Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION OF CFO (302) - CC Holdings GS V LLC | gsvexhibit312123117.htm |

| EX-32.1 - CERTIFICATION OF CEO AND CFO (906) - CC Holdings GS V LLC | gsvexhibit321123117.htm |

| EX-31.1 - CERTIFICATION OF CEO (302) - CC Holdings GS V LLC | gsvexhibit311123117.htm |

| EX-12 - COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES - CC Holdings GS V LLC | gsv2017exhibit12.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 10-K

__________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 333-187970

__________________________

CC HOLDINGS GS V LLC

(Exact name of registrant as specified in its charter)

__________________________

Delaware | 20-4300339 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1220 Augusta Drive, Suite 600, Houston Texas 77057-2261 | ||

(Address of principal executive offices) (Zip Code) | ||

(713) 570-3000

(Registrant's telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: NONE.

Securities Registered Pursuant to Section 12(g) of the Act: NONE.

______________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicated by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Explanatory Note: The registrant is a voluntary filer and not subject to the filing requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934; however, the registrant has filed all reports that would have been required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months had the registrant been subject to such filing requirements.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a small reporting company, or an emerging growth company. See definitions of a "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company o Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of December 31, 2017, the only member of the registrant is a wholly-owned indirect subsidiary of Crown Castle International Corp.

Documents Incorporated by Reference: NONE.

The registrant is a wholly-owned indirect subsidiary of Crown Castle International Corp. and meets the conditions set forth in General Instructions (I)(1)(a) and (b) for Form 10-K and is therefore filing this form with the reduced disclosure format.

CC HOLDINGS GS V LLC

TABLE OF CONTENTS

Page | |||

Item 1. | |||

Item 1A. | |||

Item 1B. | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Item 5. | |||

Item 7. | |||

Item 7A. | |||

Item 8. | |||

Item 9. | |||

Item 9A. | |||

Item 9B. | |||

Item 14. | Principal Accounting Fees and Services | ||

Item 15. | |||

Item 16. | Form 10-K Summary | ||

Cautionary Language Regarding Forward-Looking Statements

This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements that are based on management's expectations as of the filing date of this report with the Securities and Exchange Commission ("SEC"). Statements that are not historical facts are hereby identified as forward-looking statements. In addition, words such as "estimate," "anticipate," "project," "plan," "intend," "believe," "expect," "likely," "predicted," "positioned" and any variations of these words, and similar expressions are intended to identify forward-looking statements. Such statements include plans, projections, and estimates contained in "Item 1. Business," "Item 3. Legal Proceedings," "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A"), and "Item 7A. Quantitative and Qualitative Disclosures About Market Risk" herein. Such forward-looking statements include (1) expectations regarding anticipated growth in the wireless industry, carriers' investments in their networks, tenant additions, customer consolidation or ownership changes, and demand for our communications infrastructure (as defined below), (2) expectations regarding non-renewals of tenant contracts (including the impact of our customers' decommissioning of the former Leap Wireless, MetroPCS and Clearwire networks), (3) availability and adequacy of cash flows and liquidity for, or plans regarding, future discretionary investments, including capital expenditures limitations created as a result of being a wholly-owned indirect subsidiary of Crown Castle International Corp. ("CCIC" or "Crown Castle") and reliance on strategic decisions made by CCIC management that enable such discretionary investments, (4) potential benefits of our discretionary investments, (5) anticipated changes in our financial results, including future revenues and operating cash flows, (6) expectations regarding our capital structure and the credit markets, our availability and cost of capital, or our ability to service our debt and comply with debt covenants, (7) expectations for sustaining capital expenditures, and (8) expectations related to CCIC's ability to remain qualified as a real estate investment trust ("REIT"), and the advantages, benefits or impact of, or opportunities created by the inclusion of our assets and operations in CCIC's REIT and the impact of the Tax Cuts and Jobs Act ("Tax Reform Act").

Such forward-looking statements should, therefore, be considered in light of various risks, uncertainties and assumptions, including prevailing market conditions, risk factors described under "Item 1A. Risk Factors" herein and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. As used herein, the term "including," and any variation thereof, means "including without limitation." The use of the word "or" herein is not exclusive.

Unless this Form 10-K indicates otherwise or the context otherwise requires, the terms, "we," "our," "our company," "the company," or "us" as used in this Form 10-K refer to CC Holdings GS V LLC ("CCL") and its consolidated wholly-owned subsidiaries (collectively, "Company"). The Company is a wholly-owned subsidiary of Global Signal Operating Partnership, L.P. ("GSOP"), which is an indirect subsidiary of CCIC.

PART I

Item 1. Business

Overview

We are an indirect, wholly-owned subsidiary of CCIC, which is one of the largest owners and operators in the United States ("U.S.") of shared communications infrastructure, including (1) towers and other structures, such as rooftops (collectively, "towers"), and (2) fiber primarily supporting small cell networks ("small cells") and fiber solutions. As of December 31, 2017, CCIC and its subsidiaries collectively owned, leased, or managed (1) approximately 40,000 towers and (2) approximately 60,000 route miles of fiber in the U.S., including Puerto Rico.

Our core business is providing access, including space or capacity, to certain shared communications infrastructure sites ("sites") via long-term contracts in various forms, including license, sublease and lease agreements (collectively, "contracts"). Our customers on our communication infrastructure are referred to herein as "tenants." We seek to increase our site rental revenues through tenant additions or modifications of existing tenant installations (collectively, "tenant additions"). Our operating costs generally tend to escalate at approximately the rate of inflation and are not typically influenced by tenant additions.

Below is certain information concerning our business and organizational structure:

• | We own, lease, and manage approximately 7,600 sites. |

• | Approximately 62% and 77% of our sites are located in the 50 and 100 largest basic trading areas ("BTAs"), respectively. |

• | Approximately 68% of our sites are leased or subleased or operated and managed ("Sprint Sites") pursuant to 32-year master leases (expiring in May 2037) ("Sprint Master Leases") or other agreements with subsidiaries of Sprint. |

• | The contracts for land interests under our towers have an average remaining life (calculated by weighting the remaining term for each contract by its percentage of our total site rental revenues) of approximately 24 years. |

• | Our subsidiaries (other than Crown Castle GS III Corp.) are organized specifically to own, lease, and manage certain shared communications infrastructure, such as sites or other structures, and have no employees. |

• | Management services, including those functions reasonably necessary to maintain, market, operate, manage, or administer the sites, are performed by Crown Castle USA Inc. ("CCUSA"), an affiliate of CCIC, under a management agreement ("Management Agreement"). The management fee under the Management Agreement is equal to 7.5% of our "Operating Revenues," as defined in the Management Agreement. |

• | For U.S. federal income tax purposes, our assets and operations are included in CCIC's REIT. |

◦ | The recently enacted Tax Reform Act makes substantial changes to the Internal Revenue Code of 1986, as amended ("Code"). Among the many corporate changes are a significant reduction in the corporate income tax rate, repeal of the corporate alternative minimum tax for years beginning in 2018 and limitations on the deductibility on interest expense. In addition, under the Tax Reform Act, qualified REIT dividends (within the meaning of Section 199A(e)(3) of the Code) constitute a part of a non-corporate taxpayer's "qualified business income amount" and thus CCIC's non-corporate U.S. stockholders may be eligible to take a qualified business income deduction in an amount equal to 20% of such dividends received from CCIC. Without further legislative action, the 20% deduction applicable to qualified REIT dividends will expire on January 1, 2026. We do not expect the Tax Reform Act to significantly impact us. |

Certain information concerning our customers and site rental contracts is as follows:

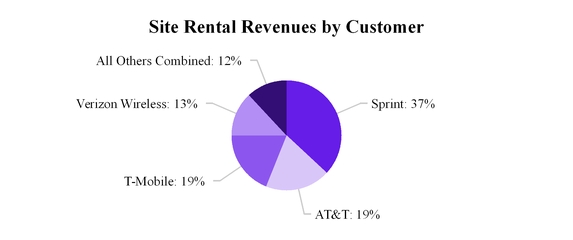

• | Our customers include Sprint, AT&T, T-Mobile, and Verizon Wireless, which collectively accounted for 88% of our 2017 site rental revenues. |

• | The vast majority of our site rental revenues are of a recurring nature, and typically, in excess of 90% have been contracted for in a prior year. |

• | Our site rental revenues typically result from long-term tenant contracts with (1) initial terms of five to 15 years, (2) multiple renewal periods at the option of the tenant of five to ten years each, (3) limited termination rights for our tenants, and (4) contractual escalations of the rental price. |

• | Exclusive of renewals at the tenants' option, our tenant contracts have a weighted-average remaining life of approximately six years and represent $4.2 billion of expected future cash inflows. |

See "Item 7. MD&A—General Overview" for a further discussion of our business fundamentals.

1

Item 1A. Risk Factors

You should carefully consider all of the risks discussed below, as well as the other information contained in this document when evaluating our business.

Our business depends on the demand for our communications infrastructure, driven primarily by demand for wireless data, and we may be adversely affected by any slowdown in such demand. Additionally, a reduction in the amount or change in the mix of network investment by our tenants may materially and adversely affect our business (including reducing demand for tenant additions).

Customer demand for our communications infrastructure depends on the demand for wireless data from their customers. The willingness of our customers to utilize our communications infrastructure, or renew or extend existing contracts on our communications infrastructure, is affected by numerous factors, including:

•consumers' demand for wireless data;

•availability or capacity of our communications infrastructure or associated land interests;

•location of our communications infrastructure;

•financial condition of our customers, including their profitability and availability or cost of capital;

• | willingness of our customers to maintain or increase their network investment or changes in their capital allocation strategy; |

• | availability and cost of spectrum for commercial use; |

•increased use of network sharing, roaming, joint development, or resale agreements by our customers;

•mergers or consolidations by and among our customers;

•changes in, or success of, our customers' business models;

• | governmental regulations and initiatives, including local or state restrictions on the proliferation of communications infrastructure; |

•cost of constructing communications infrastructure;

•our market competition;

• | technological changes including those (1) affecting the number or type of communications infrastructure needed to provide wireless data to a given geographic area or otherwise serve as a substitute or alternative to our communications infrastructure or (2) resulting in the obsolescence or decommissioning of certain existing wireless networks; and |

•our ability to efficiently satisfy our customers' service requirements.

A slowdown in demand for wireless data or our communications infrastructure may negatively impact our growth or otherwise have a material adverse effect on us. If our customers or potential customers are unable to raise adequate capital to fund their business plans, as a result of disruptions in the financial and credit markets or otherwise, they may reduce their spending, which could adversely affect our anticipated growth or the demand for our communications infrastructure.

The amount, timing, and mix of our customers' network investment is variable and can be significantly impacted by the various matters described in these risk factors. Changes in carrier network investment typically impact the demand for our communications infrastructure. As a result, changes in carrier plans such as delays in the implementation of new systems, new and emerging technologies (including small cells), or plans to expand coverage or capacity may reduce demand for our communications infrastructure. Furthermore, the wireless industry could experience a slowdown or slowing growth rates as a result of numerous factors, including a reduction in consumer demand for wireless data or general economic conditions. There can be no assurances that weakness or uncertainty in the economic environment will not adversely impact the wireless industry, which may materially and adversely affect our business, including by reducing demand for our communications infrastructure. In addition, a slowdown may increase competition for site rental customers. Such an industry slowdown or a reduction in customer network investment may materially and adversely affect our business.

2

A substantial portion of our revenues is derived from a small number of customers, and the loss, consolidation, or financial instability of any of such customers may materially decrease revenues or reduce demand for our communications infrastructure.

For the year ended December 31, 2017, our site rental revenues by customer were as follows:

The loss of any one of our large customers as a result of consolidation, merger, bankruptcy, insolvency, network sharing, roaming, joint development, resale agreements by our customers, or otherwise may result in (1) a material decrease in our revenues, (2) uncollectible account receivables, (3) an impairment of our deferred site rental receivables, communications infrastructure assets, intangible assets, or (4) other adverse effects to our business. We cannot guarantee that contracts with our major customers will not be terminated or that these customers will renew their contracts with us. In addition, we also derive a portion of our revenues, and anticipate future growth from new entrants offering or contemplating offering wireless services. Such customers may be smaller or have less financial resources than our four largest customers, may have business models that may not be successful, or may require additional capital.

Consolidation among our customers will likely result in duplicate or overlapping parts of networks, for example, where they are co-residents on a tower, which may result in the termination or non-renewal of the tenant contracts and negatively impact revenues from our communications infrastructure. Due to the long-term nature of tenant contracts, we expect, but cannot be certain, that any termination of tenant contracts as a result of this potential consolidation would be spread over multiple years. Such consolidation may result in a reduction in such customers' future network investment in the aggregate because their expansion plans may be similar. Customer consolidation could decrease the demand for our communications infrastructure, which in turn may result in a reduction in our revenues or cash flows.

In recent years, AT&T, T-Mobile and Sprint acquired Leap Wireless, MetroPCS, and Clearwire ("Acquired Networks"), respectively. During 2018, we expect site rental revenues to be negatively impacted by non-renewals as a result of the decommissioning of the Acquired Networks. The Acquired Networks represented approximately 8% of our site rental revenues for the year ended December 31, 2017. We currently expect the majority of the potential non-renewals from the decommissioning of the Acquired Networks to occur predominately through the end of 2018. Depending on the eventual network deployment and decommissioning plans of AT&T, T-Mobile and Sprint, the impact and timing of such non-renewals may vary from our expectations.

See note 10 to our consolidated financial statements.

Our ability to repay the principal under our 2012 Secured Notes on or prior to the relevant maturity date will be subject to a number of factors outside our control.

The indenture ("Secured Notes Indenture") governing our $1.0 billion aggregate principal amount of 3.849% secured notes due 2023 ("3.849% Secured Notes") and our previously outstanding $500 million aggregate principal amount of 2.381% secured notes due 2017 ("2.381% Secured Notes") (collectively, the "2012 Secured Notes"), requires us to repay the principal under the 3.849% Secured Notes by their maturity date in April 2023. We currently expect to distribute a substantial portion of our cash flow to our member as dividends. Therefore, our ability to repay the principal under the 3.849% Secured Notes on or prior to their maturity date depends upon our ability either to refinance the indebtedness under the 3.849% Secured Notes or to sell our interests in the sites for an amount that is sufficient to repay the 3.849% Secured Notes in full with interest. Our ability to achieve either of these goals will be affected by a number of factors, including the availability of credit for wireless communications sites, the fair market value of the sites, our equity in the sites, our financial condition, the operating history of the sites, tax laws, or general economic conditions. Since the current term of the tenant contracts as of the date of this filing will have substantially expired by

3

the date 3.849% Secured Notes mature, our ability to sell or refinance at such date will also be affected by the degree of our success in extending existing tenant contracts or obtaining new tenant contracts as those remaining terms expire. In addition, neither the trustee for the 3.849% Secured Notes nor any of its respective affiliates or any other person is obligated to provide the funds to refinance the 3.849% Secured Notes.

CCL is a holding company, and therefore its ability to repay its indebtedness is dependent on cash flow generated by its subsidiaries and their ability to make distributions to CCL.

CCL is a holding company with no operations or material assets other than the direct or indirect equity interests it holds in its subsidiaries. As a result, its ability to pay principal and interest on its indebtedness is dependent on the generation of cash flow by its subsidiaries and their ability to make such cash available to CCL by dividend, debt repayment, or otherwise. The earnings and cash flow generated by CCL's subsidiaries will depend on their financial and operating performance, which will be affected by general economic, industry, financial, competitive, operating, legislative, regulatory, or other factors beyond our control. Any payments of dividends, distributions, loans, or advances to CCL by its subsidiaries could also be subject to restrictions on dividends under applicable local law in the jurisdictions in which such subsidiaries operate.

In the event that CCL does not receive distributions from its subsidiaries, or to the extent that the earnings from, or other available assets of, such subsidiaries are insufficient, CCL may be unable to make payments on its indebtedness. Furthermore, Crown Castle GS III Corp., the co-issuer of the 3.849% Secured Notes, has no assets, conducts no operations, and has no independent ability to service the interest and principal obligations under the 3.849% Secured Notes.

As a result of competition in our industry, we may find it more difficult to negotiate favorable rates on our new or renewing tenant contracts.

Our growth is dependent on our entering into new tenant contracts (including amendments to contracts upon modification of an existing tower installation), as well as renewing or renegotiating tenant contracts when existing tenant contracts terminate. Competition in our industry may make it more difficult for us to attract new customers, maintain or increase our gross margins or maintain or increase our market share. We face competition for site rental tenants and associated rental rates from various sources, including (1) other independent communications infrastructure owners or operators, including those that own, operate, or manage sites, rooftops, broadcast towers, utility poles, fiber or small cells, or (2) new alternative deployment methods for communications infrastructure.

New technologies may reduce demand for our communications infrastructure or negatively impact our revenues.

Improvements in the efficiency, architecture, and design of wireless networks may reduce the demand for our communications infrastructure. For example, new technologies that may promote network sharing, joint development, wireless backhaul, or resale agreements by our customers, such as signal combining technologies or network functions virtualization, may reduce the need for our communications infrastructure. In addition, other technologies, such as Wi-Fi, Distributed Antenna Systems ("DAS"), femtocells, other small cells, or satellite (such as low earth orbiting) and mesh transmission systems may, in the future, serve as substitutes for or alternatives to leasing on communications infrastructure that might otherwise be anticipated or expected had such technologies not existed. In addition, new technologies that enhance the range, efficiency, and capacity of wireless equipment could reduce demand for our communications infrastructure. Any reduction in demand for our communications infrastructure resulting from the new technologies may negatively impact our revenues or otherwise have a material adverse effect on us.

If we fail to retain rights to our communications infrastructure, including the land interests under our towers, our business may be adversely affected.

The property interests on which our towers reside, including the land interests under our towers (other than the sites sub-leased under the Sprint Master Leases) consist of leaseholds and exclusive easements, as well as permits granted by governmental entities. A loss of these interests for any reason, including losses arising from the bankruptcies of a significant number of our lessors, from the default by a significant number of our lessors under their mortgage financings or from a legal challenge to our interest in the real property, may interfere with our ability to conduct our business or generate revenues. If a material number of the grantors of these rights elect not to renew their terms, our ability to conduct business or generate revenues could be adversely affected. Further, we may not be able to renew ground leases on commercially viable terms. Our ability to retain rights to the land interests on which our towers reside depends on our ability to purchase such land, including fee interests and perpetual easements, or renegotiate or extend the terms of the leases relating to such land. In some cases, other subsidiaries of CCIC have acquired certain third party land interests under certain of our sites as a result of negotiated transactions, and we have entered into leases with such affiliates. Approximately 15% of our sites for the year ended December 31, 2017 are under our control for less than 10 years. If we are unable to retain rights to the property interests on which our towers reside, our business may be adversely affected.

4

As of December 31, 2017, approximately 68% of our sites were Sprint Sites. CCIC, through its subsidiaries (including us), has the option to purchase, in 2037, all (but not less than all) of the leased and subleased Sprint Sites (as well as other Sprint sites leased or subleased by other subsidiaries of CCIC) from Sprint for approximately $2.3 billion; CCIC has no obligation to exercise such purchase option. CCIC may not have the required available capital to exercise such purchase option at the time this option is exercisable. Even if CCIC does have available capital, it may choose not to exercise its purchase option for business or other reasons. In the event that CCIC does not exercise the purchase option, or is otherwise unable to acquire an interest that would allow us to continue to operate these towers after the applicable period, we will lose the cash flows derived from such towers, which may have a material adverse effect on our business. In the event that CCIC decides to exercise the purchase option, the benefits of the acquisition of the sites may not exceed the costs, which could adversely affect our business.

Failure on our subsidiaries' part to cause the performance of their obligations as landlords under tenant contracts could lead to abatement of rent or termination of tenant contracts.

The vast majority of our tenant contracts are not net contracts. Accordingly, each of our subsidiaries that acts as a landlord is responsible for ensuring the maintenance and repair of its sites and for other obligations and liabilities associated with its sites, such as the payment of real estate taxes related to the tower and ground lease rents, the maintenance of insurance or environmental compliance and remediation. The failure of such subsidiary to cause the performance of their obligations as landlords under a tenant contract could entitle the related lessee to an abatement of rent or, in some circumstances, could result in a termination of the tenant contract. Because our subsidiaries nor we have any employees, as further discussed herein, the Manager (as defined below) is responsible for carrying out the landlord's responsibilities under the tenant contracts. An unscheduled reduction or cessation of payments due under a tenant contract may result in a reduction of the amounts available to make payments on the 3.849% Secured Notes.

Bankruptcy proceedings involving either our subsidiaries or their lessors under the ground leases could adversely affect our ability to enforce our subsidiaries' rights under the ground leases or to remain in possession of the leased property.

Upon the bankruptcy of a lessor or a lessee under a ground lease, the debtor entity generally has the right to assume or reject the ground lease. Pursuant to Section 365(h) of the United States Bankruptcy Code ("Bankruptcy Code"), a ground lessee (i.e., a subsidiary) whose ground lease is rejected by a debtor ground lessor has the right to remain in possession of its leased premises under the rent reserved in the contract for the term of the ground lease, including any renewals, but is not entitled to enforce the obligation of the ground lessor to provide any services required under the ground lease. In the event of concurrent bankruptcy proceedings involving the ground lessor and the ground lessee, the ground lease could be terminated.

Similarly, upon the bankruptcy of one of our subsidiaries or a third-party owner of a managed site, the debtor entity would have the right to assume or reject any related site management agreement. Because the arrangements under which we derive revenue from the managed sites would not likely constitute contracts of real property for purposes of Section 365(h) of the Bankruptcy Code, the applicable subsidiary may not have the right to remain in possession of the premises or otherwise retain the benefit of the site management agreement if the site management agreement is rejected by a debtor third-party owner.

The bankruptcy of certain Sprint subsidiaries, which are sublessors to one of our subsidiaries, could result in such subsidiary's sublease interests being rejected by the bankruptcy court.

Certain of the towers leased from Sprint are located on land leased from third parties under ground leases. One of our subsidiaries, Global Signal Acquisitions II LLC ("Global Signal Acquisitions II"), subleases these sites from bankruptcy remote Sprint subsidiaries. If one of these Sprint subsidiaries should become a debtor in a bankruptcy proceeding and is permitted to reject the underlying ground lease, Global Signal Acquisitions II could lose its interest in the applicable sites. If Global Signal Acquisitions II were to lose its interest in the applicable sites or if the applicable ground leases were to be terminated, we would lose the cash flow derived from the towers on those sites, which may have a material adverse effect on our business. We have similar bankruptcy risks with respect to sites that we operate under management agreements.

Our failure to comply with our covenants in the Sprint Master Leases, including our obligation to timely pay ground lease rent, could result in an event of default under the applicable Sprint Master Leases, which would adversely impact our business.

Subject to certain cure, arbitration, or other provisions, in the event of an uncured default under a Sprint Master Lease, Sprint may terminate the Sprint Master Lease as to the applicable sites. If we default under the Sprint Master Leases with respect to more than 20% of the Sprint Sites within any rolling five-year period, Sprint will have the right to terminate the Sprint Master Leases with respect to all Sprint Sites. If Sprint terminates Sprint Master Leases with respect to all of or a significant number of sites, we would lose all of our interests in those sites (which collectively represent approximately 68% of our sites as of December 31, 2017) and our ability to make payments on the 3.849% Secured Notes would therefore be significantly impaired.

5

We have no employees of our own and hence are dependent on the Manager for the conduct of our operations. Any failure of the Manager to continue to perform in its role as manager of the sites could have a material adverse impact on our business.

Pursuant to a management agreement among CCL, certain of its direct and indirect subsidiaries and CCUSA ("Management Agreement"), all of our sites are managed by CCUSA ("Manager"). The Manager continues to be responsible for causing maintenance to be carried out in a timely fashion, carrying out the landlord's responsibilities under the tenant contracts, and marketing the site spaces. Management errors may adversely affect the revenue generated by the sites. In addition, the Manager's performance continues to depend to a significant degree upon the continued contributions of key management, engineering, sales and marketing, customer support, legal, or finance personnel, some of whom may be difficult to replace. The Manager does not have employment agreements with any of its employees, and no assurance can be given that the services of such personnel will continue to be available to the Manager. Furthermore, the Manager does not maintain key man life insurance policies on its executives that would adequately compensate it for any loss of services of such executives. The loss of the services of one or more of these executives could have a material adverse effect on the Manager's ability to manage our operations.

The management of the sites requires special skills and particularized knowledge. If the Management Agreement is terminated or the Manager is for any reason unable to continue to manage the sites on our behalf, there may be substantial delays in engaging a replacement manager with the requisite skills and experience to manage the sites. There can be no assurance that a qualified replacement manager can be located or engaged in a timely fashion or on economical terms. If an insolvency proceeding were commenced with respect to the Manager, the Manager as debtor or its bankruptcy trustee might have the power to prevent us from replacing it with a new manager for the sites.

The Manager may experience conflicts of interest in the management of the sites and in the management of sites of affiliates carried out pursuant to other management agreements.

In addition to managing our operations, the Manager is currently party to, and may in the future enter into, separate management agreements with its other affiliates that own, lease, and manage towers or other wireless communications sites. These other affiliates may be engaged in the construction, acquisition, or leasing of wireless communications sites in proximity to our sites. As a result, the Manager may engage in business activities that are in competition with our business in respect of the sites, and the Manager may experience conflicts of interest in the management of our sites and such other sites. Pursuant to the Management Agreement, the Manager continues to be prohibited from soliciting lessees to transfer tenant contracts from sites owned, leased, or managed by us to sites owned, leased or managed by our affiliates. However, there can be no assurance that the persons that control us, the Manager, or those other affiliates will allocate their management efforts in such a way as to maximize the returns with respect to our sites, as opposed to maximizing the returns with respect to other sites. The expansion and development of the Manager's business through acquisitions, increased product offerings or other strategic growth opportunities may cause disruptions in our business, which may have an adverse effect on our business operations or financial results. As a result, the Manager and we may experience conflicts of interest in the management of the land sites. Pursuant to the Management Agreement, the Manager has agreed to manage the sites in the same manner as if the lessees thereunder were not affiliates.

In addition, we may, subject to certain restrictions on affiliate transactions in the Secured Notes Indenture, enter into arms-length transactions with our affiliates to acquire land under our sites. There can be no assurance that the persons that control us will allocate potential opportunities in such a way as to maximize the returns with respect to our sites, as opposed to maximizing the returns for our affiliates.

New wireless technologies may not deploy or be adopted by customers as rapidly or in the manner projected.

There can be no assurances that new wireless services or technologies will be introduced or deployed as rapidly or in the manner projected by the wireless or broadcast industries. In addition, demand or adoption rates for such new technologies may be lower or slower than anticipated for numerous reasons. As a result, growth opportunities or demand for our communications infrastructure arising from such technologies may not be realized at the times or to the extent anticipated.

If radio frequency emissions from wireless handsets or equipment on our communications infrastructure are demonstrated to cause negative health effects, potential future claims could adversely affect our operations, costs, or revenues.

The potential connection between radio frequency emissions and certain negative health effects, including some forms of cancer, has been the subject of substantial study by the scientific community in recent years. We cannot guarantee that claims relating to radio frequency emissions will not arise in the future or that the results of such studies will not be adverse to us.

6

Public perception of possible health risks associated with cellular or other wireless data services may slow or diminish the growth of wireless companies, which may in turn slow or diminish our growth. In particular, negative public perception of, and regulations regarding, these perceived health risks may slow or diminish the market acceptance of wireless services. If a connection between radio frequency emissions and possible negative health effects were established, our operations, costs or revenues may be materially and adversely affected. We currently do not maintain any significant insurance with respect to these matters.

If we fail to comply with laws or regulations which regulate our business and which may change at any time, we may be fined or even lose our right to conduct some of our business.

A variety of federal, state, local, and foreign laws and regulations apply to our business. Failure to comply with applicable requirements may lead to civil or criminal penalties, require us to assume indemnification obligations or breach contractual provisions. We cannot guarantee that existing or future laws or regulations, including federal, state and local tax laws, will not adversely affect our business (including CCIC's REIT status), increase delays or result in additional costs. We also may incur additional costs as a result of liabilities under applicable laws and regulations, such as those governing environmental and safety matters. These factors may have a material adverse effect on us.

CCIC’s failure to remain qualified to be taxed as a REIT would result in its inability to deduct dividends to stockholders when computing its taxable income, which could reduce our available cash or subject us to income taxes.

CCIC operates as a REIT for federal income tax purposes. As a REIT, CCIC is generally entitled to a deduction for dividends that it pays and therefore is not subject to U.S. federal corporate income tax on its taxable income that is distributed to its stockholders. As a REIT, CCIC may still be subject to certain federal, state, local, and foreign taxes on its income and assets, including alternative minimum taxes, taxes on any undistributed income, and state, local, or foreign income, franchise, property, and transfer taxes. We are an indirect subsidiary of CCIC and, for U.S. federal income tax purposes, our assets and operations are part of the CCIC REIT. Furthermore, as a result of the deduction for dividends paid, some or all of CCIC's net operating loss carryforwards ("NOLs") related to its REIT status may expire without utilization.

While CCIC intends to operate so that it remains qualified as a REIT, given the highly complex nature of the rules governing REITs, the importance of ongoing factual determinations, the possibility of future changes in circumstances, and the potential impact of future changes to laws and regulations impacting REITs, no assurance can be given by CCIC or us that CCIC will qualify as a REIT for any particular year.

We do not expect the recently enacted legislation commonly referred to as the Tax Reform Act to significantly affect us, although we cannot predict with certainty how such legislation will affect CCIC and us in the future. In addition, the present U.S. federal tax treatment of REITs is subject to change, possibly with retroactive effect, by legislative, judicial or administrative action at any time, and any such change might adversely affect CCIC's REIT status or benefits. We cannot predict the impact, if any, that such changes, if enacted, might have on our business. However, it is possible that such changes could adversely affect our business or inclusion of our assets and operations in CCIC's REIT.

If, in any taxable year, CCIC fails to qualify for taxation as a REIT and it is not entitled to relief under the Code, then we will be subject to federal and state income tax, including for applicable years beginning before January 1, 2018, any applicable alternative minimum tax, on our taxable income at regular corporate rates.

As a REIT, CCIC needs to continually satisfy tests concerning, among other things, the sources of its income, the nature and diversification of its assets, the amounts it dividends to its stockholders, and the ownership of its capital stock in order to maintain REIT status. Compliance with these tests requires CCIC to refrain from certain activities and may hinder its ability to make certain attractive investments, including the purchase of non-qualifying assets, the expansion of non-real estate activities, and investments in the businesses to be conducted by its taxable REIT subsidiaries ("TRSs"), and to that extent limit its opportunities and its flexibility to change its business strategy. Furthermore, acquisition opportunities in domestic or international markets may be adversely affected if CCIC needs or requires the target company to comply with some REIT requirements prior to completing any such acquisition. In addition, as a REIT, CCIC may face investor pressures not to pursue growth opportunities that are not immediately accretive.

Available Information

CCIC maintains a website at www.crowncastle.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K (and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended) ("Exchange Act") are made available, free of charge, through the investor relations section of CCIC's website at http://investor.crowncastle.com or at the SEC's website at http://sec.gov as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. You may also read or copy any document we

7

file with the SEC at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Towers are vertical, metal structures generally ranging in height from 50 to 300 feet. Our towers are located on tracts of land that support the towers, equipment shelters and, where applicable, guy-wires to stabilize the structure. As of December 31, 2017, the average number of tenants (defined as a unique license and any related amendments thereto) per site is approximately 2.8. Substantially all of our towers can accommodate additional tenancy either as currently constructed or with appropriate modifications to the structure.

See "Item 1. Business—Overview" for information regarding our communications infrastructure portfolio and for a discussion of the location of our towers, including the percentage of our towers in the top 50 and 100 BTAs. See "Item 7. MD&A—General Overview" for information on land interests under our sites as of December 31, 2017.

Item 3. Legal Proceedings

We are periodically involved in legal proceedings that arise in the ordinary course of business. Most of these proceedings arising in the ordinary course of business involve disputes with landlords, vendors, collection matters involving bankrupt customers, zoning or siting matters or condemnation. While the outcome of these matters cannot be predicted with certainty, management does not expect any pending matters to have a material adverse effect on us.

Item 4. Mine Safety Disclosures

N/A

8

PART II

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our equity is not publicly traded. Our only member is GSOP, a wholly-owned indirect subsidiary of CCIC. During 2017, we recorded an equity distribution from GSOP of amounts due to our affiliates of $296.5 million. During 2016, we recorded a net equity contribution from GSOP of amounts due from our affiliates of $228.0 million, comprised of an equity contribution from GSOP of $508.5 million related to the repayment of debt and an equity distribution to GSOP of $280.5 million of amounts due to affiliates. See notes 5 and 6 to our consolidated financial statements.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

General Overview

Overview

We own, lease, and manage approximately 7,600 sites located across the United States. See "Item 1. Business" for additional information regarding our sites and contracts.

Business Fundamentals

The following are certain highlights of our business fundamentals as of and for the year ended December 31, 2017:

• | Potential growth resulting from wireless network expansion and new entrants caused by increasing demand for wireless data |

◦ | We expect wireless carriers will continue their focus on improving network quality and expanding capacity by adding additional antennas or other equipment on our communications infrastructure. |

◦ | We expect existing and potential new customer demand for our towers will result from (1) new technologies, (2) increased usage of mobile entertainment, mobile internet usage, and machine-to-machine applications, (3) adoption of other emerging and embedded wireless devices (including smartphones, laptops, tablets, and other devices), (4) increasing smartphone penetration, (5) wireless carrier focus on expanding both network quality and capacity and (6) the availability of additional spectrum. |

◦ | Substantially all of our towers can accommodate additional tenancy, either as currently constructed or with appropriate modifications to the structure. |

◦ | U.S. wireless carriers continue to invest in their networks. |

• | Organizational Structure |

◦ | For U.S. federal income tax purposes, CCIC operates as a REIT and, as its indirect subsidiary, our assets and operations are included in the CCIC REIT. See "Item 1A. Risk Factors" and notes 2 and 8 to our consolidated financial statements. |

◦ | Our subsidiaries (other than Crown Castle GS III Corp.) were organized specifically to own, lease, and manage certain shared communications infrastructure, such as towers or other structures, and have no employees. |

◦ | Management services, including those functions reasonably necessary to maintain, market, operate, manage, or administer the sites, are performed by CCUSA. The management fee under the Management Agreement is equal to 7.5% of our "Operating Revenues," as defined under the Management Agreement. |

• | Site rental revenues under long-term tenant contracts |

◦ | Initial terms of five to 15 years, with contractual escalations and multiple renewal periods at the option of the tenant of five to ten years each. |

◦ | The weighted-average remaining term (calculated by weighting the remaining term for each contract by the related site rental revenue) of tenant contracts was approximately six years, exclusive of renewals at the tenants' option, currently representing approximately $4.2 billion of expected future cash inflows. |

• | Revenues predominately from large wireless carriers. |

◦ | Approximately 88% of our site rental revenues were derived from Sprint, AT&T, T-Mobile, and Verizon Wireless. See "Item 1A. Risk Factors" and note 11 to our consolidated financial statements. |

◦ | The average number of tenants per site was approximately 2.8. |

• | Majority of land interests under our towers are under long-term control |

◦ | More than 80% and more than 50% of our sites are under our control for greater than 10 and 20 years, respectively. The aforementioned include sites that reside on land interests that are owned, including fee interests and perpetual easements. |

9

◦ | The contracts for land interest under our towers had an average remaining life (calculated by weighting the remaining term for each contract by its percentage of our total site rental revenues) of approximately 24 years. |

◦ | Approximately 20% of our site rental cost of operations represents ground lease payments to our affiliates. Such affiliates acquired the rights to such land interests as a result of negotiated transactions with third parties in connection with a program established by CCIC to extend the rights to the land under its portfolio of towers. |

• | Relatively fixed tower operating costs |

◦ | Our operating costs tend to escalate at approximately the rate of inflation and are not typically influenced by tenant additions or non-renewals. |

• | Minimal sustaining capital expenditure requirements |

◦ | Sustaining capital expenditures represented approximately 2% of site rental revenues. |

• | Fixed rate debt with no short-term maturities |

◦ | Our debt consists of $1.0 billion aggregate principal amount of 3.849% Secured Notes. See note 5 to our consolidated financial statements. |

• | Significant cash flows from operations |

◦ | Net cash provided by operating activities was $357.3 million. See "Item 7. MD&A—Liquidity and Capital Resources." |

Outlook Highlights

The following are certain highlights of our outlook that impact our business fundamentals described above.

• | We expect demand for tenant leasing to continue during 2018. |

• | During 2018, we also expect that the impact from tenant leasing will be offset by non-renewals of tenant contracts, primarily from our customers' decommissioning of the Acquired Networks, at least in part. |

10

Consolidated Results of Operations

The following discussion of our results of operations should be read in conjunction with "Item 1. Business," "Item 7. MD&A—Liquidity and Capital Resources" and our consolidated financial statements. The following discussion of our results of operations is based on our consolidated financial statements prepared in accordance with generally accepted accounting principles in the U.S. ("GAAP") which requires us to make estimates and judgments that affect the reported amounts. See "Item 7. MD&A—Accounting and Reporting Matters—Critical Accounting Policies and Estimates" and note 2 to our consolidated financial statements.

Comparison of Consolidated Results of Operations

The following is a comparison of our 2017, 2016 and 2015 consolidated results of operations:

Years Ended December 31, | Percent Change | ||||||||||||||||

2017 | 2016 | 2015 | 2017 vs. 2016 | 2016 vs. 2015 | |||||||||||||

(In thousands of dollars) | |||||||||||||||||

Site rental revenues | $ | 616,897 | $ | 611,639 | $ | 607,276 | 1 | % | 1 | % | |||||||

Operating expenses: | |||||||||||||||||

Costs of operations(a)(b): | 186,419 | 185,713 | 182,084 | — | % | 2 | % | ||||||||||

Management fee(b) | 46,946 | 45,433 | 43,709 | 3 | % | 4 | % | ||||||||||

Asset write-down charges | 181 | 4,851 | 6,021 | * | * | ||||||||||||

Depreciation, amortization and accretion | 210,607 | 209,361 | 207,825 | 1 | % | 1 | % | ||||||||||

Total operating expenses | 444,153 | 445,358 | 439,639 | — | % | 1 | % | ||||||||||

Operating income (loss) | 172,744 | 166,281 | 167,637 | 4 | % | (1 | )% | ||||||||||

Interest expense and amortization of deferred financing costs(b) | (39,874 | ) | (49,515 | ) | (53,223 | ) | (19 | )% | (7 | )% | |||||||

Gain (loss) on retirement of debt | — | (10,273 | ) | — | * | * | |||||||||||

Other income (expense) | 287 | (242 | ) | (244 | ) | * | * | ||||||||||

Income (loss) before income taxes | 133,157 | 106,251 | 114,170 | * | * | ||||||||||||

Benefit (provision) for income taxes | 614 | 668 | 733 | * | * | ||||||||||||

Net income (loss) | $ | 133,771 | $ | 106,919 | $ | 114,903 | * | * | |||||||||

____________________

* | Percentage is not meaningful. |

(a) | Exclusive of depreciation, amortization and accretion shown separately and certain indirect costs included in the management fee. |

(b) | Inclusive of related parties' transactions. |

Years Ended December 31, 2017 and 2016

Site rental revenues for 2017 increased by approximately $5.3 million, or 1%, from 2016. Site rental revenues were impacted by the following items, inclusive of straight-line accounting: tenant additions across our entire portfolio, renewals of tenant contracts, escalations and non-renewals of tenant contracts. Tenant additions were influenced by our customers' ongoing efforts to improve network quality and capacity. See also "Item 7. MD&A—General Overview."

Operating income for the twelve months ended December 31, 2017 increased by $6.5 million or 4%, from the same period in the prior year. The increase in operating income was predominately due to the aforementioned increase in site rental revenues and a decrease in asset write-down charges from the twelve months ended December 31, 2016.

During September 2016, CCIC issued $700 million aggregate principal amount of 2.250% senior unsecured notes ("September 2016 Senior Notes") and used a portion of the proceeds to repay all of our previously outstanding 2.381% Secured Notes, which resulted in a loss on retirement of debt of approximately $10.3 million.

Interest expense and amortization of deferred financing costs for the twelve months ended December 31, 2017 decreased by $9.6 million, or 19%, from the same period in the prior year. This decrease was related to the aforementioned repayment in September 2016 of the previously outstanding 2.381% Secured Notes.

Benefit (provision) for income taxes remained consistent from 2016 to 2017. The effective tax rates for 2017 and 2016 differ from the federal statutory rate predominately due to CCIC's REIT status (including the dividends paid deduction) and our inclusion therein. See "Item 1A. —Risk Factors" and notes 2 and 8 to our consolidated financial statements.

11

Net income for 2017 was approximately $133.8 million, compared to net income of approximately $106.9 million for 2016, which was predominately due to the aforementioned loss on retirement of debt, decrease in interest expense and amortization of deferred financing costs.

Years Ended December 31, 2016 and 2015

Site rental revenues for 2016 increased by approximately $4.4 million, or 1%, from 2015. Site rental revenues were impacted by the following items, inclusive of straight-line accounting: tenant additions across our entire portfolio, renewals of tenant contracts, escalations and non-renewals of tenant contracts. Tenant additions were influenced by our tenants' ongoing efforts to improve network quality and capacity. See also "Item 7. MD&A—General Overview."

Operating income for the twelve months ended December 31, 2016 decreased by $1.4 million or 1%, from the same period in the prior year. The decrease in operating income was predominately due to increases in cost of operations, the management fee and depreciation, amortization and accretion, partially offset by a decrease in asset write-down charges.

During September 2016, CCIC issued $700 million aggregate principal amount of September 2016 Senior Notes and used a portion of the proceeds to repay all of our previously outstanding 2.381% Secured Notes, which resulted in a loss on retirement of debt of approximately $10.3 million.

Benefit (provision) for income taxes remained consistent from 2015 to 2016. The effective tax rates for 2016 and 2015 differs from the federal statutory rate predominately due to CCIC's REIT status (including the dividends paid deduction) and our inclusion therein. See "Item 1A. —Risk Factors" and notes 2 and 8 to our consolidated financial statements.

Net income for 2016 was approximately $106.9 million, compared to net income of approximately $114.9 million for 2015, which was predominately due to the aforementioned loss on retirement of debt recorded for the repayment of our previously outstanding 2.381% Secured Notes.

Liquidity and Capital Resources

Overview

General. Our core business generates revenues under long-term contracts (see "Item 7. MD&A—General Overview"), predominately from the largest U.S. wireless carriers. Historically, our net cash provided by operating activities (net of cash interest payments) has exceeded our capital expenditures. For the foreseeable future, we expect to continue to generate net cash provided by operating activities (exclusive of movements in working capital) that exceeds our capital expenditures. We seek to allocate the net cash provided by our operating activities in a manner that we believe drives value for our member.

From a cash management perspective, we currently distribute cash on hand above amounts required pursuant to the Management Agreement to our member. If any future event would occur that would leave us with a deficiency in our operating cash flow, while not required, CCIC may contribute cash back to us.

CCIC operates as a REIT for U.S. federal income tax purposes. We are an indirect subsidiary of CCIC and for U.S. federal income tax purposes, our assets and operations are part of the CCIC REIT. We expect to continue to pay minimal cash income taxes as a result of CCIC's REIT status and NOLs. "Item 1A. Risk Factors" and notes 2 and 8 to our consolidated financial statements.

Liquidity Position. The following is a summary of our capitalization and liquidity position as of December 31, 2017:

December 31, 2017 | |||

(In thousands of dollars) | |||

Cash and cash equivalents | $ | 30,771 | |

Debt | 992,663 | ||

Total equity | 2,576,471 | ||

Over the next 12 months:

• | We expect that our net cash provided by operating activities should be sufficient to cover our expected capital expenditures. |

• | We have no debt maturities. |

12

Long-term Strategy. We may increase our debt in nominal dollars, subject to the provisions of the 2012 Secured Notes outstanding and various other factors, such as the state of the capital markets and CCIC's targeted capital structure, including with respect to leverage ratios. From a cash management perspective, we currently distribute cash on hand above amounts required pursuant to the Management Agreement to our member. If any future event would occur that would leave us with a deficiency in our operating cash flow, while not required, CCIC may contribute cash back to us.

See note 5 to our consolidated financial statements for additional information regarding our debt.

Summary Cash Flows Information

Years Ended December 31, | |||||||||||

2017 | 2016 | 2015 | |||||||||

(In thousands of dollars) | |||||||||||

Net cash provided by (used for): | |||||||||||

Operating activities | $ | 357,317 | $ | 333,052 | $ | 310,986 | |||||

Investing activities | (49,551 | ) | (53,409 | ) | (85,216 | ) | |||||

Financing activities | (296,545 | ) | (280,494 | ) | (231,600 | ) | |||||

Net increase (decrease) in cash and cash equivalents | $ | 11,221 | $ | (851 | ) | $ | (5,830 | ) | |||

Operating Activities

The increase in net cash provided by operating activities for 2017 of $24.3 million, or 7%, from 2016 was primarily due to (1) growth in cash revenues, including cash escalations that are subject to straight-line accounting and (2) a net benefit from a year-over-year change in working capital. This year-over-year change in working capital primarily related to changes in deferred site rental receivables and other assets. The increase from 2015 to 2016 was primarily due to (1) growth in cash revenues, including cash escalations that are subject to straight-line accounting and (2) a net benefit from year-over-year changes in working capital. This year-over-year change in working capital primarily related to changes in deferred revenues and other assets.

Investing Activities

Capital Expenditures

Our capital expenditures include the following:

• | Site improvement capital expenditures consist of improvements to existing sites to accommodate tenant additions and typically vary based on, among other factors: (1) the type of site, (2) the scope, volume, and mix of work performed on the site, (3) existing capacity prior to installation, or (4) changes in structural engineering regulations and standards. Our decisions regarding capital expenditures are influenced by (1) sufficient potential to enhance CCIC's long-term stockholder value, (2) CCIC's availability and cost of capital and (3) CCIC's expected returns on alternative uses of cash, such as payments of dividends and investments. |

• | Sustaining capital expenditures consist of capital improvements on our sites that enable our customers' ongoing quiet enjoyment of the site. |

A summary of our capital expenditures for the last three years is as follows:

Years Ended December 31, | ||||||||

2017 | 2016 | 2015 | ||||||

(In thousands of dollars) | ||||||||

Site improvements | 40,051 | 43,721 | 76,064 | |||||

Sustaining | 9,500 | 9,688 | 9,152 | |||||

Total | 49,551 | 53,409 | 85,216 | |||||

Capital expenditures decreased by approximately $3.9 million from 2016 to 2017. This decrease is predominately due to lower volume of improvements performed on existing sites.

13

Financing Activities

The net cash flows used for financing activities during the years ended December 31, 2017, 2016, and 2015 were impacted by our continued practice of distributing excess cash to our member. In addition, in September 2016, CCIC issued $700 million aggregate principal amount of September 2016 Senior Notes and used a portion of the net proceeds from the September 2016 Senior Notes offering to repay $500 million of our previously outstanding 2.381% Secured Notes. We recorded an equity contribution related to the debt repayment of our previously outstanding 2.381% Secured Notes for the year ended December 31, 2016. See notes 5 and 6 to our consolidated financial statements.

Contractual Cash Obligations

The following table summarizes our contractual cash obligations as of December 31, 2017. These contractual cash obligations relate primarily to our 3.849% Secured Notes and lease obligations for land interests under our towers.

Years Ending December 31, | |||||||||||||||||||||||||||

Contractual Obligations(a) | 2018 | 2019 | 2020 | 2021 | 2022 | Thereafter | Totals | ||||||||||||||||||||

(In thousands of dollars) | |||||||||||||||||||||||||||

Debt | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 1,000,000 | $ | 1,000,000 | |||||||||||||

Interest payments on debt | 38,490 | 38,490 | 38,490 | 38,490 | 38,490 | 19,245 | 211,695 | ||||||||||||||||||||

Lease obligations(b) | 138,940 | 140,350 | 141,363 | 141,078 | 138,026 | 1,726,965 | 2,426,722 | ||||||||||||||||||||

Total contractual obligations | $ | 177,430 | $ | 178,840 | $ | 179,853 | $ | 179,568 | $ | 176,516 | $ | 2,746,210 | $ | 3,638,417 | |||||||||||||

(a) | The following items are in addition to the obligations disclosed in the above table: |

• | We have a legal obligation to perform certain asset retirement activities, including requirements upon contract and easement terminations to remove communications infrastructure or remediate the land upon which our communications infrastructure resides. The cash obligations disclosed in the above table, as of December 31, 2017, are exclusive of estimated undiscounted future cash outlays for asset retirement obligations of approximately $132 million. As of December 31, 2017, the net present value of these asset retirement obligations was approximately $30.9 million. |

• | We are contractually obligated to pay or reimburse others for property taxes related to our sites. |

• | CCIC has the option to purchase approximately 68% of our sites that are leased or subleased or operated and managed under Sprint Master Leases at the end of their contract term. CCIC has no obligation to exercise the purchase option. See note 1 to our consolidated financial statements for further discussion. |

• | We have legal obligations for open purchase order commitments obtained in the ordinary course of business that have not yet been fulfilled. |

(b) | Amounts relate primarily to contract obligations for the land interests on which our towers reside. The operating lease payments included in the table above include payments for certain renewal periods at our option up to the estimated tower useful life of 20 years and an estimate of contingent payments based on revenues and gross margins derived from existing tenant contracts. As of December 31, 2017, the contracts for land interests under our towers had an average remaining life of approximately 24 years, weighted based on site rental revenues. See note 10 to our consolidated financial statements. |

Debt Restrictions

The Secured Notes Indenture does not contain financial maintenance covenants but it does contain restrictive covenants, subject to certain exceptions, related to our ability to incur indebtedness, incur liens, enter into certain mergers or change of control transactions, sell or issue equity interests, and enter into related party transactions. With respect to the restriction regarding the issuance of debt, we may not issue debt other than (1) certain permitted refinancings of the 3.849% Secured Notes, (2) unsecured trade payables in the ordinary course of business and financing of equipment, land or other property up to an aggregate of $100.0 million, or (3) unsecured debt or additional notes under the Secured Notes Indenture provided that the Debt to Adjusted Consolidated Cash Flow Ratio (as defined in the Secured Notes Indenture) at the time of incurrence, and after giving effect to such incurrence, would have been no greater than 3.5 to 1. As of December 31, 2017, our Debt to Adjusted Consolidated Cash Flow Ratio was 2.5 to 1, and, as a result, we are currently not restricted in our ability to incur additional indebtedness. Further, we are not restricted in our ability to distribute cash to affiliates or issue dividends to our member.

Accounting and Reporting Matters

Critical Accounting Policies and Estimates

The following is a discussion of the accounting policies and estimates that we believe (1) are most important to the portrayal of our financial condition and results of operations or (2) require our most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. The critical accounting policies and estimates for 2017 are not intended to be a comprehensive list of our accounting policies and estimates. See note 2 to our consolidated financial statements for a summary of our significant accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP, with no need for management's judgment. In other cases, management is required to exercise judgment in the application of accounting principles with respect to particular transactions.

14

Revenue Recognition. Our revenue consists solely of site rental revenues, which are recognized on a monthly basis over the fixed, non-cancelable term of the relevant contract (generally ranging from five to 15 years), regardless of whether the payments from the tenant are received in equal monthly amounts. If the payment terms call for fixed escalations (as in fixed dollar or fixed percentage increases), upfront payments or rent-free periods, the revenue is recognized on a straight-line basis over the fixed, non-cancelable term of the contract. When calculating our straight-line rental revenues, we consider all fixed elements of tenant contractual escalation provisions, even if such escalation provisions contain a variable element (such as an escalator tied to an inflation-based index) in addition to a minimum. Since we recognize revenue on a straight-line basis, a portion of the site rental revenues in a given period represents cash collected or contractually collectible in other periods. Our assets related to straight-line site rental revenues are included in "deferred site rental receivables." Amounts billed or received prior to being earned, are deferred and reflected in "deferred revenues" and "above-market leases and other liabilities." See note 2 to our consolidated financial statements.

Accounting for Long-Lived Assets—Valuation. As of December 31, 2017, our largest assets were our intangible assets, including goodwill and site rental contracts and customer relationships (approximately $1.3 billion and $903 million in net book value, respectively, resulting predominately from the merger of Global Signal Inc. with and into a subsidiary of CCIC in 2007), followed by our $1.0 billion in net book value of property and equipment, which predominately consists of sites. Nearly all of our identifiable intangibles relate to the site rental contracts and customer relationships intangible assets. See notes 2 and 4 to our consolidated financial statements for further information regarding the nature and composition of the site rental contracts and customer relationships intangible assets.

For our business combinations, we allocate the purchase price to the assets acquired and liabilities assumed based on their estimated fair value at the date of acquisition. Any purchase price in excess of the net fair value of the assets acquired and liabilities assumed is allocated to goodwill. The fair value of the vast majority of our assets and liabilities is determined by using either:

(1) | estimates of replacement costs (for tangible fixed assets such as towers), or |

(2) | discounted cash flow valuation methods (for estimating identifiable intangibles such as site rental contracts and customer relationships and above-market and below-market leases). |

The purchase price allocation requires subjective estimates that, if incorrectly estimated, could be material to our consolidated financial statements, including the amount of depreciation, amortization and accretion expense. The most important estimates for measurement of tangible fixed assets are: (1) the cost to replace the asset with a new asset and (2) the economic useful life after giving effect to age, quality, and condition. The most important estimates for measurement of intangible assets are (1) discount rates and (2) timing, length, and amount of cash flows including estimates regarding customer renewals and cancellations.

We record the fair value of obligations to perform certain asset retirement activities, including requirements, pursuant to our ground contracts or easements, to remove sites or remediate the land upon which our sites reside. In determining the fair value of these asset retirement obligations, we must make several subjective and highly judgmental estimates such as those related to: (1) timing of cash flows, (2) future costs, (3) discount rates, and (4) the probability of enforcement to remove the towers or remediate the land. See note 2 to our consolidated financial statements.

Accounting for Long-Lived Assets—Useful Lives. We are required to make subjective assessments as to the useful lives of our tangible and intangible assets for purposes of determining depreciation, amortization, and accretion expense that, if incorrectly estimated, could be material to our consolidated financial statements. Depreciation expense for our property and equipment is computed using the straight-line method over the estimated useful lives of our various classes of tangible assets. The substantial portion of our property and equipment represents the cost of our sites, which is depreciated with an estimated useful life equal to the shorter of (1) 20 years or (2) the term of the contract (including optional renewals) for the land interests under the towers.

The useful life of our intangible assets is estimated based on the period over which the intangible asset is expected to benefit us and gives consideration to the expected useful life of other assets to which the useful life may relate. We review the expected useful lives of our intangible assets on an ongoing basis and adjust if necessary. Amortization expense for intangible assets is computed using the straight-line method over the estimated useful life of each of the intangible assets. The useful life of the site rental contracts and customer relationships intangible assets is limited by the maximum depreciable life of the communications infrastructure (20 years), as a result of the interdependency of the sites and site rental contracts and customer relationships. In contrast, the site rental contracts and customer relationships are estimated to provide economic benefits for several decades because of the low rate of tenant cancellations and high rate of renewals experienced to date. Thus, while site rental contracts and customer relationships are valued based upon the fair value of the site rental contracts and customer relationships which includes assumptions regarding both (1) tenants' exercise of optional renewals contained in the acquired contracts and (2) renewals of the acquired contracts past the contractual term including exercisable options, the site rental contracts are amortized over a period not to exceed 20 years as a result of the useful life being limited by the depreciable life of the sites.

15

Accounting for Long-Lived Assets—Impairment Evaluation. We review the carrying values of property and equipment, intangible assets, or other long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable. We utilize the following dual grouping policy for purposes of determining the unit of account for testing impairment of the site rental contracts and customer relationships:

(1) | we pool site rental contracts and customer relationships intangible assets and property and equipment into portfolio groups, and |

(2) | we separately pool site rental contracts and customer relationships by significant tenant or by tenant grouping for individually insignificant tenants, as appropriate. |

We first pool site rental contracts and customer relationships intangible assets and property and equipment into portfolio groups for purposes of determining the unit of account for impairment testing, because we view sites as portfolios and sites in a given portfolio and its related tenant contracts are not largely independent of the other sites in the portfolio. We re-evaluate the appropriateness of the pooled groups at least annually. This use of grouping is based in part on (1) our limitations regarding disposal of sites, (2) the interdependencies of site portfolios, and (3) the manner in which sites are traded in the marketplace. The vast majority of our site rental contracts and customer relationships intangible assets and property and equipment are pooled into the U.S. owned communications infrastructure group. Secondly, and separately, we pool site rental contracts and customer relationships by significant tenant or by tenant grouping (for individually insignificant tenants), as appropriate, for purposes of determining the unit of account for impairment testing because we associate the value ascribed to site rental contracts and customer relationships intangible assets to the underlying contracts and related customer relationships acquired.