Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - AMETEK INC/ | d507265dex322.htm |

| EX-32.1 - EX-32.1 - AMETEK INC/ | d507265dex321.htm |

| EX-31.2 - EX-31.2 - AMETEK INC/ | d507265dex312.htm |

| EX-31.1 - EX-31.1 - AMETEK INC/ | d507265dex311.htm |

| EX-23 - EX-23 - AMETEK INC/ | d507265dex23.htm |

| EX-21 - EX-21 - AMETEK INC/ | d507265dex21.htm |

| EX-12 - EX-12 - AMETEK INC/ | d507265dex12.htm |

| EX-10.12 - EX-10.12 - AMETEK INC/ | d507265dex1012.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-12981

AMETEK, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 14-1682544 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 1100 Cassatt Road Berwyn, Pennsylvania |

19312-1177 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (610) 647-2121

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 Par Value (voting) |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ |

Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | |||

| (Do not check if a smaller reporting company) | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $14.0 billion as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s Common Stock outstanding as of January 31, 2018 was 231,334,609.

Documents Incorporated by Reference

Part III incorporates information by reference from the Proxy Statement for the Annual Meeting of Stockholders on May 8, 2018.

Table of Contents

2017 Form 10-K Annual Report

Table of Contents

1

Table of Contents

PART I

| Item 1. | Business |

General Development of Business

AMETEK, Inc. (“AMETEK” or the “Company”) is incorporated in Delaware. Its predecessor was originally incorporated in Delaware in 1930 under the name American Machine and Metals, Inc. AMETEK is a leading global manufacturer of electronic instruments and electromechanical devices with operations in North America, Europe, Asia and South America. AMETEK maintains its principal executive offices in suburban Philadelphia at 1100 Cassatt Road, Berwyn, Pennsylvania, 19312. Listed on the New York Stock Exchange (symbol: AME), the common stock of AMETEK is a component of the Standard and Poor’s 500 and the Russell 1000 Indices.

Website Access to Information

AMETEK’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 are made available free of charge on the Company’s website at www.ametek.com in the “Investors – Financial News and Information” section as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission. AMETEK has posted free of charge on the investor information portion of its website its corporate governance guidelines, Board committee charters and codes of ethics. Those documents also are available in published form free of charge to any stockholder who requests them by writing to the Investor Relations Department at AMETEK, Inc., 1100 Cassatt Road, Berwyn, Pennsylvania, 19312.

Products and Services

AMETEK’s products are marketed and sold worldwide through two operating groups: Electronic Instruments (“EIG”) and Electromechanical (“EMG”). Electronic Instruments is a leader in the design and manufacture of advanced instruments for the process, power and industrial, and aerospace markets. Electromechanical is a differentiated supplier of precision motion control solutions, thermal management systems, specialty metals and electrical interconnects. Its end markets include aerospace and defense, medical, automation, mass transit and other industrial markets.

Competitive Strengths

Management believes AMETEK has significant competitive advantages that help strengthen and sustain its market positions. Those advantages include:

Significant Market Share. AMETEK maintains significant market share in a number of targeted niche markets through its ability to produce and deliver high-quality products at competitive prices. EIG has significant market positions in niche segments of the process, power and industrial, and aerospace markets. EMG holds significant positions in niche segments of the aerospace and defense, automation, medical and mass transit markets.

Technological and Development Capabilities. AMETEK believes it has certain technological advantages over its competitors that allow it to maintain its leading market positions. Historically, it has demonstrated an ability to develop innovative new products and solutions that anticipate customer needs. It has consistently added to its investment in research, development and engineering, and improved its new product development efforts with the adoption of Design for Six Sigma and Value Analysis/Value Engineering methodologies. These have improved the pace and quality of product innovation and resulted in the introduction of a steady stream of new products across all of AMETEK’s lines of business.

2

Table of Contents

Efficient and Low-Cost Manufacturing Operations. Through its Operational Excellence initiatives, AMETEK has established a lean manufacturing platform for its businesses. In its effort to achieve best-cost manufacturing, as of December 31, 2017, AMETEK had plants in Brazil, China, the Czech Republic, Malaysia, Mexico, and Serbia. These plants offer proximity to customers and provide opportunities for increasing international sales. Acquisitions also have allowed AMETEK to reduce costs and achieve operating synergies by consolidating operations, product lines and distribution channels, benefitting both of AMETEK’s operating groups.

Experienced Management Team. Another component of AMETEK’s success is the strength of its management team and that team’s commitment to improving Company performance. AMETEK senior management has extensive industry experience and an average of approximately 25 years of AMETEK service. The management team is focused on achieving results, building stockholder value and continually growing AMETEK. Individual performance is tied to financial results through Company-established stock ownership guidelines and equity incentive programs.

Business Strategy

AMETEK is committed to achieving earnings growth through the successful implementation of a Corporate Growth Plan. The goal of that plan is double-digit annual percentage growth in sales and earnings per share over the business cycle and a superior return on total capital. In addition, other financial initiatives have been or may be undertaken, including public and private debt or equity issuance, bank debt refinancing, local financing in certain foreign countries and share repurchases.

AMETEK’s Corporate Growth Plan consists of four key strategies:

Operational Excellence. Operational Excellence is AMETEK’s cornerstone strategy for accelerating growth, improving profit margins and strengthening its competitive position across its businesses. Operational Excellence focuses on initiatives to drive increased organic sales growth, improvements in operating efficiencies and sustainable practices. It emphasizes team building and a participative management culture. AMETEK’s Operational Excellence strategies include lean manufacturing, global sourcing, Design for Six Sigma, Value Engineering/Value Analysis and growth kaizens. Each plays an important role in improving efficiency, enhancing the pace and quality of innovation and driving profitable sales growth. Operational Excellence initiatives have yielded lower operating and administrative costs, shortened manufacturing cycle times, resulted in higher cash flow from operations and increased customer satisfaction. They also have played a key role in achieving synergies from newly acquired companies.

Strategic Acquisitions. Acquisitions are a key to achieving the goals of AMETEK’s Corporate Growth Plan. Since the beginning of 2013 through December 31, 2017, AMETEK has completed 18 acquisitions with annualized sales totaling over $1 billion, including three acquisitions in 2017 (see “Recent Acquisitions”). AMETEK targets companies that offer the right strategic, technical and cultural fit. It seeks to acquire businesses in adjacent markets with complementary products and technologies. It also looks for businesses that provide attractive growth opportunities, often in new and emerging markets. Through these and prior acquisitions, AMETEK’s management team has developed considerable skill in identifying, acquiring and integrating new businesses. As it has executed its acquisition strategy, AMETEK’s mix of businesses has shifted toward those that are more highly differentiated and, therefore, offer better opportunities for growth and profitability.

Global & Market Expansion. AMETEK has experienced strong growth outside the United States, reflecting an expanding international customer base, investments in our global infrastructure and the attractive growth potential of its businesses in overseas markets. While Europe remains its largest overseas market, AMETEK has pursued growth opportunities worldwide, especially in key emerging markets. It has grown sales in Latin America and Asia by strategically building, acquiring and expanding manufacturing

3

Table of Contents

facilities. AMETEK also has expanded its sales and service capabilities in China and enhanced its sales presence and engineering capabilities in India. Elsewhere in Asia and in the Middle East, it has expanded sales, service and technical support. Recently acquired businesses have further added to AMETEK’s international presence.

New Products. New products are essential to AMETEK’s long-term growth. As a result, AMETEK has maintained a consistent investment in new product development and engineering. In 2017, AMETEK added to its highly differentiated product portfolio with a range of new products across many of its businesses. They included:

| • | Creaform has teamed its SmartDENT 3D™ surface inspection software with its HandyPROBE Next 3D scanner to perform inspection and damage assessment of aircraft surfaces; |

| • | Dunkermotoren expanded its range of smart motors with external Ethercat electronics with the addition of its flagship BG95 brushless DC motor; |

| • | Technical Manufacturing Corporation (“TMC”) incorporated the latest vibration isolation technology into its UltraDamp™ system for highly sensitive equipment and SEM-Base® VI system for scanning electron microscopes; |

| • | Vision Research built upon its award-winning imaging technology in designing the Phantom® Flex4K-GS high-speed camera for scientific research, defense and aerospace applications; |

| • | Acquired in February 2017, Rauland-Borg Corporation’s (“Rauland”) Responder® 5 systems bring advanced communications, information exchange and intelligent workflow technology solutions to hospitals and healthcare facilities; |

| • | Reichert Technologies added to its leading position in vision testing and eye disease diagnosis with its ClearChart® 4 family of digital acuity systems; |

| • | Land Instruments introduced its Near Infrared Borescope non-contact thermal imager for the aluminum and glass processing industries; |

| • | CAMECA developed the first cryo-transfer local electrode atom probe helping researchers conduct breakthrough research into three-dimensional atomic analysis; |

| • | EDAX was granted a U.S. patent for the technology that underlies the software for its latest electron backscatter diffraction microanalysis instruments; |

| • | The ORTEC Detective X™, a handheld radioisotope identifier represents the gold standard for many of world’s leading homeland security and defense agencies; |

| • | Solidstate Controls designed its SlimLine uninterruptible power supply product line to meet the highly specialized needs of offshore oil and gas platforms; |

| • | Acquired in June 2017, MOCON, Inc. launched the AQUATRAN Model 3 system to measure the water vapor transmission rate of ultrahigh barrier materials; |

| • | The SPECTROPORT portable metals analyzer from SPECTRO Analytical Instruments offers advanced optical emission spectroscopy technology in an easy-to-use handheld device; and |

| • | Grabner Instruments’ MINISCAN IR VISION portable analyzer offers cutting-edge performance and speeds in delivering reliable and accurate analysis of diesel and jet fuels. |

4

Table of Contents

2017 OVERVIEW

Operating Performance

In 2017, the Company established records for orders, sales, operating income, net income, diluted earnings per share and operating cash flow. The strengthening global economic environment compared to 2016, contributions from recent acquisitions, and continued focus on and implementation of Operational Excellence initiatives, had a positive impact on 2017 results. See “Results of Operations” in Part II, Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations for further details.

In 2017, AMETEK achieved sales of $4,300.2 million, an increase of 12.0% from 2016 due to 6% organic sales growth, with 5% organic sales growth in EIG and 8% organic sales growth in EMG, and a 6% increase from the 2017 and 2016 acquisitions. Diluted earnings per share for 2017 were $2.94, an increase of $0.75 or 34.2%, compared with $2.19 per diluted share in 2016.

On December 22, 2017, the U.S. enacted the Tax Cuts and Jobs Act (the “Act”). As a result, in the fourth quarter of 2017, the Company recorded a net benefit of $91.6 million in the consolidated statement of income as a component of Provision for income taxes. The Act had the effect of increasing 2017 diluted earnings per share by $0.39. See “Results of Operations” in Part II, Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 8 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K for further details.

Recent Acquisitions

AMETEK spent $556.6 million in cash, net of cash acquired, to acquire three businesses in 2017.

In February 2017, AMETEK acquired Rauland, a global provider of enterprise clinical and education communications solutions for hospitals, healthcare systems and educational facilities. Rauland is part of EIG.

In June 2017, AMETEK acquired MOCON, a provider of laboratory and field gas analysis instrumentation to research laboratories, production facilities and quality control departments in food and beverage, pharmaceutical and industrial applications. MOCON is part of EIG.

In December 2017, AMETEK acquired Arizona Instrument LLC, a provider of differentiated, high-precision moisture and gas measurement instruments for use in the food, pharmaceutical and environmental markets. Arizona Instrument is part of EIG.

Financing

In the fourth quarter of 2017, the Company paid in full, at maturity, $270 million in aggregate principal amount of 6.20% private placement senior notes.

Financial Information About Reportable Segments, Foreign Operations and Export Sales

Information with respect to reportable segments and geographic areas is set forth in Note 15 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

AMETEK’s international sales increased 10.1% to $2,214.0 million in 2017. International sales represented 51.5% of consolidated net sales in 2017 compared with 52.4% in 2016. The increase in international sales was primarily driven by organic sales growth.

5

Table of Contents

Description of Business

Described below are the products and markets of each reportable segment:

EIG

EIG is a leader in the design and manufacture of advanced instruments for the process, power and industrial, and aerospace markets. Its growth is based on the four strategies outlined in AMETEK’s Corporate Growth Plan. In many instances, its products differ from or are technologically superior to its competitors’ products. It has achieved competitive advantage through continued investment in research, development and engineering to develop market-leading products and solutions that serve niche markets. It also has expanded its sales and service capabilities globally to serve its customers.

EIG is a leader in many of the specialized markets it serves. Products supplied to these markets include process control instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries. It provides a growing range of instruments to the laboratory equipment, ultraprecision manufacturing, medical, and test and measurement markets. It is a leader in power quality monitoring and metering, uninterruptible power systems, programmable power equipment, electromagnetic compatibility (“EMC”) test equipment, sensors for gas turbines, dashboard instruments for heavy trucks and other vehicles, and instrumentation and controls for the food and beverage industries. It supplies the aerospace industry with aircraft and engine sensors, monitoring systems, power supplies, fuel and fluid measurement systems, and data acquisition systems.

In 2017, 52% of EIG’s net sales was to customers outside the United States. At December 31, 2017, EIG employed approximately 9,200 people, of whom approximately 1,200 were covered by collective bargaining agreements. At December 31, 2017, EIG had 86 operating facilities: 55 in the United States, nine in the United Kingdom, eight in Germany, three in Canada, two each in China, Denmark and France and one each in Argentina, Austria, Finland, Mexico and Switzerland. EIG also shares operating facilities with EMG in Brazil, China and Mexico.

Process and Analytical Instrumentation Markets and Products

Process and analytical instrumentation sales represented 69% of EIG’s 2017 net sales. These sales include process analyzers, emission monitors and spectrometers; elemental and surface analysis instruments; level, pressure and temperature sensors and transmitters; radiation measurement devices; level measurement devices; precision manufacturing systems; materials- and force-testing instruments; contact and non-contact metrology products; and clinical and educational communication solutions. Among the industries it serves are oil, gas and petrochemical refining; power generation; pharmaceutical manufacturing; medical and healthcare; water and waste treatment; natural gas distribution; and semiconductor manufacturing. Its instruments are used for precision measurement in a number of applications, including radiation detection, trace element and materials analysis, nanotechnology research, ultraprecise manufacturing, and test and measurement.

Acquired in June 2017, MOCON is a leading provider of detectors, instruments, systems and consulting services to research laboratories, production facilities, and quality control and safety departments in the medical, pharmaceutical, food and beverage, packaging, environmental, oil and gas and other industries worldwide. MOCON’s products and technologies complement the Company’s existing gas analysis instrumentation business and provides it with opportunities to expand into the growing food and pharmaceutical package testing market.

Acquired in February 2017, Rauland is a global provider of enterprise clinical and education communications solutions for hospitals, healthcare systems and educational facilities. Rauland provides the Company with attractive new growth opportunities within the medical technology market, strong growth opportunities in its core markets and incremental growth opportunities through acquisitions and international expansion.

6

Table of Contents

Acquired in July 2016, HS Foils develops patented silicon nitride window technology that significantly expands the limits of x-ray window performance and areas of application. HS Foils also has extensive expertise in silicon PIN diode and silicon drift detector manufacturing.

Acquired in July 2016, Nu Instruments offers a full suite of magnetic sector mass spectrometers used in advanced laboratory analysis across demanding research applications in the environmental and earth sciences, material characterization and nuclear isotope analysis. Nu Instruments’ customers include leading universities and research institutions, and technical manufacturing and materials analysis companies.

Power and Industrial Instrumentation Markets and Products

Power and industrial instrumentation sales represented 24% of EIG’s 2017 net sales. This business provides power monitoring and metering instruments, uninterruptible power supply systems and programmable power supplies used in a wide range of industrial settings. It is a leader in the design and manufacture of power measurement, quality monitoring and event recorders for use in power generation, transmission and distribution. It provides uninterruptible power supply systems, multifunction electric meters, annunciators, alarm monitoring systems and highly specialized communications equipment for smart grid applications. It also offers precision power supplies and power conditioning products, and electrical immunity and EMC test equipment.

Acquired in December 2017, Arizona Instrument is a provider of differentiated, high-precision moisture and gas measurement instruments for use in the food, pharmaceutical and environmental markets. Arizona Instrument complements the Company’s existing Brookfield Engineering Laboratories (“Brookfield”) viscosity measurement business. Its high-quality products support their customers’ increasingly complex production processes and more stringent environmental and safety standards.

Acquired in January 2016, Brookfield is the global leader in viscosity measurement instrumentation and offers a complete range of viscometers and rheometers, as well as instrumentation to analyze texture and powder flow. Its products are used primarily for quality control applications in a broad range of markets, including food and beverage, pharmaceuticals, oil and gas, paints, solvents, chemicals, coatings and packaging.

Acquired in January 2016, ESP/SurgeX is a leader in power protection, monitoring, and diagnostic solutions. ESP/SurgeX is the leading industry provider of on-site and remote power protection products used by industries to lower service costs and ensure reliable electric power to critical equipment. Its patented technology is widely used by the business equipment, imaging, audio visual, information technology, gaming and vending industries.

Aerospace Instrumentation Markets and Products

Aerospace instrumentation sales represented 7% of EIG’s 2017 net sales. AMETEK’s aerospace products are designed to customer specifications and manufactured to stringent operational and reliability requirements. These products include airborne data systems, turbine engine temperature measurement products, vibration-monitoring systems, cockpit instruments and displays, fuel and fluid measurement products, and sensors and switches. It serves all segments of the commercial and military aerospace market, including commercial airliners, business jets, regional aircraft and helicopters.

AMETEK operates in highly specialized aerospace market segments in which it has proven technological or manufacturing advantages versus its competition. Among its more significant competitive advantages is its 70-year-plus reputation as an established aerospace supplier. It has long-standing relationships with the world’s leading commercial and military aircraft, jet engine and original equipment manufacturers and aerospace system integrators. AMETEK also is a leading provider of spare part sales and repair and overhaul services to commercial aerospace.

7

Table of Contents

Customers

EIG is not dependent on any single customer such that the loss of that customer would have a material adverse effect on EIG’s operations. Approximately 6% of EIG’s 2017 net sales was made to its five largest customers.

EMG

EMG is a differentiated supplier of automation solutions, thermal management systems, specialty metals and electrical interconnects. EMG is a leader in many of the niche markets in which it competes. Products supplied to these markets include its highly engineered electrical connectors and electronics packaging used in aerospace and defense, medical, and industrial applications, as well as its advanced precision motion control products, which are used in a wide range of automation applications across the medical, semiconductor, aerospace, defense, and food and beverage industries.

EMG supplies high-purity powdered metals, strip and foil, specialty clad metals and metal matrix composites. Its blowers and heat exchangers provide electronic cooling and environmental control for the aerospace and defense industries. Its motors are widely used in commercial appliances, fitness equipment, food and beverage machines, hydraulic pumps and industrial blowers. Additionally, it operates a global network of aviation maintenance, repair and overhaul (“MRO”) facilities.

EMG designs and manufactures products that, in many instances, are significantly different from or technologically superior to competitors’ products. It has achieved competitive advantage through continued investment in research, development and engineering, efficiency improvements from operational excellence, acquisition synergies and improved supply chain management.

In 2017, 50% of EMG’s net sales was to customers outside the United States. At December 31, 2017, EMG employed approximately 7,400 people, of whom approximately 2,200 were covered by collective bargaining agreements. At December 31, 2017, EMG had 63 operating facilities: 36 in the United States, ten in the United Kingdom, three in China, two each in France, Germany, Italy, Mexico and Serbia and one each in Brazil, the Czech Republic, Malaysia and Taiwan.

Technical Motors and Systems Markets and Products

Technical motors and systems sales represented 65% of EMG’s 2017 net sales. Technical motors and systems primarily consist of precision motion control solutions, brushless motors, blowers and pumps, heat exchangers and other electromechanical systems. These products are used in aerospace and defense, semiconductor equipment, computer equipment, mass transit, medical equipment and power industries among others. Additionally, technical motors and systems includes floor care and specialty motors which are used in a wide range of products, such as household, commercial and personal care appliances, fitness equipment, food and beverage machines, lawn and garden equipment, material handling equipment, hydraulic pumps, industrial blowers, and other household and commercial floor care products.

EMG produces motor-blower systems and heat exchangers used in thermal management and other applications on a variety of military and commercial aircraft and military ground vehicles. In addition, EMG provides the commercial and military aerospace industry with third-party MRO services on a global basis with facilities in the United States, Europe and Asia.

Engineered Materials, Interconnects and Packaging Markets and Products

Engineered materials, interconnects and packaging sales represented 35% of EMG’s 2017 net sales. AMETEK is a leader in highly engineered electrical connectors and electronics packaging used to protect

8

Table of Contents

sensitive devices and mission-critical electronics. Its electrical connectors, terminals, headers and packaging are designed specifically for harsh environments and highly customized applications. In addition, AMETEK is an innovator and market leader in specialized metal powder, strip, wire and bonded products used in medical, aerospace and defense, telecommunications, automotive and general industrial applications.

Acquired in October 2016, Laserage Technology Corporation (“Laserage”) offers precision tube fabrication of minimally invasive surgical devices, stents and catheter-based delivery systems. Laserage’s expertise includes laser fabrication of flat stock and tube for medical devices and specialty catheters.

Customers

EMG is not dependent on any single customer such that the loss of that customer would have a material adverse effect on EMG’s operations. Approximately 9% of EMG’s 2017 net sales was made to its five largest customers.

Marketing

AMETEK’s marketing efforts generally are organized and carried out at the business unit level. EIG makes use of distributors and sales representatives to market its products along with a direct sales force for its more technically sophisticated products. Within aerospace, the specialized customer base of aircraft and jet engine manufacturers is served primarily by direct sales engineers. Given the technical nature of many of its products, as well as its significant worldwide market share, EMG conducts much of its domestic and international marketing activities through a direct sales force and makes some use of sales representatives and distributors, both in the United States and in other countries.

Competition

In general, AMETEK’s markets are highly competitive with competition based on technology, performance, quality, service and price.

In EIG’s markets, AMETEK believes it ranks as a leader in certain analytical measuring and control instruments, and power and industrial markets. It also is a major instrument and sensor supplier to commercial aviation. In process and analytical instruments, numerous companies compete in each market on the basis of product quality, performance and innovation. In power and industrial and in aerospace, AMETEK competes with a number of companies depending on the specific market segment.

EMG’s businesses compete with a number of companies in each of its markets. Competition is generally based on product innovation, performance and price. There also is competition from alternative materials and processes.

Availability of Raw Materials

AMETEK’s reportable segments obtain raw materials and supplies from a variety of sources and generally from more than one supplier. For EMG, however, certain items, including various base metals and certain steel components, are available from only a limited number of suppliers. AMETEK believes its sources and supplies of raw materials are adequate for its needs.

9

Table of Contents

Backlog and Seasonal Variations of Business

AMETEK’s backlog of unfilled orders by reportable segment was as follows at December 31:

| 2017 | 2016 | 2015 | ||||||||||

| (In millions) | ||||||||||||

| Electronic Instruments |

$ | 718.1 | $ | 587.0 | $ | 581.4 | ||||||

| Electromechanical |

678.0 | 569.5 | 566.4 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 1,396.1 | $ | 1,156.5 | $ | 1,147.8 | ||||||

|

|

|

|

|

|

|

|||||||

Of the total backlog of unfilled orders at December 31, 2017, approximately 88% is expected to be shipped by December 31, 2018. The Company believes that neither its business as a whole, nor either of its reportable segments, is subject to significant seasonal variations, although certain individual operations experience some seasonal variability.

Research, Development and Engineering

AMETEK is committed to, and has consistently invested in, research, development and engineering activities to design and develop new and improved products and solutions. Research, development and engineering costs before customer reimbursement were $221.2 million in 2017 and $200.8 million in both 2016 and 2015, respectively. Customer reimbursements in 2017, 2016 and 2015 were $5.4 million, $7.2 million and $6.9 million, respectively. These amounts included research and development expenses of $130.4 million, $112.0 million and $116.3 million in 2017, 2016 and 2015, respectively. All such expenditures were directed toward the development of new products and solutions and the improvement of existing products and solutions.

Environmental Matters

Information with respect to environmental matters is set forth in Part II, Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations section entitled “Environmental Matters” and in Note 13 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Patents, Licenses and Trademarks

AMETEK owns numerous unexpired U.S. and foreign patents, including counterparts of its more important U.S. patents, in the major industrial countries of the world. It is a licensor or licensee under patent agreements of various types, and its products are marketed under various registered and unregistered U.S. and foreign trademarks and trade names. AMETEK, however, does not consider any single patent or trademark, or any group of them, essential either to its business as a whole or to either one of its reportable segments. The annual royalties received or paid under license agreements are not significant to either of its reportable segments or to AMETEK’s overall operations.

Employees

At December 31, 2017, AMETEK employed approximately 16,900 people at its EIG, EMG and corporate operations, of whom approximately 3,400 employees were covered by collective bargaining agreements. AMETEK has four collective bargaining agreements that expire in 2018, which cover fewer than 400 employees. It expects no material adverse effects from the pending labor contract negotiations.

Working Capital Practices

AMETEK does not have extraordinary working capital requirements in either of its reportable segments. Its customers generally are billed at normal trade terms that may include extended payment provisions. Inventories are closely controlled and maintained at levels related to production cycles and normal delivery requirements of customers.

10

Table of Contents

You should consider carefully the following risk factors and all other information contained in this Annual Report on Form 10-K and the documents we incorporate by reference in this Annual Report on Form 10-K. Any of the following risks could materially and adversely affect our business, financial condition, results of operations and cash flows.

A downturn in the economy generally or in the markets we serve could adversely affect our business.

A number of the industries in which we operate are cyclical in nature and therefore are affected by factors beyond our control. A downturn in the U.S. or global economy, and, in particular, in the aerospace and defense, oil and gas, process instrumentation or power markets could have an adverse effect on our business, financial condition and results of operations.

Our growth could suffer if the markets into which we sell our products and services decline, do not grow as anticipated or experience cyclicality.

Our growth depends in part on the growth of the markets which we serve and visibility into our markets is limited (particularly for markets into which we sell through distribution). Our quarterly sales and profits depend substantially on the volume and timing of orders received during the fiscal quarter, which are difficult to forecast. Any decline or lower than expected growth in our served markets could diminish demand for our products and services, which would adversely affect our financial statements. Certain of our businesses operate in industries that may experience periodic, cyclical downturns. In addition, in certain of our businesses, demand depends on customers’ capital spending budgets, as well as government funding policies, and matters of public policy and government budget dynamics, as well as product and economic cycles can affect the spending decisions of these entities. Demand for our products and services is also sensitive to changes in customer order patterns, which may be affected by announced price changes, changes in incentive programs, new product introductions and customer inventory levels. Any of these factors could adversely affect our growth and results of operations in any given period.

Our growth strategy includes strategic acquisitions. We may not be able to consummate future acquisitions or successfully integrate recent and future acquisitions.

A portion of our growth has been attributed to acquisitions of strategic businesses. Since the beginning of 2013, through December 31, 2017, we have completed 18 acquisitions. We plan to continue making strategic acquisitions to enhance our global market position and broaden our product offerings. Although we have been successful with our acquisition strategy in the past, our ability to successfully effectuate acquisitions will be dependent upon a number of factors, including:

| • | Our ability to identify acceptable acquisition candidates; |

| • | The impact of increased competition for acquisitions, which may increase acquisition costs and affect our ability to consummate acquisitions on favorable terms and may result in us assuming a greater portion of the seller’s liabilities; |

| • | Successfully integrating acquired businesses, including integrating the financial, technological and management processes, procedures and controls of the acquired businesses with those of our existing operations; |

| • | Adequate financing for acquisitions being available on terms acceptable to us; |

11

Table of Contents

| • | U.S. and foreign competition laws and regulations affecting our ability to make certain acquisitions; |

| • | Unexpected losses of key employees, customers and suppliers of acquired businesses; |

| • | Mitigating assumed, contingent and unknown liabilities; and |

| • | Challenges in managing the increased scope, geographic diversity and complexity of our operations. |

The process of integrating acquired businesses into our existing operations may result in unforeseen operating difficulties and may require additional financial resources and attention from management that would otherwise be available for the ongoing development or expansion of our existing operations. Furthermore, even if successfully integrated, the acquired business may not achieve the results we expected or produce expected benefits in the time frame planned. Failure to continue with our acquisition strategy and the successful integration of acquired businesses could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The indemnification provisions of acquisition agreements by which we have acquired companies may not fully protect us and as a result we may face unexpected liabilities.

Certain of the acquisition agreements by which we have acquired companies require the former owners to indemnify us against certain liabilities related to the operation of the company before we acquired it. In most of these agreements, however, the liability of the former owners is limited and certain former owners may be unable to meet their indemnification responsibilities. We cannot assure you that these indemnification provisions will protect us fully or at all, and as a result we may face unexpected liabilities that adversely affect our financial statements.

We may not properly execute, or realize anticipated cost savings or benefits from, our Operational Excellence initiatives.

Our success is partly dependent upon properly executing and realizing cost savings or other benefits from our ongoing production and procurement initiatives. These initiatives are primarily designed to make the Company more efficient, which is necessary in the Company’s highly competitive industries. These initiatives are often complex, and a failure to implement them properly may, in addition to not meeting projected cost savings or benefits, adversely affect our business and operations.

Foreign and domestic economic, political, legal, compliance and business factors could negatively affect our international sales and operations.

International sales for 2017 and 2016 represented 51.5% and 52.4% of our consolidated net sales, respectively. As a result of our growth strategy, we anticipate that the percentage of sales outside the United States will increase in the future. Approximately half of our international sales are of products manufactured outside the United States. As of December 31, 2017, we have manufacturing operations in 17 countries outside the United States, with significant operations in China, the Czech Republic, Mexico and Serbia. A prolonged disruption of our ability to obtain a supply of goods from these countries or a change in the effective cost of these products could have a material adverse effect on our sales and operations. International sales and operations are subject to the customary risks of operating in an international environment, including:

| • | Imposition of trade or foreign exchange restrictions, including in the United States; |

| • | Overlap of different tax structures; |

| • | Unexpected changes in regulatory requirements, including in the United States; |

12

Table of Contents

| • | Trade protection measures, such as the imposition of or increase in tariffs and other trade barriers, including in the United States; |

| • | The difficulty and/or costs of designing and implementing an effective control environment across diverse regions and employee bases; |

| • | Restrictions on currency repatriation; |

| • | General economic conditions; |

| • | Unstable political situations; |

| • | Nationalization of assets; and |

| • | Compliance with a wide variety of international and U.S. laws and regulatory requirements. |

Furthermore, fluctuations in foreign currency exchange rates, including changes in the relative value of currencies in the countries where we operate, subject us to exchange rate exposure and may adversely affect our financial statements. For example, increased strength in the U.S. dollar will increase the effective price of our products sold overseas, which may adversely affect sales or require us to lower our prices. In addition, our consolidated financial statements are presented in U.S. dollars, and we must translate our assets, liabilities, sales and expenses into U.S. dollars for external reporting purposes. As a result, changes in the value of the U.S. dollar due to fluctuations in currency exchange rates or currency exchange controls may materially and negatively affect the value of these items in our consolidated financial statements, even if their value has not changed in their local currency.

Our international sales and operations may be adversely impacted by compliance with export laws.

We are required to comply with various import, export, export control and economic sanctions laws, which may affect our transactions with certain customers, business partners and other persons, including in certain cases dealings with or between our employees and subsidiaries. In certain circumstances, export control and economic sanctions regulations may prohibit the export of certain products, services and technologies and in other circumstances, we may be required to obtain an export license before exporting a controlled item. In addition, failure to comply with any of these regulations could result in civil and criminal, monetary and non-monetary penalties, disruptions to our business, limitations on our ability to import and export products and services and damage to our reputation.

Our reputation, ability to do business and financial statements may be impaired by improper conduct by any of our employees, agents or business partners.

We cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by employees, agents or business partners of ours (or of businesses we acquire or partner with) that would violate U.S. and/or non-U.S. laws, including the laws governing payments to government officials, bribery, fraud, kickbacks and false claims, pricing, sales and marketing practices, conflicts of interest, competition, export and import compliance, money laundering and data privacy. In particular, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business, and we operate in many parts of the world that have experienced governmental corruption to some degree. Any such improper actions or allegations of such acts could damage our reputation and subject us to civil or criminal investigations in the U.S. and in other jurisdictions and related shareholder lawsuits could lead to substantial civil and criminal, monetary and non-monetary penalties and could cause us to

13

Table of Contents

incur significant legal and investigatory fees. In addition, we rely on our suppliers to adhere to our supplier standards of conduct and material violations of such standards of conduct could occur that could have a material effect on our financial statements.

Any inability to hire, train and retain a sufficient number of skilled officers and other employees could impede our ability to compete successfully.

If we cannot hire, train and retain a sufficient number of qualified employees, we may not be able to effectively integrate acquired businesses and realize anticipated results from those businesses, manage our expanding international operations and otherwise profitably grow our business. Even if we do hire and retain a sufficient number of employees, the expense necessary to attract and motivate these officers and employees may adversely affect our results of operations.

If we are unable to develop new products on a timely basis, it could adversely affect our business and prospects.

We believe that our future success depends, in part, on our ability to develop, on a timely basis, technologically advanced products that meet or exceed appropriate industry standards. Although we believe we have certain technological and other advantages over our competitors, maintaining such advantages will require us to continue investing in research and development and sales and marketing. There can be no assurance that we will have sufficient resources to make such investments, that we will be able to make the technological advances necessary to maintain such competitive advantages or that we can recover major research and development expenses. We are not currently aware of any emerging standards or new products which could render our existing products obsolete, although there can be no assurance that this will not occur or that we will be able to develop and successfully market new products.

Our technology is important to our success and our failure to protect this technology could put us at a competitive disadvantage.

Many of our products rely on proprietary technology; therefore, we endeavor to protect our intellectual property rights through patents, copyrights, trade secrets, trademarks, confidentiality agreements and other contractual provisions. Despite our efforts to protect proprietary rights, unauthorized parties or competitors may copy or otherwise obtain and use our products or technology. In addition, our ability to protect and enforce our intellectual property rights may be limited in certain countries outside the U.S. Actions to enforce our rights may result in substantial costs and diversion of resources and we make no assurances that any such actions will be successful.

A shortage of, or price increases for, our raw materials could increase our operating costs.

While we manufacture certain parts and components used in our products, we require substantial amounts of raw materials and purchase some parts and components from suppliers. The availability and prices for raw materials, parts and components may be subject to curtailment or change due to, among other things, supplier’s allocation to other purchasers, interruptions in production by suppliers, changes in exchange rates and prevailing price levels. In addition, certain items, including base metals and certain steel components, are available only from a limited number of suppliers and are subject to commodity market fluctuations. Shortages in raw materials or price increases therefore could affect the prices we charge, our operating costs and our competitive position, which could adversely affect our business, financial condition, results of operations and cash flows.

Certain environmental risks may cause us to be liable for costs associated with hazardous or toxic substance clean-up which may adversely affect our financial condition.

Our businesses, operations and facilities are subject to a number of federal, state, local and foreign environmental and occupational health and safety laws and regulations concerning, among other things, air

14

Table of Contents

emissions, discharges to waters and the use, manufacturing, generation, handling, storage, transportation and disposal of hazardous substances and wastes. Environmental risks are inherent in many of our manufacturing operations. Certain laws provide that a current or previous owner or operator of property may be liable for the costs of investigating, removing and remediating hazardous materials at such property, regardless of whether the owner or operator knew of, or was responsible for, the presence of such hazardous materials. In addition, the Comprehensive Environmental Response, Compensation and Liability Act generally imposes joint and several liability for clean-up costs, without regard to fault, on parties contributing hazardous substances to sites designated for clean-up under the Act. We have been named a potentially responsible party at several sites, which are the subject of government-mandated clean-ups. As the result of our ownership and operation of facilities that use, manufacture, store, handle and dispose of various hazardous materials, we may incur substantial costs for investigation, removal, remediation and capital expenditures related to compliance with environmental laws. While it is not possible to precisely quantify the potential financial impact of pending environmental matters, based on our experience to date, we believe that the outcome of these matters is not likely to have a material adverse effect on our financial position or future results of operations. In addition, new laws and regulations, new classification of hazardous materials, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that future environmental liabilities will not occur or that environmental damages due to prior or present practices will not result in future liabilities.

We are subject to numerous governmental regulations, which may be burdensome or lead to significant costs.

Our operations are subject to numerous federal, state, local and foreign governmental laws and regulations. In addition, existing laws and regulations may be revised or reinterpreted and new laws and regulations, including with respect to climate change, may be adopted or become applicable to us or customers for our products. We cannot predict the form any such new laws or regulations will take or the impact any of these laws and regulations will have on our business or operations.

We are subject to a variety of litigation and other legal and regulatory proceedings in the course of our business that could adversely affect our financial statements.

We are subject to a variety of litigation and other legal and regulatory proceedings incidental to our business (or the business operations of previously owned entities), including claims for damages arising out of the use of products or services and claims relating to intellectual property matters, employment matters, tax matters, commercial disputes, competition and sales and trading practices, environmental matters, personal injury, insurance coverage and acquisition-related matters, as well as regulatory investigations or enforcement. These lawsuits may include claims for compensatory damages, punitive and consequential damages and/or injunctive relief. The defense of these lawsuits may divert our management’s attention, we may incur significant expenses in defending these lawsuits, and we may be required to pay damage awards or settlements or become subject to equitable remedies that could adversely affect our operations and financial statements. Moreover, any insurance or indemnification rights that we may have may be insufficient or unavailable to protect us against such losses. In addition, developments in proceedings in any given period may require us to adjust the loss contingency estimates that we have recorded in our financial statements, record estimates for liabilities or assets previously not susceptible of reasonable estimates or pay cash settlements or judgments. Any of these developments could adversely affect our financial statements in any particular period. We cannot assure you that our liabilities in connection with litigation and other legal and regulatory proceedings will not exceed our estimates or adversely affect our financial statements and reputation. However, based on our experience, current information and applicable law, we do not believe that any amounts we may be required to pay in connection with litigation and other legal and regulatory proceedings in excess of our reserves as of the date of this information statement will have a material effect on our financial statements.

15

Table of Contents

We operate in highly competitive industries, which may adversely affect our results of operations or ability to expand our business.

Our markets are highly competitive. We compete, domestically and internationally, with individual producers, as well as with vertically integrated manufacturers, some of which have resources greater than we do. The principal elements of competition for our products are product technology, quality, service, distribution and price. Although we believe EIG is a market leader, competition is strong and could intensify in the markets served by EIG. In the aerospace markets served by EIG, a limited number of companies compete on the basis of product quality, performance and innovation. EMG’s competition in specialty metal products stems from alternative materials and processes. Our competitors may develop new or improve existing products that are superior to our products or may adapt more readily to new technologies or changing requirements of our customers. There can be no assurance that our business will not be adversely affected by increased competition in the markets in which it operates or that our products will be able to compete successfully with those of our competitors.

Restrictions contained in our revolving credit facility and other debt agreements may limit our ability to incur additional indebtedness.

Our existing revolving credit facility and other debt agreements (each a “Debt Facility” and collectively, “Debt Facilities”) contain restrictive covenants, including restrictions on our ability to incur indebtedness. These restrictions could limit our ability to effectuate future acquisitions, limit our ability to pay dividends, limit our ability to make capital expenditures or restrict our financial flexibility. Our Debt Facilities contain covenants requiring us to achieve certain financial and operating results and maintain compliance with specified financial ratios. Our ability to meet the financial covenants or requirements in our Debt Facilities may be affected by events beyond our control, and we may not be able to satisfy such covenants and requirements. A breach of these covenants or our inability to comply with the financial ratios, tests or other restrictions contained in a Debt Facility could result in an event of default under one or more of our other Debt Facilities. Upon the occurrence of an event of default under a Debt Facility, and the expiration of any grace periods, the lenders could elect to declare all amounts outstanding under one or more of our other Debt Facilities, together with accrued interest, to be immediately due and payable. If this were to occur, our assets may not be sufficient to fully repay the amounts due under our Debt Facilities or our other indebtedness.

Our business and financial performance may be adversely affected by cybersecurity incidents, and other information technology and business disruptions.

Our facilities, supply chains, distribution systems, products and information technology systems may be impacted by natural or man-made disruptions, including cybersecurity attacks, other information technology attacks or failures, threats to physical security, armed conflict, as well as damaging weather or other acts of nature, pandemics or other public health crises. For example, our information technology systems may be damaged, disrupted or shut down due to attacks by computer hackers, computer viruses, cyberattacks or other security breach, employee error or malfeasance, power outages, hardware failures, telecommunications or utility failures, or other unforeseen events, and in any such circumstances our disaster recovery planning and security upgrade efforts may be ineffective or inadequate. A shutdown of, or inability to utilize, one or more of our facilities, our supply chain, our distribution system, our products or our information technology, telecommunications or other systems, could significantly disrupt our operations, delay production and shipments, our relationships and reputation with customers, suppliers, employees, stockholders and others, result in lost sales, result in the misappropriation or corruption of data, or result in legal exposure and large remediation or other expenses.

16

Table of Contents

Our goodwill and other intangible assets represent a substantial proportion of our total assets and the impairment of such substantial goodwill and intangible assets could have a negative impact on our financial condition and results of operations.

Our total assets include substantial amounts of intangible assets, primarily goodwill. At December 31, 2017, goodwill and other intangible assets, net of accumulated amortization, totaled $5,129.0 million or 66% of our total assets. The goodwill results from our acquisitions, representing the excess of cost over the fair value of the net tangible and other identifiable intangible assets we have acquired. At a minimum, we assess annually whether there has been impairment in the value of our intangible assets. If future operating performance at one or more of our reporting units were to fall significantly below current levels, we could record, under current applicable accounting rules, a non-cash charge to operating income for goodwill or other intangible asset impairment. Any determination requiring the impairment of a significant portion of goodwill or other intangible assets would negatively affect our financial condition and results of operations.

Item 1B. Unresolved Staff Comments

None.

17

Table of Contents

| Item 2. | Properties |

At December 31, 2017, the Company had 149 operating facilities in 25 states and 17 foreign countries. Of these facilities, 60 are owned by the Company and 89 are leased. The properties owned by the Company consist of approximately 724 acres, of which approximately 5.3 million square feet are under roof. Under lease is a total of approximately 3.3 million square feet. The leases expire over a range of years from 2018 to 2082, with renewal options for varying terms contained in many of the leases. The Company’s executive offices in Berwyn, Pennsylvania, occupy approximately 43,000 square feet under a lease that expires in September 2023.

The Company’s machinery and equipment, plants and offices are in satisfactory operating condition and are adequate for the uses to which they are put. The operating facilities of the Company by reportable segment were as follows at December 31, 2017:

| Number of Operating Facilities |

Square Feet Under Roof | |||||||||||||||

| Owned | Leased | Owned | Leased | |||||||||||||

| Electronic Instruments |

29 | 57 | 2,146,000 | 2,194,000 | ||||||||||||

| Electromechanical |

31 | 32 | 3,160,000 | 1,056,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

60 | 89 | 5,306,000 | 3,250,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Item 3. | Legal Proceedings |

Please refer to “Environmental Matters” in Part II, Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 13 to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K for information regarding certain litigation matters.

The Company is subject to a variety of litigation and other legal and regulatory proceedings incidental to its business (or the business operations of previously owned entities), including claims for damages arising out of the use of the Company’s products or services and claims relating to intellectual property matters, employment matters, tax matters, commercial disputes, competition and sales and trading practices, environmental matters, personal injury, insurance coverage and acquisition-related matters, as well as regulatory investigations or enforcement. Based upon the Company’s experience, the Company does not believe that these proceedings and claims will have a material adverse effect on its results of operations, financial position or cash flows.

18

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The principal market on which the Company’s common stock is traded is the New York Stock Exchange and it is traded under the symbol “AME.” On January 31, 2018, there were approximately 1,900 holders of record of the Company’s common stock.

Market price and dividend information with respect to the Company’s common stock is set forth below. Future dividend payments by the Company will be dependent on future earnings, financial requirements, contractual provisions of debt agreements and other relevant factors.

Under its share repurchase program, the Company repurchased approximately 114,000 shares of its common stock for $6.9 million in 2017 and approximately 7,099,000 shares of its common stock for $336.1 million in 2016.

The high and low sales prices of the Company’s common stock on the New York Stock Exchange composite tape and the quarterly dividends per share paid on the common stock were:

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||

| 2017 |

||||||||||||||||

| Dividends paid per share |

$ | 0.09 | $ | 0.09 | $ | 0.09 | $ | 0.09 | ||||||||

| Common stock trading range: |

||||||||||||||||

| High |

$ | 55.48 | $ | 62.89 | $ | 66.70 | $ | 73.06 | ||||||||

| Low |

$ | 48.55 | $ | 53.19 | $ | 60.50 | $ | 65.65 | ||||||||

| 2016 |

||||||||||||||||

| Dividends paid per share |

$ | 0.09 | $ | 0.09 | $ | 0.09 | $ | 0.09 | ||||||||

| Common stock trading range: |

||||||||||||||||

| High |

$ | 52.93 | $ | 52.61 | $ | 50.27 | $ | 51.26 | ||||||||

| Low |

$ | 42.82 | $ | 43.28 | $ | 43.30 | $ | 43.98 | ||||||||

Issuer Purchases of Equity Securities

The following table reflects purchases of AMETEK, Inc. common stock by the Company during the three months ended December 31, 2017:

| Period |

Total Number of Shares Purchased (1)(2) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plan (2) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plan |

||||||||||||

| October 1, 2017 to October 31, 2017 |

1,647 | $ | 68.73 | 1,647 | $ | 368,751,020 | ||||||||||

| November 1, 2017 to November 30, 2017 |

345 | 68.42 | 345 | 368,727,415 | ||||||||||||

| December 1, 2017 to December 31, 2017 |

— | — | — | 368,727,415 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total |

1,992 | 68.68 | 1,992 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | Represents shares surrendered to the Company to satisfy tax withholding obligations in connection with employees’ share-based compensation awards. |

| (2) | Consists of the number of shares purchased pursuant to the Company’s Board of Directors $400 million authorization for the repurchase of its common stock announced in November 2016. Such purchases may be effected from time to time in the open market or in private transactions, subject to market conditions and at management’s discretion. |

19

Table of Contents

Securities Authorized for Issuance Under Equity Compensation Plan Information

The following table sets forth information as of December 31, 2017 regarding all of the Company’s existing compensation plans pursuant to which equity securities are authorized for issuance to employees and nonemployee directors:

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||||

| Equity compensation plans approved by security holders |

5,582,803 | $ | 48.99 | 6,395,457 | ||||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

|

|

|

|

|

|||||||||

| Total |

5,582,803 | 48.99 | 6,395,457 | |||||||||

|

|

|

|

|

|

|

|||||||

20

Table of Contents

Stock Performance Graph

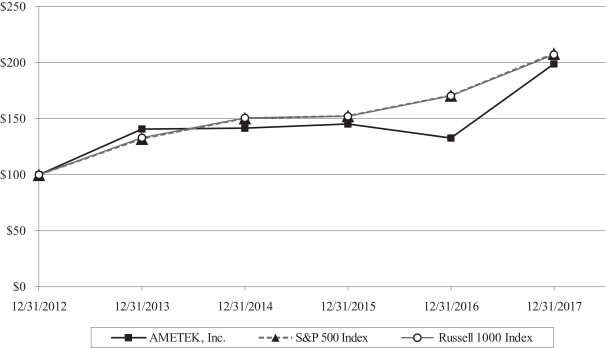

The following graph and accompanying table compare the cumulative total stockholder return for AMETEK over the last five years ended December 31, 2017 with total returns for the same period for the Standard and Poor’s (“S&P”) 500 Index and Russell 1000 Index. AMETEK’s stock price is a component of both indices. The performance graph and table assume a $100 investment made on December 31, 2012 and reinvestment of all dividends. The stock performance shown on the graph below is based on historical data and is not necessarily indicative of future stock price performance.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

| December 31, | ||||||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||||||||||||

| AMETEK, Inc. |

$ | 100.00 | $ | 140.95 | $ | 141.73 | $ | 145.28 | $ | 132.75 | $ | 199.09 | ||||||||||||

| S&P 500 Index |

100.00 | 132.39 | 150.51 | 152.59 | 170.84 | 208.14 | ||||||||||||||||||

| Russell 1000 Index |

100.00 | 133.11 | 150.73 | 152.12 | 170.45 | 207.42 | ||||||||||||||||||

21

Table of Contents

| Item 6. | Selected Financial Data |

The following financial information for the five years ended December 31, 2017, has been derived from the Company’s consolidated financial statements. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form 10-K.

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| (In millions, except per share amounts) | ||||||||||||||||||||

| Consolidated Operating Results (Year Ended December 31): |

||||||||||||||||||||

| Net sales |

$ | 4,300.2 | $ | 3,840.1 | $ | 3,974.3 | $ | 4,022.0 | $ | 3,594.1 | ||||||||||

| Operating income |

$ | 915.1 | $ | 801.9 | $ | 907.7 | $ | 898.6 | $ | 815.1 | ||||||||||

| Interest expense |

$ | 98.0 | $ | 94.3 | $ | 91.8 | $ | 79.9 | $ | 73.6 | ||||||||||

| Net income |

$ | 681.5 | $ | 512.2 | $ | 590.9 | $ | 584.5 | $ | 517.0 | ||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

$ | 2.96 | $ | 2.20 | $ | 2.46 | $ | 2.39 | $ | 2.12 | ||||||||||

| Diluted |

$ | 2.94 | $ | 2.19 | $ | 2.45 | $ | 2.37 | $ | 2.10 | ||||||||||

| Dividends declared and paid per share |

$ | 0.36 | $ | 0.36 | $ | 0.36 | $ | 0.33 | $ | 0.24 | ||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic |

230.2 | 232.6 | 239.9 | 244.9 | 243.9 | |||||||||||||||

| Diluted |

231.8 | 233.7 | 241.6 | 247.1 | 246.1 | |||||||||||||||

| Performance Measures and Other Data: |

||||||||||||||||||||

| Operating income — Return on net sales |

21.3 | % | 20.9 | % | 22.8 | % | 22.3 | % | 22.7 | % | ||||||||||

|

— Return on average total assets |

12.3 | % | 11.7 | % | 13.9 | % | 14.6 | % | 14.7 | % | ||||||||||

| Net income — Return on average total capital |

11.6 | % | 9.5 | % | 11.6 | % | 12.3 | % | 12.1 | % | ||||||||||

|

— Return on average stockholders’ equity |

18.7 | % | 15.7 | % | 18.2 | % | 18.3 | % | 18.2 | % | ||||||||||

| EBITDA(1) |

$ | 1,076.0 | $ | 966.0 | $ | 1,046.9 | $ | 1,022.6 | $ | 916.3 | ||||||||||

| Ratio of EBITDA to interest expense(1) |

11.0x | 10.2x | 11.4x | 12.8x | 12.4x | |||||||||||||||

| Depreciation and amortization |

$ | 183.2 | $ | 179.7 | $ | 149.5 | $ | 138.6 | $ | 118.7 | ||||||||||

| Capital expenditures |

$ | 75.1 | $ | 63.3 | $ | 69.1 | $ | 71.3 | $ | 63.3 | ||||||||||

| Cash provided by operating activities |

$ | 833.3 | $ | 756.8 | $ | 672.5 | $ | 726.0 | $ | 660.7 | ||||||||||

| Free cash flow(2) |

$ | 758.2 | $ | 693.5 | $ | 603.4 | $ | 654.7 | $ | 597.4 | ||||||||||

| Consolidated Financial Position (At December 31): |

||||||||||||||||||||

| Current assets |

$ | 1,934.7 | $ | 1,928.2 | $ | 1,618.8 | $ | 1,577.6 | $ | 1,368.3 | ||||||||||

| Current liabilities |

$ | 1,138.7 | $ | 924.4 | $ | 1,024.0 | $ | 934.5 | $ | 872.7 | ||||||||||

| Property, plant and equipment, net |

$ | 493.3 | $ | 473.2 | $ | 484.5 | $ | 448.4 | $ | 402.8 | ||||||||||

| Total assets |

$ | 7,796.1 | $ | 7,100.7 | $ | 6,660.5 | $ | 6,415.9 | $ | 5,874.4 | ||||||||||

| Long-term debt, net |

$ | 1,866.2 | $ | 2,062.6 | $ | 1,553.1 | $ | 1,424.4 | $ | 1,140.1 | ||||||||||

| Total debt, net |

$ | 2,174.3 | $ | 2,341.6 | $ | 1,938.0 | $ | 1,709.0 | $ | 1,411.5 | ||||||||||

| Stockholders’ equity |

$ | 4,027.6 | $ | 3,256.5 | $ | 3,254.6 | $ | 3,239.6 | $ | 3,136.1 | ||||||||||

| Stockholders’ equity per share |

$ | 17.42 | $ | 14.20 | $ | 13.82 | $ | 13.42 | $ | 12.80 | ||||||||||

| Total debt as a percentage of capitalization |

35.1 | % | 41.8 | % | 37.3 | % | 34.5 | % | 31.0 | % | ||||||||||

| Net debt as a percentage of capitalization(3) |

27.5 | % | 33.3 | % | 32.4 | % | 29.1 | % | 26.3 | % | ||||||||||

See Notes to Selected Financial Data on the following page.

22

Table of Contents

Notes to Selected Financial Data

| (1) | EBITDA represents earnings before interest, income taxes, depreciation and amortization. EBITDA is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. It should not be considered, however, as an alternative to operating income as an indicator of the Company’s operating performance or as an alternative to cash flows as a measure of the Company’s overall liquidity as presented in the Company’s consolidated financial statements. Furthermore, EBITDA measures shown for the Company may not be comparable to similarly titled measures used by other companies. The following table presents the reconciliation of net income reported in accordance with U.S. generally accepted accounting principles (“GAAP”) to EBITDA: |

| Year Ended December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Net income |

$ | 681.5 | $ | 512.2 | $ | 590.9 | $ | 584.5 | $ | 517.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Add (deduct): |

||||||||||||||||||||

| Interest expense |

98.0 | 94.3 | 91.8 | 79.9 | 73.6 | |||||||||||||||

| Interest income |

(2.0 | ) | (1.1 | ) | (0.8 | ) | (0.8 | ) | (0.8 | ) | ||||||||||

| Income taxes |

115.3 | 180.9 | 215.5 | 220.4 | 207.8 | |||||||||||||||

| Depreciation |

82.0 | 74.8 | 68.7 | 63.7 | 57.2 | |||||||||||||||

| Amortization |

101.2 | 104.9 | 80.8 | 74.9 | 61.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total adjustments |

394.5 | 453.8 | 456.0 | 438.1 | 399.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

$ | 1,076.0 | $ | 966.0 | $ | 1,046.9 | $ | 1,022.6 | $ | 916.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | Free cash flow represents cash flow from operating activities less capital expenditures. Free cash flow is presented because the Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. (Also see note 1 above). The following table presents the reconciliation of cash flow from operating activities reported in accordance with U.S. GAAP to free cash flow: |

| Year Ended December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| (In millions) | ||||||||||||||||||||

| Cash provided by operating activities |

$ | 833.3 | $ | 756.8 | $ | 672.5 | $ | 726.0 | $ | 660.7 | ||||||||||

| Deduct: Capital expenditures |

(75.1 | ) | (63.3 | ) | (69.1 | ) | (71.3 | ) | (63.3 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Free cash flow |

$ | 758.2 | $ | 693.5 | $ | 603.4 | $ | 654.7 | $ | 597.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||