Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYNASIL CORP OF AMERICA | tv486645_8k.htm |

Exhibit 99.1

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick, Chairman, President and CEO February 22, 2018

2 Forward - Looking Statements The statements made in this presentation which are not statements of historical fact are forward looking statements within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Forward - looking statements involve known and unknown risks, uncertainties and other factors . The words “potential,” “develop,” “promising,” “believe,” “will,” “would,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “may,” “likely,” “could,” and other expressions which are predictions of or indicate future events and trends and which do not constitute historical matters identify forward - looking statements . Forward - looking statements include statements regarding management’s discussion of the company’s strategic plans and objectives and the development of, and potential market for, Xcede’s product pipeline . Future results of operations, projections, and expectations, which may relate to this presentation, involve certain risks and uncertainties that could cause actual results to differ materially from the forward - looking statements . Factors that would cause or contribute to such differences include, but are not limited to, our ability to develop and commercialize the Xcede patch, including obtaining regulatory approvals, the size and growth of the potential markets for our products and our ability to serve those markets, the rate and degree of market acceptance of any of our products, our ability to identify acquisition and other strategic opportunities, our ability to obtain and maintain intellectual property protection for our products, competition, the loss of key management and technical personnel, the availability of financing sources, as well as the factors detailed in the Company's Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as in the Company's other Securities and Exchange Commission filings . We undertake no obligation to update the foregoing information to reflect subsequently occurring events or circumstances .

3 Corporate Objectives - Ongoing 1. Continued growth in Optics revenue through organic growth and opportunistic acquisitions. 2. Conversion of job shop revenue stream across the Optics companies to more predictable, longer term, recurring revenue. • 2018 launch of HEAR/IR business • 2018 launch of optical assembly business 3. Develop technology and transfer into commercial development: • RMD scintillator technology (CLYC, CsI , Thin Film, SrI , HRM) • Dynasil Biomedical – Xcede Patch, Intellectual Property 4. Maintain conformity with loan covenants. Improve overall cost of capital through conversion to lower cost funding where possible. 5. Capital allocation to support the above objectives . 6. Focus on shareholder returns.

4 Financial Summary Fiscal Year 2017 vs. 2016 Revenue decreased from $43.4 million in fiscal 2016 to $37.3 million in 2017. • Optics revenue decreased 19%, from $23.7 million to $19.3 million. (Details to follow, but essentially one customer.) • Contract Research revenue decreased 9 %, from $19.8 million to $18.0 million Net Income from Operations, pre - Xcede of $815,000 vs. $2,749,000 in 2016, an decrease of 70% Net Loss from Operations of $582,000 versus Net Income from Operations of $679,000 in the prior year, an decrease of 186%

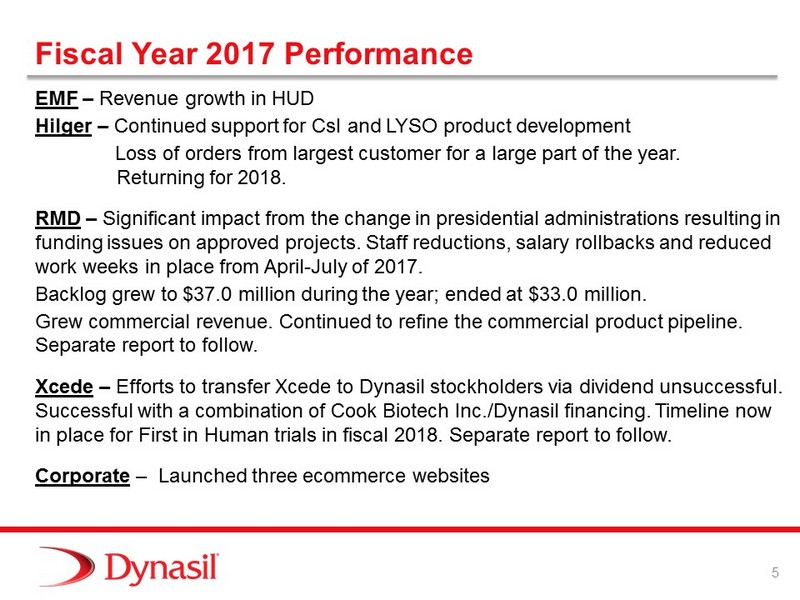

5 Fiscal Year 2017 Performance EMF – Revenue growth in HUD Hilger – Continued support for CsI and LYSO product development Loss of orders from largest customer for a large part of the year. Returning for 2018. RMD – Significant impact from the change in presidential administrations resulting in funding issues on approved projects. Staff reductions, salary rollbacks and reduced work weeks in place from April - July of 2017. Backlog grew to $37.0 million during the year; ended at $33.0 million. Grew commercial revenue. Continued to refine the commercial product pipeline. Separate report to follow. Xcede – Efforts to transfer Xcede to Dynasil stockholders via dividend unsuccessful. Successful with a combination of Cook Biotech Inc./Dynasil financing. Timeline now in place for First in Human trials in fiscal 2018. Separate report to follow. Corporate – Launched three ecommerce websites

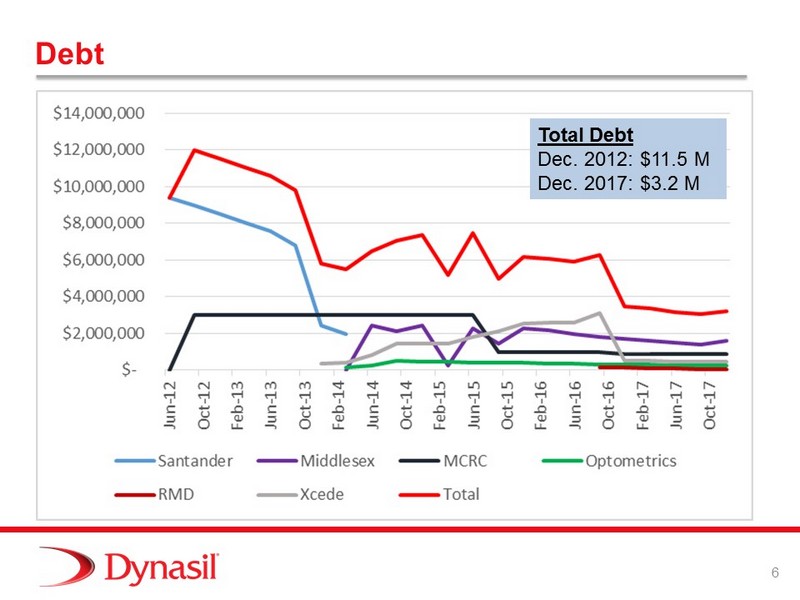

6 Debt Total Debt Dec. 2012: $11.5 M Dec. 2016: $3.5 M Total Debt Dec. 2012: $11.5 M Dec. 2017: $3.2 M

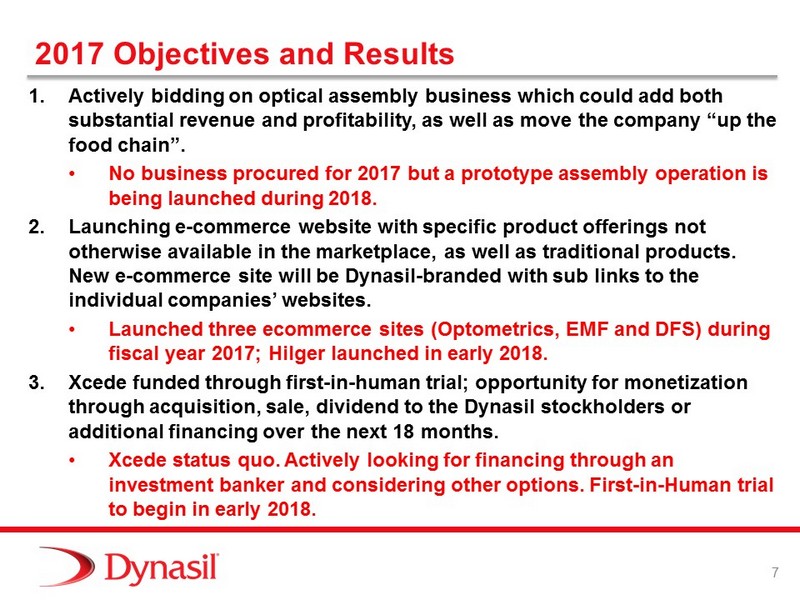

7 2017 Objectives and Results 1. Actively bidding on optical assembly business which could add both substantial revenue and profitability, as well as move the company “up the food chain ”. • No business procured for 2017 but a prototype assembly operation is being launched during 2018. 2. Launching e - commerce website with specific product offerings not otherwise available in the marketplace, as well as traditional products. New e - commerce site will be Dynasil - branded with sub links to the individual companies’ websites. • Launched three ecommerce sites (Optometrics, EMF and DFS) during fiscal year 2017; Hilger launched in early 2018. 3. Xcede funded through first - in - human trial; opportunity for monetization through acquisition, sale, dividend to the Dynasil stockholders or additional financing over the next 18 months. • Xcede status quo. Actively looking for financing through an investment banker and considering other options. First - in - Human trial to begin in early 2018.

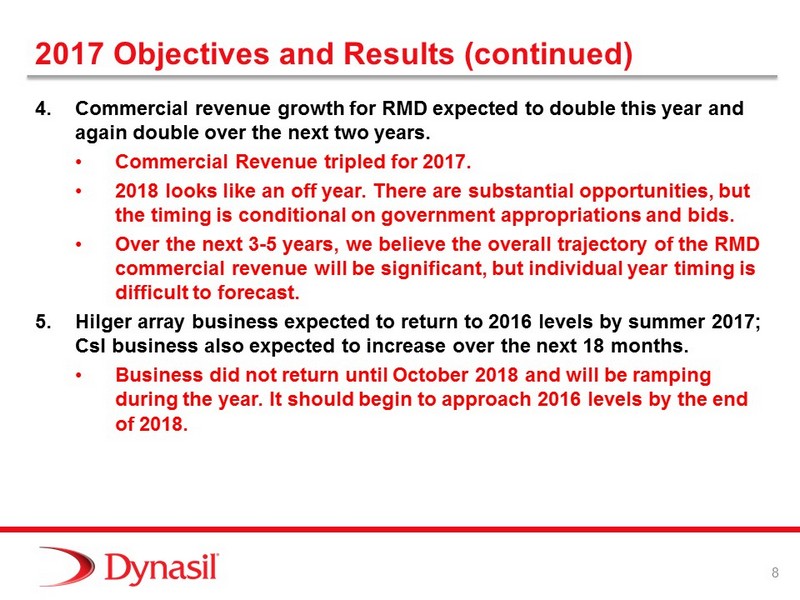

8 2017 Objectives and Results (continued) 4. Commercial revenue growth for RMD expected to double this year and again double over the next two years. • Commercial Revenue tripled for 2017. • 2018 looks like an off year. There are substantial opportunities, but the timing is conditional on government appropriations and bids. • Over the next 3 - 5 years, we believe the overall trajectory of the RMD commercial revenue will be significant, but individual year timing is difficult to forecast. 5. Hilger array business expected to return to 2016 levels by summer 2017; CsI business also expected to increase over the next 18 months. • Business did not return until October 2018 and will be ramping during the year. It should begin to approach 2016 levels by the end of 2018.

9 The Future: 2018 - 2019 • Launch and procure business for both the HEAR/IR and Optics assembly business. • Processes and equipment necessary for HEAR/IR to be procured and installed by the third quarter of 2018. • Continued development of a long - term strategic plan. • Continued support of Xcede through clinical trial. Financing will be necessary during 2018. • Focus on marketing – maximizing exposure of products through ecommerce websites, generation of leads for sales teams, planning for and implementation of CRM system. VP of Marketing to be added.

10 Dynasil Annual Stockholders’ Meeting February 22, 2018 Linda Zuckerman, Ph.D. President & CEO

11 Where we stand today….

Focus Our Vision: Dedicated to the development and commercialization of innovative surgical, hemostatic, trauma, and sealant products Our Strengths: Experienced Management Strong Strategic Partners Unique Technology Deep Pipeline Large Markets Intellectual Property (IP) Protection Our Goal: Bring superior products to the surgical space that benefit both patients and hospital payors while building value to our investors 12

Xcede Corporate Accomplishments 2017 Increased cash runway: Managed costs to remain 30% under budget Evaluated in - licensing and out licensing opportunities: Increased Xcede’s visibility in market as a “player” to be watched Intellectual Property: Awarded 3 patents for Tissue Patch and Adhesive family ; filed numerous patent applications outside the U.S. to increase IP coverage world wide Transition company standing: Moved company from “Start - up” to “Clinical & Pre - Commercial” stage 13

Xcede Patch Accomplishments 2017 PreClinical : Completed Efficacy and Safety Testing of the Xcede Patch Manufacturing at Cook Biotech Inc: Validated Good Manufacturing Practices (GMP) Regulatory: Submitted Xcede Patch dossier to the Medical Research Ethics Committee in Netherlands for clinical trial Clinical: Identified clinical trial sites and L ead Investigator, completed clinical protocol (liver resection), & all key clinical documents. eCRF and database builds Lead Commercial Product: Xcede Hemostatic Patch for mild to moderate surgical bleeding when suture, ligature or cautery are ineffective or impractical 14

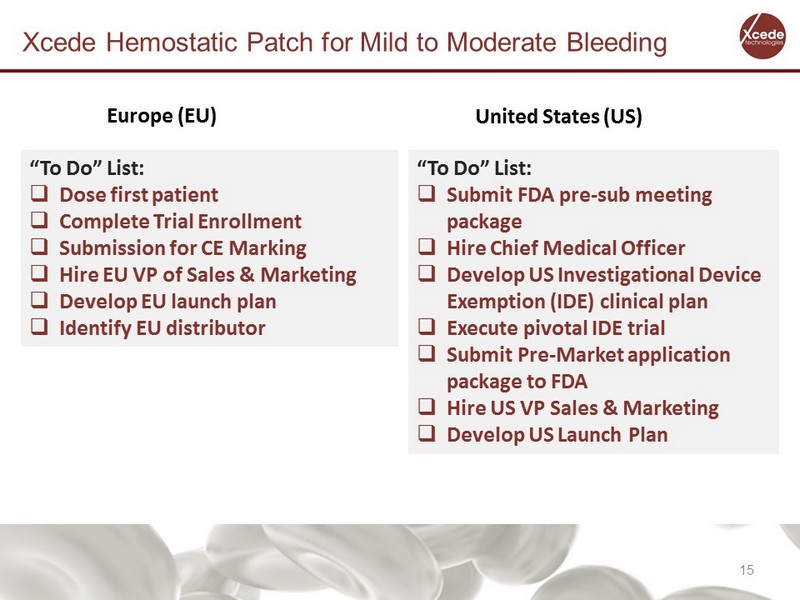

Xcede Hemostatic Patch for Mild to Moderate Bleeding “To Do” List: □ Dose first patient □ Complete Trial Enrollment □ Submission for CE Marking □ Hire EU VP of Sales & Marketing □ Develop EU launch plan □ Identify EU distributor Europe (EU) United States (US) “To Do” List: □ Submit FDA pre - sub meeting p ackage □ Hire Chief Medical Officer □ Develop US Investigational Device Exemption (IDE) clinical plan □ Execute pivotal IDE trial □ Submit Pre - Market application package to FDA □ Hire US VP Sales & Marketing □ Develop US Launch Plan 15

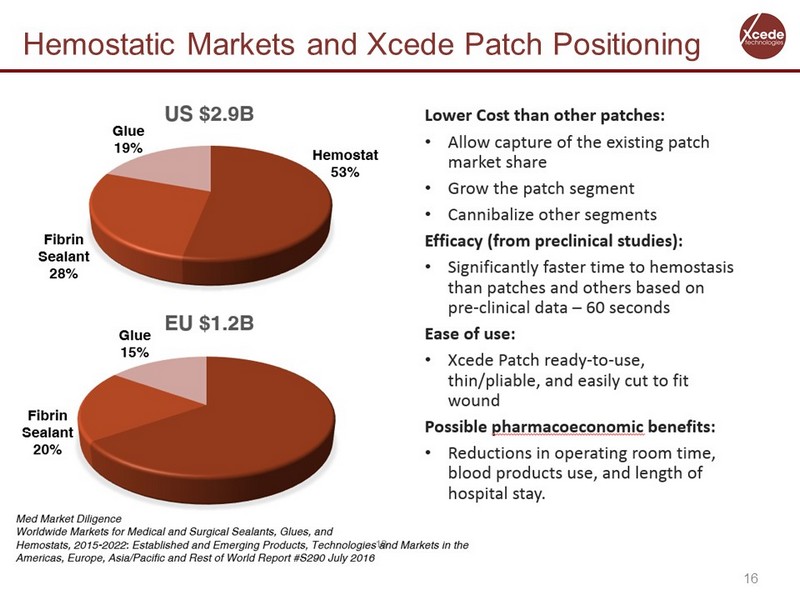

16 Hemostatic Markets and Xcede Patch Positioning

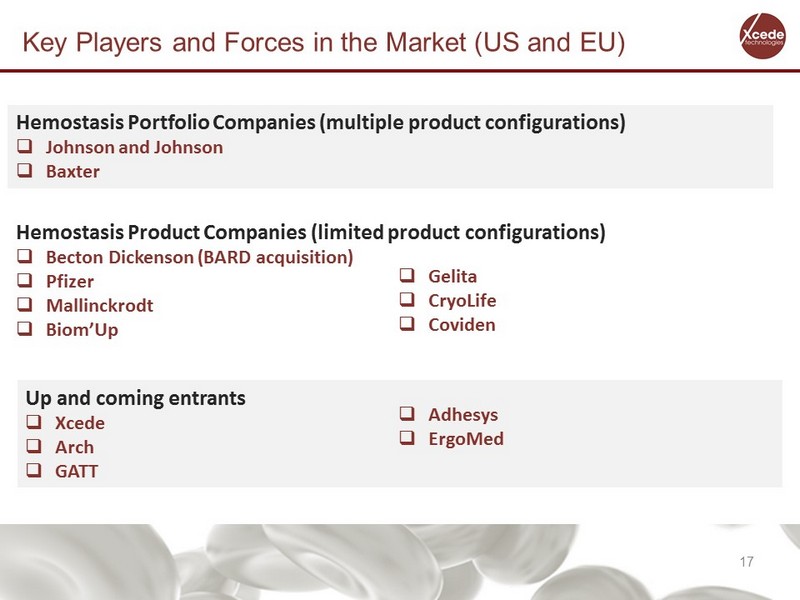

Key Players and Forces in the Market (US and EU) Hemostasis Portfolio Companies (multiple product configurations) □ Johnson and Johnson □ Baxter Hemostasis Product Companies (limited product configurations) □ Becton Dickenson (BARD acquisition) □ Pfizer □ Mallinckrodt □ Biom’Up Up and coming entrants □ Xcede □ Arch □ GATT □ Gelita □ CryoLife □ Coviden □ Adhesys □ ErgoMed 17

RMD Highlights Kanai Shah, Ph.D. President February 21, 2018

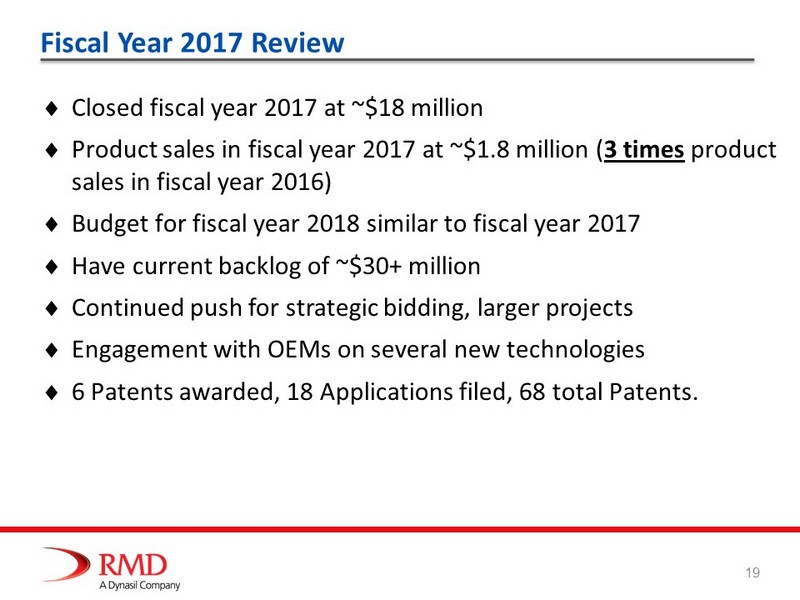

Fiscal Year 2017 Review 19 Closed f iscal year 2017 at ~ $18 million Product sales in fiscal year 2017 at ~$1.8 million ( 3 times product sales in fiscal year 2016) Budget for fiscal year 20 18 similar to fiscal year 20 17 Have current backlog of ~$30+ m illion Continued push for strategic bidding, larger projects Engagement with OEMs on several new technologies 6 Patents a warded, 18 Applications filed, 68 t otal P atents.

Current Development Projects of Interest 20

21 Nearly two - thirds of all cancer patients will receive radiation therapy Radiation kills cancer cells by damaging their DNA by: • Creating oxygen free radicals that damage DNA • As the cancer grows inner regions are depleted of oxygen • These regions may still contain viable cancer cells • These remaining cells can cause the cancer to recur • In vitro studies show similar treatment effect at half the dose UV - Emitting Nanoparticles for Targeting Hypoxic Tumors Hypoxic cells are resistant to radiotherapy 0.0 0.5 1.0 2.5 5.0 7.5 0.0 0.5 1.0 2.5 5.0 7.5 1 10 100 Concentration of NPs, mg x ml -1 S u r v i v i n g f r a c t i o n , % 0 Gy 2 Gy * * * * * * *

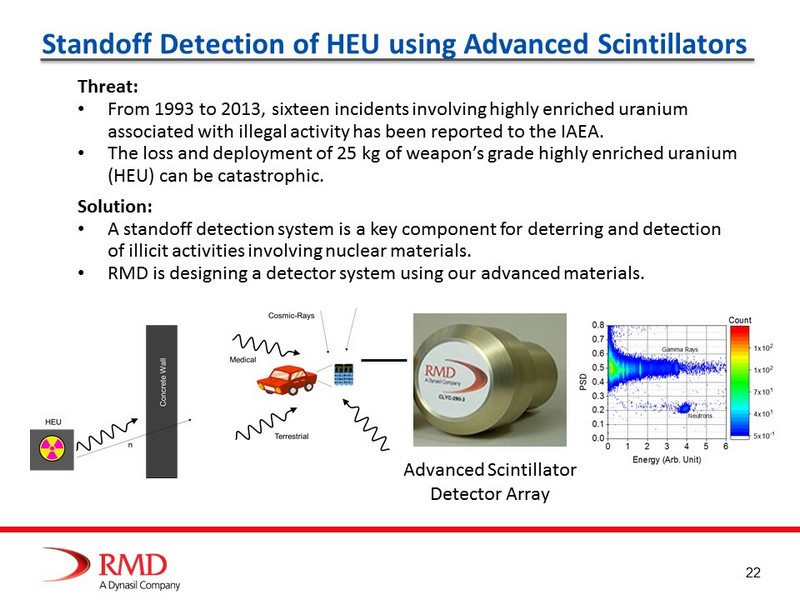

22 Standoff Detection of HEU using Advanced Scintillators Advanced Scintillator Detector Array Threat: • From 1993 to 2013, sixteen incidents involving highly enriched uranium associated with illegal activity has been reported to the IAEA. • The loss and deployment of 25 kg of weapon’s grade highly enriched uranium (HEU) can be catastrophic. Solution: • A standoff detection system is a key component for deterring and detection of illicit activities involving nuclear materials. • RMD is designing a detector system using our advanced materials.

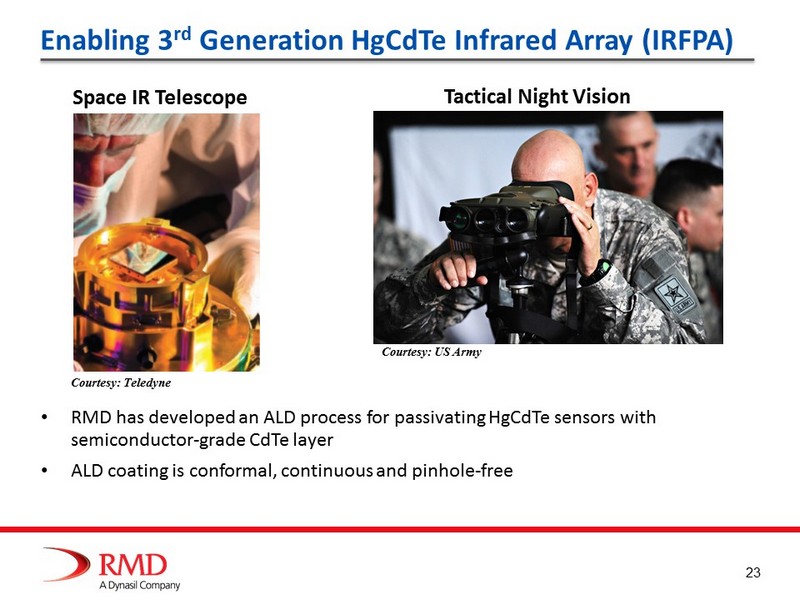

23 Enabling 3 rd Generation HgCdTe Infrared Array (IRFPA) Space IR Telescope Tactical Night Vision Courtesy: Teledyne Courtesy: US Army • RMD has developed an ALD process for passivating HgCdTe sensors with semiconductor - grade CdTe layer • ALD coating is conformal, continuous and pinhole - free

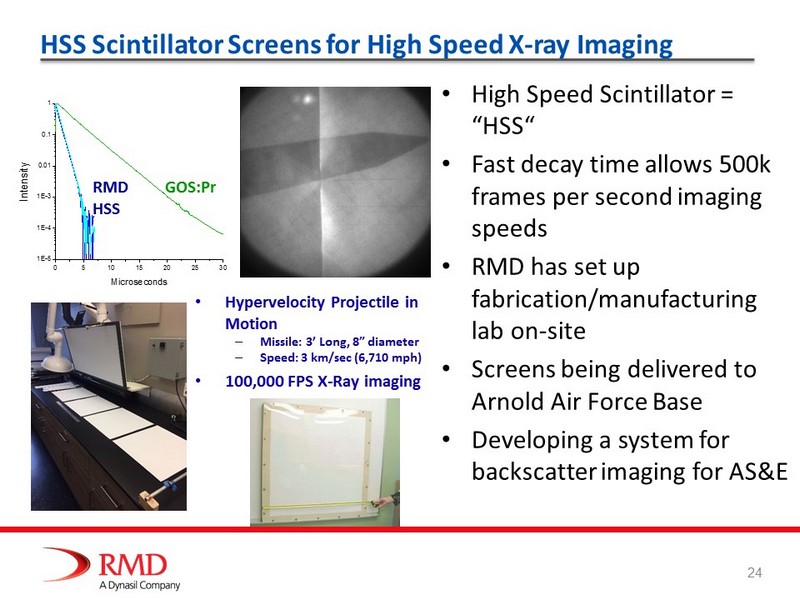

HSS Scintillator Screens for High Speed X - ray Imaging • High Speed Scintillator = “HSS“ • Fast decay time allows 500k frames per second imaging speeds • RMD has set up fabrication/manufacturing lab on - site • Screens being delivered to Arnold Air Force Base • Developing a system for backscatter imaging for AS&E 0 5 10 15 20 25 30 1E-5 1E-4 1E-3 0.01 0.1 1 Intensity Microseconds GOSPr BFB50 BFBnolam RMD HSS GOS:Pr • Hypervelocity Projectile in Motion – Missile: 3’ Long, 8” diameter – Speed: 3 km/sec (6,710 mph) • 100,000 FPS X - Ray imaging 24

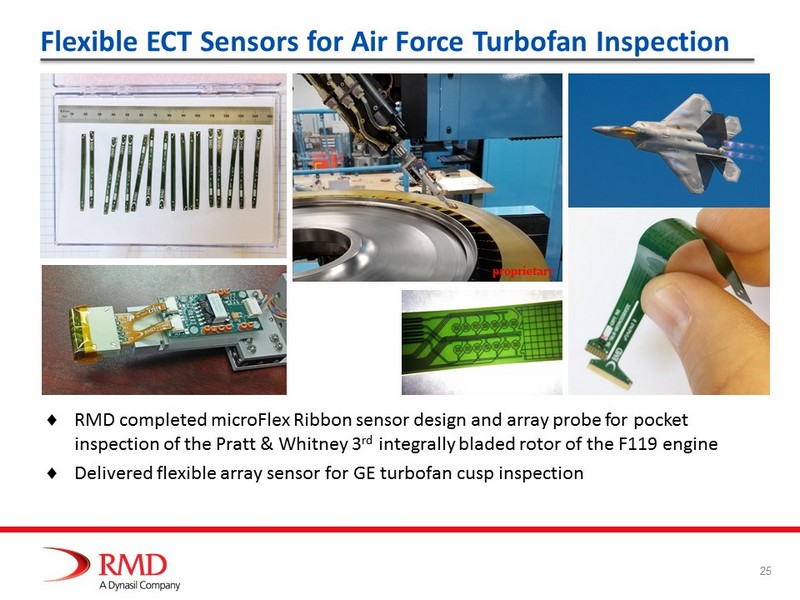

Flexible ECT Sensors for Air Force Turbofan Inspection RMD completed microFlex Ribbon sensor design and array probe for pocket inspection of the Pratt & Whitney 3 rd integrally bladed rotor of the F119 engine Delivered flexible array sensor for GE turbofan cusp inspection proprietary 25

26 TlBr Cherenkov Light Detection for Fast Timing T= 370 ps

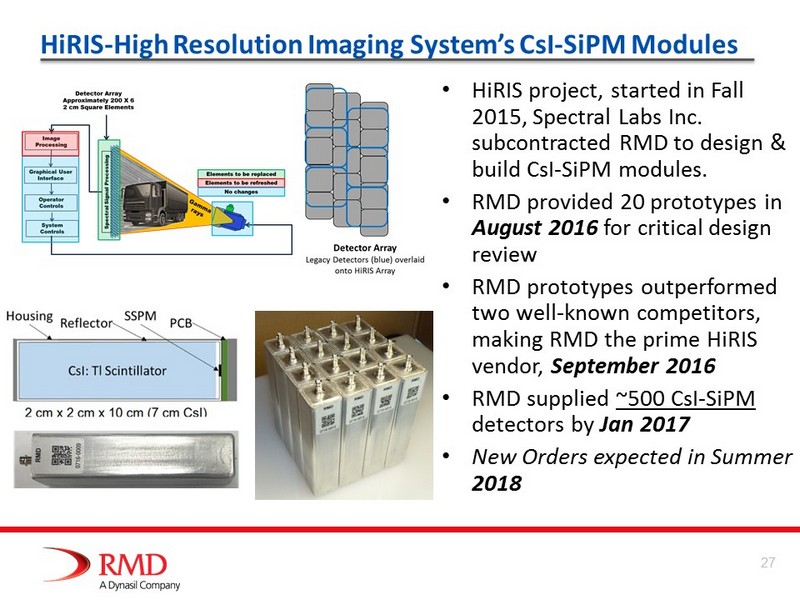

HiRIS - High Resolution Imaging System’s CsI - SiPM Modules • HiRIS project, started in Fall 2015, Spectral Labs Inc. subcontracted RMD to design & build CsI - SiPM modules. • RMD provided 20 prototypes in August 2016 for critical design review • RMD prototypes outperformed two well - known competitors, making RMD the prime HiRIS vendor, September 2016 • RMD supplied ~500 CsI - SiPM detectors by Jan 2017 • New Orders expected in Summer 2018 27

Dynasil Optics Gary J. Bishop, Ph.D. Executive Vice President, Photonics

Dynasil Optics Capabilities ▪ Optical Coatings x Diamond - Like Carbon x High - Efficiency Anti - Reflection x Precision Optical ▪ Fused silica fabrication ▪ Holographic recording (replication) ▪ Mechanical rulings ▪ Optical component manufacturing ▪ Photolithography Products ▪ Beamsplitters ▪ Custom coated optics ▪ Diffraction gratings ▪ Filters ▪ Fused silica blanks ▪ Holographic wire - grid polarizers ▪ Infrared components ▪ Infrared polarizers ▪ Mirrors ▪ Monochromators 29

2018 New Initiatives Anti - Reflective Infrared Optics ▪ $3.5 billion market serving the defense, automotive and industrial industries ▪ Investing in capital equipment and hired key industry veterans with over 30 years experience to exploit poorly served market ▪ Dynasil’s value proposition to customers • Provide both the protective Diamond Like Carbon (DLC) coating and High Efficiency Anti Reflective (HEAR) Infrared coatings so customers have a “One - Stop Shop” • Developed coatings that can be stripped from substrate, allowing expensive substrates to be reused Develop Capability to Manufacture Optical Assemblies ▪ Upgrading facility and expertise to vertically integrate ▪ Able to capture higher revenue business and provide more value to the customer 30

New Initiatives: Infrared Optics Target Markets and Products Applications/Products Infrared Thermal Imaging Optoelectronics Plano Windows Meniscus Lenses Aspheric Lenses Fixed Focus Assemblies Continuous Zoom Lenses Automotive Defense/Aerospace 31

New Initiatives: Develop Capability to Produce Optical Assemblies ▪ Upgrade existing facility to allow Dynasil to manufacture optical components and basic optical assemblies ▪ Planned facility upgrades: • Build out clean space assembly floor • HEPA filtered room • Laminar flow benches (ISO 5, Class 1,000) ▪ Will expand capabilities as business grows 32

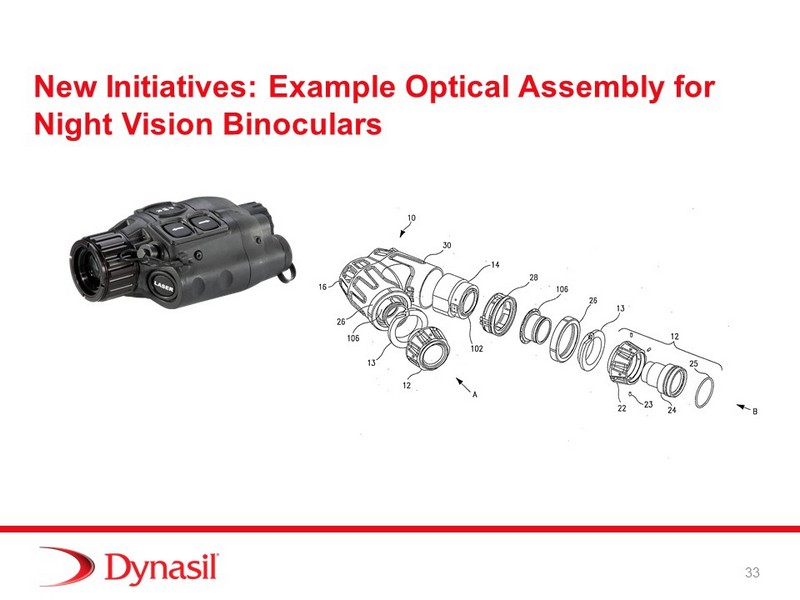

New Initiatives: Example Optical Assembly for Night Vision Binoculars 33

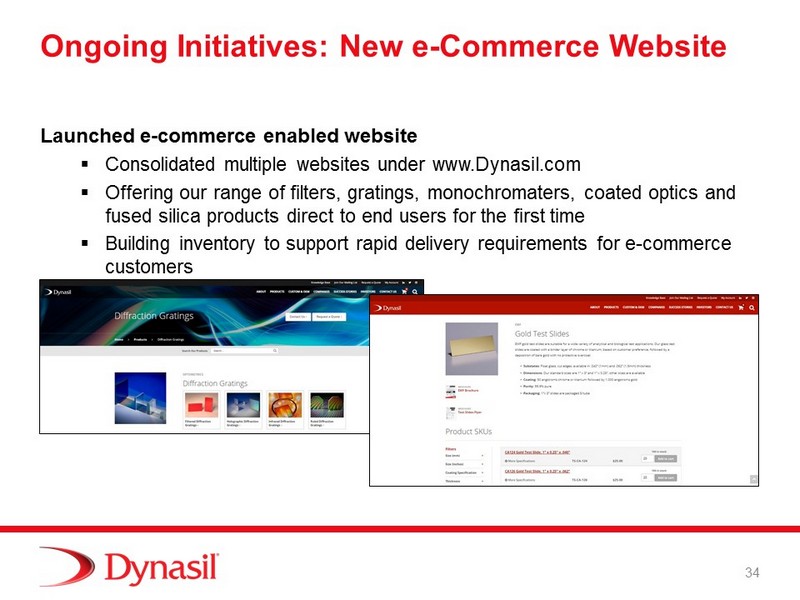

Ongoing Initiatives: New e - Commerce Website Launched e - commerce enabled website ▪ Consolidated multiple websites under www.Dynasil.com ▪ Offering our range of filters, gratings, monochromaters , coated optics and fused silica products direct to end users for the first time ▪ Building inventory to support rapid delivery requirements for e - commerce customers 34

Ongoing Initiatives Optical material precision blank fabrication ▪ Strong 2018 demand primarily driven by electronics industry ▪ Used in the manufacturing of electronics, lasers, optical components, scientific instruments, semiconductors, telecom equipment, and an assortment of energy and aerospace applications ▪ Authorized distributor of Corning HPFS® 7980 and ULE® 7972 and 7973 ▪ Equipped to cut, core and fine grind into any shape, in prototype and production quantities ▪ Continue to promote Dynasil Fused Silica branding which is known in the optics industry for quality and service 35

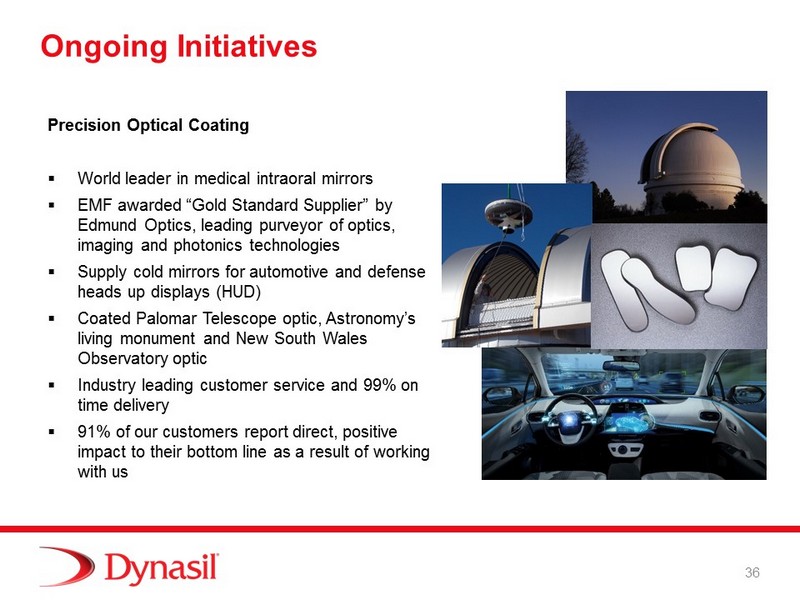

Ongoing Initiatives Precision Optical Coating ▪ World leader in medical intraoral mirrors ▪ EMF awarded “Gold Standard Supplier” by Edmund Optics, leading purveyor of optics, imaging and photonics technologies ▪ Supply cold mirrors for automotive and defense heads up displays (HUD) ▪ Coated Palomar Telescope optic, Astronomy’s living monument and New South Wales Observatory optic ▪ Industry leading customer service and 99% on time delivery ▪ 91% of our customers report direct, positive impact to their bottom line as a result of working with us 36

37 Questions

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick, Chairman, President and CEO February 22, 2018