Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Q4 2017 SUPPLEMENTAL FINANCIAL INFORMATION - KAR Auction Services, Inc. | exhibit992-q42017ersupplem.htm |

| EX-99.1 - EXHIBIT 99.1 - Q4 2017 EARNINGS RELEASE - KAR Auction Services, Inc. | exhibit991-q42017earningsr.htm |

| 8-K - 8-K - Q4 EARNINGS RELEASE, SUPPLEMENT & SLIDES - KAR Auction Services, Inc. | form8-kxearningsreleasesup.htm |

Q4 2017 & Annual Earnings Slides

February 20, 2018

Forward-Looking Statements

This presentation includes forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995. Such forward

looking statements are subject to certain risks, trends, and uncertainties that

could cause actual results to differ materially from those projected,

expressed or implied by such forward-looking statements. Many of these

risk factors are outside of the company’s control, and as such, they involve

risks which are not currently known to the company that could cause actual

results to differ materially from forecasted results. Factors that could cause

or contribute to such differences include those matters disclosed in the

company’s Securities and Exchange Commission filings. The forward-

looking statements in this document are made as of the date hereof and the

company does not undertake to update its forward-looking statements.

2

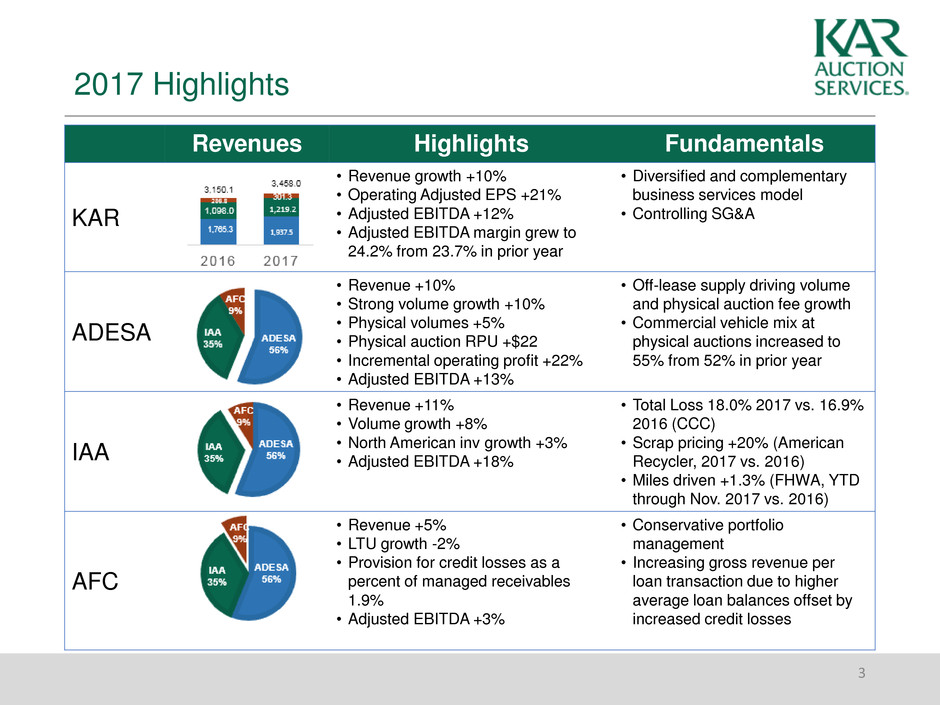

2017 Highlights

3

Revenues Highlights Fundamentals

KAR

• Revenue growth +10%

• Operating Adjusted EPS +21%

• Adjusted EBITDA +12%

• Adjusted EBITDA margin grew to

24.2% from 23.7% in prior year

• Diversified and complementary

business services model

• Controlling SG&A

ADESA

• Revenue +10%

• Strong volume growth +10%

• Physical volumes +5%

• Physical auction RPU +$22

• Incremental operating profit +22%

• Adjusted EBITDA +13%

• Off-lease supply driving volume

and physical auction fee growth

• Commercial vehicle mix at

physical auctions increased to

55% from 52% in prior year

IAA

• Revenue +11%

• Volume growth +8%

• North American inv growth +3%

• Adjusted EBITDA +18%

• Total Loss 18.0% 2017 vs. 16.9%

2016 (CCC)

• Scrap pricing +20% (American

Recycler, 2017 vs. 2016)

• Miles driven +1.3% (FHWA, YTD

through Nov. 2017 vs. 2016)

AFC

• Revenue +5%

• LTU growth -2%

• Provision for credit losses as a

percent of managed receivables

1.9%

• Adjusted EBITDA +3%

• Conservative portfolio

management

• Increasing gross revenue per

loan transaction due to higher

average loan balances offset by

increased credit losses

2018 Outlook

4

Annual Guidance

2018 Low 2018 High 2017

Net income $329.0 $349.7 $362.0

Add back:

Income tax expense $115.6 $122.9 $36.0

Interest expense, net of interest income $191.0 $191.0 $162.6

Depreciation and amortization $268.0 $268.0 $264.6

EBITDA $903.6 $931.6 $825.2

Total addbacks, net ($8.6) ($6.6) $12.8

Adjusted EBITDA $895.0 $925.0 $838.0

Capital expenditures $185.0 $185.0 $152.2

Cash taxes related to calendar year $125.0 $125.0 $131.8

Cash interest expense on corporate debt $130.0 $130.0 $110.9

Free cash flow $455.0 $485.0 $443.1

Effective tax rate 26% 26% 9%

Net income per share - diluted $2.40 $2.55 $2.62

Operating adjusted net income per share - diluted $2.89 $3.04 $2.50

Weighted average diluted shares 137 137 138

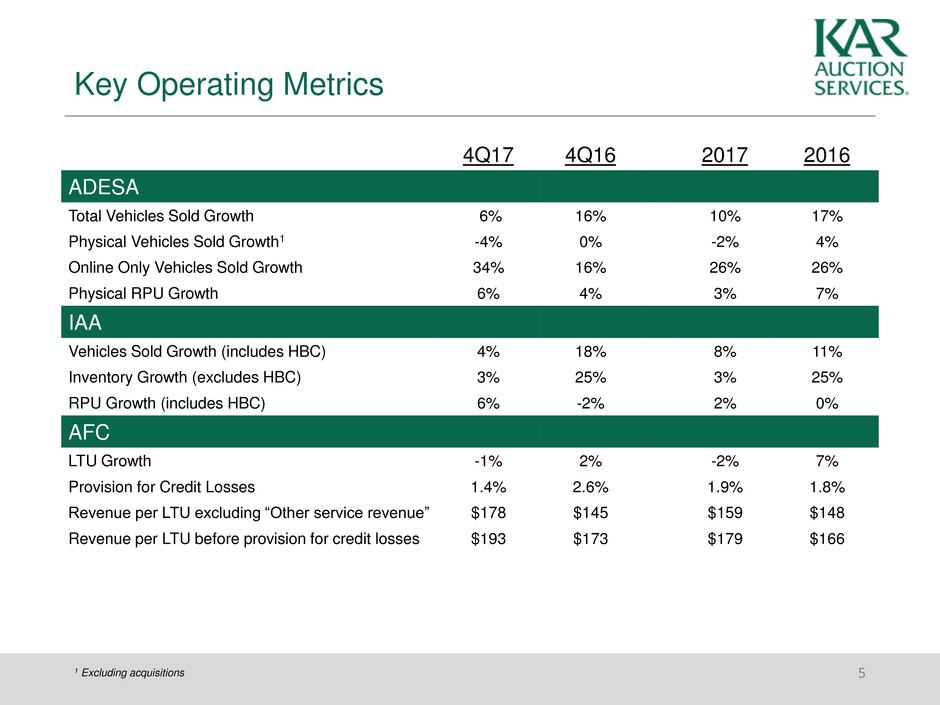

Key Operating Metrics

5

4Q17 4Q16 2017 2016

ADESA

Total Vehicles Sold Growth 6% 16% 10% 17%

Physical Vehicles Sold Growth1 -4% 0% -2% 4%

Online Only Vehicles Sold Growth 34% 16% 26% 26%

Physical RPU Growth 6% 4% 3% 7%

IAA

Vehicles Sold Growth (includes HBC) 4% 18% 8% 11%

Inventory Growth (excludes HBC) 3% 25% 3% 25%

RPU Growth (includes HBC) 6% -2% 2% 0%

AFC

LTU Growth -1% 2% -2% 7%

Provision for Credit Losses 1.4% 2.6% 1.9% 1.8%

Revenue per LTU excluding “Other service revenue” $178 $145 $159 $148

Revenue per LTU before provision for credit losses $193 $173 $179 $166

1 Excluding acquisitions

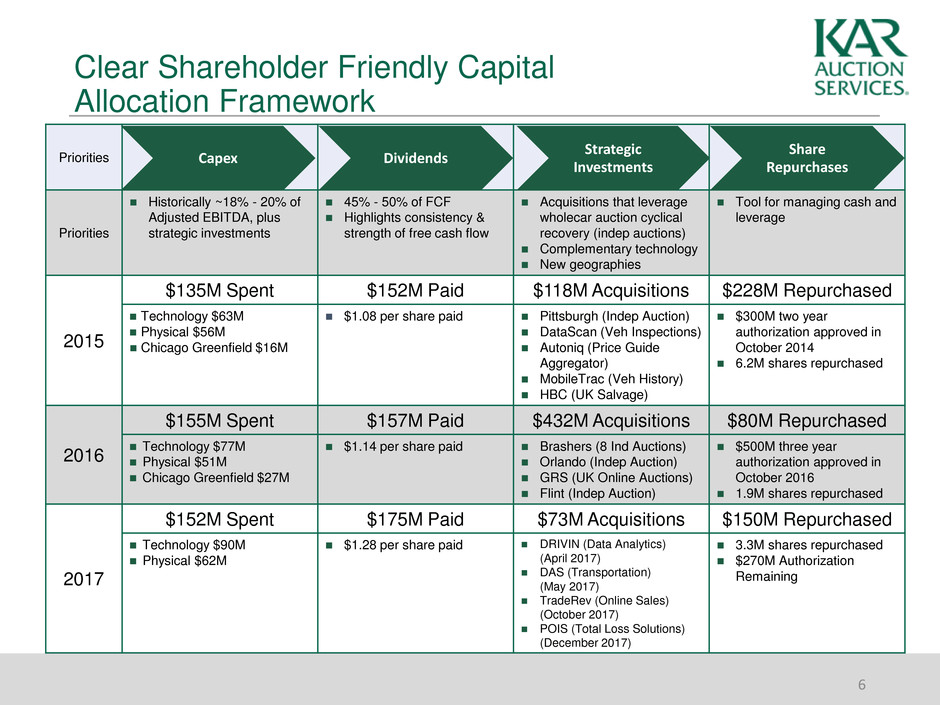

Share

Repurchases

Clear Shareholder Friendly Capital

Allocation Framework

6

Priorities

Priorities

Historically ~18% - 20% of

Adjusted EBITDA, plus

strategic investments

45% - 50% of FCF

Highlights consistency &

strength of free cash flow

Acquisitions that leverage

wholecar auction cyclical

recovery (indep auctions)

Complementary technology

New geographies

Tool for managing cash and

leverage

2015

$135M Spent $152M Paid $118M Acquisitions $228M Repurchased

Technology $63M

Physical $56M

Chicago Greenfield $16M

$1.08 per share paid

Pittsburgh (Indep Auction)

DataScan (Veh Inspections)

Autoniq (Price Guide

Aggregator)

MobileTrac (Veh History)

HBC (UK Salvage)

$300M two year

authorization approved in

October 2014

6.2M shares repurchased

2016

$155M Spent $157M Paid $432M Acquisitions $80M Repurchased

Technology $77M

Physical $51M

Chicago Greenfield $27M

$1.14 per share paid Brashers (8 Ind Auctions)

Orlando (Indep Auction)

GRS (UK Online Auctions)

Flint (Indep Auction)

$500M three year

authorization approved in

October 2016

1.9M shares repurchased

2017

$152M Spent $175M Paid $73M Acquisitions $150M Repurchased

Technology $90M

Physical $62M

$1.28 per share paid DRIVIN (Data Analytics)

(April 2017)

DAS (Transportation)

(May 2017)

TradeRev (Online Sales)

(October 2017)

POIS (Total Loss Solutions)

(December 2017)

3.3M shares repurchased

$270M Authorization

Remaining

Dividends

Strategic

Investments

Capex 4

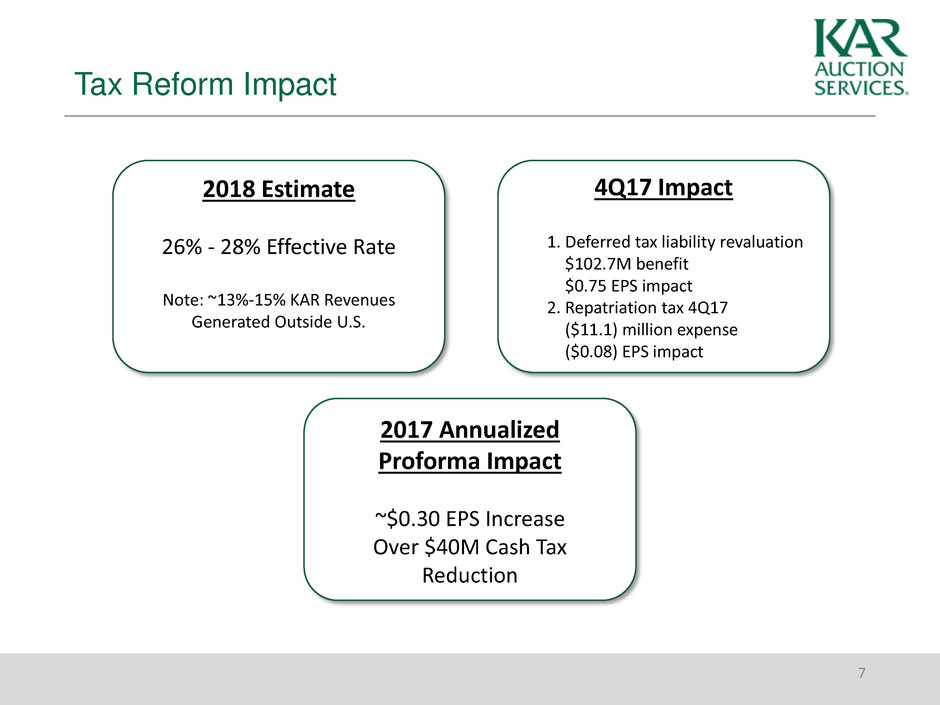

Tax Reform Impact

7

2018 Estimate

26% - 28% Effective Rate

Note: ~13%-15% KAR Revenues

Generated Outside U.S.

2017 Annualized

Proforma Impact

~$0.30 EPS Increase

Over $40M Cash Tax

Reduction

4Q17 Impact

1. Deferred tax liability revaluation

$102.7M benefit

$0.75 EPS impact

2. Repatriation tax 4Q17

($11.1) million expense

($0.08) EPS impact

Catastrophic Events (Hurricanes Harvey & Irma)

8

Real Estate

Enough acreage to store 100K+ units to

meet initial estimates from providers

Trucks

900 trucks within 4 days; 1,100 trucks &

3,000+ daily pickups at peak

Personnel

350 IAA Volunteers Deployed

~100 Non-IAA KAR employees

Financial Impact

4Q17 Volume Sold 65,000+

Revenue $44.6M

Gross Profit $4.0M

2017 Volume Sold 65,000+

Revenue $45.1M

Gross Profit/(Loss) ($0.3M)

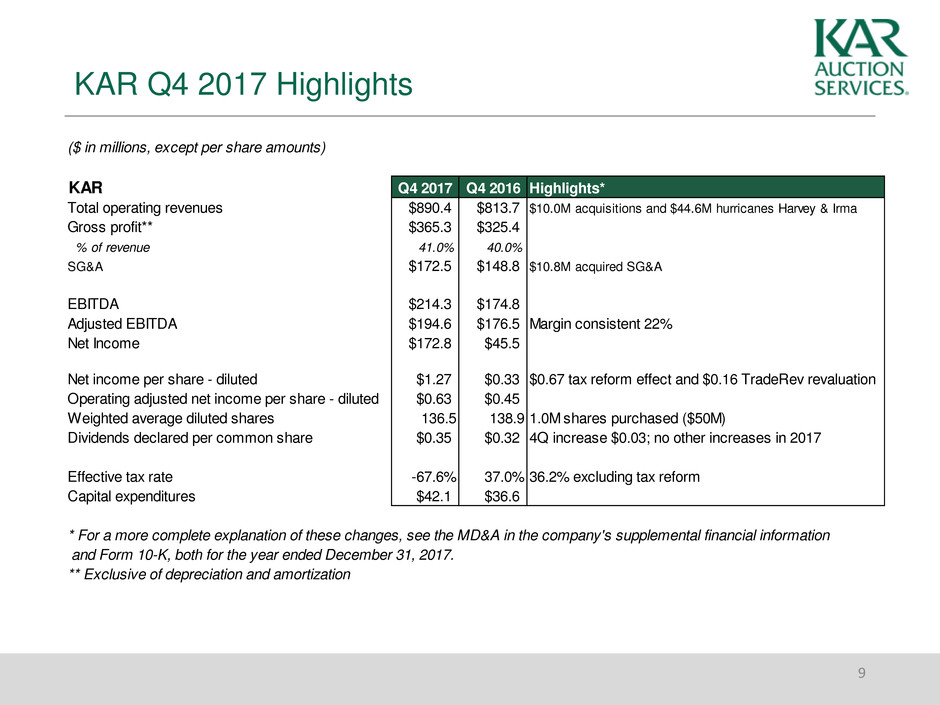

KAR Q4 2017 Highlights

9

($ in millions, except per share amounts)

KAR Q4 2017 Q4 2016 Highlights*

Total operating revenues $890.4 $813.7 $10.0M acquisitions and $44.6M hurricanes Harvey & Irma

Gross profit** $365.3 $325.4

% of revenue 41.0% 40.0%

SG&A $172.5 $148.8 $10.8M acquired SG&A

EBITDA $214.3 $174.8

Adjusted EBITDA $194.6 $176.5 Margin consistent 22%

Net Income $172.8 $45.5

Net income per share - diluted $1.27 $0.33 $0.67 tax reform effect and $0.16 TradeRev revaluation

Operating adjusted net income per share - diluted $0.63 $0.45

Weighted average diluted shares 136.5 138.9 1.0M shares purchased ($50M)

Dividends declared per common share $0.35 $0.32 4Q increase $0.03; no other increases in 2017

Effective tax rate -67.6% 37.0% 36.2% excluding tax reform

Capital expenditures $42.1 $36.6

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

ADESA Q4 2017 Highlights

10

($ in millions, except RPU)

ADESA Q4 2017 Q4 2016 Highlights*

Revenue $473.2 $442.3 +$10.0M acquisitions

Gross profit** $191.5 $172.9

% of revenue 40.5% 39.1%

SG&A $99.9 $89.2 0% growth excluding $10.8M of acquired SG&A

EBITDA $109.1 $80.4

Adjusted EBITDA $95.7 $88.0 9% growth

% of revenue 20.2% 19.9%

Vehicles sold 744,000 700,000 6% growth; 3% excluding acquisitions

Physical vehicles sold 507,000 523,000 -3% growth; -4% excluding acquisitions

Online only volume 237,000 177,000 34% growth; 23% excluding acquisitions

Dealer consignment mix % (physical only) 44% 45% Continued off-lease increase displaced dealer consignment

Conversion rate (N.A. physical) 57.3% 54.9% Increased commerical mix

Physical RPU $822 $773 Excludes purchased vehicles

Online only RPU $122 $115 Excludes ADESA Assurance

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

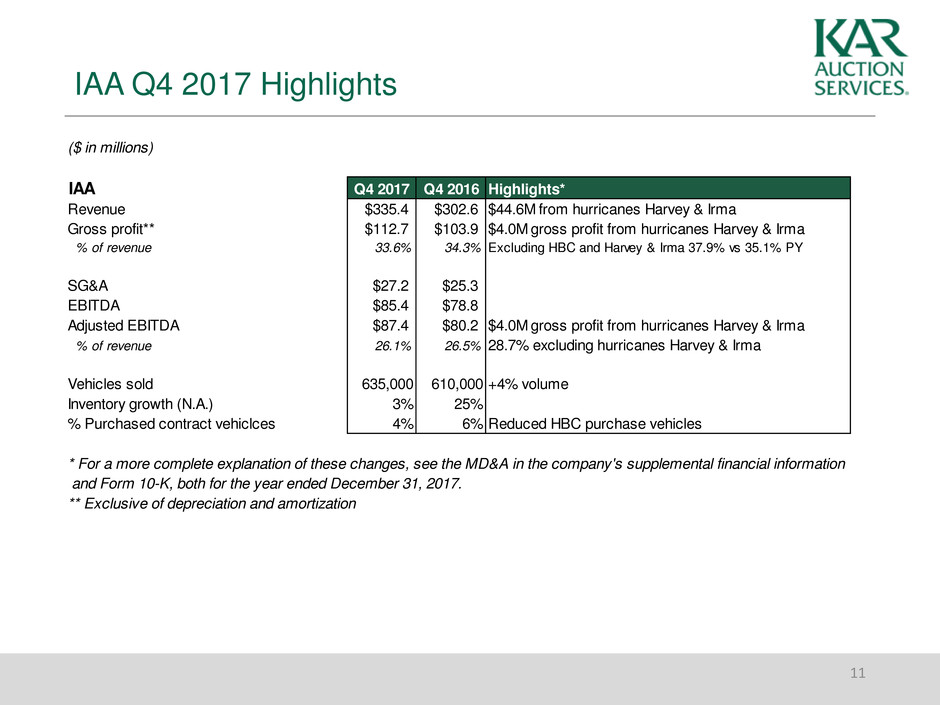

IAA Q4 2017 Highlights

11

($ in millions)

IAA Q4 2017 Q4 2016 Highlights*

Revenue $335.4 $302.6 $44.6M from hurricanes Harvey & Irma

Gross profit** $112.7 $103.9 $4.0M gross profit from hurricanes Harvey & Irma

% of revenue 33.6% 34.3% Excluding HBC and Harvey & Irma 37.9% vs 35.1% PY

SG&A $27.2 $25.3

EBITDA $85.4 $78.8

Adjusted EBITDA $87.4 $80.2 $4.0M gross profit from hurricanes Harvey & Irma

% of revenue 26.1% 26.5% 28.7% excluding hurricanes Harvey & Irma

Vehicles sold 635,000 610,000 +4% volume

Inventory growth (N.A.) 3% 25%

% Purchased contract vehiclces 4% 6% Reduced HBC purchase vehicles

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

AFC Q4 2017 Highlights

12

($ in millions, except for revenue per loan transaction)

AFC Q4 2017 Q4 2016 Highlights*

Interest and fee income $77.2 $69.6

Other revenue $2.9 $2.6

Provision for credit losses ($6.4) ($11.7)

Other service revenue $8.1 $8.3 Largely PWI

Total AFC revenue $81.8 $68.8 +23% revenue per LTU

Gross profit** $61.1 $48.6

% of revenue 74.7% 70.6% Floorplan lending business 79.8% vs 76.8% prior year

SG&A $8.5 $6.8

EBITDA $52.5 $40.4

Adjusted EBITDA $44.3 $34.7 27.7% increase

Loan transactions 414,000 417,000

Revenue per loan transaction unit (LTU)*** $178 $145 $193 vs $173 P/Y excluding provision for credit losses

Provision for credit losses % of finance receivables 1.4% 2.6% Reduction as anticipated

Expected to be under 2% annually going forward

Managed receivables $1,912.6 $1,792.2 Increasing vehicle values on floorplan

Obligations collateralized by finance receivables $1,358.1 $1,280.3

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

Year-to-Date Slides

KAR Year Ended December 31, 2017

Highlights

14

($ in millions, except per share amounts)

KAR YTD 2017 YTD 2016 Highlights*

Total operating revenues $3,458.0 $3,150.1 $89.6M acquired businesses & $45.1M hurricanes

Gross profit** $1,470.8 $1,322.7

SG&A $640.2 $583.1 $27.7M acquired SG&A

EBITDA $825.2 $734.3

Adjusted EBITDA $838.0 $747.9 12% growth

Net Income $362.0 $222.4

Net income per share - diluted $2.62 $1.60 $0.66 tax reform effect and $0.16 TradeRev revaluation

Operating adjusted net income per share - diluted $2.50 $2.06

Weighted average diluted shares 138.0 139.1 3.3M shares repurchased

Dividends declared per common share $1.31 $1.19 Increased to $0.35 per quarter in 4Q17

Effective tax rate 9.0% 37.4%

Capital expenditures $152.2 $155.1

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

ADESA Year Ended December 31, 2017 Highlights

15

($ in millions, except RPU)

ADESA YTD 2017 YTD 2016 Highlights*

Revenue $1,937.5 $1,765.3 $89.6M from acquisitions

Gross profit** $813.6 $728.8

% of revenue 42.0% 41.3% Increased mix of online only volumes

SG&A $360.0 $327.0 $27.7M acquired SG&A

EBITDA $462.7 $391.0

Adjusted EBITDA $473.3 $419.5 13% growth

% of revenue 24.4% 23.8%

Vehicles sold 3,180,000 2,885,000 10% growth; 5% excluding acquisitions

Physical vehicles sold 2,242,000 2,142,000 5% growth; -2% excluding acquisitions

Online only volume 938,000 743,000 26% growth; 24% excluding acquisitions

Dealer consignment mix % (physical only) 45% 48% Off-lease growth displacing dealer consignment units

Conversion rate (N.A. physical) 60.4% 58.0% Higher commercial vehicle mix converting at higher rates

Physical RPU $775 $753 Higher auction fees from higher value transactions

Online only RPU $113 $110 0% growth excluding acquisitions

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

IAA Year Ended December 31, 2017

Highlights

16

($ in millions)

IAA YTD 2017 YTD 2016 Highlights*

Revenue $1,219.2 $1,098.0 $45.1M hurricanes Harvey & Irma

Gross profit** $441.1 $390.0 ($0.3M) loss from hurricanes Harvey & Irma

% of revenue 36.2% 35.5% 38.3% excluding hurricanes Harvey & Irma and HBC

SG&A $107.1 $104.2 3% growth

EBITDA $334.9 $286.1

Adjusted EBITDA $339.5 $288.9 18% growth

% of revenue 27.8% 26.3% 28.9% excluding hurricanes Harvey & Irma

Vehicles sold 2,369,000 2,184,000 8% growth

Inventory growth (N.A.) 3% 25%

% Purchased contract vehiclces 5% 7% Lower HBC purchased vehicles

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

AFC Year Ended December 31, 2017

Highlights

17

($ in millions, except for revenue per loan transaction)

AFC YTD 2017 YTD 2016 Highlights*

Interest and fee income $290.3 $275.1

Other revenue $11.8 $10.3

Provision for credit losses ($33.9) ($30.7)

Other service revenue $33.1 $32.1 Largely PWI

Total AFC revenue $301.3 $286.8 5% growth

Gross profit** $216.1 $203.9

% of revenue 71.7% 71.1% Floorplan finance business 77.6% consistent with P/Y

SG&A $30.9 $28.7

EBITDA $185.2 $173.8

Adjusted EBITDA $153.9 $149.3 3% growth

Loan transactions 1,688,000 1,718,000 Intentional reduction of selected large accounts

Revenue per loan transaction unit (LTU)*** $159 $148 8% growth ($179 vs $166) excluding credit losses

Provision for credit losses % of finance receivables 1.9% 1.8% Below 2017 guidance mid-point of 1.75% - 2.25%

Expected to be under 2% annually going forward

Managed receivables $1,912.6 $1,792.2 Increased vehicle values on floorplan

Obligations collateralized by finance receivables $1,358.1 $1,280.3

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information

and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

Historical Data

ADESA Metrics - Annual

2017 2016 2015 2014 2013

Revenue2 $1,937.5 $1,765.3 $1,427.8 $1,271.0 $1,165.5

Total Volume 3,180 2,885 2,465 2,198 2,055

Online Only Volume 938 743 592 495 407

Total Online Volume % 45% 42% 40% 38% 35%

Physical Conversion % (N.A.) 60.4% 58.0% 58.3% 58.2% 56.9%

Dealer Consignment Mix % (Physical) 45% 48% 50% 51% 51%

Physical RPU1 $775 $753 $701 $685 $649

Online RPU1 $113 $110 $102 $104 $119

Gross Margin2 42.0% 41.3% 41.4% 41.3% 41.9%

1 Excluding Acquired Vehicles

2 Includes purchased vehicles

19

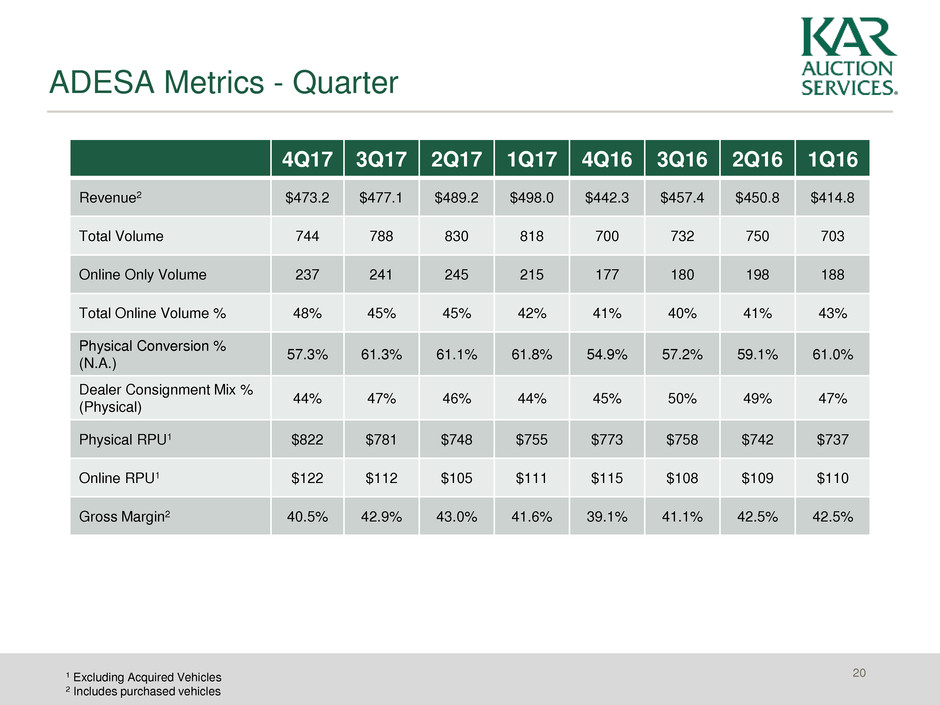

ADESA Metrics - Quarter

4Q17 3Q17 2Q17 1Q17 4Q16 3Q16 2Q16 1Q16

Revenue2 $473.2 $477.1 $489.2 $498.0 $442.3 $457.4 $450.8 $414.8

Total Volume 744 788 830 818 700 732 750 703

Online Only Volume 237 241 245 215 177 180 198 188

Total Online Volume % 48% 45% 45% 42% 41% 40% 41% 43%

Physical Conversion %

(N.A.)

57.3% 61.3% 61.1% 61.8% 54.9% 57.2% 59.1% 61.0%

Dealer Consignment Mix %

(Physical)

44% 47% 46% 44% 45% 50% 49% 47%

Physical RPU1 $822 $781 $748 $755 $773 $758 $742 $737

Online RPU1 $122 $112 $105 $111 $115 $108 $109 $110

Gross Margin2 40.5% 42.9% 43.0% 41.6% 39.1% 41.1% 42.5% 42.5%

1 Excluding Acquired Vehicles

2 Includes purchased vehicles

20

Increased industry (commercial) volumes drive average industry

transaction wholesale prices higher (ADESA)

Revenue per unit sold increased as a result of increased commercial

mix (ADESA)

Declining used car values increase likelihood of total losses (IAA)

YoY Index

Change

Age 1Q17 2Q17 3Q17 4Q17 YTD17

Industry All +4.1% +3.7% +1.9% +2.3% +3.0%

JCP/NADA 0-8 yrs -4.7% -4.5% -2.6% -0.1% -3.0%

Black Book 2-6 yrs -5.9% -5.1% -3.5% -0.8% -3.9%

RVI 2-5 yrs -6.1% -5.6% -2.7% +0.1% -3.3%

Used Vehicle Value Indices – Quarterly 2017

21

IAA Metrics - Annual

2017 2016 2015 2014 2013

Revenue $1,219.2 $1,098.0 $994.4 $895.9 $830.0

Total Volume 2,369 2,184 1,970 1,732 1,616

Inventory Growth (North

America)

3% 25% 14% 20% -3%

Purchased Vehicle Mix % 5% 7% 7% 6% 7%

Gross Profit $441.1 $390.0 $360.8 $340.2 $284.1

Gross Margin (IAA) 36.2% 35.5% 36.3% 38.0% 34.2%

Gross Margin (North America) 36.9% 36.7% 37.0% 38.0% 34.2%

22

IAA Metrics - Quarter

4Q17 3Q17 2Q17 1Q17 4Q16 3Q16 2Q16 1Q16

Revenue $335.4 $287.7 $298.7 $297.4 $302.6 $261.0 $264.8 $269.6

Total Volume 635 562 580 592 610 516 523 534

Inventory Growth (North America) 3% 12% 9% 17% 25% 22% 11% 4%

Purchased Vehicle Mix % 4% 5% 5% 5% 6% 7% 6% 7%

Gross Profit $112.7 $102.9 $117.2 $108.3 $103.9 $92.5 $97.5 $96.1

Gross Margin (IAA) 33.6% 35.8% 39.2% 36.4% 34.3% 35.4% 36.8% 35.6%

Gross Margin (North America) 33.9% 36.3% 40.2% 37.4% 35.1% 36.6% 38.4% 37.1%

23

IAA Year Ended December 31, 2017

Gross Profit

24

($ in millions)

IAA HBC Total IAA HBC Total

Revenue $1,181.3 $37.9 $1,219.2 $1,046.4 $51.6 $1,098.0

Cost of Services** 745.9 32.2 778.1 662.2 45.8 708.0

Gross Profit** $435.4 $5.7 $441.1 $384.2 $5.8 $390.0

% of Revenue 36.9% 15.0% 36.2% 36.7% 11.2% 35.5%

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial

information and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

Year Ended

December 31, 2017

Year Ended

December 31, 2016

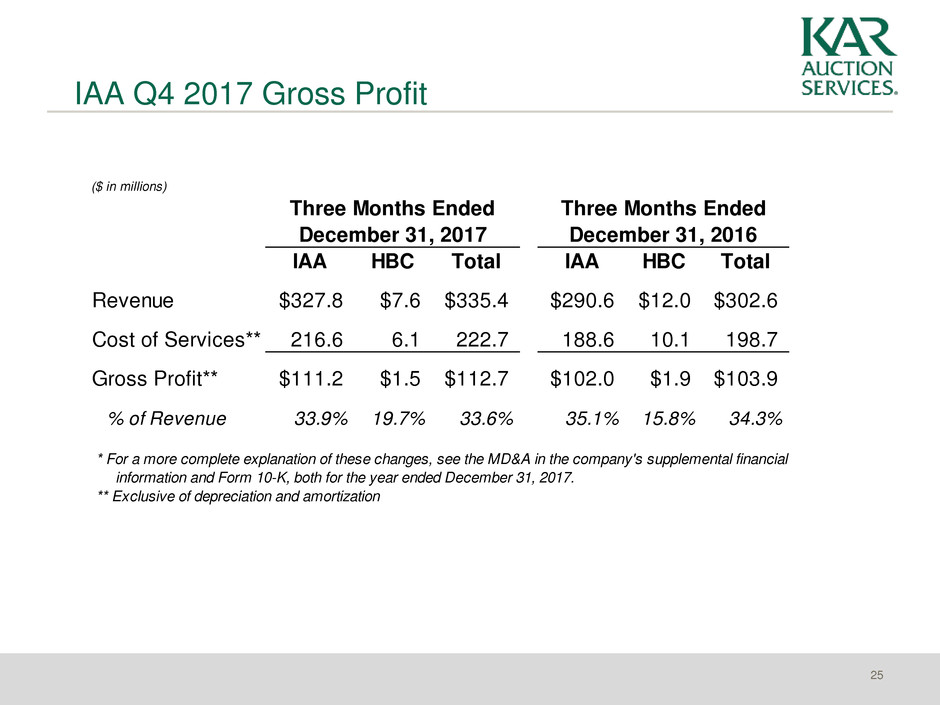

IAA Q4 2017 Gross Profit

25

($ in millions)

IAA HBC Total IAA HBC Total

Revenue $327.8 $7.6 $335.4 $290.6 $12.0 $302.6

Cost of Services** 216.6 6.1 222.7 188.6 10.1 198.7

Gross Profit** $111.2 $1.5 $112.7 $102.0 $1.9 $103.9

% of Revenue 33.9% 19.7% 33.6% 35.1% 15.8% 34.3%

* For a more complete explanation of these changes, see the MD&A in the company's supplemental financial

information and Form 10-K, both for the year ended December 31, 2017.

** Exclusive of depreciation and amortization

Three Months Ended

December 31, 2017

Three Months Ended

December 31, 2016

AFC Metrics - Annual

2017 2016 2015 2014 2013

Revenue $301.3 $286.8 $268.4 $250.1 $224.7

Loan Transaction Units (LTU) 1,688 1,718 1,607 1,445 1,355

Revenue per Loan Transaction,

Excluding “Other Service

Revenue”

$159 $148 $150 $155 $157

Ending Managed Finance

Receivables

$1,912.6 $1,792.2 $1,641.0 $1,371.1 $1,107.6

Ending Obligations Collateralized

by Finance Receivables

$1,358.1 $1,280.3 $1,189.0 $859.3 $763.3

% Vehicles Purchased at Auction 85% 83% 84% 84% 83%

Active Dealers 12,400 12,200 11,300 10,100 9,300

Vehicles per active dealer 15 15 16 16 14

Average Credit Line $250,000 $260,000 $230,000 $219,000 $185,000

Avg Value Outstanding per

Vehicle

$9,900 $9,500 $9,100 $8,630 $8,360

26

AFC Metrics - Quarter

4Q17 3Q17 2Q17 1Q17 4Q16 3Q16 2Q16 1Q16

Revenue $81.8 $78.2 $70.1 $71.2 $68.8 $71.2 $72.9 $73.9

Loan Transaction Units (LTU) 414 402 416 456 417 426 422 454

Revenue per Loan

Transaction, Excluding “Other

Service Revenue”

$178 $174 $148 $138 $145 $148 $154 $146

Ending Managed Finance

Receivables

$1,912.6 $1,809.2 $1,736.5 $1,760.7 $1,792.2 $1,785.4 $1,738.6 $1,705.5

Ending Obligations

Collateralized by Finance

Receivables

$1,358.1 $1,259.3 $1,224.9 $1,241.8 $1,280.3 $1,275.1 $1,231.2 $1,202.9

27

AFC Provision for Credit Losses - Annual

2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

Ending

Managed

Receivables

$1,912.6 $1,792.2 $1,641.0 $1,371.1 $1,107.6 $1,004.2 $883.2 $771.6 $613.0 $506.6 $847.9

Average

Managed

Receivables

$1,802.2 $1,732.5 $1,474.9 $1,208.4 $1,051.4 $925.8 $798.8 $688.6 $516.4 $744.4 $835.3

Provision for

Credit

Losses

$33.9 $30.7 $16.0 $12.3 $9.6 $7.2 $6.1 $11.2 $17.1 $44.7 $25.0

% of

Managed

Receivables

1.9% 1.8% 1.1% 1.0% 0.9% 0.8% 0.8% 1.6% 3.3% 6.0% 3.0%

28

AFC Provision for Credit Losses - Quarterly

4Q17 3Q17 2Q17 1Q17 4Q16 3Q16 2Q16 1Q16

Ending

Managed

Receivables

$1,912.6 $1,809.2 $1,736.5 $1,760.7 $1,792.2 $1,785.4 $1,738.6 $1,705.5

Average

Managed

Receivables

$1,860.9 $1,772.9 $1,748.6 $1,776.5 $1,788.8 $1,762.0 $1,722.1 $1,673.3

Provision for

Credit Losses

$6.4 $5.0 $11.4 $11.1 $11.7 $8.0 $5.5 $5.5

% of Managed

Receivables

1.4% 1.1% 2.6% 2.5% 2.6% 1.8% 1.3% 1.3%

29

Appendix

Non-GAAP Financial Measures

31

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit),

depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and

expected incremental revenue and cost savings as described in the company's senior secured credit agreement

covenant calculations. Free cash flow is defined as Adjusted EBITDA less cash interest expense on corporate debt

(Credit Facility), capital expenditures and cash taxes related to the calendar year. Management believes that the

inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide

additional information to investors about one of the principal measures of performance used by the company’s creditors.

In addition, management uses EBITDA, Adjusted EBITDA and free cash flow to evaluate the company’s performance.

Depreciation expense for property and equipment and amortization expense of capitalized internally developed

software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired

intangible assets, such as customer relationships, software, tradenames and noncompete agreements are not

representative of ongoing capital expenditures, but have a continuing effect on our reported results. Non-GAAP

financial measures of operating adjusted net income and operating adjusted net income per share, in the opinion of the

company, provide comparability to other companies that may not have incurred these types of non-cash expenses or

that report a similar measure. In addition, net income and net income per share have been adjusted for certain other

charges, as seen in the following reconciliation.

EBITDA, Adjusted EBITDA, free cash flow, operating adjusted net income and operating adjusted net income per share

have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the

results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other

companies.

Q4 2017 Adjusted EBITDA Reconciliation

32

($ in millions)

Three Months ended December 31, 2017

ADESA IAA AFC Corporate Consolidated

Net income (loss) $108.9 $68.5 $42.3 ($46.9) $172.8

Add back:

Income taxes (39.5) (16.5) (9.3) (4.4) (69.7)

Interest expense, net of interest income 0.4 – 11.8 29.6 41.8

Depreciation and amortization 30.6 23.9 7.8 7.1 69.4

Intercompany interest 8.7 9.5 (0.1) (18.1) –

EBITDA $109.1 $85.4 $52.5 ($32.7) $214.3

Intercompany charges 4.0 – – (4.0) –

Non-cash stock-based compensation 2.2 1.1 0.8 3.6 7.7

Acquisition related costs 1.4 – – 0.3 1.7

Securitization interest – – (9.9) – (9.9)

Minority interest 0.1 – – – 0.1

Gain on previously held equity interest value (21.6) – – – (21.6)

Severance 0.6 0.1 0.2 – 0.9

Other (0.1) 0.8 0.7 – 1.4

Total Addbacks (13.4) 2.0 (8.2) (0.1) (19.7)

Adjusted EBITDA $95.7 $87.4 $44.3 ($32.8) $194.6

Revenue $473.2 $335.4 $81.8 – $890.4

Adjusted EBITDA % margin 20.2% 26.1% 54.2% 21.9%

Q4 2016 Adjusted EBITDA Reconciliation

33

($ in millions)

Three Months ended December 31, 2016

ADESA IAA AFC Corporate Consolidated

Net income (loss) $27.9 $29.0 $19.8 ($31.2) $45.5

Add back:

Income taxes 16.0 16.8 12.2 (18.3) 26.7

Interest expense, net of interest income (0.2) – 9.4 28.7 37.9

Depreciation and amortization 27.4 23.5 7.7 6.1 64.7

Intercompany interest 9.3 9.5 (8.7) (10.1) –

EBITDA $80.4 $78.8 $40.4 ($24.8) $174.8

Intercompany charges 3.1 – – (3.1) –

Non-cash stock-based compensation 1.2 0.7 0.4 1.7 4.0

Loss on extinguishment of debt – – 1.4 – 1.4

Acquisition related costs 1.3 – – 0.1 1.4

Securitization interest – – (7.7) – (7.7)

Minority interest 1.1 – – – 1.1

Severance 0.3 0.1 – – 0.4

Other 0.6 0.6 0.2 (0.3) 1.1

Total Addbacks 7.6 1.4 (5.7) (1.6) 1.7

Adjusted EBITDA $88.0 $80.2 $34.7 ($26.4) $176.5

Revenue $442.3 $302.6 $68.8 – $813.7

Adjusted EBITDA % margin 19.9% 26.5% 50.4% 21.7%

YTD 2017 Adjusted EBITDA Reconciliation

34

($ in millions)

Year ended December 31, 2017

ADESA IAA AFC Corporate Consolidated

Net income (loss) $260.9 $166.0 $103.9 ($168.8) $362.0

Add back:

Income taxes 52.9 38.0 26.6 (81.5) 36.0

Interest expense, net of interest income – – 43.6 119.0 162.6

Depreciation and amortization 113.1 93.1 31.3 27.1 264.6

Intercompany interest 35.8 37.8 (20.2) (53.4) –

EBITDA $462.7 $334.9 $185.2 ($157.6) $825.2

Intercompany charges 11.6 – – (11.6) –

Non-cash stock-based compensation 7.3 3.9 2.6 11.4 25.2

Loss on extinguishment of debt – – – 27.5 27.5

Acquisition related costs 5.2 – – 1.6 6.8

Securitization interest – – (34.9) – (34.9)

Minority interest 4.4 – – – 4.4

Gain on previously held equity interest value (21.6) – – – (21.6)

Severance 2.3 0.3 0.3 – 2.9

Other 1.4 0.4 0.7 – 2.5

Total Addbacks 10.6 4.6 (31.3) 28.9 12.8

Adjusted EBITDA $473.3 $339.5 $153.9 ($128.7) $838.0

Capital Expenditures 152.2

Cash taxes related to calendar year 131.8

Cash interest on corporate debt 110.9

Free Cash Flow $443.1

Revenue $1,937.5 $1,219.2 $301.3 – $3,458.0

Adjusted EBITDA % margin 24.4% 27.8% 51.1% 24.2%

YTD 2016 Adjusted EBITDA Reconciliation

35

($ in millions)

Year ended December 31, 2016

ADESA IAA AFC Corporate Consolidated

Net income (loss) $156.9 $101.1 $88.4 ($124.0) $222.4

Add back:

Income taxes 92.7 59.3 54.0 (73.1) 132.9

Interest expense, net of interest income (0.3) – 34.1 104.6 138.4

Depreciation and amortization 100.0 87.9 31.1 21.6 240.6

Intercompany interest 41.7 37.8 (33.8) (45.7) –

EBITDA $391.0 $286.1 $173.8 ($116.6) $734.3

Intercompany charges 10.9 0.3 – (11.2) –

Non-cash stock-based compensation 4.6 2.6 1.8 10.1 19.1

Loss on extinguishment of debt – – 1.4 4.0 5.4

Acquisition related costs 4.9 0.2 0.1 3.4 8.6

Securitization interest – – (28.0) – (28.0)

Minority interest 3.8 – – – 3.8

(Gain)/Loss on asset sales 1.6 0.2 – 0.6 2.4

Severance 1.7 0.1 0.1 – 1.9

Other 1.0 (0.6) 0.1 (0.1) 0.4

Total Addbacks 28.5 2.8 (24.5) 6.8 13.6

Adjusted EBITDA $419.5 $288.9 $149.3 ($109.8) $747.9

Revenue $1,765.3 $1,098.0 $286.8 – $3,150.1

Adjusted EBITDA % margin 23.8% 26.3% 52.1% 23.7%

Operating Adjusted Net Income

per Share Reconciliation

36

($ in millions, except per share amounts), (unaudited)

2017 2016 2017 2016

Net income $172.8 $45.5 $362.0 $222.4

Acquired amortization expense 27.0 25.8 103.7 97.1

Loss on extinguishment of debt – 1.4 27.5 5.4

Gain on previously held equity interest value (21.6) – (21.6) –

Reduction in taxes for revaluation of deferred taxes (102.7) – (102.7) –

Increase in taxes for mandatory repatriation of undistributed

foreign earnings

11.1 – 11.1 –

Income taxes

(1) (1.1) (10.0) (35.1) (38.3)

Operating adjusted net income $85.5 $62.7 $344.9 $286.6

Net income per share − diluted $1.27 $0.33 $2.62 $1.60

Acquired amortization expense 0.20 0.19 0.75 0.70

Loss on extinguishment of debt – 0.01 0.20 0.04

Gain on previously held equity interest value (0.16) – (0.16) –

Reduction in taxes for revaluation of deferred taxes (0.75) – (0.74) –

Increase in taxes for mandatory repatriation of undistributed

foreign earnings

0.08 – 0.08 –

Income taxes (0.01) (0.08) (0.25) (0.28)

Operating adjusted net income per share − diluted $0.63 $0.45 $2.50 $2.06

Weighted average diluted shares 136.5 138.9 138.0 139.1

Three Months ended

December 31,

Year ended

December 31,

(1)The effective tax rate for 2016 was used to determine the amount of income tax benefit on the adjustments to net income. The effective

income tax rates for 2017 were adjusted to reflect the tax reform items reflected as separate line items in the above reconciliation

(revaluation of deferred taxes and repatriation of undistributed foreign earnings).

Q4 2017 KAR Incremental Operating Profit

Margin Analysis

37

Reported

Impact of

Acquisitions

KAR Excluding

Acquisitions

Q4 2017

Revenue 890.4$ 10.0$ 880.4$

Operating Profit 123.4$ (8.8)$ 132.2$

Operating Profit % 13.9% -88.0% 15.0%

Q4 2016

Revenue 813.7$

Operating Profit 111.9$

Operating Profit % 13.8%

Q4 2017 Reported Growth

Reported Revenue Growth 76.7$

Reported Operating Profit Growth 11.5$

Incremental Operating Margin 15.0%

Q4 2017 Excluding Acquisitions

Revenue Growth 66.7$

Operating Profit Growth 20.3$

Incremental Operating Margin 30.4%

YTD 2017 KAR Incremental Operating Profit

Margin Analysis

38

Reported

Impact of

Acquisitions

KAR Excluding

Acquisitions

Q4 YTD 2017

Revenue 3,458.0$ 89.6$ 3,368.4$

Operating Profit 566.0$ 2.5$ 563.5$

Operating Profit % 16.4% 2.8% 16.7%

Q4 YTD 2016

Revenue 3,150.1$

Operating Profit 499.0$

Operating Profit % 15.8%

Q4 YTD 2017 Reported Growth

Reported Revenue Growth 307.9$

Reported Operating Profit Growth 67.0$

Incremental Operating Margin 21.8%

Q4 YTD 2017 Excluding Acquisitions

Revenue Growth 218.3$

Operating Profit Growth 64.5$

Incremental Operating Margin 29.5%