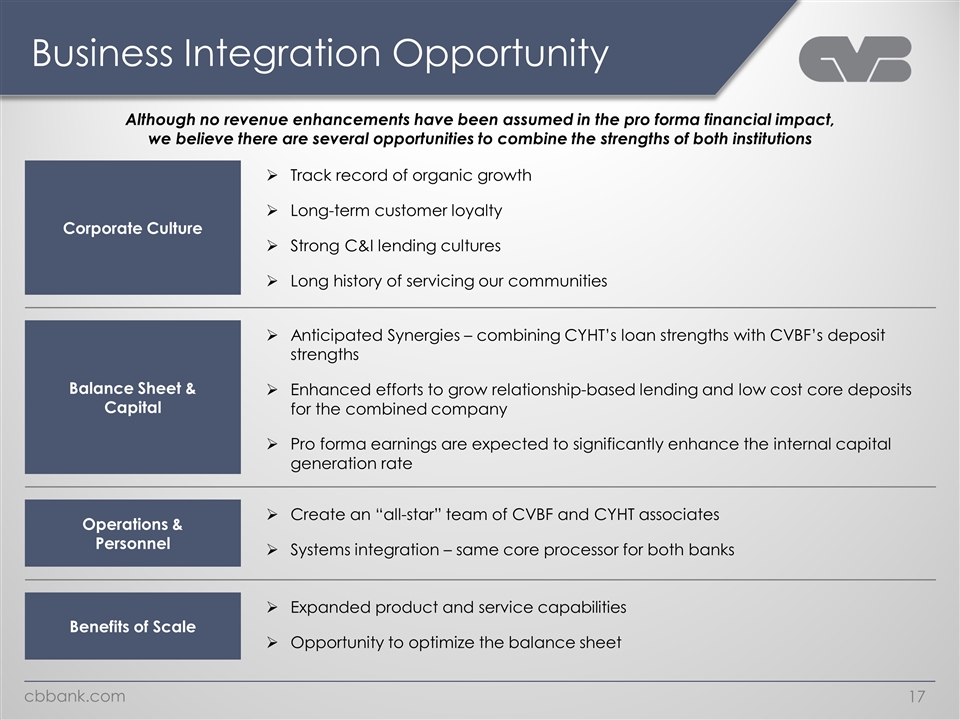

Business Integration Opportunity Corporate Culture Track record of organic growth Long-term customer loyalty Strong C&I lending cultures Long history of servicing our communities Balance Sheet & Capital Benefits of Scale Anticipated Synergies – combining CYHT’s loan strengths with CVBF’s deposit strengths Enhanced efforts to grow relationship-based lending and low cost core deposits for the combined company Pro forma earnings are expected to significantly enhance the internal capital generation rate Expanded product and service capabilities Opportunity to optimize the balance sheet Although no revenue enhancements have been assumed in the pro forma financial impact, we believe there are several opportunities to combine the strengths of both institutions Operations & Personnel Create an “all-star” team of CVBF and CYHT associates Systems integration – same core processor for both banks

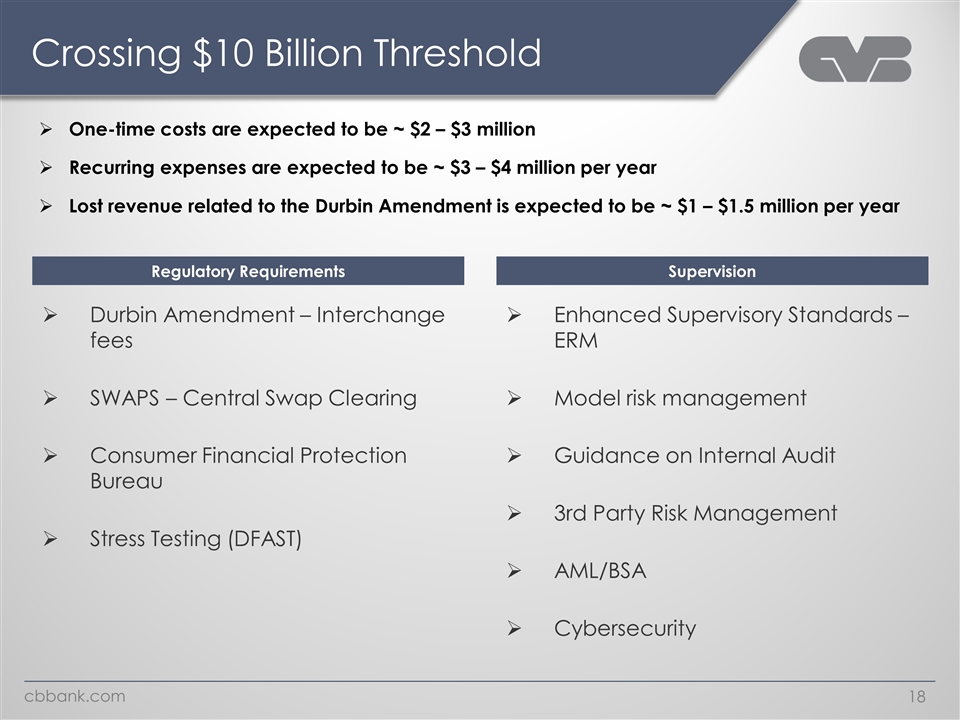

Crossing $10 Billion Threshold Durbin Amendment – Interchange fees SWAPS – Central Swap Clearing Consumer Financial Protection Bureau Stress Testing (DFAST) Regulatory Requirements Supervision Enhanced Supervisory Standards – ERM Model risk management Guidance on Internal Audit 3rd Party Risk Management AML/BSA Cybersecurity One-time costs are expected to be ~ $2 – $3 million Recurring expenses are expected to be ~ $3 – $4 million per year Lost revenue related to the Durbin Amendment is expected to be ~ $1 – $1.5 million per year

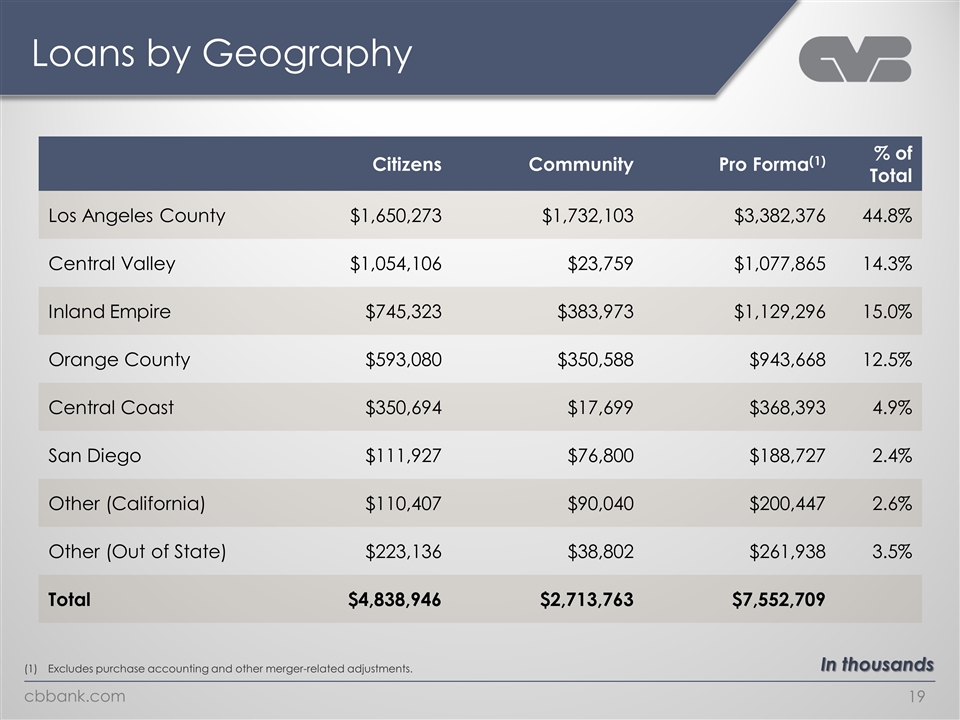

Loans by Geography Excludes purchase accounting and other merger-related adjustments. Citizens Community Pro Forma(1) % of Total Los Angeles County $1,650,273 $1,732,103 $3,382,376 44.8% Central Valley $1,054,106 $23,759 $1,077,865 14.3% Inland Empire $745,323 $383,973 $1,129,296 15.0% Orange County $593,080 $350,588 $943,668 12.5% Central Coast $350,694 $17,699 $368,393 4.9% San Diego $111,927 $76,800 $188,727 2.4% Other (California) $110,407 $90,040 $200,447 2.6% Other (Out of State) $223,136 $38,802 $261,938 3.5% Total $4,838,946 $2,713,763 $7,552,709 In thousands

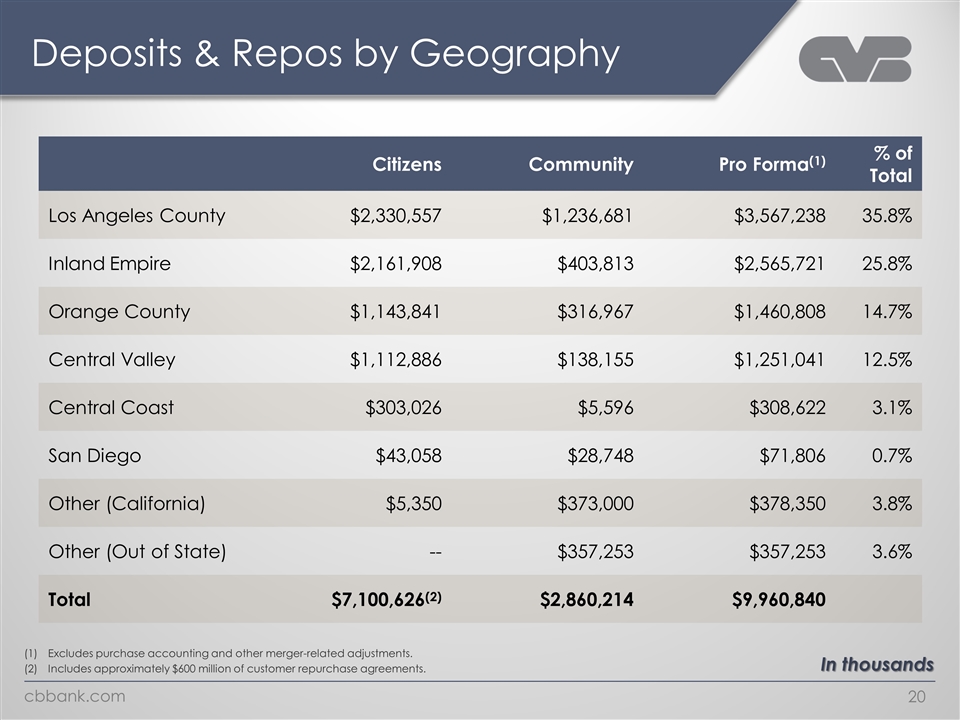

Deposits & Repos by Geography Excludes purchase accounting and other merger-related adjustments. Includes approximately $600 million of customer repurchase agreements. Citizens Community Pro Forma(1) % of Total Los Angeles County $2,330,557 $1,236,681 $3,567,238 35.8% Inland Empire $2,161,908 $403,813 $2,565,721 25.8% Orange County $1,143,841 $316,967 $1,460,808 14.7% Central Valley $1,112,886 $138,155 $1,251,041 12.5% Central Coast $303,026 $5,596 $308,622 3.1% San Diego $43,058 $28,748 $71,806 0.7% Other (California) $5,350 $373,000 $378,350 3.8% Other (Out of State) -- $357,253 $357,253 3.6% Total $7,100,626(2) $2,860,214 $9,960,840 In thousands

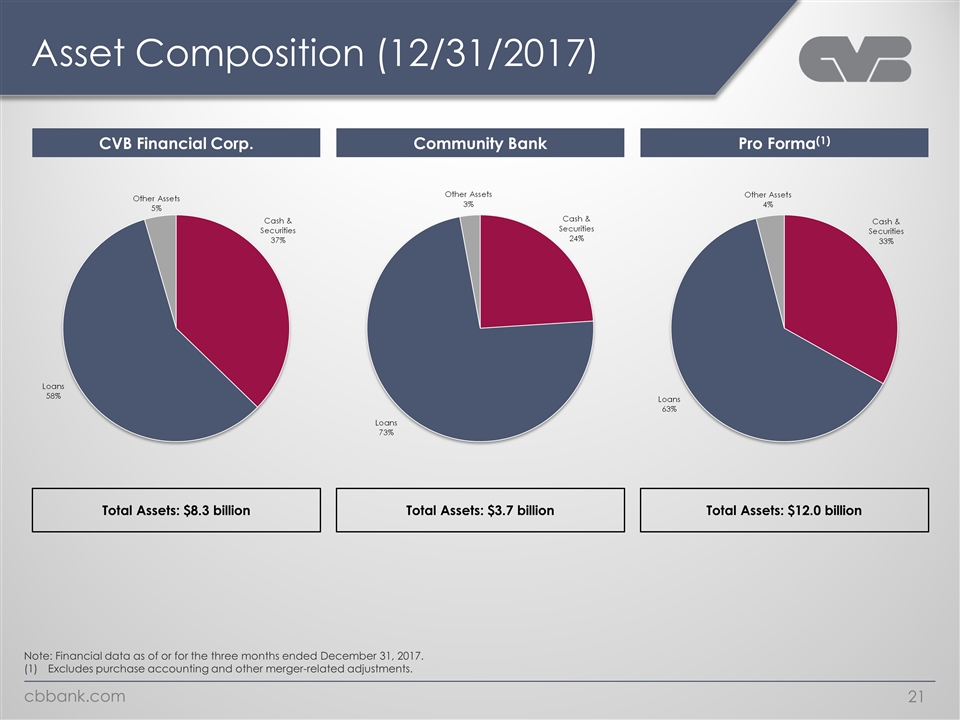

Asset Composition (12/31/2017) Note: Financial data as of or for the three months ended December 31, 2017. Excludes purchase accounting and other merger-related adjustments. CVB Financial Corp. Pro Forma(1) Community Bank Total Assets: $8.3 billion Total Assets: $3.7 billion Total Assets: $12.0 billion

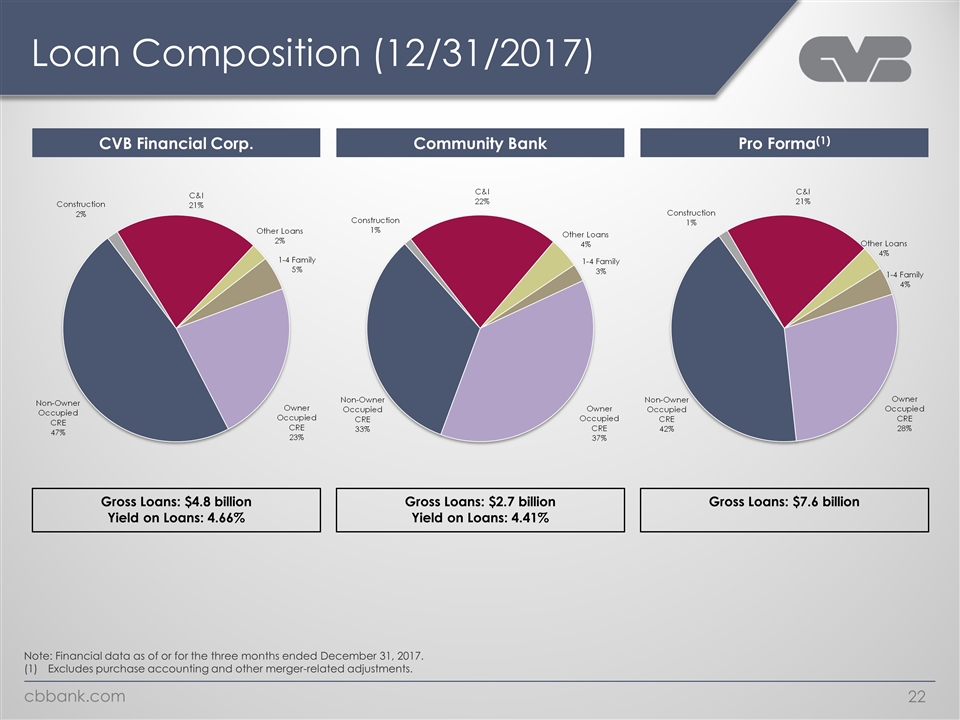

Loan Composition (12/31/2017) Note: Financial data as of or for the three months ended December 31, 2017. Excludes purchase accounting and other merger-related adjustments. CVB Financial Corp. Pro Forma(1) Community Bank Gross Loans: $4.8 billion Yield on Loans: 4.66% Gross Loans: $2.7 billion Yield on Loans: 4.41% Gross Loans: $7.6 billion

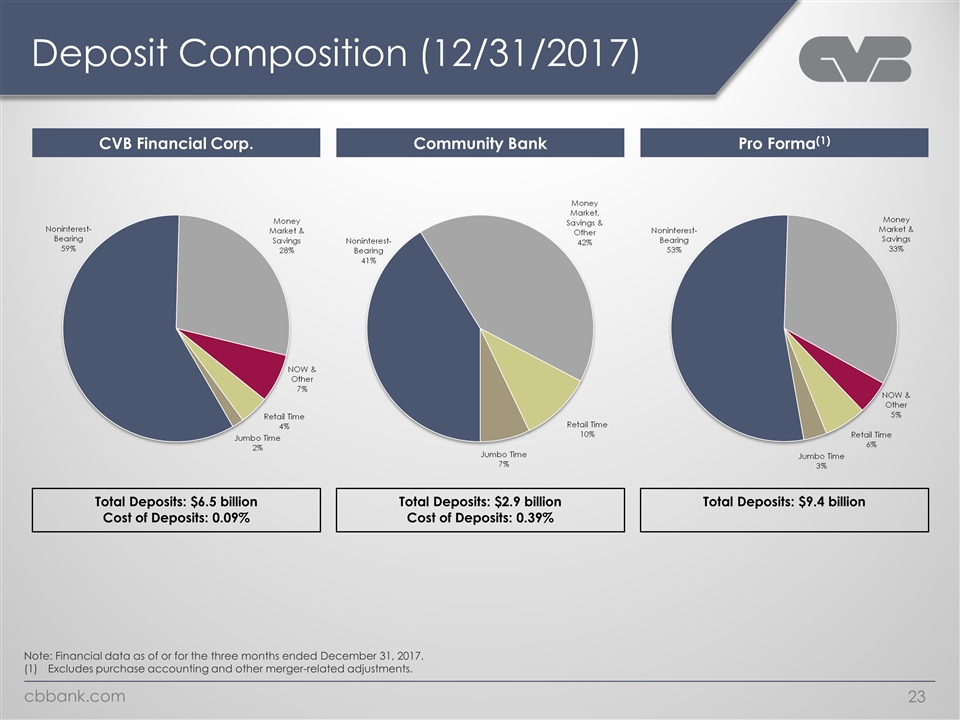

Deposit Composition (12/31/2017) Note: Financial data as of or for the three months ended December 31, 2017. Excludes purchase accounting and other merger-related adjustments. CVB Financial Corp. Pro Forma(1) Community Bank Total Deposits: $6.5 billion Cost of Deposits: 0.09% Total Deposits: $2.9 billion Cost of Deposits: 0.39% Total Deposits: $9.4 billion

2018 ‘Critical Few’ Grow loans through Relationship Banking Strategy Grow core deposits Execute on Community Bank integration Prepare for $10 billion and beyond Fraud prevention

Copy of presentation at www.cbbank.com