Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MARTIN MIDSTREAM PARTNERS L.P. | exhibit991pressrelease2-21.htm |

| 8-K - 8-K - MARTIN MIDSTREAM PARTNERS L.P. | a8kanalystpresentation.htm |

2018 Financial guidance &

Operational overview

February 21

www.martinmidstream.com

Exhibit 99.2

2

MARTIN MIDSTREAM PARTNERS L.P.

Agenda

Opening remarks &

introductions

2018 guidance

Bank amendment

Question & answer

Operational overview

Bob Bondurant, Executive Vice President & Chief Financial Officer

Joe McCreery, Vice President of Finance & Head of Investor Relations

Joe McCreery, Vice President of Finance & Head of Investor Relations

Bob Bondurant, Executive Vice President & Chief Financial Officer

Joe McCreery, Vice President of Finance & Head of Investor Relations

Listening Audience

Closing remarks Bob Bondurant, Executive Vice President & Chief Financial Officer

Additional Partnership Representatives: Ruben Martin, President & Chief Executive Officer

David Cannon, Director of Financial Reporting

Danny Cavin, Director of Financial Planning & Analysis

3

This presentation includes certain non-GAAP financial measures such as EBITDA and Adjusted EBITDA. These non-

GAAP financial measures are not meant to be considered in isolation or as a substitute for results prepared in

accordance with accounting principles generally accepted in the United States (GAAP). A reconciliation of non-

GAAP financial measures included in this presentation to the most directly comparable financial measures calculated

and presented in accordance with GAAP is set forth in the Appendix of this presentation or on our web site at

www.martinmidstream.com

MMLP’s management believes that these non-GAAP financial measures may provide useful information to investors

regarding MMLP’s financial condition and results of operations as they provide another measure of the profitability

and ability to service its debt and are considered important measures by financial analysts covering MMLP and its

peers.

MARTIN MIDSTREAM PARTNERS L.P.

Use of Non-GAAP Financial Measures

4

MARTIN MIDSTREAM PARTNERS L.P.

Forward Looking Statements

Statements included that are not historical facts (including any statements concerning plans and objectives of

management for future operations or economic performance or assumptions or forecasts related thereto), are

forward-looking statements. These statements can be identified by the use of forward-looking terminology including

“forecast,” “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “continue,” or other similar words. These

statements discuss future expectations, contain projections of results of operations or of financial condition or state

other “forward-looking” information. We and our representatives may from time to time make other oral or written

statements that are also forward-looking statements.

These forward-looking statements are based upon management’s current plans, expectations, estimates,

assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and

uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ

materially from those expressed or implied in the forward-looking statements.

Because these forward-looking statements involve risks and uncertainties, actual results could differ materially from

those expressed or implied by these forward-looking statements for a number of important reasons. A discussion of

these factors, including risks and uncertainties, is set forth in Martin Midstream Partners L.P.’s annual and quarterly

reports filed from time to time with the Securities and Exchange Commission. Martin Midstream Partners L.P.

expressly disclaims any intention or obligation to revise or update any forward-looking statements whether as a

result of new information, future events, or otherwise.

5

M A R T I N M I D S T R E A M P A R T N E R S L . P .

2018 GUIDANCE

6

• NASDAQ Listed: MMLP

• Formed October 31, 2002

• MMLP is a publicly traded, diversified master limited

partnership with operations including:

Natural Gas Services

Terminalling & Storage

Sulfur Services

Marine Transportation

• MMLP Trading Summary (1)

• Unit Price: $16.05

• Units Outstanding 38.5 million

• Market Cap: $618 million

• Quarterly Distribution: $0.50/$2.00 annualized

• Current Yield: 12.5%

(1) As of February 20, 2018

MARTIN MIDSTREAM PARTNERS L.P.

Partnership Overview

($171.8 million before $15.6 million unallocated SG&A

and other non-operating income)

$156.2 million Adjusted

EBITDA

7

Natural Gas Services

$69.7

Sulfur Services

$34.5

Marine Transportation

$8.5

Terminalling & Storage

$58.8

($171.5 million before $15.4 million unallocated SG&A

and other non-operating income)

$156.1 million Adjusted

EBITDA

$ millions

Maintenance Capital Expenditures projected to be $27.5 to $30.0 million*

MARTIN MIDSTREAM PARTNERS L.P.

2018E Guidance by Segment UPDATE

*See slide 37 of the Appendix for a historical comparison of Maintenance CapEx

8

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

2018E

Net income (loss) $42.5 $22.4 $23.0 $1.4 $(16.0) $(52.7) $20.6

Interest expense add back -- -- -- -- -- $52.7 $52.7

Depreciation and amortization $25.1 $36.4 $11.5 $7.1 -- -- $80.1

Distributions from unconsolidated entities $8.4 -- -- -- -- -- $8.4

Equity in earnings of unconsolidated entities $(6.3) -- -- -- -- -- $(6.3)

Unit-based compensation -- -- -- -- -- -- --

Income tax expense -- -- -- -- $0.6 -- $0.6

Adjusted EBITDA $69.7 $58.8 $34.5 $8.5 $(15.4) $0.0 $156.1

MARTIN MIDSTREAM PARTNERS L.P.

2018E Adjusted EBITDA Guidance Reconciliation

Natural Gas Services 1Q18E 2Q18E 3Q18E 4Q18E 2018E

Cardinal $9.7 $8.6 $6.4 $6.3 $31.0

Butane $9.1 $1.3 $1.5 $14.2 $26.1

WTLPG $1.5 $1.6 $2.5 $2.9 $8.5

NGLs $0.4 $0.4 $0.4 $0.3 $1.5

Propane $1.2 $0.2 $0.2 $1.0 $2.6

Total NGS $21.9 $12.1 $11.0 $24.7 $69.7

Terminalling &

Storage

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Marine Shore-Based

Terminals

$3.1 $3.1 $3.1 $3.1 $12.4

Martin Lubricants $2.9 $3.2 $3.0 $2.4 $11.5

Smackover Refinery $4.8 $5.1 $5.0 $5.0 $19.9

Specialty Terminals $2.3 $2.5 $2.6 $2.8 $10.2

Hondo Asphalt $1.2 $1.2 $1.2 $1.2 $4.8

Total T&S $14.3 $15.1 $14.9 $14.5 $58.8

Sulfur Services 1Q18E 2Q18E 3Q18E 4Q18E 2018E

Fertilizer $6.8 $6.1 $4.9 $3.6 $21.4

Molten Sulfur $1.6 $1.5 $1.5 $1.5 $6.1

Sulfur Prilling $1.6 $1.8 $1.8 $1.8 $7.0

Total Sulfur Services $10.0 $9.4 $8.2 $6.9 $34.5

Marine

Transportation

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Inland $1.8 $2.5 $2.5 $2.6 $9.4

Offshore $0.8 $0.9 $0.9 $0.9 $3.5

Marine USG&A $(1.1) $(1.1) $(1.1) $(1.1) $(4.4)

Total Marine $1.5 $2.3 $2.3 $2.4 $8.5

Unallocated SG&A $(3.8) $(3.8) $(3.9) $(3.9) $(15.4)

Total Adjusted EBITDA $43.9 $35.1 $32.5 $44.6 $156.1

$ millions

9

Natural Gas Services

• Fee-based, multi-year natural gas storage contracts (weighted average

life approximately 3.0 years as of December 31, 2017)

• Fee-based, regulated common carrier tariffs (WTLPG)

• Margin-based, wholesale NGLs

Terminalling & Storage

• Fee-based contracts for traditional storage assets – Specialty and Marine

Shore-Based Terminals (with minimum volume commitments)

• Fee-based, long-term tolling agreement for Smackover Refinery (with

guaranteed minimum volume)

• Margin-based, lubricants contracts/revenue

Sulfur Services

• Fee-based, multi-year “take-or-pay” contracts for prilling assets

• Fee-based molten sulfur transportation and handling contract

• Margin-based fertilizer contracts/revenue

Marine Transportation

• Fee-based, day-rate contracts

*See slide 36 of the Appendix for reconciliation of Fee-based vs. Margin-based cash flows by segment

MARTIN MIDSTREAM PARTNERS L.P.

Strong Fee-Based Contract Mix

*

M A R T I N M I D S T R E A M P A R T N E R S L . P .

Bank amendment

11

MARTIN MIDSTREAM PARTNERS L.P.

Bank Amendment - Situation Overview & Objectives

• MMLP has amended its revolving credit facility to accommodate growth capital expenditures necessary for the

previously announced WTLPG extension/expansion project.

• MMLP expects to spend approximately $40 million during 2018 on the project.

• Working with our bank group, we achieved two primary objectives:

• Objective No. 1: Covenant Relief for Pipeline Expansion

• Starting in the first quarter of 2017, the amendment will provide short-term (5 quarters) covenant

relief by increasing the total leverage ratio to 5.75x with step downs back to 5.25x.

• Objective No. 2: Working Capital Sublimit

• Borrowings under the working capital sublimit are excluded from the total leverage and secured

leverage calculations given the seasonal, self-liquidating nature of the NGL (butane) business.

• Sublimit not to exceed $75 million, with seasonal step-down to $10 million for the months of March

through June of each fiscal year

• Sublimit subject to a monthly borrowing base not to exceed 90% of the value of forward sold /

hedged inventory

A detailed description of the credit facility amendment is shown on slide 39 of the Appendix.

M A R T I N M I D S T R E A M P A R T N E R S L . P .

OPERATIONAL

OVERVIEW

13

• Cardinal Gas Storage operates approximately 50 billion cubic feet of natural gas storage capacity across four

facilities throughout northern Louisiana and Mississippi.

• MMLP distributes NGLs purchased primarily from refineries and natural gas processors. The Partnership stores and

transports NGLs for delivery to refineries, industrial NGL users and wholesale delivery to propane retailers.

• MMLP owns an NGL pipeline which spans approximately 200 miles from Kilgore, Texas to Beaumont, Texas. MMLP

also owns and operates approximately 2.4 million barrels of underground storage capacity for NGLs.

• MMLP owns a 20% non-operating interest in WTLPG. WTLPG owns an approximate 2,300 mile common carrier

pipeline system that transports NGLs from New Mexico and Texas to Mont Belvieu, Texas for fractionation.

Key

Assets

2017

Adj. EBITDA

2018E

Adj. EBITDA

Cardinal $39.4 $31.0

Butane $28.1 $26.1

WTLPG $5.3 $8.5

NGLs $0.9 $1.5

Propane $2.1 $2.6

Total NGS $75.8 $69.7

$ millions

MARTIN MIDSTREAM PARTNERS L.P.

Natural Gas Services Overview

14

• Firm contracted model (90%) for natural gas

storage with interruptible service upside

• Long-term contracts – Cardinal’s weighted

average contract life of approximately 3.0 years

protects against significant cash flow deterioration

in the near term

• Potential storage demand drivers:

• LNG exports

• Natural gas exports to Mexico

• Increasing industrial and petrochemical use

• Coal-fired power conversions to natural gas

• Increased volatility – Due to demand drivers

above, natural gas price volatility should enhance

the value of storage assets

Type

Working Gas

Capacity (bcf)

Currently

Contracted Years

Arcadia Salt Dome 16.0 97% 2.2

Cadeville

Depleted

Reservoir

17.0 100% 5.4

Perryville Salt Dome 12.7 67% 1.7

Monroe

Depleted

Reservoir

7.4 95% 2.6

Source 10-K, December 31, 2017

Firm Contracted/Fee-Based Storage Model Cardinal Contract Summary

MARTIN MIDSTREAM PARTNERS L.P. – natural gas services

Cardinal Gas Storage

(1) Cardinal wholly-owned since August 2014

(2) Reflective of the results from 2017 open season and original Perryville contracts maturing 6/30/18

$15.8

$44.3

$42.0

$39.4

$31.0

2014 2015 2016 2017 2018E

Cardinal Gas Storage Adjusted EBITDA

( 1 ) ( 2 )

15

Arcadia Gas Storage

• Salt dome facility (Arcadia, Louisiana) – 16.0 bcf

Perryville Gas Storage

• Salt dome facility (Delhi, Louisiana) – 12.7 bcf

Cadeville Gas Storage

• Depleted reservoir facility (Monroe, Louisiana) – 17.0 bcf

Monroe Gas Storage

• Depleted reservoir facility (Amory, Mississippi) – 7.4 bcf

MARTIN MIDSTREAM PARTNERS L.P. – natural gas storage

Cardinal Gas Storage Asset Overview

Monroe

Gas Storage

Site

16

• Refineries adjust the vapor pressure of gasoline

to meet seasonal EPA standards and are allowed

to blend butane into the gasoline pool during

winter months.

• MMLP owns and leases a network of

underground storage facilities in Louisiana and

Mississippi.

• MMLP has rail and truck transloading capabilities

at its Arcadia, Louisiana facility.

• Further assists refineries in balancing butane

offtake during non-blending seasons

Butane Optimization

MARTIN MIDSTREAM PARTNERS L.P. – natural gas services

Butane Optimization

$15.7

$19.9

$23.5

$28.1

$26.1

2014 2015 2016 2017 2018E

Butane Adjusted EBITDA

17

• The WTLPG system is approximately 2,300 miles of Y-grade pipeline from Eastern New Mexico to Mt. Belvieu, Texas.

• MMLP owns a 20% non-operating interest in WTLPG (OKE is owner/operator of remaining 80%).

• Nameplate capacity of approximately 240 MBbls/day; 2017 volumes were approximately 190 MBbls/day

• Connection into Cajun Sibon pipeline provides delivery alternative to Mt. Belvieu, Texas.

• Moves west to east/southeast across multiple producing regions:

• Permian Basin

• Barnett Shale

• East Texas/Cotton Valley

• Planned expansion into Delaware Basin on-line 3Q 2018

• Railroad Commission of Texas tariff dispute and adjudication process is ongoing. (1)

System Map

MARTIN MIDSTREAM PARTNERS L.P. – natural gas services

West Texas LPG Pipeline (WTLPG)

$4.3

$11.2

$7.5

$5.3

$8.5

2014 2015 2016 2017 2018E

WTLPG Adjusted EBITDA

(1) See slide 38 in Appendix for detailed timeline of RRC tariff case

18

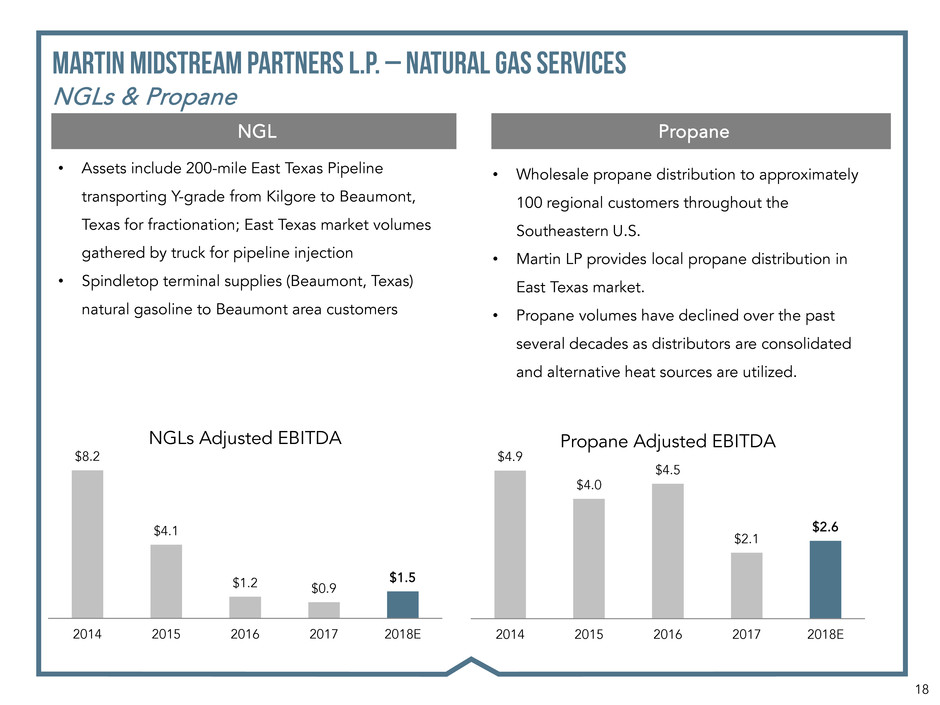

• Assets include 200-mile East Texas Pipeline

transporting Y-grade from Kilgore to Beaumont,

Texas for fractionation; East Texas market volumes

gathered by truck for pipeline injection

• Spindletop terminal supplies (Beaumont, Texas)

natural gasoline to Beaumont area customers

• Wholesale propane distribution to approximately

100 regional customers throughout the

Southeastern U.S.

• Martin LP provides local propane distribution in

East Texas market.

• Propane volumes have declined over the past

several decades as distributors are consolidated

and alternative heat sources are utilized.

Propane NGL

MARTIN MIDSTREAM PARTNERS L.P. – natural gas services

NGLs & Propane

$8.2

$4.1

$1.2 $0.9

$1.5

2014 2015 2016 2017 2018E

NGLs Adjusted EBITDA

$4.9

$4.0

$4.5

$2.1

$2.6

2014 2015 2016 2017 2018E

Propane Adjusted EBITDA

19

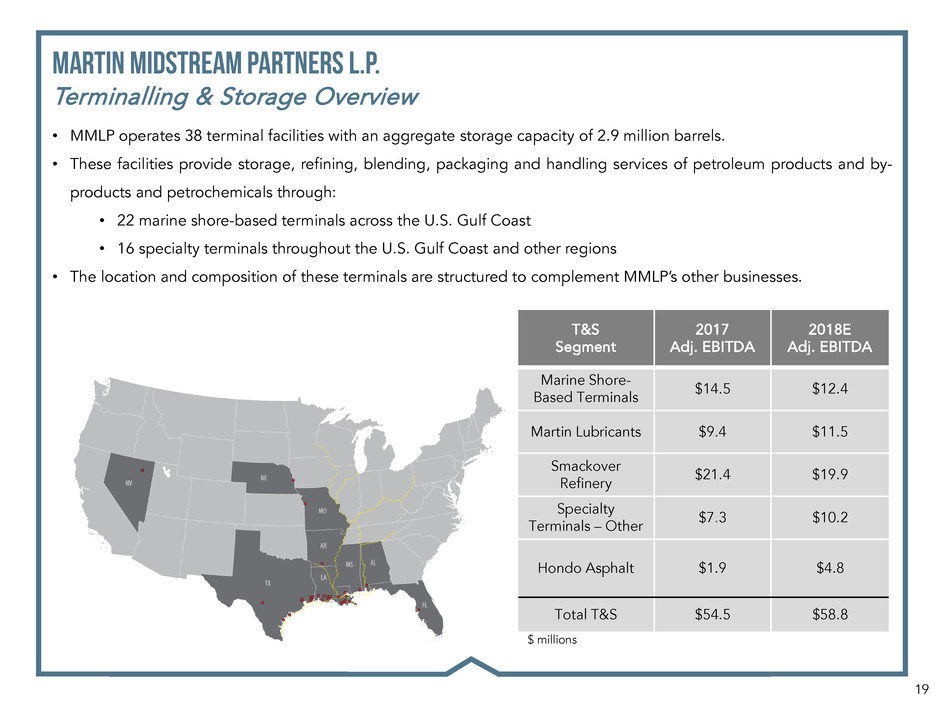

• MMLP operates 38 terminal facilities with an aggregate storage capacity of 2.9 million barrels.

• These facilities provide storage, refining, blending, packaging and handling services of petroleum products and by-

products and petrochemicals through:

• 22 marine shore-based terminals across the U.S. Gulf Coast

• 16 specialty terminals throughout the U.S. Gulf Coast and other regions

• The location and composition of these terminals are structured to complement MMLP’s other businesses.

T&S

Segment

2017

Adj. EBITDA

2018E

Adj. EBITDA

Marine Shore-

Based Terminals

$14.5 $12.4

Martin Lubricants $9.4 $11.5

Smackover

Refinery

$21.4 $19.9

Specialty

Terminals – Other

$7.3 $10.2

Hondo Asphalt $1.9 $4.8

Total T&S $54.5 $58.8

$ millions

MARTIN MIDSTREAM PARTNERS L.P.

Terminalling & Storage Overview

20

Gulf Coast Fuel and Lubricant Distribution Network

• 22 terminals along the Gulf Coast from Theodore,

Alabama to Corpus Christi, Texas

• Terminalling assets utilized by Martin Energy Services

(MRMC) to facilitate the distribution and marketing of

fuel and lubricants to oil and gas exploration and

production companies, oilfield service companies,

marine transportation companies and offshore

construction companies

• Additional logistical support services provided:

• Storage and handling of tubular goods

• Loading and unloading bulk materials

• Providing facilities and equipment to store and

mix drilling fluids

• Fee-based contract structure provides stable cash

flow.

• Annual MVC contract with MRMC guaranteeing

minimum fuel throughput

MARTIN MIDSTREAM PARTNERS L.P. – Terminalling & Storage

Marine Shore-Based Terminals

$15.3 $16.9 $15.1

$10.1 $8.4

$3.0

$2.6

$3.3

$4.4

$4.0

$18.3 $19.5 $18.4

$14.5

$12.4

2014 2015 2016 2017 2018

Marine Shore-Based Terminals

Adjusted EBITDA

Marine Shore-Based Terminals Ship Channel Lubricants

21

Lubricant Blending & Packaging

• Specialty lubricant product blending and packaging

assets located within MMLP’s Smackover Refinery in

Smackover, Arkansas include:

• 235,000 sq. ft. warehouse

• 3.9 million gallons bulk storage

• MMLP purchases base oils to blend and package

branded and private label lubricants for agricultural

and industrial applications.

Grease

• Commercial and industrial grease processing and

packaging assets located in Kansas City, Missouri

and Houston, Texas include:

• 75,000 sq. ft. warehouse

• 0.2 million gallons bulk storage

Lubricant Packaging Facility, Smackover, Arkansas

MARTIN MIDSTREAM PARTNERS L.P. – terminalling & storage

Martin Lubricants

$8.2 $8.5 $8.7

$9.4

$11.5

2014 2015 2016 2017 2018E

Martin Lubricants Adjusted EBITDA

22

Specialized Naphthenic Refinery

• 7,700 bpd capacity naphthenic lube refinery located

in Smackover, Arkansas

• Specialized facility processes crude oil into finished

products including naphthenic lubricants, distillates

and asphalt

• Naphthenic lubricants have customized non-

paraffinic industrial uses including:

• Transformer oils

• Rubber extenders

• Base oil for lubricants

• Fee-based contract structure provides stable cash flow.

• Long-term tolling agreement with MRMC

eliminates commodity exposure and working

capital requirements

MARTIN MIDSTREAM PARTNERS L.P. – terminalling & storage

Smackover Refinery

Smackover Refinery, Smackover, Arkansas

$11.3

$15.4

$20.4 $21.4 $19.9

2014 2015 2016 2017 2018E

Smackover Refinery Adjusted EBITDA

23

Hondo Asphalt Terminal, Hondo, Texas

Specialty Terminals Overview

• Network of 14 terminals which facilitate the movement

of petroleum products and by-products and

petrochemicals from oil refiners and natural gas

processing facilities

• Specialized capabilities include the ability to store and

handle products with a wide range of temperature

requirements (-30° to +400°F) and receives products

transported by vessel, barge, rail or truck

• Products handled include:

• Anhydrous ammonia (temp requirement: -30°F)

• Asphalt (temp requirement: up to 400°F)

• Crude oil

• Fuel oil

• Molten sulfur (temp requirement: 270°F)

• Sulfuric acid

• Other assorted petroleum products and by-

products

MARTIN MIDSTREAM PARTNERS L.P. – terminalling & storage

Specialty Terminals

(1)Represents Specialty Terminals cash flow from ongoing operations

(2)Represents partial year 2017 (asset purchased February 22, 2018) and full year 2018 operations

from Hondo Asphalt Terminal

$5.3

$6.8

$10.4

$7.3

$10.2

$1.9 (2)

$4.8 (2)

2014 2015 2016 2017 2018E

Specialty Terminals Adjusted EBITDA (1)

$9.2

$15.0

24

Expertise In “Hard to Handle” Product and By-Product Logistics

• South Houston and Omaha Asphalt

• Asphalt terminalling and processing facilities

backed with minimum throughput guarantee

(with MRMC)

• Dunphy

• Elko, Nevada sulfuric acid terminal serving the

mining industry

• Minimum throughput guarantee

• Tampa

• Asphalt and fuel oil terminalling capabilities

• Minimum throughput guarantees (with MRMC

and multiple other counterparties)

• Hondo Asphalt Terminal

• Facility located 40 miles west of the San

Antonio city center with capacity of 182,100

barrels of asphalt storage, and blending

and processing capabilities

• Transportation advantage over the

competition in relation to serving strong

demographic growth area of San Antonio

and the surrounding markets

• Located in close proximity to multiple

aggregate quarries and surrounded by

numerous hot mix plants

• Third party supply optionality from the Gulf

Coast and Midwest regions

Specialized Sites (continued) Specialized Sites

MARTIN MIDSTREAM PARTNERS L.P. – terminalling & Storage

Specialty Terminals

25

Expertise In “Hard to Handle” Product and By-Product Logistics

• Beaumont Neches

• Multi-service terminal

• Sulfur offtake and gathering point for Texas

and Louisiana refiners

• Deep water and barge dock access

• Serviced by 3 rail lines (BNSF, KCS, UP)

• Dry bulk shiploader – 20,000 tons/day

• Additional 96 acres available for expansion

• Beaumont Spindletop

• Natural gasoline terminal providing feedstock

to petrochemical manufacturer

• Beaumont Stanolind

• Multi-product handling facility including:

• Molten sulfur

• Asphalt/Fuel oil

• Sulfuric acid

Specialized Sites (continued)

MARTIN MIDSTREAM PARTNERS L.P. – terminalling & Storage

Specialty Terminals

Dunphy Sulfuric Acid Terminal, Elko, Nevada

26

• Molten sulfur, a refinery by-product is aggregated, stored and prilled through MMLP’s integrated value chain

systems along the U.S. Gulf Coast and Northern California region.

• MMLP manufactures and markets sulfur-based fertilizers and related sulfur products (sulfuric acid) to wholesale

fertilizer distributors and industrial users.

• MMLP has the necessary assets and expertise to handle the unique requirements for transportation and storage of

molten sulfur.

• By managing sulfur offtake, MMLP assists refineries in balancing production runs.

Sulfur Services

Segment

2017

Adj.

EBITDA

2018E

Adj.

EBITDA

Fertilizer $19.6 $21.4

Molten Sulfur $6.9 $6.1

Sulfur Prilling $7.5 $7.0

Total Sulfur

Services

$34.0 $34.5

$ millions

MARTIN MIDSTREAM PARTNERS L.P.

Sulfur Services Overview

27

• Provides transportation, processing and marketing services necessary to move product from producer to consumer

• Intermodal transportation offers multiple fee opportunities for MMLP

MARTIN MIDSTREAM PARTNERS L.P. – sulfur services

Integrated Sulfur Value Chain

28

• MMLP manufactures and markets sulfur-based

fertilizers and related sulfur products for

agricultural and industrial use from manufacturing

plants in Texas and Illinois.

• Typical customers include large distributors that

own or control local retail and wholesale

distribution outlets.

Fertilizer Overview

• The single largest factor influencing fertilizer demand

in the U.S. is corn acres planted.

• Global population growth is expected to further

increase demand for corn from the U.S. (food/fuel-

ethanol).

• 90.2 million corn acres were planted in 2017; current

USDA estimate for 2018 is 91.0 million acres

Supply/Demand

MARTIN MIDSTREAM PARTNERS L.P. – sulfur services

Fertilizer

$16.2

$19.5

$21.7

$19.6

$21.4

2014 2015 2016 2017 2018E

Fertilizer Adjusted EBITDA

29

• Sulfur production is driven by refinery utilization

and demand for refined products.

• Refiners require security of by-product offtake

Supply Demand

• Demand for sulfur is primarily driven by fertilizer

and sulfuric acid demand both of which are

correlated with global industrial and agricultural

economic drivers.

Handling and Transportation Agreement

• MMLP transports molten sulfur from U.S. Gulf Coast refineries to the Tampa market for fertilizer production.

MARTIN MIDSTREAM PARTNERS L.P. – sulfur services

Molten Sulfur

$8.7

$9.8

$6.7 $6.9 $6.1

2014 2015 2016 2017 2018E

Molten Sulfur Adjusted EBITDA

30

Terminal Location Production

Capacity

Products Stored

Neches Beaumont,

Texas

5,500 metric

tons/day

Molten, prilled &

granulated sulfur

Stockton Stockton,

California

1,000 metric

tons/day

Molten & prilled

sulfur

• Refiners pay MMLP minimum reservation fees, plus

additional operating fees for prilling services

• Contracts consist of 3 to 5 year service agreements

with evergreen provisions – long-term customer

relationships

Prilling Agreements

• Security of sulfur/by-product offtake is critical to

operational stability of all refiners

• Prilled sulfur enables large scale transportation

for exportation on dry bulk vessels

• At Beaumont, Texas the export option provides

pricing leverage for Gulf Coast refiners selling

sulfur into the domestic market.

• At Stockton, California export is the primary

option for disposal of residual sulfur production

from Northern California refineries.

Supply/Demand

MARTIN MIDSTREAM PARTNERS L.P. – sulfur services

Prilled Sulfur

$8.9

$6.7 $6.7

$7.5

$7.0

2014 2015 2016 2017 2018E

Sulfur Prilling Adjusted EBITDA

31

• MMLP utilizes inland and offshore tows to provide marine transportation of petroleum products and by-products.

• MMLP’s marine transportation business operates coastwise along the Gulf of Mexico, East Coast and on the U.S.

inland waterway system, primarily between domestic ports along the Gulf of Mexico, Intracoastal Waterway, the

Mississippi River system and the Tennessee-Tombigbee Waterway system.

Marine

Transportation

Segment

2017

Adj. EBITDA

2018E

Adj. EBITDA

Inland $9.2 $9.4

Offshore $2.9 $3.5

Marine SG&A $(4.6) $(4.4)

Total Marine $7.5 $8.5

$ millions

MARTIN MIDSTREAM PARTNERS L.P.

Marine Transportation Overview

32

• 33 inland marine tank barges

• 18 inland push-boats

• 1 offshore tug and barge unit

• Ability to handle specialty products (asphalt, fuel

oil, gasoline, sulfur and other bulk liquids), which

complements MMLP’s Specialty Terminals

• Marine Transportation contracts with other MMLP

segments, MRMC, major and independent oil gas

refiners and select international and domestic

trading companies.

• Fee-based day-rate contracts

Marine Transportation

MARTIN MIDSTREAM PARTNERS L.P. – marine transportation

Assets

33

Current Environment

• Weak day-rates continue even as utilization has improved

• Contract tenor trending toward short term and spot market

• Asset rationalization continues with $5.4 million in assets currently held for sale

• Fleet reduction of 13 units (4 boats/9 barges) in last 24 months has significantly reduced operating expenses

MARTIN MIDSTREAM PARTNERS L.P. – marine transportation

Inland & Offshore

$3.3

$7.3

$3.0 $2.9

$3.5

2014 2015 2016 2017 2018E

Offshore Marine Adjusted EBITDA

$21.6

$16.3

$9.6 $9.2 $9.4

2014 2015 2016 2017 2018E

Inland Marine Adjusted EBITDA

M A R T I N M I D S T R E A M P A R T N E R S L . P .

APPENDIX

35

12/31/2016 12/31/2017

DEBT

Revolving Credit Facility Due March 2020 $443.0 $445.0

Senior Secured Debt $443.0 $445.0

Senior Notes Due February 2021 $373.8 $373.8

Total Debt $816.8 $818.8

EQUITY

Partners’ Capital $312.0 $298.2

Total Capitalization $1,128.8 $1,117.0

Market Capitalization $650.6 $538.2

Enterprise Value $1,467.4 $1,357.0

CREDIT METRICS

Revolver Capacity $664.4 $664.4

Availability $221.4 $219.4

Adjusted EBITDA per lender compliance (1) $166.4(2) $160.3

Senior Debt/Adjusted EBITDA 2.66x 2.78x

Total Debt/Adjusted EBITDA 4.91x 5.11x

Debt/Cap 72.4% 73.3%

(1) Adjusted EBITDA per lender compliance certificates

(2) Per lender compliance adjusted for divestiture of Corpus Christi terminal assets

MARTIN MIDSTREAM PARTNERS L.P.

Capitalization

$ millions

36

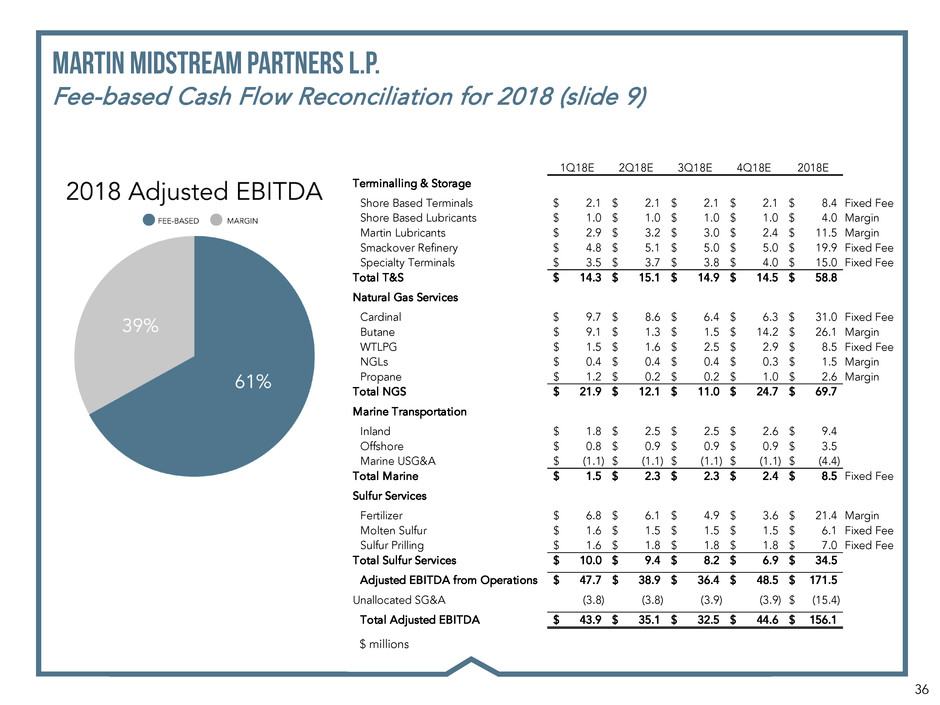

MARTIN MIDSTREAM PARTNERS L.P.

Fee-based Cash Flow Reconciliation for 2018 (slide 9)

1Q18E 2Q18E 3Q18E 4Q18E 2018E

Terminalling & Storage

Shore Based Terminals 2.1$ 2.1$ 2.1$ 2.1$ 8.4$ Fixed Fee

Shore Based Lubricants 1.0$ 1.0$ 1.0$ 1.0$ 4.0$ Margin

Martin Lubricants 2.9$ 3.2$ 3.0$ 2.4$ 11.5$ Margin

Smackover Refinery 4.8$ 5.1$ 5.0$ 5.0$ 19.9$ Fixed Fee

Specialty Terminals 3.5$ 3.7$ 3.8$ 4.0$ 15.0$ Fixed Fee

Total T&S 14.3$ 15.1$ 14.9$ 14.5$ 58.8$

Natural Gas Services

Cardinal 9.7$ 8.6$ 6.4$ 6.3$ 31.0$ Fixed Fee

Butane 9.1$ 1.3$ 1.5$ 14.2$ 26.1$ Margin

WTLPG 1.5$ 1.6$ 2.5$ 2.9$ 8.5$ Fixed Fee

NGLs 0.4$ 0.4$ 0.4$ 0.3$ 1.5$ Margin

Propane 1.2$ 0.2$ 0.2$ 1.0$ 2.6$ Margin

Total NGS 21.9$ 12.1$ 11.0$ 24.7$ 69.7$

Marine Transportation

Inland 1.8$ 2.5$ 2.5$ 2.6$ 9.4$

Offshore 0.8$ 0.9$ 0.9$ 0.9$ 3.5$

Marine USG&A (1.1)$ (1.1)$ (1.1)$ (1.1)$ (4.4)$

Total Marine 1.5$ 2.3$ 2.3$ 2.4$ 8.5$ Fixed Fee

Sulfur Services

Fertilizer 6.8$ 6.1$ 4.9$ 3.6$ 21.4$ Margin

Molten Sulfur 1.6$ 1.5$ 1.5$ 1.5$ 6.1$ Fixed Fee

Sulfur Prilling 1.6$ 1.8$ 1.8$ 1.8$ 7.0$ Fixed Fee

Total Sulfur Services 10.0$ 9.4$ 8.2$ 6.9$ 34.5$

Adjusted EBITDA from Operations 47.7$ 38.9$ 36.4$ 48.5$ 171.5$

Unallocated SG&A (3.8) (3.8) (3.9) (3.9) (15.4)$

Total Adjusted EBITDA 43.9$ 35.1$ 32.5$ 44.6$ 156.1$

$ millions

37

0.97 1.00 0.96

1.18

1.00

2014 2015 2016 2017 2018E

Distribution Coverage Ratio

x x x

x x

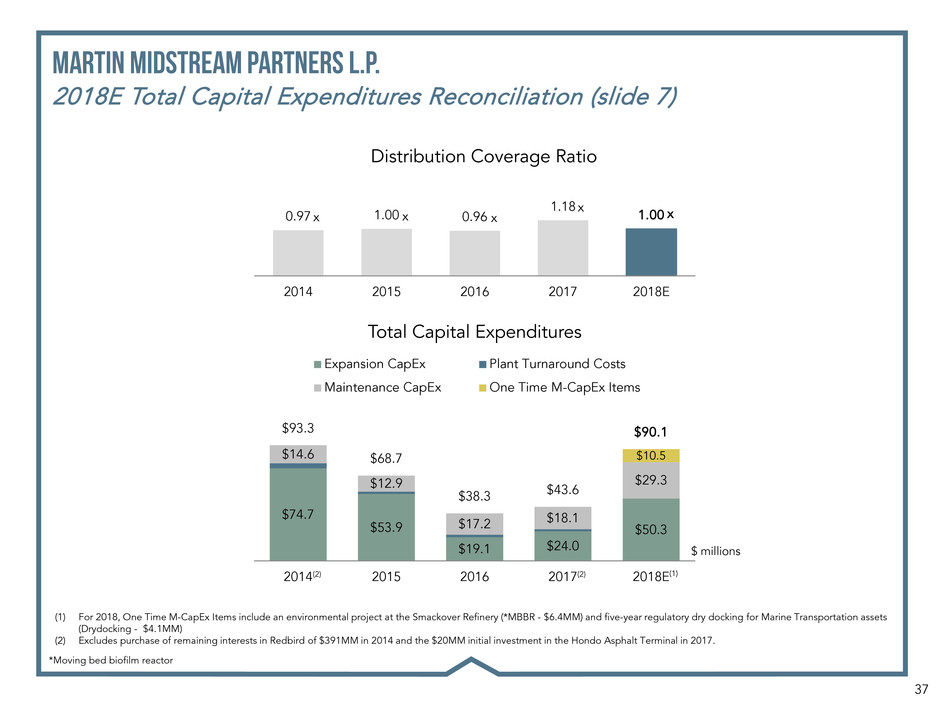

MARTIN MIDSTREAM PARTNERS L.P.

2018E Total Capital Expenditures Reconciliation (slide 7)

(1) For 2018, One Time M-CapEx Items include an environmental project at the Smackover Refinery (*MBBR - $6.4MM) and five-year regulatory dry docking for Marine Transportation assets

(Drydocking - $4.1MM)

(2) Excludes purchase of remaining interests in Redbird of $391MM in 2014 and the $20MM initial investment in the Hondo Asphalt Terminal in 2017.

*Moving bed biofilm reactor

$ millions

(1)

$74.7

$53.9

$19.1 $24.0

$50.3

$14.6

$12.9

$17.2 $18.1

$29.3

$10.5

$93.3

$68.7

$38.3 $43.6

$90.1

2014 2015 2016 2017 2018E

Total Capital Expenditures

Expansion CapEx Plant Turnaround Costs

Maintenance CapEx One Time M-CapEx Items

(2) (2)

38

MARTIN MIDSTREAM PARTNERS L.P.

West Texas LPG Pipeline Rate Update (slide 17)

• Certain shippers filed complaints with the Texas RRC (Railroad Commission of Texas) challenging the increased rates

WTLPG (West Texas LPG Pipeline) implemented effective July 1, 2015.

• On March 8, 2016, contrary to the recommendation of the administrative law judge, the RRC issued an order

directing that WTLPG charge the rates that were in effect prior to July 1, 2015.

• A hearing on the merits of the complaints was held before a hearings examiner during the week of March 27, 2017.

• The hearings examiner subsequently issued a Proposal for Decision on September 29, 2017. This Proposal for

Decision was favorable to WTLPG and found that a competitive market exists both geographically and functionally.

• On December 5, 2017, this matter was delayed until the next RRC meeting on January 23, 2018 as one of the

commissioners requested more time to read the case.

• At the January meeting, Commissioner Ryan Sitton strongly agreed with the findings of the hearings examiner that

a competitive market exists and acknowledged that the case should be dismissed. Despite such findings, the other

two commissioners requested a new (further) market study to be developed for the limited purpose of considering

additional relevant evidence regarding competition—nearly 22 months after the RRC’s initial ruling.

• On January 31, 2018, WTLPG filed a Motion for Reconsideration asking that the Commission revert back to the

previous findings of the hearings examiner, or at a minimum, the Commission consider interim rate relief.

• Our Motion for Reconsideration is on the agenda for February 27, 2018.

39

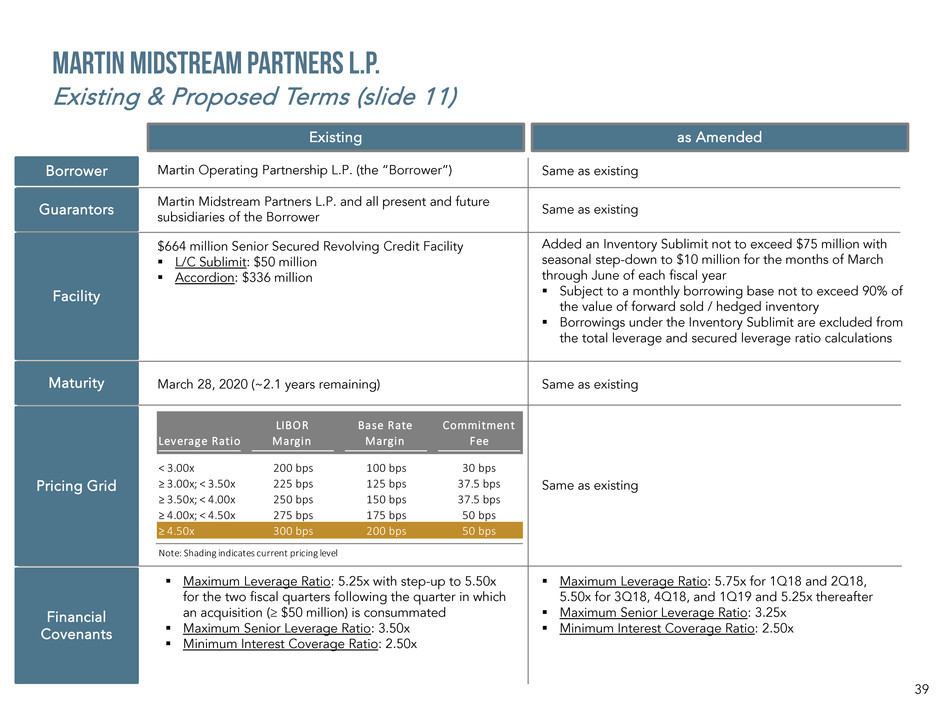

Borrower Martin Operating Partnership L.P. (the “Borrower”)

Guarantors

Martin Midstream Partners L.P. and all present and future

subsidiaries of the Borrower

Facility

$664 million Senior Secured Revolving Credit Facility

L/C Sublimit: $50 million

Accordion: $336 million

Maturity March 28, 2020 (~2.1 years remaining)

Financial

Covenants

Pricing Grid

Leverage Ratio

LIBO R

Margin

Base Rate

Margin

Commitment

Fee

< 3.00x 200 bps 100 bps 30 bps

≥ 3.00x; < 3.50x 225 bps 125 bps 37.5 bps

≥ 3.50x; < 4.00x 250 bps 150 bps 37.5 bps

≥ 4.00x; < 4.50x 275 bps 175 bps 50 bps

≥ 4.50x 300 bps 200 bps 50 bps

Note: Shading indicates current pricing level

Added an Inventory Sublimit not to exceed $75 million with

seasonal step-down to $10 million for the months of March

through June of each fiscal year

Subject to a monthly borrowing base not to exceed 90% of

the value of forward sold / hedged inventory

Borrowings under the Inventory Sublimit are excluded from

the total leverage and secured leverage ratio calculations

Same as existing

Same as existing

Same as existing

Same as existing

Maximum Leverage Ratio: 5.25x with step-up to 5.50x

for the two fiscal quarters following the quarter in which

an acquisition (≥ $50 million) is consummated

Maximum Senior Leverage Ratio: 3.50x

Minimum Interest Coverage Ratio: 2.50x

Maximum Leverage Ratio: 5.75x for 1Q18 and 2Q18,

5.50x for 3Q18, 4Q18, and 1Q19 and 5.25x thereafter

Maximum Senior Leverage Ratio: 3.25x

Minimum Interest Coverage Ratio: 2.50x

Existing as Amended

MARTIN MIDSTREAM PARTNERS L.P.

Existing & Proposed Terms (slide 11)

40

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

2017

Actual

Net income (loss) $53.5 $3.3 $25.9 $(1.2) $(16.6) $(47.8) $17.1

Interest expense add back -- -- -- -- -- $47.8 $47.8

Depreciation and amortization $24.9 $45.2 $8.1 $7.0 -- -- $85.2

(Gain) loss on sale of property, plant and

equipment

$0.1 $(0.8) -- $0.1 -- -- $(0.6)

Impairment of long lived assets -- $0.6 -- $1.6 -- -- $2.2

Non-cash hurricane contingency accrual -- $0.7 -- -- -- -- $0.7

Asset retirement obligation accrual -- $5.5 -- -- -- -- $5.5

Unrealized mark-to-market on commodity

derivatives

$(3.8) -- -- -- -- -- $(3.8)

Distributions from unconsolidated entities $5.4 -- -- -- -- -- $5.4

Equity in earnings of unconsolidated entities $(4.3) -- -- -- -- -- $(4.3)

Unit-based compensation -- -- -- -- $0.7 -- $0.7

Income tax expense -- -- -- -- $0.3 -- $0.3

Adjusted EBITDA $75.8 $54.5 $34.0 $7.5 $(15.6) $0.0 $156.2

MARTIN MIDSTREAM PARTNERS L.P.

2017 Adjusted EBITDA and GAAP Reconciliation

$ millions

41

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

2016

Actual

Net income (loss) $43.1 $44.1 $26.8 $(19.8) $(16.4) $(46.1) $31.7

Interest expense add back -- -- -- -- -- $46.1 $46.1

Depreciation and amortization $28.1 $45.5 $8.0 $10.5 -- -- $92.1

(Gain) loss on sale of property, plant and

equipment

$0.1 $(35.4) $0.3 $1.6 -- -- $(33.4)

Impairment of goodwill -- -- -- $4.1 -- -- $4.1

Impairment of long lived assets -- $15.3 -- $11.7 -- -- $27.0

Unrealized mark-to-market on commodity

derivatives

$4.6 -- -- -- -- -- $4.6

Distributions from unconsolidated entities $7.5 -- -- -- -- -- $7.5

Equity in earnings of unconsolidated entities $(4.7) -- -- -- -- -- $(4.7)

Unit-based compensation -- -- -- -- $0.9 -- $0.9

Income tax expense -- -- -- -- $0.7 -- $0.7

Adjusted EBITDA $78.7 $69.5 $35.1 $8.1 $(14.8) $0.0 $176.6

MARTIN MIDSTREAM PARTNERS L.P.

2016 Adjusted EBITDA and GAAP Reconciliation

$ millions

42

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

2015

Actual

Income (loss) from continuing operations $47.6 $18.8 $27.1 $4.6 $(17.6) $(43.3) $37.2

Interest expense add back -- -- -- -- -- $43.3 $43.3

Depreciation and amortization $34.1 $38.7 $8.5 $11.0 -- -- $92.3

Loss on sale of property, plant and equipment $0.3 $0.5 $0.4 $1.0 -- -- $2.2

Impairment of long lived assets -- $9.3 -- $1.3 -- -- $10.6

Unrealized mark-to-market on commodity

derivatives

$(0.7) -- -- -- -- -- $(0.7)

Distributions from unconsolidated entities $11.2 -- -- -- -- -- $11.2

Equity in earnings of unconsolidated entities $(9.0) -- -- -- -- -- $(9.0)

Gain on retirement of senior unsecured notes -- -- -- -- $(1.2) -- $(1.2)

Unit-based compensation -- -- -- -- $1.4 -- $1.4

Income tax expense -- -- -- -- $1.0 -- $1.0

Adjusted EBITDA $83.5 $67.3 $36.0 $17.9 $(16.4) $0.0 $188.3

MARTIN MIDSTREAM PARTNERS L.P.

2015 Adjusted EBITDA and GAAP Reconciliation

$ millions

43

Natural Gas

Services

Terminalling

& Storage

Sulfur

Services

Marine

Transportation

SG&A

Interest

Expense

2014

Actual

Income (loss) from continuing operations $36.1 $27.0 $25.7 $3.2 $(56.2) $(42.2) $(6.4)

Interest expense add back -- -- -- -- -- $42.2 $42.2

Depreciation and amortization $13.1 $37.6 $8.2 $9.9 -- -- $68.8

Loss on sale of property, plant and equipment -- $0.1 -- $1.4 -- -- $1.5

Impairment of long lived assets -- -- -- $3.5 -- -- $3.5

Unrealized mark-to-market on commodity

derivatives

$0.8 -- -- -- -- -- $0.8

Distributions from unconsolidated entities $4.3 -- -- -- -- -- $4.3

Equity in earnings of unconsolidated entities $(5.5) -- -- -- -- -- $(5.5)

Debt prepayment premium -- -- -- -- $7.8 $7.8

Reduction in fair value of investment in Cardinal

due to the purchase of the controlling interest

-- -- -- -- $30.1 $30.1

Unit-based compensation -- -- -- -- $0.8 -- $0.8

Income tax expense -- -- -- -- $1.1 -- $1.1

Adjusted EBITDA $48.8 $64.7 $33.9 $18.0 $(16.4) $0.0 $149.0

MARTIN MIDSTREAM PARTNERS L.P.

2014 Adjusted EBITDA and GAAP Reconciliation

$ millions

4200 B STONE ROAD

KILGORE, TEXAS 75662

877-256-6644

WWW.MARTINMIDSTREAM.COM

IR@MARTINMLP.COM