Attached files

| file | filename |

|---|---|

| 8-K - SMLP 4Q17 ER FORM 8-K - Summit Midstream Partners, LP | smlp-8k_20180222.htm |

EXHIBIT 99.1

Summit Midstream Partners, LP Reports Fourth Quarter and Full Year 2017

Financial Results and Provides 2018 Financial Guidance

|

|

- |

Fourth quarter 2017 net loss of $18.3 million and full year 2017 net income of $86.1 million |

|

|

- |

Fourth quarter 2017 adjusted EBITDA of $72.9 million and DCF of $49.2 million and full year 2017 adjusted EBITDA of $290.4 million and DCF of $205.0 million |

|

|

- |

Distribution coverage ratio of 1.09x for the fourth quarter of 2017 and 1.14x for the full year 2017 |

|

|

- |

Total leverage ratio of 3.62x at December 31, 2017 |

|

|

- |

2018 adjusted EBITDA guidance of $285.0 million to $300.0 million |

|

|

- |

2018 capital expenditures guidance to range from $175.0 million to $225.0 million, primarily related to previously announced expansion projects in Delaware and DJ basins |

|

|

- |

The undiscounted amount of the Deferred Purchase Price Obligation was reduced from $656.5 million to $454.4 million given updated Utica Shale well connection estimates for 2018 and 2019 |

The Woodlands, Texas (February 22, 2018) – Summit Midstream Partners, LP (NYSE: SMLP) announced today its financial and operating results for the three months and year ended December 31, 2017. SMLP reported a net loss of $18.3 million for the fourth quarter of 2017 compared to net income of $14.0 million for the prior-year period. Net income in the fourth quarter of 2017 included (i) a long-lived asset impairment of $187.1 million related to our Bison Midstream system in the Williston Basin segment and (ii) $145.6 million of non-cash income related to the decrease in the present value of the estimated Deferred Purchase Price Obligation (“DPPO”) at December 31, 2017, compared to September 30, 3017. Net income for the fourth quarter of 2016 included $24.7 million of non-cash DPPO expense. Net cash provided by operations totaled $41.3 million in the fourth quarter of 2017 compared to $61.8 million in the prior-year period. Adjusted EBITDA totaled $72.9 million and distributable cash flow (“DCF”) totaled $49.2 million for the fourth quarter of 2017 compared to $72.7 million and $52.8 million, respectively, for the prior-year period.

Natural gas volume throughput averaged 1,761 million cubic feet per day (“MMcf/d”) in the fourth quarter of 2017, an increase of 17.1% compared to 1,504 MMcf/d in the prior-year period, and a decrease of 3.6% compared to 1,826 MMcf/d in the third quarter of 2017. SMLP’s natural gas volume throughput metrics exclude its proportionate share of volume from its 40% ownership interest in Ohio Gathering. Crude oil and produced water volume throughput in the fourth quarter of 2017 averaged 74.1 thousand barrels per day (“Mbbl/d”), a decrease of 10.0% compared to 82.3 Mbbl/d in the prior-year period, and flat compared to 74.0 Mbbl/d in the third quarter of 2017.

Steve Newby, President and Chief Executive Officer, commented, “SMLP’s financial and operating results for the fourth quarter of 2017 were in line with expectations. During the quarter, we announced a new 60 MMcf/d processing plant expansion in the DJ Basin and acquired strategically important rights-of-way in and around our northern Delaware Basin operating footprint. In addition, we strengthened our balance sheet with a $300.0 million issuance of perpetual preferred equity, which allowed us to reduce leverage by nearly 1.0x. The perpetual preferred equity offering allows the company to buildout its northern Delaware and DJ basin gathering systems and processing plants without any requirements to access the debt or equity capital markets in 2018.”

SMLP reported net income of $86.1 million for the year ended December 31, 2017 compared to a net loss of $38.2 million for the prior-year period. Net income for 2017 included (i) $200.3 million of non-cash income related to the decrease in the present value of the estimated DPPO since December 31, 2016, (ii) long-lived asset impairments of $188.7 million, primarily related to our Bison Midstream system in the Williston Basin segment, (iii) $37.7 million related to a Williston Basin contract amendment that accelerated the recognition of deferred revenue on the balance sheet as gathering revenue on the income statement and (iv) $22.0 million of expense related to the early extinguishment of debt. Net income for 2016 included (i) $55.9 million of non-cash expense related to the increase in the present value of the estimated DPPO from March 3, 2016 to December 31, 2016 and (ii) a $37.8 million impairment loss, net to SMLP, recognized by Ohio Condensate Company, L.L.C. Net cash provided by operations totaled $237.8 million for the year ended December 31, 2017 compared to $230.5 million in the prior-year period. SMLP reported adjusted EBITDA of $290.4 million and DCF of $205.0 million for the year ended December 31, 2017

EX 99.1-1

EXHIBIT 99.1

compared to $291.6 million and $210.9 million, respectively for the prior-year period. Natural gas volume throughput averaged 1,748 MMcf/d for the year ended December 31, 2017 compared to 1,528 MMcf/d in the prior-year period. Crude oil and produced water volume throughput averaged 75.2 Mbbl/d for the year ended December 31, 2017 compared to 88.9 Mbbl/d in the prior-year period.

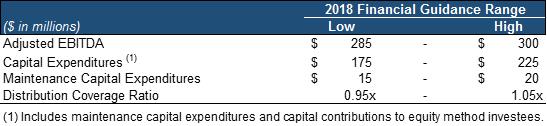

2018 Financial Guidance

SMLP is announcing its 2018 financial guidance, which is summarized in the table below:

SMLP’s 2018 adjusted EBITDA guidance includes approximately $8.0 million of incremental operating expense relative to 2017, related to a higher than normal level of compressor overhaul work and right-of-way repair expense in our Piceance/DJ and Ohio Gathering segments. We expect these costs will revert to more normal levels in 2019. In addition, we are estimating minimal adjusted EBITDA contribution from our northern Delaware and DJ basin natural gas gathering and processing projects in 2018, given the anticipated timing of project commissioning.

Capital expenditures in 2018 will primarily relate to the continued development of SMLP’s northern Delaware Basin gathering and processing system, which is expected to be commissioned in June 2018, and the 60 MMcf/d expansion of SMLP’s DJ Basin processing plant, which is expected to be commissioned in the fourth quarter of 2018. SMLP expects to fund its 2018 capital expenditures under its $1.25 billion revolving credit facility, which was partially repaid in the fourth quarter of 2017 with the net proceeds from the $300.0 million perpetual preferred equity offering.

Mr. Newby commented, “Due to the 2016 Drop Down payment mechanics, the estimated undiscounted amount of the DPPO was reduced by approximately $376.0 million in 2017 to $454.4 million at year end. This Deferred Payment structure is working as designed and is mitigating the negative financial impact to SMLP associated with our customers’ measured pace of near-term development behind our Ohio Gathering and Utica Shale segments. We continue to expect significant growth in our Utica segments in 2019 and beyond. In addition, we expect our northern Delaware Basin and DJ expansion projects to begin to contribute meaningfully to SMLP’s growth in 2019.”

EX 99.1-2

EXHIBIT 99.1

Fourth Quarter 2017 Segment Results

The following table presents average daily throughput by reportable segment:

|

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Average daily throughput (MMcf/d): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica Shale |

|

|

369 |

|

|

|

211 |

|

|

|

365 |

|

|

|

186 |

|

|

Williston Basin |

|

|

19 |

|

|

|

17 |

|

|

|

19 |

|

|

|

22 |

|

|

Piceance/DJ Basins |

|

|

575 |

|

|

|

615 |

|

|

|

595 |

|

|

|

586 |

|

|

Barnett Shale |

|

|

258 |

|

|

|

287 |

|

|

|

267 |

|

|

|

319 |

|

|

Marcellus Shale |

|

|

540 |

|

|

|

374 |

|

|

|

502 |

|

|

|

415 |

|

|

Aggregate average daily throughput |

|

|

1,761 |

|

|

|

1,504 |

|

|

|

1,748 |

|

|

|

1,528 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average daily throughput (Mbbl/d): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Williston Basin |

|

|

74.1 |

|

|

|

82.3 |

|

|

|

75.2 |

|

|

|

88.9 |

|

|

Aggregate average daily throughput |

|

|

74.1 |

|

|

|

82.3 |

|

|

|

75.2 |

|

|

|

88.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio Gathering average daily throughput (MMcf/d) (1) |

|

|

825 |

|

|

|

848 |

|

|

|

766 |

|

|

|

865 |

|

__________

(1) Gross basis, represents 100% of volume throughput for Ohio Gathering, based on a one-month lag.

Utica Shale

The Utica Shale reportable segment includes Summit Midstream Utica (“SMU”), SMLP’s natural gas gathering system, which is currently in service and under development in Belmont and Monroe counties in southeastern Ohio. SMU gathers and delivers dry natural gas to interconnections with a third-party intrastate pipeline that provides access to the Clarington Hub.

Segment adjusted EBITDA for the fourth quarter of 2017 totaled $8.2 million, up 32.9% from $6.1 million for the prior-year period, primarily due to higher volume throughput, which averaged 369 MMcf/d in the fourth quarter of 2017 compared to 211 MMcf/d in the prior-year period and 403 MMcf/d in the third quarter of 2017. Volume throughput for the fourth quarter of 2017 increased relative to the prior-year period due to the completion of 15 new wells in 2017, including two new wells completed late in the fourth quarter of 2017. Relative to the prior-year period, SMU gathered incremental volume throughput in the fourth quarter of 2017 from the TPL-7 Connector Project, which was commissioned in the second quarter of 2017 and accounted for 48 MMcf/d in the fourth quarter of 2017, compared to no volumes in the prior year period, and 74 MMcf/d in the third quarter of 2017. Volume throughput in the fourth quarter of 2017 was down 8.4% relative to the third quarter of 2017, primarily due to our customers temporarily shutting in producing wells throughout the quarter for simultaneous completion activities and maintenance-related work; we estimate that these temporary volume curtailments impacted SMU’s fourth quarter 2017 volumes by approximately 25 MMcf/d. We expect that our customers will continue to implement temporary production curtailments throughout 2018, averaging approximately 10 MMcf/d, as they conduct simultaneous drilling activity on connected pad sites with producing wells.

Our customers currently have one drilling rig running on acreage behind the SMU system, and we have visibility for over 20 new wells behind the TPL-7 Connector Project in 2018, beginning late in the first quarter of 2018. We expect that our customers will operate an additional two drilling rigs behind the SMU system, beginning in the second quarter of 2018. We do not expect new wells from these two drilling rigs to begin flowing until the first quarter of 2019.

Ohio Gathering

The Ohio Gathering reportable segment includes our 40% ownership interest in Ohio Gathering, a natural gas gathering system spanning the condensate, liquids-rich and dry gas windows of the Utica Shale in Harrison,

EX 99.1-3

EXHIBIT 99.1

Guernsey, Noble, Belmont and Monroe counties in southeastern Ohio. This segment also includes our 40% ownership interest in Ohio Condensate, a condensate stabilization facility located in Harrison County, Ohio. Segment adjusted EBITDA for the Ohio Gathering segment includes our proportional share of adjusted EBITDA from Ohio Gathering and Ohio Condensate, based on a one-month lag.

Segment adjusted EBITDA for the fourth quarter of 2017 totaled $12.0 million, an increase of 15.5% from $10.4 million for the prior-year period, primarily due to lower operating expenses and incremental compression revenue, partially offset by lower volume throughput. Volume throughput on the Ohio Gathering system, which is based on a one-month lag, averaged 825 MMcf/d, gross, in the fourth quarter of 2017 compared to 848 MMcf/d, gross, in the prior-year period and 763 MMcf/d, gross, in the third quarter of 2017. Volume throughput in the fourth quarter of 2017 increased relative to the third quarter of 2017 due to the completion of 28 wells behind the system in the third and fourth quarters of 2017, including 7 new wells in the fourth quarter of 2017.

Our customers are currently running four drilling rigs in Ohio Gathering’s operating footprint. We expect volume throughput on Ohio Gathering to be positively impacted by the completion of over 40 new wells throughout 2018, which we expect will begin in the second quarter of 2018. Relative to 2017, we expect higher operating expense in 2018 related to an increase in compressor overhaul work and right-of-way repair expense. We expect these expenses will revert to more normal levels in 2019.

Williston Basin

The Polar and Divide, Tioga Midstream and Bison Midstream systems provide our midstream services for the Williston Basin reportable segment. The Polar and Divide system gathers crude oil production in Williams and Divide counties in North Dakota and delivers to third-party intra- and interstate pipelines as well as third-party rail terminals. The Polar and Divide system also gathers and delivers produced water to various third-party disposal wells in the region. Tioga Midstream is a crude oil, produced water and associated natural gas gathering system in Williams County, North Dakota. All crude oil and natural gas gathered on the Tioga Midstream system is delivered to third-party pipelines, and all produced water is delivered to third-party disposal wells. Bison Midstream gathers associated natural gas production in Mountrail and Burke counties in North Dakota and delivers to third-party pipelines serving a third-party processing plant in Channahon, Illinois.

Segment adjusted EBITDA for the Williston Basin segment totaled $15.2 million for the fourth quarter of 2017 compared to $18.7 million for the prior-year period due to lower volume throughput and lower MVC shortfall payments. Liquids volumes averaged 74.1 Mbbl/d in the fourth quarter of 2017, a decrease of 10.0% from 82.3 Mbbl/d in the prior-year period and roughly flat compared to the third quarter of 2017.

Compared to the prior-year period, fourth quarter 2017 liquids volumes were impacted by natural volume declines, partially offset by 46 new wells in 2017, including 20 new wells late in the fourth quarter of 2017. Liquids volumes were also impacted by operational issues at third-party produced water disposal sites, as well as temporary crude oil production curtailments from certain customers implementing simultaneous completion activities on pad sites with flowing wells. For the fourth quarter of 2017, we estimate that these issues impacted our liquids volumes by nearly 8,000 Bbl/d. The majority of these upstream and downstream issues were resolved in January 2018.

Certain of our customers remain active across the Polar and Divide system, with two drilling rigs currently working. These rigs are adding to an existing backlog of approximately 39 drilled uncompleted wells (“DUCs”) in inventory behind our Polar and Divide gathering system as of December 31, 2017. We expect volume growth to resume behind the Polar and Divide system beginning in the first quarter of 2018 and we expect sequential quarterly volume growth throughout 2018.

Associated natural gas volumes averaged 19 MMcf/d in the fourth quarter of 2017, an increase of 11.8% from 17 MMcf/d in the prior-year period and a decrease of 9.5% from 21 MMcf/d in the third quarter of 2017. Relative to the prior-year period, volume increases were primarily related a two-week suspension of gathering activities on the Bison Midstream system in the fourth quarter of 2016 due to scheduled maintenance on third-party, downstream midstream infrastructure. No new wells were connected during the quarter and we expect 12 new associated natural gas wells in 2018.

EX 99.1-4

EXHIBIT 99.1

The Grand River and the Niobrara G&P systems provide our midstream services for the Piceance/DJ Basins reportable segment. These systems provide natural gas gathering and processing services for producers operating in the Piceance Basin located in western Colorado and eastern Utah and in the Denver-Julesburg (“DJ”) Basin located in northeastern Colorado.

Segment adjusted EBITDA totaled $31.5 million for the fourth quarter of 2017, an increase of 4.5% from $30.1 million for the prior-year period, primarily due to increased volume throughput from the Niobrara G&P system and higher MVC shortfall payments, partially offset by lower volumes on the Grand River system and higher operating expense. Fourth quarter 2017 volume throughput averaged 575 MMcf/d, a decrease of 6.5% from 615 MMcf/d in the prior-year period and a decrease of 3.2% from 594 MMcf/d in the third quarter of 2017. Volume declines relative to the prior-year period were primarily due to natural declines from producing wells on the system, partially offset by the completion of 76 new wells in 2017, including 17 new wells in the fourth quarter of 2017. This activity was partially offset by the impact of our anchor customer’s continued suspension of drilling activities behind our gathering system, and the resulting natural declines from existing production.

Certain of our customers remain active across our Piceance and DJ gathering systems with four drilling rigs currently working. We expect volume growth to resume in this segment beginning in the first quarter of 2018.

Barnett Shale

The DFW Midstream system provides our midstream services for the Barnett Shale reportable segment. This system gathers and delivers low-pressure natural gas received from pad sites, primarily located in southeastern Tarrant County, Texas, to downstream intrastate pipelines serving various natural gas hubs in the region.

Segment adjusted EBITDA for the Barnett Shale segment totaled $10.3 million for the fourth quarter of 2017, a decrease of 23.7% from $13.5 million for the prior-year period, primarily due to lower volume throughput, together with lower MVC shortfall payments. Volume throughput in the fourth quarter of 2017 averaged 258 MMcf/d, which was down 10.1% compared to the prior-year period average of 287 MMcf/d and up 1.6% from 254 MMcf/d in the third quarter of 2017. Volume throughput declined relative to the prior-year period, primarily due to natural production declines, partially offset by the commissioning of seven new wells late in the fourth quarter of 2017.

We have visibility towards our customers commissioning six new wells in the first quarter of 2018. We expect that certain of our customers will operate workover rigs and drilling rigs intermittently in the second and third quarters of 2018 with additional new well completions in the fourth quarter of 2018, resulting in relatively flat volume throughput compared to 2017.

Marcellus Shale

The Mountaineer Midstream system provides our midstream services for the Marcellus Shale reportable segment. This system gathers high-pressure natural gas received from upstream pipeline interconnections with Antero Midstream Partners, LP and Crestwood Equity Partners LP. Natural gas on the Mountaineer Midstream system is delivered to the Sherwood Processing Complex located in Doddridge County, West Virginia.

Segment adjusted EBITDA for the Marcellus Shale segment totaled $6.1 million for the fourth quarter of 2017, an increase of 31.5% from $4.6 million for the prior-year period, primarily due to an increase in volume throughput, partially offset by $0.3 million of higher operating expense related to repair work on certain rights-of-way. Volume throughput for this segment averaged 540 MMcf/d in the fourth quarter of 2017, an increase of 44.4% from 374 MMcf/d in the prior-year period and a decrease of 2.5% from 554 MMcf/d in the third quarter of 2017. Volume throughput growth relative to the prior-year period resulted from our customer completing 27 new wells behind our system in 2017, including 12 new wells in the fourth quarter of 2017.

There are no drilling rigs currently working behind our system. We expect our customer will complete nine new wells, currently in our customer’s DUC inventory, beginning in the second quarter of 2018.

MVC Shortfall Payments

SMLP billed its customers $22.2 million in the fourth quarter of 2017 related to MVCs. For those customers that do not have credit banking mechanisms in their gathering agreements, or do not have the ability to use MVC shortfall

EX 99.1-5

EXHIBIT 99.1

payments as credits, the MVC shortfall payments are accounted for as gathering revenue in the period that they are earned. For the fourth quarter of 2017, SMLP recognized $23.3 million of gathering revenue associated with MVC shortfall payments from certain customers in the Williston Basin, Barnett Shale, Piceance/DJ Basins and Marcellus Shale reportable segments. Of this amount, $1.1 million is related to the deferred revenue recognition associated with a certain Piceance/DJ Basins segment customer that SMLP determined that it would be remote that this customer could ship volumes in excess of its future MVC as an offset to future gathering fees. As such, the customer’s MVC credit bank, as represented as deferred revenue on the balance sheet, was reduced by $1.1 million and recognized as revenue on the income statement.

MVC shortfall payment adjustments in the fourth quarter of 2017 totaled ($7.1) million which was related to MVC shortfall payment adjustments from certain customers in the Piceance/DJ Basins, Williston Basin and Barnett Shale reportable segments.

SMLP’s MVC shortfall payment mechanisms contributed $15.1 million of adjusted EBITDA in the fourth quarter of 2017.

|

|

Three months ended December 31, 2017 |

|

||||||||||||||

|

MVC Billings |

|

|

|

Gathering revenue |

|

|

Adjustments to MVC shortfall payments |

|

|

Net impact to adjusted EBITDA |

|

|||||

|

|

(In thousands) |

|

||||||||||||||

|

Net change in deferred revenue related to MVC shortfall payments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica Shale |

$ |

— |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Williston Basin |

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Piceance/DJ Basins |

|

3,082 |

|

|

|

|

4,169 |

|

|

|

(1,087 |

) |

|

|

3,082 |

|

|

Barnett Shale |

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Marcellus Shale |

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total net change |

$ |

3,082 |

|

|

|

$ |

4,169 |

|

|

$ |

(1,087 |

) |

|

$ |

3,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MVC shortfall payment adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica Shale |

$ |

— |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Williston Basin |

|

9,166 |

|

|

|

|

9,166 |

|

|

|

(5,946 |

) |

|

|

3,220 |

|

|

Piceance/DJ Basins |

|

8,608 |

|

|

|

|

8,608 |

|

|

|

(870 |

) |

|

|

7,738 |

|

|

Barnett Shale |

|

382 |

|

|

|

|

382 |

|

|

|

(284 |

) |

|

|

98 |

|

|

Marcellus Shale |

|

1,007 |

|

|

|

|

1,007 |

|

|

|

— |

|

|

|

1,007 |

|

|

Total MVC shortfall payment adjustments |

$ |

19,163 |

|

|

|

$ |

19,163 |

|

|

$ |

(7,100 |

) |

|

$ |

12,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (1) |

$ |

22,245 |

|

|

|

$ |

23,332 |

|

|

$ |

(8,187 |

) |

|

$ |

15,145 |

|

__________

(1) Exclusive of Ohio Gathering due to equity method accounting.

EX 99.1-6

EXHIBIT 99.1

|

|

Year ended December 31, 2017 |

|

||||||||||||||

|

MVC Billings |

|

|

|

Gathering revenue |

|

|

Adjustments to MVC shortfall payments |

|

|

Net impact to adjusted EBITDA |

|

|||||

|

|

(In thousands) |

|

||||||||||||||

|

Net change in deferred revenue related to MVC shortfall payments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica Shale |

$ |

— |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Williston Basin |

|

— |

|

|

|

|

37,693 |

|

|

|

(37,693 |

) |

|

|

— |

|

|

Piceance/DJ Basins |

|

13,106 |

|

|

|

|

16,171 |

|

|

|

(3,065 |

) |

|

|

13,106 |

|

|

Barnett Shale |

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Marcellus Shale |

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total net change |

$ |

13,106 |

|

|

|

$ |

53,864 |

|

|

$ |

(40,758 |

) |

|

$ |

13,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MVC shortfall payment adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica Shale |

$ |

— |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Williston Basin |

|

12,958 |

|

|

|

|

12,958 |

|

|

|

— |

|

|

|

12,958 |

|

|

Piceance/DJ Basins |

|

28,608 |

|

|

|

|

28,608 |

|

|

|

(3 |

) |

|

|

28,605 |

|

|

Barnett Shale |

|

4,032 |

|

|

|

|

4,032 |

|

|

|

(612 |

) |

|

|

3,420 |

|

|

Marcellus Shale |

|

4,398 |

|

|

|

|

4,398 |

|

|

|

— |

|

|

|

4,398 |

|

|

Total MVC shortfall payment adjustments |

$ |

49,996 |

|

|

|

$ |

49,996 |

|

|

$ |

(615 |

) |

|

$ |

49,381 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (1) |

$ |

63,102 |

|

|

|

$ |

103,860 |

|

|

$ |

(41,373 |

) |

|

$ |

62,487 |

|

__________

(1) Exclusive of Ohio Gathering due to equity method accounting.

Capital Expenditures

Capital expenditures totaled $41.9 million in the fourth quarter of 2017, including $3.9 million of contributions to equity method investees, maintenance capital expenditures of approximately $4.0 million and approximately $5.0 million related to SMLP’s acquisition of strategic rights-of-way located in the northern Delaware Basin. Development activities during the fourth quarter of 2017 were primarily related to the procurement and development of associated natural gas gathering and processing infrastructure in the northern Delaware Basin, as well as ongoing expansion of SMLP’s gathering systems in the Utica Shale, Piceance/DJ Basins and Williston Basin segments.

Capital & Liquidity

As of December 31, 2017, SMLP had $261.0 million of outstanding debt under its $1.25 billion revolving credit facility and $989.0 million of available borrowing capacity, subject to covenant limits. Based upon the terms of SMLP’s revolving credit facility and total outstanding debt of $1.06 billion (inclusive of $800.0 million of senior unsecured notes), SMLP’s total leverage and senior secured leverage ratios (as defined in the credit agreement) as of December 31, 2017 were 3.62 to 1.0 and 0.89 to 1.0, respectively.

In November 2017, SMLP issued $300.0 million of 9.50% Series A Fixed-to-Floating Cumulative Redeemable Perpetual Preferred Units (the “Preferred Equity”), representing limited partner interests in SMLP. The net proceeds from this Preferred Equity were used to repay approximately $293.0 million of outstanding borrowings under SMLP’s revolving credit facility.

Deferred Purchase Price Obligation

The consideration for the 2016 Drop Down consisted of (i) an initial $360.0 million cash payment (the “Initial Payment”) which was funded on March 3, 2016 with borrowings under SMLP’s revolving credit facility and (ii) a deferred payment which will be paid no later than December 31, 2020 (the “Deferred Purchase Price Obligation,” “DPPO” or “Deferred

EX 99.1-7

EXHIBIT 99.1

Payment,” as defined below). At the discretion of the board of directors of SMLP’s general partner, the Deferred Payment can be made in either cash or SMLP common units, or a combination thereof.

The Deferred Payment will be equal to: (a) six-and-one-half (6.5) multiplied by the average Business Adjusted EBITDA of the 2016 Drop Down Assets for 2018 and 2019, less the G&A Adjuster, as defined in the Contribution Agreement; less (b) the Initial Payment; less (c) all capital expenditures incurred for the 2016 Drop Down Assets between March 3, 2016 and December 31, 2019; plus (d) all Business Adjusted EBITDA from the 2016 Drop Down Assets between March 3, 2016 and December 31, 2019, less the Cumulative G&A Adjuster, as defined in the Contribution Agreement.

The Deferred Payment calculation was designed to ensure that, during the deferral period, all of the EBITDA growth and capex development risk associated with the 2016 Drop Down Assets is held by the GP, Summit Investments. The Deferred Payment was structured such that SMLP will ultimately pay a 6.5x multiple of the actual EBITDA generated from the 2016 Drop Down Assets in 2018 and 2019.

SMLP reduced the estimated undiscounted amount of the Deferred Payment related to the 2016 Drop Down transaction from $656.5 million at September 30, 2017 to $454.4 million at December 31, 2017. The reduction is primarily related to updated Utica Shale well connection estimates in 2018 and 2019. The structure of the Deferred Payment insulates SMLP from this volume risk, and as a result, we have reduced the future obligation of SMLP.

A slower pace of growth capital expenditures, particularly in the Utica Shale, is also expected.

Quarterly Distribution

On January 25, 2018, the board of directors of SMLP’s general partner declared a quarterly cash distribution of $0.575 per unit on all of its outstanding common units, or $2.30 per unit on an annualized basis, for the quarter ended December 31, 2017. This quarterly distribution remains unchanged from the previous quarter and from the quarter ended December 31, 2016. This distribution was paid on February 14, 2018, to unitholders of record as of the close of business on February 7, 2018.

Fourth Quarter 2017 Earnings Call Information

SMLP will host a conference call at 10:00 a.m. Eastern on Friday, February 23, 2018, to discuss its quarterly operating and financial results. Interested parties may participate in the call by dialing 847-585-4405 or toll-free 888-771-4371 and entering the passcode 46320995. The conference call will also be webcast live and can be accessed through the Investors section of SMLP's website at www.summitmidstream.com.

A replay of the conference call will be available until March 9, 2018 at 11:59 p.m. Eastern, and can be accessed by dialing 888-843-7419 and entering the replay passcode 46320995#. An archive of the conference call will also be available on SMLP's website.

Upcoming Investor Conferences

Members of SMLP’s senior management team will participate in the Barclays Select Series: MLP Corporate Access Day in New York, New York, on February 27, 2018, and in the Morgan Stanley Utilities, Clean Tech and Midstream Energy Conference in New York, New York on February 28, 2018. The presentation materials associated with these events will be accessible through the Investors section of SMLP’s website at www.summitmidstream.com prior to the beginning of each conference.

Use of Non-GAAP Financial Measures

We report financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). We also present adjusted EBITDA and distributable cash flow, each a non-GAAP financial measure. We define adjusted EBITDA as net income or loss, plus interest expense, income tax expense, depreciation and amortization, our proportional adjusted EBITDA for equity method investees, adjustments related to MVC shortfall payments, unit-based and noncash compensation, Deferred Purchase Price Obligation, early extinguishment of debt expense, impairments and other noncash expenses or losses, less interest income, income tax benefit, income (loss) from equity method investees and other noncash income or gains. We define distributable cash flow as adjusted EBITDA plus cash interest received and cash taxes received, less cash interest paid, senior notes interest adjustment, cash taxes paid and maintenance capital expenditures. Because adjusted EBITDA and distributable cash flow may be

EX 99.1-8

EXHIBIT 99.1

defined differently by other entities in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other entities, thereby diminishing their utility.

Management uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating our financial performance. Furthermore, management believes that these non-GAAP financial measures may provide external users of our financial statements, such as investors, commercial banks, research analysts and others, with additional meaningful comparisons between current results and results of prior periods as they are expected to be reflective of our core ongoing business.

Adjusted EBITDA and distributable cash flow are used as supplemental financial measures by external users of our financial statements such as investors, commercial banks, research analysts and others.

Adjusted EBITDA is used to assess:

|

|

• |

the ability of our assets to generate cash sufficient to make cash distributions and support our indebtedness; |

|

|

• |

the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; |

|

|

• |

our operating performance and return on capital as compared to those of other entities in the midstream energy sector, without regard to financing or capital structure; |

|

|

• |

the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities; and |

|

|

• |

the financial performance of our assets without regard to (i) income or loss from equity method investees, (ii) the impact of the timing of minimum volume commitments shortfall payments under our gathering agreements or (iii) the timing of impairments or other noncash income or expense items. |

Distributable cash flow is used to assess:

|

|

• |

the ability of our assets to generate cash sufficient to make future cash distributions and |

|

|

• |

the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities. |

Both of these measures have limitations as analytical tools and investors should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. For example:

|

|

• |

certain items excluded from adjusted EBITDA and distributable cash flow are significant components in understanding and assessing an entity's financial performance, such as an entity's cost of capital and tax structure; |

|

|

• |

adjusted EBITDA and distributable cash flow do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

|

|

• |

adjusted EBITDA and distributable cash flow do not reflect changes in, or cash requirements for, our working capital needs; and |

|

|

• |

although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and adjusted EBITDA and distributable cash flow do not reflect any cash requirements for such replacements. |

We compensate for the limitations of adjusted EBITDA and distributable cash flow as analytical tools by reviewing the comparable GAAP financial measures, understanding the differences between the financial measures and incorporating these data points into our decision-making process. Reconciliations of GAAP to non-GAAP financial measures are attached to this press release.

We do not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because we are unable to predict, without unreasonable effort, certain components thereof including, but not limited to, (i) income or loss from equity method investees, (ii) deferred purchase price obligation and (iii) asset impairments. These items are inherently uncertain and depend on various factors, many of which are

EX 99.1-9

EXHIBIT 99.1

beyond our control. As such, any associated estimate and its impact on our GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.

About Summit Midstream Partners, LP

SMLP is a growth-oriented limited partnership focused on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in the continental United States. SMLP provides natural gas, crude oil and produced water gathering services pursuant to primarily long-term and fee-based gathering and processing agreements with customers and counterparties in five unconventional resource basins: (i) the Appalachian Basin, which includes the Marcellus and Utica shale formations in West Virginia and Ohio; (ii) the Williston Basin, which includes the Bakken and Three Forks shale formations in North Dakota; (iii) the Fort Worth Basin, which includes the Barnett Shale formation in Texas; (iv) the Piceance Basin, which includes the Mesaverde formation as well as the Mancos and Niobrara shale formations in Colorado and Utah; and (v) the Denver-Julesburg Basin, which includes the Niobrara and Codell shale formations in Colorado and Wyoming. SMLP is in the process of developing new gathering and processing infrastructure in a sixth basin, the Delaware Basin, in New Mexico. SMLP also owns substantially all of a 40% ownership interest in Ohio Gathering, which is developing natural gas gathering and condensate stabilization infrastructure in the Utica Shale in Ohio. SMLP is headquartered in The Woodlands, Texas, with regional corporate offices in Denver, Colorado, Atlanta, Georgia, Pittsburgh, Pennsylvania and Dallas, Texas.

About Summit Midstream Partners, LLC

Summit Midstream Partners, LLC (“Summit Investments”) beneficially owns a 35.4% limited partner interest in SMLP and indirectly owns and controls the general partner of SMLP, Summit Midstream GP, LLC, which has sole responsibility for conducting the business and managing the operations of SMLP. Summit Investments is a privately held company controlled by Energy Capital Partners II, LLC, and certain of its affiliates. An affiliate of Energy Capital Partners II, LLC directly owns an 8.1% limited partner interest in SMLP.

Forward-Looking Statements

This press release includes certain statements concerning expectations for the future that are forward-looking within the meaning of the federal securities laws. Forward-looking statements contain known and unknown risks and uncertainties (many of which are difficult to predict and beyond management’s control) that may cause SMLP’s actual results in future periods to differ materially from anticipated or projected results. An extensive list of specific material risks and uncertainties affecting SMLP is contained in its 2016 Annual Report on Form 10-K as updated and superseded by the Current Report on Form 8-K filed with the Securities and Exchange Commission on November 6, 2017, and as amended and updated from time to time. Any forward-looking statements in this press release are made as of the date of this press release and SMLP undertakes no obligation to update or revise any forward-looking statements to reflect new information or events.

We do not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because we are unable to predict, without unreasonable effort, certain components thereof including, but not limited to, (i) income or loss from equity method investees, (ii) deferred purchase price obligation and (iii) asset impairments. These items are inherently uncertain and depend on various factors, many of which are beyond our control. As such, any associated estimate and its impact on our GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.

EX 99.1-10

EXHIBIT 99.1

SUMMIT MIDSTREAM PARTNERS, LP AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

December 31, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

|

|

(In thousands) |

|

|||||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,430 |

|

|

$ |

7,428 |

|

|

Accounts receivable |

|

|

72,301 |

|

|

|

97,364 |

|

|

Other current assets |

|

|

4,327 |

|

|

|

4,309 |

|

|

Total current assets |

|

|

78,058 |

|

|

|

109,101 |

|

|

Property, plant and equipment, net |

|

|

1,795,129 |

|

|

|

1,853,671 |

|

|

Intangible assets, net |

|

|

301,345 |

|

|

|

421,452 |

|

|

Goodwill |

|

|

16,211 |

|

|

|

16,211 |

|

|

Investment in equity method investees |

|

|

690,485 |

|

|

|

707,415 |

|

|

Other noncurrent assets |

|

|

13,565 |

|

|

|

7,329 |

|

|

Total assets |

|

$ |

2,894,793 |

|

|

$ |

3,115,179 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Partners' Capital |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

16,375 |

|

|

$ |

16,251 |

|

|

Accrued expenses |

|

|

12,499 |

|

|

|

11,389 |

|

|

Due to affiliate |

|

|

1,088 |

|

|

|

258 |

|

|

Deferred revenue |

|

|

4,000 |

|

|

|

— |

|

|

Ad valorem taxes payable |

|

|

8,329 |

|

|

|

10,588 |

|

|

Accrued interest |

|

|

12,310 |

|

|

|

17,483 |

|

|

Accrued environmental remediation |

|

|

3,130 |

|

|

|

4,301 |

|

|

Other current liabilities |

|

|

11,258 |

|

|

|

11,471 |

|

|

Total current liabilities |

|

|

68,989 |

|

|

|

71,741 |

|

|

Long-term debt |

|

|

1,051,192 |

|

|

|

1,240,301 |

|

|

Deferred Purchase Price Obligation |

|

|

362,959 |

|

|

|

563,281 |

|

|

Deferred revenue |

|

|

12,707 |

|

|

|

57,465 |

|

|

Noncurrent accrued environmental remediation |

|

|

2,214 |

|

|

|

5,152 |

|

|

Other noncurrent liabilities |

|

|

7,063 |

|

|

|

7,566 |

|

|

Total liabilities |

|

|

1,505,124 |

|

|

|

1,945,506 |

|

|

|

|

|

|

|

|

|

|

|

|

Series A Preferred Units |

|

|

294,426 |

|

|

|

— |

|

|

Common limited partner capital |

|

|

1,056,510 |

|

|

|

1,129,132 |

|

|

General Partner interests |

|

|

27,920 |

|

|

|

29,294 |

|

|

Noncontrolling interest |

|

|

10,813 |

|

|

|

11,247 |

|

|

Total partners' capital |

|

|

1,389,669 |

|

|

|

1,169,673 |

|

|

Total liabilities and partners' capital |

|

$ |

2,894,793 |

|

|

$ |

3,115,179 |

|

EX 99.1-11

EXHIBIT 99.1

SUMMIT MIDSTREAM PARTNERS, LP AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

|

|

(In thousands, except per-unit amounts) |

|

|||||||||||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gathering services and related fees |

|

$ |

95,543 |

|

|

$ |

111,378 |

|

|

$ |

394,427 |

|

|

$ |

345,961 |

|

|

Natural gas, NGLs and condensate sales |

|

|

23,804 |

|

|

|

10,086 |

|

|

|

68,459 |

|

|

|

35,833 |

|

|

Other revenues |

|

|

6,852 |

|

|

|

5,619 |

|

|

|

25,855 |

|

|

|

20,568 |

|

|

Total revenues |

|

|

126,199 |

|

|

|

127,083 |

|

|

|

488,741 |

|

|

|

402,362 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of natural gas and NGLs |

|

|

20,909 |

|

|

|

7,281 |

|

|

|

57,237 |

|

|

|

27,421 |

|

|

Operation and maintenance |

|

|

23,871 |

|

|

|

23,023 |

|

|

|

93,882 |

|

|

|

95,334 |

|

|

General and administrative |

|

|

14,311 |

|

|

|

14,287 |

|

|

|

54,681 |

|

|

|

52,410 |

|

|

Depreciation and amortization |

|

|

29,291 |

|

|

|

28,569 |

|

|

|

115,475 |

|

|

|

112,239 |

|

|

Transaction costs |

|

|

(46 |

) |

|

|

25 |

|

|

|

73 |

|

|

|

1,321 |

|

|

(Gain) Loss on asset sales, net |

|

|

(3 |

) |

|

|

69 |

|

|

|

527 |

|

|

|

93 |

|

|

Long-lived asset impairment |

|

|

187,125 |

|

|

|

23 |

|

|

|

188,702 |

|

|

|

1,764 |

|

|

Total costs and expenses |

|

|

275,458 |

|

|

|

73,277 |

|

|

|

510,577 |

|

|

|

290,582 |

|

|

Other income |

|

|

84 |

|

|

|

24 |

|

|

|

298 |

|

|

|

116 |

|

|

Interest expense |

|

|

(16,248 |

) |

|

|

(16,160 |

) |

|

|

(68,131 |

) |

|

|

(63,810 |

) |

|

Early extinguishment of debt |

|

|

(19 |

) |

|

|

— |

|

|

|

(22,039 |

) |

|

|

— |

|

|

Deferred Purchase Price Obligation |

|

|

145,648 |

|

|

|

(24,738 |

) |

|

|

200,322 |

|

|

|

(55,854 |

) |

|

(Loss) income before income taxes and income (loss) from equity method investees |

|

|

(19,794 |

) |

|

|

12,932 |

|

|

|

88,614 |

|

|

|

(7,768 |

) |

|

Income tax benefit (expense) |

|

|

76 |

|

|

|

66 |

|

|

|

(341 |

) |

|

|

(75 |

) |

|

Income (loss) from equity method investees |

|

|

1,468 |

|

|

|

997 |

|

|

|

(2,223 |

) |

|

|

(30,344 |

) |

|

Net (loss) income |

|

$ |

(18,250 |

) |

|

$ |

13,995 |

|

|

$ |

86,050 |

|

|

$ |

(38,187 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per limited partner unit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common unit – basic |

|

$ |

(0.32 |

) |

|

$ |

0.16 |

|

|

$ |

0.99 |

|

|

$ |

(0.71 |

) |

|

Common unit – diluted |

|

$ |

(0.32 |

) |

|

$ |

0.16 |

|

|

$ |

0.98 |

|

|

$ |

(0.71 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average limited partner units outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common units – basic |

|

|

73,068 |

|

|

|

72,096 |

|

|

|

72,705 |

|

|

|

68,264 |

|

|

Common units – diluted |

|

|

73,068 |

|

|

|

72,096 |

|

|

|

73,047 |

|

|

|

68,264 |

|

EX 99.1-12

EXHIBIT 99.1

SUMMIT MIDSTREAM PARTNERS, LP AND SUBSIDIARIES

UNAUDITED OTHER FINANCIAL AND OPERATING DATA

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

|

(Dollars in thousands) |

|

|||||||||||||

|

Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(18,250 |

) |

|

$ |

13,995 |

|

|

$ |

86,050 |

|

|

$ |

(38,187 |

) |

|

Net cash provided by operating activities |

$ |

41,335 |

|

|

$ |

61,790 |

|

|

$ |

237,832 |

|

|

$ |

230,495 |

|

|

Capital expenditures |

$ |

38,009 |

|

|

$ |

19,984 |

|

|

$ |

124,215 |

|

|

$ |

142,719 |

|

|

Contributions to equity method investees |

$ |

3,932 |

|

|

$ |

11,425 |

|

|

$ |

25,513 |

|

|

$ |

31,582 |

|

|

Acquisitions of gathering systems (1) |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

866,858 |

|

|

Adjusted EBITDA |

$ |

72,923 |

|

|

$ |

72,721 |

|

|

$ |

290,387 |

|

|

$ |

291,601 |

|

|

Distributable cash flow |

$ |

49,173 |

|

|

$ |

52,802 |

|

|

$ |

205,010 |

|

|

$ |

210,906 |

|

|

Distributions declared (2) |

$ |

45,054 |

|

|

$ |

44,452 |

|

|

$ |

179,705 |

|

|

$ |

170,981 |

|

|

Distribution coverage ratio (3) |

1.09x |

|

|

1.19x |

|

|

1.14x |

|

|

1.23x |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aggregate average daily throughput – natural gas (MMcf/d) |

|

1,761 |

|

|

|

1,504 |

|

|

|

1,748 |

|

|

|

1,528 |

|

|

Aggregate average daily throughput – liquids (Mbbl/d) |

|

74.1 |

|

|

82.3 |

|

|

|

75.2 |

|

|

|

88.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio Gathering average daily throughput (MMcf/d) (4) |

825 |

|

|

848 |

|

|

766 |

|

|

865 |

|

||||

__________

(1) Reflects cash and noncash consideration, including working capital and capital expenditure adjustments paid (received), for acquisitions and/or drop downs.

(2) Represents distributions declared to common unitholders in respect of a given period. For example, for the three months ended December 31, 2017, represents the distributions paid in February 2018.

(3) Distribution coverage ratio calculation for the three months ended December 31, 2017 and 2016 is based on distributions declared to common unitholders in respect of the fourth quarter of 2017 and 2016. Represents the ratio of distributable cash flow to distributions declared.

(4) Gross basis, represents 100% of volume throughput for Ohio Gathering, based on a one-month lag.

EX 99.1-13

EXHIBIT 99.1

SUMMIT MIDSTREAM PARTNERS, LP AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF REPORTABLE SEGMENT ADJUSTED EBITDA

TO ADJUSTED EBITDA

|

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

|

|

(In thousands) |

|

|||||||||||||

|

Reportable segment adjusted EBITDA (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Utica Shale |

|

$ |

8,154 |

|

|

$ |

6,137 |

|

|

$ |

34,011 |

|

|

$ |

21,035 |

|

|

Ohio Gathering (2) |

|

|

12,045 |

|

|

|

10,429 |

|

|

|

41,246 |

|

|

|

45,602 |

|

|

Williston Basin |

|

|

15,237 |

|

|

|

18,730 |

|

|

|

66,413 |

|

|

|

79,475 |

|

|

Piceance/DJ Basins |

|

|

31,481 |

|

|

|

30,121 |

|

|

|

117,737 |

|

|

|

109,241 |

|

|

Barnett Shale |

|

|

10,308 |

|

|

|

13,516 |

|

|

|

46,232 |

|

|

|

54,634 |

|

|

Marcellus Shale |

|

|

6,113 |

|

|

|

4,649 |

|

|

|

23,888 |

|

|

|

19,203 |

|

|

Total |

|

$ |

83,338 |

|

|

$ |

83,582 |

|

|

$ |

329,527 |

|

|

$ |

329,190 |

|

|

Less Corporate and other (3) |

|

|

10,415 |

|

|

|

10,861 |

|

|

|

39,140 |

|

|

|

37,589 |

|

|

Adjusted EBITDA |

|

$ |

72,923 |

|

|

$ |

72,721 |

|

|

$ |

290,387 |

|

|

$ |

291,601 |

|

__________

(1) We define segment adjusted EBITDA as total revenues less total costs and expenses; plus (i) other income excluding interest income, (ii) our proportional adjusted EBITDA for equity method investees, (iii) depreciation and amortization, (iv) adjustments related to MVC shortfall payments, (v) unit-based and noncash compensation, (vi) change in the Deferred Purchase Price Obligation, (vii) early extinguishment of debt expense, (viii) impairments and (ix) other noncash expenses or losses, less other noncash income or gains.

(2) Represents our proportional share of adjusted EBITDA for Ohio Gathering, based on a one-month lag. We define proportional adjusted EBITDA for our equity method investees as the product of (i) total revenues less total expenses, excluding impairments and other noncash income or expense items and (ii) amortization for deferred contract costs; multiplied by our ownership interest in Ohio Gathering during the respective period.

(3) Corporate and other represents those results that are not specifically attributable to a reportable segment or that have not been allocated to our reportable segments, including certain general and administrative expense items, natural gas and crude oil marketing services, transaction costs, interest expense, early extinguishment of debt and a change in the Deferred Purchase Price Obligation.

EX 99.1-14

EXHIBIT 99.1

SUMMIT MIDSTREAM PARTNERS, LP AND SUBSIDIARIES

UNAUDITED RECONCILIATIONS TO NON-GAAP FINANCIAL MEASURES

|

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

|

|

(In thousands) |

|

|||||||||||||

|

Reconciliations of net income or loss to adjusted EBITDA and distributable cash flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(18,250 |

) |

|

$ |

13,995 |

|

|

$ |

86,050 |

|

|

$ |

(38,187 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

16,248 |

|

|

|

16,160 |

|

|

|

68,131 |

|

|

|

63,810 |

|

|

Income tax (benefit) expense |

|

|

(76 |

) |

|

|

(66 |

) |

|

|

341 |

|

|

|

75 |

|

|

Depreciation and amortization (1) |

|

|

29,140 |

|

|

|

28,603 |

|

|

|

114,872 |

|

|

|

112,661 |

|

|

Proportional adjusted EBITDA for equity method investees (2) |

|

|

12,045 |

|

|

|

10,429 |

|

|

|

41,246 |

|

|

|

45,602 |

|

|

Adjustments related to MVC shortfall payments (3) |

|

|

(8,187 |

) |

|

|

(22,218 |

) |

|

|

(41,373 |

) |

|

|

11,600 |

|

|

Unit-based and noncash compensation |

|

|

1,978 |

|

|

|

1,985 |

|

|

|

7,951 |

|

|

|

7,985 |

|

|

Deferred Purchase Price Obligation (4) |

|

|

(145,648 |

) |

|

|

24,738 |

|

|

|

(200,322 |

) |

|

|

55,854 |

|

|

Early extinguishment of debt (5) |

|

|

19 |

|

|

|

— |

|

|

|

22,039 |

|

|

|

— |

|

|

(Gain) loss on asset sales, net |

|

|

(3 |

) |

|

|

69 |

|

|

|

527 |

|

|

|

93 |

|

|

Long-lived asset impairment |

|

|

187,125 |

|

|

|

23 |

|

|

|

188,702 |

|

|

|

1,764 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from equity method investees |

|

|

1,468 |

|

|

|

997 |

|

|

|

(2,223 |

) |

|

|

(30,344 |

) |

|

Adjusted EBITDA |

|

$ |

72,923 |

|

|

$ |

72,721 |

|

|

$ |

290,387 |

|

|

$ |

291,601 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash taxes received |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

50 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash interest paid |

|

|

24,078 |

|

|

|

5,783 |

|

|

|

71,488 |

|

|

|

63,000 |

|

|

Senior notes interest adjustment (6) |

|

|

(7,855 |

) |

|

|

9,750 |

|

|

|

(5,261 |

) |

|

|

— |

|

|

Distributions to Series A Preferred unitholders (7) |

|

|

2,375 |

|

|

|

— |

|

|

|

2,375 |

|

|

|

— |

|

|

Series A Preferred units distribution adjustment (8) |

|

|

1,188 |

|

|

|

— |

|

|

|

1,188 |

|

|

|

— |

|

|

Maintenance capital expenditures |

|

|

3,964 |

|

|

|

4,386 |

|

|

|

15,587 |

|

|

|

17,745 |

|

|

Distributable cash flow |

|

$ |

49,173 |

|

|

$ |

52,802 |

|

|

$ |

205,010 |

|

|

$ |

210,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared (9) |

|

$ |

45,054 |

|

|

$ |

44,452 |

|

|

$ |

179,705 |

|

|

$ |

170,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution coverage ratio (10) |

|

1.09x |

|

|

1.19x |

|

|

1.14x |

|

|

1.23x |

|

||||

__________

(1) Includes the amortization expense associated with our favorable and unfavorable gas gathering contracts as reported in other revenues.

(2) Reflects our proportionate share of Ohio Gathering adjusted EBITDA, based on a one-month lag.

(3) Adjustments related to MVC shortfall payments account for (i) the net increases or decreases in deferred revenue for MVC shortfall payments and (ii) our inclusion of expected annual MVC shortfall payments.

(4) Deferred Purchase Price Obligation represents the change in the present value of the Deferred Purchase Price Obligation.

(5) Early extinguishment of debt includes $17.9 million paid for redemption and call premiums, as well as $4.1 million of unamortized debt issuance costs which were written off in connection with the repurchase of the outstanding $300.0 million 7.5% Senior Notes in the first quarter of 2017.

(6) Senior notes interest adjustment represents the net of interest expense accrued and paid during the period. Interest on the $300.0 million 5.5% senior notes is paid in cash semi-annually in arrears on February 15 and August 15 until maturity in August 2022. Interest on the $500.0 million 5.75% senior notes is paid in cash semi-annually in arrears on April 15 and October 15, beginning October 15, 2017 until maturity in April 2025.

EX 99.1-15

EXHIBIT 99.1

(7) Distributions on the Series A preferred units are paid in cash semi-annually in arrears on June 15 and December 15 each year, beginning on December 15, 2017 through and including December 15, 2022, and, thereafter, quarterly in arrears on the 15th day of March, June, September and December of each year.

(8) Series A Preferred unit distribution adjustment represents the distributions accrued on the Series A preferred units.

(9) Represents distributions declared to common unitholders in respect of a given period. For example, for the three months ended December 31, 2017, represents the distributions paid in February 2018.

(10) Distribution coverage ratio calculation for the three months ended December 31, 2017 and 2016 is based on distributions declared in respect of the fourth quarter of 2017 and 2016. Represents the ratio of distributable cash flow to distributions declared.

EX 99.1-16

EXHIBIT 99.1

SUMMIT MIDSTREAM PARTNERS, LP AND SUBSIDIARIES

UNAUDITED RECONCILIATIONS TO NON-GAAP FINANCIAL MEASURES

|

|

|

Year ended December 31, |

|

|||||

|

|

|

2017 |

|

|

2016 |

|

||

|

|

|

|

|

|||||

|

Reconciliation of net cash provided by operating activities to adjusted EBITDA and distributable cash flow: |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

237,832 |

|

|

$ |

230,495 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

Interest expense, excluding amortization of debt issuance costs |

|

|

63,973 |

|

|

|

59,834 |

|

|

Income tax expense |

|

|

341 |

|

|

|

75 |

|

|

Changes in operating assets and liabilities |

|

|

28,890 |

|

|

|

(11,014 |

) |

|

Proportional adjusted EBITDA for equity method investees (1) |

|

|

41,246 |

|

|

|

45,602 |

|

|

Adjustments related to MVC shortfall payments (2) |

|

|

(41,373 |

) |

|

|

11,600 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

Distributions from equity method investees |

|

|

40,220 |

|

|

|

44,991 |

|

|

Write-off of debt issuance costs |

|

|

302 |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

290,387 |

|

|

$ |

291,601 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

Cash taxes received |

|

|

— |

|

|

|

50 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

Cash interest paid |

|

|

71,488 |

|

|

|

63,000 |

|

|

Senior notes interest adjustment (3) |

|

|

(5,261 |

) |

|

|

— |

|

|

Distributions to Series A Preferred unitholders (4) |

|

|

2,375 |

|

|

|

— |

|

|

Series A Preferred units distribution adjustment (5) |

|

|

1,188 |

|

|

|

— |

|

|

Maintenance capital expenditures |

|

|

15,587 |

|

|

|

17,745 |

|

|

Distributable cash flow |

|

$ |

205,010 |

|

|

$ |

210,906 |

|

__________

(1) Reflects our proportionate share of Ohio Gathering adjusted EBITDA, based on a one-month lag.

(2) Adjustments related to MVC shortfall payments account for (i) the net increases or decreases in deferred revenue for MVC shortfall payments and (ii) our inclusion of expected annual MVC shortfall payments.

(3) Senior notes interest adjustment represents the net of interest expense accrued and paid during the period. Interest on the $300.0 million 5.5% senior notes is paid in cash semi-annually in arrears on February 15 and August 15 until maturity in August 2022. Interest on the $500.0 million 5.75% senior notes is paid in cash semi-annually in arrears on April 15 and October 15, beginning October 15, 2017 until maturity in April 2025.

(4) Distributions on the Series A preferred units are paid in cash semi-annually in arrears on June 15 and December 15 each year, beginning on December 15, 2017 through and including December 15, 2022, and, thereafter, quarterly in arrears on the 15th day of March, June, September and December of each year.

(5) Series A Preferred unit distribution adjustment represents the distributions accrued on the Series A preferred units.

Contact: Marc Stratton, Senior Vice President and Treasurer, 832-608-6166, ir@summitmidstream.com

SOURCE: Summit Midstream Partners, LP

EX 99.1-17